Gold World News Flash |

- Review: QE3 To Infinity–The Final End Game

- Quantitative Easing Did Not Work For The Weimar Republic Either

- 32 Survival Skills Your Child Should Know and Be Able to Do ASAP!

- What To Expect Next After The Recent Surge In Gold & Silver

- Commodities Look to US Home Sales, German CPI to Drive Risk Trends

- Gold and the harsh realities of a 42 year old currency experiment

- The Eurozone Con Game Just Keeps Cracking

- $1,900 likely the decisive price point for gold, Hathaway tells King World News

- Weekend Report: The Gold to XAU Ratio, Some Major Clues

- Your Liberty and Your Money

- Gold Price Rose $1.70 to $1,763.80 Correction still Looks Likely

- Junior Explorer/GDX Ratio Still At Historical Extremes….Will Explorers Be Rocketing Higher?

- City of Contented Industries

- Is Gold Overpriced? Maybe Not Until $2,390

- Hathaway - Gold Shorts To Panic As This Key Level is Breached

- Silvercrest Mines’ Scott Drever Discusses The Shiny Metal’s Prospects 25.Sept.12

- Gold Daily and Silver Weekly Charts - Slouching Into the End of Quarter

- QE To Have Major Economic Impact On Western Financial World

- Gold Seeker Closing Report: Gold and Silver End Slightly Lower

- Ranting Andy Hoffman–Comex Short Position-Silver Under $35 Or Bust 24.Sept.12

- Platinum: fragility of supply highlights need for global diversification

- Jeff Thomas: Manipulation of the gold price

- Ted Butler Urges JPMorganChase Board Members to Try Transparency in Silver

- Net Asset Value Premiums For Certain Precious Metal Trusts and Funds - Sprott Buys More Silver

- LGMR: Gold ETFs Set New Record, Bullion Prices "Should Break Higher After Consolidation Period"

- Measuring Gold Fiat Currency Performance Since 1971

- This Gold and Silver Miner May Be The Next Takeout Target

- Is JP Morgan Shorting Paper Metals While Acquiring Massive Physical Stockpiles?

- In The News Today

- Gold Firm but Unable to Continue through Upside Resistance

| Review: QE3 To Infinity–The Final End Game Posted: 26 Sep 2012 12:15 AM PDT by Jim Sinclair, JS Mineset:

Here is a review to offset the drivel pouring out of MSM declaring "QE to Infinity" as powerless and ineffectual. Expectations of deflationary powers overpowering QE to infinity is rank madness pandered to by world class morons in, and outside our community. My Dear Extended Family, The final end game of QE3 to infinity, with a month or two off from time to time, will be a product of the long term viability of the Federal Reserve Balance sheet and the impact on the dollar there from. Let's review what has transpired and begin to look at what will happen:

|

| Quantitative Easing Did Not Work For The Weimar Republic Either Posted: 25 Sep 2012 11:15 PM PDT from The Economic Collapse Blog:

Of course we are not going to see hyperinflation in the U.S. this week or this month. But don't think that it will never happen. The people of Germany never thought that it would happen to them, but it did. |

| 32 Survival Skills Your Child Should Know and Be Able to Do ASAP! Posted: 25 Sep 2012 10:30 PM PDT from TheSurvivalMom.com:

Knowledge is something that takes time to develop, so we need to start teaching the next generation now. In case God forbid, our children are left to fend for themselves or we are injured or even just to make your family more apt to survive, every child must learn these survival skills so they can pull their own weight and contribute as much as they can. If your family learns now to be a well oiled machine, you will be more likely to survive any type of collapse.

|

| What To Expect Next After The Recent Surge In Gold & Silver Posted: 25 Sep 2012 10:01 PM PDT  Today Tom Fitzpatrick spoke with King World News about the recent action in both gold and silver. Fitzpatrick has been incredibly accurate in forecasting the movements of gold and silver. He has been noting $1,791 as a key level in gold for some time on KWN, and remarkably gold went almost to the dollar to that number, hitting $1,790 before pulling back. Now Fitzpzatrick lets KWN readers know what to expect next. Today Tom Fitzpatrick spoke with King World News about the recent action in both gold and silver. Fitzpatrick has been incredibly accurate in forecasting the movements of gold and silver. He has been noting $1,791 as a key level in gold for some time on KWN, and remarkably gold went almost to the dollar to that number, hitting $1,790 before pulling back. Now Fitzpzatrick lets KWN readers know what to expect next. This posting includes an audio/video/photo media file: Download Now |

| Commodities Look to US Home Sales, German CPI to Drive Risk Trends Posted: 25 Sep 2012 09:13 PM PDT courtesy of DailyFX.com September 25, 2012 03:44 PM Commodities may rise if a pickup in US New Home Sales and/or a soft German CPI reading drive a broad-based recovery in risk appetite trends. Talking Points [LIST] [*]Crude Oil, Copper May Advance as US New Home Sales Hit 28-Month High [*]Gold and Silver to See Support if Risk Appetite Recovery Weighs on US Dollar [*]Sentiment May Strengthen if Soft German CPI Drives Hopes for ECB Stimulus [/LIST] Commodities pushed higher as expected through much of the US trading session on the back of broadly better-than-expected economic data set but gains were swiftly erased toward the end of the session after the Fed’s Charles Plosser came across the wires. The President of the central bank’s Philadelphia branch said the newly-initiated QE3 stimulus effort won’t boost employment and endangers the Fed’s credibility. Looking ahead, the spotlight turns to US New Home Sales figures. Expectations call for a print at 38... |

| Gold and the harsh realities of a 42 year old currency experiment Posted: 25 Sep 2012 09:00 PM PDT Julian Philips argues that the concept of a currency as a measure of value has now departed completely. by Julian Philips, MineWeb.com

In 1971 President Nixon closed the window that allowed U.S. dollars to be sold for gold owned by the U.S. Just before that, the price of gold was $35 an ounce. Since then gold has been called a 'barbarous relic', a term used by Keynes, the famous economist. From that time on, the world's currencies stood merely on the confidence their governments engendered and the control they exercised over international financial dealings of all kinds. That confidence lasted until 2007 when the credit crunch brought government financing on both sides of the Atlantic into question. Up until now the performance of the underlying value of currencies has hidden these questions as exchange rates are adequately 'managed' through swap arrangements to stabilize exchange rate movements to the extent that violent moves don't happen. But the real value of currencies in terms of their real solvency is now a matter of open debate. As of now, relative to the amount of gold available to markets, the price of gold is the only measure of value that currencies can be held to. We look at that and look at the conditions that are determining the value of currencies now and in the future. |

| The Eurozone Con Game Just Keeps Cracking Posted: 25 Sep 2012 07:06 PM PDT Wolf Richter www.testosteronepit.com “European leaders have not been able to meet their responsibilities,” French Prime Minister Jean-Marc Ayrault said about Germany and some other countries that are reluctant to pile more taxpayer money on Greece, whose economy is grinding to a halt, and whose government, deprived of the flow of bailout funds and cut off from the financial markets, can no longer fulfill its promises. And Greeks are leery of new “structural reforms” currently fought over by the coalition government. They oppose more cuts in salaries, pensions, and health care. On Wednesday, they will attempt to bring the economy to a halt with a general strike and demonstrations in Athens and Thessaloniki. Meanwhile, Germany and other countries are wondering how Greece can possibly “reform” if the government can’t agree on the reforms to inflict on its people, and if the people aren’t willing to suffer them. To his French compatriots, Ayrault defended the Fiscal Union treaty, which, after having been silenced to death, has come under blistering attack from the far right and the far left ahead of the parliamentary debate. They’re clamoring for a referendum, something the government wants to avoid at all costs—the people might well kill it, as they’d killed the European Constitution in the referendum of 2005 [read.... A French Rebellion Against Unelected Bureaucrats: “European Coup D’Etat And Rape Of Democracy”]. “This treaty doesn’t damage the budgetary sovereignty of parliament,” he said. “There is no transfer of sovereignty.” THE issue with that treaty. Even the German Constitutional Court acknowledged that it transferred sovereignty to the European Union. “There must be much more,” Ayrault told his listeners. “The reorientation of Europe” would continue, he said. “Europe is a combat.” Indeed. A melee broke out in Madrid on Tuesday between protesters trying to occupy Parliament and riot police with batons. In Barcelona, Artur Mas, President of the Catalan government, announced that he’d hold early election on November 25 to initiate Catalonia’s path to “self-determination.” Another blow to the central government, which strongly opposes the early elections and categorically opposes any form of independence by Catalonia. Political turmoil just when Spain is teetering near the financial abyss [read.... Catalonia Cries for Independence, Spain Might Break Apart, And Its Military Threatens To “Crush” The “Vultures”]. The same day, ECB President Mario Draghi headed to Berlin for a charm offensive. His meeting with Chancellor Angela Merkel focused on “the economic and monetary union” and on preparations for the next EU summit in October, the 22nd such summit to solve the debt crisis once and for all. Then at the Conference of German Industry, he defended his plan to purchase “unlimited” amounts of government bonds from countries like Spain and Italy. There was really no alternative to his program, he said. Alas, rumors began swirling around that legal experts at the Bundesbank have been vivisecting every syllable of the EU treaties that govern the ECB to determine the amount and duration beyond which these purchases might violate the treaties. Apparently, the Bundesbank, which has vigorously opposed Draghi’s plan, is preparing for a complaint before the European Court of Justice. Still, Draghi patted himself on the back. “The Eurozone makes progress, investors acknowledge it,” he told about 1,000 managers. The ECB had succeeded in rebuilding confidence, he said. Yet, confidence is in short supply among the very managers he was talking to. The Ifo Business Climate Index fell for the fifth month in a row. Particularly hard hit were expectations for the next six months which dropped to a level not seen since mid-2009, when the Federal Republic was emerging from the worst GDP collapse in its history. Part of the problem: German industry has been highly skeptical of the bond-buying program, declared Hans-Peter Keitel, President of the Association of German Industry (BDI). He warned against relying on the ECB to deal with the debt crisis—thus fully backing Bundesbank President Jens Weidmann. Politicians should use the ESM bailout fund and structural reforms, he said, though the ECB’s printing press would be the “seemingly more comfortable path.” So, to use the words of the French Prime Minster Ayrault, what are the “responsibilities” of the “European leaders?” Bailing out banks. Particularly German and French banks whose basements are full of decomposing paper from periphery countries. And bailing out investors of all stripes. Certainly, no one has yet bailed out the Greeks themselves, those who’ve lost their jobs or had their salaries cut. They don’t figure into the equation when politicians and unelected bureaucrats plot their next moves. Jan Bennink, a columnist and self-described anti-EU populist, muses: “guys like me, who make films, sing songs, and publish stuff, suddenly have a lot to worry about from those grey mice in Brussels with their newspeak and absolute power.” And he wonders, “Is there anything more frightening than bureaucrats with a dream?” For his fantastic and troubling article, read.... The New Great Dictators Are Gaining Momentum In Europe. |

| $1,900 likely the decisive price point for gold, Hathaway tells King World News Posted: 25 Sep 2012 06:59 PM PDT 9p ET Tuesday, September 25, 2012 Dear Friend of GATA and Gold: Tocqueville Gold Fund manager John Hathaway today tells King World News that $1,900 is likely the decisive price point for gold. Hathaway expects gold to remain under attack until then but once $1,900 is passed, increases of hundreds of dollars are possible. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/9/25_Ha... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Fred Goldstein and Tim Murphy open All Pro Gold Longtime GATA supporters Fred Goldstein and Tim Murphy have brought their many years of experience in the precious metals and numismatic coins to All Pro Gold as metals brokers who specialize in the delivery of gold and silver bullion bars and coins as well as numismatic gold and silver coins. Fred and Tim follow these markets closely and are assisted by a team of consultants in monitoring market trends. All Pro Gold offers GATA supporters competitive pricing on all bullion products and welcomes inquiries. Tim can be reached at 602-299-2585 and Tim@allprogold.com, Fred at 602-799-8378 and Fred@allprogold.com. Ask about their ratio strategy and the relationship of generic $20 dollar gold pieces to 1-ounce gold bullion coins. Visit their Internet site at http://www.allprogold.com/. Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Weekend Report: The Gold to XAU Ratio, Some Major Clues Posted: 25 Sep 2012 05:18 PM PDT |

| Posted: 25 Sep 2012 05:07 PM PDT We begin with a cynical thought experiment. It's really a conclusion about what's going on in the financial markets. And the conclusion is this: the value of financial assets and currencies is being deliberately crashed in order to transfer wealth from the public to a small group of global elites. Sounds crazy, right? Maybe even cranky? We'll get to that shortly. But first… The typical result of credit booms and busts is to transfer ownership of real assets and productive businesses from the public to the insiders. In our thought experiment, the Federal Reserve exists to make this happen in a way that doesn't alert the public to what's really going on. The insiders — or anyone who knows how these things work — sell to the public in the mania phase. The panic and crash phase of a bust is when the public realizes the game is up. Prices crash and liquidity disappears in the bust. Real assets and the share prices of real businesses are left lying around on the ground. If your money didn't get destroyed in the crash, all the good assets can be bought cheap. The end result is that the middle class ends up poorer and the financial/political elites end up owning all the good stuff. This happens time after time in financial markets. Productive assets are slowly accumulated by a small group while in real terms, incomes fall for the majority. Another way to think of this is as modern feudalism, but with better-dressed peasants who have iPhones. In the modern feudal world, you don't work the land. You work a keyboard, if you can find a job. And if you can't, the government will pay you a token wage to keep you from starving/working. The main improvement of the modern feudal system is that the King can't kill you extra-judicially. In the modern feudal system, only the Chief Executive has the power to deny you life, liberty, and the pursuit of happiness via a drone strike. This reprieve from arbitrary death from above (the King) is probably the biggest improvement in modern feudalism. So far, the only people to be killed thusly are terrorists and unlucky strangers who don't vote in US elections. And to be fair, when it comes to subsistence, there are plenty of cheap calories in the modern world. People may be malnourished on modern food, but they won't starve. Worst case scenario, you eat your way into a food coma or some medical crisis. Up until now, being a financial serf was bearable. But something is different about the preceding boom and the current bust. When Internet stocks crashed, it was a wealth transfer. People lost money. But it wasn't real money anyway. It was the gains from the bubble, not capital saved for retirement. Besides, in response to the dotcom crash the US Fed lowered interest rates. World monetary policy became synchronised. The result was a boom in all assets and in all places. Stocks, bonds, real estate, commodities…you name it. Nearly everything boomed. Now we get to the part that's different about this bust. This bust began in 2009. But the authorities soon discovered that things had become so complex and so large that a normal correction/wealth transfer was not possible. It's okay to pump up Internet stocks and then watch them crash. But you can't very well pump up the whole global financial system and then watch it crash, can you? Can you? Well, yes, you could. But there would be a couple of unavoidable results. One result would be a global economic collapse. The system is interlinked now. A financial crash becomes an economic crash…the Greater Depression Ben Bernanke wants to avoid. But that's just the start. A financial crash means the end of the current global monetary system. US dollar devaluation played a key role in the credit boom. But it undermined the stability of the whole dollar system. You crash the system, you crash the dollar. What comes after the dollar? You can bet the people who benefit from the dollar system — the Fed — don't want to find out. But the most serious result of the system crash — and we're talking much more serious than Microsoft's blue screen of death — is that real people see their real lives really wiped out. When Middle Class savings are destroyed through stock market crashes, housing crashes, and inflation, people end up a lot poorer. And that's just the Middle Class. The people who went into the crash with even less come out of it worse than ever before. Let's end the thought experiment there. It can't be possible that anyone would wish for all those consequences of a system crash, could it? The only people who could wish for such a thing are the people who see it as a chance to build an anti-democratic global system from the ruins of the current one…a system with one government and one money and one rule of law which only applies to the governed and not the rule makers or money makers. That can't really be what they're after, can it? In any event, we will find out this week if coordinated central bank interventions from the Federal Reserve, the Bank of Japan, and the European Central Bank are enough to keep markets from crashing for a little longer. The central bankers are fighting a losing battle, we fear. When you look at the world's financial system as a series of geometric shapes, it's a giant wedge of credit supported by a tiny triangle of equity. In banking terms, there's only a small portion of real, quality collateral supporting a huge edifice of asset values. Sovereign government bonds used to count as quality collateral. But the debt crisis has changed perceptions of value and safety. What you have is a financial system supported by very few reliable, quality assets which aren't also someone else's obligation or promise to pay. So let's keep an eye on stocks and see how they hold up. Each new phase of money printing has packed a weaker punch. If the pattern holds, markets will be under pressure soon. And then we'll see if the financial crash is simply a pretext for getting you to surrender your liberty as well as your money. Regards, Dan Denning, Your Liberty and Your Money originally appeared in the Daily Reckoning. The Daily Reckoning, published by Agora Financial provides over 400,000 global readers economic news, market analysis, and contrarian investment ideas. ". |

| Gold Price Rose $1.70 to $1,763.80 Correction still Looks Likely Posted: 25 Sep 2012 04:30 PM PDT Gold Price Close Today : 1763.80 Change : 1.70 or 0.10% Silver Price Close Today : 33.886 Change : (0.035) or -0.10% Gold Silver Ratio Today : 52.051 Change : 0.104 or 0.20% Silver Gold Ratio Today : 0.01921 Change : -0.000038 or -0.20% Platinum Price Close Today : 1631.80 Change : 9.80 or 0.60% Palladium Price Close Today : 639.70 Change : -4.65 or -0.72% S&P 500 : 1,441.59 Change : -15.30 or -1.05% Dow In GOLD$ : $157.72 Change : $ (1.33) or -0.83% Dow in GOLD oz : 7.630 Change : -0.064 or -0.83% Dow in SILVER oz : 397.14 Change : -2.58 or -0.65% Dow Industrial : 13,457.55 Change : -101.37 or -0.75% US Dollar Index : 79.59 Change : 0.049 or 0.06% The silver and GOLD PRICE charts don't offer much more comfort today. Gold rose $1.70 to $1,763.80 while silver lost 3.5 cents to 3388.6c. The GOLD/SILVER RATIO rose ominously from 51.947 to 52.051. The GOLD PRICE five day chart shows that peak above $1,785 Friday, a crash to $1,755 over the weekend, and a recovery today to $1,775. Today it also backed off to close at the range's lower end. $1,755 is now the sling underneath as $1,775 is the canopy overhead. A break below $1,755 -- today's low was $1,758.96 -- would send gold to visit $1,720 right quickly. 20 DMA stands at $1,732.05., so a drop to $1,720 would turn gold decidedly lower. That all important 150 day moving average is now paralleling the 200 DMA, $1,641.66 to $1,648.25. That would be a logical safety net for gold should it pierce $1,720. Nix all the above and buy gold both-handedly if the GOLD PRICE closes above $1,885. Like gold, the SILVER PRICE 5 day chart also shows a declining right triangle, with lower tops and a floor about 3360. Should silver break 3360c, the 300 DMA stands ready to catch it at 3240c. If that fails then 3100 - 3050c ought to stop it. If you go in for Fibonacci or other fizzly drinks, ponder that 3200c corrects the foregoing move by 38.2%, 3100c by 50%. That offers those levels as targets, too. Dealing in words, I am REALLY picky about using them correctly. Thus was I instantly appalled this morning listening to National Proletarian Radio (Motto: "Using your tax dollars to promote socialism and statism"). They were discussing the ongoing economic "crisis." Crisis? Ongoing? That's a contradiction in terms, for, LO! a "crisis" is a "turning point," "a condition of instability leading to a decisive change," or, medically "the point in a serious disease's course when a decisive change occurs, either to recovery or death." So subtly have the bureaucrats and central bankers and statist cheerleaders tortured this poor word "crisis" that it ceases to have meaning, no, worse still, it has come to signify a PERMANENT condition. Never comes the turning point, never the decisive change, only the eternal emergency, which they must manage. And of course y'all remember, "Necessitie, the tyrant's plea?" Emergency, like war, wraps all sorts of tyranny in the toga of righteousness and patriotism. Yet when you lift the toga, underneath dwelleth still the same old fascists. Crisis, indeed. US dollar index, keeping its snail-ish rally running, added 5 basis points (0.6%) today to end at 79.593. Worse, it appears to be rolling over downward on the five day chart. Yen gained 0.7% to 128.54c (Y77.80), still fluttering below the downtrend line. No news until it breaks above 130 or below 127. Yawn. It's been a rough six days for the euro. Dropped 0.22% again today to close at $129.03 (E0.7750). Barely hovering above 200 day moving average (128.38) and 20 DMA (128.21). Sliding down the downtrend line. Tears lurk in its scrofulous future. The five day Dow chart shows a head and shoulders top with a neckline about 13520. Today the Dow broke that neckline and plunged to a 13,457.49 low, closing just 0.10 point higher. This smashing fall took the down 101,.37 or 0.75%. Today was even more cruel to the S&P500. It lost 15.3 (1.05%, whew!) to 1,441.59. Who am I, natural born fool from Tennessee, to parse the import of these moves? Well, I am fool enough to hazard a guess. All y'all who've pinned on stocks the hopes the hopes for your retirement and later happiness in life don't get too mad at me. I've been warning y'all. Charts for both S&P500 and Dow have traced out near identical patterns. They rose off a June low to create a long rising wedge, then bumped up and through highs for the year. Bear in mind that they might still reach for slightly higher highs, but for right now the chart unfolds only bad news. After trading in an island type pattern (suspect for a reversal), both have traded back down into their rising wedge. For the S&P500 the rising bottom boundary of that wedge (itself no happy omen) hits today about 1,425, and for the Dow about 13, 350. Closes below those push both over a very sharp cliff toward the rocks below. Again I mention that stocks measured in gold are trading below their 200 day and 20 day moving average, having broken down after a long topping process. Might turn up for a final kiss of that 200 DMA, but might just keep on falling like your car keys down a well. This is getting to be too much fun. Delaware, Maine, and Louisiana all showed up to order At Home In Dogwood Mudhole today, not to mention our first order from Russia. Y'all have to buy At Home in Dogwood Mudhole. You'll learn about "Straingin' Bob War,", how the dog we thought was eating our eggs turned out to be a 10 foot snake, and whether to shoot horses after they run away the first time or try to train it out of 'em. I know I have some sensible readers in Rhode Island and Wyoming who will thoroughly enjoy this book. Where are y'all? First order from each of those states gets an additional copy free, autographed and shipped to you at no charge in plenty of time to give as a Christmas gift. For some reason we're having problems with that bitly link. Instead, you can order the book at http://store.the-moneychanger.com/products/at-home-in-dogwood-mudhole-vol1 Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Junior Explorer/GDX Ratio Still At Historical Extremes….Will Explorers Be Rocketing Higher? Posted: 25 Sep 2012 04:00 PM PDT I've been banging the table for the last 6 months about remaining optimistic during bear markets, and becoming incrementally more excited about a particular investment class as the market appears bleaker. Since the release of my favorite mining stocks list at the beginning of September, mid-tier and major gold mining companies have rocketed higher. At this time, they are no longer at "catastrophe" level pricing as they were just 30+ days ago. However, the junior resource exploration market is. The ratio of GDX to many junior exploration plays is varying between 500-800 to 1, while in the previous 3 years, the average was about 100-200 to 1. In my opinion, this moment may be a twilight, the slow and precise tipping-point moment in which the explorers edge up ever so slightly—before a historic boom. And by boom, I mean many of these companies moving up in price by 200%-400% in a matter of days, weeks and months. We saw this type of action occur following the 2008-2009 crash. Here is a ratio chart of one of my favorite junior explorers. A snap-back reversion to the mean prior to this summer, equates to 150%+ move. Many analysts comment that money needs to first move into the upper echelons of the mining sector, before trickling down to the explorers. This is a given. However, the timing of this process cannot be fully predicted, and when it occurs, it happens in a flash. By concluding that you will "wait" for the money to come back in first…is almost like saying, I'll buy a life preserver when the ship starts sinking. We are still in a market environment in which risk is abhorred…and for retail investors, this is the perfect time to take positions in low-volume juniors, without driving the share prices up. Our advantage here in this market, is our size. As mice, we can move in with agility, and calmly wait for the ultimate ground vibrations of the "risk-on" elephants…who always return to the feed. In conclusion, after 3+ years of waiting and hard work, I've identified a small handful of junior explorers, and I've added them to my list of favorite mining stocks. I expect them to perform exceptionally well in the coming months and years, as we move into the next speculative mining cycle. To get immediate access to my list of favorite mining stocks, check out the link below. As always, with all my products, I offer a 100% lifetime guarantee, so if you're not happy–you get every penny back–plus you get to keep the report! "Tek's Favorite Mining Stocks List" Plus 1 yr updates - A list of my favorite 15+ mining stocks plus any change updates made in the next 12 months. ($99.95)

|

| Posted: 25 Sep 2012 03:50 PM PDT September 25, 2012

America's most violent city, Camden, N.J., will lay off its entire police force, breaking all prior contracts, and begin to rely on a county-run force instead. Starting anew, the plan's advocates say, will allow the city to add 130 more pairs of boots on the ground to respond to rampant crime. "Camden Mayor Dana Redd and Frank Moran, the city council president," The Huffington Post reports, "say the city cannot afford its current contract with the police department, which includes generous pension and health care benefits and perks like longevity pay. "Shifting to a county-run force allows the city to negate the current contract and start from scratch with lower salaries and less benefits for officers."

"But just like what we're seeing play out right now, they eventually got in over their heads…"

"The fear quotient has been raised," said Rev. Heyward Wiggins, pastor of the local church. His fellowship once held choir practice on Thursday and Friday evenings. He canceled those. Members are simply too afraid of being out after dark. Fellow Camden resident George Watson feared for his life… and home. He told the local news that "[Criminals will] be coming into the houses… they know you can't call the cops. There won't be any cops to call." And with the current plan, help is even further away — just one of the many things foretold in our "Mother of All Bubbles" forecast here.

With ongoing worldwide labor riots, rising global wages and equalizing expenditures, the cost advantages for American companies to produce goods overseas are shrinking. And according to BCG, a mass migration of jobs back to the United States will be, and already is, taking place. According to BCG's "Made in America, Again" report, in less than three years, the U.S. will have a cost advantage superior to Germany, Italy, France, the U.K. and Japan in several industries including machinery, chemicals, transportation equipment along with electrical and appliance equipment. Also:

If this is all news to you, our resource hound Byron King has been saying this for months. In fact, for so long now that it's become a little drab for Mr. King… and he's moved on to something that he says is right now "on the verge of something with the potential to top them ALL." [Ed note. How do we reconcile the demise of a city like Camden, N.J., and the birth of 5 million new manufacturing jobs? It's a recurrent phenomenon in U.S. history Patrick Cox calls the "Phoenix Event." We began formulating our own "Remade in America" thesis at a small inn located in Fells Point in southeast Baltimore over a year ago. We brought together a new team of researchers and writers to understand what new ideas small companies were bringing to the table. More to come on what opportunities we expect to rise from the ashes... just one of those ideas was coincidentally sprouting right in our own backyard. Don't miss out on the part of The 5 in which you can take action and put some of your money to work by harnessing one of these important new trends. Click here to learn more.

Last year, Venezuelan president for life Hugo Chavez recalled 200 tons of his gold reserves from the hands of "mafia and smugglers," in a plan to end the "dictatorship" of the U.S. dollar. Chavez then announced an oil deal with China, allowing the Middle Kingdom to secure oil supplies in exchange for low-interest loans. Today, they've announced they're joining forces to mine Las Cristinas. In typically humble fashion, Chavez describes the mine as, "one of the biggest resources of gold that exists -- not only in Venezuela, not only in Latin America... but in the world!" Heh. The mine will be taken over by China International Trust and Investment Corp. (Citic). So it goes.

"Let's first consider one of the great mysteries of current Fed policy," Doug writes. "Why is the Federal Reserve paying banks 25 basis points on their excess reserves parked at the Fed? This policy guarantees that banks have greater incentive to do nothing, rather than lend to you and me. In this way, the Fed's policy seems to be at war with Bernanke's stated objectives. "Of course, a quarter point doesn't sound like much. But it has made a world of difference. Since the Fed put the policy in place during the dark days of October 2008, there is now over $1.4 trillion sloshing around the central bank. Before 2008, there were exactly zero excess reserves held by the Fed."

"I don't quite understand," French cites Volcker, "why they're putting all this money into the economy and then paying interest on excess reserves of the banks, which is where the banks are parking some of the money." "And remember," Doug continues. "the Federal Reserve sends most of its income to the U.S. Treasury. The Fed transferred $76.9 billion in earnings to the U.S. Treasury during 2011, but it could have transferred nearly $4 billion more. That won't balance the budget, but that's another few billion dollars that taxpayers are ultimately on the hook for. "It's suspicious if nothing else." [Ed. note. If you missed Mr. French's mind-blowing piece on TAG last week at The 5, this is part deux of the eye-opening series continued here.]

Gold shed $2 from its recent spike and is now sitting on the nose of $1,765.00. Silver lost 18 cents herself… and is now hovering around $33.90.

"It's been a great run," Chris Mayer left us with yesterday about oil. Today, he's back to elaborate on why he thinks oil's downturn is sticking around. "Crude oil is 230% above its long-term average in inflation-adjusted terms," Chris writes. "Besides, it is not as if we can't see what will slay the oil price. There are many sharp swords all over the place. "Let us consider demand. The biggest economies on the Earth — the United States, Japan, China and the EU — are all slowing down or contracting." On the supply side, "New technology continues to unveil giant sources of supply once thought uneconomic. David Fingold, a portfolio manager at DundeeWealth, writes:

"The Bazhenov shale could be another game-changer for the oil industry," Mr. Mayer announces. "It is yet another massive oil source to add to a list that keeps getting longer as new technology cracks open sources once thought unreachable. "People will come up with all kinds of reasons to discount the new oil supplies. But history shows that human beings are creative and tenacious." As Chris mentioned yesterday, "I am interested in putting my money in areas where the odds favor me. Increasingly, I don't see the odds favoring me when it comes to oil prices. To me, oil is much like stocks in 2000 or housing in 2006. It's overpriced and it will come down at some point."

As 2012′s drought wears on, the ever-useless FEMA is usurping responsibility by stating, "There is no national drought policy." Classified as one of the worst in decades, it completely destroyed half of U.S. corn, pushing prices up to record highs.

"FEMA doesn't deal with droughts"… Err…what do you guys do, again? What are some farmers doing to quell this situation? "Kansas dairy farmer Orville Miller says he's replacing about 5% of his cow feed with chocolate," APM continues. "'Cows love chocolate,' Miller says. 'When I feed the cows, they go nosing through their total mixed ration trying to find pieces of chocolate and they'll eat those out first." While Miller also feeds his cows taco shell rejects, other farmers are replacing feed with the more cost-effective french fries, ice cream sprinkles, cereal, cookies, marshmallows and gummy worms. "Cattle can utilize gummy worms just the same way we can," Fanning tells APM. "They put on a lot of weight with those products because they're high in sugar." It gets worse: The farmers are getting the sacchariferous "salvage" from candy companies' throwaway product that's been broken, spoiled or oversugared. Marilyn Noble at the American Grassfed Association, acting as the only apparent voice of reason, says, "Cows were meant to eat grass, not candy."

A carwash in Kuala Lumpur, Malaysia, which been open for three months was raided by police. Apparently, they'd formed a partnership with a local massage parlor in which patrons were able to redeem free sex after their ninth wash.

Levy Li Su Lin, Miss Malaysia: not likely to be the premium for your 10th visit. "To get the extra 'offer,' customers had to send their cars for washing nine times within a certain period," Officer Emmi Shah Fadhil said. "The 10th car wash will entitle them to free sex." Upon raiding the participating massage parlor, the police squad found five customers on their "10th wash." Hmmn…

The 5: Amen.

"Lack of fish returning closed the season early on kings as well as silvers here on the Kenai Peninsula, leaving a lot of tourists very disgruntled, not to mention the average-size halibut on a charter boat less than 20 pounds, with a two-fish limit! How would you like to pay $300 for a six-hour charter and get back about 12 pounds of fillets. Ouch! "It is getting harder and harder to subsist off the land here. Same goes for moose hunting: You have to shoot a bull that is at least 50 inches wide (antlers) or three brow tines. There were only 17 legal moose taken on the entire peninsula last season, and there were over 235 killed by automobiles or starvation. Got to hand it to the gov, they really know to rain on your parade!"

SELF-DISCIPLINE "Needless to say, this country and a lot of others in the West are sorely lacking in this quality. This quality is something no government wants anybody to have and will do and promise anything to take it away from anybody and everybody. All that so they can replace it with innumerable regulations and an autocratic bureaucracy to enforce compliance. What is this thing we seem to be lacking in? It's easy." The 5: Easy for you to say. Scroll up a few time segments. Cheers, Addison Wiggin The 5 Min. Forecast P.S. Moments before we hit "send" on today's 5, we received this email from our options specialist Steve Sarnoff: "FYI: "The small caps are under renewed pressure today, dropping a little over 1%, as euro stress is returning to boost the U.S. dollar and pressure risk asset prices. Our 'protective play' on this unfolding scenario is doing its job… we're up 61% in less than a week. "Thanks, and all the best, "Steve" Mr. Sarnoff's track record has been impeccable. To get in on his next recommendation, please subscribe here. |

| Is Gold Overpriced? Maybe Not Until $2,390 Posted: 25 Sep 2012 03:17 PM PDT 25-Sep (Baron's) — Gold enthusiasts, take note of the latest from Deutsche Bank (DB), whose commodity analysts point as high as $2,960 for an "extreme" gold price. How do you define "extreme"? Some investors might consider today's $1,763 already there. The price record is around $1,900. But there could be room to rise if you think that other measures are more important. [source] |

| Hathaway - Gold Shorts To Panic As This Key Level is Breached Posted: 25 Sep 2012 02:47 PM PDT  Today John Hathaway spoke with King World News about a key level in the gold market that will cause panic among the shorts when it is breached. The four decade veteran and prolific manager of the Tocqueville Gold Fund also believes that gold will surge, "... quite dramatically, several hundred dollars." He believes this will take place after the key level is taken out on gold. Today John Hathaway spoke with King World News about a key level in the gold market that will cause panic among the shorts when it is breached. The four decade veteran and prolific manager of the Tocqueville Gold Fund also believes that gold will surge, "... quite dramatically, several hundred dollars." He believes this will take place after the key level is taken out on gold.Hathaway went on to cover silver, but first, here is what he had to say about what is taking place in the gold market: "It seems to me we are ready to go into a back and fill mode (on gold) because people are going to start looking at the election in the US, and that's probably an excuse not to do too much. One thing that had concerned me, at least in terms of a short-term trading perspective, was a Republican win which would make people think, incorrectly, that all of our problems were over." This posting includes an audio/video/photo media file: Download Now |

| Silvercrest Mines’ Scott Drever Discusses The Shiny Metal’s Prospects 25.Sept.12 Posted: 25 Sep 2012 02:33 PM PDT www.FinancialSurvivalNetwork.com presents Scott Drever has mining in his blood. He's been working in the industry for 45 years. Silvercrest is an actual producer of silver and gold. In fact the name is a misnomer as half their revenue is coming from gold. They've got $33 million in the bank, $10 million in highly liquid inventory and much more on the way. They're also very open to profitable acquisitions and as we know there's no shortage of juniors that are down on their luck and unable to obtain financing for very viable and profitable projects. Therefore, Silvercrest's prospects for growth look quite favorable. But as always, be careful when dealing with juniors. We don't own this one yet, but we might at some point in the future. Go to www.FinancialSurvivalNetwork.com for the latest info on the economy and precious metals markets. This posting includes an audio/video/photo media file: Download Now |

| Gold Daily and Silver Weekly Charts - Slouching Into the End of Quarter Posted: 25 Sep 2012 02:30 PM PDT |

| QE To Have Major Economic Impact On Western Financial World Posted: 25 Sep 2012 02:28 PM PDT Jim Sinclair's Mineset My Dear Extended Family, For years we took major criticism for saying that QE to infinity was guaranteed. Recently we took major criticism for even saying QE itself was possible. Now we take criticism for saying QE to infinity is going to have a major impact economically in the entire Western financial world. All the talking heads and writers are on a tear saying QE will do nothing, emphasizing deflationary scenarios both from within the community to financial TV. Those that take that position are raving morons. The markets today are full of normal manipulation based on the MSM disinformation that QE to infinity is a hollow tool. It is dynamite and will have an impact of historical dimensions, but not necessarily the ones the morons expect. Keep your gold investments. Gold is going to $3500 and beyond, about which there is no question. Stand tall. Don't trade, and shut off the gold naysayers sensationalists we have battled f... |

| Gold Seeker Closing Report: Gold and Silver End Slightly Lower Posted: 25 Sep 2012 02:13 PM PDT |

| Ranting Andy Hoffman–Comex Short Position-Silver Under $35 Or Bust 24.Sept.12 Posted: 25 Sep 2012 01:58 PM PDT www.FinancialSurvivalNetwork.com presents Ranting Andy Hoffman joined us for an update of the metals markets. Seems the elites have drawn a line in the sand–silver will not be permitted to cross the pivotal $35 mark without a fight. Demand is picking up for physical metal and it seems that the elite's ability to affect reality. The manipulation of so many indexes had made them irrelevant. Now the rest of the decoupled world, the Brics in particular, are slowing down. There's no longer any pretense that prosperity is just around the corner. So the enthusiasm for the markets continues to wane and the only real investments left are gold and silver. Go to www.FinancialSurvivalNetwork.com for the latest info on the economy and precious metals markets. This posting includes an audio/video/photo media file: Download Now |

| Platinum: fragility of supply highlights need for global diversification Posted: 25 Sep 2012 12:32 PM PDT Bloomberg News point recently pointed out that this month platinum prices rallied to their highest level since February amidst violent labour conflicts at South Africa's Lonmin Plc's (LON) Marikana mine - which accounts for about 10 percent of global output - and the U.S. central bank's announcement of a third (and perpetual) round of quantitative easing. And now, per the Globe and Mail, "the industrial strife hitting South Africa's mining industry has spread to AngloGold Ashanti, the world's third-largest bullion producer by sales." |

| Jeff Thomas: Manipulation of the gold price Posted: 25 Sep 2012 12:01 PM PDT 2p ET Tuesday, September 25, 2012 Dear Friend of GATA and Gold: A good summary of the Western gold price suppression scheme as construed by GATA has been written by Jeff Thomas of the International Man newsletter and financial advisory service. The essay stresses the use by bullion banks of "paper gold" to discourage investors from putting strains on the market by demanding real metal. But Thomas is confident that the scheme is being found out and is starting to unravel and will lead to a short squeeze and "mania" phase in gold's bull market. Thomas' essay is headlined "Manipulation of the Gold Price" and it's posted at the International Man Internet site here: http://www.internationalman.com/global-perspectives/manipulation-of-the-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Platinum Intercepts Best Pt+Pd+Au Grades Yet Company Press Release VANCOUVER, British Columbia -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) announces more results of its 2012 drill program on the company's fully-owned Wellgreen platinum group metals, nickel, and copper project in southwestern Yukon Territory, Canada. Four surface holes and four underground holes all intercepted significant mineralized widths, ranging from 28.5 meters (WS12-201) and up to 459.5 metres (WS12-193). Highlights include WU12-540, which returned 8.9 metres of 5.36 grams per tonne platinum, palladium, and gold; 1.73 percent copper; and 1.01 percent nickel within 304.5 meters of 0.66 g/t platinum-palladium-gold, 0.20 percent copper, and 0.27 percent nickel. The surface drill program started in June and has completed 16 holes (assays pending for 12 holes) with two rigs now on site. The surface program continues to progress at a steady pace. Prophecy Chairman John Lee commented: "Wellgreen is a very large nickel, copper, and platinum group metals project with near-surface high-grade zones. High-grade intercepts will be incorporated into resource modeling and mine planning in the pre-feasibility study. We expect further positive drill results from Wellgreen shortly." Wellgreen features a low 2.59-to-1 strip ratio, is situated at an altitude of 1,300 meters, and is only 15 kilometers from the two-lane paved Alaska Highway. Those factors significantly minimize the project's indirect costs. For the complete company statement with full tabulation of the drilling results, please visit: http://prophecyplat.com/news_2012_sep11_prophecy_platinum_drill_results.... Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT GoldMoney adds Toronto vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, and the United Kingdom, GoldMoney customers now can store their gold and silver in a high-security vault operated by Brink's in Toronto, Ontario, Canada. GoldMoney also has recently partnered with Rhenus Freight Logistics to offer another gold storage option in Switzerland. The Rhenus vault is in the secured zone of Zurich Airport and offers customers superb security as well as the ability to inspect their gold. Storage at the new vaults in Canada and Switzerland is available at GoldMoney's lowest fees. Customers can select their storage location when placing their buy order. GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata |

| Ted Butler Urges JPMorganChase Board Members to Try Transparency in Silver Posted: 25 Sep 2012 11:55 AM PDT "JPMorgan is now short over 31 percent of the Comex futures market in silver all by themselves." [COLOR=#7f4028] Yesterday in Gold and Silver The gold price was under pressure right from the 6:00 p.m. New York open on Sunday night...and by shortly before 10:00 a.m. Hong Kong time, gold had hit its Far East low price tick of the day, which was around the $1,658 spot mark. From there, the price recovered a bit, before rolling over again about 9:00 am. in London, with the absolute low of the day [around $1,755 spot] coming just minutes after 11:00 a.m. BST. The subsequent rally took gold to its New York high which came just minutes before the 4:00 p.m. BST close in London...11:00 a.m. in New York. The gold price didn't do a whole heck of a lot after that. Gold closed at $1,764.50 spot...down $8.50 on the day. Net volume was very heavy at 178,000 contracts, a big chunk of which were traded before the Hong Kong lunch hour, as volume was pretty heavy ... |

| Net Asset Value Premiums For Certain Precious Metal Trusts and Funds - Sprott Buys More Silver Posted: 25 Sep 2012 11:55 AM PDT |

| LGMR: Gold ETFs Set New Record, Bullion Prices "Should Break Higher After Consolidation Period" Posted: 25 Sep 2012 11:45 AM PDT London Gold Market Report from Ben Traynor BullionVault Tuesday 25 September 2012, 08:00 EDT SPOT MARKET gold bullion prices traded around $1765 an ounce Tuesday morning in London, 1.8% off last Friday's seven-month high. "It looks to me like we've got a short period of consolidation," says Standard Chartered analyst Daniel Smith. "[We'll see] maybe a month of sideways trading possibly and then generally trending higher in the next six months to a year." Stock markets were also broadly flat as major government bond prices gained, while the Euro recovered early losses ahead of a meeting between the leaders of Germany and the European Central Bank. Tuesday also brought fresh news of central bank gold buying, while SPDR Gold Shares (GLD), the world's biggest gold ETF, saw its gold bullion holdings hit a new record Monday at 1326.8 tonnes. Overall gold ETF holdings tracked by newswire Reuters also hit a new record at 2294.3 tonnes. Silver bullion held by the world's biggest si... |

| Measuring Gold Fiat Currency Performance Since 1971 Posted: 25 Sep 2012 11:39 AM PDT In 1971 President Nixon closed the window that allowed U.S. dollars to be sold for gold owned by the U.S. Just before that, the price of gold was $35 an ounce. Since then gold has been called a 'barbarous relic', a term used by Keynes, the famous economist.From that time on, the world's currencies stood merely on the confidence their governments engendered and the control they exercised over international financial dealings of all kinds. That confidence lasted until 2007 when the credit crunch brought government financing on both sides of the Atlantic into question. Up until now the performance of the underlying value of currencies has hidden these questions as exchange rates are adequately 'managed' through swap arrangements to stabilize exchange rate movements to the extent that violent moves don't happen. But the real value of currencies in terms of their real solvency is now a matter of open debate. As of now, relative to the amount of gold available to markets, the price of gold is the only measure of value that currencies can be held to. We look at that and look at the conditions that are determining the value of currencies now and in the future. |

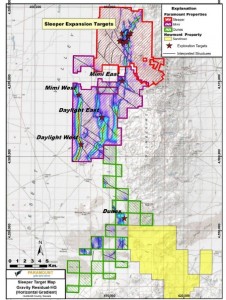

| This Gold and Silver Miner May Be The Next Takeout Target Posted: 25 Sep 2012 11:08 AM PDT In 2010, we predicted the acquisition of Fronteer Gold by Newmont Mining (NEM) for $2.3 billion dollars. See the prediction here. One gold and silver miner which we believe is a near term takeout target possibly before the end of 2013 is Paramount Gold and Silver (PZG). We highlighted this company a few weeks ago and already it has made a powerful move. The primary reasons we believe the majors are looking at Paramount is that they have known advanced NI 43-101 resources of over 100 million ounces of silver and 4 million ounces of gold at their two properties in mining friendly Nevada and the historic Sierra Madre Trend Mexico. This is a company with a major resource base in the two most exciting mining areas in the world. The Sleeper Project in mining friendly Nevada was a past producer and their San Miguel Project surrounds Coeur D'alene's (CDE) highly successful Palmarejo Mine in the world renowned Sierra Madre Gold-Silver Belt. Earlier this year, Pan American Silver (PAAS) acquired Minefinders for access to their Dolores Gold and Silver Mine for $1.5 billion. In 2010, Newmont bought out Fronteer for $2.3 billion. Fronteer's Sandman Mine, now controlled by Newmont is very close to Paramount's Sleeper Project. We believe this takeout trend will continue with Paramount possibly being one of the next targets. Paramount announced today that new core drilling on its 100%-owned Sleeper Gold Project in Nevada is expanding the size of the recently discovered PAD zone. The company recently released a Preliminary Economic Assessment which demonstrated that they could produce approximately 172,000 ounces of gold annually over 17 years at a gold price below $1400. These recent results is demonstrating that the company is continuing to improve the already profitable economics. Paramount's CEO Christopher Crupi commented: "With the successful completion of the Sleeper PEA, we are now working to optimize the project`s economics by adding close-in resources at a higher average grade. One core rig is focused on targets in the vicinity of the original Sleeper mine site to find satellite deposits. We also have a reverse circulation rig drilling the recently acquired MIMI claims, located south of Sleeper towards Newmont's Sandman project, where our geologists have defined several priority targets with the potential to discover a high grade deposit similar to the original Sleeper mine." In addition to their exciting Nevada project, their San Miguel Project located in the Sierra Madre's is an exciting area for the majors and Coeur has recently shown that they are looking for resource growth especially around Palmarejo as this mine is the biggest contributor of cash flow out of all their operations. San Miguel seems an obvious target looking at their land position, especially as we see jurisdictions such as Bolivia, Argentina and Peru dealing with increased resource nationalism. Recent drilling results at San Miguel appeared to be quite positive and a Preliminary Economic Assessment (PEA) is expected by year end. The company has plenty of cash in its treasury of $28 million and has a strong insider and institutional base of over 35%. There is plenty of liquidity as it trades over 150,000 shares a day.

Paramount appears to be breaking out of downtrend and a base of over 18 months. Now it has made an 8 month cup and now in September is forming the handle near 2012 highs. The 50 and 20 day has crossed above the 200 day. This is called a golden cross and may predict a positive move similar to late 2010 when Paramount rallied from $1.25 to $4.25. We believe if you look at the comparables of previous acquisitions such as Minefinders, Fronteer and AuEx that a $6 target is reasonable. See my video interview from a few weeks ago with Paramount CEO Chris Crupi as we discuss the progress in Nevada and Mexico and why Paramount is in a strong financial position to explore and expand their already large resource base.

Make sure to subscribe to my premium service to receive reports on a timely basis by clicking here… Disclosure: Long PZG and Paramount is a featured company on GST's Free Website

|

| Is JP Morgan Shorting Paper Metals While Acquiring Massive Physical Stockpiles? Posted: 25 Sep 2012 10:59 AM PDT As silver investors are likely aware, leading silver analyst Ted Butler has openly speculated whether JP Morgan's alleged massive short silver position is held on behalf a client such as the Federal Reserve (with the intent to prop up the … Continue reading |

| Posted: 25 Sep 2012 10:32 AM PDT My Dear Extended Family, Twice today the manipulators hit gold at $1775 again. That adds up to 9 body blocks at that price. The manipulation is so transparent it is sad. The manipulators own Washington and do not fear any regulator or regulation. They are free to rape and pillage. This is 1979 all Continue reading In The News Today |

| Gold Firm but Unable to Continue through Upside Resistance Posted: 25 Sep 2012 10:28 AM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] Gold is trading firmly today as risk appetite is back on after a bit of a hiccup yesterday. Many investors/traders are growing a bit more sanguine about the impact of any QE program and are still concerned about slowing global economic growth in spite of Central Bank actions to stimulate borrowing and spending. That is leading to more two-sided trade in gold, and in silver I might add, as traders sort out clues to see which direction the economy might be taking. Frankly, I think it is pathetic that we have reached a point in our nation's history that the actions of the Fed have so discombobulated common sense. No one knows whether to call "Good", "Bad" or "Bad", "Good", as far as any impact on the direction of the stock market. In other words, we really have reached a point where many traders do not know what to do with either good or bad news. If the news were to become too "good", traders are... |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Jim Sinclair's Commentary

Jim Sinclair's Commentary Did printing vast quantities of money work for the Weimar Republic? Nope. And it won't work for us either. If printing money was the secret to economic success, we could just print up a trillion dollars for every American and be done with it. The truth is that making everyone in America a trillionaire would not mean that we would all suddenly be wealthy. There would be the same amount of "real wealth" in our economy as before. But what it would do is render our currency meaningless and totally destroy faith in our financial system. Sadly, we have not learned the lessons that history has tried to teach us. Back in April 1919, it took 12 German marks to get 1 U.S. dollar. By December 1923, it took approximately 4 trillion German marks to get 1 U.S. dollar. So was the Weimar Republic better off after all of the "quantitative easing" that they did or worse off? Of course they were worse off. They destroyed their currency and wrecked all confidence in their financial system. There was an old joke that if you left a wheelbarrow full of money sitting around in the Weimar Republic that thieves would take the wheelbarrow and they would leave the money behind. Will things eventually get that bad in the United States someday?

Did printing vast quantities of money work for the Weimar Republic? Nope. And it won't work for us either. If printing money was the secret to economic success, we could just print up a trillion dollars for every American and be done with it. The truth is that making everyone in America a trillionaire would not mean that we would all suddenly be wealthy. There would be the same amount of "real wealth" in our economy as before. But what it would do is render our currency meaningless and totally destroy faith in our financial system. Sadly, we have not learned the lessons that history has tried to teach us. Back in April 1919, it took 12 German marks to get 1 U.S. dollar. By December 1923, it took approximately 4 trillion German marks to get 1 U.S. dollar. So was the Weimar Republic better off after all of the "quantitative easing" that they did or worse off? Of course they were worse off. They destroyed their currency and wrecked all confidence in their financial system. There was an old joke that if you left a wheelbarrow full of money sitting around in the Weimar Republic that thieves would take the wheelbarrow and they would leave the money behind. Will things eventually get that bad in the United States someday?

The New Jersey city that became the poster child for yawning budget deficits and high crime during The 5's look at how the

The New Jersey city that became the poster child for yawning budget deficits and high crime during The 5's look at how the

No comments:

Post a Comment