Gold World News Flash |

- Ted Butler urges JPMorganChase to try transparency in silver

- Investing in Physical Gold rather than ETF

- Silver outperforms as gold also hits a 2012 high but the best is yet to come

- Richard Russell - A Crashing Sector, Gold & The Fiscal Cliff

- Silver Update 9/24/12 Silver Substitutes

- Chinese Firm Markets Tungsten Filled Gold Bars & Coins!

- Gold Drops but Remains Constructive

- Guest Post: The Wolf In Sheep's Clothing

- A trip back to 1964 proves Silver creates wealth

- Buyers of real metal slowly overwhelming central planners, Turk tells KWN

- GATA Chairman Murphy interviewed by Sprott Money's Neil Lome

- Creating Currency Is a Blank Check for Miners: Leonard Melman

- Audacious Oligarchy: The Double Flash Crash In Gold – Sept 13, 2012

- Get Your Fake Tungsten-Filled Gold Coins Here

- The Silver and Gold Price Lost Ground Today Great Opportunity to Buy at Reduced Prices

- Beating the Wrong Horses

- You Know You Are A Conspiracy Theorist If...

- Open-ended Rally in Gold, Silver and Stocks?

- In The News Today

- Madeline Schnapp – Why Bernanke Launched QE3 Now?

- Winners Lose As Safety Outperforms

- Gold Seeker Closing Report: Gold and Silver Fall With Stocks and Oil

- Gold Daily and Silver Weekly Charts - End of Quarter - When Dollar and the Pound Are But Dust

- How Gold Has Measured Currency Performance…since 1971, when it became a ‘barbarous relic’

- Turk - There Is A War Going On In The Gold & Silver Markets

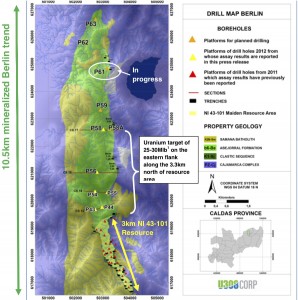

- Major Capital Accumulating This Fast Growing Uranium Miner In Colombia

- Gold:Silver Ratio Suggests MUCH Higher Price of Silver in Next Few Years

- Post Credit Crisis Performance Gold, Silver and the Dow Jones

- Get Your Orders In Today In Time For Christmas Gift Season!!!

- How Gold and Silver Provide a Safe Haven in Today's Troubled World

| Ted Butler urges JPMorganChase to try transparency in silver Posted: 24 Sep 2012 11:08 PM PDT 1a ET Tuesday, September 25, 2012 Dear Friend of GATA and Gold (and Silver); Having pretty much given up on the U.S. Commodity Futures Trading Commission, which can't seem to do anything about the concentrated short position in silver maintained by JPMorganChase, silver market analyst Ted Butler discloses that he has appealed to JPMorganChase board members. He hasn't gotten a reply yet. Butler's commentary is headlined "Transparency" and it's posted at GoldSeek's companion site, SilverSeek, here: http://www.silverseek.com/commentary/transparency-6501 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT GoldMoney adds Toronto vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, and the United Kingdom, GoldMoney customers now can store their gold and silver in a high-security vault operated by Brink's in Toronto, Ontario, Canada. GoldMoney also has recently partnered with Rhenus Freight Logistics to offer another gold storage option in Switzerland. The Rhenus vault is in the secured zone of Zurich Airport and offers customers superb security as well as the ability to inspect their gold. Storage at the new vaults in Canada and Switzerland is available at GoldMoney's lowest fees. Customers can select their storage location when placing their buy order. GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Intercepts Best Pt+Pd+Au Grades Yet Company Press Release VANCOUVER, British Columbia -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) announces more results of its 2012 drill program on the company's fully-owned Wellgreen platinum group metals, nickel, and copper project in southwestern Yukon Territory, Canada. Four surface holes and four underground holes all intercepted significant mineralized widths, ranging from 28.5 meters (WS12-201) and up to 459.5 metres (WS12-193). Highlights include WU12-540, which returned 8.9 metres of 5.36 grams per tonne platinum, palladium, and gold; 1.73 percent copper; and 1.01 percent nickel within 304.5 meters of 0.66 g/t platinum-palladium-gold, 0.20 percent copper, and 0.27 percent nickel. The surface drill program started in June and has completed 16 holes (assays pending for 12 holes) with two rigs now on site. The surface program continues to progress at a steady pace. Prophecy Chairman John Lee commented: "Wellgreen is a very large nickel, copper, and platinum group metals project with near-surface high-grade zones. High-grade intercepts will be incorporated into resource modeling and mine planning in the pre-feasibility study. We expect further positive drill results from Wellgreen shortly." Wellgreen features a low 2.59-to-1 strip ratio, is situated at an altitude of 1,300 meters, and is only 15 kilometers from the two-lane paved Alaska Highway. Those factors significantly minimize the project's indirect costs. For the complete company statement with full tabulation of the drilling results, please visit: http://prophecyplat.com/news_2012_sep11_prophecy_platinum_drill_results.... |

| Investing in Physical Gold rather than ETF Posted: 24 Sep 2012 10:19 PM PDT |

| Silver outperforms as gold also hits a 2012 high but the best is yet to come Posted: 24 Sep 2012 10:15 PM PDT by Peter Cooper, Silver Seek:

But over the past month silver is the clear winner. Gold has gained roughly $100 to silver's $5 an ounce. But that translates into a two-and-a-half times bigger price increase for silver than gold. Trend spotting This is a trend that ArabianMoney thinks is going to become a commodity investor's best friend. We wrote about it in our paid-for investment newsletter last month that we are giving to would-be subscriibers on request for this month only (Email us: circulation@arabianmoney.net). The particular silver ETF we recommended in that newsletter is up 26 per cent in three weeks. It is our practice not to give such tips on this website and keep them for subscribers to our newsletter who also get a wide range of other investment ideas each month. |

| Richard Russell - A Crashing Sector, Gold & The Fiscal Cliff Posted: 24 Sep 2012 10:01 PM PDT  The Godfather of newsletter writers, Richard Russell, had a great deal to say about gold, the fiscal cliff, stocks, and a collapsing sector. Here is what Russell had in his latest report: "The US faces a one trillion dollar debt. How will the US get the money to pay off this frightening deficit? The Fed will buy mortgage-backed securities from the banks at the rate of $40 billion a month, thus re-liquifying the banks. The banks will then spend the money on Treasury bonds." The Godfather of newsletter writers, Richard Russell, had a great deal to say about gold, the fiscal cliff, stocks, and a collapsing sector. Here is what Russell had in his latest report: "The US faces a one trillion dollar debt. How will the US get the money to pay off this frightening deficit? The Fed will buy mortgage-backed securities from the banks at the rate of $40 billion a month, thus re-liquifying the banks. The banks will then spend the money on Treasury bonds." This posting includes an audio/video/photo media file: Download Now |

| Silver Update 9/24/12 Silver Substitutes Posted: 24 Sep 2012 09:41 PM PDT |

| Chinese Firm Markets Tungsten Filled Gold Bars & Coins! Posted: 24 Sep 2012 09:12 PM PDT Yesterday news broke that at least 10 tungsten filled 10 oz PAMP gold bars have been discovered in Manhattan's jewelry district. Apparently Louis Vuitton & Coach bags aren't the only thing being counter-fitted by the Chinese, as thanks to Microsoft … Continue reading |

| Gold Drops but Remains Constructive Posted: 24 Sep 2012 08:31 PM PDT courtesy of DailyFX.com September 24, 2012 03:21 PM 240 Minute Bars Prepared by Jamie Saettele, CMT The decline from the high in gold is impulsive (5 waves) but that decline could just as well complete a flat. As such, it is best to refrain from the short side until a drop below last week’s low (1752). Also, the chart shown today highlights a common bullish setup in which RSI slips to new lows while price makes higher (although barely in this case) closes. Focus would shift to 1715 in the event of a 1752 break. LEVELS: 1715 1737 1752 1780 1790 1800... |

| Guest Post: The Wolf In Sheep's Clothing Posted: 24 Sep 2012 08:17 PM PDT Submitted by Nicholas Bucheleres of NJBDeflator blog, Let's call the collection of investors and traders that have been ceaselessly squabbling over the Fed's policy decisions, card players, and let's call Bernanke, the dealer. Throughout this summer and fall, investors have been playing cards against a guarded Bernanke, until September 14's FOMC meeting wherein Uncle Ben slated the Fed to purchase an additional $40billion in agency mortgage-backed securities (MBS) per month (increasing total monthly agency MBS purchases to $85billion). Despite all counter-arguments and despite the fact that central banking is going even beyond unchartered waters, it is now clear that the dealer is being forced to show his hand. These days every pundit and his barber are suddenly central banking gurus and monetary transmission mechanism experts, but while some of them may have an educated guess as to the reality of the matters at hand, none can envisage that which the Fed is able to. What is almost never considered by most wanna-bees is that no one in the world has access to as many economic and financial data sets, metrics, and indicators, and the synthesis thereof, as the United States Federal Reserve. Ben may make mistakes, but he is no fool. When he acts, he either sees present reason to do so, or he is bracing for a future shock. A famous guy named Socrates from the 400s (BC, that is) once said,

Although already agreed upon by the Fed, claims against the pursuance of further monetary action are numerous, and the argument that it fails to ignite the real economy has been proven correct in recent history. The Dallas Federal Reserve President Richard Fisher, who is a non-voting member of the FOMC, has been one of the most reputable and vocal dissenters of further Fed balance sheet expansion:

There is an obvious dissonance between the above metrics and the Fed's decision to further prop up the economy but, let's get back to the card game: That the Fed has enacted another round of easing, even though many of the economic indicators it aims to improve are either robust or have clearly not been effected by recent rounds of liquidity, should be troubling. It means that the Fed foresees imminent headwinds that would be disastrous to our economy in its current state. Maybe Richard Fisher can put it more eloquently than I can. Take it away, Dick.

Sobering words from Richard Fisher; Bernanke has recently been speaking to the notion of helplessness, also. If we want our questions about the economy answered, we should look Bernanke's recent move to intuit an idea of the cards he is playing with. There are disconnects between what is considered the common knowledge of investors, and the behavior of the Fed. This move gave Bernanke's hand away, and it is becoming clear that negative developments around the world (some yet to come to fruition) are cornering Bernanke and forcing him to come to terms with his inability to provide the panacea again. The god-like powers of central banking are being questioned, and maybe Bernanke's 2008 silver-bullet should have been a one-off. Has the writing on the walls faded since 2008? Have we not figured out that whenever the Fed acts, things are either really bad, or are on the way there? Further than that, have we not figured out that the Fed cannot carry the entire economy on its balance-sheet? Do I even need to sarcastically say, "This time it's different!"? Bernanke is not a chump--he is well aware of the short-comings of recent Fed activity and their limited effects going forward. It is quite clear at this point that Ben is pulling his nose out of the textbook and is beginning to act out of last resort. This last resort scenario is confirmed by his preemptive strike and implies that Ben, who has it from the best data in the world, thinks that this economy needs to return to "trend" as quickly as possible in order to weather near-term storms. An important (and I believe severely under-appreciated) tenant of Bernanke's FOMC stance was his response to a question by a journalist after his speech. His response gave coy indication of his implicit goal to elevate the United States economy to a level of momentum which would allow it to overcome future (unspecified) headwinds. Which headwinds might those be?

...and the list goes on. Bernanke is king-of-the-data-hill and it is more than likely that he is privy to negative developments in one or more of the risks facing the US economy that even the most savvy bank economists cannot or may not see. Despite entropy from within its own entity, the Federal Reserve is at it once again. This time, we have recent history to act as reference, which is not very encouraging. For many reasons, some aforementioned, the United States economy is clearly not amenable to Fed balance-sheet expansion anymore, yet, despite dissent and all, the members of the Federal Reserve's Federal Open Markets agreed on September 14th to increase their monthly purchases. This last resort scenario is not just isolated to the United States and the Federal Reserve. The ECB, the Bank of Japan, and the Bank of England are of the most notable "easers" of the last couple weeks. The cases for and against their monetary accommodation are beyond the scope of this article, but the takeaway is the same: central bankers around the world are grasping at straws. It is a matter of time before markets lose complete faith in the recklessness of central planning Ponzi artists, and this reality is self-evident through the late-summer/early-fall hope-rally.

S&P500 (white) & Dow Jones Transportation sub-sector (blue) over two years. One of the withstanding pillars of Dow Theory is the notion that market extremes are determined by comparing extremes in the Dow Jones Transportation sub-sector and extremes in the broader equity market. As is clear above, the S&P is a nudge below all-time highs while the Dow Transportation sector continues to set lows of longer time horizons. According to the century old Dow Theory, and among a plethora of other reasons, it might be time to reconsider the beta of your portfolio. |

| A trip back to 1964 proves Silver creates wealth Posted: 24 Sep 2012 08:00 PM PDT from Silver Enthusiast:

How often have you heard people waxing nostalgic over what prices were fifty, thirty, even just ten years ago? When you hear things like "I remember when gas was a quarter!", it's a little skewed because you have to take into account what the current incomes were at the time and a host of other factors. Sure, they were making around $6,000 a year in 1964 when gas was indeed around a quarter (Google seems to suggest around $.27/gal), but there's a lot of sites out there that can better illustrate the decline of the dollar. What I think would be more interesting is to illustrate the rise of silver relative to purchasing power. Stodgy minds in the media like Jon Nadler, Kitco's omnipresent bearish mouthpiece, love to suggest that metals ownership is only worth a small place in your portfolio to preserve wealth. Looking back through 1964, though, paints a different story. As you know,1964 was the last time the US minted 90% silver coinage. Had you hung on to more of that face-value silver back then, your wealth would have increased substantially: In 1964, ten dimes could often buy you 10 McDonald's hamburgers on a promotion. ($.15/e or 10/$1) To fill up a 12 gallon tank of gas, you'd have to fork over thirteen 1964 quarters to do it. ( $.27/gal) |

| Buyers of real metal slowly overwhelming central planners, Turk tells KWN Posted: 24 Sep 2012 07:02 PM PDT 9p ET Monday, September 24, 2012 Dear Friend of GATA and Gold (and Silver): GoldMoney founder and GATA consultant James Turk today tells King World News that buyers of real metal are slowly overwhelming the paper hangers on the futures exchanges. The shorts and central planners are losing, Turk says, and the mining shares are starting to perform well. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/9/24_Tu... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Fred Goldstein and Tim Murphy open All Pro Gold Longtime GATA supporters Fred Goldstein and Tim Murphy have brought their many years of experience in the precious metals and numismatic coins to All Pro Gold as metals brokers who specialize in the delivery of gold and silver bullion bars and coins as well as numismatic gold and silver coins. Fred and Tim follow these markets closely and are assisted by a team of consultants in monitoring market trends. All Pro Gold offers GATA supporters competitive pricing on all bullion products and welcomes inquiries. Tim can be reached at 602-299-2585 and Tim@allprogold.com, Fred at 602-799-8378 and Fred@allprogold.com. Ask about their ratio strategy and the relationship of generic $20 dollar gold pieces to 1-ounce gold bullion coins. Visit their Internet site at http://www.allprogold.com/. Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| GATA Chairman Murphy interviewed by Sprott Money's Neil Lome Posted: 24 Sep 2012 06:33 PM PDT 8:25p ET Monday, September 24, 2012 Dear Friend of GATA and Gold: Neil Lome of Sprott Money News has just interviewed GATA Chairman Bill Murphy about the manipulation of the monetary metals markets, incorporating questions from Sprott Money clients. The interview, conducted via a Skype video call, is 14 minutes long and is posted at YouTube here: http://www.youtube.com/watch?v=gnPzChgfsfA&feature=youtu.be Full text of the interview is posted at the Sprott Money Internet site here: http://www.sprottmoney.com/news/ask-the-expert-bill-murphy-september-201... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Platinum Intercepts Best Pt+Pd+Au Grades Yet Company Press Release VANCOUVER, British Columbia -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) announces more results of its 2012 drill program on the company's fully-owned Wellgreen platinum group metals, nickel, and copper project in southwestern Yukon Territory, Canada. Four surface holes and four underground holes all intercepted significant mineralized widths, ranging from 28.5 meters (WS12-201) and up to 459.5 metres (WS12-193). Highlights include WU12-540, which returned 8.9 metres of 5.36 grams per tonne platinum, palladium, and gold; 1.73 percent copper; and 1.01 percent nickel within 304.5 meters of 0.66 g/t platinum-palladium-gold, 0.20 percent copper, and 0.27 percent nickel. The surface drill program started in June and has completed 16 holes (assays pending for 12 holes) with two rigs now on site. The surface program continues to progress at a steady pace. Prophecy Chairman John Lee commented: "Wellgreen is a very large nickel, copper, and platinum group metals project with near-surface high-grade zones. High-grade intercepts will be incorporated into resource modeling and mine planning in the pre-feasibility study. We expect further positive drill results from Wellgreen shortly." Wellgreen features a low 2.59-to-1 strip ratio, is situated at an altitude of 1,300 meters, and is only 15 kilometers from the two-lane paved Alaska Highway. Those factors significantly minimize the project's indirect costs. For the complete company statement with full tabulation of the drilling results, please visit: http://prophecyplat.com/news_2012_sep11_prophecy_platinum_drill_results.... Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT GoldMoney adds Toronto vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, and the United Kingdom, GoldMoney customers now can store their gold and silver in a high-security vault operated by Brink's in Toronto, Ontario, Canada. GoldMoney also has recently partnered with Rhenus Freight Logistics to offer another gold storage option in Switzerland. The Rhenus vault is in the secured zone of Zurich Airport and offers customers superb security as well as the ability to inspect their gold. Storage at the new vaults in Canada and Switzerland is available at GoldMoney's lowest fees. Customers can select their storage location when placing their buy order. GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata |

| Creating Currency Is a Blank Check for Miners: Leonard Melman Posted: 24 Sep 2012 05:22 PM PDT The Gold Report: Now that the curtain has been raised and we can see the Federal Reserve's much-anticipated program of a third round of quantitative easing (QE3), what are your thoughts? How do you expect QE3 to affect your portfolio? Leonard Melman: There are two portions to the QE3 program. First, there's the open-ended agreement to buy $40 billion (B) of mortgage assets every month. The second is the commitment to hold and extend short-term interest rates to near zero through mid-2015. What this tells me is that the Fed is essentially throwing in the towel and abandoning conservative economic policies. It is going to stimulate the economy as long as necessary. The Fed's pledge of virtually unlimited money creation will almost certainly have a negative impact on the U.S. dollar, which in turn should have a tremendously positive effect on gold, silver, other precious metals and, to some extent, all other commodities. TGR: Have the Fed's prior QE1 and QE2 programs delivered? LM: ... |

| Audacious Oligarchy: The Double Flash Crash In Gold – Sept 13, 2012 Posted: 24 Sep 2012 04:38 PM PDT Audacious Oligarchy: The Double Flash Crash In Gold – Sept 13, 2012 - JESSE'S CAFÉ AMÉRICAIN For this event, this basically means that if this order represented a true intent to sell, then we should expect additional selling (from the balance of … Continue reading |

| Get Your Fake Tungsten-Filled Gold Coins Here Posted: 24 Sep 2012 04:34 PM PDT In the aftermath of the recent stories about Tungsten-filled 10 ounce gold bars discovered in midtown Manhattan, there have been two broad sentiments expressed by the precious metals community: i) that this is as many have expected, and that of the physical inventory in circulation, much is fake (particularly that held in official hands, either via ETFs or in sovereign repositories which for various reasons still can not be publicly assayed) and ii) is the comfort that while it is relatively easy and cost-effective to use tungsten to falsify larger gold bars and bricks, those who own primarily gold coins are safe as for some reason, it is less economic, feasible or widespread to counterfeit smaller precious metal denominations. Sadly, while i) may be true, ii) is patently false. The proof comes courtesy of a firm called ChinaTungsten Online which proudly markets its broad "tungsten-alloy services" including, you guessed it, the gold plating of various tungsten formulations among them "gold" bricks, bars and, yes, coins. Oh did we mention a Chinese company openly advertizes its tungsten gold-plating and precious metals replication services, something which the tabloid media's CTRL-C/V majors openly mock as improbable conspiracy theory. Well, as they say, it is only conspiracy theory until it becomes conspiracy fact. From the website's Tungsten Heavy Alloy Scan Gold Coin section:

Well at least the company that markets itself as proving "all kinds of tungsten fake gold coin" has extensive disclaimers. The point is that anyone wishing to, can procure tungsten-plated gold coins with one simple telephone call. Of course, for those for whom gold coins are not enough, the Chinese firm is happy to provide every other imaginable formulation. Such as Tungsten fake gold bars:

There are many more options, for those who are so inclined, to reinforce their inventory of gold-plated tungsten products on the company's website. And naturally, in addition to the bolded applications of tungsten gold bars, one can conceive of some more. Especially in verticals in which the actual end product does not exist, and all that does exist is a receipt claiming gold is at the end of a rehypotehcation chain. One wonder how many invoices CIF Liberty 33 or various other gold ETF secret "warehouses" one could find upon rummaging through the garbage behind the firm's headquarters in Xiamen. With all that said, perhaps the best use of the abovementioned services would be for a contingency case in which the government of country X, Y and/or Z were to decide to replicate a certain 1930's executive order in a global coordinated attempt to devalue the fiat system not on a relative basis, something which fiat printers are more than capable of, but on an absolute basis by confiscating all the gold in circulation. It just might make such a confiscation more complicated if all the usual suspects were to hand over to said governments not gold but gold-plated Tungsten, which in turn would make the endgame, i.e. the terminal currency devaluation of fiat, that much more problematic. It would be truly ironic if in the end the same Tungsten that is now the bane of precious metals dealers everywhere would be the reason why central bank X, Y and/or Z was unable to destroy its currency sufficient fast. Note: Zero Hedge does not advise, encourage nor endorse its readers to hypothetically exchange their gold inventory for a comparable but worthless yet prominently positioned inventory of "rehypothecated" pseudo-equivalent products - note that only bankers have been known to rehypothecate valuable assets into worthless liabilities - in advance of an even more hypothetical physical gold confiscation order endorsed by the authorities. h/t SilverDoctors |

| The Silver and Gold Price Lost Ground Today Great Opportunity to Buy at Reduced Prices Posted: 24 Sep 2012 04:06 PM PDT Gold Price Close Today : 1762.10 Change : -13.40 or -0.75% Silver Price Close Today : 33.921 Change : -0.646 or -1.87% Gold Silver Ratio Today : 51.947 Change : 0.583 or 1.14% Silver Gold Ratio Today : 0.01925 Change : -0.000219 or -1.12% Platinum Price Close Today : 1622.00 Change : -15.60 or -0.95% Palladium Price Close Today : 644.35 Change : -25.70 or -3.84% S&P 500 : 1,456.89 Change : -3.26 or -0.22% Dow In GOLD$ : $159.06 Change : $ 0.98 or 0.62% Dow in GOLD oz : 7.695 Change : 0.047 or 0.62% Dow in SILVER oz : 399.72 Change : 6.88 or 1.75% Dow Industrial : 13,558.92 Change : -20.55 or -0.15% US Dollar Index : 79.56 Change : 0.048 or 0.06% Following through on Friday's step one of a key reversal, the silver and GOLD PRICE filled out step two today. Silver lost 64.6c to close 3392.1 (Owch! Below 3400c) and GOLD gave up $13.40 to $1,762.10. The SILVER PRICE high today at 3418c began the day lower than its Friday low (3433.2c). Gaps down betray an underlying readiness to fall. At 64.1 cents silver did not fall terribly, but morale was whipped across the face with a cat o'nine tails by the close below 3400c. Ratio jumped from 51.364 to 51.947, also a bearish flag on the track. The GOLD PRICE, too, gapped down over the weekend. Friday's low was $1,769.77 while today's high was $1,767.30. Critical level is $1,755. If gold breaks that level -- and it's now pointed in that direction -- it should tumble quickly toward $1,720. Cheer up, long faces! This is good news, since we want to buy more silver and gold at reduced prices, and now should get the chance. US dollar index continues to wallow upward, a massive 4.8 basis points (0.6%) today to 79.563. Meaningless. Euro fell 0.38% to l$1.2930 (E0.7734), leaving it below the downtrend line. Not a hopeful sign. Yen, on the other hand, gained 0.41% to 128.48 c (Y77.842). This remains in the same old range. Stocks couldn't do anything today. Dow lost 20.55 (0.15%) to 13,558.92. S&P500 lost 3.26 (0.22%) to 1,456.89. This looks bad after Friday's rise into new high territory. Sort of makes it look like a key reversal. But what do I know? I don't work on Wall Street OR wear shark skin suits. On 24 September 1769 a panic on Wall Street ruined thousands. Jay Gould and James Fisk were trying to corner the gold market, President Grant found out who had been bought in his administration, and ordered enough gold sold to break them. I suppose even a blind squirrel finds an acorn now and then. Readers from 45 states have now ordered my new book, At Home In Dogwood Mudhole. Where are y'all, Delaware, Louisiana, Maine, and Rhode Island? New orders came in from Belize, Hong Kong, Viet Nam, Portugal, Zimbabwe, Kenya, and Wales. Yes, in Tennessee we count Wales a country. And to our friend in Wales and Slovenia: your emails are being returned. We've got a solution. Email us. I forgot to tell y'all that At Home in Dogwood Mudhole contains my own hand-drawn maps, like the map of the Massive Planned Pasture Adjustment. Inside you will also learn how to teach pigs to jump rope, terrorists in Wayne County, water-witching, and the Demon Cow. Read it, and if you don't think it's the best thing to come out of Tennessee since Davy Crockett, I refund your money and you can keep the book and use it to start fires with. I am extending the same Special-Special Offer one more day. Be the first to order from your state or country, and you'll get two books for the price of one. Order at htty://bit.ly/ahidm-vol1 Better hurry. My generous gland is about to shut down. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Posted: 24 Sep 2012 04:00 PM PDT September 24, 2012 [LIST] [*]"The U.S. is sinking"... Jeffrey Tucker discovers why the U.S. is now #18 in global economic freedom... [*]The invisible bread line continues to grow... Eric Fry drops in from Nicaragua to explain why America refuses to teach its citizens how to fish... [*]While the economy deteriorates, Byron King has one potentially profitable product that could be hot as the iPhone as early as Christmas... [*]Mr. Market's case of the Mondays... Why oil is on its way down... did Germany just foretell an upcoming gold standard? Why one reader thinks we're "beating the wrong horses"... and more! [/LIST] "The U.S. is sinking," our book maven Jeffrey Tucker writes, "now down to the 18th freest in the world, below Finland and Canada." Over the weekend, Jeffrey interviewed economics professor and editor of the Economic Freedom Index, Robert Lawson, and posted it to the Laissez Faire Blog. According to Mr. Lawson's 2012 Economic ... |

| You Know You Are A Conspiracy Theorist If... Posted: 24 Sep 2012 03:06 PM PDT Submitted by Mike Krieger of Liberty Blitzkrieg blog,

If you answered yes to more than five of the 32 questions above, you might be a conspiracy theorist. You also may be on the government's terror watch list. Be very alarmed and report it to the authorities immediately should you discover your neighbors engaged in such uncivilized thought. |

| Open-ended Rally in Gold, Silver and Stocks? Posted: 24 Sep 2012 03:02 PM PDT |

| Posted: 24 Sep 2012 02:51 PM PDT Jim Sinclair's Commentary It is. Is gold heading to $4,500? Commentary: Are gold fundamentals, technicals most bullish ever? By Peter Brimelow, MarketWatch Aug. 23, 2012, 2:04 a.m. EDT NEW YORK (MarketWatch) — Gold makes its move. The bugs are rampant. The yellow metal made life very difficult for commentators trying to keep a regular Continue reading In The News Today |

| Madeline Schnapp – Why Bernanke Launched QE3 Now? Posted: 24 Sep 2012 02:44 PM PDT For those who have not yet discovered the delightfully intelligent Madeline Schnapp, Director of Macroeconomic Research (and we think the figurative indispensible "right arm" of Charles Biderman's firm, Trim Tabs Research), the video just below is a good introduction to her valuable insights. We won't spoil the video by saying why. Not yet at least, but over the years we have found Ms. Schnapp's work to be worthy of our time. She has a way of distilling the complex economic issues of our day down to their essence. In this short video she reasons, we think correctly, why Fed Chairman Ben S. Bernanke decided to go full bore with "QE to infinity and beyond," – the unlimited mortgage backed security (MBS) purchases just announced by the Fed. |

| Winners Lose As Safety Outperforms Posted: 24 Sep 2012 02:29 PM PDT Following Friday's two-year high volume levels on the NYSE - as OPEX and rebalancing dominated - today saw reversion to the dismal mean in both cash and futures market volumes. It seems sell-the-news was the meme today as builders (LEN earnings exuberance) and AAPL (less than whisper sales) sold off and broadly speaking we saw the month/quarter's winners lagging as safety and stability lead the way. Utilities bounced, Health care kept going, and as the NASDAAPL reverted, so the underperforming Dow Transports rose. Equity indices closed in the red - once again for a Monday - despite an effort to test back above 1450 in the S&P to see if any willing buyers remained. Cross asset-class correlations were high - quite systemically high - but while Treasury yields closed near their lows (down 2-5bps on the day), S&P futures ended in the middle of their range (back at VWAP). USD strength hurt commodities but Gold managed to outperform its peers (though closed -0.45% compared to USD's +0.22% move). High yield credit underperformed and chatter of postponed and downsized deals suggests a regime shift in exuberance. VIX ended slightly higher, back over 14% though risk premia remained on the high side. Somewhat remarkably - the last six days have seen the S&P drop a stupendous 0.6% - this is the biggest soix-day drop in over 5 weeks and 2nd largest in over 2 months!!!! -0.6% in 6 days!! bwuahahah...

Risk assets generally opened weaker but traded up during the day session...

but it seems like some of the month/quarter's exuberance is being unwound as NASDAAPL underperforms and Trannies outperform...

and in sectors (post-FOMC), Healthcare remains the big winner (a la QE1-Extension discussed earlier) and Utilities finally played catch-up today...

EUR weakness and JPY strength did not help carry traders provide juice to stocks (nor did TSY 2s10s30s) but the USD ended +0.2% from Friday - though well off its highs during the European session...

and while commodities were all lower on the day (USD strength), Oil spurted after the pit close and Gold limped higher during the day (with OPEX tomorrow)...

Charts: Bloomberg

Bonus Chart: CAT leaked its presentation ahead of tomorrow's investor day - noting higher recession chances while trying to sound as upbeat about China as possible - stock is dropping after-hours... as 2015 EPS from $15-20 to $12-18

and the slide... |

| Gold Seeker Closing Report: Gold and Silver Fall With Stocks and Oil Posted: 24 Sep 2012 02:20 PM PDT |

| Gold Daily and Silver Weekly Charts - End of Quarter - When Dollar and the Pound Are But Dust Posted: 24 Sep 2012 02:20 PM PDT |

| How Gold Has Measured Currency Performance…since 1971, when it became a ‘barbarous relic’ Posted: 24 Sep 2012 02:00 PM PDT |

| Turk - There Is A War Going On In The Gold & Silver Markets Posted: 24 Sep 2012 01:58 PM PDT  Today James Turk told King World News there is a fierce battle taking place between the bulls and bears in the gold and silver markets. But Turk noted, "... the uptrend shows the physical buyers of gold and silver gaining the upper hand, while the shorts and central planners are losing this war." Today James Turk told King World News there is a fierce battle taking place between the bulls and bears in the gold and silver markets. But Turk noted, "... the uptrend shows the physical buyers of gold and silver gaining the upper hand, while the shorts and central planners are losing this war." Here is what Turk had to say: "It's a real battleground out there, Eric. It started at the beginning of last week when gold was looking like it would break through $1780 while silver was already climbing through $35. But then the shorts started throwing everything they could at that price advance and stopped both precious metals." This posting includes an audio/video/photo media file: Download Now |

| Major Capital Accumulating This Fast Growing Uranium Miner In Colombia Posted: 24 Sep 2012 12:43 PM PDT Generally, bullish factors may be coming to a confluence in this natural resource market rebound, which we not only predicted almost one year ago, but we reiterated over the summer that such developments of a rotation from the overvalued dollar and treasuries into the undervalued precious metals and miners. The current euphoria may be the "caffeinated" response to a severely oversold market combined with short covering. Discretion in the marketplace is oft the better part of valor. Be assured we are watching this encouraging activity with an eagle's eye. It is most welcome as the mining stocks seek to emerge from their season of discontent-the summer goldrums. The Post Labor Day risk on rally has presented us with a plethora of significant new developments. One company that we recommended in July is U3O8 Corp (UWE.TO or UWEFF). Since that time a lot of institutional interest and analyst coverage has been initiated. The company has also graduated to the TSX from the Venture Exchange demonstrating its rapid growth from a small junior to a mid-tier uranium mine developer. This Berlin Project will gain further awareness as it announces its Preliminary Economic Assessment by year end 2012 and move into Pre-Feasibility. Yesterday, U3O8 Corp confirmed that they extended the mineralization at Berlin over 6.3km, which means that the resource may be about 1.5 times bigger than the original resource which is around 47.6 million lbs. We expect more drill results from the northern portion and further infill results to expand the previous resource estimate. Based on these exploration results showing the continuity of the mineralization to the north, we expect a large increase of uranium, vanadium, phosphate, molybdenum, rhenium, yttrium, neodymium and nickel. We are excited that the company has reiterated its target of producing a Preliminary Economic Assessment by year end 2012. We have been attracted to their flagship Berlin Project in Colombia where they showed incredible uranium resource growth in 2011, almost seven-fold increase and expect to see impressive growth in 2012. The main project is in pro-mining, pro-business Colombia. The Berlin Deposit also contains valuable amounts of phosphate and vanadium and rare earths as a byproduct. U3O8 Corp. has shown some very positive metallurgical recoveries. What is really fascinating about this project is that it might attract the eyes of the majors such as BHP and Rio Tinto who are dealing with rising costs and depleting mines in Austrailia and Africa. The phosphate, vanadium and rare earths may pay the way with the uranium as pure profit. The positive cost aspect of operating in Colombia may make the majors more hungry for this rapidly expanding asset. We expect the downtrend started by the Fukushima Accident to be broken to the upside and the 200 day moving average at $.44 to be regained. It is finding support at its rising 50 day moving average and is forming a major long term bullish symmetrical triangle. Despite an incredible seven fold increase in uranium resources it is still being ignored by the market and priced at long term support near three year lows. This represents an undervalued play that could see a repeat of the fall of 2010 move where it made almost a seven-fold increase in price. Disclosure: Long U3O8 Corp and company is featured on GST's Free Website Sign up for my premium service to get these updates ahead of the masses by clicking here… |

| Gold:Silver Ratio Suggests MUCH Higher Price of Silver in Next Few Years Posted: 24 Sep 2012 12:30 PM PDT The majority of analysts are now of the opinion that gold willreach a parabolic peak price somewhere*in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold, silver could escalate dramatically in price over the next few years. How much? This article takes a look at historical gold:silver ratios and what attaining certain relationships would mean for the price of silver should specific price levels for gold be realized.*Words: 691 So says*Lorimer Wilson, editor of*www.munKNEE.com*in an article outlining the historical price correlation between gold and silver and what it means for the future price of silver as the gold bull runs it course.*Please note*that this complete paragraph, and ... |

| Post Credit Crisis Performance Gold, Silver and the Dow Jones Posted: 24 Sep 2012 12:17 PM PDT Mark J. Lundeen [EMAIL="Mlundeen2@Comcast.net"]Mlundeen2@Comcast.net[/EMAIL] 21 September 2012 There is something to be said about following the markets every day, but taking a longer term view of the markets is always worthwhile. For instance, since their credit crisis lows of four years ago, how has the Dow Jones performed compared to gold and silver? Not so good. Just one quick look at the chart above, shows us that silver has been the place to be for the past four years. Gold and the Dow Jones have greatly lagged silver's performance, and that's been true since 2001; but why? Because silver is a tiny market compared to gold. This is especially so when silver is compared to the stock market. And also because, unlike gold, silver has a steady, continual demand for industrial uses, and its above ground stocks have been greatly depleted. Market commentators who manage billions of dollars of other people's money frequently ignore silver, because as a marke... |

| Get Your Orders In Today In Time For Christmas Gift Season!!! Posted: 24 Sep 2012 11:51 AM PDT |

| How Gold and Silver Provide a Safe Haven in Today's Troubled World Posted: 24 Sep 2012 11:44 AM PDT The reasons for holding precious metals as a relatively safe haven for one's personal wealth are numerous. One common investing thesis for buying precious metals is that these intrinsically valuable commodities can hold their value in times of rising price levels. This characteristic can help American savers keep pace with credit expansion and paper currency debasement. Diversify Out of the Dollar For example, precious metals can provide a safe haven in terms of the diversification they offer relative to holding U.S. Dollars in cash or Dollar-denominated assets. Physical gold and silver investments can take up a core position in an investment portfolio since they offer an easy way to have some wealth stashed out of Dollar-denominated assets. These hard assets also provide a viable alternative to holding foreign currencies or foreign equities. Basically, precious metals allow investors to engage in a new way of thinking, where investment priorities are anchored to r... |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment