saveyourassetsfirst3 |

- Euroland 2012-2016 (Part 2)

- Euroland 2012-2016 (2ème partie)

- PepsiCo Earnings Preview

- Central Bank Gold-Grab Intensifies Further, Part I

- July 23, 1965 : Silver is removed from coinage in the USA

- Gold in Euros “Making Gains” on Stronger Dollar

- Currency Confidence Puncture Accelerating for Euro and USD

- Silver .9999 is the Way

- Huldra Silver Provides Progress Update

- Corvus Drills 72.4 m @ 1.74 g/t gold & 98.7 g/t silver at Yellow Jacket

- Anatomy of a Future Gold & Silver Bubble

- Dollar Printing to Follow Renewed Stock and Oil Market SellOff

- Fed Plans Dollar Devaluation, New Evidence; Why Now?

- “It’s Spreading”: US Census Reports Nearly 100 Million Poor in America; Worst Conditions in Fifty Years

- Andrew Hepburn: Market rigging by central banks is gaining respectability

- Money Is Technology!

- Time To Get To Work

- Gold goes where The Money is

- Bullion's Long Term Support from Ichimoku Technicals

- Gold in Euros 'Making Gains' on Stronger Dollar

- Market Vulnerable to Summer Selling

- Fabian: Collapse Confirmation News 7.23.12

- silverfuturist: Silver tour continues with Shawna

- China's Precious Metals Strategy

- Gold & Silver Market Morning, July 24 2012

- Silver Update: Loco London 7.23.12

| Posted: 24 Jul 2012 12:49 PM PDT - Excerpt GEAB N°62 (February 16, 2012) - 2nd Sequence - 2013-2015: Definition of the implementation of Euroland's international strategy (NATO, UNO, Euro-BRICS, G20…)  If the 2012-2013 period is going to be particularly marked by the stabilization of Euroland's institutional and economic-financial base, nevertheless it's from 2013 that we will see the Europeans' new international maturity. The crisis, and in particular the violent attack suffered by the Eurozone by those who were supposed to be its strategic allies, the United Kingdom and the United States, has in fact radically modified the perception of Euroland's vital interests, not only on the part of its elite but also its citizens. Outside of the fast contracting core consisting of the Eurosceptic/Occidentalist tandem, 2010/2011 has shown Eurolanders that their allies were at least equally present in Moscow, Beijing, New Delhi or Brasilia, as in London and Washington; just like future of their economic, technological and commercial development (1). The trend to the continental Europe/USA-UK geopolitical decoupling had started with the crisis over the invasion of Iraq in 2002/2003. It had then been masked by the coming to power in many European countries, in particular in France, of leaders supported by Washington. The crisis blew the dominant Anglo-Saxon model into smithereens and the Eurozone attack showed that Washington and London were nothing more than allies of circumstance for Europe relegating the special transatlantic relationship of the seventy last years to the level of an historical relic. Between 2013 and 2015, this situation will crystallize in particular along three major axes. On one side, the return of France in its traditional Mitterrand-Gaullist way will imply an important updating within NATO from 2013. The situation is particularly favourable to such a (r)evolution of the old transatlantic machine since the United States no longer has the financial means to impose their will on the European diplomatic and military apparatus (2), and that the analysis of the threats is de facto increasingly divergent. Once the burden of Sarkozy is lifted, European discussion, which on the subject needs a strong French presence to be credible, will find itself completely at odds with that of Washington and London on major issues: Iran, Israel/Palestine, China, Russia,… The "Occidentalists" within the Foreign affairs and Defence ministries are already starting to sense a change in the wind. Most of them having the convictions of their own interests at heart will very quickly convert to the prevailing European viewpoint; the remaining few will join think-tanks whose work will never be read. In practical terms, Euroland will claim control of the European defence theatre - NATO (nomination of European generals in key functions, withdrawal of US nuclear weapons from continental Europe,…) whilst demanding the power to build operational bases for common defence (European HQ, own means,…). The United States will have neither a great wish nor a great capacity to oppose it because of the internal political trends which aim at reducing the size of their own army (3). At the same time, and in the rationale of François Hollande's statements on the usefulness of a European seat at the UN Security Council, one has to expect several French initiatives around the concept of Europe-power. They will involve the European presence in international organisations and the positioning of the French nuclear deterrent in the European defence system. These practical details will be the fruit of the discussions of these informal networks integrating the heads of the ministries and heads of government involved. Probably, the creation of a Euroland geopolitical network will result in the introduction of three major proposals in 2014: the holding of Euroland meetings before important votes of the Security Council to determine the position of Euroland countries sitting on the Security Council (including France), the support for a vast reform of the Security Council and major international institutions creating specific seats for Euroland (2 or 3 according to the institution) instead of national seats, and finally, the establishment of a Euroland "nuclear committee" (probably only Franco-German at the outset) intended to associate the other countries to the French nuclear deterrent (4). As regards global partnerships, Germany having already shown itself as the example at the time of the attack on Libya, Euroland will quickly approach the network of BRICS countries since its economic, commercial, financial, monetary and geopolitical interests converge. We have already had the occasion to address the anticipation on Euro-BRICS relations in the GEAB N°56 in detail and the report of the Europe 2020 seminar on the subject which was held in Moscow in May 2011. We confirm two significant elements here: the holding, at the latest in 2015, of a Euro-BRICS summit which will illustrate the independence of Euroland international activity (5); and importance of the relationship with Europe for the BRICS. We underline this last point because it can appear paradoxical. In fact, the BRICS network is still a very fragile project, bringing together countries often with very divergent, even conflicting interests (which is particularly China's case with respect to Russia and India), and whose principal raison d'être at this stage is together being able to get their voice better heard at world level. The setting up of a Euro-BRICS partnership would further reinforce the nature of the "lever of influence" of the BRICS network, reinforcing its legitimacy and bringing in the European partner with which each BRICS is used to discussing and which can help to structure the multiple sub-networks (education, research, environment, social,…) that the BRICS start to set up. Finally, only the combined Euro + BRICS weight is able to change world governance, to rebalance towards the social dimension the current Anglo-Saxon financial chaos and to recast the international monetary system in particular by replacing the US Dollar by a global currency (a preliminary to any lasting exit from the crisis). In continental Europe, starting from 2012, public opinion will increasingly push so that these developments occur, bringing a strong drive to the closer cooperation between Euroland and the BRICS. This Euro-BRICS co-operation won't avoid difficult questions like that of international trade and the inevitable reinforcement of Euroland customs protection. On the contrary, it will offer a general framework of negotiations making it possible to approach a whole series of convergence and divergence points between Euroland and the BRICS simultaneously. The potential of this embryonic Euro-BRICS co-operation will be tested in 2013 in the framework of the first G20 summit to be held outside the West, namely in Moscow. Russia will be able to put "taboo" questions on the summit's table such as the role and the future of the Dollar in the world monetary system. It will be the occasion for Euroland and the BRICS to discover in vivo if they are able to free themselves from the "world of before the crisis" and build the one "after the crisis". If the test is positive and the G20 debates finally relate to the fundamental problems, then Euro-BRICS co-operation will be launched on a very promising road and it will be it and it alone which is able to give the G20 the legitimacy which it has never had: that of an association where the world of tomorrow really is being prepared. Let's not forget that Euroland and the BRICS represent a big majority of the world's wealth and population. ----------- Notes: (1) The United States and the United Kingdom are insolvent and nothing but a shadow of their former selves in scientific and technological matters. The conquest of space provides a brilliant illustration: Europe is turning at great speed with a capital S to Russia, Japan, India and China for its future partnerships. Washington is no longer able to send men into space by itself (and contrary to US official announcements, this situation will continue for the whole decade at least). And this week once again, the United States had to cancel, for lack of funds, their involvement in the important Exomars mission jointly conceived with the ESA. Source: Cyberpresse, 11/02/2012 (2) And it's not only a question of US military budget cuts. Thus the ongoing failure of the JSF put off Washington's docile allies definitively which is in the process of losing billions for a plane which is never really likely to be operational. The Afghan failure and the Libyan adventure will weigh heavily in the refusal to continue to accept a US leadership which has mainly led NATO into dead ends these last ten years. An eventual attack on Iran would do nothing but reinforce this division between the two sides of the Atlantic and the English Channel. (3) Keep in mind that according to LEAP/E2020, the complete withdrawal of the US troops of continental Europe will be effective in 2017. See GEAB N°59. (4) At the same time, strategically, it is probable that London will be busy trying to find a solution to an independent Scotland's refusal to keep the English nuclear submarine base there. Plymouth is already in the running. Source: Thisisplymouth, 27/01/2012 (5) In fact, this summit will be prepared by the Eurozone and not by the EU. The United Kingdom will probably not be involved, except in so far as radical changes become manifest in London by then. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Euroland 2012-2016 (2ème partie) Posted: 24 Jul 2012 12:30 PM PDT - Extrait GEAB N°62 (15 février 2012) - Séquence 2 - 2013-2015 : Définition et mise en œuvre de la stratégie internationale de l'Euroland (OTAN, ONU, Euro-BRICS, G20, ….)  Si les années 2012-2013 vont surtout être marquées par la pérennisation du socle institutionnel et économico-financier de l'Euroland, c'est néanmoins dès 2013 qu'on va constater la nouvelle maturité internationale des Européens. La crise, et en particulier la violente attaque qu'a subi la zone Euro de la part de ceux qui étaient censés être ses alliés stratégiques, Royaume-Uni et Etats-Unis, a en effet radicalement modifié la perception des intérêts vitaux de l'Euroland, tant de la part de ses élites que de ses citoyens. En-dehors du noyau en voie de rétrécissement rapide constitué par le tandem eurosceptique/occidentaliste, les années 2010/2011 ont montré aux Eurolandais que leurs alliés se trouvaient au moins autant à Moscou, Pékin, New Delhi ou Brasilia, qu'à Londres et Washington ; tout comme l'avenir de leur développement économique, technologique et commercial (1). La tendance au découplage géopolitique Europe continentale / USA-UK avait commencé avec la crise autour de l'invasion de l'Irak en 2002/2003. Puis elle avait été masquée par l'arrivée au pouvoir dans nombre de pays européens, en particulier en France, de dirigeants soutenus par Washington. La crise qui a fait voler en éclats le modèle dominant anglo-saxon et l'attaque de la zone Euro qui a montré que Washington et Londres n'étaient plus pour l'Europe que des alliés de circonstances ont relégué la relation privilégiée transatlantique des soixante-dix dernières années au rang de relique historique. Entre 2013 et 2015, cette situation va se concrétiser notamment selon trois grands axes. D'une part, le retour de la France dans son chemin traditionnel mitterrando-gaullien va impliquer dès 2013 un important aggiornamento au sein de l'OTAN. La situation est particulièrement propice à une telle (r)évolution de la vieille machine transatlantique puisque les Etats-Unis n'ont plus les moyens financiers d'imposer leur domination sur l'appareil diplomatique et militaire européen (2), et que l'analyse des menaces est de facto de plus en plus divergente. Une fois l'hypothèque Sarkozy éliminée, le discours européen, qui en la matière a besoin d'une forte composante française pour être crédible, va se trouver en décalage complet avec celui de Washington et Londres sur les grands dossiers : Iran, Israël/Palestine, Chine, Russie, … Les « occidentalistes » au sein des ministères des Affaires étrangères et des ministères de la Défense commencent déjà à sentir que le vent tourne. La plupart d'entre eux ayant les convictions de leurs propres intérêts se convertiront très vite à l'européisme ambiant ; les quelques autres iront rejoindre des think-tanks dont personne ne lira les travaux. En termes concrets, l'Euroland va revendiquer une prise de contrôle du pôle européen de défense de l'OTAN (nomination de généraux européens dans les fonctions-clés, retrait des armes nucléaires US d'Europe continentale, ...) tout en exigeant de pouvoir construire les bases opérationnelles d'une défense commune (QG européen, moyens propres, …). Les Etats-Unis n'auront ni une grande volonté ni une grande capacité à s'y opposer du fait des tendances politiques internes qui visent à réduire la taille de leur armée (3). Parallèlement, et dans la logique des déclarations de François Hollande sur l'utilité d'un siège européen au Conseil de Sécurité de l'ONU, il faut s'attendre à plusieurs initiatives françaises autour du concept d'Europe-puissance. Elles toucheront à la fois la présence européenne dans les enceintes internationales et le positionnement de la dissuasion nucléaire française dans le dispositif de défense européen. Les modalités seront le fruit des discussions de ces réseaux informels intégrant responsables des ministères concernés et chefs de gouvernement. Probablement, la création d'un réseau géopolitique Euroland conduira à formuler en 2014 trois grandes propositions : la tenue de réunions de l'Euroland avant les grands votes du Conseil de Sécurité pour déterminer les positions des pays de l'Euroland siégeant au Conseil de Sécurité (y compris la France), le soutien à une vaste réforme du Conseil de Sécurité et des grandes institutions internationales créant des sièges spécifiques pour l'Euroland (2 ou 3 selon les institutions) à la place des sièges nationaux et enfin, la mise en place d'un « comité nucléaire » de l'Euroland (probablement seulement franco-allemand à l'origine) destiné à associer les autres pays à la dissuasion nucléaire française (4). En matière de partenariats globaux, l'Allemagne ayant déjà montré l'exemple lors de l'attaque de la Libye, l'Euroland va se rapprocher rapidement du réseau des pays BRICS puisque ses intérêts économiques, commerciaux, financiers, monétaires et géopolitiques convergent. Nous avons déjà eu l'occasion d'aborder en détail l'anticipation des relations Euro-BRICS dans le GEAB N°56 et dans le rapport du séminaire Europe 2020 qui s'est tenu à Moscou en Mai 2011 sur le sujet. Nous confirmons ici deux éléments importants : la tenue au plus tard en 2015 d'un sommet Euro-BRICS qui illustrera l'indépendance de l'action internationale de l'Euroland (5) ; et l'importance pour les BRICS de la relation avec l'Europe. Nous soulignons ce dernier point car il peut paraître paradoxal. En fait, le réseau BRICS est un projet encore très fragile, rassemblant des pays aux intérêts souvent très divergents voire conflictuels (c'est en particulier le cas de la Chine vis-à-vis de la Russie et de l'Inde) et dont la principale raison d'être à ce stade est de pouvoir ensemble faire mieux entendre leur voix au niveau mondial. La mise en place d'un partenariat Euro-BRICS renforcerait encore la nature de « levier d'influence » du réseau BRICS, renforçant sa légitimité et apportant le partenaire européen avec lequel chacun des BRICS a l'habitude de discuter et qui peut aider à structurer les multiples sous-réseaux (éducation, recherche, environnement, social, …) que les BRICS commencent à mettre en place. Enfin, seul le poids conjoint Euro-BRICS est en mesure de modifier la gouvernance mondiale, de rééquilibrer vers la dimension sociale l'actuel chaos financier anglo-saxon et de refonder le système monétaire international notamment en remplaçant le Dollar US par une devise globale (préalable à toute sortie durable de la crise). En Europe continentale, l'opinion publique va pousser de plus en plus à partir de 2012 pour que ces évolutions se produisent, apportant un puissant moteur à la coopération renforcée entre l'Euroland et les BRICS. Cette coopération Euro-BRICS n'évitera pas les questions difficiles comme celle du commerce international et de l'inévitable renforcement des protections douanières de l'Euroland. Elle offrira au contraire un cadre général de négociations permettant d'aborder simultanément toute une série de points de convergence et de divergence entre l'Euroland et les BRICS. Le potentiel de cette coopération Euro-BRICS embryonnaire va être testé dès 2013 à l'occasion du premier sommet du G20 qui se tiendra hors du camp occidental, à savoir à Moscou. La Russie va pouvoir mettre sur la table du sommet des questions « tabous » comme celle sur le rôle et l'avenir du Dollar dans le système monétaire mondial. Ce sera l'occasion pour l'Euroland et les BRICS de découvrir in vivo s'ils sont capables de s'affranchir du « monde d'avant la crise » pour construire celui d'après la crise. Si le test est positif et que les débats du G20 portent enfin sur les problèmes fondamentaux, alors la coopération Euro-BRICS sera lancée sur un chemin très porteur et elle sera à elle seule en mesure de donner au G20 la légitimité qui lui manque toujours : celle d'une enceinte où se prépare vraiment le monde de demain. N'oublions pas qu'Euroland et BRICS représentent une large majorité de la richesse et de la population du monde. ----------- Notes: (1) Etats-Unis et Royaume-Uni sont insolvables et ne sont plus que l'ombre d'eux-mêmes en matière scientifique et technologique. La conquête spatiale en fournit une illustration éclatante : l'Europe se tourne à vitesse grand V vers la Russie, le Japon, l'Inde et la Chine pour ses futurs partenariats. Washington n'est plus en mesure d'envoyer des hommes dans l'espace par ses propres moyens (et contrairement aux discours officiels US, cette situation perdurera au moins toute la décennie). Et cette semaine encore, les Etats-Unis ont dû annuler, faute d'argent, leur participation à l'importante mission Exomars conçue en commun avec l'ESA. Source : Cyberpresse, 11/02/2012 (2) Et il ne s'agit pas que des coupes budgétaires dans le budget militaire US. Ainsi l'échec en cours du JSF a échaudé définitivement les dociles alliés de Washington qui sont en train de perdre des milliards pour un avion qui risque de ne jamais vraiment être opérationnel. L'échec afghan et l'aventure libyenne vont peser lourdement dans le refus de continuer à accepter un leadership US qui a essentiellement conduit l'OTAN dans des impasses ces dernières dix années. Une éventuelle attaque sur l'Iran ne ferait que renforcer cette division entre les deux côtés de l'Atlantique et de la Manche. (3) Gardons en mémoire que selon LEAP/E2020, le retrait complet des troupes US d'Europe continentale sera effectif en 2017. Voir GEAB N°59. (4) A la même date, en matière stratégique, il est probable que Londres sera occupée à essayer de trouver une solution au refus d'une Ecosse indépendante de garder la base des sous-marins nucléaires anglais sur son territoire. Plymouth est déjà sur les rangs. Source : Thisisplymouth, 27/01/2012 (5) Ce sommet sera en effet préparé par la zone Euro, et non pas par l'UE. Le Royaume-Uni n'en sera probablement pas partie prenante, sauf à ce que des changements radicaux se fassent jour à Londres d'ici là. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jul 2012 11:44 AM PDT By David Silver: Before the opening bell on July 25, PepsiCo (PEP) is scheduled to release earnings for its second quarter of fiscal year 2012. The Street is expecting the food and beverage giant to report earnings of $1.10 per share on revenue of $16.59 billion. PepsiCo has surpassed the Street's earnings per share forecast in the past three quarters, but these quarters were far from blowout quarters. PEP has consistently trailed the Coca-Cola company (KO) over the past few quarters on the beverage side of the business. However, the food business for PEP (KO doesn't have a food business) continues to operate extremely well around the world. Europe Snack and Beverage volumes have remained strong. The following chart shows volume growth by segment over the past three quarters. Volumes in Europe and AMEA (Asia, Middle East, and Africa) have remained strong, especially snack volumes as PEP has remained active Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central Bank Gold-Grab Intensifies Further, Part I Posted: 24 Jul 2012 11:25 AM PDT Precious metals commentators (the legitimate ones) are continually striving to tear away the veils of deceit and propaganda, in order to present the global economy (and the world as a whole) in a realistic manner. This, in turn, is done in order to warn people of the grave financial/economic peril which looms ahead of us; thanks to the unholy alliance of unscrupulous bankers and corrupt politicians (and regulators). It is a frustrating task. It is a fundamental trait of human psychology that most people expect tomorrow to be just like today. Couple that inherent defect in thinking with history's greatest propaganda-machine, continually blaring to the masses an endless chorus of "don't worry, be happy"; and the result is as predictable as it is tragic: hordes of lemmings blissfully marching toward the gaping chasm ahead. This is why we continually look for opportunities to demonstrate how the actions of the duplicitous bankers are entirely contrary to their words, and thus reinforce the reasoning and analysis of commentators like myself. Recall how the bankers and their minions in the ivory towers of academia have spent nearly a century attempting to brainwash the masses into believing the absurd proposition that gold was/is "a barbarous relic". To reinforce this Big Lie, the bankers dumped thousands of tons of gold onto the market – gold that (ironically) was actually owned by these same legions of lemmings – because (amazingly) all of the peoples' gold has been placed in the custody of this cabal of private bankers, the central banks. It was a strategy doomed to fail; because today they have no more gold to dump, and their Big Lie has been exposed. Now nothing remains except for them to attempt to (quietly) buy back -- or simply steal -- as much of this gold as possible. This task is greatly complicated by the fact that Western bankers cannot simply go out and re-purchase large quantities of gold on the open market, for myriad reasons (including the fact that gold-buying by other central banks is already soaring to record levels). To begin with, supplies of actual bullion are very tight. We can deduce this in various ways directly: the sixfold increase in the price of gold, the extremely abrupt end to Western gold-dumping, and the naked hunger which governments such as China and India are demonstrating in finding new supply-sources for gold bullion (i.e. ore that hasn't even been dug out of the ground yet, let alone refined). As Forbes Magazine tells us, there are also indirect ways in which we can deduce that actual supplies of bullion are extremely limited, such as the unscrupulous people who sell "paper gold" to Chumps, only for the Chumps to discover that they are holding all "paper" and no "gold". Where did the intrepid sleuths of Forbes Magazine spot these gold-scammers? Halfway around the world in China. There are a few preliminary points to make regarding Forbes' "discovery". First of all it is incongruous (bordering on outright absurdity) that these same Corporate Media talking-heads have spent literally decades scoffing at even the possibility of bullion-scamming of this nature taking place in New York and London; despite mountains of empirical evidence and even a bona fide whistleblower. Indeed, one of these New York fraud-factories has already been fined once for its own "paper bullion" escapades. Yet here we have this (supposedly) prestigious New York financial publication pointing an accusatory finger halfway around the world, even though it openly acknowledges that "details are unclear how the scam worked". Meanwhile, with 25% of Wall Street bankers being openly confessed thieves, the sleuths at Forbes Magazine claim to be totally unable to "see" manipulation and scamming taking place right outside the windows of their own head office – despite a trail of bread-crumbs so obvious that even Inspector Clouseau could get to the bottom of things. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| July 23, 1965 : Silver is removed from coinage in the USA Posted: 24 Jul 2012 11:00 AM PDT Presidency | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold in Euros “Making Gains” on Stronger Dollar Posted: 24 Jul 2012 09:59 AM PDT

U.S. DOLLAR gold prices fell to $1573 an ounce Tuesday morning in London – a few Dollars above last week's low – as stocks and commodities also traded lower, while US Treasuries were flat and German bunds fell after Germany's credit rating was placed on negative outlook. Silver prices briefly dipped below $27 per ounce – 1.2% below where they began the week. On the currency markets, the Euro briefly dropped below $1.21 for the second day in a row, while Euro gold prices hovered around €1300 per ounce – 3.2% off its six-month high. The gold price in Euros has gained 8% since the middle of May. "Thanks to the Euro's depreciation vis-a-vis the US Dollar, gold in Euro terms has been making gains for some time now," says a note from Commerzbank. Ratings agency Moody's said last night that it is placing three Aaa-rated Eurozone sovereigns, Germany, Luxembourg and the Netherlands, on negative outlook. "There is an increasing likelihood that greater collective support for other Euro area sovereigns, most notably Spain and Italy, will be required," said a statement from Moody's. "Given the greater ability to absorb the costs associated with this support, this burden will likely fall most heavily on more highly rated member states if the Euro area is to be preserved in its current form." The German finance ministry responding by insisting that "Germany will, through solid economic and financial policy, defend its 'safe haven' status and continue to maintain its responsible anchor role in the Eurozone". Moody's also said it will "assess the implications" of recent Eurozone developments for Austria and France, whose Aaa ratings the agency put on negative outlook in February. "In all large industrialized countries, AAA is an endangered species," says Joerg Kraemer, chief economist at Commerzbank. "They're all under fire." Spain and Italy meantime both announced short-selling bans on Monday following heavy stock market losses. Spain's regulator CMNV has banned short-selling – by which traders bet on a fall in prices – on all Spanish securities for three months, Reuters reports. Italy's Consob has banned the short-selling of 29 banking and insurance stocks for one week. Spain's Ibex stock index saw the biggest loss of major European bourses in Tuesday morning's trading, falling 2.7% by lunchtime, while Italy's FTSE MIB index was down 1.3%. Both nations introduced short-selling bans last August, which also saw similar bans implemented by Belgium and France. Benchmark yields on Spanish 10-Year government bonds continued to rise Tuesday to just below 7.6%, after two Spanish regions confirmed over the weekend that they plan to seek financial aid from the government in Madrid. Several other regions are also expected to ask for bailouts. Despite this, Spain managed to sell just over €3 billion of three-month and six-month debt at an auction this morning, although borrowing costs were higher than at a similar auction last month. In Italy, ten major cities, including Milan, Naples and Turin, are on the verge of financial collapse, according to a report in newspaper La Stampa, which also reports on growing calls on social media sites for a return to the Lira, as well as for people to withdraw funds from their bank accounts. Italian 10-Year bond yields hit six-month highs at over 6.4% on Tuesday. CME Group, the futures and options exchange operator that runs the New York Comex, announced Monday that is "exploring the concept of having clearing houses or other depositories hold all customer segregated funds". A statement from CME Group said it "is appalled at the recent misuse of segregated funds by two firms, MF Global Inc. and PFG", adding that "the current system in which customer funds are held at the firm level must be re-evaluated". Over in China – which has overtaken India in recent months to become the world's largest source of demand to buy gold – manufacturing has contracted at a slower pace this month than last, according to preliminary purchasing managers index data published by HSBC today. HSBC's flash PMI for this month was 49.5, up from 48.2 in June, with a figure below 50 indicating sector contraction. The survey however showed a faster rate of employment contraction, with the sub-index for employment growth hitting its lowest level in 40 months. "[This] should ring alarm bells in Beijing," says Nikolaus Keis, economist at UniCredit, who adds that he expects authorities to respond with fiscal and monetary stimulus measures. "Creating enough jobs for millions of new graduates and rural migrant workers is crucial for the government." Ben Traynor Gold value calculator | Buy gold online at live prices Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK's longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. (c) BullionVault 2011 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Currency Confidence Puncture Accelerating for Euro and USD Posted: 24 Jul 2012 09:44 AM PDT HOUSTON -- Democracy has a fatal flaw. We allow people who get a check from the government to vote despite the direct conflict of interest. That is why all democracies are doomed eventually to turn into debt monsters that have to be killed off in a great deflationary Armageddon every once in a while. We have the unfortunate condition of being in the stage where that Armageddon scenario has become much more likely and sooner, rather than later. We believe the fiat currencies in use today are a barometer signaling that a major, generational storm is bearing down on the debt-bloated western democracies.

If the work and research we have done on this subject is right, the "good news" is that the events leading up to the eventual bond market collapse, social upheaval and mayhem ought to be extremely profitable for those who prepare for it in advance, don't get sidetracked or bucked off or out of their positions. It ought to be good for "stuff," hard assets, food, fuel, energy, some real estate and some collectibles. Continued... History tells us the effects of unchecked monetary inflation are gradual at first, but once confidence in the currency reaches its final tipping point, the collapse in its value can accelerate with lightening speed.

Tipping Point of no Return

There is no reason to fear that the U.S. will go as far down the road to currency collapse as did the Weimar Republic, but the destruction of the purchasing power of the greenback is already advanced as evidenced in the chart below comparing the U.S. dollar index with gold. Notice that the only breaks in the long term trend have been in times of crisis as wealth seeks the temporary shelter and liquidity of the least sick member of the Fiat Currency Leper Colony.

Gene Arensberg

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jul 2012 09:42 AM PDT The best small investment for the middle-class is several ounce of .9999 silver (Canadian). .9999 will command a high premium in the future and also has a duel use in that it can make a quality colloidal silver to be be used as the best disinfectant ever known. from syyenergy7: ~TVR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Huldra Silver Provides Progress Update Posted: 24 Jul 2012 08:59 AM PDT Vancouver, British Columbia – July 23, 2012 – Huldra Silver Inc. (TSX-V:HDA) (the "Company" or "Huldra") today provides a progress update on the mining operations at its 100% owned Treasure Mountain Property and an update on the construction of its 200 tonne per day mill in Merritt, BC. The second stope at the eastern end of Level 1 of the mine, with a length of 65 metres, a height of 55 metres and an anticipated mining width of 1.5 to 1.8 metres has been mined to a height of 15 metres and is anticipated to be complete before the end of August. 36 locations from the first, third and sixth lifts have been sampled. All samples were delivered by truck to Acme Analytical Laboratories' facility in Vancouver, BC for analysis and will be published once received. Engineering work is being completed for the design of the crown pillar removal and backfilling of the first two stopes. Once this work is complete, the first two developed stopes will be drawn down and the remaining mill feed will be transported to the mill site. This will allow for the mining of a third developed stope between the first two stopes. The third stope has a length of 65 metres and a height of 55 metres. The estimated tonnage of mill feed from the three stopes is 55,000 tonnes. Commissioning of the 200 tonne per day mill in Merritt is scheduled to begin on August 7, 2012. During the mill commissioning the tailings pond and civil works will be completed. All construction is scheduled to be substantially complete before the end of August. Stockpiled mill feed from development work done in 1988 will be used in the commissioning process before the 10,000 tonne bulk sample is processed. Once the bulk sample is complete the Company expects to continue to process mill feed from the current stopes and other mill feed from recently completed development work. There are currently over 100 of engineers, contractors, management and employees working on the mill completion project. About Huldra Huldra is currently working on plans to put its Treasure Mountain Mine, located three hours east of Vancouver, BC, into development, subject to permitting and financing, utilizing a mill being constructed at the Company's mill property outside of Merritt, BC. The Company is also actively assessing other opportunities for acquisition and development. The Company also wishes to confirm that it has not undertaken any preliminary feasibility study or preliminary economic assessment with respect to the Property and does not intend to undertake such a study or assessment prior to making a production decision. The Company cautions readers that such production may not be economically feasible and that there are significant risks associated with making a production decision without a valid, current, economic analysis. Technical information in this news release has been reviewed and approved by Al Beaton, P. Eng, a Qualified Person as defined in NI 43-101. For more information see the Company's technical report entitled "Technical Report, Project Update, Treasure Mountain Property" dated June 7, 2012, available on SEDAR at www.sedar.com. On behalf of the Board of Directors "Ryan Sharp" For additional information contact: NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

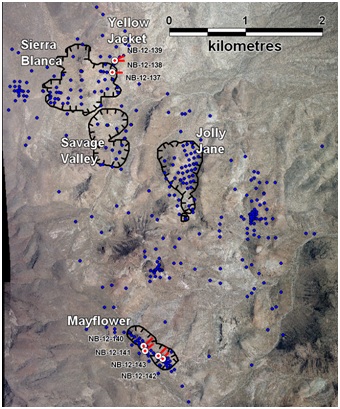

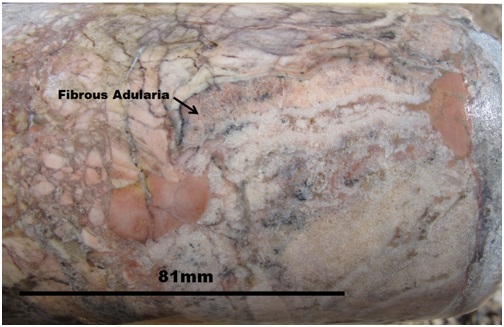

| Corvus Drills 72.4 m @ 1.74 g/t gold & 98.7 g/t silver at Yellow Jacket Posted: 24 Jul 2012 08:42 AM PDT Vancouver, B.C. – July 24, 2012 - Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) is pleased to release the final results from the 2012 phase 1 core drilling program that ended June 2012 at the North Bullfrog Project, Nevada. Final assays from hole NB-12-138 in the Yellow Jacket target area defined a thick mineralized zone around the previously discovered high grade vein (NR12-14, May 23, 2012) that has now expanded the overall intercept to 72.4 metres @ 1.74 g/t gold and 98.7 g/t silver or a gold equivalent* grade of 3.53 g/t (0.114 opt gold equivalent* over 237 feet), beginning at about 40 metres vertically below surface (Table 1). * Gold equivalent grade calculated using a 55 to 1, silver to gold ratio Yellow Jacket Results At the Yellow Jacket target the complete results from hole NB-12-138 has now outlined a thick, near-surface zone of high-grade mineralization which could expand the Sierra Blanca open pit deposit north in this direction (Figure 1). Hole NB-12-139 at the Yellow Jacket target, 60 metres north of NB-12-138 drilled through a fault into the distal footwall zone of the high-grade vein target intersected in hole NB-12-138 and intersected a high-grade quartz veining with 5.14 g/t gold over 1.5 metres. It also encountered extensive explosive hydrothermal zones indicating the target boiling zone lies below this elevation. These new intersections have opened up potential for defining a new, higher grade, bulk tonnage zone of mineralization to the North of the currently defined deposits. In August, a 3D induced polarization (IP) survey will be carried out over Yellow Jacket to evaluate the depth and continuity of this new high-grade discovery. Phase 2 drilling of the Yellow Jacket target is scheduled for Q4 2012, subject to drill permit issuance. Mayflower Deposit Additionally, results from large diameter core drilling at the Mayflower Deposit has validated and enhanced earlier reverse circular (RC) drilling results. This drilling also intersected a massive quartz-adularia vein (Figure 2) which returned high-grade gold within a broader lower grade interval (54.4 metres @ 0.81 g/t gold including 1.1 metres @ 6.85 g/t gold). This intersection and the general higher grade nature of the core drilling over RC drilling results (Table 1) suggests higher-grade mineralization may be underrepresented in the Mayflower resource estimate where the current indicated resource averages 0.38 g/t gold (Technical Report and Preliminary Economic Assessment for the North Bullfrog Project, Bullfrog Mining District, Nye County, Nevada, February 28, 2012). The current phase 2 Mayflower infill drilling program will determine the extent of the higher-grade mineralization and result in an updated resource summary and preliminary economic assessment (PEA) in Q4 of this year. Table 1 Significant Intercepts* from Phase 1 2012 Mayflower and Yellow Jacket Programs

*Intercepts calculated with 0.1 g/t cutoff and up to 2.0 m of internal waste.

Jeff Pontius, Corvus Gold CEO states: "This round of core drilling has opened the door to expanding the Yellow Jacket high-grade system as well as defining a new high-grade target in the Mayflower area 4 kilometres to the south. This ongoing exploration success coupled with our near-term mine development project and ongoing partner funded exploration in Alaska bodes well for adding significant shareholder value in the near future." The current North Bullfrog mine development program is focussing on infill drilling, advanced metallurgical work and environmental baseline characterization studies in conjunction with a completion of a feasibility study by early 2013 on the Mayflower deposit. The recently completed financing has now provided the Company with the financial resources needed to rapidly advance the mine development assessment of the North Bullfrog area as well as continued exploration of this major new high-grade Nevada gold discovery.

Figure 1: North Bullfrog Project area showing the location of drill holes reported in this release and mine pits outlined in the Preliminary Economic Assessment (NR 12-07, Feb. 28, 2012)

Figure 2: Brecciated banded quartz adularia vein from NB-12-141, @ 116 meters. The banded texture of the pink adularia is commonly associated with high-grade mineralization in Bullfrog type gold systems. About the North Bullfrog Project, Nevada Corvus controls 100% of its North Bullfrog Project, which covers approximately 43 km² in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold. The property package is made up of a number of leased patented federal mining claims and 461 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The Company and its independent consultants completed a robust positive Preliminary Economic Assessment on the existing resource in February 2012. The project currently includes numerous prospective gold targets with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an NI 43-101 compliant estimated Indicated Resource of 15 Mt at an average grade of 0.37 g/t gold for 182,577 ounces of gold and an Inferred Resource of 156 Mt at 0.28 g/t gold for 1,410,096 ounces of gold (both at a 0.2 g/t cutoff), with appreciable silver credits. Mineralization occurs in two primary forms: (1) broad stratabound bulk-tonnage gold zones such as the Sierra Blanca and Jolly Jane systems; and (2) moderately thick zones of high-grade gold and silver mineralization hosted in structural feeder zones with breccias and quartz-sulphide vein stockworks such as the Mayflower and Yellowjacket targets. The Company is actively pursuing both types of mineralization. A video of the North Bullfrog project showing location, infrastructure access and 2010 winter drilling is available on the Company's website at http://www.corvusgold.com/investors/video/. Qualified Person and Quality Control/Quality Assurance Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options. Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101. The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. McClelland Laboratories Inc. prepared composites from duplicated RC sample splits collected during drilling. Bulk samples were sealed on site and delivered to McClelland Laboratories Inc. by ALS Chemex or Corvus personnel. All metallurgical testing reported here was conducted or managed by McClelland Laboratories Inc. About Corvus Gold Inc. Corvus Gold Inc. is a resource exploration company, focused in Nevada, Alaska and Quebec, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% owned North Bullfrog, Nevada project towards a production decision while continuing to explore for major new gold discoveries. Corvus is committed to building shareholder value through advancing new gold discoveries to production while leveraging noncore assets via partner funded exploration work into a portfolio of royalty and carried interests in its projects. On behalf of (signed) Jeffrey A. Pontius Contact Information: Ryan Ko | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Anatomy of a Future Gold & Silver Bubble Posted: 24 Jul 2012 08:40 AM PDT Presently, the strength in each major asset class is holding gold back. With both performing well, who needs gold or commodities? However, the long-term outlook for stocks and bonds is not good. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar Printing to Follow Renewed Stock and Oil Market SellOff Posted: 24 Jul 2012 06:43 AM PDT

from wealthcycles.com: It is obvious today, after years of first-hand evidence, that money supply and expectations for changes in the money supply–in other words, dollar printing–impact asset prices and investing more than any other factor. On March 19th we penned End of Covert Dollar Printing Expected to Result in Stock SellOff, making the claim, in the midst of a field of green shoots and sprouts, that sentiment would begin to reflect reality as doubts over further printing became more prominent. We will look at where we stand today, and the criteria for further printing at this point. Tyler Durden, our anonymous friend, provides the chart below. We note that the bottom pane (the blue bars) illustrate average trade size. What we can observe (bottom green circle) is that those with the capability of larger trades sizes, executed at the highs. We alerted our readers of the erroneous excess in sentiment, and therefore an opportunity to reposition from stocks at the highs, into savings, rather than an investing-mode as the storm approaches. A stance we maintain. Keep on reading @ wealthcycles.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fed Plans Dollar Devaluation, New Evidence; Why Now? Posted: 24 Jul 2012 06:38 AM PDT

from beaconequity.com: erohedge.com once in a while posts a bombshell. The latest, This Is The Government: Your Legal Right To Redeem Your Money Market Account Has Been Denied – The Sequel, proves once again that Trends JournalFounder Gerald Celente should top investors' Google News alerts for his latest outlook and commentary. "You don't own your money unless you have it in your possession. And to put some official sanction to an already corrupt banking system, the safest of safe assets, cash, will shockingly turn out to be not safe after all when the big reset nears. In fact, cash, too, will be confiscated through, maybe, another Obama Executive Order, more un-prosecuted fraud and consolidation to benefit JP Morgan, or just an old-fashion overnight currency devaluation, which is usual and customary—and is, presently, the odds on favorite after all attempts by the Fed to jury-rig the banking system fails. Keep on reading @ beaconequity.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jul 2012 06:34 AM PDT from shtfplan.com: It's bad out there. Really bad. As world leaders finally begin to admit that we are smack dab in the middle of another Great Depression and the economy stands at the cusp of another earth-shaking collapse of the financial system, the US census reports that nearly 100 million Americans are now classified as living in poverty or are considered "near poor." That's nearly 1/3 of our populace who are living in the worst economic conditions in nearly fifty years. We haven't seen these highs since the mid '60s. That survey indicates the poverty level has grown from 15.1% to as high as 15.7% [since 2010], and it's spreading at record levels to many socio-economic groups from unemployed workers, suburban families, to the poorest poor. …More discouraged workers are giving up on the job market and unemployment aid is running out. They found that the suburbs are seeing an increase in poverty… Keep on reading @ shtfplan.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Andrew Hepburn: Market rigging by central banks is gaining respectability Posted: 24 Jul 2012 06:09 AM PDT

from gata.org: Dear Friend of GATA and Gold: Writing again for the Canadian magazine Macleans, sometime GATA researcher Andrew Hepburn argues that it wouldn't have been so odd for the Bank of England to intervene surreptitiously with the LIBOR interest rate reports of Barclays Bank, since central banks lately have been intervening, both openly and surreptitously, all over the place, and since academic rationales for more and more market rigging by central banks are gaining respectability. Hepburn's commentary is headlined "Why the Idea of the Bank of England Tampering with LIBOR Isn't as Crazy as You Think" and it's posted at Macleans here: http://www2.macleans.ca/2012/07/23/why-the-idea-of-the-bank-of-england-t… CHRIS POWELL, Secretary/Treasurer Keep on reading @ gata.org | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jul 2012 06:07 AM PDT

from dailyreckoning.com: 07/23/12 Pittsburgh, Pennsylvania – Money, although most people don't view it as such, is technology. Think about it. Money is not a "natural" thing. Money is a human abstraction. Money is an idea that's harnessed to certain standards. For example, archaeologists tell us that primitive societies used colored stones, seashells or pieces of bone as money. Then for much of human history (including now, depending where you are), mankind used gold, silver and copper as money. In the 13th century, Kublai Khan introduced what some consider the first paper currency (the "chao") throughout China — an idea that Marco Polo brought back to Europe. The point is that across the ages, money is a construct — an invented tool — whether it's seashells, gold, paper currency or even digital ones and zeros on a mobile device app. Another way of viewing it is that money is an agreed-upon standard. Money is like time zones, where it's the same time to the east, west, north and south. Money is like a standard unit of measurement, where a pound of steel weighs the same as a pound of feathers. Or money is like the width of railway gauge, so that r Keep on reading @ dailyreckoning.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jul 2012 06:04 AM PDT

from jsmineset.com: My Dear Friends, I am allowed to be tired at times so here are two briefs. Gold: All the funds required to meet state and federal insolvencies will be produced here and there. Since the insolvencies are coming fast, so is QE to infinity with lots of spin and MOPE. The price of gold will go to and through $3500. The physical demand for gold that has produced its resiliency comes from the robber barons with their trillions in fiat currency as well as central banks. The short sellers: A reasonable assumption of the population of stockholders for the 500 meaningful precious metals companies, from exploration to mid tier production, is 1,500,000 stockholders. Arab Spring came from organizing people of like mind and motivating them to take action using high tech methods. The chat rooms are a start even though they are a major tool of the manipulators via bashing. Every company out there should have a website set up by the stockholders to meet and organize. If there is not a legitimate stockholder site out there for your company, start one. The name of the site should be the name of the company stockholder forum. There are many tricks to get the stockholder's site ranked highly on Google and other search engines. Keep on reading @ jsmineset.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jul 2012 05:48 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bullion's Long Term Support from Ichimoku Technicals Posted: 24 Jul 2012 05:31 AM PDT Gold traded sideways in a very tight range (1,572.20-1,578.27/oz.) in Asia and remains in this range after the open in Europe. Gold fundamentals are strengthened as the euro zone's debt crisis deepens. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold in Euros 'Making Gains' on Stronger Dollar Posted: 24 Jul 2012 05:16 AM PDT US dollar gold prices fell to $1,573 an ounce Tuesday morning in London – a few dollars above last week's low – as stocks and commodities also traded lower, while US Treasuries were flat and German bunds fell after Germany's credit rating was placed on negative outlook. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market Vulnerable to Summer Selling Posted: 24 Jul 2012 03:28 AM PDT Here is my forecast after checking on the charts as of July 19th. Dow Jones Industrial Average: Closed at 12943.36 +34.66 on higher volume and supported on mildly rising momentum. A lower base was found at the beginning of June and the price has been gently rising ever since. New resistance is 13,000 and support is 12,900 with the close above all moving averages. We expect the price to peak and sell-off next week in a normal cycle. Watch the dates of July 24 and July 27 for market disruptions and selling. This market is vulnerable to summer selling in this season. Last year at the end of July the Dow sold down 2,000 points. It can happen again but it's difficult to tell to what degree with artificial support. The broader markets are mixed to down in choppy trading from now until the first of August. Beware of September 23-25 when it is possible the Dow could sink -38% to -50% unless severely propped for the election. Post election, we expect larger market moves in the Dow being mostly negative with a potential to drop to 8500-7500. S&P 500 Index: Closed at 1376.51 +3.73 on higher than normal volume and rising momentum. Price is above all moving averages with new hard resistance just under 1400 at 1390-1395. Expect more buying until next Monday or Tuesday. At this date, the index should peak out and level off near 1400 and set-up for selling. Support is 1375 and resistance is 1385. If the trends follow last year, we could be setting up for some serious selling but no crash during the last week of July. Afterwards, expect a new bottom to be forming in the first week of August. S&P 100 Index: Closed at 632.01 +1.75 on higher volume and a rising momentum. Surprisingly, this index, which normally moves slower due to larger company sizes, was tracking along nicely and upward with the other stock indexes. This signal says there is more cash moving into the larger stable companies with exits from the smaller ones, prone to wider price swings and more instability. Resistance is 640-645 and support is 625-630. Price remains bullish being above all moving averages. Expect an index peak price next week followed by new sector selling in the broader markets. Nasdaq 100 Index: Closed at 2655.81 +29.94 on normal volume (the other indexes closed above hard higher volumes). The chart pattern in June and July formed a bear head and shoulders top. However, rather selling off with higher pressure, the Nasdaq recovered and had a breakout above the 20 and 50 day averages. The 200-day average provides a hard, base support at 2500-2513. Today was interesting as the index had a buying gap up but hit a down-trending, longer view top channel line and stalled in place on that line. On nearly 30 points up today, trade was bullish-strong but that top today signaled we are near to a peak and should soon see some selling with our forecast taking the price back to first 2600 and then at least 2500, or more over the next two weeks. 30-Year Bonds: Closed at 150.99, say 151.00 on double top last seen near June 1st. We are in nosebleed territory with these prices and they might even go higher should the Euro make a faster selling move toward 120.00, or even lower. We expect that but not until the 4th quarter of 2012. Look for bond prices to levitate in a peaky-trying-to-sell-action, but support remains strong at 150.00 for now with stocks preparing to sell-off in a normal correction. Momentum was selling but has now supported being flat to sideways. This chop should stay in play until August 1 when the stocks regain some footing. Resistance is 151.00 on the close with support at 150.00. This is not a good trading market until possibly the end of this month. Gold: Closed at 1582.10 +6.60 on flat momentum with the price moving sideways in a continuation triangle from the middle of May. Gold is very close to a breakout within just days. It could happen tomorrow but more likely next week. Most moving averages are nearby and above the close, which remains in negative territory. Last year gold rallied from near $1500 to $1923 in only six weeks. It could happen again but a +50% retracement is $1,736.50 first. We recommend investors and traders who want to be long gold should get ready and fairly quickly. This breakout could come over the weekend in Asia and might even start during the trading day tomorrow on Friday. Silver: Closed at 27.27 +0.06 on gently rising momentum after having posted a small, inverted bullish head and shoulders pattern since the third week in June. To get busy with some serious buying, gold is going to have to show silver some leadership with a stronger upside. Major silver support is 26.62 with resistance at 27.45 on the 20-day moving average. Our forecast is for silver to touch $38.85 on a 50% retracement in September, or in the early 4th quarter. A $10 move up is a big one, but it is possible with some leadership from the gold sector. We should finally find the base support for the next rally during next week. XAU: Closed at 148.02 +1.72 on still declining momentum and a metal to shares ratio that produced a bullish double bottom. The related shares are normally 1-2 weeks behind the rallies in gold and silver but we can see new and mildly higher support on the chart pattern. Support is 145.00. The new moves are higher lows and a tiny continuation sideways move in preparation for a bull breakout. The price of 150 is resistance and all of the moving averages remain higher, which is bearish. It will take some serious precious metals buying to boost the XAU, but we can see it coming next week. US Dollar: Closed at 82.89 with 83.00 resistance and 82.50 support. The dollar had peaked and sold down last month. In mid-June support was found and a new rally took the price from 81.00 to above 83.00. The close is above and supported the nearby 20-day and 50 moving averages. The Euro is now supported and finally quit selling. This stalled the dollar rally. However, we now see both currencies in chop and in a stall mode for the next 4-6 weeks until the first of September. This summer congestion does not provide markets in either currency for traders to find a good trend. Rather, we would focus on a long dollar and short Euro for the month of September for new trading. Crude Oil: Closed at 92.63 on a new fear rally after sinking and supporting to about $77 last month. Iran sanctions and new Middle Eastern violence are creating higher prices. Momentum is up since the first of July on a price oversold condition. Tensions have reached a new level this week and the move from 88.50 to 92.63 was created in our view as a war premium scare. The price of $92.50 is new support and $96.50 is resistance. Politics is out of control on the situation and the entire region's volatility is signaling something bad could happen very quickly and easily. US Navy ships are standing by in the Gulf near Iran. The related energy shares are not doing that well for now, but the trading ETF's are moving in response to the crisis. Expect a small rally to the 200-day average at $94.09-94.50 followed by a pullback to 92.50 next week. CRB: Closed at 304.97 +5.89 in higher momentum and a rising price gap up today on crude oil prices. Grains are also providing hard support on new drought conditions. Gold and silver are poised for new rallies. Some of the other CRB markets like base metals were off but have found new support on media pap from China saying things are ok and under control. We say they are not but now we see harder inflation from numerous sources supporting the CRB. With the price above all averages and a tiny oil correction coming, this market should slip back to 300 hard support and then resume a tiny rally. We forecast some corrective selling in the first week of August. – Traderrog This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fabian: Collapse Confirmation News 7.23.12 Posted: 24 Jul 2012 03:16 AM PDT With the ongoing tragedy in Colorado overtaking the MSM whats not being reported? from fabian4liberty: ~TVR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| silverfuturist: Silver tour continues with Shawna Posted: 24 Jul 2012 03:13 AM PDT silverfuturist: Silver tour continues with Shawna ~TVR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China's Precious Metals Strategy Posted: 24 Jul 2012 03:02 AM PDT by Dr. Jeffery Lewis, silver-coin-investor.com The Chinese currency the Yuan is still pegged to the U.S. Dollar at a level that undervalues it substantially, provoking criticism of this exchange rate policy. The world still believes that China cannot survive and prosper without the West to fund its development, and so most analysts are focused on a hard landing for China. Nevertheless, what is really happening is that new currency swaps are forming the backdrop of Chinese metals accumulation and production. In essence, China is gradually amassing the lion's share of global wealth in the form of hard assets. An amusing quote posted by Tyler Durden at ZeroHedge.com sums this situation up rather well:

The movement first began in Asia, but then spread to South America, and now to Africa. These may seem like small steps, but the ultimate impact could well be a dramatic shift out of the U.S. Dollar. This will make it harder and harder for the United States to continue to sustain its twin deficits and fund its massive national debt. China Encourages Precious Metal Ownership In effect, by encouraging domestic hard asset ownership, this creates a third tier or leg of support for the accumulation of precious metals. This means that China is becoming a global force in the import, production — and now the domestic ownership — of precious metals. China is already a major producer and importer of gold. The country was also a net exporter of silver, but it has now become a net importer of silver. To further support the growing Chinese precious metals market, new metals exchanges are opening.

Perceptually speaking, such a trend will initially be ignored and downplayed by both sides. China would rather buy precious metals while their prices are low and unwind their massive U.S. Dollar positions without creating a market panic. Furthermore, to strengthen its funding position, the United States will continue to chant the strong Dollar mantra. Nevertheless, as the official announcement of such an intention approaches and Chinese metals buying becomes increasingly evident, the affected precious metals market(s) will have little choice but to rally substantially. For more articles like this, and to stay updated on the most important economic, financial, political and market events related to silver and precious metals, visit http://www.silver-coin-investor.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold & Silver Market Morning, July 24 2012 Posted: 24 Jul 2012 03:00 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Update: Loco London 7.23.12 Posted: 24 Jul 2012 02:58 AM PDT BJF discusses a Forbes article on the Asian gold scam in Silver Update 7/23/12 Loco London from brotherjohnf: ~TVR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment