saveyourassetsfirst3 |

- COMEX Swap Dealers Ease Back to Net Short Gold

- Gold: Technical or Fundamental Analysis?

- MineWeb Notes Jim Sinclair's Call to Arms Against Market Manipulation

- China Gold Scam Could Translate Into Higher Demand

- Three King World News Blogs/Interviews

- America’s Competitive Spirit

- How to Profit From Europe's New Gold Rush

- Gold price up by Rs 50, silver Rs 200 on global cues

- Gold last hope for Sudan to avert economic collapse

- How to Profit from Gold with a Proven System from Absolute Wealth

- Gold to Remain Range Bound as Investors Weigh Fed and Europe

- Links 7/21/12

- Libor Scandal Apologist Avinash Persaud Displays Inability to Do Math

- Gold Price Range “Flat and Contracting”, Helping Spain “Is in Germany's Interest”

- Gold Q2, 2012 – Investment Statistics and Commentary

- It's a fine line between gold manipulation and intervention

- Explaining Wage Stagnation

- Greyerz: $1.5 Quadrillion Bubble & Gold Into The Stratosphere

- Syria and Iran Under Attack, Families Turn to Gold for Stability

- Gold set for weekly decline

- Corn price concerns increasing

- Are gold mining stocks too risky?

- Silver Is Undervalued

- Sic Semper Tyrannis

- Silver Stuck In Tight Range Above $27

- Olympic False Flag Or Total Diversion–By Brigadier General Friend Retired

| COMEX Swap Dealers Ease Back to Net Short Gold Posted: 21 Jul 2012 08:04 AM PDT

HOUSTON -- One week ago we reported that for only the third time in the six years of Commodity Futures Trading Commission (CFTC) disaggregated trader data, commercial futures traders the CFTC classes as Swap Dealers reported a net long position in gold futures on the COMEX bourse in New York. (Link to the July 14 article.) New data released by the CFTC Friday, July 20, show that the veteran Swap Dealers are no longer net long, but they are not all that net short either.

So as gold edged about $16 higher in the choppy, range bound COT trading week, the traders classed as Swap Dealers flipped from 799 contracts net long (which is unusual) back to 618 contracts net short, a net swing of 1,417 contracts added to the net short side of the equation. (A rather small move, barely visible in the chart above.) Meanwhile, as shown in our weekly recap of COMEX DCOT trader positioning yesterday, Producer/Merchant commercial traders, which include bullion banks and the largest bullion dealers, increased their net short positioning by a modest 4,636 lots to show a net 158,201 contracts net short. Continued... All the other classes of traders, Managed Money, Other Reportables and Non-Reportables reported higher net long positioning, with smaller traders doing the bulk of the net buying, as shown in the DCOT recap linked above. Swap Dealers are commercial derivatives traders who primarily trade in the form of swaps in other markets and then hedge those sophisticated positions using futures contracts. The CFTC requires all large traders to report their open positions as of the close on Tuesday each week and then releases that Commitments of Traders (COT) data to the public, usually the following Friday. A net long futures position benefits if prices rise. A net short position increases in value if prices fall. Either or both positions can be used to hedge opposite exposure in the same market or in other markets. The bottom line for this message is that it didn't take very much of a rise in gold to send the normally net short Swap Dealers back from net long to net short, but they are not very far from net flat, which is itself remarkable. Traders we correspond with are nearly unanimous that is a more bullish than bearish condition, especially taken in context of Managed Money traders covering or reducing their short bets by a larger 6,340 contracts or 18% to report 28,444 shorts.

Swap Dealers near flat; Managed Money traders near their lowest net long position in four years; Other Reportable traders within 5,000 contracts of their highest ever net long position, all in a summer, light liquidity, nervous environment. The largest trader positioning is a high-octane powder keg recipe for explosive volatility just ahead, we believe. Get ready for the fireworks, but whichever side of the battlefield one favors be sure and MIND YOUR TRADING STOPS (for short term trading). Stick with the real deal physical metal for peace of mind and protection against currency debasement, purchasing power preservation and contagion insurance. We will have more in our subscriber charts by the usual time on Sunday. Subscribers just log in and click on whichever chart is of interest. – Gene Arensberg |

| Gold: Technical or Fundamental Analysis? Posted: 21 Jul 2012 07:00 AM PDT SunshineProfits |

| MineWeb Notes Jim Sinclair's Call to Arms Against Market Manipulation Posted: 21 Jul 2012 05:54 AM PDT ¤ Yesterday in Gold and SilverThe gold price did nothing until the start of London trading. During the next hour or so the smallish rally added five bucks to the price before the high-frequency traders showed up...and within ten minutes of the Comex open, gold's low price tick of the day [$1,572.50 spot] was in. From that low, the gold price developed a positive bias, with the high tick of the day [$1,588.40 spot] coming at 2:10 p.m. Eastern standard time. From that point the gold price got sold down a few dollars before trading quietly into the close. Gold finished the day at $1,584.00 spot...up $2.30 from Thursday's close. Net volume was very light at around 101,000 contracts. Silver's chart pattern was pretty much the same as gold's. Silver's low tick [$26.71 spot] came at 8:45 a.m. in New York...and the high water mark [$27.56 spot] came around lunchtime...and from that high, silver more or less traded sideways into the close of electronic trading. Silver had an intraday price move of 85 cents...and when all was said and done, the price finished up a nickel from Thursday's close. Net volume was pretty decent...around 36,000 contracts. The dollar index did little of anything until shortly after 9:00 a.m. in London trading...and then away it went to the upside...hitting its zenith about 9:50 a.m. in New York...and from there it more or less traded sideways in the close. That rally tacked about 60 basis points on the U.S. dollar index. Most of gold's price decline in London trading can be pinned on this dollar index rally...but that answer runs out of gas at the open of Comex trading, because the relationship fell apart after that. I certainly wouldn't read much into the share price action yesterday, although the index traded above unchanged for most of the day...and the HUI finished up 0.29%. The same can be said for the silver equities, which finished mixed as well. Nick Laird's Silver Sentiment Index closed down 0.27%. (Click on image to enlarge) The CME's Daily Delivery Report showed that there were no gold or silver contracts posted for delivery on Tuesday...and that's the first time in my memory that this report has come up blank in both precious metals at once. There was another withdrawal from GLD yesterday...the third this week. This time it was 77,609 troy ounces. During the past week 485,063 ounces of gold were withdrawn from GLD. Considering the price action, it was probably withdrawn for other reasons. There were no reported changes in SLV. The U.S. Mint had another small sales report. They sold 125,000 silver eagles. Month-to-date gold eagle sales total 17,500 ounces...along with 1,500 one-ounce 24K gold buffaloes...and 1,228,000 silver eagles. There was a fair amount of activity over at the Comex-approved warehouses on Thursday. A total of 304,097 ounces of silver were received...and a pretty chunky 1,079,473 ounces of the stuff were shipped out the door. The link to that action is here. The Commitment of Traders Report wasn't very exciting yesterday. For the reporting week there were slight gains in both silver and gold prices...and the Commercial net short position in silver rose by 1,028 contracts...and gold's Commercial net short position rose by 6,053 contracts. I didn't have the chance to talk to Ted Butler yesterday, so I have no idea whether the increases were caused by the 'usual suspects' going short...or the small commercial traders [Ted Butler's raptors] selling long positions at a profit...or a combination of both. I'll find out for sure when I read his Weekly Review later today. Regardless, it was pretty much a nothing report...and the set-up in both metals is still incredibly bullish. The Central Bank of the Russian Federation updated their website with June's numbers yesterday...and it showed that they added 200,000 troy ounces to their official gold reserves during that month. Their gold reserves currently sit at 29.5 million ounces. Here's Nick Laird's wonderful graph updated with that number. (Click on image to enlarge) Along with the updated chart above, Nick sent along the updated "Transparent PM Holdings" graph. It shows minor declines in all the precious metals. But please note that the long-term trend is firmly up regardless of what's happening with the price. (Click on image to enlarge) Lastly is this chart titled "Buyers of [Very] Last Resort" that I borrowed out of a Daily Reckoning piece headlined "Market Rigging and Price Fixing" by Eric Fry that Roy Stephens sent me...and it's pretty self-explanatory.

I have the usual number of stories for a Saturday...quite a few. And since it's the weekend, I hope you can find the time to at least skim the 'cut and paste' portion that I've included with each news item. The last ace in the hole left to the world's powers that be is the gold card...and it remains to be seen if, or when, they play it. China Gold Scam Could Translate Into Higher Demand. Senior IMF Economist Resigns. Says "Ashamed To Have Had Any Association With Fund At All". GLD has 485,000 ounces of gold withdrawn this past week. ¤ Critical ReadsSubscribeU.S. banks haunted by mortgage demons that won't go awayLenders like Bank of America Corp and Wells Fargo & Co say they are facing mounting pressure to buy back bad mortgages they sold to investors, signaling that banks' home-loan headaches could continue for years. Investors like Fannie Mae and Freddie Mac have been pressing banks to buy back bad mortgages for years, but in recent months those requests have intensified, the banks have said in recent second-quarter earnings reports. These comments from banks provide a fresh reminder of the loose ends that remain from the housing bust that started five years ago. The threat of new expenses and litigation is dampening bank share prices, and the problem could linger for some time, analysts and experts said. "This is not done yet," said Paul Miller, analyst with FBR Capital Markets. "There will be continued surprises in the industry." This Reuters story was posted on their website shortly after the markets closed yesterday afternoon. I thank West Virginia reader Elliot Simon for sending it along...and the link is here.  Now It's the Big Banks That Are Getting Foreclosed OnCall it a case of man bites dog. Since the start of the housing crash, millions of Americans have lost their homes to foreclosure. Many of them lived in homeowner or condo associations. These are organizations that collect monthly dues to pay for amenities, like added security, maintenance and recreational areas; one in five Americans currently lives in an association-governed community. These associations have been hit hard by the housing crisis, as many delinquent borrowers stopped paying their monthly HOA dues. In some cases, HOA's, which do have the authority in many states, managed to foreclose on properties even before the banks, by using the back dues as liens. Now the homeowner associations are taking it one step further. They are going after the banks, claiming that several of the largest lenders are not paying monthly HOA/condo fees on homes they've repossessed and now hold as bank-owned properties (Real Estate Owned, or commonly called REO's). As a 27-year veteran in residential real estate here in Edmonton, this is a process that I'm intimately familiar with. Here in Alberta, arrears in condo fees are in first position on any condominium title...and take precedence over any other financial encumbrance. This CNBC story is Elliot Simons' second offering in a row...and the link is here.  GEITHNER: 'I Have Been The Most F------ Transparent Secretary Of The Treasury In This Country's Entire F------ History'Well, well, well... Treasury Secretary Timothy Geithner has quite the mouth on him. In Neil Barofsky's new book-- "Bailout: An Inside Account of How Washington Abandoned Main Street While Rescuing Wall Street"-- Geithner drops a few F-bombs in his interviews with the former Inspector General for TARP. Like all sociopaths, little Timmy is lying through his f------ teeth. This short story appeared on the businessinsider.com Internet site mid-afternoon on Friday...and I thank reader 'David in California' for bringing it to our attention. It's a very short piece...and the link is here.  Barclays's Diamond Finds a Friend When It CountsImagine you ran a too-big-to-fail bank under criminal investigation by U.S. prosecutors. Now ask yourself this: How much of your company's money would you pay to have the Justice Department inoculate you personally against the prospect of any government charges? If you said "the sky's the limit," you're not alone. Prosecutors often settle claims against corporations in exchange for fines, while letting the executives off scot-free. This brings us to the $160 million non-prosecution agreement that Barclays Plc (BARC) reached last month with the Justice Department, a week before Robert Diamond resigned as its chief executive officer. In essence, although it didn't mention him by name, the Justice Department publicly cleared Diamond of wrongdoing over the way he responded to a pivotal phone call from Paul Tucker, the Bank of England's deputy governor, on Oct. 29, 2008, during one of the worst moments of the financial crisis. Here's the crucial sentence from the "statement of facts" that the Justice Department and Barclays agreed were "true and accurate," as part of their settlement: "As the substance of the conversation was passed to other Barclays employees, certain Barclays managers formed the understanding that they had been instructed by the Bank of England to lower Barclays's Libor submissions, and instructed the Barclays dollar and sterling Libor submitters to do so -- even though that was not the understanding of the senior Barclays individual who had the call with the Bank of England official," the June 26 document said. This op-ed piece by Bloomberg reporter Jonathan Weil was posted on their website on Thursday afternoon...and I thank Washington state reader S.A. for sending it. The link is here.  Sir Mervyn King called Libor review 'wholly inadequate', new emails showRegulators and central banks have been drawn into scandal over the manipulation of the key interbank lending rate which has led to a £290m fine for Barclays and the resignation of the bank's top executives. The newly published emails showed that the Bank of England urged the BBA, the body responsible for Libor, for "greater energy" in overhauling the lending benchmark at the height of the financial crisis. There were widespread concerns about the rate at the time. Barclays, which admitted rigging the rate between 2005 and 2009, is just one of 16 banks being investigated by US, UK and EU regulators. Paul Tucker, now deputy governor at the BoE, said in 2008 that he did not expect the BBA to do a "root and branch review" of Libor, despite concerns raised by over "misreporting" of the rate by Tim Geithner, US Treasury Secretary who at the time was head of the New York Fed. This story was posted on the telegraph.co.uk Internet site yesterday afternoon local time...and I thank Roy Stephens for finding it for us. The link is here.  HSBC Reminds Us Why Anger at Bankers Is the NormYou have to love the chutzpah at HSBC Holdings Plc. At the very moment it's asking the courts to remove a ragged band of Occupy Wall Street protesters encamped under its Hong Kong headquarters, the largest European bank is also reminding the world why many people are so angry at bankers. The subject of the anti-Wall Street crusade isn't much to behold: A few dozen 20-somethings living in tents, lounging on shabby sofas, strumming guitars and handing out pamphlets. Their notoriety is all about location, location, location -- the plaza beneath one of Asia's most iconic buildings in the heart of Hong Kong (HSI)'s financial district. Turns out, HSBC is a more deserving target for the 99 percent than we knew. While it obsesses over a few demonstrators, HSBC has been cited for helping terrorists, drug cartels and other criminals launder money, according to a U.S. Senate investigation. That includes, among others, transactions involving North Korea, Myanmar and Sudan, an axis of evil customers. All the worlds biggest banks are involved in this sort of activity, as there's big money to be made in these activities. Either HSBC Holdings Plc became too big for its britches, or too obvious...and it became the sacrificial lamb. Maybe more banks will receive the same treatment. That's one of the reasons why JPMorgan will no longer deal with the Vatican's bank...just too much shady stuff going on and, as you know, JPMorgan itself wouldn't bear close scrutiny either. This Bloomberg story was posted on their website on Thursday afternoon...and I thank Washington state reader S.A. for his second offering in today's column. The link is here.  Protests in Spain as EU bank aid approvedSpain may soon be getting aid for its troubled banking sector, but that appears to be of no comfort to the Spaniards. After Madrid passed another round of tough austerity measures on Thursday, tens of thousands took to the streets in some 80 cities around the country. The protests, which reportedly saw some 100,000 demonstrators in Madrid alone, were called by the CCOO and UGT trade unions, which reject the government's planned belt-tightening efforts. The two unions have threatened to call a general strike in September. Dozens of injuries and a handful of arrests were reported following scuffles with police. Prime Minister Mariano Rajoy's conservative People's Party (PP), which has an absolute majority in parliament, pushed the controversial plan to cut spending by some €65 billion ($80 billion) through parliament on Thursday, despite staunch resistance from the opposition. The austerity measures include a significant boost in the value-added tax, the abolition of Christmas bonuses for state employees and cuts to unemployment payments. The deep reductions in state spending have been met with widespread resistance, with police officers, firefighters, soldiers, judg |

| China Gold Scam Could Translate Into Higher Demand Posted: 21 Jul 2012 05:54 AM PDT  While this has not been widely reported in the Western media, news broke this week of a massive illegal gold-futures trading scam in China. Not only does it underscore the growing hunger for gold among the newly minted Chinese middle class, but also hits home the rationale for owning physical gold, according to one U.S. based asset manager. Over 5,000 investors were bilked out of 380 billion yuan, or $59.62 billion in a scheme involving Loco London gold since 2008, according to a report in the China Daily. While details are unclear how the scam worked, the implications could be bullish for gold in a number of ways. Perhaps gold prices could be at even higher levels than they are right now, if this money had been properly invested. |

| Three King World News Blogs/Interviews Posted: 21 Jul 2012 05:54 AM PDT  Eric King's 'London trader' source tells KWN that the "LBMA's gold price fixing scheme is about to collapse". We'll see. The second blog is with Egon von Greyerz...and it's headlined "$1.5 Quadrillion Bubble...and Gold Going Into the Stratosphere". Lastly is this Nigel Farage |

| Posted: 21 Jul 2012 05:36 AM PDT From our good friend Frank Holmes at U. S. Global Investors: One of the few things that Barack Obama and Mitt Romney can agree on is that our economy is still struggling to regain its strength. Stubborn unemployment and sluggish growth at home combined with a slowing China and a dysfunctional eurozone have cast a dark shadow on America's eternal optimism. The media favors negative news and the 24/7 cycle of gloom and doubt can be dispiriting. We are always looking for the economic points of light around the globe and strive to provide a counterpoint to the pervasive pessimism. As Warren Buffett once said, "It's never paid to bet against America. We come through things, but it's not always a smooth ride." I moved from Toronto to San Antonio more than twenty years ago. A Canadian pursuing the American Dream. I bought a business that became U.S. Global Investors. I believed back then, as I still do today, that there is nowhere else in the world where opportunity abounds and initiative is rewarded as it is in the U.S.A. "Despite all its setbacks, the U.S. remains at the center of world competiveness because of its unique economic power, the dynamism of its enterprises and its capacity for innovation," according to IMD, a well-regarded Swiss business school.IMD recently released the findings of its annual World Competitiveness Yearbook (WCY). Its rankings survey more than 4,200 international executives and measure how well countries manage their economic and human resources to increase prosperity. The top three most competitive of the 59 ranked economies in 2012 are Hong Kong, the U.S. and Switzerland.

Barron's editorial page editor Thomas G. Donlan wrote, "It's worth contemplating the advantages that a group of international business executives and analysts still can find in the U.S. economy. At the top is access to financing, following a strong research-and-development culture, an effective legal environment, dynamism of the economy, a skilled workforce, and reliable infrastructure. At the bottom, they find the U.S. lacks competency of government and a competitive tax regime." During tough times, Americans must be vigilant in safeguarding our competitive edge by continuing to be a compassionate and generous nation while resisting the siren calls of socialism. A system that strangles private property rights and sponsors excessive bureaucracy, regulation and taxation cannot deliver on a promise of prosperity to its people. We must not lose our collective faith in capitalism because it has proven to be the only social system that rewards individual ability, initiative and achievement. What Henry Ford said a century ago holds true today, "What's right about America is that although we have a mess of problems, we have great capacity—intellect and resources—to do something about them."

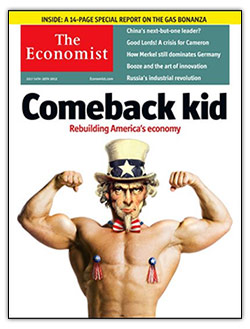

The Economist's cover story last week heralded America's economy the "Comeback kid." "Led by its inventive private sector, the economy is remaking itself. Old weaknesses are being remedied and new strengths discovered, with an agility that has much to teach stagnant Europe and dirigiste Asia," according to the story. The story notes that while America's overall growth is unimpressive, some components show signs of boom. We have shifted from a consumption-driven economy to a more outward-facing one. In the post-recession economy exports contributed 43 percent of growth, one of the strongest showings in any recent economic recovery. While sales to traditional markets in the OECD have risen just 20 percent since the end of 2007, they are up 51 percent to Latin America and 53 percent to China.

According to The Economist, emerging markets have also reinvigorated America's role as a big commodity producer. Grain exports are soaring, agricultural land values are rising, and higher oil prices have triggered new output. American innovation in discovering new techniques to release oil and gas from shale has paid massive dividends to the energy sector and created thousands of new jobs in the industry. I wrote about this employment boom recently in Frank Talk and we see this explosion of growth first-hand just south of San Antonio with the development of the Eagle Ford Shale. Cheap, plentiful natural gas benefits industries as diverse as glass, fertilizers, plastic and steelmakers. Last year for the first time in decades, America became a net exporter of refined products. And our nation's gap between oil consumption and domestic production is shrinking.

A way to take advantage of a potential upturn in commodities is by choosing dividend-paying global resources equities. In the S&P 500 Index, nearly all of the materials and utilities stocks and more than half of energy companies pay a dividend that is higher than the 10-year Treasury. Materials and utilities companies yield an average of 2.3 percent and 4.1 percent, respectively, while energy stocks pay an average yield of 2.2 percent. We like the combination of income with growth and it is an important factor in our stock selection process for the Global Resources Fund, as well as our other equity funds. We believe there are many great American companies to invest in. We like those that are growing their top line revenues and paying robust dividends. Currently 47 percent of the S&P 500 stocks pay a dividend yielding more than a 10-year Treasury, demonstrating the resiliency and strength of American enterprises. Professor Stephane Garelli, director of IMD's World Competitiveness Center, said, "U.S. competiveness has a deep impact on the rest of the world because it is uniquely interacting with every economy, advanced or emerging. No other nation can exercise such a strong 'pull effect' on the word. In the end, if the U.S. competes, the world succeeds!" It is the nature of humans to compete. The Summer Olympics commencing next week in London will bring together more than 10,500 athletes from 204 countries to compete for the gold. I look forward to watching this showcase of the human spirit and the drive to succeed. July 20, 2012 (Source: U. S. Global Investors) |

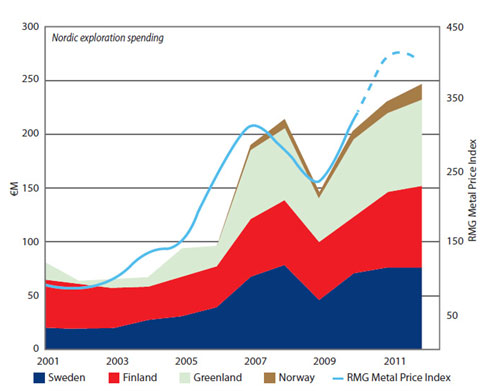

| How to Profit From Europe's New Gold Rush Posted: 21 Jul 2012 05:20 AM PDT

from marketoracle.co.uk: Europe owns a sizable chunk of the world's natural resources. Over the past few decades, however, EU countries have mostly imported their resources. Outlandish? Maybe. But it was simply easier, cheaper, and most importantly it avoided most environmental conflicts. Getting through government regulation and facing off eco-friendly groups is a time-consuming and outrageously expensive business… a fool's errand. When you can simply import and let other countries deal with all the hassle, it made a lot of sense. But things change. When no one's got a job, it truly focuses the political agenda. Europe's job market is a mess. Demonstrators are crying out for action, for opportunity, for jobs. And mines employ a lot of people. The trend is reversing because of Europe's sluggish economy and the real benefits of the increase in local jobs and the leap in tax revenue that mining projects bring. Of course, local economies benefit. Hotels are full of transient engineers and specialists, grocery stores feed the workers, and bars serve liquor to quench their dusty throats. Then, of course, the government got involved… Brussels, 2011. Seeing the benefits of the jobs, income-tax revenues, and all-around political advantages, a "Raw Materials Strategy" was initiated in 2008, then revised and updated in 2010, and again in 2011. The aim was to encourage sustainable supplies of raw materials from within the EU. It calls for policies in support of domestic mining. So far, so good… In September 2011, the European Parliament adopted the "EU Raw Materials Strategy," a generally pro-mining document, though it's sometimes criticized by the industry for being "too bureaucratic." "It's positive, of course, that the political climate in Europe is at least in theory becoming more supportive of mining" So on the one hand, the government says, "Sure, go ahead," and spends years (and no doubt millions of euros) coming up with a plan, while the other hand slaps down a bunch of rules that stifles initiative, adds massively to production costs, and once more makes mining companies think twice before they put down the millions it takes to get started. Driller killers, indeed. Yet the gold mining sector in Europe represents 16,000 direct and indirect jobs as of 2009, and that is surely growing. So for the gold, the tax, the jobs, and for more than a few political careers, mining is right up at the top of the political agenda. And despite the regulation stranglehold governments put on mining companies, they are still reopening abandoned mines and are exploring entirely new areas. For investors, that's very positive, exciting news. Europe's New Gold Rush In Casey Research's BIG GOLD, we've been talking a lot lately about the three main zones of metallogenic significance for gold in Europe: the Iberian Pyrite Belt; the Carpathian Arc; and the Baltic Shield. The first crosses from Portugal through southern Spain. The second stretches from the Czech Republic through Hungary, Slovakia, Bulgaria, Ukraine, Romania, Serbia, and into Turkey. Number three, the Baltic Shield, traverses from western Russia through Finland, Sweden, and Norway. Europe's gold mining contribution is approximately 1.2% of global mine production (though demand from the EU is roughly 15% of worldwide totals). Sweden, Finland, Spain, and Bulgaria are currently the largest gold producers in Europe. They mine about 640,000 million ounces of gold annually. Other countries with operating gold mines are Greenland, France, Greece, Romania, Portugal, Slovakia, and the UK. Keep on reading @ marketoracle.co.uk |

| Gold price up by Rs 50, silver Rs 200 on global cues Posted: 21 Jul 2012 05:17 AM PDT

from indianexpress.com: Gold rose for the second day in a row by adding Rs 50 to Rs 29,700 per 10 grams in the bullion market here today on good demand amid a firming global trend while silver gained Rs 200 to Rs 52,450 per kg on increased offtake by industrial units. Traders said buying in gold picked up after the metal gained in global markets as Russia's central bank increased holdings of the precious metal. In New York, gold rose by USD 2.30 to USD 1,584 an ounce and silver by 0.18 per cent to USD 27.33 an ounce. In addition, buying by stockists and jewellers for the coming festival and wedding season also led to a rise in prices of the precious metals. On the domestic front, gold of 99.9 and 99.5 per cent purity advanced by Rs 50 each to Rs 29,700 and Rs 29,500 per 10 grams, respectively. It had gained Rs 20 yesterday. Keep on reading @ indianexpress.com |

| Gold last hope for Sudan to avert economic collapse Posted: 21 Jul 2012 05:10 AM PDT from reuters.com: (Reuters) – In his office in Khartoum's gold market, central bank sales agent Mohamed Adam sips tea and watches while his staff load bundles of cash worth tens of thousands of dollars from the safe into four boxes. The government will use these piles of Sudanese pounds to purchase gold, which it plans to sell for the dollars needed to pay for imports of food and other essentials. "We buy all gold from local traders and people who search for gold," Adam said. Outside his office, gold traders make deals in the busy market in a rundown downtown building, where paint is peeling from the walls. Sudan is looking to expand gold mines and boost production of the metal to help keep the economy afloat. Oil had been the main source of state revenues as well as the dollars needed to pay for imports, but Sudan lost three-quarters of its oil production when South Sudan split off last year. A scarcity of dollars has driven the annual inflation rate to 37.2 percent in June, double the level of June 2011, and officials warn prices will rise further. The country sits on what could be Africa's largest gold reserves, and the government has handed out exploration contracts to more than 600 mining firms to search for gold and other minerals. Khartoum hopes to make up to $3 billion from gold exports this year, double the amount from last year. It made $603 million by the start of April, according to the latest official data. Much of that output currently comes from small, individual miners, lured by high gold prices to seek gold in remote corners of the country. The central bank is now buying up their gold, which in the past was often smuggled abroad. The government estimates that about 250,000 Sudanese search for gold, mostly in the north of the vast Arab African country, where the Nubian desert has been a source of gold since the Egyptian pharaohs. "I always go and buy up gold from local people and sell it to the central bank," said gold trader Jumaa Mohamed Said, who travels every month to a desert area 300 kilometer (190 miles) north of Khartoum. "Sometimes I buy a few grams, sometimes 500 grams, a kilo. I'm always busy," the 25-year old Said said. He brings the gold to Khartoum, where he does business with the central bank. Experts verify its grade before it ends up on Adam's desk. The central bank has appointed three sales agents at the gold market, who buy gold for a little less than the global price, Adam said. But a senior official at an international organization said the agents sometimes pay above the global price to stop other traders from snapping it up for smuggling to Dubai, a large gold market. "The central bank sometimes pays well above market prices," he said, declining to be identified. "It fuels inflation, but they need the dollars from gold exports." BIG POTENTIAL, BIG CHALLENGES The targeted $3 billion in gold revenue for this year is still well below Sudan's 2010 oil revenue of at least $5 billion. But the government hopes it will keep the economy afloat while it seeks a negotiated solution over oil export fees from South Sudan. Khartoum faces a budget deficit of 6.5 billion pounds ($1.4 billion) following South Sudan's independence a year ago under a 2005 peace deal. The finance ministry had counted on export fees paid in dollars by the landlocked new nation, which needs to ship its crude through northern pipelines and the Red Sea port of Port Sudan to get to international markets. Keep on reading @ reuters.com |

| How to Profit from Gold with a Proven System from Absolute Wealth Posted: 21 Jul 2012 05:04 AM PDT

from news.yahoo.com: Finding out how to profit from gold can make a serious impact on finances, according to a recent article from AbsoluteWealth.com. The industry leading providers of financial and economic information, Absolute Wealth is working to equip determined entrepreneurs with the power to make real income in simple and effective ways. The article said that the "Gold Profit Formula" is a perfect example of Absolute Wealth's value and worth, and it's the latest training program to be offered by the experts in wealth generation. The "Gold Profit Formula" will guide people in the formation of their own scrap gold business. While that sounds like a huge undertaking, it actually means little more than a few hours spent each day on learning the trade and practicing what has been learned. The online article said that once people gain some knowledge and experience in the scrap gold and precious metal business, they're amazed at the profits that come rolling in. The money earned for scrap gold is based on the high-swinging stock prices per ounce, said the article. Gold is being viewed as a valuable asset, perhaps even more so than regular currency. The article said that scrap and unwanted gold looks like a waste to some people, but it can actually earn generous amounts of money from the refining process. That is leading to serious money-making opportunities. The "Gold Profit Formula" consists of video and audio training modules. Each one teaches a different aspect of the business, and the program is all located conveniently online and available at any time. Absolute Wealth is an expert team of real investors and advisors devoted to identifying winning strategies for exceptional returns. Members subscribe to the company's Independent Wealth Alliance for professional investment analysis and recommendations on the latest market trends and progressions. For more information and subscription instructions, visit AbsoluteWealth.com. As an added bonus, members of the "Gold Profit Formula" program will also receive guides on attracting and maintaining business on the independently-owned level. These bonuses are normally priced quite handsomely, but the article said they are Absolute Wealth's gift to prove their motivation and dedication to any business started under their tutelage. Keep on reading @ news.yahoo.com |

| Gold to Remain Range Bound as Investors Weigh Fed and Europe Posted: 21 Jul 2012 05:00 AM PDT

from finance.yahoo.com: Perhaps Friday is an indication of things to come for the precious metals complex. While the US Dollar was busy rallying sharply against the Euro and posting modest gains across the rest of the majors (save the Japanese Yen), Gold was busy posting a 0.19 percent gain on the day, pulling close to unchanged on the week, finishing down only 0.32 percent overall. There were a number of things at work for and against precious metals this week, but mainly it boiled down to two things: the Federal Reserve and whether or not QE3 will be implemented; and the financial stresses in Europe. Accordingly, given the likelihood of QE3 and the financial conditions in Europe, we expect Gold to be skewed to the downside going forward. At his Semi-Annual Monetary Policy Report to Congress this week, Federal Reserve Chairman Ben Bernanke discussed a few pertinent points that should clarify his stance on more accommodative efforts from the Fed. They can be summarized as such: the US economy is slowing, more needs to be done, the Fed may not be the best institution to help the economy, fiscal authorities need to do more, and the Fed will only do more if it is completely necessary. Is it completely necessary at present time, when longer-term US Treasury yields (and thus mortgage rates) hold near all-time lows? Absolutely not. But is the US economy struggling, thus justifying further stimulative measures? Perhaps. Regardless, no definitive answer to this question is another sign of uncertainty for market participants, which should weigh on Gold. When this stance shifts – which it will – to a more definitive pro-QE3 position, Gold should be very well supported. But for now, this is not the case. Accordingly, the European sovereign debt crisis has created quite the tug-and-pull on commodities over the past several weeks, and this is likely to continue. On one hand, the promise of more liquidity from the Euro-zone's financial leaders will boost Gold in the near- and long-term. However, with no new measures proposed and the current ones deemed inadequate – as evidenced by rising Italian and Spanish bond yields and the major sell-off on Friday by European equity markets – it's likely that demand for the most liquid asset, cash (US Dollars), will be high and thus the demand for Gold will be dampened. In terms of data for the week ahead, our main focus lies on the US GDP print for the second quarter which will be released on Friday. At an expected print of +1.4%, this would represent a major letdown from the initially projected +3.0% figure for the first quarter. The +1.4% reading would also come in below the prior +1.9% reading. In all likelihood, a weak US GDP print will result in a US Dollar sell-off, which in turn should bolster QE3 expectations, and thus, support Gold. Keep on reading @ finance.yahoo.com |

| Posted: 21 Jul 2012 03:55 AM PDT "Goat Man" Hides Among Real Goats in Utah Gawker In focus: Incredible raindrops on spiders Wired (Richard Smith) Vast African water source found BBC More Guns, More Equilibria EconoSpeak What is wrong with people? Ed Harrison Europe Staggered by New Round of Debt Crisis Dave Dayen, Firedoglake Ireland Bulldozes Ghost Estate In Life After Real Estate Bubble Bloomberg (Richard Smith). The pictures look sad. All this waste and Ireland broke. Liborfest!

Israeli who performed self-immolation dies Aljazeera Obama Administration Encourages Syrian Suicide Bombers Kabul Press (nathan) Obama Wants $1 Billion for "Master Teachers Corps" Slate (furzy mouse) Tax Loopholes Block Efforts to Close U.S. Deficit New York Times Congressional insider trading ban might not apply to families CNN Goldman Employee Struggles With Inability To Regularly Visit Summer Home Huffington Post THE HUFFPO BUSINESS MODEL: DELIBERATELY OBLITERATING THE SEPARATION BETWEEN PAID ADVERTISING AND REAL REPORTING Yasha Levine, eXiled Retirees hit hard by foreclosures MarketWatch (Carol B). The NYT reported on this too, but this sad fact bears repeating, since conventional thinking is retirees are not suffering all that much from housing market tsuris. JPMorgan Ordered to Identify Witness in Blavatnik Lawsuit Bloomberg (MBS Guy). A reminder as to why only a guy like Blavatnik (80th richest man in the world) can prevail against big banks. Look at the stonewalling by JPM. Does Money Make Us Write Better? New York Review of Books. Wow, I can't relate to the way he thinks about this question. But then again, I've never aspired to "being a writer," just to writing well. There is a much simpler answer to his question: 1. Writing more makes you better, provided you can look at what you've written at least somewhat clinically. 2. A good editor helps but they are not very common. America in denial: We're number 29 (of 30) Paul Rosenberg, Aljazeera (Paul S). Today's must read. * * * lambert here: D – 49 and counting* Q: Is war inevitable? A: In some form, yes. The state was organized in order to prosecute war; as long as we have states, we will have war. — Phillip Bobbitt Occupy. Movie review: "[Revolution] is a social healing process and the resolution of violence between opposed social strata if it is successful. The occupation of Zuccotti Park was the beginning of such process rather than a declaration of war against those with privilege. The occupation gave many of us the support and confidence we needed in order to end the isolation we've felt obliged to impose upon ourselves in order to avoid the stigma, guilt, and shame that perpetually broke, debt-ridden people tend to experience from living in the most crassly materialistic society ever designed by human beings. The occupation of Zuccotti Park helped many of us feel less angry, less violent, and more like dignified human beings for the first time in our lives." Well, there's your problem. AZ. Privatization: "A year after AZ began a nationally publicized effort to build its own border fence through private contributions, not a single fencepost has gone up." CA. San Bernardino bankruptcy: "Bankruptcy law also does not allow for a court to force a city to change any voter-approved law, so a judge cannot impose changes on the City Charter or taxes in light of the provisions of Proposition 218, a 1996 state ballot measure requiring voter approval for local taxes." CO. Aurora shooting: Atlantic's coverage. Detail on the suspect (Denver Post). "After graduation from UCR, Holmes took a part-time job at a nearby McDonald's. 'I felt bad for him because he studied so hard. My brother said he looked kind of down; he seemed depressed.'". Just saying. Twitter timeline (from local teen). Detail on the suspect (AP). Shooting timeline, Aurora. Shooting timeline, US history. "Politicizing a tragedy". Would "good guy" shooters have helped? No. Yes, answers gun trainer. Campaigns suspended. Candidate quotes. FL. Public records: "The identity of students who submit complaints about teachers to public schools, including colleges and universities, are public records and must be disclosed to citizens, a FL appellate court ruled Thursday." … Corruption: "According to the story, former [University of Miami] equipment manager Sean Allen – previously linked to rogue booster and convicted Ponzi schemer Nevin Shapiro – was used as an 'off-the-books recruiter' by Miami assistant coaches" with the direct knowledge of coach Al Golden. ME. D Sen candidate Dill attempts to get the DSCC's attention. OH. Privatization: "Of the 77 people in attendance Tuesday, 75 raised their hands to say they are against the governor's idea of privatizing the 241-mile [Ohio Turnpike]." … Fracking: "When I found that essentially no government agency had the jurisdiction to protect public health and safety due to exemptions granted to the oil and gas industry, I figured it was my civic duty to advise the community. I wrote a letter to the editor for the first time in my life." PA. Abortion: "The [Abington Health and Holy Redeemer merger] plan is dead. Cause of death: the spiral of opposition to the elimination of abortion services at Abington. The demise of the merger is clearly a tribute to the tireless and impressive community opposition effort. The defeat of the merger was the fastest in their history of work on such issues." TN. Overton Window: "The center of gravity in TN politics has shifted so hard to the right that two dozen conservative R incumbents are under attack as moderate squishes and cowardly sell-outs in their own party's primary elections for the state legislature." TX. Market state: "[Medicaid practitioners say that] an anonymous call to a fraud hotline or a computer-generated analysis of a handful of billing codes is enough to halt their financing… The majority of [payment holds] were 'Credible Allegation of Fraud,' or CAF, holds — a provision in the new federal health reform law that authorizes states to suspend Medicaid payments if allegations of fraud have an 'indicia of reliability.'" Signature strikes. … Aurora shooting: "[Rep. Louie Gohmert R: W]th all those people in the theater, was there nobody that was carrying a gun that could have stopped this guy more quickly?" Sigh. … Corruption: "Instructors and trainees [Lackland AFB] at the center of an Air Force sex scandal are under constant surveillance, a witness testified Thursday in the trial of an instructor facing rape and sexual assault charges." VA. Constitution party: "The PPP poll showed a potential disaster for Mitt Romney in Virginia: Constitution Party candidate Virgil Goode, a former R Congressman in VA, getting 9% of the vote. With Virgil included, Obama leads 49-35-9 with 7% undecided." VT. Solid waste: "Last week the Chittenden Solid Waste District recalled all of its Green Mountain Compost products sold on the retail market. … Laboratory tests showed trace amounts of the herbicides Clopyralid and Picloram in the products. Some garden plants were damaged by the chemicals. The district is conducting tests to determine the original source of the contamination." Openly, I hope. WI. Revealing metaphors: "[Gov] Walker saw fields would normally be bright green this time of year instead dotted with splotches of tan, yellow and brown. He said the ground looked like a big golf course with massive sand traps. He later commented that it looked like the green, tan and brown camouflage uniform." Just saying. … Corruption: "The head of Milwaukee County's office for disadvantaged business development was jailed Thursday, suspended from her county job and locked out of her county office." … Privatized voting: "[L]ike so many other rural counties that voted strongly D in recent elections, Crawford County went for Walker by +100 votes. This was a curiosity that sent me to the County Clerk's office in Prairie Du Chein, and I learned the election materials had already been send back to the machine vendor, Command Central, before the time prescribed by state statutes." Not sure on the statistical analysis. ObamaCare. OH pundit Suddes: "[Y]ou can forget R campaign vows to repeal [ObamaCare]. You may think Obamacare is about "health." It's really about who picks up the check. It's likely that more Rs than Ds are OH hospital trustees. But either way, hospital trustees tend to have money. And political connections. And pride in "their" hospital. Hospitals and allied health businesses are huge Ohio employers." Jobs. Qu'ils mangent de la brioche: "Near-suicidal despair. That is what many Americans have earned from this recession." That's not a bug. It's a feature. (GW is quite right.) … Razor thin margin: "The jobless rate climbed a 10th of a percentage point last month in MI, PA, CO, IA, NH and VA, the Labor Department said in a report released Friday." … Leading the witness: "Representative John Carney, D [!!] of DE, asked [Bernanke], 'The Fed is doing everything it can to address the unemployment part of your mandate, is that correct?'" One big happy! … Payroll tax: "The emerging consensus in the Senate Democratic Conference is that the payroll tax holiday should not be extended for another year, even though the economy is slowing. Ds are worried about the impact on Social Security." Taxes do not fund spending! Outside baseball. Post-constitututional government: "'On at least one occasion,' the intelligence shop has approved [!!] Sen. Ron Wyden (D-Ore.) to say, the Foreign Intelligence Surveillance Court found that 'minimization procedures' used by the government while it was collecting intelligence were 'unreasonable under the Fourth Amendment.' Minimization refers to how long the government may retain the surveillance data it collects." "Approved?" "Approved"?! How come Issa can use the Speech and Debate clause, and Wyden wusses out? … Hmmm: "Sen. Jim DeMint (R-S.C.) is delaying Senate consideration of the United Nations treaty on people with disabilities amid growing opposition from home-schooling advocates." The trail. Aurora shooting: "Be a little careful with polls you see over the next few days. Tragic events can sometimes bolster support for the incumbent president because of a rally-around-the-flag effect, but the impact is usually short-lasting." … Winning the political class, or not: "Romney's campaign isn't winning many plaudits from the country's political class, according to the latest National Journal Political Insiders Poll. [Then again, said] another Republican, 'You don't get to be president by winning July.'" … Money: Handy interactive on ad spending in presidential battleground states. … Money: "The biggest spending is yet to come in a presidential race that could hit an eye-popping $3 billion." … Oppo: "It strains credulity that the firestorm of recent anti-Bain articles was entirely sparked by the journalistic equivalent of spontaneous combustion." … Campaign ads, good read: "Political ads are too multifaceted to be labeled simply as negative or positive — and to conclude that one type is superior to the other." … Not rehabiliated. Via Bush spokeshole: "[Bush is] still enjoying his time off the political stage and respectfully declined the invitation to go to Tampa." Also too, Jebbie. Romney. Dog not barking: "Despite outraising the president for the past two months, Mr. Romney cannot spend much of that money until he officially becomes the GOP nominee at the party's national convention in late August." The dead woman or live boy needs to come from Rove, then. Why hasn't it? … Tax returns: "Tax experts have devised a different theory of how Mr Romney's IRA grew exponentially [wish mine had!], and it involves a complex valuation of the securities that it held." It would be irreponsible not to speculate! … Tax returns: "Obama has turned debate on taxes into a personal responsibility issue for Romney." … Bain flap: "[Romney] drove the complex negotiations over his own large severance package. Indeed, by remaining CEO and sole shareholder, Romney held on to his leverage." Quelle horreure! So, that big executive decision Lord Richistan has been holding out on us is his own severage package? That is the "elephant in the room"? … Snark watch: "The president campaigned in FL in 2008 and said he would help to make things better. And they're not better. And you can only run on 'hope and change' once." Ouch! Obama. Hopey Change 2.0: "Obama for America," a voice-over rumbles. "This year, we don't have the budget for nuance." … Hopey change 2.0: "[OBAMA:] If you still believe in me, and you stand up with me, and make phone calls and knock on doors and get out there and organize with me, we're going to finish what we started in 2008." I don't know about you, but "finish what we started" doesn't make it for me. * 49 days until the Democratic National Convention ends with a swell feed of bushels of dried corn husks and dead locusts on the floor of the Antidote du jour. Did someone give that raccoon a mullet? |

| Libor Scandal Apologist Avinash Persaud Displays Inability to Do Math Posted: 21 Jul 2012 12:51 AM PDT Nothing like putting your foot in mouth in public and chewing. Avinash Persaud, who is listed at VoxEU as "Chairman, Intelligence Capital Limited; Emeritus Professor, Gresham College; Senior Fellow, London Business School," put up a "nothing to see here" post on the Libor scandal. It's clear from this piece that Persaud hasn't deigned to do basic homework, like reading the FSA's letter to Barclays, which describes its findings from its investigation and recounts the regulatory violations. For instance, Persaud describes the scandal as having "two phases", June 2007 to June 2008, and after the collapse of Lehman. The FSA also described two phases of manipulation, but the first was 2005 to 2007, in which Barclays derivatives traders were seeking to move specific Libor indexes, most often the one month or three month Libor, apparently by small amounts (targets of single basis point moves were mentioned), to improve the value of trades they had on. The later phase was in 2007 to 2009, when banks were lowering Libor in an effort to signal that they were healthier than they were. (Within this period, Persaud makes a case that immediately post Lehman, there was no interbank lending market, so it made sense to have the banks keep posting Libor, given all the instruments priced off of it). And his air-brushing out the 2005-7 manipulation also means he does not have to deal with charges made by many and recounted by the Economist, that the gaming of Libor goes back 15 years or more before that 2005 date. To get to the embarrassing part, we need to review how Libor is set. 16 banks submit a figure that is supposed to represent their cost of borrowing/lending at various maturities in various currencies. For each index value, say one month Euribor, of the 16 value provided, the highest four and lowest four are omitted and an average is taken of the remaining eight. This is the part of Persaud's piece that is the stunner:

This is completely wrong. The ease or difficulty of manipulating Libor is a function of the dispersion of the submissions, and whether the submitter can make an accurate guess as to how high or low a bid it will take for his value to be knocked out on the high or low end. If your submission would have been among the ones in range and you move your submission to a level where you are pretty sure you'll be excluded, you'll effect a change in the submissions chosen to be averaged. And the Barclays traders understood that this was an effective strategy. The e-mails included in the FSA release has multiple instances of traders pleading with the submitters to put in a bid that was high or low enough to be excluded from the calculation. To illustrate, just take a series of submissions that are dispersed (for convenience, percentage signs omitted): 1.0, 1.1, 1.2, 1.3, 1.4, 1.5….2.4, 2.5 Let's say your submission would have been one of the ones in the middle. We'll pick 1.8. So the average per the Libor rules would be: Knock out four bottom, so 1.3 and below. Knock out 4 top, so 2.2 and above. Average the rest (1.4, 1.5, 1.6, 1.7, 1.8, 1.9, 2.0. 2.1): 1.75 Now assume you have nefarious reasons for wanting to move Libor lower. Instead of submitting 1.8, you bid someplace really low but acceptable, say 1.0. The effect in the 8 numbers to be averaged is to replace 1.8 (the number that would have been in) with 1.3 (the number formerly excluded but now included) This is a difference of 0.5 in the total to be averaged. Divide by 8, and you've moved Libor by 6.25 basis points (If you do it the hard way, you'll see this is correct). Now if there is less dispersion or less ability of the submitters to make good guesstimates of where they need to place their bid (actually, luck will do, but people who are out to manipulate markets don't want to rely on being lucky), then it will take collusion to effect a change. But again, that does not mean it takes collusion on the scale asserted by Persaud. Persaud presents some other peculiar ideas in his article. For instance:

Note that while Persaud here is giving the theory of Libor, the rest of his piece does not voice disagreement with this part. Second, it charmingly speaks of "bank" incentives. Employees, particularly traders, game their organizations all the time. The inmates may well have been running the asylum, yet Persaud refuses to acknowledge that possibility. Third, Persaud like many others, thinks only of the implications for lending and borrowing, when as we've said repeatedly, the action in the Libor scandal was all about the derivatives. And remember, there are certain types of exposures where it is highly likely the dealers were largely positioned on one side of a trade and end customers on another. So dealer incentives may well have been largely consistent. For instance, one customer trade done is scale is borrowing floating rate debt short and swapping into fixed. It's hard to think of customers who'd be natural swap providers (although the dealers may be accompanied by some Treasury departments and hedgies who are taking a speculative position). What is the lesson of this flagrantly off-base article? That being an economist means you don't have to bother with facts? That defending banks is so highly paid that someone like Persuad is willing to write credible-sounding drivel on their behalf? Oh, but I forgot. Mainstream economists gave advice that wrecked the global economy and they haven't shown any remorse, much the less changed their ways. |

| Posted: 20 Jul 2012 11:54 PM PDT from goldnews.bullionvault.com: The Gold Price traded in a narrow range above $1580 per ounce Friday morning – in line with where it has spent the last two weeks – while stocks and commodities ticked lower and US Treasuries gained, as market attention returned to the European debt crisis, currently focused on Spain. The Silver Price dipped to $27.07 per ounce, though it too remained firmly within its range for the last fortnight. Based on Friday afternoon London Fix prices, the Gold Price has alternated between up and down weeks since the week ended 11 May. A Gold Fix below $1595.50 per ounce this afternoon would see this pattern extended for a tenth week. "The [daily trading] range is contracting these days," says Standard Bank's Yuichi Ikemizu, head of commodity trading, Japan. "I don't see much encouragement for people to have a big position." "Daily momentum is flat," agrees Tim Riddell, head of global markets research, Asia, at ANZ Bank "Gold appears to have lost its glimmer…as it languishes in the lower reaches of a $1555-$1635 range. The near-term inability to regain levels above $1600 will keep the bias towards retesting the base of this range." For both Dollar and Sterling investors, the Gold Price is at the same level it was two months ago. In New York, the volume of gold held to back SPDR Gold Trust (GLD) shares fell to a six-month low yesterday, falling nine tonnes to just over 1257 tonnes. Over in Europe, Germany's Bundestag yesterday voted in favor of Spain's banking bailout – which would see the Spanish government borrow up to €100 billion to finance banking sector restructuring. The aid may in time be converted so it takes the form of direct loans to banks, subject to conditions such as the creation of a single European banking supervisor. The vote passed by 473 votes to 97. "Any problems in the Spanish banking sector are a problem for the financial stability of the Eurozone," said German finance minister Wolfgang Schaeuble ahead of the vote. "Spain is the fourth biggest economy in the Eurozone," added Andrea Nahles, deputy leader of the main opposition party the Social Democrats. "A couple of its banks need to be stabilized. If we don't do it, the country that suffers most is Germany, so it is in Germany's interests to help Spain." Keep on reading @ goldnews.bullionvault.com |

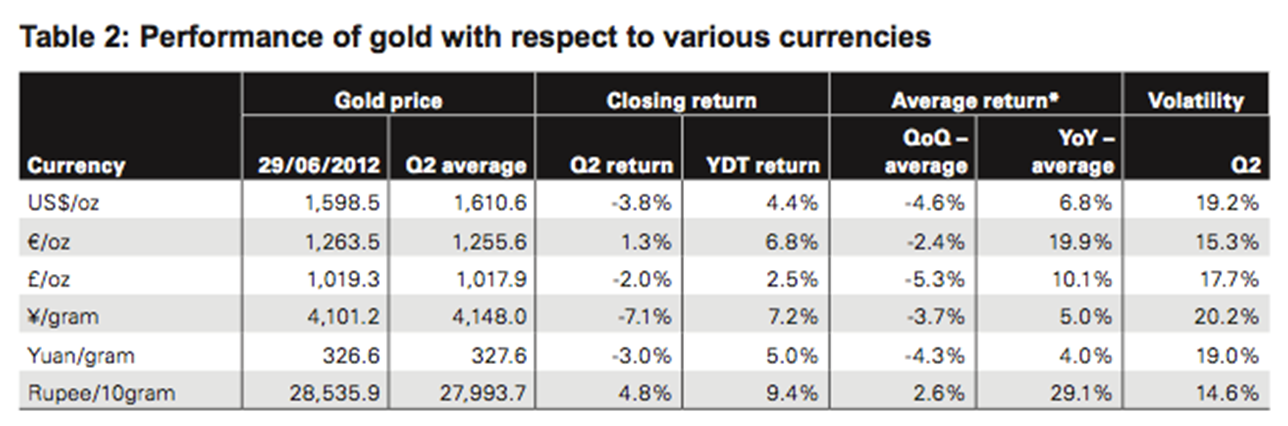

| Gold Q2, 2012 – Investment Statistics and Commentary Posted: 20 Jul 2012 11:47 PM PDT

from goldcore.com: Today's AM fix was USD 1,583.00, EUR 1,291.30, and GBP 1,007.83 per ounce. Silver is trading at $27.07/oz, €22.22/oz and £17.32/oz. Platinum is trading at $1,418.25/oz, palladium at $577.80/oz and rhodium at $1,190/oz. Gold rose $3.70 or 0.23% in New York yesterday and closed at $1,581.00/oz. It rose as high as $1,590/oz prior to determined selling which saw gold fall. Gold ticked higher in Asia prior to falling soon after the European open. Gold has been trading in a range between $1,530/oz and $1,630/oz for nearly 2 months despite the Eurozone debt crisis entering its 3rd year and looking set to escalate and despite signs that the US economy is on the verge of a sharp recession. These two factors alone mean that gold will likely resume its upward march due to continuing safe haven demand. The likelihood of further QE from the Fed will be icing on the cake for gold and silver. US data yesterday showed factory activity shrunk in July for a 3rd consecutive month and the jobless claims rose last week. Those who continue to put "lipstick on the pig" that is the US economy are lulling themselves and other unfortunates into another false sense of security. "Blue skies thinking" regarding individual economies and the global economy got us into this mess and it will not get us out. The World Gold Council have just published their commentary on gold's price performance in various currencies, its volatility statistics and correlation to other assets in the quarter - It provides macroeconomic context to the investment statistics published at the end of each quarter and highlights emerging themes relevant to gold's future development. One of their key findings is that gold will act as hedge against possible coming dollar weakness and gold will act as a "currency hedge in the international monetary system." Keep on reading @ goldcore.com |

| It's a fine line between gold manipulation and intervention Posted: 20 Jul 2012 11:41 PM PDT

from mineweb.com: LONDON - Writing in his latest comprehensive treatise on gold and the gold market, Erste Bank's Ronald Peter Stoeferle comments that it is a fine line between intervention (usually a governmental/political interference) and manipulation (negative connotation in terms of "exerting influence"). The full 120-page report is available on Mineweb by clicking here. This, in our view, is a very apposite comment on the situation as applied to the global gold and silver markets. There are so many hugely interested parties in precious metals price movements – from both financial, and political ends that it would actually be remarkable if there was no manipulation or intervention of the gold and silver markets in particular – indeed many of the manipulators, or interventionists, would just not see it as such but as a normal part of their day-to-day business. The world is at last becoming aware that everything is almost certainly manipulated in some way or another – particularly by governments and the major financial institutions, who have the political and financial clout to carry this out, to meet their own agendas. But what is acceptable manipulation and what is not? GATA has kindly provided their answer on this matter vai a response to this article from Chris Powell: "First, market manipulation by private entities is, in most modern economies, against the law, like anti-trust law, though the law may not be much enforced anymore as the West sinks haplessly into corruption and demoralization. Second, market manipulation by governments is at least morally wrong if it is undertaken in secret to deceive market participants, and in some circumstances freedom-of-information law may be brought to bear against it, as GATA has done" As Stoeferle points out there have been numerous official and legitimised open interventions by central banks in bond rates (recent examples include: Operation Twist, Quantitative Easing) and currencies (Swiss franc, Japanese yen). Both the quantity and the price of money are managed, i.e. controlled. The oil price is subject to interventions (OPEC cartel, release of strategic reserves), as are the food prices (subsidies). The LIBOR manipulation scandal is yet another example of the pervasive influence of unregulated big bank policy ultimately affecting interest rates paid by the man-in-the-street and comes into the obviously illegal category. These are almost certainly just the tip of the iceberg if one takes into account the self-interests of governments and the major institutions all around the world. Political 'spin' is designed to influence public opinion, as is advertising. What is this if not attempted manipulation? Manipulation is definitely mainstream! Keep on reading @ mineweb.com |

| Posted: 20 Jul 2012 11:35 PM PDT

from azizonomics.com: Why? Well, my intuition says one thing — the change in trajectory correlates very precisely with the end of the Bretton Woods system. My intuition says that that event was a seismic shift for wages, for gold, for oil, for trade. The data seems to support that — the end of the Bretton Woods system correlates beautifully to a rise in income inequality, a downward shift in total factor productivity, a huge upward swing in credit creation, the beginning of financialisation, the beginning of a new stage in globalisation, and a myriad of other things. Some, including Peter Thiel and James Hamilton, have suggested that there is data to suggest that an oil shock may have been the catalyst that put us into a new trajectory. Oil prices in terms of US wages ended up lower than they had been before the oil shock. What happened in the late 70s and early 80s was a blip caused by the (very real) drop-off in American reserves, and the (in my view, psychological — considering that global proven oil reserves continue to rise to the present day) drop-off in global production. But while oil production recovered and prices fell, wages continued to stagnate. This suggests very strongly to me that the long-term issue was not an oil shock, but the fundamental change in the nature of the global trade system and the nature of money that took place in 1971 when Richard Nixon ended Bretton Woods. Keep on reading @ azizonomics.com |

| Greyerz: $1.5 Quadrillion Bubble & Gold Into The Stratosphere Posted: 20 Jul 2012 11:28 PM PDT

from kingworldnews.com: Today Egon von Greyerz told King World News, "The world is simply drowning in debt." Greyerz, who is founder and managing partner at Matterhorn Asset Management out of Switzerland, also said, "This is why it is guaranteed that governments will print money," and that "Prices of hard assets will go into the stratosphere." But first, here is what Greyerz had to say about the ongoing financial crisis and where we are headed: "Spanish rates have broken back above the 7% level once again, but in reality we know that many European countries will never be able to repay these debts. You now have a total worldwide debt of around $150 trillion. If you add to that contingent liabilities, unfunded liabilities, pension funds, etc., you are talking about $500 trillion." Keep on reading @ kingworldnews.com |

| Syria and Iran Under Attack, Families Turn to Gold for Stability Posted: 20 Jul 2012 11:22 PM PDT

from wealthcycles.com: Escalating tensions and sanctions in Syria and Iran have led those nations to the brink of currency collapse and left families to deal with skyrocketing prices. Seeking shelter from financial ruin as well as bullets, many families are moving their assets into gold. Hours after UK Prime Minister David Cameron pleaded with Russian President Vladimir Putin to help the UN Security Council send "clear and tough messages about sanctions" to Syrians, the East bloc nations did just that. China and Russia both vetoed the UN resolution for further sanctions. China's ambassador denounced what he called an uneven resolution, while Russia's representative pointed out that the resolution would have opened the path to UN military involvement in Syria's affairs. International sanctions on commerce and trade "worked" in Libya, pressuring currency exchange rates. As a result prices on raw goods used in local food production spiked in local currency terms. The effect was to demoralize and impoverish the population, with some turning to the streets in protest, forming what the media called Arab Spring. On the chart of social unrest imposed over food cost below (credit: Lagi, et al), Libya recorded over 10,000 instances of unrest, and Syria, over 900: Libyan sanctions also opened the door, in terms of international law, for the justification of UN military intervention. In the end, more than 300 bombs from one U.S. warship slammed Tripoli, complementing the UN air assault in subjugating the people. Considering its Security Council vote, it appears this is the repeat Russia is seeking to avoid. As WealthCycles readers know, war has a large impact on prices, in particular prices of currencies, gold, silver, and oil. When imperialism reaches its later stages, frequency of attempts to grab foreign resources intensifies, and the debts and costs incurred to maintain the aggressive stance rise. As with the fall of Rome, currency degradation (via debt or debasement) spurs big moves in real money, gold and silver, when denominated in the inflating currency. So how close is war? Keep on reading @ wealthcycles.com |

| Posted: 20 Jul 2012 11:21 PM PDT

from theage.com.au: Gold is set for a weekly drop after Federal Reserve Chairman Ben S. Bernanke provided no specific plans for further purchases of debt to bolster the US economy, while saying policy makers are studying options for more easing. Immediate-delivery gold was little changed at $US1,583.10 an ounce at 12:34 p.m. in Singapore after earlier advancing 0.2 per cent to $US1,585.25. The price is set to decline 0.4 per cent this week. August-delivery bullion was little changed at $US1,582.10 an ounce on the Comex, also poised for a weekly loss. Bernanke said on July 18 the central bank is ready to take further action to boost the recovery if necessary. Tools include further asset purchases, cutting the interest rate the Fed pays on the reserves banks store with it and altering communications on the outlook for interest rates. Gold rose 70 per cent from the end of December 2008 to June 2011 as the central bank kept borrowing costs at a record low and bought $US2.3 trillion of debt in two rounds of so-called quantitative easing. Keep on reading @ theage.com.au |

| Corn price concerns increasing Posted: 20 Jul 2012 11:16 PM PDT

from goldmoney.com: Rising commodity prices are back in the news in a big way, with many column inches being devoted in particular to rising crop prices. Corn and soybean prices hit new record highs yesterday, with half the continental US in the grip of the worst draught since 1956. The US Department of Agriculture cut its estimate of the size of the corn crop by 12%. Nymex crude oil and gasoline futures also had another strong session, with WTI gaining $3 to settle at $92 a barrel, while gasoline continues what has been a relentless march higher since the start of this month. Interestingly, a report yesterday from the US Energy Information Administration reported American gasoline use as being at a 13-year low for July! Imagine what the price would be if the Fed had started another round of quantitative easing. The continuing tensions surrounding Iran and Syria are not helping as far as crude oil and gasoline shorts are concerned. Precious metals had another quiet day yesterday, palladium being the standout performer, gaining around $7 (1.2%). Strength across the commodity sector is supporting precious metals, with gold receiving good support on dips towards $1,550, while silver appears to have decent support at $26. It was also reported that the Conference Board Leading Economic Index® for the US declined 0.3% in June to 95.6 (2004 = 100), following a 0.4% increase in May, and a 0.1% decline in April. Jobless claims were also reported as higher, while existing home sales fell, as did an index of manufacturing activity in the Mid-Atlantic states. Rising food and energy prices and a struggling economy: not a happy recipe. Keep on reading @ goldmoney.com |

| Are gold mining stocks too risky? Posted: 20 Jul 2012 11:10 PM PDT

from sovereignman.com: Bruce Lee, one of the most focused and driven human beings to have ever lived, passed away 39 years ago on this day. He went way before his time. As a kid, I idolized the man. As a teenager I trained in his style. And as an adult, I studied his philosophy. He once wrote: "A good martial artist does not become tense, but ready… ready for whatever may come." These words are quite prescient today; I'll explain. A lot of people go through what I call the "Aha moment". It's the point at which they realize not everything is what it seems… that the government is not their friend, that the system is stacked against them, that their paper money is a total fraud, that their bank is insolvent, etc. These realizations can happen quite suddenly, often because of a catalyzing event. Perhaps they had their bank account frozen by the tax authorities or watched their kids be frisked at an airport. Whatever it is, it can be a powerful event. In many cases, this discovery of truth can lead to a great deal of anxiety. When you find out that most of what you were brought up to believe is just smoke and mirrors, it can be an emotional experience. Bruce Lee's words are a good reminder that this anxiety… being 'tense'… is actually destructive. It can cause people to overreact and take irrational steps. Being 'ready' on the other hand comes from measured action. In Lee's case, it was mastery of his art through disciplined practice. In the context of what's happening in the world today, measured action means making a realistic, big picture analysis and creating a real plan to follow. To give you an example, I spoke to one of our members recently who has a very clear idea of how he expects things to unfold in the coming years. He has moved abroad, has precious metals secured overseas, is working on a thriving international business, and is currently seeking a second passport. It's all part of a plan to be ready for whatever may come, whether amazing opportunity or yet another bonehead move by a government gone wild. With this idea of opportunity in mind, I want to address a question from a reader who asked: "Simon, I subscribe to a lot of newsletters that recommend investing in small mineral exploration companies, what they call 'junior mining stocks.' I haven't heard you mention much about this, can you give me your take?" Keep on reading @ sovereignman.com |

| Posted: 20 Jul 2012 11:05 PM PDT

from theaureport.com: "While there are rare and short-lived exceptions, the vast majority of the time silver only rallies significantly when gold is strong and only sells off materially when gold is weak. Gold is the key to silver's price action." After being sucked into the general commodities correction, silver has been relentlessly drifting lower since late February. But this weakness has forced the white metal down to a very bullish place technically. Silver is now quite undervalued compared to prevailing gold prices, its primary driver. Thus it has great potential to rally mightily in the coming months to regain much lost ground relative to gold. Silver is a fascinating commodity that has won a fanatical following among traders. It is extremely volatile, with big spikes or plunges always possible. This makes it irresistibly alluring to speculators, who alternately pile in to ignite huge rallies before running for the exits to spawn near-crashes. The perpetual back-and-forth struggle between greed and fear is the essence of speculation, and silver embodies it. But what drives these winds of sentiment that buffet silver around? Gold. Silver traders constantly look to the yellow metal's fortunes to figure out whether they should buy or sell the white metal. While there are rare and short-lived exceptions, the vast majority of the time silver only rallies significantly when gold is strong and only sells off materially when gold is weak. Gold is the key to silver's price action. Greed flares up in silver traders' hearts when gold is strong, motivating them to aggressively buy silver and catapult it higher. And fear rears its ugly head when gold is weak, scaring silver traders into dumping silver hand over fist, which crushes its price. Because gold overwhelmingly influences silver-trader psychology, it is the primary driver of silver. Technically this has proven irrefutably true for decades now. And silver's recent correction is no exception to this rule. Silver's last major interim high was on February 28, the exact day gold's latest top was carved. The next day gold plunged when the Fed chairman failed to hint at a third round of quantitative easing in testimony before the US Congress. Since then, silver has lost 26% while gold only gave back 12%. This has left silver "undervalued" compared to gold. Now since silver doesn't spin off any earnings like a stock, it can't be valued with traditional valuation metrics like price-to-earnings ratios. But its historical relationship with gold is so strong that it can be valued compared to gold, an alternative valuation measure. When silver gets too high relative to gold, a correction is due to restore this relationship. And when it gets too low, like today, a rally is probable. Keep on reading @ theaureport.com |

| Posted: 20 Jul 2012 10:58 PM PDT