Gold World News Flash |

- A Response to de Soto's 'Defense of the Euro'

- Australian Dollar: 'Still Surging'-- Why, Again?

- Nigel Farage – If This Happens In Europe Frankly It’s Meltdown

- House to vote Tuesday on Paul's Fed audit bill

- By the Numbers for the Week Ending July 20

- Guest Post: Falling Interest Rates Destroy Capital

- The Gold Price Seasonal Weakness and Correction Rapidly Coming to an End Stay Calm and Buy on Retreats

- Gold Q2, 2012 – Investment Statistics and Commentary

- How to Buy Gold Bars

- Economic Countdown To The Olympics 3: A Winning FX Strategy

- Making A Gold Nugget From Electronic Waste

- Profiting from Europe’s New Gold Rush

- The Return of Food Riots

- Greyerz: $1.5 Quadrillion Bubble & Gold Into The Stratosphere

- Gold market cited in speculation on where next financial scandal will come from

- Weekly Chart Porn - Uber-Bullish Silver Signals

- How to Best a Bureaucrat

- Financials FUBAR As S&P/NASDAAPL Close Unch For The Month

- Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week

- Gold and Silver Disaggregated COT Report (DCOT) for July 20

- Gold Daily and Silver Weekly Charts - Coiling for an Imminent Move

- The Great Demise: EUR at Two-Year Low

- Weekly Bull/Bear Recap

- “We are talking here about a run on the bullion bank. As this unfolds there will be a failure. These people will only receive the fixed price before trading is halted. This will not be called a default. Then there will be a massive gap in the price o

- COT Gold, Silver and US Dollar Index Report - July 20, 2012

- MineWeb notes Jim Sinclair's call to arms against market manipulation

- Why Won't Fine Art Collapse?

- The Weaponization of Economic Theory

- LBMA's gold price fixing scheme about to collapse, London trader tells KWN

- How to Minimize Risk and Increase Returns on Juniors: Joe Mazumdar

| A Response to de Soto's 'Defense of the Euro' Posted: 20 Jul 2012 09:21 PM PDT | ||||||||||||||||||

| Australian Dollar: 'Still Surging'-- Why, Again? Posted: 20 Jul 2012 09:17 PM PDT | ||||||||||||||||||

| Nigel Farage – If This Happens In Europe Frankly It’s Meltdown Posted: 20 Jul 2012 08:15 PM PDT from KingWorldNews:

On the heels of German lawmakers backing the European bailout of Spanish banks, today MEP (Member European Parliament) Nigel Farage told King World News, "All I can say with absolute confidence is that this crisis will roll on." Farage also said, "If Spain needs a full bailout, and if it even looks like Italy needs a bailout, well, then frankly the game is up." Farage also discussed gold, but first, here is what he had to say about the fear in Europe: "The reality is there are now tens of millions of people in Europe who feel absolutely desperate and without hope. And I still feel if they stay trapped inside this eurozone, in the end this could have disastrous social consequences." | ||||||||||||||||||

| House to vote Tuesday on Paul's Fed audit bill Posted: 20 Jul 2012 07:18 PM PDT By Donna Smith and Tim Ahmann http://www.reuters.com/article/2012/07/20/us-usa-fed-audit-idUSBRE86J1CI... WASHINGTON -- The House of Representatives is expected to vote on Tuesday on a bill that would allow for a congressional audit of Federal Reserve monetary policy decisions, a senior House aide said on Friday. The legislation proposed by Republican Rep. Ron Paul, a long-time critic of the U.S. central bank and author of the book "End the Fed," has already gathered 274 co-sponsors, virtually guaranteeing passage. The Republican-led House will consider the bill under a fast-track procedure that requires a two-thirds majority, but nearly two-thirds of the House has already signed onto the bill. Paul's son, Republican Sen. Rand Paul, has introduced a companion bill in the Democrat-controlled Senate, but chances of success there are remote given a less critical view of the central bank in that chamber and a tight legislative calendar before congressional elections in November. ... Dispatch continues below ... ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf The Fed stopped Ron Paul's measure during congressional debate over financial regulatory reforms in 2010. Fed Chairman Ben Bernanke told House lawmakers on Wednesday that the legislation would open the door to a "nightmare scenario" of political meddling in monetary policy. "That is very concerning because there's a lot of evidence that an independent central bank that makes decisions based strictly on economic considerations and not based on political pressure will deliver lower inflation and better economic results in the longer term," Bernanke said. Paul's bill would direct the Government Accountability Office, an independent, nonpartisan congressional agency, to conduct a Fed review and would remove an exemption that monetary policy has enjoyed. The central bank's political standing has suffered since the financial crisis struck in 2007. Critics claim Fed policies benefited Wall Street more than Main Street, and many Republicans charge that the central bank is courting inflation with its efforts to lift the economy. The Fed cut overnight interest rates to near zero in December 2008 and has held them there since. It has also bought $2.3 trillion in government and mortgage-related bonds in a further effort to press down borrowing costs. Despite the Fed's aggressive and unconventional monetary policy, the economic recovery is only limping along. Growth slowed to just a 1.9 percent annual rate in the first three months of this year, and economists expect a report next Friday will show it slowed further to a 1.5 percent pace in the second quarter. Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res... | ||||||||||||||||||

| By the Numbers for the Week Ending July 20 Posted: 20 Jul 2012 07:09 PM PDT | ||||||||||||||||||

| Guest Post: Falling Interest Rates Destroy Capital Posted: 20 Jul 2012 06:08 PM PDT Submitted by Keith Weiner of 'Gold and Silver and Money and Credit' blog, I have written other pieces on the topic of fractional reserve banking (http://keithweiner.posterous.com/61391483 and http://keithweiner.posterous.com/fractional-reserve-is-not-the-problem) duration mismatch, which is when someone borrows short-term money to lend long-term and how falling interest rates actually encourages duration mismatch (http://keithweiner.posterous.com/falling-interest-rates-and-duration-mis...). Falling interest rates are a feature of our current monetary regime, so central that any look at a graph of 10-year Treasury yields shows that it is a ratchet (and a racket, but that is a topic for another day!). There are corrections, but over 31 years the rate of interest has been falling too steadily and for too long to be the product of random chance. It is a salient, if not the central fact, of life in the irredeemable US dollar system, as I have written (http://keithweiner.posterous.com/irredeemable-paper-money-feature-451).

Here is a graph of the interest rate on the 10-year US Treasury bond. The graph begins in the second half of July 1981. This was the peak of the parabolic rise interest rates, with the rate at around 16%. Today, the rate is 1.6%. Pathological Falling Interest Rates

Professor Antal Fekete introduced the proposition that a falling interest rate (as opposed to a low and stable rate) causes capital destruction. But all other economists, commentators, and observers miss the point. It is no less a phenomenon for being unseen. In early 2008, a question was left begging: how could a company like Bear Stearns which had strong and growing net income collapse so suddenly?

Here is Bear's five-year net income and total shareholder's equity

Isn't that odd? Even in 2007, Bear shows a profit. And they show robust growth in shareholder equity, with only a minor setback in 2007.

And yet, by early 2008 Bear experienced what I will call Sudden Capital Death Syndrome. JP Morgan bought them on Mar 16, for just over $1B. But the deal hinged on the Fed taking on $29B of Bear's liabilities, so the real enterprise value was closer to $-19B.

Obviously, Bear's reported "profit" was not real. And neither was their "shareholder's equity". I think it something much more serious than just a simple case of fraud. Simple fraud could not explain why almost the entire banking industry ran out of capital at the same time, after years of reporting good earnings and paying dividends and bonuses to management.

Also, other prominent companies were going bankrupt in 2008 and 2009 as well. These included Nortel Networks, General Growth Partners, AIG, two big automakers.

I place the blame for Sudden Capital Death Syndrome on falling interest rates. The key to understanding this is to look at a bond as a security. This security has a market price that can go up and down. It is not controversial to say that when the rate of interest falls, the price of a bond rises. This is a simple and rigid mathematical relationship, like a teeter-totter.

A bond issuer is short a bond. Unlike a homeowner who takes out a mortgage on his house, a bond issuer cannot simply "refinance". If it wants to pay off the debt, it must buy the bonds back in the market, at the current market price.

Let's repeat that. Anyone who issues a bond is short a security and that security can go up in price as well as go down in price.

Everyone understands that if a bond goes up, the bondholder gets a capital gain. This is not controversial at all. Nor is it controversial to say that there are two sides to every trade. And yet it is highly controversial—to the point of being rejected with scorn—that the other side of the trade from the bondholder incurs the capital loss. It is the bond issuer's capital that flows to the bondholder. To reject this is to say that money grows on trees.

We won't explore that any further; money does not grow on trees! Instead, we will look at this phenomenon of the capital loss of the bond issuer from several angles: (1) Hold Until Maturity; (2) Mark to Market; (3) Two Borrowers, Same Amount; (4) Two Borrowers, Different Amounts; (5) Net Present Value; (6) Capitalizing an Income; (7) Amortization of Plant; and (8) Real Meaning of an Interest Rate.

Hold Until MaturityThere is an argument that the bond issuer can just keep paying until maturity. While that may be true in some circumstances, it misses the point. When one enters into a position in a financial market, one must mark one's losses as they occur, no matter than one may intend to hold the position until maturity. How would a broker respond in the case of a client who shorted a stock and the stock rose in price subsequently? Would the broker demand that the client post more margin? Or would the broker be sympathetic if the client explained how the company had poor prospects and that the client intended to hold the short position until the company's share price reflected the truth? Mark to MarketThe guiding principle of accounting is that it must paint an accurate and conservative picture of the current state of one's finances. It is not the consideration of the accountant that things may improve. If things improve, then in the future the financial statement will look better! In the meantime, the standard in accounting (notwithstanding the outrageous FASB decision in 2009 to suspend "mark to market") is to mark assets at the lower of: (A) the original acquisition price, or (B) the current market price.

There ought to be a corresponding rule for liabilities: mark liabilities at the higher of (A) original sale price, or (B) current market price. Unfortunately, the field of accounting developed its principles in an era where a fall in the rate of interest from 16% to 1.6% would have been inconceivable. And so today, liabilities are not marked up as the rate of interest falls down.

Refusing to put ink on paper does not change the reality, however. Closing one's eyes does not prevent one from falling into a pit on the path in front of one's feet. The capital loss is very real, as we will explore further below. Two Borrowers, Same AmountLet's look at two hypothetical companies in the same industry, pencil manufacturing. Smithwick Pen sells a 20-year $10M bond at 8% interest. It uses the proceeds to buy pencil-manufacturing equipment. To fully amortize the $10M over 20 years, Smithwick must pay $83,644 per month.

The rate of interest now falls to half its previous rate. Barnaby Crayon sells a 20-year $10M bond at 4%. Barnaby buys the same equipment as Smithwick and becomes Smithwick's competitor. Barnaby pays $60,598 per month to amortize the same $10M debt. Is it correct to say that both companies have identical balance sheets? Obviously Barnaby will have a better income statement. This is because it has a superior capital position, and this should be reflected on the balance sheets. It certainly is not because of its superior product, management, or marketing.

Let's look at this from the perspective of the capital position: the present value of a stream of payments. Obviously, at 4% interest the monthly payment of $60,598 has a present value of $10M (otherwise we made a mistake in the math somewhere). But what is the value of an $83,644 monthly payment at the new, lower rate of 4%? It is $13.8M. Smithwick's has just experienced the erosion of $3.8M of capital! This is reflected in reality, by the uncontroversial statement that it has a permanent competitive disadvantage compared to Barnaby. Barnaby can undercut Smithwick and set prices wherever it wishes. Smithwick is helpless. Most likely, Barnaby will eke out a subsistence living, until the rate of interest falls further. When Cromwell Writing Instruments borrows money at 2%, then Smithwick will be put out of its misery. And Barnaby will be forced into the untenable position it had previously placed Smithwick.

It should be noted that the longer the bond maturity, the bigger this problem becomes. For example, if this were a 30-year bond, then Smithwick would take a $5.4M hit to its capital if interest rates were 8% when it issued the bond and then fell to 4%. Two Borrowers, Different AmountsThis is not the only way that a competitor can exploit the capital loss of a company who made the mistake of borrowing at a too-high interest rate. Let's look at the case of Poddy Hoddy Hotel and Casino. Poddy sells a 20-year $100M bond at 8%, and has a monthly payment of $836K. It builds a nice hotel and casino with bars, a restaurant, a pool, and a few jewelry stores.

A short while later, Xtreme Hotels sells a $138M bond at 4%, and has the same monthly payments. The extra $38M goes into a second pool with a swim-up bar, another restaurant that is themed based on the Galapagos Islands, bigger and more opulent retail stores, and a spiral glass elevator to take guests up to their rooms while enjoying the breathtaking 270-degree views of the city.

Which hotel will consumers prefer?

The Poddy Hoddy Hotel may have been planned based on accurate market research that showed real demand for such a hotel in that location. Unfortunately, the falling interest rate has undermined it. Its investors will likely lose money.

The Xtreme Hotel, on the other hand, is probably a mal-investment. It is likely a project for which there is no real demand. But the falling interest rate gives a false signal to the entrepreneur to build it. Of course, the Xtreme won't be the one to experience Sudden Capital Death Syndrome first. That fate will befall Poddy. Xtreme's turn will come later, at a lower interest rate.

With Smithwick, one might argue that it can pay off its bond in the 20 years it originally expected, so it has not experienced a loss. But in fact, there is a loss even from this angle. Smithwick is paying off its 8% bond at $83,644 per month. But the rate of interest is now 4%, which should be a payment of $60,598. The accurate way to look at this is that Smithwick is paying off a market-rate bond plus a penalty of $23,046 for every month remaining before the bond is fully amortized.

With Poddy Hoddy, one might similarly argue that it can pay off its bond as planned, so it has not taken a loss. But the loss here is even clearer. By borrowing $100M at a rate that was too high, it has effectively dissipated the extra $38M that its competitor, Xtreme, put to good use. It will pay for this waste every month for 20 years (or until it goes bankrupt).

By not marking the losses at Smithwick and Poddy, the accountants are not doing these companies or their investors any favors. In the short run, these companies may declare "profits" and based on that pay dividends to investors and bonuses to management. But sooner or later, they will meet Barnaby and Xtreme who will deal the coup de grace of Sudden Capital Death Syndrome. Net Present ValueAs alluded above, one can calculate the Net Present Value (NPV) of a stream of payments. First, let's look at the formula to calculate the present value of a single payment is: It should be obvious that the present value of a payment is lower the farther into the future it is to be made. One does not value a payment due in 2042 the same as a payment to be made next year. What is not so glaring is that the value is lower for higher rates of interest. A $1000 payment due next year is worth $909 if the rate of interest is 10%, but $990 at 1%. This difference is amplified due to compounding. At 10 years, the payment is worth $385 at 10% versus $905 at 1%.

The NPV of a stream of payments is the sum of the value of each payment. The value of a $1000 payment made annually for 20 years is $9818 at 8% interest. That same payment at 4% has an NPV of $13,590, a 38% increase.

It is important to emphasize that while the bond issuer's monthly payment is fixed based on the amount of capital raised and the interest rate at the time, the NPV of its liability must be calculated at the current rate of interest. The market (and the universe) does not know nor care what bond issuer's entry point was. Objectively, all streams of payments of $1000 per month have the same value at a given maturity and current interest rate, regardless of the original rate. Capitalizing an IncomeLet's look at this from yet another angle. An income can be capitalized, and the purpose of capital is to produce an income. Professor Antal Fekete wrote[3]:

"Suppose you are a worker taking home $50,000 a year in wages. When your income-flow is capitalized at the current rate of interest of, say, 5 percent, you arrive at the figure of $1,000,000. The sum of one million dollars or its equivalent in physical capital must exist somewhere, in some form, the yield of which will continue paying your wages. Capital has been accumulated and turned into plant and equipment to support you at work. Part of your employer's capital is the wage fund that backs your employment. Assuming, of course, that no one is allowed to tamper with the rate of interest." [Emphasis in the original]

"Suppose for the sake of argument that the rate of interest is cut in half to 2½ percent. Nothing could be clearer than the fact that the $1,000,000 wage fund is no longer adequate to support your payroll, as its annual yield has been reduced to $25,000. This can be described by saying that every time the rate of interest is cut by half, capital is being destroyed, wiping out half of the wage fund. Unless compensation is made by adding more capital, your employment is no longer supported by a full slate of capital as before. Since productivity is nothing but the result of combining labor and capital, the productivity of your job has been impaired. You are in danger of being laid off ? or forced to take a wage cut of $25,000."

Without capital, human productivity is barely enough to produce a subsistence living. Without tools, one is obliged to work long hours at back-breaking tasks in order to have a meager meal, some sort of clothing, and something to keep the rain off one's head. Capital destruction is the process of moving backwards towards a time where one worked harder to obtain less.

As described earlier, when the rate of interest falls, it erodes the capital of every bond issuer. If one looks at this capital as being the wage fund (or part of it is the wage fund), then the bond issuer can no longer afford to pay its employees the same wage. If it does continue the same wage anyway, it will eventually suffer the consequences of running out of capital. Amortization of PlantNow let's consider the concept of amortizing equipment and plant at Smithwick Pen. Smithwick borrows $10M to buy equipment. Out of its revenues, it must set aside something to amortize this over the useful life of the equipment, which is 20 years in our example. This set-aside reduces net income; it is not profit but capital maintenance assuming the company intends to remain in business after the current generation of equipment and plant wears out.

How much should it set aside every month? This is the inverse of the NPV calculation. We are now interested in the current monthly payment to arrive at a fixed sum at a future point in time (as opposed to the present value of a stream of fixed payments). The lower the rate of interest, the more Smithwick must set aside every month in order to reach the goal by the deadline. To understand this, just look at what Smithwick must do. Each month, it puts some money into an interest-bearing account or bond. Even if it chooses the longest possible maturity for each payment (i.e. the first payment is put into a 20-year bond, the next into a 19-year 11-month bond, etc.) it is clear that if interest rates are falling then each payment must increase to compensate. Smithwick's profits are falling with the rate of interest!

If Smithwick persists in setting aside every month what it initially calculated when it purchased the pencil-making equipment, it will have a shortfall at the end, when it needs to replace the equipment. Real Meaning of an Interest RateLet's consider what it really means to have a high or a low rate of interest. I propose to do reductio ad absurdum. We will look at two cases (which would be pathological if they occurred) to make the point clearer.

The first case is if the rate of interest is 100%. This means that a $1000 payment one year from today is worth ½ of the nominal value, or $500 today. A payment due in two years is worth $250 today, etc. At this rate of interest, for whatever reason, "future money" is worth very little present money. In other words, the burden experienced by the debtor is a small fraction of the nominal value of the debt.

The second case is if the rate of interest is zero. This means that a $1000 payment due one year from today or 100 years from today is worth $1000 today. At this rate of interest, for whatever reason, future money is worth every penny of its nominal value today. There is no discount at all, not for the loss of use of the money in the meantime, not for the risk, not for currency debasement. In other words, the burden experienced by the debtor is the full nominal value of the debt.

Again, to emphasize, one must use the current market rate of interest not the rate of interest contracted by the borrower at the time of the bond issuance.

The lower the rate of interest, the more highly one values a future payment. The higher the rate of interest, the more highly one discounts a future payment. These statements are true whether one is the payer or the payee. The payer and payee are just parties on opposite sides of the same trade.

Irving Fisher, writing about falling prices (I shall address the connection between falling prices and falling interest rates in a forthcoming paper) proposed a paradox[4]:

Debtors slowly pay down their debts and reduce the principle owed. This would reduce the NPV of their debts in a normal environment. But in a falling-interest-rate environment, the NPV of outstanding debt is rising due to the falling interest rate at a pace much faster than it is falling due to debtors' payments. The debtors are on a treadmill and they are going backwards at an accelerating rate.

How apropos is Fisher's eloquent sentence summarizing the problem! [2] http://www.wikinvest.com/stock/Bear_Stearns_Companies_(BSC)/Data/Balance_Sheet#Balance_Sheet | ||||||||||||||||||

| Posted: 20 Jul 2012 05:46 PM PDT Gold Price Close Today : 1,582.50 Gold Price Close 13-Jul : 1,591.60 Change : -9.10 or -0.6% Silver Price Close Today : 2727.9 Silver Price Close 13-Jul : 2734.4 Change : -6.50 or -0.2% Gold Silver Ratio Today : 58.012 Gold Silver Ratio 13-Jul : 58.207 Change : -0.19 or -0.3% Silver Gold Ratio : 0.01724 Silver Gold Ratio 13-Jul : 0.01718 Change : 0.00006 or 0.3% Dow in Gold Dollars : $ 167.50 Dow in Gold Dollars 13-Jul : $ 165.95 Change : $ 1.55 or 0.9% Dow in Gold Ounces : 8.103 Dow in Gold Ounces 13-Jul : 8.028 Change : 0.07 or 0.9% Dow in Silver Ounces : 470.05 Dow in Silver Ounces 13-Jul : 467.27 Change : 2.78 or 0.6% Dow Industrial : 12,822.57 Dow Industrial 13-Jul : 12,777.09 Change : 45.48 or 0.4% S&P 500 : 1,362.66 S&P 500 13-Jul : 1,356.28 Change : 6.38 or 0.5% US Dollar Index : 83.462 US Dollar Index 13-Jul : 83.384 Change : 0.078 or 0.1% Platinum Price Close Today : 1,412.10 Platinum Price Close 13-Jul : 1,432.50 Change : -20.40 or -1.4% Palladium Price Close Today : 574.85 Palladium Price Close 13-Jul : 584.50 Change : -9.65 or -1.7% The GOLD PRICE mounted by $2.40 today to rest at $1,582.50. Silver waxed 8.5 cents to 2727.9 when the closing bell rang at Comex. GOLD PRICE was beaten up but not dismayed this week. On the 5 day chart it scratched out a kind of rounding bottom, with a low at $1,568. Clearly at $1,575 lurk plenteous buyers. But that only offers us a floor. Up above, gold must break out of this jail by closing above $1,600. GOLD tradeth still within an ambiguous even-sided triangle. Next week the bottom of that triangle stands about $1,560 and rising, the top boundary at $1,610 and falling. Today's close left gold below its 20 day moving average ($1,583.10) and its 50 DMA ($1,586.94), but barely. It's trading sideways into a tighter and tighter range, but we'll see some fun if it breaks $1,600 or $1,560. This is not failure, only gold working out the last of its correction from last August's $1,927 high. Be patient, and buy gold whenever it has a bad day and falls. Autumn will reveal that all this sidewise trading amounted to no more than base building for a rally. In the last fortnight's trading the SILVER PRICE has built a flat topped rising triangle within a falling wedge. These patterns usually break out upside. Until SILVER punches through 2760c, nothing much will happen. Down below it needs to hold 2610c. As with gold, buy on any retreats. Premiums on silver and gold physicals still indicate strong physical demand. If you haven't yet traded gold for silver, now's about your time. Ratio stands at 58.012 today, and surely won't linger there for long. I sing the same song as last week: summer seasonal weakness for silver and gold and a correction rapidly coming to its end. Be calm, keep your eyes on the horizon, not the bumpy ground in front of you, and don't listen to anybody who works on Wall Street or in Washington or the mainstream media.. If markets get any flatter, we'll need to hold a mirror under their nose to see if they're still breathing. This week silver gave up a empty 6.5 cents, dollar a piddlin' $9.10, Dow escalated a nugatory 0.4%, S&P500 a hollow 0.5%, while the almighty US dollar (index) levitated a feckless 0.1%. Look at that US Dollar index 5 day chart. (You can view it yourself at www.ino.com, using symbol "NYBOT:DX".) These tea leaves present two warring interpretations. First, the dollar made a correction this week with a rounding bottom and next week will burst through 83.60 to greater highs. On the other hand, the dollar may have broken and today jumped up for a final kiss good bye before falling through 82.75 next week headed for the earth's core. My outlook for the dollar is strongly colored by central bankers' needs. Those needy fellers right now need stability more than anything else, and neither the European criminals (ECB) nor the US racketeers (Fed) want the dollar to run moonward while the euro plumbs the Marianas trench. They want to keep the whole system together, not preside over its demise. Therefore expect the dollar to remain BELOW the last 83.83 high, but above the 81.52 last low. But the stability plan isn't panning out. Surprise. Euro gapped down and made another new low for the move today -- $1.2144, lowest since May, 2010. None of that is liable to make Mario Draghi or Angela Ferkel or Bloviating Ben sleep well tonight. Closed down 0.94% at $1.2164. As grounds for this tumble media tout a request from the heavily indebted Valencia region asking Madrid for financial aid. That hints that Spain itself needs rescuing. That sucked all optimism out of stocks and the euro and sent it hurtling into the black hole of outer space. Note, dear readers, how the Central Bank criminals have been applying the "slow burn" technique to European problems. In their book, if it doesn't flare up into a full-blown panic with lines outside the banks and blood running by gallons in the street, they are still winning. If they get to 5:00 p.m. and the financial system hasn't exploded, they win. Today. I could almost guarantee that they already have a target for the new $/Euro exchange rate, somewhere around $1.1800 - $1.2000, and when it reaches that level they'll all start intervening to set a new rate. In other words, they are devaluing the euro like a kid slowly hissing the air out of a balloon. I'm telling y'all, as I have told y'all, this is past saving, past reforming, and you are smoking meth if you believe the measures tried so far will resuscitate severely debt-poisoned and debt-addicted economies. Ain't no central bankers going to let that yen run away, either. Today it gained 0.11% to end at 127.36c (Y78.47), but that just edged it sidewise and didn't rise through the downtrend line. Remains, however, above the 200 DMA (126.68), a sure botheration for the Japanese Nice Government Men. Stocks this week hit their top Bollinger Band (a measure of current range) and, unable to penetrate, bounced down, losing most of the weeks' gains today. S&P 500 dipped 1.01% today (13.85) to close 1,362.66. Dow slipped 0.93% (120.79) and ended 12,822.57. A bear market likes to lure investors into its den where it can maul them and gnaw their bones at leisure. 'Twouldn't surprise me to see the Dow reach 13,000 to universal jubilation before it plunges again. Y'all just remember that when the jubilation breaks out, so you don't get mangled in the bear's cave. Y'all enjoy your weekend. | ||||||||||||||||||

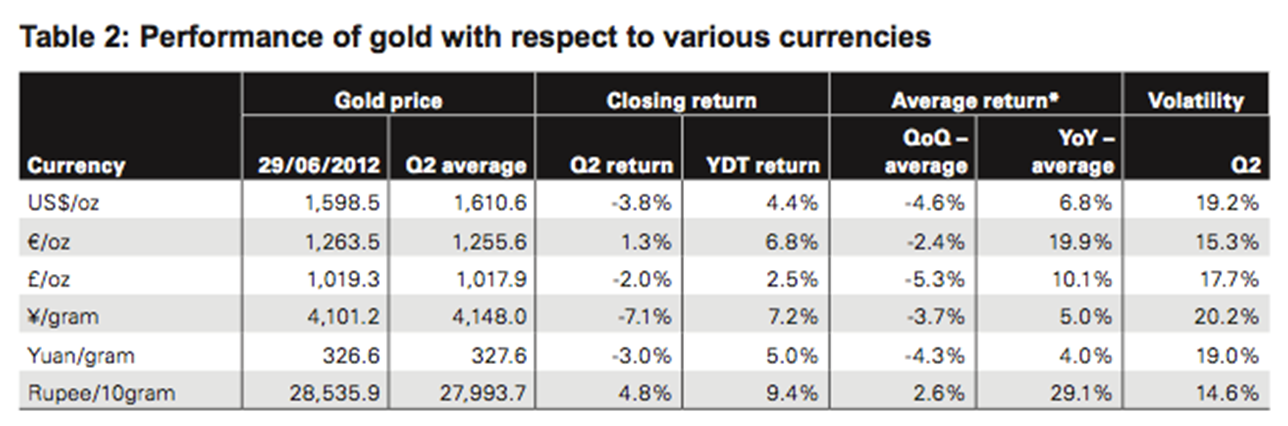

| Gold Q2, 2012 – Investment Statistics and Commentary Posted: 20 Jul 2012 05:15 PM PDT from GoldCore:

Silver is trading at $27.07/oz, €22.22/oz and £17.32/oz. Platinum is trading at $1,418.25/oz, palladium at $577.80/oz and rhodium at $1,190/oz. Gold rose $3.70 or 0.23% in New York yesterday and closed at $1,581.00/oz. It rose as high as $1,590/oz prior to determined selling which saw gold fall. Gold ticked higher in Asia prior to falling soon after the European open. Gold has been trading in a range between $1,530/oz and $1,630/oz for nearly 2 months despite the Eurozone debt crisis entering its 3rd year and looking set to escalate and despite signs that the US economy is on the verge of a sharp recession. | ||||||||||||||||||

| Posted: 20 Jul 2012 04:29 PM PDT | ||||||||||||||||||

| Economic Countdown To The Olympics 3: A Winning FX Strategy Posted: 20 Jul 2012 04:28 PM PDT In part three of our five-part series tying the Olympics to economics (previously here and here), we note that in a rather surprising coincidence, the Olympics' host nation has been a rather simple tool to pick long-term 'winners' in the FX market. As Goldman points out, while we doubt that the Olympics directly affects the FX market, it has provided excellent long-term appreciation potential. We assume this means that the BoE will stop QE or we really don't see cable extending this performance record, though the findings suggest that systematically picking the 'next' host tends to pick winners more than losers. Goldman Sachs: The Olympics As A Winning FX Strategy Is it possible that the Olympics affect foreign exchange markets? At first glance, this may seem unlikely as the Olympics are a relatively small event when compared to the size of the Global FX market, which turns over several trillion Dollars every single day. However, from an economic point of view, the question does make some sense. In a standard open economy model, government spending such as constructing the Olympic sites and improving the infrastructure typically leads to real appreciation. Also, a country hosting the Olympics is likely to see an influx of visitors during the actual Games. This would be recorded as a services export in the balance of payments and, all else equal, it would increase the demand for local currency. To investigate whether the Games do affect FX markets, we constructed a real effective exchange rate for the Olympics, by combining the Goldman Sachs Real Trade Weighted FX Indices (GS RTWI) of the host countries starting after the Moscow Olympics in 1980. For example, the GS RTWI for the Chinese Yuan is used between August 29, 2004 (the closing date of the Athens Olympics) and August 24, 2008 (the closing ceremony of the Beijing Olympics). For host cities in the Euro area, we use the Euro RTWI.

The Olympic RTWI has appreciated by around 90% since the end of the Moscow Olympics in 1980, which is vastly more than any other individual currency (apart from a few hyperinflation cases with highly unstable exchange rates). The table shows that the currency with the second strongest real appreciation was the Japanese Yen: it has appreciated by around 54% since 1980, and remains substantially below the appreciation of our synthetic Olympic index. This suggests that individual currencies do tend to appreciate more than usual in the run-up to hosting the Olympics. By systematically picking the next hosting currency, the Olympic FX Index tends to pick 'winning' currencies more often than 'losers'. However, there are a few important caveats. First, the four-year periods preceding the Seoul 1988, Sydney 2000 and London 2012 Olympics saw the host currency depreciate. In other words, the Olympic FX Index is not guaranteed an FX Gold Medal. Second, real effective exchange rates can appreciate because of high inflation rather than nominal appreciation. Carry may be higher as well, meaning that investors may still be able to benefit, but Olympic currencies are not guaranteed to appreciate in nominal terms. To check the performance of the Olympic currency, we calculated the return to date on an initial investment of $100 in the Olympic currency at the end of the Moscow Games, including carry. Following the host country rules laid out above, this would mean that at the end of the Beijing Olympics the investment would have been shifted out of Renminbi and into Sterling. Starting with $100 in 1980, this Olympic investment would currently be held in Sterling and worth about $1,020. In comparison, investing $100 in rolling 1-year USD investments would have returned only about $700. In summary, the empirical results suggest that a synthetic Olympic currency would outperform over time. Even though Olympic investment spending is a relatively small share of GDP (for example, around 0.8% for the UK 2012 Games), one potential explanation is that there is a positive selection bias in picking the host city. For example, countries with strong growth in the years before a decision would be able to invest more in their Olympics bid, increasing the chances of winning the Games. This is even more so if growth is supported by a structural story that lasts longer than just one business cycle. The Beijing Olympics are an obvious recent example. Overall, we continue to doubt that the Olympics directly affect the foreign exchange market. However, the Olympics may be a rather simple tool to pick long-term 'winners' in the FX market with good long-term appreciation potential. Thomas Stolper and Constantin Burgi | ||||||||||||||||||

| Making A Gold Nugget From Electronic Waste Posted: 20 Jul 2012 04:08 PM PDT | ||||||||||||||||||

| Profiting from Europe’s New Gold Rush Posted: 20 Jul 2012 03:47 PM PDT | ||||||||||||||||||

| Posted: 20 Jul 2012 03:44 PM PDT Dave Gonigam – July 20, 2012

This morning is a good time to recall what set off the riots that swept away authoritarian regimes in Tunisia, then Egypt, then Libya and perhaps now Syria. "Much of this," Addison wrote here 18 months ago, "is backlash against corrupt and/or authoritarian regimes. But it took empty bellies to finally bring the rage to the surface."

The situation today is "not even comparable to 2007-08," a veteran trader tells the Financial Times.

The National Drought Mitigation Center reckons 42% of the continental United States is in severe, extreme or exceptional drought — up from 37% only last week:  "The corn and soybean crops are at risk," says Dan, scanning the landscape for winners and losers. "Yields will likely fall to multi-year lows. This is tragic for crop farmers devastated by the drought." "But farmers with the good fortune of water resources will see a much-deserved windfall of high corn and soy prices paid by food companies and consumers. This windfall will bolster the financial strength of the U.S. farm sector, so it can remain world-class in its productivity and technology (to mitigate supply damage from future droughts). A lot is riding on their shoulders." On the other hand, "Large food processors relying on steady supplies of farm products at low prices will struggle."

"Fears of slowing global growth and how it will affect commodities have caused many investors to dig their heels in the ground and resist owning natural resources." But Mr. Holmes says the demand for resources is nowhere near played out. He cites Jeremy Grantham, the legendary strategist from GMO, who says, "in the long run, you can't afford to miss this opportunity":  "The past decade shows a clear tipping point for resources," Frank says, referring to the above chart. But a decade into the broad resource rally, it becomes more important to pick your targets: "Smart investors look past the rampant negativity in the media to see these patterns and anomalies to determine where the opportunities and threats lie." "There's always an ebb and flow of commodities, both seasonal and cyclical. It's important to anticipate these global trends to know how to participate." At this stage of the game, Mr. Holmes is partial to dividend-paying resource stocks.

Laissez Faire Books senior editor Doug French sums up Mr. Rule's recent appearance at FreedomFest in Las Vegas: "The opportunity in resource markets is that millions of people around the world are enjoying a higher standard of living. As these people climb out from under the thumb of oppressive governments, their living standards rise — not to buy iPads, but to buy stuff requiring natural resources." Meanwhile, "the stock prices of companies that have secured natural resource deposits are unloved and may get more so, setting up what Rule thinks will be the 'best resources M&A [mergers and acquisitions] market ever.'" No doubt Mr. Rule will rattle off dozens of names and ticker symbols next week during the Agora Financial Investment Symposium. If you can't join us, there's always the next best thing — which this year is even better.

Despite the slowdown in China, he too believes there are still opportunities in the resource sector. "I don't want to be short copper," he tells CNBC, "because copper can, like other markets, be manipulated because there are not that many players in the copper market, so we could see a rally in copper prices, we could see a rally in gold prices and so forth and so on."

Count Mr. Ritholtz as unimpressed — especially after the existing home sales numbers yesterday from the National Association of Realtors. Fully 25% of June sales were foreclosures or short sales sold at deep discount. The NAR makes a big deal of the fact this is down from 30% a year ago. "Hence," writes Barry, "a huge drop in distressed sales pressuring prices (which would have caused even more distressed sales) is an artificial benefit of the voluntary foreclosure abatements — which have now ended." "The present residential real estate situation can be best described as massive Fed stimulus + government-induced foreclosure abatements = some stabilization." "Anything beyond that statement falls between wishful thinking and a guess."

"Bernanke still subscribes to the view that if you make credit cheaper, you'll boost economic growth. As far as we could tell, he provided absolutely no proof that the Fed's purchase of U.S. Treasury bonds and mortgage bonds in QE1 and QE2 did anything to promote growth in the real economy. All he's done is boost stock prices and make it easier for the U.S. government to finance its deficits." "The Fed can't 'promote growth' when households are reducing debt. It's telling that Bernanke said the government needs to get fiscal policy in order (spending), in order for consumers and businesses to be more confident about taking risk."

"The German parliament voted and passed the resolution to have the ESM [European Stability Mechanism] recapitalize the troubled Spanish banks," says EverBank's Chuck Butler. "But remember, this is still the final decision of the German Constitutional Court, and they have stated that they will not have a decision on this until September. That's a long time to go with uncertainty hanging over the euro like the Sword of Damocles — and another reason that I just don't like the euro this summer." Meanwhile, it takes 78.576 Japanese yen to equal one U.S. dollar this morning — good news for Abe Cofnas' "mock trade" of the week. Recall from Monday's episode that Abe expected the yen to end the week below 80.25. Barring a major market dislocation after we go to press… the trade is good for a 7% gain in four days. [Ed. note: We have to go back and count: Eight experts cited in today's 5 will appear next week at the Agora Financial Investment Symposium. And that doesn't count historian/author/documentarian Niall Ferguson... or perennial favorite Doug Casey... or the stable of Agora Financial editors like Byron King, Chris Mayer and Patrick Cox... or Agora Inc. founder Bill Bonner. (The Symposium is the only event in which he speaks every year.) Right now, you can lock in the lowest price on recordings of this year's event. And because so many people have asked for it, we're making a video option available too. That's right: Whether you want to watch at your desk or listen on the go, we have you covered. Act now for your best value.

You sue the documentarian who made a film about your experience because she made you look bad. Windermere, Fla., is home to Versailles, a mansion inspired by the French original and, in the words of colleague Chris Campbell, "the Godzilla footprint of the American delusion." Consisting of 90,000 square feet of 13 bedrooms, 22 bathrooms, a 20-car garage, three pools, two movie theaters, a bowling alley, a ballroom... (pausing for breath...) ... a banquet kitchen, 10 'satellite' kitchens, a two-story wine cellar, a two-story library, full spa, a bar and game room, a fitness center, an arcade, and an indoor roller-skating rink... (haaaaa..) ... with Italian white marble outlining throughout... and that's just the interior:  Two-thirds of the way through building this monstrosity, time share tycoon David Siegel was caught up in the market meltdown of 2009 and nearly ended up in foreclosure. He tried to sell, cutting the price from $100 million (finished) or $75 million (as is) to $65 million (as is). Producer Lauren Greenfield figured it was the stuff of a documentary... so she made one called Queen of Versailles, featuring the 76-year-old Siegel and his 46-year-old wife, Jackie. (Jackie seems like a fine sort: Nightline recently caught her making snarky comments about piddly 99%ers jealous of their elite status... and one of their eight children complaining that one of the movie theatres isn't big enough...)  The Siegels are now suing Greenfield for defamation, saying the film puts them — get this — in a bad light. At the very least, David Siegel says she should update the film — now in limited release — to reflect the fact that he's recovered his footing and managed to secure a $25 million loan to finish construction and hang onto the place himself. If that's something he's actually proud of...

[We've been at this long enough to know there's a "but" coming...] "However, can you please stop destroying the concept of capitalism and free markets by using the term 'crony' as a modifier of capitalism? Since when is a franchise enabled and protected by government force capitalistic or free market? It is neither. Call a spade a spade. It is fascism, mercantilism, socialism, Marxism, monarchy or any other authoritarian system. It is not capitalism." The 5: You mean yesterday's 5? That was professor Niall Ferguson's choice of words, not ours. We hear your complaint loud and clear… but we fear the damage to those once-noble terms was done long ago.

"Ticks will eventually drop off a dog. More appropriate would be comparing government to a tapeworm. You seem to be getting weaker and weaker, but can't see the reason why until it eventually kill its host."

"In actuality, this country is in the financial mess we are in for a number of reasons, ONE of which is because the Republican Party was extremely complicit in helping the corporate structure of America export most of our manufacturing job to defund the unions that supported the Democratic Party. So please stop with your Republican BULL; what this country needs are policies that will benefit the general welfare, and not just the welfare of the corporations and wealthy elite. If the middle class does well, all levels of society will do well." The 5: "Republican bull"? You must be fairly new 'round these parts. Heh…

"The use of person (perhaps social or place?) deixis — on which I did a graduate paper — seems to indicate that indeed Obama was referring to the business builder. Unfortunately, Obama ham-hands language just as much as Bush, so it is a bit unclear. However, it appears relatively clear Obama was talking about the business creator." "In any event, I humbly suggest your Obamaphile correspondent stop reading your newsletters on how to make money, and get busy scouring the IRS manuals to find out how new and creative ways to pay more taxes to support… well… whatever."

"In the not so distant past (and even right now sometimes), child development experts were divided into two rather polarized camps: 'nature' (you will do well if you inherited good genes — upbringing is secondary) and 'nurture' (you will do well if you were raised well — good genes are secondary). Most students of child development now agree that the values of nature and nurture are equally important and totally intertwined." "I suspect this is true with regard to the evolution of societies, as well. In America today, we increasingly burden our emerging entrepreneurs with oppressive regulations (the equivalent of otherwise healthy children being born with club feet)… and then… if they succeed in running a good foot race, anyway, we take much of their prize away from them (the equivalent of children being beaten the hardest when they succeed the most)." "Thankfully for the future of America, many entrepreneurs are like the best race horses: They don't care if they die racing… they just love to run." The 5: Amen… Have a good weekend, Dave Gonigam P.S. Our final correspondent's comment gets to the heart of the theme of this year's Agora Financial Investment Symposium. It's "Innovate or Die: Empire at a Turning Point." As Niall Ferguson pointed out in yesterday's 5, the United States — and developed nations in general — can break out of their economic funk by either fixing fouled-up laws and institutions… or by technological innovation. The latter seems like a far better bet… and Ferguson leads a cavalcade of speakers who will address that very issue. Politicians and central banks will always muck up the works, but there's still a world of profit opportunities our expert lineup will identify. If you can't join us in Vancouver next week, you can always get the high-quality audio — and now video — recordings of the event. Sign up here to secure the best price. | ||||||||||||||||||

| Greyerz: $1.5 Quadrillion Bubble & Gold Into The Stratosphere Posted: 20 Jul 2012 03:44 PM PDT  Today Egon von Greyerz told King World News, "The world is simply drowning in debt." Greyerz, who is founder and managing partner at Matterhorn Asset Management out of Switzerland, also said, "This is why it is guaranteed that governments will print money," and that "Prices of hard assets will go into the stratosphere." Today Egon von Greyerz told King World News, "The world is simply drowning in debt." Greyerz, who is founder and managing partner at Matterhorn Asset Management out of Switzerland, also said, "This is why it is guaranteed that governments will print money," and that "Prices of hard assets will go into the stratosphere." But first, here is what Greyerz had to say about the ongoing financial crisis and where we are headed: "Spanish rates have broken back above the 7% level once again, but in reality we know that many European countries will never be able to repay these debts. You now have a total worldwide debt of around $150 trillion. If you add to that contingent liabilities, unfunded liabilities, pension funds, etc., you are talking about $500 trillion." This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||

| Gold market cited in speculation on where next financial scandal will come from Posted: 20 Jul 2012 03:27 PM PDT After Libor, Where Will the Next Scandal Be? By James Moore http://www.independent.co.uk/news/business/analysis-and-features/special... No one would have believed Libor interest rates could generate the biggest scandal in financial services since Fred Goodwin waltzed off into the sunset with a L500,000 annual pension. That was until a journalist on the Wall Street Journal noticed there was something odd about the numbers banks were submitting during the financial crisis, prompting a multi-million-pound transatlantic investigation. Its findings shone an unflattering light into one of the City's dark corners that resulted in Barclays paying L290 million in fines and saw the resignations of its chief executive, chief operating officer, and chairman. ... Dispatch continues below ... ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf But Libor interest rates aren't the only oddity in the Square Mile. Here we shine a light into a few more of the City's dark corners. The professionals dismiss talk of a scandal coming from any of them. But they used to say that about Libor interest rates. Gold fixing Twice a day the price of the precious metal is set -- or (and it's a rather unfortunate term) fixed -- by five banks: Bank of Nova Scotia, Deutsche Bank, HSBC, Societe Generale, and (wait for it) Barclays. The leader of the fix begins by proposing a price and the five then simulate trading, by looking at their own and client's buy and sell orders, around it until the price is set. All transactions in gold in London are based on this price. It's an arcane process to say the least and until 2004 used to be done in conditions of high secrecy at the offices of NM Rothschild in St Swithin's Lane. The price was only set when all five members lowered little Union Jack flags. Since Rothschild sold its interest in the market (to Barclays) a teleconference has been set up and members simply call out "flag" to indicate a change in position or "flag down" when they are ready to complete. Seriously. The market itself is not regulated as such. It's done under the auspices of the London Bullion Market Association and follows a code of conduct. There are also silver and platinum fixes. The FTSE 100 Britain's premier stock market index. But did you know it's not even made up of the 100 biggest companies? To get in you have to be better than 90th place in terms of market capitalisation (the value of all your shares put together). And to get booted out you need to be below 111th (the index is reviewed every three months). You also have to be a British company. Sort of. Kazakhmys, for example, is headquartered in London and its shares are listed here. But it's a bit of a stretch to call it British. WPP, the advertising and media group, is headquartered in Dublin but because its shares have a primary listing in London it gets in. Ryanair, however (to the chagrin of its boss, Michael O'Leary), is out. Even though it has an operating base here, the primary listing of its shares is not in London. What that shows is the FTSE Committee is scrupulously honest. It obeys the somewhat quixotic rules to the letter. Being in the FTSE 100 is a big deal. It gets you noticed, brings in analysts to write about you, and forces tracker funds to invest in you. Indices can also be traded and there are innumerable derivatives contracts linked to them. If there's to be a scandal it's more likely to involve traders trying to influence who gets in (or is booted out). Trading in stocks and shares is, of course, tightly regulated. The formation of the index, though, is not. The Foreign Exchange Market Or the Forex market in City-speak. It's hard to call this a dark corner. It's the biggest market in London, and in the world, in terms of the sheer volumes of money changing hands -- $4 trillion (L 2.6 trillion) daily. Not that this stops people from trying to manipulate it. Central banks such as the Bank of England, the US Federal Reserve, and lots of others are always at it, either trying to push their currencies higher (when they fear a forced devaluation and inflation) or lower (to make exports more competitive). Their efforts tend to meet with very limited success. Speculators, particularly hedge funds, are very active and their role can also prove highly controversial. Of more concern right now are the games being played by so called "high-frequency traders" who use black boxes to place blistering numbers of currency trades in nano-seconds. Lots of influential people question their activities and want the hammer brought down. They might have a point. Over-the-Counter Derivatives No, this is not a strange new product at Waitrose. It is a contract between two parties and usually involves a bank either as a broker or on one side or another of the deal. Let's say you produce animal feed and you're worried the price of lysine (an additive) will go up. For a fee, you can ask an investment bank to produce a contract that will allow you to buy the stuff at a fixed price in, say, six months' time. Thus you are protected. A supplier of lysine (worried that the price might fall) might also sign a deal to sell at a similar, fixed price. The bank sits in the middle. These contracts can be highly complex. The consequences of a big bank having a lot of nasties that could blow up in the event of the economy doing something unexpected keeps watchdogs awake at night. They want to regulate the whole thing more tightly, standardise contracts and make them tradeable over exchanges. Which might help a bit. Oil markets This one could be a real nasty. Derivatives based on oil prices are, of course, regulated. But the "spot" crude price is not. And a report for the G20 has found -- guess what -- that the market is open to manipulation. The price at the pump is (in part) dependent on oil price benchmarks which retailers use to work out the price for future supplies. The rates are calculated based on submissions from firms which trade oil daily. So -- guess what -- it rather depends on how honest banks and hedge funds that do this trading are. Oh dear. Price-reporting agencies point out that they employ journalists to weed out false submissions from those with an incentive to push prices one way or another. But the Libor affair has set alarm bells ringing about markets based on the submissions of people who participate in those markets. Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res... | ||||||||||||||||||

| Weekly Chart Porn - Uber-Bullish Silver Signals Posted: 20 Jul 2012 03:11 PM PDT | ||||||||||||||||||

| Posted: 20 Jul 2012 03:01 PM PDT Synopsis: How a group of Amish took a page from the Gandhi playbook to triumph over state and federal bureaucrats Dear Reader, Due to one thing and another, I am only just now beginning today's missive. "Now" being 10 AM. Normally, I would be starting closer to 7:00 or even 6:00 AM – so I will have to hurry along or be responsible for causing our always patient production team to work into Friday evening, after an already long and very busy week. To speed things along, it is my intention not to engage in long essaying but rather to fly through some snippets that caught my eye this week, as well as to share with you a couple of contributions from colleagues and one from a dear reader. As we set off on today's adventure in musing, I have the music turned up loud on a song titled Angel by Massive Attack, a largely overlooked English group that is now defunct. You may recognize the song from Guy Ritchie's excellent movie Snatch, featuring a terrific English cast along with Brad Pitt in a stellar role as a gypsy boxer. Later on, I plan on telling you about two other movies I've seen recently that appear to have been seen by almost no one – but which I enjoyed quite a bit and hope you will, too (at least if you have a somewhat warped sense of humor!). But first, on with the musing...

| ||||||||||||||||||

| Financials FUBAR As S&P/NASDAAPL Close Unch For The Month Posted: 20 Jul 2012 02:28 PM PDT Oh the exuberance. CRAAPL led the NASDAQ down heavily today as its high-beta ebullience reverted back to 'normal' and the S&P 500 and NASDAQ are closing practically unchanged for the month of July. The Dow Industrials are down 0.4% but the Dow Transports are down 2.65% - near their lows of the month. Financials have been monkey-hammered as today's offer-a-thon dragged them dramatically lower (MS/BAC -13% for the month). A late-day OPEX-inspired activity burst dragged volume up from near year lows and likely inspired the surge lower in VIX into the close (even as stocks went sideways to lower) - but still ended up 0.75vols back above 16%. Treasuries end the week down 2-3bps at the long-end and 4-5bps at the short-end with a decent rally today. The USD is up a modest 0.25% on the week - thanks to notable weakness today in EURUSD (which broke its pattern of reverting today) though dispersion was broad with AUD stronger by 1.5% and EUR weaker by 0.75% on the week. Gold and Silver are practically unchanged on the week, Copper down around 1.5% and WTI up over 5% - but only WTI is up for the month. Cross asset class correlation picked up towards the end of the day as ES caught-down to broad risk asset's less sanguine view of the world. ES ended the week up around 7pts, VIX down around 0.5 vols with financials -2.25% and Energy +3%. The major US equity indices are unch for the month...with the Trannies lagging badly... but Treasuries are very significantly lower in yield... as the major financials have been pummeled this month... With some very considerable dispersion among the sectors this week... and for the month... and on the week, equities remain modest winners relative to the Friday close as the rest of the QE-sensitive assets converge lower... Correlation rose notably (more systemic risk off flows) as ES converged lower to where broad risk assets were (please ignore the gap in the data - there was a data center error)... But Oil was the big mover on the week (and month so far) especially compared to the rest of the economically sensitive commodities... Charts: Bloomberg and Capital Context Bonus Chart: While all eyes were focused on Kayak's IPO - which ended well off its highs, we note that Palo Alto Networks - while well above its IPO price - ended at the lows of the day, 15% off its highs of the day, oops! Bonus Bonus Chart: The scary echo chart....another perfectly correlated failed retest of the latest swing high to continue the correlation with last year... | ||||||||||||||||||

| Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week Posted: 20 Jul 2012 02:17 PM PDT Gold climbed $5.79 to $1586.79 in Asia before it fell back to $1573.80 by a little before 8:30AM EST, but it then rallied back higher in New York and ended near its new afternoon high of $1587.10 with a gain of 0.18%. Silver slipped to as low as $26.82 before it also rallied back higher and ended near its new afternoon high of $27.437 with a gain of 0.22%. | ||||||||||||||||||

| Gold and Silver Disaggregated COT Report (DCOT) for July 20 Posted: 20 Jul 2012 02:12 PM PDT HOUSTON -- This week's Commodity Futures Trading Commission (CFTC) disaggregated commitments of traders (DCOT) report was released at 15:30 ET Friday. Our recap of the changes in weekly positioning by the disaggregated trader classes, as compiled by the CFTC, is just below.

In the DCOT table above a net short position shows as a negative figure in red. A net long position shows in black. In the Change column, a negative number indicates either an increase to an existing net short position or a reduction of a net long position. A black figure in the Change column indicates an increase to an existing long position or a reduction of an existing net short position. The way to think of it is that black figures in the Change column are traders getting "longer" and red figures are traders getting less long or shorter. All of the trader's positions are calculated net of spreading contracts as of the Tuesday disaggregated COT report. Vultures, (Got Gold Report Subscribers) please note that updates to our linked technical charts, including our comments about the COT reports and the week's technical changes, should be completed by the usual time on Sunday (18:00 ET). That is all for now. | ||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Coiling for an Imminent Move Posted: 20 Jul 2012 02:09 PM PDT | ||||||||||||||||||

| The Great Demise: EUR at Two-Year Low Posted: 20 Jul 2012 01:55 PM PDT The Great Demise: EUR at Two-Year Low  Dislaimer: I have not position in any stocks listed above and do not plan on entering the market within the next 48 hours.  | ||||||||||||||||||

| Posted: 20 Jul 2012 01:40 PM PDT Via Rational Capitalist Speculator, Weekly Bull/Bear Recap: Jul. 16-20, 2012Bull + Housing continues to show signs that the worst is finally over and that the recovery is slowly gaining strength. Improvement on the margin is becoming clear. The NAHB Housing index rises by the most since 2002 to its highest reading since 2007. Housing starts rise to their highest since October 2008 and are up 40% over the past 18 months (permits remain in an uptrend). Higher starts than completions signal that job creation is coming soon as the latter catches up. Meanwhile, refinancing through the HARP program is gaining momentum, leading to improved income streams for many consumers. + Manufacturing remains a sturdy sector for the U.S. recovery. Despite a negative reading in the ISM's latest survey, the hard data tells a different story. Total output rises 0.4% in June, led by a 0.7% rebound in manufacturing, to a new post-recovery high and more than reversing a decline of 0.2% in the prior period. Output has expanded for 29 consecutive months. YoY rates for Industrial and Manufacturing Production are 4.7% and 5.6% respectably, still reasonably healthy. Production of business equipment remains in solid growth territory. + Global economic activity is stabilizing and growth is set to resume in the coming months. China has begun preparations for additional spending/stimulus and copper is starting to sniff this strengthening development (3-Mth chart view is best). The country's housing market is already heating up. Meanwhile, Italian Industrial Orders are stabilizing, rising by 1.7% in May, offsetting a 1.8% drop in the prior month. Moreover, Spanish Industrial New Orders also came in better than expected; the country's OECD leading indicator shows stabilization in the coming months. + The U.S. economy is dynamic and is transforming before our very eyes. Exports, shale gas/oil investments, and oil discoveries are new fountains of growth. Consumer deleveraging has come far and home prices are enticing for long-term investment. Furthermore, China is finally embarking on the path towards becoming the next world's consumer. This is undoubtably bullish. + Risk assets are holding up well, even as investors are concluding that QE3 may not be forthcoming. Furthermore, short-interest is at levels preceding powerful bullish moves, such as in Q3 2011: "To the extent people have gone short U.S. domestic equities, I think they're kind of wasting their time" — Michael Shaoul. Continued bearishness means there's a wall of worry to climb… + …Furthermore, earnings reports from international companies have surpass expectations. Continued signs of stabilization in global economic conditions will lead to higher stock prices. Tech has been buoyant even in the face of all the sour macro news. The market's reaction to the news is more telling than the news itself. Bear - In Spain, home prices are absolutely imploding, bad loans are mushrooming, and bank deposits are dwindling. Valencia signals distress and taps assistance from the government. The results? A Spanish Treasury official says there's "no money left to pay services" and sovereign bond prices collapse (so much for the summit); 100 billion euros will not be enough to shore up Spain's banking system. Meanwhile the ECB reverses its position and now advocates imposing losses on senior bondholders of slumping financial companies. The threat of losses is the pin to pop the "Moral Hazard Bubble." Meantime, Germany says sovereigns will still be responsible for bailout money; the country's economic sentiment report falls for the 3rd consecutive month; and Deutsche-marks are making a comeback. Moreover, 13 Italian banks are downgraded by Moody's. The Eurozone has already split according to intra-bank capital flows. - The U.S. economy is entering a recession. The consumer is faltering, evident by the third consecutive drop in headline and core retail sales, both falling for the third consecutive month, the first time that's happened since the dark days of 2008 (weekly consumer metrics don't point to a rebound in the immediate term). Meanwhile, the job market looks to be headed south as per a plunging employment sub-index in the Philly Fed's manufacturing report as well as the National Association's for Business Economic report on hiring trends. These trends are confirmed by both the Gallup Poll's U.S. Economic Confidence Indicator and the Conference Board's U.S. Leading Indicator. Continued suffering in the middle to lower-class is slowly creeping to its breaking point. - Bernanke warns on the assumption that funny money will cure all ills (in fact, the "unintended consequences" of ZIRP are clearly making things worse). The looming fiscal cliff as well as weakness in Europe are together critically damaging confidence. Both must be resolved he says. Unfortunately, "it's out of our hands," which means that the Fed would be powerless to stop the oncoming contagion from a Eurozone implosion or a crisis of confidence from continued political bickering —likely to lead right up to the final hours. Meanwhile, how on earth can the bulls say there's high bearishness out there when the VIX just recently leaked under 16? This sticks of complacency — there's continued misplaced hope that Europe will get things done and that China will stimulate the global economy back into recovery. - Continued uncertainty in Europe is negatively affecting global business sentiment. The IMF slashes its global growth forecast, while foreign investment in China falls almost 7% YoY in June. Premier Wen sure sounds more worried than bullish analysts banking on a second-half rebound. Global bellwethers are sounding the alarm of a slowing business environment. - Geopolitics continues to cast its shadow over the faltering global economy. Syria is now officially in a "non-international armed conflict," or civil war; Russia reaffirms its support for al-Assad. Meanwhile, the Middle East is fast turning into a proxy war among the mightiest. Israel vows a response against "a global campaign of terror carried out by Iran and Hezbollah" after 5 Israelis are killed in a bus explosion in Bulgaria. Finally, the thinly covered South China Sea dispute isn't going away. - Housing prices have not bottomed, not when you have rising shadow inventory, stagnant purchase applications, and an unclogging foreclosure pipeline. But keep on building those houses . ————————————————————- Tons of info. Want to know how I see things? Check out my macro and market outlooks. | ||||||||||||||||||

| Posted: 20 Jul 2012 01:38 PM PDT | ||||||||||||||||||

| COT Gold, Silver and US Dollar Index Report - July 20, 2012 Posted: 20 Jul 2012 01:32 PM PDT | ||||||||||||||||||