saveyourassetsfirst3 |

- Gold is Holding Up Better in Euro than in the Dollar

- Fear of a dollar collapse will make the Chinese the biggest buyers of gold this year

- BOLD Prediction For End Of Week Silver Spot

- 4 Industrial Metals & Minerals Stocks Sporting Strong Dividends While Raking In Profits

- Germany’s Bunds “Behaving More Like Peripheral Bonds” as Spain Yields Hit Fresh High, Gold Sets New Record in India

- It's Not Just Dinah In The Kitchen Anymore At Williams-Sonoma

- 5 Consumer Dividend Stocks Sustained By Lean/Mean Profits

- Watch Tony Robbins discuss the $15 trillion U.S. national debt

- Dow Industrial Bulls, Gold Bugs, Wagering Big Bets on QE-3

- Why Physical Silver Demand is Heading Higher

- Update: Central Bank Gold Holdings

- Physical silver demand heading higher

- Silver correction putting miners under pressure

- Euro Debt Crisis is Good for Gold and Silver: Sprott Money Manager Charles Oliver

- Anthony Robbins Bullish On Gold - Faber and Bass His Financial Gurus

- Oil 20% Down, Price at the Pump Stays the Same, The-Powers-That-Be Hover Above & Beyond

- Gold & Silver Market Morning

- We Will Now See Extreme Turbulence in Global Markets

- Platinum to join fight against cancer?

- The Aspen silver mine is on sale for $9.5M

- German Bunds 'Not Behaving Like Safe Haven'

- Motivation Speaker Follows Faber & Bass as Gold Gurus

- Harry Dent: Distorted Markets

- The Crisis Shifts to Italy

- Blaming the Machines for Gold Price Moves

- Silver Futurist: The Hyperinflation Discussion

| Gold is Holding Up Better in Euro than in the Dollar Posted: 14 Jun 2012 06:41 AM PDT

from blog.milesfranklin.com: Today, Bill Holter wrote his first exclusive article for Miles Franklin. He will regularly post to our blog. You can read his first article here: Jamie Dimon Speaks! – Bill Holter An archive of his articles will be accessible under the Author Section here: Bill Holter Articles Later, in the daily, I have included the first few pages of John Williams (Shadowstats) Special Commentary, A Review of Economic, Systemic-Solvency, Inflation, U.S. Dollar and Gold Circumstances. I urge all of you to subscribe to Shadowstats. If you only subscribe to one newsletter, this should be first on your list. Without Williams' unique data, it is extremely difficult to make rational decisions on your finances. The phrase "garbage in / garbage out" is true not only for computers, but also with our financial data. The crap we get from the MSM and BLS is truly "garbage in." Here are some comments from a friend: As soon as Gold moves above $1642 it will initiate a new pattern of higher highs & higher lows, which confirms the intermediate bottom on May 16TH. I can find nothing to disagree with in his analysis. Keep on reading @ blog.milesfranklin.com |

| Fear of a dollar collapse will make the Chinese the biggest buyers of gold this year Posted: 14 Jun 2012 06:38 AM PDT

from arabianmoney.net: China is widely expected to overtake India as the world's biggest consumer of gold this year with gold purchases rising by 10 per cent, according to the leading Chinese bank ICBC. Why? The Chinese are moving out of the dollar and into gold. That is what a seemingly ill-educated gold trader in the Sharjah Gold Souk told us earlier this year. King for a day As the largest holder of foreign dollar reserves the Chinese are only too painfully aware of how exposed this leaves their savings in a slump. US treasuries are the biggest bubble in history as legendary investment adviser Dr Marc Faber reminded us recently. Diversification for protection really means something if you have most of your wealth tied up in US t-bonds. And where do you go for safety? Things have already gotten so bad for the Swiss franc that it has become pegged to the euro to stop further appreciation. Then again if you are Indian and with your money in gold and not rupees then you are laughing. The massive depreciation of the rupee puts gold at a fresh all-time high in rupees, even while it is several hudred dollars off its dollar-denominated high of last September. This experience is not lost on the Chinese. Keep on reading @ arabianmoney.net |

| BOLD Prediction For End Of Week Silver Spot Posted: 14 Jun 2012 06:11 AM PDT 28-something. You'll all be laughing out of the other side of your mouth when you see for yourselves how dead on I am at the spot price tomorrow. |

| 4 Industrial Metals & Minerals Stocks Sporting Strong Dividends While Raking In Profits Posted: 14 Jun 2012 05:36 AM PDT By ZetaKap: Are you a dividend investor looking for new sources of yields? Do you want those yields to be backed by solid company fundamentals? Today we focused on industrial metals and minerals stocks that offer sustainable yields, due to their significant profitability. We focused further by looking at only those stocks that analysts have rated as 'Buy'. We came up with a pretty interesting list - we hope you find it helpful in your search. The Net Margin is a profitability metric that illustrates, by percentage, how much of every dollar earned gets turned into a bottom line profit. This is just one of many profitability metrics used by investors and analysts to better understand what the company is being left with at the end of the day. Generally, a firm that can expand its net profit margins over a period of time will see its stock price rise as well Complete Story » |

| Posted: 14 Jun 2012 05:30 AM PDT

WHOLESALE MARKET gold prices rose to $1627 an ounce shortly ahead of US trading on Thursday – their highest level so far this week – immediately following the publication of US economic data. Silver prices by contrast continued to trade sideways, hovering around $29 an ounce – around 1.6% up on where they started the week. US consumer price inflation fell to 1.7% last month – down from 2.3% in April – according to official figures published Thursday. This week's initial jobless claims meantime were 386,000 higher than many analysts expected. A day earlier, official data showed the producer price index, regarded by many as an indicator of commodity price inflation, fell 1.0% in May, while retail sales were down 0.2%. The Federal Open Market Committee meets next Tuesday and Wednesday to decide on any changes to US monetary policy. "Once there's evidence that the policymakers on the monetary side are going to have to release stimulus, we should see rising interest in gold and silver," said Jeremy Friesen, Hong Kong-based commodity strategist at Societe Generale, speaking before Thursday's US data was released. "We feel that [a third round of quantitative easing] is still unlikely at present," counters Marc Ground, commodities strategist at Standard Bank, in a note this morning. "The best prospect for Fed monetary accommodation coming from an extension or "Operation Twist" and perhaps pushing out their expectations of when rates would be hiked." Earlier on Thursday, gold prices traded within a $5 range around $1620 an ounce throughout London's morning session, while stocks and commodities traded lower during following more negative ratings action in the Eurozone. Ratings agency Moody's last night cut its sovereign ratings for Spain and Cyprus. Spain was cut three notches to Baa3 – one notch above junk – while Cyprus fell further into junk territory when its rating was cut to Ba3. "Moody's believes that the debts of Euro area sovereigns that are fully dependent upon official sources to fund their borrowing requirements represent speculative-grade risk," said a statement from the ratings agency. The Eurogroup of single currency finance ministers confirmed on Saturday that Spain will borrow up to €100 billion from Eurozone rescue funds to finance its banking sector restructuring. Spanish 10-Year bond yields this morning came within touching distance of the 7% mark, hitting a fresh Euro-era high at 6.998%. Italy meantime successfully auctioned €4.5 billion in government bonds of varying maturities. Yields on German government debt meantime continued their recent rise Thursday, breaching 1.5% – up from an all-time low of less than 1.13% at the start of the month. "All eyes are on Germany," Chancellor Angela Merkel told the German parliament this morning, adding that the Eurozone crisis is likely to dominate this weekend's G20 summit. "[But] Germany's power is not infinite…We must all resist the temptation to finance growth again through new debt." "German bund yields [are this morning] behaving more like periphery bonds rather than a safe haven," says a note from UBS, pointing out that German bond yields have been rising faster than those on UK government debt. "Of course, it is too early to make any conclusions about German bonds losing their safe-haven value…but such a scenario, wherein bunds lose some of their safety appeal, would mean investors would be on the lookout for new 'secure' places to park their money, and given the much-reduced list of alternatives, gold would be one of the top options." Based on London Fix prices, the gold price in Euros rose to within 5% of its all-time high on Wednesday, dipping slightly to €1289 per ounce at this morning's fixing. On the currency markets, the Euro traded sideways Thursday morning around $1.256. "The Euro has been relatively stable as we head into [this Sunday's] Greek election and that will dictate market direction next week," reckons Lee Hardman, currency economist at Bank of Tokyo-Mitsubishi. "The situation in Europe," Federal Reserve chairman Ben Bernanke told Congress last week, "poses significant risks to the US financial system and economy and must be monitored closely." "As always, the Federal Reserve remains prepared to take action as needed to protect the US financial system and economy in the event that financial stresses escalate." Bernanke is due to give a press conference next week following the FOMC meeting on Wednesday. Switzerland's central bank meantime repeated that it will buy "unlimited quantities" of foreign exchange in order to prevent the Swiss Franc rising above its peg to the Euro at SFr 1.20. The Swiss National Bank today announced it is keeping its interest rate on hold at 0.0%. "In the foreseeable future, there is no risk of inflation in Switzerland," said a statement from the SNB. Over in India, traditionally the world's biggest source of private demand to buy gold, newspapers report gold prices in Delhi hit a new all-time high of Rs 30,550 per 10 grams Thursday, with some dealers citing buying by gold jewelers ahead of the upcoming marriage season. Dealers elsewhere in Asia however reported "sluggish" demand, according to newswire Reuters. "June is a quiet month for jewelers' demand," says Dick Poon, precious metals manager at bullion refiner Heraeus in Hong Kong, adding that investors are only buying gold "on dips". Ben Traynor Gold value calculator | Buy gold online at live prices Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK's longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. (c) BullionVault 2011 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. |

| It's Not Just Dinah In The Kitchen Anymore At Williams-Sonoma Posted: 14 Jun 2012 04:56 AM PDT By F.A.S.T. Graphs: Dividend Challenger: Williams-Sonoma Inc Founded in 1956, Williams-Sonoma (WSM) is not just a quality kitchen store, but a specialty leading home furnishing retail store. Williams-Sonoma has historically grown earnings at a compounded rate of 12.9% since 1998, resulting in a 3.4 billion dollar market cap. Williams-Sonoma's earnings per share have risen from $0.51 per share in 1998, with a drop in 2008 to $0.22 per share, to a current forecast earnings per share of approximately $2.49 for fiscal 2012. The current dividend yield is 2.6% and the dividend has increased each year for the past 7 years. This article looks at Williams-Sonoma Inc, a Dividend Challenger, through the lens of our graphs. Since a picture is worth a thousand words, the reader will be provided the "essential fundamentals at a glance" expressed vividly in pictures. A Dividend Challenger is defined as a company that has increased its dividend every year Complete Story » |

| 5 Consumer Dividend Stocks Sustained By Lean/Mean Profits Posted: 14 Jun 2012 04:33 AM PDT By ZetaKap: Are you a dividend investor searching for stocks that not only offer attractive yields, but also payouts that they can sustain over time? One place to look is at companies with hearty profits fueling those dividends. Today we screened for consumer companies with strong profitability, and narrowed our focus to only the stocks rated as "Buy" or "Strong Buy" by industry analysts. We think you'll find our list rather interesting. EPS growth (earnings per share growth) illustrates the growth of earnings per share over time. EPS growth rates help investors identify stocks that are increasing or decreasing in profitability. This profitability metric is generally a key driver in the price of the stock as it directly correlates to the profitability of the company as a whole. The Net Margin is a profitability metric that illustrates, by percentage, how much of every dollar earned gets turned into a bottom line profit. Complete Story » |

| Watch Tony Robbins discuss the $15 trillion U.S. national debt Posted: 14 Jun 2012 04:15 AM PDT How big is it really? And what can we do about the enormous federal budget deficit?

|

| Dow Industrial Bulls, Gold Bugs, Wagering Big Bets on QE-3 Posted: 14 Jun 2012 04:00 AM PDT |

| Why Physical Silver Demand is Heading Higher Posted: 14 Jun 2012 03:20 AM PDT The silver price is depressed compared with its historical relationship to gold, one ounce being worth about 55 of silver, against the historical rate of 15 or 16. For now, pricing is managed for industrial use, and industry has a vested interest in keeping the price low. |

| Update: Central Bank Gold Holdings Posted: 14 Jun 2012 02:57 AM PDT |

| Physical silver demand heading higher Posted: 14 Jun 2012 02:46 AM PDT |

| Silver correction putting miners under pressure Posted: 14 Jun 2012 02:43 AM PDT |

| Euro Debt Crisis is Good for Gold and Silver: Sprott Money Manager Charles Oliver Posted: 14 Jun 2012 01:59 AM PDT |

| Anthony Robbins Bullish On Gold - Faber and Bass His Financial Gurus Posted: 14 Jun 2012 01:51 AM PDT gold.ie |

| Oil 20% Down, Price at the Pump Stays the Same, The-Powers-That-Be Hover Above & Beyond Posted: 14 Jun 2012 01:45 AM PDT

from silvervigilante.com: Since May, crude oil has tanked from near-highs to near-lows. At the onset of May, crude oil traded above $105. Since, it has fallen to $80. Nonetheless, the prices at the pump have stayed the same. Although explanations are difficult to come by from the mainstream press, the phenomenon is likely not to be explained by the type of events which might affect a localized, freer market structure. Such as, an oil boom in a U.S. state. In this case, North Dakota's economic conditions have led to a record setting increase in their oil production. But, global economic factors weigh more on all markets, and a declining euro and appreciating dollar in the medium-term have provided the conditions for a decline in the crude oil price. But, the winners-and-losers are not who one might expect. Keep on reading @ silvervigilante.com |

| Gold & Silver Market Morning Posted: 14 Jun 2012 01:39 AM PDT

from news.goldseek.com: Gold Today – Gold closed in New York at $1,618.80 and in London's early morning rose slightly to $1,619.75. The Fixing in London today was set at $1,619.00 up $6.25. In the euro it was set at €1,289.834 up€6.7. Ahead of New York's opening gold stood at $1,620.68 and in the euro, €1,288.30 while the euro was at €1: $1.2580. Silver Today – Silver held steady in New York at $28.95 in New York and held there in London's morning. Ahead of New York's opening at $28.95, the same as yesterday. Gold (very short-term) Gold may well show a steady to positive bias, today in New York. Silver (very short-term) Silver may well show a steady to positive bias, today in New York. Keep on reading @ news.goldseek.com |

| We Will Now See Extreme Turbulence in Global Markets Posted: 14 Jun 2012 12:57 AM PDT

from kingworldnews.com: Today top Citibank analyst, Tom Fitzpatrick, warned that despite the initial enthusiasm surrounding the Spanish bank bailout, "this is yet another over-promise, under-deliver dynamic coming out of Europe." Fitzpatrick, a 28 year veteran and top analyst at Citibank, which has $1.3 trillion in assets, also said, "we are moving to the point where we're no longer going to be able to see the stabilization on false promises and under-deliveries." He also remained bullish on gold and let KWN readers know when the attention will shift to the problems in the US. But first, here is what Fitzpatrick had to say about the ongoing crisis: "Well, obviously this past weekend we had the announcement that we were going to see some type of bailout package for Spain. But I think as we move through this week there is a certain amount of disillusionment as people look at the structure of it." Tom Fitzpatrick continues: "At the end of the day you are getting a sovereign nation that people are already concerned about in terms of their borrowings. Now Spain is looking to borrow even more money to give to the banks. You are not getting a European type of solution. So we saw a lot of euphoria on Sunday night and early Monday, but that seems to have dissipated. Keep on reading @ kingworldnews.com |

| Platinum to join fight against cancer? Posted: 14 Jun 2012 12:54 AM PDT

from goldmoney.com: Spanish 10-year sovereign bond yields have shot above 7% this morning, following rating agency Moody's decision to cut the country's credit rating to Baa3 from A3. This is one notch above junk status. When this happened to Greece, Ireland and Portugal it prompted bailouts from the European Union and International Monetary Fund, while the same occurrence in Italy at the end of last year spelled the end of Silvio Berlusconi's colourful premiership. The problem is that bailing out Spain could cost as much as €300 billion, which would exhaust most of the €500bn allocated to the European Stability Mechanism. The ESM is the permanent eurozone rescue fund that will succeed the temporary European Financial Stability Facility (EFSF) from July. So Spain is arguably too big to bail absent the European Central Bank taking more aggressive steps to monetise the country's debt. Keep on reading @ goldmoney.com |

| The Aspen silver mine is on sale for $9.5M Posted: 14 Jun 2012 12:28 AM PDT |

| German Bunds 'Not Behaving Like Safe Haven' Posted: 14 Jun 2012 12:23 AM PDT Wholesale market gold prices rose to $1,627 an ounce shortly ahead of US trading on Thursday – their highest level so far this week – following the publication of US economic data. Silver prices by contrast continued to trade sideways, hovering around $29 an ounce. |

| Motivation Speaker Follows Faber & Bass as Gold Gurus Posted: 13 Jun 2012 11:46 PM PDT Gold traded sideways in Asia prior to a sudden buying bout which saw gold rise from $1,618/oz to $1,625/oz. Those gains have gradually been given up in European trading where gold is now trading near yesterday's close. |

| Posted: 13 Jun 2012 11:43 PM PDT

About Gold Seek Radio: More interviews @ radio.goldseek.com |

| Posted: 13 Jun 2012 11:39 PM PDT By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness. As we head towards Greece's weekend election, rumoured to be celebrated by the locals by moving ever larger sums of money elsewhere, the Eurozone appears to be seriously straining under the constant pressure of its ongoing crisis. I have long felt that Italy would be the limit for the monetary union, most notable for its sheer size, and due to this I expected much more decisive action, one way or the other, once the crisis returned to Italian shores. Last week I noted a warning from the head of the IMF suggesting Europe only has a short period of time left and did wonder whether it was triggered by growing concerns that Italy was next after Spain:

Not to be outdone, the UK finance minster has also suggested that it could be time to let Greece go in order to shift Germany into action:

Such stability. Last night was the first night of three in which the Italians are again taking to the debt markets and the results weren't impressive. The country auctioned €6.5bn of 1 year paper at 3.972% up from 2.34% just one month ago. The cover was 1.73 but the auction was reduced in size in advance due to market nervousness. Tonight Italy will to auction up to €4.5 billion of longer dated debt which has the potential to see larger changes in yields. Meanwhile it appears that Mario Monti is facing increasing issues with new fiscal settings as demand and production continue to fall in the face of new taxes:

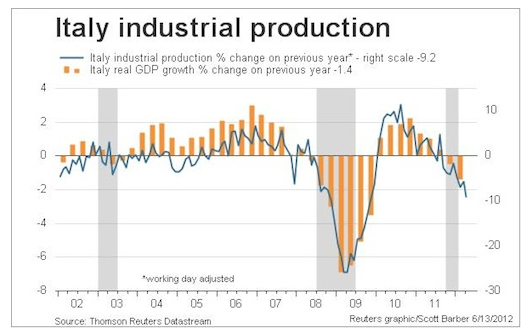

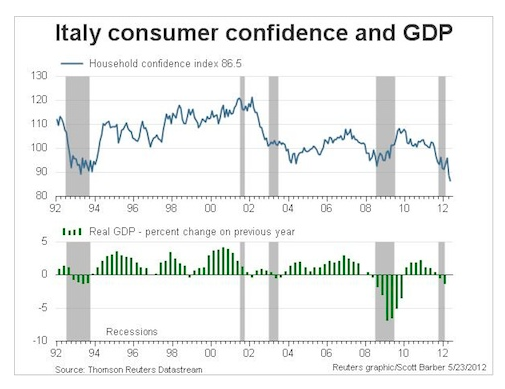

As I have spoken about previously Italy has multiple issues with its economy, including a serious demographics problem, but much of its sovereign debt, currently at around 120% of GDP or approximately €2 trn, is long dated and so the economic issues of Italy are building up slowly. In addition, the Italian private sector has a large amount of wealth which could potentially offset the governments debt, but in the long run what is really needed in order to save Italy is increased productivity leading to economic growth. The major issue is that Italy appears to be going in the opposite direction with growth stagnation over the last decade followed by a recent period of negative numbers. In addition, although the country is home to some of the most recognisable brands in the world, it's industrial production has been falling for nearly two years and is now approximately 25% lower than it was pre-GFC: As you can also see from the chart, GDP growth is now negative with the 2012 Q1 figure coming in at -0.8% taking Italy deeper into recession. The Bank of Italy suggested the yearly figure will come in around -1.5% but with a solid trend in place that figure could now be optimistic. Unemployment has also increased by 2% this year to stand at Eurozone record high of 9.8% with youth unemployment hovering in the mid 30s. To add to the woe, business confidence is the lowest it has been since the GFC and consumer confidence is now at record lows: As usual, however, Germany is there to give moral support to a fellow country in need:

Under these circumstance it is no real surprise that Mario Monti is a member, perhaps the lead, of a growing chorus demanding that Europe changes it current policy course:

But, as I said yesterday, I am sceptical anything will change in the German camp until the weaker economies of Europe are shackled to the fiscal compact, one way or another. Angela Merkel still has a stumbling block, however. The future European shared responsibility mechanism to support weaker countries, the ESM, is yet to be ratified by her own parliament and her opposition isn't making it too easy:

Not really a surprise then that the rest of the world continues to look nervously at the Continent. |

| Blaming the Machines for Gold Price Moves Posted: 13 Jun 2012 10:01 PM PDT The recent swoons and jumps in the gold price have the market scratching its head. Both of this week's pops came just as New York got to its desk, but with barely a ripple in the gold futures market – where US traders typically throw their weight around. |

| Silver Futurist: The Hyperinflation Discussion Posted: 13 Jun 2012 09:25 PM PDT In this podcast from altinvestorshangout: Part One: Part Two ~TVR |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment