Gold World News Flash |

- Sprott donates $25 million to medical center, $10 mill of it into Silver. Huh.

- Gold Takes a Dive

- USTBonds: Black Hole Dynamics

- Exclusive: Fed Memorandum related to Gold Price Suppression in French and German

- Silver Update 6/7/12 ZIRP

- Silver Price Forecast: Silver Offers A Great Opportunity

- Is Now the Time to Acquire Gold ? Or Run Away From It?

- The ‘Big Reset' Is Coming: Here Is What To Do

- VAT Silver suppression

- Mrs. Watanabe, Meet Mrs. Brown

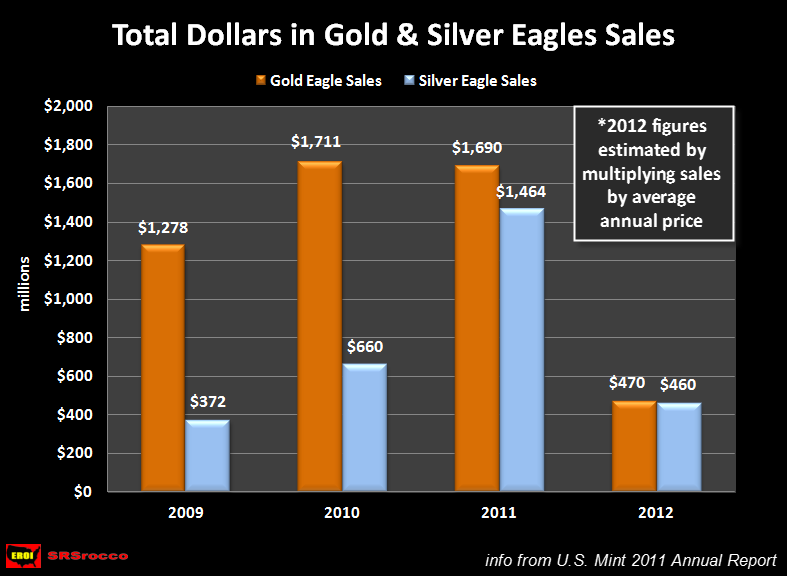

- 2012 SILVER EAGLE SALES ALMOST EQUAL GOLD EAGLE SALES

- Europe At A Crucial Crossroad

- Asia Opens And Risk-On Closes

- Central Banks Dither Today, Panic Tomorrow

- How Can Gold And Silver Not Go To The Moon?

- The 'Big Reset' Is Coming: Here Is What To Do

- Hitler Is Long The USD, Gets A Margin Call

- Bernanke Strikes Again!

- Bernanke Remarks Take Wind Out Of Rally

- Is Human Progress Slowing?

- Gold: A Modest Proposal

- James Dines - Debt Liquidating Depression & Systemic Failure

- Guest Post: The World Before Central Banking

- Gold Price Closed Lower at $1,586.60

- The Big Lie

- Grandich Client Sunridge Gold

- Where Does All the Money Go?

- Take Note: Gold and Silver are NOT an Investment!

- Mike Krieger: China Will Blink And Gold Will Soar

- Late-Day Crumble As Stocks Join Gold's Stumble

| Sprott donates $25 million to medical center, $10 mill of it into Silver. Huh. Posted: 07 Jun 2012 05:33 PM PDT |

| Posted: 07 Jun 2012 05:21 PM PDT courtesy of DailyFX.com June 07, 2012 03:45 PM Daily Bars Prepared by Jamie Saettele, CMT Be sure to stay abreast of the current interpretation of wave structure in risk. “Gold has rallied in 5 waves from the 5/30 low, which may mark wave C of an A-B-C corrective advance from the 5/16 low. Notice that RSI has exceeded previous peaks yet the series of lower highs in price is still in place. This is in place now across the board for the USD but we should respect the potential for weakness on balance into the end of the week (with a USD low in place on Monday). I am bearish against 1671.49 (May high).” There is no change but I’ll note that 1573/78 is probably short term support (former resistance and 20 day average). LEVELS: 1522 1545 1574 1600 1612 1629... |

| Posted: 07 Jun 2012 04:40 PM PDT by Jim Willie, Gold Seek:

|

| Exclusive: Fed Memorandum related to Gold Price Suppression in French and German Posted: 07 Jun 2012 04:15 PM PDT By Chris Powell, GATA:

Dear Friend of GATA and Gold: In support of the campaign for Germany to repatriate its gold reserves from foreign central banks, the Bavarian chapter of the German Taxpayer Association has translated into German and French the June 1975 letter from Federal Reserve Chairman Arthur Burns to President Ford confirming a secret agreement with the German chancellor about surreptitiously controlling the gold market. The translations are posted at the Internet site of our friend, the German freelance journalist Lars Schall, here |

| Posted: 07 Jun 2012 03:54 PM PDT [Ed. note: Cartel throws 125 million ounces of paper silver at the market the moment the Bernank's remarks are released. Terrific! More opportunity for the informed. I propose we keep on dollar cost averaging the stackin' of PHYSICAL. We WIN. They LOSE.] from BrotherJohnF: |

| Silver Price Forecast: Silver Offers A Great Opportunity Posted: 07 Jun 2012 03:46 PM PDT |

| Is Now the Time to Acquire Gold ? Or Run Away From It? Posted: 07 Jun 2012 03:28 PM PDT Is this the time to acquire gold? Or is this the time to run away from it? Either answer could be correct, depending upon what course government chooses. Government is at a decision point, one that will determine how our economic malaise next turns. [Let's review their choices.] Words: 922 *So says "Monty Pelerin" (a pseudonym derived from The Monty Pelerin Society) in edited excerpts from his original article* as posted at [url]www.economicnoise.com[/url]. [INDENT] Lorimer Wilson, editor of [B][COLOR=#0000ff]www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor's Note at the bottom of the page. This, and the preceding paragraph, must be included in any article re-posting to avoid copyright infringement.[/COLOR][/B] [/INDENT] Pelerin goes on to say, in part: Governments have*two choices: [*]Fight deflation by increasing the money supply by whatever amount necessary. [*]Stop using monetary policy to offset the inevita... |

| The ‘Big Reset' Is Coming: Here Is What To Do Posted: 07 Jun 2012 03:25 PM PDT from Zero Hedge:

|

| Posted: 07 Jun 2012 03:17 PM PDT |

| Mrs. Watanabe, Meet Mrs. Brown Posted: 07 Jun 2012 03:17 PM PDT "Risk on, risk off" might be the most essential hallmark of the current market, but just focusing on the day-to-day whims of capital markets ignores longer term changes to investor risk preferences. Nic Colas, of ConvergEx looks at the topic from the vantage point of gender-specific investment choices. For example, more women are participating in deferred compensation (DC) plans, and the data from millions of 401(k) accounts tells a useful story. Their retirement accounts still lag those of their male counterparts in total value and they remain a bit more risk-averse. But for the first time in at least a decade they are more likely than men to contribute to a retirement account and are contributing a greater percentage of their earnings. Pulling in some other academic work on the risk preferences that create the "Venus/Mars" divide dovetails nicely with investment specific analysis: women may not "Know" as many of the grimy details of investing or shoot from the hip as much as their male counterparts but they know when to cut their losses and they tend to be more methodical. Lastly, we can't help but wonder how much of the much-discussed money flows into fixed income versus equities has to do with the shifting gender profile of the "Average" American investor. "Risk off" may well be "risk shift." Note from Nick: Men may be from Mars, and women from Venus, both they both want to make something on their investments. You'll never see pink or blue dots on the "Efficient Frontier" of academic models, to be sure. However, both empirical data and psychological studies do point to subtle – but notable – differences in how men and women consider the classic risk-reward tradeoff inherent in the challenge of investing. Beth picks up the thread from here.

She was savvy, she was smart, and she was a moneymaker. And now she's on the move. Mrs. Watanabe, the market's metaphor for Japan's housewife currency speculators, was a star of the yen's glory days in the early 2000s. Dedicated salaryman "Mr. Watanabe" made the money, sure, but it was his wife who controlled financial decisions. And a decade ago, she was the "Whale" of the yen-denominated currency market.

The reason she was so active was that she was looking for better yields than those on offer in low interest rate, newly deflationary Japan. She wanted a safe return, yes, but to make a little bit extra as well. Which turns out to be a common female approach to investing as we'll outline today. (Just in case you're wondering, "Watanabe" is the fifth most common Japanese surname, equivalent to "Brown" in the States.)

This same sort of female investment psychology has been documented in the Mrs. Browns of America. We turn to a 2011 report regarding "How America saves," courtesy of The Vanguard Group's research department. The report highlights data on defined contribution (DC) retirement plans, which represent the centerpiece of the American private-sector retirement system. More than 60 million US citizens are covered by such plans – predominately 401Ks – and assets now exceed $4 trillion. Vanguard is a large player in this market, and their data aggregates information from millions of individual accounts.

Since our focus is on male versus female investing habits, we note the following 3 gender-oriented takeaways from the data in the report.

To cast a larger net over the topic of gender and investing, let's tread a little closer to the slippery slope of stereotypes, albeit with the aid of some academic studies related to male-female behavioral patterns. A few points here:

As for the financial world, a 2001 study by Brad Barber and Terrance Odean ("Boys Will Be Boys: Gender, Overconfidence, and Common Stock Investment") showed that men traded stocks almost 50% more than women. The findings suggest that overconfident investors are more apt to interpret what's going on around them and react to short-term financial news. Women are more cautious, especially in the wake of the recession, and it shows in their current saving habits. For the first time ever, they're more likely to contribute to a 401(k), and even with lower incomes, they're contributing a greater percentage of their earnings than are men.

You can read the full report here: http://faculty.haas.berkeley.edu/odean/papers/gender/BoysWillBeBoys.pdf.

Along the same lines, women are generally less knowledgeable and interested investors than men, but they also make fewer mistakes and are less apt to repeat the mistakes they do make. All this according to a study by Merrill Lynch Investment Managers (http://www.ml.com/media/47547.pdf). Forty seven percent of women reported not being knowledgeable about investing, compared with just 30% of men. Women were significantly less likely to know what "dollar cost averaging" means (39% of females versus 65% of males), and they also were less likely to correctly identify historical inflation rates (43% versus 67%).

However, women are less likely than men to hold a losing investment too long (35% versus 47%), buy a hot investment without doing any research (13% versus 24%), and allocate too much capital to one asset (23% versus 32%). When it comes to repeating mistakes, women were less likely to report repeating the following: buying a stock without doing any research (47% of women versus 63% of men), waiting too long to sell an investment (48% versus 61%), and ignoring the tax consequences of an investment decision (47% versus 68%).

So women are less confident and more risk-averse when it comes to investment decisions, but they've also shown to be more prudent. Why? Well, a 2010 New York Times article (http://www.nytimes.com/2010/03/14/business/14mark.html?_r=1&dxnnl=1&dxnnlx=1338484453-jmoi1rSaFjCeVgDOrh2UWg) quotes Alexandra Bernasek, an economics professor at Colorado State University, as saying that historical disparities in earnings, power, wealth and social status could explain certain behavioral differences. As could evolutionary behavioral patterns that pre-date recent history. Aggressive risk-taking likely once helped men find mates, while women were more risk-averse because their role was to protect their offspring.

However, research out of the University of New Hampshire (http://www.unh.edu/news/cj_nr/2011/jul/lw20venture.cfm) shows that gender stereotypes affect the investment decision-making of women, often resulting in counterintuitive results. Researchers found that when a group of angel investors was less than 10% women, then the group as a whole was more cautious about investing. But when women comprise more than 10% of the group, investments increased. Researchers pointed to a psychological theory called "stereotype threat" to explain this finding; when a stereotype exists about a person, that person will behave in a manner consistent with the stereotype when they're in a situation that highlights the stereotype. As the number of women in angel investor groups increased, the stereotype of women as cautious investors became less apparent and they were more recognized for their ability as investors. Now, what does this all mean? The increasing share of individual savings and investments managed by women is one overlooked driver of the continued rally in "Risk-off" assets. Assets controlled by women are clearly increasing. Patterns in labor force participation rates for women mean they have more money to invest directly in assets such as 401Ks. Also, divorce rates have increased over the last 30 years, as has the number of women-led households. In summary, it makes sense to reconsider the notion that continued money flows into bonds and other safe haven investments is really "Risk off" market behavior. At least a piece of it may well be "Risk shifting," driven by the demographic and psychological factors I have outlined here. |

| 2012 SILVER EAGLE SALES ALMOST EQUAL GOLD EAGLE SALES Posted: 07 Jun 2012 03:00 PM PDT by SRSrocco Silver Doctors:

In 2012, that ratio has now moved up significantly to nearly 98%. 2009-2011 total dollar figures came from the 2011 US MINT ANNUAL REPORT. The 2012 figures were calculated taking the total sales ending in MAY 2012 times their respective average annual price according to Kitco.com. It is plain to see that SILVER EAGLE SALES have been gaining on GOLD EAGLE SALES since 2009 and may even surpass them in 2012.

|

| Posted: 07 Jun 2012 02:45 PM PDT by Jeff Nielson, Bullion Bulls Canada:

In fact this is precisely what we have seen transpire. As this made-in-Wall-Street financial holocaust intensified, roughly one year ago I wrote a four-part series ("Economic Rape of Europe Nearly Complete") where I first explained what had already taken place, and then detailed what was to come. |

| Posted: 07 Jun 2012 02:32 PM PDT Update: Gold and Silver are extending losses now. Asian markets have been open for an hour or two now and markets have done nothing but extend the late-day derisking from the last hour of the US day-session. S&P 500 e-mini futures (ES) are down around 8pts from the close, Treasury yields are 5-7bps off their intraday highs now (3-4bps lower than where they closed), JPY is strengthening (carry-off - even though Noda is scheduled to speak), AUD is weakening (carry-off - almost back to post Aussie jobs print levels), and Copper & Oil are tumbling (WTI back under $83). Gold and Silver are falling off quicker now (having suffered during the day session and stabilized a little) as it seems markets are playing catch up to their signals (still around unch from 5/28 closing levels while WTI is down almost 9% and Copper -3.5% from those swing equity highs). Broadly speaking risk assets are increasing in correlation and ES is getting dragged lower. Commodities are struggling as USD strength leaks back into the markets this evening... It would appear that Gold's relative exuberance on QE hope has reverted and post 5/29 swing highs in stocks it looks like QE-sensitive assets are recoupled for now... After being led up by ES for a few days, broad risk assets (as proxied by CONTEXT) are now being led back down... and cross-asset-class correlation is picking up (generally implying a systemic response to either risk-on or risk-off)...

S&P 500 e-mini futures have almost retraced 38.2% of the bull short-squeeze leg up now...

Charts: Bloomberg and Capital Context |

| Central Banks Dither Today, Panic Tomorrow Posted: 07 Jun 2012 02:16 PM PDT |

| How Can Gold And Silver Not Go To The Moon? Posted: 07 Jun 2012 01:46 PM PDT Seriously... A Precious Metals Bubble? Bernanke Sees Risks to Economy From Europe to U.S. Budget Bernanke can't see two feet in front of his manicured beard... The real risk to the economy is right here at home: Paul Craig Roberts Prisonplanet.com June 5, 2012 Ever since the beginning of the financial crisis and quantitative easing, the question has been before us: How can the Federal Reserve maintain zero interest rates for banks and negative real interest rates for savers and bond holders when the US government is adding $1.5 trillion to the national debt every year via its budget deficits? Not long ago the Fed announced that it was going to continue this policy for another 2 or 3 years. Indeed, the Fed is locked into the policy. Without the artificially low interest rates, the debt service on the national debt would be so large that it would raise questions about the US Treasury's credit rating and the viability of the dollar, and the trillions of dollars in Interest Rate Swaps and other derivatives would come unglued. In other words, financial deregulation leading to Wall Street's gambles, the US government's decision to bail out the banks and to keep them afloat, and the Federal Reserve's zero interest rate policy have put the economic future of the US and its currency in an untenable and dangerous position. It will not be possible to continue to flood the bond markets with $1.5 trillion in new issues each year when the interest rate on the bonds is less than the rate of inflation. Everyone who purchases a Treasury bond is purchasing a depreciating asset. Moreover, the capital risk of investing in Treasuries is very high. The low interest rate means that the price paid for the bond is very high. A rise in interest rates, which must come sooner or later, will collapse the price of the bonds and inflict capital losses on bond holders, both domestic and foreign. The question is: when is sooner or later? The purpose of this article is to examine that question. Let us begin by answering the question: how has such an untenable policy managed to last this long? A number of factors are contributing to the stability of the dollar and the bond market. A very important factor is the situation in Europe. There are real problems there as well, and the financial press keeps our focus on Greece, Europe, and the euro. Will Greece exit the European Union or be kicked out? Will the sovereign debt problem spread to Spain, Italy, and essentially everywhere except for Germany and the Netherlands? Will it be the end of the EU and the euro? These are all very dramatic questions that keep focus off the American situation, which is probably even worse. The Treasury bond market is also helped by the fear individual investors have of the equity market, which has been turned into a gambling casino by high-frequency trading. High-frequency trading is electronic trading based on mathematical models that make the decisions. Investment firms compete on the basis of speed, capturing gains on a fraction of a penny, and perhaps holding positions for only a few seconds. These are not long-term investors. Content with their daily earnings, they close out all positions at the end of each day. High-frequency trades now account for 70-80% of all equity trades. The result is major heartburn for traditional investors, who are leaving the equity market. They end up in Treasuries, because they are unsure of the solvency of banks who pay next to nothing for deposits, whereas 10-year Treasuries will pay about 2% nominal, which means, using the official Consumer Price Index, that they are losing 1% of their capital each year. Using John Williams' (shadowstats.com) correct measure of inflation, they are losing far more. Still, the loss is about 2 percentage points less than being in a bank, and unlike banks, the Treasury can have the Federal Reserve print the money to pay off its bonds. Therefore, bond investment at least returns the nominal amount of the investment, even if its real value is much lower. (For a description of High-frequency trading, see:http://en.wikipedia.org/wiki/High_frequency_trading ) The presstitute financial media tells us that flight from European sovereign debt, from the doomed euro, and from the continuing real estate disaster into US Treasuries provides funding for Washington's $1.5 trillion annual deficits. Investors influenced by the financial press might be responding in this way. Another explanation for the stability of the Fed's untenable policy is collusion between Washington, the Fed, and Wall Street. We will be looking at this as we progress. Unlike Japan, whose national debt is the largest of all, Americans do not own their own public debt. Much of US debt is owned abroad, especially by China, Japan, and OPEC, the oil exporting countries. This places the US economy in foreign hands. If China, for example, were to find itself unduly provoked by Washington, China could dump up to $2 trillion in US dollar-dominated assets on world markets. All sorts of prices would collapse, and the Fed would have to rapidly create the money to buy up the Chinese dumping of dollar-denominated financial instruments. The dollars printed to purchase the dumped Chinese holdings of US dollar assets would expand the supply of dollars in currency markets and drive down the dollar exchange rate. The Fed, lacking foreign currencies with which to buy up the dollars would have to appeal for currency swaps to sovereign debt troubled Europe for euros, to Russia, surrounded by the US missile system, for rubles, to Japan, a country over its head in American commitment, for yen, in order to buy up the dollars with euros, rubles, and yen. These currency swaps would be on the books, unredeemable and making additional use of such swaps problematical. In other words, even if the US government can pressure its allies and puppets to swap their harder currencies for a depreciating US currency, it would not be a repeatable process. The components of the American Empire don't want to be in dollars any more than do the BRICS. However, for China, for example, to dump its dollar holdings all at once would be costly as the value of the dollar-denominated assets would decline as they dumped them. Unless China is faced with US military attack and needs to defang the aggressor, China as a rational economic actor would prefer to slowly exit the US dollar. Neither do Japan, Europe, nor OPEC wish to destroy their own accumulated wealth from America's trade deficits by dumping dollars, but the indications are that they all wish to exit their dollar holdings. Unlike the US financial press, the foreigners who hold dollar assets look at the annual US budget and trade deficits, look at the sinking US economy, look at Wall Street's uncovered gambling bets, look at the war plans of the delusional hegemon and conclude: "I've got to carefully get out of this." US banks also have a strong interest in preserving the status quo. They are holders of US Treasuries and potentially even larger holders. They can borrow from the Federal Reserve at zero interest rates and purchase 10-year Treasuries at 2%, thus earning a nominal profit of 2% to offset derivative losses. The banks can borrow dollars from the Fed for free and leverage them in derivative transactions. As Nomi Prins puts it, the US banks don't want to trade against themselves and their free source of funding by selling their bond holdings. Moreover, in the event of foreign flight from dollars, the Fed could boost the foreign demand for dollars by requiring foreign banks that want to operate in the US to increase their reserve amounts, which are dollar based. I could go on, but I believe this is enough to show that even actors in the process who could terminate it have themselves a big stake in not rocking the boat and prefer to quietly and slowly sneak out of dollars before the crisis hits. This is not possible indefinitely as the process of gradual withdrawal from the dollar would result in continuous small declines in dollar values that would end in a rush to exit, but Americans are not the only delusional people. The very process of slowly getting out can bring the American house down. The BRICS–Brazil, the largest economy in South America, Russia, the nuclear armed and energy independent economy on which Western Europe (Washington's NATO puppets) are dependent for energy, India, nuclear armed and one of Asia's two rising giants, China, nuclear armed, Washington's largest creditor (except for the Fed), supplier of America's manufactured and advanced technology products, and the new bogyman for the military-security complex's next profitable cold war, and South Africa, the largest economy in Africa–are in the process of forming a new bank. The new bank will permit the five large economies to conduct their trade without use of the US dollar. In addition, Japan, an American puppet state since WWII, is on the verge of entering into an agreement with China in which the Japanese yen and the Chinese yuan will be directly exchanged. The trade between the two Asian countries would be conducted in their own currencies without the use of the US dollar. This reduces the cost of foreign trade between the two countries, because it eliminates payments for foreign exchange commissions to convert from yen and yuan into dollars and back into yen and yuan. Moreover, this official explanation for the new direct relationship avoiding the US dollar is simply diplomacy speaking. The Japanese are hoping, like the Chinese, to get out of the practice of accumulating ever more dollars by having to park their trade surpluses in US Treasuries. The Japanese US puppet government hopes that the Washington hegemon does not require the Japanese government to nix the deal with China. Now we have arrived at the nitty and gritty. The small percentage of Americans who are aware and informed are puzzled why the banksters have escaped with their financial crimes without prosecution. The answer might be that the banks "too big to fail" are adjuncts of Washington and the Federal Reserve in maintaining the stability of the dollar and Treasury bond markets in the face of an untenable Fed policy. Let us first look at how the big banks can keep the interest rates on Treasuries low, below the rate of inflation, despite the constant increase in US debt as a percent of GDP–thus preserving the Treasury's ability to service the debt. The imperiled banks too big to fail have a huge stake in low interest rates and the success of the Fed's policy. The big banks are positioned to make the Fed's policy a success. JPMorgan Chase and other giant-sized banks can drive down Treasury interest rates and, thereby, drive up the prices of bonds, producing a rally, by selling Interest Rate Swaps (IRSwaps). A financial company that sells IRSwaps is selling an agreement to pay floating interest rates for fixed interest rates. The buyer is purchasing an agreement that requires him to pay a fixed rate of interest in exchange for receiving a floating rate. The reason for a seller to take the short side of the IRSwap, that is, to pay a floating rate for a fixed rate, is his belief that rates are going to fall. Short-selling can make the rates fall, and thus drive up the prices of Treasuries. When this happens, as these charts illustrate, there is a rally in the Treasury bond market that the presstitute financial media attributes to "flight to the safe haven of the US dollar and Treasury bonds." In fact, the circumstantial evidence (see the charts in the link above) is that the swaps are sold by Wall Street whenever the Federal Reserve needs to prevent a rise in interest rates in order to protect its otherwise untenable policy. The swap sales create the impression of a flight to the dollar, but no actual flight occurs. As the IRSwaps require no exchange of any principal or real asset, and are only a bet on interest rate movements, there is no limit to the volume of IRSwaps. This apparent collusion suggests to some observers that the reason the Wall Street banksters have not been prosecuted for their crimes is that they are an essential part of the Federal Reserve's policy to preserve the US dollar as world currency. Possibly the collusion between the Federal Reserve and the banks is organized, but it doesn't have to be. The banks are beneficiaries of the Fed's zero interest rate policy. It is in the banks' interest to support it. Organized collusion is not required. Let us now turn to gold and silver bullion. Based on sound analysis, Gerald Celente and other gifted seers predicted that the price of gold would be $2000 per ounce by the end of last year. Gold and silver bullion continued during 2011 their ten-year rise, but in 2012 the price of gold and silver have been knocked down, with gold being $350 per ounce off its $1900 high. In view of the analysis that I have presented, what is the explanation for the reversal in bullion prices? The answer again is shorting. Some knowledgeable people within the financial sector believe that the Federal Reserve (and perhaps also the European Central Bank) places short sales of bullion through the investment banks, guaranteeing any losses by pushing a key on the computer keyboard, as central banks can create money out of thin air. Insiders inform me that as a tiny percent of those on the buy side of short sells actually want to take delivery on the gold or silver bullion, and are content with the financial money settlement, there is no limit to short selling of gold and silver. Short selling can actually exceed the known quantity of gold and silver. Some who have been watching the process for years believe that government-directed short-selling has been going on for a long time. Even without government participation, banks can control the volume of paper trading in gold and profit on the swings that they create. Recently short selling is so aggressive that it not merely slows the rise in bullion prices but drives the price down. Is this aggressiveness a sign that the rigged system is on the verge of becoming unglued? In other words, "our government," which allegedly represents us, rather than the powerful private interests who elect "our government" with their multi-million dollar campaign contributions, now legitimized by the Republican Supreme Court, is doing its best to deprive us mere citizens, slaves, indentured servants, and "domestic extremists" from protecting ourselves and our remaining wealth from the currency debauchery policy of the Federal Reserve. Naked short selling prevents the rising demand for physical bullion from raising bullion's price. Jeff Nielson explains another way that banks can sell bullion shorts when they own no bullion. (See,http://www.gold-eagle.com/editorials_08/nielson102411.html) Nielson says that JP Morgan is the custodian for the largest long silver fund while being the largest short-seller of silver. Whenever the silver fund adds to its bullion holdings, JP Morgan shorts an equal amount. The short selling offsets the rise in price that would result from the increase in demand for physical silver. Nielson also reports that bullion prices can be suppressed by raising margin requirements on those who purchase bullion with leverage. The conclusion is that bullion markets can be manipulated just as can the Treasury bond market and interest rates. How long can the manipulations continue? When will the proverbial hit the fan? If we knew precisely the date, we would be the next mega-billionaires. Here are some of the catalysts waiting to ignite the conflagration that burns up the Treasury bond market and the US dollar: A war, demanded by the Israeli government, with Iran, beginning with Syria, that disrupts the oil flow and thereby the stability of the Western economies or brings the US and its weak NATO puppets into armed conflict with Russia and China. The oil spikes would degrade further the US and EU economies, but Wall Street would make money on the trades. An unfavorable economic statistic that wakes up investors as to the true state of the US economy, a statistic that the presstitute media cannot deflect. An affront to China, whose government decides that knocking the US down a few pegs into third world status is worth a trillion dollars. More derivate mistakes, such as JPMorgan Chase's recent one, that send the US financial system again reeling and reminds us that nothing has changed. The list is long. There is a limit to how many stupid mistakes and corrupt financial policies the rest of the world is willing to accept from the US. When that limit is reached, it is all over for "the world's sole superpower" and for holders of dollar-denominated instruments. Financial deregulation converted the financial system, which formerly served businesses and consumers, into a gambling casino where bets are not covered. These uncovered bets, together with the Fed's zero interest rate policy, have exposed Americans' living standard and wealth to large declines. Retired people living on their savings and investments, IRAs and 401(k)s can earn nothing on their money and are forced to consume their capital, thereby depriving heirs of inheritance. Accumulated wealth is consumed. As a result of jobs offshoring, the US has become an import-dependent country, dependent on foreign made manufactured goods, clothing, and shoes. When the dollar exchange rate falls, domestic US prices will rise, and US real consumption will take a big hit. Americans will consume less, and their standard of living will fall dramatically. The serious consequences of the enormous mistakes made in Washington, on Wall Street, and in corporate offices are being held at bay by an untenable policy of low interest rates and a corrupt financial press, while debt rapidly builds. The Fed has been through this experience once before. During WW II the Federal Reserve kept interest rates low in order to aid the Treasury's war finance by minimizing the interest burden of the war debt. The Fed kept the interest rates low by buying the debt issues. The postwar inflation that resulted led to the Federal Reserve-Treasury Accord in 1951, in which agreement was reached that the Federal Reserve would cease monetizing the debt and permit interest rates to rise. Fed chairman Bernanke has spoken of an "exit strategy" and said that when inflation threatens, he can prevent the inflation by taking the money back out of the banking system. However, he can do that only by selling Treasury bonds, which means interest rates would rise. A rise in interest rates would threaten the derivative structure, cause bond losses, and raise the cost of both private and public debt service. In other words, to prevent inflation from debt monetization would bring on more immediate problems than inflation. Rather than collapse the system, wouldn't the Fed be more likely to inflate away the massive debts? Eventually, inflation would erode the dollar's purchasing power and use as the reserve currency, and the US government's credit worthiness would waste away. However, the Fed, the politicians, and the financial gangsters would prefer a crisis later rather than sooner. Passing the sinking ship on to the next watch is preferable to going down with the ship oneself. As long as interest rate swaps can be used to boost Treasury bond prices, and as long as naked shorts of bullion can be used to keep silver and gold from rising in price, the false image of the US as a safe haven for investors can be perpetrated. However, the $230,000,000,000,000 in derivative bets by US banks might bring its own surprises. JPMorgan Chase has had to admit that its recently announced derivative loss of $2 billion is more than that. How much more remains to be seen. According to the Comptroller of the Currency http://www.occ.treas.gov/topics/capital-markets/financial-markets/trading/derivatives/dq411.pdf the five largest banks hold 95.7% of all derivatives. The five banks holding $226 trillion in derivative bets are highly leveraged gamblers. For example, JPMorgan Chase has total assets of $1.8 trillion but holds $70 trillion in derivative bets, a ratio of $39 in derivative bets for every dollar of assets. Such a bank doesn't have to lose very many bets before it is busted. Assets, of course, are not risk-based capital. According to the Comptroller of the Currency report, as of December 31, 2011, JPMorgan Chase held $70.2 trillion in derivatives and only $136 billion in risk-based capital. In other words, the bank's derivative bets are 516 times larger than the capital that covers the bets. It is difficult to imagine a more reckless and unstable position for a bank to place itself in, but Goldman Sachs takes the cake. That bank's $44 trillion in derivative bets is covered by only $19 billion in risk-based capital, resulting in bets 2,295 times larger than the capital that covers them. Bets on interest rates comprise 81% of all derivatives. These are the derivatives that support high US Treasury bond prices despite massive increases in US debt and its monetization. US banks' derivative bets of $230 trillion, concentrated in five banks, are 15.3 times larger than the US GDP. A failed political system that allows unregulated banks to place uncovered bets 15 times larger than the US economy is a system that is headed for catastrophic failure. As the word spreads of the fantastic lack of judgment in the American political and financial systems, the catastrophe in waiting will become a reality. Everyone wants a solution, so I will provide one. The US government should simply cancel the $230 trillion in derivative bets, declaring them null and void. As no real assets are involved, merely gambling on notional values, the only major effect of closing out or netting all the swaps (mostly over-the-counter contracts between counter-parties) would be to take $230 trillion of leveraged risk out of the financial system. The financial gangsters who want to continue enjoying betting gains while the public underwrites their losses would scream and yell about the sanctity of contracts. However, a government that can murder its own citizens or throw them into dungeons without due process can abolish all the contracts it wants in the name of national security. And most certainly, unlike the war on terror, purging the financial system of the gambling derivatives would vastly improve national security. This article first appeared at Paul Craig Roberts' new website Institute For Political Economy. Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. He was columnist for Business Week, Scripps Howard News Service, and Creators Syndicate. He has had many university appointments. His Internet columns have attracted a worldwide following. ____________________________ The apparent end to momentum in the 12-year bull market in the gold price is a carefully coordinated exercise in perception management. J.P. Morgan and a handful of the world's largest banks have been permitted the right to originate contracts for forward sales and purchases of various commodity products far in excess of what is produced of each commodity annually. There is seldom any delivery of physical metals, and the contracts are originated on completely false premises equivalent to a casino where every game is rigged in favour of the house. Thus, the effect of real supply has been replaced by the effect of artificial supply. This represents a regulatory deficiency on the part of the Commodities Futures Trading Commission at minimum, and at worst, outright criminal fraud and collusion among the U.S. government, the banks, and the market operators themselves. CFTC Commissioner Bart Chilton has admitted on behalf of his agency that they are of the opinion that certain entities are engaged in manipulative and unlawful practices in the futures markets, and announced and investigation was under way. Four years ago. No results from the investigation have materialized, and that's because the apparent end to the momentum in the 12-year bull market in the gold price is a carefully coordinated exercise in perception management. The banks will forever be able to lay legitimate claim to the pursuit of profit as the primary motivation for exploiting the regulatory aberration that permits and even abets fraud on such a large scale. The government will never admit to active collusion. CNBC, Bloomberg, the Wall Street Journal et al refuse to extend their line of inquiry into the factors controlling the price of gold beyond superficial fundamentals such as jewelry demand and store-of-value investor demand. This perception management apparatus has now become so finely-tuned that the gold price is rather deftly handled upward and downward in movements that serve the requirements of the two parties operating the scam. For the banks, reliable risk-free profit, and for the government of the United States, the perception that the U.S. dollar is a safer haven than gold. I think the current continuous downward pressure on gold is undertaken to create the reality of a gold price that declines below its 52-week low. That would, in the invisible deliberations of the fraud participants, end the perception of gold as a safer store of value than U.S. Treasury bills, widely understood to be a key component of keeping the U.S. dollar lie alive. The Bloomberg headline of May 29th is precisely the objective of anti-gold dollar defenders: "Gold Set for Worst Run Since 1999 as Dollar Strengthens". The U.S. Dollar lie is complete. When you're living a lie, perception outweighs the importance of reality, and that is optimally here achieved. The second part of the elaborate perception management ploy is that the third round of U.S. stimulus will coincide perfectly with the re-emergence of the U.S. deficit and debt position at the top of the news heap once Europe has fallen the rest of the way apart. Stimulus will be required then, because the banks who are the recipients of the stimulus are subject to conditions that result in substantial proportions of that money being invested into U.S. Treasuries, which is essentially the mechanism by which the United States government counterfeits its own currency to the detriment of U.S. dollar-denominated sovereign reserve currency positions and its own population. Thus the objective of the perception management exercise – the condition where selling U.S. debt is just slightly more egregious in a net-net evaluation of sovereign reserve value than buying more of it – is achieved. And the U.S. can continue bullying the rest of the world around because theoretically we are all unfortunate passengers in the same boat. The problem with this strategy, as the perps likely comprehend perfectly, is that there is a point where the math can simply no longer support the illusion. That point is visible in a not-too-distant future. That is when all the major currencies collapse into t |

| The 'Big Reset' Is Coming: Here Is What To Do Posted: 07 Jun 2012 01:22 PM PDT A week ago, Zero Hedge first presented the now viral presentation by Raoul Pal titled "The End Game." We dubbed the presentation scary because it was: in very frank terms it laid out the reality of the current absolutely unsustainable situation while pulling no punches. Yet some may have misread the underlying narrative: Pal did not predict armageddon. Far from it: he forecast the end of the current broken economic, monetary, and fiat system... which following its collapse will be replaced with something different, something stable. Which, incidentally, is why the presentation was called a big "reset", not the big "end." But what does that mean, and how does one protect from such an event? Luckily, we have another presentation to share with readers, this time from Eidesis Capital, given at the Grant's April 11 conference, which picks up where Pal left off. Because if the Big Reset told us what is coming, Eidesis tells us how to get from there to the other side... First of all, what is systemic risk?

Usually, the best warning indicator of a major systemic "event" are soaring cross-asset correlations: something we are experiencing right now.

What are the key systemic risks:

What to look for:

But more than anything, the one biggest giveaway is near endless complacency: the more the pros exhibit it, the closer we are:

One simple example of the true cost of systemic risks in vitro:

What's the big deal: they bailed us out before, they will do it again. Wrong: "Due to massive new debts and politics governments' capacity for future bailouts is limited." Which means that systemic hedges should be used by everyone. At what cost though:

As Eidesis notes: Insurance is cheap whenever consensus under?estimates the Probability of Disruption. Or, worse, when the status quo is artificially keeping the price of systemic insurance low to prevent the general public from realizing just how precarious reality truly is. Remember:

So if we are handed cheap insurance options, where should we be looking? Long-time Zero Hedge readers likely already know the answer:

Which leaves...

But don't take our word for it... Or that of Eidesis. How about that of... the Federal Reserve: Here is the FRBNY explaining why people own gold:

Why the US government nationalized gold:

What else does the Fed tell us:

Which means that as we approach the date with the Grand Reset which Raoul Pal predicted could come as soon as the end of the year, and which Soros has as under 3 months and counting, there is only one question:

Do You Have Systemic Insurance?

Full Eidesis Presentation:

|

| Hitler Is Long The USD, Gets A Margin Call Posted: 07 Jun 2012 11:51 AM PDT It's been a while since we had a close encounter with Hitler and specifically his trading prowess. Today we learn just how truly powerless the German is when faced with the terrible trio of Geithner's "strong dollar policy", a CFTC barrage of margin calls, and the fine print of various precious metal ETFs. And of course FX sellside "recommendations" by the TBTFs. h/t ReboilRoom |

| Posted: 07 Jun 2012 11:45 AM PDT Submitted by Ben Traynor | BullionVault Thursday, 7 June 2012 - Another big fall for gold as the Fed chairman appears before Congress… SIX DAYS after they climbed back above $1600 an ounce, gold prices dropped back below that level on Thursday, as Federal Reserve chairman Ben Bernanke appeared before Congress at the Joint Economic Committee. This is [...] This posting includes an audio/video/photo media file: Download Now |

| Bernanke Remarks Take Wind Out Of Rally Posted: 07 Jun 2012 11:45 AM PDT Jim Sinclair's Mineset My Dear Extended Family, Hi Jim, Uncle Ben puts a temporary halt to the gold rally and JPM and Company assist in the smack-down. Of course the US Dollar is down another 24 cents and gold should be rising. Bernanke printing is put on hold (MOPE to infinity) and I have a nice bridge in Brooklyn to sell! Any buyers? CIGA David Dear David, Ignore the MOPE and fabrications. What I have told you will occur, will occur, without any doubt. That is the bottom line. Regards, Jim "Bernanke remarks take wind out of rally" NEW YORK (Reuters) - Stocks pared steep gains on Thursday after prepared remarks from Federal Reserve chairman Ben Bernanke showed the Fed was ready to shield the economy if financial troubles mount, but he offered few hints that further monetary stimulus was imminent. The Dow Jones industrial average rose 105.58 points, or 0.85 percent, to 12,520.37. The S&P 500 Index gained 9.08 points, or 0.69 pe... |

| Posted: 07 Jun 2012 11:39 AM PDT June 7, 2012 [LIST] [*]Is technological progress decelerating? Or... what good is a smartphone and an iPad while we still wait for a flying car? [*]Progress in computers and nothing else? Jeffrey Tucker and Patrick Cox tag-team wrestle with the "deceleration" thesis. (Warning: Patrick attempts a body slam) [*]Gold sinks back below $1,600... Addison with a timely reminder about the right reasons to own it [*]Bernanke bloviates... Large dogs subject to "new taxes and weird fees"... an Xer and a member of the GI generation weigh in on Social Security... and more! [/LIST] "We wanted flying cars, instead we got 140 characters." So reads the subtitle of a report from Founders Fund, a venture capital firm co-founded by Peter Thiel — the man who launched PayPal. We missed it when it came out. We were busy at last year's Agora Financial Investment Symposium. But we see Thiel's opinion hasn't changed. His thesis? Computers are getting faster, cheaper, better. But in the... |

| Posted: 07 Jun 2012 11:38 AM PDT by Paul Tustain BullionVault Wednesday, 6 June 2012 Zurich, Hong Kong, Mumbai, Shanghai and Singapore have all detected the UK's ambivalence to physical metal... A GOLD SOVEREIGN coin is within the UK tax authority's definition of investment gold. But would a new one pass the tests of fairness which government rightly demands of the investment industry? Probably not. It retails from the Royal Mint for £495 on a day when its gold content is worth £244.78. Sovereign gold costs more than twice its real value. It is a wonder they can sell sovereigns at all, but they can, because of a tax anomaly. There is no capital gains tax on legal tender, and the sovereign — worth £244.78 in gold — has a nonsense legal tender value of £1. The tax status of a sovereign rests on your infrequently exercised right to pay with one in Poundland. This is not the only tax anomaly around gold investment. Long-term owners of real gold see a rising apparent value but devaluation flatters to deceive, ... |

| James Dines - Debt Liquidating Depression & Systemic Failure Posted: 07 Jun 2012 10:48 AM PDT  With central planners actively scrambling to address mounting problems facing the United States and Europe, and uncertainty continued uncertainty in global markets, today King World News interviewed legendary James Dines, author of The Dines Letter. Dines told KWN that "a collapse of Europe's banking system is inevitable" and "the United States is headed towards a Greek tragedy of its own." Here is what Dines had to say about what is taking place: "The Fed has lowered interest rates to record low levels, and Bernanke has printed unimaginable amounts of money, but it hasn't worked. Instead of acknowledging that Keynesian economic theories are bankrupt and at a dead end, Bernanke can only wonder if even more of the same medicine might somehow work." With central planners actively scrambling to address mounting problems facing the United States and Europe, and uncertainty continued uncertainty in global markets, today King World News interviewed legendary James Dines, author of The Dines Letter. Dines told KWN that "a collapse of Europe's banking system is inevitable" and "the United States is headed towards a Greek tragedy of its own." Here is what Dines had to say about what is taking place: "The Fed has lowered interest rates to record low levels, and Bernanke has printed unimaginable amounts of money, but it hasn't worked. Instead of acknowledging that Keynesian economic theories are bankrupt and at a dead end, Bernanke can only wonder if even more of the same medicine might somehow work." This posting includes an audio/video/photo media file: Download Now |

| Guest Post: The World Before Central Banking Posted: 07 Jun 2012 10:44 AM PDT Submitted by John Aziz of Azizonomics, In today's world, there are many who want government to regulate and control everything. The most bizarre instance, though — more bizarre even than banning the sale of large-sized sugary drinks — is surely central banking. Why? Well, central banking was created to replace something that was already working well. Banking panics and bank runs happen, and they have always happened as long as there has been banking. But the old system that the Fed displaced wasn't really malfunctioning — unlike what the defenders of central banking today would have us believe. Following the Panic of 1907, a group of private bankers led by J.P. Morgan successfully bailed out the system by acting as lender of last resort. The amount of new liquidity disbursed into the system was set not by academics like Ben Bernanke, but by experienced market participants. And because the money was directed from private purses, rather than being created out of thin air, only assets and companies with value were bought up. The rationale of the supporters of the Federal Reserve Act was that a central banking liquidity mechanism would act as a safeguard against such events, to act as a permanent lender-of-last-resort backed by government fiat. They wanted something bigger and better than a private response. Yet the Banking Panic of 1907 — a comparable market drop to both 1929 or 2008 — didn't result in a residual depression. As the WSJ noted:

Ben Bernanke, widely seen as the pre-eminent scholar of the Great Depression thought things would be much, much better under his watch. After all, he has claimed that he understood the lessons of Friedman and Schwartz who criticised the 1930s Federal Reserve for continuing to contract the money supply, worsening the Great Depression; M2 in 1933 was just 72% of its 1929 peak. So a bigger crash and liquidation in 1907 allowed the economy to roar back, and continue growing. Meanwhile, in today's controlled, planned and dependent world of central liquidity insurance, quantitative easing and TARP, growth remains anaemic four years after the crash. Have the last four years proven conclusively that central banking — even after the lessons of the 1930s — is inferior to the free market? Certainly, Bernanke's response to 2008 has been superior to the 1930s Fed — M2 has not dropped by anything like what it did from 1929:

Does central banking retard the economy by providing liquidity insurance and a backstop to bad companies that would not otherwise be saved under a free market "bailout" (like that of 1907)? And is it this effect — that I call zombification — that is the force that has prevented Japan from fully recovering from its housing bubble, and that is keeping the West depressed from 2008? Will we only return to growth once the bad assets and bad companies have been liquidated? That conclusion, I think, is becoming inescapable. |

| Gold Price Closed Lower at $1,586.60 Posted: 07 Jun 2012 10:25 AM PDT Gold Price Close Today : 1586.60 Change : -46.20 or -2.83% Silver Price Close Today : 2851.9 Change : -95.7 or -3.25% Gold Silver Ratio Today : 55.633 Change : 0.239 or 0.43% Silver Gold Ratio Today : 0.01797 Change : -0.000078 or -0.43% Platinum Price Close Today : 1439.40 Change : 13.60 or 0.95% Palladium Price Close Today : 624.35 Change : 12.10 or 1.98% S&P 500 : 1,314.99 Change : -0.14 or -0.01% Dow In GOLD$ : $162.35 Change : $ 5.20 or 3.31% Dow in GOLD oz : 7.854 Change : 0.251 or 3.31% Dow in SILVER oz : 436.94 Change : 15.75 or 3.74% Dow Industrial : 12,460.96 Change : 46.17 or 0.37% US Dollar Index : 82.80 Change : 0.408 or 0.50% Franklin did not publish commentary today. He will return Monday. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Posted: 07 Jun 2012 09:49 AM PDT Wolf Richter www.testosteronepit.com Since the lousy jobs report last Friday, there has been a veritable orgy of Fed Speak with juicy morsels and contradictions, interspersed with leaks and rumors, that climaxed today with Chairman Ben Bernanke’s words of wisdom before the Congressional Joint Economic Committee. It whipped markets into a frenzy, drove the Dow up 500 points, knocked yields into historic basements, and caused gold, the safe-haven investment, to bounce up and down like a rubber ball. All this was peppered with the impending collapse and bailout of Spanish banks and an endless litany of other problems in the Eurozone whose miasma is drifting across the Atlantic and might infect the presidential campaign. Yet Bernanke wasn’t totally gung-ho about more Quantitative Easing. The “economy must be monitored closely,” he said instead of promising the immediate restart of the printing press. On Tuesday, it was Richard Fisher, President of the Dallas Fed, who came out swinging against more quantitative easing despite the “hue and cry of financial markets.” He blamed the federal government for lack of direction in its tax and spending policies that leave businesses mired in uncertainty. The same day, James Bullard, President of the St. Louis Fed, didn’t think the jobs situation and the broader economy was bad enough for the Fed to pile into another round of ineffectual QE—maybe they were trying to stay out of a political minefield. Read.... Squeezing the Fed from both Sides. On Wednesday, Vice Chair Janet Yellen took the opposite tack. Citing the still dismal job and housing markets, she pushed for more QE and more interest rate manipulation for an even longer period, probably for all times to come—ironically because the job and housing markets are precisely the markets that have not recovered since the Fed started its QE programs and zero-interest-rate policy (ZIRP) in December 2008, along with its massive corporate and bank bailouts. The effect of the Fed’s policies on the job market can best be seen through the Employment-Population ratio, which measures the percentage of people age 16 and older who have jobs. It’s not perfect. But it’s the least corrupted employment number out there: it’s not seasonally adjusted, manipulated by the infamous “Birth Death Adjustment,” or mucked up in other ways. After peaking in April 2000 at 64.7%, it now hovers near its 30-year low—despite, or because of, the Fed’s policies:

The beneficial impact of QE and ZIRP on the housing market can best be seen through the Case-Shiller 20-City Composite home price index. Note the new multi-year low at the end of the line—despite the Fed’s gyrations and manipulations, and despite record low 30-year mortgage rates:

So, how can anyone still couch the justification for QE and ZIRP in fatuous language of job creation and housing market recovery? The Fed employs an army of number-crunchers who know all this. Yellen and Bernanke also know that the impact of QE and ZIRP on jobs and housing, as well as on the broader economy, has been nil, or even a negative. However, QE and ZIRP have had a colossal impact, and not just on the financial markets and the status-quo banking system that caused the financial crisis, and on capitalism and free markets as a whole, which no longer exist, but also on the real economy. A friend of mine is a partner at a restructuring firm. Their specialty was to take companies that were cratering and restructure them back to health. Typically, they were paid by creditors that had ended up with these companies. But a couple of years ago, his firm had to reinvent itself. With boundless amounts of money floating through the system, and with yields being so low, creditors had become enamored with “extend and pretend” where, instead of recognizing losses on these defunct loans, they would simply offer forbearance agreements, issue new loans, and pretend everything was fine. These companies are still out there, un-restructured, burdened with even more debt, and losing even more money. The rejuvenation and cleansing process that debt-fueled capitalism needs from time to time to get rid of management deadwood, too much debt, and other problems, and that wipes out equity holders and makes creditors come to grips with reality, has not taken place. The energy and job growth that would normally sprout from the ashes have mostly faltered. And my friend, to stay relevant, became an expert in performance improvement to help entrenched management stay in place. While preventing the economy from going through its necessary cleansing process—and the heavy losses associated with it—the Fed’s policies have in spectacular fashion enabled Congress to run up gargantuan deficits year after year that make the Eurozone, now ravaged by a debt crisis, look virtuous. Sen. Jim DeMint, a South Carolina Republican, tried to politely nudge Chairman Bernanke on that, but he shrugged it off. And Congress will once again shrug off Bernanke’s suggestion that it needs to come up, as he said, with a “sustainable” deficit—a term that has replaced the concept of “balanced budget.” And here is a hilarious cartoon Ben Garrison about what happened to Ron Paul when he hit one out of the ballpark.... “Ron Paul Hits A Home Run.” |

| Posted: 07 Jun 2012 09:28 AM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! June 07, 2012 11:41 AM Despite the absolute worse junior resource market I ever had the “displeasure” to be in, Sunridge managed to secure a $ 9.25 million *private placement at $0.37 per unit – a 10% premium to market.. *This investment with the Shanghai Richstone Investment Group out of Beijing demonstrates a strong vote of confidence in the company and the excellent economics of the Asmara Project as announced in their PF study on May 2. This shows that large, sophisticated Chinese companies are still looking for great projects that are undervalued in this current market. The Sunridge team has accomplished what juniors are supposed to do – explore, discover, increase size of resources, complete economic studies and develop to production. This success is being recognized by groups like Shanghai Richstone and if there’s justi... |

| Posted: 07 Jun 2012 09:14 AM PDT Bill Bonner View the original article. June 07, 2012 08:14 AM The 1%…the zombies…and the rest of us… How about that Dow? Up 286 points yesterday. And gold up $17. Markets are counting on their hero, Mr. Benjamin S. Bernanke, to come to the rescue. They can practically hear the printing presses warming up…and smell the fresh $100 bills rolling off. And where does all the money go? Long time passing… Where does all the money go? Long time ago… Where does all the money go? Gone to rich people every one… When will they ever learn? Oh when will they ever learn? But nobody seems to make the connection. Only here at The Daily Reckoning will we give it to you straight: The working classes made substantial gains until the 1970s. Then, wages went flat for the next 40 years. Wealth was shared out fairly evenly too…until the 1970s. From Wikipedia: …data from a number of sources indicate that income inequality over all has grown signif... |

| Take Note: Gold and Silver are NOT an Investment! Posted: 07 Jun 2012 09:14 AM PDT Gold and Silver are not an investment! Let me repeat that. Gold and silver are not an investment! Gold and silver are (excuse the pun) the most “solid” form of money you can possess. Yes, these two precious metals are money!…Don’t fear owning gold my friends. Fear not owning gold and silver, especially if you are a saver. [Let me explain.] Words: 812 So says H. Pelham ([url]http://retirefund.blogspot.ca[/url]) in edited excerpts from his original article*. [INDENT]Lorimer Wilson, editor of [B][COLOR=#0000ff]www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor's Note at the bottom of the page. This, and the preceding paragraph, must be included in any article re-posting to avoid copyright infringement.[/COLOR][/B] [/INDENT]Pelham goes on to say, in part: Gold*& Silver Hold Their Purchasing Power Over Time [Gold and silver]*have been money for about 4,000 years. Right up until 1964, silver was used in U... |

| Mike Krieger: China Will Blink And Gold Will Soar Posted: 07 Jun 2012 08:58 AM PDT Submitted by Michael Kriger of A Lightning War On Liberty blog,

The Game Continues Mapping the Next Five Months Ok so let's start with the FOMC meetings. Between now and election day there are four. The first one as everyone know is June 20th, followed by August 1st, September 13th and then October 24th. Many pundits claim that if the Fed is going to act they may as well do so well before the election so as not to appear to be "influencing the election." I'm not so sure about that. Maybe in times past, when the power structure was a bit more reserved and less blatant about their corruption and manipulations. They don't hide that stuff anymore. The "elites" in America today are simply gangsters. We have already been officially christened as a Banana Republic. The criminal behavior that now governs our political and economic system is now all out in the open for anyone with eyes to see. They don't care. What I want to make clear in this piece is that just because I think a massive wave of liquidity is coming from the Central Planners, that doesn't mean I expect it to happen in June. There is no doubt that The Bernank is now doubting all of his academic theories of the past and is scared out of his mind to "do more." He is afraid it won't work, he is afraid of the demand for physical gold and silver that it might spark, and he is also afraid to use the bullets now with asset prices where they are. He wants to save it for when he needs it and he knows he will need it. So the game continues. Talk up the economy, talk down printing and pray. The beige book and today's testimony represented textbook Fed strategy in 2012. Strategy that I have discussed many, many times in months prior. They can talk all they want and give all the reassurances they want but talk from monetary magicians does not alter the reality on the ground. As I have stated repeatedly in the last two weeks, I think the Fed is more behind the curve than at any point since 2008. Back then, The Bernank assured us that there was no housing bubble and that subprime was contained. Big bank CEOs were pimped out on CNBS to claim their solvency weeks before going under or needing a bailout. The only strategy left was to lie. Despite the fact that it didn't work then doesn't stop them from trying now. Why? They are insane. Barring a market catastrophe in the next two weeks I do not expect the Fed to act at the June meeting. With rates where they are and stocks where they are there is little upside to action; however, this lack of action is precisely what will set the stage for the massive action that must come later. One of the main things that has allowed the Fed to kick the can down the road as long as it has is the fact that ever since 2008 they have acted aggressively on the first hint of weakness. While the beige book pointed to relatively rosy conditions for the U.S. economy, I think that is because they were looking at data from early April through late May together. If you look at the U.S. economic statistics, the data didn't start turning for the worse in a serious manner until late in the second half of the month of May. The Fed knows this but they are purposefully misleading the market. In reading a Bloomberg article about the beige book the following quote stood out to me: "'The Beige Book is clearly at odds with the hard data we've been seeing,' said Millan Mulraine, senior U.S. strategist at TD Securities in New York. 'We've seen a dramatic slowdown in economic growth momentum that you'd think would be reflected in a few, if not the majority, of districts.'" Move along folks…nothing to see here. As a result, if the market heads into the Fed meeting at current levels it runs the risk of being disappointed. If this is combined with continued economic weakness then the real set up happens between the June meeting and the August one. It is in that interim period that the market could throw another one of its hissy fits and beg for more liquidity. Money supply growth is extremely sluggish right now all over the world. The velocity never happened and the global economy is rolling over. The Fed is already behind the curve and so when they are forced to act the infusion will have to be huge just to stem the momentum. What will really be interesting is if they will be able to stem the momentum. I have no idea but the longer they wait the less likely they will be able to.

China Will Blink and Gold Will Soar China's M2 Monthly year-over-year growth The big point is that China will act and in a meaningful way. What I suggest people do is go back and look at different asset classes from the prior two lows in China's M2 year-over-year growth rate. The first one occurred in late 2004. The M2 growth rate then accelerated until around mid 2006. In that time period gold prices went up around 65% and the S&P 500 went up 20%. In the second period of acceleration from late 2008 to late 2009 gold was up 65% and the S&P500 was up 15%. We are at one of these inflection points and considering the DOW/Gold ratio is still holding gains from its countertrend rally from last August of almost 40%, this is probably one of the best entry points to buy gold and short the Dow of any time in the last decade. Oh and if you want more juice, when China blinks silver does much, much better than gold... |

| Late-Day Crumble As Stocks Join Gold's Stumble Posted: 07 Jun 2012 08:31 AM PDT Whether it was the deterioration in Consumer Credit, downgrade rumors for US financials, Greek bank restructuring/run chatter, or a final realization that near-term QE is off at these levels of equity prices (as signaled by Bernanke and Gold this morning), the equity short-squeeze stumbled hard in the last hour of the day to end unch. Utilities managed to outperform handily as all the high beta sectors dumped into the close as Tech and Financials closed red for the day. Treasury yields and the USD were signalling considerably more equity weakness than we got though the dive caught stocks up but Gold remained the biggest loser of the day (-2% on the week against the 0.7% loss in the USD). Silver remains positive for the week - though matched gold's weakness on the day as Copper and Oil whipsawed up and down on rumor and then lack of follow-through. Equities pulled back closer to the underperforming investment grade (and less so high yield) credit market at the close. Treasury yields ended marginally lower (with the long-bond underperforming) and 7s and 10s -2bps)leaving 5Y flat still up 9bps on the week (and outperforming). Risk markets in general slid as Bernanke's speech was delivered and the Q&A proceeded but stocks went almost totally dead with financials and the S&P 500 e-mini clinging to VWAP as volumes died - until that last hour plunge. MS and BofA took the brunt of the selling pressure (ending down 3-4%) - though they are still well of the lows from a few days ago. VIX cracked back above 22% as we dropped in the end but closed down 0.5vols at 21.7% but implied correlation rose back over the somewhat critical 70 threshold and equities remain notably rich to broad risk assets in general still. Gold stood out as the big mover (beta-adjusted) today - but stocks pulled back down to a more realistic level based on TSYs and and the USD by the close... Equity and HY credit remain in sync but pressure on IG credit is still there - unwillingness to lift systemic overlays or putting on cheap macro hedges into the short-squeeze? HYG and VXX tended to overshoot down and up today as the early weakness and mid-afternoon pop came but by the close, SPY was back in sync (rather miraculously) with VXX, HYG, and TLT. Equities remain rich to broads risk assets after leading them higher for the last few days - despite some TSY/FX driven give-ups by the look of it early in the day today for CONTEXT. VIX touched fair-value earlier, sold back off and then by the close was back up near its credit/equity vol fair-value but correlation remains on the low side but picked up in the afternoon - which given the downswing is perhaps a little worrisome... It appeared today's action was very much about juicing stocks up for some better exit levels - as is clear here we dumped right out of the gate in the QE-sensitive sectors, stabilized after Ben's speech and algos lifted us to VWAP and then dumped into the close once again... Not pretty but then an unch close is hardly epic (yet)... medium-term we are at some upside resistance and it appears (yellow/blue bars courtesy @eminiwatch) that it was small players pushing us into the highs today and pros covering... But perhaps what is most scary about today's action was the huge jump up in average trade size which smells a lot like a short-squeeze up being used by the big boys to get better exits also (as opposed to jumping aboard to start a trend)... Charts: Bloomberg and Capital Context Bonus Chart: Facebook ended the day -2% MORE! Oscillating between VWAPs - this has become the new 'Pong' it seems... Bonus Bonus Chart: The term structure of Vol has got extremely steep once again (5 month highs) - the last time we were this steep, thanks to short-term vol compression exuberance, equities sold off quite sharply... |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Man-made financial phenomena imitate nature, but more importantly they are subject to the powerful laws of economic nature. The Wall Street financial engineers have built vast structures, which tragically are crumbling and soon will fall to the ground. Vast illusory wealth will be lost, never truly garnered. The fiat currency system has required tremendous efforts not only to build the financial skyscrapers ever higher each year, but also to provide support structures that prevent their topple. With the aid of the subservient press, an illusion of wealth, prosperity, and stability has been fashioned and defended. It is all being blown away by the powerful storms known as the global financial crisis. The term has even earned an acronym for the popular lexicon GFC. My alternative view is that the global monetary war is in full swing, World War III with the USDollar at the epicenter of the conflict and pecuniary violence. A few years ago in June 2005, the Jackass penned an obscure article entitled "Financial Market Physics" just for amusement. Thanks to Vronsky and his intrepid work, the Gold-Eagle archive still lives (for old article CLICK

Man-made financial phenomena imitate nature, but more importantly they are subject to the powerful laws of economic nature. The Wall Street financial engineers have built vast structures, which tragically are crumbling and soon will fall to the ground. Vast illusory wealth will be lost, never truly garnered. The fiat currency system has required tremendous efforts not only to build the financial skyscrapers ever higher each year, but also to provide support structures that prevent their topple. With the aid of the subservient press, an illusion of wealth, prosperity, and stability has been fashioned and defended. It is all being blown away by the powerful storms known as the global financial crisis. The term has even earned an acronym for the popular lexicon GFC. My alternative view is that the global monetary war is in full swing, World War III with the USDollar at the epicenter of the conflict and pecuniary violence. A few years ago in June 2005, the Jackass penned an obscure article entitled "Financial Market Physics" just for amusement. Thanks to Vronsky and his intrepid work, the Gold-Eagle archive still lives (for old article CLICK

A week ago, Zero Hedge

A week ago, Zero Hedge

In 2011 total Silver Eagle Sales in Dollars were 86% compared to Gold Eagle sales.

In 2011 total Silver Eagle Sales in Dollars were 86% compared to Gold Eagle sales.

Nearly two and a half years ago, I first began warning readers of the

Nearly two and a half years ago, I first began warning readers of the

No comments:

Post a Comment