saveyourassetsfirst3 |

- Smelting the Family Silver to Beat the Recession..

- The Gold Market's Steep Wall of Worry: Mark Hulbert

- U.S. Stocks are 'Very Cheap' Greenspan Says

- CME members win 90-day reprieve from higher margin rules

- Peter Daniels Talks On "Gold"

- BrotherJohnF: Unemployment

- Links 5/5/12

- Lost Gold and Buried Loot in northern California

- Calculating the "Fair Value" of Gold

- Lynn Parramore: Why the Rich Are Sending Pets on a Diamond-Studded Trip to the Afterlife

- By the Numbers for the Week Ending May 4

- The Goldbug, Variations V

- Primer On International Investing - Part I

- T&S: Metals and Currency Update

- A Eurozone breakup's affect on precious metals

- China Buys Gold…No Matter Who’s Selling

- The Silver Bull Market Is Over?

- Central Bank Demand to Change Gold & Silver Prices

- Lassonde: Here is What I’m Doing With My Own Money

- SF: Silver.. Bull Market or Not?

- David Morgan: Silver Suppression Is Ending

- Chris Duane: The Silver Door Is Closing

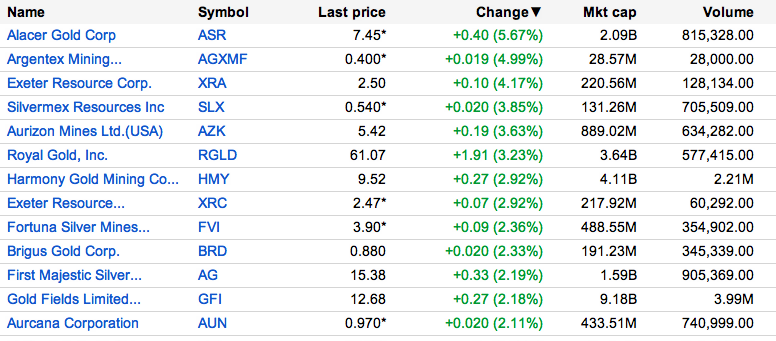

- Today’s Winners and Losers

- Keynes, the closet gold bug

- The Separation of Money and State

- Buy a House Now for Capital Gains and Income

- Gold and Silver Disaggregated COT Report (DCOT) for May 4

- What was the point for 40% Kennedy halves?

- Juniors vs. Senior Mining Stocks

- Gold Rallies Following Disappointing Nonfarm Jobs Data, Gold in Pounds Touches Lowest Level This Year, Fed Interest Rates “Too Low” by Taylor Rule

| Smelting the Family Silver to Beat the Recession.. Posted: 05 May 2012 02:27 AM PDT |

| The Gold Market's Steep Wall of Worry: Mark Hulbert Posted: 05 May 2012 12:57 AM PDT ¤ Yesterday in Gold and SilverThe Kitco website went down for scheduled maintenance for about two and a half hours in the wee hours of Friday morning...and did not come back on line until after I'd hit the 'send' button on Friday's column. During that time, the low price print for gold was in for the day...and maybe even for this move down. Once that low was in, which came shortly before 10:00 a.m. in London, gold began to rally. It really took off once the jobs numbers were released at 8:30...and the price got hit the moment that happened. But the gold price continued to rally until an amazing out-of-the-blue rally in the dollar index showed up around the London p.m. gold fix...and that put a temporary kibosh on the gold rally. Once the dollar rally burned itself out, the gold price began to rally anew, but never made it back to it's earlier high...and once Comex trading ended at 1:30 p.m. in New York, the gold price got sold off a few dollars in the close of electronic trading. The low for the day in morning trading in London came in around the $1,625 spot mark...and the New York high [$1,648.50 spot] came about 9:50 a.m. Eastern. The gold price closed up $6.30 on the day. Net volume was pretty healthy at around 132,000 contracts...so it's a good bet that JPMorgan et al had to use some heavy lumber on the gold price yesterday morning in New York to prevent it from getting away on them. Silver's price path was mostly same, except the low of the day came about 11:15 a.m. in London...quite a bit later than the low in gold. After that the silver price followed the gold price very closely. The silver price closed at $30.34 spot...up 27 cents from Thursday's close. Net volume was pretty heavy at 39,000 contracts. The dollar index didn't do much during Far East or early London trading...and was up about ten basis points to 79.33 by 8:00 a.m. in New York. Then it rolled over...and by 10:50 a.m. the index was down to 79.10...and then mysteriously exploded higher by over 40 basis points in the next ninety minutes. From there it traded flat into the close. Only one precious metal headed south in lock-step with this dollar rally...and the other three looked like they had some help after the fact...gold, platinum and palladium. Check out the charts...and then you be the judge. The gold stocks were up about two percent until shortly after the gold price headed south...and then lost half those gains by the time that gold hit its New York low. After that they didn't do a lot...and the HUI closed up only 0.48%. I suppose one shouldn't complain too much considering how badly the generally equity markets got beaten up on Friday. Despite the 27 cent gain, silver stocks closed mixed...and Nick Laird's Silver Sentiment Index closed down 0.71%. (Click on image to enlarge) The CME Daily Delivery Report for Friday was very quiet, as only 5 gold and 14 silver contracts were posted for delivery on Tuesday. There were no reported changes in GLD yesterday...but the SLV ETF showed that an authorized participant had added 1,553,027 troy ounces of silver. The U.S. Mint had no sales report. It was a very quiet day over at the Comex-approved depositories on Thursday. They didn't receive any silver...and only shipped 81,408 troy ounces of the stuff out the door. Here's a chart that Australian reader Wesley Legrand borrowed from a zerohedge.com post. It shows U.S. vs. European Unemployment Rates going back to 2004. And you thought American unemployment was bad. Here's Nick Laird's first of two charts. It's the "Global Indices" graph. Nick points out that we have reached a critical point...and it's looking pretty ugly from here. (Click on image to enlarge) Nick's second offering is the latest "Total PMs Pool" chart updated for the end of the week...and although it's hard to tell, Nick says that it's at another new high in weight. So no matter how much 'da boyz' huff and puff...or how much Charlie Munger tries to put down the precious metals...that's where the money is going. It's only a matter of time before we hit a new high in total value as well. (Click on image to enlarge) Reader Scott Pluschau has a commentary about gold over at his website. It's headlined "The intermediate term trend in Gold has changed..." The link is here. Well, the Commitment of Traders Report in silver was not what I was expecting at all...and even Ted was taken aback. We were both expecting a decent sized drop in the Commercial net short position after the big engineered decline in silver prices on April 25th...but it didn't happen. As a matter of fact, the Commercial net short position in silver actually increased by 1,390 contracts. What Ted discovered in the Disaggregated COT Report was that the 'raptors'...the small Commercial traders that work in sync with JPMorgan...instead of buying with both hands on that sell-off...which they have always done without fail on every other engineered price decline, actually sold a whole pile of long positions instead. Ted didn't have a clue why that would be the case. This is uncharted territory...and I'll see what more Ted has to say about it in his weekend review when he posts it on his website on Saturday sometime. I suppose there could have been an error in the data...and it's always possible that the CFTC could issue a corrected report on Monday...but until that happens, one must presume that the data is correct. The other big takeaway from this report was the big drop in open interest. It declined by 11,463 contracts...a decline of more than 10 percent. Ted also mentioned the fact that the '1-4' largest short holders [read JPMorgan] covered a lot of short positions during the reporting week. In gold, JPMorgan et al increased their net short position by 10,766 contracts. The Commercial net short position is now up 17.8 million ounces. Gold spent most of the reporting week above its 20-day moving average...and there were obviously some speculators coming into the market on the long side. If these sellers of last resort hadn't shown up to take the short side of these trades, the price of gold would have finished the reporting period materially higher, as there are no legitimate short sellers left...at least not at these low prices. That's what 'da boyz' are there for...to ensure that the gold price does not run away to the upside. The May Bank Participation Report in silver showed that 4 U.S. bullion banks decreased their net short position in silver by 3,215 contracts...and the lion's share of that would have involved JPMorgan...and virtually all the rest would have been HSBC USA. As of the Tuesday cut-off, these four banks were net short 16,681 silver contracts, which is 83.4 million ounces. And once the market-neutral spread trades in the Non-Commercial category are subtracted from total open interest, these 4 U.S. banks are short 18.6% of the entire Comex futures market in silver...and I'd guess that about 99% of that is held by JPM and HSBC combined. The 13 non-U.S. banks that hold Comex positions in silver decreased their net short position by 923 contracts...and now hold 1,352 contracts short between all thirteen...about 100 contracts apiece. I would bet some serious money that only two or three of these thirteen foreign banks hold more than 50 percent of that short position between them. Not that it matters, as the non-U.S. banks positions in the Comex futures market in silver are immaterial in the grand scheme of things. It's not rocket science to see that 2 U.S. banks run the silver price fixing scheme all by themselves...and everyone else is immaterial. As I said last month...and the every other month before that...this is a "Made in the U.S.A." price fixing operation. In gold, it was a different story...and I checked my numbers twice to make sure I had it right. The same 4 U.S. banks decreased their net short position in Comex gold futures market in the May report by a very tiny 1,708 contracts...an immaterial change. As of Tuesday, these 4 banks were net short 67,765 Comex gold contracts...or 6.78 million ounces. Once again it would be JPM and HSBC holding the biggest percentage of those short positions...but they aren't any where near as extreme as their net short position in silver, as the other two U.S. banks that are short gold hold pretty large positions, which dilutes the percentages held by JPM and HSBC. But, having said that, these 4 U.S. banks are short 17.8 percent of the Comex futures market in gold once all the market-neutral spread trades are subtracted from total open interest. The 20 non-U.S. banks that hold gold contracts in the Comex futures market actually increased their net short position in gold by 3,717 contracts...also a mostly immaterial change. As of the Tuesday cut-off, these 20 banks were net short 41,519 Comex gold contracts...or about 2,000 contracts apiece, which isn't a lot. But, as in silver, it would be my guess that only a handful of these 20 banks would hold the lions share of these short positions. I have the usual number of stories for you today...and some I've been saving for Saturday's column because of length or subject matter. We're all set up to go to the upside...and it just remains to be seen how far and how fast JPMorgan et al will allow prices to rise. Boardrooms are quaking with fear as shareholders revolt. Smelting the Family Silver in Britain. Is an Economic Deluge Nigh? - David Galland ¤ Critical ReadsSubscribePeople Not In Labor Force Soar By 522,000, Labor Force Participation Rate Lowest Since 1981It is just getting sad now. In April the number of people not in the labor force rose by a whopping 522,000 from 87,897,000 to 88,419,000. This is the highest on record. The flip side, and the reason why the unemployment dropped to 8.1% is that the labor force participation rate just dipped to a new 30 year low of 64.3%. This very short zerohedge.com piece contains two tell-all graphs...and will only take thirty seconds of your time. I thank West Virginia reader Elliot Simon for sending it...and the link is here.  Announced U.S. Job Cuts Rise 11% From Year Ago, Challenger SaysEmployers in the U.S. announced more job cuts in April than a year earlier, led by education and government agencies. Planned firings rose 11 percent to 40,559 from April 2011, according to figures released today by Chicago-based Challenger, Gray & Christmas Inc. The monthly average of 45,913 cuts through the first four months of this year is lower than the full-year average of 50,507 for 2011. Employers in education, government, and the consumer goods and transportation industries are easing the pace of dismissals even as they continue to trim headcount, the report said. Job creation in the world's largest economy is yet to reach a level that will make a "substantial dent" in joblessness, it said. This Bloomberg story from Thursday is well worth the read if you have the time. I borrowed it from yesterday's King Report...and the link is here.  The Emperor is Naked: David StockmanA "paralyzed" Federal Reserve Bank, in its "final days," held hostage by Wall Street "robots" trading in markets that are "artificially medicated" are just a few of the bleak observations shared by David Stockman, former Republican U.S. Congressman and director of the Office of Management and Budget. Everyone is bashing the Fed these days...and for very good reasons. Yesterday I posted a story with Jim Grant calling the Fed "the great vampire squid...even bigger than Goldman Sachs." David Stockman tees the Fed up and drives them down the fairway as well. This interview is posted over at theaureport.com website...and I thank Nick Laird for taking the time to get his nose out of his charts long enough to share it with us. The link is here.  Piece of my Mind: James GrantWhile on the subject of James Grant and the Fed...here's a copy of the speech that he gave when he was invited to speak at them back in late March. It's a longish read...which is why I saved it for the weekend. I thank Roy Stephens for bringing it to my attention...and it's posted over at the grantspub.com website in a pdf file. The link is here...and it's definitely worth the read.  Ron Paul taking end-Fed bill before panelA House panel led by longtime Federal Reserve critic Rep. Ron Paul will take direct aim at the central bank next week when it considers a bill to abolish the powerful institution. The legislation will be among a handful of bills that will be looked at on Tuesday by the congressional committee that could all spell significant change to — if not outright elimination of — the Federal Reserve. "More and more people are beginning to understand just how destructive the Federal Reserve's monetary policy has been," said Paul, a Texas Republican and chairman of the House Financial Services subcommittee on Domestic Monetary Policy and Technology, which has oversight authority over the Fed. This marketwatch.com story from yesterday was sent to me by reader Scott Pluschau in the wee hours of this morning...and the link is here.  U.S. Stocks are 'Very Cheap' Greenspan SaysHere's a long 45-minute interview with Alan Greenspan that was on Bloomberg TV on Tuesday. Australian reader Wesley Legrand, who sent me this piece, made these comments about it..."Greenspan told the host, Tom Keene, that equities are the collateral of the financial system, hence that's why they are propped up. Another tidbit near the end -- Greenspan confronted with his own statements of 40 years ago that gold stands as the protector of property rights." I've had no time to listen to this myself, but it will be on my list of things to do this weekend. I listened to the first few minutes, though...and it's my humble opinion that Alan needs to be put out to pasture as soon as humanely possible. The interview is posted over at the businessweek.com website...and the link is here. U.S. Stocks are 'Very Cheap' Greenspan Says Posted: 05 May 2012 12:57 AM PDT  Here's a long 45-minute interview with Alan Greenspan that was on Bloomberg TV on Tuesday. Australian reader Wesley Legrand, who sent me this piece, made these comments about it..."Greenspan told the host, Tom Keene, that equities are the collateral of the financial system, hence that's why they are propped up. Another tidbit near the end -- Greenspan confronted with his own statements of 40 years ago that gold stands as the protector of property rights." |

| CME members win 90-day reprieve from higher margin rules Posted: 05 May 2012 12:48 AM PDT CME members win 90-day reprieve from higher margin rules By Josephine Mason NEW YORK | Thu May 3, 2012 8:01pm EDT NEW YORK (Reuters) - The CME Group was granted a 90-day reprieve from imposing new rules that will hike margins for some exchange members by as much as a third, one day after news of the increase riled locals and roiled markets. The new rules, which would have increased trading costs for exchange members who are classified as speculators, will now come into effect on August 5 instead of on Monday, it said in a release. Members will continue to enjoy special terms that allow them to meet the lower "hedger" margin requirement during the 90 days. "During the extension period, CME Clearing will work with the CFTC (Commodity Futures Trading Commission) to address member-customer concerns," the CME said. The exchange said it had requested and been granted the delay on Thursday. While traders are likely to be relieved, the abrupt announcement and initial confusion over the plan could add to frustration with the CME. Earlier on Thursday the exchange had to scramble to defer a shift to extended trading hours in its Chicago grain futures due to a regulatory snafu. "They probably got a bunch of heat from the members," said J. Mark Kinoff, president of Ceres Hedge, who owns a CBOT membership. From the Chicago trading pits to the New York oil and metals markets, "locals" who typically trade with their own money were aghast at the change in policy. Few had anticipated the changes, although they are part of the financial reforms that regulators have been working to implement for two years. "You have regulations coming into algos (algorithms), into banks' prop (proprietary) trading and now we're having issues with locals having to put up more liquidity. It's got to hurt liquidity," said a senior executive at a large futures commission merchant. Some traders said news of the new margins had roiled the Chicago Board of Trade corn market on Wednesday as local speculators liquidated spread positions rather than face the need to put more capital on margin to maintain positions. Some also blamed the shift for losses in New York oil futures. Initial margin, the amount of collateral required to open a new trade or meet a margin call, is typically set by exchanges at two different levels: a higher "speculator" margin to reflect the more volatile nature of those positions; and a lower "hedger" margin for farmers, producers and other firms. In the case of COMEX metals, for instance, the speculator margin is 35 percent higher than the hedge margin. With the change, any exchange members who are required to meet a margin call would have had to put up 35 percent more capital. END OF EXCEPTION That exception on margins will end because of new federal Dodd-Frank exchange rules, which mean members will have to pay the higher speculative margins to initiate a new speculative position. There is no change for members who qualify as hedgers, and will be able to continue paying the lower hedge margin. An official at the CME's clearing operation said his department had been inundated by calls from traders seeking clarification, some of whom mistakenly believed the new margins applied only to financial contracts, not commodities. The official confirmed that it applied to all products. The changes only apply to those who hold exchange membership, a group that typically includes local, individual traders who are among the most active but also the smallest -- and those most likely to feel the pinch of higher costs. "It's going to drain liquidity out of the market. It's a shame because the people this market was made for, this is going to make it difficult for them," said Kinoff. The CME's energy and commodity exchange rival InterContinentalExchange has already taken measures to distinguish between hedgers and speculators, although the impact is expected to be lower than at the Chicago exchange as it has few members. At ICE U.S. the margin for speculators used to be 40 percent higher than hedgers, but was lowered to 10 percent to be in compliance with the Dodd-Frank rules and ICE Clear Europe, where Brent crude and gasoil trade, has already announced plans to raise the spec margin by 10 percent from May 7. It was not immediately clear whether the ICE had also received permission to delay implementing the changes. http://www.reuters.com/article/2012/...84300620120504 |

| Posted: 05 May 2012 12:19 AM PDT Peter Daniels Talks On "Gold" by Philip Judge - Anglo Far-East Company By anybody's standards Peter Daniels has a most amazing "rags to riches" story. At the age of 26 Peter was an illiterate bricklayer, from a 3rd generation welfare recipient family. Today he has involvement in business than spans the globe, has chaired boards of directors, advised corporations and governments and written several books. When asked if there was one key factor that brought about this change, Peter Daniels sites when he, and his wife Robina, attended a Billy Graham Crusade and May 25th 1959; "I suddenly realized I was equal with all men before God." Peter Daniels kindly made time for this interview in September 1999. PHILIP: Your understanding of business comes from its successful practical application rather than theoretical knowledge; for a long time you have been saying that at some point there is going to be a major down turn in the global economy. Why are you so sure? PETER DANIELS: Well Phil I'm a pragmatist, which means I'm interested in things that work. There are many factors that are going to cause this downturn. People lose sight of the fact that economies are cyclic; we have had the longest economic free run in probably in the history of mankind. The 1st reason is simply DEBT. I'm very interested in history and the thing we learn from history is that we learn nothing from history. As I travel around western countries, the debt factor is bigger than it has ever been before in history, and I'm talking about in every single level. As we have a look at the debt of individuals, corporations and governments; its never been as large and never been as frightening. The 2nd thing is we are having POWER SHIFTS; there is an emerging neo-nationalism around the world we are seeing it in the region of the old Soviet Union; to the north of our shores in Indonesia, India and Africa. Wherever there are power shifts there are always difficulties and economic downturns, even if prosperity comes later. And 3rdly we have a TRADE WAR. Interestingly with this trade war, no-one is talking about it, its happening right under our noses. People are putting up economic and other barriers. In my opinion this trade war may last 20 years and I think we are going to have acceleration in it. The 4th thing is DECEIT. I don't think we have never had so much deception. That's not only with America, we've had that with almost every country of the world, we've had so much deceit, cover-ups people breaking their contracts. We are having a resurgence of what we had in the 1970's with "situation ethics" which means "I will keep my ethic as long as the situation remains the same and if the situation changes I have every right o break my commitment." We see this in divorce, delinquency and even in things such as law enforcement. PHILIP: We have all seen those graphic pictures of the great depression. While many contemporary economists believe we wont have another depression, the many people I've spoken with all maintain the next depression will be far worse than the one we experienced in the 1930's – how bad do you feel it will be? PETER DANIELS: I was a child during the Great Depression and I remember it with a certain amount of vividness. They were desperate days, very desperate days. I believe because of the demographics the next one will be much larger and more severe. We need only look at the stock market. When we look at the Dow Jones we find that many of those stocks are valued at 50 or 60 times earnings. It could happen tomorrow morning its that close, it has to happen at some point, there is no way of avoiding it. There is no way that anyone can pay all this money back, there is no way we can ride it through. PHILIP: Do you feel it could happen very dramatically - very quickly? PETER DANIELS: I am convinced of that, I don't think it will happen slowly, I think it will happen very quickly and I believe it could happen as quickly as a few hours. The stock exchange could drop and suddenly right across the world people would start to panic; it happened in the last Great Depression. PHILIP: What can the average "man on the street" expect form this kind of economic shake-up? PETER DANIELS: We could expect inflation or even deflation and that could happen quickly as well. You will find there will be mass unemployment, banks will begin to call loans and any assets they can get, a lot of commodities we take for granted will start to disappear from the shelves and fuel may become scarce. Of course you will see an increase in crime and that's one of the frightening sides of it because when someone is faced with feeding their family and someone has more and they have less, then an ordinary person who is normally quite passive, becomes an entirely different human-being. There is another good side to it though. We saw in the Great Depression that people went back to their churches, they got down on their knees as they started to realise that their wealth wasn't in a political system, it wasn't in their factories but it was in the hands of God. I believe it could see the greatest revival time in the history of Christendom. PHILIP: You have maintained for many years that gold and silver performs very well in the kind of environment we are talking about, but this is contrary to the views of many of today's popular economists. What makes you so sure you are right on this? PETER DANIELS: History tells us that we are right. The majority is always wrong, it is always the minority that is right. Since the beginning of time gold and silver has always been the measure for value. Then remember its rarity. For some reason or another we feel, think or hope that something printed on paper has more value, yet there is less than 1 oz of gold for each individual on the planet. Looking at history from the 15th century, the number of countries that got in trouble from debasing their coinage, and finally when the bankers call out, they would say "pay us back with gold", that's just the way its been. When the axe finally falls, gold is the only thing that people are interested in. It may go up and down in value, although I believe it will explode when thing start to look really bad, but if you have it in small denominations and in a protected form, you will be able to do anything that you want to do. PHILIP: You talk about cycles, whether its debasing currency or just people in trouble rushing back into gold. PETER DANIELS: It interesting to see what happened to gold recently. For a long time it kept going down, even though there is (relatively speaking) less and less above the ground. Many people know its because cartels are selling to one and other to keep it down. Then when it went up 20% in 10days (September 1999), if it had been any other commodity it would have been headlines and yet for some reason it failed to stir the imagination of the newspapers. Yet when it continues to go up people will start to buy it and it will accelerate far greater than we can imagine; we saw this in 1980. PHILIP: This brings me to a very interesting and bold statement you've said in the past "if every Christian owned 2 oz of gold and 6 oz of silver, we would absolutely control tomorrows economy". Can you explain what you meant by this? PETER DANIELS: We would then have the majority of the wealth in the world. You don't need the total wealth, you just need to have a percentage that is big enough to shift markets. If you look at the Christians of the world (including nominal) and multiply that by 2 oz of gold and 6 oz of silver, there is no question, we would control global economics, and you not talking about a lot of money in western terms to own that amount of gold and silver. I cant believe why Christians will not do that, they have read the story of the flood, they have read the story of the wise virgins who had to trim their lamps, in both those stories the door was shut when they did not take head of the warnings. We understand Ecclesiastes, "there is a time for every purpose under heaven", there was a time to negatively gear, a time for borrowing big, but now is not the time, now is the time for being conservative. Now is the time to acquire gold, not using it for growth return, but putting it aside as a heritage for your family. One of the things I hear all the time is that "the wealth of the wicked is laid up for the righteous" but people don't always recall the beginning of the verse where it is written "a good man leaves an inheritance to his children's children." We need to be leaving an inheritance to our future generations, and if we did this today we wouldn't be so poor, we would be the movers and shakers of the world. Philip Judge Anglo Far-East Company Philip Judge is the 3rd generation of a family that has had substantial involvement in the Precious Metals markets. He has researched, written and spoken on the gold, silver and commodities markets for over a decade. Philip works in the marketing and operations department of The Anglo Far-East Bullion Company, an internationally based Bullion Banking, Investment Management and Financial Services Company http://www.24hgold.com/english/news-...r=Philip+Judge |

| Posted: 04 May 2012 10:40 PM PDT |

| Posted: 04 May 2012 06:15 PM PDT Housewife asked to knit a spacesuit for NASA's rubber chicken Daily Mail (May S) Penguin p-p-p-picks up more votes than the Lib Dems Guardian (John L). Wonder if someone here will try running as a polar bear. Yogurt diet leads to 'swaggering' mice with larger testicles Raw Story. This is a marketer's wet dream. First-of-its-kind study reveals surprising ecological effects of 2010 chile earthquake EarthSky (furzy mouse) Judge says Facebook 'like' not protected by First Amendment Washington Post (martha r) Secret Roast-Pork Recipe Tests Value of Real Estate Bloomberg. Another train wreck of a headline. Effective, though. Syrian forces executing and burning residents of Idlib, Amnesty says and Inside Syria's crackdown: 'I found my boys burning in the street' Guardian (John L) Hollande Poll Lead Narrows With Sarkozy Closing in as Race Ends Bloomberg Is LTRO QE in disguise? VoxEU The Denial on Housing in Spain Credit Writedowns France faces 40pc house price slump Ambrose Evans-Pritchard, Telegraph Arizona Gov. Jan Brewer Signs Planned Parenthood Funding Ban Huffington Post Feingold links Pelosi with Steny Hoyer for supporting Simpson-Bowles "Catfood" proposal AmericaBlog Shale Gas Export Boom: Planned All Along? Firedoglake (Carol B) Anaemic jobs data hit Obama launch Financial Times. I try to resist saying "I told you so…" so forgive me (more from Lambert below on the political tooth-gnashing). Reasons Abound for Ebb in Job Growth New York Times US should return stolen land to Indian tribes, says United Nations Guardian How retiring makes the unemployed happier VoxEU Discrepancies on Medical Bills Can Leave a Credit Stain New York Times UBS Loses Bid to Block Fannie, Freddie Suits Wall Street Journal National Mortgage Settlement Expires In 2015, Banks Battling To Keep Reforms From Becoming Permanent Huffington Post. This is beyond pathetic. Montreal students stage nearly-nude protest Montreal Gazette (Lambert) Cops Caught Mass Drugging Teens And Dropping Them At Occupy Minnesota Alexander Higgins (Walter Mit Man, ohmyheck) Occupied Oakland's May Daze Truthout (Lambert) Occupy pledges to 'un-Frieze' art fair Financial Times Can the Colleges Be Saved? New York Review of Books * * * D – 126 and counting* "I am not willing that the vitality of our people be further sapped by the giving of cash, of market baskets, of a few hours of weekly work cutting grass, raking leaves or picking up papers in the public parks. " –FDR SOTU, 1935 Unemployment: The world's most frightening chart is still frightening. Izvestia: "A robust recovery continues to elude the White House". Robama's campaign office at the Council of Economic Advisors: "The economy is continuing to heal." Robama blames somebody else; in this case, Congress, and tries to make lowering student loan interest a job creating measure. Unemployment: Dueling benchmarks; have they changed? Romney's 4% is aspirational. (And what's wrong with that?) The Atlantic sets the "politically-important" benchmark at 8% (Just like 2010). Felix Salmon: "When more than half a million people in one month decide that they're not even going to bother looking for work any more, there's no way you can say you're in a healthy recovery." DeLong agrees. The Rs blast Robama's unemployment record from a call center in Manila. My take: It's not unemployment, but DISemployment; the most frightening chart in world shows that Robama has successfully achieved a new normal where far fewer people have work (except in System D). Further, since actions speak louder than words, this is the preferred policy of the elite and both legacy parties, or they would have done something about it. FDR created 15 million jobs during his administration. He also created the WPA by executive order. Robama could do the same thing tomorrow, same as he can whack U.S. citizens without due process. He doesn't, because he thinks other things are more important: Among them, keeping people desperate to find and keep work, which keeps wages low, profits high, and enables the banksters to keep seizing people's homes as they fail to able to afford them. Just saying. "Clooney's Obama fundraiser expected to collect record $12 million". Bainster Ed Conard (shredded by Yves here) was the headline-making million-dollar anonymous contributor to Obomney Super PAC. WSJ claims Robama tries to intimate Obomney contributors. (And indeed, "most of them are scared stiff".) Ron Paul benefits the least from Super PACs. Returning to Bloomberg's Carlson's claim that Obama can't be swift-boated, Yves's exclusive shows that's not so. Whatever happened to the fine art of oppo? Surely it was and is possible to send a film crew to Grove Parc, and get at least one tenant on video about the vermin and the no-heat calls? Exactly as on the issues, tactical decisions are now made in a very narrow, a trivially narrow range. The party that impeached Bill Clinton over a blow-job can't get it together to show community organizer Obama's tenants freezing in rat-infested quarters? WTF? Ron Paul supporters hope to take over the ME GOP. The Green's Jill Stein attends May Day rally in Gainesville, FL. And I bet Elizabeth Warren can't believe what's happening to her with the Cherokee ancestry thing. Politics ain't beanbag, even if it is kabuki. – Horse race-related tips, links, hate mail to lambert * 126 days 'til the Democratic National Convention ends with a Dinner At Trimalchio's in Bank of America Stadium, Charlotte, NC. Those who go out weeping, carrying seed to sow,will return with songs of joy, carrying sheaves with them (Ps 126). Cross-posted to Corrente. Antidote du jour: |

| Lost Gold and Buried Loot in northern California Posted: 04 May 2012 04:47 PM PDT Geocities |

| Calculating the "Fair Value" of Gold Posted: 04 May 2012 04:45 PM PDT |

| Lynn Parramore: Why the Rich Are Sending Pets on a Diamond-Studded Trip to the Afterlife Posted: 04 May 2012 04:19 PM PDT Yves here. Two NC themes, animals and income inequality, in one post! By Lynn Parramore, an Alternet contributing editor. Cross posted from Alternet I live in Manhattan, where signs of the New Gilded Age scream from the windows of deluxe pet spas and boutiques hawking crystal-studded dog collars. The trend of celebrity-style pet pampering is one the rise, producing ever-greater demand for freakily fancy products and services. You can fly dear Fido in high style on a specially outfitted pet airline. Whiskers can relax in gold-plated splendor at Disney's recently launched Best Friends Pet Care luxury dog and cat resort. An attentive "certified" camp counselor will care for his every whim. But the biggest emerging trend of all? That would be giving dead pets the star treatment. Even in a sluggish economy, companies are making a fortune from the rituals and services sought by grieving pet owners. Clever marketers are finding new ways to give adored pets a glamorous send-off into the afterlife. Egyptian royalty started their journey accompanied by mummified cats sporting gold earrings. Why not today's 1 percent? The obsession with furry friends knows no bounds, reaching beyond the excesses of kitty wigs, haute raincoats and pet perfume right into the Great Beyond. The modest backyard burial has given way to the professional ceremony, complete with lace-trimmed casket and religious readings. If you've ever seen documentary-maker Errol Morris's indelible Gates of Heaven, you know that pet cemeteries have been around for a few decades. But the International Association of Pet Cemeteries and Crematories in Georgia reports that pet funerals are dramatically increasing. In the U.S., costs for a pet funeral starts at around $800 — and sky's pretty much the limit from there. The "Royal Pet Casket," boasting three layers of foam and waterproof materials, is sold on the PetHeavenExpress Web site for $458. The elegant "Gold Cherry Blossom Hour Glass Cremation Urn," available from Perfect Memorials, comes in at $499.95. Does all that seem a bit cheap for Precious? Then go Nile-style and have your dog mummified for $30,000. Freeze-dried preservation is a less expensive option, but it will still run you several hundred dollars. Perhaps you'd prefer to wear your dead pet. You can do that by having the corpse rendered into a synthetic diamond with a company called LifeGem. For realz. In 2004, the first stand-alone pet funeral home opened in Indianapolis. Today, there are over 750 pet funeral homes, pet crematories and pet cemeteries across the country. And the trend is global. Luxury pet resting places are popping up in China. According to a recent press release from Alibaba.com, the UK market for pet "bespoke" coffins, caskets and urns soared 467 percent last year. Brits are apparently taking pet love "to the next level" with "increasing demand for funeral and remembrance products." The rituals of death are not limited to funerals and caskets. You can have your dead pet whisked from your house on a special "pet removal cart" designed to offer a dignified mode of transport for pet remains. Pet industry related "death-care items," as such accoutrements are called, range from garden sculptures to musical memorials — including a special ringtone to remind you of your lost pet. Pet psychologists offer individual and group therapy for the bereaved. In this era of late capitalism, we live in a top-heavy society where the rich are flush with far more cash than they know what to do with. That development has merged with a post-war trend in which pet owners increasingly view animal companions as surrogate children and even mates. The anthropomorphizing tendency seems to be speeding along full-tilt, with owners choosing human-sounding names for their pets and insisting on bringing furballs along to bed and even to the dinner table. Developments in medicine — and the profitability of the health care industry — have increased the means by which pets can be kept alive, and have, perhaps, made owners less able to accept the inevitability of death. A neighbor in my apartment building in New York once rang my bell, distraught over the liver failure of her 15-year old dachshund. She wanted to know if I thought she should put the dog on a respirator at a cost of several thousand dollars a day. Veterinarians of the less ethical variety know they can rake in big fees when distressed –and deep-pocketed –pet owners break down at the idea of saying goodbye. Such grief is real and potent. But when does it become excessive? Or even cruel? Emotion-driven humans are prone to perpetual folly. And capitalists, it seems, are everlastingly ready to take advantage of them. Greed, alas, springs eternal.

|

| By the Numbers for the Week Ending May 4 Posted: 04 May 2012 04:04 PM PDT |

| Posted: 04 May 2012 04:00 PM PDT Gold University |

| Primer On International Investing - Part I Posted: 04 May 2012 03:48 PM PDT By Guraaf: I am a small individual investor interested in dividend growth stocks and foreign equities. Most of my current holdings are U.S. companies but over the last couple of years, I have diversified into foreign stocks as well. I want to share some of the lessons that I learned about investing in foreign equities that trade on the U.S. stock market. Even though the article is targeted primarily at an investor who resides in the U.S., I am hoping that Seeking Alpha's large international audience may find something of interest as well. Reasons to look outside the U.S.

Complete Story » |

| T&S: Metals and Currency Update Posted: 04 May 2012 01:39 PM PDT - The Big move is still. Time is running out on the triangles which have formed over the past few months to a year. Time always wins in the end. I present the bullish Elliott Wave viewpoint and why I chose to present that point in htis update which covers gold silver the Us Dollar and the Euro. from mrthriveandsurvive: ~TVR |

| A Eurozone breakup's affect on precious metals Posted: 04 May 2012 01:14 PM PDT

from goldmoney.com: As funding pressures and economic distress increase in Spain, talk of a potential breakup of the eurozone has returned. There has been debate as to whether this would be a deflationary or inflationary event, and how it would affect the precious metals markets. In the event of a breakup, investors need to be prepared for a period of extreme volatility, characterised by chaotic trading conditions in all markets. Similar to 2008 a financial shock such as the failure of the eurozone would likely be met by trading that is more characteristic of panic/liquidation decision-making than fundamentally sound trading. Remember that after the collapse of Lehman Brothers gold traded almost as low as $700 after previously being above $1,000 all while an historic expansion of the Federal Reserve's balance sheet was getting underway. So it will be important to distinguish between short term trading noise and longer-term fundamentals. With increasing debt burdens and little evidence of a plan to effectively address them, a look around the globe shows few safe havens remaining. Where would capital flee in the event of a eurozone breakup? The dollar and the US Treasury have long played such a safe haven role, but with continued US economic weakness, an expanded Fed balance sheet, and little progress towards addressing government spending that status is being challenged. Now with sanctions against Iran leading to the development of an oil for gold barter market, and with China and its trading partners continuing to seek out non-dollar payment settlement mechanisms, the possibility of an end of the dollar as the international reserve standard continues to increase. In response to the public spectacle around last summer's debate about the raising of the debt ceiling in the United States, capital flowed to the Swiss franc until their central bank effectively pegged the franc to the euro. While China has recently allowed for more flexibility in the trading band of the renminbi, its past track record combined with weakness in their economy makes further accommodative policy likely. Interestingly one factor that is providing strength for the renminbi is the Chinese appetite for gold. If China's currency were to appreciate considerably, it could be in part because of recognition of the monetary significance of Beijing's growing gold hoard. Meanwhile, further east, Japanese Finance Minister Jun Azumi has repeatedly intervened to weaken the yen, at one point even stating that he will, "continue to intervene until I am satisfied." Rhetoric aside, the policy actions to date over the past 20 years continue to leave the yen as a poor choice as a store of value. And while some of the BRIC nations don't have the same extreme debt burdens as the western world, there do not appear to be any potential candidates that seem prepared to assume the reserve currency/safe haven role. Keep on reading @ goldmoney.com |

| China Buys Gold…No Matter Who’s Selling Posted: 04 May 2012 01:05 PM PDT

from dailyreckoning.com: Someone is selling in size…Someone is buying in size. That's what makes markets, as the saying goes. But that's also what makes market manipulations, according to the bloggers at Zero Hedge. The seller in this case is very large and very sloppy, perhaps intentionally so. The buyer is also very large, but very patient and methodical. Trapped between these two powerful opposing market participants we find a "range-bound" gold market. Let's take a closer peek at the curious goings-on… Last Monday, a large early-morning sell order in the gold market whacked the price of the precious metal by about $15 in a matter of seconds. "The CME Group Inc.'s Comex division recorded an unusually large transaction of 7,500 gold futures during one minute of trading at 8:31 a.m.," The Wall Street Journal reported. "The sale took out blocks of bids as large as 84 contracts in one fell swoop and cut prices down to $1,648.80 a troy ounce [from $1,663.00]. The overall transaction was worth more than $1.24 billion. "Gold traders buzzed with speculation that the transaction was an input error — a so-called 'fat finger' trade," the Journal continued. "'Or a Gold Finger as it might be known in the bullion market,' traders at Citi joked in a note to clients. "Still, not everyone agreed Monday's slip in gold was caused by a keystroke error," said the Journal. "Chuck Retzky, director of futures sales for Mizuho Securities USA, said that silver prices suffered a similar leg down at the same time as gold, tumbling 35 cents to $30.805 a troy ounce, but other markets like Treasurys, currencies and stocks were unperturbed. 'To do it both in gold and silver tells me that it wasn't a trade done in error,' Retzky said." A second trader chimed in, "No one who has the account size and the money to trade thousands of gold contracts would do it in one transaction, that's just stupid." Or maybe this "stupidity" was intentional, as the folks at ZeroHedge suspect. Again yesterday, a large 3,000-plus lot gold sell order hit the Comex overnight trading system around 1:30 AM, Chicago time — causing the gold price to quickly fall more than $5. "Volume that size is unusual for that time of the day on the COMEX," ZeroHedge remarks. Keep on reading @ dailyreckoning.com |

| The Silver Bull Market Is Over? Posted: 04 May 2012 12:59 PM PDT

from silverseek.com: The Silver Bull Market Is Over?Is the Silver Bull Market Over?This is one question that we feel very confident that the answer to it is no; but still we are specifically watching for articles or news stories suggesting that the precious metals bull market is over.We have seen a few articles announcing the end of the metals bull market and we will explain why this is significant to us later in this article.But first, there are a host of reasons why we think the bull market in precious metals is alive and well and we will address a few of these reasons in this article. Basic price performance of the precious metals market simply does not match that of other bull markets.Yes silver did rise from about $4.00 to about $50.00 but that is not nearly as impressive as it first sounds.When we compare the price appreciation in the current bull market to other bull markets we can clearly see that there is a lot of room for further upside.The following chart illustrates other examples of bull market price performance.

Next, given the quantity of money we have seen printed around the world, we would expect to see even more of an extreme price move than what we have seen.It is true that the price of nearly all commodities has risen significantly, but the metals have barely budged in comparison to the quantity of currency being printed.

When we consider the underperformance of precious metals mining companies relative to the metals themselves we certainly do not see signs of a "feeding frenzy mania".Contrary to typical action in a bubble market, the mining equities have been dismally underperforming the metals as they wait for their turn to grow in value, like Cisco Systems or Microsoft did in 1999.

In the above chart when the blue line heads up silver is outperforming mining stocks and when the blue line heads down mining stocks are outperforming silver.Looking back as far as 1984 we can see how cheap mining equities are relative to the price of silver.At some point this trend will reverse.

In our opinion the bull market in precious metals is far from over, which makes the mining equities very attractive when compared to the metal itself. Why do we want to hear others talk about the bull market being over? We know that the best buying opportunities come when investors feel negative and very pessimistic, because if investors are pessimistic they are not investing, and if they are not investing the market is cheap.When everyone is excited and jumping in with both feet, wet think a wise investor should be cautious and take money out of the market.It is our expectation that a great buying opportunity in precious metals is marked with commentary about the end of a bull market.In our view it is positive news to read stories about the end of the precious metals bull market. Finally, we have a set of custom indicators that suggest to us that the bull market in precious metals is alive and well.We were expecting this latest correction and we continue to monitor its progress at www.investmentscore.com.Please visit our website to learn more about our system and to sign up for our free newsletter. Keep on reading @ silverseek.com |

| Central Bank Demand to Change Gold & Silver Prices Posted: 04 May 2012 12:57 PM PDT

from financialsense.com: here is a tide in the affairs of gold that is changing the entire shape of the gold market. We are not just talking about the demand side but the supply side as well. Neither the gold market nor the gold price has factored in these changes yet. And the changes are designed to affect the gold market both unobtrusively and over time. The developed world markets are myopically riveted to short-term factors in the developed world's economies, distracted from reacting to forces considerably greater than those. The changes are significantly deeper than we saw in the 1970's. By extension, the forces involved will change the future of the silver price as well. These forces will prove so decisive because they are not price-dependent or price-sensitive. We are currently watching the final moves of a long-term consolidation period, in the near-term and ahead of a strong move either way. A look at the bulk of market commentators shows they are pretty well split on which way the gold and silver prices are headed, up or down? It depends whether the short-term traders take control of the precious metal prices, or whether the forces we are about to describe will take over. It could be a combination of both, with short-term forces breaking resistance, or support, initially, until new pressures take over and force traders and speculators to go with them. We shall see! We will be tracking each step of the way and keeping subscriber's fingers on the pulse. So what are these new forces, or are they old forces re-shaped? Let's look at the central bank demand first. Keep on reading @ financialsense.com |

| Lassonde: Here is What I’m Doing With My Own Money Posted: 04 May 2012 12:55 PM PDT

from kingworldnews.com: With continued worry surrounding the gold and silver markets, today King World News interviewed legendary Pierre Lassonde, to get his thoughts on what on what investors should expect next. Lassonde is arguably the greatest company builder in the history of the mining sector. He is past President of Newmont Mining, past Chairman of the World Gold Council and current Chairman of Franco Nevada. Lassonde is one of the wealthiest, most respected individuals in the resource world, so KWN was pleased that Pierre talked about what he was doing with his own money. But first, here is what he had to say about gold: "In terms of gold, the two largest buyers continue to be China and India. For the gold market, what matters most are these two countries. Are they growing? If they do, then the uptake in the gold market will continue, and that's what's happening." Pierre Lassonde continues: Keep on reading @ kingworldnews.com |

| SF: Silver.. Bull Market or Not? Posted: 04 May 2012 12:32 PM PDT If silver is still in a bull market the noise this year won't matter unless you trade silver this year. "Nothing fools you better than the lie you tell yourself http://www.smithsonianmag.com/arts-culture/Teller-Reveals-His-Secrets.html?c=y&page=2 from silverfuturist: ~TVR |

| David Morgan: Silver Suppression Is Ending Posted: 04 May 2012 12:06 PM PDT David Morgan is one of the world's leading authorities on silver, from how it's mined, to how the price is manipulated on the relatively minuscule Comex Silver Futures. from financialsurvivalnet: David has had an affinity for the shiny metal since he was a toddler; he's also old enough to have lived through the prior boom and bust that took place in the 70′s and 80′s. Armed with this historic perspective, he sees exactly what is taking place now, and while appalled by the blatant price suppression, he's not surprised at all. David is joining us today for the latest update, and why the only thing you need to fear, is fear itself. Fear inevitably leads to making the wrong decision at the wrong time, and then you miss the next move, and invariably you'll buy at the higher prices. Go to http://www.FinancialSurvivalNetwork.com for the latest info on the Economy, Markets and Precious Metals. ~TVR |

| Chris Duane: The Silver Door Is Closing Posted: 04 May 2012 12:00 PM PDT The Silver Bullet & The Silver Shield # 25: The Silver Door Is Closing If you like this go to http://TheGreatestTruthNeverTold.com and join ~TVR |

| Posted: 04 May 2012 10:35 AM PDT |

| Posted: 04 May 2012 10:31 AM PDT Posted MAY 4 2012 by JAN SKOYLES in GOLD BULLION, ORIGINAL COMMENTARY In his 1923 book 'A Tract on Monetary Reform', John Maynard Keynes famously wrote 'In truth, the gold standard is already a barbarous relic.' Many gold bugs have come to take this quote as a belief that Keynes applied this line of thought, by implication, to gold as well. However, according to a new paper, 'Keynes the Stock Market Investor' it seems the British economist was a bigger fan of gold and gold mining stocks than we have been led to believe. The paper aims to show the relevance of Keynes' asset management approach to today's investors. It praises him for his alternative approach to investing which paved the way for, 'institutional investors in making a substantial allocation to the new asset class, equities.' However, it seems that the most successful areas of his portfolio were thanks to his contacts with people in significantly high places. As the Wall Street Journal wrote, in light of the new paper, Keynes 'made titanic bets on industries he thought were cheap; by 1936, he had 66% of his portfolio in mining stocks and not a farthing in bank or energy shares. South African gold companies, he correctly foresaw, would benefit from falling currency values.' How clever of him. To use his contacts that is. Not to appreciate the importance of gold ownership. Gold price climbsAccording to Robert Wenzel; Keynes, along with Bernard Baruch, heavily influenced Roosevelt's decisions in regard to gold confiscation and the fixing of the gold price. In 1933, President Roosevelt's administration cut the United States' ties to the gold standard, two years after the United Kingdom. Not only this, but Roosevelt went on to confiscate all physical gold and gold certificates, in exchange for fiat money. It was even prohibited for gold to be used as a reference for value in contracts. Gold confiscation occurred in April 1933, later that year the New York Times published an open letterfrom the economist to the US president. The letter urged President Roosevelt to, 'control the dollar exchange by buying and selling gold and foreign currencies so as to avoid wide or meaningless fluctuations, with a right to shift the parities at any time but with a declared intention only so to do either to correct a serious want of balance in America's international receipts and payments or to meet a shift in your domestic price level relatively to price-levels abroad.' John Maynard Keynes, by urging the US government to prop up the price of gold, was able to invest in gold mining stocks (those of Union Corporation) safe in the knowledge that the cost of gold was guaranteed to increase at the behest of the President of the United States. In 1933, when it is assumed Keynes bought the majority of his gold mining stocks, the gold price was fixed at $20.67. Gold miners knew therefore, that they would be able to receive $20.67 regardless of their cost of production. Looking at the CPI and unemployment rates during the 1930s (as Paul Kasriel demonstrates) production costs were most likely going down yet the price of gold was still guaranteed. Whilst other non-gold producing companies may also have been experiencing lower production costs, they were unable to receive a guaranteed price for their product. Devalue the dollar with goldPresident Roosevelt's aim was to boost depressed commodity prices by devaluing the dollar through the increase in the gold price. Through a series of legislations the dollar was removed from the gold standard. On May 12 1933, the President was given powers to decrease the gold content of the dollar by up to 50%. In October 1933, during one of his 'fireside chats' he told the American public of his plans with gold. FDR Operative Jesse Jones explains: He reiterated that the "definite policy of the Government has been to restore commodity price levels." He said that when these had been restored "we shall act to establish and maintain a dollar which will not change its purchasing and debt paying power during the succeeding generation." Then he said "It becomes increasingly important to develop and apply further measures which may be necessary from time to time to control the gold value of our own dollar at home." And he added that "the United States must take firmly in its own hands the control of the gold value of our dollar." …Mr. Roosevelt went on to announce the establishment of a government market for gold in the United States. He said he was authorizing the RFC to buy gold newly mined in the United States at prices to be determined from time to time after we had consulted with him and the Secretary of Treasury. "Whenever necessary to the end in view," he added, "we shall also buy or sell gold in the world market…Government credit will be maintained and a sound currency will accompany a rise in the American commodity price level." Thus he began to haul in the anchor to which the dollar had been tied for thirty-four years. The gold price climbed 69% to $35 per ounce by January 1934. The US had, as Kasriel writes, 'established a dollar-gold convertibility for foreign entities and, presumably for domestic gold producers, of $35 per ounce of gold… Moreover, the Treasury stood ready to purchase as much gold as was presented to it at $35 an ounce.' As Mr Jones explains, by the time the gold-buying program was completed on January 17 1934, '[T]he RFC had bought 695,027.423 ounces of domestic gold for $23,363,754.56 and 3,418,993.045 ounces of foreign gold in the London and Paris markets for $111,037,195.78, a total of $134,400,950.34. The average cost to us for the foreign gold had been $32.48 per ounce, and for the newly mined domestic gold, $33.62 per ounce. At the start the RFC had decided to issue $50,000,000 of notes with which to buy gold. This was increased by our board a few weeks later to $100,000,000 and then to $150,000,000.' Therefore, it is little wonder that Keynes' portfolio performed so spectacularly for its time. There is little chance other mining stocks experienced government lead price increases of 69%. Learn from KeynesKeynes' behaviour in buying up gold mining stocks just goes further to prove that citizens are unable to trust governments when it comes to maintaining the value of the currency and therefore your wealth. The economist may have had insider knowledge of the plans to push the gold price up, investors today are lucky that they do not need to resort to the same immoral and (now) illegal practices. The European, British and US Central banks have spray painted the message on the wall; 'CURRENCIES ARE BEING DEVALUED'. The message gets bolder with every round of quantitative easing and debt auction. At present we are witnessing a delay in the markets catching up to the implications of currency devaluation. Perhaps, for once, we need to take a page out of Keynes' book and invest in gold. But do one better and buy the real stuff, rather than his favoured paper. Keynes chose his gold investment in light of the currency devaluation which lead us into this current crisis, surely the fundamental reasons to buy gold are now even stronger?

Want to take advantage of currency devaluation? Buy gold bullion in minutes… -OR- SIGN UP NOW to receive your FREE* oz of silver Please Note: Information published here is provided to aid your thinking and investment decisions, not lead them. You should independently decide the best place for your money, and any investment decision you make is done so at your own risk. Data included here within may already be out of date. CATEGORIES: Gold bullion, Original commentary About the Author |

| The Separation of Money and State Posted: 04 May 2012 10:02 AM PDT "So what do you think should be done?" I often get this question after I presented my case against our fiat money system, and I sense there is a trace of frustration in it, a bit along the lines of, you are telling us that we are in quite a mess but you offer no policy prescriptions. That is a fair point, I guess. Most writers who lament the economic ills of our time usually have a bag of policy advice on offer. Indeed, whispering new policy ideas into the ears of those in power is what most of these writers aspire to. I reckon what separates them from me is that they believe in government and I don't. The mess we are in is the result of policy, of the very idea - the silly idea - that the field of money and finance would work better if it were supervised, managed, guided and controlled by the state; that if we had clever, powerful and astute policymakers, consulted by economist philosopher kings, we could enjoy a smoother, better functioning economy. And if ever things were not running so smoothly, we would change the policy. "So what is your policy, Mr. Schlichter? Could you not be a bit more...constructive?"