Gold World News Flash |

- Fearful, Anti-Social Cash Hoarding

- Silver Update 4/18/12 Trickle Done

- 3.1 M Ounces of Silver Withdrawn from Brink’s Tuesday, JPM Reports Paper Deposit as ‘Silver’

- Gold at Risk of Sharp Decline

- SBSS 22. Look How Far Silver Has Come

- The Euro Could Collapse Causing Panic Warns IMF

- Gold Seeker Closing Report: Gold and Silver Fall Slightly

- Cambodia, Once Secret, Is Now Open for Business

- Unsinkable Silver Investments? World Mints Unveil Centenary Titanic Coins

- “I purchased my physical silver at $45.88/oz”

- Guest Post: How Far To The Wall?

- The Gold Price Gave Back $11.50 to Close at $1,638.80 Watch $1,638.24 Tomorrow as it Shouldn't Cross that Line

- Michael Hudson: Debt: The Politics and Economics of Restructuring

- Compulsive Hoarding is an affliction, an illness

- Nigel Farage: There Are Going to Be Serious Banking Collapses

- Charles Nenner See's $2500 Gold Coming

- Priceless Precious Metals vs Worthless Dollars

- Time To Confront Central Bank Liars

- Eric Sprott Interview on Gold and Silver

- Patrick Heller: Gold and silver price suppression is now a weekly event

- 2 Years After the BP Oil Spill, Is the Gulf Ecosystem Collapsing?

- Jim Willie: “In 2 Year’s Time, the Gold Cartel WILL HAVE NO PHYSICAL GOLD”

- Penny Unwise, Dollar Insane

- GoldSeek Radio interviews Eric Sprott

- Fading Faith in Fiat

- Euro zone breakup now a real possibility, Farage tells King World News

- Cambodia, Once Secret, Is Now Open for Business: Richard Stanger

- Gold Daily and Silver Weekly Chart

- Eric Sprott Interview: Silver, Gold, Mining Stocks and more - GoldSeek.com Radio Nugget

- GoldSeek.com Radio Nugget: Dr. Quinton Hennigh, Gold Canyon Resources

| Fearful, Anti-Social Cash Hoarding Posted: 18 Apr 2012 06:00 PM PDT | ||

| Silver Update 4/18/12 Trickle Done Posted: 18 Apr 2012 04:23 PM PDT | ||

| 3.1 M Ounces of Silver Withdrawn from Brink’s Tuesday, JPM Reports Paper Deposit as ‘Silver’ Posted: 18 Apr 2012 04:19 PM PDT from Silver Doctors:

The farce continues: JP Morgan again made a mockery of the COMEX physical inventory update by reporting Tuesday's deposit of exactly 720,000.000 ounces. The statistical likelihood of 720 one-thousand ounce bars adding up to exactly 720k ounces…to 3 decimal places is roughly the same as the likelihood of the sun rising in the Western sky on 4/19. | ||

| Posted: 18 Apr 2012 04:14 PM PDT courtesy of DailyFX.com April 18, 2012 02:09 PM Daily Bars Prepared by Jamie Saettele, CMT “Price is testing a long term trendline that extends off of the 2008, 2010, and December 2011 lows. A break of such a well-defined trendline would signal a significant shift. The downside is favored below the April high of 1683.35.” A short term bear flag appears complete and price is pressured by the 20 day average. Bottom Line (next 5 days) – lower... | ||

| SBSS 22. Look How Far Silver Has Come Posted: 18 Apr 2012 04:14 PM PDT | ||

| The Euro Could Collapse Causing Panic Warns IMF Posted: 18 Apr 2012 04:11 PM PDT | ||

| Gold Seeker Closing Report: Gold and Silver Fall Slightly Posted: 18 Apr 2012 04:00 PM PDT | ||

| Cambodia, Once Secret, Is Now Open for Business Posted: 18 Apr 2012 01:03 PM PDT Resource investors are always looking for the next untapped region and Richard Stanger thinks he has found it. President and founder of the Cambodian Association of Mining and Exploration Companies, Stanger has been working to get the word out about Cambodia, a growing, stable country with the right geology for some big discoveries. In this exclusive interview with The Gold Report, Stanger gives an insider's view of the secrets to investing in Cambodia and explains why he's expecting a land rush. | ||

| Unsinkable Silver Investments? World Mints Unveil Centenary Titanic Coins Posted: 18 Apr 2012 11:51 AM PDT The sinking of the Titanic has captured the imagination of people since the tragedy struck on the night of the 14th April 1912. The centenary of the disaster is being marked around the world and particularly in the UK and North America which were deeply affected by the tragedy. Victims of the disaster came from [...] | ||

| “I purchased my physical silver at $45.88/oz” Posted: 18 Apr 2012 11:40 AM PDT An interesting extract from Jim's Mailbox. Mr. Sinclair, I am writing you because I think you are the real deal in the precious metal markets. I am in my mid sixties and got into silver almost one year ago. I made a big mistake and purchased my physical silver at $45.88/oz. It was for me [...] This posting includes an audio/video/photo media file: Download Now | ||

| Guest Post: How Far To The Wall? Posted: 18 Apr 2012 11:15 AM PDT Submitted by Terry Coxon of Casey Research How Far to the Wall? Decades of manipulation by the Federal Reserve (through its creation of paper money) and by Congress (through its taxing and spending) have pushed the US economy into a circumstance that can't be sustained but from which there is no graceful exit. With few exceptions, all of the noble souls who chose a career in "public service" and who've advanced to be voting members of Congress are committed to chronic deficits, though they deny it. For political purposes, deficits work. The people whose wishes come true through the spending side of the deficit are happy and vote to reelect. The people on the borrowing side of the deficit aren't complaining, since they willingly buy the Treasury bonds and Treasury bills that fund the deficit. And taxpayers generally tolerate deficits as a lesser evil than a tax hike. Deficits are politically convenient for a second reason. They can take a little of the sting out of a recession. That effect is transient, and it's not strong – more like weak tea than Red Bull. But it can be enough to help a struggling politician get past the next election. Yes, sometimes there's a big turnover in the personnel, such as with the 2010 election, when a platoon of self-styled anti-deficit commandoes parachuted into Congress. As soon as they had taken their seats, they began offering proposals to deal with the government's trillion-dollar revenue shortfall. But none of the proposals were serious. They were merely tokens intended to make politicians wearing anti-deficit uniforms look less ridiculous. Cut a ginormous $2 billion out of this program and a great big $500 million out of that program. Reduce spending by half a trillion dollars... over ten years. Balance the budget to the penny, but later. No one proposed anything close to dealing with the deficit now. So stay up as late as you like on election night to see who wins, but the deficits aren't going to stop anytime soon. The debt mountain will keep growing. The part of it the government acknowledges is now approaching $16 trillion, which is more than the country's gross domestic product for a year. Obviously, the debt can't keep growing faster than the economy forever, but the people in charge do seem determined to find out just how far they can push things. Inflation as Savior At some point, personal and institutional portfolios will be glutted with Treasury securities, and the government will be forced to pay higher and higher rates to induce investors to take more of the paper – and the accelerating interest cost will make the deficits that much bigger. When that happens, the problem will be feeding on itself. The only way for the politicians to buy time will be through price inflation, to reduce the real burden of the debt, and whether they admit it or not, inflation is what they will be praying for. The Federal Reserve will hear their prayer. It is 100% committed to protecting the value of the dollar, except when it is debasing the dollar in an effort to cure a recession or prevent a depression. It's been doing that important work since 1971, when the dollar slipped the leash of the gold standard. With every downturn in the economy, the Fed speeds up the creation of new cash. Each time, the economy does seem to recover, but the economic distortions that caused the recession are allowed to linger to one degree or another. They accumulate like the grotesqueries in the picture of Dorian Gray and predispose the economy to further and deeper slowdowns. For the last three years, the Fed has been performing an additional service to help keep the system going. Whether or not you believe that suppressing interest rates with newly conjured dollars stimulates the economy in a healthy way, the practice certainly makes it easier for the Treasury to sell bonds to cover its deficit. And as total debt grows, the Fed will be biased more and more toward printing in order to retard any rise in interest rates. In short, the cost of postponing the bankruptcy of a government engaged in nonstop deficit spending will be progressively higher rates of inflation. There is no inherent stopping point in the process short of hyperinflation and the destruction of the currency. Will it actually go that far? My guess is that it won't, but that's a guess about politics, not about economics. At some point, perhaps at an inflation rate of 30% or 40%, the turmoil that comes with runaway inflation will become so painful that the public will accept, and the politicians will find it wise to deliver, a balanced budget and a return to a stable currency. But even a year or two of such high inflation rates, while not a Weimar experience, would be a calamity. Most people's savings would be destroyed. Most businesses would be badly damaged, and most investment portfolios would be ruined. It would be like the economy hitting a wall. But when will the economy reach the wall toward which it is headed? Not soon, I believe, but in the meantime there will be plenty of excitement. The twin motors driving the economy toward the wall are deficits and money printing. Let's take them in turn and try to foresee their pace. Danger Zone When federal debt recently overtook a year's worth of gross domestic product, the US government crossed over into the zone at which, by historical experience, governments can get caught in a debt trap. High debt raises doubt about creditworthiness; doubt raises borrowing costs; higher borrowing costs add to deficits and day by day to the total debt burden; growing debt increases doubt about credit worthiness. Once in the cycle, it is hard to escape. But Debt = GDP is not a formula for certain doom. It's possible to spend some time in a bad neighborhood without getting shot. Japan's ratio of government debt to GDP, to cite an extreme example, is over 230%. Perhaps the Japanese government is living on borrowed time as well as on borrowed money, but it is still able to find buyers for its debt at low yields. The US may outdo Japan's ratio before hitting the wall. The capital markets will tolerate an especially high debt-to-GDP ratio for the US for a simple reason – it's safer than most other places. It doesn't get invaded, it doesn't get blown up in wars, it doesn't have revolutions and it hasn't destroyed its currency recently. Still, there is a limit to what the capital markets will tolerate. How rapidly the US ratio of debt to GDP will grow depends on a list of barely-guessables, including how long the recovery from the recent recession drags on, the time elapsed until the next recession and the level of the public's actual tolerance for deficits. Assuming that the recent level of deficits continues indefinitely, it would take on the order of ten years for the US debt-to-GDP ratio to get where Japan's is now, which would bring us near 2022. After that, the safety factor still should buy the government a few years more. That adds up to a long time to wait for the end of the world. Fortunately for the impatient, there is the Federal Reserve, and what the Fed will be doing, what the effects will be and when they will be felt all can be anticipated with a bit more clarity than the doings of Congress, although it remains guesswork. Approaching the Wall The M1 money supply has grown by 52% since the Federal Reserve opened the spigot in October of 2008. That alone is reason to believe that the current recovery, though painfully slow, is real. It has been held to a snail's pace by the fear of deflation that so many people learned in 2009. Fear of deflation is a reason to hold on to cash, but as 2009 becomes more distant, that fear is waning, and the holders of that 52% are becoming more and more disposed to think of it as excess cash that should be spent on something. That feeds the recovery. Given the slow pace, it should be perhaps two years until the economy seems more or less normal, but the excess cash will still be at work. Give it one more year, and price inflation will emerge as a noticeable complaint. Then the Federal Reserve will let interest rates rise, but only slowly at first. By the time it tightens in earnest, price inflation will be approaching double-digit rates. It will look like the 1970s. And despite all the statistics it publishes, the Fed will only be feeling its way in the dark, since there is no reliable, real-time indicator of how much excess cash there is in the system. So inflation will keep rising, and the Fed will keep tightening until it produces a rerun of 2008-2009, with crashing investment markets announcing a new recession. But there will be two important differences vis-à-vis 2008-2009. First, it will be happening with the US government far deeper in debt than it was when the last recession began. In the tightening phase, the government's interest expense will move above $1 trillion per year, and the budget deficit will jump to new record highs. Second, it will be happening with the rate of price inflation already at a troubling level. Another round of the monetary therapy the Fed applied to cure the last recession would push price inflation to levels beyond those reached in the 1970s. They'll do it anyway. This gets us to 2016 or 2017 with the system in turmoil but still functioning. No wall yet, and there will be room for at least one more cycle of reflation. But it will be a fast cycle, since in an environment of already high inflation, people will be quick to spend the newly created cash. That means a quick recovery from the 2017 recession and a catapult into the 20% plus range for price inflation. Then the wall may be in sight. In the Meantime Did you hear about the 60-meter-wide rock? Asteroid 2012 DA14, with the kinetic energy of a thermonuclear bomb, is headed toward us. In February of next year, its approach path, as recently estimated, will bring it to within 17,000 miles of the Earth. What I haven't seen mentioned in any of the reports is that the closer an orbiting body is expected to get to the Earth, the less precise and reliable the estimates of its path become. Its path may veer this way or veer that way. And in astronomical terms, 17,000 miles is very, very close – closer than most man-made satellites. So it's not just the economy we need to anticipate. | ||

| Posted: 18 Apr 2012 10:37 AM PDT Gold Price Close Today : 1638.80 Change : (11.50) or -0.70% Silver Price Close Today : 3147.80 Change : 18.70 cents or -0.59% Gold Silver Ratio Today : 52.062 Change : -0.056 or -0.11% Silver Gold Ratio Today : 0.01921 Change : 0.000021 or 0.11% Platinum Price Close Today : 1576.60 Change : -5.20 or -0.33% Palladium Price Close Today : 657.40 Change : -5.60 or -0.84% S&P 500 : 1,385.14 Change : -5.64 or -0.41% Dow In GOLD$ : $164.40 Change : $ 0.13 or 0.08% Dow in GOLD oz : 7.953 Change : 0.006 or 0.08% Dow in SILVER oz : 414.03 Change : -0.17 or -0.04% Dow Industrial : 13,032.75 Change : -82.79 or -0.63% US Dollar Index : 79.59 Change : 0.055 or 0.07% Today GOLD PRICE gave back $11.50 to shutter Comex at $1,638.80. GOLD PRICE defended its $1,638.24 low thrice, then pulled up and away a bit. Watch that $1,638.24 tomorrow, because gold shouldn't cross that line if it does intend to rise soon. I try not to allow myself to see things on charts that aren't there, and force myself to see what is there. So I will report that the 5 day gold chart shows a flattish (that makes one suspect it) upside down head and shoulders in gold. Think of the neckline about $1,656, with a left shoulder on Monday, a head in that sudden down-spike on Tuesday, and a right shoulder today. If it is an upside down Hands, it targets another sprint for $1,675. Mercy, this narrowing trading range is wearing me out. Here soon silver and gold will break through in a stout move, but can't tell yet which way that will be. And of course, there's always Europe with its looming financial crisis that might burst forth any time, changing everything -- but which way, for which metal? In 2008, investors dumped everything, stocks, gold, silver, in favor of dollars, but back in the summer they were dumping euros and dollars for gold. Which way will they jump this time? Heavens above, I don't think like they do. If I was running the world, most of the people running it now would be in jail, a lot of those in jail would be turned loose, everybody would be good looking, and nobody would sweat much. Like I say, I just don't think like the public. The SILVER PRICE had another tight-lipped day, giving us no clue what's on its mind. It sank 18.7c to 3147.8c Oh, it's left a little scoopy pattern on the 5 day chart since the weekend, but that doesn't tell you anything. It must hold 3120c or 'twill sink like your algebra average after the teacher caught you reading formulas off your palm during a test. Low today came at 3134c, and I really wouldn't like silver even to draw nigh that number tomorrow. One thing I did notice on the longer term silver chart that causes the heart to leap: I believe silver has traced out a bullish falling wedge pattern. If so, it might possible fall to the bottom boundary, now about 3000c, then blast right back up. Wedges, remember, point the OPPOSITE direction to their breakout, so falling wedges break out upwards. It's springtime in Tennessee, and I'm fretting to be outside. That doesn't make watching a taxing, vexing sideways market any easier. Still, y'all know that eventually the silver and GOLD PRICE will resolve this the only way they can in a bull market: by rallying much, much higher. On the Internet today I read, "The Eurozone could break up and trigger a 'full-blown panic in financial markets and depositor flight' and a global economic slump to rival the Great Depression, the IMF warned yesterday." Setting aside for the nonce the IMF's need to toot the crisis horn in order to boost its own powers, let us calmly digest this statement. The IMF opines that the still-unaddressed European sovereign debt (and related bank insolvency) crisis could trigger a financial market panic like 2008's in the US "and depositor flight." I reckon that means depositors would try to withdraw their money from banks, an old-fashioned bank run. Well, lots of luck, Depositors, cause there ain't no money in them banks. Naw, I don't mean that they are loaded to the gills with bad paper, although that's true, too, but literally, there ain't no money there, not even paper money. Banks keep only a tiny bit of cash on hand. Back in 1998 there was only $1,177.54 per head circulating in the whole US. Latest (3/12, from St. Louis Fed) reading for Federal Reserve Currency issued is $1,033.1 billions. 75% or more of that circulates overseas, so for 313,387,357 Americans, that leaves in circulation $824.14 per red-white-and-blue pate. And I'll bet sitting here not 10% of y'all have as much as $1,000 in cash (green paper money) on you now or at home, although most of you spend more than $3,000 a month just to stay dry and fed. And to make sure y'all don't wise up and try to get your hands on some pictures of dead presidents, the US government treats dealing in cash or even holding it above certain amounts as a crime. As I said, Depositors, in the event of a bank run, y'all stand the same change of getting cash that a three-legged June bug stands at a Rhode Island Red chicken convention on a hungry day. All that constitutes yet another sound reason to get your hands on always reliable US 90% silver coin and gold coin. I warn y'all, the sun is shining, the wild flox and wild azaleas and tulip poplars are blooming, and my mind is not on staying in this office. But here goes. Dollar index today moved a bare 5.5 points to 79.585, leaving the dollar's intent still unclear, although with a bias to the upside that can only be contradicted by a close below 79.2. Euro ended down 0.05% at $1,3119, still trending down. Yen stumbled and tumbled today, closing down 0.49% to 123.07c (y81.25/US$1). Chart shows that's below the 50 dma (123.38) but it also gapped down, leaving behind what might be an "island reversal." That occurs when a market rallies, gaps up, trades sideways, then gaps down again, leaving a little island behind. It's a right deadly and reliable reversal pattern. STOCKS showed what they were made of today, falling back to support just above 13,000. Dow closed down 82.79 (0.63%) at 13,032.75; S&P500 lost 5.64 (0.41%) to 1,385.14. For the Dow, that's below the 20 day moving average (13,057) which means the Dow isn't getting any traction here for higher prices. But then, I can say that because I don't work for the yankee government, the Fed, or Wall Street. And the legitimate government agents never did get their assault rifles. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||

| Michael Hudson: Debt: The Politics and Economics of Restructuring Posted: 18 Apr 2012 10:33 AM PDT Michael Hudson: Debt: The Politics and Economics of Restructuring | ||

| Compulsive Hoarding is an affliction, an illness Posted: 18 Apr 2012 10:06 AM PDT Submitted by Adrian Ash | BullionVault Just because you hoard money or Gold Bullion, doesn't mean you're sick or wrong… - It disables the sufferer and those around them, presenting a health hazard as stuff piles up and the home turns into a trash can. "Hoarding and anxiety go hand-in-hand," says one struggling survivor. "For many people, [...] This posting includes an audio/video/photo media file: Download Now | ||

| Nigel Farage: There Are Going to Be Serious Banking Collapses Posted: 18 Apr 2012 09:43 AM PDT from KingWorldNews:

| ||

| Charles Nenner See's $2500 Gold Coming Posted: 18 Apr 2012 09:39 AM PDT Charles Nenner is now calling for $2500/oz gold within 12-18 months. At the end of March he figured mid April would be a bottom and good entry point. He also see's silver blowing thru $50 in a similar timeframe. See article here. | ||

| Priceless Precious Metals vs Worthless Dollars Posted: 18 Apr 2012 09:28 AM PDT by Andy Hoffman, MilesFranklin.com:

Some of the most common questions I am asked are the following: 1. Why should I buy physical gold and silver if the government might confiscate it? 2. What use will physical gold and silver have if the dollar collapses, and anarchy and/or chaos reigns? 3. What use will physical gold and silver be if the government bans their use or institutes 90% windfall taxes? Many other variants of these questions are also asked, with the common theme that if gold could be confiscated, decreed to be contraband, or dangerous to hold, why would I want to own it? | ||

| Time To Confront Central Bank Liars Posted: 18 Apr 2012 09:24 AM PDT by Jeff Nielson, Bullion Bulls Canada:

For three years we have had to listen to B.S. Bernanke (yes, his initials really are "B.S.") drone on and on about the mythical "U.S. economic recovery." I recently pointed out with an abundance of long-term charts and elementary reasoning that it wasn't even theoretically possible for the crippled U.S. economy to be growing. However, don't take my word for it. Instead, let's look at the actions of B.S. Bernanke. Until Japan's failed experiment with taking interest rates to zero – and leaving them there – no nation in modern history had ever engaged in such recklessly insane monetary policy. | ||

| Eric Sprott Interview on Gold and Silver Posted: 18 Apr 2012 09:01 AM PDT Great interview with Eric the topic as you'd expect was a focus on silver, and gold. see interview here. | ||

| Patrick Heller: Gold and silver price suppression is now a weekly event Posted: 18 Apr 2012 09:00 AM PDT 5p ET Wednesday, April 18, 2012 Dear Friend of GATA and Gold: Writing at Coin Week, Patrick Heller of Liberty Coin Service in Michigan comments on how gold and silver price suppression in the futures markets has gone beyond obvious. Heller's commentary is headlined "Major Gold and Silver Price Suppression Now a Weekly Occurrence -- So What?" and it's posted at Coin Week here: http://www.coinweek.com/commentary/opinion/major-gold-and-silver-price-s... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Platinum (TSXV: NKL) and Ursa Major Minerals Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) and Ursa Major Minerals Inc. have signed a binding letter of agreement for a business combination through a proposed all-share transaction. In doing so Prophecy and Ursa have acted at arm's length and the transaction has been negotiated at arm's length. Prophecy will issue one common share in exchange for every 25 outstanding common shares of Ursa. Ursa options and warrants will be exchanged for options and warrants of Prophecy on an agreed schedule. Prophecy's offer represents a value of about $0.15 per each common share of Ursa based on Prophecy's share price of $3.70 as at March 1, representing a premium of 130 percent to Ursa's March 1 closing price of $0.065. Prophecy is to subscribe for $1 million common shares of Ursa by way of private placement financing at $0.06 per share, subject to regulatory approval. Upon placement completion, John Lee and Greg Hall, current Prophecy directors, will be appointed to Ursa's board. Prophecy thus will become a mid-tier resource company with a robust and diversified pipeline of platinum nickel projects, including: -- The fully permitted open-pit Shakespeare PGM-Ni-Cu mine close to Sudbury, Ontario, infrastructure with near-term production capabilities. -- The flagship Wellgreen (Yukon) PGM-Ni-Cu project with more than 10 million ounces of Pt-Pd-Au inferred resource. Drilling is under way and a preliminary economic assessment study is pending. -- Manitoba's Lynn Lake Ni-Cu project with more than 262 million pounds Ni and 138 million pounds Cu measured and indicated. For the complete announcement, please visit Prophecy Platinum's Internet site here: http://www.prophecyplat.com/news_2012_mar02_prophecy_platinum_ursa_major... Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf | ||

| 2 Years After the BP Oil Spill, Is the Gulf Ecosystem Collapsing? Posted: 18 Apr 2012 08:57 AM PDT 2 Years After the BP Oil Spill, Is the Gulf Ecosystem Collapsing?The Gulf Ecosystem Is Being DecimatedThe BP oil spill started on April 20, 2010. We’ve previously warned that the BP oil spill could severely damage the Gulf ecosystem. Since then, there are numerous signs that the worst-case scenario may be playing out:

If you still don’t have a sense of the devastation to the Gulf, American reporter Dahr Jamail lays it out pretty clearly:

Did the BP Spill Ever Really Stop?We’ve repeatedly documented that BP’s gulf Mocando well is still leaking. Stuart Smith – a successful trial lawyer who won a billion dollar verdict against Exxon Mobil – noted recently:

| ||

| Jim Willie: “In 2 Year’s Time, the Gold Cartel WILL HAVE NO PHYSICAL GOLD” Posted: 18 Apr 2012 08:34 AM PDT by Tekoa Da Silva, Bull Market Thinking:

Starting out with the global markets overall, Jim indicated we are currently in a "false calm." He said, "We have not gotten past the aftermath of MF Global, the distrust of COMEX is enormous, a lot of companies are just not permitted to use COMEX anymore…We've had a few naked short raids of the gold market, and I think they go hand in hand with some of the gigantic dollar swap exercises that have—I believe—dumped at least $2 trillion dollars into the system in the last several weeks alone. We're on the verge of Europe fracturing Tekoa. I think it's happening right in front of our eyes." Here's the interview:

| ||

| Posted: 18 Apr 2012 08:34 AM PDT by Ron Paul, LewRockwell.com:

There is an old German saying that goes, "whoever does not respect the penny is not worthy of the dollar." It expresses the sense that those who neglect or ignore the small things cannot be trusted with larger things, and fittingly describes the problems facing both the dollar and our nation today. For nearly a century monetary policy has been delegated to the Federal Reserve System. Congress has ignored the importance of monetary policy and relegated monetary oversight to the sidelines, considering it less important than such matters as welfare spending, warfare spending, and who to tax and how much they should be taxed. While Congress has dithered, the Federal Reserve has destroyed the value of the dollar, so much so that the metal value of our already much-debased token coinage now exceeds its face value. | ||

| GoldSeek Radio interviews Eric Sprott Posted: 18 Apr 2012 08:31 AM PDT 4:30p ET Wednesday, April 18, 2012 Dear Friend of GATA and Gold (and Silver): Sprott Asset Management CEO Eric Sprott this week gave a comprehensive interview to GoldSeek Radio's Chris Waltzek, covering not just the monetary metals but the ongoing crackup of the world financial system. The interview is 16 minutes long and you can listen to it at GoldSeek's companion site, SilverSeek, here: http://www.silverseek.com/commentary/eric-sprott-interview-silver-gold-m... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Golden Phoenix Discusses Royalty Mining Growth Strategy Golden Phoenix Minerals Inc. has discussed its royalty mining growth strategy on the Fox Business Network program "21st Century Business" with host Jackie Bales. Golden Phoenix's director of corporate communications, Robert Ian, told how the company narrows its focus to project generation and future royalty streams. He explained why Golden Phoenix believes it's better to own joint-venture interests in several producing mines instead of full exposure to just one project. "21st Century Business" has been airing for 15 years. Previous hosts have included Gen. Alexander Haig, Gen.l Norman Schwarzkopf, and Secretary of Defense Caspar Weinberger. Golden Phoenix appeared as paid programming on this broadcast. To view the program with Golden Phoenix, please visit Golden Phoenix's Internet site here: http://www.goldenphoenix.us/company-videos.html Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. | ||

| Posted: 18 Apr 2012 08:26 AM PDT April 18, 2012 [LIST] [*]"Losing faith" in fiat money: Only now? [*]Frank Holmes with a bullish signal for gold... Rick Rule on why gold stocks are set to rebound [*]Chuck Butler with two signals from China threatening the dollar's reserve currency status [*]"But what is a slave?" Doug Casey sounds off as Tax Day and "Tax Freedom Day" coincide [*]"What kind of freedom is this?" a reader asks: Why you have something to worry about even "if you've done nothing wrong" [/LIST] "I'm not one of those religious believers in gold," says Matthew Bishop, "but I guess I've become a bit of an agnostic/atheist about my faith in government-backed money, so I really think governments are in a position where they're going to debase in a big way." Mr. Bishop is New York bureau chief of The Economist... and he's penned a book called In Gold We Trust?: The Future of Money in an Age of Uncertainty. He has put us in a difficult position as we aim to stake out "fat tail" ideas. We li... | ||

| Euro zone breakup now a real possibility, Farage tells King World News Posted: 18 Apr 2012 08:25 AM PDT 4:20p ET Wednesday, April 18, 2012 Dear Friend of GATA and Gold: Interviewed today by King World News, former commodities broker Nigel Farage, leader of the United Kingdom Independence Party and a most troublesome member of the European Parliament, says the dissolution of the euro zone is suddenly a topic of legitimate discussion and a real possibility even as there's no plan for managing it. Farage says markets may just overwhelm the whole international central banking system. (Let's hope.) An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/4/18_Ni... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Golden Phoenix Discusses Royalty Mining Growth Strategy Golden Phoenix Minerals Inc. has discussed its royalty mining growth strategy on the Fox Business Network program "21st Century Business" with host Jackie Bales. Golden Phoenix's director of corporate communications, Robert Ian, told how the company narrows its focus to project generation and future royalty streams. He explained why Golden Phoenix believes it's better to own joint-venture interests in several producing mines instead of full exposure to just one project. "21st Century Business" has been airing for 15 years. Previous hosts have included Gen. Alexander Haig, Gen.l Norman Schwarzkopf, and Secretary of Defense Caspar Weinberger. Golden Phoenix appeared as paid programming on this broadcast. To view the program with Golden Phoenix, please visit Golden Phoenix's Internet site here: http://www.goldenphoenix.us/company-videos.html | ||

| Cambodia, Once Secret, Is Now Open for Business: Richard Stanger Posted: 18 Apr 2012 08:23 AM PDT The Gold Report: Cambodia's gross domestic product (GDP) is roughly $13.2 billion (B) annually, or around $1,000 a person, according to the Association for Southeast Asian Nations. It's clearly an impoverished nation, but until the last few years, the country has done little to develop its mineral wealth. Why? Richard Stanger: Mainly because there was almost no information available about the geology of the country. Most of it was destroyed during the civil war. The country is a bit of a secret. People don't know much about Cambodia, or, in some cases, even where it is located. The infrastructure was pretty poor until recently. Roads were very difficult to travel. Telecommunications were really undeveloped. There was almost no infrastructure available for exploration. TGR: How did you find your way to Cambodia? RS: I was looking for a country that had the right geological setting and a good government with a legal system that is workable. Cambodia fit that bill. TGR: What is the co... | ||

| Gold Daily and Silver Weekly Chart Posted: 18 Apr 2012 08:20 AM PDT | ||

| Eric Sprott Interview: Silver, Gold, Mining Stocks and more - GoldSeek.com Radio Nugget Posted: 18 Apr 2012 08:00 AM PDT Eric SprottEric Sprott has earned a recognized standing not only as one of the world's premiere gold and silver investors, but also as an expert in the precious metals industry. Eric Sprott is Chairman of Sprott Money Ltd. Additionally, he is CEO, CIO and Senior Portfolio Manager of Sprott Asset Management LP and Chairman of Sprott Inc.. | ||

| GoldSeek.com Radio Nugget: Dr. Quinton Hennigh, Gold Canyon Resources Posted: 18 Apr 2012 07:53 AM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Brink's reported a massive 3.1 million ounce silver withdrawal from the customer inventory Tuesday, and our friends at JPMorgan reported a deposit of 720,000 ounces.

Brink's reported a massive 3.1 million ounce silver withdrawal from the customer inventory Tuesday, and our friends at JPMorgan reported a deposit of 720,000 ounces.

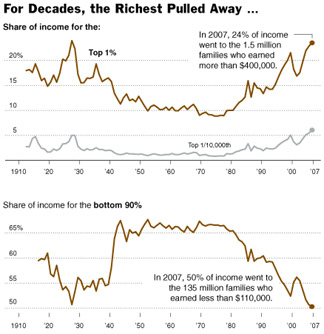

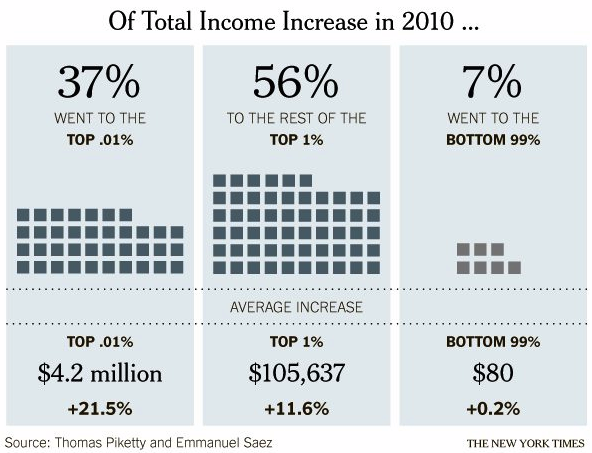

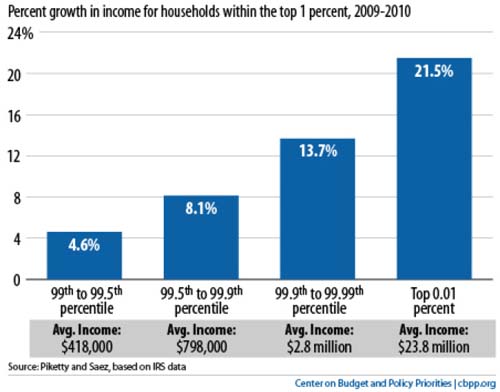

The government provides the freedom and assistance (deregulation, failure to enforce laws, bills that help perpetuate quasi-monopolies) that enable the top 1%+ to continue accumulating more and more of the country's total wealth. It is also charged with keeping those at the top safe from the rage brewing at the bottom.

The government provides the freedom and assistance (deregulation, failure to enforce laws, bills that help perpetuate quasi-monopolies) that enable the top 1%+ to continue accumulating more and more of the country's total wealth. It is also charged with keeping those at the top safe from the rage brewing at the bottom. "Of course things seem fine if you are in the top 1%... and that means – very simply – less for the bottom 99%. When do we have the ideal amount? When we have 100% and the bottom 99% has zero? We already have 25% and in 2010 we captured 56% of the income gains, so our disproportionate share is, indeed, growing even more disproportionate every year...

"Of course things seem fine if you are in the top 1%... and that means – very simply – less for the bottom 99%. When do we have the ideal amount? When we have 100% and the bottom 99% has zero? We already have 25% and in 2010 we captured 56% of the income gains, so our disproportionate share is, indeed, growing even more disproportionate every year... With escalating fears regarding the stability of the eurozone, today King World News interviewed former LBMA commodities broker and trader and current MEP Nigel Farage to get his take on the situation. Farage had some very interesting comments regarding the Italians moving large quantities of gold to Switzerland, but when KWN asked about the chaos in Europe, Farage stated, "Well, so far, from all of the European officials and from the new IMF branch office in Washington, we've had unanimity that there was no prospect, at any stage, of the euro being under threat."

With escalating fears regarding the stability of the eurozone, today King World News interviewed former LBMA commodities broker and trader and current MEP Nigel Farage to get his take on the situation. Farage had some very interesting comments regarding the Italians moving large quantities of gold to Switzerland, but when KWN asked about the chaos in Europe, Farage stated, "Well, so far, from all of the European officials and from the new IMF branch office in Washington, we've had unanimity that there was no prospect, at any stage, of the euro being under threat." In my role as Precious Metal information communicator, I am asked dozens of questions each week, which over the course of a year accumulates to the thousands. My writings tend to focus on a handful of vital sub-topics, which in turn are molded from the aforementioned questions. Many RANT topics are devoted to such issues, as is this one.

In my role as Precious Metal information communicator, I am asked dozens of questions each week, which over the course of a year accumulates to the thousands. My writings tend to focus on a handful of vital sub-topics, which in turn are molded from the aforementioned questions. Many RANT topics are devoted to such issues, as is this one. I've had enough. Day after day of 100% manure from these propagandists. It's time to shout out that "the Emperors are wearing no clothes."

I've had enough. Day after day of 100% manure from these propagandists. It's time to shout out that "the Emperors are wearing no clothes."

I had the chance once again to speak with the "Golden Jackass" this afternoon out of Central America, namely, Jim Willie, publisher of the Hat Trick Letter. It was once again a fascinating interview (our last conversation can be found

I had the chance once again to speak with the "Golden Jackass" this afternoon out of Central America, namely, Jim Willie, publisher of the Hat Trick Letter. It was once again a fascinating interview (our last conversation can be found  Statement to the Subcommittee on Domestic Monetary Policy Hearing on "The Future of Money: Coin Production," April 17, 2012.

Statement to the Subcommittee on Domestic Monetary Policy Hearing on "The Future of Money: Coin Production," April 17, 2012.

No comments:

Post a Comment