Gold World News Flash |

- Open Forum

- Does Gold Ever Pay?

- These 2 Sites Are the BEST Places to Buy Gold & Silver Online ? Here?s Why

- BRICS Plan to Abandon U.S. Dollar Will Hurt U.S. and Help Gold

- Details Of The $291 Trillion In Derivatives To Which American Taxpayers Are Exposed

- The Coming Depression & Next World War

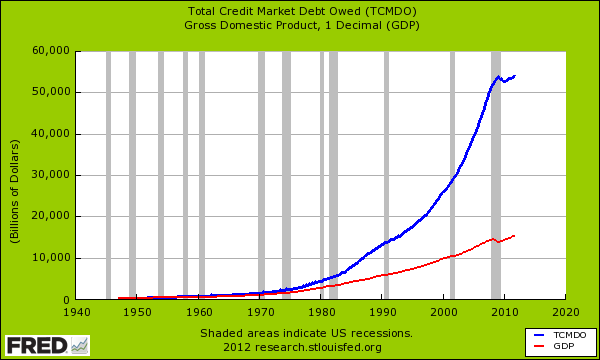

- The long debt emergency has arrived – with total US credit market debt at $54 Trillion

- Gold Pressured from Trendline and 20 Day Average

- Gold Seeker Closing Report: Gold and Silver End Near Unchanged Again

- Risk-Takers And Tattoo-Haters

- The Too Big To Fail Banks Are Now Much Bigger And Much More Powerful Than Ever

- Silver Update 4/17/12 Silver Stockpiles

- COLLAPSE Confirmation News: SPECIAL REPORT

- Guest Post: 10 More Years Of Low Returns

- Slaying the sacred cow: Biderman

- NY bureau chief for The Economist says gold is a better currency

- Complete Gundlach Presentation

- Silver, Gold, Stocks, India, & Focus on the Fundamentals – David Morgan

- The Price Of Oil: The Crybaby President vs. The Evil Oil Speculators

- A Return to the Gold Standard, or Gold Behind Currencies – Part 3/5

- Oligarchy That Runs The World Now Verified By Science

- Gold Daily and Silver Weekly Charts – Bear Raid Breaks Momentum

- Gold and Silver Manipulation and How They Do It

- Doug Casey: Sociopathy Is Running the US - Part Two

- Gold Price was Driven Down to $1,634.88 but Snapped Back to the Day's High Holding Above $1,650 in After Market

- French elections / Faulty retail sales data / Failed raid on gold and silver

- Moriarty – Sprott Will Signal Silver Bottom

- “It Is Incumbent On Every Generation to Pay Its Own Debts As It Goes - A Principle Which If Acted On Would Save [Half] The Wars"

- Some Answers to Doug Casey’s Questions On Gold Manipulation

- Peter Schiff - Gold Bears to Get Pummeled, No Crash in Stocks

| Posted: 17 Apr 2012 06:29 PM PDT Here's a riddle. What do Smeagol, Ragnarok, Bruce Dickinson and Samuel Taylor Coleridge all have in common? The Rhyme of the Ancient Gold-Mariner Written in 2004 by Smeagol (who now goes by the name Ragnarok, reads this blog, but won't participate in the comments here for the superstitious reason that every site where he comments seems to go the way of the albatross, which he then hangs |

| Posted: 17 Apr 2012 06:08 PM PDT |

| These 2 Sites Are the BEST Places to Buy Gold & Silver Online ? Here?s Why Posted: 17 Apr 2012 06:02 PM PDT One of the most common questions I receive is about where to buy gold. There are countless small and large sized dealers, each claiming to have the best prices, best inventory, best service, etc. Of course, you can't take them on their word — you need outside analysis and a good old-fashioned review. In this article, you'll find just such a review. Words: 532 So says Shaun Connell ([COLOR=#0000ff]www.livegoldprices.com) in edited excerpts from his original article*[/COLOR] which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited below for length and clarity – see Editor's Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement. Connell*goes on to say, in part: Our review of the best places to buy gold online…[are] dependent on what your goal with the gold is — amassing physical bullion for financial security or*to speculate on gold prices. Below are strategies and recommended deale... |

| BRICS Plan to Abandon U.S. Dollar Will Hurt U.S. and Help Gold Posted: 17 Apr 2012 06:02 PM PDT Frustrated with what they viewed as being ignored by the West and not having a prominent role in institutions like the World Bank and the International Monetary Fund, Brazil, Russia, India, China and South Africa (also known as the BRICS countries) have held their*second summit…[and declared war on the U.S. dollar. Let me explain.]*Words: 572 So says Michael Lombardi ([url]www.ProfitConfidential.com[/url]) in edited excerpts from his original article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited below for length and clarity – see Editor's Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement. Lombardi*goes on to say, in part: The BRICS countries represent 40% of the world's population and 20% of the world's gross domestic product (GDP)…[and] are growing their portion of world GDP faster than the West, which means that, even in a decade, the BRICS countries are g... |

| Details Of The $291 Trillion In Derivatives To Which American Taxpayers Are Exposed Posted: 17 Apr 2012 04:47 PM PDT Dear CIGAs, This article was called to my attention by the legendary CIGA Green Hornet. It is simply too good, too correct and too educational not to be published. For those with the attention span larger than gold fish, this must be read and understood. Today's JSMineset is big but there is a great Continue reading Details Of The $291 Trillion In Derivatives To Which American Taxpayers Are Exposed |

| The Coming Depression & Next World War Posted: 17 Apr 2012 04:34 PM PDT  The Coming Depression & Next World War Gerald Celente on Guy Show Part 1 Freedom US Government Socialisim Obama Bernanke Martial Law Lies False Flag Rervolution Breaking Supream Court Economy Wall Street Bail Outs Banks Your Money Glenn Beck Peter Schiff Marc Faber Jim Rogers Max Keiser Lou Dobbs economy collapse meltdown Ron Paul jobs unemployment stock market manipulation. Read more....... The Coming Depression & Next World War Gerald Celente on Guy Show Part 1 Freedom US Government Socialisim Obama Bernanke Martial Law Lies False Flag Rervolution Breaking Supream Court Economy Wall Street Bail Outs Banks Your Money Glenn Beck Peter Schiff Marc Faber Jim Rogers Max Keiser Lou Dobbs economy collapse meltdown Ron Paul jobs unemployment stock market manipulation. Read more....... This posting includes an audio/video/photo media file: Download Now |

| The long debt emergency has arrived – with total US credit market debt at $54 Trillion Posted: 17 Apr 2012 04:15 PM PDT From 1950 to 1980 total US credit market debt to GDP held a ratio of 1.5. Today that figure is above 3.5

|

| Gold Pressured from Trendline and 20 Day Average Posted: 17 Apr 2012 04:02 PM PDT courtesy of DailyFX.com April 17, 2012 01:18 PM Daily Bars Prepared by Jamie Saettele, CMT “Price is testing a long term trendline that extends off of the 2008, 2010, and December 2011 lows. A break of such a well-defined trendline would signal a significant shift. The downside is favored below the April high of 1683.35. Exceeding the April high would shift focus to pivots throughout March (1696.88, 1716.55, 1726.05).” Bottom Line (next 5 days) – lower?... |

| Gold Seeker Closing Report: Gold and Silver End Near Unchanged Again Posted: 17 Apr 2012 04:00 PM PDT Gold fell to $1645.20 in Asia before it climbed back to $1656.71 in London and then dropped to a new session low of $1634.81 at about 10AM EST, but it then climbed to a new session high of $1657.40 in the next hour and a half of trade and ended with a loss of just 0.09%. Silver slipped to $31.221 in Asia, but it then rose to as high as $31.898 in New York and ended with a gain of 0.67%. |

| Posted: 17 Apr 2012 03:38 PM PDT One of the great existential debates about U.S. equities is essentially demographic in nature. Nic Colas, of ConvergEx, asks the question, will retiring Baby Boomers cash out of stocks in the coming years, leaving lower valuations in their wake? At least one recent Fed paper pointed to an 8x earnings multiple for stocks – down from 14x currently – in 2025, all due to the changing face (and age) of the typical investor. But all this doom and gloom only fits if every generation has a similar risk tolerance. If younger cohorts – dubbed Generation X and "Next" – have higher risk thresholds, they may actually buy more equities than their parents, alleviating the demographic time bomb behind that dire Fed prediction. Getting a fix on how these nascent investors will evaluate the risk-return tradeoff is tough; they still don't have much money to put to work. Still, some signs exist. Believe it or not, a third of young Americans have tattoos, an acknowledged sign of risk-loving behavior. And if you think that is just bad decision-making, consider the business rock-stars of the under-30 set. This latest wave of billionaires are all outsized risk takers, and role models to their generation. Stocks may not be dead just yet.

Nic Colas, ConvergEx; Tattoo You, But Not Me One of the most powerful bearish arguments against U.S. stocks is not another European debt crisis or a collapse of confidence in the Federal Reserve or a hard landing it China; it is demographics. Simply put:

The problem with this analysis is that it assumes every generation has a similar risk tolerance profile. The children of the Baby Boom (1946-1964) – Generation X, born from 1964 to 1982 - are assumed to have the same risk threshold as their parents. And what is being called "Generation Next" – those born from 1983 onwards – should have the same risk profile as their parents and grandparents. If these future generations have greater appetites for risk, then the Fed analysis is too pessimistic. They will own more stocks than the prior generations, thereby diffusing some of the demographic time bomb of Baby Boomer stock sales. And, of course, if they are more risk-averse then the Fed might be too optimistic. Searching through a Pew Research Center report from 2007 on "Gen Next," an odd fact caught my eye – more than a third of the respondents reporting having a tattoo. Yes, there is a lot of other information in the notes about this survey (see here: http://www.people-press.org/2007/01/09/a-portrait-of-generation-next/). But seriously – a third of people from the ages of 18-25 are inked up? That's a lot more interesting than the fact that this cohort wants to get rich, thinks very little about religion, or thinks that government does a good job (all of which are actually conclusions of the study, by the way). Now, if you happen to have a tattoo (or two, or three), don't take this the wrong way, but… tattoos are a highly reliable indicator of risky behavior. There are numerous studies in well regarded social sciences publications (see here: http://www.sciencedirect.com/science/article/pii/S089932890100061X, and here: http://www.sciencedirect.com/science/article/pii/S1054139X02004469, and here http://www.jfponline.com/Pages.asp?AID=4762 ). OK, the last one is really more about body piercing, but the idea is the same. Teenagers and young adults with tattoos are significantly more likely to engage in risky behaviors such as intravenous drug use, risky sex, and smoking. There is, of course, a big 'Correlation/causation" problem here. Do risk-loving young people cluster around the tattoo parlor because they see it as adventuresome? Or do they simply get a tattoo as a matter of social solidarity with their like-minded friends? Hard to know. But take one look at the Google Trends data for the number of people searching the phrase "Get a tattoo" – we've included the chart below. As you might guess, it is essentially straight up and to the right.

That Google data also reveals some unexpected information about where these tattoo searchers reside. It is not in New York or Los Angeles, which is where I expected to see the majority of the pings. Nope – the top state for tattoo searches is South Caroline, followed by Iowa, Oklahoma, North Carolina, and Nevada. By city, Las Vegas is #1, followed by Charlotte and San Antonio. NYC is a distance 7th. Bottom line – tattooing is not a bicoastal beatnik/rebel thing. It is an American as hot dogs and apple pie. Or a nicely inked "Mom" on your upper arm.

While this might seem a frivolous exercise, I think the tattoo anecdote does yield something useful in the discussion about risk tolerances by generation. OK, if you want something boring, consider how every generation finds their new billionaire. Ancient: Henry Ford. Build a huge company in the 1920s. take it public in the 1950s. Old School: Warren Buffett, investor. Focus on value for the long term. Don't worry too much about any 10 years period of returns. Baby Boomer: Bill Gates. Build a dominant software platform, grow with the industry. Don't change too much one you get in the lead. Generation Next: Mark Zuckerberg. Build something, retain all the control you can, only go public when the regulators say you have to. Change stuff all the time. To my mind, both Generation X and Next have some distinct gearing to higher risk tolerances relative to their predecessors. It's not just the tattoos, of course. It is the desire to work at the "Right" startup if you are a top-flight computer science grad rather punch a clock at a larger company. Or start your own business in college, as several notable tech business stars did. How and if this translates into greater (or lesser) levels of equity ownership remains to be seen, of course. But the demographic destiny of U.S. stocks isn't as preordained as the most bearish analyses would indicate. |

| The Too Big To Fail Banks Are Now Much Bigger And Much More Powerful Than Ever Posted: 17 Apr 2012 02:49 PM PDT from The Economic Collapse Blog:

|

| Silver Update 4/17/12 Silver Stockpiles Posted: 17 Apr 2012 02:45 PM PDT |

| COLLAPSE Confirmation News: SPECIAL REPORT Posted: 17 Apr 2012 01:56 PM PDT [Ed. Note: Unfortunately, Ted Nugent who is mentioned in this piece and who does actually care about this county, did not endorse Ron Paul for President. He endorsed Mitt Romney. Doh.] from Fabian4Liberty: |

| Guest Post: 10 More Years Of Low Returns Posted: 17 Apr 2012 01:49 PM PDT Submitted by Lance Robert of StreetTalk Advisors 10 More Years Of Low Returns

In this past weekend's newsletter I wrote that "If you put all of your money into cash today and don't look at the market for another decade – you will be better off..." I realize that this statement is equivalent to heresy where Wall Street is concerned but there is one simple reason behind my apparent madness - the power of "reversion". This is not a new concept by any means as witnessed by Bob Farrell's rule #1 - "Markets tend to return to the mean over time." However, the reality of what "reversion" means is grossly misunderstood by Wall Street, and the mainstream media, as witnessed by the many valuation calls that "stocks are now cheap because the market is now trading in line with its long term average." The power of "reversion" is much more than just returning back to the average (or mean) price level over time. In reality the movement is far greater. Let me explain it this way. If you take a rubber band and stretch it as far as you can in one direction and release it - the band does not return back to its original starting point. What you will find is that the band will "revert" approximately an equal distance in the opposite direction before returning back to its starting point. Stock prices and valuations are very similar in this regard as highlighted in Bob Farrell's rule #2; "Excesses in one direction will lead to excesses in the opposite direction." In the first chart I have plotted the S&P 500 index on an inflation adjusted basis compared to its long term growth trend. The area chart below is the most critical to this analysis as it shows the deviation above and below the long term growth trend. Since 1900, when the market has attained excesses in one direction the reversion process has never, and I repeat never, retraced back only to the long term growth trend before starting a new cycle. Yet, this is exactly what Wall Street are telling you will happen. In the past 112 years each and every reversion process has traveled roughly an "equal distance in the opposite direction" much like the rubber band. When the market has risen 50% above the long term growth trend subsequent market performance fell markedly until the reversion process was complete. In almost every case a 50% upside deviation ultimately led to a deviation of 50% to the downside. As my friend Doug Short eloquently stated: "About the only certainty in the stock market is that, over the long haul, over performance turns into under performance and vice versa." Unfortunately, for baby boomers rapidly approaching retirement, the reversion process that is currently underway still has further to progress which means future stock market returns are unlikely to shore up any shortfall in savings. The Reversion Of Earnings What will drive the continued reversion process. It will be the next recession which will drive a reversion of earnings. While Wall Street analysts currently have earnings growth forecasted to rise indefinitely into the future - the reality is that earnings cannot out grow the economy for very long. The companies within the S&P 500 are a reflection of the economy and not the other way around. Therefore, if the economy is growing at a sub-par rate then corporate earnings cannot continue to post substantial earnings growth into the future.

However, If the next decade of a debt laden economy burdened by high unemployment, higher rates of inflation and lower wages, then economic growth may be more aligned to grow at a mere 2-3%. If you Include a current dividend yield of 2% plus 2-3% growth in the markets on an annualized basis; it becomes very difficult to navigate through retirement particularly if you were underfunded to began with." The chart of S&P 500 earnings shows the long term growth trend of earnings. The reversion cycle in earnings, like the price, is quite apparent. While the price of the stock market has ranged between a +/- 50% deviation of the long term growth trend line; earnings have swung between a 6% peak-to-peak and 5% trough-to-trough growth rate. With index earnings currently heading towards the peak of the current cyclical earnings cycle there has already been a marked slow down of year-over-year growth rates. The phenomenal earnings growth posted from the 2009 recessionary lows was exceptionally strong but unsustainable as earnings have now caught up with the sub-par economic growth rate.

A Reversion of The "P" And The "E" = P/E Reversion Are stocks cheap? The media valuation argument, as discussed, is consistently "based on forward earnings expectations". There are two primary problems with this argument. The first is that when valuations are discussed the current level is ALWAYS compared to reported trailing earnings not estimates. Using forward estimates to make a valuation argument is comparing apples to oranges and reeks of poor analysis. Secondly, since forward estimates are historically over estimated by as much as 30% - using inflated forward estimates, which are subject to downward revisions, consistently skews the argument. For example, let's examine the 1st quarter of 2012. Valuation arguments in October of 2011 were based on an assumption of 10% earnings growth. Today that growth rate has been revised down to less than 1%. At the same time market prices have surged in the first quarter driving valuations higher. What was "cheap" in October is "expensive" today.

The chart shows P/E valuations using Shiller's trailing reported 10-year smoothed earnings model. As you will immediately notice the deviation chart looks very similar to the deviation chart of the price of the index. Valuations, like the price, are well entrenched in the long term reversion process. With valuations still well above the long term median the real question is whether or not you will survive the reversion process. 10 Years And Loving It If we look at the reversion process as a whole we can see that the process requires time, a lot of time, to complete. Currently, we are already 12 years into the current reversion grind and it has not been kind to investors trying to save for retirement. Assuming that we are in a "normal" reversion process then theoretically we should only have about 5 to 6 years left to complete a normal cycle. However, given that the current cycle is anything but normal, the reality is that the process most likely has much longer to go. This got me to thinking about the things we need to consider, as investors, when thinking about saving for retirement and managing portfolio risks. Here is a list of things to consider.

Of course, there are many other investments that will do well and these are just a few ideas to start the thinking process. Furthermore, there will be fantastic and tradable bull market rallies like we have seen twice so far this century. Being able to capitalize on those rallies will be critical in offsetting the rate of inflation and creating portfolio returns. Unfortunately, the ensuing declines will also destroy all the gains and then some so being vigilant and disciplined in your risk management process will be critical. However, the most important asset destroyed by reversion processes is "time". It is the one commodity that you have a very limited supply of and no ability to replace. Reversion doesn't mean that the markets "crash", although they certainly can, but the slow grind through the process will be like "Chinese water torture" for investors slowly destroying valuable assets over time. Understanding the environment that we are in today, and will continue to face going forward, can help us make better decisions in both our planning and investment process. Ignore the reversion process at your own risk. |

| Slaying the sacred cow: Biderman Posted: 17 Apr 2012 01:40 PM PDT I can see what reverence people on this site have for data. Government data are not good. If it is seasonally adjusted it has been contaminated. Government surveys are crap. And private data are better. Well are they really? And if you reject so much government data how you know anything about anything? Or do we just make it up from our own neighborhood experience like we are Mr. Rogers or something? Today Tyler put up a video of the revered Mr. Biderman of Trim Tabs fame. Mr. B was making an absolute fool of himself while trying to be critical of government reports. The video is embarrassing to watch. It's his right to do that of course. Just as it's your right ( I guess) to reply snarkily to what I write using profanity. But as sacred cows go this guy is probably better off on the grill than being worshipped. I'd like mine well done, please. Where to start? Advance release: Retail sales every month comes out as an advance release… I know how stupid that is; they should release the final report first then the prelim then the advance! But they don't you actually have to wait for the final report for two more months. Then they are revising data in each of the next two months. Of course we analyze the report for what it is when it's released. Economists are well aware that for retail sales sometimes the revisions bring a bigger change than the original release. It's why the retail sales report is not just about the headline. And no Mr. B did not discover this; no he did not discover America either. Maybe we economists and those in the press do not stress that this is the advance report enough? But the report write up usually features comments about how previous data were revised. I'd assume the 'we have a brain in our head crowd' would realize that next month this number, too, could be revised. It's not final. Admittedly that's s a subtlety. Auto sales; Biderman does his worst when he takes a pot shot at auto sales. The BLS reported that the advance report's value of retail auto sales rose. But Biderman insists that - and everyone knows that - this last month unit sales fell in March from Feb. Well, yes but… Production is not consumption: I just went through this subtlety with something I wrote on industrial production. Apparently some people do not make a distinction between production and consumption or producer good and consumer goods. . We economists do. Biderman is so confused in this rant I hope he is embarrassed to have gone on so smugly on and on about something he was just dead wrong about. The auto figures reported as unit sales by the industry are about all units produced and imported, they are not about consumption at the retail level. Dollars are not units- The retail sales report is a dollar-value report not a volume report. So that is the first disconnect for Biderman. When you look at car production in the US you get unit sales the percentage change is volume percentage. Retail sales is a dollar-value report. Investment goods are not consumer goods - You might be aware that businesses use vehicles. In the GDP accounts we keep separate data for investment and for consumption. So all the vehicles that are produced each month plus imported do not go into retail sales…big mistake here Mr B. When businesses buy cars or trucks the amount of domestic production allocated to consumption will differ from the headline on unit sales. One big factor here is the auto rental companies who periodically need to upgrade their fleet. When they buy to renew their product it makes a big subtraction relative to the headline reported that month. Used cars sales are in retails sales- Retail sales have yet another fly in the ointment. Retail sales are about all sales, not just the sale of new production. Used car sales are in the BLS mix but are not in Biderman's. Yet another reason why monthly retail car sales expressed in dollars are different from the monthly production and import numbers. And you guys LIKE his data? And he is going to save us? He is so confused I don't know what you can learn by listening to him. You cannot even compare the monthly unit sales numbers to car sales in retailing. It makes no sense. Yet, go to the tape, there he is spouting off and smug. BLS data collection is archaic but….Now this is always a problem because economists have lots of rules. Data are carefully collected to ensure things get counted up correctly. And if they are not careful then they can undercount or double count so data in the economics system are put though very specific processes. I'm sure that there are ways to make things more up to date. The BLS system is old and it an old technology system. But there are issues in collecting data if you want to report out data that really make sense. USING FICA tax receipts as a jobs proxy – Next, the idea of using the FICA taxes data as a proxy for job growth may seem like a good idea – a no brainer. Economists do look at it as a gauge but it is a very flawed gauge. There are some major assumptions in doing that which is to say several ways in which there is actual slippage so that the gauge may actually be wrong. . Wage/salary differences are an issue- The employment tax is a flat rate tax but it's assessed on the income you make that week until you reach the max. So there is a big zone in between a zero pay check and the max. There is no way of knowing when workers are added if they are higher or lower paid than the average for workers as a whole last week or last month. Hours or length of the work week - Another little wrinkle is that hours-worked change. As that happens comparisons wills change week to week or month to month even if the number of workers does not change. Overtime- If you get paid more for working overtime that could be another factor causing this tax data to shift without any link to new employment. So you have several disconnects that make this approach only a very raw proxy for what Mr B uses it. He acts like its gospel and it is only a ballpark sort of guess-timate. Yet he wants you to think it is superior to government data? Actually it is government data and it is being tortured when put to that use. Interesting. So thumb your nose at me, at economists, whatever. But at least after posting this I can say I told ya so or that I explained it to you. You can ignore this or read it and learn something the choice is yours. But in my opinion the government data are not cooked. They have not been bent for any election cycle, though that allegation is often made. And private-sector data are rarely are offered up with the kind of attention that would allow them to compete in any way with the government's reports. The only exception to this is the ADP which is often different from the government report it tries to track and is derided mercilessly despite the great effort put into that report. I just think some people want data that go the other way because they want to be contrary. So be contrary and don't change your opinion. But I will continue to try and point out how things are shifting and some of you will appreciate it and a few of you will continue to make fools of yourselves. Your choice. Bidermans' data are flawed. He has no insight on job growth or on retail sales. He does not even understand the concepts. |

| NY bureau chief for The Economist says gold is a better currency Posted: 17 Apr 2012 01:18 PM PDT 9:15p ET Tuesday, April 17, 2012 Dear Friend of GATA and Gold: Matthew Bishop, New York bureau chief for The Economist magazine, has just given a video interview to The Wall Street Journal advocating gold ownership as a defense against currency devaluation. Bishop has even written a book favorable to gold, "In Gold We Trust? The Future of Money in an Age of Uncertainty." It's very strange for anyone associated with a mainstream financial news organization finding any virtue in gold, but the interview is a bit more than seven minutes long and it's posted here: http://www.ustream.tv/recorded/21901610 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Golden Phoenix Discusses Royalty Mining Growth Strategy Golden Phoenix Minerals Inc. has discussed its royalty mining growth strategy on the Fox Business Network program "21st Century Business" with host Jackie Bales. Golden Phoenix's director of corporate communications, Robert Ian, told how the company narrows its focus to project generation and future royalty streams. He explained why Golden Phoenix believes it's better to own joint-venture interests in several producing mines instead of full exposure to just one project. "21st Century Business" has been airing for 15 years. Previous hosts have included Gen. Alexander Haig, Gen.l Norman Schwarzkopf, and Secretary of Defense Caspar Weinberger. Golden Phoenix appeared as paid programming on this broadcast. To view the program with Golden Phoenix, please visit Golden Phoenix's Internet site here: http://www.goldenphoenix.us/company-videos.html |

| Complete Gundlach Presentation Posted: 17 Apr 2012 01:17 PM PDT Earlier today, thousands listened to Jeff Gundlach live (if with the occasional flash crash) lay out his latest views on the economy and markets. For those who missed it, as well as for those who may want a refresher on why Gundlach is slowly building up a natgas position, or why he is buying gold on dips, here is the full slidedeck used by the DoubleLine manager.

|

| Silver, Gold, Stocks, India, & Focus on the Fundamentals – David Morgan Posted: 17 Apr 2012 01:13 PM PDT [Ed. Note: Silver bugs aren't concerned with near term "silver performance", we're concerned with fiat debt-based monetary policy and associated metals manipulation via paper games.] from silverguru: |

| The Price Of Oil: The Crybaby President vs. The Evil Oil Speculators Posted: 17 Apr 2012 01:03 PM PDT Today we were treated to ANOTHER episode of "The Crybaby President". As you well know by now, The Crybaby President ALWAYS finds somebody, something, or some-make-believe to blame for the absolute failure of his administration. Today, The Crybaby President is blaming the evil Oil Speculators for ruining his economic recovery. Ignoring the fact that there has been no economic recovery, The Crybaby President fails to see the simplicity of his failure as an economic Renaissance Man. If only The Crybaby President could see that it is HIS economic policies that have driven the price of Oil up, and NOT the evil Oil Speculators. Let us begin at the beginning -- The Crybaby President crying: Pres. Obama Discusses Oil Market Manipulation CSpan Washington, DC Tuesday, April 17, 2012 President Obama announced a new plan to strengthen federal oversight of oil markets. The $52 million proposal, which requires congressional passage to take effect, would help federal law enforcement officials detect illegal speculation in the oil markets, which some say plays a role in rising gas prices. Attorney General Eric Holder and Treasury Secretary Timothy Geithner joined the president for this announcement in the White House Rose Garden. ZeroHedge sums up The Crybaby President's demonizing of the Oil Speculators succinctly: After Obama's "fairness doctrine" was roundly rejected by the Senate last night as the doomed from the beginning Buffett Rule was voted down, Obama needs to find some more evil villains for society to demonize, and whom to blame for the failure of central planning, or rather its success in pushing gas prices to all time highs. Today - it is that mysterious, amorphous blob of vile, conspiratorial henchmen known as "oil speculators." Forget that these "speculators" are merely conduits for the Fed to conduct its open market operations, forget that the same free liquidity that drives stocks up relentlessly in nominal terms (what? no demonization of evil stock pumping speculators?), even as it produces ever increasing inflation in all those items not tracked by the Fed, forget that Obama's speech is about to be replica of Jimmy Carter's Crisis of Confidence platitude in 1979. Finally forget that the biggest speculator is none other than the White House with its periodic release of SPR release rumors any time WTI approaches $110. Forget all that, and merely focus on the hypnotic, undulating intonation of the engrossing, populist sermon: that is all that is demanded of you. Everything else is to be ignored. And now since the time of "fairness" is over, it is time to do a shot every time "speculator" is uttered. And get ready for many, many CL margin hikes. ____________________ The Crybaby President should be EMBARRASSED for even suggesting that the evil Oil Speculators are the lone wolf behind the rise in Oil prices. As the liberal mainstream media would tell it, rising gasoline prices are a "sign" of strong economic growth: Chicago Tribune: 'Pricey Gas Seen as Good, in a Way' By Mike Bates | March 24, 2012 | 19:22 Today on the Chicago Tribune's front page, above the fold, is the headline "Pricey gas seen as good, in a way." The story also appears on the Los Angeles Times's Web site with the title "Gas prices' jump attests to upbeat economy." Yes, happy days are here again and much of the mainstream media are feeling glad all over, hoping the purported much-improved economy will enhance President Barack Obama's re-election bid. The article notes: The U.S. recovery has solidified through the fall and so far this year, as shown by strong job reports and last week's news of 1.1% increase in retail sales in February. The job reports aren't really that strong when you consider the recession ended almost three years ago, as determined by National Bureau of Economic Research, and this is the most sluggish recovery in post-WWII history. As to the increase in February's retail sales, the Associated Press reported: One factor driving the retail sales increase was a 3.3% rise in gasoline sales last month. It was the biggest increase in nearly a year and reflected a surge in gas prices. So let's see how this works: Higher gas prices are a significant factor in increased retail sales, which in turn are a reflection of a stronger economy, which in turn is a reason gas prices are higher. Yep, definitely a win-win situation. And ain't Obama doing just one heck of a job? In recent weeks we've seen press items contending the president can do little, if anything, about higher gas prices. Also we've seen the stories suggesting that, placed in "proper" perspective, gas prices aren't really all that high. Now we're instructed that sky-high prices are just more evidence that the economy is rebounding. The truth is the mainstream media, having helped sell the American electorate on an unvetted empty suit in 2008, are heavily invested in making him appear a success. We can expect much more of the same through November. ________________________ Obama: Rising Gas Prices Means The Economy Is Strengthening [video]At a press event on the payroll tax cut yesterday, President Obama mentioned how extending the proposal would help Americans pay for gas as the price increases. Obama attributed the growing price of oil to a strengthening economy which in turn means demand for oil increases. "And when gas prices are on the rise again because as the economy strengthens, global demand for oil increases. And if we start seeing significant increases in gas prices, losing that $40 could not come at a worse time," Obama said. ______________________ Has there ever been an economic claim by ANY US President that was frosted with more bullshit than The Crybaby President's claim that rising gas prices are attributable to a strengthening economy? If the economy is strengthening, why do we even need the hokey payroll tax cut to pay for rising gas prices? Has The Crybaby President even considered, or been told by his brilliant energy staffers that the price of Oil is rising because of his banking-bail-out economic policies? Debasing the US Dollar by doubling the total US Government debt in three years is hardly a recipe for lower Oil prices...but then that doubling of the nation's debt is not The Crybaby President's fault now is it? No, it is somebody, something, or some-make-believe that has caused that debt to double...NOT The Crybaby President's brilliant economic policies! In February 2009, the price of Oil was only $38 a barrel. At that same time, the US Dollar index was at 89. Today, April 2012, the US Dollar index is hovering around 79, down over 11%. Today, April 2012, the price of Oil is hovering around $105 a barrel, up over 175%: click image to enlarge How come The Crybaby President never mentions the crumbling currency of our nation as a cause for the rise in Oil prices? The answer to that is simple...he would have to tell the truth! Could The Crybaby Presidents attack on the evil Oil Speculators simply be a political ploy to address his fall in the polls due to rising gasoline prices? Obama's Approval Dips on Gas Prices and EconomyObama's Approval Rating Plummets As Gas Prices RiseGas prices a drag on Obama's numbers - EconomyPresident Obama Targets Oil Speculators: Another Election Ploy?By The Daily Ticker | Daily Ticker By Bernice Napach President Obama today raised the ante on his efforts to limit the rise in oil prices. The president, joined by Treasury Secretary Tim Geithner and Attorney General Eric Holder, called on Congress to adopt tougher rules on speculators in the oil market. "We can't afford a situation where some speculators can reap millions while millions of American families get the short end of the stick," President Obama said. The president's $52 million proposal would stiffen penalties for firms found to manipulate markets and raise the amount of money traders would have to put up to back their positions. It would also beef up the enforcement staff of the Commodity Futures Trading Commission and increase spending on technology to oversee and monitor energy markets. The Daily Ticker's Henry Blodget says the proposal is "embarrassing" because speculators have little to do with the rising price of oil and gasoline. Prices are moving higher, Henry says, because "three billion new capitalists" in India and China are consuming oil and gasoline. It's the balance between supply and demand that determines whether oil prices rise or fall, not speculators, Henry argues. The International Energy Agency and the U.S. Energy Department both reported last week that global oil supplies are loosening even with Western sanctions on Iranian oil. Saudi Arabia and other producers are increasing output which has helped to put some downward pressure on oil prices. Oil is trading higher on Tuesday afternoon. ______________________ Has The Crybaby President and his staff of brilliant economic spin meisters ever considered for a moment that global Oil supplies are sought by other nations besides the great and all powerful USA? Has the consideration that supply is insufficient to meet "global demand" and the supply shortfall has created a premium for the fuel that makes the world go round? Fox News Seriously, when will The Crybaby President STOP blaming somebody, something, or some-make-believe for all of his failures as the leader of the United States of America? Always pointing fingers, NEVER LOOKING IN THE MIRROR. Time for change? You bet!!! Got Gold You Can Hold? Got Silver You Can Squeeze? It's NOT Too Late To Accumulate!!! |

| A Return to the Gold Standard, or Gold Behind Currencies – Part 3/5 Posted: 17 Apr 2012 01:00 PM PDT The questions gold investors have to ask themselves is, "if the days of the dollar are numbered, how will gold be used in the monetary system that follows? Will there be a global monetary system that all nations subscribe to or will the monetary world fragment?" For one thing, we will continue to live in a global world with nations trading amongst each other. To gold investors, such an eventuality –let alone its potential reality—would cause a return to the use of gold as a foundation for any monetary system, but not as a means of exchange, ever again. |

| Oligarchy That Runs The World Now Verified By Science Posted: 17 Apr 2012 12:52 PM PDT from Silver Vigilante:

With movements like the Tea Party, Occupy Wall Street and the Silver Liberation Army attempting to gain influence in global decision making, "science may have confirmed the protesters' worst fears." In a study of the relationships between 43,000 transnational corporations a "relatively small group of companies, mainly banks" have been cited as institutions wielding a disproportionate amount of power and influence over the globe. But, whether or not this power results in undue influence over political processes remains a mystery to Science, according to the study. |

| Gold Daily and Silver Weekly Charts – Bear Raid Breaks Momentum Posted: 17 Apr 2012 12:33 PM PDT from Jesse's Café Américain:

Silver came in this morning with some serious momentum, and so we saw a fairly quick and sharp bear raid. See the first chart. Yes, the bear raid 'failed' but it broke the upward momentum which was the point. Silver registed for delivery at the Comex is down to historically low levels again. They will have to be replenished before the next big delivery month. Some of the commentators are remarking on the unusually low open interest in gold at Comex. While that could be a bullish or bearish indicator depending on how you wish to twist it, it could also very well indicate that the players are shunning the US futures market and so volume is down. Before these scandals work themselves out I expect it to fall much lower. |

| Gold and Silver Manipulation and How They Do It Posted: 17 Apr 2012 11:57 AM PDT |

| Doug Casey: Sociopathy Is Running the US - Part Two Posted: 17 Apr 2012 11:49 AM PDT Submitted by Doug Casey of Casey Research Sociopathy Is Running the US - Part Two (part One here) I recently wrote an article that addresses the subject of sociopaths and how they insinuate themselves into society. Although the subject doesn't speak directly to what stock you should buy or sell to increase your wealth, I think it's critical to success in the markets. It goes a long way towards explaining what goes on in the heads of people like Bernie Madoff and therefore how you can avoid being hurt by them. But there's a lot more to the story. At this point, it seems as if society at large has been captured by Madoff clones. If that's true, the consequences can't be good. So what I want to do here is probe a little deeper into the realm of abnormal psychology and see how it relates to economics and where the world is heading. If I'm correct in my assessment, it would imply that the prospects are dim for conventional investments – most stocks, bonds and real estate. Those things tend to do well when society is growing in prosperity. And prosperity is fostered by peace, low taxes, minimal regulation and a sound currency. It's also fostered by a cultural atmosphere where sociopaths are precluded from positions of power and intellectual and moral ideas promoting free minds and free markets rule. Unfortunately, it seems that doesn't describe the trend that the world at large and the US in particular are embarked upon. In essence, we're headed towards economic and financial bankruptcy. But that's mostly because society has been largely intellectually and morally bankrupt for some time. I don't believe a society can rise to real prosperity without a sound intellectual and moral foundation – that's why the US was so uniquely prosperous for so long, because it had such a foundation. And it's also why societies like Saudi Arabia will collapse as soon as the exogenous things that support them are pulled away. It's why the USSR collapsed. It's the reason why countries everywhere across time reach a peak (if they ever do), then stagnate and decline. This isn't a matter of academic contemplation, for the same reason that it doesn't matter much if you're in a first-class cabin when the ship it's in is taking on water. Economics and EvilWhen I was a sophomore in college, I asked my father – a worldly wise man but one of few words – some cosmic question, as sophomores are famous for doing. His answer was, "It's all a matter of economics." Some months later I asked him another, similar question. His answer: "It's all a matter of psychology." They were unsatisfactory to me at the time, but those simple answers stuck in my mind. And I've since come to the conclusion that they comprehend most of what drives human action. Let's look at the "matter of economics" only briefly, because it's covered at length elsewhere and because it's not nearly as significant as the "matter of psychology." One definition of economics is: The study of who gets what, and how, in the material world. Unfortunately, it's been distorted over the years into the study of who determines who gets what, and how, in the material world. In other words, economic power has gradually been transferred from producers to political allocators. This has had predictably bad results, including not only the bankruptcy of the US government but of large segments of US society. But what's happening today is much more serious than an economic bankruptcy; you can recover from financial woes by cultivating better habits. We're talking about psychological and spiritual bankruptcy. The word psychology comes from psyche, which is Greek for soul. When you look at the word's origin, it's clear that psychology is about much more than mental peculiarities. It's not just about what a person has or what he does. It's about what he is. The real essence of a man, his soul, is revealed by his philosophy and his beliefs. In any event, it's rare that anyone goes bankrupt because of a single bad decision. It takes many missteps, and consistently bad decisions aren't accidents. Consistently bad decisions are the product of a flawed moral philosophy. Moral philosophy guides you as to what is right or wrong. The prevailing moral philosophy has so degenerated that Americans think it's OK to invade other countries that not only haven't attacked it but can't even credibly threaten to attack it. I'm not talking just about Afghanistan, Iraq or Libya – pitiful non-entities on the other side of the world. They were preceded by even weaker prey, closer to home, like Granada, Panama, Haiti and the Dominican Republic. Not only that, but they think coercion should be used to steal wealth from the people who produce it, and give it to those who've done absolutely nothing to deserve it. It's hard to pick an exact time America's moral bankruptcy started; perhaps the draconian Alien and Sedition Acts of 1798 were the first real breach in the country's ethical armor – but they were quickly repealed and subsequently served as an example of what not to do for many years. There were real moral problems that arose because of the Mexican War, the War between the States and the Indian Wars. There were early attempts to create a central bank, but they fortunately failed. But I believe the real change in direction came with the Spanish-American War, which resulted in the accretion of an overseas empire, particularly in the Philippines where 200,000 locals were killed. As Randolph Bourne said, "War is the health of the state." Then came the creation of both the Federal Reserve and the income tax in the very unlucky year of 1913, which made it possible to finance the country's completely pointless entry into World War 1. From there, with the New Deal, World War 2, Korea, the Great Society, Vietnam and so on, the US has gradually descended into becoming a very aggressive welfare/warfare state. It now has an overt government policy of inflating the currency, which constitutes a fraud, and running up the national debt, which is a swindle because it will never be repaid. America is not the first to start with moral failure and move on to economic failure. In all the examples history provides, economic bankruptcy and political tyranny are invariably preceded by moral bankruptcy. It's bad enough that these things have happened. But it's even worse that they're celebrated and taught to students as triumphs. That guarantees that the trend will accelerate towards a real disaster. Most people accept what they're taught in school uncritically. The pattern is no secret to historians. Machiavelli noted in his Florentine Histories (1532): "It may be observed that provinces, among the vicissitudes to which they are accustomed, pass from order to confusion, and afterwards pass again into a state of order. The way of the world doesn't allow things to continue on an even course; as soon as they arrive at their greatest perfection, they again start to decline. Likewise, having sunk to their utmost state of depression, unable to descend lower, they necessarily reascend. And so from good, they naturally decline to evil. Valor produces peace, and peace repose; repose, disorder; disorder, ruin. From ruin order again springs, and from order virtue, and from this glory, and good fortune." This isn't the place to deconstruct Machiavelli, but he makes a couple of points that are worth pondering. Does "good ... naturally decline to evil"? In politics (which is his subject) it does, because politics necessarily attracts evil people, and evil necessarily brings ruin. Then order reasserts itself, because people despise chaos. And from order virtue arises, and from that good fortune. Machiavelli is right. Virtue does bring good fortune, and evil brings ruin. I believe it would be clear to Machiavelli that in the US virtue is vanishing and evil is on the rise. And Machiavelli would predict that things aren't going to get better at this point until they "sink to their utmost state of depression, unable to descend lower, they necessarily reascend." In general, he's correct. But sometimes it takes quite a while for a society to reset. After the collapse of Rome, real civilization didn't return to the West until the Italian Renaissance, which was when Machiavelli lived. Interestingly, culture in Italy started a rapid decline in the 1490s, and the peninsula became a backwater – a quaint theme park at best – for hundreds of years. You can argue Italy is still headed downhill today. Perhaps it simply has to do with the nature of entropy: all complex systems eventually wind down, no flame can burn forever. But that's another subject. It would have been nice, though, to keep the flame of America burning for longer than turned out to be the case. Moral and Intellectual BankruptcyOne element of moral bankruptcy is intellectual bankruptcy, to wit, belief in the effectiveness of statism and collectivism. This is one reason why I counsel kids who are thinking of going to college (unless it's to acquire very specific knowledge in science, engineering, medicine or the like) to do something more intelligent with their time and money. The higher education system is totally controlled and populated by morally and intellectually bankrupt instructors who are believers in socialism. It's said Obama is a socialist. I don't doubt he's sympathetic to socialism but, to be true to the meanings of words, he's a fascist. Let's define these terms and two others with a little help from Karl Marx. His recommended solutions are part of the world's problems, but his analysis of conditions was often quite astute. As Marx pointed out, political systems are all about the ownership and control of goods, whether consumer goods (houses, cars, clothes, toothbrushes) or capital goods (farms, factories and other means of production). Although he didn't break it down this way, his analysis gives us four possible economic systems – communism, socialism, fascism and capitalism. A communist advocates state ownership and control of all the means of production and all consumer goods. That's a practical impossibility, of course, even in the most primitive aboriginal bands. The idea is even more absurd and preposterous for an industrial society. But that doesn't keep professors and politicians from pretending that it's a good idea, even if just in theory. A socialist advocates state ownership of society's means of production but accepts private ownership (with state control) of consumer goods. While it's a big improvement over communism, socialism is also completely impractical and always either collapses or evolves into fascism. North Korea and (now to a lesser degree) Cuba are the world's only socialist states. A fascist advocates nominal private ownership of both the means of production and consumer goods – but with strong state control over both. In other words, you can own mines, farms, and factories – but the state reserves the right to tax, regulate or even expropriate them. Fascism has nothing to do with jackboots and black uniforms; you can have those in communist and socialist states as well. It has to do with a corporate state and a revolving door between business and government, with each protecting and enriching the other. Fascism can be maintained for a long time but necessarily entails all the problems we now face. Almost all the world's states are fascist today; they differ only in degree and detail. A capitalist advocates the private ownership of everything. An extreme capitalist may be an anarchist, who believes that anything people need or want should be, and would be, provided by entrepreneurs at a profit. No country provides a perfect example of any of these four arrangements. But every government promotes one or the other as a theoretical ideal. In most places, certainly including the US, the "mixed economy" is put forward as a good thing; the "mixed economy" is a polite way of describing fascism. Nobody wants to call fascism by its name today because of its strong association with Hitler's "National Socialists." In any event, look and analyze closely before you use these words and attach any of the four tags to any country. In that light, it's funny how the Chinese are still referred to as communists, even though communism was tried only briefly, under Mao. In fact, up to the mid-'80s, China was a socialist state. Now it's a fascist state. China's Communist Party? It's just a scam enabling its members to live high off the hog. Sweden is usually referred to as socialist, but it's always been a fascist country. All of its means of production – businesses, factories, farms, mines and so forth – have always been privately owned but heavily taxed and regulated. The presence of lots of "free" welfare benefits is incidental. People often conflate a welfare state with socialism, but they're two different things. Socialist states necessarily become too poor to provide any welfare. Fascist states can better afford it and usually offer some in order to help justify the government's costly and annoying depredations. There is no truly capitalist state in the world today; perhaps Hong Kong comes closest (although not very close).The early US came quite close in some regards. In fact, the West as a whole was quite free in the century from the fall of Napoleon in 1815 to the start of World War 1 in 1914. Almost everywhere taxes were low and regulations few; there was no inflation because gold was currency everywhere; there were almost no serious wars and passports hardly existed, which enabled most anyone to travel almost anywhere without permission. It's no accident that, in percentage terms, the 19th century saw far greater and wider advances in prosperity than any time before or since. Capitalism is both natural and ideal – but, oddly, it doesn't exist anywhere. Why not? I'll explore that shortly. One sign of intellectual bankruptcy in the US is the absence of serious discussion about capitalism (except in small, specialized forums). Nearly all political debate is about how to fine-tune a fascist system to best suit those who benefit from it – or who think they do. Almost everyone in the public eye is a political statist and an economic collectivist. Those who start attacking the heart of the matter, like Andrew Napolitano or even Pat Buchanan, are quickly evicted from their bully pulpits. In reality, there's little philosophical difference between the Republicrats and the Demopublicans; they're really just two wings of the same party. The left wing of the party claims to believe in social freedom (but doesn't) and overtly disbelieves in economic freedom. The right wing says it believes in economic freedom (but doesn't) and overtly disbelieves in social freedom. The right wing uses more aggressive rhetoric to build the warfare state, and the left wing talks more about the welfare state. But the net difference between them is minuscule. That's because they share the same corrupt intellectual and moral views. What made America unique was its foundation in a philosophy of freedom. That word, however, has become so corrupted that the younger Bush was able to use it two dozen times in some of his early speeches without being laughed off the stage or targeted with shoes and rotten vegetables. Perversely but predictably, Bush is today presented in the mainstream media as a free-marketeer, in order to pin blame for the current depression on the free market. This is as much of a hoax as calling Hoover a supporter of the free market. One is forced to acknowledge a bit of respect for Obama's intellectual honesty, in that he almost never speaks of "freedom" or "liberty." But pointing out the sad state of the world today serves little purpose. It's rare that an intellectual argument changes anyone's mind. Opinions are mostly a matter of psychology. But it's almost impossible to change someone's psychology and the attitude with which he views the world, simply by presenting facts and arguments. A person's beliefs have much more to do with his character and spiritual essence than anything else. You'll hear some of the candidates for the upcoming elections talk about "American exceptionalism." The phrase makes me wince because it's so anachronistic. In the first place, America was only incidentally a place, a piece of geography. In essence, America was an idea, and an excellent one, that was unique in world history. But now America has morphed into the US, which is essentially no different than the other 200 nation-states that cover the face of the planet like a skin disease. It's funny, actually, to see how quickly and profoundly things have changed in the US. Back in the '50s and '60s, kids used to say, when one of us did something the others didn't approve of, "Hey, it's a free country." I'll bet you haven't heard that expression for many years. Back in the '70s, there used to be a joke: "America will never have concentration camps. We'll call them something else." Guantanamo, and the long rumored FEMA detention centers, are proof that it wasn't a joke after all. It's all a matter of mass psychology, which is to say a moral acceptance of collectivism and statism. These systems actually aren't serious intellectual proposals, despite being doctrine at almost every university in the Western world. They're psychological or spiritual disorders on a grand scale. It's important to gain an intellectual understanding of why freedom is good and collectivism is bad, why freedom works and government doesn't. It's important – but it doesn't strike at the root of the problem. The root of the problem is psychological, not intellectual. Do you think for a moment that if you could make Dick Cheney, Barack Obama, Hillary Clinton or any of the other sociopaths who control the state sit down and listen to intellectual arguments, it would change their attitudes? The chances of that are Slim and None. And Slim's anorexic. Why am I so certain of that? It's not because these people have low IQs and can't understand the arguments. It's because most of the people at high levels of government are sociopaths. They're susceptible to reasoned argument against a police state to about the same degree that a cat can be convinced he shouldn't torment a mouse before killing it. People like Obama, Hillary or Cheney – which is to say most people with real power in Washington and every other government – do what they do because it's their nature. They're as cold, unemotional and predatory as reptiles, even though they look like people. You may think I'm kidding or exaggerating for effect. I'm not. It's been said that power corrupts, and that's true. But it's more to the point to say that the corrupt seek power. A good case can be made that anyone who wants to be in a position of power should be precluded from it simply because he wants it. As a purely practical matter, the US would be far better off – assuming a Congress and a Senate are even needed – if their 525 members were randomly selected from a list of taxpayers. But that's impossible in today's poisonous environment because it would leave over half the population – those who only receive government largess and don't pay any income taxes – ineligible. This last fact is a further assurance that the situation in the US is now beyond the point of no return. There are lots of ways to divide people into two classes: rich/poor, male/female, smart/dumb, etc. But from the perspective of political morality, I'd say the most useful dichotomy may be people who want to control the material world vs. those who want to control other people. The former are scientists, engineers and entrepreneurs; the latter are politicians, bureaucrats and assorted busybodies. Guess which group inevitably – necessarily – gravitate toward government? And I might also add, toward big corporations and the media. Big corporations are political arenas where the prize is economic power, and they're heavily populated by backslappers and backstabbers. The media specialize in a different type of power, manipulating opinion; one way they do that is by promoting an atmosphere of bad news, threats and general paranoia for which they imply government action is needed. Government, mega-corps and media – they are the triumvirate ruling today's world. StupidityYou may be thinking: Sure, I can see that Obama or Hillary or Cheney may be evil. But how about Bush or Vice President Biden or Prime Minister Cameron of the UK? It's sometimes hard to tell whether one is dealing with a knave or a fool. The fool does destructive things that may make him seem knavish. And the knave can do stupid things that make him seem like a fool. Isn't it a mistake to accuse someone of malevolence when Occam's Razor might indicate stupidity as a more likely answer? They seem more like fools than knaves. Pity the poor fools. Stupidity certainly can account for many of the world's problems. As Einstein said, after hydrogen, stupidity is the most common thing in the universe. Unfortunately, the word "stupidity" is thrown about too carelessly, usually as a pejorative, and then often by stupid people. Let's define the word. It's important to be precise in the use of words, because if you're not, then how can you possibly say you know what you're talking about? A failure to define words properly invites sloppy thinking. Most of the time people use "stupidity" to mean low intelligence. That's accurate, but it's a synonym, not an explanation. So it's not terribly helpful, because it doesn't really tell us anything we don't already know. Just look at how stupid the average person is (they're thick underfoot on Jay Leno's many "Jay Walking" segments) and then figure that, by definition, half of the electorate are lower than average. It's helpful to use an example, and since we're talking about politics, let's pick a well-known political figure. George W. Bush was president recently enough that everyone can still remember him clearly. I've always said that the Baby Bush was stupid. Technically speaking, I believe he's actually a borderline moron. You may or may not know that a moron, an imbecile and an idiot are not at all the same thing – even though in common usage, the words are more or less interchangeable. In fact, these terms have clinical definitions. Briefly, an idiot is so dim that he may have to be institutionalized. An imbecile functions at a higher level; he can get by in normal life, given some assistance. A moron does even better. He can conduct himself quite well in day-to-day society and even be liked and respected – a little bit like the character Chauncey Gardiner (who, as it turned out, was being groomed to become the president) in Peter Sellers' movie Being There. A moron can carry on a conversation about the weather, the state of the roads, sports, TV sitcoms or even, with a bit of coaching – as Bush proved – the economy or a war. Bush seemed more or less normal, even though I suspect he only has an IQ of around 90. I'm not saying that just to be offensive to Bush fans. I believe I can back up that assertion, even if Bush could actually score above 100 on a standard test, by showing you some more practical definitions of stupidity. Let me give you two of them. One is: an unwitting tendency to self-destruction. Another is: an inability to correlate cause and effect and thereby anticipate the consequences of an act. I would suggest to you that almost everything Bush has done, it seems his entire life, but absolutely while he was the president, would fit those definitions of stupidity precisely. A moron can see the immediate and direct consequences of actions, even though the indirect and delayed consequences escape his understanding. At least to a cynic, that would seem to indicate that not only Bush but the average American voter is likely not just a moron but an imbecile. Such a deficit of intelligence almost guarantees that we'll see controls of all types – absolutely including foreign exchange controls – imposed as the Greater Depression unfolds. In fact, when the next 9/11-style incident, real or imagined, occurs, they're going to lock the US down like one of their numerous new federal prisons. It's going to be, as I've gotten in the habit of saying, worse than even I think it's going to be. But stupidity is clearly only a partial explanation of Bush's character, just as it was only a partial explanation of Hitler's. Please don't misapprehend me on this. Bush wasn't in the same class as Hitler. Hitler was a criminal genius. But criminals, even so-called criminal geniuses, are basically stupid, according to our definitions – they show an unwitting tendency toward self-destruction. How stupid was it of Hitler to attack Russia, especially while he still had a front open with Britain? How stupid was it to declare war against the US shortly after the Japanese attacked Pearl Harbor? How stupid was it to murder six million innocents in concentration camps? How stupid was it to throw the Wehrmacht's Sixth Army into Stalingrad? It's a long list. Stalin provides another example. How stupid was Stalin to murder several million of the most productive farmers when Russians already lacked enough to eat? How stupid was it to liquidate half of the Red Army's most experienced officers and higher NCOs just before WW2? Or Roosevelt. How stupid was it of him to pour milk into the gutter and slaughter livestock in order to drive up prices while millions were hungry? How stupid was it to burden the US, in the middle of the last depression, with huge taxes and a score of new regulatory agencies? A catalog of stupidities of these and most other famous political leaders fills libraries. As Gibbon said, history is little more than a chronicle of the crimes, follies and misfortunes of mankind. There are different types of intelligence – emotional, athletic, mathematical and literary intelligence, for instance. A person can be a genius in one and an idiot in the others. The same is true of stupidity; it comes in flavors. I think a case can be made that liberty cultivates intelligence, because it rewards seeing the distant and indirect consequences of actions. Conversely, statism and collectivism, by restricting liberty, tend to reward stupidity. Remember that political leaders are oriented toward controlling other people; they're clever about it, but they're basically stupid about the rest of reality. Nonetheless, their animal shrewdness is enough for them to gain and keep power over others. The immediate and direct consequences of that political power are gratifying for those who have it; the indirect and delayed consequences, however, are disastrous for everyone. But wait. It sounds like stupidity is related to evil. Which it is. Stupidity is a signpost of evil. It's why it often takes a while, when things are going badly, to determine whether you're dealing with a knave or just a fool. In that regard, Robert S. McNamara offers something of |

| Posted: 17 Apr 2012 11:05 AM PDT Gold Price Close Today : 1650.30 Change : 1.60 or 0.10% Silver Price Close Today : 3166.50 Change : 30.1 cents or 0.96% Gold Silver Ratio Today : 52.117 Change : -0.449 or -0.85% Silver Gold Ratio Today : 0.01919 Change : 0.000164 or 0.86% Platinum Price Close Today : 1581.80 Change : 8.60 or 0.55% Palladium Price Close Today : 663.00 Change : 10.95 or 1.68% S&P 500 : 1,390.78 Change : 21.21 or 1.55% Dow In GOLD$ : $164.29 Change : $ 2.29 or 1.41% Dow in GOLD oz : 7.947 Change : 0.111 or 1.41% Dow in SILVER oz : 414.20 Change : 2.21 or 0.54% Dow Industrial : 13,115.54 Change : 194.13 or 1.50% US Dollar Index : 79.56 Change : 0.020 or 0.03% Today the GOLD PRICE made a new low for the move, $1,634.88. In overnight trading gold climbed to $1,556.40, then about 9:30 New York time somebody big tried to slap the fool out of gold. Drove it down to $1,634.88 by 10:00, but didn't reckon with gold's ability to snap back. As quickly as it had fallen or even more quickly, gold bounded back to the day's high, then settled down to scoot along $1,650 the rest of the day. Comex closed up $1.60 at $1,650.30, but that didn't tell much of a story. Aftermarket is holding on above $1,650. Caption here is, "Out of weakness, strength." Unless the GOLD PRICE closes below today's low, it is out of danger. SILVER PRICE also suffered an early morning attack, but its five day chart doesn't quite match gold's. Rather, silver made a low early Monday at 3116c, then climbed, and edged off the balance of the day. Started today around 3130c in Europe and reached 3180c before New York opened. Next the Attacker struck, driving silver down to 3133.2, and it recovered just as quickly as gold. Comex closed up 30.1c to 3166.5c. This leaves a distinctly bottomy look behind. To maintain that bottom, SILVER needs to remain above 3130c tomorrow. Crucial mark to defend remains 3100c. Nothing makes me as edgy as watching flat markets, knowing that pressure is building up somewhere that won't blow off until its ready. Some blew today, some stayed flat. Stocks jumped straight up. Yesterday I said the Dow needed to pierce 13,000 or 'would crumple, and it must have heard me. Rose 194.13 (1.5%) to close at 13,115.54. S&P 500 kept pace today, rising 21.21 (1.55%) to 1,390.78. Y'all will think this is merely my bias speaking, but regardless, look for a very short, sharp rise in stocks, maybe to the last high at 13,297, maybe over 1,400 for the S&P500. Following this speedy rise, stocks will step into a laundry chute that leads to Dow 12,500 or lower. Flat currency markets bother me. NGM are up to something, maybe for the International Monetary Fund meeting this weekend. Scabby dollar went no place today, up 2 basis points to 79.563. Sorry euro closed $1.3129 versus yesterday's 1.3136. These are not differences big enough to see, much less change anything. Scruffy yen backed off 0.62% to 123.62c (Y80.89/US$1), but remains above its 50 day moving average, so momentum should carry it higher. However, that 124 level has very strong magnetism. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| French elections / Faulty retail sales data / Failed raid on gold and silver Posted: 17 Apr 2012 11:02 AM PDT by Harvey Organ, HarveyOrgan.Blogspot.ca: Good evening Ladies and Gentlemen: Gold closed up $1.60 to $1650.50. Silver also responded in kind by rising by 28 cents to $31.66. Today before the second fix, a huge 6000 contracts (non backed paper gold) were thrown by the bankers and this immediately caused gold to crater to around $1634. However gold and silver rose to close above par as Europe rejoiced on wonderful news from Spain that sold two year treasury bills in quantities higher than anticipated and the market exploded with excitement. As I remarked to you yesterday the LTRO refinancing allows for all treasuries purchased with a 1 to 3 year duration. The ECB exchanged freshly minted Euros for treasuries. These must be reswapped in 3 years time. What happens to the banks if the ECB decides that it wishes not to extend the swap? The excitement today made no sense and many commentaries today suggest the same. Before we see these stories let us proceed to the comex and assess trading today. |

| Moriarty – Sprott Will Signal Silver Bottom Posted: 17 Apr 2012 10:53 AM PDT SOUTHEAST TEXAS -- Astute market watcher and savvy resource company guru Bob Moriarty may be onto something. Bob writes today for his 321Gold.com website: "I've been watching the Sprott Physical Silver Trust (PSLV) daily chart (Ed. for premiums over net asset value) for over a year now. It gave a very strong signal for a top with a daily reading of a 26% premium last April when silver topped. Cash silver was only $46 an ounce but investors buying into the "Silver is going to the moon, tomorrow," story paid an incredible $57.73 an ounce. Needless to say they are sadder and poorer today. I may have mentioned how foolish it is to buy at tops."

Continued... Moriarty continues: "Anything that gives you a clear picture of investor psychology can be used as a strong signal of when to buy or when to sell. With all the noise in the market of JP Morgan and manipulation and silver is going to the moon, we still suffer from a dearth of valid indicators. You may well believe silver is the most manipulated commodity in the history of the known and unknown universe but that doesn't tell you when to buy or sell. Actually a belief in manipulation doesn't give you any information. If you are so naïve that you think there is such a thing as a non-manipulated market you probably won't be in touch with your money for long." – Mr. Moriarty's offering continues at the link below. We consider it worthy of sharing.

|

| Posted: 17 Apr 2012 10:42 AM PDT Thomas Jefferson said:

He was right. The father of modern economics – Adam Smith – agreed:

Libertarian economics writer Lew Rockwell noted in 2008:

Progressive economics writer Chris Martenson explains as part of his “Crash Course” on economics:

Blanchard Economic Research pointed out in 2001:

James Madison said: