Gold World News Flash |

- Ron Paul on Gold April 5th

- Is the Wimpy Recovery Morphing into a Recession?

- Gold Surges As Indian Jeweller Strike Ends, Equity Futures Slide

- Gold crash on Fed tightening and euro salvation looks premature

- Rich People Of The World Are About To See 50% Of Their Wealth Destroyed

- IceCap Asset Management March Perspectives: "I Need A Job"

- Copper and Yuan Carry Trade

- Betting on the race to the bottom

- India's gold jewelers call off strike, expecting tax rollback

- Exposure of gold market manipulation is producing results

- International Forecaster April 2012: Gold, Silver, Economy + More

- Fleckenstein: How Can So Many People Who Believe in Santa Claus, the Easter Bunny and Goldilocks Be Employed on Wall Street?

- We Owe How Much??

- Greece Launches Rent-A-Cop To Fill Empty Public Servant Coffers

- Blythe Masters Speaks Out On JPM and Market Manipulation

- Gold Reality Check

- Ambrose Evans-Pritchard: Gold crash on Fed tightening and euro salvation looks premature

- China investing in foreign mines and buying gold directly

- Tedbits: Jaws of DEATH; Wind Shear; Bombs and Breakouts; Red Tape Rising

- America: A Government Out Of Control

- 178 MOTT ST. NYC THURSDAY, APRIL 12 – 8 PM – MAX LIVE – WE WILL ATTEMPT AN EXORCISM OF BLYTHE MASTERS WITH THE HELP OF REVEREND BILLY

- Chris Duane Explains Why Silver Confiscation Won't Happen--06.Apr.2012

| Posted: 08 Apr 2012 06:11 PM PDT | ||

| Is the Wimpy Recovery Morphing into a Recession? Posted: 08 Apr 2012 04:51 PM PDT  We've just begun coming to grips with the wimpy recovery. Are we actually in for another recession? That was the implication of a couple of economic reports I read this week, including one by ITG Investment Research, which tracked how the pace of this recovery (which was never great to begin with) has by some measures been slowing, particularly among middle-income consumers and industries producing for overseas markets. (Europe is definitely in a double dip, and many emerging markets are slowing too, as I've written about many times.) We've just begun coming to grips with the wimpy recovery. Are we actually in for another recession? That was the implication of a couple of economic reports I read this week, including one by ITG Investment Research, which tracked how the pace of this recovery (which was never great to begin with) has by some measures been slowing, particularly among middle-income consumers and industries producing for overseas markets. (Europe is definitely in a double dip, and many emerging markets are slowing too, as I've written about many times.)One of the most interesting snippets from the report: While there are fewer goods on sale in American malls and retail shops than there were last year around this time, what is on sale is being discounted at much steeper rates — and not just at dollar stores but at outlets catering to middle- as well as lower-income people. That's not surprising given that the gains we've seen during this recovery have mainly gone to the upper classes. Stocks are up, but it's mostly rich people who own those. The residential real estate market, where most Americans keep the majority of their wealth, is still down. (I met Robert Shiller for lunch last week, and he said we've got years of pain to go on that front.) Salaries are also down – there's been almost no growth in real income throughout the wimpy recovery. Read more....... This posting includes an audio/video/photo media file: Download Now | ||

| Gold Surges As Indian Jeweller Strike Ends, Equity Futures Slide Posted: 08 Apr 2012 04:38 PM PDT from Zero Hedge :

| ||

| Gold crash on Fed tightening and euro salvation looks premature Posted: 08 Apr 2012 04:00 PM PDT April 08, 2012 12:00 PM - Until the rising reserve powers of Asia, Russia and the Gulf regain trust in the shattered credibility of the world's two great fiat currencies - if they ever do - gold is unlikely to crash far or remain in the doldrums for long. `Peak gold' cements the price floor in any case. Read the full article at the Telegraph...... | ||

| Rich People Of The World Are About To See 50% Of Their Wealth Destroyed Posted: 08 Apr 2012 03:10 PM PDT by Henry Blodget, Business Insider:

Specifically, he says that the world's wealthy will soon see half their wealth destroyed. Faber's smart, of course, so he's not laying bets on exactly how it will be destroyed. He's also not picking a particular time frame: "Somewhere down the line we will have a massive wealth destruction that usually happens either through very high inflation or through social unrest or through war or a credit market collapse," he told CNBC (via the Wall Street Journal). The remarkable thing here is that this actually isn't a bold a prediction. In fact, for monetary wealth NOT To be destroyed, we'd have to have a major shift in the world economy. | ||

| IceCap Asset Management March Perspectives: "I Need A Job" Posted: 08 Apr 2012 02:39 PM PDT From IceCap Asset Management March 2012: Just as Mr. Greenspan had a conundrum, so too does Mr. Bernanke. And just as Mr. Greenspan completely misunderstood his conundrum and how to address it, so too does Mr. Bernanke. Mr. Bernanke was very clear that his conundrum is the job market. The reason his brow has become furrowed is due to the eternal question of whether the lack of a strong recovery in jobs is cyclical or structural. Now since most people live in the real World, this concept of cyclical versus structural falls on deaf ears. However, it's actually a very important concept for you to understand and it could even save you a few bucks in your portfolio. Cyclical simply means the regular ebbs and flows of a market. Think of your daily commute to work (if you have a job) – some days are longer, some are shorter but in general they are quite predictable. Structural refers to the underlying foundation and how it supports the system. For example, what happens if suddenly in the middle of the night the bridge everyone uses collapses. Suddenly your commute has become a lot more complicated and will remain complicated for a long time. In the real World, 6 million people had their bridge collapse and lost their jobs. Yet, in Mr. Bernanke's World this cyclical inconvenience could easily be fixed simply by cutting interest rates to 0%, spending billions on "shovel ready" projects, and cutting taxes. Sadly, a funny thing didn't happen - the usual boomerang (or cyclical) rebound in new jobs has not occurred, and for some strange reason the collapsed bridge hasn't been replaced either. The high levels of employment reached during the 2004-2007 period were achieved on the backs of the housing and debt bubbles. During that time, economic growth was boosted by 400% as a result of people taking equity out of their homes (mortgage equity withdrawal). Considering no one has any equity left in their homes to withdraw, economic growth and the jobs that come with it are going to have to find another adrenalin shot. If you know the next big thing – feel free to share it, the World needs it. Full note:

| ||

| Posted: 08 Apr 2012 02:03 PM PDT

By EconMatters

Copper fell more than 3% on Wednesday, April 4, its most in nearly two months after the latest meeting minutes from the U.S. Federal Reserve meeting showed policymakers seem not quite ready to launch further economic stimulus. The red metal did manage to rebound a bit to $3.79 per pound on Friday after the BLS reports showing an improving labor market, and on hopes that China may loosen its monetary policy to avoid a hard landing.

Prices of copper have slid about 5% since hitting their highest levels in nearly five months at $3.9950 per lb in February. China, the biggest copper consumer in the world., reported strong copper and copper product imports in February to 484,569 tons, up 17% over January and imports in the first two months this year were 50% higher than the same time last year (see chart below).

However, rather than a sign of strong end user demand, a lot of the stockpile copper will never get shipped out to end-users because they were bought for speculative reasons. Traders are using copper as collateral for other investments - offshore yuan forwards and interest rate differentials seems to be the most popular trade right now. #000000;">

From Reuters,

According to Reuters, the offshore market, or CNH (Chinese yuan traded in Hong Kong), is largely the result of China's experiment to promote its currency's use in international trade and has traditionally traded at a higher value in dollar terms than the mainland yuan.

The premium for the offshore market has climbed as high as 3% over the onshore rate last year. Local traders estimate some 80-90% of the bonded copper stocks in Shanghai belong to trading houses using imports as a way to get cheaper financing.

This type of financing deals draws world's copper stocks into China depressing local prices, tightening supply outside of China, while distorting other supply, demand and price indicators such as imports data and reported stock levels.

Various projections point to a world copper production deficit of about 250,000 metric tons in 2012 as supply growth continues to lag behind demand growth, and supply and demand is expected to reach balance by 2013. However, analysts estimate that more than 1 million tonnes of mostly unreported commercial stocks of refined copper cathode are currently sitting in warehouses, the highest level since 2009. That's about 4 times of the expected deficit this year, which suggests the current copper market seems more than balanced than most people believe given the slowdown in China's economy.

For now, traders are still bullish on copper as Managed money funds increased their net long position on copper futures and options by 25% in the week ended April 3, according to the data from the CFTC (see chart below).

In the long run, copper price outlook is positive just on rising mining costs, diminishing resource base, and the demand growth expectation. But don't expect copper to break out unless there's a real pickup in consumption, and Chinese players start offloading the surplus stockpile.

From a technical standpoint (see chart above), copper's been trading in the $3.70 to $3.95 per pound range since the start of the year, and should find short-term support at $3.70, with major support at $3.30, major resistance at $4.00. So if you are shorting copper, put the stop at $3.70, but start the long position (with a stop at $4.00) if copper breaks the $4 resistance.

© EconMatters All Rights Reserved | Facebook | Twitter | Post Alert | Kindle | ||

| Betting on the race to the bottom Posted: 08 Apr 2012 02:02 PM PDT Betting on the race to the bottomCourtesy of Bruce Krasting On Monday and Tuesday the market’s attention will be on the USA and the negative economic implications of the Nonfarm payroll (NFP) miss. Market eyes will also be focused on the bond markets in Italy and Spain. As of last Thursday, Europe seemed to be on the verge of another “accident.” The EURCHF closed the week a fraction above the 1.20 peg to the Euro. The Swiss National Bank will likely be forced to show its muscle. While the peg will not break, news of the attack will rile the FX markets. If this scenario plays out, the Yen should benefit against the dollar and the Euro. If the Yen crosses get cheap, I think it will be a good opportunity to short the Yen. As bad as Euroland appears, and as shaky as the USA looks, Japan looks like it might end up winning the race to the bottom.

+

There are two very big issues that Japan is confronting; energy and taxes. Both of these issues will come to a head over the next sixty days. I don’t see a soft landing. Fourteen months ago Japan had 54 operating nukes. Today it has one. By the end of May, it will have none.

The Japanese press is discussing options such restarting the nukes, but many people want to shut them all down: . . There are two significant consequences of the shutdowns: (A) soaring imports of expensive hydrocarbons (LNG, oil and coal), and (B) this summer, there will be as much as a 12% shortfall in electricity to to cool homes and run factories. The shutdown of the nukes has already led to a major turnaround of Japan’s external trade position. In 2011 Japan reported its first annual trade deficit in over 30 years. The shortfall came to Y2.5T ($32B). In 2012 that number could be as large as $100B.

The shortage of “juice” this summer will cause cut backs in supply to big industry. As a result, industrial production will fall. Depending on the severity of the summer slump, Japan could face negative GDP growth for the full year. This will translate into more red ink in the national budget (already 10+% of GDP). More debt will have to be issued to cover the gap. Japan’s already insane Debt to GDP (230%) has nowhere to go but up. Japan is leading the world into trouble as far as demographics go. The Social Security and medical costs of its aging population are exploding. Unlike in the USA, most of the Japanese leaders have acknowledged that the country's position is un-sustainable. Not a day goes by without it being the subject of an article in the press. On March 31, the Noda government formally proposed doubling the consumption tax from 5% to 10% in a desperate effort to shore up the government’s empty coffers. The proposal for new taxes will be debated in the Japanese Diet in April. A final vote is anticipated in June. I doubt this critical legislation will pass. The proposal has opposition from many political directions. It has fierce opponents within Mr. Noda's own party, the Democratic Party of Japan, but the real opposition will come from the Liberal Democratic Party (LDP). Japan’s politics are not unlike that of the USA. The opposition parties will do anything to undermine the efforts of those in power. My reading is that the LDP would support a tax increase as a philosophical matter, but it will oppose Noda’s legislation with the objective of bringing down the government. It’s a good bet that the LDP will succeed, and the Noda government will be forced to call for new national elections. That would be a "worst case” outcome. As of today, polls show that there is substantial opposition to the new tax. Failure to pass new taxes would put Japan on a debt trajectory pointing to infinity. Political instability in Japan is becoming a real issue. The country has had six Prime Ministers in six years. Another recession may kick in this summer. The trade deficit will be at levels never seen before. ($500m USDYEN must be bought every trading day to fund the deficit.) The failure of the country to pass new taxes will force downgrades of the public sector debt. Japan will be on track to exceed 300% Debt to GDP. +

I like USDYEN on the long side at 81 and under. EURYEN is hard to call, and for the time being is a “stay-away”. If the EURYEN cross would somehow get down to around 100, I think it would be“safe” to get long. . . | ||

| India's gold jewelers call off strike, expecting tax rollback Posted: 08 Apr 2012 01:44 PM PDT NEW DELHI -- India's gold-jewelry trade associations agreed Friday to call off a 20-day strike, after Finance Minister Pranab Mukherjee promised to look into rollbacks on newly implemented gold taxes. Indian retailers have been protesting measures, effective March 16, that doubled the import tax on gold to 4% and imposed excise taxes on most gold jewelry. Earlier, the excise tax was applicable only on gold jewelry sold by large, private companies. Imports by India, the world's top consumer of gold, have nearly stopped due to the strike, impacting global prices. "We are more than satisfied after meeting the finance minister," said Bachhraj Bamalwa, chairman of the All-India Gems and Jewellery Trade Federation. "We and all our associated members have decided to call off the strike until May 11 and expect some favorable announcement by the finance minister in Parliament by then." – The Wall Street Journal article continues courtesy of our friends at GATA at the link below. Source: WSJ via GATA | ||

| Exposure of gold market manipulation is producing results Posted: 08 Apr 2012 01:40 PM PDT by C. Powell, GATA.org:

Our friend J.T. writes: "I'm sure you know by now, probably from all the e-mails and comments you've received from GATA members and other 'gold bug' types, that many if not most of us are so 'up to here' with all the information about gold market manipulation that at some level we don't even want to hear it anymore. "We believe it. We know it. We've watched it for years. It's part of our DNA by now. "But many if not most of us are way more than ready for you or someone else to start the new project of what to do about it. "I no longer find much information about the manipulation to be of use. I can watch the manipulation myself. I don't need to be told anymore. I want to know what else we can do. What else is anyone else doing? "We know that the U.S. Commodity Futures Trading Commission and the Securities and Exchange Commission won't do anything. Congress won't do anything. So who will? Are we just waiting around for something to happen, waiting for the 'delivery default' that will set off the short squeeze that probably won't happen because of either a declaration of 'force majeure' or some forced acceptance of fiat in exchange? | ||

| International Forecaster April 2012: Gold, Silver, Economy + More Posted: 08 Apr 2012 01:37 PM PDT by Bob Chapman, The International Forecaster via GoldSeek.com:

| ||

| Posted: 08 Apr 2012 01:02 PM PDT We are going to get more money printing…[yet,] somehow, guys who want to buy stocks at 1,400 on the S&P all conclude that the Fed is going to stop easing…I just don’t understand [when] the consequences of money printing are going to be more inflation and the metals (gold and silver) are going to be a big beneficiary of that. So says*Bill Fleckenstein in excerpts from a King World News interview, as provided by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!). This paragraph must be included in its entirety in any re-posting to avoid copyright infringement. In the interview*Fleckenstein goes on to say, in part: We are in a period now where people don't think we need the metals and the place to be is in stocks. So, now the same people who missed the stock bubble, the real estate bubble and every other problem that we've had, now, once again believe in Goldilocks. Even though the rest of the world is slowing down, somehow, magically it's going to ... | ||

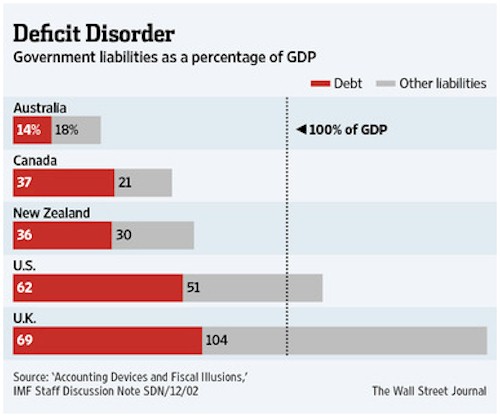

| Posted: 08 Apr 2012 10:22 AM PDT So, here's a formula: take $55 or so trillion of reported total debt (from the Fed's Z-1 report), and $100 or so trillion of unfunded liabilities, and toss in a modest portion of the derivatives that are effectively debt (any thoughts on that one?), and divide by 300 million Americans - we get more than half a million per capita. Anyone have some other suggestions for the formula to determine what the actual debt is for all, and per capita? ~ Ilene We Owe How Much??Courtesy of John Rubino. One of the problems with the debate over the "national debt" is that there's no generally agreed upon definition of that term. Is it what the federal government owes, or what it owes foreigners, or what the whole country, private and public sector together, owes? Does it include off-balance-sheet items and contingent liabilities? There's a hundred-trillion dollar gap between lowest and highest on this spectrum, which allows each commentator to confuse the rest of us by picking the measure that best suits their point of view. New York Times columnist Paul Krugman, for instance, uses "net debt" — the amount that the US owes foreigners — to argue that since this number is relatively small and slow-growing, we're actually fine. Analysts using broader definitions of debt come to the opposite, more apocalyptic conclusion. Consider this from today's Wall Street Journal, on the impact of off-balance-sheet obligations:

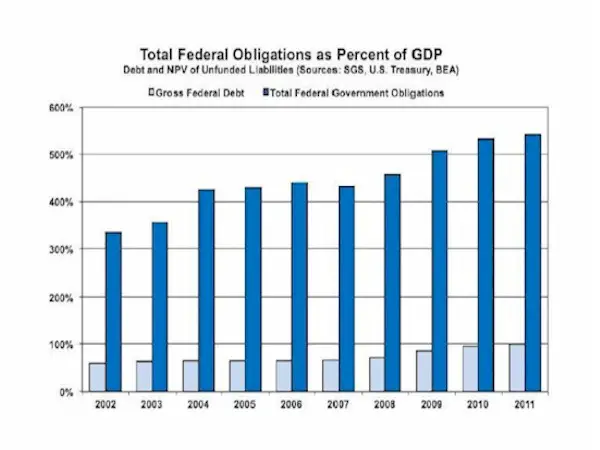

Then there are the "unfunded liabilities" of entitlements like Social Security and Medicare, which dwarf the official national debt. From a recent Zero Hedge article:

Here's a chart (compiled by John Williams' Shadowstats) illustrating the impact of adding unfunded liabilities to the national debt: There are two reasons that debt and unfunded liabilities are treated as separate things: 1) The practice allows government to hide its true obligations in the same way that Enron did — right up to the day it evaporated. In other words, it's a legally sanctioned lie. 2) Debt and unfunded liabilities are, at first glance, different in some ways. Debt is a legal obligation that gives the lender recourse, i.e. some way of getting back some of their money. In the private sector a lender who's not getting paid can seize the borrower's assets or force the latter into bankruptcy court where a judge decides who gets what. With sovereign debt, the creditor (who lent money by buying bonds) can sell those bonds and use the proceeds to buy up the borrower's assets. Unfunded liabilities, in contrast, are simply promises that don't carry a legal obligation. In theory, Medicare could be cancelled tomorrow by Congress. Just like that, the program and its associated unfunded liabilities would disappear. So the question becomes, how real — and therefore how dangerous — are US unfunded liabilities? The answer is that because they represent a promise to tens of millions of retired baby boomers who expect to get free money and health care for the last 30 or so years of life, they're effectively more real an obligation than a Treasury bond. A politician who messes with the Most Selfish Generation's free health care will find himself back in the private sector before the polls close in the next election. Compare this with the probable repercussions of stiffing China or Saudi Arabia on bond interest — some contentious headlines and a bit of turmoil in the foreign exchange markets that most voters would hardly notice — and it's clear that unfunded liabilities have, if anything, a more solid claim on future economic activity in the US than does interest on Treasury bonds. So our true national debt is government debt plus private sector debt plus off-balance-sheet obligations plus unfunded liabilities, which comes to somewhere around half a million dollars per man, woman and child, or two million per family of four. We can't pay this of course, so the story of the next few years will be the search for the least painful way of breaking our promises. And history is pretty clear on this: a country with a printing press will always use it before exploring the harder options of actual default, whether through non-payment of interest or cancellation of benefits. Visit John's Dollar Collapse blog here > | ||

| Greece Launches Rent-A-Cop To Fill Empty Public Servant Coffers Posted: 08 Apr 2012 09:38 AM PDT Now that the time has come to expect Greek March economic data, which will show an acceleration in the total financial collapse of a society which is merely used as an intermediary to bail out insolvent European banks, something that virtually everyone takes for granted, together with a third bailout package sometime in the late summer, we can focus on the more entertaining developments out of the country that has become a symbol of all that is broken in Europe. Such as this story from Greek Protothema that one can now hire a cop for as little as €30/hour. €20 more gives one the option of chosing between the Athenian version of Erik Estrada, together with bike and ambiguous sexual tendencies, or a K-9 option. Finally, for those who are in need of urgent transport from point A to point B in total security, the Greek police choppers can be had for as little as €1500 an hour. In other words, one can own a 24/7 full-time militia of 20 policemen for as little as €14,400 a month. Naturally, the Greek PD has stooped so low because it simply has no money, and in its attempt to protect and serve, it has to do a little paid moonlighting on the side. As to what happens when all the wealthy robber barrons and tax evaders in Greek society end up owning all the officers in circulation, leaving the rest of the country defenseless, well, we are confident the local underworld elements will be more than happy to find out just what the consequences of that particular outcome will be. But at least Greece is still in the euro. And that's all that matters. According to Protothema, police officers can be engaged for example to accompany transports of valuable goods or as bodyguards. There will also be bulk discounts for good customers. Google translated:

So with various government services now being rented out to the highest bidder, how long until prison wardens will be happy to hold open door happy when one of their guests offers them a little "bailout" of their own? Or until the local banks "rent out" their deposit base to other, still solvent banks? Or until virtually any other public servant does whatever he is supposed to do, only if some comparable "rental" payment is incurred? Because that, not with a bang, but a banker-induced, technocrat-facilitated chokehold whimper, is how society dies. But, again, at least Greece is still in the euro. And that's all that matters. | ||

| Blythe Masters Speaks Out On JPM and Market Manipulation Posted: 08 Apr 2012 08:37 AM PDT A number of people have asked me what I think about Blythe Masters' interview on CNBC in which she categorically denies that JPM is involved in anything but legitimate hedging of customer positions in the silver market. I think a detailed description of all of JPM's hedging positions in the futures and derivatives market, and the related customers and bullion holdings, should be supplied to Gary Gensler's CFTC as government regulator so they can look them over. That is what the CFTC has been asked by the people who pay them, the investing public, to do. | ||

| Posted: 08 Apr 2012 08:30 AM PDT For well over a decade GATA has been “ranting” about the evils of the Fed and how the world economy is going to collapse in a heap. Of course, there is an element of truth in all their arguments but the fact is that the world economy has not collapsed in a heap. “Oh but it will, it will, trust us, it will.” | ||

| Ambrose Evans-Pritchard: Gold crash on Fed tightening and euro salvation looks premature Posted: 08 Apr 2012 08:29 AM PDT By Ambrose Evans-Pritchard http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/919336... It has been an unsettling experience for late-comers who joined the gold rush near all-time highs of $1,923 an ounce last September. The slide has become deeply threatening since the US Federal Reserve took quantitative easing (QE3) off the table six weeks ago -- or appeared to do so -- and signalled the start of a new tightening cycle. Spot gold ended the pre-Easter week at $1,636. "The game has changed," says Dennis Gartman, apostle of the long rally who now scornfully tells gold bugs that he is just a "mercenary," not a member of their cult. "They genuflect in gold's direction; we merely acknowledge that it exists as a trading vehicle and nothing more. There are times to be bullish, and times to be bearish ... to every season, as Ecclesiastes tells us." Gold has risen sevenfold from its nadir below $260 in 2001, that Indian summer of American hegemony, when the 10-year US Treasury bond was the ultimate "risk-free" asset and Gordon Brown ordered the Bank of England to auction half its metal. ... Dispatch continues below ... ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. The stock markets of Europe, America, and Japan churned sideways over the same decade, and that precisely is the clinching argument against gold for contrarian traders. You avoid yesterday's stars like the plague. "Gold is far too popular," said James Paulsen from Wells Capital. It has reached a half-century high against a basket of indicators: equities, treasuries, homes, and workers' pay. Each interim low in price has been lower, and chartists tell us that gold's 100-day moving average has fallen through its 200-day average for the first time since March 2009. It is a variant of the "death's cross." Ugly indeed, though Ashraf Laidi from City Index said the more powerful monthly trend-line remains unbroken. Whether or not the global economy has really put the nightmare or 2008-2009 behind it and embarked on a durable cycle of growth is of course the elemental question. The answer depends on what you think caused the crisis in the first place. If you think, as I do, that the root cause was the deformed structure of globalization over the last 20 years -- a $10 trillion reserve accumulation by China and the emerging powers, with an investment bubble in manufacturing to flood saturated markets in the West, disguised for a while by debt bubbles in the Anglo-sphere and Club Med -- then little has changed. In some respects it is now worse. China's personal consumption has fallen to 37 percent of GDP from 48 percent a decade ago. The mercantilist powers (chiefly China and Germany) are still holding on to their trade surpluses through rigged currencies, the dirty dollar-peg, and the dirty D-Mark peg (euro), exerting a contractionary bias on output in the deficit states -- though China at least recognizes that this must change. There is still too much world supply and too little demand, the curse of the inter-war years. That at least is the Weltanschauung of the pessimists. If correct, we face a globalized "lost decade," a string of false dawns as each recovery runs into the headwinds of scarce demand, and debt leveraging grinds on. There are two implications to this: Central banks will have to keep printing money for a long time, and the Asian surplus powers -- as well as Russia and the Gulf states -- will have to find somewhere to park their growing foreign reserves. "These countries don't want other peoples' paper promises any longer," said Peter Hambro, chair of the Anglo-Russian miner Petrovalovsk. "There is no sign yet that we are returning to a well-balanced and normal financial system. The European Central Bank is accepting bus tickets as collateral and the only way out of this debt and banking crisis will be inflation in the end." Russia is raising the gold share of its reserves to 10 percent, buying the dips with panache. China is coy, but Wikileaks cables reveal that Beijing is eyeing "large gold reserves" to back the internationalization of the renminbi. China's declared gold reserves of 1,054 tonnes are tiny, though it may be accumulating on the sly. Sascha Opel from Orsus Consult expects Beijing to boost its holdings by "several thousand tonnes" over the next five years to match the US stash of 8,000 and the Euro zone's 11,000. We do not know whether China's central bank or wealth funds suffered a 75 percent haircut on Greek bonds -- as Norway's petroleum fund did -- but they are undoubtedly nursing large paper losses in other Club Med bonds, and the precedent for EMU sovereign default is now established. The euro zone has become a danger zone. Rules are not upheld. Some bondholders are spared while others are not. Last week's jump in Spanish bond yields to 5.61 percent -- from 4.9 percent a month ago -- should puncture the illusions of those such as France's Nicolas Sarkozy who think the EMU crisis has been solved. The stock line in Berlin, Brussels, and Paris is that premier Mariano Rajoy has needlessly stirred up trouble by refusing to abide by Spain's original fiscal targets, but the contraction of the Spanish economy had made the targets meaningless. To adhere to such demands would have been criminal. As it is, Madrid is embarking on a further fiscal squeeze of 2.5 percent of GDP this year, in the midst of deep recession, with unemployment already at 23.6 percent and rising fast and without offsetting monetary and exchange rate stimulus. Yes, markets are punishing Spain, not Europe's politicians, but that is because bond vigilantes know that the European Central Bank will be very slow to rescue an EMU "rebel" with fresh bond purchases. Agile funds do not want to be left holding Spanish debt while the country is hung out to teach it a lesson. In the meantime, the real M1 deposits have contracted at a 10.9 annual rate over the last six months in the peripheral bloc of Italy, Spain, Portugal, Greece, and Ireland, a leading indicator of trouble later this year. "The rate of contraction has accelerated, not slowed," said Simon Ward from Henderson Global Investors. As for the US, its economy in uncomfortably close to stall speed, and real M1 money has levelled out over the last four months. The underlying pace may not be much more than 1.5 percent. The US Economic Cycle Research Institute is sticking to its recession call, describing the warning signals as "pronounced, persistent, and pervasive." We will see what happens as markets prepare for the "massive fiscal cliff" at the end of the year -- as Ben Bernanke called it -- when stimulus wears off and a tax rises kick in automatically, and as the delayed effect of Brent crude at $125 feeds through. Fed hawks are making much noise, as they did in the Spring of 2008, but Goldman Sachs says they will be forced into QE3 whatever they now hope, probably in June. Hence its call that gold will rally to fresh highs of $1,940 over the next year. Interest rates are falling in real terms as inflation creeps up, and that may be the biggest single driver of gold prices. "Even without QE3, the Fed is still ultra-accommodative and they are about to reverse this," said James Steel, HSBC's gold guru. Mr Steel said the "marginal cost" for mining gold is around $1,450. That is when miners leave low-grade ore in the ground and weaker producers shut down. It creates a natural floor of sorts. Besides, "peak gold" is a more immediate reality than "peak oil," he said. There has been no equivalent to the shale revolution seen in oil and gas. World output has been stuck for a decade at around 2,700 tonnes a year despite a fourfold increase in investment. There are no great finds, no Wittwatersrand this time. There will come a day then the bullion super-cycle finally sputters out. My guess is that it will come once Europe's monetary system has returned to a viable footing -- either by real fiscal union or by breakup -- and once China's renminbi becomes fully convertible and takes its place as the third pillar of the world's currency system. We are not there yet. Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Golden Phoenix Discusses Royalty Mining Growth Strategy Golden Phoenix Minerals Inc. has discussed its royalty mining growth strategy on the Fox Business Network program "21st Century Business" with host Jackie Bales. Golden Phoenix's director of corporate communications, Robert Ian, told how the company narrows its focus to project generation and future royalty streams. He explained why Golden Phoenix believes it's better to own joint-venture interests in several producing mines instead of full exposure to just one project. "21st Century Business" has been airing for 15 years. Previous hosts have included Gen. Alexander Haig, Gen.l Norman Schwarzkopf, and Secretary of Defense Caspar Weinberger. Golden Phoenix appeared as paid programming on this broadcast. To view the program with Golden Phoenix, please visit Golden Phoenix's Internet site here: http://www.goldenphoenix.us/company-videos.html | ||

| China investing in foreign mines and buying gold directly Posted: 08 Apr 2012 08:11 AM PDT China to Maintain Golden Focus By Robin Bromby http://www.theaustralian.com.au/business/opinion/china-to-maintain-golde... It was just the tip of the iceberg. We're talking about last week's move by Zijin Mining Group to launch a $299 million bid for Norton Gold Fields, which operates the Paddington goldmine near Kalgoorlie. There was some surprise expressed at this. While Chinese companies have been snapping up bulk and base metals projects around the world, it was generally thought they had little interest in picking up gold projects. Think again. A very reliable source close to several gold companies tells us Chinese interests are not only taking stakes in explorers and miners, they are also buying gold directly from producers and shipping it home. There is much talk in gold bug circles in the United States that the recent purchase by the Bank of International Settlements of more than 4 tonnes of gold may have been wholly or in part on behalf of the People's Bank of China. ... Dispatch continues below ... ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf Our source is quite clear on one thing: The move on NGF is just the beginning. China wants more gold and it doesn't want to pay full market price for it (as it doesn't for any mineral) so it will be looking to pick up more Australian gold producers and add the yellow metal to its existing central bank gold pile. Not something the Perth Mint will be happy to hear. Chinese interests took control last year at Laverton-area goldminer A1 Minerals, now renamed Stone Resources after its Hong Kong parent. That parent took an unsuccessful lunge also at Crescent Gold. Last year a Chinese consortium spent $US79 million on a 17.7 per cent holding in Gold One International. Chinese interests spent $80 million to buy the controlling stake in Australian-owned Zara gold project in Eritrea and Yunnan Tin owns 12.3 per cent of YTC Resources, which is developing the Hera goldmine near Cobar in New South Wales. And Sovereign Gold, which featured here two weeks ago for uncovering long lost shafts on the Rocky River-Uralla goldfield in northern NSW, has subsequently signed up partner Jiangsu Geology & Engineering to pay $4 million to buy 30 per cent of two tenements. Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum (TSXV: NKL) and Ursa Major Minerals Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) and Ursa Major Minerals Inc. have signed a binding letter of agreement for a business combination through a proposed all-share transaction. In doing so Prophecy and Ursa have acted at arm's length and the transaction has been negotiated at arm's length. Prophecy will issue one common share in exchange for every 25 outstanding common shares of Ursa. Ursa options and warrants will be exchanged for options and warrants of Prophecy on an agreed schedule. Prophecy's offer represents a value of about $0.15 per each common share of Ursa based on Prophecy's share price of $3.70 as at March 1, representing a premium of 130 percent to Ursa's March 1 closing price of $0.065. Prophecy is to subscribe for $1 million common shares of Ursa by way of private placement financing at $0.06 per share, subject to regulatory approval. Upon placement completion, John Lee and Greg Hall, current Prophecy directors, will be appointed to Ursa's board. Prophecy thus will become a mid-tier resource company with a robust and -- The fully permitted open-pit Shakespeare PGM-Ni-Cu mine close to Sudbury, Ontario, infrastructure with near-term production capabilities. -- The flagship Wellgreen (Yukon) PGM-Ni-Cu project with more than 10 million ounces of Pt-Pd-Au inferred resource. Drilling is under way and a preliminary economic assessment study is pending. -- Manitoba's Lynn Lake Ni-Cu project with more than 262 million pounds Ni and 138 million pounds Cu measured and indicated. For the complete announcement, please visit Prophecy Platinum's Internet site here: http://www.prophecyplat.com/news_2012_mar02_prophecy_platinum_ursa_major... | ||

| Tedbits: Jaws of DEATH; Wind Shear; Bombs and Breakouts; Red Tape Rising Posted: 08 Apr 2012 07:27 AM PDT Jaws of DEATH As leviathan government, Central Bankers and the welfare states battle Mother Nature and Darwin, the stakes for the global banksters and elites could not be higher. Governments in the US and Europe are striving to place debt and legal shackles on those they pretend to serve and working for the interests of banksters, power-hungry public servants and entrenched government bureaucrats against that of their own constituents. Welfare states on both sides of the Atlantic are creating legions of government dependents to justify their TAKINGS of the private sector. Having already spent the money they have collected and borrowed since Bretton Woods II, credit markets are REJECTING their requests for further lending. New sources of REVENUES must be found since they have effectively DESTROYED wealth and income creation in their economies. So it's off to the printing press and PROGRESSIVE, rubber-stamp legislatures they go. Using FEAR, FORCE and runaway legislation/regulation to achieve their goals of domination, unaccountable socialists in Washington and Brussels are working overtime with their mainstream media to dupe and subjugate their constituents. The public misunderstands socialism. They think socialism is the government transferring wealth from the rich to the poor. NO, it is the transfer of wealth from the poor and confiscating the fruits of the private sector for government to spread as thin gruel for all. It is misery spread widely for all. The Jaws of DEATH spell doom for the dollar over the long term. This is the mother and father of dozens of BLACK SWANS throughout the financial systems of the world. What are the Jaws of Death you ask? Take a look:

See that YAWNING gap on the right side of that chart? That is the Jaws of DEATH. It is signaling the UNFOLDING demise of the US dollar and ultimately the financial systems of the WORLD. Keep in mind this DOES NOT include the Social Security holiday, the extension of unemployment insurance or the theft of Social Security, Medicare or Highway Trust funds which would add another 5% to the GAP. This is the demise of the world's financial systems on the HORIZON. In a fiat currency world everything is a DERIVATIVE of the dollar. Why? Because between 60 and 70% of most of the major central banks' RESERVES are dollar denominated. They and US treasuries are the FOUNDATIONS of the world's major currencies. When they become worthless the foundations of all the major central banks will COLLAPSE. It is inevitable. It has happened to every fiat currency in HISTORY, and this time will be NO DIFFERENT. Continue Reading This Article - Click Here | ||

| America: A Government Out Of Control Posted: 08 Apr 2012 04:44 AM PDT

Something odd and not quite as planned happened as America grew from its "City on a Hill" origins, on its way to becoming the world's superpower: government grew. A lot. In fact, the government, which by definition does not create any wealth but merely reallocates it based on the whims of a select few, has transformed from a virtually invisible bystander in the economy, to the largest single employer, and a spending behemoth whose annual cash needs alone are nearly $4 trillion a year, and where tax revenues no longer cover even half the outflows. One can debate why this happened until one is blue in the face: the allures of encroaching central planning, the law of large numbers, and the corollary of corruption, inefficiency and greed, cheap credit, the transition to a welfare nanny state as America's population grew older, sicker and lazier, you name it. The reality is that the reasons for government's growth do not matter as much as realizing where we are, and deciding what has to be done: will America's central planners be afforded ever more power to decide the fates of not only America's population, but that of the world, or will the people reclaim the ideals that the founders of this once great country had when they set off on an experiment, which is now failing with every passing year? As the following video created by New America Now, using content by Brandon Smith whose work has been featured extensively on the pages of Zero Hedge, notes, "we tend to view government as an inevitability of life, but the fact is government is not a force of nature. It is an imperfect creation of man and it can be dismantled by man just as easily as it can be established." Unfortunately, the realization that absolute power corrupts absolutely, and absolute central planning leads to epic catastrophes without fail, seems a long way away: most seem content with their lot in life, with lies that their welfare money is safe, even as the future is plundered with greater fury and aggression every passing year, until one day the ability to transfer wealth (benefiting primarily the uber rich, to the detriment of the middle class which is pillaged on an hourly basis), from the future to the present is gone, manifesting in either a failed bond auction or hyperinflation. The timing or shape of the transition itself is irrelevant, what is certain is that America is now on collision course with certain collapse unless something changes. And one of the things that has to change for hope in the great American dream to be restored, is the role, composition and motivations of government, all of which have mutated to far beyond what anyone envisioned back in 1776. Because America is now saddled with a Government Out Of Control. Watch the two clips below to understand just how and why we have gotten to where we are. Also watch it to, as rhetorically asked by the narrator, prompt us to question whether the government we now have is still useful to us and what kind of powers it should be allowed to wield.

| ||

| Posted: 07 Apr 2012 10:03 PM PDT The Coming Paradigm Shift in Silver Paradigm Shift: —n, a radical change in underlying beliefs or theory The coming paradigm shift in silver will not happen due to technical analysis, fundamentals, or supply & demand forces, but rather due to … Continue reading | ||

| Chris Duane Explains Why Silver Confiscation Won't Happen--06.Apr.2012 Posted: 07 Apr 2012 10:03 AM PDT FinancialSurvivalNetwork.com presents: Chris Duane has just finished a new video about silver confiscation and why it's not going to happen. Many people are concerned about the ever-expanding government. We fear that eventually our silver will be confiscated, just like gold was in the 1930's. This is a highly unlikely occurrence, as there are too many large, attractive confiscation candidates, such as: COMEX, GLD, SLV and the other major dealers. Going house-to-house to seize physical holdings of precious metals is just not practical and could lead to violent backlashes. Chris and I also discussed why Homeland Security needs 450 million rounds of .40 caliber ammunition and 20,000 cleaning kits. It sounds much more like a lucrative corpratist giveaway that the government has become so expert at over the years. That's not to say you shouldn't be concerned, but rather there are much more important matters right now that need your attention, like building your financial survival plan. Go to FinancialSurvivalNetwork.com for the latest info on the Economy, Markets and Precious Metals. This posting includes an audio/video/photo media file: Download Now |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

As reported earlier, the

As reported earlier, the  Investor Marc Faber is still warning about the horrible future that awaits us.

Investor Marc Faber is still warning about the horrible future that awaits us.

Dear Friend of GATA and Gold:

Dear Friend of GATA and Gold: We've all heard the old adage about adding insult to injury but the IMF has turned it into an art form. The new IMF Director, Christine Lagarde, came to Washington this week begging for yet more billions so the fund can continue propping up insolvent European banks and wrapping developing countries around the globe in debt chains. Lagarde is on a political junket with the aim of raising an additional $500 billion for the IMF, money that will be used for future Eurozone bailouts and other financial crises, or so they say. The speech was delivered 64 years to the day after Truman's signing of the Marshall Plan (coincidence, surely) as she asked the American taxpayers to search their hearts, take one for the team and dig deep to help foot the bill for Europe. Except this is not 1948 and Europe is not recovering from the Nazis. It's 2012 and the Eurozone is falling apart at the seams because it was a failed concept from the beginning. The cracks in the Euro have been showing for years, despite the best efforts of the Goldman Sachs gang to paper over the debt swap deal that helped Greece lie its way into the Eurozone and helped Goldman earn 12 percent of its entire trading and investment revenue in 2001 on a single day. Lagarde didn't mention this in her speech, but she did assure the crowd that at the IMF "your money is used prudently."

We've all heard the old adage about adding insult to injury but the IMF has turned it into an art form. The new IMF Director, Christine Lagarde, came to Washington this week begging for yet more billions so the fund can continue propping up insolvent European banks and wrapping developing countries around the globe in debt chains. Lagarde is on a political junket with the aim of raising an additional $500 billion for the IMF, money that will be used for future Eurozone bailouts and other financial crises, or so they say. The speech was delivered 64 years to the day after Truman's signing of the Marshall Plan (coincidence, surely) as she asked the American taxpayers to search their hearts, take one for the team and dig deep to help foot the bill for Europe. Except this is not 1948 and Europe is not recovering from the Nazis. It's 2012 and the Eurozone is falling apart at the seams because it was a failed concept from the beginning. The cracks in the Euro have been showing for years, despite the best efforts of the Goldman Sachs gang to paper over the debt swap deal that helped Greece lie its way into the Eurozone and helped Goldman earn 12 percent of its entire trading and investment revenue in 2001 on a single day. Lagarde didn't mention this in her speech, but she did assure the crowd that at the IMF "your money is used prudently."

No comments:

Post a Comment