Gold World News Flash |

- April 5, 1933 : Gold Confiscation Executive Order #6102

- This Month In Fascism

- Peak Civilization: MIT Research Team Predicts Global Economic Collapse and Precipitous Population Decline

- Blizzard of Printing Looms on Horizon

- Eveillard - Mass of Government Debt Underpinning Gold Market

- Gold Resistance Expected at 1638

- Gold Seeker Closing Report: Gold and Silver Gain About 1%

- Silver Update 4/5/12 Apple Bubble

- One of the 'Masters' of the universe gets a market manipulation question on CNBC

- The Gold Price Closed $1,628.50 Up $16.20 Down for the Week

- JPMorgan Trader Accused Of "Breaking" CDS Index Market With Massive Prop Position

- A Golden Idea

- London Trader – Fed's Global War Against Gold Escalating

- HILARIOUS: Blythe Masters on CNBC – Refutes Claims that JP Morgan Manipulates Silver Markets

- The Most Terrifying Aspect of Our Lives

- Greece: Even Corruption Is In A Deep Recession

- It speaks

- Gold: The Big Lie

- Misguided Faith in an Economic Recovery

- Stratigraphy and host rock controls of gold deposits of the northern Carlin Trend

- Commodities Recover As AAPL Saves The Tech Sector

- Asia breaks West's code in gold war, London trader tells King World News

- SBSS 18. Silver Confiscation

- Gold Daily and Silver Weekly Charts - The Dr. Evil Strategy and Some Targets

- Commodities at Risk of Deeper Losses as Euro Debt Fears Reemerge

- Eat the Rich

- London Trader - Fed’s Global War Against Gold Escalating

- Weekly Gold Chart

- Why is Turkey Turning to Gold?

- Gold to Spike to New Record by Years End

| April 5, 1933 : Gold Confiscation Executive Order #6102 Posted: 05 Apr 2012 05:45 PM PDT |

| Posted: 05 Apr 2012 05:26 PM PDT America Slides Into FascismThe U.S. Supreme Court, based on the urging of the Obama administration,- has ruled that any prisoner - even those arrested for offenses such as dog leash laws, peaceful protests, and driving with an expired license - can be subject to a routine strip search upon entering prison.

The government is also openly saying that it will use all of our smart devices, internet connections, and tv to spy on Americans. President Obama has issued an executive order entitled "National Defense Resources Preparedness", which instructs the heads of various U.S. agencies to be on standby for authorization of martial law under by the Secretary of the Department of Homeland Security. The order in fact gives Executive Branch immediate to power to seize and control of any and all assets declared as critical to maintain its industrial and technological base and to control the general distribution of any material (including applicable services) in the civilian market. The order further authorizes the immediate issuance of regulations to allocate, ration, or seize and all materials, including every thing from food, live stock and farm equipment to transportation, energy and even water. (However, some commentators say that this new executive order is only a minor tweak of previous executive orders dating back to 1994.) Yawning or having goose bumps have been added to the list of things acts which might get you labeled as a potential terrorist. Senators Ron Wyden and Mark Udall recently made a statement that Americans would be "stunned" if they knew how the American Government is interpreting, applying and using the Patriot Act: The National Security Agency is building a $2 billion dollar facility in Utah which will use the world's most powerful supercomputer to monitor virtually all phone calls, emails, internet usage, purchases and rentals, break all encryption, and then store everyone's data permanently. A former head of the program held his thumb and forefinger close together, and said:

|

| Posted: 05 Apr 2012 05:03 PM PDT by Mac Slavo, SHTFPlan:

The recent study, completed on behalf of The Club of Rome, an organization which issued it's own findings on 'peak everything' back in the 1970′s in a controversial environmental report dubbed The Limits to Growth (video), takes into account the relations between various global developments and produces computer simulations for alternative scenarios. |

| Blizzard of Printing Looms on Horizon Posted: 05 Apr 2012 04:33 PM PDT from Gold Money: For some, the news blurb put out by Bloomberg, "Jobless Claims in U.S. Decrease to Lowest Level in Four Years," is enough to believe that the economy is improving. But as usual, looking at the details matters, this will be the third consecutive 'miss' of expectations, and the previous numbers are constantly being revised for the worse behind the backs of market watchers.

|

| Eveillard - Mass of Government Debt Underpinning Gold Market Posted: 05 Apr 2012 04:20 PM PDT  Today legendary value investor, Jean-Marie Eveillard told King World News that many governments have their backs against the wall. But first, Eveillard, who oversees $50 billion at First Eagle Funds, had these observations about what is happening in the gold market: "I was in Paris for the past two weeks and while I was in Paris there was one evening where I was watching Bloomberg and I saw that Marc Faber was being interviewed." Today legendary value investor, Jean-Marie Eveillard told King World News that many governments have their backs against the wall. But first, Eveillard, who oversees $50 billion at First Eagle Funds, had these observations about what is happening in the gold market: "I was in Paris for the past two weeks and while I was in Paris there was one evening where I was watching Bloomberg and I saw that Marc Faber was being interviewed." This posting includes an audio/video/photo media file: Download Now |

| Gold Resistance Expected at 1638 Posted: 05 Apr 2012 04:15 PM PDT courtesy of DailyFX.com April 05, 2012 12:56 PM Daily Bars Prepared by Jamie Saettele, CMT Focus remains on early year pivots at 1600/10. As highlighted last week, price is testing a long term trendline that extends off of the 2008, 2010, and December 2011 lows. A break of such a well-defined trendline would signal a significant shift. Near term resistance is 1638. Bottom Line (next 5 days) – lower... |

| Gold Seeker Closing Report: Gold and Silver Gain About 1% Posted: 05 Apr 2012 04:00 PM PDT Gold climbed to $1630.20 by about 4AM EST before it fell back to $1619.99 in the next couple of hours of trade, but it then rose to a new session high of $1633.40 in New York and ended with a gain of 0.76%. Silver slipped back to $31.203 in London, but it then rose to as high as $31.805 in New York and ended with a gain of 1.44%. |

| Silver Update 4/5/12 Apple Bubble Posted: 05 Apr 2012 03:43 PM PDT |

| One of the 'Masters' of the universe gets a market manipulation question on CNBC Posted: 05 Apr 2012 02:40 PM PDT 10:50p ET Thursday, April 5, 2012 Dear Friend of GATA and Gold (and Silver): Though the monetary metals have been under the most severe attack for the last few weeks, today may be considered a great victory for our side, insofar as a softball interviewer on CNBC managed to question JPMorganChase commodity executive Blythe Masters about whether the bank is manipulationg the metals markets: http://video.cnbc.com/gallery/?video=3000082631 Masters acknowledged that this has become an issue. "There's been a tremendous amount of speculation, particularly in the blogosphere, on this topic," she told CNBC. "I think the challenge is it represents a misunderstanding of the nature of our business. ... Our business is a client-driven business where we execute on behalf of clients to achieve their financial and risk-management objectives. ... We have offsetting positions. We have no stake in whether prices rise or decline." The latter remark caused a bit of a sensation and mockery on our side but it was, in fact, only what JPMorganChase CEO Jamie Dimon said several times a few years ago when similar questions about monetary metals market manipulation were put to him -- that the bank has little exposure of its own in those markets and that the metals positions on the bank's books are client positions. ... Dispatch continues below ... ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. As Morgan's positions in not only the monetary metals markets but also the interest-rate derivatives markets are beyond comprehension and what any private company could possibly carry on its own, GATA has always believed Dimon (and today believes Masters too) and has long maintained that the positions on Morgan's books are actually U.S. government positions and that the bank is essentially a government agency. For example: http://www.gata.org/node/11159 GATA consultant Rob Kirby of Kirby Analytics in Toronto has often written in detail about the government-MorganChase connection: http://news.goldseek.com/GoldSeek/1326469500.php http://news.silverseek.com/SilverSeek/1301340431.php http://news.goldseek.com/GoldSeek/1322414866.php After all, MorganChase has 150 years of experience in market rigging and fronting for the U.S. government at critical moments. This is a matter of public record and established history extending from the bank's Federal Reserve-engineered acquisition of Bear Stearns & Co. in 2008 back to the panics of 1893 and 1907, when the bank was run by its founder, the financier and industrial monopolist J.P. Morgan himself, who arranged bailouts not for the government but of the government and considered it his civic duty to do so: http://en.wikipedia.org/wiki/J._P._Morgan In Chapter 7 of her prize-winning 1999 biography, "Morgan: American Financier" -- http://www.amazon.com/Morgan-American-Financier-Jean-Strouse/dp/00609558... -- Jean Strouse describes how Morgan's first big score came in the fall of 1863, when, perhaps foreshadowing his firm's current endeavors, he cornered the gold market in New York. Watching today's CNBC interview with Masters, Zero Hedge's Tyler Durden figured things out quickly: http://www.zerohedge.com/news/blythe-masters-blogosphere-silver-manipula... "JPMorgan has intimate access to U.S. government officials, and particularly the Federal Reserve, which will in turn take advantage of all JPM facilities, including its trading desk, to preserve the sanctity and foundations of the +$30 trillion in custodial assets and the rehypothecation system, which further means that any potential implication that fiat money is impaired has to be wiped out. ... Soaring prices of gold and silver are the primary if not only means left to express rising doubts not just of the future viability of the dollar but of the viability of the fiat system in the first place. Which means that the Fed is, without a doubt, one of the biggest 'clients' of JPM in a symbiotic crosshold, where what the Fed wants JPM has to execute and vice versa. ... "There is one simple explanation that would make Blythe's story 100 percent correct: Would JPMorgan consider the Fed, whose interests are in keeping the price of precious metals as low as possible and are aligned with those of JPM for the reasons listed above, its client? Because, if so, then absolutely everything falls into place, as JPMorgan is merely the overt conduit by which the Fed, and specifically the New York Fed, conducts monetary policy in the commodities space, just as [the New York Fed's] Brian Sack would conduct open market operations in the bond arena, and as the New York Fed uses, on occasion, Citadel and its high-frequency trading expertise to execute its discretionary stock trades. (Yes, we know about those too.)" Or as GATA's Washington conference heard four years ago this month, "There are no markets anymore, just interventions": But in discouragement people increasingly ask us: How much longer will all this go on? What will stop it? GATA sure doesn't know, as there are too many variables, like how much real metal is left to the Western central banks for market rigging and how much more they are ready to lose; the strategy of those nations that would escape or even overthrow the dollar empire; and the perceptiveness and indignation of the American people themselves, or their lack of such virtues. We'd like to think the outcome will have something to do with our work. But probably it will be determined only by what usually brings down the bad guys -- themselves, when they go too far and wake up even the morons and enrage even the timid. The same question -- how much longer? -- was often put to the greatest liberator of modern times, Martin Luther King Jr. Marching right up to the face of the most evil hatefulness in Montgomery, Alabama, in March 1965 (your secretary/treasurer's father was in the march too), King proclaimed a religious faith in justice. He answered, "Not long," and quoted James Russell Lowell: Truth forever on the scaffold, Wrong forever on the throne, http://www.youtube.com/watch?v=TAYITODNvlM But Lowell's next two lines may be consolation for us tonight as well: We see dimly in the present what is small and what is great, For if one of the "Masters" of the universe now gets market manipulation questions even on CNBC, the word is getting out, and we'll press on in the morning, if only out of spite. We can't let the bad guys think that nobody is on to them. CHRIS POWELL, Secretary/Treasurer Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Golden Phoenix Discusses Royalty Mining Growth Strategy Golden Phoenix Minerals Inc. has discussed its royalty mining growth strategy on the Fox Business Network program "21st Century Business" with host Jackie Bales. Golden Phoenix's director of corporate communications, Robert Ian, told how the company narrows its focus to project generation and future royalty streams. He explained why Golden Phoenix believes it's better to own joint-venture interests in several producing mines instead of full exposure to just one project. "21st Century Business" has been airing for 15 years. Previous hosts have included Gen. Alexander Haig, Gen.l Norman Schwarzkopf, and Secretary of Defense Caspar Weinberger. Golden Phoenix appeared as paid programming on this broadcast. To view the program with Golden Phoenix, please visit Golden Phoenix's Internet site here: http://www.goldenphoenix.us/company-videos.html |

| The Gold Price Closed $1,628.50 Up $16.20 Down for the Week Posted: 05 Apr 2012 01:25 PM PDT Gold Price Close Today : 1,628.50 Gold Price Close 30-Mar : 1,669.30 Change : -40.80 or -2.4% Silver Price Close Today : 3171.6 Silver Price Close 30-Mar : 3246.9 Change : -75.30 or -2.3% Gold Silver Ratio Today : 51.346 Gold Silver Ratio 30-Mar : 51.412 Change : -0.07 or -0.1% Silver Gold Ratio : 0.01948 Silver Gold Ratio 30-Mar : 0.01945 Change : 0.00002 or 0.1% Dow in Gold Dollars : $ 165.78 Dow in Gold Dollars 30-Mar : $ 163.61 Change : $ 2.17 or 1.3% Dow in Gold Ounces : 8.020 Dow in Gold Ounces 30-Mar : 7.915 Change : 0.11 or 1.3% Dow in Silver Ounces : 411.78 Dow in Silver Ounces 30-Mar : 406.91 Change : 4.87 or 1.2% Dow Industrial : 13,060.14 Dow Industrial 30-Mar : 13,212.04 Change : -151.90 or -1.1% S&P 500 : 1,398.08 S&P 500 30-Mar : 1,408.47 Change : -10.39 or -0.7% US Dollar Index : 80.070 US Dollar Index 30-Mar : 78.949 Change : 1.121 or 1.4% Platinum Price Close Today : 1,600.00 Platinum Price Close 30-Mar : 1,639.40 Change : -39.40 or -2.4% Palladium Price Close Today : 646.10 Palladium Price Close 30-Mar : 653.90 Change : -7.80 or -1.2% It's a bit too soon after this week's fall to speak definitely about the silver and GOLD PRICE, but Mercy! I seldom can speak too definitely about anything, markets being what they are. SILVER and GOLD PRICE both dropped over 2% this week, but bounced back today. Since this is the last day of trading before a long holiday, today's bounce really says very little, as successful shorts would have been closing out positions today and that alone would have floated markets a little. The GOLD PRICE rose $16.20 to $1,628.50. It reached for that $1,630 support resistance, even touched $1,633.40, but couldn't break through. Low came at $1,608, a bit lower than yesterday's $1,612.30. The SILVER PRICE bounced 68.7c to 3171.6c when Comex closed. GOLD SILVER RATIO dropped a little, to 51.346, which smiles on an optimistic outlook. Both silver and gold are skidding down the OUTside of a downtrend line from the September highs. This is the same downtrend line they broke thru headed up in January. As long as Gold doesn't close below $1,600 nor silver below 3000c, we won't see lower prices. Back in the 1970s everybody went ga-ga for bell-bottomed pants, first time they had been in style since the 1930s. Today, you couldn't give 'em away, nor that burnt orange polyester leisure suit you wore back then, with the tie so wide you didn't really need a shirt. Fashions change, and so 'tis with this recent craze for the scrofulous US dollar. It will pass. Keep your eyes on the horizon. Silver and gold remain in a primary uptrend, and haven't even posted a third of their final bull market gains yet. Stocks have eroded all week, having touched 13,300 Monday and tumbled downhill ever since. Big blow to morale came with the S&P500 dropping under 1,400. Dow today closed down 14.61 at 13,060.14, a new low close for the move. S&P closed virtually unchanged at 1,398.08, down 0.88. Market looked confused with the Nasdaq and Nasdaq 100 rising slightly. Once the Dow breaks 13,000, investors will look like the yankee army leaving First Manassas. US dollar index finally eased above 80 today, closing 80.07, up a massive 2.3 basis points. Watch to see if dollar index can clear 80.74, the last high. Otherwise it's merely inflicting more sideways torture. The euro has taken the dollar's little spate of strength (I am too intellectually fastidious to discuss the cause of the dollar's strength, namely, ovine investors gullible enough to believe the dollar will strengthen under the Fed's wise guidance) pretty hard, and has collapsed this week. Today it ended at $1.3066, down 0.58%. It has gapped down twice this week, and now stands below all its moving averages, including the crucial 62 DMA. Euro has resumed its trajectory toward $1.2000. Yen, on the other hand, has stiffened up this week and confirmed a bottom by rising above its 20 DMA. Closed today 121.48c (Y82.31). Will continue to rise -- for no fundamental reason -- until the Nice Government Men again decide to knock it down. Sunday will be the first Sunday after the full moon following the Spring equinox -- in other words, the date the First Council of Nicaea set for celebrating Easter. Because the Eastern Church still uses the Julian Calendar to calculate the date, their Easter falls on a different date that the date the Western Church celebrates. However you calculate it, may God grant you all a memorable celebration of Christ's resurrection! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| JPMorgan Trader Accused Of "Breaking" CDS Index Market With Massive Prop Position Posted: 05 Apr 2012 12:36 PM PDT Earlier today we listened with bemused fascination as Blythe Masters explained to CNBC how JPMorgan's trading business is "about assisting clients in executing, managing, their risks and ensuring access to capital so they can make the kind of large long-term investments that are needed in the long run to expand the supply of commodities." You know - provide liquidity. Like the High Freaks. We were even ready to believe it, especially when Blythe conveniently added that JPM has a "matched book" meaning no net prop exposure, since the opposite would indicate breach of the Volcker Rule. ...And then we read this: "A JPMorgan Chase & Co. trader of derivatives linked to the financial health of corporations has amassed positions so large that he's driving price moves in the multi-trillion dollar market, according to traders outside the firm." Say what? A JPMorgan trader has a prop (not flow, not client, not non-discretionary) position so big it is moving the entire market? And we are talking hundreds of billions of CDS notional. But... that would mean everything Blythe said is one big lie... It would also mean that JPMorgan is blatantly and without any regard for legislation, ignoring the Volcker rule, which arrived in the aftermath of Merrill Lynch doing precisely this with various CDO and credit indexes, and "moving the market" only to blow itself up and cost taxpayers billions when the bets all LTCMed. But wait, it gets better: "In some cases, [the trader] is believed to have "broken" the index -- Wall Street lingo for the market dysfunction that occurs when a price gap opens up between the index and its underlying constituents." So JPMorgan is now privately accused of "breaking" the CDS Index market, courtesy of its second to none economy of scale and fear no reprisal for any and all actions, and in the process causing untold losses to, you guessed it, its clients, but when it comes to allegations of massive manipulation in the precious metals market, why Blythe will tell you it is all about "assisting clients in executing, managing, their risks." Which client would that be - Lehman, or MFGlobal? Perhaps it is time for a follow up interview, Ms Masters to clarify some of these outstanding points? From Bloomberg:

So how long until Bruno Iksil, and his massive one way bet, becomes the next Glenn Hadden, or the next Howie Hubler, or the next Boaz Weinsten? And how long until US taxpayer have to bail him out, either with direct rescue money, or with commingled deposits used to plug trading losses? Because MFGlobal was just an appetizer as to how JPM operates with "segregated" money. Repeating the punchline again, because it bears repeating.

And that, for those confused, is how JPMorgan operates: they lie about everything, fully aware they have perpetual immunity because they are more powerful than the Fed (just recall Jamie Dimon's symbolic spitting in the face of Ben Bernanke), they are a tri-party repo dealer thus in the center of the entire shadow banking system, and have the biggest single-bank derivative exposure in the world, at $70 trillion as of December 31. JPMorgan is modern finance. And because of they they can and will get away with everything, lying on prime time TV most certainly included. Yet while JPMorgan may manipulate the gold, silver, or any other market, for its or the Fed's agenda, there is a silver lining: it allows everyone to buy physical assets at artificially deflated paper spot prices. And for that, JPM should be thanked. Because until the grand reset takes place, JPMorgan will never be held accountable for any of its actions in the current status quo regime. Period. |

| Posted: 05 Apr 2012 12:03 PM PDT Dear Friends, What we need is the second coming of a determined trader so convinced of his/her opinion and feel for the market that taking on the gold banks would seem like a divine calling. The same stuff we see today went on in the great gold bull market of the 1970s. Then I Continue reading A Golden Idea |

| London Trader – Fed's Global War Against Gold Escalating Posted: 05 Apr 2012 11:55 AM PDT Dear CIGAs, With many global investors still rattled by the price action of gold and silver, today King World News interviewed the "London Trader" to get his take on these markets. Here is what the source had to say: "Gold was trashed on Monday, while the Fed minutes essentially said nothing. When a central Continue reading London Trader – Fed's Global War Against Gold Escalating |

| HILARIOUS: Blythe Masters on CNBC – Refutes Claims that JP Morgan Manipulates Silver Markets Posted: 05 Apr 2012 11:21 AM PDT [Ed. Note: This is priceless... "JP Morgan strongly supports the need for improved regulation in the financial markets..."] from bearishtrader : |

| The Most Terrifying Aspect of Our Lives Posted: 05 Apr 2012 11:12 AM PDT by Andy Hoffman, MilesFranklin.com:

That said, I'd be happy to address Radek's topic, per his condensed thoughts on the subject below: Gold manipulation/bashing makes it even more difficult for ordinary people to find that PMs are a simple and reliable mean of storing the fruits of their labor for the time they need it the most. The current system, maintained by gold manipulation, keeps the majority of the people constantly insecure about their financial well being, forcing them to work longer hours. It steals time from people which otherwise could/would be used for self education or charity. We need honest money system where the fruits of labor can be retained and commandeered by the workers. |

| Greece: Even Corruption Is In A Deep Recession Posted: 05 Apr 2012 11:05 AM PDT Wolf Richter www.testosteronepit.com Transparency International just published the results of its 2011 National Survey on Corruption in Greece, which tried to sort out the kind of bribery and petty corruption that households had to deal with in their daily lives, and the results were sobering, as they tend to be with corruption surveys—but in an unexpected way: for those asking for bribes, an outright depression has commenced. Corruption is an issue in Greece. In the Corruption Perception Index 2011, which covers 182 countries, Greece is in 80th place, sharing that honorable position with Colombia, El Salvador, Morocco, Peru, and Thailand. It is worse even than China whose corruption is legendary. It is in last place within the Eurozone which prides itself in its clean way of doing business. But they’re not that clean either: for holier-than-thou Germany, the cost of corruption has reached a quarter trillion euros! Read.... The Rising Cost of Corruption in Germany. The survey, the fifth since 2007, measured “petty corruption” of the type that touched average folks in a routine manner and not the type of high-level corruption where millions are involved. It relied on questionnaires sent to a sample of 12,000 households. Respondents reported that the number of petty corruption incidents in the public sector edged up from 7.2% in 2010 to 7.4% in 2011. They fell in the private sector from 4% in 2010 to 3.4% in 2011. The worst offenders were hospitals within the state-owned healthcare apparatus; next were tax offices and construction licenses. The price list for fakelaki—little brown envelopes—has a broad range. At state-owned hospitals, for example, the rock-bottom bribe for getting some surgery done will set you back a still affordable €100. At the upper end, however, it’s a whopping €30,000. That’s just to get into surgery. The national health system, which is administered by IKA, pays for the surgery itself. To get catapulted up the waiting list costs as well, with prices ranging from €30 at the very bottom, maybe to get ahead of some people in the emergency room, to €20,000 at the top end. Such widespread incidents of bribery in the state-owned healthcare system appear shocking to outsiders and might lead us to conclude that this kind of nastiness would never occur in privately owned hospitals where doctors and business people are in charge, not corrupt government bureaucrats. Alas, private hospitals and clinics are afflicted with the same scourge. Getting into surgery costs from €150 to €7,000. For medical tests, you dish out €30 to €500. To get a tax audit arranged in your favor costs from €100 for banal cases to a hefty €20,000. For documents, you might be asked to fork over somewhere between €15 and €1,000. A construction license goes for €200 to €8,000. Did you get caught with an illegal building? Not a problem: from €200 to €5,000. But in a sign of just how tough things have gotten in Greece, the amounts that households paid for bribes plummeted from €632 million in 2010 to €554 million in 2011, a 12.3% nosedive, and part of the drumbeat of Greece’s economic horror show. For a debacle that continues in its relentless manner, read....“A harder Default To Come.” Apparently, not only Greece’s economic and fiscal crisis exercised downward pressure on the amounts, but also a change in the perception of bribery. For example, due to new tax policies that require taxpayers to submit value-added tax receipts with their tax returns, respondents increasingly thought that a seller’s refusal to provide such a receipt constituted a corruption incident. And people appear to have become weary of it: 25.3% refused to play along when asked for a fakelaki by a public-sector employee, and 21.6% spurned such requests in the private sector. Interestingly, the bribe payers are largely educated men between 45 and 54 who were self-employed or had businesses with employees. Across the border, in deficit-plagued and inflation-infested Turkey, the government floated a plan to get its citizens to turn in their substantial pile of physical gold in exchange for paper “certificates,” a first step in what may become a process of gold confiscation. And this, just as the world's major central bankers spoke at the Fed conference in Washington. For that load of ironies, doublespeak, and red flags, read.... Gold Confiscation, Inflation, And Suddenly Virtuous Central Bankers. |

| Posted: 05 Apr 2012 10:21 AM PDT |

| Posted: 05 Apr 2012 09:37 AM PDT |

| Misguided Faith in an Economic Recovery Posted: 05 Apr 2012 09:37 AM PDT We watched last night the rows of cars below our balcony, snaking their way out of the pollution and congestion of South America's second largest metropolis, out into the peace and calm of the surrounding campos and estancias. The usual rabble and riff-raff have left for the long weekend. The city is empty. And quiet. Still, there is reckoning to be done… Markets continue with what Eric Fry yesterday dubbed the "everything off" trade. "Investors are dumping everything with a ticker symbol," observed Mr. Fry. "US stocks, foreign stocks, government bonds, corporate bonds, precious metals, crude oil and almost every other commodity"…everything is "off." And that includes ol' yella, gold. The Midas metal has lost about $100 per ounce over the past 30 days. It's back to where it was six months ago. So…what gives? This is supposed to be a recovery, isn't it? The cover of last week's Economist magazine seemed to think so. (Or was it the week before?) You might have seen the hopeful image, as we did, while strolling through an airport lobby. It depicted a couple of machete-wielding explorers shining a light on a gleaming treasure chest. "The Recovery?!!" exclaimed one of the hapless cartoon figures. Hmmm… And then there was that cover of The Atlantic magazine, the one with a smug-looking Fed Head on it, obsequiously awaiting his due praise. "The Hero" screamed the headline; the accompanying subhead pondered, "Ben Bernanke saved the global economy. So why does everyone hate him?" Another "Hmmm…" We wonder, does one have to be a cartoon sketch — or possess the cerebral processing capacity of one — to believe the world is in recovery mode? Come to think of it, what is "recovery mode" anyway? We hear so darned much about it…but who stops to think about what it really means? To recover from something supposes a return to normalcy, as if after some unnatural shock. One might "recover" from an illness, for example, returning to a normal state of health. Likewise, one might recover from a bad fall…or a drunken evening…or a bad fall as a result of a drunken evening. A relationship might recover after its participants get into a nasty row. A driver may recover control over his vehicle after a temporary distraction. In any case, the term recovery implies a return to things as they once were. A return to normal. A return to average. But what if this is not that kind of a situation? What if we are in for a new normal, and along with it, a new kind of average? What if we are, as they say, past the point of "no return"? A third, and this time more concerted, "Hmmm…" Imagine a stage coachman waiting for a return to normal after the introduction of the automobile. "Business will soon pick up again," he might have muttered as a spiffy new Model T passed him by. And imagine, for one reason or another, business actually did pick up for a few days…or a week…or even a month. "This is it," he could have concluded. "The recovery is in!" One could make the same point with a million other yesteryear industries. But will business ever return to "normal" for members of the United Blacksmith Guild? Are we to expect a sustained upward profit trajectory in the disposable camera sector? Is a recovery on the horizon for purveyors of offline pornography? In a word, no. These industries have had it, gone the way of yesterday's news. And we are all better for it, are we not? Modern 2012 Man (and Woman) needn't fuss about with the unending annoyances of the anvil-chained life. Nor does he find cause to curse his lagging photography skills when picking up his prints from the store. Now, he simply erases the offending digital composition and snaps another shot with his phone. Likewise, he needn't alert the local magazine vendor to every detail of his private whims and fetishes. One person's desire is another person's domain name. So what about this "recovery," then? The term implies a return to the way things were, "pre-GFC." Our guess is that's not going to happen. And thank goodness for that! The market wants debt destroyed. It wants accounts settled and moribund institutions extinguished. It thirsts for a flurry of "Lehman moments." The market wants capital freed from tarpit-bound enterprises so that newer, fresher-faced companies, with superior products and innovative business models, can make better use of it. It wants errors punished, mistakes corrected and the lessons of the processes therein made available for all to know and to learn from. If The Atlantic was right, and Bernanke did save the global economy, he did so only in the sense that he "saved" investors from the lessons they needed to learn. Similarly, he "rescued" the market from the evolutionary process through which it needs to go. And, having done so, the man with his hand on the dollar printing press continues to "save" us from the future we might otherwise be enjoying. Thankfully, Bernanke can't "save" the economy forever. Whether everyone hates him or he is universally adored, his job will one day go the way all things must do…the way of yesterday's news. And then, the future will be free to begin again. Joel Bowman Misguided Faith in an Economic Recovery originally appeared in the Daily Reckoning. The Daily Reckoning, published by Agora Financial provides over 400,000 global readers economic news, market analysis, and contrarian investment ideas. Recently Agora Financial released a video titled "What is Fracking?". |

| Stratigraphy and host rock controls of gold deposits of the northern Carlin Trend Posted: 05 Apr 2012 09:32 AM PDT |

| Commodities Recover As AAPL Saves The Tech Sector Posted: 05 Apr 2012 08:50 AM PDT The only sector of the S&P 500 that was not red today (and for that matter the week) is Tech as AAPL managed another wonderful 1.45% rally today (up 5.6% on the week - it's best performance in 3 weeks and notably AAPL hasn't had a down week since 1/13 -0.6%). As SNL might say, "we need more parabola". Volume was average (for equities and futures) today but bigger blocks came through to sell into the close ahead of the long weekend and tomorrow's early excitement. Financials once again struggled and along with Energy are the worst of the week but it is the majors (in particular Morgan Stanley) that has been hammered this week as MS is -8.2% from Europe's close on Monday with the rest of the TBTFs down around 6% - finally catching up to credit's weakness. Equities closed down marginally but sold off in futures after the close - back below VWAP - having dropped all the way to reconnect with IG and HY credit's less ebullient perspective this week (before credit extended its losses to its widest in three months!). Treasuries managed to entirely recover their post-FOMC spike closing near the low yields of the day/week with the 7Y belly outperforming on the week down around 5bps (with 30Y -1bps on the week). Commodities halted their descent (much to the chagrin of media commentators it seems) as Oil outperformed on the day (and into the green for the week) over $103. Gold and Silver are still underperforming the USD's gains on the week (up 1.4%) led by EUR and CHF weakness. FX chatter was dominated by the spike-save in EURCHF (taking out Goldman's stops) and the mirror CAD strength JPY weakness relative to the USD. It seems EURUSD has become relevant again as it heads back towards 1.30 the figure (3 months lows). VIX went briefly red around the European close and broke 17% before closing marginally higher on the day as the term structure steepened a little more once again. AAPL's rampage remains intact helping avoid a red week for the Tech sector as financials and energy were the biggest losers of the week (and oddly along with Utilities for the day)... and the major financials are still getting crushed - especially Morgan Stanley (as they pull back to credit's reality)... But credit markets have now slid to almost three-month wides with high-yield spreads back to 1/20 wides as AAPL once again exerts its influence, diverging broad equity indices from reality... Treasuries have recovered all of their post-FOMC losses (basically unch from that morning) as the 7Y belly has outperformed on the week and 2Y underperformed - dragging 2s10s30s (the popular carry trade) to one-month lows... Commodities staged a modest comeback today - taking WTI into the green for the week - but Gold and Silver remain underperformers relative to the USD on the week... FX markets, spooked early on by the test of Goldman's precious 1.20 stop in EURCHF, drifted USD stronger until the US open then trod water for the rest of the day - leaving the USD up 1.4% on the week (its strongest week since the first week of the year!)...

All-in-all, another weak day with volume dominating the selloffs and trickle back above VWAP. The impact that AAPL is having on broad equity indices and their now egregious disconnect from broad risk assets is becoming farcical. One can only wonder if and when a rebalancing occurs just what a hit the indices will take? Weakness after-hours in S&P futures suggests a little more anxiety into the weekend - but nothing like what was seen in Credit, Treasury, and FX markets from the perspective of risk-off. Charts: Bloomberg

Bonus Chart: S&P 500 vs NYSE net new highs - divergence (another AAPL impact)... |

| Asia breaks West's code in gold war, London trader tells King World News Posted: 05 Apr 2012 08:29 AM PDT 4:25p ET Thursday, April 5, 2012 Dear Friend of GATA and Gold (and Silver): Massive buying of physical gold by Asian government entities is being swamped by massive selling of paper gold by Western central banks and bullion banks that are waging war against the monetary metal, the London trader source of King World News says today. "Interestingly, the Asian buyers have figured out the algorithms, like breaking an enemy's code in war, and they are using the algorithmic trading to get the best prices each day for physical gold at these levels," the London trader says. "The trading is just taking place at lower levels because these bullion banks and the Fed, which manage the price of gold, get overzealous in their price fixing." He adds that the naked short positions in the metals are "unimaginable." An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/4/5_Lon... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum (TSXV: NKL) and Ursa Major Minerals Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) and Ursa Major Minerals Inc. have signed a binding letter of agreement for a business combination through a proposed all-share transaction. In doing so Prophecy and Ursa have acted at arm's length and the transaction has been negotiated at arm's length. Prophecy will issue one common share in exchange for every 25 outstanding common shares of Ursa. Ursa options and warrants will be exchanged for options and warrants of Prophecy on an agreed schedule. Prophecy's offer represents a value of about $0.15 per each common share of Ursa based on Prophecy's share price of $3.70 as at March 1, representing a premium of 130 percent to Ursa's March 1 closing price of $0.065. Prophecy is to subscribe for $1 million common shares of Ursa by way of private placement financing at $0.06 per share, subject to regulatory approval. Upon placement completion, John Lee and Greg Hall, current Prophecy directors, will be appointed to Ursa's board. Prophecy thus will become a mid-tier resource company with a robust and -- The fully permitted open-pit Shakespeare PGM-Ni-Cu mine close to Sudbury, Ontario, infrastructure with near-term production capabilities. -- The flagship Wellgreen (Yukon) PGM-Ni-Cu project with more than 10 million ounces of Pt-Pd-Au inferred resource. Drilling is under way and a preliminary economic assessment study is pending. -- Manitoba's Lynn Lake Ni-Cu project with more than 262 million pounds Ni and 138 million pounds Cu measured and indicated. For the complete announcement, please visit Prophecy Platinum's Internet site here: http://www.prophecyplat.com/news_2012_mar02_prophecy_platinum_ursa_major... |

| Posted: 05 Apr 2012 08:29 AM PDT |

| Gold Daily and Silver Weekly Charts - The Dr. Evil Strategy and Some Targets Posted: 05 Apr 2012 08:09 AM PDT |

| Commodities at Risk of Deeper Losses as Euro Debt Fears Reemerge Posted: 05 Apr 2012 08:00 AM PDT courtesy of DailyFX.com April 05, 2012 02:00 AM Commodity prices are vulnerable to deeper losses after two days of aggressive selling as Eurozone debt crisis fears return to threaten continued risk aversion. Talking Points [LIST] [*]Crude Oil, Copper Vulnerable as S&P 500 Futures Point to Risk Aversion [*]Gold and Silver to Decline if US Dollar Rides Haven Flows Higher Again [/LIST] Commodity prices are treading water in European hours as markets digest two days of aggressive selling in the aftermath of a hawkish set of FOMC minutes. S&P 500 stock index futures point firmly lower however, pointing to renewed selling pressure as Wall Street comes online. The sour mood seems to reflect renewed Eurozone debt crisis fears after yesterday’s lackluster Spanish bond auction and mixed results at today’s French sale of long-term paper. Spreads between debt-stricken countries’ and benchmark German bond yields widened, with Portugal, Spain and Italy appearing the most a... |

| Posted: 05 Apr 2012 07:59 AM PDT Addison Wiggin – April 5, 2012

"The politicians killed him!" cried another. "Hang them all!" added a third. "Traitors!" We thought it was too early yesterday to tell whether Europe would treat the suicide of an old man in front of parlaiment in Athens like another Andrew Wordes… or break into its own "Arab Spring." This morning, we see green shoots… of raw fury.

"The cops returned fire with tear gas as the so-called anarchists with their faces covered attacked the beautiful Hotel Grand Bretagne. They painted the hotel wall with this slogan: 'Eat the rich.'" "And that's how I watched despair turn into rage."

"And since my advanced age does not allow me a way of dynamically reacting (although if a fellow Greek were to grab a Kalashnikov, I would be right behind him), I see no other solution than this dignified end to my life so I don't find myself fishing through garbage cans for my sustenance. "I believe that young people with no future, will one day take up arms and hang the traitors of this country at Syntagma Square," the note said, "just like the Italians did to Mussolini in 1945." Protesters are back at the scene today. The situation is under police control. For now.

Consumerist, a website run by Consumer Reports (who knew?) holds an annual poll to find the "Worst Company in America." In 2008, the sleazy mortgage lender Countrywide Financial topped the list. In 2009, it was corporate welfare queen AIG. Worthy contenders, indeed. This year? Electronic Arts. It beat Bank of America by a 2-to-1 margin. "For years," Consumerist writes, "while movies and music became more affordable and publishers piled on bonus content — or multiple modes of delivery — as added value to entice customers to buy, video games have continued to be priced like premium goods." This sin, in the estimation of Consumerist readers, amounts to a graver sin than being Overpriced video games are apparently a more grievous infraction of the public trust than foreclosing on a house whose buyer paid cash… or, indeed, pioneering the entire "robosigning" practice that's clouded the title on millions of homes. Or knowingly selling worthless mortgage-backed securities to pension funds. (Let's not forget BofA's cute trick last fall. It took $21.6 trillion in derivatives off the balance sheet of Merrill Lynch — which can't borrow from the Fed's discount window and isn't backed by FDIC deposit insurance. Said derivatives were moved onto the books of BofA's commercial banking arm — which can, and is.) Still, the fact Dead Space costs nearly $30 including sales tax is the far greater outrage. Bummer, dude. It's enough to make us reconsider the reader whose email began, "I disagree with your scenarios of riots in the streets…" and then proceeded to rant about "sheeple" and "bread and circuses." Maybe the coming riots at the NATO summit in Chicago and the political conventions will make good fodder for a reality TV show.

"This week's release of the March 13 Federal Open Market Committee (FOMC) minutes suggested no urgent push for a quick quantitative easing," Options Hotline's Steve Sarnoff opined to readers last night. "That helped bring some selling pressure down on overextended stocks." "A pullback to support is under way, but it may be premature to conclude the upside is exhausted. The rally may be strong enough to resume. As this holiday-shortened week comes to a close, we will be watching closely to see if bonds have begun a new leg lower." Steve laid on a falling-bond play earlier this week that gained 37% in a single day. That's on top of other winners this year including 44% on a drugmaker… 55% on the S&P 500… and 88% on a precious metals miner. Steve's next play comes this Sunday. Access here.

"At the low $1,600s and below $1,600," writes the dean of the newsletter industry, Richard Russell, "it's 'enter the dragon' That is, Chinese buyers will scoop up bargains and keep an effective floor under the Midas metal." Silver, meanwhile, is bouncing off a three-month low. At last check, the bid was $31.65.

We highlighted Burma — or Myanmar, if you prefer — on Monday. Our friend Doug Clayton from Leopard Capital compares its potential with that of Thailand decades ago. "I would rate Myanmar's long-term tourism potential just as strong as Thailand's," Doug writes, "which draws 14 million tourists a year, versus Myanmar's 300,000."

"Things are happening quickly. The hotels are full. Many are already sold-out for the first few months of the year. And Burma gets more and more mainstream attention nearly every week." Little wonder: "One of the last, large frontier markets in Asia," The Wall Street Journal says, "it is rich in oil, gas, timber and gems and has the potential to be a major rice and seafood exporter." Our planned visit next month appears to be timed perfectly. What's happening in Burma "is essentially the motive force behind the world right side up idea — this narrowing of historically anomalous large gaps in development to a world more in tune with longer historical experience (and, hence, right side up)." In other words, the economic dominance of the West is an anomaly in the broad sweep of time. And it yields up scores of investment opportunities you'll never hear about without visiting far-flung places. Or having an experienced guide do the visiting for you. That's what Chris has been up to the last two years, collecting his experiences in his new book World Right Side Up. And you have the chance to watch an exclusive pre-publication briefing from Chris. As an Agora Financial reader, you'll be privy to information you won't find in the book — including specific names and tickers. This briefing is absolutely free, and it goes online one week from today. Sign up here.

"In the past," Mr. Cox explains, "scientists have focused on drugs that work on the brain. They thought your brain 'tells you' when to feel hungry. Scientists tried a variety of biological approaches to controlling cravings." It hasn't worked. Ten thousand baby boomer Americans now reach retirement age every day. And according to the Centers for Disease Control, over 45% are overweight or obese. By 2020, it'll be 75%. "Cravings are not necessarily psychological," Patrick goes on. "They are physiological. I get in a lot of trouble when I say it, but lifestyle solutions are simply not going to solve this problem. There are rare individuals with will power and time to stay trim and fit, but my wife is a dietitian. I know that statistically, most people, no matter how hard they try, fail to keep weight off." But what if a drug treatment targeted fat cells themselves… instead of trying to trick the brain? That's the key to the discovery that's caught Patrick's attention. "This treatment cuts off the blood cells that supply oxygen to one type of fat cells. If you cut off the blood cells, fat can't get into the fat cells, and the fat cells die." Early trials look very promising. Patrick believes this treatment could capture a huge share of the $40 billion weight-loss industry. He lays out a compelling case in this report. Check it out in the next four days and you'll have a chance to access Patrick's premium research at the lowest possible price. This offer expires at midnight next Monday.

The town of Buford, Wyo., is for sale. The auction is today. Minimum bid: $100,000. For that, you get about 10 acres with five buildings — including a three-bedroom house, a gas station and a cabin currently used as a toolshed. Oh, and a post office with your own ZIP code — 82052. Buford's population is down to one. His name is Don Sammons. And he's the seller. Whoever buys, he says, "I just hope their dream continues to keep Buford moving in the 21st century."  [Photo by frankenstoen] The auctioneer touts it as a "unique opportunity" to "own your own income-producing town." The income, presumably, comes from the gas station — conveniently located just off Interstate 80, midway between Cheyenne and Laramie. Act now and you get the tumbleweeds for free…

"It has been quietly going on for a while. Most of the gift card issuers begin a fee to deplete the card after it is once used. Needless to say, my wife and I never give gift cards." "Of all the Agora Financial emails I get, I read The 5 right after I read Strategic Short Report! Keep up the fine reporting."

"With a little authority, many individuals lose all common sense and humanity! The story of Mr. Wordes should be recognized for what it is: governmental overreach to the nth degree!" "A sad commentary on individual freedom."

"I am becoming a believer after a month of usage. I'm a 59-year-old ultramarathoner and my legs feel stronger after long runs and a stubborn plantar faciatis injury in the heel is improving much faster than under the normal treatment regimen of icing, taping and wearing a night splint (aka boot)." "I'll know more after my next ultra race in three weeks. Happy to provide a further update at that time. Hopefully, I'll be running long-distance events for many more years to come." "Thanks for the information. Look forward to The 5 every day." The 5: Thanks. The product is sold through a major supplement retailer's website, where we see 43 reviewers have given it an average 4.8 stars out of five. One reviewer has an arthritic hip. After three weeks of use, "I now have almost no joint pain and working out, running and yoga stretches are much more enjoyable." The small (less than $500 million market cap) company behind this product has doubled its sales… it's collected a huge celebrity endorsement… and insider buying is picking up steam. No wonder Patrick Cox is so excited. Cheers, Addison Wiggin P.S. U.S. and Canadian markets are closed tomorrow for Good Friday… and it appears by day's end Abe Cofnas will go 6 for 6 on his for-demonstration-purposes-only trades here in The 5. Mr. Cofnas was counting on the Dow to end the week in a range between 12,975-13,275… and barring something unusual before day's end, that's exactly how it'll work out. Averaging both sides of his recommended trade, you would have booked a 15.6% gain in four days. Happy Easter… The 5 returns on Monday! |

| London Trader - Fed’s Global War Against Gold Escalating Posted: 05 Apr 2012 07:45 AM PDT  With many global investors still rattled by the price action of gold and silver, today King World News interviewed the "London Trader" to get his take on these markets. Here is what the source had to say: "Gold was trashed on Monday, while the Fed minutes essentially said nothing. When a central bank coordinates that kind of attack, it's war, of course it's war. This type of action is coordinated by Bernanke and the Fed and executed by the bullion banks. It's actually laughable if anyone thinks that was a legitimate selloff, on what was, in reality, no news." With many global investors still rattled by the price action of gold and silver, today King World News interviewed the "London Trader" to get his take on these markets. Here is what the source had to say: "Gold was trashed on Monday, while the Fed minutes essentially said nothing. When a central bank coordinates that kind of attack, it's war, of course it's war. This type of action is coordinated by Bernanke and the Fed and executed by the bullion banks. It's actually laughable if anyone thinks that was a legitimate selloff, on what was, in reality, no news." This posting includes an audio/video/photo media file: Download Now |

| Posted: 05 Apr 2012 07:40 AM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] Gold did not have a good week falling below chart support at the 50 week moving average for only the second time since the bottom made way back in late 2008/early 2009. As you can see, since then it had only violated this important chart level once and that was the very last week of trading in 2011. You might recall that funds were then dumping longs, booking profits before year end and moving out of commodities over fears of European sovereign debt meltdowns. The start of the new year brought with it expectations of increased liquidity coming from Western Central Banks to deal with the fallout from that sovereign debt crisis and the deflationary impact it would necessarily have on global financial markets. As the new year unfolded, funds increased exposure to the commodity sector in general and to gold in particular, that is until Uncle Ben and his merry band of dollar creators decided to try ... |

| Why is Turkey Turning to Gold? Posted: 05 Apr 2012 07:31 AM PDT Turkey has announced some interesting policies towards gold recently. What are they up to...? |

| Gold to Spike to New Record by Years End Posted: 05 Apr 2012 07:12 AM PDT from Brittany Stepniak, Wealth Wire: You've heard it dozens of times: The Fed's foolishness and the devaluing dollar give investors little choices when it comes to selecting a safe-haven. Per usual, the long-term safe-haven is still gold. Nonetheless, commodities researcher with Commerzbank AG Eugen Weinberg says gold investors should anticipate heightened negativity within the gold market this spring and summer before gold's bull-run really picks up some energetic momentum. This past month alone, gold has fallen about four percent. Some of this may be attributed to the fact that the Fed has deviated from the earlier suspicions suggesting that QE3 would have begun by now. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Researchers at one of the world's leading think tanks have developed a computing model that predicts serious implications for our way of life as a result of our incessant need to consume resources like oil, food, and fresh water. According to a team of scientists at the Massachusetts Institute of Technology, the breaking point will come no later than 2030, and when it does, we can expect a paradigm shift unlike any we have seen before in human history – one that will not only collapse the economies of the world, but will cause food and energy production to decrease so significantly that it will lead to the deaths of hundreds of millions of people in the process.

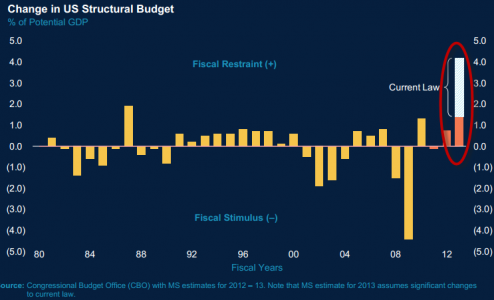

Researchers at one of the world's leading think tanks have developed a computing model that predicts serious implications for our way of life as a result of our incessant need to consume resources like oil, food, and fresh water. According to a team of scientists at the Massachusetts Institute of Technology, the breaking point will come no later than 2030, and when it does, we can expect a paradigm shift unlike any we have seen before in human history – one that will not only collapse the economies of the world, but will cause food and energy production to decrease so significantly that it will lead to the deaths of hundreds of millions of people in the process. Besides, housing has finally confirmed its double dip, with prices falling 4 months in a row, as foreclosures are beginning to be released off of bank's books. Despite the structural problems of 12% unemployment and a bloat of new currency, there are more urgent matters. There are huge economic and political challenges to debt reduction, and in fact, these upcoming issues are likely to be the largest fiscal drag on the economy in the modern era.

Besides, housing has finally confirmed its double dip, with prices falling 4 months in a row, as foreclosures are beginning to be released off of bank's books. Despite the structural problems of 12% unemployment and a bloat of new currency, there are more urgent matters. There are huge economic and political challenges to debt reduction, and in fact, these upcoming issues are likely to be the largest fiscal drag on the economy in the modern era. In response to Monday's RANT, "

In response to Monday's RANT, "

"He shouldn't have killed himself," an old man said. "He should have taken that gun and killed them (members of parliament)."

"He shouldn't have killed himself," an old man said. "He should have taken that gun and killed them (members of parliament)." "News traveled fast," Chicago Tribune columnist John Kass reported from the scene, "and by nightfall, rioters were breaking up marble steps and throwing the chunks of rock at a phalanx of police.

"News traveled fast," Chicago Tribune columnist John Kass reported from the scene, "and by nightfall, rioters were breaking up marble steps and throwing the chunks of rock at a phalanx of police. Turns out the man, a retired pharmacist named Dimitris, left a suicide note. And an incendiary one, at that. "The… government has annihilated all traces for my survival, which was based on a very dignified pension that I alone paid for 35 years with no help from the state.

Turns out the man, a retired pharmacist named Dimitris, left a suicide note. And an incendiary one, at that. "The… government has annihilated all traces for my survival, which was based on a very dignified pension that I alone paid for 35 years with no help from the state. We can't help wonder what it would take to get Americans to take up M-16s. Bailouts? Sweetheart deals? Legalized corruption? How about… "overpriced" video games?

We can't help wonder what it would take to get Americans to take up M-16s. Bailouts? Sweetheart deals? Legalized corruption? How about… "overpriced" video games? Ah, well… turning to the markets, we see stocks are "mixed," to use the journalistic parlance we

Ah, well… turning to the markets, we see stocks are "mixed," to use the journalistic parlance we  Gold is finding its footing again after a two-day shakedown. The spot price is up to $1,628.

Gold is finding its footing again after a two-day shakedown. The spot price is up to $1,628. Maybe the Chinese are buying already. Gold's strength comes despite the dollar index cresting 80 today.

Maybe the Chinese are buying already. Gold's strength comes despite the dollar index cresting 80 today. Oil is also finding a floor for the moment, dollar strength notwithstanding. A barrel of West Texas Intermediate is back up to $102.74.

Oil is also finding a floor for the moment, dollar strength notwithstanding. A barrel of West Texas Intermediate is back up to $102.74. Suddenly, the door is opening to U.S. investors in one of the more lucrative emerging markets in the world. The Obama administration announced yesterday it will begin easing some sanctions on Burma, including "lifting restrictions on U.S. investments in the country," writes The Washington Post.

Suddenly, the door is opening to U.S. investors in one of the more lucrative emerging markets in the world. The Obama administration announced yesterday it will begin easing some sanctions on Burma, including "lifting restrictions on U.S. investments in the country," writes The Washington Post. "Burma is beginning, at last, to thaw," says our own Chris Mayer, continuing the theme. "The grip of the military junta is loosening, by its own hand. The market is beginning to open up. Political prisoners have been released. Press censorship rules have been relaxed.

"Burma is beginning, at last, to thaw," says our own Chris Mayer, continuing the theme. "The grip of the military junta is loosening, by its own hand. The market is beginning to open up. Political prisoners have been released. Press censorship rules have been relaxed. "It's a revolutionary new approach to weight loss," says Patrick Cox casting his spotlight on yet another opportunity in the biotech space.

"It's a revolutionary new approach to weight loss," says Patrick Cox casting his spotlight on yet another opportunity in the biotech space. As U.S. real estate opportunities go, this one is… certainly unique.

As U.S. real estate opportunities go, this one is… certainly unique. "The state of Delaware already claims the unused balance of expired gift cards," a reader writes after seeing our item from New Jersey.

"The state of Delaware already claims the unused balance of expired gift cards," a reader writes after seeing our item from New Jersey. "Thank you for continuing to mention Mr.

"Thank you for continuing to mention Mr.  "Too bad," adds another, "that even the local papers generally painted Wordes as a kook in what little coverage there was. I guess that the media can't afford the truth — seems to be happening a lot these days."

"Too bad," adds another, "that even the local papers generally painted Wordes as a kook in what little coverage there was. I guess that the media can't afford the truth — seems to be happening a lot these days." "When I read about anatabine citrate in The 5, I was a skeptic, but decided to try it anyway," a reader writes about Patrick Cox's favorite "nutraceutical."

"When I read about anatabine citrate in The 5, I was a skeptic, but decided to try it anyway," a reader writes about Patrick Cox's favorite "nutraceutical."

No comments:

Post a Comment