Gold World News Flash |

- The Beginning of the End

- A Quick Note on China’s Economy and Gold Market

- Today's comments

- Yamada - How to Score Big in Stocks, Gold, Silver & Oil

- Gold Seeker Closing Report: Gold and Silver Fall With Stocks and Oil

- Bernanke - I'm Slowing Down the Ship

- Fund managers Fleckenstein, Bryan unfazed by gold's decline

- Corzined Marvell Muppets Sue Vampire Squid

- Jim Sinclair's Not Buying the Cartel Con, Neither Should You

- In Europe a Failed Spanish Auction/Gold and Silver BOMBED

- JPM To Pay ‘Wristslap Fine' in Misuse of Customer Segregated Funds at Lehman Brothers

- Silver, Gold Consolidate; Coiling in Anticipation of More Printing

- We?re at the ?Beginning of the End? for the Markets ? Here?s Why

- Peter Schiff – The Fed Unspun: The Other Side of the Story

- US Federal Reserve: Believing It's Own Lies?

- Will Gold be Part of the Emerging World’s Future Monetary System?

- Australian Gold Offers Good Protection: Richard Karn

- Where (and When) to Place Your Investment Bets?

- April 4th Silver Update

- Silver and Gold Price Both Fell and I Bought as Bull Market in Silver and Gold Continues Unharmed

- Dennis Gartman Now Long Of Flip Flopping In Laughing Stock Terms

- Junior Miners Building for a Rebound: Jordan Roy-Byrne

- Successful Investing Strategies in a Government-Centric Market

- The Cartel Morning Blues

- Even Hollywood's Bad Guys Know the Truth: ONLY Gold is Real Money

- Symbolic Suicide: Will Anyone Notice?

- Doug Casey on the US Constitution

- Will Gold be Part of the Emerging World's Future Monetary System?

- The Permanent Portfolio Revisited

| Posted: 04 Apr 2012 05:56 PM PDT |

| A Quick Note on China’s Economy and Gold Market Posted: 04 Apr 2012 05:42 PM PDT |

| Posted: 04 Apr 2012 04:31 PM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] The mining shares continue being pummelled to the point where one wonders who is left in the sector to sell them at these levels. Take a look at the following chart and marvel: How many of us who were trading the shares can forget what happened to them back in the summer of 2008 when the credit crisis erupted causing an avalanche of selling across the paper and hard asset sectors. When the S&P 500 was crushed ( it lost over 50% of its value plunging from over 1500 to down under 750) the mining shares were unceremoniously trampled under the feet of men. During that stage, the shares seriously underperformed against gold bullion losing value at a much faster rate than did the metal itself. The result was to take the HUI/Gold ratio down to levels not seen since the very early stages of the bull market in gold. Look at where these same shares are now in relation to gold bullion again! Yep - y... |

| Yamada - How to Score Big in Stocks, Gold, Silver & Oil Posted: 04 Apr 2012 04:02 PM PDT  With tremendous volatility in gold, silver, crude oil and stocks, King World News interviewed legendary technical analyst, Louise Yamada, of LYA Advisors, to see where she sees the markets headed. Louise not only discussed the key markets, but also surprised KWN by stating companies are leaving China and coming home. She is also had some interesting comments regarding the Nikkei: "Japan looks interesting. It might be establishing the bottom of a ten year base. There has been an impressive breakdown in the yen and the Japanese are starting to print money." With tremendous volatility in gold, silver, crude oil and stocks, King World News interviewed legendary technical analyst, Louise Yamada, of LYA Advisors, to see where she sees the markets headed. Louise not only discussed the key markets, but also surprised KWN by stating companies are leaving China and coming home. She is also had some interesting comments regarding the Nikkei: "Japan looks interesting. It might be establishing the bottom of a ten year base. There has been an impressive breakdown in the yen and the Japanese are starting to print money." This posting includes an audio/video/photo media file: Download Now |

| Gold Seeker Closing Report: Gold and Silver Fall With Stocks and Oil Posted: 04 Apr 2012 04:00 PM PDT |

| Bernanke - I'm Slowing Down the Ship Posted: 04 Apr 2012 03:26 PM PDT A full trading day after the release of the Fed minutes has brought us some reasonably significant changes in market levels. S&P –1.5%, Gold – 3.5%, Crude –1.5%. Apparently, the confirmation that it is on hold surprised the market. (link) .

I’m not surprised. Bernanke understands that upping the anti with more QE would send the price of crude through the roof. The deflationary effect on the consumer economy of another dollar increase for gas would far outweigh any positive consequences that another LSAP would have produced. Some random thoughts: (Warning, I stray from side to side on this.) . -I see that the Fed has been put in check by the global price of crude. While this is not checkmate, it forces the Fed to move to the defense. The language from the Fed meeting confirms it. For the past four years, the Fed has been on the offense. It has had no opposition from the markets. The subtle change in the Fed’s position is a major change in its strategic advantage. To me, this represents a significant change of events. + -While this represents an important strategic change, the reality is that the short-term monetary consequences are negligible. ZIRP will linger on for at least another year. As as a monetary stimulus, ZIRP has much greater consequences to the global economy than do QEs, TWISTS etc. It's as if the Fed has shifted from fifth gear down to fourth. It's still speeding ahead. The shift to fourth is more about gaining some additional traction over a rough spot, not about a change in velocity. . + -Bernanke has said that if there were to be a new TWIST, the operation would be “sterilized” by reducing very short-term cash liquidity (2-14 days). The Fed would have to do that because they have no more medium term paper to swap against long-dated paper. It is faced with an operational constraint to extending TWIST. The result is the necessity to drain short-term liquidity to complete the swap. I think the sterilized swap is a I wonder if some folks with white spats haven’t whispered to Bernanke, “If you quit on QE we will be okay. But whatever you do, don't give up on the high-octane liquidity!”

+ -IMHO if the US economy is buying up 15m cars (annually) it is not in crisis, and does not need emergency monetary measures. I’m not ignoring high unemployment. I’m saying the problem is structural. Hot money can't fix this problem and hot money is causing other problems. The question is, “Is the Fed thinking like this too?” The Fed has a dual mandate: Price Stability (PS) and Maximum Employment (ME). If Bernanke had been asked the question at any time over the past three years, “Between the two mandates, how are you allocating your efforts?” Bernanke would have answered: “99% to ME and 1% to PS.”

What would Bernanke’s answer to this question be today? Would he say: “95% to ME and 5% to PS.”

Or would he say: “We’re back to 60 - 40”. Answer: It isn’t 99 - 1 any longer, and we’re still a long way from 50 – 50. But the needle has moved on this measure. This too is very subtle, but not insignificant. . + -As Bernanke withdrew one card from the deck, he has inserted two jokers. These jokers can be played by Ben anytime he likes it. He just needs an excuse. I wholeheartedly agree with the sentiment that all it would take was a 20% correction in the S&P and we would have QE3 in a NY minute. Think about that. It’s insane, but it’s also true. The economy can’t expand unless the S&P steadily rises. What was once cause and effect is now effect and cause. . + -Bernanke has a bad sense of timing. He iniated QE2 in response to an “invisible wall”. He launched Operation Twist in response to a slowdown he (and others) thought was coming last summer. Neither of those “slowdowns” actually happened. It was just the New Normal ebb and flow of the economy. Bernanke missed the signs. I wonder if Ben is suffering another bout of bad timing. He is sailing a big ship and it is on fast forward. He is sending out signals that he going to slow the ship down. Definitive evidence that the ship is slowing will come when/if the Fed announces that it will not extend Operation Twist. (The White Spats folks are insisting it’s coming in June). If the Fed does not renew TWIST, then the history books will say that this was the turning point of a move away from monetary accommodation. Those books may compare the timing of the Fed's transition to the fateful tightening steps the Fed made in 1936 that precipitated the second leg of the Great Depression. Funny thing about those history books. . + -Absent a blow up in the stock market, I don’t think that Operation Twist will be renewed. That will be a big surprise to the folks with the spats. The likes of Morgan Stanley and PIMCO are loaded up for a new MBS TWIST. I believe that the deep thinkers on Wall Street are missing the political angle on this. Bernanke’s hands are tied by the election. If he comes forward in May with a New Twist program that will last through November 15th, the Republicans will (rightly) call foul. Bernanke does not want to take the resulting flack. It would tarnish his and the Fed’s image. . + -There will be no more QEing or TWISTING until after Christmas. By then, the fiscal time bombs that are set to go off on Jan. 1 will make any steps the Fed takes irrelevant. .

|

| Fund managers Fleckenstein, Bryan unfazed by gold's decline Posted: 04 Apr 2012 02:44 PM PDT 10:44p ET Wednesday, April 4, 2012 Dear Friend of GATA and Gold: Interviewed by King World News, fund manager Bill Fleckenstein says the equity markets will now throw a tantrum and the Federal Reserve will resort to more quantitative easing to reverse their decline: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/4/4_Fle... Also interviewed by King World News, fund manager Caesar Bryan wrings his hands about the decline in gold and the mining shares but says he remains confident that easy money from central banks will revive them: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/4/4_Cae... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Golden Phoenix Discusses Royalty Mining Growth Strategy Golden Phoenix Minerals Inc. has discussed its royalty mining growth strategy on the Fox Business Network program "21st Century Business" with host Jackie Bales. Golden Phoenix's director of corporate communications, Robert Ian, told how the company narrows its focus to project generation and future royalty streams. He explained why Golden Phoenix believes it's better to own joint-venture interests in several producing mines instead of full exposure to just one project. "21st Century Business" has been airing for 15 years. Previous hosts have included Gen. Alexander Haig, Gen.l Norman Schwarzkopf, and Secretary of Defense Caspar Weinberger. Golden Phoenix appeared as paid programming on this broadcast. To view the program with Golden Phoenix, please visit Golden Phoenix's Internet site here: http://www.goldenphoenix.us/company-videos.html Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. |

| Corzined Marvell Muppets Sue Vampire Squid Posted: 04 Apr 2012 02:44 PM PDT Pay close attention because this could be a record-breaking amount of mauling ever attempted by the colossus of client care as Goldman shows it does not discriminate between millionaire and billionaire Muppets. In a bizarre story in CNN Money, we are told that two billionaire 'married' executives of Marvell Technologies - MRVL (no, not the comic book though that would be spectacular) are suing Goldman for what initially appears to be a straight-forward alleged fraud of unauthorized transfer of ownership of their MRVL shares to Goldman's internal fund to enable more borrow availability for shorts (1 Corzine-ing). But the story gets better. The executives, upon the advice of another Goldman broker were advised to take levered long positions in competitor NVDA's shares (which GS was allegedly selling out of its own book - 2 Corzine-ings) only to very rapidly face significant losses when the company missed and the stock dropped notably (3 Corzine-ings). Then, GS sends the MRVL execs margin calls on that position (4 Corzine-ings) and unwilling to accept the MRVL shares as collateral due to its low share price (5 Corzine-ings), forces the former MRVL executives to sell their MRVL shares (6 Corzine-ings) to meet cash calls - all the while remembering that GS had transferred the ownership in order that they could allegedly have more of this hard-to-borrow stock to short (7 Corzine-ings). What's more, the couple's suit alleges that Goldman and a hedge fund run by Goldman were buying MRVL's shares at the same time the firm was forcing Sutardja and Dai to sell (8 Corzine-ings). Both NVDA and MRVL's shares have since more than doubled from their late 2008 lows. The couple claim they lost more than $100 million because of their forced sales and general Muppet massacre. Do not, however, feel too bad for these two Muppets as Sutardja and Dia are not without controversy themselves. In 2008, MRVL paid a $10 million fine to settle allegations from the SEC that the company backdated the options it paid out to its executives. As part of the settlement, Dai, who was once Marvell's COO, paid a personal fine of $500,000 and was barred from being a director or officer of a publicly traded company for five years. Couple says Goldman misused shares to assist short-sellers

|

| Jim Sinclair's Not Buying the Cartel Con, Neither Should You Posted: 04 Apr 2012 02:37 PM PDT by Jim Sinclair, JS Mineset:

Not one pro, not even Yra who is close to the establishment, believes that the action of all markets were a true price interpretation of the FOMC notes yesterday. Today and yesterday was the product of five gold banks showing the market who in their opinion is boss. It was aimed directly at the confidence in gold. These gold bank traders are legends, who are the present rulers of the universe, owners of Washington and answer to no one, even to a God. Well, in their mind they are at least. I really think ego has overcome the profit motive in the last two days. This changes nothing as to where gold is going in 2012 and beyond. It just makes trading impossible and charts useless, leaving only international fundamentals that will not be MOPEd away to make the final determination of the gold price. It coils the spring in the market even tighter than physics will allow, making the break out to the upside when it comes something to behold. |

| In Europe a Failed Spanish Auction/Gold and Silver BOMBED Posted: 04 Apr 2012 02:31 PM PDT by Harvey Organ, HarveyOrgan.Blogspot.ca: Good evening Ladies and Gentlemen: Gold closed the comex session down $59.70 at $1612.30 (1:30 PM). Silver followed suit down $2.24 to finish at $31.02. The day started out with Australia reporting a surprising deficit for the second straight month as they are feeling the effects of a downturn in China. China stunned the world with another deficit. When the pendulum swung to Europe we were greeted with a basically failed Spanish bond auction coupled with higher yields and higher credit default swaps. Even Germany had a very tame export report. The entire globe was in red ink today, including the USA .Let us now head over to the comex and assess the damage: |

| JPM To Pay ‘Wristslap Fine' in Misuse of Customer Segregated Funds at Lehman Brothers Posted: 04 Apr 2012 02:26 PM PDT from Jesse's Café Américain:

In extending the credit, JPM assumed that the customer money that was being held by Lehman Brothers could be freely used by the firm, and therefore was a legitimate part of its valuation. The comparison to MF Global is obvious. In other words, if MF Global had not failed to meet its margin call and gone bust, they might have been fined $20 million in four or five years, while taking in billions in profit and bonuses. What a deterrent! Although using customer segregated funds to calculate the value of a company is not nearly as egregious as actually stealing them, it does betray a certain mindset on Wall Street that seems to have prevailed in the last ten years or so. 'This land is our land, their money is our money.' Or perhaps there was an outbreak of sloppy book-keeping on Wall Street as the Fed induced credit bubble reached its apogee in the fraudulent securities packaging market. Who could blame them? The $20 million fine is incidental to JPM and the violations which occurred over four years ago. And I am sure that as part of settlement, JPM will agree not to do it again, while admitting no guilt. |

| Silver, Gold Consolidate; Coiling in Anticipation of More Printing Posted: 04 Apr 2012 02:19 PM PDT from GoldSilver.com:

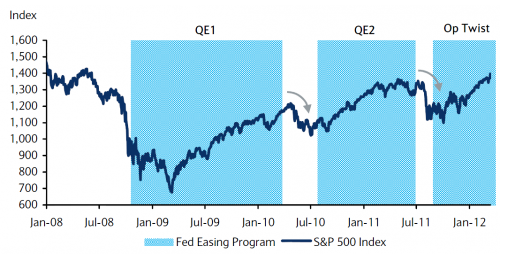

If you have been a regular reader you know the answer to that question is a resounding yes—especially so given the deliberately manufactured uncertainty coming out of the Federal Reserve. We first showed what is taking place right now on on March 19th in chart form (below), commenting, "The history is cyclical, showing markets sell off just prior to the end of printing." And once the printing begins, markets take off like addicts on Federal Reserve prescribed dope. We explained the waffling on the status of the U.S. economy in the piece Bernanke's Fed Speak Demystified, writing, "The Fed wants to temper the message of an improving economy to trim energy, commodity and gold prices, opening the door for even more currency printing." |

| We?re at the ?Beginning of the End? for the Markets ? Here?s Why Posted: 04 Apr 2012 02:11 PM PDT We are now at the mercy of oil and the commodity markets. Bernanke’s plan to print our way to prosperity is destined to fail. Ultimately, he is just going to spike inflation and collapse the global economy, resulting in a worse downturn than what we saw in 2008/09. Let me explain. Words: 510 So says Toby Connor ([url]www.goldscents.blogspot.ca[/url])*in edited excerpts from his original article* (which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited below for length and clarity – see Editor's Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.) Connor*goes on to say, in part: The Last “Four” Year Cycle Longest in History The last “four” year cycle that started in 2002 and bottomed in the spring of 2009 was the longest “four” year cycle in history. It was stretched to these extreme lengths by Bernanke’s desperate strategy of... |

| Peter Schiff – The Fed Unspun: The Other Side of the Story Posted: 04 Apr 2012 02:09 PM PDT from ReasonTV :

"Ben Bernake fancies himself as a student of the Great Depression," says renowned investment broker, global strategist, author, and Austrian economist Peter Schiff, "but… if he were my student he would have gotten an F." During a lecture entitled "The Fed Unspun: The Other Side of the Story", Schiff responded to Bernake's recent four-part college lecture series, rebutting many of the Federal Reserve Chairman's claims about the cause of the housing crisis, the role of the Federal Reserve, the value of the gold standard, and more. |

| US Federal Reserve: Believing It's Own Lies? Posted: 04 Apr 2012 01:55 PM PDT At 2PM est, Tuesday, April 3, 2012...notes, purportedly from a "meeting of the minds" at the US Federal Reserve, are released to the ever vigilant financial news media for dissemination to global investors seeking another "fix" from their Sugar Daddy. Aw shucks, Sugar Daddy says [or wants you to believe] there is no more sugar in his pocket. ALL the markets drop like a diabetic that has forgotten his lunch. No more sugar, no more fix, NO MORE NEW HIGHS. BUMMER! Why does ANYBODY, believe ANYTHING the Fed says? WHY? The are notoriously wrong! So wrong, so often in fact, that Ben Bernanke should change his name to Often Wrong Bernanke. Or, honestly, he should just change his name to Pinocchio. Bernanke Was Wrong Bernanke telling us not to worry about housing, mortgages, or car companies in the years before the recession, like denying a train wreck that is coming down the tracks. ________________________ And now we are suposed to believe the Fed when they tell us the economy is growing, the jobs market is improving, and America is on the cusp of an economic recovery so great that the need for further Fed stimulus is unneccessary? Does anybody remember this stellar Bernanke prediction? Bernanke Believes Housing Mess Contained Evelyn M. Rusli, 05.17.07, 4:21 PM ET, [Forbes] The subprime mess is grave but largely contained, said Federal Reserve Chairman Ben Bernanke Thursday, in a speech before the Federal Reserve Bank of Chicago. While rising delinquencies and foreclosures will continue to weigh heavily on the housing market this year, it will not cripple the U.S. economy, he said. The speech was the Chairman's most comprehensive on the subprime mortgage issue to date. "Given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited," Bernanke said. _______________________ Limited Ben? Guess not, huh? And yet here we are today, our bumbling Fed Chairman once again blowing smoke up our asses as we grab our ankles thanking him for yet another "vote of confidence" in the US financial system and economy. BULL SHIT! The Fed's Con Appears To Be Working But The Curtain Is Rising On The Third Act By lee Adler, April 3, 201 In today's conomic news, the mainstream media focused on the disappointment surrounding the FOMC Minutes, the massaged and sanitized fairy tale about what the participants said at last month's FOMC confab. The market was shocked! SHOCKED! that most of the members saw no need for additional QE, unless things got worse. I had concluded that a couple of months ago based on the fact that every time QE speculation arose, not only did stocks rally, but so did energy and other commodity prices. The commodity vigilantes, I thought, would tie the Fed's hands. That and the fact that the conomic data was coming in relatively perky, at least in terms of the headline data, made it highly unlikely that the Fed would do any more money printing. But here's the thing. The minutes are fake. They are fabricated, false, phony, ginned up and sterilized garbage, designed for public consumption. To put it bluntly, they're propaganda. They are what the Fed and the Wall Street casino owners want you to think. They are a blatant attempt to manipulate the behavior of market participants through the use of clever turns of phrase. The Fed wants the market to go higher, but it doesn't want commodities to go with it, so its story line is that the conomy is healthy enough to continue growing without more QE. That gives traders reason to continue buying stocks, and no reason to buy commodities, which everyone "knows" go up when the Fed prints, in spite of Bernanke's denials that he's doing that. And besides, even if he was, commodities are up for other reasons, not anything Ben did, according to Ben. That's what these "minutes" are about, self justification and market manipulation. We won't know the real story until February 2018 when the Fed will release the transcripts of this year's FOMC meetings. Why do they hold them back for at least 5 years? Because the Fed thinks that you can't handle the truth. The problem is that you can and they just don't want you to know what it is, because if you did, you'd be able to make informed investment decisions. The decisions the Fed wants you to make are to buy stocks, buy and hold Treasuries, and sell commodities. They tailored the minutes accordingly, so that the headlines would elicit the desired response. They think that they're Pavlov, and we're the dogs. Admittedly, I have not yet read the minutes (I will for this weekend's Fed Report), but I have read the news headlines. Those headlines are what the Fed-Wall Street-Media-Industrial Complex wants you to think, so you really don't need to read the minutes. Rest assured that the Fed got the propaganda it wanted. The market reaction it wanted it hasn't yet gotten, yet, but the Fed is betting that it will, and therein lies the rub. The Fed doesn't always get what it wants. If traders decide to sell the Dow off 200 points in response to this news, then the next morning, the Fed's ventriloquist dummy, Jon Hilsenrath, will float another QE3 trial balloon in the Wall Street Urinal. So we'll just have to wait and see how traders respond to what the Fed wants it to think. As for what the Fed really thinks, sorry, that will have to wait 6 years. _________________________ It looks like Ben can't have his cake and eat it too. Can't make a cake without sugar Ben...and who wants cake without frosting? If any truth came out of the Fed's minutes released yesterday afternoon it was the TRUTH that our stock market rally is based on NOTHING more than sugar from the Fed. The long rally in equities since Bernanke got the markets hooked on thats ugar in March 2009 is fundamentally baseless. Today's market reaction to a Wall Street without sugar bowls on every desktop is all the proof I need that the Fed will either continue printing money and doling out the sugar the markets crave, or the markets are going to their grave. Nevermind the equity markets...who is going to buy America's debt if the Fed withholds the suar bowl? Strictly A Rhetorical Question... From Dave In Denver, The Golden Truth ...because the answers is obvious. How will the U.S. Government fund all of the additional budget deficit spending that has already been built into this year's spending plans if the Fed does not print money in some fashion in order to help finance all of the new Treasury debt issuance in 2012? Before you answer this, you need to be aware, and you can use google to find the numerous sources of this data, from the time QE2 commenced until it ended the Fed directly or indirectly purchased over 100% of of all new Treasury debt issuance during that time period. In other words, it also paid for some of the refunding/rollover issuance. Furthermore, Operation Twist, was nothing more than a attempt a cleverly disguising the Fed's role in funding Treasury issuance since QE2 formally ended. With this operation, the Fed simply sold down its short term Treasury holdings to a collateral-starved money market and repo-collateral market and used the funds to buy Treasuries in the meat of funding curve - 7 to 10 yrs - which funded the Treasury plus helped keep a lid - sort of - of mortgage rates. For all of 2011, the Fed purchased a "stunning" 61% of ALL net Treasury issuance: LINK I think we all can see what happens if the Fed does not start printing soon. I thought I'd throw in a little humor after yesterday's post. I frequent a news aggregator and excellent market monitor website called Finviz (www.finviz.com). This morning when I pulled it up to check the list of news items, I found these two headlines posted 1st and 2nd respectively: "Private sector [adds] 209,000 jobs in March" LINK "Yahoo lays off 2,000 employees" LINK I just love that. The 1st metric comes from the monthly ADP payroll report. This report is commonly understood to be even less reliable than the monthly BLS employment report. I did some research a while back on how ADP calculates its numbers and discovered that they use similar algorithmic modelling as the BLS. I think that tells you all you need to know about the ADP monthly report. Note also that it is clearly stated as an "estimate." Yahoo, on the other hand, is reporting jobs that have already been chopped. Now they have to inform the chop-ees. I suspect we'll see a lot more reports of big companies cutting jobs. I'm sure Yahoo isn't done yet for the year as well. I wanted to stop there today, but I came across this revealing blog piece from Felix Salmon. In terms of systemic liquidity and the question of whether or not the Fed will roll out QE3 (I think we all know the true answer to that), Salmon has a chart you have to look at which shows syndicated bank lending by quarter. Syndicated bank loans - which is the big corporate loan market - are starting to cliff dive. This means that corporations are not funding new projects AND that banks are not lending to new projects. To make this data even uglier, most of the syndicated lending that has occurred - 70% in fact - has been refinancing older, higher interest rate debt. Not only are the banks NOT providing liquidity to the corporate market, but only a small relative percentage of the lending is "new blood" lending. Here's the LINK Batten down the hatches. It could get really ugly for awhile... ______________________ There's No Painless Way Out Submitted by Tyler Durden on 04/04/2012 15:02 -0400 Uncle Sam's bills of almost $4tn per year relative to his income of just over $2tn means that he does what most American's do - he borrows money - and it is this simple fact that underpins the reasoning that there is no painless way out of the mountain of debt that we have amassed over the last few decades. While none of this is new, the straightforward nature of this video's message makes it hard to argue, from anything other than an ivory tower, that this supposed self-sustaining print-and/or-borrow-fest can go on forever. Paying off your mortgage with your credit card remains the clearest analogy of what is occurring and while the Mutually Assured Destruction case is made again and again for why the analogous credit-card-providers will never halt our limit, it seems increasingly clear that the fiat money fiasco has switched regimes to chaos rather than the apparent nominal calmness of the great moderation. Is this country run by geniuses, or what? Ben says... Fed Minutes, Gold Manipulation & Fool's Play April 3, 2012, at 7:30 pm by Eric King in the category King World News |  Print This Post | Print This Post |  Email This Post Email This PostCourtesy of www.KingWorldNews.com Dear CIGAs, On the heels of the release of the Fed minutes, today legendary trader and investor Jim Sinclair told King World News the release of the Fed minutes and subsequent market reaction in gold was orchestrated. Sinclair also said this is government manipulation against the tide of the bull market and it will be overrun. Here is what Sinclair had to say about what transpired today in the gold market: "The tactic is always the same. The gold banks enter the COMEX and offer more gold for sale at the market than has been mined in the last five years. Immediately, the locals (pit traders) try to run in front and hit any bids they happen to have on their book or are out there in order to get the price down." Jim Sinclair continues: "Gold tanks down to the $1,640 level and now the brokers for the gold banks begin to enter the market to cover shorts to reduce the short position taken, and most likely to completely flatten it on the day. This has been going on from 1968 to 1980 and it's also been going on from 2001 to today. The net effect is absolutely nothing. The idea that there is a significant, improving economy directly in front of us is absolutely, completely and utterly a fabrication. The only reason car sales are firm is because they are giving away easy credit out there, so much so that even my dogs could buy a Cadillac Escalade…. "The markets are being run right in front of your eyes. Trading gold has never been easy and if you can't stand the heat, you have to get out of the kitchen. You have to have courage and know that you are right. You have to look at today as a fool's play. This was completely orchestrated and enhanced by mainstream financial media. It was operated on the exchange and covered by the close. Shame on them. QE to infinity is as sure as death and taxes and all the way through this sage of QE to infinity there will be denial of its use. Click here to read the full written interview… Click here to hear the full interview... _______________________ Fed - Actions Speak Louder Than Words By: Axel G. Merk, Merk Investments Investors may be taken for a ride by today's Minutes of the Federal Open Market Committee (FOMC), which expand on the FOMC's March 13, 2012 statement; in the interim, we believe the Federal Reserve (Fed) Chairman Bernanke has gone out of his way to assure the markets that monetary policy will remain "highly accommodative," at least through late 2014. The Fed does indeed have a credibility problem: having assured investors that rates will remain low for an extended period, it may only take one or two FOMC members to turn more optimistic about the economic outlook to cause the markets to more aggressively price-in tighter monetary policy. Conversely, Bernanke has made it clear that he is most concerned about a recovery in the housing market and that low interest rates – throughout the yield curve – are desirable. Operation Twist is specifically aimed to achieve that, lowering long-term rates and flattening the yield curve. However, should investors become increasingly optimistic about economic improvement, odds increase that investors sell bonds, putting upward pressure on long-term rates. To understand the Fed's "communication strategy", one needs to be aware of who is calling the shots. We are not just talking about Fed Chairman Bernanke, but also the composition of voting FOMC members. Without a doubt, the "hawks" (hawks are FOMC members considered to favor tighter monetary policy compared to "doves") on the FOMC are getting more vocal. At the same time, the only voting "hawk" on the FOMC this year is Richmond Fed President Jeff Lacker:  The scale may tilt a tad towards the centrist/hawkish side should Congress fill the two vacant seats with the candidates under consideration. Still, when all is said and done, it is the voting members who ultimately determine imminent monetary policy decisions, rather than the noise created by non-voting members. And those actions remain, in our interpretation, decisively on the dovish side:

Obviously, should economic data continue to surprise to the upside, the Fed will have an ever-more difficult time defending its dovish position. The credibility of the Fed will be seriously tested as the Fed has committed to keeping rates low until late 2014. However, should we enter a weak patch, we believe the odds are rather high that the FOMC will "take out insurance" against another slowdown. In a world where everyone hopes for the best, but plans for the worst, central banks around the world – including the Fed - may keep the world awash in money. After all, a world laden with debt may need inflation if deflation is to be avoided. Bernanke has argued many times that tightening monetary policy too early was one of the biggest mistakes the Fed made during the Great Depression. We don't think Bernanke will repeat this. Indeed, we consider he will err firmly on the side of inflation. As such, when the dust settles, look at actions, not words. We see doves, not hawks, managing the monetary aviary. ________________________Jim Sinclair's Commentary The transparency of today and yesterday: To put things into perspective, who did Financial TV interview on yesterday's FOMC statement from the Fed? Of course, it was the only hawk on the board, Lacker. Ten other members are ignored because what they would say would not fit with the market play the five leading US banks executed in the market yesterday and today. The transparency of the charade is so clear that it reflects an egomaniacal approach to all markets. Those who the gods wish to destroy they make mad first. Egomania is madness. A sociopath acts as if they were a demon. An egomaniac sociopath would take great joy in showing the world who is the boss. There will be great toasting on $1000 bottles of wine at a special Italian restaurant in New York tonight. If you have no margin you will prevail. If you deal on margin you are toast. If you have margin get rid of it. ____________________________ Gold Market Like a Coiled Spring Ready to Explode to the Upside April 2, 2012, at 11:02 pm by Eric King in the category King World News |  Print This Post | Print This Post |  Email This Post Email This PostDear CIGAs, Eric King of www.KingWorldNews.com has been kind enough to interview me once again on the actions in the gold market and how it has turned after hitting the low two weeks ago. Click here to listen to the full interview on KingWorldNews.com… The following is courtesy of KingWorldNews.com: Today legendary trader and Continue reading Gold Market Like a Coiled Spring Ready to Explode to the Upside ___________________________ Got Gold You Can Hold? Got Silver You Can Squeeze? It's NOT Too Late To Accumulate! |

| Will Gold be Part of the Emerging World’s Future Monetary System? Posted: 04 Apr 2012 01:00 PM PDT In our last two articles we discussed just how the U.S. dollar came to be the central part of the world's monetary system and held onto that position when its economy and balance of payments were structurally inadequate to do so. In the second article, we described how the U.S. was flexing its muscles in taking action to stop Iran from selling its oil and receiving payments for it. |

| Australian Gold Offers Good Protection: Richard Karn Posted: 04 Apr 2012 12:22 PM PDT The Gold Report: Richard, at the Gold Symposium in Sydney, Australia, last November, one of your charts tracked the erosion of U.S. dollar purchasing power. Can you give us a summary? Richard Karn: It's interesting that if you go back to the late 18th century, the dollar has been on the gold standard roughly the same amount of time it has been on the Federal Reserve System, which presents us with a wonderful opportunity to compare the dollar's purchasing power over time. Throughout the 19th century with all of the booms and busts, the wars, and the incredible territorial and industrial expansions, the dollar maintained its purchasing power very well on the gold standard. Since 1914, when the U.S. went to the Federal Reserve System and especially since it has become a purely fiat currency system since closing the gold window in 1971, the dollar's purchasing power has collapsed. Under the Fed's administration, the dollar has lost well over 95% of its purchasing power. We show this... |

| Where (and When) to Place Your Investment Bets? Posted: 04 Apr 2012 11:48 AM PDT By Jeff Clark, Casey Research Let's explore the advantages of saving in gold and silver over dollars. Here's a hypothetical look at what could occur over the remainder of this decade. The charts below compare saving $100/month in gold and silver vs. an interest-bearing money-market account. For our projections, we assumed gold's average annual gain [...] |

| Posted: 04 Apr 2012 11:02 AM PDT |

| Silver and Gold Price Both Fell and I Bought as Bull Market in Silver and Gold Continues Unharmed Posted: 04 Apr 2012 10:55 AM PDT Gold Price Close Today : 1612.30 Change : -57.70 or -3.46% Silver Price Close Today : 3102.90 Change : -222.1 cents or -6.68% Gold Silver Ratio Today : 51.961 Change : 1.736 or 3.46% Silver Gold Ratio Today : 0.01925 Change : -0.000665 or -3.34% Platinum Price Close Today : 1596.60 Change : -43.80 or -2.67% Palladium Price Close Today : 633.05 Change : -19.35 or -2.97% S&P 500 : 1,398.96 Change : 14.42 or 1.04% Dow In GOLD$ : $167.64 Change : $ 7.35 or 4.59% Dow in GOLD oz : 8.109 Change : 0.356 or 4.59% Dow in SILVER oz : 421.37 Change : 31.90 or 8.19% Dow Industrial : 13,074.75 Change : 124.80 or 0.96% US Dollar Index : 79.74 Change : 0.314 or 0.40% GOLD PRICE dropped a massive $57.70 (3.46%) today. (Gold in euros dropped through its 200 DMA!). Gold ended on the low, at $1,612.30. Silver fell a more massive 221.1c or 6.7% to 3102.9c. In January the GOLD PRICE broke out upside, through the downtrend line from the September high. It hit a high at $1,792.70, then dropped back in a correction to kiss that downtrend line, skidding along it but not penetrating it. Now gold stands right above the peak of that triangle, and if it stoppeth not at $1,600, then twill tumble toward $1,550. Momentum is firmly down, as gold stands below all the moving averages. How much more oversold might the GOLD PRICE get? Doesn't seem likely it can get more oversold, but then, I've already been proven wrong so I'll just shut my mouth and watch. Still, I bought a little gold today, just to keep from getting in the habit of cowardice. SILVER PRICE low today came at 3098c, but it closed at 3102.9c. I bought some silver, too. I can't really say much until a few more days' trading clears the picture, but as long as silver doesn't break 3000c or gold $1,600, they are okay. If they break those levels, then more pain will come our way. Think "temporary." Bull market in silver and gold continues unharmed by today's shenanigans. As they say in East Tennessee, "Fuhgeddabowdit." Housekeeping: I will not publish a commentary on Good Friday -- on purpose. We will not be at work on Good Friday. A drop like yesterday's and today's may have some of y'all thinking about trading in and out of your long term silver and gold positions. Don't do it. Big mistake. Sure, you think that you can pick tops to sell -- so try it on paper, and see how well that works. Sure's the world, you'll sell and metals will soar instead of falling. And when you sell, you have to pay a 7.5% transaction cost on physical gold and silver, you have to net 7.5% just to break even. Then there's the riddle of when to get back in. Most people miss the bottom, or it doesn't go down and hit their target, and so they watch silver and gold zoom higher while they are sitting there holding scrofulous green dollars and wondering how they outsmarted themselves. Think: What strategy made you buy silver and gold? Riding the primary trend, the bull market that lasts 15 - 20 years. You don't make profits by trading in and out, scalping off a few points here and there. And by chasing those penny profits, you'll end up losing the hundred-dollar profits. Does my "ride the bull" strategy work? Ask the people whom I talked out of selling silver at 800c when they had doubled their money. Now imagine that I were Bernard O'Bama or Ben Bernancubus Bernancubus. Imagine further that yesterday I opined that silver and gold would not drop lower, but in fact they did. At this point I would weave, dodge, bob, and squirm, trying to explain how "lower" really was "higher," in the teeth of hoary mathematics. Ahh, but ease your troubled minds! I am not one of The Mighty Masters of The Universe, so when I am wrong, I can just chuckle and say, "Well, I warned y'all I am just a natural born fool from Tennessee. Durned if I didn't get it wrong!" I got this much right: when they fell through my support points, they plunged. But let's get these other markets out of the way before we talk about silver and gold. The US DOLLAR, contrary to all reason, rose today 31.4 basis points or 0.4%. Good for the dollar, it closed above its 20 DMA (79.55) at 79.742. Technically that's about all it has going for it, and it's an ugly green besides. The dollar's little surge pulled the rug out from under the euro. It dropped 0.7% today to $1.3142. That's awful, because not only did it gap down, it also fell below the critical 62 day moving average. From here it ought to fly about as well as a Holstein cow dropped out of a C140. Japanese yen rose 0.47% to 121.28c (Y82.45). Remains above its 20 DMA, and should head higher. Stocks took it on the chin today. Dow dropped 124.8 (0.95% to 13,074.75 S&P500 dropped even further, 14.42 or 1.02%, and fell below the morale-bruising 1,400 level to 1,398.96. Dow is now flirting again with 13,000 level, and stands below its 20 DMA (13,138). Beneath stands the 50 DMA at 12,970, and when the Dow crosses that the Investment Rats will begin deserting the good ship Wall Street -- fast. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Dennis Gartman Now Long Of Flip Flopping In Laughing Stock Terms Posted: 04 Apr 2012 10:25 AM PDT That the market can be stupid long enough to make anyone seem like a fool is well-known and appreciated by all (even if the final fate of centrally planned markets is even better known by all). What apparently is not known by those who are self-professed trading experts, is that flipflopping like a windsock in a hurricane, with the comic regularity of a Goldman FX advisor who shall remain nameless hell bent on skewering what little clients one has left, only makes one look like a complete and utter buffoon. And yet this is precisely what "one of the best gold traders" CNBC knows does over and over and over, to the point where not only does nobody give any credibility to the utterances from said expert's mouth, but it makes the entire venue into sheer unadulterated, laugh out loud stand up comedy (even more so than normal). And while we do not grasp how CNBC's producers consistently invite said individual to dig ever deeper holes for himself, the other perspective is quite clear: after all each contributor makes $200 per CNBC appearance. In the case of the abovementioned gold expert, we can see how this is a make or break cash infusion. From Friday, March 30, aka Last Friday.

Apparently if you repeat a lie often enough ("best gold trader", "esteemed", "world-renowned", etc), it becomes the truth. Just speak loudly, touch the tips of your fingers, and exude faux confidence. So what happened 3 business days later? Some of the absolutely hilarious soundbites:

At least Gartman is not short of gold in Vietnamese Dong. If one is not convulsing at this absolutely incomprehensible humor, one is likely long of lobotomies in idiot terms. But even a lobotomized idiot will understand that the trend on the chart below remains from the upper left to the lower right. After all, only world renowned, expert gold traders can make millions.... when starting with billions. |

| Junior Miners Building for a Rebound: Jordan Roy-Byrne Posted: 04 Apr 2012 10:16 AM PDT The Gold Report: When we last spoke four months ago, gold and silver stocks generally, and the juniors in particular, were in their year-end, tax-loss-selling doldrums. What is your view on where these things are now? Jordan Roy-Byrne: I think the sector is basically in a bottoming process. It has been in a state of negative sentiment for weeks but has been unable to rally. We thought the market had bottomed last week but it now appears a final washout is beginning, which could be ugly. There has been a lot of technical damage inflicted on the sector. Over the next several months or so, I think we'll see a rebound but a breakout to new highs is now unlikely to happen this year. If you have ample cash then you will be able to take advantage of the coming major bottom. TGR: Last November you were expecting a breakout in the gold stocks that would start sooner than it has. Metal prices haven't cooperated very well. Do you think it's going to take $1,800/oz gold to get people's attention... |

| Successful Investing Strategies in a Government-Centric Market Posted: 04 Apr 2012 10:00 AM PDT You've heard of "risk on"; you've heard of "risk off"… But have you heard of "everything off"? That's the trade that seems to be underway right now. Investors are dumping everything with a ticker symbol: US stocks, foreign stocks, government bonds, corporate bonds, precious metals, crude oil and almost every other commodity. In Wednesday's trading worldwide, not one single major stock market index moved to the upside. In fact, here in the Americas — North, South and Central — no stock market index of any kind moved to the upside. Over in Europe, the ticker tapes were equally dismal, unless you happened to be tracking the bullish action in Slovenia, Montenegro, Cyprus or Latvia. In the commodity markets, the CRB Index of commodities stumbled 1.5% this morning, as 14 of the 19 commodities in the index slipped into the red. Only nickel and coffee managed to gain more than one percent. The newswires blamed the worldwide downticks both on the Federal Reserve and a poor government bond auction in Spain. The Fed was to blame, said Bloomberg News, "as the Fed minutes [from the March 13 FOMC meeting] showed less urgency to add stimulus." Meanwhile, the Spanish government struggled to sell bonds in its first auction since the country said its public debt would surge to record this year. The Spaniards, who had been hoping to sell €3.5 billion worth of government bonds, managed to knock down the gavel on only €2.6 billion worth of bonds. The poor auction results kicked off a steep selloff in the Spanish bond market — pushing the yield on the 10-year government bond to its highest level since January, which was immediately before the ECB "solved" the eurozone crisis. In other words, Dear Reader, the capricious gales of bureaucratic meddling and governmental manipulations continue to buffet the financial markets. Setting a reliable course in these conditions is no easy task. Over the long run, of course, underlying fundamentals like earnings growth and dividend yields will dictate the course of one's investments. But over the short run, the treacherous seas of interventionist governments and too-big-to-fail crony capitalism can capsize even the most seaworthy of investment strategies. Sure, exceptional companies will still be exceptional. But when governments are actively price-fixing the cost of credit, while selectively rescuing fatally flawed governments and enterprises, rot flourishes. And when rot flourishes, healthy organisms struggle to take root and grow. Furthermore, no one wants to build any kind of structure on a rotting foundation. So if investors, en masse, believe that the foundations underlying their investments are corrupt and rotten, they will seek to build their wealth elsewhere — either in other jurisdictions or simply in other asset classes. They will seek to build their wealth as far away from rotten interventionist policies as possible. That could mean anything from seeking out the safest currencies to tracking down the most compelling foreign stocks or bonds to accumulating the kinds of assets that governments cannot easily corrupt — like real estate, precious metals and other hard assets. This little introduction brings us to the latest (and most exciting) installment of what we call the Daily Reckoning Group Research Project. We will ask you, Dear Readers, to devise a "permanent portfolio." Here's the context: A few decades ago, a guy named Harry Browne devised an investment strategy he dubbed the "Permanent Portfolio." The idea was so simple it seemed almost moronic. And yet, with the passage of time we have discovered that his idea was pure genius. He suggested building an investment portfolio out of only four components: gold, bonds, stocks and cash.

The idea was that at any given time, two or three of these four components might underperform — but the other portfolio components would perform so strongly, you'd get an overall gain that would outpace any increase in the cost of living. Incredibly, this simple strategy has delivered some surprisingly strong investment results. In our column "The Permanent Portfolio Revisited", written with Addison Wiggin, we provide a bit more detail about Browne's Permanent portfolio, followed by a few questions: 1) Is Harry Browne's original allocation still ideal for today's macro-economic environment? Please read on here, then submit your own version of the Permanent Portfolio. Eric Fry Successful Investing Strategies in a Government-Centric Market originally appeared in the Daily Reckoning. The Daily Reckoning, published by Agora Financial provides over 400,000 global readers economic news, market analysis, and contrarian investment ideas. Recently Agora Financial released a video titled "What is Fracking?". |

| Posted: 04 Apr 2012 09:37 AM PDT by Andy Hoffman, MilesFranklin.com:

Believe it or not, until I researched it in last Thursday's RANT, "WHY THE U.S. WANTS WAR," I wasn't sure exactly what 3:00 AM EST – the first KEY ATTACK TIME of the day – corresponded to. I was pretty sure it was the London pre-market hours, which I then confirmed to be 2:15 AM EST through 4:00 AM EST. In other words, the Cartel traders come to work at 7:15 AM London time, have a cup of coffee, allow the market to sit quietly for 45 minutes to prevent speculation as to why it would PLUMMET at the pre-market open, then do their thing. After the 3:00 AM EST hit, gold prices tend to stabilize until the New York pre-market, which I define as 7:00 AM EST (when I typically arrive at the gym) to 9:30 AM EST – the NYSE opening. |

| Even Hollywood's Bad Guys Know the Truth: ONLY Gold is Real Money Posted: 04 Apr 2012 09:33 AM PDT by SGT Given the recent pummeling in the precious metals, I figure a lighter more upbeat post is in order, this should suffice. After a week of traveling for my day job, I was in need of a mental break – as in, no thinking required. Fortunately for me, Delta was showing Ben Stiller's 'Tower Heist' on my flight home. If you care to see the movie, you may want to stop reading because I'm gonna reveal a central plot point. The comedy, and and I use the term loosely, revolves around a working-class group of guys whose lives all center around either working at or living in a posh New York high-rise residence, think Trump tower. In the five star Penthouse apartment atop the building lives Arthur Shaw, a Bernie Madoff clone played by Alan Alda.

The working class guys all rolled their life savings over to Shaw to invest when he agreed to manage their small account as a favor to building manager and good guy Josh Kovacs, played by Stiller. Problem is, none of them knew it – Stiller acted alone thinking he had done them a favor. When Arthur Shaw is arrested by the FBI it soon becomes apparent that he was operating a Ponzi scheme, and the working class folks realize they have all been wiped out. Sound familiar? I wonder if Bernie Madoff owned a Ferrari 250 GT Lusso — because in the movie Alan's character Arthur Shaw does. In fact, his pride and joy is Steve McQueen's Ferrari 250 GT Lusso, which he had meticulously disassembled, transported skyward and re-built piece by piece in his living room. When Shaw is placed under house arrest by the FBI, Stiller's character begins to scheme about ways to recover his friends' retirement money – surely bad guys like Shaw keep a hidden stash of cash for times like these. The rest of the film takes place just as you'd imagine, but with less humor or action than you might expect. So given that this is a precious metals blog and not a movie review blog, lets jump to the chase.

Arthur Shaw's stolen millions has long since been converted to gold – and hand crafted, ounce by ounce, into a Ferrari 250 GT Lusso which sits in the center of his living room, hidden in plain sight. And so it goes, Gold and Silver, the money of the elite – and the true wealth of nation's and the people is hidden in plain sight to this day. And the unknowing, uniformed common man has no idea, for men like Arthur Shaw control media empires who tell the common man "precious metals are barbarous relics", even as they fleece the working class out of what little they have left. Social Darwinist Bernie Madoff types run the world and most of them know exactly what REAL money is. Heck, even Hollywood bad guys played by Alan Alda know what real money is. Got physical? |

| Symbolic Suicide: Will Anyone Notice? Posted: 04 Apr 2012 09:23 AM PDT Addison Wiggin – April 4, 2012

"This was a symbolic suicide," said one of the passers-by in Syntagma Square, in the heart of Athens. "If it hadn't happened here, in the square, in front of parliament, no one would notice." From what we can tell, we're not sure anyone is noticing. The facts of the case made it to The Wall Street Journal. It happened this morning toward the end of rush hour. The man left no suicide note, but from his last words, it was evident he was despondent over his debts. The news is only a few hours old… too soon to tell the impact. Perhaps it will touch off an uprising in the PIIGS countries; recall the Arab Spring began with a man setting himself on fire in Tunisia because the police harassed him for selling vegetables without paying off the proper authorities. On the other hand, it may go as unheralded as that of Andrew Wordes.

"Americans might ask themselves: Why should what happens in the rest of the world concern us? Don't we have our own problems?" she pleaded. "In today's world, we cannot afford the luxury of staying in our own mental backyards." Really. Ms. Lagarde argued the U.S. should put up more cash to bail out Europe. Because, apparently, funding 17% of the IMF's operations isn't enough. She did, helpfully, however, offer very little in the way of details as to what magic she thought the U.S. government could employ to conjure up the money…

"Somewhere down the line," the Gloom Boom & Doom Report editor tells CNBC, "we will have a massive wealth destruction that usually happens either through very high inflation, or through social unrest, or through war, or a credit market collapse." "Maybe all of it will happen, but at different times." He continues that that well-to-do "people may lose up to 50% of their total wealth. They'll still be well-to-do; instead of having a billion, they'll have, say, 500 million. But I think there is a massive wealth destruction coming down the line." In the event of a crisis, Dr. Faber still likes farmland. Or an island if you can afford one. Real estate, in Australia, New Zealand and Canada, rates high… along with foreign stocks, precious metals held outside the United States and collectibles like diamonds, stamps and art. [Ed. note. The good doctor is a crowd favorite at our annual Symposium in Vancouver; we've invited him back again for this year's edition. Early-bird registration is still available; learn how to lock in the lowest possible rate at this link.]

At last check, the bid was $1,616. The most dramatic part of the sell-off came at precisely 2:00 p.m. EDT yesterday.  The sell-off comenced right after the Fed mintes were released yesterday. As Dr. Faber suggests, we may see continued selling in the gold market, but our outlook remains unchanged. We see gold as a buy… and a cheaper buy, at that.

Like archaeologists examining hieroglyphs, traders examined the minutes for signs of the imminent QE3 they ardently hoped for. Finding none, thus realizing the next hit off the easy-money crack pipe won't be coming for a while yet, they hit the sell button on nearly everything… yesterday and today:

The only beneficiary is the greenback. The dollar index is up to 79.8.

At 80 cents a pound, wholesale ham prices are more or less unchanged from a year ago… but the figure far outpaces the five-year average of 55 cents a pound. Blame it on the cost of pig feed, which is mostly corn. Right now, corn's running about $6 a bushel — down from last summer's $8 record, but still well above historical norms. "Even in the face of a bumper crop, with the highest planting expectations since 1937," writes Daily Resource Hunter's Matt Insley, "the price of corn has barely been affected, still trading in its six-month trading range." Beyond this weekend, that doesn't bode well for the cost of Thanksgiving dinner… which as we noted last fall rose 13% last year.

"Global supply is tight," he says. And he doesn't believe Saudi Arabia has the spare capacity to ease that tightness. "No, I don't think they can can cover. If they do, they'll cover it out of storage" — not added production. A caveat: Pickens doesn't see the U.S. benchmark price — West Texas Intermediate — hitting $148. But Brent crude, a more representative figure for the rest of the world, is $123.21 this morning.

"Spain still carries huge debts on property not worth anywhere near the mortgages on them. Fitch Ratings found that repossessed homes in Spain were 43% less on average than the debts they carried. Home prices in Spain have fallen between 20-58% from the highs." "It seems as if this has been the story for the Western world since the financial crisis began in 2007. If you look at what's happened from the onset of the financial crisis until now, there is a definite pattern to the winners and losers."  "But don't jump to obvious conclusions," Chris advises. "The right-hand part of this chart promises to be rich in deep value." By way of example, he points to a Greek engineering and construction firm. "It has 20 years of profits, 36% of the share price in cash, earns most of its revenue outside of Greece and trades for only 3.3 times trailing income while paying out a whopping 7.7% yield. Sounds good to me." "Those kinds of prices already reflect a world of pain. Buy a basket of stocks like these and hang on and making money seems as easy as lying down." The euro crisis is the other side of Chris' thesis in his new book World Right Side Up: Yes, there's ample opportunity in the emerging and frontier markets, where people are reaching for middle-class standards of living. But in the ash heap of the Western world lie some real treasures you can pick up super-cheap. Chris reveals more opportunities like these, gleaned from his extensive travels, during an "online adventure tour" we're organizing in advance of the book's publication. You can come along for the ride on Thursday, April 12 — that's a week from tomorrow. Sign up here — there's no cost and no obligation.

This conference brought together dozens of people with big money looking for a place to put it in the biotech space… and Patrick delivered no shortage of ideas, from stem cells to anti-cancer vaccines. But perhaps the most enthusiastic reception was for anatibine citrate, a compound found in tomatoes and bell peppers. It's the key ingredient in an anti-inflammatory product that's allowed Patrick to resume his paddleboarding hobby. It's also enabled one of the scientific community's movers and shakers to recover more quickly from ultramarathons. One of the other speakers was Bill Andrews, CEO of Sierra Sciences. Patrick didn't know until they met up at the conference, but Andrews swears by this nutraceutical — enough to put his family on it. But others in attendance were hearing about it for the first time. Which goes to show that even for specialists in the field, there are knowledge gaps. Patrick did his part to fill in those gaps over the weekend… which could easily prove another catalyst for the company that makes this product. To learn about several others, you might want to check out this report Patrick just finished updating.

"Our car was involved in a fender bender, so we rented another for eight days while ours was in the shop":

"Excuse me, a fee? The word implies payment for services rendered. According to the rental agent, these monies go directly to the Deprtment of Homeland Security, not to the rental company. And DHS services for my rental car? The dog did not sniff it for explosives. The driver and passengers were not screened, X-rayed, or patted down. The alert signs on the highways mostly show gobbledygook." "So I received no services for my eight-day rental. And it's insulting that they should call it a 'fee' rather than a 'tax.' I should contact my senators/representatives and see how they pulled this particular wad of wool over my eyes." The 5: If you do, be sure to let us know what they say. Might have some high entertainment value. Cheers, Addison Wiggin P.S. The Dow is selling off hard this week, but Abe Cofnas' sample trade anticipating the Dow's movement is still good. Recall from Monday's episode that Abe laid on a range play — expecting the Dow to remain within a range between 12,975-13,275. So far, so good. If the trend keeps up, it means a 15.6% gain by the close on Friday. Meanwhile, Abe's making his way back from Asia, where he got the rock star treatment signing the Chinese-language edition of his book Sentiment Indicators.  Abe's in Sydney right now, but he keeps the market's pulse from wherever he happens to be. Stay tuned… |