Gold World News Flash |

- None so Blind

- Jim Sinclair - Fed Minutes, Gold Manipulation & Fool’s Play

- Brace For “Massive Wealth Destruction”

- Gold Seeker Closing Report: Gold and Silver Fall On Fed Minutes

- Silver Update 4/3/12 It's The FED Stupid

- Gold?s Range May Lead to Sharp Decline

- Wolfson gurus see euro break-up as dangerous but liberating

- EPIC CRIMINALITY: 637.5 MILION OUNCES OF PAPER SILVER DUMPED in One Hour After FED Minutes Released

- beige Report indicates new QEIII yet/Europe in the red due to higher bond yields for Italy and Spain/ Raid on gold and silver in access market

- Why Is The Heartland Of America Being Ripped To Shreds By Gigantic Tornadoes That Are Becoming More Frequent And More Powerful?

- Schizo

- Jim Sinclair – Fed Minutes, Gold Manipulation & Fool’s Play

- Guest Post: Gold's Critical Metric

- Salinas: Legislation Required That Recognizes Gold & Silver as Different Forms of Money

- Dr. Nu Yu?s Latest Market Update on Gold/Silver, USD and Stock Market

- Fed Minutes, Gold Manipulation & Fool's Play

- J.S. Kim explodes nine myths about investing in gold

- ARE PREPPERS CRAZY? DON’T BET YOUR LIFE

- Today was 'pure manipulation ... almost without camouflage,' Sinclair says

- Guest Post: Global Oil Risks in the Early 21st Century

- The Gold Price "Must Hold" Support is $1,630 I Expect Higher Lows Tomorrow

- The "Tax Anything" Issue

- Education Price Inflation Funded Boom Time Bubble Lending and Lax Underwriting- Bubble, Bubble, Toil & Trouble!

- The Mechanical Fed: Fast for a Robot, Slow for a Dog

- Gold’s Critical Metric

- Never Underestimate Country Risk

- The “Tax Anything” Issue

- In The News Today

- Peter Schiff - Reaction to Fed Minutes Wrong, QE3 is Coming

| Posted: 03 Apr 2012 06:07 PM PDT |

| Jim Sinclair - Fed Minutes, Gold Manipulation & Fool’s Play Posted: 03 Apr 2012 04:11 PM PDT  On the heels of the release of the Fed minutes, today legendary trader and investor Jim Sinclair told King World News the release of the Fed minutes and subsequent market reaction in gold was orchestrated. Sinclair also said this is government manipulation against the tide of the bull market and it will be overrun. Here is what Sinclair had to say about what transpired today in the gold market: "The tactic is always the same. The gold banks enter the COMEX and offer more gold for sale at the market than has been mined in the last five years. Immediately, the locals (pit traders) try to run in front and hit any bids they happen to have on their book or are out there in order to get the price down." On the heels of the release of the Fed minutes, today legendary trader and investor Jim Sinclair told King World News the release of the Fed minutes and subsequent market reaction in gold was orchestrated. Sinclair also said this is government manipulation against the tide of the bull market and it will be overrun. Here is what Sinclair had to say about what transpired today in the gold market: "The tactic is always the same. The gold banks enter the COMEX and offer more gold for sale at the market than has been mined in the last five years. Immediately, the locals (pit traders) try to run in front and hit any bids they happen to have on their book or are out there in order to get the price down." This posting includes an audio/video/photo media file: Download Now |

| Brace For “Massive Wealth Destruction” Posted: 03 Apr 2012 04:02 PM PDT  Reminiscent of the 1970s and the U.S. fiscal and monetary conditions which soared gold from $35 to $875 per ounce by Jan. 1980, Marc Faber, author of the Gloom Boom Doom Report warned investors of the dire implications of the world's central banks presently engaged in a global currency war. Reminiscent of the 1970s and the U.S. fiscal and monetary conditions which soared gold from $35 to $875 per ounce by Jan. 1980, Marc Faber, author of the Gloom Boom Doom Report warned investors of the dire implications of the world's central banks presently engaged in a global currency war.But unlike the 1970s and the problems with the U.S. dollar, this time, in addition to the dollar, the euro, pound sterling and yen are also devaluing against everything of tangible value. And the speed at which these currencies depreciate in the coming years will most likely dwarf the decade which included the Vietnam War, Middle East conflicts, U.S. budget deficits and resulting stagflation. Get my next ALERT 100% FREE "Somewhere down the line we will have a massive wealth destruction that usually happens either through very high inflation or through social unrest or through war or credit market collapse," he told CNBC, Monday. "Maybe all of it will happen, but at different times." Read more...... This posting includes an audio/video/photo media file: Download Now |

| Gold Seeker Closing Report: Gold and Silver Fall On Fed Minutes Posted: 03 Apr 2012 04:00 PM PDT |

| Silver Update 4/3/12 It's The FED Stupid Posted: 03 Apr 2012 03:46 PM PDT |

| Gold?s Range May Lead to Sharp Decline Posted: 03 Apr 2012 03:36 PM PDT courtesy of DailyFX.com April 03, 2012 02:11 PM Weekly Bars Prepared by Jamie Saettele, CMT I wrote last week that “when viewed in the proper context, price action since September appears as nothing more than consolidation within a secular bull market. Still, resistance is 1670/85 and a drop below last week’s low should trigger losses towards 1600.” It may be appropriate to adopt a more bearish tone on gold however as the metal is weakening in early month trade for the second consecutive month (early month direction is often a ‘tell’ as to the larger trend). I’d much rather express my views through FX, but look lower towards early year pivots at 1600/10 as long as gold is below 1700. Bottom Line (next 5 days) – lower?... |

| Wolfson gurus see euro break-up as dangerous but liberating Posted: 03 Apr 2012 03:17 PM PDT |

| EPIC CRIMINALITY: 637.5 MILION OUNCES OF PAPER SILVER DUMPED in One Hour After FED Minutes Released Posted: 03 Apr 2012 02:56 PM PDT [Ed. Note: For you educated home gamers, 637 million ounces of (paper) silver is getting darn close to the total amount of physical silver mined worldwide, in an entire year.]

In a sign of the diminishing returns of paper market manipulation, on the heels of today's Fed minutes disappointment, beginning at 2pm EST, over 127,000 contracts, or 637.535 MILLION OUNCES OF PAPER SILVER were dumped on the market in only 1 hour, resulting in a massive silver decline of…. $0.65. Nearly 80% of ENTIRE ANNUAL WORLD MINING SUPPLY was dumped on the market (during the thinly traded Globex session), over a single hour, and all the cartel could muster was a lousy .65 decline in the paper price of silver! |

| Posted: 03 Apr 2012 02:26 PM PDT by Harvey Organ, HarveyOrgan.Blogspot.ca: Good evening Ladies and Gentlemen: Gold closed down today to the tune of $5.20 to $1672.00. Silver on the other hand rose by 18 cents to 433.26. At 2:00 pm est we got the FOMC beige report and that showed the USA was not going to do QEIII unless a crisis was upon it. Interestingly gold and silver were bombed one second after the comex closed at 1:30 pm. The market pundits blamed gold and silver's fall to the Beige Report. Somehow the boys got their timing wrong. Right now in the access market: Gold: $1643.33 Let us now head over to the comex and assess trading today. |

| Posted: 03 Apr 2012 02:02 PM PDT from The Economic Collapse Blog:

|

| Posted: 03 Apr 2012 01:57 PM PDT from TF Metals Report:

schiz·o·phre·ni·a[skit-suh-free-nee-uh, -freen-yuh] noun 1. Psychiatry . Also called dementia praecox. a severe mental disorder characterized by some, but not necessarily all, of the following features: emotional blunting, intellectual deterioration, social isolation, disorganized speech and behavior, delusions, and hallucinations. 2. a state characterized by the coexistence of contradictory or incompatible elements. Whaddayagonnado? The Bernank giveth and The Bernank taketh away. Just a short 6 trading/business days ago, we were greeted with this: Gold rallied over $23 last Monday, following upon a $20 UP day the previous Friday. Pretty impressive. Today, gold had been threatening critical moving average, technical and Fibonacci resistance near 1680 and silver had finally looked like it was gaining a significant toe-hold above $33. Unfortunately, the latest FOMC minutes were released after the Comex close and lookee here: "Now, wait a second", you must be saying. "Hold on just a minute", you must be mumbling. "Just last week, The Bernank mentioned more QE was on the way and now today it's not. Did things change overnight? Huh?" |

| Jim Sinclair – Fed Minutes, Gold Manipulation & Fool’s Play Posted: 03 Apr 2012 01:53 PM PDT from King World News:

|

| Guest Post: Gold's Critical Metric Posted: 03 Apr 2012 01:51 PM PDT Submitted by Jeff Clarke of Casey Research Gold's Critical Metric There are many reasons why gold is still our favorite investment – from inflation fears and sovereign debt concerns to deeper, systemic economic problems. But let's be honest: It's been rising for over 11 years now, and only the imprudent would fail to think about when the run might end. Is it time to start eyeing the exit? In a word, no. Here's why. There's one indicator that clearly signals we're still in the bull market – and further, that we can expect prices to continue to rise. That indicator is negative real interest rates. The real interest rate is simply the nominal rate minus inflation. For example, if you earn 4% on an interest-bearing investment and inflation is 2%, your real return is +2%. Conversely, if your investment earns 1% but inflation is 3%, your real rate is -2%. This calculation is the same regardless of how high either rate may be: a 15% interest rate and 13% inflation still nets you 2%. This is why high interest rates are not necessarily negative for gold; it's the real rate that impacts what gold will ultimately do. What History Tells Us The chart below calculates the real interest rate by extracting annualized inflation from the 10-year Treasury nominal rate. Gray highlighted areas are the periods when the real interest rate was below zero, and as you can see, this is when gold has performed well. (Click on image to enlarge) Gold climbs when real interest rates are low or falling, while high or rising real rates negatively impact it. This pattern was true in the 1970s and it's true today. A closer study of this chart tells us there's actually a critical number for real rates that seem to have the most impact on gold. Take a look at how gold performs when real rates are at 2% or below. (Click on image to enlarge) The reason for this phenomenon is straightforward. When real interest rates are at or below zero, cash or debt instruments (like bonds) cease being effective because the return is lower than inflation. In these cases, the investment is actually losing purchasing power – regardless of what the investment pays. An investor's interest thus shifts to assets that offer returns above inflation… or at least a vehicle where money doesn't lose value. Gold is one of the most reliable and proven tools in this scenario. Politicians in the US, EU, and a range of other countries are keeping interest rates low, which, in spite of a low CPI, pushes real rates below zero. This makes cash and Treasuries guaranteed losers right now. Not only are investors maintaining purchasing power with gold, they're outpacing most interest-bearing investments due to the rising price of the metal. Here's another way to verify this trend. As the following chart shows, from January 1970 through January 1980 gold returned a total of 1,832.6%. This is much higher than inflation during that decade, which totaled 105.8%. (Click on image to enlarge) In the current bull market, gold has gained 556.3% since 2001, while inflation has thus far totaled 30%. (Click on image to enlarge) Further supporting this thesis is the fact that when real rates are positive, gold has not performed well. You can see this in the following chart of when real interest rates were higher than inflation. (Click on image to enlarge) The gold price fluctuated between $300 and $500 for the twenty-year period when rates were positive. This is a strong reminder that bull markets don't last forever – even golden ones – and that at some point we'll need to sell to lock in a profit. So if history demonstrates that gold does well during a negative-rate environment and poorly during positive periods, the natural question becomes… How Much Longer Will Negative Real Rates Last? US Federal Reserve Chairman Ben Bernanke stated in January that he expects to keep short-term interest rates close to zero "at least through late 2014." This low-rate, loose-money policy is intended to "support a stronger economic recovery and reduce unemployment." While his strategy is debatable, this implies that almost any inflation at all will continue to keep the real rate negative and thus gold will stay in a bull market. What if the economy improves? After all, there are economic data showing the economy may be finding its footing, making some believe interest rates could be raised earlier, as soon as next year. Based on the data above, the answer to the question is, "What does inflation do?" In other words, interest-rate fluctuations alone aren't important; it's how the rate interacts with the inflation rate. If inflation simultaneously rises and keeps the real rate negative, we should expect gold to remain in a bull market. With the obscene amount of money that's already been printed, high inflation seems almost certain at some point, even if there isn't any more money creation. This is why we think the end to the gold bull market is not yet in sight. One more point. You'll notice in the above charts that this trend doesn't reverse on a dime. It takes anywhere from months to years for investors to shift from interest-bearing investments to metals – and vice versa. And the longer the trend, the slower the change. Real rates have been negative for a decade now, and with broad institutional investment in gold largely still in absentia, it seems reasonable to expect that the trend in gold won't shift anytime soon. Implications for Investors Armed with these data, there are definite steps you can take with your investments at this point, as well as reasonable expectations you can have going forward:

There are a lot of reasons to own gold today, and there will likely be more before it's time to say goodbye. In the meantime, we take comfort in the fact that the strongest historical indicator of all tells us the gold bull market is alive and well and has years to play out. |

| Salinas: Legislation Required That Recognizes Gold & Silver as Different Forms of Money Posted: 03 Apr 2012 01:31 PM PDT I think that unless we see legislation, somewhere, that is rational and recognizes that gold and silver are really different forms of money, and that this whole scheme of paper is unworkable, then the world is going to go down in flames. The only thing that would last*[would] be people's savings of gold and silver. So says Hugo Salinas Price in edited excerpts from*a King World News interview, as provided by Lorimer wilson, editor of www.munKNEE.com (Your Key to Making Money!). This paragraph must be included in its entirety in any re-posting to avoid copyright infringement. In the interview Price*goes on to say: In spite of having gold and silver, that may not be enough to save you. They're good things to have, but what we actually need to do is save our civilization and not go down in flames. I think the first thing to do would be to insert silver coins into the monetary system. That would be a healthy thing to do. [INDENT][COLOR=#ff0000]Home Delivery Available! If you enjoy this... |

| Dr. Nu Yu?s Latest Market Update on Gold/Silver, USD and Stock Market Posted: 03 Apr 2012 01:31 PM PDT [B][/B][B][B]What is currently transpiring with gold, silver, the US Dollar Index, 30-year U.S. Treasury bonds and the broad stock market is no surprise to those who follow my weekly market updates. Take a look. [/B][/B]Words: 750 So says Dr. Nu Yu ([url]http://fx5186.wordpress.com[/url]) in edited excerpts from his original article* (which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited below for length and clarity – see Editor's Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.) Yu goes on to say, in part: The Broad Stock Market (Wilshire 5000 Index) The Dow Jones Wilshire 5000 index, as an average or a benchmark of the total equity market, has been in a “Rising Wedge” pattern (see here) for four months, on the way towards the wedge apex. Although the rising wedge pattern typically has a bearish bias, it is one of the worst performing chart patterns to tak... |

| Fed Minutes, Gold Manipulation & Fool's Play Posted: 03 Apr 2012 01:30 PM PDT Courtesy of www.KingWorldNews.com Dear CIGAs, On the heels of the release of the Fed minutes, today legendary trader and investor Jim Sinclair told King World News the release of the Fed minutes and subsequent market reaction in gold was orchestrated. Sinclair also said this is government manipulation against the tide of the bull market Continue reading Fed Minutes, Gold Manipulation & Fool's Play |

| J.S. Kim explodes nine myths about investing in gold Posted: 03 Apr 2012 12:41 PM PDT 8:40p ET Tuesday, April 3, 2012 Dear Friend of GATA and Gold: With print and with video J.S. Kim of the SmartKnowledgeU investment system explodes what he calls the nine myths about gold that investors need to know to survive the worldwide financial turmoil. Part 1 is at Kim's Internet site, the Underground Investor, here: http://www.theundergroundinvestor.com/2012/04/nine-gold-myths-everyone-n... And Page 2 is here: http://www.theundergroundinvestor.com/2012/04/nine-gold-myths-everyone-n... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Golden Phoenix Discusses Royalty Mining Growth Strategy Golden Phoenix Minerals Inc. has discussed its royalty mining growth strategy on the Fox Business Network program "21st Century Business" with host Jackie Bales. Golden Phoenix's director of corporate communications, Robert Ian, told how the company narrows its focus to project generation and future royalty streams. He explained why Golden Phoenix believes it's better to own joint-venture interests in several producing mines instead of full exposure to just one project. "21st Century Business" has been airing for 15 years. Previous hosts have included Gen. Alexander Haig, Gen.l Norman Schwarzkopf, and Secretary of Defense Caspar Weinberger. Golden Phoenix appeared as paid programming on this broadcast. To view the program with Golden Phoenix, please visit Golden Phoenix's Internet site here: http://www.goldenphoenix.us/company-videos.html |

| ARE PREPPERS CRAZY? DON’T BET YOUR LIFE Posted: 03 Apr 2012 12:16 PM PDT [Ed. Note: We read a lot about financial and economic collapse. The prediction is not without material consequences.] from The Burning Platform:

Time is running out folks. If your sitting on the fence about your preparations, you will fall awfully hard. Get off your asses now and start stocking up on food, water, ammo. This article might shock some of you into action. If it doesn't, it's already too late for you sucker. Read This First Before You Decide That Preppers Are Crazy Do you believe that preppers are a few cards short of a full deck? Do you assume that anyone that is "preparing for doomsday" does not have their elevator going all the way to the top floor? Well, you might want to read this first before you make a final decision that all preppers are crazy. The information that you are about to read shook me up a bit when I first looked it over. To be honest, I had no idea how incredibly vulnerable our economic system is to a transportation disruption. I am continually getting emails and comments on my websites asking "how to prepare" for what is coming, so when I came across this information I knew that I had to share it with all of you. Hopefully what you are about to read will motivate you to prepare like never before, and hopefully you will share this information with others. Read More @ The Burning Platform

|

| Today was 'pure manipulation ... almost without camouflage,' Sinclair says Posted: 03 Apr 2012 11:57 AM PDT 7:50p ET Tuesday, April 3, 2012 Dear Friend of GATA and Gold: Today's pounding of gold amid the announcement of the Federal Reserve's minutes was "pure manipulation ... executed almost without camouflage," gold advocate and mining entrepreneur Jim Sinclair tells King World News tonight. But as it is manipulation "against the tide of the market," Sinclair adds, it will fail as gold goes to $4,500. May we all live to see the day. An excerpt from Sinclair's interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/4/4_Jim... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum (TSXV: NKL) and Ursa Major Minerals Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) and Ursa Major Minerals Inc. have signed a binding letter of agreement for a business combination through a proposed all-share transaction. In doing so Prophecy and Ursa have acted at arm's length and the transaction has been negotiated at arm's length. Prophecy will issue one common share in exchange for every 25 outstanding common shares of Ursa. Ursa options and warrants will be exchanged for options and warrants of Prophecy on an agreed schedule. Prophecy's offer represents a value of about $0.15 per each common share of Ursa based on Prophecy's share price of $3.70 as at March 1, representing a premium of 130 percent to Ursa's March 1 closing price of $0.065. Prophecy is to subscribe for $1 million common shares of Ursa by way of private placement financing at $0.06 per share, subject to regulatory approval. Upon placement completion, John Lee and Greg Hall, current Prophecy directors, will be appointed to Ursa's board. Prophecy thus will become a mid-tier resource company with a robust and -- The fully permitted open-pit Shakespeare PGM-Ni-Cu mine close to Sudbury, Ontario, infrastructure with near-term production capabilities. -- The flagship Wellgreen (Yukon) PGM-Ni-Cu project with more than 10 million ounces of Pt-Pd-Au inferred resource. Drilling is under way and a preliminary economic assessment study is pending. -- Manitoba's Lynn Lake Ni-Cu project with more than 262 million pounds Ni and 138 million pounds Cu measured and indicated. For the complete announcement, please visit Prophecy Platinum's Internet site here: http://www.prophecyplat.com/news_2012_mar02_prophecy_platinum_ursa_major... |

| Guest Post: Global Oil Risks in the Early 21st Century Posted: 03 Apr 2012 11:29 AM PDT This is a guest post by Dean Fantazzini, Moscow School of Economics, Moscow State University, Moscow, Russia; Mikael Höök, Uppsala University, Global Energy Systems, Department of Physics and Astronomy, Uppsala, Sweden; and André Angelantoni, Post-Peak Living, San Francisco, CA. This paper has been previously published in Energy Policy, Volume 39, Issue 12, December 2011, Pages 7865-7873.

Abstract:The Deepwater Horizon incident demonstrated that most of the oil left is deep offshore or in other locations difficult to reach. Moreover, to obtain the oil remaining in currently producing reservoirs requires additional equipment and technology that comes at a higher price in both capital and energy. In this regard, the physical limitations on producing ever-increasing quantities of oil are highlighted, as well as the possibility of the peak of production occurring this decade. The economics of oil supply and demand are also briefly discussed, showing why the available supply is basically fixed in the short to medium term. Also, an alarm bell for economic recessions is raised when energy takes a disproportionate amount of total consumer expenditures. In this context, risk mitigation practices in government and business are called for. As for the former, early education of the citizenry about the risk of economic contraction is a prudent policy to minimize potential future social discord. As for the latter, all business operations should be examined with the aim of building in resilience and preparing for a scenario in which capital and energy are much more expensive than in the business-as-usual one. 1. IntroductionAn economy needs energy to produce goods and deliver services and the size of an economy is highly correlated with how much energy it uses (Brown et al., 2010a, Warr and Ayers, 2010). Oil has been a key element of the growing economy. Since 1845, oil production has increased from virtually nothing to approximately 86 million barrels per day (Mb/d) today (IEA, 2010), which has permitted living standards to increase around the world. In 2004 oil production growth stopped while energy hungry and growing countries like China and India continued increasing their demand. A global price spike was the result, which was closely followed by a price crash. Since 2004 world oil production has remained within 5% of its peak despite historically high prices (see Figure 1). Figure 1. Oil production stopped growing in 2004 while demand continued to increase. The result was a global oil price spike that contributed to the subsequent economic contraction. Liquid fuels include crude oil, lease condensate, natural gas plant liquids, other liquids, and refinery processing gains and losses as defined by the EIA. Source: Hirsch (2010) The combination of increasingly difficult-to-extract conventional oil combined with depleting supergiant and giant oil fields, some of which have been producing for seven decades, has led the International Energy Agency (IEA) to declare in late 2010 that the peak of conventional oil production occurred in 2006 (IEA, 2010). Conventional crude oil makes up the largest share of all liquids commonly counted as "oil" and refers to reservoirs that primarily allow oil to be recovered as a free-flowing dark to light-coloured liquid (Speight, 2007). The peak of conventional oil production is an important turning point for the world energy system because many difficult questions remain unanswered. For instance: how long will conventional oil production stay on its current production plateau? Can unconventional oil production make up for the decline of conventional oil? What are the consequences to the world economy when overall oil production declines, as it eventually must? What are the steps businesses and governments can take now to prepare? In this paper we pay particular attention to oil for several reasons. First, most alternative energy sources are not replacements for oil. Many of these alternatives (wind, solar, geothermal, etc.) produce electricity, not liquid fuel. Consequently, the world transportation fleet is at high risk of suffering from oil price shocks and oil shortages as conventional oil production declines. Though substitute liquid fuel production, like coal-to-liquids, will increase over the next two or three decades, it is not clear that it can completely make up for the decline of oil production. Second, oil contributes the largest share to the total primary energy supply, approximately 34%. Changes to its price and availability will have worldwide impact especially because alternative sources currently contribute so little to the world energy system (IEA, 2010).

Figure 2. Fuel shares of world total primary energy supply. The "other" category includes tidal, solar and wind generation. Source: IEA (2007) Last, oil is particularly important because of its unique role in the global energy system and the global economy. Oil supplies over 90% of the energy for world transportation (Sorrell et al., 2009). Its energy density and portability have allowed many other systems, from mineral extraction to deep-sea fishing (two sectors particularly dependent on diesel fuel but sectors by no means unique in their dependence on oil), to operate on a global scale. Oil is also the lynchpin of the remainder of the energy system. Without it, mining coal and uranium, drilling for natural gas and even manufacturing and distributing alternative energy systems like solar panels would be significantly more difficult and expensive. Thus, oil could be considered an "enabling" resource. That is, it enables us to obtain all the other resources required to run our modern civilization. 2. The production perspectiveIt is commonly claimed that peak oil, i.e. the concept that oil production will reach a maximum level and then decline, is only about geology. To some extent this is a result of the polarized debate that has raged between geologists, such as Hubbert (1949; 1956) or Campbell (1997; 2002), and economists, including Adelman (1990) and Lynch (2002; 2003). In fact, peak oil is the result of a complex set of forces that includes geology, reservoir physics, economics, government policies and politics. However, a solid understanding of the peaking and subsequent decline of oil production begins with acknowledging the natural laws that create a framework for everything. The intrinsic limitations of these laws eventually affect all human activities because neither economic incentives nor political will can bend or break these laws of nature. There are a number of physical depletion mechanisms that affect oil production (Satter et al., 2008). Depletion-driven decline occurs during the primary recovery phase when decreasing reservoir pressure leads to reduced flow rates. Investment in water injection, the secondary recovery phase, can maintain or increase pressure but eventually increasingly more water and less oil is recovered over time (i.e. increasing water cut). Additional equipment and technology can be used to enhance oil recovery in the tertiary recovery phase, but this comes at a higher price in terms of both invested capital and energy to maintain production. The situation is similar to squeezing water out of a soaked sponge. It is easy at first, but increasingly more effort is required for diminishing returns. At some point, it is no longer worth squeezing either the sponge or the oil basin and production is abandoned. Another way to explain peaking oil production is in terms of predator-prey behavior, as Bardi and Lavacchi (2009) have done. Their idea is that, initially, the extraction of "easy oil" leads to increasing profit and investments in further extraction capacity. Gradually the easiest (and typically the largest) resources are depleted. Extraction costs in both energy and monetary terms rise as production moves to lower quality deposits. Eventually, investments cannot keep pace with these rising costs, declining production from mature fields cannot be overcome and total production begins to fall. An additional factor plays an important role. In both models, regardless of the abundance of capital or high prices, an oil well is unable to deliver net energy at some point. Hubbert (1982) wrote: "There is a different and more fundamental cost that is independent of the monetary price. That is the energy cost of exploration and production. So long as oil is used as a source of energy, when the energy cost of recovering a barrel of oil becomes greater than the energy content of the oil, production will cease no matter what the monetary price may be." These physical trends conspire to make oil production increasingly difficult and expensive in monetary and energy terms. Economic incentives and technological advancement can slow these trends but they cannot be stopped. 2.1 Oil production todayProduction peaks occur for many energy sources ranging from firewood and whales to fossil fuels (Höök et al., 2010). Currently, around 60 countries have passed "peak oil" (Sorrell et al., 2009) — their point of maximum production. In most cases this is due to physical depletion of the available resources (e.g. USA, the UK, Norway, etc.) while in a few cases socioeconomic factors limit production (e.g. Iraq). Attempts to disprove peak oil that focus solely on the amount of oil available in all its forms demonstrate a fundamental, and an unfortunately common confusion between how much oil remains versus how quickly it can be produced. Although until recently, oil appeared to be more economically available than ever before (Watkins, 2006), others have shown this to be an artifact of statistical reporting (Bentley et al., 2007). Further, it is far less important how much oil is left if demand , for instance, is 90 Mb/d but only 80 Mb/d can be produced. Still, the most realistic reserve estimates indicate a near-term resource-limited production peak (Meng and Bentley, 2008; Owen et al., 2010). Total oil production is comprised of conventional oil, which is liquid crude that is easy and relatively cheap to pump, and unconventional oil, which is expensive and often difficult to produce. It is vital to understand that new oil is increasingly coming from unconventional sources like polar, deep water, and tar sands. Almost all the oil left to us is in politically dangerous or remote regions, is trapped in challenging geology or is not even in liquid form. Today, over 60% of the world production originates from a few hundred giant fields. The number of giant oil field discoveries peaked in the early 60s and has been dwindling since then (Höök et al., 2009). This is similar to picking strawberries in a field. We picked the biggest and best strawberries first (just like big oil fields they are easier to find) and left the small ones for later. Only 25 fields account for one quarter of global production and 100 fields account for half of production. Just 500 fields account for two-thirds of all the production (Sorrell et al., 2009a). As the IEA (2008) points out, it is far from certain that the oil industry will be able to muster the capital to tap enough of the remaining, low-return fields fast enough to make up for the decline in production from current fields. All oil sources are not equally easy to exploit. It takes far less energy to pump oil from a reservoir still under natural pressure than to recover the bitumen from tar sands and convert it to synthetic crude. The energy obtained from an extraction process divided by the energy expended during the process is the Energy Return on Energy Invested (EROEI). It is a return on investment calculation applied to a physical process. As Hubbert noted, regardless of the price the market is willing to pay for oil, just as we won't spend a dollar to receive only a dollar in return, when we expend as much oil as we get back from a particular oil deposit, production will stop. The EROEI of US domestic oil production (chiefly originating from giant oil fields) has declined from 100:1 in 1930 to less than 20:1 for developments in the 2000s, e.g. Gulf of Mexico,(Gately, 2007; Hall et al., 2008; Murphy and Hall, 2010). Since giant and super giant oil fields dominate current production, they are good indicators for the point of peak production (Robelius, 2007; Höök et al., 2009). There is now broad agreement among analysts that the decline in existing production is between 4-8% annually (Höök et al., 2009). In terms of capacity, this means that roughly a new North Sea (~5 Mb/d) has to come on stream every year just to keep the present output constant. In 2010, the IEA (2010) abruptly announced that the peak of conventional oil production was reached in 2006. The IEA also again lowered their estimate of total world oil production to less than 100 Mb/d by 2035. However, it has been shown that the IEA oil production model is flawed. To reach the production level in their model, they assume oil field depletion rates that are so high that they have never been seen in any oil region before (Aleklett et al., 2010). The remaining oil simply cannot be produced as quickly as would be required to push the production peak as far into the future as they project, thus the peak must occur sooner than the IEA asserts. Miller (2011) found that the IEA had not addressed any of the recent critique and concluded that the IEA outlooks likely remain too optimistic. Most discussions about oil focus on the size of the resource left. However, in the near term, it is far more important to pay attention to production flows and the constraints operating on them. Peak oil is the point in time where production flows are unable to increase. It is not just underinvestment, political gamesmanship or remote locations that make oil production increasingly difficult. The physical depletion mechanisms (increasing water cut, falling reservoir pressure, etc.) will unavoidably affect production by imposing restrictions and even limitations on the future production of liquid crude oil. No amount of technology or capital can overcome this fact. 3. The economic perspective3.1 The economics of oil supplyOne important feature of oil supply is its cyclical boom and bust cycle in prices and production. Maugeri (2010, p. 12-13) describes this phenomenon: "if petroleum becomes scarce and there is no spare capacity...oil price climbs. This rise in prices fosters a new cycle of investment from which new production will flow. It also triggers gains in energy efficiency, consumer frugality and the rise of alternative energy resources. By the time the new production arrives at the market, petroleum demand may have dropped. This vicious circle has been a feature of all oil crises of the past." However, oil production recently became less responsive to traditional economic stimuli. The first decade of this century witnessed a dramatic increase in oil exploration and production when the price of oil increased (Sorrell et al., 2009; 2009a). Unfortunately, as noted already, total world oil production seems to have reached a plateau nonetheless. To a large degree this is because the oil that remains tends to be unconventional oil, which is expensive and takes more time to bring to market. Some consequences of having extracted much of the easy oil are the following: a) It takes significantly more time once a field is discovered to start production. Maugeri (2010) estimates it now takes between 8 and 12 years for new projects to produce first oil. Difficult development conditions can delay the start of production considerably. In the case of Kashagan, the world's largest oil discovery in 30 years, production has been delayed by almost 10 years due to difficult environmental conditions. b) In mature regions, an increased drilling effort usually results in little increase in oil production because the largest fields were found and produced first (Höök and Aleklett, 2008; Höök et al., 2009). c) Because the cost of extracting the remaining oil is much higher than easy-to-extract OPEC or other conventional oil, if the market price remains lower than the marginal cost for long enough, producers will cut production to avoid financial losses. See Figure 3. d) Uncertainty about future economic growth heightens concerns for executing these riskier projects. This delays or often cancels projects (Figure 4). e) Most remaining oil reserves are in the hands of governments. They tend to under-invest compared to private companies (Deutsche Bank, 2009). f) Possible scarcity rents have to be taken into account. Hotelling (1931) showed that in the case of an depletable resource, price should exceed marginal cost even if the oil market were perfectly competitive (the resulting difference is called scarcity rent). If this were not the case, it would be more profitable to leave the oil in the ground, waiting to produce it until the price has risen. Hamilton (2009a, 2009b) noted that while in the 1990s the scarcity rent was negligible relative to costs of extraction, the strong demand growth from developing countries in the last decade together with limits to expanding production "could in principle account for a sudden shift to a regime in which the scarcity rent is positive and quite important." In this regard, the Reuters news service reported on April 13, 2008 that "Saudi Arabia's King Abdullah said he had ordered some new oil discoveries left untapped to preserve oil wealth in the world's top exporter for future generations, the official Saudi Press Agency (SPA) reported." Therefore, a possible intertemporal calculation considering scarcity rents may have already influenced (i.e. limited) current production. Although the sudden fall of prices at the end of 2008 is difficult to reconcile with scarcity rents, the following quick price recovery to the $70-$120 range during the enduring global financial crisis indicates that this aspect cannot be dismissed. This is despite the assertion by Reynolds and Baek (2011) that the Hotelling principle "... is not a powerful determinant of nonrenewable resources prices," and that "...the Hubbert curve and the theory surrounding the Hubbert curve is an important determinant of oil prices." We agree that the Hubbert curve, which defines the depletion curve of a non-renewable resource, may be the prime determinant of oil price but it is not the only one.

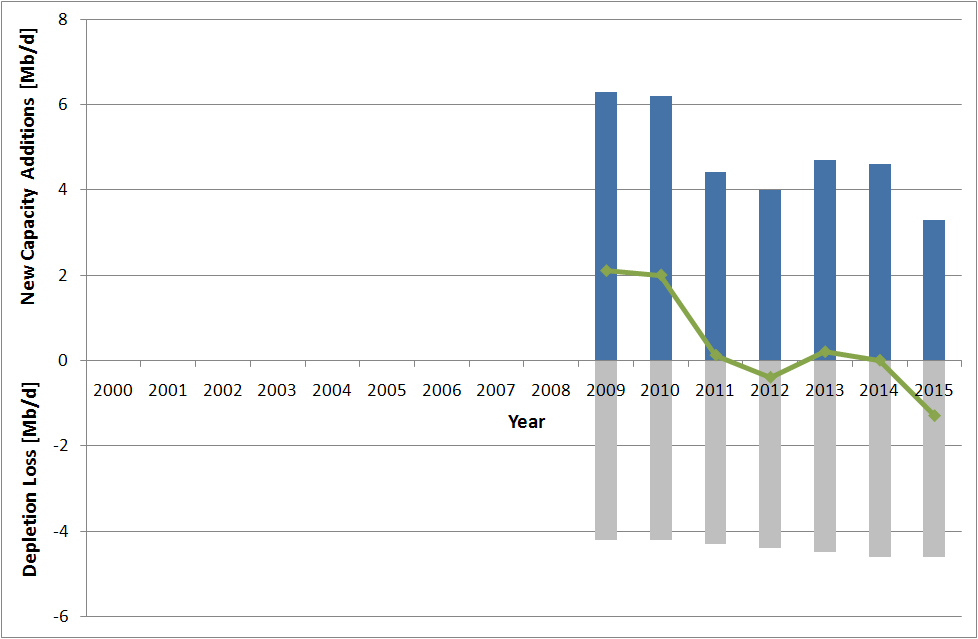

Figure 3. Global marginal cost of production 2008. Source: LCM Research based on Booz Allen/IEA data (Morse, 2009). The unlabeled items, from left to right are OPEC Middle East, Former Soviet Union and Enhanced Oil Recovery. The consequence of these issues is that in the short-medium term the available supply is essentially fixed and thus relatively straightforward to compute. As Figure 4 shows, net production capacity will decline due to the difficulty in finding new reserves at an accessible cost while the existing capacity is steadily depleted. Just as occurred in 2004, by 2011 there is again no new net capacity while the world economy, and thus oil demand, has resumed growth. After 2014, it appears that global oil production will begin its decline (See the second report of the UK Industry Taskforce on Peak Oil and Energy Security (UK ITPOES, 2010), Lloyd's (2010), Deutsche Bank (2009, 2010), the report by the UK Energy Research Centre (Sorrell et al., 2009a) and the 2010 World Energy Outlook by the IEA (2010).)

Figure 4. Global annual new gross production (blue bars), annual decline (grey bars) and net new oil production capacity (thin green line). Source: UK Industry Task Force on Peak Oil and Energy Security (2010) 3.2 The economics of oil demandNow an important question is what are the consequences of high oil prices on world economic growth? In the economic literature, Hamilton (2009b) and Kilian (2008; 2009) attempt an answer, while in the professional financial literature, the report by Deutsche Bank (2009) is one of the most comprehensive. Hamilton (2009b) in particular highlighted the importance of the share of energy expenditure as a percentage of total consumer expenditure. When this ratio is too high, an economic recession tends to occur. Similarly Deutsche Bank (2009) showed how each country seems to have a "threshold percentage of national income at which crude pricing meets stern resistance and demand is broken." Deutsche Bank (2009) asserts that for American consumers this point is when energy represents 7.5% of gross domestic product. This value is close to the one calculated by Hamilton (2009b) but is based on monthly data and uses a different methodology. In a more recent report, Deutsche Bank (2010) lowered this threshold to 6.5 % because "...the last shock set in motion major behavioral and policy changes that will facilitate rapid behavioral changes when the next one comes and underemployment and weak wage growth has increased sensitivity to gasoline prices. Last time it took $4.50/gal gasoline to finally tip demand, this time it might only take $3.75/gal to $4.00/gal to do it." However, they also highlighted that "Americans have become comfortable with paying more for gasoline, and it may take higher prices to force behavior change". Kopits (2009) suggested that when crude oil expenditures exceed 4% of GDP, oil prices increase by more than 50% year-on-year, and oil price increases are so great that a potential demand adjustment should have to reach 0.8% of GDP on an annual basis, then a recession in the US is very likely. A similar outcome was found by Hall et al. (2009) who showed a recession in the US is likely when oil amounts to more than 5.5% of GDP. We remark that the difference between the 4% (Kopits, 2009) and 5.5% (Hall et al., 2009) is simply a wholesale versus retail difference, and the result comes out the same [1]. Finally, Hamilton (2011) highlighted that 11 of the 12 U.S. Recessions since World War II were preceded by an increase in oil prices. Unfortunately, there is no clear alternative source of energy able to fully substitute for oil (see, for example, Maugeri (2010) for a recent non-technical review of the limits of alternative sources of energy with respect to oil). It possesses a combination of energy density, portability and historically very high EROEI that is difficult for alternatives to match. 4. A timely energy system transformation not assuredAs oil production declines, significant changes to the current oil-dependent economy in the medium term are likely to be needed. However, it isn't clear that there will the financial means to implement such a change. For example, Deutsche Bank (2009, 2010) suggested that the widespread use of electric cars in the second part of this decade will be the disruptive technology that will finally destroy oil demand. Apart from technology and resource constraints (lithium necessary for electrical batteries is quite abundant in nature but production is currently very limited), the availability of sufficient financial resources to transition the entire vehicle fleet seems dubious. As Hamilton (2009b) demonstrates, tightened credit follows high oil prices and most vehicles are purchased on credit. Others suggest that natural gas is the next energy paradigm. Again, will be there sufficient financial resources to switch to it as oil production declines? Reinhart and Rogoff (2009, 2010) found that historically, after a banking crisis, the government debt on average almost doubles (86% increase) to bail out the banks and to stimulate the economy. They also showed that a sovereign debt crisis usually follows: not surprisingly we saw Iceland, Greece, Ireland, Hungary and Portugal turning to the EU/ECB and/or the IMF for financial help to refinance their public debts to avoid default. The need to switch to alternative energy sources with the enormous financial investments that such a task would require — and the simultaneous presence of large public and private debts — may well form a perfect storm.

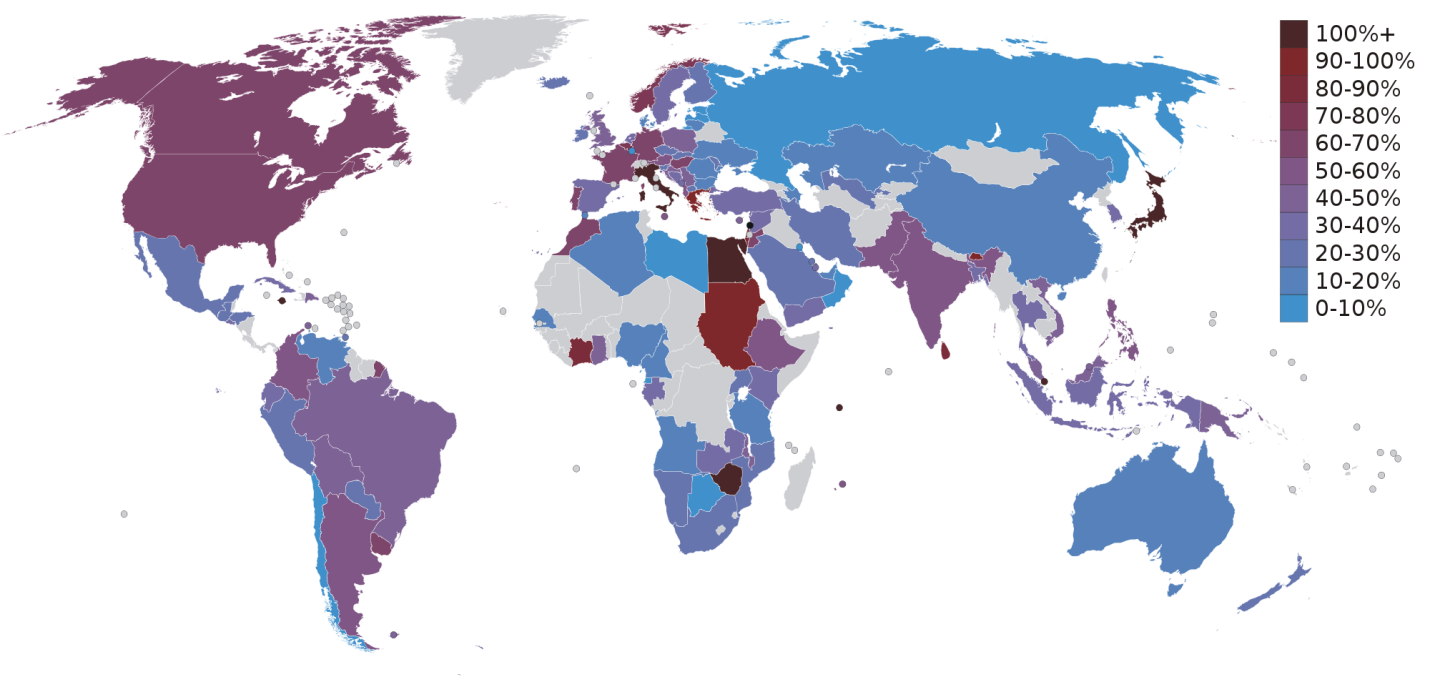

Figure 5. Public debt as a percent of GDP (2009/2010) taken from CIA Factbook (2010). Additional forces will play a role. New regulations to be introduced by Basel III are likely to impact investment expectations, budgeting and planning. Basel III is a new global regulatory standard on bank capital adequacy and liquidity proposed by the Basel Committee on Banking Supervision following the recent global financial crisis and whose aim is to "...to improve the banking sector's ability to absorb shocks arising from financial and economic stress, whatever the source, thus reducing the risk of spillover from the financial sector to the real economy", BCBS (2009). Demography will also be extremely important in the next decade as well. Europe and the United States have aging populations and their baby boomers are entering pension age. China faces a similar demographic problem due to their one child policy, too. The combination of declining oil production (and thus oil priced high enough to cause recessions), high taxes, austerity measures, more restrictive credit conditions and demographic shifts have the potential to severely constrain the financial resources needed to move the economy away from oil and to alternative energy sources. Another consequence of this combination of forces is the likely contraction of the world economy (Hamilton, 2009b; Dargay and Gately, 2010). 4.1 Energy transition risksWith higher priced oil, technology substitution (such as electric cars gradually replacing internal combustion engine cars) and fuel substitution (such as natural gas replacing oil) will occur. History is filled with many such examples and they are frequently highlighted in the debate. However, one must read carefully and not overstate the simplicity of an energy transition. For example, whale oil was – technically – an energy source in the 19th century, but the economy was based on coal at the time. Whale oil was used only for very specific purposes (primarily illumination), and the transition to kerosene was easy and occurred very rapidly. Bardi (2007) explored this in more detail and made several important remarks that pinpoint how difficult it can be to substitute energy sources. In particular, he showed that resource scarcity often dramatically increases the amplitude of price oscillations, which often slow an energy source transition. Businesses and governments struggle with alternating circumstances of insufficient cash flow to handle price spikes and plummeting prices that don't cover their cost structure. Long term planning in this ever-changing environment becomes extremely difficult and investment — even highly needed investment — can drop precipitously. Friedrichs (2010) also cautions that after peak oil countries have several sociological trajectories available to them, they can follow predatory militarism like Japan before WWII, totalitarian retrenchment like North Korea, or, ideally, socioeconomic adaptation like Cuba after the fall of the Soviet Union. Given the recent century of conflict and the extensive weapon stocks and militaries held by modern nations (especially the United States, which spends on its military almost as much as the remaining countries of the world |

| The Gold Price "Must Hold" Support is $1,630 I Expect Higher Lows Tomorrow Posted: 03 Apr 2012 10:58 AM PDT Gold Price Close Today : 1670.00 Change : (7.50) or -0.45% Silver Price Close Today : 3325.0 Change : 16.7 cents or 0.50% Gold Silver Ratio Today : 50.226 Change : -0.480 or -0.95% Silver Gold Ratio Today : 0.01991 Change : 0.000189 or 0.96% Platinum Price Close Today : 1640.40 Change : -9.50 or -0.58% Palladium Price Close Today : 652.40 Change : -3.25 or -0.50% S&P 500 : 1,413.38 Change : -5.66 or -0.40% Dow In GOLD$ : $163.39 Change : $ (0.05) or -0.03% Dow in GOLD oz : 7.904 Change : -0.003 or -0.03% Dow in SILVER oz : 396.98 Change : -3.97 or -0.99% Dow Industrial : 13,199.55 Change : -64.94 or -0.49% US Dollar Index : 79.37 Change : 0.599 or 0.76% The silver and GOLD PRICE were slapped around by the Fed, too. Although gold closed down only $7.50 (not many people knew what the Fed's announcement held, I reckon) to $1,670, while the SILVER PRICE actually gained 16.7c by Comex close, ending at 3325c. Then came the Fed's moldy FOMC minutes, and just like flying a jet plane in a movie, things went bad fast. Time the smoke and dust cleared, gold had touched $1,638.90 and silver 3245. Well, shucks! Should I cry or just wring my hands. Didn't do any more than drive them both back to their uptrend lines. If it was victory the Fed was looking for, this wasn't it. My "must-hold" lines are $1,630 for gold and 3140c for silver. I'm speculating that tomorrow they will see lows no lower than today's. Like a pit bull-alligator cross, I am holding on. I think the SILVER PRICE and the GOLD PRICE have seen their lows, and unless they breach my "must hold" points, I'm clamped down on that and won't let go till Bernanke thunders. Mercy, I won't even let go then, knowing what a little mouse-burp deal that would be. Mercy, we got skewered by 3 week old news today -- yet another reason to love that good old stabilizing, prosperity-promoting Federal Reserve. They released minutes of the FOMC meeting 3 weeks ago which suggested they saw little need for more stimulating, which suggests they MIGHT not inflate with another round of money printing like QE1 and QE2. Here we enter into the wholly irrational realm of reading the Fed's tea leaves. Market today read it that Fed will back off inflating (well, not inflate any faster than they already are) so if nature takes its course, interest rates must rise and the dollar's value will bloom. Then there is this natural born fool from Tennessee, who trusts the Fed to (1) speak their minds truthfully or (2) have any mind at all or (3) not inflate, about as much as I trust a 6 foot rattler not to bite me if I warm him up in my bosom. I think the Fed has a problem. Every time they make one of these "we're going slow on inflation" announcement, interest rates rise. But their announced policy -- to stimulate the economy -- is to keep interest rates near zero (to match their economic IQ). So how will they keep rates near zero if their own words make them rise? Why, by buying more bonds. And how do they do that? By printing more money. The phrase "shoot yourself in the foot" springs to mind. It pains the rational mind to deal with such trifling liars, cheats, and fools. Triflin' -- that's the best I can say about 'em. Stocks dropped on the Fed's news. Dow gave back 64.94 (0.49%) to 13,199.55 and the S&P500 dropped 5.66 (0.4%) to 1,413.38. Stocks are still defying gravity, and fool that I am, I have never seen anybody succeed at that endeavor. Fed's announcement drove the dollar up 59.9 basis points or 0.77% to 79.366. That amounts to nothing more than a kiss-back to the uptrend line it lately broke down through (I'll try to string more prepositions together, but how I know not to). 'Tain't nothing permanent or substantial there. All pop, no corn. Euro took it on the chin, losing 0.68% to $1.3234. Continueth the same indecision. Yen was knocked back below its 20 DMA, dropping 0.93% to 120.71c (Y82.84). Till giving Nice Government Men fits because it wants to rise. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Posted: 03 Apr 2012 10:54 AM PDT April 3, 2012 [LIST] [*]Unused gift cards and other things you never thought the government could tax... [*]An emerging economy set to double in two years... [*]How "phytochemicals" will change your life for the better... with limited FDA meddling (gasp!) [*]Why Apple's dividend looks puny: The 5 cracks the "mountains of corporate cash" mystery... [*]Gold tops a CNBC poll (seriously)... a hot commodity in the back seat of a Civic... Patrick Cox's "unsafe" hobby... and more! [/LIST] The state of New Jersey wants to tax the value of unused gift cards. We'll let that sink in for a bit. [a bit] "The state will soon begin requiring gift card sellers to obtain ZIP codes from buyers so it can claim the value of cards not redeemed after two years," according to an Associated Press story sent in by an alert 5 reader. If you have a two-year-old gift card sitting around, you can still use it as long as it's not expired. "But if the state has already laid claim to ... |

| Posted: 03 Apr 2012 10:53 AM PDT More excerpts from the Max Keiser interview that Aired Monday as well as a piece from RTs Capital Account... The US Education Ponzi causes rampant tuition inflation in the face of tepid if not non-existent increases in actual education quality - of course all of this is financed by a credit/loan bubble where you have a ~trillion dollar market that already has a ~25% delinquency rate. Exactly how is this expected to end? Speakng of education... |

| The Mechanical Fed: Fast for a Robot, Slow for a Dog Posted: 03 Apr 2012 10:26 AM PDT Wolf Richter www.testosteronepit.com Boston Dynamics, an engineering outfit spun off from MIT, develops a variety of ultra-cool to totally bizarre mechanical creatures, from the four-wheeled SandFlea that weighs 11 pounds and jumps 30 feet into the air to the two-legged humanoid Petman that walks and does knee bends and pushups, this being for the Army. Their four-legged dog and donkey-like creatures run and clamber over rock piles. In other words, while they don’t appear to be particularly useful in daily life, they’re the ultimate toys: noisy, expensive, rare, and hard to maintain. And what’s even better, much of this fun appears to be funded with tax-payer money through defense contracts. So please, people in Washington, stop talking about cutting the budget. We need our toys. My favorite is a robot they call Cheetah. Funded by DARPA (Defense Advanced Research Projects Agency), it can do 18 mph, a new speed record for legged robots. It’s my favorite not because it's almost cute in its ugly manner or because it looks like a cheetah—it doesn’t, I mean, not even remotely—but because it reminds me of the Fed and its ways. It's a bad sign when Zhou Xiaochuan, Governor of the mighty People’s Bank of China, whose joint has an even larger balance sheet than the Fed, is worried about the Fed’s free money policies—the combination of zero interest rates and quantitative easing—that have sent tsunami after tsunami of dollars bouncing around the world, driving up markets and prices, creating dislocations and bubbles, and heating up inflation. Zhou is in the hot seat: a big chunk of China's $3.2 trillion in foreign exchange reserves are held in dollars—the very currency that the Fed is trying to devalue. He is worried about the dollar because it's still, though maybe not much longer, the world's most important reserve currency. He was practically begging the Fed to act a bit more responsibly (good luck!) because he wants to "gradually bring inflation down" in China, he said. Utterly alien words to the Fed. That’s why Cheetah is reminiscent of the Fed: it runs backward, rather than forward. It makes a lot of noise when it moves, and the faster it moves, the more noise it makes. But it runs on a treadmill, so reasonable minds doubt that it will ever get anywhere. Its top speed of 18 mph, though a record for legged robots and fast for humans, is quite slow for a dog. Maybe a lapdog would find that speed challenging. And for a real cheetah doing 75 mph, well.... It’s powered by an off-screen hydraulic pump. All we see are the hydraulic lines that hang down from some boom and connect to its back. There also appears to be a rope-and-pulley system for controlling the thing if it were to go awry. A human hand and an arm dressed in ominous black hold the lines. But who is holding the controls that can make this thing speed up or slow down or come to a stop? Here is the video Just as the world's major central bankers spoke at the Fed conference in Washington, deficit-plagued and inflation-infested Turkey floated a plan to get its citizens to turn in their substantial pile of physical gold in exchange for paper “certificates,” a first step in what may become a process of gold confiscation. For that load of ironies, doublespeak, and red flags, read.... Gold Confiscation, Inflation, And Suddenly Virtuous Central Bankers. |

| Posted: 03 Apr 2012 10:13 AM PDT |