saveyourassetsfirst3 |

- Bernanke Sells The Gold Standard Short

- Jim Sinclair Is Getting Out Of Dodge

- Family Dollar Stores' CEO Discusses Q2 2012 Results - Earnings Call Transcript

- Hostile Bid For Magma Metals Will Not Suffice

- Bob Chapman: Corzine Spends Weekend at Bernie's

- Interview with The Silver Doctor

- Auxilium Pharmaceuticals Has The Approvals; Can It Get The Revenue?

- Lessons from the King of Blackjack

- Japanese ETFs And Currency Hedging

- Money Printing In Fractals

- Spain Follows Greece

- Jeffrey Christian on Kitco News

- RNN: Gold and Silver Price Action

- The Gold Groundhog Grind

- Gold and Silver as Standards of Value

- The Sunday Night Paper Silver Massacre – Revisited

- Davincij15: Silver Update

- Andy Hoffman talks with Alt Investors

- 50,000 to spend. Where and on which PM should I spend it?

- Goldman Gold Bullish: $1,940/oz. in 12 Months

- Current Gold & Oil Trading Patterns Unfolding

- Turkey Once Again Proves That Gold is First and Foremost Money

- Turkey increasingly recognizes gold as money

- Three King World News Blogs/Interviews

- Central banks controlling advance of gold, silver, fund manager Fitzwilson says

- Will euro last? Let’s see what William Hill says

- 600k Ounces of Silver Withdrawn from ScotiaMocatta

- LISTEN: Marcus Grubb of the World Gold Council

- Fukushima: More Media Blackout than Ron Paul

- Fatal Flaws and Opportunities in Gold Investing: Brent Cook

| Bernanke Sells The Gold Standard Short Posted: 28 Mar 2012 06:46 AM PDT By Paul Nathan: Ben Bernanke has made several negative comments about the gold standard recently. In his lecture at George Washington University, Bernanke asserted that the gold standard is an inferior monetary system compared to the modern Federal Reserve System. So many erroneous points were made regarding the gold standard in his lecture that it would take a book on the subject to properly refute them. I've written such a book, The New Gold Standard, and I feel it is important that I point out some fatal flaws in Bernanke's argument. First, let it be clear that I am not a Fed basher and fully support Ben Bernanke in trying to prevent a repeat of the Great Depression. I'm one of the few gold standard advocates who applauded the Fed's actions during our great financial crisis. And when it comes to the Fed's anti-deflationary monetary policy and its heroic acts as a lender Complete Story » |

| Jim Sinclair Is Getting Out Of Dodge Posted: 28 Mar 2012 06:31 AM PDT Jim Sinclair Selling Connecticut Estate: Plans to Expatriate from Silver Doctors: The man who predicted gold would reach $1600 while it was trading below $300 and was ridiculed by nearly everyone, has placed his 34-acre Connecticut farm/ estate up for auction and plans to flee from the growing fascism in the US. Sinclair states on JSMineset that those who decide to stay will look back and recall his advice to leave the US come 2015-2017. Like many, Sinclair can see the writing on the wall for the end of prosperity and freedom in America. Clearly, putting one's 34-acre estate up for auction with plans of becoming an expatriate is not a small nor an easy decision. Full details of the Sinclair Farm/Estate Auction can be found below. Read More @ SilverDoctors.com |

| Family Dollar Stores' CEO Discusses Q2 2012 Results - Earnings Call Transcript Posted: 28 Mar 2012 06:30 AM PDT Family Dollar Stores (FDO) Q2 2012 Earnings Call March 28, 2012 10:00 am ET Executives Kiley F. Rawlins - Vice President of Investor Relations & Communications Howard R. Levine - Executive Chairman, Chief Executive Officer and Member of Equity Award Committee Michael R. Bloom - President and Chief Operating Officer Kenneth T. Smith - Chief Financial Officer, Principal Accounting Officer and Senior Vice President Analysts Aram Rubinson - Nomura Securities Co. Ltd., Research Division Bernard Sosnick - Gilford Securities Inc., Research Division Adrianne Shapira - Goldman Sachs Group Inc., Research Division Stephen Shin - Morgan Stanley, Research Division Laura A. Champine - Canaccord Genuity, Research Division Meredith Adler - Barclays Capital, Research Division Unknown Analyst Deborah L. Weinswig - Citigroup Inc, Research Division Matthew R. Boss - JP Morgan Chase & Co, Research Division Scot Ciccarelli - RBC Capital Markets, LLC, Research Division John Heinbockel - Guggenheim Securities, LLC, Research Complete Story » |

| Hostile Bid For Magma Metals Will Not Suffice Posted: 28 Mar 2012 06:27 AM PDT By Felix Pinhasov: Whether opportunistic or fair, a hostile takeover bid puts an acquisition target at a peculiar place - either find another buyer that will pay more, or give in to the offer. On February 3, Panoramic Resources Limited (PANRF.PK), an Australian based nickel-gold miner, announced it is proceeding with a hostile takeover bid for Magma Metals Limited (MMTDF.PK), a junior resource company with assets in Canada and Australia. Under the offer, Magma shareholders will receive two Panoramic shares for every 17 Magma shares. The offer represented around 87 percent premium to the prior closing price of Magma shares, however, was it fair or opportunistic? The offer is subject to conditions of which one is key: a minimum acceptance of the offer by 90 percent of shareholders (Panoramic already owned 9.34 percent of the company prior to the bid) of Magma Metals. (Click charts to enlarge) According to Panoramic Resources filing of Complete Story » |

| Bob Chapman: Corzine Spends Weekend at Bernie's Posted: 28 Mar 2012 06:26 AM PDT

Bob Chapman joins us again today for our biweekly check-in. Since we've been doing the show together for almost a year, nothing much has changed, except that the elites are getting more and more brazen in their exploitative criminal enterprises. Bob thinks that Corzine maybe spending a weekend at Bernie's or perhaps even several years. While Corzine repeatedly claimed he had no idea where the money was, now it looks like he probably did. Yet again, and again, and again gold and silver under attack. However, the system is cealrly moving to metals so you need to get there ahead of it. China doesn't have enough gold to back its currency; actually, very few countries do. So there's a scramble taking place by the banks to acquire gold at virtually any cost, regardless what the paper markets say the price is. But we'll know the true value of unbacked paper soon enough. Much more @ KerryLutz.com or @ 347.460.LUTZ |

| Interview with The Silver Doctor Posted: 28 Mar 2012 06:25 AM PDT In this 25 minute interview, Jason Burack and Mo Dawoud of Wall St for Main St, LLC. interview "The Doc" from the up and coming Precious Metals Information website, Silver Doctors. from WallStForMainSt: ~TVR |

| Auxilium Pharmaceuticals Has The Approvals; Can It Get The Revenue? Posted: 28 Mar 2012 06:13 AM PDT By Stephen Simpson: FDA approval is undoubtedly a major event in the life of a biotech company, but it is only a part of the puzzle. Marketing an approved drug is a battle in its own right, as investors in Auxilium Pharmaceuticals (AUXL) know all too well. The company has found it difficult to drive market acceptance of its Testim testosterone gel and Xiaflex injection for Dupuytren's contracture and expectations have come down markedly. While the company's current products could still have billion-dollar potential, investors need to be prepared for a long, difficult slog to realize that potential. Testim Testing Patience While the market for supplemental testerone gel in the U.S. has been growing nicely (from 15-25% a year, depending on whose estimates you accept), Auxilium's Testim has been something of a disappointment. Despite attractive pricing compared to Abbott Labs' (ABT) Androgel, Abbott still holds more than two-thirds of the market according to Complete Story » |

| Lessons from the King of Blackjack Posted: 28 Mar 2012 05:23 AM PDT

Lieutenant Colonel John "Jack" Churchill, aka "Fighting Jack Churchill," aka "Mad Jack," was a British soldier in World War II. "Mad Jack" was known for fighting with a longbow, arrows, and a Scottish broadsword. In World War II! His famous quote was, "Anyone who goes into action without his sword is improperly armed." I'm not sure how that translates to markets. Maybe "Anyone who goes into a trade without his risk point is improperly armed." But Mad Jack deserves recognition simply for being the ultimate gentleman badass — elegantly dispatching foes, Braveheart style, with his longbow, broadsword and top hat. (Okay, maybe no top hat.) The other guy did something of a more recent vintage:

Don Johnson — no relation to the Miami Vice guy — took $6 million in one night from the Atlantic City Tropicana casino. Not long before, he hit Caesars for $4 million and the Borgata for $5 million. And he did it all playing blackjack. The tale is fascinating. You can read it here: "The Man Who Broke Atlantic City" from, oddly enough, The Atlantic magazine. Here's an excerpt:

Later on, Ben Mezrich wrote a book called "Bringing Down the House" about an MIT blackjack team that made millions in Vegas. (The book was later turned into a crappy movie with Kevin Spacey. I normally like Kevin Spacey, but this time he was slumming for a paycheck. Or so I heard. I read the book but missed the flick.) Anyhow, when you hear about someone making millions at blackjack, you automatically think "card counting" — the spotter, the big player, doing a smash and grab on the casinos, that kind of thing. But what is so fascinating about Don Johnson's multi-million dollar scores is, he didn't count cards (which would have gotten him thrown out anyway). The edge he found was actually much more subtle, and brilliant, than that. Here is the money excerpt:

Did you catch that? Here's the breakdown:

That 2% edge is like a biased coinflip — big enough for the house to win all the money over time. With 100% correct theoretical play — not counting cards, just playing every hand in mathematically optimal fashion — it's estimated that the house edge is whittled down to 0.5%. Now you are getting very, very close to 50/50 odds… but that 0.5% is still enough for the house to make good. Johnson figured out how to drive the house edge even lower. Through hard negotiations, he got it down to (by his estimate) just one quarter of one percent. That's super close to dead even — but still not quite enough. And then came the coup de gras: With some negotiated loss discounts on top of that — agreements for the casino to reimburse a certain amount of if Johnson lost — he actually flipped the overall edge in his favor without the casino realizing it. House management got played by a math shark:

Now I'm no blackjack player (and never will be). There are bigger games to play, with better odds and less headache (like poker for example!). But from a trading perspective, what Don Johnson did is absolutely fantastic:

Finding an incredible reward to risk opportunity… cultivating your edge through careful analysis and bold decision making… stepping up with proper capitalization and risk control… and then maximizing that opportunity to the hilt. And as a side note, how many "random walk" academic theoreticians would have said it's even possible, in the known universe as we know it, to make circa $5 million at the blackjack tables in one night… and repeat the feat twice more… and to do it all without counting cards? "No way," they would say. But of course there was a way. Johnson did it. Point being, it's no wonder the efficient market theorists have no clue — they cannot conceive of the opportunity sets that arise, or the dynamic features of the fitness landscape, when it comes to the sufficiently motivated and creative human mind. The edges are out there… and you don't have to be a Don Johnson to find them. JS (jack@mercenarytrader.com)  |

| Japanese ETFs And Currency Hedging Posted: 28 Mar 2012 05:12 AM PDT By Tom Lydon: Over the past few years, investors that have taken a chance on the iShares MSCI Japan Index (EWJ) have been rewarded by the appreciating yen against the U.S. dollar. As the yen has started to weaken, exchange traded funds that hedge foreign currency exposure could be a better choice. "The near-term outlook for corporate Japan might finally be improving. Aside from the falling yen, other positive trends include an improving U.S. economy, relatively healthy Asian economies (a growing major export destination for Japanese products), and post-quake-related spending. These factors should support significantly better earnings in the next fiscal year (which ends March 2013)," Patricia Oey for Morningstar wrote in a recent article. The Bank of Japan recently boosted its asset purchase program with an inflation target of 1%, creating a headwind for the Japanese yen. In turn, Japanese large-cap companies have spurred a rally because most of them are exporters Complete Story » |

| Posted: 28 Mar 2012 04:54 AM PDT By Bruce Pile: In "Money Printing's Biggest Show Of All Time" I looked at some characteristics of the quantitative easing mania beginning to grip our global central bankers. The bull market in creative debt we are witnessing in our day can be studied with fractals the same as other historic bull markets. I've written a series of articles on this, "The 64-Month Bull Market Fractal" and others, as it relates to gold. I can't go over that here, but I recommend you look at these articles to better understand this one. I also show some examples in "The Bull Market In Money Printing" at my blog. I would just like to present here a generic example of the 64-month fractal that is presented by David Nichols, a pioneer in this emerging science of market study. He came across these fractals as it relates to gold. But it is a pattern that is common Complete Story » |

| Posted: 28 Mar 2012 04:14 AM PDT By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness. Back in November last year I posted on my confusion over the jubilation shown by the citizens of Spain as they elected Mariano Rajoy as their new political leader. Mr Rajoy's strategy during the election campaign was to say very little about what he was actually intending to do to address his country's financial problems, preferring to simply let the incumbent party fall on its own sword so that he could take the reins. It became obvious soon after the election that, despite his party's best efforts to dodge questions, the intention was simply to continue with even more austerity. Since that post I have continually warned that although Spain is obviously a different country to Greece in regards to how its problems have manifested, it still faces significant macroeconomic challenges that were not being correctly reflected in the bond market.

As I mentioned this week, since I made those comments bad loans have risen further , house prices have continued to fall and the government's debt position has worsened. So it should come as little surprise to MacroBusiness readers that overnight the bank of Spain announced that the country has now fallen back into recession:

And so, once again, we see failings of economic logic creeping back into Europe. The reason that Spain's economy is suffering is because the government sector is attempting to de-leverage in the face of the same behaviour from the private sector after the collapse of the Spanish housing market. You can obviously point to all sort of things that happened in the past and claim they never should have been allowed to occur. Where were the bank regulators? the macro-prudential oversight ? the fiscal policy in order to push against the housing bubble?. All good questions, but none of them change the fact that the Spanish economy is demonstrating its current behaviour because of the government sectors attempt to lower its deficit. As I have explained previously in terms of national income, a country with a long running current account deficit has been borrowing goods and services from the rest of the world. In order to support this one, or both, of the non-external sectors of the economy will have expanding debt positions and due to this the economy tends to restructure around consumption over investment and production. Because the external sector is a net drain on capital from the country, the government and/or private sector must continually expand their debt in order to maintain economic growth. In many cases this debt accumulation leads to asset bubbles, because the expanding debt drives asset prices which attracts speculation and in doing so accelerates the external borrowing. This in turn drives up national income, which in turn drives higher prices and further speculation. In the EuroZone, if either sector's debt is accumulating faster than its income then at some point in the future a limit will be reached and the rate of debt accumulation will fall. This leads to falling asset prices and national income, which ultimately leads to a crisis as accumulated debts start to sour. This is what we have seen in Spain. The private sector accumulated large debts on the back foreign capital inflows leading to a housing bubble. This bubble has since collapsed leaving the private sector in a position of significant wealth loss and indebtedness, the banking system holding significant and growing levels of bad debts and the economy structured around the delivery of a failed industry.

The growing unemployment is leading to a slowing of industrial production, which means that even though the country is importing less it also appears to be exporting less. Combine this with the interest payments on borrowings from the rest of the world and at this point Spain continues to run a current account deficit which, in the most basic terms, means Spain is still paying others more than it is being paid back. That is, the external sector is still in deficit. So with the external sector in this state and the private sector unable and/or unwilling to take on additional debt as it attempt to mend its balance sheet after an 'asset shock', the only sector left to provide for the short fall in national income is the government sector. If it fails to do so then the economy will continue to shrink until a new balance is found between the sectors at some lower national income, and therefore GDP. It may appear logical to you that this must occur, and I don't totally disagree, but that doesn't change the fact that under these circumstances there is simply no way that the private sector will be able to continue to make payments on the debts it has accumulated during the period of significantly higher income. This is a major unaddressed issue. This is why we continue to see a rise in bad and doubtful debts in the Spanish banking system which, under direction from the Government, banks continue to merge.

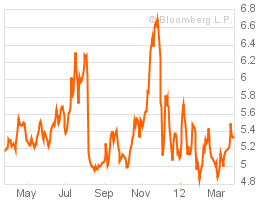

The problem is that, apart from economies of scale, merging banks doesn't actually help that much because impaired assets don't suddenly disappear. The other issue is that Spanish banks have been large users of the ECB's 3 year LTRO facility which means they have continued to load up their balance sheets with their own countries sovereign debt in order to participate in the carry trade. It is quite possible, as I explained above, that the LTRO was masking the true value of those sovereign bonds and that Spanish banks have made a terrible decision by making those purchases. Here are the current 10 year yields for Spanish government bonds, courtesy of Bloomberg: If yields continue to rise, and I see no reason to discount this possibility, then Spanish banks are eventually going to have to front-up more capital to cover those ECB loans. Where exactly is this going to come from? And so I am starting to get a bit of deja vu.

I'm sure we've been here before. |

| Jeffrey Christian on Kitco News Posted: 28 Mar 2012 04:10 AM PDT Jeffrey Christian talks with Daniella Cambone Kitco News from 3.28.12. ~TVR |

| RNN: Gold and Silver Price Action Posted: 28 Mar 2012 04:07 AM PDT RNN Midday News for March 28th, discusses the current situation with Paper Gold and Silver pricing. The fact that Silver is the Achilles Heel for the Central Bankers is discussed. We feature an exclusive video of Ben Bernanke at George Washington University giving his Lecture Series about the Federal Reserve. Ben's lecture is disrupted when he receives a phone call from his Mom. ~TVR |

| Posted: 28 Mar 2012 03:30 AM PDT

A very important objective change has taken place in the gold market. Its price is not moving above the resistance established in the 1600 to 1900 wide berth range. Its price is not moving below support in the same wide permitted range. When the gold price has approached the 1800 level recently, all manner of naked soldiers emerge with imaginery swords to whack the price down, to bring it under heel. The ruse has a high cost in the real world though, as the gold cartel has been forced to shed an enormous supply of gold as punishment for each naked short episode. The opponents to fraudulent controlled manipulated markets have emerged in force to respond. They fight from the East. They fight for a fair and equitable market. They are poking holes in the floor of the syndicate helm where legs fall through. Demand for the gold core has become acute with pitched battles. The financial presss reports none of it. In desperation, the cartel has conducted regular and routine raids of the Exchange Traded Funds, using shorted shares as the ticket at the rear dock window to cart off gold bars. What a corrupted bill of lading. Meanwhile, the major gold suppliers from mine output appear to be on the defensive or actually on the ropes. The deficit in silver only punctuates the precious metals shortage, as investment demand ramps up. The dutiful lapdog press prefers to tell the story of reduced jewelry demand, without noting how it emphatically signals the powerful bull market. The stories rely on the public being poor students of history. Still, the underlying forces behind the Gold & Silver bull markets remain a team of horses, the 0% cost of money and the debasement of currency in sovereign bond redemptions. The system is broken. Long live the new system that comes, based upon gold and barter, as the USDollar loses its vital ticket in global trade settlement.

GOLD REVOLVING DOOR BLEEDS GOLD The battle has expanded. It is no longer solely on price. It has focus on draining the crooked camps of their physical gold. The latest wrinkle is the revelation that the derivative sector is as corrupt as the bond core, as banks are liable for hundreds of $trillions they cannot pay following years of hefty ripe fees taken in. The constant backdrop since 2008 is that the big Western banks are almost all hollow bankrupt insolvent and moribund operating zombies. The talk of tight lending standards is intended to conceal their deep insolvency and inability to serve as the economic credit engines. The lack adequate reserves to serve as system lenders. They are slowly having their gold removed, methodically bank by bank, as a consequence of their insolvency and ruin, aggravated by their derivative exposure. The newest agent in the game is the anonymous London Trader, whose activity has been nicely chronicled by King World News in a series of interviews. A central bank has been buying with both hands with lust for the yellow metal. What great news for gold investors, an enforcer.

The Gold Wars have significantly changed in the last two years in particular. From 2004 to 2009, the battle was to win a fair higher gold price. No longer. The war has turned the corner and reached an end game scenario. The objectives have changed. The tactics used have been altered. The upper hand by the Good Guys against the Crooked Boyz is evident. Some new confusion has entered the room. The objective is to remove gold from the bullion bank inventories and major bank inventories, all of it. This is a new battlefield in the war. Being a Zombie bank means losing all the gold in reserves, in a time hourglass process that reflects the reality of their balance sheets. By the end of 2013, no big bank will own any physical gold. They cannot defend against off-side positions in the sovereign bond market and the currency market. See what happened to JPMorgan in such a case, as it preyed upon MFGlobal accounts. Other big banks are losing all their gold from the balance sheet. UBS is a dead body on the field, their false story of a rogue trader having provided a little distraction. Few if any financial press stories are honestly told anymore. Certainly not the Libya story, where 144 tons of gold were confiscated as war booty by London. That supply filled some gaps but only temporarily.

Price implications are part of the sacrifice, as the Good Guys will help to push down the Gold price at times in order to kill a gold cartel player. Like right here, right now. Every couple months (the last being in January), a massive group of orders must be filled at a low price, for the benefit of the Good Guys, with an evil player in a vulnerable position, who knows he is dead and must forfeit its gold. The gold market stalls until the hairball is passed and another gold cartel player is gutted, carried off the battlefield under the cover of press darkness. Therefore the Gold price stays down until the order is completely filled, and only then will recover a couple hundred dollars in price per ounce, but only after this gold cartel player is killed off. The player will be identified later, in the fair market obituaries known to the internet journals. The tombstone epitaph will be carved by an Eastern hand. The US press would never report on a cartel bank having to sell $70 to $100 million worth of gold bullion to remove their big off-side position in bonds or currencies. The Good Guys have put in a series of escalating orders at low prices, from extremely well funded accounts whose war chests boast tens of $billions. The damage done to the gold cartel is immense, yet not adequately reported. The pattern showed itself in January, when after a similar event, the gold price moved from roughly 1600 to almost 1800. By February 29th, the cartel leaped on the day into position to conduct one of the largest naked short events in history. The press never seemed to catch wind, since paid not to notice.

RAIDERS OF THE ETF ARK Nothing new on this Modus Operandi, used heavily for over three years. The game is easy. The ignorance is widespread. The gold analysts barely notice, certainly not the deaf dumb blind Adam Hamilton. The cartel wrote the GLD and SLV prospectus. They permit shorting of shares for some odd reason, yet pose in legitimacy. They permit satisfaction of short shares in the removal of bullion from inventory. They might not permit altered bar lists that bear no consistency, but that is convenient to cloud the loading docks from which bars are removed in high volume. The gold and silver supply in a pinch for cartel banks is the very metal that stooge nitwit naive folks believe they indirectly hold by exercising their lazy fingers to punch in GLD or SLV while eating at their desks. The smart investors, the intrepid winners, they own vaulted accounts of physical metal in safe distant lands, untouched by the vagaries of paper certificates, the ultimate in forged wealth. The ETFund investors are victims to be revealed at a later date, when those corrupted funds trade at a 25% discount to the spot price and the differential is blamed on something lame like accumulated management fees. The march of lawsuits will make for great theater, possibly more entertaining than the MFGlobal & JPMorgan criminal travesty. The metal taken from these Exchange Traded Funds will soon gather much attention, and high time!

SUPPLY REDUCED FROM THE FIELD A comment will be made on only two camps, but significant camps. Australian gold production fell in year 2011. Supply is struggling to keep pace with surging physical demand. The dynamics are gradually changing as the gold price rises, making deeper and lower yielding deposits more attractive and profitable. The output might decline, but the profits have continued upward. The consulting firm Surbiton Associates conducted a study on Australian gold production. On a full year basis, for the year 2011, output went surprisingly into decline. Last year, Australia retained its position as the second largest gold producing country after China, but in comparison with 2010, Australian gold production dropped by two tonnes. In 2011 mining companies Down Under produced a total of 264 tonnes (=8.5 million troy oz) of gold. This occurred despite a higher average gold price, proof of my longstanding argument of an inelastic gold supply in the equation. Output does NOT respond to higher price. In 1997-1998 Australian gold production reached a peak of 318 tonnes, a record not matched in recent years despite more attractive prices. Production declined by 6% year-on-year in Q4. Despite the decline, most Australian mining companies increased their profits due to higher gold prices. Last year China produced a total of 300 tonnes. America is the third largest producer. Couple the burgeoning investment demand with reduced supply to arrive at a simple conclusion that the gold price will rise in a powerful way in the next couple years.

South Africa has become a basket case, predictably though, since the marxist track record is so well established. Gold production has hit a 90-year low in the former gold giant. Multiple factors are involved, from gross mismanagement by the marxist clowns in charge, to labor interruption, and even to deposit depletion. The official blame is given to depletion, but it is a lame excuse actually. A real example is given in contradiction. The scale of the collapse is utterly incredible. The gold output from the former leader in South Africa has fallen by a factor of five or more in the last 40 years. The old Apartheid regime might have exaggerated the volume of their national gold production. In January, a sizeable 11.3% decline was realized, which eclipsed the already hefty December 8.2% gold output decline. The explanation attributed by the Jo-burg government ministry is that many of the country's biggest gold mining operations having reached the ends of their lives and have closed down. They say depletion has occurred. Don't believe it, nonsense. They fail to mention recent attempts to impose higher taxes on the cash cow industry. The higher gold price justifies deeper mining efforts and even lower yields, as seen in the Australian story.

A real example came in response from a gold trader source who has SA contacts. He offered details about a reclamation project that turned into riches, a success story. He wrote, "The white mine owners went underground for centuries, but totally ignored the placer/aluvia deposits. Those are very rich and plentiful. The big mining firms jump for joy if they get 3 to 5 grams per ton of dirt moved. We have a number of aluvia mines exclusively supplying refiner outfits that have 150 to 285 grams per ton. A South African mining engineer recently bought a closed shaft, deep mine from his former employer for peanuts. He turned the mine into an aluvia operation and produced 890 kilograms of nuggets and dust at 94% purity last year. He expects to bring it up to 2 tons this year and beyond for the next 10 years." So opportunities exist is these so-called shut down mines that are supposedly depleted. The Marxist morons cannot even assess what is under their noses, after they destroy an industry. The global gold investment demand is growing exponentially, while physical gold production in several important nations is flat, in decline, or in South Africa's case in steep chronic decline due to horrendous mismanagement and stupidity. It all adds up to shortage of supply and much higher physical gold price. Observe the reduction since 1970 from 2600 tons of annual SA output, while the SA share of global output has fallen from 80% to 15%. Marxist morons do what they do best, ruin industries amidst elevated crowd support and noise from the dumbest sections of society.

SILVER DEFICIT CHART Mine output for silver is running a losing battle. Notice how silver demand in 2005 was greater than in 2011. However, the silver price was around $9 per oz a full seven years ago. Higher price does not translate into reduced demand, even four times higher price! It might result in more recycling of scrap and recovery of grandma's silverware from the hope chest though. The zinger factor is investment demand. Notice the dark green segment on the rise, powerfully so in 2009 after the Lehman, Fannie, and AIG disasters. These were Titanic sink events following in delayed fashion the Pearl Harbor event of 2001. Investment demand has at least tripled from 2005 and 2006 to today. The same surge is seen in coin demand, shown in the darker gray bar segment. Conclude that reduced mine output will come against fast growing investment demand, to produce an upward price spike in silver. Just a matter of time. Actually time is necessary to remover the crooked players who sell silver contracts without the benefit of collateral or metal, with the full permission and blessing of the USDept Treasury, which operates on a leash from Wall Street. Of course, the motive is to keep America strong. For the purchase of exciting Tennessee oceanfront property, enter the room to the left.

GROUNDHOG GOLD PRICE REDUX The repeated episodes of naked short ambush in price takedown, followed by depletion of gold cartel member banks, followed by swift rising price, all to be replayed in two months, is a pattern made evident. Most within the gold community have little clue of the depletion, except for the London Trader accounts barely heard. The motive for the naked short illicit ambush was clear. On the week of February 29th, the central banks poured $1.2 trillion in funny money into the banking system. To offset the powerful monetary hyper inflation, they sold 22 million oz of gold without the metal. The Bernanke comments this week gave lift to gold. He and Mario Draghi and Mervyn King, along with the other central bank chorus, have no choice except to keep the monetary press running. They begin to comprehend how the economies do not respond to the supposed 0% stimulus, when in fact it kills capital. They must recapitalize the big banks. My guess is that the coordinated Greek solution is not much of a solution, merely a patch job with a focus on covering the newest black hole in the derivative market by pitching paper money at the big banks. The next $trillion joins the previous several $trillions in a great debasement of the USDollar, the Euro, and the British Pound. The Dollar Swap Facilities have been abused to the hilt. The hidden nugget lies in Germany, where vast rescue funds have been replenished for the expressed purpose of aiding their big banks, should the nation depart from the Euro currency. Imagine all that bad debt from the PIGS pen to absorb. The European Monetary Union is doomed. Look for France to be the Lord of the Flies. Great disruption cometh to the FOREX currency market. Big gains lie ahead for Gold. As the cycle plays out, up and down, up and down, the market forces have set up a potential for a strong reversal with momentum off a familiar reliable pattern. The Head & Shoulders reversal pattern is quite reliable to forecast high breakout prices. Look to the Eastern Coalition to eventually resist the next paper ambush that has contributed to the ruin of the COMEX integrity. Let's watch JPMorgan squirm before Congress. Will it be soft lobs or hard line with prosecution for high financial crimes? Sometime in the near future, the day will come when JPMorgan is brought to trial for $trillion fraud, $billion fraud, and $million fraud, all of which has brought the nation to the brink of systemic failure. by Jim Willie CB March 28, 2012 home: Golden Jackass website

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS. From subscribers and readers: At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

"Your monthly reports are at the top of my list for importance, nothing else coming close. You are the one resource I can NOT do without! You have helped me and countless others to successfully navigate the most treacherous times one can possibly imagine. Making life altering decisions during tough times means you must have all the information available with direct bearing on the decision. Jim Willie gives you ALL the needed information, a highly critical difference. You cant afford to be wrong in today's world." (BrentT in North Carolina) "You have warned over and over since Fall of 2009 that Europe would come apart and it sure looks like exactly that is happening. You have warned continually about the COMEX and now the entire CME seems to be unraveling. You must receive a lot of criticism regarding your analysis, trashing the man, without debate. Your work is appreciated. I do not care how politically incorrect or how impolite your style is. What is happening to our economy and financial system is neither politically correct or polite." (DanC in Washington) "The best money I spend. Your service is the biggest bang for the buck." (DaveJ in Michigan) "As the nation screams down the mountain out of control into the abyss, it is good to have a guide. Jim Willie helps to understand what is happening and more important, why. With that information, you can make the right decisions to protect yourself from the current apocalyptic catastrophe. Forget the MSM propaganda. Here is offered good in-depth actionable reports that are the most insightful and valuable." (AlanS in New Mexico)

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com. For personal questions about subscriptions, contact him at JimWillieCB@aol.com |

| Gold and Silver as Standards of Value Posted: 28 Mar 2012 02:00 AM PDT Lysander Spooner |

| The Sunday Night Paper Silver Massacre – Revisited Posted: 28 Mar 2012 01:30 AM PDT Andy Hoffman |

| Posted: 28 Mar 2012 12:18 AM PDT |

| Andy Hoffman talks with Alt Investors Posted: 28 Mar 2012 12:17 AM PDT Rahul from AltInvestors.com talks with Andy Hoffman about variety of issues including short term gold/silver fundamentals, the govt-media-bank complex, and the implications of an Israeli/Iran strike. from AltInvestorshangout: More @ AltInvestors.com |

| 50,000 to spend. Where and on which PM should I spend it? Posted: 28 Mar 2012 12:15 AM PDT I value the opinions of the GIMers. Please help me make a good choice. Thanks |

| Goldman Gold Bullish: $1,940/oz. in 12 Months Posted: 27 Mar 2012 11:31 PM PDT Gold traded sideways in Asia prior to seeing slight falls which continued in Europe prior to a bounce to over $1,684/oz. and then further selling saw gold fall back to $1,676/oz. |

| Current Gold & Oil Trading Patterns Unfolding Posted: 27 Mar 2012 11:14 PM PDT By: Chris Vermeulen – www.GoldAndOilGuy.com The past two months we have seen all the focus from traders and investors be on the equities market. And rightly so and stocks run higher and higher. But there are two commodities that look ready to explode being gold and oil (actually three if you count silver). Below are the charts of gold futures and crude oil 4 hour charts. Each candle stick is 4 hours allows us to look back 1-2 months while still being able to see all the intraday price action (pivot highs, pivot lows, strong volume spikes and if they were buyers or sellers…). The 4 hour chart is one time frame most traders overlook but from my experience I find it to be the best one for spotting day trades, momentum trades and swing trades which pack a powerful yes quick punch. As you can see below with the annotated charts both gold and silver are setting up for higher prices in the next 1-2 weeks from a technical point of view. That being said we may see a couple days of weakness first before they start moving up again.

4 Hour Momentum Charts of Gold & Oil:

Watch Full Video Analysis: |

| Turkey Once Again Proves That Gold is First and Foremost Money Posted: 27 Mar 2012 09:09 PM PDT Yesterday in Gold and SilverThe smallish rally that started in London didn't last long...and certainly didn't make it over the $1,700 spot price level. The high of the day [$1,698.50 spot] came at the 3:00 p.m. BST London p.m. gold fix...which was 10:00 a.m. in New York. It was all down hill from there...with the gold price getting sold off in two small stages...and closing virtually on its low. Gold closed at $1,680.60 spot...down $9.30 on the day. Because of roll-overs out of the April contract, gross volume was monstrous. But once all the switches were subtracted, net volume turned out to be a tiny 70,000 contracts. As it turned out, silver's high of the day came about twenty minutes before I hit the 'send' button on Tuesday's column...around 10 a.m. British Summer Time...with a secondary high at the London p.m. gold fix. That was the last time on Tuesday that silver had a $33 price handle...as it was quickly sold off from there. Silver closed at $32.59 spot...down exactly two bits on the day. Net volume was pretty skinny...around 27,000 contracts. The dollar index, which had opened the Tuesday trading day in the Far East around the 78.90 level, added a bit over twenty basis points during the next twenty-four hours...and closed Tuesday at the 79.15 mark. Nothing to see here, folks...please move along. It should come as no surprise that the high of the day in the gold stocks came at the London p.m. gold fix...and that is the standout feature on this graph. From there, the shares got sold off in sync with the gold price. The HUI finished down 1.40%...barely off its low of the day. The silver stocks didn't do any better...and Nick Laird's Silver Sentiment Index closed down 1.16%. (Click on image to enlarge) The CME's Daily Delivery Report showed that zero gold contracts along with 51 silver contracts were posted for delivery on Thursday. In silver it was JPMorgan on the short/issuer side with all 51 contracts...and the Bank of Nova Scotia being the largest long/stopper with 41 contracts. For the first time in about four months, Jefferies was nowhere to be found. The GLD ETF showed that an authorized participant withdrew a rather small 67,995 troy ounces...and there were no reported changes in SLV. The U.S. Mint reported selling 25,000 silver eagles...and that was it. Over at the Comex-approved depositories on Monday, they reported receiving 921,251 ounces of silver...and shipped 613,960 ounces out the door. The link to that action is here. Here's an interesting chart that Washington state reader S.A. sent me yesterday. It's the median net worth of the 35 and younger vs. the 65 and older crowd over a 25-year period...adjusted for inflation. Shortly after I received the above, reader Bob Fitzwilson sent me the Zero Hedge article that this chart came from. It's headlined "Guest Post: The Chart Of The Decade"...and the link is here. Washington state reader S.A.'s second graph needs no further explanation from me...as its contents are self evident after a few seconds of study.

I have slightly fewer stories today, so I hope you have the time to sift through most of them. With net volumes at extremely low levels...especially in gold...it was a very quiet trading day yesterday. Central banks controlling advance of gold, silver, fund manager Fitzwilson says. Gold, Silver, Oil, Global Turmoil & Quiet Markets: Rick Rule. Big Brother wants your Facebook password. Critical ReadsMF Global's Top Lawyer Will Break Her SilenceMF Global's top lawyer is expected to break her five-month silence on Wednesday to tell Congress that she was unaware of a gaping shortfall in customer money until hours before the brokerage firm filed for bankruptcy on Oct. 31. Laurie Ferber, MF Global's general counsel, was expected to tell a House panel that she "had no reason to believe" that the firm had raided customer accounts to meet its own obligations, according to a copy of her prepared testimony. While Ms. Ferber learned of a shortfall in customer money in the afternoon of Oct. 30, she said she believed it to be an accounting error. "My impression throughout the afternoon and late into the evening was that the apparent deficit was a reconciliation issue and did not represent an actual shortfall in customer funds," she planned to tell the oversight panel of the House Financial Services Committee. This story was posted over at The New York Times website late on Monday night...and I thank reader Phil Barlett for sending it along. The link is here. MF Global Executive Saw Early Warning Sign on Customer MoneyAn internal MF Global document suggested that the firm was putting customer money at risk days before its bankruptcy filing, an executive said in prepared testimony that was released on Tuesday for a Congressional hearing on Wednesday. The document showed "a substantial deficit" in the amount of firm money used to protect customer accounts, according to the testimony by Christine Serwinski, the firm's North American chief financial officer. Futures firms typically keep a cushion of cash in customer accounts as a buffer to cover losses in case of volatile market swings. The deficit, revealed in a report on Thursday, Oct. 27, did not in and of itself violate federal laws, she said. But Ms. Serwinski, who was on vacation during MF Global's final week, had stated "clearly and repeatedly" that the firm should keep a surplus of cash to protect customer money. This New York Times story was posted on their website at noon yesterday...and is Phil Barlett's second offering in a row. The link is here. House votes overwhelmingly to ease financial rulesTo the chagrin of consumer groups, the House gave overwhelming bipartisan approval Monday to two bills easing requirements that President Barack Obama's overhaul of financial regulations impose on some exotic financial instruments blamed for helping trigger the 2008 financial crisis. Lawmakers of both parties said they were relaxing rules that would otherwise inhibit the ability of companies to manage the risks of prices and investments, ultimately reducing their profitability and job creation. Consumer groups said legislators were bowing to the interests of their corporate and finance-world contributors and taking steps that might prove harmful to the public. The instruments are called derivatives, assets tied to the value of commodities like petroleum or fluctuating economic variables like interest rates. This AP story was picked up by yahoo.com on Monday...and I thank reader Washington state reader Duane Zelinka for sending it along. I consider it worth running through...and the link is here. S&P: Home Prices Fall to New LowU.S. home prices fell again in January, dropping to their lowest level since the housing crash occurred, according to the latest Standard & Poor's/Case-Shiller Home Price Indices. Home prices in the index of 20 major U.S. cities showed a monthly decline of 0.8 percent in January, dropping to their lowest level since the beginning of 2003. All told, average home prices are now down 34.4 percent since peaking in 2006. Reader Eddie Costik, who sent me this story had this to add in the covering e-mail..."I can tell you, having been in the lumber business for 37 years, that the housing market will never come back. I know what it's like in this small market here in Pennsylvania. I can only imagine what's happening around the rest of the country. Even though I'm retired from the business, I stay in touch with key contractor friends and my old suppliers. I can report that no one in the industry is busy and wholesalers are either sitting with a lot of inventory, or running lean and mean. No one is making any money. Retailers are giving stuff away just to stay busy which affects margins and wholesales are cannibalizing each others territories...stealing business to stay alive! So don't believe any of the B.S. coming out of any politician's mouth." This story was posted over a the mortgageloan.com website yesterday...and the link is here. Big Brother Wants Your Facebook PasswordIf you want to become a state trooper in Virginia, you should probably delete any indelicate information you have on Facebook. During the job interview process, the Virginia State Police requires all applicants to sign into Facebook, Twitter, and any social-networking site to which they regularly post information in front of an administrator. "You sign a waiver, then there's a laptop and you go to these sites and your interviewer reviews your information," says Corinne Geller, spokeswoman for the Virginia State Police. "It's a virtual character check as much as the rest of the process is a physical background check." Geller says the practice has been around for only three months and is just one of many ways the state makes sure its law enforcement officials are ethically sound. (Potential troopers also have to submit to a polygraph test). Virginia is not the only state to do this; other police departments and government entities have similar policies. Until recently, the city of Bozeman, Mont., and the Maryland Division of Correction both asked job applicants to hand over their passwords. Each has discontinued the practice—in Maryland's case it was after a prison security guard named Robert Collins contacted the American Civil Liberties Union (ACLU) and complained. Now they go for the over-the-shoulder approach that Virginia favors. University of North Carolina at Chapel Hill has a unique method: It requires all student athletes to friend a designated coach or administrative official on Facebook so that he or she can monitor their pages. This businessweek.com story was sent to me by West Virginia Reader Elliot Simon...and the link to this must read story is here. Europe Urged to Increase Firewall to a Trillion EurosThe European Union should increase its financial firewall to about 1 trillion euros to restore market confidence in the euro zone and prevent the spread of fiscal contagion, the head of the Organization for Economic Cooperation and Development, Ángel Gurría, said on Tuesday. Mr. Gurría's comments came a day after Germany dropped its opposition to increasing the Continent's total bailout capacity to more than 690 billion euros, or about $920 billion. That could help stop the spread of the crisis to large economies like Spain's. "The mother of all firewalls should be in place," Mr. Gurría said at a news conference in Brussels. But he also said the current level of political commitment to the funds was not enough. This is another story from The New York Times yesterday...and another offering from Phil Barlett. The link is here. Parties Reach Compromise: German Parliament to Get Greater Say in Euro BailoutsUnder a compromise reached between the ruling parties and the opposition on Tuesday, Germany's parliament will decide on future measures to release billions of euros to bail out troubled EU member states. The deal fulfills a requirement for greater parliamentary powers stipulated by the country's highest court. According to legislation drafted by the ruling conservative Christian Democrats and Free Democrats, along with the opposition Social Democrats and Greens, the whole parliament will decide on bailouts, even in urgent cases, contrary to earlier plans for a small parliamentary panel to give swift approval. This story was posted over at the German website spiegel.de yesterday...and I thank Roy Stephens for bringing it to our attention. The link is here. A Lesson For Europe: Why Iceland Won't Join The EuroIn a brief but as usual succinct statement, MEP Daniel Hannan points out the country that decided to say no to establishment-rules and stuck to its guns by taking losses, devaluing its currency, and growing its way out of its pit of despair. The eloquent Englishman notes Iceland's current enviable position in terms of not just growth but Debt to GDP and proffers upon his European Parliamentarian peers that perhaps, just perhaps, there is a lesson in here for all European governments (cough Greece/Portugal cough)...as 67% of Icelanders are now against joining the Euro. This 1:20 minute video is posted over at zerohedge.com...and I thank Dutch reader Victor de Waal for bringing it to my attention. It's a must watch...and the link is here. Will euro last? Let's see what William Hill saysTreasury forecasters rely on odds calculated by William Hill, the bookmaker, to assess the likelihood of another economic collapse, a top official has revealed. In a candid admission to MPs, Professor Steve Nickell said he turned to the betting shop to find out whether Euro is likely to fail in the course of his work at the Office of Budget Responsibility. Professor Nickell is one of the independent experts brought in by George Osborne, the Chancellor, to make sure Britain's economic estimates are robust. You just can't make this stuff up! This story was posted in The Telegraph late on Monday evening...and it's worth the read. I thank Roy Stephens for sending this story to us...and the link is here. Central banks controlling advance of gold, silver, fund manager Fitzwilson saysFund manager Robert Fitzwilson gave King World News his impression of central bank intervention in the monetary metals markets: "There is a limit that central banks have imposed on the price of gold and silver. When it gets to that limit, the central banks pile in and drive the price of gold and silver back down. The smart central banks then buy the bullion at incredibly cheap and subsidized prices. ... The advance in gold and silver is being managed." This blog was posted over at the KWN website on Monday...and then appeared in this GATA dispatch from yesterday. The link is here. |

| Turkey increasingly recognizes gold as money Posted: 27 Mar 2012 09:09 PM PDT  Zero Hedge's Tyler Durden calls attention to Turkey's increasing recognition that gold is money, with an important place in the country's banking system. The Zero Hedge post is headlined "Turkey Once Again Proves that Gold Is First and Foremost Money". I borrowed the introduction from a GATA release...and I thank reader 'David in California' for being the first one through the door with this story. As you've probably already surmised, this is a must read...and the link is here. |

| Three King World News Blogs/Interviews Posted: 27 Mar 2012 09:09 PM PDT  The first blog is with Caesar Bryan, manager of the Gabelli gold fund, and is headlined "Watch Gold as Europe Headed into Crisis Again". The second blog is with Rick Rule. Its entitled "Gold, Silver, Oil, Global Turmoil & Quiet Markets". Lastly is this audio interview with Jim Sinclair. I posted the blog on this |

| Central banks controlling advance of gold, silver, fund manager Fitzwilson says Posted: 27 Mar 2012 09:09 PM PDT  Fund manager Robert Fitzwilson gave King World News his impression of central bank intervention in the monetary metals markets: "There is a limit that central banks have imposed on the price of gold and silver. When it gets to that limit, the central banks pile in and drive the price of gold and silver back down. The smart central banks then buy the bullion at incredibly cheap and subsidized prices. ... The advance in gold and silver is being managed." This blog was posted over at the KWN website on Monday...and then appeared in this GATA dispatch from yesterday. The link is here. |

| Will euro last? Let’s see what William Hill says Posted: 27 Mar 2012 09:09 PM PDT  Treasury forecasters rely on odds calculated by William Hill, the bookmaker, to assess the likelihood of another economic collapse, a top official has revealed. In a candid admission to MPs, Professor Steve Nickell said he turned to the betting shop to find out whether Euro is likely to fail in the course of his work at the Office of Budget Responsibility. Professor Nickell is one of the independent experts brought in by George Osborne, the Chancellor, to make sure Britain's economic estimates are robust. |

| 600k Ounces of Silver Withdrawn from ScotiaMocatta Posted: 27 Mar 2012 09:03 PM PDT

from Silver Doctors: More apparent shenanigans in COMEX silver warehouses Monday, as a nearly identical 600,000 ounce withdrawal from Scotia's registered vault showed up in Brink's eligible ledger. No need to worry however, as the CME reported the transfers down to the thousandth of an ounce, removing any doubts over the credibility of their reports. At least the 3-card Monte will be accounted for properly- minus the 1.4 million ounces still missing from MFG clients. Read More @ SilverDoctors.com |

| LISTEN: Marcus Grubb of the World Gold Council Posted: 27 Mar 2012 08:50 PM PDT IN this interview Marcus Grubb shares his thoughts on the record gold supply and demand numbers for 2011, the recent pullback in prices and more.

I had the chance to reconnect last week with Marcus Grubb, Managing Director of Investment with the World Gold Council. It was another exciting interview (last commentary available here), as the World Gold Council's influence and access to market data on gold is arguably deeper than any other organization globally. During the interview, we spoke about the council's recent publication of the "Gold Demand Trends" report published for Q4 and full year 2011 (click here to access the report). Marcus shared his thoughts on the record gold supply and demand numbers for 2011, the recent pullback in prices due to U.S. Federal Reserve Chairman Ben Bernanke's recent statements, and exciting global "blue-sky" potential for gold consumption in the coming years. More @ bullmarketthinking.com |

| Fukushima: More Media Blackout than Ron Paul Posted: 27 Mar 2012 07:09 PM PDT

First and foremost, this illustration, from ASR, is not a radiation plume.It is a biological matter plume, as free-floating material (fish eggs, algae, plankton, plant life, flotsam) present in the seawater would be the method by which some material will spread. The illustration is a probability heat map, not a radioactive concentration heat map; however, logically, a correlation should be drawn. By now everyone knows that Japan has admitted that fission reactions at its Fukushima nuclear plant, wrecked by last year's earthquake and tsunami, are restarting, and that boric acid is being injected into at least one reactor to control the rate at which neutrons can be absorbed, slowing the process. Japan is importing more boric acid from South Korea, and that was the end of the story. Unfortunately, for Japan and for Earth itself, that is not where the story ends. |

| Fatal Flaws and Opportunities in Gold Investing: Brent Cook Posted: 27 Mar 2012 07:00 PM PDT |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

I picked up two new heroes last week. The first, amusingly enough, is named Jack.

I picked up two new heroes last week. The first, amusingly enough, is named Jack. You may think this is another "card counting" story. Some famous and successful traders, like Blair Hull in New Market Wizards, and more notably Ed Thorpe and Bill Gross, got their start counting cards at the blackjack table.

You may think this is another "card counting" story. Some famous and successful traders, like Blair Hull in New Market Wizards, and more notably Ed Thorpe and Bill Gross, got their start counting cards at the blackjack table. Johnson is very good at gambling, mainly because he's less willing to gamble than most. He does not just walk into a casino and start playing, which is what roughly 99 percent of customers do. This is, in his words, tantamount to "blindly throwing away money." The rules of the game are set to give the house a significant advantage. That doesn't mean you can't win playing by the standard house rules; people do win on occasion. But the vast majority of players lose, and the longer they play, the more they lose.

Johnson is very good at gambling, mainly because he's less willing to gamble than most. He does not just walk into a casino and start playing, which is what roughly 99 percent of customers do. This is, in his words, tantamount to "blindly throwing away money." The rules of the game are set to give the house a significant advantage. That doesn't mean you can't win playing by the standard house rules; people do win on occasion. But the vast majority of players lose, and the longer they play, the more they lose. It's estimated that the house has a 2% advantage over the typical blackjack player.

It's estimated that the house has a 2% advantage over the typical blackjack player. That, friends and neighbors, is the epitome of trading excellence.

That, friends and neighbors, is the epitome of trading excellence.

No comments:

Post a Comment