saveyourassetsfirst3 |

- 2 Market Meltdowns: BATS And TVIX

- HKMEx: to launch yuan-settled gold, copper futures by July

- Texe Marrs: “Die America Die”

- Gunning For Gold: Ben Traynor

- Biderman Montage - Still Bullish due to Government Rigging, But!

- Silver Update: “Unsustainable Debt”

- Mild Up Trend

- James Turk on Gold

- Peter Grandich on Gold

- All Paper is STILL a short position on gold

- The Fed, Gold, the S&P 500, & the Retail Mindset

- Gold-Stock Panic Levels

- Bullish Outlook for the Precious Metals Sector Holds

- Gunning for Gold

- China’s Real Choices for Growth

- By the Numbers for the Week Ending March 23

- Fed Warns: “Inflation Genie Out of the Bottle”

- News Flash: Europe Is Slowing, China Is Slowing, Goldilocks Has Left The Building

- Friday ETF Roundup: GDX Soars On Gold's Glitter, TVIX Loses Another 30%

- Asia’s golden future

- Today’s Winners and Losers

- Gold and Silver Disaggregated COT Report (DCOT) for March 23

- Ross Beaty: Silver Manipulation & Conspiracy Theories

- Bullish Outlook for the Precious Metals Sector

- Memo Show Corzine Ordered Raiding MF Global Customer Account of $200 Million

- TheDailyGold Updated Gold & Silver Stock Indexes

- Europe’s Counterproductive Economic Policies Proceeding as Expected

- Gold and Silver Financial Review With Bob Chapman by Gold Radio Cafe - March 22, 2012

| 2 Market Meltdowns: BATS And TVIX Posted: 24 Mar 2012 03:33 AM PDT  By Roger Nusbaum: By Roger Nusbaum: A few brief items this morning. Complete Story » |

| HKMEx: to launch yuan-settled gold, copper futures by July Posted: 24 Mar 2012 03:02 AM PDT HKMEx: to launch yuan-settled gold, copper futures by July

|

| Texe Marrs: “Die America Die” Posted: 24 Mar 2012 02:23 AM PDT from bobchapmanradio: ~TVR |

| Posted: 24 Mar 2012 01:35 AM PDT ¤ Yesterday in Gold and SilverGold's low print on Friday came about 2:30 p.m. Hong Kong time...and the subsequent rally was only ten bucks...and that came to an end shortly after 10:00 a.m. in London. From that point, gold gave back half those gains going into the Comex open. The rally that began at that point came to an end at its high tick of the day...$1,667.70 spot...just a few minutes after 11:00 a.m. Eastern time in New York...which was a few minutes after the London close at 4:00 p.m. GMT. But by the time that electronic trading was done in New York at 5:15 p.m...gold had slid back five bucks from that high. Gold closed at $1,662.80 spot...up $17.90 on the day. Net volume was on the lighter side...around 112,000 contracts. Silver's chart looks more or less the same as the gold chart...but the rally during the Comex trading session in New York was far more substantial on a percentage basis...and the high tick of the day [$32.41 spot] came either shortly before, or just after, the close of Comex trading at 1:30 p.m. Eastern time. From that high, silver gave back a bit of its gain going into the weekend. Silver closed at $32.24 spot...up 65 cents on the day. Net volume was pretty light...around 31,000 contracts. The dollar index traded mostly flat during early Far East trading, with the high tick [79.74] coming shortly after 3:00 p.m. Hong Kong time...less than an hour before London opened on their Friday morning. Less than three hours later...and a few minutes after 10:00 a.m. in London...the dollar index had fallen 50 basis points. Three hours after that...8:00 a.m. in New York...the dollar index had gained back 30 points of that decline...but continued to fall after that, closing almost on its low of the day. When all was said and done, the dollar index was down 43 basis points from Thursday's close. If you examine the major dollar index inflection points against the major deflection points in gold and silver prices, you'll find a perfect match but...as I've said for the last three days...the match is almost too perfect. It looks suspiciously like the same traders buying gold/silver and selling the dollar simultaneously...or doing the exact opposite...selling gold/silver and buying the dollar. There's no lag time at all, as the inflection points in both are either simultaneous or within minutes...and the only people who would know the exact price direction of either the dollar index or the precious metals, would be those who are doing those trades at the same time. Talk about insiders gaming the system! I wish I was making their money. But, as I've said before, maybe I'm looking for black bears in dark rooms that aren't there. Even though both gold and silver were up a decent amount at the open of the New York equity markets, the HUI opened flat...but began climbing from there...reaching it's high tick a few minutes after 12 o'clock noon Eastern time. It held that level until about 1:45 p.m...and then declined a few basis points going into the close at 4:00 p.m. All in all, the gold stocks pretty much mirrored the gold price. The HUI finished up 1.74% on the day. Well, the silver shares were certainly the stars yesterday...particularly the juniors. It's too bad that Nick Laird's Silver Sentiment Index doesn't reflect all that, but it still closed up a respectable 3.18%. (Click on image to enlarge) The CME's Daily Delivery Report for Friday showed that 29 gold and 113 silver contracts were posted for delivery on Tuesday and, as has been the case all year, it was Jefferies as the short/issuer on all 113 contracts...and the Bank of Nova Scotia and JPMorgan were the long/stoppers...with 75 and 31 contracts respectively. The Issuers and Stoppers Report is worth a look...and the link is here. There were no reported changes in GLD yesterday...but an authorized participant withdrew a rather smallish 339,921 troy ounces of silver out of SLV. And, for the first time in a while, the U.S. Mint had a sales report worthy of the name. They sold 8,500 troy ounces of gold eagles...4,500 one-ounce 24K gold buffaloes...and 275,000 silver eagles. Month-to-date the mint has sold 43,500 ounce of gold eagles...23,000 one-ounce 24K gold buffaloes...and 2,137,000 silver eagles. So far this month, silver eagles are up about 33% over February's sales month...and gold eagle/buffalo sales are up 120% over the same period. I would agree with what Ted Butler had to say in one of his recent commentaries, that once this market turns to the upside with some real force behind it, we'll see some daily sales that will make your eyes water, because the mint has probably been building up inventory over the last six weeks or so...and will be able to fill all orders regardless of size, as they won't be constrained by current production levels. Thursday was another day of big silver inflows into the Comex-approved warehouses. They reported receiving 1,215,567 troy ounces of silver...and shipped out an insignificant 10,610 ounces. When they finally parked the forklifts on Thursday night, the five depositories held 135,850,575 ounces of silver. The link to that action is here. It suddenly dawned on me yesterday that maybe the reason that silver inventories are climbing at these warehouses is that Jefferies has been bringing in silver to meet its delivery requirements since December 1st of 2011. From then until yesterdays close, Jefferies has delivered 2,874 silver contracts on the Comex. That works out to 14.37 million ounces...447 tonnes...and that, dear reader, is a lot. The Commitment of Traders Report came in as Ted Butler expected...however I was hoping for a bigger improvement in silver, but regardless of what I thought, the improvement was pretty substantial, as the Commercial net short position declined by 3,505 contracts...or 17.5 million ounces. The Commercial net short position in silver is now down to 160.6 million ounces. That's pretty low, but about 90 million paper ounces above its late-December absolute low. The '1 through 4' largest Commercial traders are short 188.3 million ounces of silver...and the '5 through 8' Commercial traders are short another 42.3 million ounces on top of that. Once you subtract all the market-neutral spread trades out of the Non-Reportable category, the '1 through 4' Commercial traders/bullion banks are short a bit more than 43% of the entire Comex futures market in silver. That's preposterous!!! For the second week in a row, it was gold that showed the biggest improvement, as the Commercial net short position declined by 25,550 contracts, or 2.56 million ounces. As of Tuesday's cut-off, the Commercial net short position is now down to 16.6 million ounces. The '1 through 4' and '5 through 8' Commercial traders on the short side are short 11.4 million and 5.2 million ounces respectively. And once the market-neutral spread trades are removed, the '1 through 4' Commercial traders/bullion banks are short 28.4% of the entire Comex futures market in gold. That's equally as preposterous. Here's Nick Laird's up-to-date "Days of World Production to Cover Short Contract" chart that he designed at Ted Butler's request over a decade ago. This shows all the commodities that are traded on the Comex in New York. Notice that the biggest short positions by the four largest bullion banks are in the four precious metals...and how silver stands out "Above the Crowd"...as they say over at Re/Max. (Click on image to enlarge) I got a monster e-mail from Nick Laird late last night...and thought all the charts, plus everything had to say in association with them, was worth posting....so here goes. "The gold oscillator is indicating that the latest move up by gold is a breakout. "There is good probability that gold has finished it's decline and the next wave should be up and taking out the recent highs at $1,780. (Click on image to enlarge) "On a larger scale, the impending move up - if it is strong enough i.e.. takes out $1,800 & then $1,900 - will then trigger a massive rise out of the triangle shown in the chart below. "This is indicative of a major rise coming in gold - something strong enough to take us up to the mid $2,000's. (Click on image to enlarge) "The first rise up off the bottom was from $1,520 to $1,790 - a rise of 270 or 17.7%. We are now down at the retest level and should move up from here so a 270 rise up from $1,640 will take us up to $1,910. "We will in all probability see a larger rise here i.e. larger than 18%. "With that rise we retest the all time highs & break through. This will trigger the breakout on the Long Term Gold Oscillator giving us the buy signal for the next leg up to $3,500. "The last major wave up took us from $700 to $1,900 in 2.5 years. This major wave up should take us from $1,500 to $3,600 in 1.5 years. "So - a rise from here up to the old highs should occur in the next leg up. This should trigger the buy signal signaling a major move up to the mid $2,000's. A pullback and then a continued rise into the high $2,000's - low $3,000's. "Another pullback and then the parabolic move up to the top of the leg in mid 2013 at around $3,500. This a possible wave structure for the major rise - a major wave comprised of several sub-major waves. "That will put in a wave up that will fit in with the e-wave chart... (Click on image to enlarge) "So expectations are for a strong move up to be continued by strong moves - large runs up with minor pullbacks moving the market up over 100% from low to high i.e. from $1,500 to $3,500. If it does take on this stance then it will be affirmative of the plotted advance speculated on in the chart above. "If it doesn't then one can suspect that we are more likely to follow Martin Armstrong's path for gold with a soft year this year as gold gathers strength to run up from 2013 through to 2017. "At the moment I prefer my version & believe that it has good chance to play out. What the market will depend upon is any manipulation that will prevent the above scenario from playing out. "But when I look at the last 12 years I see nothing that has impeded the price and amounted to much in stopping gold's relentless rise. "So we are fast closing in on a position that if confirmed would mean that you should be fully invested in gold & ready for the rise ahead...and I still prefer bullion over gold stocks for this move up. "I'm still looking for a major bear market in equities & believe that this will weigh heavily upon gold stocks leaving few out performers. "However if we do get this equities correction then gold stocks will become a definitive buy. "So - exciting times ahead of us. - Nick Frank Barbera's The Gold Stock Technician report for Thursday had this to say in its opening paragraph... "This report is unlike any other report we have ever written, as the list of data extremes in the Gold Stocks has grown so rapidly in the last few days, that it is almost impossible to stress how potentially major a low we could be witnessing in the mining stocks at the current time. That a violent upside reversal rally, lies dead ahead, there can be virtually no doubt. Personally, I would not be the least bit surprised to see the Gold Stocks up 150% to 200% over the next 18 months coming off the current lows. There is now historical technical evidence in spades to support the case that we are watching the final day or two of what is likely another major secular low in the group, and a bottom which could easily kick start a major bull market advance. We feel there is very good chance that today was the closing low on GDX, XAU, and HUI. In the past, readings like those now present, have systematically led to major upside advances in the sector, and we see no reason to believe that past precedent won't repeat again. In this report, which we believe will stand as a seminal update, we summarize our views right up front, and then provide a lot of historical charts to support the case walking down the long list of individual indicators which we track each day. For some, looking at a long list of charts, can be to taxing, and that is why we cut straight to the bottom line on this first page." This is all well and good. I'm certainly of the belief that we saw the bottom on Thursday...but how things turn out in the future is...as Nick Laird pointed out in his comments...as always, in the hands of JPMorgan et al. Supply and demand fundamentals mean nothing when you're dealing with a managed market. And as much as the wildly bullish part of me wants to believe both Nick and Frank...the 'born in Missouri' part of me says "show me". Stay tuned. Here's a chart from a Zero Hedge article that Australian reader Wesley Legrand sent my way yesterday. It need needs no further embellishment from me...and the link to the hard copy of the story is here. (Click on image to enlarge) These last three charts were sent to me by reader Phil Barlett...and shows just how much monetary pumping at all levels is currently going on at the moment. It's already showing up in the real inflation numbers...and certainly before the end of the year, monetary inflation will be noticeable to all...even if official government figures don't show it. (Click on image to enlarge) (Click on image to enlarge) (Click on image to enlarge) In his latest blog, reader Scott Pluschau points out that the Commitment of Traders short/long ratio for the U.S. dollar is now greater than 10 to 1. I would suggest that his short blog is worth the read...and the link is here. Since it's Saturday, I have a huge list of stories for you that I hope you have the time to plow through in what's left of the weekend. And so it begins...another precious metals rally in the making...at least that's what the talk is on the Internet right now. Chinese gold imports will keep increasing: Turk. Gold investors ditch equity funds, favor bullion. Hong Kong exchange to launch yuan-settled gold, copper futures. Apple Flash Crash vs. Silver Flash Smash. ¤ Critical ReadsSubscribeMF's Corzine Ordered Funds Moved to JP Morgan, Memo SaysJon S. Corzine, MF Global Holding Ltd. chief executive officer, gave "direct instructions" to transfer $200 million from a customer fund account to meet an overdraft in a brokerage account with JPMorgan Chase & Co., according to a memo written by congressional investigators. Edith O'Brien, a treasurer for the firm, said in an e-mail quoted in the memo that the transfer was "Per JC's direct instructions," according to a copy of the memo obtained by Bloomberg News. The e-mail, dated Oct. 28, was sent three days before the company collapsed, the memo says. The memo does not indicate whether that phrase was the full text of the e-mail or an excerpt. O'Brien's internal e-mail was sent as the New York-based broker found intraday credit lines limited by JPMorgan, the firm's clearing bank as well as one of its custodian banks for segregated customer funds, according to the memo, which was prepared for a March 28 House Financial Services subcommittee hearing on the firm's collapse. O'Brien is scheduled to testify at the hearing after being subpoenaed this week. Well, I wonder if Jon is finally about to do the perp walk? The first one through the door with this Bloomberg story was Edmonton reader B.E.O...and the link is here.  Student-Loan Debt Tops $1 TrillionThe amount Americans owe on student loans is far higher than earlier estimates and could lead some consumers to postpone buying homes, potentially slowing the housing recovery, U.S. officials said Wednesday. Total student debt outstanding appears to have surpassed $1 trillion late last year, said officials at the Consumer Financial Protection Bureau, a federal agency created in the wake of the financial crisis. That would be roughly 16% higher than an estimate earlier this year by the Federal Reserve Bank of New York. The new figure—released Wednesday at a banking conference in Austin, Texas—is a preliminary finding from a study of student debt that the bureau plans to release this summer. Bureau officials said the estimate is based on a survey of private lenders, as opposed to other estimates that rely on a sampling of consumer credit reports. I borrowed this Wall Street Journal story from yesterday's King Report...and the link is here.  |

| Biderman Montage - Still Bullish due to Government Rigging, But! Posted: 24 Mar 2012 12:59 AM PDT Trim Tabs chief Charles Biderman's message has not changed - yet. He more or less says that people have to stay bullish with stocks while the Federal Reserve and the U.S. government is "rigging the markets" with about $5 trillion in pump priming in order to insure an Obama reelection. But he continues to sound a longer term warning – the markets are levitating only because of monetary stimulus and massive money printing. – It ain't real, folks; It's unreal. ... Continued... Below is a montage of messages from Mr. Biderman courtesy of the magic of YouTube.

Source: YouTube http://www.youtube.com/watch?v=9u_v9bftQ2A&feature=player_detailpage March 20, Third Consecutive False Dawn for Stocks & Economy

Source: YouTube

Markets totally dependent on Central Bank Manipulation and people continue to believe in miracles. No worries this election year, but then what? At some point, without a real economic recovery, even Wyle E Coyote has to fall back to earth.

Source:YouTube |

| Silver Update: “Unsustainable Debt” Posted: 23 Mar 2012 11:27 PM PDT BJF examines Ag technicals, answers questions, and addresses unsustainable debt in the 3.23.12 Silver from BrotherJohnF: Got Physical ? ~TVR |

| Posted: 23 Mar 2012 11:25 PM PDT This is what I see from the charts as of March 22. Dow Jones Industrial Average: Closed at 13046.14 -78.48 on normal volume and flat momentum. Price is above all moving averages and the close is one point above the 20-day moving average providing new support. Nearby lower support is 13,000. Resistance is 13,250. The close signaled neutral to down but we see very strong support for the Dow for the Friday, 3-23-12 open. We are expecting a mild to good up-day on Friday for stocks with more follow-on up-side pressure next Monday barring any unforeseen news. S&P 500 Index: Closed at 1392.78 -10.11 on flat momentum and normal volume. Price closed above all moving averages but the big traders were cut down primarily by selling in Fed-Ex on warnings of softer sales. The price closed in the lower portion of the down bar telling us tomorrow could see more selling. However, we think under the circumstances most stocks are still well supported within technical bounds and the traders would prefer to go out on Friday with some plus signals. Should there be another down day, and the price leg is telling us this, we think its very mild and new lower support would be found at 1381.75 on the 20-day moving average. S&P 100 Index: Closed at 633.77 -4.12 with resistance near 640-650. momentum got weaker and is flat for today but appears ready to do a moving average cross-over to the sell side. Yet, while lighter weakness is apparent, the close landed in the middle of the daily price bar signaling neutral. Due to larger size here, the 100 moves slower and appears to be completing an ABC with an ok flat price bar. Support is 627 on the 20- day average. If we get more Friday selling it should be mild and supported at the 627.41 20-day moving average. Nasdaq 100 Index: Closed at 2731.50 -5.38 on normal volume and rising momentum. The PMO momentum dipped to sell briefly this month but then kept right on rising. The topping pattern is composed of small price bars with tiny price ranges. However, the overall pattern is one of straining to buy and not sell. Since this index continues to rise, albeit slowly, we have to stick with the trend and say stocks will be buying in the Nasdaq and the other indexes; while weaker, they should soon follow. Except for one selling correction at the end of February-first week of March, the overall pressure is to go higher with a strong 45-50 degree up-line trend. While there might be mild selling on Friday in some of the indexes, we see this one either flat with no losses, or rising higher to 2735-2740. The price of 2735 is upper resistance followed by 2750. Lower resistance is 2725. Expect a mild up-tick on Friday and Monday. 30-Year Bonds: Closed at 137.06 +0.97 on skidding momentum and a price that took a cliff dive this month from 142.50 all the way to 135.00 support. That is a larger move for a big bond market in only three trading weeks. There were four touches and breakout failures at 145.00-145.50 on the top with a lot of support at 140.00. When Euro-land finally quit selling on bailout news, these bonds got busy falling down as an inverse trade. There is previous major and lower support from last October's low of 135.00. The price fell under two channel lines and all three moving averages. However, we have a new two point up-tick from 135.00 driving toward the 200-day moving average resistance at 137.49. Expect the price to close near there on Friday with a bit of mild selling next Monday. Then next Tuesday, we could see more buying with another try to breakout up and through the 137.49 resistance. XAU: Closed at 174.26 -3.53 on falling momentum and in the metal to shares ratio. The latter signal is the most important being a correct leading indicator 90% of the time. Price is under all moving averages, which is quite negative. However, after constant selling since last fall we think the XAU has finally found firmer support and resistance near 175.00 plus, or minus a few points. There were previous key price supports at 175 .00 just after Christmas and again last fall near the first of October. On cycles and time we are due to find a new XAU base with a follow-on rally in gold, silver and the related shares for the next two weeks. Expect a flat and basing XAU on Friday at 175.00 support and resistance, with a chance to finally get some buying next week. Gold: Closed at 1643.50 -5.80 on falling momentum and the price struggling to support and resist near the 200-day moving average at 1650.01. Near the 1650 price, gold likes 1648.50 to 1655.00 as a small trading range. The cycle of March 9 to 21 pretty much turned out as we expected; a convoluted mess of choppy trading for several markets including gold. The wave counts signal we should see the beginnings of a new rally on later Friday, or Monday. A 50% retracement should take gold back to $1,715 resistance. Silver: Closed at 31.51 -0.67 on falling momentum and lower volumes. Price dropped out of a continuation triangle and appears to be headed for a selling overshoot at $30.00 support. A price recovery there would provide a bull inverse head and shoulders pattern for new buying. However, to push through the $30.48 to $34.48 trading range, silver will have a major battle to win. Theoretically, on the cycles and calendar, silver is set-up for a spring rally to gain an upside to $38.85 resistance by the end of next month. It could be slow going at first to get past 34.48. The price should now settle and prepare to rally next week. US Dollar: Closed at 79.70 +0.07 on flat momentum as price new support and resistance is 80.00. All the moving averages and the close are clustered between 78.26 and 79.70. The main resistance therefore is 80.00; the major longer view magnet moving average for the US Dollar Index. Even when traders move the price 1-2 points above, or below 80.00, it tends to go back to 80.00 once again. The intermediate and longer view of the dollar is to sell, but very slowly. Near last May, we had touched a floor near 72.50-73.00. We expect the dollar low to touch 77.00-77.50 in about six weeks. Meanwhile, expect the dollar trades to stay in a range between 78.50 to 81.00, for some time. Crude Oil: Closed at 105.35 -1.46 on slightly falling momentum with price stuck in a trading channel. The new oil trading range is $104.50 to $108.50. There were political moves this week to knock down oil prices and it worked somewhat, but the overall trend is long and we forecast oil to $115.00 minimum by May with a chance at $120.00. In our view politics is the prime driver for oil and there is plenty of gasoline and crude oil with an over-supply of natural gas. Yet, just the fear of Middle Eastern disruptions can easily install a $10 premium in the oil prices. Support is $104.50 with resistance at 108.50. We are close to the beginnings of a new rally perhaps next week. CRB: Closed at 312.27 -3.71 on falling momentum with a price gap down today. The price of 310 support is next followed by a new rally when oil can get busy. The price and moving averages are all between 312 and 318.92 with the latter being the 200-day moving average and most resistant near 320.00. We need to get through the current selling pause before a run to 330-332.50 on the median or mean. Oil being half the CRB is the key but grains and precious metals should add buying. Base metals are weaker on prices but should not sell off too much. The next price rally should take us up to 316.05 on the 50-day moving average next week. This posting includes an audio/video/photo media file: Download Now |

| Posted: 23 Mar 2012 11:19 PM PDT

James Turk discusses gold and his thoughts for the future. More @ KEReport

|

| Posted: 23 Mar 2012 11:05 PM PDT

Al talks with Peter Grandich about, what else, gold. More @ KEReport

|

| All Paper is STILL a short position on gold Posted: 23 Mar 2012 06:00 PM PDT |

| The Fed, Gold, the S&P 500, & the Retail Mindset Posted: 23 Mar 2012 05:30 PM PDT |

| Posted: 23 Mar 2012 05:19 PM PDT |

| Bullish Outlook for the Precious Metals Sector Holds Posted: 23 Mar 2012 04:18 PM PDT

It's tough being a lone voice saying that gold prices will go up when they have tumbled and the financial press is writing obituaries for the gold bull market. It's also encouraging being a lone voice saying that gold prices will go up precisely because it means that the general sentiment is very bearish and this is what we see at major bottoms. Gold has gotten clobbered and silver has taken a beating as Treasury yields surged and markets are moved by optimism that a recovery has gained traction. Fears over an implosion in the Eurozone seem to have receded. February's jobs report signaled a strengthening recovery. Greece's widely expected default has momentarily taken Europe's sovereign debt crisis off the radar screen. UBS's Edel Tully has lowered the one-year price target of gold to $1,550 an ounce, a 12.7% downgrade.

Yet, it was the case that many analysts were quite bullish in February 2012, when we suggested waiting on the sidelines… Since then we have gotten a long-term buy signal from the SP Gold Bottom Indicator along with many other signals and suggested that now is the time to go long with a portion of one's speculative money. In our previous essay on the possible rally in precious metals (March 20th, 2012), we wrote that the bullish outlook was still in place. To quote:

(…) the situation in gold remains very bullish for both the short term and long term based on this week's charts.

We are of the view that the declines in gold prices last week and this week do not invalidate it in any way.

Another one of our indicators, the SP Gold Stock Extreme Indicator, also shows a bullish signal. This indicator has been very good at spotting short term and medium term bottoms since 2008. It has, in fact, been 100% accurate since that time as far as short-term bottoms are concerned. This serves to further reassure us that being on the long side of the precious metals market is a good place to be right now, despite the clamor and noise all around us.

There is no denying that it is emotionally difficult to be long gold right now – but that's also bullish in a way. Please note that the hardest investment decision that you have to make will often be the best one. The metal has now fallen almost $150 an ounce from a Feb. 29 high.

While we are bullish on gold and silver, let's take a look at the possible developments in the related mining stocks sector. We'll begin the technical part with the analysis of the XAU Index. We will start with the very long-term chart (charts courtesy by http://stockcharts.com.)

In the very long-term XAU Index chart, the breakdown is still not confirmed. The miners remain above the medium-term support line but below the very long-term resistance line. Many more days below this line are needed before the breakdown is confirmed in this very long-term chart. Overall, the situation here remains mixed.

In the medium-term HUI Index chart, we also have a breakdown, which has not been confirmed. The first attempt was immediately invalidated and it appears that a second attempt is likely to be unsuccessful as well. This is based on RSI levels and the situation in gold, the latter being discussed in full detail in our premium analysis.

In the GDX SPY ratio chart, we see further evidence that the breakdown has not been confirmed. Prices moved below the previous low temporarily and are now there once again but this is not viewed as a confirmation. The breakdown is simply not in and the situation is still bullish right now. The RSI level remains oversold and below 30 as well.

In the Gold Miners Bullish Percent Index chart, we see that the two important indicators, the RSI and Williams' %R are both below oversold levels. This has been a very reliable indicator pointing to a bottom being seen very soon situation. These signs have been in place for several days now, so the suggestion is that the bottom is in or very, very close.

In the gold miners to gold ratio chart (you can click the chart to enlarge it if you're reading this essay at sunshineprofits.com), we are going to take a slightly different approach. Instead of focusing on the poor performance of mining stocks relative to gold, we will analysis their volume levels with respect to those of the GLD ETF. Here we see an extraordinary event in this ratio. The gold mining stock volume has been exceptionally high as compared to that of the GLD ETF.

This type of situation has only been seen a few times in the past and in five of the six previous times, a rally of at least a few weeks duration followed. The one exception was in December 2011. At that time, a rally had just been seen and the RSI level was well above 50, so the situation was overall quite different from other cases.

In the other five instances, rallies of at least a few weeks duration followed, including three major rallies. These were the rallies, which followed the 2008 bottom, the September-October 2009 bottom, and the post correction rally in early 2010.

Summing up, the situation doesn't look too encouraging for gold and silver mining stock investors at first glance. However, taking into account volume spikes and the Gold Miners Bullish Percent Index, a fairly bullish picture emerges. The situation is even more bullish for the underlying metals: gold and silver.

Thank you for reading. Have a great and profitable week! P. Radomski * * * * *

Sunshine Profits provides professional support for Gold & Silver Investors and Traders.

All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. |

| Posted: 23 Mar 2012 03:22 PM PDT

Q: What links Turkey, India and Vietnam? A: Weak currencies, trade deficits – and a suspicion that gold is to blame… HERE'S the scenario: a falling currency, a widening trade deficit, and a population buying more and more gold. What's the result? Well, it tends to be an unhappy government – followed by a policy response. We've seen it Vietnam, where central bankers continue to make noises about "mobilizing" the country's privately held gold, having last year handed an effective monopoly to a single refiner (later "administratively acquired" by the central bank). We're seeing it in India, where the government has quadrupled import duties since the start of the year. And we may be about to see it in Turkey where, the Wall Street Journal reports, the government is to publish plans designed to encourage people to deposit their gold bullion with the country's banking sector. One proposal reportedly being considered would involve interest-paying gold deposit accounts, with depositors being offered the ability to withdraw gold bars from ATM machines. It remains to be seen whether this will get off the ground, and whether it will be successful. If the scheme does go ahead, it will be the latest move by Turkey's authorities designed to inject a bit of gold into the nation's banking system. Last November, the country's central bank announced that banks could hold up to 10% of their reserves as gold. The backdrop to all this is a falling currency, allied to a balance of payments problem. The Turkish Lira fell 23% against the Dollar in 2011. Turkish gold demand in the fourth quarter of last year meantime was up 128% year-on-year, according to the latest World Gold Council data. Over the year as a whole, gold jewelry demand fell slightly, but demand for gold bars and coins, which people tend to buy primarily for investment purposes, rose 99% to 80.4 tonnes (indeed, Turkey was the world's largest producer of gold coins last year). Almost all of that demand was matched by imports, with Turkey importing 79.7 tonnes of gold in 2011, according to data from the Istanbul Gold Exchange. This is not great news in country whose current account deficit is around 10% of GDP. Here we have a clear case of cumulative causation: the Turkish Lira depreciates, people hedge by buying gold, the gold has to be imported thus putting further pressure on the exchange rate and widening the trade deficit. It is not entirely clear how gold deposit accounts are supposed to break this cycle. Perhaps the government hopes that if banks have gold on their balance sheets, this will boost confidence in the financial system, diminish the propensity to buy gold, and by association support the Lira. Or perhaps the authorities think that by gathering together a "liquidity pool" of gold, banks will be able to meet spikes in domestic demand without the country needing to rely as heavily on imports. In effect, banks would lend out depositors' gold much as they already do their cash, holding a proportion in reserve from which to satisfy any withdrawals. If this is what Turkey is considering, it would involve the obvious risk that banks could be subject to a run. Gold depositors, one suspects, would be most likely to try and take their gold back when a) financial or economic stress has created a need for them to realize its value and b) they fear the bank with which they've deposited the gold may be about to go under. Both such scenarios have in recent times tended to occur together. Furthermore, they are often (though not always) associated with a rising gold price as investors run into perceived safe havens. A run on gold deposits is arguably more likely than a run on cash. Government deposit guarantees are one way of maintaining confidence and avoiding a run, but these are more credible for cash deposits than they would be for bullion. Unlike domestic currency cash deposits, gold deposits cannot be guaranteed by a government unless that government has large gold reserves it is prepared to see diminished, or it is willing and able to buy gold then and there on the international market. Neither move could be expected to promote confidence in the currency, bringing us right back to the situation in which Turkey finds itself now – a weak Lira, weak current account position and a population fleeing to gold. The other option, of course, is that a government could shift the goalposts, denying depositors access to their gold. The history of gold deposit schemes does not bode well for Turkey's planners. India, another country which last year experienced a depreciating currency and a rising domestic gold price, launched a gold deposit bond scheme in 1999 through its largest commercial bank, the State Bank of India. It was not a roaring success, but that didn't stop the SBI re-launching the scheme in 2009. Neither version of the gold bond scheme managed to prevent India's gold imports rising dramatically in recent years, with all the attendant effects on the exchange rate and balance of payments. Indian policymakers have changed tack. This week, they moved to limit gold's value as collateral, with the central bank imposing a cap on the loan-to-value ratio gold financing companies can offer. Reducing the financial utility of owning gold may not have been the primary motivation for this move, but it is a side-effect that is unlikely to worry the authorities. What most definitely is designed to curb gold demand is last week's announcement that India is doubling gold import duties for the second time this year, which sparked off a strike by Indian gold dealers. Finance minister Pranab Mukherjee specifically cited gold imports as "one of the primary drivers of the current account deficit" and a major cause of Rupee weakness. As MineWeb reports, one side-effect of last week's move is the possibility that imports of jewelry routed through Thailand could now end up cheaper than those produced in India, since a free trade agreement between the two countries means imports from Thailand are currently subject to a much lower duty. Domestic gold jewelry makers are understandably upset. This may well be an unintended side-effect rather than a deliberate policy, and one which the government may well iron out. The structure of gold import duties now seems designed to give an advantage to the domestic refining industry, with unrefined gold being subject to a lower duty than refined. It would seem perverse therefore to allow a situation to persist whereby domestic jewelers lose out while gold imports are barely stemmed. Another country with direct experience of gold deposit accounts is Vietnam, which in recent years has also suffered from currency weakness and a current account deficit. Vietnam's central bank is something of a pioneer when it comes to domestic gold market regulation. Last May saw the State Bank of Vietnam ban gold lending activities, at that time the latest in a series of interventions in the gold market. What happened next is interesting. The authorities issued a decree to the effect that refiners of gold bullion should have a minimum of VND500 billion registered capital, as well as a domestic market share of at least 25%. They must have known that the market was dominated by a single refiner, Saigon Jewelry Co, whose market share was around 90%. Having handed Saigon Jewelry a monopoly, the SBV announced in November that it had "administratively acquired" the refiner. Then a rather odd thing happened. The SBV's former governor, Cao Sy Kiem, said that the central bank should issue gold certificates as a way of mobilizing privately-hoarded bullion. Then, in January this year, current SBV governor Nguyen Van Binh also spoke of "mobilizing" gold for the "socio-economic development" of the country, suggesting a role for credit institutions suspiciously similar to the one they were performing before the SBV shut them down. In Vietnam, it would seem, gold should only be mobilized once the government is in a position to call the shots. There would seem to be a deeper trend here. Vietnam, Turkey and India are all emerging economies whose governments, faced with currency and balance of payments problems, have identified gold as an area worthy of attention. So far Turkey is considering the carrot of paying interest on deposits and giving incentives to banks to hold gold. But the experiences of India and Vietnam suggest it may at some point choose to pick up a stick. Another country whose authorities may now be paying closer attention to its citizens' appetite for gold is China. As BullionVault reported last month, some dealers are finding it now takes longer to import gold since importers need to get permission from the State Administration of Foreign Exchange as well as the People's Bank of China. China saw its gold imports from Hong Kong triple last year. Are the authorities beginning to worry about the impact of gold on the country's trade position? If emerging market policymakers continue to flex their regulatory muscles, this could have significant implications for global gold demand. Consumers in India and China accounted for one in every two ounces of gold bought last year. The growth in demand from these two countries – and from China in particular, which only de-regulated its gold market at the start of the last decade – has been a major driving force behind gold's bull market. There is probably a limit to how far policymakers are willing to risk alienating populations who have demonstrated a desire to buy gold. In India, Mukherjee has said he does not intend to raise duties any further (time will tell if the government sticks to that). In Vietnam, for all the many decrees, leaders have been keen to pay lip service to private gold ownership and have said they will continue to permit it. But we are yet to find out where that limit is. As Robert Kennedy said half a century ago (wrongly attributing it as an ancient Chinese curse): "Like it or not, we live in interesting times…" Ben Traynor Gold value calculator | Buy gold online at live prices Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK's longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. (c) BullionVault 2011 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. |

| China’s Real Choices for Growth Posted: 23 Mar 2012 03:15 PM PDT Yves here. I particularly like this post because Michael Pettis takes some boundary conditions about China and works through their implications. One quibble I have is that he talks of "debt capacity limits." That depends who the issuer is. The national government could in theory "print," it has no need to issue debt to fund its activities. But the constraint on that sort of approach is inflation, and China is trying to cool off inflation without crimping growth too much. So China is pretty much in the conundrum Pettis describes, but for slightly more complicated reasons. Cross posted from MacroBusiness An exclusive excerpt from Michael Pettis' most recent newsletter:

|

| By the Numbers for the Week Ending March 23 Posted: 23 Mar 2012 01:42 PM PDT |

| Fed Warns: “Inflation Genie Out of the Bottle” Posted: 23 Mar 2012 12:55 PM PDT

from Gold Alert: Central banks are "known for overstaying their welcome" with regard to easy monetary policies, according to James Bullard, President of the Federal Reserve Bank of St. Louis. In an interview with Bloomberg, Bullard argued that the global economy will face higher inflationary risks in the years ahead if central banks such as the Fed maintain their ultra-accommodative stance for too long. "There's some risk that you lock in this policy for too long a period," he stated. "Once inflation gets out of control, it takes a long, long time to fix it," Bullard added. On Friday, the St. Louis Fed President also gave a speech entitled "Monetary Policy and the U.S. Economy in 2012″ at the 15th annual Credit Suisse Asian Investment Conference in Hong Kong. Notable items from Bullard's speech included: Read More @ GoldAlert.com |

| News Flash: Europe Is Slowing, China Is Slowing, Goldilocks Has Left The Building Posted: 23 Mar 2012 12:21 PM PDT By Stephen L. Weiss:

Like most, I tend to operate from selective memory. Sometimes I have to venture far into the archives to find a pearl of wisdom, other times the proverbial ink has yet to dry. Fortunately, this occasion finds me in the latter camp leading to a trip back to March 6th. I actually present this somewhat cheekily since the S&P has had a nice move since the Complete Story » |

| Friday ETF Roundup: GDX Soars On Gold's Glitter, TVIX Loses Another 30% Posted: 23 Mar 2012 12:08 PM PDT By Jarred Cummans: What started as a down day saw markets turn things around and hold tight to cap off the week. Despite today's minimal gains, markets were forced to ink a down week, marking only the second time that has happened this year. The S&P 500 gained 0.3% but was unable to break through the 1,400 barrier that it lost hold of earlier in the week. Luckily, the Dow was able to gain roughly 34 points and keep from sinking below the coveted 13,000 line that it worked for so long to pass. The only major data point on the day came from new home sales, which disappointed, however, home prices were still high, leading to a mixed outlook from the indicator. Commodities took over during the session, as gold was able to amass gains of nearly 20 points. The precious metal has been frustrating investors all year as it has failed Complete Story » |

| Posted: 23 Mar 2012 12:00 PM PDT For most of the last century the default currency for international settlements has been the US dollar. This has given America ultimate power over international trade. In recent months, the US wielded ... |

| Posted: 23 Mar 2012 10:11 AM PDT |

| Gold and Silver Disaggregated COT Report (DCOT) for March 23 Posted: 23 Mar 2012 09:41 AM PDT SOUTHEAST TEXAS -- This week's Commodity Futures Trading Commission (CFTC) disaggregated commitments of traders (DCOT) report shows considerable short covering by the traditional hedgers on a $23 decline in the price of gold and a $1.26 fall in Cash Market silver. As of Tuesday Managed Money was still of a mood to reduce long exposure. Interestingly, traders classed as "Other Reportables" were notably on the buy side this week. All of the trader's positions are calculated net of spreading contracts as of the Tuesday disaggregated COT report.

Vultures, (Got Gold Report Subscribers) please note that updates to our linked technical charts, including our comments about the COT reports and the week's technical changes, should be completed by the usual time on Sunday evening (around 18:00 ET). As a reminder, the linked charts for gold, silver, mining shares indexes and important ratios are located in the subscriber pages. In addition Vultures have access anytime to all 30-something Vulture Bargain (VB) and Vulture Bargain Candidates of Interest (VBCI) tracking charts – the small resource-related companies that we attempt to game here at Got Gold Report. Continue to look for new commentary directly in the charts often.

|

| Ross Beaty: Silver Manipulation & Conspiracy Theories Posted: 23 Mar 2012 09:01 AM PDT Pan American Silver Chairman Ross Beaty Doesn't "Resort To Silver Manipulation And Conspiracy Theories" Jason Burack and Mo Dawoud of Wall St for Main St. interview Founder and Chairman of Pan American Silver and Executive Chairman of Alterra Power Corp, Ross Beaty. from WallStForMainSt: Ross talks about the Silver market and his price expectations over the next 18-24 months along with an update on Pan American Silver's recent acquisition of Minefinders and PAAS' growth profile the next few years. Ross also talks at length about his newest venture, alternative energy company, Alterra Power Corp. Ross talks about the geothermal business and answers many questions about why Alterra has a very big top and bottom line growth portfolio the next 5 years. ~TVR |

| Bullish Outlook for the Precious Metals Sector Posted: 23 Mar 2012 08:24 AM PDT by Przemyslaw Radomski, Gold Seek:

Read More @ GoldSeek.com |

| Memo Show Corzine Ordered Raiding MF Global Customer Account of $200 Million Posted: 23 Mar 2012 08:21 AM PDT We know America is a hopeless kleptocracy, but if Corzine does not go to jail, given the revelation that he approved the raiding of a customer account of $200 million, it means that no one in the officialdom is interested in keeping up the pretense that we have a functioning regulatory and judicial system. The revelation per Bloomberg:

The transfer occurred on October 28, when the firm had an overdrawn London account with JP Morgan and JP Morgan was holding up business in the US as a result. It isn't hard to imagine the firm would have failed that day as opposed to on the 31st, and with lower customer losses, had the pilfering of the account not taken place. This was also the same transfer in which JP Morgan asked for written assurance that the funds were not coming from customer holdings. The assistant treasurer, Edith O'Brien (who was also the author of the e-mail saying that she had the approval of Corzine for the action) never provided the requested confirmation. Note that this e-mail contradicts Congressional testimony by Corzine:

It isn't hard to anticipate that Corzine will deny the O'Brien e-mail, but with the CFO on holiday during the meltdown and O'Brien an assistant treasurer, it seems entirely credible that she's seek senior level approval for an action like this. And we have this tidbit:

Put it another way: if there isn't some serious action after this revelation, between this and Obama's Make America Safe for Bucket Shops Act, investors can no longer regard themselves as having adequate protection from broker chicanery. |

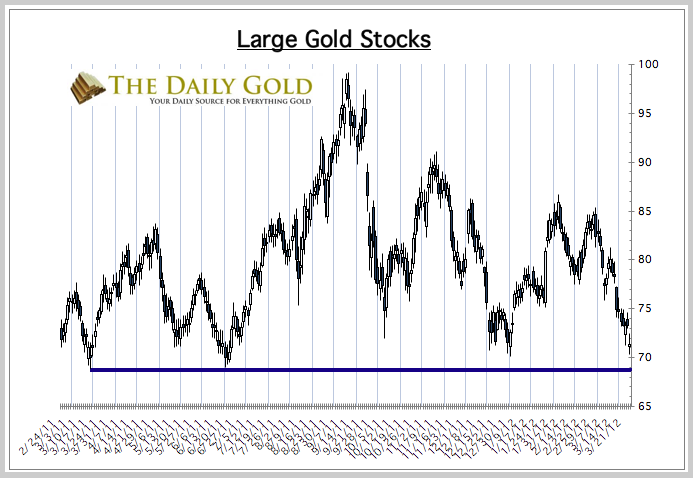

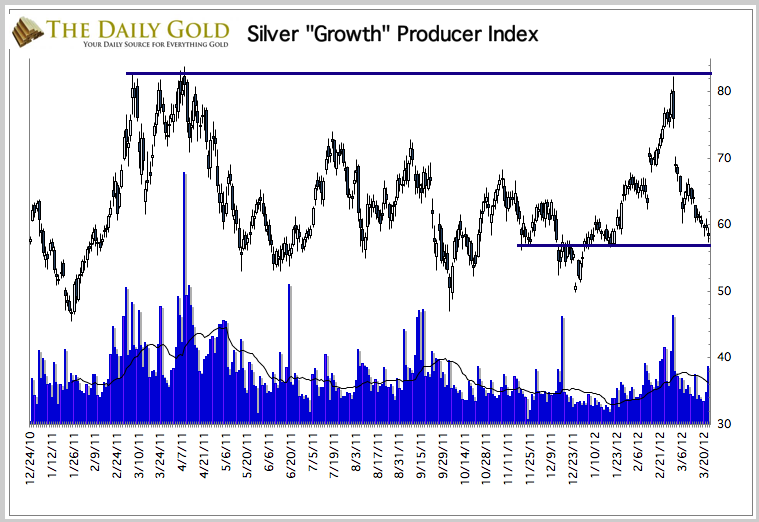

| TheDailyGold Updated Gold & Silver Stock Indexes Posted: 23 Mar 2012 07:34 AM PDT |

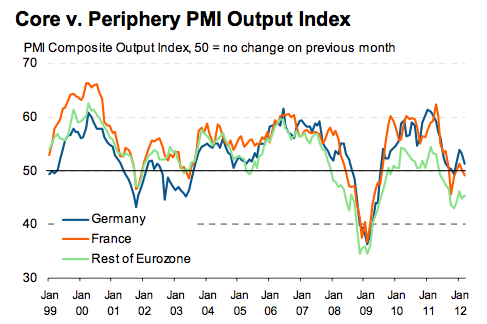

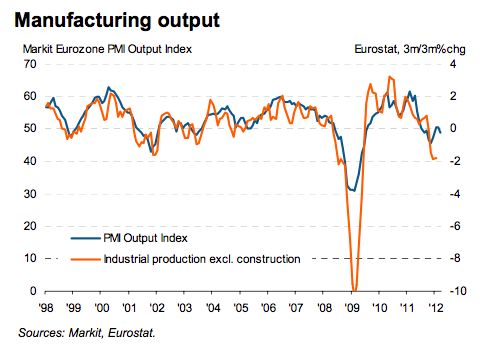

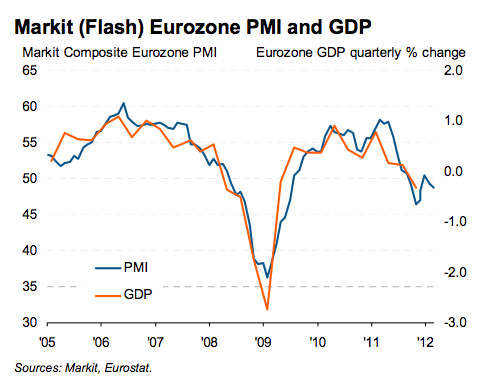

| Europe’s Counterproductive Economic Policies Proceeding as Expected Posted: 23 Mar 2012 07:28 AM PDT By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness. Anyone who has been following my European commentary for any length of time will know that I have been running a number of risk themes on Europe due to what I consider to be misguided and one-sided policy which will ultimately be counterproductive. These themes come under the major trend that I see in the Eurozone:

This analysis is based on the sectoral view of the European periphery which I explained on Monday in a discussion of the Australian economy:

And the story is the same if you look at this from the perspective of national income. A country with a long running current account deficit has been borrowing goods and services from the rest of the world. In order to support this the non-external sectors of the economy will have expanding debt positions and due to this an economy structured around consumption over production. Because the external sector is a net drain on capital from the country, the government and/or private sector must continually expand their debt in order to maintain economic growth. In many cases this debt accumulation leads to asset bubbles, because the expanding debt drives asset prices which attracts speculation and in doing so accelerates the external borrowing. This in turn drives up national income, which in turn drives higher prices and further speculation. If a sector's debt is accumulating faster than its income then at some point in the future a limit will be reached and the rate of debt accumulation will fall. This leads to falling asset prices and national income, which ultimately leads to a crisis as accumulated debts start to sour. This is what we have seen across the European periphery, although the debt has accumulated in different sectors of the economy across different countries. Ultimately, however, once a European country falls into crisis the debt has ended up in the government sector, even if it didn't start there, because Europe has chosen to keep banks alive at all costs. This ideology, however, is the major issue with the "Austerity" plan. After a financial crisis the private sector tends to have lost significant amounts of wealth which leads to both the loss of demand for, and ability to support new borrowing. The debts to the rest of the world still exist which tends to mean the external sector is still in deficit even with lower demand for imported goods. This means that in order for the nation's income to remain at the previous level the government sector must go into deficit to offset the fall in private sector credit creation. If this does not occur then the economy will shrink until a new balance is found between the sectors, which basically means the economy will try to find equilibrium at some lower national income, and therefore GDP. This is the sort of deflationary policy that Europe is endeavouring to implement in the European periphery. There is just one BIG problem. At a lower national income the country has no ability to service the debts that it accumulated on its previous income, yet that is what Europe expects to occur. This is simply delusional, because it is a mathematical impossibility and in trying to break these basic laws of arithmetic Europe is slowly destroying the economies of the European periphery which will, in turn, bring down the stronger economies. Which brings me to last night's Flash PMI data.

And so you can see that the major theme continues. Stemming from that major theme ,and associated analysis, I have had some major expectations. 1. That Portugal would follow Greece. This now appears to be occurring in ernest:

2. Spain was a large unrecognised problem that would return to the spot light:

Since I made that statement bad loans have risen further, house prices have continued to fall and the government's debt position has worsened. 3. Italy could grow out of its economic slump but was unlikely to owing to history, structure and demographics:

The latest stats from Italy appear to show that the economy continues to weaken and GDP continues on its long running downward trend. 4. Although the ECB's emergency response to the crisis may have averted the crisis in the short term, it is likely to lead to a zombification of the periphery banking system and therefore add to the downward pressure on periphery economies. The jury is still out on this one because we need to wait for the ECB's Quarterly bank lending survey to get the results. This was noted by FTAlphaville overnight:

So we will just have to wait and see on that one. Overnight we also saw news that Ireland, the strongest of the periphery in terms of export potential, fell back into recession due to falling trade volumes. In total, it is fairly clear to me that Europe's troubles are far from over because the area continues to meet my predictions. That, however, didn't stop Mario Draghi from trying to convince the world otherwise: European Central Bank President Mario Draghi has said the worst of the eurozone crisis is over. In an interview with Germany's Bild newspaper, he said the situation in Europe was "stabilising".

The European crisis and the associated delusional rolls on. |

| Gold and Silver Financial Review With Bob Chapman by Gold Radio Cafe - March 22, 2012 Posted: 23 Mar 2012 06:14 AM PDT Bob Chapman : The Canadian real estate bubble is about to burst especially in... [[ This is a content summary only. Visit my blog http://www.bobchapman.blogspot.com for the full Story ]] This posting includes an audio/video/photo media file: Download Now |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

It's tough being a lone voice saying that gold prices will go up when they have tumbled and the financial press is writing obituaries for the gold bull market. It's also encouraging being a lone voice saying that gold prices will go up precisely because it means that the general sentiment is very bearish and this is what we see at major bottoms. Gold has gotten clobbered and silver has taken a beating as Treasury yields surged and markets are moved by optimism that a recovery has gained traction. Fears over an implosion in the Eurozone seem to have receded. February's jobs report signaled a strengthening recovery. Greece's widely expected default has momentarily taken Europe's sovereign debt crisis off the radar screen. UBS's Edel Tully has lowered the one-year price target of gold to $1,550 an ounce, a 12.7% downgrade.

It's tough being a lone voice saying that gold prices will go up when they have tumbled and the financial press is writing obituaries for the gold bull market. It's also encouraging being a lone voice saying that gold prices will go up precisely because it means that the general sentiment is very bearish and this is what we see at major bottoms. Gold has gotten clobbered and silver has taken a beating as Treasury yields surged and markets are moved by optimism that a recovery has gained traction. Fears over an implosion in the Eurozone seem to have receded. February's jobs report signaled a strengthening recovery. Greece's widely expected default has momentarily taken Europe's sovereign debt crisis off the radar screen. UBS's Edel Tully has lowered the one-year price target of gold to $1,550 an ounce, a 12.7% downgrade.

No comments:

Post a Comment