saveyourassetsfirst3 |

- Top 5 Places NOT To Be During A Dollar Collapse

- Platinum price recaptures the lead from gold

- Time To Buy The Dip On McEwen Mining

- CNG Interstate Conversions from Gasoline to NatGas for Cars

- Analyzing Wednesday's Noteworthy Insider Trades In Consumer And Retail Sectors

- Is gold going mainstream?

- Gold “Vulnerable” as Treasury Bond Sell-Off Worsens, Indian Demand Revives

- Dividend Ideas: 2 Buys, 3 Sells

- WATCH: When The Dollar Collapses..

- Barry Stuppler: Platinum's Golden Future

- Schlichter: The Coming Paper Money Collapse

- ECB: increase of oz3175.68 in gold and gold receivables

- Barron’s Gold Mining Index To Double by 2014?

- Bob Chapman - Kerry Lutz on Gold, Greece, and the Military - March 14, 2012

- Daniel Alpert: Deconstructing the Federal Reserve’s 2012 Comprehensive Capital Analysis and Review

- Gold Investment Explosion

- South African Gold Production Dives Again To 90 Year Lows

- Gold: Dark Clouds or Sunshine Profits?

- New evidence suggests interest rates could finally be on the verge of a big move higher

- JPMorgan issues a new warning on China: The "hard landing" is here

- Barron’s Gold Mining Index To Double Over The Next Couple Of Years?

- Time to buy some Platinum??

- Bullion ‘Looks Vulnerable’ as Treasury Bonds Fall Again

- South African Gold Output Dives to 90-Year Lows

- GEAB N°63 est disponible! Crise systémique globale - Les cinq orages dévastateurs de l'été 2012 au cœur du basculement géopolitique mondial

- New Timberline Video

- Friedman – How to Cure Inflation

- US Treasuries sell-off gathering pace

- Matt Stoller: On Foreclosure Fraud, One of the Good Guys Gets a Win for a Change

| Posted: 15 Mar 2012 06:27 AM PDT

As the silver price breaks below $32, precious metals investors will soon see whether KWN's mysterious London trader is correct, or not, about the Chinese exercising "massive accumulation" orders "on dips" below $33. "The Chinese are doing the exact same thing in the silver market that they are doing in the gold market, massive accumulation on dips," Anonymous told KWN's Eric King in a Mar. 8 interview. Sign-up for my 100% FREE Alerts Whether the paper market holds somewhere near $33 isn't relevant to the long-term holders of silver, it's timing the purchases along with the elephant buyer in Beijing that has traders wondering about Anonymous. It would, however, be nice to know that someone with access to the same internal data as JP Morgan could be indeed a blessing to the 'good guys' in the war to free the public from the tyranny of the banking cartel. "The physical silver orders that were just filled have been waiting since February 16th," Anonymous continued. "Those orders near the $33 level were filled in huge size on Tuesday. These long-term accumulators are buying every dip. There were some fills at $34, but some very large orders were filled near $33." Below, is a chart of silver, using monthly data and Richard Russell's favorite moving average parameters for the precious metals of 20 and 40 months. According to the chart, silver's 20-month MA stands at $32.71, a price consistent with expected levels of buy orders. So, Anonymous' intelligence appears to square with the charts. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top 5 Places NOT To Be During A Dollar Collapse Posted: 15 Mar 2012 05:47 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Platinum price recaptures the lead from gold Posted: 15 Mar 2012 05:45 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Time To Buy The Dip On McEwen Mining Posted: 15 Mar 2012 04:57 AM PDT By Simit Patel: The whole precious metals sector -- both gold and silver as well as mining stocks -- have gotten hit pretty hard over the past few days. For those who remain convinced that the "solution" to the global debt crisis that monetary authorities are putting forth, which is simply to add more debt, will only serve to catapult the price of precious metals much higher, such sell-offs constitute little more than a great buying opportunity. And when I looked at stocks that I thought would be especially worth buying in light of the recent sell-off -- meaning stocks with outstanding fundamentals that sold off sharply -- near the top of the list is McEwen Mining (MUX). First, let's start with the technicals: the chart below illustrates my take on the basic technicals at play here. As we are at a 61.8% Fibonacci retracement level from accumulation to distribution, and as this Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CNG Interstate Conversions from Gasoline to NatGas for Cars Posted: 15 Mar 2012 04:50 AM PDT CNBC's Rick Santelli interviews Craig Wright, president of CNG Interstate, a company that does conversions for cars and trucks to allow them to run on NatGas (CNG or compressed natural gas). One can tell we are in an election year by what surfaces at the end of this interview – an apparent release from the Strategic Petroleum Reserve by the U.S. and the U.K. To learn more about CNG Interstate, start here: http://www.cnginterstate.com/ Source: CNBC | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Analyzing Wednesday's Noteworthy Insider Trades In Consumer And Retail Sectors Posted: 15 Mar 2012 04:38 AM PDT By Ganaxi Small Cap Movers: We present here noteworthy trades in the consumer and retail sectors from Wednesday's (March 14th, 2012) SEC Form 4 (insider trading) filings, as part of our daily and weekly coverage of insider trades. These were selected by a review of over 455 separate SEC Form 4 transactions filed by insiders on Wednesday. The filings are noteworthy based on the dollar amount sold, the number of insiders buying or selling, and based on whether the overall buying or selling represents a strong pick-up based on historical buying and selling in the stock (for more info on how to interpret insider trades, please refer to the end of this article): American Eagle Outfitters (AEO): AEO is an apparel and accessories retailer that operates over a thousand American Eagle Outfitters, Aerie standalone, and 77Kids stores in the U.S. and Canada. On Wednesday, Vice Chairman Roger Markfield filed SEC Form 4 indicating that he Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 15 Mar 2012 04:29 AM PDT Is gold going mainstream?Posted MAR 14 2012 Will Bancroft takes a look at the growing attention that gold is getting from investors and the media. Is this a flash in the pan? Is the attention justified? And, why are investors turning to gold? Read on for a discussion of why gold's position in the investment landscape is growing. Gold only makes up between one and one and a half per cent of global investments, and although gold's recent bull market has lasted 12 odd years now, gold is still a relatively small and out of sight investment market. When considering gold, most people merely know that Gordon Brown sold most of our national loot in 1999 to 2002, when gold was at its lowest point in 20 years, in an event termed 'Brown's Bottom'. However, the attention and focus gold has been getting has grown considerably, even if few invest in gold. Gold's part in the investment landscape has been growing as the legitimacy of other investments has been declining. Gold is deemed an 'alternative' investment, but the fact is that the traditional investment world has disappointed us individual investors for too long now. Comparing gold with equitiesInvestors in the world's developed equity markets might feel mighty unimpressed with their returns since the turn of the millennium. The FTSE 100 is lower today than it was at the beginning of 2000, whilst the S&P500 is also down from the same start date. European equities maybe in a relatively softer period, but the EURO STOXX 50 are still in negative territory since the beginning of 2002. Much retail wealth has gone unrewarded by the mainstream indexes, and inflation has quietly been picking the investor's pocket further. Many retail investors have been sold the dream of ever rising equity markets. It's been more of a nightmare. However, whilst equity indexes and fund managers have largely been disappointing, the gold price has been quietly putting in steady performances each year. There are also more recent phenomena that have emerged these last few years that have compounded investors' plight. Inflation and dying moneyWhilst inflation was not overly problematic during the calmness of the Greenspan era 'Great Moderation', it started to increasingly affect investors and savers immediately prior to and since the Credit Crunch. Inflation has consistently been above its target of 2% for a few years now. The Governor of the Bank of England, Mervyn King, has to write an explanation letter to the Chancellor each time inflation figures come in above target. This letter has become such a regular broadcast perhaps it is no longer an embarrassment to the 'Old Lady' of Threadneedle Street. A growing awareness of inflation by the population, and changing future inflation expectations have contributed to the angst of today's saver and investor. There are worried about the value of their money and purchasing power, and are increasingly noticing that gold investors have been sailing by rather nicely. Compounding the notice we might take of official inflation figures, we in the developed West have witnessed another decline in the value of our money; when we try and spend it abroad. Western currencies have been steadily losing value against emerging market currencies, and against the currencies of places we often like to go on holiday. Since 2007 the British Pound has lost value by approximately 40% against the Australian Dollar and the Vietnamese Dong, 31% against the Canadian Dollar, 25% against the South African Rand, 23% against the Thai Baht, 18% against the Brazilian Real and has even lost 25% against the euro. We have lost spending power on the international arena and it does not feel good. Rethinking the housing bubbleWhilst much of the above was occurring, we were soothed by the fact that so many savers and investors were seeing the value of their homes rise each year. Our homes often represented by far the largest part of our personal portfolios and for some years the property market was our darling, and often our financial saviour. The Credit Crunch and the bursting of the housing bubble, although to a lesser extend in the UK than US, provided a painful reality for many. According to the Halifax National house Price Index, in the UK, the average house price has fallen from £197,244 in January 2008 to £160,907 in January 2012. This represents a decline of more than 18%, and it was much worse in the US. The housing market's wealth effect had become negative, and the sickly housing market with its confidence shot is propped up by incredibly low interest rates. This was even more painful when inflation is factored in. Savers, investors and much of the population are now in a tighter financial bind. All the while the media was mentioning constantly rising gold prices, but often with a negative slant on gold and frequent mentions of gold being a bubble. Perhaps it is not surprising then that to this day very few in the UK own gold even though they know about rising gold prices. How many friends and family do you know that have a significant proportion (5%+) of their wealth in gold? (We'd be interested to read your thoughts in the comment section below.) Growing appreciation of gold investmentSafe havens seem to be few and far between for investors today, but popular understanding of gold's legitimacy as an investment is growing. Gold investment is first about capital preservation and maintaining purchasing power, and secondly about potentially achieving capital appreciation. It is best to see gold as a better way to save your money, not as a speculative bet to make lots more of it. Gold cannot be printed, counterfeited or inflated. It has no time limit, counterparty risk, or shelf life. It is liquid, portable, divisible and consistent. This is why it has made such sound money for thousands of years of human progress. It sits there quietly doing its job depending on no-one. One should not be put off by gold not being an income-producing vehicle. Gold is not meant to be like a stock. Gold's function is as money and a store of value. It should thus be compared to pounds, dollars, euros, gilts, treasuries, etc. The dollar and pound have lost over 95% of their value since 1913. Gold can be considered a superior savings mechanism and is now an asset class that it getting growing attention and acceptance. Our leaders have boxed themselves into a corner behind mountains of debt, and continue to spend too much money. Monetary history has shown that this is not a sustainable state of affairs. The downfall of fiat (paper) currencies that are not backed by a commodity occurs due to debts and deficits. This is why it is sensible to put a percentage of one's wealth into gold, and not be totally dependent on paper assets. Swiss bankers have traditionally advised a minimum allocation of 10% to gold bullion to act as a solid foundation to our wealth and act like a financial insurance policy of last resort. Gold is one of the few assets that are not simultaneously someone else's liability, and it could not be more relevant to today's saver and investor. We insure our cars; our houses; our health; but too few currently insure their wealth. It's not a case of doom-mongering, but of prudently preparing for the worst, whilst hoping for the best. Time to invest in gold? Register for free and claim your welcome gift of an ounce of silver… -OR- SIGN UP NOW to receive your FREE* oz of silver Please Note: Information published here is provided to aid your thinking and investment decisions, not lead them. You should independently decide the best place for your money, and any investment decision you make is done so at your own risk. Data included here within may already be out of date. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold “Vulnerable” as Treasury Bond Sell-Off Worsens, Indian Demand Revives Posted: 15 Mar 2012 04:25 AM PDT

Gold "Vulnerable" as Treasury Bond Sell-Off Worsens, Indian Demand Revives The WHOLESALE-MARKET gold price twice rose within a few cents of $1650 per ounce in London Thursday morning, adding 0.9% from yesterday's fresh 8-week low as industrial commodities ticked lower again. The price of silver bullion rallied 2.3% to $32.40 per ounce, but remained over 5% down for the week so far, being "very much influenced" by the gold price according to one Swiss precious-metals dealer. Japanese and Hong Kong equities rose, but European stock markets were flat while US equity futures pointed higher. The price of US Treasury fell for the seventh consecutive session, pushing the 10-year bond's yield up to 2.29% – just shy of Wednesday's 5-month high – and extending the longest period of price falls since 2006 on Bloomberg's data. "The [bond] market is on the back foot," reckons head strategist Charles Diebel at Lloyds Banking Group in London. "The catalyst seemed to be the Fed acknowledging the better growth." Analyst forecasts for today's US jobless data pointed to a further drop in the number of people claiming unemployment benefits. US manufacturing and consumer price data – due Thursday and tomorrow respectively – were forecast to show a slight rise. "Overall, the [gold price] looks rather vulnerable with a likelihood of testing lower levels before it resumes it upward run," says refinery and finance group MKS in its latest note. "What seems to be surprising at these levels is lack of firm physical demand." Over in India, however – the world's No.1 gold buying nation – "Demand has improved significantly in the past two days," Reuters quotes a Mumbai dealer. "Prices have fallen and there is also concern about import duty hike in tomorrow's budget." New Delhi doubled gold import duties – and handed India's domestic gold-recycling operators a strong price advantage – in January. Despite yesterday's fresh drop in the gold price, the quantity of physical bullion held to back the SPDR Gold Trust – the world's single largest exchange-traded gold trust (ETF), now capitalized at $68 billion on the New York Stock Exchange – remained unchanged after slipping half-a-tonne Tuesday to 1293.3 tonnes. Gold ETF holdings worldwide were unchanged Wednesday at a record high of 2409.7 tonnes, according to Bloomberg data. Open interest in US gold futures crept 0.6% higher on Wednesday to 445,163 contracts – greater by 1.2% from a week before. "Gold dropped bearishly [on Wednesday] through our Fibo support level," says Russell Browne at bullion bank Scotia Mocatta, pointing to another Fibonacci level – based on a number series used by some technical analysts to spot important prices – for the "the next key support level at 1625. "A definitive close below this support level opens up a full retracement to the December low of 1522." On the currency market Thursday morning, the US Dollar eased back from last night's rise close to a 7-week high against the Euro, which slipped near $1.30. That held the gold price in Euros below €40,600 per kilo (€1263 per ounce). Spain today sold €3 billion in new debt, paying 3.37% annually on 4-year debt – just less than it paid at a sale in January, despite prime minister Mariano Rajoy saying last week that Madrid will breach the newly-agreed budget deficit limit for Eurozone members. Europe's benchmark Brent crude slipped but held near record-highs in Euro and Sterling terms. The Reuters newswire claims that US president Obama and British prime minister Cameron yesterday discussed using emergency oil reserves to bring prices lower. "The window for solving [Iran's nuclear program] diplomatically is shrinking," Obama told a press conference. Adrian Ash Gold price chart, no delay | Buy gold online at live prices Adrian Ash is head of research at BullionVault, the secure, low-cost gold and silver market for private investors online, where you can buy gold today vaulted in Zurich on $3 spreads and 0.8% dealing fees. (c) BullionVault 2012 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividend Ideas: 2 Buys, 3 Sells Posted: 15 Mar 2012 04:25 AM PDT By Osman Gulseven: Due to the expansionary monetary policy in the aftermath of the financial crises, we are very likely to observe a higher-than-expected inflation in the next few years. Some investors prefer precious metals such as gold to protect their savings against inflation. However, I believe dividends provide the best hedge against rising prices. A diversified portfolio of high dividend stocks can support superior returns for the long-term investors. Given the volatility of the markets and paltry bond yields, dividend investing is probably the best method to beat the market with significantly higher alpha. Nevertheless, one needs to be careful when choosing the right dividend stock at the right price. The paltry yields of government bonds and low interest rates have driven many high-dividend stocks above their fair values. To choose the right stock at the right price, I use O-Metrix Scores, and FED+ Valuations to rank dividend scores. Interestingly, both models Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WATCH: When The Dollar Collapses.. Posted: 15 Mar 2012 04:09 AM PDT The Greatest Truth Never Told: Top Five Places Not To Be During A Dollar Collapse ~TVR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Barry Stuppler: Platinum's Golden Future Posted: 15 Mar 2012 04:04 AM PDT

Barry Stuppler, veteran precious metals investor and dealer said back in October that Platinum was a screaming buy. For good reason. Platinum's price had dipped below the gold price for only the fourth time in the post WWII era. Of course the Platinum market is extremely small compared to others, but it is an extremely important industrial metal that also has some investment attributes. Sure enough, Platinum closed out the year at around $1400 and in no time at all has surpassed gold and has been the best performing metal so far this year. There's a number of factors adding to Platinum's rise. Labor unrest in South Africa (the largest producer), increased auto sales, jewelry demand in Japan and the Canadian Mint's reintroduction of Platinum Maple Leafs. If these factors continue in force, we could see record increases in Platinum prices and for that reason Barry believes it has a golden future. Much more @ KerryLutz.com or @ 347.460.LUTZ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Schlichter: The Coming Paper Money Collapse Posted: 15 Mar 2012 04:02 AM PDT In this podcast Detlev Schlichter author of Paper Money Collapse and Alasdair Macleod of the GoldMoney Foundation discuss the flaws inherent to fiat currency, the role of central banks and how gold acts as a means of financial protection. Schlichter points out that one cannot really make a case for paper or fiat money from a fundamental economic standpoint. In contrast to commodity money it can be shown that the elastic money supply in a fiat money world must lead to economic imbalances and instability over time. The inevitable crisis can be postponed by money printing, but this will only result in an even bigger crisis at some point in the future. ~TVR

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ECB: increase of oz3175.68 in gold and gold receivables Posted: 15 Mar 2012 03:52 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Barron’s Gold Mining Index To Double by 2014? Posted: 15 Mar 2012 03:36 AM PDT Based on the fractals on the chart, we could still have more than two years before we could get a top in the BGMI, like we had at the end of 1980. That is more than 14 years after the Dow/Gold ratio top. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bob Chapman - Kerry Lutz on Gold, Greece, and the Military - March 14, 2012 Posted: 15 Mar 2012 03:33 AM PDT Bob Chapman - Kerry Lutz - March 14, 2012 : gold is down because the us... [[ This is a content summary only. Visit my blog http://www.bobchapman.blogspot.com for the full Story ]] This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

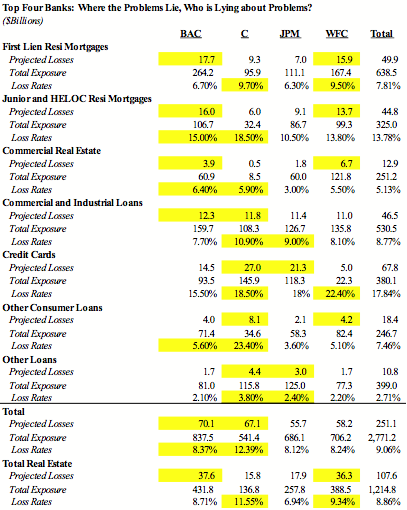

| Daniel Alpert: Deconstructing the Federal Reserve’s 2012 Comprehensive Capital Analysis and Review Posted: 15 Mar 2012 03:10 AM PDT By Daniel Alpert, the founding Managing Partner of Westwood Capital. Cross posted from EconoMonitor What Does the CCAR Really Tell Us About the Big 4 Commercial Banks?It has been just over 36 hours since the release of the 2012 CCAR (the "stress test") of 19 banks. Market response has been decidedly positive with respect to the three of the four top banks that passed, the bloom has somewhat come off the rose with respect to some regional banks, and Citigroup has, well, wilted. But there is much more in the stress test than is found in the headlines and in media reports, so we thought we'd hunker down with the report yesterday and, after some overall review, focus more on the top four bank holding companies, Bank of America, Citigroup, J.P. Morgan Chase and Wells Fargo – to see what further conclusions might be drawn. After all, those four banks comprise 68% of all the activity in the CCAR. First off, let's start with what the stress test is, and what it is not. The CCAR is a test of the banks' ability to see themselves through a 25 month devastating economic and financial crisis without experiencing a fall in Tier 1 Common Capital (and other ratios, but this is the one most people care about) to below 5% of assets. The CCAR is NOT a solvency test of the banks, or bank assets, on a marked-to-market basis. It does not purport to claim that the carrying values of the banks' existing hold-to-maturity (HTM) assets are money good today relative to the market value thereof. Nor does it address what would happen to the operating results of the banks after the aforementioned 25 month period. It explicitly assumes a downturn followed by a period of recovery thereafter – not an unreasonable assumption – but it does not continue to "clock" (or present value) likely losses to assets that would be recognized after the projection period. The foregoing is an important point to understand, so an example is called for. If, as the CCAR hypothesizes, housing was to fall 21% from Q3 2011 levels and stay near or close to those levels (as it has since it fell 33% from 2006 peak levels), the losses after the projection period to banks' portfolios of residential mortgage loans could be far more extensive than those set forth in the CCAR. The CCAR, however, does open a very useful window on the degree of expected performance of the 19 banks' HTM portfolio loans, on a bank-by-bank basis, and permits conclusions to be drawn with regard to the levels appropriateness of current (Q3 2011) carrying values for those assets, net of existing provisions for losses assessed by each institution. This report, accordingly, includes a comparison of the foregoing information with respect to the top four banks (and the others, of course) and the results may surprise some folks who have only looked at the headlines. In fact, the extent of the losses in the HTM portfolio, on a relative basis (bank to bank) is a reasonable test of the adequacy of loss provisions already taken by the banks (thus reducing additional provisions required during the projection period). For example, in real estate-related loans – some 45% of the top four banks' HTM assets – we believe the CCAR demonstrates that one bank that is generally regarded as a "safe" has perhaps been less than forthright about the quality of that category of assets from the standpoint of adequately provisioning for future losses. With that out of the way, let's get to some specifics: ■ Total Losses During Projection Period The CCAR projects a total of $534 billion of losses on some $7.4 trillion (Q3 2011) of risk-weighted assets during the projection period. About 36% of the losses come from trading and securities operations, but the remaining majority – $341 billion (64%) – are losses during the projection period on the so-called portfolio loans held to maturity by banks that are not subject to market valuation. These are the assets that would also likely continue to remain impaired (and experience additional losses) after the projection period. Against these losses, the CCAR assumes that banks will earn, during the projection period, a total of $294 billion in pre-provision net revenue (PPNR) to partially offset the effects of the losses. It is, however, important to note that the PPNR has been reduced by $115 billion of operational risk event losses (lawsuits, systems failures), so that the total "damage" that results from the Fed's disaster scenario of actually $649 billion. Of the PPNR and the projected losses, the following is attributable to the top four banks:

It is pretty clear why Citigroup took it on the chin in this study. But stay tuned, there is more under the hood.

■ "Missed it by That Much" (with apologies to Maxwell Smart) It has been well publicized that the breakpoint for failure of the CCAR is any stressed minimum capital ratio that falls below 5% during the projection period (using the banks' proposed capital plans submitted as part of the study). While four institutions failed that test – including one of the top four, Citi – there are a number of others that exceeded the minimum threshold by only tenths of a point. Those under 5.5%, but above 5.0%, on Tier 1 Common Capital (after their proposed capital plans) include some pretty hefty names: J.P. Morgan Chase Keycorp MetLife (which failed on other counts) Morgan Stanley U.S. Bancorp Of course, one needs to draw the line somewhere, but there is a certain relativity to who has a "fortress balance sheet" and who does not. Which brings us to our final, and most important, point: ■ The Westwood Acid Test Ultimately, the eventual stability and strength of each bank and the banking system is derived from the quality of bank assets (chiefly, the ability to actually collect amounts lent out on the HTM side of things) and the equity capital available to plug any shortfall. A rolling "going concern" analysis, such as the CCAR (which will now be a regular element of bank regulation in the U.S., under Dodd Frank), is very important. But after a period of severe dislocation, such as the credit bubble and its aftermath, it is appropriate to take a closer look at legacy assets (those originated during the credit bubble – as most HTM assets in fact were) on a class-by-class basis. The banks that look healthier on a headline basis often do not look quite as robust relative to the losses they would likely see on individual classes of assets. Furthermore, certain asset classes – such as real estate loans – are liable to collection problems that may remain unresolved because of a more or less permanent (or at least long-term) reset in property values. Fortunately the CCAR does give us some guidance in the foregoing respect. What we have done on the following page is to reflect the winners and losers among the top four banks in the CCAR on an asset class basis with respect to their HTM portfolios. We picked as "losers" two of the four banks that had the most losses in each class during the CCAR projection period by either dollar amount or by percentage of total assets of that class. They are highlighted in yellow. The results, as we noted above – particularly with regard to real estate loans – may come as no surprise to some and a big surprise to many. Especially when considered in light of the future collectability of those assets after the projection period – should even far less adverse circumstances prevail. Please turn the page and draw your own conclusions (and beware the ides of March): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 15 Mar 2012 02:48 AM PDT Andy Hoffman | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| South African Gold Production Dives Again To 90 Year Lows Posted: 15 Mar 2012 02:44 AM PDT gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: Dark Clouds or Sunshine Profits? Posted: 15 Mar 2012 02:00 AM PDT SunshineProfits | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New evidence suggests interest rates could finally be on the verge of a big move higher Posted: 15 Mar 2012 01:31 AM PDT From Dollar Collapse: For years now, U.S. government bonds have looked like terrible investments, what with those trillion-dollar deficits and multiple wars and all. But Treasurys just kept rising, earning their owners nice returns and making their critics seem like financial illiterates who didn't know a AAAA credit when they saw one. Check out the chart for TBT, a 2X negative long-term Treasury ETF (in other words, a fund that bets against Treasury bonds). In case the price numbers are hard to read, this fund peaked at 70 in 2008 and has since fallen steadily if irregularly to less than 20. Far from being the short of the decade, Treasurys, especially if you were using leverage to bet against them, have been a sound-money investor’s nightmare. But two things are true of bubbles always and everywhere: They tend to go on longer than a reasonable analyst believes possible. And they burst when fundamentals finally win out. Treasurys will go the way of all bubbles someday and, just maybe, today is that day... Read full article... You can also see a top trader's take on the move in Treasurys here. More on Treasurys and interest rates: Warning: U.S. Treasurys could be setting up for a BIG move "Dr. Doom" Marc Faber: You must get out of government bonds Yesterday's Fed announcement could be the No. 1 reason to buy gold and silver now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JPMorgan issues a new warning on China: The "hard landing" is here Posted: 15 Mar 2012 01:28 AM PDT From Bloomberg: China's economy is already in a so-called "hard landing," according to Adrian Mowat, JPMorgan Chase & Co.'s chief Asian and emerging-market strategist. "If you look at the Chinese data, you should stop debating about a hard landing," Mowat, who is based in Hong Kong, said at a conference in Singapore yesterday. "China is in a hard landing. Car sales are down, cement production is down, steel production is down, construction stocks are down. It's not a debate anymore, it's a fact." His team was a runner-up for best Asian equity strategists in a 2011 Institutional Investor magazine poll. The Shanghai Composite Index fell 2.6 percent yesterday, the most since Nov. 30, after Premier Wen Jiabao said home prices are still "far from a reasonable level." His comments fueled concern the government will maintain restrictions on the property market for an extended period even as the curbs threaten to slow economic growth. Wen announced at the beginning of a national lawmakers' congress on March 5 an economic growth target of 7.5 percent for this year, down from 8 percent over the past seven years. Data last week showed China's factory output in the first two months of the year rose the least since 2009, while retail sales increased less than economists predicted and inflation eased to the slowest pace in 20 months. A report today showed foreign direct investment in China fell in February. Mowat said in May the risk of a hard landing was building in China as fixed-asset investment in real estate had increased even as property demand remained weak. That meant residential inventories will increase and lead to a contraction in construction activity, he said in a May 17 interview. Excessive Decline "One should be concerned about what's happening in the China property market," Mowat said at yesterday's conference. "People are too complacent that the government can turn what's going on in this market." The slump in Chinese stocks to Wen's speech yesterday was "overdone" as his comments on property were only a reiteration and don't reflect consensus in the government, Jason Todd, global head of equity strategy at Religare Capital Markets Ltd., wrote in a report. The Shanghai Composite (SHCOMP) slid 0.7 percent today for the biggest two-day loss since August. Wen, set to leave office next year after a decade in power, also said yesterday his nation must adopt political change to support an economic transformation that has produced rapid development at the cost of a widening wealth gap. 'Vastly Overblown' Gary Shilling, president of A. Gary Shilling & Co., a Springfield, New Jersey-based consultancy firm, said on Feb. 2 that China's economy is headed for a "hard landing" this year as weaker demand overseas chokes off exports. Shilling, who correctly forecast the U.S. recession that began in December 2007, defines a hard landing as a growth rate below 6 percent. Shilling and Mowat's views are in contrast with Yale University Professor Stephen Roach, a former non-executive chairman for Morgan Stanley in Asia, who said on March 8 that concerns China will enter a hard landing are "vastly overblown." "I don't think the banking system will collapse and the property bubble will burst," Roach said at a conference in Shanghai. "These are all exaggerations." China is easing restrictions on lending capacity at three of the nation's four biggest banks after new loans dropped to a four-year low, officials at the banks with knowledge of the matter said. The government's two-year effort to control the property market helped spur a 25 percent drop in home sales in the first two months of the year after surging 26 percent in January and February of 2011. "What you can look forward to is to see a pickup in property demand that will clear up the inventory; that doesn't appear likely," Mowat said in an interview after the conference yesterday. "I don't see any evidence of a policy move that will cause the economy to reaccelerate." To contact the reporter on this story: Weiyi Lim in Singapore at wlim26@bloomberg.net. To contact the editor responsible for this story: Darren Boey at dboey@bloomberg.net. More on China: New reports suggest the collapse in China has begun These reports could show the real state of China's economy A startling Chinese development we haven't seen in over a decade | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Barron’s Gold Mining Index To Double Over The Next Couple Of Years? Posted: 15 Mar 2012 01:27 AM PDT Barron's Gold Mining Index Forecast The behaviour of gold stocks during this gold bull market is really not that different to the gold bull market of the 70s. It was not until almost the end of the bull market (in 1979) that the gold stocks really started to take-off. Those who think gold stocks will [...] This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 15 Mar 2012 01:25 AM PDT Impala's Hand Forced as Zimbabwe Starts Nationalization.... Impala Platinum Holdings Ltd. (IMP), the world's second-largest producer of the metal, is set to lose control over the unit holding 41 percent of its resources as Zimbabwe starts nationalizing foreign-owned assets. Impala agreed in principle this week, in the face of a government ultimatum, to sell 31 percent of the unit to a state agency and 20 percent to employees and communities. Zimplats Holdings Ltd. (ZIM) holds 134 million ounces of platinum resources, valued at $228 billion at today's prices. "You are effectively losing 20 percent of your total resources," given that Impala will be left with half the deposits owned by Zimplats, said Clinton Duncan, a resources analyst at Avior Research Ltd. "Impala's hand was forced." Zimbabwe, which with South Africa holds more than three- quarters of the world's platinum, gazetted a law two years ago that compels foreign-owned companies to cede or sell 51 percent of their shares to black Zimbabweans or state-approved agencies. Impala owns 87 percent of Zimplats. Impala, which produces about a quarter of global platinum supplies, said this week it will sell 31 percent to the national Indigenization Fund for an "independently determined fair value." That transaction will happen once it's been compensated for releasing land, containing platinum, to the value of $153 million to the government in 2006, Impala said. An employee group and one representing the community will each buy 10 percent, to be paid for with dividends. Cars, Mugabe Zimbabwe is home to the world's second-largest reserves of the metal, increasingly used in devices that cut vehicle emissions as environment rules are tightened in Europe and the U.S. Its economy is recovering from collapse under President Robert Mugabe, who wants to call elections this year. "The Zimplats transaction will set a dangerous precedent and poses a real threat to other investors," Anne Fruhauf, an analyst with Eurasia Group, said in e-mailed comments. "The Zimplats debacle gives the impression that things are going from bad to worse." The government last year doubled platinum royalties to help the economy recover from a decade-long recession that ended in 2009. It may increase mining registration costs to $2.5 million from $300,000, the state-owned Herald newspaper said Jan. 25. State Spending Whether Impala receives appropriate value for the 31 percent stake "remains to be seen due to Zimbabwe's limited cash flow situation," Avior's Duncan said. The government's ability to fund its share of any capital spending to develop projects "is also likely be called into question," Justin Froneman, an analyst at SBG Securities Ltd., said in a note. While Zimplats accounted for 10 percent of Impala's refined platinum production last year, it generated 18 percent of profit. It's the lowest-cost producer of Impala's five operations. "I don't think we've lost control of the crown jewels," David Brown, Impala's chief executive officer, told investors on a call yesterday. "If they don't come up with the cash, then those shares don't get transferred," he said. "The approach is not to stand in the stead of government to actually make available funding for the sale of those particular shares." Impala proposed that the current management team remains in place and reports to a board. The board would reflect the new ownership, Brown said. 'Crown Jewels' Zimbabwe is "very happy that the operations continue as they already are," Brown said. "There's a recognition that they wouldn't necessarily want to change that or become involved in the operational aspect of it." Impala and Zimbabwe will thrash out details of the agreement "over the next weeks and months" Brown said. If there is a satisfactory outcome, Impala may look at building a refinery in the country, also for use by rivals, and it may consider $1 billion of expansion plans. Impala added 1.3 percent to 164.33 rand by 11:49 a.m. in Johannesburg, heading for a fifth day of gains and matching its longest winning streak since November. Zimplats' mention of "appropriate value" is "positive" and clarity on the issue may unlock future value from the company, SBG's Froneman said. Separately from Zimplats, Impala owns the Mimosa mine with Aquarius Platinum Ltd. (AQP) Mimosa was given 30 days starting Feb. 22 to reach an agreement with the government on ownership. It remains to be seen whether the Zimplats agreement sets an ownership precedent for the Mimosa venture in the southern African country, Froneman said. Anglo American Plc (AAL)'s platinum unit started producing platinum in the country at the Unki mine last year. Given its complexity, it can't be expected that there will be "a speedy resolution to the indigenization process" in Zimbabwe, Edward Sterck, an analyst at BMO Capital Markets, said in a note today. To contact the reporter on this story: Carli Cooke in Johannesburg at clourens@bloomberg.net To contact the editor responsible for this story: John Viljoen at jviljoen@bloomberg.net http://www.bloomberg.com/news/2012-0...alization.html | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bullion ‘Looks Vulnerable’ as Treasury Bonds Fall Again Posted: 15 Mar 2012 12:59 AM PDT The gold price crept higher towards $1,650 per ounce early in London on Thursday, adding 0.9% from yesterday's new 8-week low as crude oil and industrial commodities slipped once again. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| South African Gold Output Dives to 90-Year Lows Posted: 15 Mar 2012 12:15 AM PDT Gold recovered some strength on Thursday after a drop in the prior session attracted bargain hunters, however a strong dollar and diminished expectations of more QE in the US made the yellow metal vulnerable to more selling. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 15 Mar 2012 12:12 AM PDT - Communiqué public GEAB N°63 (15 mars 2012) - Dans son numéro de Janvier 2012, LEAP/E2020 a placé l'année en cours sous le signe du basculement géopolitique mondial. Le premier trimestre 2012 a largement commencé à établir qu'une époque était en effet en train de se terminer avec notamment : les décisions de la Russie et de la Chine de bloquer toute tentative occidentale d'ingérence en Syrie (1) ; la volonté affirmée des mêmes, associées à l'Inde (2) en particulier, d'ignorer ou de contourner l'embargo pétrolier décidé par les Etats-Unis et l'UE (3) à l'encontre de l'Iran ; les tensions croissantes dans les relations entre les Etats-Unis et Israël (4) ; l'accélération de la politique de diversification hors du Dollar US conduite par la Chine (5) et les BRICS (mais également le Japon et l'Euroland (6)) ; les prémisses du changement de stratégie politique de l'Euroland à l'occasion de la campagne électorale française (7) ; et l'intensification des actes et discours alimentant la montée en puissance de guerres commerciales trans-blocs (8). En Mars 2012, on est loin de Mars 2011 et du « bousculement » de l'ONU par le trio USA/UK/France pour attaquer la Libye. Mars 2011, c'était encore le monde unipolaire d'après 1989. Mars 2012, c'est déjà le monde multipolaire de l'après crise hésitant entre confrontations et partenariats.  Ainsi, comme anticipé par LEAP/E2020, le traitement de la « crise grecque » (9) a rapidement fait disparaître la soi-disant « crise de l'Euro » des unes des médias et des inquiétudes des opérateurs. L'hystérie collective entretenue à ce sujet au cours du second semestre 2011 par les médias anglo-saxons et les Eurosceptiques aura fait long feu : l'Euroland s'impose de plus en plus comme une structure pérenne (10), l'Euro est à nouveau en vogue sur les marchés et pour les banques centrales des pays émergents (11), le duo Eurogroupe/BCE a fonctionné efficacement et les investisseurs privés auront dû accepter une décote allant jusqu'à 70% de leurs avoirs grecs, confirmant ainsi l'anticipation de LEAP/E2020 de 2010 qui parlait alors d'une décote de 50% quand personne ou presque n'imaginait la chose possible sans une « catastrophe » signifiant la fin de l'Euro (12). In fine, les marchés se plient toujours à la loi du plus fort … et à la peur de perdre plus, quoiqu'en disent les théologiens de l'ultra-libéralisme. C'est une leçon que les dirigeants politiques vont précieusement garder en mémoire car il y a d'autres décotes à venir, aux Etats-Unis, au Japon et en Europe. Nous y revenons dans ce GEAB N°63.  Parallèlement, et cela contribue à expliquer la douce euphorie qui alimente les marchés et nombre d'acteurs économiques et financiers ces derniers mois, pour cause d'année électorale et par nécessité de faire à tout prix bonne figure face à une zone Euro qui ne s'effondre pas (13), les médias financiers américains nous refont le coup des « green shoots » du début 2010 et de la « reprise » (14) du début 2011 afin de peindre une Amérique en « sortie de crise ». Pourtant les Etats-Unis de ce début 2012 ressemblent bien à un décor déprimant peint par Edward Hopper (15) et non pas à un chromo 60s rutilant à la Andy Warhol. Comme en 2010 et 2011, le printemps va d'ailleurs être le moment du retour au monde réel. Dans ce contexte d'autant plus dangereux que tous les acteurs sont bercés d'une dangereuse illusion de « retour à la normale », en particulier du « redémarrage du moteur économique US » (16), LEAP/E2020 estime nécessaire d'alerter ses lecteurs sur le fait que l'été 2012 va voir cette illusion voler en éclat. En effet, nous anticipons que l'été 2012 verra la concrétisation de cinq chocs dévastateurs qui sont au cœur du processus de basculement géopolitique mondial en cours. Les nuages noirs qui s'amoncellent depuis le début de la crise en matière économique et financière sont maintenant rejoints par les sombres nuées des affrontements géopolitiques. Ce sont donc, selon LEAP/E2020, cinq orages dévastateurs qui vont marquer l'été 2012 et accélérer ainsi le processus de basculement géopolitique mondial : . rechute des USA dans la récession sur fond de stagnation européenne et de ralentissement des BRICS . impasse pour les banques centrales et remontée des taux . tempête sur les marchés des devises et des dettes publiques occidentales . Iran, la guerre « de trop » . nouveau krach des marchés et des institutions financières. Dans ce GEAB N°63, notre équipe analyse donc en détail ces cinq chocs de l'été 2012. Parallèlement, en partenariat avec les Editions Anticipolis, nous publions un nouvel extrait du livre de Sylvain Périfel et Philippe Schneider, « 2015 – La grande chute de l'immobilier occidental », à l'occasion de la mise en vente de sa version française. Il traite des perspectives du marché immobilier résidentiel américain. Enfin, nous présentons nos recommandations mensuelles ciblées dans ce numéro sur l'or, les devises, les banques et la fiscalité des actifs financiers. --------- Notes: (1) Un article de CameroonVoice, publié le 06/03/2012, offre un tour d'horizon intéressant de cette situation de blocage qu'il nous paraît utile d'analyser sous l'angle géopolitique autant que sans l'angle humanitaire qui a tendance à camoufler nombre de paramètres derrière les « évidences de la cause juste ». Souvenons-nous de l'attaque sur la Libye et des conséquences désastreuses qu'elle entraîne aujourd'hui pour de nombreux Libyens et pour toute la région ; dernière en date : la déstabilisation de toute une partie de l'Afrique sub-saharienne, comme le Mali par exemple. A ce sujet, on peut lire la très intéressante analyse de Bernard Lugan dans Le Monde du 12/03/2012. (2) Et au Japon qui fait profil bas mais n'a pas l'intention d'arrêter de s'approvisionner en pétrole iranien. La Chine et l'Inde de leurs côtés accroissent leurs livraisons de pétrole iranien et s'engouffrent dans le vide laissé par les Occidentaux. Les Indiens utilisent même désormais l'Iran comme une porte vers le pétrole d'Asie centrale. Sources : Asahi Shimbun, 29/02/2012 ; Times of India, 13/03/2012 ; IndianPunchline, 18/02/2012 (3) Attendons de voir ce que sera la volonté de l'UE en la matière dans la seconde moitié de 2012. Avec la fin de la tutelle US sur la politique étrangère française suite au changement de président français, de nombreux aspects de la politique internationale de l'Europe vont changer. (4) Nombreux sont les responsables israéliens et américains qui se demandent dans quel état vont être les relations entre les deux pays à l'issue de cette quasi-confrontation sans précédent sur la question d'une éventuelle attaque de l'Iran. Pour certains, on s'approche du moment de « ras-le-bol » d'Israël de la part des Etats-Unis, comme l'analyse l'article de Gideon Levy dans Haaretz du 04/03/2012. (5) Derniers exemples en date : l'accord des BRICS pour organiser entre eux des échanges en devises nationales, et particulièrement en Yuan du fait de la volonté de Pékin d'internationaliser sa devise ; et la décision du Japon d'acheter des bons du Trésor chinois en accord avec Pékin. Pékin agit ainsi à l'opposé du Japon « dominant » des années 1980 qui n'avait jamais osé pousser à l'internationalisation du Yen. Cet aspect suffit à réduire à néant toutes les comparaisons entre l'ascension avortée du Japon et la situation de la Chine aujourd'hui. Tokyo était sous contrôle de Washington ; Pékin ne l'est pas. Sources : FT, 07/03/2012 ; JapanToday, 13/03/2012 (6) Les banques de l'Euroland se dégagent de leurs activités de prêts en USD. Source : JournalduNet, 23/02/2012 (7) A savoir la fin du social-libéralisme qui avait pris la place de la social-démocratie européenne au cours de ces deux dernières décennies ; et le retour de l' « économie sociale de marché » au cœur du modèle rhénan, modèle historique européen continental. De la Slovaquie du nouveau premier ministre Fico à la France du futur président Hollande (ceci n'est pas un choix politique mais le résultat de nos anticipations publiées dès Novembre 2010 dans le GEAB N°49) en passant par l'Italie de Mario Monti et une Allemagne où conservateurs et sociaux-démocrates doivent désormais faire le chemin européen ensemble puisqu'il le faut pour obtenir la majorité nécessaire à la ratification des nouveaux traités européens, on voit se dessiner les contours de la future stratégie économique et sociale de l'Euroland : fiscalité progressive renforcée, solidarité sociale, efficacité économique, mise sous contrôle du secteur financier, vigilance douanière, … en résumé : éloignement à grande vitesse du modèle anglo-saxon à la mode depuis 20 ans parmi les élites du continent européen. (8) Derniers épisodes en date : l'attaque devant l'OMC de la politique commerciale chinoise concernant les « terres rares » par les Etats-Unis, appuyés par l'UE et le Japon ; les nouveaux rebondissements des accusations réciproques USA/UE toujours devant l'OMC concernant les subventions à Boeing et Airbus ; la « guerre monétaire » déclenchée par le Brésil contre les Etats-Unis et l'Europe. Sources : CNNMoney, 12/03/2012 ; Bloomberg, 13/03/2012 ; Mish's GETA, 03/03/2012 (9) D'ailleurs, impensable pour beaucoup il y a seulement trois mois, l'agence de notation vient de remonter la note de la Grèce. Source : Le Monde, 13/03/2012 (10) Les questions de démocratisation de ces structures se posent comme nous l'avons souligné. Mais ces structures (MES, BCE, …) sont désormais établies. Aux acteurs et forces politiques des deux prochaines années d'entamer leur mise sous contrôle par les citoyens plutôt que de passer leur temps à regretter un temps merveilleux … où les citoyens n'avaient même pas la moindre idée de comment leur pays gérait sa dette. Et ce n'est pas en attaquant les technocrates qui ont fait le « sale boulot » au milieu de la tempête que les politiques trouveront le chemin de la légitimation démocratique des institutions de l'Euroland, mais en proposant de nouveaux mécanismes et des processus d'implication des peuples dans les décisions. A ce propos, il est utile de savoir qu'au Parlement européen, le groupe PPE (où siègent notamment les partis de Nicolas Sarkozy et Angela Merkel) tente de tuer dans l'œuf une proposition trans-partisane de création de 25 sièges du Parlement européen qui seraient élus sur des listes transnationales avec l'UE comme circonscription unique. Selon LEAP/E2020, cette proposition est un petit pas sur le seul chemin qui peut conduire à un contrôle citoyen des décisions européennes. Il est regrettable que des chantres de la nécessité de rapprocher l'Europe des peuples soient en fait complices du blocage d'une première tentative sérieuse dans cette direction. Source : European Voice, 11/03/2012 (11) Même le Financial Times, pourtant l'un des acteurs-clés de l'hystérie anti-Euro, doit désormais reconnaître que les marchés émergents (acteurs publics et privés) ont retrouvé leur appétit pour la devise européenne. Source : Financial Times, 26/02/2012 (12) Nous insistons sur ces points car il ne faut pas oublier trop vite les discours dominants de 2010 et 2011 qui ont incité les investisseurs à acheter de la dette grecque car c'était une « affaire en or » ! Souvent les mêmes « experts » ont aussi pronostiqué une parité €/$ entraînant nombre d'opérateurs à vendre leurs Euros pour acheter du Dollar dans cette même logique. Résultat : ces « experts », qui peuplent les unes des médias et les émissions financières, ont fait perdre beaucoup d'argent aux uns et aux autres. Pour savoir anticiper l'avenir, il faut aussi entretenir sa mémoire ! (13) N'oublions pas que sans l'hystérie collective entretenue autour de la « crise de l'Euro », dès la fin 2011, les Etats-Unis auraient été incapables de financer leurs énormes déficits. Wall Street et la City ont dû peindre une Europe au bord du gouffre pour pouvoir maintenir le flux d'achats de leurs titres. Maintenant que cette propagande ne fonctionne plus, il est donc vital d'essayer d'embellir la situation US faute de tarir la source extérieure du financement de l'économie américaine. Voir GEAB N°58 à 61. (14) Pour mémoire, mi-2010, le FMI se préoccupait de ne pas « handicaper la reprise ». Et en Janvier 2011, les experts se demandaient comment bénéficier de la « reprise » démontrée par les fameux « indicateurs clés » ! Sources : FMI, 07/07/2010 ; CreditInfocenter, 27/01/2011 (15) Notre équipe tient à préciser que nous apprécions le talent de Hopper et qu'il n'est cité ici que parce qu'il est le peintre par excellence de la classe moyenne de l' « âge d'or » des Etats-Unis, qu'il a pourtant en général montrée dans une atmosphère très dépressive. Nous ne pouvons qu'imaginer ce que serait l'ambiance de ses tableaux aujourd'hui avec une classe moyenne en perdition dans un « âge de fer » pour le pays. (16) Nous rappelons que c'est le crédo fondamental sur lequel repose tout le système économique et financier global. Et en trois ans de crise, pour la première fois depuis 1945, ce moteur ne fonctionne plus. Alors il faut prétendre le plus longtemps possible, en espérant un miracle. A l'été 2012, les orages porteront bien des éclairs mais il n'y aura pas de foudre miraculeuse ; bien au contraire. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Mar 2012 11:28 PM PDT HOUSTON -- Those following Timberline Resources (AMEX:TLR; TSX:TBR.V) will find this short video of their main prospects interesting. Continued... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Friedman – How to Cure Inflation Posted: 14 Mar 2012 11:12 PM PDT Although the U.S. Fed seems to be unable to see inflation we beg to differ. Just yesterday we had to shell out about $38 for two windshield wiper blades. In a recent trip to a large discount retail store we were stunned at the prices of some goods. Inflation as measured by the Fed may be in check, but on the street the symptoms are showing. The one-hour program below is worthwhile and timely, even though it was produced in 1980. The breakdown of the bond market this week quite possibly may be a harbinger of an acceleration of inflation. The introduction for the video reads: "Inflation results when the amount of money printed or coined increases faster than the creation of new goods and services. Money is a "token" of the wealth of a nation. If more tokens are created than new wealth, it takes more tokens to buy the same goods. Friedman explains why politicians like inflation, and why wage and price controls are not solutions to the problem. Friedman visits Japan, U.S. and Britain."

Source: YouTube

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Treasuries sell-off gathering pace Posted: 14 Mar 2012 10:30 PM PDT The gold price got whacked once again yesterday, with traders scrambling to buy equities. "Who needs safe havens?" seems to be the dominant market sentiment at the moment. The yellow metal ... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Matt Stoller: On Foreclosure Fraud, One of the Good Guys Gets a Win for a Change Posted: 14 Mar 2012 10:10 PM PDT This is wonderful news.

Most people don't know Lynn Symoniak, but the banks certainly do. And so should you. If you want to know how the foreclosure fraud scandal was uncovered, she is a key figure. I first encountered her work in 2009, when I was a naive bewildered staffer working on policy issues I didn't quite understand with enthusiasm and adrenaline that could partially make up for the ignorance. In 2009, I was a Congressional staffer focused on the complex awkward mash note to regulators that eventually became known as Dodd-Frank. The financial crisis was in full effect, with hearings that for all intents and purposes were held with caps locks enabled. Every week was a new scandal or systemic risk, from AIG bonuses to multi-trillion dollar Fed balance sheet expansions. I didn't know a lot about how banking regulations interacted with the real economy at the time, but then, it didn't seem like that was the main criteria for working on the Financial Services Committee. The committee was not set up to do good policy, it was designed explicitly as a fundraising mechanism for new members of Congress. The ignorance of those on the committee was remarkable, to which anyone watching hearings at the time could attest. Rep. Brad Miller, who is a real legislator and a geek on mortgage issues, has said that he had to look up the meaning of credit default swap on Wikipedia in 2008. That's the level of information we're talking about. To be fair, the world at large didn't know much about the true nature of the financial system, and frankly, neither did many people inside the big banks. But still, this was a committee in Congress charged with oversight of the capital markets, so it was confusing that there seemed to be a lack of basic knowledge of how the system worked. Actually, that's not quite right – many staffers and members on the committee had a wide and deep well of financial expertise, but it was built on faulty assumptions about credit. The cocoon of lobbyists had created an environment inevitably built on groupthink, on the idea that the big banks were somehow good for society. Staffers had to increasingly ignore the suffering of homeowners and mounds of data on income inequality in order to believe this. This is not so hard to do in DC, there is a lot of money and infrastructure invested in ignorance. Applied ignorance, however, has a psychological side affect. In order to believe that your bad harmful decisions do not invalidate you as a human being, a wonderful sense of aggressive ignorance had to be paired with an almost artistic level of privileged self-pity. One story should suffice to describe this attitude. A staffer once turned to me after a hearing that ran late and actually said, in typical Capitol Hill asshole fashion, "our job is so hard". I looked at his plushy chair and the enormously fun and interesting subject matter before us, and momentarily enjoyed the hatred I felt for him. That was the attitude. Self-pity mixed with ignorance and privilege. My guess is that he's now working for some trade association for predatory lenders talking about the need for creative credit products to serve under-banked communities, and making an enormous amount in the process. Now, this does not apply to everyone – there are spectacularly brilliant morally upstanding people there, and they are the reason that policy success happens, when it does. But that was/is the general vibe. This is the environment of policy-making that someone like Lynn had to penetrate. I would naturally have wanted to work with her, and eventually did – but I was at the time looking at her from the other side of the funhouse mirror. In the spring, I got a weird email from a Puerto Rican realtor in Orlando. It was the kind of message you'd get from a Nigerian spammer, with an attached that purported to show "MILLIONS OF FORGERIES ALL OVER THE COURTS". It was a time of intense claims, a kind of cultural transition where a billion dollars began to seem like chump change, and a trillion dollars was worth paying attention to. I spent some time looking into this email, probably violating house policy on opening attachments from people I didn't know (the Chinese attempt thousands of hacking attempts on the Capitol every day, apparently, which means they have access to a supremely boring picture of the increasingly irrelevant legislative process). Attached was a document that was quietly going around foreclosure-related circles, showing obvious forgeries on documents put together by banks, documents necessary to foreclose on the millions of Americans lucky enough to participate in the great housing bubble party of 2002-2008. Of course, like a good Capitol Hill staffer receiving an incredibly important piece of evidence on a multi-trillion dollar scandal, I was like "this guy is crazy" and quickly got back to working on regulatory reform and surfing the internet. (Unofficial motto of Dodd-Frank: Hey, um, regulators, why don't you make all the rules and we'll check out Twitter? Mkay. Also your budget is cut!) I returned to the topic a year later, tricked by the funhouse mirror into believing that the foreclosure fraud scandal wasn't, couldn't possibly be the real thread tugging at our economic foundations. While Dodd-Frank passed in 2010, most of the action in 2009 was on the House side. Then in 2010, the Senate took it up, and we could move on to other issues. Near the middle of 2010, I encountered that strange document again. Over the course of that year, I had developed a set of contacts with bloggers and ex-regulators who had helped on various pieces of Dodd-Frank, and they started letting me know of forgeries and fraud in the foreclosure process. The real problem I had was connecting that directly to the capital markets. A few reports starting coming out about foreclosure fraud, with the real kickoff a Gretchen Morgenson column in the summer. Yves Smith of Naked Capitalism began describing strange legal theories around securitization and foreclosures. One day, it clicked. Holy shit foreclosures are where the financial system meets the real economy, and the bank servicers are chewing through our entire housing stock. Meanwhile, that strange set of documents kept resurfacing. And those documents, which showed obvious forgeries side by side with easy to comprehend descriptions, turned out to be pivotal evidence. Rep. Grayson used them in a speech on MERS in Sept, 2010. Lynn Symoniak was the person who put them together. She had been waging a frustrating, agonizing, multi-year fight against banks who had been lying and deceiving millions of people around the housing market. Some of the staffers who had been working on banking began to work internally on generating hearings to pressure regulators, and there were a slew of hearings in late 2010. Wells Fargo executives came in for a briefing at that time, and told staffers that they were the good bank, the Warren Buffett owned bank. They didn't dare robosign. Of course I had seven robosigned affidavits in my inbox by Wells, courtesy of among others Lynn. I ended up yelling at those executives and calling them out as liars, though it didn't matter because the writing was on the wall for the 2010 elections. Man that was a lonely briefing, as everyone else seemed to be looking to get a job with Wells (the banking staffer of the Congressman who fought against the Fed audit is now the head lobbyist for Wells, incidentally). That loneliness, that social isolation, really gets to you. I know at times, it's gotten to every single person fighting the banks. And they know it, and use it. But the fight went on, despite the onrushing bloodbath of an election. We used Lynn's documents to prepare for aggressive hearings under housing subcommittee chair Rep. Maxine Waters, and the expertise generated by the lawyers in the fight and people like Lynn to drive this issue to the regulators. Lynn continued to fight as aggressively as anyone I've seen, using media platforms like 60 Minutes and every political and policy connection should could make to drive this massive fraud into the public arena so it could be addressed. I'm guessing that untold numbers of lawyers, law enforcement officials, homeowners, policymakers, regulators, bankers, and homeowners have made use of her work, for better or worse. And she has paid the price for it. Going up against the banks is not easy. What these banks do to ensure that their opponents (their real opponents, not the pliant risk-averse operations like the Center for Responsible Lending) are weak is starve them of funds, over-lawyer them, smear them with PR, and basically do anything they can to ensure that it is painful, lonely, agonizing, and horrible to stand up for your rights and the rights of others. Another one of these heroic figures, Lisa Epstein, was smeared in a juvenile report put out by the Florida Inspector General back in January. Florida attorneys June Clarkson and Theresa Edwards were fired by Attorney General Pam Bondi, and their reputations savaged. There's a lot more to the story, of course. It's just a very narrow slice of what I saw. I don't particularly like the settlement. First of all it's complex, thus it presents a natural territorial advantage for those with many lawyers. Second of all, it doesn't address one of the root problems, which is that bank servicers cannot actually do their jobs properly because they haven't invested in either the people or the personnel to do it. And there are many more problems, of course. That said, a small group of people really can change the world. Lynn did so. I was privileged enough to witness her integrity and competence. That she will no longer be financially persecuted, that she will have succeeded in doing well by doing good, means something. It's not help for homeowners, it's not jail for those who ordered fraud and forgery, it's not the pink slip that oh so many regulators should get. But it's meaningful. There's a reason the side that commits fraud overfunds its people, provides support for them, and makes sure they are given prestigious positions and plum jobs. It works, it means they win. But for once, one of ours won the ability to go about her life, free from the constraints of having big enemies and no money. This isn't the biggest deal in the world. But tt means that those who fought the good fight, can keep fighting. That's not nothing. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment