Gold World News Flash |

- Hidden Strength Showing in Small Mining Shares, Part 2

- Gold Price Heads for Second Monthly Drop

- Gold Resistance at 1670

- Household Net Worth: The "Real" Story

- Scotia Transfers 600k Ounces of Silver into JP Morgan Vaults Wednesday

- MF Global Customer & Fund Manager on JP Morgan and the Goldman Connection

- Gold Seeker Closing Report: Gold and Silver End Near Unchanged

- A Cashless Society May Be Closer Than Most People Would Dare To Imagine

- Silver Update 3/29/12 Republican Jokers

- A View on Inflation & Keynesian Talking Points

- Death of the Dollar by End of 2012 as Lindsey Williams Predicted? BRICS Banks May Ditch the Dollar

- What Steve Jobs Should Have Said, When He Had the Chance.

- Ben Bernanke Considers Your Happiness and Security Expendable

- Edgewater's (EDW) Corcoesto Project In Spain Continues To Return Exciting Infill Drilling Results

- In The News Today

- Goldrunner fractal analysis: 2012 silver to $70++

- Canada will scrap the penny this year; nickel next?

- On Liquidity And The False Recovery

- Interpreting The Head Scratching Unemployment Claims Data

- Fatal Flaws and Opportunities in Gold Investing: Brent Cook

- Gold Price and Silver Price Had a Split Close Today With Gold Down and Silver Up

- Bashing Buffett…Once Again With Feeling

- Gold has bottomed at $1,650, silver at $32, Turk tells King World News

- The next leg of gold’s bull run

- Mike Krieger On When Central Banking Dies: China and Oil

- The Flaw In Europe's Austerity Plan: Elections

- James Turk - Quiet Gold Market Masks Important Development

- Martin Armstrong on the Sovereign Debt Crisis

- Gold Daily and Silver Weekly Charts - Silver Refused to be Used

| Hidden Strength Showing in Small Mining Shares, Part 2 Posted: 29 Mar 2012 06:23 PM PDT • Taking Advantage of Long-Period Weakness, Not Easy, but Potentially Rewarding HOUSTON (Got Gold Report) -- In Part 1 we looked at the relationship of the CDNX to the HUI and noted that the underperformance of the former seemed to be reversing to over-performance although it may not feel like it. The smaller miners have seen a tremendous amount of liquidity wrung out of them over the past year. (Part 1 should be read prior to this continuation.) Just below is the Market Vectors Junior Gold Miner's Index or GDXJ, showing, in our view, that the popular index of smaller and mid-cap mining shares has been sold back down into a zone of potential support (green on the chart). We recently concluded a marginally profitable trade with GDXJ and are currently eying it for reentry. Judging by our mail, by the wretched action in The Little Guys and by the pathetic volume for most of the 60 or so issues we track on technical charts, sentiment for the smaller miners and explorers can only be described as abysmal at present. It is a Vulture Playground deluxe.

*** Buyer's strikes coincide with periods of negative liquidity, when there is more capital or wealth leaving a market than entering it. Negative liquidity periods are self-curing, however, because they eventually reach a level that encourages bargain hunters and deep value speculators to step in. More about that in a moment, including what we call that condition. SRC Opportunity If one believes in our thesis, that The Little Guys have seen too much of a liquidity exodus since February of 2011 and are thus primed for a significant reversal back to an extended positive liquidity environment (PLE); if one believes that sooner or later better investor sentiment and enthusiasm will return and therefore the market for the smaller junior miners and explorers probably offers more upside potential than the opposite looking ahead, then the current environment has to rank high on the small resource company (SRC) "opportunity scale." It is the height of irony that we are in a fairly rare period where investor sentiment is rotten while the underlying commodities these companies look for and produce are at prices that will reward execution and success. It isn't commodity prices per se affecting the junior miners; they suffer from a sector-wide confidence puncture. If one believes that the "animal spirits" will return to this beaten up sub-sector of resource market, then allow us to make the admittedly biased case, once again, that the time to build new positions or to improve existing positions is when they are obviously and strongly out of favor – when it seems that no one wants anything to do with them. The best time to build a position in an SRC is when they have been trounced, pummeled, marauded, clocked … beaten to a pulp and chunked overboard like so much chum by panicked retail gamers into a buyer's strike.

Below is one case in point, ATAC Resources (TSX:ATC.V). ATAC blasted higher during the 2009-2010 positive liquidity event (PLE) for the small miners thanks to a very good series of discoveries in the then red-hot Yukon area play. High expectations and dramatic investor fury drove ATAC up from pennies in 2009 to as high as $10.34 and a market capitalization of more than $900 million in July of 2011.

Volatility is Our Friend We Vultures try to keep in mind that once a period of negative liquidity, with its attendant low volume and relentless downward drift runs its course it is almost always replaced by the opposite condition. Near low extremes it really doesn't take all that much buying pressure to have high price/percentage impact on our Faves. We've seen it before, over and over again, and we approach The Little Guys differently than we do all the other markets we trade because of it. Indeed, because of the way we trade them, we find ourselves welcoming periods of harsh weakness and shareholder fatigue like an old friend. At Got Gold Report we have been using this anomalous period of severe weakness to build meaningful positions in a number of guru-recommended smaller resource related companies; tracking them on charts, attempting to add to our positions when they are being fearfully sold off to levels we deem as Stupid Cheap or Ridiculous Cheap (SC or RC on our charts). We try as best we can to lay in wait at specific targeted zones where we believe the shares of the companies we call our "Faves" may find what we call "Overwhelming Support" (OS on our charts). Stupid Cheap, for new readers doesn't have anything to do with the mentality of the people doing the selling at that time. SC simply means that we believe that to be a price level we will look back at a year or two hence and say to ourselves, "Man, it was stupid for it to have traded down that low back then." RC, being always lower than SC, simply means that we believe that the price has gotten down to levels that when viewed a year or two from now we will be compelled to say, "That price was ridiculous!" "Overwhelming Support" (OS) is a theoretical (and actual) zone in periods of negative liquidity for specific issues where the price gets so low that insiders, Vulture bargain hunters and deep value specialists all converge on the bid consistently, each acting in their own self-interest. At OS the price seems to have difficulty trading any lower, even during market-moving news. At OS if the issue does trade lower it immediately (within a day or two) snaps back up to above the OS mark. We call what we do Vulture Bargain Hunting and we only employ this technique with junior and micro-cap issues – as we attempt to game their inherent extreme two-way volatility. We track the guru-recommended companies on technical charts and keep a running dialog of what we are up to directly in the oversized charts themselves. Just below is a greatly reduced sample of what one of our "VB" charts looks like. Vultures (Got Gold Report Subscribers) of course have access to the full-sized, crystal clear linked version on the password protected subscriber pages.

With time and a little luck from the Drill Gods or the Market Gods the meaningful positions we are accumulating today at SC or RC prices or at OS – with a small portion of our resource gaming line - could make an important difference in our bank accounts. That is assuming we have the Vulture determination and patience to weather a protracted negative liquidity event like the one that has been in play since February of 2011. Well, actually, if we are right about the signals we have attempted to point out in this special two-part GGR public offering; if we are right about the CDNX outperformance versus the HUI being a "tell" it could be that the 2011 NLE actually peaked (troughed) in October last year. Here's the CDNX chart again for reference.

An important point here: When we speak in terms of patience, we really mean it when talking about the micro-cap issues. Sometimes the negative liquidity periods we are gaming are over quickly, in just a few months, but sometimes they seem to last for a trading eternity. We Vultures have to be mentally and financially prepared to build a position and then stay with that position for a long period of time. Long enough to survive in the trade until a positive liquidity environment returns. Unless the issue we are gaming does something to destroy our confidence in them, we take the position that our timing is, simply, "as long as it takes." We cannot expect our Faves to reach their speculative potential when there is a negative liquidity event underway. Oh, once in a while one of them might get a takeover bid (such as happened last year with Trade Winds Ventures, our Vulture Bargain #9), or perhaps one might make a fantastic discovery that might launch it no matter the environment (think ATAC Resources or Kaminak Resources), but for the most part we are all positioning now for when the negative liquidity tide turns strongly positive again ... and it will.

Just about the time we get used to being able to wait for a Ridiculous Cheap price to buy in, the market will undoubtedly quit providing them again – kind of like that PLE in the CDNX chart above.

If it does then we will have another sign to point to. If it doesn't (this time), then we can use the negative liquidity and downside volatility to improve our positioning even more for when it does. That is all, carry on. |

| Gold Price Heads for Second Monthly Drop Posted: 29 Mar 2012 05:42 PM PDT |

| Posted: 29 Mar 2012 04:54 PM PDT courtesy of DailyFX.com March 29, 2012 03:35 PM Weekly Bars Prepared by Jamie Saettele, CMT Bigger picture, the rally and decline from the December low may compose the base that propels gold to all-time highs. When viewed in the proper context, price action since September appears as nothing more than consolidation within a secular bull market. Still, resistance is 1670/85 and a drop below last week’s low should trigger losses towards 1600. Bottom Line (next 5 days) – ?... |

| Household Net Worth: The "Real" Story Posted: 29 Mar 2012 04:38 PM PDT  Note from dshort: With today's release of the Fed Flow of Funds for Q4 2011, I have updated this commentary to reflect the latest data. Note from dshort: With today's release of the Fed Flow of Funds for Q4 2011, I have updated this commentary to reflect the latest data.A quick glance at the complete quarterly data series in linear chart suggests a bubble in net worth that peaked in Q2 2007 with a trough in Q1 2009, the same quarter that the markets bottomed. The latest Fed balance sheet shows a total net worth that is 15.9% above the 2009 trough but still 12.5% below the 2007 peak. The positive news in the Q4 balance sheet is that real total net worth has increased 2.1% from Q3 of 2011, although the year-over-year number is a fractional decline of 0.6%. But there are problems with this analysis. Over the six decades of this data series, total net worth has grown by 5000%. A linear vertical scale on the chart above is misleading in its failure to provide an accurate visual illustration of growth over time. It also gives an exaggerated dimension to the bubble that began in 2002. But there is another problem, one that has to do with the data itself rather than the method of display. Over the same time frame that net worth grew 5000%, the value of the 1951 dollar shrank to about 10.5 cents. The Federal Reserve gives us the nominal value of total net worth, which is significantly skewed by money illusion. Here is my own log scale chart adjusted for inflation using the Consumer Price Index. Read more..... This posting includes an audio/video/photo media file: Download Now |

| Scotia Transfers 600k Ounces of Silver into JP Morgan Vaults Wednesday Posted: 29 Mar 2012 04:22 PM PDT [Ed. Note: If JP Morgan hates silver so much, why are they acquiring it in physical form hand over fist?] from Silver Doctors: It appears that Scotia Mocatta's silver vaults are currently the emergency silver reserves for our friends at alleged silver manipulators HSBC and JPMorgan. Tuesday we reported that 600k ounces of silver had left Scotia's vaults only to appear in HSBC's. Well, the 3-card monte continued in COMEX silver warehouses Wednesday, as Scotia Mocatta reported a withdrawal of 605,601.130 ounces out of registered vaults, and JP Morgan listed receipt of an identical 605,601.130 ounces into eligible vaults! Apparently Blythe had a fire or 2 to put out at the end of the March delivery month for silver. |

| MF Global Customer & Fund Manager on JP Morgan and the Goldman Connection Posted: 29 Mar 2012 04:16 PM PDT from CapitalAccount:

Yesterday, the MF Global collapse took center stage on Capitol Hill. The threat of crony capitalism and the sanctity of customer money in US markets hangs in the balance. The unprecedented disappearance, loss, and theft of customer money (1.6 billion dollars worth of customer money to be exact) kept in segregated accounts remains unexplained. And as MF Global executives yesterday — legal counsel, CFO, and assistant treasurer — came to answer questions, what did their answers reveal? Not much unfortunately. General Counsel of MF Global Laurie Ferber, Chief Financial Officer Henri Steenkamp, and Christine Serwinski, former chief financial officer of the company's brokerage unit, all seem to know nothing! In fact, listening to the testimony, you would think that this firm ran on autopilot. |

| Gold Seeker Closing Report: Gold and Silver End Near Unchanged Posted: 29 Mar 2012 04:00 PM PDT Gold saw a slight gain at $1663.86 in Asia before it fell back to as low as $1645.30 in late morning New York trade, but it then rallied back higher in afternoon trade and ended with a loss of just 0.18%. Silver slipped to as low as $31.634 before it also rallied back higher in afternoon trade and ended with a gain of 0.59%. |

| A Cashless Society May Be Closer Than Most People Would Dare To Imagine Posted: 29 Mar 2012 03:48 PM PDT [Ed. Note: There seems to be a theme developing here tonight. This cashless society thing is catching on.] from The Economic Collapse Blog:

Most people think of a cashless society as something that is way off in the distant future. Unfortunately, that is simply not the case. The truth is that a cashless society is much closer than most people would ever dare to imagine. To a large degree, the transition to a cashless society is being done voluntarily. Today, only 7 percent of all transactions in the United States are done with cash, and most of those transactions involve very small amounts of money. Just think about it for a moment. Where do you still use cash these days? If you buy a burger or if you purchase something at a flea market you will still use cash, but for any mid-size or large transaction the vast majority of people out there will use another form of payment. Our financial system is dramatically changing, and cash is rapidly becoming a thing of the past. We live in a digital world, and national governments and big banks are both encouraging the move away from paper currency and coins. But what would a cashless society mean for our future? Are there any dangers to such a system? Those are very important questions, but most of the time both sides of the issue are not presented in a balanced way in the mainstream media. Instead, most mainstream news articles tend to trash cash and talk about how wonderful digital currency is. |

| Silver Update 3/29/12 Republican Jokers Posted: 29 Mar 2012 03:44 PM PDT |

| A View on Inflation & Keynesian Talking Points Posted: 29 Mar 2012 03:38 PM PDT

Volumes can and have been written on these two schools of economic thought - what I'd like to focus on is inflation. Austrians are always sounding the alarm on inflation, and the Keynesians always laugh and point to the monthly CPI figures the BLS publishes. They say that it's in the 2%-3% range, everything is fine. And besides, the velocity of money is down significantly, so the Austrians need to be quiet and take their "crazy" somewhere else. That's one way to look at it. I would argue that inflation is all around us, we just choose not to look. Some context: Say you were buying apples at your local store. What if you thought that there were only a dozen apples in the store you were in, with no chance of more apples being delivered. You'd place a higher value on each apple right? Now what if you knew there was a truck load of apples being delivered shortly - you'd place a little less value on each apple, knowing that the supply of apples will be increasing shortly. This is the same way Austrians view the value of money. They believe that individuals value money based on both quantity, and QUALITY. If the Federal Reserve can just print money and increase the money supply, creating more dollars to chase a similar amount of goods, why would you value each dollar the same as you would before the money supply was increased? And in regards to velocity of money, the velocity of money does not create inflation, it is a symptom of inflation. Think about it, if you knew there were more and more dollars chasing the same amount of goods around, you'd begin to draw on your account & borrow to purchase goods now instead of in the future, thus increasing the velocity of money. But the inflation was already there when the money supply increased arbitrarily. Inflation is all around us. I don't need to get into things like WTI or Brent, you feel the effects of those each time you get gas. What I'd like to point out are things like healthcare, energy as a whole, housing prices, and student loans. Do you not see the inflation in those areas? -- As an aside, I recommend reading this piece ZH published on student loans. Here's the case I lay out for those reading to make up their own minds. The Federal Reserve prints money, "buying" treasuries & increasing the money supply, thus devaluing the dollar. The Government then subsidizes all of the aforementioned areas, which means more dollars are available to purchase those goods & services. And this is how the game is played (also, banks net income swells as a result). A. M2 (Money Supply) skyrockets (Fed printing)

B. An Example of Government Subsidies in Student Loans

C. Here's Your Inflation (that nobody can seem to find)

D. All with a declining velocity of money

E. The USD is losing value at a rapid pace (but who wants the paper tied to something of value, that's crazy) -- Also, you can look at DXY, but you'd only be looking at how the U.S. is doing devaluing their currency vs. the rest of the currencies in the race to the bottom.

And may I present to you the only reason money is printed - so everyone can consume all those iPads and sweet big screen tv's:

Eventually the game will be up folks, and I strongly recommend you learn to live below your means before you're forced to. The ponzi will fail, and the economy will reset - the only question is when. In the spirit of the Zero Hedge Mob

|

| Death of the Dollar by End of 2012 as Lindsey Williams Predicted? BRICS Banks May Ditch the Dollar Posted: 29 Mar 2012 03:03 PM PDT from Russia Today:

The BRICS summit has wrapped up in India. Creating an alternative global lender and stepping away from the dollar as a reserve currency were among their main objectives. RT's Priya Sridhar is in New Delhi. Earlier RT spoke to Dr Sreeram Chaulia, who is a Vice Dean at the Jindal School of International Affairs. He believes institutions like the IMF and the World Bank have outlived their uselfulness. |

| What Steve Jobs Should Have Said, When He Had the Chance. Posted: 29 Mar 2012 02:24 PM PDT By SGT

It was 2001 when I told my work mates "There is no other company delivering on the promise of Star Trek and the Jetsons like Apple." From the day I learned to edit with Apple's Final Cut Pro more than ten years ago, I knew the company was special. Then, the stock was trading at $12 a share with a total market capitalization of around $6 Billion. I told my friends, "There is no technology company in the world as undervalued as Apple." I was laughed at. Sure, we used their machines throughout our offices, particular in the graphics department. In fact I'm sure there isn't an After-Effects, Photoshop or Illustrator expert on the planet that would choose a Dell over a Mac. "But the niche is small" the naysayers told me, "The real market, the worldwide market is and will always be PC." Probably as a result of my Apple shareholder experience being short lived (I got out early – everyone's a genius when they double their money) and partly because I was displeased that Apple off-shored the majority of its manufacturing, I resisted buying an iPhone for several years. I clung with pride to my "dumb" phone for as long as I could. But it got to the point that I couldn't do my job properly when I traveled with my old-school phone. So finally, I caved and bought an i-Phone a year ago. In fact, as I write this now I'm using an iMac. Today, with more than $100 billion in the bank, Apple is the shining jewel of the Nasdaq, accounting for over 17% in the weighting of the Nasdaq 100. And that my friends is the point. We are all complicit in the crimes that made Apple a success - the very crimes we all decry every day at SGTreport. And we are therefore complicit in the crimes against humanity being committed by Corporations all over the planet.

What? Don't like it? Then quit! There are tens of thousands of other hungry Chinese peasants literally standing in line waiting for the opportunity to become a slave for Apple. And if you really don't like it? Kill yourself. At Foxconn, the largest Apple plant in China, its distraught, enslaved workers, out of exhaustion and sheer desperation, were literally jumping off the buildings in droves.

Meanwhile, as Apple morphed from a $6 Billion company into a $600 Billion company, Steve Jobs – the apple of Wall Street and the mainstream financial media's eye – did nothing. Steve Jobs had more power than any single person on the face of the planet to say "No more." Steve Jobs alone had the adoring support of millions of Apple-addicts and shareholders alike. He was essentially the fifth Beatle in the world of business and technology. In just one dramatic shareholder meeting before his untimely death Steve Jobs could have said: "We owe our success to the freedom this great country provides, and from this moment on, we are going to make every single Apple product in the continental United States." But he didn't. Or he could have used his incredible power and influence to make this candid, heartfelt admission: "For years Apple has made a lot of money by paying the least amount possible for human labor. And for that we are ashamed. We make products we are very proud of. But those products are useless without human beings around to use them. It is for the enhancement of the lives of human beings that we make iMacs and iPhones and iPads at all. Human beings are to be valued and appreciated. Human beings are not expendable resources. And it is human beings that are incredibly special. Our products are merely innovative gadgets. It's human beings that give Apple products their remarkable power. A iPhone in a locked closet is no more useful than a brick or a stone. It is for this reason that we are announcing today that we are going to enforce a living pay wage for every single worker, in every one our factories, on our assembly lines both here and abroad. I have been part of a company that I am immensely proud of. Apple is a huge part of who I am, but Apple – the product – does not define me. It is my hope that through the lens of history I will be viewed as a passionate human being who truly cared about his fellow human beings. Which I do. And this is just one small step for Apple which I hope will reflect that. Thank you." But he didn't. And now he's gone. Of course there's news this week that Apple's Foxconn factory is responding to the worldwide criticism of its practices by giving workers "up to 25% pay raises". Great. What a message to the world! Let's see… 25% of $2.00 is 50 cents. So now the average Foxconn worker may possibly receive $2.50 per hour for their slave labor. Oh, and their work weeks may be cut down to 49 hours (though you can bet the $2.50 pay will stop at 49 hours as well). So really nothing changes. Globalist slave wages for those who are literally pushed to the edge so that you and I can walk around with an iPhone. The truth is, the $600 stock which is well on its way to becoming the world's first Trillion dollar company, did it the old fashioned way. With incredible innovation – and slaves. And you and me and Wall Street and every single Apple shareholder and Steve Jobs allowed it. For that, we should all be ashamed. |

| Ben Bernanke Considers Your Happiness and Security Expendable Posted: 29 Mar 2012 02:24 PM PDT “Ben Bernanke the money bomber has resorted to delivering his anti-gold, pro-fiat sermons to captive audiences on US college campuses,” writes Dan Denning of The Daily Reckoning Australia. That’s right. Bernanke is taking his easy money message to the streets. [INDENT]According to Bloomberg: “Now that the weather is nice, I’m half-expecting Ben Bernanke to set up a lectern outside Federal Reserve headquarters on Constitution Avenue so he can enlighten passersby about the need for easy money. He’s been delivering the message lately to anyone who will listen–including a couple dozen lucky students at the nearby George Washington University School of Business. The Fed chairman is worried that the economic recovery could stall out if the Fed yanks monetary stimulus too soon.” Source [/INDENT]Dan Denning continues: [INDENT]“He is returning to his roots as a professor. But professors must profess. So what is Dr Bernanke? Obviously ... |

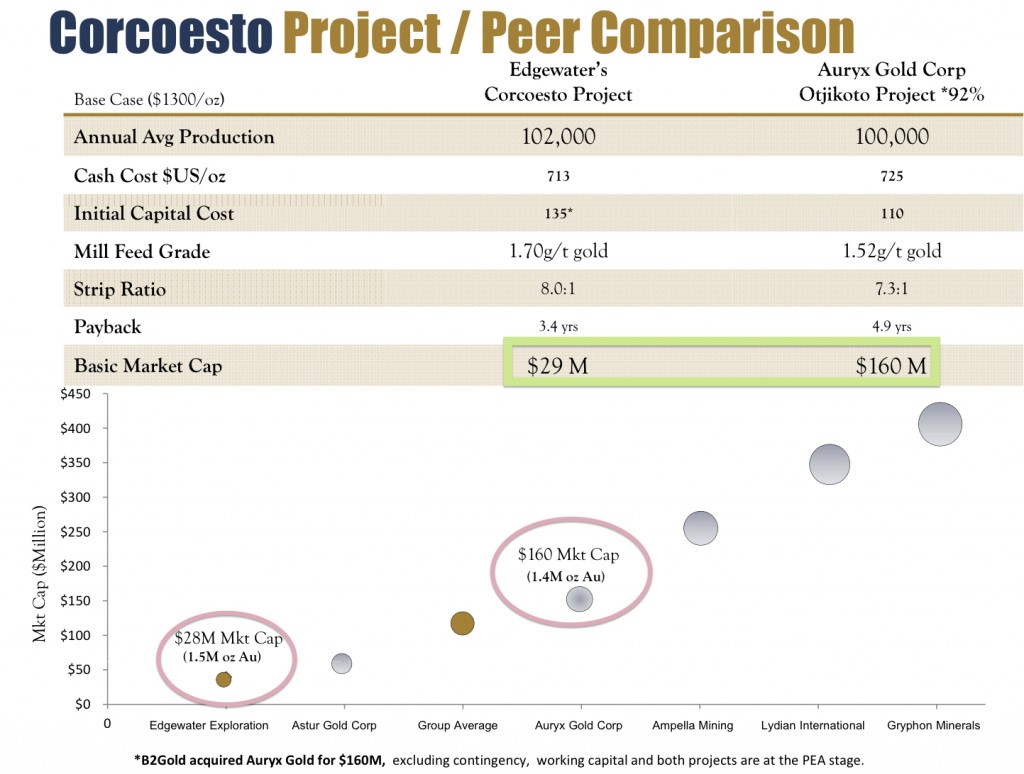

| Edgewater's (EDW) Corcoesto Project In Spain Continues To Return Exciting Infill Drilling Results Posted: 29 Mar 2012 01:49 PM PDT A cheap Euro means better margins for miners. It accrues to the advantage of nascent companies such as Edgewater Exploration (EDW.V or EDWZF) who is developing their Corcoesto Gold Project in Galicia, Spain. They recently announced the addition of an experienced mining engineer and finance advisor as they rapidly advance this project into a bankable feasibility study. The company is significantly undervalued for the asset base they have with their advanced Corcoesto Project in Spain which is currently progressing a bankable feasibility. The major miners are looking for economically viable mines capable of profitable development that are moving into the developmental stage. The big companies are flush with cash and are eager to buy projects at wholesale prices. The Spanish Government is eager to entertain such deals as it will provide employment for hundreds of workers who are currently unemployed. Spain has one of the highest unemployment rates on the continent and these kind of liaisons could provide jobs and growth to a nation that urgently needs both. Corcoesto may soon receive strategic status by the Spanish Government which could significantly accelerate permitting in order to provide jobs to a country which has high unemployment. Today, Edgewater Exploration (EDW.V or EDWZF) reported additional drill results from their on-going in-fill diamond drilling program on the Company's 100% owned Corcoesto Gold Project, Galicia, Northwest Spain. George Salamis, President and CEO of Edgewater stated: "The infill drilling program at Corcoesto continues to confirm good continuity and excellent widths in some cases surpassing expectations in grades and widths encountered. The current phase of drilling will culminate in the tabling of an updated resource estimate during Q3/12 which will form an integral part of the ongoing definitive feasibility study being completed by Tetra Tech. In conjunction with our project finance advisor, we are finalizing discussions with several financial institutions for the initial project development capital. The capital requirement will be based on the completion of the feasibility study later this year." Read the full press release by clicking here… Listen to my recent interview with George Salamis, CEO of Edgewater, where we discuss the recent appointments of an experience mine engineer and project finance advisor who will help advance this project into production. Disclosure: Long Edgewater and Edgewater is a GST featured company. Please do your own due diligence before investing in any stock. |

| Posted: 29 Mar 2012 12:58 PM PDT My Dear Friends, The future is US dollar Bloc down, Euro Bloc sideways, Bric Bloc up. This means the absolute end of dollar dominance. Utilizing the SWIFT system as a weapon caused it. It began today. Jim

Jim Sinclair's Commentary It depends on who collects the information. Technology Comforting or Creepy? Google Continue reading In The News Today |

| Goldrunner fractal analysis: 2012 silver to $70++ Posted: 29 Mar 2012 12:42 PM PDT [/CENTER] So says Goldrunner (www.GoldrunnerFractalAnalysis.com)*in excerpts from an article*edited by*Lorimer Wilson, editor of www.munKNEE.com. This paragraph must be included in any article re-posting to avoid copyright infringement. Goldrunner*goes on to say, in part: Dollar Devaluation Drives The Fractal Relationships The fractal relationships to the late 70's are driven by the aggressive Dollar Devaluation in both periods, with the current period one Elliott Wave Degree higher.* Both periods present as pure 5th wave parabolas in Dollar Devaluation, and thus, in the Gold and Silver Charts.* We are seeing a price expansion in the current Vth wave versus the 5th wave of III in the late 70's for Gold and for Silver. We have noted for years that the Fed "owns" the psychology of the markets.* The Fed is in the process of converting the Deflationary K-Winter into a period of Stagflation.* "Stag" refers to the very sluggish economy, and "flation" refers to rising inflation created b... |

| Canada will scrap the penny this year; nickel next? Posted: 29 Mar 2012 12:05 PM PDT Canada to Scrap the Penny This Year By Steven Chase http://www.theglobeandmail.com/news/politics/ottawa-to-scrap-the-penny-t... Canada is scrapping the penny, ending production of the country's smallest unit of currency this spring. The 2012 federal budget, unveiled Thursday, announced the government will jettison the one-cent coin this year -- a casualty of Ottawa's drive for efficiency and thrift. Finance Minister Jim Flaherty, whose department described the penny as a "nuisance" in budget documents, said the coin is now more trouble than it's worth. ... Dispatch continues below ... ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. "Pennies take up too much space on our dressers at home," Mr. Flaherty said to the Commons. "They take up far too much time for small businesses trying to grow and create jobs." This means Canadians must get used to rounding off cash transactions if they've got no pennies on hand -- an arrangement the federal government says it's leaving to consumers and businesses to work out. "The penny is a currency without currency in Canada," Mr. Flaherty told reporters. The last one-cent coin will be minted this April, ending close to 150 years of the issuance of Canadian pennies. This unit of currency was first produced in 1858 although Canadian-based minting of the coin began only in 1908. The Royal Canadian Mint will stop distributing pennies to financial institutions in the fall of 2012 and the government will work to withdraw one-cent coins from circulation. The Harper government said the production cost of each penny exceeds its face value. "It costs taxpayers a penny and a half every time we make one," Mr. Flaherty told the Commons. "Therefore we will stop making them." Ottawa will save $11 million annually by scrapping the one-cent coin, an amount that reflects the cost of supplying the economy with both new and recirculated pennies. The Royal Canadian Mint produced 660 million pennies in 2011, federal officials said. The Harper government says savings for business and consumers will vastly exceed what Ottawa recoups by killing the penny. A study by one Canadian bank, Desjardins, has estimated the economic costs of the penny for the private sector total $150 million annually. This includes counting, storing, and transporting the coins. The penny will continue to be Canada's smallest unit of currency for pricing goods and services. Canadians who use credit or debit cards to make purchases won't have to worry about rounding-off transactions. The Canadian government is hardly alone in scrapping the penny. Federal officials noted that 17 other countries have ceased production of low-denomination coins over the past four decades. The Finance Department recommends businesses cope with the demise of the penny by rounding off the value of cash transactions to the nearest five-cent increment. This would take place after tax has been added to the price. Ottawa says it won't be policing consumer-business transactions, but added that "businesses are expected to round prices in a fair, consistent, and transparent manner." It couldn't guarantee that consumers would be better off but cited a 2005 Bank of Canada study that concluded the inflationary impact of eliminating the penny would be "small or non-existent." The Canadian government had no estimates Thursday on how many pennies remain in circulation, including those piling up in jars or cans. It noted a Desjardins Group study that estimated Canadians could be hoarding several billion pennies. Federal officials said more than 35 billion pennies have been minted in Canada in the past 104 years. This, they noted Thursday, would weigh 94 million kilograms -- or as much as 1,500 Leopard 2 tanks. The federal government says it will encourage charities to collect pennies from Canadians and redeem them through banks and the Mint as a fundraising venture. Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Golden Phoenix Discusses Royalty Mining Growth Strategy Golden Phoenix Minerals Inc. has discussed its royalty mining growth strategy on the Fox Business Network program "21st Century Business" with host Jackie Bales. Golden Phoenix's director of corporate communications, Robert Ian, told how the company narrows its focus to project generation and future royalty streams. He explained why Golden Phoenix believes it's better to own joint-venture interests in several producing mines instead of full exposure to just one project. "21st Century Business" has been airing for 15 years. Previous hosts have included Gen. Alexander Haig, Gen.l Norman Schwarzkopf, and Secretary of Defense Caspar Weinberger. Golden Phoenix appeared as paid programming on this broadcast. To view the program with Golden Phoenix, please visit Golden Phoenix's Internet site here: http://www.goldenphoenix.us/company-videos.html |

| On Liquidity And The False Recovery Posted: 29 Mar 2012 11:57 AM PDT David McWilliams (of Punk Economics) is back (previous discussions here and here) and this time he takes on the the flood of liquidity and the false recovery that has been created. Starting with a discussion of gas prices and the central banks' recklessness behind it, he swiftly shifts to the 'shambles in Greece' where more debt is supposed to solve the problem of too much debt yet again. From extreme highs in Greek rates to extreme lows in rates among the major developed economies he juggles with the conundrum of injecting liquidity to reflate a bubble in order to avoid the consequences of the bursting of a bubble - brilliant (as those Guinness chaps would say) - as this merely pushes the next crash out a few more years but making it bigger and more devastating. Global Central banks have pumped $8.7tn into the banking system to 'save the world'. Saving the banks has cost more money than it cost to fight WWII, the first Gulf War, put a man on the moon, clean up after last year's Japanese Tsunami, and the entire African aid budget for the last 20 years all put together. Context is key - is it any wonder asset prices have risen since there has been so much cash looking for a new home - why hold something that is printed everyday (cash) when you can hold something that is actually running out like oil or gold. The punchline is what goes in must come out - and that means inflation - as the 'trip' of excess liquidity comes home to roost. Must watch.

|

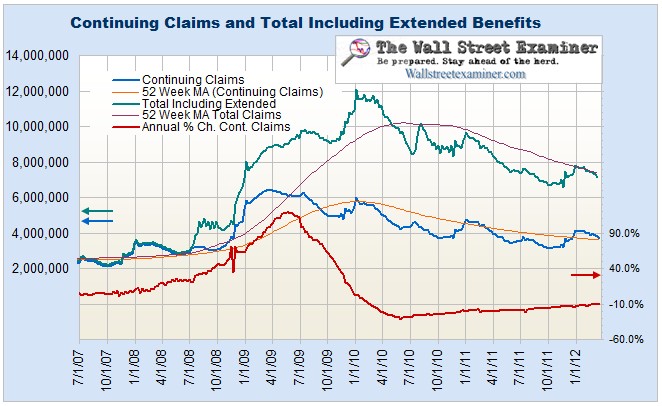

| Interpreting The Head Scratching Unemployment Claims Data Posted: 29 Mar 2012 11:37 AM PDT Interpreting The Head Scratching Unemployment Claims DataCourtesy of Lee Adler of the Wall Street Examiner Actual, not seasonally adjusted, initial unemployment claims totaled 319,349 last week, according to the Department of Labor tabulation of weekly data submitted to it by the 50 state employment departments. This number was virtually unchanged from the prior week total of 319,382. As always, the media reported only the seasonally manipulated numbers showing a decline of 5,000 claims to 359,000. And that left them scratching their heads because of a major revision of 5 years worth of seasonally adjusted crap data. Here's how the DOL put it:

The good news is that the actual data is the actual data. It doesn't change because of some ever changing seasonal hocus pocus factor that results in 5 years worth of data revisions that still do not accurately reflect reality. I analyze only the actual data, which is the data that everyone should be focused on. The government reports it. The mainstream media and the economic punditry ignore it. It's no wonder that their guesstimates have all the accuracy of a coin flip. Because there are seasonal fluctuations that do vary widely based on underlying economic conditions, in order to determine whether this week's number is good, bad or indifferent, we need to compare like to like. That's easy. Just compare this week's number to the same week in prior years, comparing both the total, and the weekly change. Total claims during the week ended March 26, 2011 were up by 3,000 to 357,457. Total initial claims this year in the week ended March 24 were down 10.7% from that level. The flat week to week change was this year, represents a not material improvement versus the 2011 data. In the week ended March 27, 2010, initial claims fell by 449 to 408,204. This week's report was not materially different than that change, and it represents a 21.8% decline from that total. Looking at the big picture, the trend rate of decline in first time claims has consistently been around 10% for the past 18 months. There's no sign of any change in that rate, suggesting that the economy remains in a slow growth path, shedding far fewer jobs than during the 2008-2009 collapse. Continuing claims are on a similar downward plane, declining for the past 3 months at approximately a 10% rate. The problem here is that we have no way to know how much of that is due to people getting jobs and how much is due to people exhausting their benefits and falling through the social safety net. Many of these unfortunates resort to what I call "synthetic unemployment compensation," aka government guaranteed student loans. This chart represents the growth of Federal student loans outstanding. After hovering around $10 billion in 2007, the amounts outstanding grew to around $175 billion at the end of 2010, tracking the growth of continuing unemployment claims. But as continuing claims began to decline in 2010, these loan programs continued to grow, with another big spike in 2010 when the Federal government temporarily allowed extended unemployment benefits to expire. Finally late in 2011 and early this year, with continuing claims and extended and emergency Federal unemployment claims in declining trends, Federal student borrowing programs again surged. This is a sign of the hidden unemployment problem among young adults, who turn back to school out of desperate need for funds of any kind. Unfortunately, many of these loans will only be partly repaid in 40 years when the government garnishes the borrowers' social security benefits. For now, for many this funding represents a last desperate means of sustenance. None of the data tells us how many jobs the economy is adding, but the real time withholding tax data, adjusted for inflation tells us, "Not many," in fact, none. The 4 week moving average of the annual percentage change in withholding tax collections is virtually zero, suggesting that the economy hasn't added any jobs since this time last year. It's probably a good bet that the March payrolls data to be released a week from Friday will disappoint. The claims data suggests that the labor market has been a model of consistency. While that may raise suspicion in the "vast government conspiracy" wing of economic chatterers, if the government is fudging, it has been doing so for a long time with multiple data streams. That would involve manipulation across a multitude of government agencies involving scads of data managers, analysts, and other employees. It's likely that somebody would have squealed if the data was being falsified on a large scale over time. While the media wallows and flails in the clearly unreliable seasonally adjusted nonsense, I think the actual data tells a reasonably clear story that seems consistent with a wide range of data that I track, as well as simple empirical observation of the real world. Things are marginally improved today. We can debate whether the forces driving that improvement are sustainable (they're not), and we also know that a growing parallel universe is developing with increasing numbers of people who have fallen through the cracks. But the relative improvement, however slight, is real, and that's all that matters to buyers of equities. As long as these trends hold their own, the stock market should do so as well. That does not change the fact that while fewer people are claiming unemployment benefits, many more have fallen off the rolls, and far fewer people have full time jobs today than 4 years ago. That does not look likely to change any time soon based on the current data. Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days! Copyright © 2012 The Wall Street Examiner. All Rights Reserved. This article may be reposted with attribution and a prominent link to the source The Wall Street Examiner. |

| Fatal Flaws and Opportunities in Gold Investing: Brent Cook Posted: 29 Mar 2012 11:01 AM PDT The Gold Report: In the late 1990s, when the gold price was falling steadily lower, you vetted companies for Rick Rule's company, Global Resource Investments. Could you give us a comparison of what this space was like then versus what it's like now? Brent Cook: During 1997–2002, we were probably in the most unloved sector in the whole investment world. Gold had collapsed to less than $250/ounce (oz), copper was under $0.85/pound (lb) and anything that didn't have a dot-com to its name didn't get much respect. The idea of blowing up rocks to make metal out of them was an archaic concept clung to by the remnants of the industrial revolution; it was a brave new world. By contrast, today gold is over $1,600/oz, copper is $3.80/lb and iron ore has gone from $12/ton (t), to $140/t; we're in the 10th year of a commodities boom. Back then, it was very difficult for mining companies to raise money. Working with Rick, I was fortunate. He'd put together two funds of about $14 million (M), so w... |

| Gold Price and Silver Price Had a Split Close Today With Gold Down and Silver Up Posted: 29 Mar 2012 10:55 AM PDT Gold Price Close Today : 1652.30Change : (5.70) or -0.34%Silver Price Close Today : 3197.80Change : 16.1 cents or 0.51%Gold Silver Ratio Today : 51.670Change : -0.441 or -0.85%Silver Gold Ratio Today : 0.01935Change : 0.000164 or 0.85%Platinum Price Close Today : 1627.20Change : -8.30 or -0.51%Palladium Price Close Today : 645.35Change : -3.80 or -0.59%S&P 500 : 1,403.28Change : -2.26 |

| Bashing Buffett…Once Again With Feeling Posted: 29 Mar 2012 10:14 AM PDT "Right now bonds should come with a warning label," opines Warren Buffett in this year's letter to Berkshire Hathaway shareholders. That seems like a reasonable idea, but why stop there? Why not slap a warning label on each one of Buffett's public pronouncements as well? The warning would go something like this: This pronouncement may or may not express my honest opinions, but it will almost certainly advance a hidden political agenda that enables me to gain access to preferential treatment from elected officials and various agencies of the federal government. Buffett knows investing, no doubt about it. He's an expert's expert. But Buffett also knows how to make sure the government's butter lands on at least one side of his bread, if not both. He's an expert's expert. Both activities are perfectly legal, but only one of them is perfectly disgusting. "Stop Coddling the Super-Rich," Buffett pleaded last summer in an infamous op-ed piece for the New York Times. "Our leaders have asked for 'shared sacrifice.' But when they did the asking, they spared me. I checked with my mega-rich friends to learn what pain they were expecting. They, too, were left untouched… "Last year," Buffett continued, "my federal tax bill — the income tax I paid, as well as payroll taxes paid by me and on my behalf — was $6,938,744. That sounds like a lot of money. But what I paid was only 17.4 percent of my taxable income — and that's actually a lower percentage than was paid by any of the other 20 people in our office. Their tax burdens ranged from 33 percent to 41 percent and averaged 36 percent." Ah shucks!… Gee whiz!… and Golly gosh! Mr. Buffett must feel just awful about this injustice. If only he had discovered it earlier, he could have paid tens of billions of dollars more in taxes during his lifetime. And, gee willickers, he could have told all his mega-rich friends about his great discovery so that they, too, could have paid tens of billions of dollars more in taxes. Golly gee, isn't that just the way life is? You always discover the best stuff after it's too late to do anything about it. It's just too darn bad that Buffett and his mega-rich friends had already amassed their mega-billions of dollars during the "unfair" tax regime of the last two or three decades before Buffett discovered how unfair it was. But, shucks, you can't turn back the clock. So despite Buffett's profound regret, he will simply have to keep all those billions of dollars that the IRS did not permit him to contribute to the US government. Gee whiz…life just ain't fair sometimes. You try to be magnanimous with the US government and the IRS just won't let you. Hey, but at least you can publicly proscribe for others the identical high-tax regime that you methodically and assiduously avoided throughout a career spanning several decades. And fortunately for the US government, there is a brand-new generation of folks who aspire to become billionaires like Buffett, or perhaps merely millionaires. And as Buffett astutely observes, it's not too late to tax them. At this point, a few Dear Readers may be saying to themselves, "Well, okay, but even if Buffett should have said something earlier, at least he said something now… and that means that he would start paying higher taxes now. False. Implementing a higher income tax would barely move the needle on Buffett's annual tax bill, as the nearby chart illustrates.

Buffett paid $6.9 million in taxes on his 2010 personal income of $39.9 million dollars — or 17.4%. But he paid zero personal taxes on his portion — $2.9 billion — of Berkshire Hathaway's net income. (Of course Berkshire paid corporate tax, but that fact is not germane to the discussion of personal taxes that Buffett addressed in his article last year). In other words, even if you bumped the personal income tax all the way up to 100%, and literally confiscated every cent of Buffett's direct personal income, the effective tax rate on the totality of his increased wealth in 2010 would have been only 1.4%! So you see how easy it is to be a do-gooding, "fair-share-paying" billionaire? Buffett's "tax fairness" ideas — focusing as they do on personal income, dividends and capital gains taxes — would leave Buffett, himself, virtually unscathed. That's because: 1) His personal income represents less than 2% of his annual wealth accumulation; 2) Berkshire Hathaway has never paid a dividend in its history; 3) Buffett, himself, has no intention of generating any capital gains because he has no intention of selling a single share of Berkshire Hathaway. Tellingly, Buffett's proposals exclude any mention of estate taxes or of disallowing certain deductions for those he calls the "mega-rich." These exclusions are no accident. When disclosing his multi-billion-dollar gift to the Bill and Melinda Gates foundation in 2006, Buffett established three conditions, the second of which was that the foundation "must continue to satisfy legal requirements qualifying my gift as charitable and not subject to gift or other taxes." More recently, Buffett defended the tax-deductibility of corporate jets and urged Berkshire Hathaway shareholders at the 2010 shareholder meeting to "follow my tax dodging example." Unfortunately, dear reader, Buffett's hypocrisy on this topic does not end there. It merely begins. In fact, the story just goes on and on, ad nauseum. Buffett, the tax crusader, is also Buffett, the IRS litigant. Yes that's right, just a few months after complaining to the nation that rich folks aren't paying their fair share of taxes, this particular rich folk filed a lawsuit against the IRS asserting an unfairly large tax bill. "Last November," Bloomberg News reports, "NetJets, the private-plane company owned by Warren Buffett's Berkshire Hathaway Inc. (BRK/A), sued the US, saying the federal government had wrongly imposed taxes, interest and penalties totaling more than $642.7 million. "Claiming the federal Internal Revenue Service wrongfully assessed a so-called ticket tax — an excise tax on payments made in exchange for air transportation — to private aircraft owners maintaining their own planes, the Columbus, Ohio-based company demanded refunds and abatements." A few weeks ago, the federal government countersued — asserting that, not only does the IRS owe no money to NetJets, but also that NetJets owes an additional $366 million in taxes and penalties. Certainly, Warren Buffett has a fiduciary responsibility to NetJets shareholders to advance their interests. So if, in fact, the IRS is trying to take funds from NetJets that it does not legally deserve, so be it. But in light of the fact that Buffett publicly laments his inability to pay more taxes, the do-gooding billionaire would seem to be passing up a golden opportunity. Why not, for example, allow NetJets to battle the IRS, while simultaneously, and very publicly, agreeing to pay the disputed taxes out of his own pocket? If Buffett genuinely wished to hand more money to Uncle Sam, the solution would be relatively simple: "Just write a check and shut up," as New Jersey Governor, Chris Christie put it succinctly. But don't hold your breath waiting for Buffett to write any charity checks to the government, or even to write any op-eds about forms of "tax fairness" that would cost him much more per year than the cost of his vacations on Martha's Vineyard with President Obama. Warren Buffett has not become a latter-day tax crusader so that he can pay his "fair share"; he has become a crusader so that he can continue plundering his unfair share of tax receipts and crony favoritism. By lending his reputation to the "tax fairness" crusade, Buffett legitimizes the progressive/socialist agendas that tickle the fancy of so many political leaders. As a result, Buffett endears himself to those with the power to advance his financial interests. Fanning class warfare is good business, assuming you don't mind the whole dishonest, hypocritical part of it. This tactic added billions of dollars to his personal wealth during the credit crisis of 2008-9, while also saving Berkshire Hathaway from a near-certain demise. During the depths of the 2008 Credit Crisis and stock market selloff, "Wall Street was of fire," recalls Peter Schweizer in his expose, Throw Them All Out. "[But] Buffett was running toward the flames…with the expectation that the fire department (that is, the federal government) was right behind him with buckets of bailout money…Indeed, Buffett needed the bailout…Beyond Goldman Sachs, Buffett was heavily invested in several other banks that were at risk and in need of federal cash. He began immediately to campaign for the $700 billion TARP rescue plan that was being hammered together in Washington." "As the political debates surrounding the proposed $700 billion Troubled Asset Relief Program (TARP) bailout bill heated up," recalls blogger, Pat Dollard, "Buffett maintained an appearance of naiveté, an 'aw shucks' shtick that deferred to the judgment of politicians. 'I'm not brave enough to try to influence the Congress,' Buffett told the New York Times. "Behind closed doors, however, Buffett had become a shrewd political entrepreneur," Dollard continues. "The billionaire exerted his considerable political influence in a private conference call with then-Speaker of the House Nancy Pelosi and House Democrats. During the meeting, Buffett strongly urged Democratic members to pass the $700 billion TARP bill to avert what he warned would otherwise be 'the biggest financial meltdown in American history.'" "If the bailout went through," Schweizer correctly observes, "it would be a windfall for Goldman. If it failed, it would be disastrous for Berkshire Hathaway." Buffett's "hard work" paid off. "In all, Berkshire Hathaway firms received $95 billion in bailout cash from the Troubled Asset Relief Program (TARP). Berkshire held stock in the Wells Fargo, Bank of America, American Express, and Goldman Sachs, which received not only TARP money but also $130 billion in FDIC backing for their debt. All told, TARP-assisted companies constituted a whopping 30% of its entire company disclosed stock portfolio." But these billions of dollars represented only the most visible portions of the bailout funds that flowed to Berkshire's companies. Wells Fargo, for example, received "only" $25 billion of TARP funding, but it also received another $45 billion at the same time from the Federal Reserve's Term Auction Facility (TAF).

Incredibly, Wells Fargo's borrowings paled alongside those of Goldman Sachs. Throughout the crisis, Goldman gorged itself at every available government trough. The morally challenged investment bank borrowed only $10 billion from the TARP. But at the same time Goldman was griping about "being forced" to take the $10 billion TARP loan, the company was borrowing tens of billions of dollars more from obscure government lending programs with acronyms like: CPFF, PDCF and TSLF. And that's not all! Amidst much fanfare and self-congratulatory press releases, Goldman repaid its TARP loan in June 2009, but only after securing $25 billion of government capital at a different trough. As we observed in a December 15, 2010 edition of The Daily Reckoning: On June 17, 2009…thanks to some timely, undisclosed assistance from the Federal Reserve, Goldman repaid its $10 billion TARP loan. But just six days before this announcement, Goldman sold $11 billion of mortgage-backed securities (MBS) to the Fed. In other words, Goldman "repaid" the Treasury by secretly selling illiquid assets to the Fed. One month later, Goldman's CEO Lloyd Blankfein beamed, "We are grateful for the government efforts and are pleased that [the monies we repaid] can be used by the government to revitalize the economy, a priority in which we all have a common stake."

As it turns out, the government continued to "revitalize" that small sliver of the economy known as Goldman Sachs. During the three months following Goldman's re-payment of its $10 billion TARP loan, the Fed purchased $27 billion of MBS from Goldman. In all, the Fed would purchase more than $100 billion of MBS from Goldman during the 12 months that followed Goldman's TARP re-payment. Is it any wonder that Buffett's $5 billion "investment" in Goldman Sachs succeeded so nicely? "Later, astonishingly," recalls Peter Schweizer, "Buffett would publicly complain about the bailouts in his annual letter to Berkshire investors, claiming that government subsidies put Berkshire at a disadvantage…" "It takes chutzpah to lobby for bailouts," observes Reuters journalist, Rolfe Winkler, "make trades seeking to profit from them, and then complain that those doing put you at a disadvantage." Yes indeed, chutzpah and a wee dose of hypocrisy. Please don't misunderstand us dear reader; the only difference between our hypocrisy and Warren Buffett's is the number of dollars that flow from it. But that's a meaningful difference. Our hypocrisy does not divert hundreds of billions of dollar from the government coffers into our pockets, while masquerading as folksy, good old-fashion "fairness." Let's start printing those warning labels! Eric Fry Bashing Buffett…Once Again With Feeling originally appeared in the Daily Reckoning. The Daily Reckoning, published by Agora Financial provides over 400,000 global readers economic news, market analysis, and contrarian investment ideas. |

| Gold has bottomed at $1,650, silver at $32, Turk tells King World News Posted: 29 Mar 2012 10:00 AM PDT 6p ET Thursday, March 29, 2012 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk tells King World News tonight that gold has bottomed at $1,650 and silver at $32. Turk adds: "Sentiment is near rock-bottom as everyone's patience is being severely tested, even the old-timers'. That is another reliable sign that we are near an end of this correction. The longer the correction, the bigger the base that is formed. The bigger the base, the more prices will soar when they finally start heading higher." From Turk's lips and the King World News blog to the Great Market Manipulator's ear, and we don't mean Bernanke: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/3/29_Ja... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum (TSXV: NKL) and Ursa Major Minerals Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) and Ursa Major Minerals Inc. have signed a binding letter of agreement for a business combination through a proposed all-share transaction. In doing so Prophecy and Ursa have acted at arm's length and the transaction has been negotiated at arm's length. Prophecy will issue one common share in exchange for every 25 outstanding common shares of Ursa. Ursa options and warrants will be exchanged for options and warrants of Prophecy on an agreed schedule. Prophecy's offer represents a value of about $0.15 per each common share of Ursa based on Prophecy's share price of $3.70 as at March 1, representing a premium of 130 percent to Ursa's March 1 closing price of $0.065. Prophecy is to subscribe for $1 million common shares of Ursa by way of private placement financing at $0.06 per share, subject to regulatory approval. Upon placement completion, John Lee and Greg Hall, current Prophecy directors, will be appointed to Ursa's board. Prophecy thus will become a mid-tier resource company with a robust and -- The fully permitted open-pit Shakespeare PGM-Ni-Cu mine close to Sudbury, Ontario, infrastructure with near-term production capabilities. -- The flagship Wellgreen (Yukon) PGM-Ni-Cu project with more than 10 million ounces of Pt-Pd-Au inferred resource. Drilling is under way and a preliminary economic assessment study is pending. -- Manitoba's Lynn Lake Ni-Cu project with more than 262 million pounds Ni and 138 million pounds Cu measured and indicated. For the complete announcement, please visit Prophecy Platinum's Internet site here: http://www.prophecyplat.com/news_2012_mar02_prophecy_platinum_ursa_major... |

| The next leg of gold’s bull run Posted: 29 Mar 2012 09:20 AM PDT By Matthew Lynn On the surface it looks as if it might have. After running up close to $2,000 an ounce during the market panic of last autumn, it has slipped below $1,700. And it shows little sign of reclaiming its highs. But here's one reason why it could have a lot further to go. The big, developed world central banks will start buying again. And if they do, it would put real rocket fuel into the price of the precious metal. …foreign exchange reserves are critical if you face a financial crisis. If the banking system needs to be propped up, then you need some assets to play with. Of course, the central bank can always print some money. But in a crisis, the markets may demand something more solid – and that means having reserves. …[Reserves] give you the ability to intervene in the currency markets…But you can't manipulate the markets without anything to sell, and that means holding reserves. [source] |

| Mike Krieger On When Central Banking Dies: China and Oil Posted: 29 Mar 2012 09:11 AM PDT From Mike Krieger of KAM LP No quotes today. Just this image. This applies to everyone in every country on this planet. You are being herded. The gate is closing. "Rise and Rise Again until Lambs become Lions."

When Central Banking Dies: China and Oil China China is a topic on which I have differed greatly from many analysts and macro commentators with whom I generally share a similar economic philosophy. What I have heard from many in this camp is this story about how China was the next great power and that they are going to revalue the yuan higher. In that process, they would be able to shift their economy away from a dangerous overemphasis on fixed asset investment and toward consumption. There was this notion that China had its house in order and was about to totally shift the balance of economic power in the world as the West melted away. In the middle part of the last decade I heard this argument yet it always seemed a little preposterous. In 2007/2008 as the Western housing markets and banking systems came apart this view was expressed in the now much maligned (and rightfully so) "decoupling thesis" which turned out to be nothing but a fantasy. Nevertheless, in the aftermath of the implosion in the West there was still this notion that China was ok. That they had figured it out and were about to take over the world. This concept was furthered by the very robust bounce back that they had compared to the weak recoveries in the Western world. Nevertheless, I was extremely disturbed from day one by the manner in which they were going about achieving this recovery. First of all, almost none of it was related to a sudden preeminence of currency strength based consumption that would have potentially allowed the economy to actually restructure. In fact, the yuan stopped appreciating relative to the dollar in July 2008 and didn't begin strengthening again until June, 2010. the interim, the Chinese did absolutely nothing to restructure and instead went on a Keynesian orgy of stimulus packages and fixed asset investment. Million person cities with no one living in them were built seemingly overnight. The biggest mall in the world was built and there was no one shopping in it. I saw all of these things and immediately called them out on it. I was writing about how China's recovery was a total sham by the first half of 2009, yet there were all these China bulls talking about how they are "the best capitalists in the world." What a ridiculous statement. That economy is total command and control at the top, just like EVERY single major economy on earth today. To say China isn't is total delusion and their response to the crisis proved it to me 100%. They didn't allow market forces to take over, the flooded the system with liquidity and tried to direct it as well. In light of that, there was always going to come a time where China suffered the affects of it absurd policies and that time seems to be now. Anyone that watches markets and pays attention to economic statistics understands that China's economy is in the midst of a serious slowdown. In fact, I wouldn't be surprised if they are already experiencing close to negative real growth if you strip out true inflation. The bottom line is nobody knows because the data is so clouded in a centrally planned haze. The more interesting question is what are they going to do about it? So far not that much. So why is that? Well, they are in a similar predicament to the Western world (no surprise there as this is what happens in centrally planned ponzi economies). Do they triple down on the prior policies or do they try something different? That question has yet to be answered and the reason I think they haven't responded is they hope inflation can come down enough to triple down on prior policies. This of course is very dangerous because with each passing day the economy will get worse and worse and they risk things getting totally out of control. The main point I am trying to make here is that no major country ever restructures because if any of them tried the entire global ponzi that has benefited all these "leaders" would rapidly unravel in their faces. This is why the U.S. never does the right thing and it is also why China never does the right thing. This ponzi is global and it will not be dismantled from the top. Rather it's dismantling will be fought by TPTB all the way and to the end because they know when it unravels everyone will see they were just little greedy central planning bureaucrats who brought death and destruction to the world as they played out their fantasies with our lives hanging in the balance. Recently there were rumors of a coup in China that turned out to be unfounded. This story got me thinking and although this turned out to be untrue I think that with each passing day the odds of a genuine coup or outright revolution in China increases exponentially. Here is why. The people that are actually pulling the strings in China at the moment are clearly in bed with the Western PTB. The elites in China benefitted greatly by agreeing to use their citizens as slave labor to fatten up Western multinational profits. That said, you can be sure there is a growing faction of powerful people in China that see these characters as traitors and the longer they do nothing and the economy slumps lower the more the person on the street will become enraged and the more vocal and powerful those that oppose these Western Keynesian lapdogs will become in Chinese society. With each passing day that the leadership does nothing with the economy, the greater the threat of a political and social change of massive proportions becomes in China. I expect historic political and social change to come to every country including the United States I just think China's power structure may fall before ours does. This is something everyone should keep a very close eye on. Oil Besides gold and silver, there is nothing that scares Central Planners (Bankers) more that oil. In their delusional world where they play god with our futures, they think they can make the sheeple do whatever they want by adjusting the settings on a printing press and can thus determine the fate of the global economy and humanity itself. What they hate more than anything else is when all of their money printing causes things like oil to rise because it exposes them for the charlatans that they are. This is why Obama is constantly attacking speculators and oil companies. It is all an attempt to scapegoat someone else for the financial nightmare that is hitting everyone's wallet. This is why they floated the absurd idea of releasing more oil from the U.S. Strategic Petroleum Reserve and then denied it once the market failed to react vigorously enough to the rumor. This is also why Obama surely has called the Saudis up repeatedly as of later to remind them that they might see regime change unless they ramp up oil production to help his reelection. This brings us to one of the most important aspects of the entire global economy at the moment. Saudi oil production is hitting record highs at the moment. In fact if you look at the chart below you will see that the Saudis have never consistently pumped more oil than they are right now. Saudi Oil Production 1980-Present Now this chart has been going around the street for weeks now, but I am not convinced people really understand the significance of it. There has been a tremendous amount of debate in the oil world over the past decade about what the Saudis can actually pump. Many such as the late Matt Simmons repeatedly claimed that the situation on the ground there was much worse than people understood and that the Kingdom might be on the verge of experiencing a major peak in production. Others, such as the Saudis themselves claim they have plenty of room to grow and indeed claim to have the ability to ramp production to 12-12.5 million barrels per day relatively quickly. Well if I am right we are about to find out. The Bernank knows he needs to launch QE3 because without it interest rates could rise and officially bankrupt the government. He also knows that QE3 will be seen by the market as proof that the economy still sucks and they were just lying and that it will just prop up more mal-investment. Mal-investment will support unproductive consumption and of course result in flying oil prices. The Bernank and Obama will want to make sure the Saudis come in and raise production further along with the commencement of QE3 so that the rise in gasoline prices is not as severe as it otherwise would be. Check out the chart of wholesale gasoline prices below. Gasoline Prices 2002-Present As you can see from the chart above, gasoline prices are already at last year's highs (right before the stock market experienced a correction) and also back very close to the 2008 highs when the whole system imploded. So what I take away from this is that we may be about to see what the Saudis really have. In order to print the massive amounts of new money the Central Planners want (need actually) to save their delusional little system they will need Saudi Arabia to pump more oil. If the Saudis cannot do so, it will create a total panic attack in the markets everywhere. Why? Because this will mean that the Central Planners have finally hit the brick wall. It will mean that any more money printing will result in nothing less than exploding gasoline prices and ultimately judgment day when we finally find out if the world will spiral into uncontrollable inflation or deflationary collapse. Saudi oil is a major key to this equation. The Most Ominous Chart in the World The Chinese Yuan 2005-Present Take a look at the chart of the Chinese currency above. When it is declining it represents appreciation versus the U.S dollar. What you can see is that the appreciation trend from June 2010 has stopped. It has been flat since the end of 2011. Recently, such behavior has foreshadowed major negative events. I think the reason is because it signals a resource wall has been hit that therefore constrains central planning printing and liquidity expansion. The last time it stopped appreciating was in early July of 2008. This coincided perfectly with the collapse of the commodity bubble. Three months later the entire financial system imploded. We don't have a commodity bubble this time but we have other ones. We have a luxury goods bubble. A retail sector bubble. A treasury bubble and then the biggest bubble of all the fiat money bubble. Which of them will collapse this time? Good luck out there. Peace and wisdom, |

| The Flaw In Europe's Austerity Plan: Elections Posted: 29 Mar 2012 08:26 AM PDT Getting Europe's mainstream politicians and appointed technocrats to agree to bailouts and austerity was actually the easy part. The real challenge for these guys will be holding onto their jobs — and preserving the deals they've cut — in upcoming elections. Voters, it seems, aren't convinced that that a depression is the only solution to the euro's design flaws. Faced with the immediate reality of poverty, they're listening to formerly fringe voices calling for a better deal, either in the form of more help from Germany (via the European Central Bank) or a quick exit from the euro zone and a return to national monetary sovereignty. Greece, of course, is first in line:

Spain, meanwhile, might be next:

Some thoughts The problem is that the European financial system is so interconnected that even one small country leaving might spark a bank run in the other likely candidates, which might push the whole continent into political and economic chaos. Given this choice, one has to wonder if future election results will just be ignored, with the people in charge simply declaring an emergency and going on with their plans. From here on out every major election is an "event risk" that threatens the eurozone as a financially viable democracy. |

| James Turk - Quiet Gold Market Masks Important Development Posted: 29 Mar 2012 08:22 AM PDT  With gold and silver rallying strongly off the lows, today King World News interviewed James Turk out of London. Turk told King World News the quiet gold and silver markets are hiding some important developments. Here is what Turk had to say about the situation: "The precious metal markets have been unbelievably quiet for the past two weeks, Eric. It is something that you might expect in August during the middle of summer holidays, but not here in March -- particularly with a quarter-end approaching." With gold and silver rallying strongly off the lows, today King World News interviewed James Turk out of London. Turk told King World News the quiet gold and silver markets are hiding some important developments. Here is what Turk had to say about the situation: "The precious metal markets have been unbelievably quiet for the past two weeks, Eric. It is something that you might expect in August during the middle of summer holidays, but not here in March -- particularly with a quarter-end approaching." This posting includes an audio/video/photo media file: Download Now |