Gold World News Flash |

- Intermediate-term outlook for gold stocks

- XAU to Gold Ratio Beckons....

- Is Gold a part of your currency reserve?

- Emerging Gold Juniors and Explorers Should Recover in 2012

- Chinese gold imports will keep increasing

- Tokyo Soil – Blanketed With Fukushima Radiation – Would Be Considered “Radioactive Waste” In the United States

- Countries Swapping Billions & Transferring Oil Ahead of War

- On The Price Of Gold

- Gold Seeker Closing Report: Gold and Silver Gain About 2%

- Here is how the banker's game works

- They're all gonna laugh at you

- Pass the Juice Please

- US Launches Economic War, Gold Reacting

- The Right Place, The Right Price and The Right Time For Undervalued Uranium

- Money in America, Part Six

- Is the US Dollar Headed for a Major Fall?

- Ron Paul On Bloomberg 3/26/12

- Gold Rockets Back towards 1700

- What Gives Money Value, and is Fractional-Reserve Banking Fraud?

- Gold Price Closed at $1,685.60 Strong Resistance Awaits at $1,705

- Wave of Banking Resignations Likely Foreshadows Financial Collapse

- TBTF Get TBTFer: Top 5 Banks Hold 95.7%, Or $221 Trillion, Of Outstanding Derivatives

- We Are Moving SWIFT-ly Toward the Demise of the Dollar

- Super Mogambo Comments (SMC).

- What Inflation Could Look Like in 2014

- Emerging Gold Juniors and Explorers Should Recover in 2012: Jeff Berwick

- Gold: 17 Day Decline

- Stealth Bottom Coming in Gold Stocks

- Dodge These Market Schemes

- Gold Daily and Silver Weekly Charts - A Burst of Liquidity Expectations Sparks a Flight to the Metals

| Intermediate-term outlook for gold stocks Posted: 27 Mar 2012 03:12 AM PDT In other words, economic trends, or at least the general perception of the economy's trend, could push the starting points of the next major advances in the prices of gold, silver and the associated equities out to at least the final quarter of this year. In the interim there would be tradable rallies, but these rallies would end prematurely. |

| Posted: 27 Mar 2012 03:00 AM PDT What's the most despised industry sector in the market today? Solar stocks? China frauds? Sure, you can average down on these to zero. What about a real industry that's starting to finally hemorrhage cash flow? After a decade of continually disappointing investors, large cap gold stocks are finally cheap. |

| Is Gold a part of your currency reserve? Posted: 27 Mar 2012 02:15 AM PDT The whole talk about the USD being the world currency reserve seems silly to me. Over the last decade the USD has been consistently loosing value to commodities, we can clearly see that with higher gold and oil prices. This trend will not change any time soon with ballooning debts and the money printing junkies running central banks all around the world. |

| Emerging Gold Juniors and Explorers Should Recover in 2012 Posted: 27 Mar 2012 02:04 AM PDT |

| Chinese gold imports will keep increasing Posted: 26 Mar 2012 06:00 PM PDT |

| Posted: 26 Mar 2012 05:46 PM PDT Tokyo Soil – Blanketed With Fukushima Radiation – Would Be Considered “Radioactive Waste” In the United StatesWe noted in August that some parts of Tokyo have more radiation than existed in the Chernobyl Exclusion Zones. And see this and this. There are indications that radiation levels are increasing in Tokyo. Nuclear engineer Arnie Gundersen took 5 random soil samples in Tokyo recently, and found that all 5 were so radioactive that they would be considered radioactive waste in the United States, which would have to be specially disposed of at a facility in Texas: Tokyo Soil Samples Would Be Considered Nuclear Waste In The US from Fairewinds Energy Education on Vimeo.

Indeed, shortly after the earthquake, U.S. government officials notes widespread contamination throughout northern Japan, including Tokyo, and said:

No wonder the potential evacuation of Tokyo has been quietly discussed by Japanese officials ever since the earthquake hit. @ Tepco: Less Than 2 Feet of Water Left in Fukushima ReactorNHK reports today that only 60 centimeters – or 23.62 inches – of water still cover the number 2 reactor:

There are other troubling data coming from unit 4. For example, hydrogen levels within the reactor have increased 500% in the last two weeks. Temperatures have also fluctuated fairly dramatically within reactor 2 in recent weeks. DID FUKUSHIMA MELTDOWN 30 YEARS AGO? We assume the following is just a bad translation or ambiguious statement. German speakers: Please let us know...

We've previously noted that governments have been covering up nuclear meltdowns for 50 years to protect the nuclear power industry. This month, German state television broadcaster ZDF (which has previously interviewed workers at Fukushima) ran a special on Fukushima which - according to a Youtube translation - claims:

Here is a screenshot from the English subtitles (viewable by clicking "CC" at the bottom of the Youtube video):

We would appreciate it if a fluent German speaker could verify the translation of the phrase "a nuclear meltdown in Fukushima that was concealed for 30 years", and - if accurate - any information about what is actually being referenced. |

| Countries Swapping Billions & Transferring Oil Ahead of War Posted: 26 Mar 2012 05:36 PM PDT  With gold and silver surging higher recently, today King World News interviewed 40 year veteran, Robert Fitzwilson. Fitzwilson is founder of The Portola Group, one of the premier boutique firms in the Unites States. He told King World News that countries are engaging in currency swaps out of fear of being cutoff from international transfers. Fitzwilson also said gold and silver are getting ready for a major move. But first, here is what Fitzwilson had to say about recent developments: "Another development that's been happening in recent days is swaps are being made. China and Australia just recently completed a $31 billion swap of their currencies. To me that's tantamount to barter. These countries have essentially pre-positioned their currencies, probably because they are worried about being cutoff from international transfers." With gold and silver surging higher recently, today King World News interviewed 40 year veteran, Robert Fitzwilson. Fitzwilson is founder of The Portola Group, one of the premier boutique firms in the Unites States. He told King World News that countries are engaging in currency swaps out of fear of being cutoff from international transfers. Fitzwilson also said gold and silver are getting ready for a major move. But first, here is what Fitzwilson had to say about recent developments: "Another development that's been happening in recent days is swaps are being made. China and Australia just recently completed a $31 billion swap of their currencies. To me that's tantamount to barter. These countries have essentially pre-positioned their currencies, probably because they are worried about being cutoff from international transfers." This posting includes an audio/video/photo media file: Download Now |

| Posted: 26 Mar 2012 05:34 PM PDT from Zero Hedge:

|

| Gold Seeker Closing Report: Gold and Silver Gain About 2% Posted: 26 Mar 2012 04:00 PM PDT |

| Here is how the banker's game works Posted: 26 Mar 2012 03:52 PM PDT  Here is how the banker's game works: Here is how the banker's game works:1) Get the government to issue some currency (cash -- paper or reserves at the central bank -- reserves are government issued cash central bank deposits). Government issued cash is around 5% of the currency (money) supply. The government issued currency is put into circulation by the government simply spending it. 2) The rest (95%) of the currency is issued by the private banks. Each customer loan is a new bank deposit (i.e., new currency) and increases the currency (money) supply of the economy. Note that this newly created money (currency) is put into circulation by the borrower spending it. Most currency (about 95% America's currency supply) has been borrowed into existence and when bank customer pays the loan back that amount of currency is removed from circulation. The banking system cannot go backwards (fewer net loans) as time moves on because fewer net loans means less currency in circulation in the economy. Accumulation of interest charges on outstanding loans means that the currency supply must constantly increase even if it means giving out lower quality loans. Think of it like a plane flying it must fly at some minimum speed or else the plane (the banking system) will crash (i.e., banking system collapse). Read more..,,,,,,, This posting includes an audio/video/photo media file: Download Now |

| They're all gonna laugh at you Posted: 26 Mar 2012 03:01 PM PDT US Equity markets continue to make the sky is black crowd look foolish. However ridiculous the 'reasons' are getting for the continued momentum (LTRO, QE, multiple expansion, fund flows, generational opportunity, etc), there are a few things the economist in me would like to point out.

|

| Posted: 26 Mar 2012 02:35 PM PDT Click here to visit Trader Dan Norcini's blog… Dear CIGAs, In news this morning that most of the gold community was completely expecting I might add , Chairman 'Easy Money Ben' Bernanke announced this morning that he was concerned whether economic recovery was strong enough to sustain itself without supportive and accomodative monetary policy. Continue reading Pass the Juice Please |

| US Launches Economic War, Gold Reacting Posted: 26 Mar 2012 02:34 PM PDT **Check back early tomorrow morning for the full audio interview** Dear CIGAs, Today legendary trader and investor Jim Sinclair told King World News that gold has taken a major step towards becoming the currency of choice when it comes to international trade. Sinclair also said the US has launched an economic war against key Continue reading US Launches Economic War, Gold Reacting |

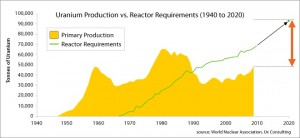

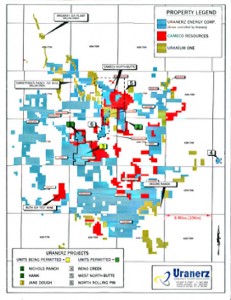

| The Right Place, The Right Price and The Right Time For Undervalued Uranium Posted: 26 Mar 2012 01:26 PM PDT Uranium is Undervalued Gold Stock Trades (GST) has been in the vanguard in affirming that uranium stocks are undervalued. They had been pummeled unfairly. Using a boxing metaphor, when Fukushima was sending them to the mat they should've been down for the count. Instead, GST refused to succumb to the uppercuts of pessimism that were battering even the champions in the sector. When it was not fashionable to advocate uranium miners, GST recognized that nuclear power remains a viable contributor to inexpensive electrical energy vital to the needs of not only major industrial nations, but to developing countries throughout the world. GST continues to see the powerful resurrection of the entire nuclear energy sector. Resurrection Of Nuclear Power In a current report, The International Energy Agency (IEA) stated that nuclear power remains the indispensable factor in the global energy grid. Moreover, there needs to be a new mindset of how nuclear energy is perceived. The "Fukushima Fever" is abating and it is time for the world to realize that the outmoded concepts of the 1970's have gone the way of the dinosaurs. Instead, little mention is made of the new generation of safer, smaller, portable and inexpensive nuclear reactors, which are being built at this very moment throughout the world. There are 439 operating reactors and 63 currently under construction, many of which are the new breed. Much of the demand emanates from China, India, Russia and strikingly the United States, home to a powerful environmental movement. Increase In Air Pollution And Demand For Oil Increasingly, the scientific community is already aware that Germany and Japan are witnessing increases in air pollution and carbon emissions generated by their diminished use of nuclear power. Additionally, the price of oil continues to rise as tensions in the Middle East escalate. Syria has turned into a fiasco while Iran continues to make advancements on nuclear bomb making capability. All this makes nuclear a cleaner and more affordable option. We have recently written about the simmering cauldron in the Middle East. The Iranian-Israeli confrontation looms increasingly. A sudden spike in the price of oil remains on the table. Such an eruption and a possible closure of the Straits of Hormuz would strengthen the case for dependable nuclear energy. Uranium Supply Demand Equation There are many factors that are already impacting the all important supply-demand ratio for uranium. Already supply is outstripping the rising demand of uranium with a deficit to be expected in 2013-14. This is despite the Fukushima panic and the resultant negative news. Add to this the ending of the Megatons to Megawatts Program between the United States and Russia whereby Russian nuclear warheads were being furnished for U.S. nuclear energy production. At present this is providing half of all U.S. nuclear needs. By 2013 this program will be phased out, thereby increasing the need for uranium miners to fill this gap. Presently, domestic uranium miners are supplying less that 4% of U.S. demand. Utilities will become increasingly dependent on these emerging uranium producers to make up for the shortfall. Increase in Uranium Merger and Acquisition Activity Recent news substantiates the long standing support of uranium selections by Gold Stock Trades. Hathor reached new heights and erupted into a bidding war between Cameco and Rio Tinto. Cameco offered $4.50 a share, triple the price Hathor was after Fukushima. That was not enough as Rio Tinto outbid Cameco. This should serve as a strong signal to investors seeking a growth sector that is significantly undervalued and under-loved. Remember Hathor will not becoming into production for several years. It is not even in pre-feasibility and yet the mining giants are locking horns to guarantee supply past 2018. This excitement will grow to envelope other uranium miners, particular those on our select list. We are witnessing the most buying in Uranium Participation Corp since the Fukushima Disaster. To discover these beaten down nuggets, we use our proprietary "PPT" (Place, Price, Time) method of analysis to identify miners that may attract significant investment interest. One of these companies that should eventually attract these searching eyes of the hungry majors. Rio Tinto's first move after the Credit Crisis of 2008 was to deploy their cash for Hathor. There should be others as this is just the beginning of the uranium feeding frenzy. Uranerz Next Possible Target of Majors Uranerz Energy (URZ: TSX and NYSE) meets the requisites of PPT analysis. They are in the right place, the right price at the right time. Critics may be put off by the low price of URZ. Always remember that Apple, Microsoft, Cisco, Barrick and Goldcorp were all penny stocks and certainly under $1. We are in search for geometric, multiple rewards. There is always one proviso: patience and fortitude are requisites in order to reap the subsequent rewards. It would be no surprise to see a handsome payoff for the following reasons. Uranerz has a cash position of $38 million. It should also be noted in addition to their cash reserves, they have signed contracts with two major utility companies in the United States, including the giant Exelon and a processing agreement with the largest uranium miner in the world and Powder River Basin neighbor Cameco. This capital is allocated for the development of a profitable mine at the Nichols Ranch In-Situ Recovery (ISR) Uranium Project. These monies are additionally being used on continuing exploration in the fertile Powder River Basin as the company is on record saying that production will begin in the second half of 2012. The Uranerz Advantage A word for In-Situ Recovery. This may well be Uranerz's ace cards. It is a low cost process with which environmentalists have little cavil as it is an environmentally friendly process with no waste rock and no tailings pond. Moreover, it involves lower labor costs and a smaller workforce. It is profitable even on lower grade uranium deposits. They have hired additional staff to expedite the Nichols Ranch Project. A map of their properties in Wyoming, indicate that they are directly in the middle of such Goliaths as Cameco and Uranium One. Moreover, they are in a friendly, mining jurisdiction right here in the United State in beneficent Wyoming, immunized from resource nationalism that is sweeping nations throughout the world. Uranerz's management is the perfect combination of experience and know-how. As if the Nichols Ranch, which is on the cusp of productivity barely 6 months into 2012 were not enough, they intend to use this project to serve as a springboard to develop other Powder River Basin projects specifically the Hank project which is already permitted and Jane Dough which is well on the way.

Looking at the map we notice a plethora of other units that are about to begin permitting. Subsequent development of other projects should undergo an accelerated permitting process through the standard permit amendment provisions of the bureaucratic regulatory process. An examination of the above map makes Uranerz an irresistible candidate for investment monies. Uranerz Technical Analysis From a technical perspective, the long range point and figure chart on Uranerz reveals a pattern of rising bottoms in the maturation process of wealth in the ground resources. Add to this a developing reverse head and shoulders pattern is taking place before our very eyes. The 50 day moving average has been penetrated to the upside after reaching long term trend support. This indicates that the bottoming process may be completing as the 50 day has crossed above the 200 day. We have witness a short term pullback as it forms the right shoulder above the 200 day moving average and is now poised to breakout. The past six months has been excellent for Uranerz as it has more than doubled in value and has outperformed the general equity market since our October 4th buy signal. Its entitled to this current pause before a breakout from this pattern, which gives us a short term target of $3.25 and a long term target of $7.

There is one proviso that must be added to this study. Patience and fortitude are de rigueur. Remember the previous references to such illustrious money makers as Goldcorp, Barrick and Apple are applicable to Uranerz. The eventual profits will be well worth the wait. It is rare to find a stock that is selling at the $2 mark with so many attractive aspects. To reiterate the long term search for nuclear energy is on the rise. Demand for uranium is growing far in excess of available supply. Uranerz is the best of breed of near term U.S. uranium producers with significant upside potential. Disclosure: Long URZ and URZ is a featured company on http://goldstocktrades.com |

| Posted: 26 Mar 2012 01:05 PM PDT In the last episode, we followed post-World War One arrangements to return to a gold standard generally; the little-known Recession of 1920-1; the Strong-Norman dynamic duo; the Weimar collapse; the easy money that put the roar in the Roaring 20s; Black Thursday and Hoover's seeds of the New Deal. An overture: February, 1929, Montague Norman [...] |

| Is the US Dollar Headed for a Major Fall? Posted: 26 Mar 2012 01:00 PM PDT One of the facts of life over the last 40 years has been that the U.S. dollar is the world's sole global reserve currency. This is despite the fundamental factors underlying the U.S. balance of payments, which has been awful over that entire time. Nevertheless, the dollar ruled the global monetary system through these four decades and appears to be doing so still. But is that coming to an end? |

| Posted: 26 Mar 2012 12:38 PM PDT from RonPaulFriends2: Ron Paul Video Playlist FAIR USE NOTICE: This video may contain copyrighted material. Such material is made available for educational purposes only. This constitutes a 'fair use' of any such copyrighted material as provided for in Title 17 U.S.C. section 107 of the US Copyright Law. |

| Gold Rockets Back towards 1700 Posted: 26 Mar 2012 12:15 PM PDT courtesy of DailyFX.com March 26, 2012 01:02 PM Daily Bars Prepared by Jamie Saettele, CMT Gold slid lower for about a month after the 2/29 mini crash before rallying sharply today. Bigger picture, the rally and decline from the December low may compose the base that propels gold to all-time highs. When viewed in the proper context, price action since September appears as nothing more than consolidation within a secular bull market. Near term, former support is now potential resistance at 1704. Bottom Line (next 5 days) – ?... |

| What Gives Money Value, and is Fractional-Reserve Banking Fraud? Posted: 26 Mar 2012 11:48 AM PDT by Detlev Schlichter, Cobden Centre.org:

The first point is related to the question what gives money its value? The second point is the question of whether fractional-reserve banking is fraudulent, and should be banned on the basis of property rights. |

| Gold Price Closed at $1,685.60 Strong Resistance Awaits at $1,705 Posted: 26 Mar 2012 11:44 AM PDT Gold Price Close Today : 1685.60 Change : 23.20 or 1.40% Silver Price Close Today : 3272.6 Change : 47.8 cents or 1.48% Gold Silver Ratio Today : 51.506 Change : -0.044 or -0.09% Silver Gold Ratio Today : 0.01942 Change : 0.000017 or 0.09% Platinum Price Close Today : 1647.70 Change : 21.50 or 1.32% Palladium Price Close Today : 668.00 Change : 8.80 or 1.33% S&P 500 : 1,416.51 Change : 19.40 or 1.39% Dow In GOLD$ : $162.39 Change : $ (0.00) or 0.00% Dow in GOLD oz : 7.856 Change : 0.000 or 0.00% Dow in SILVER oz : 404.62 Change : -0.39 or -0.10% Dow Industrial : 13,241.63 Change : 180.90 or 1.39% US Dollar Index : 78.93 Change : -0.357 or -0.45% The GOLD PRICE jumped up when Bernanke was slapping the dollar, which was no surprise to anyone with an IQ greater than the temperature of his feet on a cold day. GOLD PRICE gained $23.20 on top of Friday's $20 gain to close at $1,685.60, and has now reached the bottom of the range where it fell away. The GOLD PRICE has gained $43.20 in the last two days, 2.63%, from last Thursday $1,642.30. Mmmmm. The GOLD PRICE hit a $1,693.30 high today, plus closing above its 200 day moving average (1,683.66). Momentum is plainly up, but gold again meets its 150 DMA ($1,708.36) at $1,708.36, where strong resistance also awaits ($1,705). But who knows? Maybe last week we saw Gold's low for the move? Right now gold has its dander up, so expect higher prices tomorrow. Gold needs that close above the 150 DMA to prove it has finished its correction. SILVER PRICE closed the Comex at 3272.6c. In the last two trading days silver has added 140.7c (4.5%). Today it augmented (that's for you engineers out there) 47.8c. Today buoyed silver up to that internal support/ resistance line, but its 3304c high also reached for the 20 (3345c) and 50 (3333c) day moving averages. For the present I'm working on a tentative theory that both silver and gold bottomed last week, but that will only be proven when this move falters and falls back to a slightly HIGHER low than the last one. Hang on. Silver and gold are turning exciting. The comrades on the supreme court, known affectionately here as "The Supremes," are hearing a gang of lawsuits on Obamacare. Let me cut to the bone for you right here: no way congress can "mandate" you buy life insurance, a hamburger, a Chevrolet, or anything else, The Supremes notwithstanding. Listen here: if you have to sign something to participate, they can't mandate it. Think about it: You murder somebody with a meat ax. The police come to arrest you. At any point in the proceeding, will anybody present you with a contract proving you signed promising that you will not kill anybody with a meat ax? Nope. It is therefore MANDATORY that you not kill people with a meat ax. However, to buy the "mandated" insurance, you will have to sign a contract. If government can make you sign anything, then you are not free. Same argument applies to social security: did you have to SIGN something, something called an "application," before you got a social security number? What would have happened had you NOT signed? Would they have given you a number anyway? Like I said, the yankee government can NOT make you buy insurance, medical or otherwise. TODAY gave us another example of how the Fed destabilizes markets. The Bernancubus made statements the market interpreted as soft on inflation. That broke the dollar's back and sent stocks jumping high, and boosted silver and gold. The Bernancubus is the same old drunk driver, slamming on the brakes, then pushing the gas pedal to the floor. Here's the irony so bitter it makes you want to spit: they claim that a central bank stabilizes markets. I will not even touch, as a subject too painful for honest and rational minds to dwell on, how badly the Fed's jimmying interest rates lower destabilizes the entire economy and guarantees future poverty. Highest Dow close for this move took place on 15 March at 13,252.76, and for the S&P500 on 19 March at $1,409.59. Today the Dow added 180.9 (1.23%) to close at 13,241.63 while the S&P500 added 19.4 (1.39%) to 1,416.51. For the S&P500 that was also a marginal new intraday high, but not for the Dow. In other words, rather than first steps on a new rally, this may mark the opposite, a deadly double top. How can we tell? If not a double top, tomorrow stocks will advance, should advance strongly. If they piddle, then drop below 13,000, standing under them will be like standing on a sidewalk watching piano movers hoist up a piano on a pulley. Nothing good will be coming your way. Stupid people are not necessarily evil, but evil people can sometimes look stupid to those who don't know they are evil. Take for instance Bernanke's statements today, and I am not saying Bernanke is personally evil any more than being involved in any fundamentally, irretrievably evil institution makes one evil. I suppose you might work for the Mafia and be a really good person, but it doesn't seem likely. Anyhow, since I presuppose to virtual certainty that central bankers do to markets what they INTEND to do, I suppose the Nice Government Man Mr. B. WANTED to knock the US dollar index down. Dollar dropped like your mother-in-law's opinion of you when you showed up for Thanksgiving dinner sloppy drunk, just about the time NGM Bernanke was stating his statement. Broke that 79.40-79.30 level that had been supporting it and ended up down 35.7 basis points to 78.928 (-.4%). Of course, I'm as enthusiastic about the dollar as I am about cholera, and like the euro almost as much as smallpox. The yen ranks around pneumonic plague. But I digress, because all are so patently vile. The dollar's fall goosed the euro above its 20 DMA but only to the downtrend line. Closed at $1.3356 or up 0.65%, so all y'all planning a trip to France will be paying more (unless you were clever enough to buy GOLD instead of vile paper currencies -- integrity occasionally has its rewards). In Japan the NGM must be worrying that the yen was about to recover after its extended plunge, so despite the dollar's tumble, the yen tumbled, too, down 0.6% to 120.74/Y100 (Y82.82/US$1). No matter, the yen has still pointed its nose skyward. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Wave of Banking Resignations Likely Foreshadows Financial Collapse Posted: 26 Mar 2012 11:40 AM PDT by Brandon Turbeville, The Intel Hub: On March 20th, I wrote an article entitled "Worldwide Banking Resignations Triple According To Revised Numbers: Why Now?" which listed the latest banking, CEO, and financial institution resignations as compiled by independent blog, American Kabuki. At the time of the writing of that article, the list of resignations had reached a total of 358. This was in fact the third article I had written on the subject; the second being a discussion on the statistics provided by American Kabuki regarding the average number of resignations in years past compared to those currently being announced which, if the information is correct, skyrocketed in late 2011. In all three of the articles in which I addressed this topic, I ended the piece by asking the obvious question — "Why?" |

| TBTF Get TBTFer: Top 5 Banks Hold 95.7%, Or $221 Trillion, Of Outstanding Derivatives Posted: 26 Mar 2012 11:36 AM PDT from Zero Hedge:

|

| We Are Moving SWIFT-ly Toward the Demise of the Dollar Posted: 26 Mar 2012 11:29 AM PDT by David Schectman, Miles Franklin:

Under the category of "Extremely Important," I have placed the following TWO releases from Jim Sinclair – front and center in today's Daily. THE DEMISE OF THE DOLLAR – THE LOSS OF "RESERVE CURRENCY" STATUS IS NOW IN MOTION. IF YOU ARE NOT POSITIONED TO CUSHION THE ONRUSHING INFLATION, YOU WILL BE SWEAPT ASIDE! Sinclair has sounded the warning siren on the two events that will define the gold market for the next several years: QE to infinity, as the Fed will continue to execute its purchases of US Treasuries, and misguided use of the SWIFT system in a form of "economic warfare" leading to the US dollar's loss of prominence as the world's Reserve Currency. This will lead to the dollar's demise and it will first test 72.0 on the USDX and then drop below the all-important support level on the way to Hell. The clock is now ticking. The time available to you to switch out of the dollar and into the safety of precious metals is waning. |

| Posted: 26 Mar 2012 11:03 AM PDT A lot of people have been very quizzical lately, asking me things like "What in the hell is wrong with you, you idiot?" (to which I answer "If I knew that, don't you think I'd stop taking these stupid pills, you ugly moron?"), and, of course, the ever-popular question "Are you as stupid as you look and sound?" (Answer "Yes"). Of course, these are only two completely random examples of the many, many questions I get asked on a regular basis. But lately, like I said, more and more people are asking about things that I classify as What To Do (WTD) questions. They plead and cry at me, as I am hunkered down safe inside my bunker, to come out, like I am some kind of idiot or something. Actually, they are idiots in not knowing what "bunker" means! Hahaha! Anyway, I can hear them whining and saying "Please come out and help us!" Soon tiring of hearing me laughing at them and mocking them (e.g. "Morons!"), they try a vain appeal to my vanity (where "vain appeal to my vanity" is some kind of clever literary thing that I can't remember the name of, which I throw in for free to show you an example of the value inherent in each and every Mogambo Guru newsletter). "Wonderful Mogambo Genius (WMG)!" they plead. "Surely an intellect so powerful as yours that can come up with clever literary things like the one in the precious paragraph, a man with powers and abilities obviously far beyond those of mortal men, can help us!" Delighted at the smarmy, servile flattery, I ask, "Do you have gold, silver and oil like I have been advising you to buy for the last 15 years?" Soon I can hear them muttering among themselves, sounding like the bleating, dimwitted sheep that they really are. Finally, they admit that, alas, they have not bought any gold, silver or oil in the whole time. So I say, with a Huge Stinking Glob (HSG) of sarcasm and replete with Overtones Of Scorn (OOS) in my voice, "Then you people are idiots! Hahaha! You're going to die, you idiots, because of your own idiocy! Die! Hahaha!" To which they reply, "We know! That's why we need you to tell us What To Do (WTD), which is another of your brilliant acronyms, this one actually referred to in an earlier paragraph of this, your latest Brilliant Mogambo Prose (BMP)." Sensing a trap, I turned up the Volume Out control of the intercom to a terrifying 11, a rare decibel level invented by the band Spinal Tap. Once adjusted, I screamed so loud into the microphone that my vocal cords still ache. With Occam's Razor-like keenness, I bellowed "The answer is simplicity itself, you morons! Do anything you want! Anything! Do anything you can think of! Unfortunately, whatever you think of will not work, because nothing CAN work, you dumb-ass, lowlife, 'free lunch' losers! "Nothing -- repeat, nothing! -- can make staggering, bankrupting debt painlessly go away, you pea-brained idiots! Not somehow, not anyhow, not any way, not any day, not any time, not no how, which doesn't rhyme, but now suddenly does, and not even with a thousand million tons of magic pixie dust. If it was possible to make debt disappear with nobody losing money, then everyone would have always done it! And we would doing it Right Freaking Now (RFN), you economically-illiterate morons!" Feeling smug and self-satisfied with myself for having provided such a good education on them, I turned off the intercom, intending to update my Double-Secret Mogambo Enemies List (D-SMEL) which, admittedly, has grown to unwieldy proportions over the years as a result of my rampant paranoia, and we are nearing that time when it will be more efficacious to merely list those people who are NOT on the damned enemies list. But how can I NOT add enemies? Like that snotty little grocery bagger at the grocery store who looked at me funny. Oh, you can be sure that HE'S on the list! Why? Because I could tell what he was thinking. "I know you, Big Mogambo Idiot (BMI)" he was thinking to himself. "I hate you!" I instantly used my Powerful Mogambo Powers (PMP) to read his mind to find that he hates me because I am a brilliant and handsome economist who has -- mirabile dictu! -- achieved True Mogambo Enlightenment (TME) that the Austrian Business Cycle Theory is the only true economic theory, and (as a corollary) that the laughably inept economists are neo-Keynesian econometric dunderheads, particularly Princeton neo-Keynesian econometric dunderheads, who should all be rounded up in a big mooing herd and kept in some kind of corral until we build enough dank, fetid, stinking hellhole dungeon cells in which to keep them so that they, as the saying goes, "Don't scare the women-folk or the livestock" with their incredible, unbelievable, idiot-savant smug gullibility and complete lack of independent, critical thinking that would have instantly made them say, as I say, as all Junior Mogambo Rangers (JMRs) say, indeed as all thinking people around the Whole Freaking Globe (WFG) say, "This stupid Keynesian crap of continual government deficit-spending to replace lost consumer spending, financed by the evil Federal Reserve vastly expanding the money supply, is a Big Stinking Load (BSL When he was finished bagging my groceries, I naturally confronted him, accusing him of plotting against me and probably being a closet Keynesian who deserved being dragged into the street and handed over, bound and gagged, to angry mobs. He denied it, of course (the little liar!), and then he suddenly got really nervous for no reason that I could see, so that's how I really knew he was guilty. His treachery is why he is on the enemies list, and, even worse for him, I will not tell him to feverishly buy gold, silver and oil stocks when, like now (in spades!), the money supply is hyper-expanding and the national debt is being increased so terrifyingly much, for so terrifyingly long, to such terrifying levels. Then, without this Crucial Investing Knowledge (CIK), this hateful little snot-faced bag-boy will end up broke, filthy, homeless, and starving in the gutter. That will be my sweet revenge! Hahaha! I shall laugh at him and his suffering! But caution: Instead of celebrating just another bagboy getting what he deserved, heed the essential lesson to make sure that this tragedy won't happen to you: Buy gold, silver and oil today, and buy them Every Freaking Day (EFD) of your miserable life, and only then will you thankfully never hear the mocking and scornful voice of the Mogambo wafting over you, stinging and magnifying the bitter pain of your laying broke, filthy, homeless and starving in the gutter. And probably cold sober, too, making it all worse, whereas buying gold, silver and oil is a happy thing, as in "Whee! This investing stuff is easy!" |

| What Inflation Could Look Like in 2014 Posted: 26 Mar 2012 10:15 AM PDT Synopsis: A sober analysis of historical economic data shows that inflation is poised to skyrocket. Dear Readers, I'm dashing through Amsterdam today, on my way back out into the field to look for more opportunities. Many mining stocks have been soundly thrashed over the last week or two – that's great news for those new to the sector. Anyone thinking they are too late to get on the gold train before it leaves the station should get off the fence and take action. In order to "buy low and sell high" you have to be a contrarian; you have to buy when an underlying trend is clear and going strong, but others are selling – exactly what's happening now. Jeff Clark's article below on the coming inflation is a good reminder of exactly why that trend remains our friend. There are risks, of course – some of our miners are facing possible force majeure in Mali – but that's why there are also enormous gains possible in our field. Succ... |

| Emerging Gold Juniors and Explorers Should Recover in 2012: Jeff Berwick Posted: 26 Mar 2012 10:15 AM PDT The Gold Report: Your newsletter, The Dollar Vigilante, is the closest thing the newsletter industry has to a comic book superhero. Why the name? Jeff Berwick: In 2007 a headline, "Where are the bond vigilantes?" started me thinking that you really cannot have bond vigilantes when the central banks can buy as many bonds as they want. There is no point in being a bond vigilante if you cannot influence governments and central banks by selling bonds. I realized that the only way you could do that was by selling dollars. A dollar vigilante is a free market individual who protests the government monopoly and financial policies, such as fractional reserve banking and unbacked fiat currencies, by selling those same fiat currencies in favor of other assets, including gold and precious metals. We are dollar vigilantes to protect ourselves from what we see is the coming demise of the fiat currency system and the collapse of the socialist, Western nation base as we know it. TGR: Are you real... |

| Posted: 26 Mar 2012 10:11 AM PDT |

| Stealth Bottom Coming in Gold Stocks Posted: 26 Mar 2012 08:45 AM PDT The struggle of the mining stocks has surprised many including us. We thought record profits and a bullish environment would catapult the miners out of a consolidation and into a major breakout. The perception of an enduring recovery and the endurance and persistence of the wall of worry stage has left the gold stocks unloved and under-owned and for far longer than we expected. We do have to remember that the miners exploded in 2009 and 2010 and it is normal for a bull market to spend months in consolidation. |

| Posted: 26 Mar 2012 08:32 AM PDT Dave Gonigam – March 26, 2012

The financial blogosphere erupted after the close on Friday, when Bloomberg got its hands on some internal emails from MF Global. That's the company former Goldman Sachs honcho and New Jersey politico Jon Corzine turned from a stodgy commodities trader… into a go-go derivatives outfit… and finally into the eighth-largest bankruptcy in U.S. history. Five months after its initial filing, MF's customers are still out $1.6 billion. The emails reveal Corzine issued "direct instructions" to tap customer funds to meet an overdraft in a brokerage account MF held with J.P. Morgan Chase. Not only is such a practice "the third rail of the brokerage industry," as we cited at the time… this revelation also um, contradicts Corzine's testimony to Congress. Hence, a torrent of online outrage. We're not holding our breath for a perjury indictment now… any more than we held our breath for an embezzlement indictment when this sorry saga started. Getting mad is easy. Doesn't accomplish much, though. Getting even? That's actually easier, as you'll discover today…

BATS is the third-largest trading platform, after the NYSE and the Nasdaq — specializing in the high-frequency trading (HFT) that's the province of the biggest banks and brokerage firms, running prices up and down in nanoseconds. The exchange went public on Friday. Or it tried to. "Things went sour," says Jonas, "when a glitch in the exchange's own computers caused an issue when the system tried to open the 'BATS' trading symbol." "The BATS glitch," adds our small-cap specialist Greg Guenthner, "triggered a mini flash crash — an event that even caused Apple to halt trading for a few moments." BATS withdrew the IPO and proceeded to refund the botched trades. "In this case," Greg explains, "the exchange error was a safety net for eager investors who bought BATS early Friday. The glitch allowed them to recoup their money. They can walk away clean."

"So far in 2012, 32 companies have gone public. Of the IPOs that have been on the market for more than a week, only six are currently trading lower than their opening day price. Twelve are up at least double digits. In short, it's next to impossible to find any value in these names right now. Buyer beware."

At 1:22 p.m. SLV was forced down by rapid-fire machine-generated quotes — more than 75,000 per second. "Before you start to think that this was merely a bunch of people hitting the sell button all at once," writes Cris Sheridan at Financial Sense, "consider this: They were all launched within the space of 25 milliseconds — 10 times faster than you and I can blink!" Here's a chart of the action, from 1:14 through 1:31 p.m. The volume spike at 1:22:33 is highlighted and enlarged…  And in less than 1/100th of a second, the price slipped from $31.18 to $30.91. "While that may not seem like much," writes Chuck Gibson of the money-management firm Financial Perspectives, "if you were short tens of millions of shares (there were over 200 million shares that traded hands this day) or, in fact, wanted to buy SLV, either way, a drop in price of 27 cents could make you millions of dollars." If you were on the inside, that is. Outrages abound…

It examined 600 markets around the world. "Over the most recent five years of market data analyzed, 18,520 crashes and spikes occurred at a speed far exceeding human origin."

"As it turns out, millions of investors around the world reveal their emotional tolerance for how far a stock can vary before automatically buying or selling at a set price. With access to such highly valuable information and some very fast computers, one could make a killing by simply preying on the emotional levels of human greed and fear revealed by investors tipping their hand to the market." You might feel this is unjust. You might wish, in the words of The Daily Reckoning's Eric Fry, to write a strongly worded letter. You might wish to lodge a complaint with the SEC or the CFTC. But to draw on the example of silver, dozens of smart people have raised holy hell with the CFTC for more than two years now… and have gotten precisely nowhere.

What you do instead is take advantage of the same "emotional levels of human greed and fear" the pros do… and play a completely different market. A market that's not subject to the manipulations of high-frequency trading or outright theft. It's a little-known, but fast-rising market followed by our in-house monitor of market sentiment, Abe Cofnas. As we haven't tired of reminding you for the last month, Abe has been recommending a "mock trade" every Monday… with the outcome always known by Friday. Out of four recommendations, he's delivered four winners. Let's recap them to date…

That brings us to this week's trade.

Examining the market that Abe follows alone among North American newsletter editors, he sees only 13% of traders expecting the yen to move to the 84.25 level. The other 87% believe it will stay below that. "I recommend going with the crowd," Abe recommends.  If this trade works out — remember, he's 4 for 4 so far — this will mean a 26% gain come Friday. You've seen the power of Abe's method in action. Now's your chance to put it to work in your portfolio. It's your opportunity to get even with the pros and the crooks. As long as fear and greed move the market, you can make money. And in four days or less. We opened up Abe's trading service to new readers on March 10. We will close it on March 29. That's this Thursday night at midnight. Move on it before then and you can secure access at half off the regular fee. Full details on this extraordinary offer are at this link.

Major financial media attribute this rise to a speech by Federal Reserve chief Ben Bernanke. "Further significant improvements in the unemployment rate," he said, "will likely require a more-rapid expansion of production and demand from consumers and businesses, a process that can be supported by continued accommodative policies." We're not sure how you read "QE3's just around the corner!" between the lines of that turgid prose… but there you go.

Gold's up nearly 1.5%, to $1,686. Silver's up even stronger, to $32.85.

"In the last 12 months, I've been to South Africa, Colombia, Vietnam, Thailand, Cambodia and now Chile. Buying a car is one of those basic things nearly everyone does when they can afford it." And the number of cars on the world's roads will no doubt keep growing as emerging markets close the gap with the Western world — a theme Chris explores in his new book. The Chinese, for instance, bought 8 million cars in 2007. They'll buy 20 million in 2013. "Generally," says Chris, "investors like to go where the growth is. You have that in the automotive world. Growth of production just based on the platforms in place and current expansion plans should be strong out to 2015 in emerging markets, as the chart below shows."  "The problem with growth," says Chris, "is that you usually have to pay for it." In other words, skip the automakers. Go instead with the auto parts suppliers. "They are all pretty cheap on earnings and cash flow." Chris has a favorite he believes "will be a sweet spot in the global economy over the next several years." Last week during the Rancho Santana Sessions, Chris shared a wide variety of global investing ideas gleaned from his travels. This briefing, limited to 30 Reserve members, also featured experts on moving your assets overseas safely and legally. You can still get your hands on the recordings of these sessions; our technical team is mastering them this week. The MP3 files should be ready for delivery to your email inbox by Friday. And if you order before midnight tomorrow, you secure the best-available price. [Ed. Note: Chris will deliver still more insights about how to invest globally when he's Lauren Lyster's guest on RT's Capital Account tomorrow at 4:30 p.m. EDT. RT America's live stream is here.]

"It makes me really angry," says Oleg Kirichek of Great Britain's Rutherford Appleton Laboratory. "It costs £30,000 a day to operate our neutron beams, but for three days, we had no helium to run our experiments on those beams," he explains. "In other words, we wasted £90,000 because we couldn't get any helium." The shortage, as with many crises, is a failure of government. The United States stockpiled helium for much of the 20th century as a "strategic" asset. After the Cold War, it started to be sold off — haphazardly, plunging the price. "Now the stockpile is used up, prices are rising and we are realizing how stupid we have been," Kirichek says. When we first chronicled the helium shortage in August 2010, professor Robert Richardson from Cornell estimated the market value of a typical helium balloon was $99.36. It's now up to $119.51. "I will not be happy if I cannot have a medical scan in my 70s," says British researcher David Ward, "because we wasted helium on party balloons while I was in my 30s."

"The 'T' people are law-abiding; the 'O' people are not. The 'T' people want less government. The 'O' people want the government to take over all student debt and on and on and on." "I deeply resent," adds another, "your drawing any analogy between the Tea Party and Occupy Wall Street. Hitler loved children; most people love children. So let's draw an analogy between Hitler and most people." "Please don't make such foolish statements in your letters," a third threatens, "or I shall have to unsubscribe." The 5: Maybe a Venn diagram will explain it better. A few have been going around since last fall: This one comes from lawyer and blogger James Sinclair (not the mining investor/gold trader)…  You know what else they have in common? They stand apart from — and in opposition to — the power elite that allows people like Jon Corzine to walk free. Not that it's worth getting mad about. Better to get even. Cheers, Dave Gonigam P.S. Addison is making his way back from Rancho Santana on this day… but not without incident. "Backed into a tree on one occasion," he says via email, "into a ditch on another." Before he can board a flight back home, there will be claims to file and other assorted messiness. But he's read some of the reader mail inspired by the fellow who groused about the "gated community" on Friday. Look for Addison's take tomorrow… P.P.S. "Nearly three-quarters of the world markets are 'frontier markets,'" writes colleague Samantha Buker. "But only a smart hunter knows which are worth the effort to unlock." Doug Clayton is such a hunter. Addison and I first met up with him in Colombia a year ago, when he told us about the stunning opportunities he uncovers investing in places like Cambodia and Haiti. Then he spoke to our Symposium in Vancouver last July. And last week, he delivered a confidential briefing to 30 Reserve members during the Rancho Santana Sessions. He named the 12 frontier markets he likes best… and the 10 factors that go into his selection. You can listen in to his entire session only a few days from now with the MP3 files of the Rancho Santana Sessions. You'll also hear from several other experts… including Bill Bonner's personal estate-planning lawyer, who spelled out essential steps to take before the rules change on Dec. 31, 2012. Only 36 hours remain in which to secure your recordings at the best-available price. |

| Posted: 26 Mar 2012 08:14 AM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

On a day where gold surged generously on the same thesis with which it managed a five-fold increase in the last decade or so – that of paper money debasement – we thought it appropriate to get some context as to the yellow metal's history, current implications, and potential future. In a mere 111 seconds, we are treated to a history of sound money (from Croesus to The Bank of England to The Great Depression), the growing division between some of the world's most-famous

On a day where gold surged generously on the same thesis with which it managed a five-fold increase in the last decade or so – that of paper money debasement – we thought it appropriate to get some context as to the yellow metal's history, current implications, and potential future. In a mere 111 seconds, we are treated to a history of sound money (from Croesus to The Bank of England to The Great Depression), the growing division between some of the world's most-famous

I thought I should address a couple of points that I consider to be misconceptions and that frequently come up in discussions with the audience or other speakers when I present my views on the fundamental problems with fiat money. I am not always in a position to correct these misconceptions right then. They are often woven into questions on other points and I have to leave them uncommented so as not to disrupt the flow of the debate. My book is, I believe, quite clear on these points, so I could simply refer people to Paper Money Collapse. But, for whatever reason, it is still the case that many in my audience make inferences from similar arguments to my own, and I fear that some of the differences between these positions might get overlooked. These differences are not unimportant, and I think it is worthwhile to highlight and clarify them.

I thought I should address a couple of points that I consider to be misconceptions and that frequently come up in discussions with the audience or other speakers when I present my views on the fundamental problems with fiat money. I am not always in a position to correct these misconceptions right then. They are often woven into questions on other points and I have to leave them uncommented so as not to disrupt the flow of the debate. My book is, I believe, quite clear on these points, so I could simply refer people to Paper Money Collapse. But, for whatever reason, it is still the case that many in my audience make inferences from similar arguments to my own, and I fear that some of the differences between these positions might get overlooked. These differences are not unimportant, and I think it is worthwhile to highlight and clarify them.

"Where's the indictment? I want to see handcuffs. Now!"

"Where's the indictment? I want to see handcuffs. Now!" "You just can't make this stuff up," writes our own Jonas Elmerraji of the BATS fiasco on Friday — pointing out another fin becoming visible in the markets' shark-infested waters.

"You just can't make this stuff up," writes our own Jonas Elmerraji of the BATS fiasco on Friday — pointing out another fin becoming visible in the markets' shark-infested waters. "But when it comes to other questionable IPOs floating around on this market's rising tide," Greg cautions, "investors might not be as fortunate."

"But when it comes to other questionable IPOs floating around on this market's rising tide," Greg cautions, "investors might not be as fortunate." Then there's the peculiar action on Friday in SLV, the big silver ETF — as revealed by the real-time data feed company Nanex.

Then there's the peculiar action on Friday in SLV, the big silver ETF — as revealed by the real-time data feed company Nanex. "These sorts of events happen routinely," Mr. Gibson adds. He's been reviewing an academic study called "Financial Black Swans Driven by Ultrafast Machine Ecology."

"These sorts of events happen routinely," Mr. Gibson adds. He's been reviewing an academic study called "Financial Black Swans Driven by Ultrafast Machine Ecology." So what's it to you? "Institutional traders," writes Mr. Gibson, "armed with a view of every open order (and with help from some very smart mathematicians and programmers) have figured out a way to make money off human emotion by triggering sell-stops."

So what's it to you? "Institutional traders," writes Mr. Gibson, "armed with a view of every open order (and with help from some very smart mathematicians and programmers) have figured out a way to make money off human emotion by triggering sell-stops." What chance do you, dear reader, have against these institutional traders backed up by mathematicians, computer programmers and other assorted geeks? Quite a lot, actually… as long as you don't take them on directly.

What chance do you, dear reader, have against these institutional traders backed up by mathematicians, computer programmers and other assorted geeks? Quite a lot, actually… as long as you don't take them on directly. The Japanese yen trades this morning at 82.89 yen to US$1. "The yen's been much weaker recently," says Abe. "It reached levels near 84 and cascaded back down last week." So now it's moving back up, relative to the dollar.

The Japanese yen trades this morning at 82.89 yen to US$1. "The yen's been much weaker recently," says Abe. "It reached levels near 84 and cascaded back down last week." So now it's moving back up, relative to the dollar. U.S. stocks are in rally mode as the week begins. The Dow and the S&P are up nearly 1%. The Nasdaq and the Russell 2000 are up even more.

U.S. stocks are in rally mode as the week begins. The Dow and the S&P are up nearly 1%. The Nasdaq and the Russell 2000 are up even more. If Bernanke's speech is supposed to be goosing stocks, then you could argue it's doing the same for precious metals.

If Bernanke's speech is supposed to be goosing stocks, then you could argue it's doing the same for precious metals. "Wherever I go in my travels, I can't help but notice how many cars are on the road," says Chris Mayer, forever on the lookout for opportunity.

"Wherever I go in my travels, I can't help but notice how many cars are on the road," says Chris Mayer, forever on the lookout for opportunity. The world's least-heralded resource crisis has come to this: Scientists have begun canceling scheduled experiments because of a helium shortage.

The world's least-heralded resource crisis has come to this: Scientists have begun canceling scheduled experiments because of a helium shortage. "How unbelievably wrong you are to compare the Tea Party and the Occupy movement as similar," writes a reader reviving an argument we mistakenly believed we'd settled amicably.

"How unbelievably wrong you are to compare the Tea Party and the Occupy movement as similar," writes a reader reviving an argument we mistakenly believed we'd settled amicably.

No comments:

Post a Comment