saveyourassetsfirst3 |

- Where a Nation’s Gold and Your Gold Should be Held – Part I

- Indian Gold Demand Declining

- Jim Sinclair: “Save Your Money”

- Inflation, Easy Money And The Austrian School Of Economics

- Perseus: A Junior Miner With Momentum

- Deadbeats ‘Bailing Out’ Deadbeats

- Gold: Debt, Deficits, Doom, and Gloom

- It’s All Greek to Us All

- Richard Russell: This could be 2012's "market moving" event

- It's time to watch the U.S. dollar again

- Markets encouraged by new US jobs number

- Morning Outlook from the Trade Desk 02/06/12

- Was Friday’s Price Action in Gold Signaling a Top in the S&P 500?

- Gold Bounces Back as Possible Greek Default Looms

- Junior Gold Producers: The Cycle Turns

- Gold & Silver Market Morning, February 06 2012

- More on the Role of Second Liens and the Mortgage Settlement as Stealth Bank Bailout

- Facebook, Gold, and Cheap-Money Love

- Finding Fundamentals Key to Gold Investing: Byron King

- Trading Comments, 6 February 2012 (posted 09h45 CET):

- VIDEO: "The Secret of Oz Raises" Serious Doubts About a Gold Standard

- Yet Another Make-Or-Break Week For Europe

- Uses And Sources Of Gold – Where Gold Comes ...

- The Supply of Oxen at the Federal Reserve

- How to Find the Best Junior Gold Stocks

- Is gold in a bubble?

- Gold as Money in Utah?

- Bank of England's glittering stash of £156BILLION in gold bars

- Buying Gold in Uncertain Times

- Natural Gas: The Big Transition in Energy

| Where a Nation’s Gold and Your Gold Should be Held – Part I Posted: 06 Feb 2012 05:43 AM PST |

| Posted: 06 Feb 2012 05:39 AM PST by Roman Baudzus, GoldMoney.com:

According to America's Bureau of Labor Statistics, official unemployment figures have dropped to 8.3% – the lowest rate since February 2009. Due to this development, by the end of last week both gold and silver prices came under selling pressure, with traders looking to buy back into equities and more people doubting the likelihood of further QE from Bernanke and the Fed. Nevertheless, critics argue that the official US unemployment rate is only dropping because an increasing number of long-term unemployed are not being factored into these statistics. Read More @ GoldMoney.com |

| Jim Sinclair: “Save Your Money” Posted: 06 Feb 2012 05:36 AM PST In this interview Jim Sinclair speaks with Ellis Martin about the "positive employment outlook" reported by the government and the media and the exuberance associated with it. Where do these numbers come from? Mr. Sinclair also has compelling advice for the listener regarding how to protect oneself from the ultimate endgame related to Quantitative Easing and the decline of the dollar. What is China's direct influence or input in QE 3? Is it in their best interests to prop up the dollar and the US economy? How relevent is the Yuan? ~TVR |

| Inflation, Easy Money And The Austrian School Of Economics Posted: 06 Feb 2012 05:34 AM PST By Shareholders Unite: Here is a thought experiment. What would happen if someone who is an adherent of a rather obscure economic school called Austrian economics would make economic policy or rule the Fed? This is less of a hypothetical question than might seem at first hand. There is, in fact, an Austrian school candidate (Ron Paul) who's got support of quite a number of big names in finance. Austrians would do a couple of things if they would have control over policy making. They would wind down all expansionary monetary policy and bailouts (as it happens, they would ultimately abolish the Fed altogether, but we won't go into that here). They would also reintroduce the gold standard. The timing of these policies matters a great deal, so let's first take the best case scenario, and assume they would introduce these policies when the economy is healthy (that is, not today). What the Complete Story » |

| Perseus: A Junior Miner With Momentum Posted: 06 Feb 2012 05:28 AM PST By Nima Baiati: Quite a few of the junior miners have recently begun or are set to begin actual mining operations. With gold continuing its rise and the goldbugs shouting "I told you so" its easy to get swept up in the excitement. Additionally, there are many who believe the train long ago left the station and that gold is overpriced and has entered a bubble. I am still willing to bet that gold has upside. Further, when looking at companies in the early stages of growth, be it gold miners or widget makers, fundamentals in my view are key. A company that is growing with a healthy balance sheet and is producing and more importantly getting to market something tangible is vital. Perseus Mining Limited (PMNXF.PK) is a junior miner that very recently began actual mining operations. The company currently has two projects in West Africa. The first is the Edikan Gold Complete Story » |

| Deadbeats ‘Bailing Out’ Deadbeats Posted: 06 Feb 2012 03:50 AM PST A few weeks ago I wrote a piece noting that Western regimes had mismanaged their economies to the point of structural insolvency, and were thus now only able to forestall their own debt-defaults by resorting to "cheque-kiting". That is, it has been many decades since most of these nations have actually been paying their bills. Instead, Western economies have been financed by these Western governments simply writing new cheques (with nothing backing them) to cover the old cheques they wrote (which also had nothing backing them). This is cheque-kiting, pure and simple. And the only reason that these sovereign deadbeats haven't (yet) suffered the inevitable fate of all deadbeats – having their credit refused and thus being forced into bankruptcy – is because somehow their propaganda machine has been able to prevent that realization from sinking in with the masses. This apathy and/or lack of comprehension by the citizenry is disturbing (but no longer surprising). However, where we move past "disturbing" and into the realm of the totally absurd is when the media propagandists write about these economies being "bailed out". Once again, to truly illustrate this insanity we need to define our terms. A "bail out" (in the financial context) implies some entity which possesses financial assets bestowing those assets (either via gift or loan) on some entity lacking financial assets. Immediately upon engaging in this simple exercise we can state a definitive conclusion: none of these deadbeat-debtors have been "bailed out". Indeed we can go farther than that: it is not even theoretically possible to bail out any of these deadbeats. Why? Surely the answer speaks for itself: all Western entities are net-debtors – their "national account balance" is less than zero. Surely even the media drones and market "experts" can understand the concept that one deadbeat with no money cannot (financially) bail out another deadbeat with no money? Apparently not. This begs the question: how is it possible that people whose profession it is to understand such concepts are totally incapable of comprehending the simplest possible proposition of logic and arithmetic: you can't "bail out" someone else with nothing? In this case, the answer is crystal-clear. These people, these "experts", are incapable of grasping such elementary premises because they are brainwashing victims. Specifically, they (like virtually our entire populations) have been deluded into thinking that the banker-paper being conjured-up on the bankers' printing presses (at zero cost, and in near-infinite quantities) has value. The truth, of course, is entirely opposite. Even from a purely monetary standpoint we can see this has to be the case. Once the last vestige of our gold standard was assassinated by Richard Nixon in 1971, our money became mere "fiat currency". It became mere paper, with no intrinsic value (unlike actual "money"), and doomed to suffer the fate of all fiat-currencies which came before it: collapsing into worthlessness. However, that element of "worthlessness" on a fundamental level has been replaced by a much more immediate and concrete demonstration of the worthlessness of all this banker-paper: it is being created in (near-)infinite quantities, and at (essentially) zero cost. Any item which is produced in infinite quantities and at zero cost is by definition worthless. If this were not the case, the possessor of this infinite quantity/zero cost good could simply conjure-up as much of that good as was necessary – and then exchange it for all items of (real) value which exist in the entire world. |

| Gold: Debt, Deficits, Doom, and Gloom Posted: 06 Feb 2012 03:15 AM PST by John R Ing, FinancialSense.com:

Start with cash strapped Europe where concerns about the euro crisis have sent investors into dollars instead of gold in a "dash for cash" because dollars provide liquidity at a time when liquidity is at a premium. Although the one month gold lease rate hit 0.2703 percent, European banks were "swapping" their gold in order to raise cash amidst a shortage of dollars, depressing gold prices. Investors seem to have confidence to hold dollar assets for maybe 30 seconds, 30 days but not 30 weeks. Read More @ FinancialSense.com |

| Posted: 06 Feb 2012 01:21 AM PST Gold's worst loss on over one month showed signs of continuing to deepen as markets opened for trading in New York this morning. The uncertainty manifest in the European news flows on Monday kept the selling pressure on in the precious metals and commodities' complex. |

| Richard Russell: This could be 2012's "market moving" event Posted: 06 Feb 2012 12:19 AM PST From Pragmatic Capitalism: Richard Russell senses something momentous building in the markets, and he’s waiting for the right catalyst. He thinks that catalyst will be an eventual nuclear stand-off between Iran and Israel. In his Friday note he said: I've been sensing something BIG and ominous is in the offing. What could it be? Ah, a front page article in Sunday's NY Times supplies the answer. Israel will attack Iran with nuclear bombs. Israel must attack this year for this is the year when Iran will have nuclear capabilities. Actually, the stock market is acting as though something momentous and frightening is 'out there.' The roof of a monster top is building. Gold keeps creeping higher. If Israel attacks the Mid-East will go up in flames. Suggestion – dollars and gold. If the dollar collapses... Read full article... More from Richard Russell: Richard Russell: "PLEASE MOVE INTO GOLD" Richard Russell: 12 tips for surviving the "End of America" The great Richard Russell issues a super-bearish warning |

| It's time to watch the U.S. dollar again Posted: 06 Feb 2012 12:16 AM PST From Gold Scents: ... As you can see by that first chart, a correction is now due. That doesn't mean that it will begin Monday morning or even this week. What it does mean is that it is now too dangerous to continue playing musical chairs with a market that is at great risk of a sharp corrective move. The fact is that ever since the dollar put in its three-year cycle low in May, trading conditions have changed. Trades have had to become much shorter in duration and profits taken much more quickly. Until the dollar's major three-year cycle tops, this trading condition isn't going to change. As you can see in the chart below, we still have no confirmation of a major trend reversal yet. The dollar is still making higher highs and higher lows. It's still holding well above... Read full article... More on the U.S. dollar: Developing pattern could be terrible news for the U.S. dollar The U.S. dollar could be warning of an imminent stock selloff Shocking gold story suggests the "End of America" has begun |

| Markets encouraged by new US jobs number Posted: 06 Feb 2012 12:00 AM PST The gold price declined sharply late on Friday, with a decline in the headline US unemployment rate encouraging traders to sell gold and move back into equities. Despite the fact that it usually ... |

| Morning Outlook from the Trade Desk 02/06/12 Posted: 05 Feb 2012 11:55 PM PST 20 pounds of pulled barbeque pork, 5 pounds of Italian sausage, 2 pounds of coleslaw , a freshly baked chocolate and blueberry cake with cappuccino. Sounds like the making of a great Super Bowl. It was until my team lost. To add insult to injury a very shrewd and perceptive lady from the media team also managed to relieve me of $20. Brady is just too cute to win: really ! Somewhere in IT there is a picture of the final act in defeat but my pride would not let me hit the send button. Congrats to the Giants. On a more somber note, I totally miscalled the direction of the market Friday afternoon. Thinking the sell-off in the metals did not resonate, I took a long position. In the case of silver the market actually traded above my entry point over night and gold got close. The reason, good employment numbers, took the risk of the table and had traders run to the equities. Now remember, the past six months as go equities so go the metals. Too early to tell if the markets have de-coupled, but prosperity is not here. gold sitting at $1,720 support area. Was really expecting a test higher. Call out the monkey. My gut tells me be long but ,,,Maybe time to throw the dart for short term direction. |

| Was Friday’s Price Action in Gold Signaling a Top in the S&P 500? Posted: 05 Feb 2012 11:52 PM PST "You can't feel the heat until you hold your hand over the flame. You have to cross the line just to remember where it lays." ~ Rise Against. "Satellite" Lyrics ~ Friday morning traders and market participants awaited the key January employment report from the U.S. Bureau of Labor Statistics. The reaction to the supposedly wonderful report was a surge in the S&P 500 E-Mini futures contracts as well as several other key equity index futures. The overall tenor among the financial punditry was predictable as wildly bullish predictions permeated the morning session on CNBC and in the financial blogosphere. However, after the report had been out for several hours notable independent voices such as Lee Adler of the Wall Street Examiner came out with information that suggested the numbers were an apparition of manipulated statistics. I am not going to spend a great deal of time discussing the report, but the reaction to the news was decisively bullish on Friday. The question I want to know is whether Friday was a blow off top? In the recent past the S&P 500 has seen several key inflection points and intermediate-term tops form on non-farm payroll monthly announcements. I follow a variety of indicators to help me decipher more accurately when the market is getting overbought or oversold. For nearly two weeks the market has been extremely overbought, but now we are reaching truly astonishing levels. The following charts represent just a few signals that the market is due for a pullback and a top is likely approaching.

Percentage of NYSE Stocks Trading Above Their 50 Period Moving Average The chart above clearly illustrates that as of Friday's closing bell (02/03) over 89% of stocks were trading above their 50 period moving averages. Consequently that reading is one of the highest levels that we have seen in the past 3 years. In addition, over 73% of stocks that trade on the NYSE are currently priced above their longer-term 200 period moving averages. Another extremely overbought signal.

S&P 500 Bullish Percent Index Weekly Chart The S&P 500 Bullish Percent Index is another great tool for measuring the overall position of the S&P 500. It is without question that the longer term time frame is reaching the highest level of overbought conditions in the past 3 years.

McClellan Oscillator Divergence with S&P 500 Price Action The two charts shown above present an interesting situation regarding the divergence in the McClellan Oscillator and the price action in the S&P 500. The most recent example of this type of divergence occurred in October of 2011 and prices immediately reversed to the upside after several months of selling pressure. In fact, this correlation between reversals in the S&P 500 and divergences in the McClellan Oscillator works relatively well historically. Clearly there are bullish voices arguing for the 2011 S&P 500 Index high of 1,370.58 to be taken out to the upside in the near future. Additionally, several market technicians in the blogospere have been pointing to the key resistance range between 1,350 and 1,370 on the S&P 500 as a likely price target. Obviously if those price levels are met strong resistance is likely to present itself. However, as a contrarian trader I have found that the more obvious price levels are the more likely it is that they either will not be tested or they will not offer significant resistance. It is obvious that Chairman Bernanke and the Federal Reserve have embarked on a massive fiat currency printing campaign which has helped buoy risk assets to the upside. Through a combination of reducing interest rates on safety haven investments like Treasury's and CD's, the Federal Reserve has forced conservative investors and those living on a fixed income into riskier assets in search of yield. This process helps elevate stock prices and creates the desired outcome for the Federal Reserve which involves the perception by average individuals that they are wealthier. The Fed calls this the "wealth effect" and they seem poised to insure that U.S. financial markets continue to ride upon a see of cheap money and liquidity. Ultimately the Federal Reserve's most recent announcements have served to help flatten the short end of the yield curve further while providing a launching pad for equities and precious metals. However, issues persisting in Europe could have an adverse impact on the short to intermediate term price action of the U.S. Dollar. Right now everywhere I look I hear market prognosticators commenting on how hated the U.S. Dollar is and how Chairman Bernanke will not allow the Dollar to appreciate markedly in order to protect U.S. exports and financial markets. I think that the Dollar has the potential to rally in the short to intermediate term. Right now the U.S. Dollar Index appears to be trying to form a bottom.

U.S. Dollar Index Daily Chart Obviously there is good reason to believe that the U.S. Dollar Index could reverse to the upside here. Whether it would have the strength to take out recent highs is unclear, but a correction to the upside not only seems unexpected by most market participants, but it seems plausible based on the weekend news coming out of Greece. Monday morning the Greek government is set to determine if they will agree to the demands of the Troika in exchange for the next tranche of bailout funds. If the Greek government and the Troika do not come to an agreement, the Euro could sell-off violently. Additionally there are already concerns about the next LTRO offering from the European Central Bank. The measure is to help provide European banks with additional liquidity, but there are growing concerns that the size and scope of the LTRO could have a dramatic impact on the Euro's valuation against other currencies. Time will tell, but there are certainly catalysts which could help drive the U.S. Dollar higher. Another potential indicator that the Dollar could see higher prices in coming days was the largely unnoticed bearish price action on Friday of precious metals. Both gold and silver have been on a tear higher over the past several weeks. Both precious metals have surged since the Federal Reserve announced that interest rates would remain near zero on the short end of the curve through 2014. However, on Friday gold and silver were both under extreme selling pressure. The move did not get much attention by the financial media. The price action in gold and silver on Friday could be another indication that the U.S. Dollar is set to rally. The daily chart of gold is shown below.

Gold Futures Daily Chart Obviously the reversal on Friday in gold futures was sharp. The move represented nearly a 2% decline for the session on the price of gold. However, as long term readers know I am a gold bull. I just do not see how gold and silver do not rally in the intermediate to longer term based on the insane levels of fiat currency printing going on at all of the major central banks around the world. The macro case for gold is very strong, but the short term time frame could reveal a brief pullback. At this point, I suspect a pullback will present a good buying opportunity for those that are patient. However, I think it is critical to point out that this move in gold on Friday could be a signal that the U.S. Dollar is going to find some short to intermediate term strength. If the Dollar does start to push higher, it will likely put downward pressure on risk assets like equities and oil While Friday's price action may not mark a top, nearly every indicator that I follow is screaming that stocks are overbought across all time frames. Pair that with the Greece uncertainty and LTRO considerations and suddenly the Dollar starts to look a bit more attractive. Ultimately I am not going to try to pick a top, but the evidence suggests that it might not be too many days/weeks away. By: Chris Vermeulen – Free Weekly ETF Reports & Analysis: www.GoldAndOilGuy.com This material should not be considered investment advice. J.W. Jones is not a registered investment advisor. Under no circumstances should any content from this article or the OptionsTradingSignals.com website be used or interpreted as a recommendation to buy or sell any type of security or commodity contract. This material is not a solicitation for a trading approach to financial markets. Any investment decisions must in all cases be made by the reader or by his or her registered investment advisor. This information is for educational purposes only. |

| Gold Bounces Back as Possible Greek Default Looms Posted: 05 Feb 2012 11:40 PM PST Spot gold bounced back in Asian trading Monday as investors snatched up bargains after a 2% dip the previous session. The Greek debt debacle is still supporting the price as a deal remains elusive. |

| Junior Gold Producers: The Cycle Turns Posted: 05 Feb 2012 10:07 PM PST It only took eleven years, but in 2011 global gold-mine production has finally returned to pre-bull levels. With 2011's volume expected to come in at around 88 million ounces, we'll see a new all-time production high. |

| Gold & Silver Market Morning, February 06 2012 Posted: 05 Feb 2012 09:00 PM PST |

| More on the Role of Second Liens and the Mortgage Settlement as Stealth Bank Bailout Posted: 05 Feb 2012 08:26 PM PST Readers who missed the post over the weekend entitled, "Schneiderman MERS Suit and HUD's Donovan Remarks Confirm That Mortgage "Settlement" is a Stealth Bank Bailout," since it provides important background and context for this piece, which clarifies some issues I skipped over. To give a brief recap of the post: both a small group discussion with Shaun Donovan (reported by Dave Dayen of Firedoglake and separately by Shahien Nasirpour of the Financial Times) and the Schneiderman MERS lawsuit on Friday confirm our previously-stated hypothesis that the settlement is really a transfer from mortgage investors to banks. That is why the banks remain willing to participate as the release has been whittled down to appease the formerly dissenting attorneys general (remember, the old reason for the banks to go along was that it was a cash for release deal: the banks were willing to pay hard money to get a significant waiver of liability). The reason this settlement amounts to a transfer is the banks will be given credit towards the total reported value of the settlement for modifying mortgages that they do not own, meaning that economic loss will be borne by investors. Servicers have an obvious incentive to shift losses onto other parties whenever possible, and so the only principal mods they are likely to do of loans they own are one they would have done anyhow. In addition, default rates are higher among borrowers with second liens, and second liens are almost entirely held on bank balance sheets. Which banks? Oh, the ones that happen to be the four biggest servicers: Bank of America, Citigroup, JP Morgan, and Wells. And those second lien holdings are collectively in the hundreds of billions. Were they written down to the degree that some mortgage investors argue is warranted, it would reveal that these banks were seriously undercapitalized. As we stressed, this plan is a serious violation of property rights (not that that should be any surprise at this point). The creditor hierarchy is clear: second liens should be written off in their entirety before first liens are touched. Yet we also linked to evidence in the post from top mortgage analyst Laurie Goodman that servicers were already doing everything they could to favor their second liens over firsts. This settlement would give official sanction to this practice. I also want to flag, a second time, an appalling throwaway comment in a New York Times update tonight:

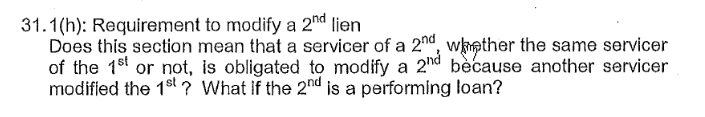

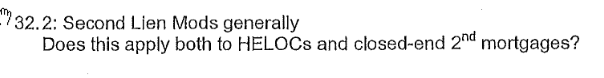

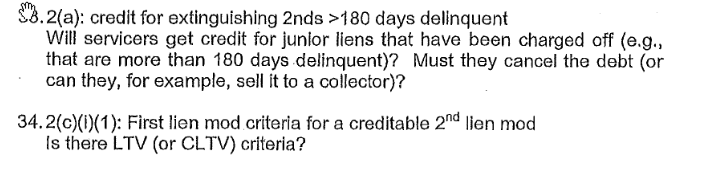

Huh? The banks have an explicit obligation to service the loans for the benefit of the certificate holders, meaning the investors. There is NO economic rationale, none, for reducing interest charges to borrowers who are current (unless they are under financial duress and at risk of delinquency/default). This is a bribe to prevent complaints by borrowers who pay on time and are in "beggar thy neighbor" mode. I did want to clarify a possible misimpression I suspect I created in my Sunday post. By inveighing against a transfer from first lienholders (investors in mortgage bonds not owned by banks) I may have left reader thinking the Powers That Be will not touch second liens at all in the agreement. That isn't true. We highlighted in an earlier post on Nevada attorney general Catherine Cortez Masto's letter which raised questions about the pact that there were some provisions about second liens. I didn't discuss them in detail because it is a bit of a Plato's cave exercise. But as we indicated, anything short of wiping out the seconds before the firsts is simply not defensible (the second liens, which are overwhelmingly home equity lines of credit, got higher interest rates precisely because they were higher risk). And from what we can infer, the provisions in the agreement, at least at the time of the Masto letter, are smokescreens to cover the goring of investor oxen. Let's look at the questions Masto asked related to second liens: This suggests that there is a requirement to modify (note modify rather than extinguish) a second lien when a first is modified. Given the desire to assist banks while trying to maintain a fiction of "fairness," I'd expect this provision to set forth some sort of parallel treatment, for instance, that a 10% principal mod on a first mortgage must be accompanied by a 10% reduction on a second. Since the dollar amounts involved in first mortgages considerably exceed those in seconds, the first lienholder would still take the bigger writedown in dollar terms, and the second lienholder will benefit by the borrower having greater ability to pay. I'd assume the answer to be "yes" unless the provisions regarding second liens meant to be a joke. Virtually all of the bank-owned second liens are home equity lines of credit. I can't infer the implications of 34.2, so if you have any good guesses, please pipe up in comments. On 33.2, the point in the settlement, of writing off second liens more than 180 days delinquent, is largely meaningless. As we indicated, banks keep insisting that their seconds are current, and that's because they can make them so. First, as we have recounted, these liens actually have a lot in common with credit cards, in that banks will allow stressed borrowers to pay only the interest due and amortize the loan. We've even been told banks will reduced the payment on a loan about to go delinquent, take a token payment, and deem the loan to be current. Banks can also increase the home equity credit line, which means borrowers can simply borrow more to make their payments. The result is that the banks report a much larger portion of their second liens are current than would actually be categorized as current if they were required to define current on a fully amortized basis. Moreover, they are not required to write down these loans, which are mostly held in their "held to maturity" books even when the first lien is defaulted or in a significant negative equity condition (remember, unless there is equity in the house, an uncured default on the first means foreclosure, which means the second is wiped out. One of the reasons bank foreclosure timelines have become so attenuated is to avoid taking losses on seconds). Not surprisingly, the supine OCC contends there is nothing it can should do, to force the banks to behave otherwise. Before you say, "Gee, is all this so unreasonable?" let's contrast this conduct with how regulators treated small bank commercial second liens recently. Bank expert Josh Rosner tells us that during the height of the crisis, certain primary prudential regulators forced the other regulators to make sure that the community banks with large commercial exposures had to have those loans reappraised and written down those exposures to fair value. This took place even when the loans were held in the held to maturity books of the banks. Keep in mind that the accounting rules were that loans in these books did not have to be revalued unless there was a credit event (such as a delinquency). Even then, they would normally be required to test the loans to see if the impairment was temporary or whether a writedown was warranted. Yet even in cases when these loans were paying on a fully amortized basis, the regulators forced these small banks to write them down. A final point: some readers questioned my comment that the current version amounted to a transfer from retirement accounts to banks. That was overly broad, but more refinement (I hope to get to when I can get my hands on market share and expected loss data) does not make the picture much prettier. I focused on private label securities, since they have and still continue to experience a much level of defaults than prime (Fannie and Freddie) mortgages. The latest data I have seen (which was a while ago) was 40% expected defaults, which would produce losses of 30% (as in you'd get 25% recovery form the foreclosure). The 75% loss on foreclosure is a valid number historically, but I expect loss severities to rise to much closer to 100%, between servicer delays, greater scrutiny by some judges in judicial foreclosure states, and more borrowers fighting foreclosures. While not all deals were total turkeys, on most deals, the lower tranches are already wiped out, and the top 3 AAA tranches are also gone due to refis. So what is left are the fourth and 5th once-rated AAA tranches and some of the lower tranches. While foreclosures distribute losses to the lowest-credit-rated borrowers first, mods are distributed pro rata across all tranches, and with the bulk of the value of the deal originally and still in what were originally AAA tranches, they will take a hit. Mind you, most investors are not opposed to mods IF any second liens were wiped out first; they are still better off taking a 25% to 50% hit than a 80% loss. So the investors that will be most affected are AAA investors, if nothing else because originally and now they represented the bulk of the value of the securitization. I'm not certain precisely who were the targets for AAA RMBS, but in general, AAA bond buyers are pension funds (particularly defined benefit funds, but bond funds that marketed themselves as "AAA" or high credit quality would also be targets, and those are often an option in 401 (k) plans, either offered directly as an investment option or bundled into a "balanced" fund) as well as insurers, who for regulatory reasons also tend to hold some of their portfolios in AAA rated assets. The appeal of private label MBS was investors got a better yield than for corporate or government bonds, supposedly in return for bearing some prepayment risk (no one thought they were eating credit risk too). But….I managed to miss the biggest investors in the former AAA private label MBS: Fannie and Freddie, which hold large exposures to private label securities. So it is both taxpayers and investors that will pay for this stealth bailout. So even with this hopefully helpful clarification, the overall picture remains the same: the deal as now constituted is a victory for the banks, shamelessly marketed as a win for repeatedly victimized ordinary citizens. - the OCC has taken the position that there is nothing they can do, or should do, to force the banks to behave otherwise. |

| Facebook, Gold, and Cheap-Money Love Posted: 05 Feb 2012 06:24 PM PST Gold and silver have both risen on a tsunami of cheap money. When the flood next retreats, both metals will likely be left well below their high-water mark, too. But that could look nothing next to the destruction around them. |

| Finding Fundamentals Key to Gold Investing: Byron King Posted: 05 Feb 2012 06:00 PM PST |

| Trading Comments, 6 February 2012 (posted 09h45 CET): Posted: 05 Feb 2012 05:45 PM PST I am not sure the retracement that began on Friday is over yet. So there may be more backing-and-filling. But I expect the metals will end the week on strength. Gold 1) Long one |

| VIDEO: "The Secret of Oz Raises" Serious Doubts About a Gold Standard Posted: 05 Feb 2012 05:30 PM PST The Prudent Investor |

| Yet Another Make-Or-Break Week For Europe Posted: 05 Feb 2012 05:05 PM PST Dollar Collapse |

| Uses And Sources Of Gold – Where Gold Comes ... Posted: 05 Feb 2012 05:00 PM PST |

| The Supply of Oxen at the Federal Reserve Posted: 05 Feb 2012 04:00 PM PST Gold University |

| How to Find the Best Junior Gold Stocks Posted: 05 Feb 2012 02:30 PM PST Speculating and investing in this sector is difficult. It is a far more difficult industry than others and that is why companies continue to struggle and fail even with the luxury of high metals prices. We've written extensively about the recent major bottom in the precious metals sector and the very positive outlook for the equities in 2012 and likely 2013. One can make money if they buy and hold a mutual fund or ETF but they can generate far superior performance with a basket of the right companies. The following explains what we look for in order to uncover the juniors that will deliver outstanding returns. Capital Structure Capital structure refers to share structure, market cap and the financial position of the company. First, we want to see a share structure that is low in shares outstanding but also low in its fully diluted count. This means there aren't tons of options and warrants that can weigh down the stock after it begins a good run. The overall share structure can also be used to grade management. Remember, most of these companies do not make money and there way to raise money is to sell more shares. Compare the achievements of the company with its current share structure. Has the company been productive or has it been ineffective and carries a bloated share structure? Second and most important, the more cash a company has the better. In looking at non-producers, it is obvious that the companies with significant capital have an advantage over those who have less than $2-3 Million in the bank and may have to finance within the year. For producers, we want to see enough cash flow and capital in the bank that the company can grow its production with minimal dilution. Projects In analyzing explorers and developers, we want to find the companies with projects that are likely to become a mine and are likely to be coveted by a large or major company. Consider the location. Is it in a friendly mining jurisdiction like Mexico, Nevada or Quebec? Is the location near an operation of a larger producer or major company? If the answer to both is yes than it is far more likely to become a mine. Also, we want to see projects that not only can be mined but mined profitably. How did the market respond to a preliminary economic assessment? Would the project payback cap-ex in a few years or five? A past producing property is another good sign. Let me provide an example. We added Trade Winds Ventures to our model portfolio last summer. The stock experienced a deep pullback but had stabilized for a few months. Trade Winds had a deposit literally right next to Detour Gold's multi-million ounce deposit at Detour Lake. It was a no brainer. This wasn't a grand slam but it was a very nice return in about five months. The key, which is our next point, is we bought it when it was cheap and not while it was zooming higher in 2010. Buy Takeover Candidates on the Cheap This is especially true of the explorers and developers. You are an investor and so are potential acquirers. You both want something that has growth potential at a reasonable price. Like a major company, you will not chase something that has already moved and has little upside from its present market value. Thus, buy these targets cheap. The market is coming out of a major bottom so there should be plenty of candidates. On the first day of the year we added a US-listed development company that we thought was cheap. Technically, it had very little downside. It's up 25% since then. Had we bought it 12 months ago we'd be down 25%. Favor Junior Producers with Development Projects Juniors who make it to production will do well but it it those juniors that can go from zero or one mine to three or four that will be the biggest winners. We prefer producers but we are looking for those that are likely to have multiple operations. Producers that have strong development projects in the pipeline have advantages over pure development companies and those producers lacking the assets to grow production. For example, our favorite gold stock for the past two years and largest position in the model portfolio is set to put its second mine in production in the coming months and then its third mine into production by the end of 2013. Find Management Teams with a Track Record This is especially important if the company wants to be a producer. Mining is an extremely difficult business and therefore your odds of success will be much higher with those who have done it before. Two of our biggest winners, Gold Resource Corp and First Majestic Silver, were led by people who had a great track record. At the same time, the absolute biggest names will command a premium in the market, so be judicious. Management is always important but in building and operating a mine, it is paramount. Technical Catalyst Again, for the more speculative non-producing juniors, one should always buy on the cheap or at least buy something that hasn't made a new high in a year or two. When the market turns favorable, juniors can rebound quickly as we've seen. For small producers and development plays we look for a technical catalyst. If the stock is near very strong support then we know the downside is limited and the risk to reward is favorable. If the stock is close to breakout out of a multi-year base then we know it has room to move significantly higher sooner rather than later. In recent commentaries we've told you why you should be buying. This time we tell you what to buy, without actually giving names. Hopefully you can extract a few nuggets from this piece that will serve as a springboard for your research. We are excited because this bull market is going to quietly ramp higher over the next several years. The present is probably your last chance for at least a year or so to buy many companies on the cheap. You can go at it alone or you can consult a professional. If you'd like help in stock selection and navigating this bull market then we invite you to learn more about our premium service. Good Luck! Jordan Roy-Byrne, CMT |

| Posted: 05 Feb 2012 01:41 PM PST Goldmoney |

| Posted: 05 Feb 2012 01:30 PM PST |

| Bank of England's glittering stash of £156BILLION in gold bars Posted: 05 Feb 2012 01:07 PM PST We've still got a few quid then! Bank of England's glittering stash of £156BILLION in gold bars stored in former canteen under London By Emma Reynolds Last updated at 8:55 AM on 3rd February 2012 Despite the financial crisis, it seems the country still has some money left in the Bank of England's vault beneath London. In fact, there are stacks of gold bars worth a whopping £156billion stored in an old canteen deep below the streets of the capital.  Treasure trove: The Bank of England's vault under central London contains 4,600 tons of the precious metal, worth an incredible £156billion Treasure trove: The Bank of England's vault under central London contains 4,600 tons of the precious metal, worth an incredible £156billion Rich pickings: The rows of simple shelves are stacked high with 28lb 24-carat gold bars Rich pickings: The rows of simple shelves are stacked high with 28lb 24-carat gold barsIt seems Gordon Brown did not manage to completely strip the country of its assets when he sold off 400 tons of gold at rock-bottom price during his time as Chancellor. The gold he got rid of when prices were at a 20-year low cost the country up to £11bn, it was estimated last April. More... He made just £2.3billion on the precious metal he sold between 1999 and 2002. So the 4,600 tons of the precious metal still stored in these concrete-lined vaults in the heart of London will be a welcome sight for those worried we have little left to fall back on. The piles of 28lb 24-carat gold bars are stacked on simple blue shelves beneath strip lighting. One image alone shows around 15,000 bars or 210 tonnes of pure gold, with a value of approximately £3billion.  Worth a fortune: In this image alone there are around around 15,000 bars and 210 tonnes of pure gold, with a value of about £3billion Worth a fortune: In this image alone there are around around 15,000 bars and 210 tonnes of pure gold, with a value of about £3billionOn the walls of one of the vaults, posters from the 1940s are still visible, from when the vast room was used as a canteen. The walls must be literally bombproof as they were used by bank staff as air raid shelters during World War II. The old-fashioned posters that hang around the room depict sunny climes, luxury cruises and happier times - which may be as welcome a sight as the valuables for many. Three-foot long keys are needed to unlock to the doors that guard the rooms holding the gold - but sadly not all of it belongs to us. Some is deposited by foreign governments as well as our own. Different shapes and marks distinguish the varying sources of the wealth. Read more: http://www.dailymail.co.uk/news/arti...#ixzz1lZEzpHux |

| Buying Gold in Uncertain Times Posted: 05 Feb 2012 01:01 PM PST Dow down slightly. Oil falling further below $100. And gold still going up. What is most interesting is the movement in the price of gold. It seems to be heading up again — almost no matter what else is happening. So, let's look at what might be going on… If investors sensed a recovery…they would expect banks to lend more freely…people to shop more freely…and prices to rise. This would raise consumer prices; the price of gold should go up. But if the market sees growth and inflation ahead, why is oil slipping? And why is the Baltic Dry Index — which measures shipping prices — at a 25-year low? And how come last month's employment figures were disappointing? And why aren't stock market prices going up? Most important, if the economy is really recovering, why is the 10-year note yielding only 1.82%? And what about the long bond? Shouldn't it be trading at a yield higher than 3%? And how come house prices fell over the last year…and the last month? And how come incomes are falling? Or, to look at it from the opposite point of view, how is it possible for a real recovery to take root in the hard, barren soil of falling house prices and slipping consumer earnings? But if the economy is not improving…then there should be no increase in inflation…and no pressure on the price of gold, right? Maybe investors don't anticipate a recovery at all. Maybe they're buying gold because they see the economy getting worse, not better. We associate a rise in the price of gold with inflation. But gold is much more versatile than we think. It protects your wealth when paper money loses its value. It also protects your wealth when paper money gains in value. It protects you when you are right…and when you are wrong. How so? During the Great Depression, for example, the price of gold rose…against dollars…even though the prices of food, clothing and other consumer items…as well as the prices of investment assets…were falling in dollar terms. Why? Because money gains value — relative to things — in a depression. Gold is money. It is the best money. It is the only money that has stood the test of time. Besides, there is more going on. In a financial crisis…or a depression…investors begin to doubt that their counterparties will make good. Banks fail. Investors go broke. You own a mortgage, and then you discover that the homeowner has left town…and the house has lost half its value. You own a note, and then you discover than the payer is bankrupt; your note is worthless. You own shares in a company; and then the company goes out of business. When you are in a de-leveraging phase, you discover that many of the assets of the previous credit bubble are not assets at all. And while you're waiting to find out, the best thing to have in your safe is gold. As uncertainty rises; so does the price of gold. The price of gold also rises when the return on other assets declines. At 1.82%, the real return on a 10-year T-note is negative. Consumer prices are rising faster. So, the reward for lending to the government is less than zero. Normally, holding gold costs you money. You give up the return you could get from 'risk free' investments (Treasury debt). Now, you give up the risk from reward-free investments. Gold goes nowhere. It produces no yield. It pays no dividends. It makes no profits. You can't live in it. You can't drive it. You can't hang it on your wall and admire it. But when the return on Treasury debt is negative, what do you give up by owning gold? You give up a loss! You also give up the risk of a much bigger loss. The Fed is bound and determined to bring up the inflation rate. Ben Bernanke has suggested that he might set the inflation target higher than 2%. He has announced that he will keep the Fed's key lending rate near zero for the next 3 years. He has hinted that he is ready to print more money — QEIII — if conditions warrant. Holding gold protects you from Bernanke's success. For if he succeeds in raising the rate of inflation, gold will surely soar. And there is substantial risk — bordering on certainty — that he will be no better at creating moderately more inflation than he has been at creating moderately more GDP growth. It is quite possible that he will overshoot. Normally, inflation is a feature of the banking system. The system takes the Fed's monetary grubstake and parleys it into the nation's money supply. Banks magnify the money supply by lending…and thereby create more demand, which raises prices. They do this by making loans…to people who then spend the money. This sort of inflation is controllable, by raising interest rates and tightening banking credit rules. But there's another form of inflation. The kind that starts with an "h." Hyperinflation happens when the banking system breaks down. People lose faith in the money itself…and the people who control it. Foreign dollar holders may worry that the Fed is printing too much money. It may even be good economic news that causes them distress; they may anticipate higher inflation rates, and a sell-off of the dollar, which would lower the value of their dollar reserves. They may figure that they are better off diversifying into yuan…or gold. Then, when other investors and householders see the dollar falling…they get panicky too. Pretty soon, people are digging around in drawers, bank accounts and mattresses…looking for dollars — just so they can get rid of them. That is when dollars hit the hyperinflationary fan. Our old friend Michael Checkan tells what it was like in Argentina in the late '80s: "Imagine a $2.00 gallon of milk spiking to $775.40 within a year — like in Argentina, 1988."

Regards, Bill Bonner for The Daily Reckoning Australia Similar Posts: |

| Natural Gas: The Big Transition in Energy Posted: 05 Feb 2012 01:01 PM PST [A quick note before today's DR begins. Our e-mail address has changed! All replies, questions, objections, threats, plaudits, and observations can now be sent to letters@dailyreckoning.com.au . If you used the old address last week, chances are your letter didn't get to us. Please send any correspondence to the new address. Thanks!] --Welcome to acronym city (AC). Today's Daily Reckoning (DR) is all about initial public offerings (IPOs), mergers and acquisitions (M&As), and what they tell you about the market. We'll also look at why energy is becoming a flash point in Europe and how natural gas is taking centre stage. First, though, we'd like to announce a changing of the guard in the leadership of the resources market. --Please, if you see them on the street today, thank iron ore and coal for all the hard work they've done over the last 10 years making Australia more prosperous. They've employed tens of thousands of Australians and made shareholders of BHP Billiton and Rio Tinto very happy, not to mention Gina Rinehart, Andrew Forrest, Clive Palmer, and Nathan Tinkler. A job well done, steel-making ingredients! --But weep not for the base metals, iron ore, and thermal coal. As Ecclesiastes tells us, there is a time for everything, including a time to mourn and a time to dance. If we mourn the passing of metals leadership in the commodity complex, we dance with joy for the emergence of energy. --Hold on just a minute! Is it too soon to announce the death of metals? Are we presuming too much when we say that Chinese metals consumption is peaking? Is it too bold to say that Australia's resource bull market is on the edge of its first major change in almost 10 years? --Well, we'll find out this week what half-year earnings are for Rio Tinto and BHP Billiton. But earnings are backward looking. The most important story in the commodity markets last week was the proposed merger between two Swiss-based companies, Glencore and Xstrata. --The all-stock merger between one of the world's largest miners and one of the world's largest commodity traders would create an $89 billion company. That's still smaller than BHP Billiton, in terms of market cap. But the combined company would suddenly become the world's largest thermal coal exporter, the world's largest zinc producer, and the world's third-largest copper miner, according to Reuters. --Investors need to watch mergers like this for a sign that organic growth in a business has peaked. Desperate CEOs can try and increase earnings by acquisition or by creating new "economies of scale". There probably ARE certain efficiencies to be gained by big companies getting even bigger. But another way to view a big merger is that CEOs have resorted to theatrics because there is no other easy way to squeeze more profit out of the business. --Mergers between mega-equals can also be as much about grandiosity as they are about increasing marginal profits. There is something irresistible about creating super corporations, like two galaxies drawn together by their own immense gravity. Human beings are fascinated by mega-sized things. The Pyramids, the Titanic, the AOL-Time Warner merger. --But bigness itself is probably a liability in the global economy/ecosystem (unless you're an Apex Predator like the State, or own a State-granted monopoly on a business...like Telstra). Making things bigger doesn't always make them better, especially in business. Often, it just makes them more complicated, hard to run, and impossible to understand. --Glencore's deal with Xstrata may not even go through. Both companies need the approval of regulators in Japan, South Korea, Canada, Australia, and Brazil. And you can be sure commodity consumers are not going to be happy about the consolidation of pricing power in a super producer. But either way, the mere idea of the merger looks to us like a consolidation at the top end of the food chain in the commodity complex. Change is afoot. --The biggest change, by our reckoning, is that China's most metals-intensive phase of economic development is behind us, not ahead of us. That changes Australia's relationship with China from one based on the iron ore of the Pilbara to one based on uranium and natural gas. --For example, the China Guangdong Nuclear Power Corporation (CGNPC) is about to make a $2.2 billion dollar bid for Perth-based Extract Resources. Extract is developing the fourth-largest uranium-only deposit in the world in Namibia. The State-owned Chinese company is close to sealing the deal on Extract because it announced on Friday that it had secured 89.5% of Kalahari Minerals. Kalahari owns 43% of Extract, making it just a hop, skip, and a jump to 50% control. --There are two important points here. First, China's State-owned companies are busy going out into the world to secure real resources for the 21st century. This is a better investment for them than buying Greek or American bonds. Second, Africa is home to some of the most promising uranium projects in the world. It's also become a hot-bed for off-shore oil and gas development (both off the west coast in Angola and the east coast in Kenya and Tanzania). --Diggers and Drillers editor Alex Cowie has two African-based uranium plays. Uranium has rallied hard since late last year, proving that the best resource investors are contrarians who buy what everyone else hates. Kris Sayce first tipped us off to the East African off-shore gas industry with one of his recent recommendations in Australian Small-Cap Investigator. --Of course there are going to be some readers who hate the idea of investing in new oil and gas ventures. But the reality is that energy is a scarce and strategically valuable resource. That makes it a compelling investment theme. --For example, a blast has hit a vital gas pipeline connecting Egypt, Israel, and Jordan. As if the Middle East wasn't combustible enough right now, this points out how unstable the region has become. That's not a good thing when it's still the home of the world's largest proven oil reserves. This instability is accelerating the search for oil and gas from other places. --And don't forget Russia. There's plenty of gas there. But Vladimir Putin is not always willing to sell it. State-owned gas giant Gazprom admitted it cut Russia's gas supply to Europe by 10% over the weekend. It was an especially bad time because Europe is literally freezing right now (climate change). --Was Russia exercising energy leverage over Europe? Russia's main naval access to the Mediterranean is through ports in Syria. Over the weekend, the United Nations tried to slap tougher sanctions on Syria. Russia and China slapped those sanctions down. And then Russia turned off the gas to Europe. --Europe gets 25% of its gas from Russia. Russia has the largest proven reserves of conventional natural gas in the world. Its pipelines to Europe are more like life lines. It's no wonder the EU has pressured the US Congress to exempt a gas pipeline from the Caspian Sea from being shut down by sanctions on Iran. --Yes. It's getting pretty interesting in the world's energy markets. We sense that we're on the verge of a big transition from one era to another. Not everyone is happy with that. For example, this Washington Post article reports what we've been saying since last summer: shale gas is a disruptive technology that changes the game in global energy markets. --You might wonder why lower petrol prices, lower power bills, and cheaper energy for industry is a problem. Well, it's a problem because no other energy source competes with that. Cheap gas makes coal-fired electric power expensive. It also renders renewables like solar and wind non-competitive. --The non-competitiveness of solar and wind with cheap gas greatly displeases the carbon-tax pushers of the world. They would like to put all hydro-carbons out of business in order to gain more power and control over energy (and over you). To be fair, they believe they are doing this for your own good, in order to save the planet. More on saving the planet through higher prices tomorrow. Regards, Dan Denning for The Daily Reckoning Australia Similar Posts: |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Following improvements in US unemployment data, both gold and silver prices faced sales pressure. Should the US labour market continue to show signs of recovery, this may reduce the likelihood of the Federal Reserve engaging in more quantitative easing.

Following improvements in US unemployment data, both gold and silver prices faced sales pressure. Should the US labour market continue to show signs of recovery, this may reduce the likelihood of the Federal Reserve engaging in more quantitative easing. Last month gold plunged more than $200 in less than a week and the dollar soared, trumping even gold. The move caused a catfight among letter writers with investors and central bankers questioning gold's safe haven status. By contrast, the US Treasury sold more debt despite growing concern about the US economy and politically dysfunctional Washington. In the seventies, gold corrected more than 50 percent, dropping $100 before heading higher. In the eighties, gold pulled back $100 after reaching $510 per ounce before reaching new highs. So, why the disconnect?

Last month gold plunged more than $200 in less than a week and the dollar soared, trumping even gold. The move caused a catfight among letter writers with investors and central bankers questioning gold's safe haven status. By contrast, the US Treasury sold more debt despite growing concern about the US economy and politically dysfunctional Washington. In the seventies, gold corrected more than 50 percent, dropping $100 before heading higher. In the eighties, gold pulled back $100 after reaching $510 per ounce before reaching new highs. So, why the disconnect?

No comments:

Post a Comment