saveyourassetsfirst3 |

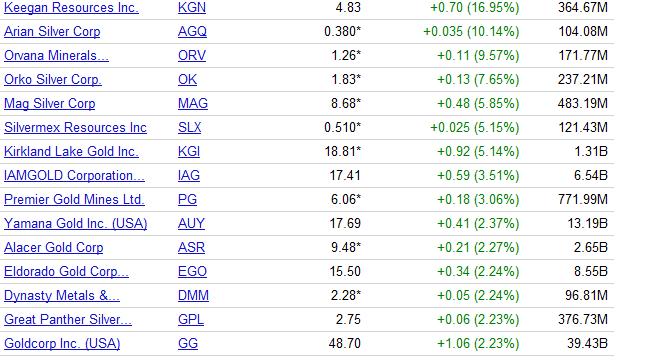

- 5 Surging Stocks Considerations For Your Portfolio

- Silver: $50 Here We Come

- LISTEN: Interview with Dudley Baker

- Northern Tiger Waking Up?

- Backup Post

- Research: US Mint Gold Coin Sales for January - Signal Return to Fundamental Driven Demand?

- CNN: States consider alternative currencies of gold and silver

- Morning Outlook from the Trade Desk 02/03/12

- Top analyst Rosenberg: This could be the best way to profit from gold now

- Silver Forecast Video: The Shift To Measuring Wealth In Ounces Instead Of Dollars

- Gold Coins: A Return to Fundamentals-Driven Demand?

- In Case You Missed It

- Whats a Companys Gold Worth?

- Gold "Volatile" But "Inflationary Distortions" Add to Appeal

- Fed Stimulus and BDI crash and USD and Gold

- Gold Will Rise Against 'Heavily Debased' Currencies

- Sinclair interviewed on currency market rigging and gold's monetary role

- Why Are the Chinese Buying Record Quantities of Gold?

- Destroy markets and you destroy economies, Arnott tells King World News

- More indications that official gold data is no good

- Gold & Dollar on the Move to start a Groove

- Gold & Silver Market Morning, February 03 2012

- Peter Grandich talks with Tekoa DaSilva

- Gold Juniors Poised to Rebound: Joe Mazumdar

- Secular Trends

- NFTRH172 Excerpt Gold Stocks

- Lost Dutchman’s Gold Mine

- Today’s Winners and Losers

- Can the US return to a Gold Standard ? (Alan Greenspan 1981)

- Investment Alternatives in a No Growth Economy

| 5 Surging Stocks Considerations For Your Portfolio Posted: 03 Feb 2012 03:58 AM PST By Cameron Kaine: In part one of this article, we discussed some 5 stocks that are in the news that might be impacted by the economic news of the day. In part two, we are going to discuss of few more. But as in the previous piece, we led with the following: Federal Reserve Chairman Ben Bernanke certainly has a lot of support when it comes to his economic policies. Considering where that the economy was on the brink of collapse a couple of years ago, the fact that the market is here thriving today is nothing short of remarkable. But even within such prosperous times, the fed chairman is not without his long list of critics. As for me, when it comes to Mr. Bernanke, I have reserved judgment until I see how the rest of the year unfolds. U.S. lacks autonomy On Thursday, Bernanke told lawmakers what the market has known Complete Story » |

| Posted: 03 Feb 2012 03:22 AM PST By Avi Gilburt: In August of last year, I warned of a large potential drop in silver, which many vociferously refused to believe. However, before the correction began, I also provided a downside target of the $26.80 region in the futures for a potential bottom, which was, in fact, .80 within the actual bottom four months later. In my last article, I stated that, "[i]n my opinion, silver is about to complete its corrective decline and should maintain support within the $26 region in the futures." I also stated that the next move in silver to the upside will be quite strong, and will exceed the $50 region a lot faster than most people believe. Since that article about a month ago, silver has rallied $8 to the $34 region in the futures, or approximately 30%. Cyclical Effects As you can see from the chart below, over the last 37 years, the greatest Complete Story » |

| LISTEN: Interview with Dudley Baker Posted: 03 Feb 2012 03:12 AM PST Ellis Martin Report with Dudley Baker-Investing with the Insiders ~TVR |

| Posted: 03 Feb 2012 02:20 AM PST HOUSTON -- Recall that we noted in these pages some rather large insider buying by the CEO of Northern Tiger Resources last month and in late December? The second of those notices of that insider activity was at this link. That notice, sent to our readers as Northern Tiger was changing hands for $0.145, pointed out that Mr. Greg Hayes had "acquired at least 924,000 shares" in a very short time at prices between $0.13 and $0.175. We also posted on January 25 our volume candle tracking chart when NTR.V was changing hands at C $0.15. We said then that: "Our view is that Northern Tiger was overly hammered late in 2011, and the fact that the CEO has stepped up to buy close to one million shares of his own company over the past month gives us more confidence for our own, more than four-unit long position. If we did not already hold such a sizable position, we would definitely be adding here, at C $0.14 OB. Of course everyone needs to study the issues and make up their own minds about such things." To further explain our views, we continued: "We see NTR at this level as having a great deal more upside potential than the opposite. "The Market" has seen fit to throw NTR overboard, ignoring their promising high-grade showings at their 3Ace prospect in the SE Yukon. We, on the other hand, have chosen not to ignore them and instead have chosen to back up the truck at what we consider Ridiculous Cheap levels in mid-December." Well, we cannot help but note that since that time there has been a marked change in the volume candle chart, as if Northern Tiger is finally trying to wake up. As we write, there has been quite a bid for the Yukon explorer underway as the updated volume candle chart below reveals. (Data as of 09:30 CT Friday, February 03, 2012.) (Volume candle chart for NTR.V in 1-hour increments since November. If any of the images are too small click on them for a larger version.) Continued … To help put the above chart into context, we share once again the chart we provided last year to illustrate NTR as a possible "LVPS" candidate. (A Low-Volume-Panic-Spike event issue. Vultures know the significance of LVPS events.)(NTR.V, weekly, 18 months. Notice that the huge sell-down in 2011 was on less than remarkable volume. Large percentage moves on less than robust volume are often reversed by the market.) As we write, NTR has surged over the past few days up to the 24-cent range on rising volume – a good sign to begin 2012, but NTR has quite a way to go to get back to where it "lived and felt comfortable" one year ago, as the chart shows very clearly. As we send this off to be posted NTR is changing hands in Toronto near $0.235, up 9-cents or about 62% from when we first noted the insider buying by Mr. Hayes. Given the improvement underway we should expect dips to be eagerly bought, but we can expect there to be some as it makes its way back to "par." We do not mean to imply that Mr. Hayes' insider buying is the only reason for the surge, far from it. NTR.V is indicative of many of the small resource companies we track and trade here at Got Gold Report. It's just that NTR had a CEO that showed us that he had confidence in his own work and company – something we appreciate when we see it. That, of course, added to our own confidence to own shares in Northern Tiger Resources. That is all for now, but there is more to come. Disclosure: Northern Tiger Resources is a Vulture Bargain Candidate of Interest (VBCI) and is our fully fledged Vulture Bargain #7. Members of the GGR team are actively accumulating and hold long positions in NTR.V or NTGSF. |

| Posted: 03 Feb 2012 01:55 AM PST Just in case the site goes down again, here is a reprint of the main post from today: Getting Caught Up After yesterday's nefarious activities, I had hoped to create a lengthy, comprehensive post for you this morning. The BLSBS has gotten in the way and, since things are moving so quickly, I figured I'd better just post what I have and worry about going into detail over the weekend. Before we get started, thank you all for your patience in dealing with the nonsense of yesterday. The attacks continue today but Ron and Stephanie have battled through the night (seriously, I don't think that either of them slept) to get the site back up. Their efforts are greatly appreciated and, since their efforts aren't inexpensive, all of those who have donated to the "TFMR DoS Defense Fund" are greatly appreciated, as well. We don't know for certain who is behind these attacks but we have our suspicions. I, for one, would like to bring in the FBI and/or Interpol but, apparently they're a little busy. Maybe we can simply organize some type of TFMR Goon Squad to go have a "visit" with the perpetrator. OK, first the BLSBS. All you really need to know can be found at ZeroHedge. (What else is new?) Go there to find the truth. Here is just one of the links: http://www.zerohedge.com/news/record-12-million-people-fall-out-labor-force-one-month-labor-force-participation-rate-tumbles- Additionally, in the spirit of seeking the truth through the manipulation and the propaganda, you are really going to enjoy the next podcast. I recorded it yesterday and it is quite timely. It will be posted later this afternoon so please be sure to check back later or over the weekend. Here are the only charts that matter. When reviewing them it is critical that you remember this: I am diligently following the daily changes to open interest in the precious metals. In doing so, it has become quite clear that there is very little, regular trading left in the PMs. All we have are The Cartel and the EE alternately covering and adding shorts as well as some HFT WOPRs that swing back and forth depending upon which way the POSX is moving. This is a double-edged sword.

To that end, let's start with the POSX charts. It looks like The Pig has, in fact, found a short-term bottom this time. I thought it had double-bottomed at 79 earlier this week. Instead, it has formed a rounded bottom. Nevertheless, you can clearly see on the one-year daily chart that 79 functions well as a technical support level...at least for now. I still have a hunch, however, that Pigatha will soon head even lower, toward 78 and maybe even 77. Next is gold. Unfortunately, the trend from last Wednesday's FOMC minutes is now broken. Oh well. It had to happen sometime. As you can clearly see, however, gold could fall quite a ways from here and still NOT violate its trend from 1/1/12. In the end, all is well. QE is going to infinity. BTFD. Lastly, silver might actually be in a tradable position. Maybe. I still think that the real Battle Royale will be at 35-35.50. IF that's the case, then it may be possible to trade some March calls from 33.25-50 up to 35-35.50. Maybe. Again, trade at your own risk and be on guard for some nasty volatility, to the UPside and the downside. OK, I'm going to stop there, cross my fingers and toes, and pray that when I hit "SAVE" that this post actually appears on "Main Street" and simply doesn't disappear into the ether. Thanks again to all who have donated in support of the Tech Team and security improvements. Be sure to check back later this afternoon or over the weekend for a great and timely podcast. Have a fun day!! TF |

| Research: US Mint Gold Coin Sales for January - Signal Return to Fundamental Driven Demand? Posted: 03 Feb 2012 01:39 AM PST |

| CNN: States consider alternative currencies of gold and silver Posted: 03 Feb 2012 12:55 AM PST |

| Morning Outlook from the Trade Desk 02/03/12 Posted: 03 Feb 2012 12:21 AM PST Should just say ditto, Some financial news, unemployment … coming out this morning. No surprises expected and again unless we get a headline report, metals are comfortably in the higher range. If it softened in the morning I would pick it up with the expectation of a firmer tone towards close. |

| Top analyst Rosenberg: This could be the best way to profit from gold now Posted: 03 Feb 2012 12:17 AM PST From Mineweb: For many years, the price of gold moved up only when the stock market moved down. With limited supply and strong demand, the precious metal was the logical place to be when the global investment landscape was looking a little ragged. No longer. Gold - unlike everything else - has rallied in each of the past 10 years. It's gone up when the U.S. dollar was soft and when the greenback was strong, when inflationary worries were paramount and when deflationary anxieties were in the headlines, when the economy was in recession and when it was expanding... Read full article... More on gold stocks: Casey Research: Move these gold stocks to the top of your buy list A "coiled spring": These gold stocks could be set for a massive rally This chart shows it could be a great time to own tiny gold mining stocks |

| Silver Forecast Video: The Shift To Measuring Wealth In Ounces Instead Of Dollars Posted: 03 Feb 2012 12:01 AM PST Video (Silver Forecast): The Shift To Measuring Wealth In Ounces Instead Of Dollars For more of this kind of analysis on silver and gold, you are welcome to subscribe to my free silver and gold newsletter or premium service. I have also recently completed a fractal analysis report for gold and silver . Warm regards [...] This posting includes an audio/video/photo media file: Download Now |

| Gold Coins: A Return to Fundamentals-Driven Demand? Posted: 02 Feb 2012 11:27 PM PST Data internationally shows that demand for gold bullion bars and coins remained robust in 2011 and into January 2012. But this remains a fringe activity of store-of-value buyers rather than a mainstream phenomenon. At this stage few retail investors have any allocation to gold whatsoever and very few have even... |

| Posted: 02 Feb 2012 11:21 PM PST A good post on Turd's site: In Case You Missed It Wednesday, February 1, 2012 at 8:39 pm Lots of interesting stuff going on today. Our precious metals rallied and the open interest numbers continue to contract. However, the biggest story of the day flew under the radar. You've probably heard it said that "gold performs best in an environment of negative real interest rates". You've probably then asked yourself: "Self, what the heck does that mean?". Well Turd The Answer Man is here to help. Everyone knows what an interest rate is but what is a real interest rate? Simply put, it is your stated interest or coupon rate minus the rate of inflation. In a simple calculation, it looks like this: 5% (interest rate) - 3% (inflation rate) = 2% real interest rate and 3% (interest rate) - 5% (inflation rate) = -2% real interest rate The real rate should always be the investors primary focus. What good is a 10% bond if inflation is 20%? The only thing you're guaranteeing yourself is a 10% annual loss of purchasing power. That dog won't hunt. Not coincidentally, managing real rates is the primary reason why the Fed manipulates the gold market through the bullion banks. Soaring gold would be a sure sign of present or future inflation. Expectations of significant inflation lessens investor demand for fixed interest rate securities like treasury bonds. Less demand equals lower prices. Lower prices equal higher rates and higher rates bring down The Great Ponzi. Similarly, managing real rates is also the reason why the Consumer Price Index is constantly being reworked to indicate a lower rate of inflation. In understanding all of this, now ask yourself: "What is it that all of the AGAs always say is the primary drawback to owning gold?". Is it because it's a barbarous relic? Is it because it costs so much to deliver and safely store? Well, yes, the AGAs do point to these two arguments. However, the main argument that you always seem to hear the most is: GOLD DOESN'T PAY ANY INTEREST. Sure, the price of gold might keep up with inflation but, since it doesn't pay interest or a dividend, the gold holder is only securing for themselves a rate of return that might approximate the rate of inflation. Stated another way...gold investors only receive a 0% real interest rate. So, there's your answer. From the traditionalist's point of view, gold suddenly has real value in an environment of negative real interest rates. Why? Because 0% is always better than -2% or -5%. It's as simple as that. Now, lets' get back to the story today that might have evaded your attention: http://www.zerohedge.com/news/superc...ve-yield-bonds In summary, something called the Treasury Borrowing Advisory Committee (think of it as the primary Primary Dealers) is advising the Treasury Department to begin "allowing for negative yield auction results as soon as practically possible". In English this means: Build a platform whereby treasuries can be sold with a guaranteed negative rate of return. You give the U.S. government $1010 and they'll return to you $1000 at maturity, thank you very much. What a sweet deal! The U.S. government charges the investor 1% for the privilege of holding their money. (I guess we should just be thankful that this facility will be voluntary...for now.) At any rate, let's go back and do some more real interest rate calculations. Shall we? -1% (interest rate) - 3% (CPI inflation rate) = -4% real interest rate and -1% (interest rate) - 8% (ShadowStats inflation rate) = -9% real interest rate So here's the point: As we move into an environment where we are institutionalizing extremely low and even negative interest rates, we are creating a permanent state of negative real rates. And, as the pundits say, "gold performs best in an environment of negative real interest rates". So, buy the dips! The secular bull market in precious metals continues and will continue indefinitely. Rock on, Wayne! Party on, Garth! TF source: http://www.tfmetalsreport.com/blog/3...-you-missed-it |

| Posted: 02 Feb 2012 10:30 PM PST |

| Gold "Volatile" But "Inflationary Distortions" Add to Appeal Posted: 02 Feb 2012 10:18 PM PST Gold may well remain volatile, but it is increasingly attractive as the only truly hard currency, and it may also induce inflationary distortions that give a rise to commodities and gold as store of value alternatives when there is little value left in paper, according to Dirk Wiedmann, head of... |

| Fed Stimulus and BDI crash and USD and Gold Posted: 02 Feb 2012 09:30 PM PST Prudent Squirrel |

| Gold Will Rise Against 'Heavily Debased' Currencies Posted: 02 Feb 2012 09:14 PM PST ¤ Yesterday in Gold and SilverThe gold price wandered around in a five dollar price range all through Far East and morning trading in London...with the London high coming at 9:00 a.m. GMT...and the London low [and low of the day] coming shortly before 1:00 p.m. GMT, which was about half an hour before the Comex opened in New York. From that low, gold rallied a bit into the London p.m. gold fix, which was 10:00 a.m. Eastern. After the 'fix' was in, gold rallied up to a bit over $1,760 spot before a not-for-profit seller showed up to sell it off once again. There was talk that that rally at the p.m. gold fix was because Bernanke opened his mouth. A second rally attempt over $1,760 also got turned back in the electronic market after the Comex close. Gold finished at $1,758.40 spot...up $15.40 on the day. Net volume was around 128,000 contracts. The silver price followed the gold price path right to the minute everywhere on Planet Earth yesterday...except the price was more 'volatile'. By the time the smoke cleared, silver ended the New York trading session at $34.36 spot...up 65 cents on the day. Volume was pretty heavy at 41,000 contracts, most of which would have been of the high-frequency trading variety. The dollar index traded with a slight positive bias yesterday...and basically spent most of Thursday trading in a 20 basis point range of 78.95. But having said that, there was certainly some co-relation between it and the gold price throughout the entire day. The gold stocks pretty much followed the gold price during the New York trading day...but even though its price finished virtually on its high of the day, the gold stocks never really recaptured their gains after the one hour sell-off between 11:30 and 12:30 a.m. in New York. If you check the Kitco gold chart above, you'll see what I mean. But having said all that, the HUI still managed to finish up 1.79% on the day. The large cap silver stocks did just OK...although some of juniors did much better. Nick Laird's Silver Sentiment Index closed up only 0.91%. (Click on image to enlarge) For 'Day 3' of the February delivery month in gold, only 54 contracts were posted for delivery on Monday...but another 73 silver contracts were posted for delivery as well. It was mostly JP Morgan, Bank of Nova Scotia and Deutsche Bank in gold...but in silver it was the same old, same old pattern that started at the beginning of January. Jefferies was the short/issuer on all 73 contracts...and it was Morgan and the Bank of Nova Scotia as the biggest long/stoppers, although Jefferies stopped 15 of the 73 contracts themselves. The link to the Issuers and Stoppers Report is here. As I said a couple of times before, I sure don't know what to make of this 'love triangle'...and even Ted Butler is wondering what's going on under the hood over at Jefferies these days. Jefferies has delivered almost every one of the 1,600 silver contracts that have been issued since January 3rd. That's a lot of silver. There were additions to both GLD and SLV yesterday. Authorized participants deposited 194,390 troy ounces of gold, along with 417,507 troy ounces of silver. The U.S. Mint had a very tiny sales report yesterday. They sold 1,000 ounces of gold eagles, along with 45,000 silver eagles...and that was it. It was quite a different story over at the Comex-approved depositories on Wednesday, as they had their busiest in-and-out day in silver that I can remember...and I can remember quite a bit. They reported receiving a staggering 3,819,280 troy ounces...and shipped a monstrous 2,626,239 troy ounces out the door, for a net gain of 1,193,041 ounces. Virtually all the action was at Brink's and Scotia Mocatta. The report is definitely worth looking at...and the link is here. Well, the data and charts on the London a.m./p.m. gold bias that I have been going on about for the last three weeks or so, was picked up by two of the most respected/well known U.S. gold analysts yesterday...John Brimelow and Dennis Gartman. Here's what Dennis had to say in yesterday's edition of The Gartman Letter... "Finally, our friend, John Brimelow, wrote a most interesting piece yesterday that we thought worthy of reporting here this morning. John wrote…giving "aid and comfort" to the conspiratorialist crowd but being interesting nonetheless… that "The recent discussion of the contrast between the systematic selling between the AM and PM fixes (tantamount to selling in the early NY floor session) and the tendency to overnight firmness has been well illustrated by a graph published at Ed Steer's Casey Research commentary today (see attachment). Steer adds..."For the month of January, the overnight bias showed an increase of $169...or 10.4%. The London intraday bias was -0.02%. So here we have one of the biggest bull market rallies in January in recorded history...and the cumulative move during the 4.5 hour intra-London trading hours during January was actually negative. This is Anglo/American price fixing scheme laid bare." "We are not conspiratorialists here at TGL and we find the "energy" expended by those always trying to prove conspiracies to be a great waste of mental capital that could be better used elsewhere. That said, this is interesting nonetheless. As they say, "Timing is everything." Neither John nor Dennis would have reprinted this if they didn't know it to be true and, true to his nature, Dennis had to hedge his approval by patronizing all us 'conspiracy theorists'. But he at least spelled my name right! I met John Brimelow at the GATA conference in London last August...and he is every inch the reserved English gentleman. I met Dennis Gartman at a David Tice-sponsored cocktail party at a gold conference in New Orleans several years back...and as long as he's got a couple of drinks in him...and no TV cameras or a microphone nearby, he's a real fun guy to be around. What I didn't include in my commentary that both John and Dennis referred to, was the actual a.m./p.m. London gold fix data itself. Nick Laird suggested that I post it for all to see...and here it is. Before getting around to my usual list of stories, here's a graph that was published by the St. Louis Fed the other day. It shows the velocity of the M1 money supply. Until it's very comfortably over the 1.0 mark, the Fed will print with abandon. The big question is, will they be able to slow it down once it really takes off? I thank West Virginia reader Elliot Simon for sending this along. (Click on image to enlarge) The other thing that I'm less than enamoured with is the overbought condition that currently exists in gold. Record silver volumes move in and out at the Comex-approved depositories on Wednesday. More indications that official gold data is no good. A Gold (And Physical Platinum) Bug At The Fed? ¤ Critical ReadsSubscribeMF Global Risk Chief Switch Stalled Euro Debt Cut by Six MonthsU.S. lawmakers questioned whether MF Global Holding Ltd. decision to replace Michael Roseman as chief risk officer a year ago was driven by his warnings over bets on European debt that helped push the firm to bankruptcy. Roseman, who said that his concerns were dismissed as "implausible" by then-Chairman and Chief Executive Officer Jon S. Corzine, testified today along with his successor, Michael G. Stockman, at a House Financial Services Investigation subcommittee hearing in Washington. "It appears Mr. Roseman was the chief risk officer until he stopped telling Mr. Corzine what he wanted to hear," Representative Michael Capuano of Massachusetts, the panel's top Democrat, said during a question-and-answer session. This Bloomberg story, along with the above graph, is also courtesy of Elliot Simon...and the link is here.  Progress on Letting Big Banks Fail: Simon JohnsonThe drafters of the Dodd-Frank financial reform law got an important thing right. Despite fierce pushback from the banks — and lackluster support from the White House at critical moments — the legislators communicated a key new intent: megabanks must be able to fail, and the Federal Deposit Insurance Corporation should be in charge of that liquidation process. The F.D.I.C. was an inspired choice for this role, because it is less captivated by the "magic" of Wall Street and less captured by its money and influence than any other group of officials. The F.D.I.C. has also long been in the business of shutting down banks while limiting the damage to taxpayers, although it did not previously have complete jurisdiction over the largest banks when they got into trouble. It could only deal with those parts that had federally insured "retail" deposits, and this turns out not to be where the biggest problems have occurred in recent times. Simon Johnson was the former chief economist at the IMF. This very interesting [but fairly long] commentary showed up in The New York Times yesterday...and I thank Phil Barlett for sending it along. The link is here.  China Considers Offering Aid in Europe's Debt CrisisPrime Minister Wen Jiabao said Thursday that China would consider working with the IMF to help shore up Europe's finances. But he left unclear whether China was willing to drop conditions that so far have made its proposed help unappealing to European nations. One big question, though, is what kind of political or trade concessions China might want in exchange for assistance. When Mr. Wen suggested last September that the European Union could dismantle its legal protections against low-price Chinese exports, the idea was immediately condemned by European trade officials. An opinion article Thursday in the official China Daily newspaper raised Mr. Wen's trade condition again and suggested that the European Union should also make political concessions — like lifting a longstanding ban on arms exports to China. "As a Chinese saying goes, one does not visit the temple for nothing," the column warned. This New York Times article from yesterday also comes courtesy of Phil Barlett...and the link is here.  Eurozone bail-out funds not enough, warns OECDInternational debt inspectors believe they have found another €15bn (£12.5bn) black hole in Greece's public finances caused by the deepening recession, delivering the crippled nation another devastating blow. Sources told news organisations in Brussels that weak growth will make it even more difficult for Greece to resolve its debt problem, leaving the eurozone and the International Monetary Fund with the prospect of an even larger bail-out than the €130bn planned. The warning came as the Organisation for Economic Co-operation and Development (OECD) said the emergency bail-out funds are not big enough. Greece, Portugal, Italy, Ireland and Spain need to repay a total of €700bn this year and €400bn next year. This story was posted in The Telegraph just after midnight GMT...and is Roy Stephens first offering of the day. The link is here.  IMF official admits austerity is harming GreeceA leading architect of the austerity programme in Greece – one of the harshest ever seen in Europe – has admitted that its emphasis on fiscal consolidation has failed to work, and said economic recovery will only come if the crisis-hit country changes tack and focuses on structural reforms. Poul Thomsen, a senior International Monetary Fund official who oversees the organisation's mission in Greece, also insists that, contrary to popular belief, Athens has achieved a lot since the eruption of the debt crisis in December 2009. "We will have to slow down a little as far as fiscal adjustment is concerned and move faster – much faster – with the reforms needed to modernise the economy," he told the Greek daily Kathimerini, adding that the policy shift would be "reflected" in the conditions foreign lenders attached to a new rescue programme for Athens. This story was posted in The Guardian on Wednesday...and I borrowed it from yesterday's edition of the King Report. The link is here& |

| Sinclair interviewed on currency market rigging and gold's monetary role Posted: 02 Feb 2012 09:14 PM PST  Gold mining entrepreneur, trader, and market analyst Jim Sinclair this week gave two interviews to the German Internet site Metallwoche, one with the freelance journalist Lars Schall, in which he concurs with GATA's view of currency market rigging and gold's role as money, and another in which he argues that China and the Federal Reserve are pretty much managing the value of the euro. Audio of the interviews is posted here. |

| Why Are the Chinese Buying Record Quantities of Gold? Posted: 02 Feb 2012 09:14 PM PST  This month, the Hong Kong Census and Statistics Department reported that China imported 102,779 kilograms of gold from Hong Kong in November, an increase from October's 86,299 kilograms. Beijing does not release gold trade figures, so for this and other reasons the Hong Kong numbers are considered the best indication of China's gold imports. Analysts believe China bought as much as 490 tons of gold in 2011, double the estimated 245 tons in 2010. "The thing that's caught people's minds is the massive increase in Chinese buying," remarked Ross Norman of Sharps Pixley, a London gold brokerage, this month. |

| Destroy markets and you destroy economies, Arnott tells King World News Posted: 02 Feb 2012 09:14 PM PST  Fund manager Rob Arnott told King World News yesterday that central bank intervention is destroying markets and thus national economies as well. Arnott says: "The three major developed economy centers are all pursuing a process of cranking the printing press to suppress natural market response and natural market interest rates. It represents a powerful distortion for the capital markets. It represents a powerful impetus for people to do one of two things: take risks they might not otherwise have been willing to take, creating the risk-on trade, or take their money off the table altogether. Think of gold as an example -- it's a way of taking money out of circulation." |

| More indications that official gold data is no good Posted: 02 Feb 2012 09:14 PM PST  MineWeb's Lawrence Williams quoted precious metals market analyst Jeff Nichols of American Precious Metals Advisers and Rosland Capital about China's gold production and gold reserves, indicating again the unreliability of official gold production and reserve data, a point long made by GATA. Williams' report is headlined "China's Gold Output and Demand Could Be Far Greater than 'Official' Data Suggest". Once again I thank Chris Powell for providing the introduction to this story...and it's posted at the mineweb.com website. The link is here. |

| Gold & Dollar on the Move to start a Groove Posted: 02 Feb 2012 09:04 PM PST Between 1980 and 2000, the gold price movement was dominated by a downtrend, whereas a so-called BREAKOUT had already begun in 1993 when the price broke above the upper-most "blue triangle" leg at approx. $350 per ounce. |

| Gold & Silver Market Morning, February 03 2012 Posted: 02 Feb 2012 09:00 PM PST |

| Peter Grandich talks with Tekoa DaSilva Posted: 02 Feb 2012 08:45 PM PST from Tekoa DaSilva of bullmarketthinking.com:

It was an exciting interview, as Peter understands the economy, gold, and the junior mining sector in a way that few other commentators do. The items we discussed were the DJIA continuing its move higher, gold breaking out technically, and the junior mining sector as being an incredibly cheap place to invest. In regards the U.S. stock market, Peter said, "I work under the premise that there is a 'don't worry be happy' crowd on wall street, and that the market is always tilted to the biased long side…the bulk of the financial institutions deal in stocks and bonds, and most times they always have a biased to be long…I like to joke that if you tossed one of them off the empire state building, all the way down they would say the same thing–'so far so good'...Most of the people that work in the financial service industry have a natural tendancy bias to be bullish, or to look at the cup half full rather than half empty." When aske With respect to the share prices of many junior mining shares, Peter said,"The junior market just got way oversold. We saw things come down to levels that their projects were just worth so much more than the current market cap…The problems that I'm hearing from the corporate side, is the concern on these companies now is that they'll get taken out before they get to a valuation that's really worthy." When asked about the complete disinterest in junior miners by investors, Peter added,"People finally threw in the towel on them, and that's when they finally do [move higher]." More @ bullmarketthinking.com |

| Gold Juniors Poised to Rebound: Joe Mazumdar Posted: 02 Feb 2012 06:00 PM PST |

| Posted: 02 Feb 2012 05:46 PM PST Secular Trends Steve Saville email: sas888_hk@yahoo.com Posted Jan 31, 2012 Below is an excerpt from a commentary originally posted at www.speculative-investor.com on 29th January 2012. The three best ways to view the secular stock market trend are via: A long-term chart of the market's price/earnings ratio. A long-term price chart with the price data adjusted for changes in money supply, productivity and population. A long-term chart of the market's performance relative to gold. One reason that these are effective methods of viewing the secular trend is that they remove changes in currency purchasing power from the picture. An alternative would be to look at a chart showing performance in nominal currency terms, but such a chart could be deceptive due to the real trend being masked by currency depreciation. The US stock market's real trend was masked by currency depreciation from the mid-1960s through to the early-1980s. During this period, a large reduction in the US dollar's purchasing power transformed a major downward trend into a horizontal trading range. Something similar has happened over the past 12 years. After we remove changes in the US dollar's purchasing power from the equation it not only becomes clear that the US stock market has been in a secular decline over the past 12 years, but also that the US stock market's most recent secular decline is unfolding in a similar way to the preceding episode (the secular bear market that lasted from the mid-1960s through to the early-1980s). The similarities are illustrated below via charts of the Dow/gold ratio. Attachment 15075 more here: http://www.321gold.com/editorials/sa...lle013112.html |

| Posted: 02 Feb 2012 04:41 PM PST |

| Posted: 02 Feb 2012 04:30 PM PST aquadesign |

| Posted: 02 Feb 2012 04:23 PM PST |

| Can the US return to a Gold Standard ? (Alan Greenspan 1981) Posted: 02 Feb 2012 03:00 PM PST |

| Investment Alternatives in a No Growth Economy Posted: 02 Feb 2012 02:55 PM PST Reckoning from Baltimore, Maryland… Baltimore…best bet for investors? We drove back into town on Sunday night. People moped around in front of bars. Groups walked uptown from the stadium, their shoulders down, the chins dragging. The city was dark…and unhappy. There was no joy in Baltimore on Sunday night. Baltimore is a sports town. The Ravens — the only team we know named after a poem — had lost. They would not be going to the Super Bowl. Baltimore is a funny place. We were happy to leave it for 15 years when we lived in Europe. And we are happy to be back. Living in Europe was hard. Here it is easy. Living in Europe was chic and fashionable. Here, moving to a trailer park would be moving up in the world. Living in Europe was expensive. Baltimore, meanwhile, is one of the cheapest cities in the world. But we'll come back to Baltimore in a minute… What's in the news today? The Dow rose 83 points yesterday. The 30-year, 'long' bond yield dropped below 3%. The price of gold rose to $1,749. Bond yields signal a recession. Stocks hint at a recovery… Gold? The correction in the gold market didn't go nearly as far as we expected. And now it's over. What to make of it? Do people expect inflation? Why are they buying gold? We know why the Syrians are buying gold. There's a war on. Gold has always been the thing to own in a war zone. But here, people think the economy is recovering. The public and the investoriat seem to think all is well. We've just had one of our best months in stock market history. Many investors are convinced that it is the beginning of something big. Our old friend Mark Hulbert, for example, tells us that some of the oldest and wisest of the newsletter gurus are now bullish on stocks. We don't have any opinion about stocks. We just don't like them. And we figure that if they were as valuable as people think, the owners wouldn't be in such a hurry to unload them. At least, not to us. Instead, they'd hold on. But some people are always selling. Others always seem to be buying. Prices go up…and down…the world goes 'round and 'round… …and who are we to argue with it? The trouble is, the economy is not nearly as strong as most people think. There is no growth to speak of. And without growth, it doesn't make sense to pay so much for stocks. Forbes:

Without growth, the average stock will go nowhere. How could it? There's nowhere to go. No growth means that the economy is no larger at the end of the year than it was at the beginning. So, for any company to grow, it would have to take sales and profits from some other company. For one to grow another must shrink. Overall, there would be no growth, and no capital gains for investors. Trouble is the dividend yield of the stock market is only around 2%. That's not enough. Take inflation and taxes into account, says our Family Office strategist, Rob Marstrand, and you need more than an 8% return just to break even. So, if you're buying stocks in a no-growth market…with a 2% dividend yield…you're losing 6% on your money. Heck, you're much better off buying gold…or property in Baltimore. Gold has been up every year for the last 11. Even last year, when it supposedly suffered a big correction, it still ended the year up about $300 — which is what you would have paid for a whole ounce of gold in 1999. As for Baltimore real estate… We've been looking at apartment buildings in B'more. This city is unusual, so you probably shouldn't generalize. But we're seeing buildings with "cap rates" of 10% and more…and return on cash as high as 20%. Interest rates are so low you can finance much of the purchase price at low cost…and leverage your investment to get a higher return. How does that work? Well, the building we just looked at had 5 units. The sales agent explained it to us. "You get gross rents of about $100,000 and you can buy the building for $800,000. You put down $100,000 and borrow the other $700,000. Then, you pay off your mortgage, pay the upkeep, property taxes, utilities and so forth… You also have to pay management…leave an allowance for vacancies and major repairs…and you end up with about $20,000. "That's your return on cash. Not bad, huh?" Well, it's about 10 times what you can expect from the stock market. Trouble is…trouble. Being a landlord in an inner city is trouble. You get trouble from the tenants. Trouble from the city. Trouble from the pipes, the roof, the wires…lead…asbestos — everything. Buy city apartment buildings and you are asking for trouble. But if you can handle the trouble, hey…see you in Charm City. Regards, Bill Bonner for The Daily Reckoning Australia Similar Posts: |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment