saveyourassetsfirst3 |

- Emerging Juniors Continue to Show Good Progress: Dale Mah

- WATCH: Juan Castañeda on Sound Money

- GLD: The Gold Stock Killer

- The Great Debt Binge: 9 Charts That Support Buying Gold

- The U.S. Government Has The Power To End the FED and Issue Debt-Free Money

- Physical Demand “Will Determine Support for Gold” while Selloff was “Driven by Euro Weakness”

- 2012 Gold Averages: Goldman $1,810/oz, Barclays $2,000/oz and UBS $2,050/oz

- There will be no major hit on gold loan biz in India

- North Korean dictator dies... Could create "nuclear crisis" in region

- Uh oh, Nigerians want to trade paper gold

- If you're betting on a rally, these are the stocks you should be buying

- Ten U.S. economic facts that are too crazy to believe

- View From the Turret: Holiday Trading

- Gold Price Fundamentals Remain Unchanged

- Draghi Warns On Cost of Eurozone Break-Up

- Oblivious Because of Mainstream Media

- So Much For the Santa Rally

- Money is Not Safe Here

- Debt-Free Money

- Africa to Control Mining Industry

- MF Global's Gold and Silver Bullion

- How The Bankers Drive Up Bullion Prices (Part I)

- Morning Outlook from the Trade Desk - 12/19/11

- Morgan: “Silver Price Flat Through Most of 2012″

- Gold & Silver Market Morning, December 19, 2011

- WATCH: How Silver Is Mined

- Taking A Look At Silver Heading Into Next Week

- Philip Mirowski: The Seekers, or How Mainstream Economists Have Defended Their Discipline Since 2008 – Part I

- Irked by GATA, Bank of England denies gold loans, swaps since 2007

- Ron Paul Takes Lead in Iowa While Reaching $4 Million Fundraising Goal

| Emerging Juniors Continue to Show Good Progress: Dale Mah Posted: 19 Dec 2011 07:00 AM PST Source: Zig Lambo of The Gold Report (12/19/11)

Companies Mentioned: Amarillo Gold Corp. – Colombia Crest Gold Corp. – Freegold Ventures Limited – Geologix Explorations Inc. – Kiska Metals Corp. – Magellan Minerals Ltd. – Probe Mines Ltd. – Sunward Resources Ltd. The Gold Report: This gold market has been relatively confused in the last few weeks. We've had some pretty big fluctuations and days where we had big drops in one day, with the markets going in the same direction as the metals, contrary to what people would expect. What's your take on what's going on now, where things are headed in the coming year, and what kind of catalysts we are looking at that are going to make these moves happen? Dale Mah: Most analysts would probably agree that the big price surge in gold during that high-week period in August/September was too fast. Lately, when we see gold selling off, it's usually because of a switch into the U.S. dollar. Considering the price of gold started the year at $1,420/ounce (oz), that's still an 18% return compared to -3% for the Dow. Our long-term view is that we're still in a good upward trend in gold with recent volatility due to global economic uncertainty. If we can see some improvements in the European debt situation, I think it will bring some confidence back. TGR: Looking at a lot of these junior stocks, it seems like they haven't gotten the message yet and are trading as if gold were still down in the $800–900/oz range versus twice that price. What do you think is the problem here? DM: Many factors affect the price of junior exploration companies. Right now, risk is the key. In the current investment climate, those looking at rebalancing their portfolios or just wanting to generate some liquidity decide the highest-risk stocks are usually the first to go. Naturally, that drives the prices down. TGR: How do you define "risky" ones at this point—from the standpoint of fundamentals or just the fact that people are not buying them and so you think they're just going to sit around and do nothing? DM: Those would be the early-stage projects or perhaps advanced projects with an element of risk, usually financial risk. A company might have huge NI 43-101 resources, but can also be associated with equally high capital expenditures (capex); that's a huge risk factor. So those will sit on the shelf, because in times like these, when you have a company needing to invest several billion dollars into a project, that's where you'll see spending cuts. TGR: We see really encouraging news releases coming out every day from all sorts of companies, and yet there doesn't seem to be much reaction. Even looking back at one of the companies you follow, Amarillo Gold Corp. (AGC:TSX.V). The company came out with a very positive news release back in the middle of September, but the stock dropped about 25% in the next few days. It came back up after that. What seems to be the problem with that? Don't people care? DM: Specifically with Amarillo there are two things. When it released its resource, it was focused more on upgrading resources so there wasn't really much growth expected. But it did increase its Measured and Indicated resources by about 89% in preparation for a feasibility study. So now it stands at 1.33 million ounces (Moz) compared with 1.17 Moz, which is a modest 14% growth. Shortly after that, beginning Sept. 22, is when we saw gold drop by about $200/oz in about a week. That certainly didn't help gold stocks. Amarillo has recovered somewhat, but it does trade fairly thin so the price doesn't seem as volatile as other juniors. TGR: There are a lot of smaller companies out there with properties that are pretty credible, and, in years past, people would have been jumping all over them. Now it seems like not much is going on. Do the majors have more on their plates than they can handle or are there just too many things to pick from out there? DM: With gold prices this high, small deposits get new life so there are a lot of projects to evaluate. However, there aren't very many world-class deposits out there anymore. The 10–20 Moz deposits are the ones that usually get snatched up. There are a lot of small, lower-grade deposits out there that look great when you run an economic cash flow model at current prices, but does a big major really want to take the risk on something small? A higher-grade deposit will be able to absorb fluctuations in gold prices whereas a low-grade deposit may not be very robust. I think they're just sitting back and waiting, unsure if gold prices can hold these levels. TGR: As far as valuations of deposits these days, what rule of thumb do you apply to gold in the ground in dollars per ounce? DM: It varies with the stage of the project. We tend to use about $50–75/oz for some early-stage projects and anywhere from $150/oz and up, maybe even up to $300/oz for advanced and developing projects. If the project has a higher degree of risk, like a prohibitively large capex, then $25/oz wouldn't be out of the question. TGR: A lot of companies seem to be pretty undervalued now. What are you using for criteria to decide who you want to cover and recommend? DM: I have three main criteria. The main one is multimillion ounce potential. The second one is good infrastructure. The third one is a politically safe jurisdiction. That's my checklist. TGR: The politically safe factor has certainly gotten into the news a lot more, recently. All these countries and jurisdictions are realizing that they want a bigger piece of the pie. It looks like that's something companies have to worry about a lot more. What are your thoughts on that? DM: Every situation is unique. Recent developments in Peru have certainly added some degree of risk. Financially speaking, the biggest change was a switch from royalty payments on sales to a new system of royalties on operating profits. It makes sense and the amount collected by the government will now scale to metals prices. It benefits the country when commodity prices are high, but is not too onerous on the company if prices dip. On the political side, however, it's getting a little bit more uncertain. Peru has received about $50 billion (B) in investments, and the country really is at risk of losing much of that because concerns have arisen from approvals that are already in place. Newmont Mining Corp. (NEM:NYSE) halted construction of the $4.8B Conga mine. The company pretty much has said it will go elsewhere if the situation isn't resolved. I agree that there needs to be a balance between economic development and social and environmental standards, but President Humala still needs to provide some stability for the country's biggest investors. TGR: Do you think he'll get the message, or is he just on a mission and doesn't care what the results are? DM: He set a precedent with what happened with Bear Creek Mining Corp.'s (BCM:TSX.V) project. Bear Creek was a project that had received all required approvals but the former President had cancelled them after locals protested. In my opinion the current government needs to take a stand and support the country's largest economy. Peru just can't afford to shut down the mining sector. TGR: You follow a number of junior companies that have pretty promising projects. A number of these have come out with some updated reports in the last few weeks. Which ones would you like to talk about at this point that you consider your top picks? DM: One of my top picks is Probe Mines Ltd. (PRB:TSX.V). It has everything I look for in a company—multimillion ounce potential (4.1 Moz and growing). It's located in northern Ontario, which is traditionally supportive of natural resource development and has excellent infrastructure. The town of Chapleau is just a short drive away and has power generation, paved highways, a rail service and an airport with a 5,000-foot runway. Another one is Sunward Resources Ltd. (SWD:TSX.V) in Colombia. It traded fairly flat despite more than doubling its resource from 3.7 Moz to 8.3 Moz. It's sitting in a great porphyry district and has excellent expansion potential where I can see a resource exceeding 10 Moz. TGR: Has the market reacted positively to that huge increase in resources? DM: It has traded fairly flat and didn't really take any giant leaps nor drastic falls. It's hung on pretty solid around $2/share. I don't think the market has really recognized the scale of this project. TGR: So what do you think is going to be the catalyst for that one to go somewhere? DM: It's going to be all about drilling right now. It has several great targets yet to be tested. The bulk of the 8 Moz is within two of seven zones. TGR: How about some of the other ones you like? DM: Colombia Crest Gold Corp. (CLB:TSX.V; EAT:Fkft) is one I have been following for a few months, and I think it's a great buy at these prices. It's actually a neighbor to Sunward, and all the signs of another big porphyry system are there—geochemistry, geophysics, surface sampling and surface mapping. IAMGOLD Corp. (IMG:TSX; IAG:NYSE) bought about 20% of the company a few weeks back. This is all before Colombia Crest has even gotten to drill a single hole. I've also recently returned from a visit to Freegold Ventures Ltd.'s (FVL:TSX) Golden Summit project in Alaska. Now this is not your typical remote Alaskan project. It's located a short drive from Fairbanks, which has a rich mining history. It's fewer than 8km from Kinross Gold Corp.'s (K:TSX; KGC:NYSE) Fort Knox project. The two projects are actually connected by a road. It has an NI 43-101 resource of about 700,000 ounces, but recent drill results show that this has potential to grow 50–100%. So again, referring to my checklist, it has multimillion ounce potential. It's not there yet, but I could definitely see it hitting that number in the next year. Infrastructure? It's a short drive from Fairbanks, which is accessed by commercial airlines. There's a highway with grid power that also connects to the Fort Knox project. This is a politically safe jurisdiction with a rich mining history going back many years. TGR: How about some of these other companies that you've talked about in the past and you still like? DM: Amarillo Gold. It just came out with the results of its prefeasibility study (PFS). It's fairly conservative and there is room for improvement: perhaps more pit shell refinement and a bit more drilling as well to upgrade Inferred resources. Currently, because it's a PFS, it can only count the Measured and Indicated resources and the Proven and Probable reserves. Even though there are Inferred resources that fall into the pit shell, they are actually counted as waste as far as the PFS is concerned. This will help decrease strip ratio and reduce operating cost. Also, the pit shell is based on $1,100/oz gold, so if you used less conservative values such as $1,300/oz or $1,400/oz gold, you would have more gold falling into the conceptual pit, more gold produced and better net present value. I think there is definite upside on Amarillo's very conservative PFS. TGR: You talked about Kiska Metals Corp. (KSK:TSX.V) last time. Anything new on that one? DM: Kiska just wrapped up its Island Mountain program with drill results that were recently released. Island Mountain is looking pretty intriguing and is a nice breccia target. I think it will have some continuity issues that it will have to work on next year but from what I see from the drill results, I think it could add, at a minimum, 0.5 Moz and could get up to 0.75Moz–1 Moz. TGR: How about Geologix Explorations Inc. (GIX:TSX)—you talked about it last time. Anything going on there? DM: It has drilled a lot of meters this year and is going to do another resource estimate to see how much bigger it was able to make its Tepal gold-copper porphyry project in Mexico. It increased the drill density, upgraded its resources and will move on to a PFS, probably next year. That will just constrain the engineering and costs to a much higher confidence level. TGR: Then there is Magellan Minerals Ltd. (MNM:TSX.V). What's happening with that one? DM: Magellan is being fairly aggressive, and I respect its management for the type of drill program it's putting together. All the holes that have been drilled this year are stepout and expansion, rather than infill holes. Many companies put out news releases with fantastic intercepts and sexy grades but when you look into them, they're infill holes, which do little to increase resources and ounce count. Magellan is drilling some risky exploration holes and I think what we've seen in the share price recently is a reflection of that. You get more value from your budget in an early-stage project when you drill and try to expand your resource than by drilling within it. Magellan has hit some new zones this year that provide more directions to grow. The question is how much. TGR: It sounds like there is progress being made with all of these. I guess, now we just need the market to recognize this and take some of these things higher. We're into tax loss selling season. It looks like most of these companies are probably pretty good buys. Would you agree? DM: Oh, absolutely. Again, it depends on your situation. There are certainly a lot of bargains out there, but in uncertain times like these, risk is not the flavor of the month. So there's a tendency more toward large cap producers that pay dividends and have a lot of cash in the bank. January has traditionally been the time to pick up a few juniors. TGR: What parting thoughts do you have for our readers on how to gauge and play this market with all these confusing factors? DM: For the average investor, try not to pick the bottom. Everyone has an opinion, including me, but make your own decisions based on the best information that is available. We are in a tough economic environment. Many stocks are at or near all-time lows, but if we just think long term, we should all be in pretty good shape. TGR: We'll keep that in mind and see how things develop. We greatly appreciate your time today and look forward to talking with you again in the new year to see what has happened with these companies. DM: My pleasure. Thanks. Dale Mah is an equity research analyst based in Mackie Research Capital's Vancouver office. Mah joined Mackie Research Capital in June 2010 after working in mining and mineral exploration industries for over 14 years and has experience in base metals, diamonds and gold in all stages of mineral exploration and mining, including grassroots exploration, advanced projects, production geology, mineral processing and resource estimation. He focuses on junior and developing exploration companies in the mining sector operating worldwide. Mah graduated with a Bachelor of Science with a specialization in geology from the University of Alberta in 1996 and has worked with both junior exploration companies and major mining companies. Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page. DISCLOSURE: |

| WATCH: Juan Castañeda on Sound Money Posted: 19 Dec 2011 04:42 AM PST Juan Castañeda Talks to Alasdair Macleod About Sound Money ~TVR |

| Posted: 19 Dec 2011 04:39 AM PST Did GLD And Other Gold ETFs Kill Gold Stocks? from ZeroHedge:

In a just released piece by Goldman's Eugene King which explains the firm's justification for why gold will peak at over $1900 in 2012, and which we will discuss in greater detail shortly, Goldman brings up a very interesting point, namely that the ongoing weakness in gold stocks, and the broad decoupling of gold miners from gold price can be attributed to one primary thing: the emergence of synthetic means of expressing a position on the gold market and "bypassing" direct gold cost pass thru exposure in the form of gold stocks. Supposedly this is a good thing, although we would caution that this is potentially a very insidious scheme to allow the world's cash-rish entities (read banks full of those ones and zeros that these days pass for "money") to procure real gold assets at very cheap prices and valuations, even as the broader retail investors proceeds to chase paper gold in the form of "synthetic CDOs" such as GLD (which as we first noted over a week ago may well disappear when the paper claims collapse and suddenly everyone has a claim on the underlying physical), only after the fact realizing they merely used gold as a paper pass thru equivalent. In other words, as the broader population continues to realize that gold is the real safe asset, yet invests in legacy forms of exposure, i.e., paper, the real hard assets: firms that actually extract gold from the ground and process it, remain out on the auction block to be snapped up quietly by all those who want exposure to the primary source of the metal, which they can then throttle at will in order to manipulate the supply side of the equation post facto. Read More @ ZeroHedge.com |

| The Great Debt Binge: 9 Charts That Support Buying Gold Posted: 19 Dec 2011 04:01 AM PST By Parsimony Investment Research: We are big believers in the simple adage that a picture is worth a thousand words. A few basic charts can help investors understand where we are in the debt super cycle as well as the structural, not cyclical problems we face. While traders and media pundits focus on minor changes to weekly jobless claims or consumer sentiment, we think investors need to step way back and take a longer term horizon of history. We are of the mindset that too many investors are looking at today's predicament as a cyclical issue. To jump to our conclusion we believe credit market debt will create significant drag on the global economy leading to frequent recessions and more monetary stimulus from central bankers. In order to protect ourselves we are focused on high quality, US equities, precious metals, and a healthy reserve of cash. We will use a few charts to help Complete Story » |

| The U.S. Government Has The Power To End the FED and Issue Debt-Free Money Posted: 19 Dec 2011 02:39 AM PST Debt-Free United States Notes Were Once Issued Under JFK And The U.S. Government Still Has The Power To Issue Debt-Free Money Another excellent article, courtesy of The Economic Collapse blog. Many believe debt-free money would be superior to a gold standard, as the banks hold most of the gold and could still concentrate and [...] |

| Physical Demand “Will Determine Support for Gold” while Selloff was “Driven by Euro Weakness” Posted: 19 Dec 2011 01:51 AM PST Monday 19 December, 08:45 EST Physical Demand "Will Determine Support for Gold" while Selloff was "Driven by Euro Weakness" WHOLESALE MARKET gold bullion prices rose to $1607 an ounce Monday lunchtime in London – 0.5% up from last Friday's close – while European stocks and commodities were broadly flat and government bond prices eased. Silver bullion meantime rose to $29.36 per ounce just ahead of New York's open – 1.2% down on last week's close. Earlier on Monday Asian stock markets sold off following news of North Korean leader Kim Jong Il's death. South Korea's Kospi index fell 3.4%, while on the currency markets the South Korean Won sold off while the Dollar strengthened. Gold bullion will fall below $1500 per ounce during the next three months, according to a poll of 20 hedge fund managers, economists and traders conducted by news agency Reuters. "You're looking at Euro weakness, rather than anything else, as the driving force behind the sell-off [in gold bullion last week]," reckons David Jollie, analyst at Mitsui Precious Metals, adding that many traders will be reluctant to buy gold so close to the end of the calendar year. "Whatever your [longer-term] view, you have to ask what the chances are of making money by the end of the year…that says to a lot of people that this is not a market to get longer in." Over in New York, the difference between the number of bullish and bearish contracts held by noncommercial gold futures and options traders on the Comex exchange – the so-called speculative net long – fell 10.6% in the week ended last Tuesday, the latest data from the Commodity Futures Trading Commission show. "The key factors that will determine how supported the gold market is on the downside will be whether the 'sticky' ETP [exchange-traded product] holdings remain relatively stable and whether physical demand responds to much lower prices," says a research note from Barclays Capital. The volume of gold bullion held to back shares in the world's largest gold ETF – the SPDR Gold Trust – has fallen 1.4% since the end of last month to just under 1280 tonnes. Over the same period, gold bullion prices have dropped around 8%. European finance ministers are meeting Monday in an effort to meet a self-imposed deadline for arranging €200 billion of loans promised to the International Monetary Fund at the European Union summit earlier this month. Ministers also hope to make progress on drawing up new budget rules for national governments. "They'll try to get as much done as they can before Christmas," says Carsten Brzeski, Brussels-based senior economist at ING Group. "But it's doubtful they'll put markets in a Christmas mood…there is still so much uncertainty." Ratings agency Fitch warned on Friday that it may downgrade Belgium, Cyprus, France, Ireland, Italy, Slovenia and Spain. Fellow ratings agency Moody's meantime announced that it has cut Belgium's rating by two notches to Aa3. "A 'comprehensive solution' to the Eurozone crisis is technically and politically beyond reach," said a statement from Fitch. "Of particular concern is the absence of a credible financial backstop. In Fitch's opinion this requires more active and explicit commitment from the [European Central Bank] to mitigate the risk of self-fulfilling liquidity crises for potentially illiquid but solvent Euro Area Member States." ECB president Mario Draghi however says his organization will not step up its program of buying government bonds on the open market – said to be capped at €20 billion per week. "People have to accept that we have to, and always will, act in accordance with our mandate and within our legal foundations," Draghi says an an interview in today's Financial Times. "The important thing is to restore the trust of the people – citizens as well as investors – in our continent. We won't achieve that by destroying the credibility of the ECB." Fitch's warning follows a similar move by Standard & Poor's earlier this month, which saw S&P put every Eurozone member on CreditWatch negative. Back in August, S&P cut its rating on US sovereign debt. Newswire Bloomberg today suggests that downgrade has proved to be "absurd", since US Treasury bond prices have since gained more than 4%. "It is the ability to print one's own currency to pay government bond investors back under any circumstances that makes a government bond a government bond, i.e. a (credit) risk- free asset for hold-to-maturity investors," points out Elga Bartsch, London-based chief European economist at Morgan Stanley in London, in a recent client note. Here in the UK, chancellor George Osborne is expected to give his full backing to the Independent Commission on Banking and promise to pass legislation by 2015 that will separate investment and retail banking. UK house prices meantime have fallen 2.7% over the last 12 months, according to figures published today by Rightmove. "It looks like no nation, no market, no investor is free from this negative outlook. And gold is no exception," says a note from Swiss gold bullion refiner MKS. "Gold appears to be playing a difficult role at the moment," adds the latest note from German precious metals group Heraeus. "On one side it is the stability anchor in times of economic and financial crisis, on the other hand there are increasing signs…that gold is in wake of the equity and interest markets." Ben Traynor Gold value calculator | Buy gold online at live prices Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK's longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. (c) BullionVault 2011 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. |

| 2012 Gold Averages: Goldman $1,810/oz, Barclays $2,000/oz and UBS $2,050/oz Posted: 19 Dec 2011 01:43 AM PST |

| There will be no major hit on gold loan biz in India Posted: 19 Dec 2011 12:57 AM PST |

| North Korean dictator dies... Could create "nuclear crisis" in region Posted: 19 Dec 2011 12:33 AM PST From Bloomberg: The death of North Korean dictator Kim Jong Il presents a potential crisis for President Barack Obama, complicating U.S. efforts to press the regime to abandon its nuclear arsenal and cease belligerent behavior. The demise of a 70-year-old ruler – who frustrated three U.S. administrations with his pursuit of nuclear weapons, threats toward American allies and economic mismanagement that resulted in mass starvation – ushers in a period of uncertainty for the isolated communist regime and North Asia. It increases the danger of misjudgment on the Korean peninsula, where 1.7 million troops from North and South Korea and the U.S. square off. The U.S. has 75,000 troops stationed in South Korea and Japan and is bound by treaty to defend its allies "This is potentially a game-changing event," Victor Cha, a former chief U.S. negotiator for North Korean nuclear talks under President George W. Bush, said in an interview. "If you asked experts what would be the most likely scenario for North Korea to collapse, the answer everyone would give you is 'if Kim Jong Il died today.' We're in that scenario." The prospect of a crisis in the region – whether a hardening of confrontational behavior or a collapse of the impoverished state triggering a humanitarian emergency – is an additional foreign policy challenge for the the Obama administration 11 months before the U.S. presidential election and just as the U.S. completes its military withdrawal from Iraq. Asia 'Pivot' Uncertainty over North Korea thrusts Asia to the forefront of the administration's agenda, just weeks after Secretary of State Hillary Clinton's statement that the U.S. plans to "pivot" its attention to Asia. Stability in Asia is essential to Obama's aim to make the region the engine of U.S. economic recovery, largely through expanded trade. The transition in North Korea adds to risks for South Korea, Asia's fourth-largest economy. The Kospi index of shares closed down 3.4 percent in Seoul, and South Korea's won sank 1.4 percent to 1,174.80 per dollar. Kim's passing may scuttle what may have been the first U.S. diplomatic breakthrough with the hermetic regime in a few years. South Korea's Yonhap News reported two days ago that the U.S. would provide food aid to North Korea with the understanding that the regime would suspend uranium enrichment. U.S. officials declined to confirm the reports, and the death of Kim may put any deal on hold. Cha, now at the Center for Strategic and International Studies in Washington, likened the focus on North Korea's tenuous situation to efforts to peer into a fishbowl. Worrisome Scenarios "We're all going to try to look in from the outside, and at same time I think everyone will be very careful about not sticking their hand in the fishbowl," Cha said. Perhaps most probable among worrisome scenarios, according to former U.S. officials, is that Kim's death may prompt his third-born son and anointed successor, Kim Jong Un, to accelerate nuclear weapons development and menace his neighbors in a show of force to consolidate his control. "One question is: Will Kim Jong Un and others around him do something to prove him being in command?" said Michael Green, former National Security Council senior director for Asia under President George W. Bush. "In next 48 hours we won't see that, but in the next weeks and months, I suspect we may." The Korea peninsula has technically been in a state of war since the 1950-53 Korean War ended in a cease-fire rather than a peace treaty. Nuclear Weapons State North Korean media has reported that the country will become "a full nuclear weapons state" in 2012; April will mark the 100th anniversary of the birth of Kim Il Sung, the founder of the regime and its cult of dynastic personality. Kim Il Sung died in 1994, after grooming his son Kim Jong Il for a decade and a half. Kim Jong Il's third son has had far less preparation or time to consolidate his authority. Believed to be 28 or 29, he was publicly tapped for the job by his father only last year, when he was appointed to the second-highest military post within the ruling Workers' Party of Korea. "It's the only communist monarchy in the world, and the king is dead. And when the king dies, even when he set his succession, there can still be rivalry and civil war," said Green, now at CSIS and Georgetown University. While the North has twice conducted underground nuclear tests in the last five years, Green said U.S. officials fear that the regime may go further by showcasing progress on triggering devices and miniaturization of a nuclear payload, or by launching more advanced ballistic missiles. Following His Father Bruce Klingner, a Korea specialist at the Heritage Foundation in Washington and a former deputy chief for Korea at the Central Intelligence Agency, said Kim Jong Un is unlikely to abandon his father's policies or his nuclear weapons as he seeks to consolidate his position. Nuclear weapons, Klingner said in an interview, "provide security against the U.S. and South Korea in case of attacks" and force the world to "pay attention to Pyongyang. It gives them leverage in trying to extract economic benefits from the West." The Obama administration has said that it resumed direct talks in recent months after determining that engaging the regime might lessen the risk of violent provocations. Glyn Davies, the U.S. special envoy on North Korea policy, told reporters in Tokyo last week that further bilateral talks hinged on the totalitarian state's changing its "provocative" behavior. Economic Mess Kim leaves behind an economy crippled by mismanagement, crop failures, sanctions and a bungled currency revaluation. North Korea's economy is less than 3 percent the size of South Korea's and has relied on economic handouts since the 1990s, when an estimated 2 million people died from famine. The United Nations and the U.S. last year tightened economic sanctions that were imposed on the North for its nuclear weapons activities and two attacks in 2010 that killed 50 South Koreans. "If there was a deal on food aid, whatever deal has been struck is pretty much off the table now," Bryce Wakefield of the Woodrow Wilson International Center for Scholars, a Washington-based research institute, said in an interview. The U.S. wouldn't be able to count on the North "to hold up its end of the deal," and it will take time for North Korea to determine its own direction. Scott Snyder, a senior fellow for Korea studies at the Council on Foreign Relations in Washington, agreed that "it will be more difficult to get answers or positions out of Pyongyang under current circumstances." Intelligence Efforts Bruce W. Bennett, a defense analyst at the Rand Corp. in Santa Monica, California, said in an interview that a number of scenarios are possible in the coming months: North Korean elites try to install an alternate leader; assassination attempts; or a show of force by Kim Jong Un purging select officials or accelerating nuclear testing. "We clearly should be trying to shape the event, but it's not likely that we're going to have much power," Bennett said. The U.S., Bennett said, will be heightening military warning and intelligence efforts to monitor North Korea, including shifting satellites, running reconnaissance aircraft and gathering intelligence from allies and from China on actions by the North Korean military and the potential for an internal uprising. At midnight, Obama spoke with South Korean President Lee Myung-bak and "reaffirmed the United States' strong commitment to the stability of the Korean Peninsula and the security of our close ally," according to a White House statement. The leaders agreed "to stay in close touch as the situation develops" and directed their national security teams to continue close coordination. To contact the reporters on this story: Indira A.R. Lakshmanan in Washington at ilakshmanan@bloomberg.net; Nicole Gaouette in Washington at ngaouette@bloomberg.net. To contact the editor responsible for this story: Mark Silva at msilva34@bloomberg.net More on North Korea: Asia could be headed for "all-out" war Eleven unbelievable facts about North Korea North Korea: War could begin "at any moment" |

| Uh oh, Nigerians want to trade paper gold Posted: 19 Dec 2011 12:28 AM PST Nigerian bourse to list first gold-backed ETF The Nigerian stock exchange said it would broaden its range of products beyond equities and bonds with the listing of a South African gold-backed fund Posted: Friday , 16 Dec 2011 LAGOS (Reuters) - Nigeria's bourse is to list its first exchange traded fund (ETF) on Monday, a South African gold-backed fund that will broaden the exchange's range of products beyond equities and bonds, the stock exchange said on Friday. NewGold, originated by South Africa's Absa Bank Limited , has a primary listing in South Africa and before its Nigeria debut had one other listing on Botswana's bourse. The fund will open on an initial offering of 1.096 billion naira ($6.76 million), split into 400,000 units, to test demand before any possible expansion into something bigger, a source at the stock exchange told Reuters. "You don't want to list a million units and find out that it's not trading. They (ABSA) are testing the waters with this and I am certain that this figure will go up based on the uptake," the source said, adding that ABSA plans to expand the ETF around Africa, including in Ghana. ETFs track equity or derivative indexes or a commodity but trade like a stock on an exchange, giving investors exposure to the underlying assets but at a much lower cost and with more short-term flexibility. Listing on the Nigerian bourse, sub-Saharan Africa's second-biggest, will increase liquidity for the security and help diversify the stock exchange away from the equities that currently dominate it, he said. "We are trying to deepen and widen the capital market. We want to provide different products not just plain vanilla," the source added. "I see a lot of EFTs being listed earlier next year. We already have an application to list another equity-based ETF next year by a local issuer and they want ... it by January." Nigerian equities have touched 8-year lows in recent weeks, dragged down by banking and oil stocks, as foreign investors spurn frontier markets and domestic funds to buy bonds in search of better yields. The all-share index is down almost 20 percent so far this year from a gain of 19.67 percent achieved in 2011. Regulators have been trying to diversify the bourse to position it as a regional trading hub rivaling South Africa. The source at the stock exchange said some of the mutual funds in the country were considering converting their funds into listed ETFs. ($1 = 162.2000 naira) (Reporting by Chijioke Ohuocha; Editing by Tim Cocks and Jane Merriman) http://www.mineweb.com/mineweb/view/...ail&id=110649 |

| If you're betting on a rally, these are the stocks you should be buying Posted: 19 Dec 2011 12:24 AM PST From Frank Holmes of U.S. Global Investors: Followers of The Stock Trader’s Almanac are probably familiar with the "January Effect" that shows how small-capitalization companies have historically crushed large-cap stocks during the first month of the year. According to Yale and Jeffrey Hirsch, small caps have delivered a forceful blow to their larger counterparts in 40 out of 43 years from 1953 through 1995. But if you dissect the performance of the small-cap Russell 2000 Index versus the large-cap Russell 1000 Index from December 15 through the end of February, you'll see that for the last 30 years, most of the "January Effect" actually occurred within the last two weeks of the year... Read full article... More trading ideas: Most traders are making a mistake with gold This could be the best trade in precious metals today The dollar has already reached a big potential turning point |

| Ten U.S. economic facts that are too crazy to believe Posted: 19 Dec 2011 12:21 AM PST From Financial Armageddon: In "50 Economic Numbers From 2011 That Are Almost Too Crazy To Believe," the Economic Collapse blog offers up a hefty list of bullet points that accurately describe an economy teetering on the edge of disaster. That said, 50 might just be a bit of overkill. In truth, the 10 I've highlighted paint a pretty frightening picture of just how bad things really are. No.1 A staggering 48 percent of all Americans are... Read full article... More on the "End of America": What the Founding Fathers really thought about democracy Must-read: If this doesn't wake you up, absolutely nothing will A mysterious group is buying up America's leading gun and ammunition manufacturers |

| View From the Turret: Holiday Trading Posted: 19 Dec 2011 12:09 AM PST

And that's the problem with trading this week. Traders have other things on their minds. Prop desks are being staffed with second string players, and rookies who have been given minimal latitude to maneuver. Most major allocation decisions have already been made – or they are postponed for the beginning of 2012. In short, this week and next are likely to feature low levels of liquidity, and unpredictable volatility on an intra-day basis. From a trading perspective, there are really just two major issues that have meaningful potential to drive markets this week. 1) The Debt Crisis in Europe – Funding issues, austerity measures, and ratings decisions aren't likely to take time off for the holidays. So the drama in Europe still has potential for headline driven swings and "risk-on" / "risk-off" decisions by managers with exposure to Europe. By the way, with correlation levels high, everyone has exposure to Europe… 2) Performance Anxiety – Mutual fund managers have largely fallen behind their benchmarks this year, as volatility along with redemptions / distributions have made it difficult to effectively manage assets. With many managers' jobs on the line, don't be surprised to see some last minute heroics push prices around this week and next. As we trade our way through the week, we will be conservative in adding new positions – focusing more on tightening risk points and managing the modest exposure on our books. Despite the many challenges, it's been a profitable trading year for the Mercenary trading book and we're focused more on protecting those gains rather than pushing hard into the end of the year. Below are a few areas we're focusing on this week:

Sign Up For the Mercenary Dispatch Get our best content delivered FREE to your inbox! Check out the Mercenary Dispatch page to learn more. Bad News for Social Media IPOs Did you see Zynga Inc. (ZNGA) on Friday? Zynga debuted on the Nasdaq Friday, pricing about 100 million shares at $10.00. The billion dollar offering was the largest internet IPO since Google went public in 2004 – and it was priced at the high end of the expected range. All good so far… Unfortunately for participants in the deal, Zynga didn't keep its $10.00 price tag. During the day, the stock lost as much as 10% of its value, settling at $9.50 per share – or a 5% loss. That's bad news for such a widely anticipated IPO – especially considering the fact that ZNGA is a profitable company and investors are expecting significant growth out of the company for years to come. I have to admit, I'm not a huge Facebook user – and I certainly don't spend a lot of time playing games like Zynga's now famous "Farmville" series. For what it's worth, I DID perform a little "hands-on" research over the weekend, playing Zynga's Texas Hold 'em for 20 minutes or so. The company's "free to play" with premium items or services for sale has been proven to work for many of the Chinese gaming companies. An estimated 3% of Zynga's gamers end up becoming paying subscribers. The question for investors is whether Zynga will continue to be able to grow – especially considering increasing competition from traditional console gaming companies like Electronic Arts (ERTS) and Activision Blizzard Inc. (ATVI). Considering the disappointing start, ZNGA could turn out to be an attractive short over the next two weeks. With IPO investors trapped below the high-water mark, there is a significant potential for massive liquidation. The $10 price level should now become resistance with investors willing to bail at this level if they can "get their money back" from this busted deal.  Euro Consolidation – Leading To… Our profitable euro short has been trading in a tight range after breaking to new lows early last week. The troubled currency has settled at the psychologically important 1.30 level (for the EURUSD pair) and traders are watching the action carefully to determine whether this is a key support area (leading to a rebound) – or simply another stop along the bearish path. If the currency pair continues to trade at this level for a few more days – and then breaks down sharply – it would give us a natural spot to tighten our risk point significantly. We've already locked in a small profit on this trade, but a new risk point just above the 1.30 consolidation would give us more than a 2R profit on the trade. "2R" refers to our "reward-over-risk" measure – meaning our return would be more than twice our original capital at risk. For a discussion of standardized units of risk, take a look at the Drivers Manual Part IV. If the euro does NOT break down from this level, we'll be watching the rebound carefully to determine if a new swing high will be reached, or if this is a more substantial rebound (leading us to go ahead and cash out of our euro position). Expect the action to continue to be headline driven with plenty of liquidity, but also plenty of volatility. The debt crisis isn't likely to take a break for the holidays and the volatile nature of this market should be respected over the next two weeks. China Weakness – No Relief Yet China's economic growth has taken a back seat to the crisis in Europe, but the issues are still significant. Recent price data shows that inflation may be easing, but that comes with serious deceleration in the growth rate. If China's growth stumbles, it will be big news for the broad global economy – investors are just too preoccupied with Europe to take note at this point. Over the past two weeks, our short positions in Baidu Inc. (BIDU) and Ctrip.com Inc. (CTRP) have given us some nice unrealized gains – and our newest Chinese position in Youku.com Inc. (YOKU) still looks promising. Portfolio Managers are lightening up on risk in this area, but premium stock price multiples still leave plenty of room for more profits on the short side.Looking at the Guggenheim China Small Cap (HAO) ETF, it looks like we are sitting right on a key support level. This is a relatively illiquid ETF – in an illiquid market environment – but the pattern is still worth watching. If HAO breaks this level, and key Chinese stocks continue to trade lower, it would represent another confirmation of weakness in this area – one which could lead to much more liquidation in early 2012. Heading into the open, traders are bidding the pre-market futures modestly higher. The strength is probably due to some relief with no significant debt issues surfacing over the weekend, but the bottom line is that at this point there are more buyers than sellers… It's a choppy environment, so keep that exposure tight. The best use of time this week is probably outlining goals and expectations for 2012 rather than trying to book a few extra bips in the final two trading weeks of the year. At Mercenary Trader, we're excited about the year ahead as we work on new research and trading initiatives, developing new product ideas, and building more value into our "community of ruthless profiteers." Trade 'em well this week – and enjoy some free time as well…

|

| Gold Price Fundamentals Remain Unchanged Posted: 19 Dec 2011 12:06 AM PST from GoldMoney.com:

Have the world's central banks started selling gold again? No, they are increasingly on the buy side of the market. What about their management of the currencies they issue – have they all suddenly "got religion", and resolved to fight inflation and offer savers real returns on cash savings? No – quite the opposite in fact, as was discussed in this column last week. What about general confidence in "the system"? Have the measures governments enacted since the crisis of 2008 restored confidence in the financial system and persuaded small investors to wade back into the market? Not exactly. And when all's said and done, it's this confidence – or lack of it – that will be key to persuading more and more people to buy physical gold. Read More @ GoldMoney.com |

| Draghi Warns On Cost of Eurozone Break-Up Posted: 19 Dec 2011 12:02 AM PST Mario Draghi, the President of the European Central Bank, has warned that a break-up of the eurozone would mean greater economic hardship for those leaving the currency. by Jonathan Russell, Telegraph.co.uk:

His comments highlight the depth of the eurozone debt crisis as talk of a collapse of the currency union has until now been regarded as taboo at the central bank. His predecessor, Jean-Claude Trichet, refused to entertain the scenario, calling it "absurd". Mr Draghi, speaking to the Financial Times, said that if a country left the euro, it would in the end be forced to undertake the same harsh austerity measures and reforms being imposed at present, "but would be in a weaker position". He said there was no long-term trade-off between growth and austerity. Read More @ Telegraph.co.uk |

| Oblivious Because of Mainstream Media Posted: 18 Dec 2011 11:59 PM PST by Greg Hunter's USAWatchdog.com:

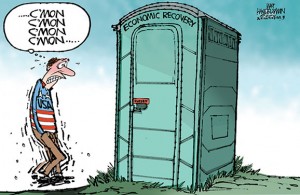

I think most people are simply oblivious to the enormous dangers the world economy faces. Oh, I think we will all get through Christmas and New Years without a meltdown, but all bets are off in 2012. A new acquaintance of mine told me last Friday, "Isn't the economy getting better?" I just looked at her and shook my head in the negative. Then she said, "I guess if it was getting bad, the media wouldn't tell us the truth." I shook my head in the affirmative. My new friend is 75 years old and gets a Social Security check every month. She's pretty sharp, but I don't blame her for being misinformed. She gets her news the old fashioned way—from the mainstream media (MSM). There is no wonder so many are in the dark and completely unprepared for the next crash. The front page of USA TODAY, last week, touted a headline that read: "Are We There Yet?" The article said,"The economic signs are encouraging, but we're a long way from a comeback." It covered recent upticks in auto and home sales. It also said the unemployment rate recently fell to "8.6%." TheUSA TODAY story went on to say, "Although the decline was partly due to a 315,000 drop in the labor force as discouraged job seekers simply gave up, employment is up an average 321,000 a month since August, according to the Labor Department's household survey. Most encouraging: Much of the hiring appears to be by small businesses, which typically fuel job growth in a recovery." Wow, the fact that 315,000 people "simply gave up" seemed completely glossed over. Why did more than 300,000 people give up? Maybe it's because there are precious few jobs. And what about the 400,000 people every week filing unemployment claims? Never let the facts get in the way of positive spin to please the advertisers. The USA TODAY story closes with a business professor who said, "I have a lot of confidence in the future." (Click here for the complete USA TODAY story.) Read More @ USAWatchdog.com |

| Posted: 18 Dec 2011 11:57 PM PST Euro Collapse Crisis Sledgehammer Pounds Into Stock Market Santa Rally by Nadeem Walayat, MarketOracle.co.uk:

Santa's Late! The stock market as measured by the DJIA closed the week down at 11,866, showing significant deviation from the santa rally script with barely a week remaining, the lack of progress to the upside has been as a consequences of the increasing mass of unserviceable debt out of the euro-zone where politicians repeatedly show themselves to be ignorant of the facts and what to do to get out of the hole that the euro-zone is sinking deeper into an economic depression each day. The euro-zone politicians appear single mindedly determined to do absolutely NOTHING to save the euro-zone, which is the reason why the bulk of my analysis and articles of the past 6 months has been centred around the risks coming out of the euro-zone, because just when you thought that they had succeeded at kicking the can a few months down the road, which was the conclusion of last weeks analysis that the risks of a collapse of the banking system had been delayed until at least Mid Jan 2012, instead this week has seen last weeks rescue plan already starting to disintegrate. Read More @ MarketOracle.co.uk |

| Posted: 18 Dec 2011 11:53 PM PST Martin Armstrong: Money is Not Safe Here, Buffett's Silver Play om King World News:

Continue reading @ KingWorldNews.com |

| Posted: 18 Dec 2011 11:52 PM PST Debt-Free United States Notes Were Once Issued Under JFK And The U.S. Government Still Has The Power To Issue Debt-Free Money from The Economic Collapse Blog:

Read More @ TheEconomicCollapseBlog.com |

| Africa to Control Mining Industry Posted: 18 Dec 2011 11:50 PM PST African Governments To Exert More Control Over Mining Industry by Roman Baudzus, GoldMoney.com:

At the end of May, Ethiopia hosted an African-Indian Forum Summit for Enhanced Cooperation, whichgave birth to the Addis Ababa Declaration. In this declaration, more than half of all African governments define how they will restructure their mining industry. Experts expect that soon most African mining companies – which are mostly privately operated – will face countless problems, asAfrican governments aim to exert more control over mining production. Hitherto, once obtaining their license, foreign mining companies could produce raw materials and sell them at the global markets without any governmental control. But now, many African governments deem that the royalties and export taxes imposed on mining companies are not enough. It seems that African governments soon will exert more control over the mining industry than ever before. Read More @ GoldMoney.com |

| MF Global's Gold and Silver Bullion Posted: 18 Dec 2011 11:39 PM PST Trustee to Seize and Liquidate Even the Stored Customer Gold and Silver Bullion From MF Global from Jesse's Café Américain:

Although the details and the individual perpetrators are yet to be disclosed, what is now painfully clear is that the CFTC and CME regulated futures system is defaulting on its obligations. This did not even happen in the big failures like Lehman and Bear Sterns in which the customer accounts were kept whole and transferred before the liquidation process. Obviously holding unallocated gold and silver in a fractional reserve scheme is subject to much more counterparty risk than many might have previously admitted. If a major bullion bank were to declare bankruptcy or a major exchange a default, how would it affect you? Do you think your property claims would be protected based on what you have seen this year? Read More @ JessesCrossRoadsCafe.Blogspot.com |

| How The Bankers Drive Up Bullion Prices (Part I) Posted: 18 Dec 2011 11:37 PM PST by Jeff Nielson, Bullion Bulls Canada:

Regular readers are excused for being confused by this title, or perhaps even suspecting a misprint. After all, having written numerous commentaries documenting the activities of the bullion banks in suppressing bullion prices, at first glance the title appears nothing less than perverse. At the same time, I have previously observed that what the banksters are able to accomplish in depressing prices over the short-term must lead to a boomerang higher in prices over the longer term. In our markets we see yet another example of the principles of economics mirroring the laws of physics: for every action, there is an equal and opposite reaction. There is a particular reason for me to raise this issue at this particular time. While the predatory actions of the bankers in the bullion market are frequently highlighted by precious metals commentators, much less often discussed is the even more rabid suppression of the gold and silver miners. Read More @ BullionBullsCanada.com |

| Morning Outlook from the Trade Desk - 12/19/11 Posted: 18 Dec 2011 11:21 PM PST Morning Outlook for 12/19/11 Gold pushed up through $1,600 while we slept, but could not hold the rally. As we approach Wednesday, the markets will get thinner every day, which sometimes leads to volatile price action. All my friends are tired and want to call it a year. No one wants to be caught on the wrong side over the Holidays. Can gold re-test levels above $1,600 yep, can gold test $1,575 yep. By the way its scary that most of the staff and readers don't know who Twiggy(the advent of the skinny and I mean skinny model) was, but had no issues with Mr. Ed (the talking horse). I wonder if it's a French Canadian thing? |

| Morgan: “Silver Price Flat Through Most of 2012″ Posted: 18 Dec 2011 09:06 PM PST David Morgan gives a great talk about where the price of silver is and where it is headed. ~TVR |

| Gold & Silver Market Morning, December 19, 2011 Posted: 18 Dec 2011 09:00 PM PST |

| Posted: 18 Dec 2011 08:57 PM PST From a episode of "How It's Made" featuring a segment on silver mining. The mining company is clearly shown, First Majestic Corp. of Canada (their active mines are in Mexico, however). Their refined bullion bars are shown at the beginning, but the segment focuses on the mining and silver extraction process. And from the looks of it, it's ain't easy. ~TVR |

| Taking A Look At Silver Heading Into Next Week Posted: 18 Dec 2011 07:10 PM PST |

| Posted: 18 Dec 2011 06:32 PM PST By Philip Mirowski, Carl Koch Professor of Economics and the History and Philosophy of Science University of Notre Dame. Professor Mirowski has written numerous books including More Heat than Light, Machine Dreams and, most recently Science-Mart Edited and with an introduction by Philip Pilkington, a journalist and writer living in Dublin, Ireland A bibliography can be found here During a recent interview with the eminent historian of economic thought, Philip Mirowski, I raised a series of questions relating to how mainstream economists had dealt with the crisis on an intellectual level and what this might mean for the discipline in the coming years. I asked if he thought that they could hope to recover their bearings and, under the tutelage of a figure like Paul Krugman, might re-establish the neoclassical research program by simply tacking on some watered-down Keynesianism, just as Paul Samuelson had done in the post-war era. Mirowski said that he did not want to answer these questions. "Of course," he wrote, "I am interested in all of them, but I have been trying to bring the application of history and philosophy of science a bit closer to the earth when it comes to the crisis." He then sent me an article he had written for a recently published book entitled The Elgar Companion to Recent Economic Methodology. After reading this 40-odd page article I knew that it was easily the most important statement on how the mainstream of the economics discipline had reacted to the crisis and what this might mean for the neoclassical research program in the future. I also knew that the book in which it was published would likely go unread by a broader audience of non-economists – and possibly even many economists – and so I asked him if we could publish an edited version. He kindly complied and the result is what the reader will see appearing on the Naked Capitalism website in the coming days. This is a long and complex article and I feel it might be worthwhile if I highlight a few key points that the reader can use as a thread to follow through this series, especially the later few pieces.

Embedded in this critique is a smaller but no less substantial critique of behavioural economics. In this regard Mirowski points to popular exponents of the behavioural tradition like Robert Schiller. As Mirowksi clearly shows, behavioural economics is but another shallow, but superficially appealing defence of orthodoxy. It fundamentally alters nothing because its concepts of 'rationality' and 'irrationality' are largely ad hoc. This is important because anyone who has ever critiqued economists' conception of 'rationality' is often met with apologists saying that the mainstream has now moved into the behavioural sphere and are thus becoming more scientific. This is nonsense of the highest order. Again, Mirowski puts it eloquently: "Two decades of behavioral research certainly has not resulted in any consensus systematic revisions of microeconomics, much less macroeconomics. Beyond wishful thinking, why should one even think that the appropriate way to approach a macroeconomic crisis was through some arbitrary set of folk psychological mental categories?" There is much more in what follows and, indeed, these are only the key points that I would pull out of Mirowski's excellent article. The piece does not drop into these critiques straight away. Instead it provides the reader with an excellent overview of the institutional critiques and counter-critiques of economics within the media. In this, the reader will see the second reason to engage fully with Philip Mirowski's work (the first being that it is the most pressing and far-reaching critique of neoclassical economics that has ever existed): Mirowski's work is entertaining. It is ironic, light-hearted and even at times genuinely funny. It engages the reader on a number of different levels – now theoretical, now literary. And in this I believe that Mirowski is one of the most important writers working today – and not only in the field of economics, but also in the fields of philosophy and the history of thought. Anyone interested in any of these areas who has not engaged with Mirowski's work is far, far behind the times. – Philip Pilkington ===================================== Part I: Them Crazy Seekers After the financial crisis of 2007-08, the economics profession were in a particularly vulnerable position. No sane person could welcome a worldwide economic contraction; but the economics profession was particularly vulnerable to scorn and derision with its onset, because the orthodox majority had been boasting of unprecedented success in guaranteeing prosperity during the first decade of the millennium, often under the rubric of 'The Great Moderation'. [1] Furthermore, the economists had grown so confident in their orthodoxy that they had driven out most rival views and approaches from the richest and most powerful academic settings. This relative homogeneity of their disciplinary convictions helped to set the stage for what has become a rolling come-uppance. Once the contraction proceeded in earnest in 2008, it became commonplace in newspapers, blogs and symposia at various universities to query openly why these economists had apparently been caught unawares. Disparagement grew sharper as time passed, such as in movies like Charles Ferguson's Inside Job (2010). Individual economists have responded with a bewildering array of diagnoses, qualifications and bald excuses, in ephemeral blogs and interviews, but also in durable print. How can an observer extract signal from noise in order to come to understand the modern predicament of economics? Has it all really been just a flash in the pan? How did economists acquit themselves during the shellacking? As the reader will appreciate, this is eminently a methodological question; but by 2008 the economists were bereft of methodological and philosophical resources to inform their responses. After a brief flirtation in the 1960s and 1970s, the grandees of the economics profession took it upon themselves to express openly their disdain and revulsion for the types of self-reflection practiced by 'methodologists' and historians of economics, and to go out of their way to prevent those so inclined from occupying any tenured foothold in reputable economics departments. [2] It was perhaps no coincidence that history and philosophy were the areas where one found the greatest concentrations of skeptics concerning the shape and substance of the post-war American economic orthodoxy. High-ranking economics journals, such as the American Economic Review, the Quarterly Journal of Economics and the Journal of Political Economy, declared that they would cease publication of any articles whatsoever in the area, after a prior history of acceptance. Once this policy was put in place, and then algorithmic journal rankings were used to deny hiring and promotion at the commanding heights of economics to those with methodological leanings. Consequently, the grey- beards summarily expelled both philosophy and history from the graduate economics curriculum; and then, they chased it out of the undergraduate curriculum as well. This latter exile was the bitterest, if only because many undergraduates often want to ask why the profession believes what it does, and hear others debate the answers, since their own allegiances are still in the process of being formed. The rationale tendered to repress this demand was that the students needed still more mathematics preparation, more statistics and more tutelage in 'theory', which meant in practice a boot camp regimen consisting of endless working of problem sets, problem sets and more problem sets, until the poor tyros were so dizzy they did not have the spunk left to interrogate the masses of journal articles they had struggled to absorb. How this encouraged students to become acquainted with the economy was a bit of a mystery – or perhaps it telegraphed the lesson that you did not need to attend to the specifics of actual economies (Klamer and Colander, 1990). Then, by the 1990s there was no longer any call for offering courses in philosophy or history of doctrine, since there were very few economists with sufficient training (not to mention interest) left in order to staff the courses. [3] Methodology had been effectively defined as 'not economics'. As one of the original interviewers noted about a follow-up survey of economics graduate students at major departments just before the crisis:

Consequently, when the Great Mortification followed in the wake of the demise of the Great Moderation, both those occupying the commanding heights of the profession and those in the trenches were bereft of any sophisticated resources to understand their predicament comprehensively. In a pinch, many fell into a defensive crouch, falling back on the most superficial of personal anecdotes, or else the last refuge of scoundrels, the proposition that 'we' already knew how to handle the seemingly anomalous phenomena, but had unaccountably neglected to incorporate these crucial ideas into our pedagogy and cutting-edge research. Streaming video sometimes captured these pageants on the Internet. [4] It takes some thick skin not to cringe at the performance of four famous economists at the January 2010 meetings of the American Economics Association in Atlanta, in a session expressly titled, 'How Should the Financial Crisis Change How We Teach Economics?' [5] Three out of the four were not even bothered actually to address the posited question, so concerned were they to foster the impression that they personally had not been caught with their pants down by the crisis. The fourth thought that simply augmenting his existing textbook with another chapter defining collateralized debt obligations and some simple orthodox finance theory would do the trick. For the ragged remnants of economic methodologists, it was a dreary sight to watch a few older economists rummaging around in the vague recesses of memories of undergraduate courses criticizing Milton Friedman's little 1953 benediction for believing whatever you pleased as long as it was neoclassical (Maki, 2009), and coming up with nothing better than badly garbled versions of Popper and Kuhn. Of course quite a few had premonitions that something had gone very wrong, but the sad truth was that they were clueless when it came to abstract philosophical argument isolating just where the flaws in professional practice might be traced, and assessing the extent that they were susceptible to methodological remedies. Mired in banality, the best they could prescribe was more of the same. No wonder almost every eminent economist took their philosophical perplexity as a convenient occasion to settle internecine scores within the narrow confines of the orthodox neoclassical profession: MIT v. Chicago, blinkered econometrics v. blinkered axiomatics, New Keynesians v. New Classicals, Pareto suboptima v. rational bubbles . . . In what follows I shall try not to pay much attention to such local settling of scores, but instead attempt to comprehend these responses as a case study in the social psychological problem of cognitive dissonance. The father of 'cognitive dissonance theory' was the social psychologist Leon Festinger. In his premier work on the subject, he addressed the canonical problem situation which captures the predicament of the contemporary economics profession:

This profound insight, that confrontation with contrary evidence may actually augment and sharpen the conviction and enthusiasm of a true believer, was explained as a response to the cognitive dissonance evoked by a disconfirmation of strongly held beliefs. The thesis that humans are more rationalizing than rational has spawned a huge literature (Fischer et al., 2008), one that gets little respect in economics. Cognitive dissonance and the responses it provokes goes well beyond the literature in the philosophy of science that travels under the rubric of 'Duhem's thesis', in that the former plumbs response mechanisms to emotional chagrin, whereas the latter sketches the myriad ways in which auxiliary hypotheses may be evoked in order to blunt the threat of disconfirmation. Philosophy of science reveals the ways in which it may be rational to discount contrary evidence; but the social psychology of cognitive dissonance reveals just how elastic the concept of rationality can be in social life. Festinger and his colleagues illustrated these lessons in his first book (1956) by reporting the vicissitudes of a group of Midwesterners they called 'The Seekers' who conceived and developed a belief that they would be rescued by flying saucers on a specific date in 1954, prior to a great flood coming to engulf Lake City (a pseudonym). Festinger documents in great detail the hour-by-hour reactions of the Seekers as the date of their rescue came and passed with no spaceships arriving and no flood welling up to swallow Lake City. At first, the Seekers withdrew from representatives of the press seeking to upbraid them for their failed prophecies, but soon reversed their stance, welcoming all opportunities to expound and elaborate upon their (revised and expanded) faith. A minority of their group did fall away, but Festinger notes that they tended to be lukewarm peripheral members of the group before the crisis. Predominantly, the Seekers never renounced their challenged doctrines. At least in the short run, the ringleaders tended to redouble their proselytizing, so long as they were able to maintain interaction with a coterie of fellow covenanters. In a manner of speaking, the legacy of renunciation of philosophy and methodology led much of the orthodox economics profession to behave in ways rather similar to the Seekers from 2008 onwards. The parallels between the Seekers and the contemporary economics profession are, of course, not exact. The Seekers were disappointed when their world didn't come to an end; economists were convinced their Great Moderation and neoliberal triumph would last forever, and were disappointed when it did appear to come to an end. The stipulated turning point never arrived for the Seekers, while the unsuspected turning point got the drop on the economists. The Seekers garnered no external support for their doctrines, indeed, quitting their jobs and contracts prior to their Fated Day; the economists, on the other hand, persist in being richly rewarded by many constituencies for remaining stalwart in their beliefs. The public press was never friendly towards the Seekers; it only turned on the economists with the financial collapse. (There are already signs it may be reverting to its older slavish adoration, however.) But nonetheless, the shape of the reactions to cognitive dissonance was amazingly similar. The crisis, which at first blush might seem to have refuted most everything that the economic orthodoxy believed in, was in the fullness of time more often than not trumpeted from both the Left and the Right as reinforcing their adherence to neoclassical economic theory. Thus was made manifest the 'spontaneous methodology of the economics profession'. ================================== 1. Federal Reserve System (Fed) Chair Ben Bernanke had begun in 2004 in speeches and writings to proclaim the onset of a 'Great Moderation' in the US macroeconomy since 2. Here is not the place to document this trend, but see Paul Samuelson's setting the tone for the community in the 1970s: 'Those who can, do science; those who can't prattle on about its methodology' (quoted in Holcombe, 1989). 3. This dynamic is described from various vantage points in Weintraub (2002). 4. See, for instance, John Cochrane attacking Paul Krugman: http://www.youtube. com/watch?v5HO4E1bs4CbE; or Cochrane on the PBS News Hour, 17 February 5. Available at: http://www.aeaweb.org/webcasts/assa2010.php. Irked by GATA, Bank of England denies gold loans, swaps since 2007 Posted: 18 Dec 2011 05:08 PM PST |

| Ron Paul Takes Lead in Iowa While Reaching $4 Million Fundraising Goal Posted: 18 Dec 2011 03:21 PM PST Public Policy Polling has reported that Ron Paul has now taken the lead in Iowa as Newt Gingrich's campaign is rapidly imploding. Ron Paul is at 23% to 20% for Mitt Romney, 14% for Gingrich, 10% each for Rick Santorum, Michele Bachmann, and Rick Perry, 4% for Jon Huntsman, and 2% for Gary Johnson. [...] |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

This year has been difficult and confusing for many investors in the resource sector. Despite that, many junior companies with credible projects have continued to show good progress toward future production. In this exclusive interview with The Gold Report, Dale Mah, equity research analyst with Mackie Research Capital, talks about the general market environment, discusses his selection criteria and shares some of his favorite picks for the coming year.

This year has been difficult and confusing for many investors in the resource sector. Despite that, many junior companies with credible projects have continued to show good progress toward future production. In this exclusive interview with The Gold Report, Dale Mah, equity research analyst with Mackie Research Capital, talks about the general market environment, discusses his selection criteria and shares some of his favorite picks for the coming year.

It's the week before Christmas and I don't know about you, but I've still got a number of items to check off my shopping list (not to mention a basement full of things that need to be "assembled" before the big day). Throw in a few family gatherings, drinks with a couple of friends, and a pickup basketball game with the old gang from school – and it's becoming a busy week…

It's the week before Christmas and I don't know about you, but I've still got a number of items to check off my shopping list (not to mention a basement full of things that need to be "assembled" before the big day). Throw in a few family gatherings, drinks with a couple of friends, and a pickup basketball game with the old gang from school – and it's becoming a busy week…

As we head towards 2012, uncertainty and growing pessimism are the dominant themes in the gold market right now. This might seem odd when one considers that the gold price is up better than 14% since January 1, with no clear signs that the fundamentals that have been driving the gold price higher over the last decade have changed.

As we head towards 2012, uncertainty and growing pessimism are the dominant themes in the gold market right now. This might seem odd when one considers that the gold price is up better than 14% since January 1, with no clear signs that the fundamentals that have been driving the gold price higher over the last decade have changed.

With growing concerns about the safety of the US financial system, today King World News released an interview with internationally followed Martin Armstrong, founder and former head of Princeton Economics International Ltd.. At one point Armstrong's firm rose to be perhaps the largest multinational corporate advisor in the world. Here are a few snippets about what Armstrong had this to say to investors who have been asking him about where to put their money: "At the conference that I just gave, one of the number one questions people were asking, 'What happens now with this MF Global stuff. I don't know what to tell them. I cannot, in good conscience say your money is safe in New York anymore. We were looking at, largely, where to put your money."

With growing concerns about the safety of the US financial system, today King World News released an interview with internationally followed Martin Armstrong, founder and former head of Princeton Economics International Ltd.. At one point Armstrong's firm rose to be perhaps the largest multinational corporate advisor in the world. Here are a few snippets about what Armstrong had this to say to investors who have been asking him about where to put their money: "At the conference that I just gave, one of the number one questions people were asking, 'What happens now with this MF Global stuff. I don't know what to tell them. I cannot, in good conscience say your money is safe in New York anymore. We were looking at, largely, where to put your money." Most Americans have no idea that the U.S. government once issued debt-free money directly into circulation. America once thrived under a debt-free monetary system, and we can do it again. The truth is that the United States is a sovereign nation and it does not need to borrow money from anyone. Back in the days of JFK, Federal Reserve Notes were not the only currency in circulation. Under JFK (at at various other times), a limited number of debt-free United States Notes were issued by the U.S. Treasury and spent by the U.S. government without any new debt being created. In fact, each bill said "United States Note" right at the top. Unfortunately, United States Notes are not being issued today. If you stop right now and pull a dollar out of your wallet, what does it say right at the top? It says "Federal Reserve Note". Normally, the way our current system works is that whenever more Federal Reserve Notes are created more debt is also created. This debt-based monetary system is systematically destroying the wealth of this nation. But it does not have to be this way. The truth is that the U.S. government still has the power under the U.S. Constitution to issue debt-free money, and we need to educate the American people about this.