saveyourassetsfirst3 |

- Gold RUSH: Another country's central bank is buying up massive amounts of gold

- COT Silver Report - December 2, 2011

- What you should keep in mind after this week's crazy moves in stocks

- A Covered Call Strategy For Vera Bradley

- Fooled Again!

- Big Markets Bust Bear’s Chops, as Expected

- Finalized November Auto Sales Figures Confirm Sirius XM Concerns

- LISTEN: Interview with Chris Duane

- Gold 1099 Repealed

- COT Indicating Silver Preparing for Big Move Up?

- Korea Increases Gold Reserves

- Federal Reserve Secret Bank Bailouts Topped $16 Trillion!

- Silver Price: Sprott Hatches an OPEC for Silver Industry

- Two Reasons Why Silver Looks Extremely Bullish

- Bank of Korea Increases Gold Reserves by Massive Nearly $1 Billion or 39% in November Alone

- Social Unrest on the Horizon if Economies Fall Like Dominoes

- Global Currency System on Shaky Ground

- Guanajuato Site Visit: Endeavour Silver Corp.

- Major Banks Teetering on the Edge of Collapse

- WATCH: USAWatchdog Weekly News Wrap-Up

- The Long View

- Gold coins: the United Kingdom´s Gold Britannia

- Bull, alive and well

- The 16 Trillion Dollar Bailout

- Hustling Ahead of The Coming Financial System Collapse

- Soros: World Financial System on Brink of Collapse

- Fabian4Liberty: Dollar Collapse

- Banking Jargon 101

- China Collapse?

- South Korea Boosts Gold Reserves Again

| Gold RUSH: Another country's central bank is buying up massive amounts of gold Posted: 02 Dec 2011 06:39 AM PST From Bloomberg: The Bank of Korea, which controls the world's eighth-biggest foreign-exchange reserves, boosted gold holdings for the second time this year as investors sought safer assets amid Europe's debt crisis. To contact the reporter on this story: Sungwoo Park in Seoul at spark47@bloomberg.net; Eunkyung Seo in Seoul at eseo3@bloomberg.net.The central bank bought 15 metric tons last month, boosting holdings to 54.4 tons, which is equivalent to 0.7 percent of its total reserves, Lee Jung, head of the investment strategy team at the bank's Reserve Management Group, told reporters in Seoul. Central banks are expanding reserves for the first time in a generation as the precious metal is in the 11th year of a bull market. Purchases of as much as 450 tons in 2011 may be repeated next year as Asian nations and emerging economies diversify their reserves, UBS AG said Nov. 30. "They want to diversify," Gavin Wendt, the founder and senior resource analyst at Sydney-based Mine Life Pty., said by phone today. Investors and "central banks are pretty nervous about all currencies, not just the U.S. dollar." Gold has risen about 23 percent this year, reaching an all- time high of $1,921.15 an ounce on Sept. 6 and beating equities, treasuries and other commodities. The U.S. dollar, which typically moves inversely to bullion, is down about 1 percent this year against a basket of six major currencies. 'Portfolio' "We're buying gold to improve profitability against risks," the Korean bank's Lee said. "This is part of our mid- and long-term strategy to diversify our portfolio and enhance efficiency of asset management." The Bank of Korea purchased 25 tons over a one-month period from June to July, the first purchases in more than a decade, joining other emerging-market countries in expanding gold holdings to guard against volatile currency movements and to diversify portfolios. The World Gold Council said central bank purchases in the third quarter jumped more than sixfold to 148.4 tons and forecast buying for the year would reach as much as 450 tons. Russia, Kazakhstan, Colombia, Belarus and Mexico added a combined 25.7 tons of gold to reserves in October, according to data on the International Monetary Fund's website. Holdings in exchange-traded products reached a record 2,356 tons on Nov. 30 and were at 2,355.5 tons yesterday, according to Bloomberg data compiled from 10 providers. South Korea's foreign-exchange reserves fell by $2.35 billion from October to $308.6 billion at the end of November as the euro weakened against the dollar, the central bank said in a statement today. To contact the editor responsible for this story: Richard Dobson at rdobson4@bloomberg.net; Paul Panckhurst at ppanckhurst@bloomberg.net. More on gold: This China gold story could literally change your life This has become the No. 1 new driver behind the gold bull market What you should know about putting gold in your retirement accounts |

| COT Silver Report - December 2, 2011 Posted: 02 Dec 2011 06:35 AM PST COT Silver Report - December 2, 2011 |

| What you should keep in mind after this week's crazy moves in stocks Posted: 02 Dec 2011 06:29 AM PST From Kimble Charting Solutions: The upside reaction to the "increase liquidity news from central banks" was impressive. Question of the day... Did it "change" anything in the big picture, pattern-wise? After large up or down days, I like looking at big-picture charts, to keep things in perspective. Back in May, when the 500 index was hitting resistance line (1), which dates back to the 1987 high, the majority of the global markets were hitting resistance and creating rising wedges, which was a good time to... Read full article... More on stocks: What the coming gold mania could do to your gold stocks Trader alert: Read this if you missed this week's massive rally A "coiled spring": These gold stocks could be set for a massive rally |

| A Covered Call Strategy For Vera Bradley Posted: 02 Dec 2011 06:17 AM PST By PowerOptions: Remember those quilted bags your Mom used to tote around when you were a kid? They've been turned into a multi-million dollar business by two smart women, Barbara Bradley Baekgaard and Patricia R. Miller. Vera Bradley Inc. (VRA), named after Ms Baekgaard's mother, produces a line of quilted fabric luggage, handbags, accessories and giftware. A dedication to quality, stylish design, functionality, strong brand identity and customer service has seen Vera Bradley grow from small beginnings in Fort Wayne, Indiana, in 1982 to the large and profitable corporation that it is today. The Initial Public Offering (IPO) of shares occurred in 2010, and the co-founders remain as Chief Creative Officer (Ms. Baekgaard) and National Spokesperson (Ms Miller). There are two main divisions within the company: Indirect Sales through 3,300 mainly U.S.-based independent retailers, together with a limited number of national chains and online stores; and, since 2006, Direct Sales through Vera Complete Story » |

| Posted: 02 Dec 2011 06:14 AM PST The pattern is by now so familiar that it deserves a place beside other technical indicators like moving averages and Fibonacci retracements. It begins with part or all of the global economy appearing to implode under its five-decade accumulation of debt. The public sector/central bank nexus responds with a liquidity injection, leading the markets to rally explosively and the pundits to declare the problem fixed. Then the markets gradually remember that liquidity and solvency are two different things, and that the mortgage lenders/money center banks/PIIGS countries/hedge funds/State and local governments, etc., are insolvent, not illiquid. And the cycle begins again. But what to call it? "Sucker rally" seems a little too benign and prosaic for a process that looks more like fraud perpetrated on a learning-disabled, desperately-credulous victim. "Death throes of a decadent system" is accurate but too pretentious and doesn't convey the cyclical (and cynical) nature of the process. "Financial terrorism" is better, since the regularity of the cycle — and the fact that central banks have absolute control over the timing — imply that there's massive insider trading going on, possibly as part of a scheme by the (name your favorite elite conspiracy group) to suck as much wealth out of the system as possible before finally letting it collapse. Still, the term doesn't convey the comic aspect of rich, supposedly-astute players getting suckered over and over. Incompetent money managers are funny. In the end, what it's called is less important than the fact that it's a great trading indicator. Starting in 2007, if you'd gone long risk when the markets were falling apart — on the assumption that panicked governments would quickly intervene — and then taken profits and gone short a few weeks after the intervention, you'd have made a fortune from all the volatility. The current market looks like another perfect set-up: A week ago, Europe was collapsing, China was slowing down and the US budgeting process was paralyzed. Stocks around the world had fallen hard, and a Euro-zone breakup was being actively planned for by governments and trading exchanges. Armageddon, in other words. So the central banks inject another hit of liquidity and Germany and the ECB appear to embrace the commingling of the continent's balance sheets. And voila, the bulls are back in charge. Now, trading strategies work until they don't, and there's always the risk that this latest bailout will actually fix the world's problems and usher in a new era of consumer-led growth with soaring corporate profits, low inflation, and rising share prices. But…nah, why even give this possibility serious consideration? Nothing that was promised this week will make much of a near-term difference. Lower reserve requirements in China and cheaper dollar-denominated loans in Europe are just tweaks to already existing programs. More fiscal integration in Europe is inevitable if the common currency is to function as promised. But think for a moment about what this implies — Germany and France getting to micromanage Italy's pension and tax system — and it clearly isn't happening this month. Getting from here to a German-run Europe will take maybe five more near-death experiences, and in any event won't address the fact that even Germany's balance sheet (when you include its unfunded liabilities) really isn't AAA. So, the pattern should hold: "Risk-on" trades work this week, then things get choppy for a while. Then the markets grow cautious and finally terrified. The most likely catalyst for the panic stage is the massive, front-loaded refinancing schedule that Italy and Spain have unwisely set up for early 2012. But it could be anything. The point is to be short risk when it hits but not to marry the position, because more liquidity is on the way. The con will keep working as long as the world continues to see fiat currencies as valuable. |

| Big Markets Bust Bear’s Chops, as Expected Posted: 02 Dec 2011 05:56 AM PST HOUSTON -- Back on November 22, the news seemed about as dire as ever and as the mainstream press sunk its fangs into the bad news out of Europe (and the U.S. Super Committee failure), keeping people on edge and very worried, we penned a web log post which, in essence, pointed to the fact that the Big Markets were not "acting" like they wanted to discount the end-of-the-world-as-we-know-it. Indeed, the chart of the granddaddy equity market of them all, the S&P 500 was refusing then to "answer" the many prophets of doom. The people who are somehow energized by gloom and doom were giddy, but the Big Markets were not sanctioning their bearish views. Just below is the very same chart we posted back then (about 10 days ago) for reference, in a piece we called "Big Markets Herald Sea Change?" At the time we asked: "If the Big Markets were pricing in "really bad" they would be doing so by cutting new and lower lows. Rhetorically: Does the chart below suggest new and lower lows?" S&P 500 from November 22, 2-year, weekly. If the images are too small click on them for a larger version. Continued… Big Markets Bust Bears Chops, as ExpectedAs we said in that November 22 offering, "So far, at least, the lows put in for 2011 were higher than last year for the S&P 500. Despite very worrisome, seemingly extremely bearish contemporary news the Big Markets have not been a place that rewards mega-bears. Certainly not in the same way that the Big Markets rewarded mega-bears in the fall of 2008 and early 2009. We assign a great deal of respect to the action of the Big Markets and the collective wisdom of countless thousands and millions of investors/traders worldwide. In our simple view the chart of the Big Markets does not "match" the news, worry and angst we are all subject to when we read the news or tune into cable financial television. Our impression is that if the Big Markets matched the news and if equities markets reflected the very dire predictions of the numerous prophets of doom on the cable networks, they would have to be marking new and lower lows, not higher lows as we see today. Thus, our view is forming, once again, that if the chart doesn't match the news and the expectations/predictions of the "gloomy doomers;" … If the chart doesn't reflect the general impression of "dire" that dominates the airways, it therefore must be discounting something less than dire – something less than the "end-of-the-world-as-we-know-it." Well, how about that? Just below is the very same chart updated through mid-day Friday, December 2, 2011. S&P 500 as of Friday, December 02, 2011. There has been quite a reversal this week, a major bear killer rally has occurred since we wrote that, but not before the SPX took a dive down to the 1,158 region first. From Friday, November 23, to Friday December 2 the S&P 500 has rocketed more than 91 points to near 1,250 as we write. Over the same period the Dow Jones Index rose from its Friday low of 11,231 to as high as 12,146 or more than 900 points. Our point then was that the Big Markets were not "answering" the dire news and therefore the collective wisdom; the actual positioning of the many thousands and millions of traders from all over the world showed they were just not "buying" the salesmen of doom then. We went on to posit a theory of why that might be so then, but clearly the confidence of the markets was bolstered by the coordinated action by the world's central banks to show they intend to liquefy and print "whatever it takes" to avoid a deflationary environment ahead and to avoid a Euro Lehman disaster. That China took their foot off the lending brakes by lowering bank reserve requirements sure didn't hurt either. The Big Markets are acting out of the assumption that not only The Fed, but now the ECB "has their backs" making the "old days" of the "Greenspan Put" seem quaint by comparison. Left out of this discussion is speculation of what the various central bankers saw in the entrails they stir and study that prompted them to take extraordinary measures, but for now, at least, the Big Markets are a bear killing fields and there are likely a good many fund and portfolio managers that are having to chase a rally they didn't think was coming. Finally, we just about have to view the central bank's policy as pretty bullish for precious metals, but we won't put the issue "to bed" until gold finds its way convincingly out of the consolidation shown in the chart just below of SPDR Gold Trust (GLD). GLD, 1-year, daily. As we write gold is not far from a triangle breakout, but silver seems to have quite a bit more "work" to do. Silver, 1-year, daily. Silver is still consolidating the second big thrust down (September) and has yet to rebuild momentum or enthusiasm. But the commitments of traders data remained very bullish as of last week and we sense tremendous dip buying coming in from the physical market on just about every probe lower. We shall get more excited about silver if and when the gold/silver ratio (GSR) begins a new trend lower. A falling GSR is a bullish GSR and vice versa in our view. Vultures (Got Gold Report Subscribers), please consult the GSR chart on the password protected GGR member pages for more. That is all for now, but there is more to come. Have a good weekend everyone. |

| Finalized November Auto Sales Figures Confirm Sirius XM Concerns Posted: 02 Dec 2011 05:09 AM PST By Spencer Osborne: "November delivered the highest SAAR rate since cash for clunkers." And ... "Auto sales rise to new two-year high." With headlines like these it would seem that Sirius XM (SIRI) investors have little to worry about. In fact my email box filled up with people saying, "I told you so" and "you were wrong" in relation to my recent article, November Auto Sales Make It A Challenge For Sirius XM To Meet Subscriber Guidance, about the fact that the level of auto sales in November would impact Sirius XM. That article was written prior to the official numbers, and nothing in the official news of the sales figures has done anything to change my mind at this point. One silver lining is that Edmunds has laid out some reasons for hope that this December could represent a good month for the auto sector. The official sales figures for November are Complete Story » |

| LISTEN: Interview with Chris Duane Posted: 02 Dec 2011 04:49 AM PST

Chris and Kerry continue their conversation on the death of the Fiat Money System. Europe and its large banks have been saved once again, but the end result can never be in doubt. Chris believes that we should all be opting out of the bankrupt system by holding physical silver. There's going to be a lot of chaos, which is bad in the short term, but in the long term a new system will be created that will reward producers and savers. The financial ruling elites are at the rope's end and it won't be long before the non-stop money printing and market manipulation ends in failure. History has shown that inflation can never bring about prosperity, but rather it sometimes brings about the illusion of prosperity for various periods of time. But eventually the debt comes due and there's no money left to pay it, or the money that is left has completely lost its value. Hyperinflation is the likely result of massive Central Bank interventions. Jim Sinclair calls it QE (Quantitative Easing) to Infinity. Others call it wealth confiscation on a mass scale. Or taxation without legislation. Much more @ KerryLutz.com or @ 347.460.LUTZ |

| Posted: 02 Dec 2011 04:45 AM PST Gold 1099 REPEAL Signed Into Law

Precious metals investors can breathe a collective sigh of relief now that the 1099 repeal has been signed into law. The controversial Form 1099 tax reporting requirements that were inserted into last year's 2,400-page healthcare legislation have been described by critics as intrusive, burdensome to businesses and simply un-American. Enacted as part of the Patient Protection and Affordable Care Act, the Form 1099 tax reporting requirements would have forced all businesses, including precious metals dealers, to issue a Form 1099 for all business transactions of $600 or greater in total. This small provision has drawn heated protests from gold and silver investors who have been rightfully concerned that the privacy of the American people would be compromised when conducting their own private transactions involving gold and silver with precious metal dealers. The law would have compelled precious metals dealers to collect personal data on any individual who sold as little as a single ounce of gold and report that information to the IRS. Read more @ nwtmint.com |

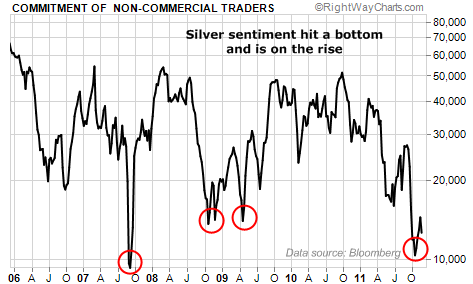

| COT Indicating Silver Preparing for Big Move Up? Posted: 02 Dec 2011 04:37 AM PST Non-Commercial COT Indicating Silver Preparing for Big Move Up? from SilverDoctors:

Does the recent bottoming in non-commercial traders COT indicate we have seen another long term bottom in silver, and prices will soon be MUCH HIGHER than the low $30′s level that silver has been consolidating in? Read More @ SilverDoctors |

| Posted: 02 Dec 2011 04:32 AM PST Bank of Korea Increases Gold Reserves by Massive Nearly $1 Billion or 39% in November Alone from GoldCore:

Gold is trading at USD 1,752.90, EUR 1,298.30, GBP 1,116.10, CHF 1,604, JPY 136,700 and AUD 1,706.4 per ounce. Gold's London AM fix this morning was USD 1,751.00, GBP 1,116.50, and EUR 1,298.29 per ounce. Yesterday's AM fix was USD 1,750.00, GBP 1,113.02, and EUR 1,298.03 per ounce. Gold is marginally higher in most currencies and is headed for its biggest weekly advance in six weeks after also seeing a gain of 1.8% in November. Gold's technical picture has become positive again and is now aligned with the very positive fundamental backdrop. The Bank of Korea's continued diversification of its foreign exchange reserves is a bullish factor which may have led to the price gains today. Read More @ GoldCore.com |

| Federal Reserve Secret Bank Bailouts Topped $16 Trillion! Posted: 02 Dec 2011 03:57 AM PST Article courtesy of The Economic Collapse Blog What you are about to read should absolutely astound you. During the last financial crisis, the Federal Reserve secretly conducted the biggest bailout in the history of the world, and the Fed fought in court for several years to keep it a secret. Do you remember the [...] |

| Silver Price: Sprott Hatches an OPEC for Silver Industry Posted: 02 Dec 2011 02:31 AM PST Hold your mined Silver and drive up prices. |

| Two Reasons Why Silver Looks Extremely Bullish Posted: 02 Dec 2011 02:11 AM PST Price correction too good to pass up. |

| Bank of Korea Increases Gold Reserves by Massive Nearly $1 Billion or 39% in November Alone Posted: 02 Dec 2011 01:44 AM PST |

| Social Unrest on the Horizon if Economies Fall Like Dominoes Posted: 02 Dec 2011 01:27 AM PST Years of on the Horizon if Economies Fall Like Dominoes

(NaturalNews) Have you been paying attention to the economic collapse of Europe? How about the rising debt of the United States? If not, you should be, because these events are very likely to have a real effect on your future quality of life and safety. Last week leaders from the world's top 20 economies were warned that a social tsunami is coming if their economies tank in the form of massive unrest that could even lead to the collapse of some governments. The United Nations International Labor Organization says souring economies will bring the loss of millions of jobs, a phenomenon that is likely to trigger social chaos on an unprecedented scale. Think of theOccupy Wall Street protests on steroids. Read More @ NaturalNews.com |

| Global Currency System on Shaky Ground Posted: 02 Dec 2011 01:26 AM PST from WealthCycles:

Hang on to your hats! Not only is Southern California, WealthCycles.com's home turf, undergoing extreme winds today, but there are increasing signs that the world monetary system is in for some buffeting as well. In Zimbabwe, central banker Gideon Gono has spurned the U.S. dollar, which the nation adopted as its national currency in 2009 after Gono and his government cohorts hyperinflated the Zimbabwean currency into oblivion three years ago, as reported by ZeroHedge: Now, the country's cult central banker Gideon Gono has made it clear he wishes to avoid another episode of transplant currency hyperinflation courtesy of his counterpart in the Marriner Eccles building and "has warned that Zimbabwe's nascent economic recovery is at the mercy of the United States dollar, which is facing new pressures from the Euro-zone debt crisis." Read More @ WealthCycles.com |

| Guanajuato Site Visit: Endeavour Silver Corp. Posted: 02 Dec 2011 01:24 AM PST Endeavour Silver Corp. [NYSE.EXK, TSX.EDR] is increasing production from three historic mines originally built by Spanish colonists about 450 years ago, and several veins they recently discovered in the legendary silver district of Guanajuato, Mexico. At the end of October I visited Endeavour's operations in Guanajuato for a tour of their modern underground mining operations and the mill expansion they just completed. The company is also producing silver at Guanacevi in the state of Durango, and looking to expand their resources by exploring three other projects in Mexico. They have optioned two district scale bulk-tonnage silver prospects near Copiapo, Chile as well. |

| Major Banks Teetering on the Edge of Collapse Posted: 02 Dec 2011 01:23 AM PST from King World News:

Continue reading @ KingWorldNews.com |

| WATCH: USAWatchdog Weekly News Wrap-Up Posted: 02 Dec 2011 01:22 AM PST from USAWatchDog: USAWatchdog.com – It's official. America is now committed to bailing out Europe—again. The Federal Reserve announced, this week, it would use something called dollar "swaps" to give EU banks cheap easy money to keep their banks from imploding under the weight of sour sovereign debt. Some big U.S. banks are also exposed and could end up in bankruptcy, if the EU collapses. The Fed may bail them out for now, but the cost to U.S. citizens will be higher inflation. News broke, this week, that China will protect Iran even if it starts World War 3. The Middle East is the wild card of wild cards and could explode at any time. Unemployment is, once again, more than 400,000 weekly claims. Home prices decline, again, nearly 4% annually. Chevy offers to buy back more than 6,000 Volt electric cars because of fire questions, but it is not as bad as you might think. Analysis of these stories and more by Greg Hunter on the Weekly News Wrap-Up. ~TVR |

| Posted: 02 Dec 2011 01:19 AM PST by Ted Butler, ButlerResearch.com via SilverBearCafe.com:

Imagine that you are going on a journey for ten years and will be out of touch for that time. With no short term trading allowed, what assets would you choose to invest in until your return? Silver is an asset that can offer spectacular returns and preserve value with low risk. It is a vital resource and essential industrial material in addition to being a precious metal. And because so few investors are familiar with the real silver story, it is a near certainty that silver will become more appreciated over time. Read More @ SilverBearCafe.com |

| Gold coins: the United Kingdom´s Gold Britannia Posted: 02 Dec 2011 12:30 AM PST The United Kingdomandacute;s Gold Britannia has been minted by the British Royal Mint since 1987. It appears in four different weights, ranging from 1/10 to 1-ounce coins. Each of the Britanniaandacute;s ... |

| Posted: 01 Dec 2011 10:37 PM PST Here it is, Friday again, and even during silly season (holiday season every year) we are still up on a Friday, its all good! :bear_original: |

| The 16 Trillion Dollar Bailout Posted: 01 Dec 2011 10:30 PM PST Have You Heard About The 16 Trillion Dollar Bailout The Federal Reserve Handed To The Too Big To Fail Banks? from The Economic Collapse Blog:

Read More @ TheEconomicCollapseBlog.com |

| Hustling Ahead of The Coming Financial System Collapse Posted: 01 Dec 2011 10:28 PM PST |

| Soros: World Financial System on Brink of Collapse Posted: 01 Dec 2011 10:23 PM PST Soros: World Financial System on Brink of Collapse by Brenda Cronin, The Wall Street Journal:

The world financial system not only isn't functioning, it's on the brink of collapse, according to investor George Soros. The Hungarian-born philanthropist (yea right), who recently spent time in areas where his charities are active, such as Africa, said he sees a growing bifurcation between emerging and developed countries – and he's more confident about prospects for the emerging ones. Despite their assorted problems, including corruption, weak infrastructure and shaky government, developing countries are relatively unscathed by the "deflationary debt trap that the developed world is falling into," Mr. Soros said at a New York gathering to mark the 10th anniversary of the International Senior Lawyers Project, a group that provides pro bono legal services around the world. Mr. Soros was among those honored by ISLP, for his work as founder and chairman of the Open Society Foundations, which supports democracy and human rights. |

| Fabian4Liberty: Dollar Collapse Posted: 01 Dec 2011 10:21 PM PST from Fabian4Liberty: ~TVR |

| Posted: 01 Dec 2011 10:19 PM PST by Chris Horlacher, MapleLeafMetals.ca: In case you've been living under a rock recently, you would have noticed that anothermajor announcement from the world's monetary authorities was released a couple days ago. Markets everywhere rallied as investors gleefully piled in to just about every asset class around. Stocks went up, bonds went up, commodities went up… everything went up. But how can that be? If there's only so much money to go around then it would logically follow that if one asset class is going up, then somewhere else assets must be falling as the money migrates from one space to another. The only situation when you would see absolutely everything going up in price is when the currency itself is actually going down. What these six central banks announced they were going to do was lower the interest rate on a specific type of transaction that only the monetary and banking elites generally engage in, liquidity swaps. Banking jargon can be a massive headache, especially since the same words take on entirely different meanings depending on the context in which they're being used. This is part of what keeps so many people's eyes averted from the banking system. To understand what is going on, you practically have to learn an entirely new language. Read More @ MapleLeafMetals.ca |

| Posted: 01 Dec 2011 09:22 PM PST The Daily Bell provides an overview of China's real estate market which they (and others) claim has already collapsed. This collapse is expected to bring down the Chinese economy and what remains of the world economy. Here is an excerpt from the article: And here is some of the text that accompanies the video below [...] |

| South Korea Boosts Gold Reserves Again Posted: 01 Dec 2011 09:10 PM PST ¤ Yesterday in Gold and SilverWell, the rally that began about 9:30 a.m. in London on Thursday morning, wasn't allowed to get far. There was also a brief spike just before, or at, the London p.m. gold fix at 10:00 a.m. Eastern time. From there, gold got sold off about fifteen bucks before rallying a bit in the New York Access Market, shortly after Comex trading ended for the day. Once that buyer disappeared, the gold price traded nearly ruler-flat going into the close at 5:15 p.m. The gold price closed at $1,745.30 spot...down $4.10 on the day. Volume wasn't overly heavy at 121,000 contracts. The silver price pretty much followed the goings-on in gold, expect the price movements were more 'volatile'. The 9:30 a.m. London rally got cut off at the knees, there was a bump at the p.m. gold fix, but the subsequent decline in the silver price after the London p.m. gold fix did not have any rally associated with it...and once Comex trading ended, the silver price more or less traded sideways into the close of electronic trading. The silver price closed at $32.73 spot...down a dime from Wednesday's close. Net volume was around 32,000 contracts. The dollar was very well behaved yesterday, trading within 25 basis points of 78.3 all day long. Nothing much to see here, folks. The London p.m. gold fix...the New York high price of the day...is pretty easy to spot on the HUI chart below. The stocks themselves hit their low tick of the day at 11:15 a.m. Eastern time...and by the time gold itself hit its nadir at 1:10 p.m...the gold stocks were well into recovery mode...and finished basically unchanged on the day, with the HUI down a tiny 0.02%. Deep pockets appeared to be 'buying the dip' despite what the metal itself was doing. Even thought silver closed down one thin dime, the stocks managed to hold their own...and Nick Laird's Silver Sentiment Index closed basically unchanged as well, up 0.07%. (Click on image to enlarge) The CME's Daily Delivery Report for Day Three of the December delivery month showed that 487 gold and 22 silver contracts were posted for delivery on Monday. In gold, most of the bad boys were there, but they were bit players this time...and the raptors predominated as issuers and stoppers. I had to laugh when I looked at the stoppers in silver. Tiny Jefferies delivered/issued 22 silver contracts...and virtually every one of the '1 through 8' Commercial bad boys from the COT report were lined up taking delivery...Deutsche Bank, HSBC, Merrill, Bank of Nova Scotia, JPMorgan, Citigroup...the lot! With no exceptions, every one of these firms is a market maker on the LBMA in London as well. Once again the Issuers and Stoppers Report is worth a look...and the link is here. There was a smallish withdrawal of 19,452 ounce from GLD yesterday...and no reported changes in SLV. The U.S. Mint had no sales report, either. Over at the Comex-approved depositories on November 30th, they reported receiving 600,326 ounces of silver...and shipped 575,333 troy ounces out the door. The month-ending inventory for silver in the five Comex-approved depositories was 108,170,808 ounces. I have about the same number of stories today as I did on Thursday. I hope you at least have the time to skim the first few paragraphs of each that I post. I'm always interested in seeing how the gold price reacts, or is allowed to react to whatever B.S. numbers come out of the BLS. Coeur would mull holding silver over cash, says CEO. Rick Rule - Gold Mania & Sprott's Letter to Silver Producers. Mervyn King: the eurozone crisis is 'systemic' ¤ Critical ReadsSubscribeMr. Corzine and His Regulators: MF Global and the New Era of Crony Capitalist RegulationMore than $1 billion of client money is still missing at failed brokerage MF Global, according to the bankruptcy trustee's latest estimate. At Thursday's hearing of the Senate Agriculture Committee, the company's principal regulator will try to explain how his agency failed to provide the most basic protection for financial consumers. Gary Gensler, chairman of the Commodity Futures Trading Commission (CFTC), has a lot of explaining to do. Segregating customer money and protecting client accounts from being raided by an unscrupulous broker, is even more important in the futures industry than it is in other markets. In the world of stocks and bonds regulated by the Securities and Exchange Commission, it's terrible when client funds go missing, but at least the average investor has a backstop in the Securities Investor Protection Corp., which provides insurance up to $500,000. There is nothing like it in the futures industry, so if they do nothing else CFTC regulators have to make sure that nobody is digging into the customer cookie jar. This must read story from yesterday's edition of The Wall Street Journal...and it's printed in the clear in this GATA release. I thank Washington state reader S.A. for bringing it to my attention...and the link is here.  Senate Committee Holds Oversight Hearing on MF Global BankruptcyHere is a 7-minute CNBC video from yesterday about the MF Global hearings referred to in the first story in today's column. All three commentators are less than kind to Mr. Gensler...and it's very much worth watching. I thank West Virginia reader Elliot Simon for sending me this video clip...and the link is here.  Ann Barnhardt: The Entire Futures/Options Market Has Been Destroyed by the MF Global CollapseHere's an interview that Ann gave with Jim Puplava over at financialsense.com yesterday. I thank Cris Sheridan for alerting me to this interview. It runs for about 33 minutes. I haven't had the time to listen to it myself, but I'll be doing that later today. The link is here.  Felix Salmon: The 'conspiracy theorists' about 'Government Sachs' were rightHere's a Reuters story from yesterday that's written by columnist Felix Salmon. It bears the headlined "Hank Paulson's Inside Job". Part of this story is found in a Bloomberg piece that I ran in this column on Tuesday...but this Reuters piece connects all the dots. What on earth did Hank Paulson think his job was in the summer of 2008? As far as most of us were concerned, he was secretary of the U.S. Treasury, answerable to the American people and the president. But at the same time, in secret meetings, Paulson was hanging out with his old Goldman Sachs buddies, giving them invaluable information about what he was thinking in his new job. Paulson was giving inside tips to Wall Street in general, and to Goldman types in particular: exactly the kind of behavior that "Government Sachs" conspiracy theorists have been speculating about for years. Turns out they were right. This Reuters piece from November 29th is well worth your time...and it's imbedded in this GATA release. The link is here.  JPMorgan, BofA Among Five Banks Sued by Massachusetts Over ForeclosuresMassachusetts Attorney General Martha Coakley filed the lawsuit [yesterday] against the three banks, as well as Wells Fargo & Co. and Ally Financial Inc., in state court in Boston. She accused the banks of engaging in unfair and deceptive trade practices in violation of state law. "The stakes could not be higher at this stage of the game," Coakley said at a press conference in Boston. "The foreclosure crisis continues to be at the root of the economic mess that we find ourselves in and our inability to turn it around." State attorneys general across the U.S. have been negotiating a possible settlement with the five banks that would resolve a probe into foreclosure practices that began more than a year ago following disclosures that faulty documents were being used to seize homes. This Bloomberg story from yesterday is Elliot Simon's second offering in today's column...and the link is here.  World is slave to a few big banks, Paul Brodsky tells King World NewsInterviewed by King World News yesterday, Paul Brodsky of QB Asset Management says the world financial system has become entirely a matter of maintaining the solvency of a few big international banks, for whom all countries and peoples are slaves. I thank Eric for sending me the blog...and Chris Powell for writing the introduction. This short piece is well worth your while...and the link is here.  How Does Europe Borrow Dollars From the Fed?The Federal Reserve and other banks announced Wednesday that they were engaging in a co-ordinated action to provide liquidity to Europe's credit markets. What essentially happened is that the Fed cut the interest rate it charges the European Central Bank to borrow dollars. The ECB wants the dollars so it can lend them out to European banks, which have been having trouble borrowing dollars at affordable rates due to fears about their financial health. It's worth taking a moment to see what actually happens with these swap facilities because they can create the illusion we're sending boatloads of dollars overseas and the ECB is sending us boatloads full of euros. This easy-to-understand explanation of making money out of nothing is a must read if you know little or nothing about how to operate the keyboard on your computer...which is how it all happens. I thank reader Howard Brown for sending me this cnbc.com story from Wednesday...and the link is here.  The World from Berlin: Central Banks' Coordinated Move Has Solved Nothing'Global stock markets on Wednesday were euphoric after the major central banks around the world made it easier for banks to access dollars. But the euro-zone debt crisis rages on nonetheless. At the most, say German commentators |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

In the wake of the MF Global collapse/ silver confiscation, the commitment of non-commercial traders plunged from nearly 30,000 to 10,000- the second lowest total of the bull run to date. The only time sentiment has been more negative among non-commercial traders was in October of 2008, when silver was smashed all the way to $8.

In the wake of the MF Global collapse/ silver confiscation, the commitment of non-commercial traders plunged from nearly 30,000 to 10,000- the second lowest total of the bull run to date. The only time sentiment has been more negative among non-commercial traders was in October of 2008, when silver was smashed all the way to $8.

With world markets still convulsing and gold and silver reasserting themselves once again, today King World News interviewed former LBMA commodities broker and trader and current MEP Nigel Farage to get his take on the situation. Farage had some powerful comments regarding the direction of gold, but when KWN asked about the chaos in Europe, Farage stated, "As the Italian credit rating started to slip, the Brussels bosses and the German Chancellor said, 'He's (Berlusconi has) got to go and we want our man in charge.' And so Mr. Mario Monti, who was a European Commissioner for ten years, one of the architects of the euro when it was introduced, a man who wasn't even in the Italian Parliament, has been put in charge and is now the Prime Minister of Italy."

With world markets still convulsing and gold and silver reasserting themselves once again, today King World News interviewed former LBMA commodities broker and trader and current MEP Nigel Farage to get his take on the situation. Farage had some powerful comments regarding the direction of gold, but when KWN asked about the chaos in Europe, Farage stated, "As the Italian credit rating started to slip, the Brussels bosses and the German Chancellor said, 'He's (Berlusconi has) got to go and we want our man in charge.' And so Mr. Mario Monti, who was a European Commissioner for ten years, one of the architects of the euro when it was introduced, a man who wasn't even in the Italian Parliament, has been put in charge and is now the Prime Minister of Italy." With more financial uncertainty in the world than in memory and with price volatility going through the roof, it's hard to think about the long term. The only problem is that our lives are still measured in the long term. In financial terms, starting families, raising and educating children, preparing for retirement and preserving hard-earned wealth are not day to day considerations; we are forced to look ahead. In looking and planning ahead, there is no crystal ball; no guarantee that things will turn out as we expect. All we can do is to make assumptions based upon what we now know and then try to position ourselves for what may come.

With more financial uncertainty in the world than in memory and with price volatility going through the roof, it's hard to think about the long term. The only problem is that our lives are still measured in the long term. In financial terms, starting families, raising and educating children, preparing for retirement and preserving hard-earned wealth are not day to day considerations; we are forced to look ahead. In looking and planning ahead, there is no crystal ball; no guarantee that things will turn out as we expect. All we can do is to make assumptions based upon what we now know and then try to position ourselves for what may come. What you are about to read should absolutely astound you. During the last financial crisis, the Federal Reserve secretly conducted the biggest bailout in the history of the world, and the Fed fought in court for several years to keep it a secret. Do you remember the TARP bailout? The American people were absolutely outraged that the federal government spent 700 billion dollars bailing out the "too big to fail" banks. Well, that bailout was pocket change compared to what the Federal Reserve did. As you will see documented below, the Federal Reserve actually handed more than 16 trillion dollars in nearly interest-free money to the "too big to fail" banks between 2007 and 2010. So have you heard about this on the nightly news? Probably not. Lately Bloomberg has been reporting on some of this, but even they are not giving people the whole picture. The American people need to be told about this 16 trillion dollar bailout, because it is a perfect example of why the Federal Reserve needs to be shut down. The Federal Reserve has been actively picking "winners" and "losers" in the financial system, and it turns out that the "friends" of the Fed always get bailed out and always end up among the "winners". This is not how a free market system is supposed to work.

What you are about to read should absolutely astound you. During the last financial crisis, the Federal Reserve secretly conducted the biggest bailout in the history of the world, and the Fed fought in court for several years to keep it a secret. Do you remember the TARP bailout? The American people were absolutely outraged that the federal government spent 700 billion dollars bailing out the "too big to fail" banks. Well, that bailout was pocket change compared to what the Federal Reserve did. As you will see documented below, the Federal Reserve actually handed more than 16 trillion dollars in nearly interest-free money to the "too big to fail" banks between 2007 and 2010. So have you heard about this on the nightly news? Probably not. Lately Bloomberg has been reporting on some of this, but even they are not giving people the whole picture. The American people need to be told about this 16 trillion dollar bailout, because it is a perfect example of why the Federal Reserve needs to be shut down. The Federal Reserve has been actively picking "winners" and "losers" in the financial system, and it turns out that the "friends" of the Fed always get bailed out and always end up among the "winners". This is not how a free market system is supposed to work.

No comments:

Post a Comment