Gold World News Flash |

- Keith Neumeyer: How to Build a Major Silver Producer

- Gold Triangle Reality Check

- Jobs Jobs Jobs

- Gold Seeker Closing Report: Gold and Silver Fall Over 2% More

- US Economic Collapse Survial Map.flv

- Sometimes it's just too hard trying to make money in gold shares

- Paul pulls within 1 point of leader Gingrich in Iowa poll

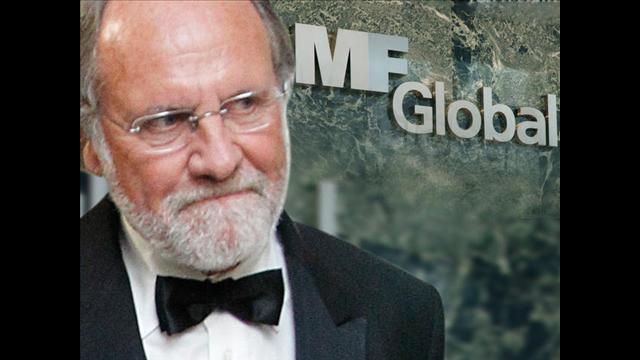

- Presenting The Three Unscripted Sentences That May Have Cost Jon Corzine His Freedom

- Mike Krieger Explains Why Silver Bullets Are The Only Defense Against Modern Financial Vampires

- Three Stooges Testify about Missing Money at MF Global

- Child Poverty In America Is Absolutely EXPLODING – 16 Shocking Statistics That Will Break Your Heart

- Money flees the corruption of U.S. markets, Armstrong tells King World News

- Shear Lunacy!!

- MF Global shoots counterparty risk worldwide, Turk tells King World News

- European nations' debts overwhelm their gold reserves

- MUST HEAR: Ann Barnhardt – Gold, Silver & Near Future, “Monumental Market Disorder?”

- Where's Jonny!?

- Was The "Collapse" Of MF Global Premeditated? A Conspiracy Theory Thought Experiment

- Was The "Collapse" Of MF Global Premeditated? A Conspiracy Theory Thought Experiment

- When a Great Correction Doesn’t Stick to the Script

- Gold Price Closed at $1,727.90, I'm Waiting a Day or Two to Take Advantage of Lower Prices

- Capital Account: Gerald Celente on his Missing MF Global Money and the COMEX Gold Ponzi (12/13/11)

- Kerry Lutz Interview with “Ranting” Andy Hoffman – The Latest Gold Takedown

- Year-end Buying Opportunities Abound in Mining Stocks

- Zulauf: Depression Will Lead To A Collapse Of The Euro

- Wow! China Gold Imports Spike 4,000% y-o-y

- All That Glitters…Will Not Solve Europe's Debt Woes

- Gold Stocks: Still a Bargain

- Gold Daily and Silver Weekly Charts - Gold Breaks But No Silver Confirm - Did Jonny Lie?

- Europe’s Problem, America’s Solution

| Keith Neumeyer: How to Build a Major Silver Producer Posted: 13 Dec 2011 06:22 PM PST |

| Posted: 13 Dec 2011 06:03 PM PST |

| Posted: 13 Dec 2011 05:46 PM PST Without sounding satirical, one must see the ironic nature to Steve Jobs passing away last week. The word on the lips of every politician in Anglo America happens to be his surname. That's right. Were talking about Jobs. Or more specifically, the lack of them. Unemployment is like a virus, it can strip growth and confidence from an economy faster than one of CERN's Neutrinos . This age old dilemma has defeated the theories of Keynes, Hayek and a plethora of other economists leaving a trail of destruction in its wake. One must question why we are able to make a phone that we can talk to, and yet we are unable to create sustainable levels of employment.

So, what exactly is the issue with jobs? Well, depending on the sector you represent, the issues vary with magnitude. Here in the UK, we have serious structural and cultural issues that are becoming increasingly engrained into society as the days role on past. Before I move onto the real topic of this piece, the US, I believe it is only fair that I elaborate on the statement regarding the UK. The UK has been on a continuous slide since the dawn of Globalisation where suddenly the world was a wash with cheaper imported goods from many a distant land. Globalisation has effectively sped up information transfer to a point where comparative advantage is solely based upon the cost of the labour force and political policy. Being a Libertarian (ebbing towards the right), I have a fundamental appreciation of the benefits that world trade encompasses but I am also quick to point out its faults.

However, in the last 30 years, the concentration of business and wealth in London has grown considerably when compared to the rest of the country. At the turn of the last century, the north of the country fulfilled a pivotal manufacturing role in the world marketplace and British goods were available globally. But with the emergence of Asia, improved logistics and cheap manufacturing, this industry has collapsed, leaving deep scars across the north of the country and deep structural unemployment. Although the UK retains its engineering prowess on the world stage, the mass employment market of manufacturing has been transferred East to both emerging Europe and Asia.

Think about it this way. When individuals become more educated, they will expect a higher level of pay as part of the cost benefit decision process. This leads them to deviate from lower income jobs or charge comparatively more for their services. As a result, migrants from EU countries that provide services at a far lower pay rate flooded areas like construction and basic retail, driving down the wage rate to levels at which higher educated individuals consider unacceptable. This process, over time, has created a large terminally unemployed proportion of society that, in financial terms, are better off receiving social security than working. Leading up to 2008-2009, this process was talked about but was not an urgent concern.

Earlier this year, a report by the Office of National Statistics revealed that graduate unemployment had reached 20% and unemployment of school leavers reached 44.3%. We expect these figures are out of date and the real figure is far higher than previously reported due to another academic year concluding since their publication. Now, onto the US. Oh, the US. Where do we start? Lets start in 2005 when the world was covered in a thick layer of Benjamin Franklins. Life was good. Your cleaner had just bought her third house in Malibu and the cheeky chaps over at AIG were printing money by selling insurance on "investment grade" debt.

We were living on Earth 2.0, leveraged to the hilt and spending like rap stars. Then what started as a small rainstorm in the housing market, turned into the mother of typhoons, reeking havoc across lands far and wide. When all the dust had settled, the folks over at the Treasury and Fed decided it was time to save the day. Pumping billions (and in some reports trillions) of dollars into the US economy to keep it afloat. However, an ugly pattern started to emerge. Captain Ben and Heroic Hank started to pump more and more money into the system to boost confidence and rally the S&P just to prove that America was a fixed land and the American Dream was still alive. Unbeknown to them, they were creating the foundations for the mother of all financial eruptions. One that we are not far from experiencing in our opinion. The problem lies in the fact that people across the world became used to this leveraged way of life. In the wake of 2009, the markets should have flattened but instead they continued to rise. Do you ever consider why people take drugs? Is it the high? The rush? The escapism? Without being a neuroscientist it would be hard to make any conclusions but it probably lies with a whole host of factors ranging across social anthropology. The point is, drugs are bad yet people all over the planet still take them. They get used to a high which they want to last forever and when it starts to wear off, they go into a depression. Leverage is like a drug, when economies have it, it feels like the best thing the world. Everyone feels rich and the world is your sub-prime oyster. People from all walks of life feel like they can achieve the extraordinary, like buying a house without a job or profiting from these funky new products called CDO's - No one knows whats in em, but they aren't half making my pension look good - Maybe I should retire early? I am the American Dream. Were we for real? Seriously…. The graph below shows the DJIA over the last 30 years, and as you can see, there has been an unprecedented growth in the last 15 years. Growth built on leverage and inflation. Our trend line, maybe a little pessimistically, points towards a level of around the 8000 mark as opposed to the 12 000 that investors are so used to.

Banding around words like leverage is all good and dandy but what does this actually mean. Well, in our opinion, the US economy is vastly overinflated and as a consequence consumption and compensation has grown disproportionately to the economy and, more importantly, what is sustainable. As a result, when times are bad, companies are forced to sack individuals to retain their margins and levels of pay which results in an increased level of unemployment. See, CEOs must look after the shareholders, or in other words: your pension, otherwise they are swiftly given the boot in favour of someone who will be more aggressive and bulk up the dividend. No one wants to be the CEO who took a company from Hero to Average, yet by not doing so, they are increasing the odds of a Hero to Zero moment as the days roll past. The problem is that there is only so much cutting that one can do, beyond that point, revenue will have to be sacrificed and no one wishes for that. This issue is far broader than many believe. A great deal of jobs could be created by merely flattening compensation and preparing the economy for reduced P/E ratios across the board.

The graph above shows the average wage rate growth of an individual in the US business sector. As you can see, growth has been prolific in the long run. However if you look closely, the growth rate between 1970 and 1997 represents a considerable slowdown when compared with the periods both before and after it. Between 1970 and 1997, the wage growth grew by around 15 index points, whereas between 1997 and 2007 compensation grew by almost 20 points. The US wage growth grew more in 10 years that it did in the previous 27. We believe that this is truly unsustainable. Our argument is that by flattening wages or decreasing them in real terms, the US could make way for new workers with a reduced state dependence. Exactly the same amount of tax would be collected and arguable the same amount consumed, yet no one and I mean no one is considering such a measure. By doing so, the US would have to acknowledge its difficulties and prepare for economic slowdown which is oh so un-American. A factor that we believe could be America's final misgiving. It is probably about time we talk about Mr Obama and his misconceived assumptions regarding job creation. Obama has been in some ways unfortunate and in others plain dumb. Before, we begin our critique, we ask you to consult this excellent graph from the Washington Post.

This graph compares the figures provided by his Recovery and Reinvestment plan against the real figures collected from the Bureau of Labour Statistics, and as is plan to see, his plan failed. Dismally. Firstly, Obama was overly optimistic about the strength of the economy. What he failed to realise is that it will take years for the troubled assets to leave the system and, whilst they still exist, their economic paralysis will continue. By focusing on jobs, Obama was treating a symptom of the crash and not the route cause. Think of it this way, if you have a leak in your roof and it wrecks your furniture, you don't replace the furniture before mending the roof. He was using an end as the justification for the mean without considering the idea that the end was uncorrelated to the means in the long term. In layman's terms, he should have focussed on encouraging commerce and promoting commercial borrowing to generate organic jobs growth and stabilise money supply. This, as Heroic Hank and Captain Ben incorrectly concluded, does not involve handing banks free cash. Secondly, by introducing a broader Medicare package Obama has left the US with another long term debt obligation that will have to be funded from the public purse. Whilst we appreciate the morality of Obama's healthcare bill, his timing could not be worse. Don't spend money when something don't need fixing in the short term, leaving your mark on a country is great but dragging razor blades through it's heart is far more detrimental and the effects are remembered far longer than you are. All of this spending came to a head in the debt ceiling debate that not only made the US look positively incompetent, it highlighted both the political division and financial stress that exists to the whole world.

Whatever Wall Street may have you think, the banks have a lot of static cash sitting in the Fed accumulating interest, yet they have very little credible businesses that want to borrow from them. The issue falls down to confidence, would you want to borrow if the world was telling you that there are no jobs and stock markets have fallen for the 10th day in a row.

The smart man in the small business owner should view this as an opportunity. Rarely has there ever been a chance to harness credit or staff at such a low cost. He should also be aware of the fact that 20% growth a year is a fallacy and navigate his operations with the view to grow organically without the previous pressures of a credit bubble. This is the message that Washington should be sending to its people instead of the current one that focuses on re-entering the gravy years through a focus on consumption and job stimulus.

Barak, Mitt, Rick, Rick and Herman, whichever of you starts to realise this will be the true champion of the American people. However, we don't keep our hopes up. Politics has become somewhat like an episode of Jersey Shore in recent months, yet upsettingly not as disassociated from the real world, and it doesn't look set to change. The very fundamentals of democracy have been turned on their head as the political hierarchy ranks the Presidency and Perception far above the importance of the people. We leave you with a pertinent quote from Economist Thomas Sowell "It is hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong."

First published on 10th October 2011

Tick By Tick Team

We have recently started sending out free Bi-Weekly opinion via email. If you would like to receive these short commentaries, please send an email with the subject line "Please add to commentary mailing list" to team@tickbytick.co.uk All email addresses will be held with complete confidentiality and there is no profit motive in any piece of writing disseminated.

|

| Gold Seeker Closing Report: Gold and Silver Fall Over 2% More Posted: 13 Dec 2011 04:00 PM PST Gold fell almost 1% to $1651.48 in Asia before it rebounded to $1677.87 in early New York trade, but it then fell back off for most of the rest of the day and ended with a loss of 2.08%. Silver dropped to $30.898 in Asia before it rose to $31.95 in early New York trade, but it then fell back off into the close and ended with a loss of 2.14%. |

| US Economic Collapse Survial Map.flv Posted: 13 Dec 2011 03:34 PM PST  The ideal situation for long-term survival in an EOTWAWKI situation includes a well-stocked home based in a sparsely populated area with fertile soil that is at least a full tank of gas (300-400 miles) away from the nearest major population center. More than that, you also need a community of people you can trust and support, as well as a positive mental attitude and the total commitment to survival. Individualist "Rambo" types will be the first to die. Read more.... The ideal situation for long-term survival in an EOTWAWKI situation includes a well-stocked home based in a sparsely populated area with fertile soil that is at least a full tank of gas (300-400 miles) away from the nearest major population center. More than that, you also need a community of people you can trust and support, as well as a positive mental attitude and the total commitment to survival. Individualist "Rambo" types will be the first to die. Read more.... This posting includes an audio/video/photo media file: Download Now |

| Sometimes it's just too hard trying to make money in gold shares Posted: 13 Dec 2011 02:33 PM PST Italian Black Cat Becomes a Fat Cat After Inheriting 10 Million Euros By Nick Squires http://www.telegraph.co.uk/news/newstopics/howaboutthat/8947420/Italian-... A black cat in Italy has lived up to its reputation for good luck after inheriting 10 million euros (L8.5 million) from his adoptive owner, a widowed heiress. Four-year-old Tommaso, who was saved from a hardscrabble existence on the mean streets of Rome as a kitten, is now the proud owner of cash, shares, and a property empire that includes flats and houses in Rome and Milan and land in Calabria. Tommaso went from flea-bitten alley cat to "pussy galore" after being rescued by a lonely old lady, named only as Maria Assunta, who was married to a property tycoon but widowed at an early age. The couple had no children. She became besotted with her pet but as her health began to fail, feared for his future. ... Dispatch continues below ... ADVERTISEMENT Prophecy Drills 384.9 Meters Grading 0.623 g/t PGM+Au, Company Press Release VANCOUVER, British Columbia -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) has announced the final drill results from 2011 drilling at the company's fully owned Wellgreen platinum group metals, nickel, and copper project in the Yukon Territory. Borehole WS11-192 intercepted 384.9 meters of 0.45 percent nickel equivalent starting from 9.45 meters depth. Included in this greater interval of continuous mineralization is a platinum group metals-rich zone with a combined platinum-palladium-gold grade of 1.358 grams per ton over 19.23 meters (nickel equivalent 0.74%). The final drilling results for 2011 have shown the Wellgreen Central-East and Central-West deposits to be one contiguous body, whereby there is good potential to broaden significantly the Central-West resource base, which currently contributes only about a quarter of the current 43-101 compliant resource at Wellgreen. Overall the drilling program met with good success in expanding the resource to the east and south. The long drill intercepts suggest the deposit remains very much open in those directions. For the complete drilling results and the full company statement, please visit: http://prophecyplat.com/news_2011_dec08_prophecy_platinum_wellgreen_dril... So in November 2009 she wrote out a will in which she bequeathed her "entire estate" to the unknowing Tommaso. She instructed her lawyers to "identify an animal welfare association or group to which to leave the estate and the commitment of looking after Tommaso." But none of the animal welfare associations matched up to the old lady's exacting standards, so she instead decided to leave her fortune to Tommaso through the nurse who had cared for her in her final months, a woman named Stefania. The will came into force when the heiress died two weeks ago at the age of 94. "She had become very fond toward the nurse who assisted her," Anna Orecchioni, one of the lawyers, told Il Messaggero newspaper. "We're convinced that Stefania is the right person to carry out the old lady's wishes. She loves animals just like the woman she devoted herself to right up until the end." The nurse said she had no inkling that her charge was so rich. "I promised her that I would look after the cat when she was no longer around. She wanted to be sure that Tommaso would be loved and cuddled. But I never imagined that she had this sort of wealth. She was very discreet and quiet. I knew very little of her private life. She told me only that she had suffered from loneliness a lot." Tommaso now lives with his new owner and another cat in a house outside Rome. The address is being kept a secret out of fear that the newly-enriched moggy will be besieged by fortune hunters and con men. Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/conference-details/vancouver-resource-investme... California Investment Conference http://cambridgehouse.com/conference-details/california-investment-confe... Support GATA by purchasing gold and silver commemorative coins: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf |

| Paul pulls within 1 point of leader Gingrich in Iowa poll Posted: 13 Dec 2011 02:25 PM PST From Agence France-Presse http://news.yahoo.com/gingrich-lead-eroding-latest-iowa-poll-004813339.h... Former House speaker Newt Gingrich's commanding lead among Republican presidential hopefuls in Iowa has eroded dramatically in the past week, a poll in the key state out Tuesday shows. Gingrich tops the survey with 22 percent support, just slightly ahead of Congressman Ron Paul, who has 21 percent, according to the Public Policy Polling survey of likely Republican voters ahead of the January 3 caucuses, which kick off the 2012 presidential nominating season. Gingrich, who is seeking the Republican nomination to take on President Barack Obama in the November 2012 election, enjoyed a 9-point lead in the previous Iowa PPP survey December 3-5. Former Massachusetts Gov. Mitt Romney, who once seemed like the inevitable nominee, has 16 percent support in Iowa, unchanged since the previous PPP survey. ... Dispatch continues below ... ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. "Newt Gingrich's momentum is fading in Iowa," said Public Policy Polling president Dean Debnam. The attacks against Gingrich "appear to be taking a heavy toll," the pollsters said, noting that his support among the ultra-conservative Tea Party wing of the party has slipped from 35 percent to 24 percent. The ex-speaker is ahead among party faithful in national polls, a lead that lead may mean little if he does not win in Iowa. An Iowa win could sweep him to victory in the New Hampshire primaries on January 10 and give him significant momentum going into January primaries in the southern states of South Carolina and Florida. Yet it is Ron Paul who is now surging as the "other-than-Romney" Republican candidate. According to the pollster Paul has strong support among young voters -- voters who historically show much enthusiasm but cast ballots in lower numbers than older voters. It is unclear if Gingrich will suffer the same fate as Congresswoman Michele Bachmann, businessman Herman Cain -- who dropped out of the race amid a growing sex scandal -- and Texas Governor Rick Perry, all of whom briefly led popularity surveys among Republicans at different times as an alternative to Romney. Bachmann has seen her support slip from 13 percent to 11 percent in the Iowa poll, while Perry has been stuck at nine percent support. PPP surveyed 555 likely Republican caucus voters between December 11-13. The poll has a plus or minus 4.2 point margin of error. Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/conference-details/vancouver-resource-investme... California Investment Conference http://cambridgehouse.com/conference-details/california-investment-confe... Support GATA by purchasing a silver commemorative coin: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT The United States Once Again Can Establish Lewis E. Lehrman, chairman of the Lehrman Institute, sponsor of The Gold Standard Now project, has released a plan to restore economic growth through a stable dollar. The plan, titled "The True Gold Standard: A Monetary Reform Plan Without Official Reserve Currencies," responds to the recurrent economic crises of the last century and outlines a detailed proposal for America's leadership on "how we get from here to there." That is, how we get from the present unstable paper dollar to a stable dollar as good as gold. James Grant, author and editor of Grant's Interest Rate Observer, says of the Lehrman plan: "If you have ever wondered how the world can get from here to there -- from the chaos of depreciating paper to a convertible currency worthy of our children and our grandchildren -- wonder no more. The answer, brilliantly expounded, is between these covers. America has long needed a modern Alexander Hamilton. In Lewis E. Lehrman the country has finally found him." To learn more and to sign up for The Gold Standard Now's free, noncommercial, weekly report, "Prosperity through Gold," please visit: http://www.thegoldstandardnow.org/gata |

| Presenting The Three Unscripted Sentences That May Have Cost Jon Corzine His Freedom Posted: 13 Dec 2011 02:22 PM PST Today, in advance of their sworn testimony, each witness to the Senate Agricultural Committee's MF Global hearing was requested to disclose what their prepared remarks would be. Sure enough, CME executive chairman Terry Duffy did that, and his prepared testimony can be found here. In and of itself there was nothing unexpected about said speech, the relevant section of which has been transcribed below. Where things got very ugly for Corzine, is when Duffy literally veered from the script, and added three unexpected sentences, catching everyone in the committee off guard (including those who had given up on the testimony which came just after Corzine's) and which according to most news wires could have buried Corzine's defense strategy, exposing him for a liar under oath, and potentially costing him his freedom. The video of the relevant 2 minutes is attached below. First: here is what the Duffy prepared remarks should have been:

And here is what they ended up being: revised text in bold.

The only question we have is: why? |

| Mike Krieger Explains Why Silver Bullets Are The Only Defense Against Modern Financial Vampires Posted: 13 Dec 2011 02:01 PM PST A Silver Bullet for Modern Vampires by Michael Krieger via ZeroHedge:

vam•pire Definition of VAMPIRE 1: the reanimated body of a dead person believed to come from the grave at night and suck the blood of persons asleep 2 a : one who lives by preying on others Does the above definition of vampire by Merriam Webster remind you of anything? Yes of course it does, it reminds you of the Too Big To Fail Banks. It was extremely appropriate for Matt Taibbi to refer to Goldman Sachs as the "Vampire Squid." Just as the above definition lays out, vampires are able to come back from the dead and once they have done so they drain the life out of the living while they sleep. Need I say more? The big banks and the Federal Reserve are modern day vampires and they are feeding off what remains of the living (productive) parts of the economy while the majority of Americans are stuck in a reality tv, Prozac induced coma of endless propaganda and brainwashing. Indeed the vampires are feeding off of an American public that still by and large remains "asleep." These are ideal hunting grounds for vampires. |

| Three Stooges Testify about Missing Money at MF Global Posted: 13 Dec 2011 01:56 PM PST by Greg Hunter's USAWatchdog.com:

I watched in amazement today at the Senate Hearing on the collapse of MF Global about 6 weeks ago. The three top executives testified about what they knew and when they knew it. CEO Jon Corzine, COO Bradley Abelow and CFO Henri Steenkamp all sat there and, essentially, said none of them knew where $1.2 billion of segregated customer money went. It might as well have been Moe, Larry and Curly testifying. As I watched these three, the basic theme was none of these guys knew what was going on in the company they were paid to run. I guess they have proof they didn't know what they were doing because the company they were running went bankrupt. Corzine said repeatedly, "I never gave any instruction to anyone at MF Global to misuse customer funds." If that is not a well-rehearsed legal answer, I don't know what is. Other legal words and phrases I heard from the three MF Global executives include: "To the best of my recollection, to the best of my knowledge, I do not recall, and no reason to believe," just to name a few. When COO Bradley Abelow was asked the simple question of where did the money go? Mr. Abelow said, "I do know what happened, and I am awaiting results of the investigation to inform us all." What? So we are awaiting the results of an investigation to find out what these three stooges were paid to know? |

| Child Poverty In America Is Absolutely EXPLODING – 16 Shocking Statistics That Will Break Your Heart Posted: 13 Dec 2011 01:53 PM PST from The Economic Collapse Blog:

|

| Money flees the corruption of U.S. markets, Armstrong tells King World News Posted: 13 Dec 2011 01:49 PM PST 9:49p ET Tuesday, December 13, 2011 Dear Friend of GATA and Gold: Interviewed today by King World News, market analyst and former political prisoner Martin Armstrong contends that the corruption of U.S. financial companies as exemplified by the collapse of MF Global is causing money to flee U.S. markets. Armstrong says the Chicago Mercantile Exchange, clearinghouse for MF Global, should reimburse the firm's clients for the money missing from their accounts and in turn seek reimbursement from the banking houses where the money ended up. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/12/13_K... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/conference-details/vancouver-resource-investme... California Investment Conference http://cambridgehouse.com/conference-details/california-investment-confe... Support GATA by purchasing gold and silver commemorative coins: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 384.9 Meters Grading 0.623 g/t PGM+Au, Company Press Release VANCOUVER, British Columbia -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) has announced the final drill results from 2011 drilling at the company's fully owned Wellgreen platinum group metals, nickel, and copper project in the Yukon Territory. Borehole WS11-192 intercepted 384.9 meters of 0.45 percent nickel equivalent starting from 9.45 meters depth. Included in this greater interval of continuous mineralization is a platinum group metals-rich zone with a combined platinum-palladium-gold grade of 1.358 grams per ton over 19.23 meters (nickel equivalent 0.74%). The final drilling results for 2011 have shown the Wellgreen Central-East and Central-West deposits to be one contiguous body, whereby there is good potential to broaden significantly the Central-West resource base, which currently contributes only about a quarter of the current 43-101 compliant resource at Wellgreen. Overall the drilling program met with good success in expanding the resource to the east and south. The long drill intercepts suggest the deposit remains very much open in those directions. For the complete drilling results and the full company statement, please visit: http://prophecyplat.com/news_2011_dec08_prophecy_platinum_wellgreen_dril... |

| Posted: 13 Dec 2011 01:49 PM PST by Harvey Organ: Good evening Ladies and Gentlemen: The stock market reversed course on news that Merkel will not increase any bailout funds for Europe. This caused the Euro to tumble and caused bourses to falter. [....] The supposition is that European banks are having difficulty selling assets and as such need to sell their remaining gold. This is very good for us as we get the last ounces of gold out of the hands of central bankers. Let us now head over to the comex and assess the damage today; Gold closed today down $4.30 d at $1659.60 while silver generally held its own rising by 27 cents to $31.20 I am witnessing some strange things going on at the comex and I would like to present this to you. |

| MF Global shoots counterparty risk worldwide, Turk tells King World News Posted: 13 Dec 2011 01:37 PM PST 9:30p ET Tuesday, December 13, 2011 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk today tells King World News that the failure of the MF Global brokerage house has spread counterparty risk throughout the world financial system, causing trading to shrink and creating a crisis worse than the collapse of Lehman Brothers. Turk echoes the advice just given via King World News by Jim Sinclair: Be your own central bank with gold and silver in possession. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/12/13_T... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sonora Aims to Follow First Majestic's Success Sonora Resources (OTCBB: SURE) is a silver mining exploration company focused on the development of prospective opportunities in Mexico. The company president and CEO is Juan Miguel Rios Gutierrez, who helped build First Majestic Silver Corp., which began trading for pennies and today is at more than $16 per share. Gutierrez was the fourth person to join First Majestic Silver, originally as general manager, then manager for new business initiatives and strategic planning. He left First Majestic Silver to work with Sonora Resources and yet maintains strong contacts with First Majestic. In fact, First Majestic is a large shareholder in Sonora and has a joint venture with the company. For more information about Sonora Resources, please visit: http://www.SonoraResources.com Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/conference-details/vancouver-resource-investme... California Investment Conference http://cambridgehouse.com/conference-details/california-investment-confe... Support GATA by purchasing gold and silver commemorative coins: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Golden Phoenix Signs Definitive Agreement Company Press Release SPARKS, Nevada -- Golden Phoenix Minerals Inc. (OTC Bulletin Board: GPXM) has signed a definitive agreement to acquire a 60 percent interest, with an option to buy an additional 20 percent interest, in the Santa Rosa gold mine in Panama, now owned by Silver Global S.A., a Panamanian corporation. Santa Rosa produced more than 100,000 ounces of gold from 1996 to 1998 before being closed in part to low gold prices, which are now more than five times higher. Golden Phoenix intends to acquire its initial 60 percent interest in Santa Rosa by acquiring 60 percent of the share capital of a recently created company under the name Golden Phoenix Panama S.A., formed to hold and operate the mine. Tom Klein, CEO of Golden Phoenix says: "The agreement establishes a solid framework from which we can advance Mina Santa Rosa to production-ready status." For Golden Phoenix's complete statement, please visit: http://goldenphoenix.us/press-release/golden-phoenix-signs-definitive-ac... |

| European nations' debts overwhelm their gold reserves Posted: 13 Dec 2011 01:29 PM PST At current gold prices, that is. * * * All That Glitters ... Will Not Solve Europe's Debt Woes European Governments Have a Lot of Gold. But That Won't Be Much Help. By Liam Pleven http://online.wsj.com/article/SB1000142405297020380220457706664129594143... Fact No. 1: European governments are among the biggest holders of gold on the planet. Fact No. 2: Massive debts owed by some of those governments are fueling a political crisis in Europe and turmoil in markets around the world. Those two facts lead to an obvious question from a lot of investors: Why don't those governments sell gold to pay off their debts? If only it were that simple. For starters, not even the Europeans own that much gold. The borrowing needs, and subsequent debts, of countries like Italy, France, and Spain are so huge, analysts say, that liquidating their gold reserves wouldn't go far toward balancing their books for the long term. "If they sold their gold, I'm not sure it would do anything to their credit rating," says Kenneth Rogoff, an economics professor at Harvard University who has studied official gold reserves. "This is not exactly a game changer." ... Dispatch continues below ... ADVERTISEMENT Golden Phoenix Completes Operating Agreement Golden Phoenix Minerals Inc. (GPXM) has entered a joint venture operating agreement with Silver Global S.A., a Panamanian corporation, governing the operational and management aspects of their new joint venture company, Golden Phoenix Panama S.A., a Panamanian corporation formed to hold and operate the Santa Rosa gold mine in Canazas, Panama, and explore the mine's adjacent property. Golden Phoenix will be manager of the joint venture company. Silver Global will handle all social programs, political and community relations, and human resource matters for the joint venture company in Panama. Golden Phoenix and Silver Global also have agreed to work together on all future acquisitions within Panama and to bring such new opportunities to the joint venture company. Golden Phoenix will be earning in to a 60 percent interest (and potentially an 80 percent interest) in the Santa Rosa mine. Upon signing the joint venture agreement and completing the corresponding acquisition payment, Golden Phoenix will earn an initial 15 percent interest in the joint venture company. Tom Klein, CEO of Golden Phoenix, says the agreement "creates a solid foundation for the development and planned re-opening of Mina Santa Rosa." For Golden Phoenix's full statement on the joint venture operating agreement, please visit: http://goldenphoenix.us/press-release/golden-phoenix-completes-joint-ven... Market and political realities too would make it challenging for Europeans to rely on a golden parachute, experts say. For one thing, there's a risk that trying to sell the gold or use it as collateral for a loan could be seen in the market as a sign of desperation -- which could drive up borrowing costs by making lenders even more wary, defeating the purpose. Nevertheless, some investors still need convincing that gold isn't the cure-all that Europe is seeking. After all, governments, central banks and multilateral financial institutions like the International Monetary Fund hold roughly 18% of the world's gold, according to the World Gold Council, a trade group. Italy has more gold than any nation besides the U.S. and Germany, the council says. France ranks fourth and Portugal 12th. Even Greece, the land of King Midas, is in the top 30, well ahead of wealthy nations such as Australia and emerging powers like Brazil. And with gold prices near a record in nominal terms -- up 17% this year alone -- the value of those holdings has soared in recent years. Italy's current gold holdings, now valued at $134 billion, would have fetched only $21 billion at the end of 2000. The other side of the coin, however, is that Italy's gold represents only about 6.7% of its gross domestic product. Portugal's supply is proportionally bigger, at more than 9% of its GDP. But cashing in its gold would barely make a dent in Portugal's government debt, which represents 93% of GDP, according to IMF data. In addition, European Union members accepted restrictions on using their gold reserves when they launched a common currency. The euro treaty prohibits the countries from financing government operations by selling gold held by central banks -- which is where most European nations have their reserves -- according to Natalie Dempster, the gold council's director of government affairs. Using gold to finance state operations "is simply not an option," she says. The gold, Ms. Dempster adds, is mainly there to protect the euro. For euro-zone nations, similar hurdles apply to the idea of using official gold as collateral to borrow at cheaper rates than investors are currently offering. But Europe could in theory transfer some gold held by member states -- or the European Central Bank, which has its own bullion -- out of reserves and use it to partially back a bond issue, according to Ms. Dempster. A similar notion was recently raised in a paper issued by the European Commission, she says. In the gold council's view, that would require the ECB to determine that the move supported member states' economic policies and didn't interfere with price stability. An additional hurdle for governments when it comes to gold markets is an accord known as the Central Bank Gold Agreement, which is signed by many European nations and, like the euro treaty, limits gold sales by governments, according to the gold council. Even if a nation found a way around such obstacles, officials could face a backlash from voters who believe gold prices will keep rising. Before 2010, many European nations were net sellers of gold, which some of them had come to view as an antiquated asset. "That," says Harvard's Mr. Rogoff, "turned out to be not such a good idea." Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/conference-details/vancouver-resource-investme... California Investment Conference http://cambridgehouse.com/conference-details/california-investment-confe... Support GATA by purchasing gold and silver commemorative coins: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sonora Aims to Follow First Majestic's Success Sonora Resources (OTCBB: SURE) is a silver mining exploration company focused on the development of prospective opportunities in Mexico. The company president and CEO is Juan Miguel Rios Gutierrez, who helped build First Majestic Silver Corp., which began trading for pennies and today is at more than $16 per share. Gutierrez was the fourth person to join First Majestic Silver, originally as general manager, then manager for new business initiatives and strategic planning. He left First Majestic Silver to work with Sonora Resources and yet maintains strong contacts with First Majestic. In fact, First Majestic is a large shareholder in Sonora and has a joint venture with the company. For more information about Sonora Resources, please visit: http://www.SonoraResources.com |

| Posted: 13 Dec 2011 12:53 PM PST from wepollock: Warren Pollock interviews Ann Barnhardt of Barnhardt Capital Management. Ann shut the doors of her brokerage because she felt customer capital was no longer safe. Ann gives us her opinions about: gold and silver, the stability of markets, conduct of regulators, and the potential for systems and currency collapse. We also discuss the possibility of the need to barter as the system fails and the mathematical impossibility of correcting the over-leveraged financial mess now reaching its inevitable conclusion, thereby creating a future of "monumental market disorder". "It's all bullshit and none of these people actually believe their own bullshit. It's just legal wrangling to draw it out as long as they can… you cannot deal with these people and work off the assumption that they are honest or that they actually believe anything they are saying… the entire planet is not worth the amount of leverage that they have… there isn't that much precious metal remaining in the crust of the earth."– Ann Barnhardt |

| Posted: 13 Dec 2011 12:41 PM PST Gold Daily and Silver Weekly Charts – Gold Breaks But No Silver Confirm – Did Jonny Lie? MF Global is more of a crime scene than a simple bankruptcy. What puzzles me is how MF Global was able to transfer … Continue reading |

| Was The "Collapse" Of MF Global Premeditated? A Conspiracy Theory Thought Experiment Posted: 13 Dec 2011 12:31 PM PST Derivatives, unlike stocks where the equation has always been murky, are for the most part zero-sum products: one's gain is someone else's loss (net of commissions) unless of course the entire system collapses in a daisylinked chain reaction (think AIG). And MF Global's bankruptcy, by dint of being a derivatives broker, and the resulting massive losses to both shareholders and clients, means that some entity, on the other side of all these failed bets, made off like a bandit. Which bring us to a rather disturbing theory proposed by Walter Burien of CAFR1.com who has floated the rather the chilling idea, and what some may call an outright conspiracy theory, that by scuttling MF, Corzine effectively helped some shell company (or companies) which were controlled by a "cabal" of his closest confidants (we will let readers come up with their own theories who the former CEO of Goldman Sachs may have been close with) to make the offsetting profit that resulted from the accelerated and massive losses borne by MF's stakeholders in the vicious liquidation. As Burien says: "A government and media cover up would just focus on MFG's loss. A true and open investigation would be focused on "who" took the other side of the coin; the profit." And now that we know that Corzine allegedly lied to the Senate, just how much deeper does his transgression go, and did his really hand over the company on a silver platter to some anonymous "Hold Co" by taking on massive risks he knew were going to blow up in his face, albeit knowing the "other" side of the trade would compensate him for it? After all, Corzine's legacy may have been forever tarnished, but if there was one thing the man knew after all those mostly successful years at Goldman, it was risk. So did he really blow up MF on a idiotic risk miscalculation bet within two years of joining, purely by mistake, or is there something more? From CAFR1 "Collapse" of MF Global?

Corzine is a thief. He lost by trading activity the house's (MF GLOBAL) money to the tune of a billion dollars and then dipped into the client's money for 700 million dollars (almost a 2-billion dollar loss). It is the #1 criminal infraction that can be committed in the commodity futures market by using client's funds for a house posistion and with something of this magnitude the CFTC would have gotten an arrest and seizure order against Corzine from day-one when discovered if it was for other than the politically connected Corzine. Here is the BIG point that needs to be immediately passed on to the public. In a situation like this the "loss" to MFG is just one side of the coin. The other side of the coin is who made the profit that counter balances with the loss. If Corzine had this set up as an intentional sting operation, in advance a shell trading company is established and for example purposes we will call it Hong Kong Trading Partners LTD. (HKTP) held in Singapore. The sting goes like this: As Corzine through MFG takes a derivative futures market position HKTP takes the exact corresponding opposite position tit for tat to what MFG is entering into. The market goes against MFG creating a loss but now the equal profit is growing in HKTP. MFG increases their position and HKTP likewise does the same and the market again goes "against" MFG and "for" HKTP. Now for the play-out of the sting. It is announced MFG has taken this large position with their own funds and also did the primary no-no of using client's funds to back it. Well, procedure is clear in this type of situation: "Forced liquidation of all positions held by MFG" What this does is give HKTP the liquidity to get out of their position from MFG's forced liquidation without causing an adverse movement to HKTP's position when being liquidated. MFG's forced liquidation is HKTP's volume needed to get out of their position and lock in their profit. Wealth transfer complete; MFG and a few of their clients decimated, and none outside of the sting are the wiser if no one carefully looks at who was playing the other side of the position against MFG. If Corzine and a few of his buddies set up a sting as noted above, as far as they are concerned, they did not loose 1. something billion dollars for MFG and MFG's clients, what they did was they transferred 1. something billion dollars to themselves through a shell global trading company(s). In most cases when a sting like this plays out it is not just one shell company used to play the other side of the coin, usually it is spreed out between ten or more shell trading companies. A government and media cover up would just focus on MFG's loss. A true and open investigation would be focused on "who" took the other side of the coin; the profit. |

| Was The "Collapse" Of MF Global Premeditated? A Conspiracy Theory Thought Experiment Posted: 13 Dec 2011 12:31 PM PST Derivatives, unlike stocks where the equation has always been murky, are for the most part zero-sum products: one's gain is someone else's loss (net of commissions) unless of course the entire system collapses in a daisylinked chain reaction (think AIG). And MF Global's bankruptcy, by dint of being a derivatives broker, and the resulting massive losses to both shareholders and clients, means that some entity, on the other side of all these failed bets, made off like a bandit. Which bring us to a rather disturbing theory proposed by Walter Burien of CAFR1.com who has floated the rather the chilling idea, and what some may call an outright conspiracy theory, that by scuttling MF, Corzine effectively helped some shell company (or companies) which were controlled by a "cabal" of his closest confidants (we will let readers come up with their own theories who the former CEO of Goldman Sachs may have been close with) to make the offsetting profit that resulted from the accelerated and massive losses borne by MF's stakeholders in the vicious liquidation. As Burien says: "A government and media cover up would just focus on MFG's loss. A true and open investigation would be focused on "who" took the other side of the coin; the profit." And now that we know that Corzine allegedly lied to the Senate, just how much deeper does his transgression go, and did his really hand over the company on a silver platter to some anonymous "Hold Co" by taking on massive risks he knew were going to blow up in his face, albeit knowing the "other" side of the trade would compensate him for it? After all, Corzine's legacy may have been forever tarnished, but if there was one thing the man knew after all those mostly successful years at Goldman, it was risk. So did he really blow up MF on a idiotic risk miscalculation bet within two years of joining, purely by mistake, or is there something more? From CAFR1 "Collapse" of MF Global?

Corzine is a thief. He lost by trading activity the house's (MF GLOBAL) money to the tune of a billion dollars and then dipped into the client's money for 700 million dollars (almost a 2-billion dollar loss). It is the #1 criminal infraction that can be committed in the commodity futures market by using client's funds for a house posistion and with something of this magnitude the CFTC would have gotten an arrest and seizure order against Corzine from day-one when discovered if it was for other than the politically connected Corzine. Here is the BIG point that needs to be immediately passed on to the public. In a situation like this the "loss" to MFG is just one side of the coin. The other side of the coin is who made the profit that counter balances with the loss. If Corzine had this set up as an intentional sting operation, in advance a shell trading company is established and for example purposes we will call it Hong Kong Trading Partners LTD. (HKTP) held in Singapore. The sting goes like this: As Corzine through MFG takes a derivative futures market position HKTP takes the exact corresponding opposite position tit for tat to what MFG is entering into. The market goes against MFG creating a loss but now the equal profit is growing in HKTP. MFG increases their position and HKTP likewise does the same and the market again goes "against" MFG and "for" HKTP. Now for the play-out of the sting. It is announced MFG has taken this large position with their own funds and also did the primary no-no of using client's funds to back it. Well, procedure is clear in this type of situation: "Forced liquidation of all positions held by MFG" What this does is give HKTP the liquidity to get out of their position from MFG's forced liquidation without causing an adverse movement to HKTP's position when being liquidated. MFG's forced liquidation is HKTP's volume needed to get out of their position and lock in their profit. Wealth transfer complete; MFG and a few of their clients decimated, and none outside of the sting are the wiser if no one carefully looks at who was playing the other side of the position against MFG. If Corzine and a few of his buddies set up a sting as noted above, as far as they are concerned, they did not loose 1. something billion dollars for MFG and MFG's clients, what they did was they transferred 1. something billion dollars to themselves through a shell global trading company(s). In most cases when a sting like this plays out it is not just one shell company used to play the other side of the coin, usually it is spreed out between ten or more shell trading companies. A government and media cover up would just focus on MFG's loss. A true and open investigation would be focused on "who" took the other side of the coin; the profit. |

| When a Great Correction Doesn’t Stick to the Script Posted: 13 Dec 2011 12:23 PM PST Bill Bonner View the original article. December 13, 2011 12:01 PM Darkness without a dawn… The Dow down 167 yesterday. Gold down $48. Nothing to get excited about. The excitement is still ahead. When the Dow cuts through the 10,000 mark and heads to 6,000. Stay tuned… In the meantime, yesterday's Financial Times told us that the industrialized nations will borrow $10 trillion this year. Next year, the figure should be higher. Where does all that money come from? It's more than the world's total savings. Not that we know exactly, but total world GDP is about $50 to $60 trillion. Savings should be about 10% of that — or only about $5 to $6 trillion. So how are the developed nations able to borrow so much? With so much debt turning over, it makes the world financial system extremely vulnerable to inflation…or just a change of sentiment in the bond market. Which makes us wonder. What would happen if the lenders balk? We are, as all Dear Readers know, in a Great Co... |

| Gold Price Closed at $1,727.90, I'm Waiting a Day or Two to Take Advantage of Lower Prices Posted: 13 Dec 2011 11:36 AM PST Gold Price Close Today : 1727.90 Change : (2.80) or -0.2% Silver Price Close Today : 3119.50 Change : 26.00 cents or 0.8% Gold Silver Ratio Today : 55.390 Change : -0.556 or -1.0% Silver Gold Ratio Today : 0.01805 Change : 0.000179 or 1.0% Platinum Price Close Today : 1474.80 Change : 0.00 or 0.0% Palladium Price Close Today : 643.10 Change : -16.80 or -2.5% S&P 500 : 1,225.73 Change : -10.74 or -0.9% Dow In GOLD$ : $143.02 Change : $ (0.57) or -0.4% Dow in GOLD oz : 6.919 Change : -0.028 or -0.4% Dow in SILVER oz : 383.23 Change : -5.43 or -1.4% Dow Industrial : 11,954.94 Change : -68.45 or -0.6% US Dollar Index : 80.27 Change : 0.733 or 0.9% The GOLD PRICE and SILVER PRICE blew hot and cold out of both sides of their mouths today, and then the Dufuss-effect took hold. GOLD dropped $4.30 to close Comex at $1,659.90. SILVER rose -- probably on short-covering -- 26c to 3119.5c. Ahh, but post-Dufusses they broke down. Silver lost 45c to 3074.5c and the GOLD PRICE gave up another $28.40 in the aftermarket to $1,631.50. Gold has now sliced through its 150 DMA ($1,665) and set its sights on the 200 DMA (now $1,614). Support at $1,600 might catch gold and stop it, but the deflation scare could also drive it further. If it can't hold at $1,600 then $1,535 becomes likely. I have the same problem y'all do. If I shoot all my cash ammunition here, I won't have anything left to take advantage of lower prices. I feel safer watching it a day or two. The SILVER PRICE's next support down below lies around 3050c. Low today was 3038.7. Last low (November) was 3065. Look the worst square in the eye: silver could easily drop to 2615. Below that lies not much to stop its fall before it reaches 2000c. Yet there is also reason to suspect silver might catch a hand hold at 2900c. We just have to be patient here and let the market tell us what it intends. Right now it's keeping its cards too close to its breast to divine its ultimate intentions. Then there are those surprise parties to consider. You never know when or what governments will do next. I've been talking to metals dealers about the MF Global debacle, because many of them are hedgers and had accounts with MFG. My guess is they'll be a lot less likely in the future to leave money with any broker. Then, too, if they can't hedge, they must sell what they buy instead of holding it hedged. That can put downward pressure on prices, but more likely it could widen out the spread between buy and sell. We are seeing come to pass what I have long anticipated. Paper markets are unraveling. Now the very structure of the market itself must be questioned. In the bull market that peaked in 1980, paper (futures) prices drove silver and gold market. This time around, I think it will be more important to have actual physical possession, and that will means the physical price would be driving the market as the "real price", not the futures. We already saw that happen in the 2008 panic, when paper silver prices were 33% or more below physicals prices (physical silver carried a 50% premium over the paper price). Now, if some big entity that claims to have beaucoup silver stored suddenly goes belly up like John Corzine sent MFG belly up, well, who'll want "stored" silver then? If yesterday saw another Euro-bobble, today saw another Fed-bobble. The dufusses in charge, who are apparently kept incommunicado in the basement of the Fed Building, announced that things were "jes' fine!" and they didn't need to turn a peg for the economy. Now while I will vehemently defend the proposition that they are correct in not doing a blessed thing, and would be even correcter if they shut down the whole operation forever and went fishing, inaction was NOT what markets wanted to hear. Is concluding that markets dropped because of the Fed's announcement the post hoc ergo propter hoc logical error? Are y'all kidding me? Markets have been trained to believe that their salvation comes only from the Fed, and if the Fed won't act, then who will save them? Sure won't be me, any more than it will be the Fed, in point of fact. But enough of this fun. I can always count on some official lamebrain somewhere in the world to furnish more fodder for my ridicule machine than I can possibly process in a single commentary. Can't help it, they make themselves ridiculous. Let's look at stocks first. In a word, they're sunk. Sinking below 12,000 today broke the back of more investors' morale. Tomorrow the Dow will break that 11,950, and its 200 day moving average (11,943) and tomorrow or the next day will slam to 11,600, then 11,400, then 11,200, and below that, 10,400. Ohh, it hurts to think about it. Dow today dropped 68.45 (0.55%) to close at 11,954.94. S&P 500 trotted right along beside it dropping 10.74 (0.87%) to 1,225.73. The Fed has created an addict. Together with the yankee government, it has created a market that is as addicted to inflation, Quantitative Easing, and all the other nicey-nice names for printing money as a meth-head is to meth. You tell a meth-head you aren't giving him any meth and to put down that two liter soft-drink bottle and stop shaking it, and he won't thank you. A nation, no, a world of meth-heads. That's what central banks have created. Y'all don't even want to think about currencies today. Dollar burst through that 79.80 resistance left by the last two tops and jumped 73.3 basis points, a perfervid 0.94%, to 80.267. And that leap took place? Right, about the time the Dufusses opened their mouths. Dollar's moving higher. Dollar now targets the late 2010 low at 81.44, no stretch at all from here. Above that is 83.50, and then 88.71. At that level the entire universe will be writhing, screaming, and begging for a lower dollar. Y'all know what this is? Not only financial panic out of Europe, THIS IS THE DEFLATION SCARE. Now the gurus will gurate, the mavens will mavinate, and the pundits will pander, all about how deflation is here and it's the bogeyman who will eat you up! Looking at the institutions built over the last 80 years with no purpose save to inflate, there's about as much chance of deflation as there is of my winning the Miss America swimsuit competition in my red long johns. But you will hear the media bloviate about it, and at last the Fed and its cronies will ride their printing presses to the rescue. I'm sorry. They're lamebrains are so active today that I feel like a dung beetle at a bull sale. There's just so much material, I don't know where to start or stop. The Euro broke down significantly, shattering that 1.3200 support and closed down a jumbo 1.13% at 1.3034. Now in sight is 1.2500. Thanks, Dufusses. Japanese yen closed down, too, a tee-tiny 0.06% to 128.25c/Y100 (Y77.97/$1). Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2011, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Capital Account: Gerald Celente on his Missing MF Global Money and the COMEX Gold Ponzi (12/13/11) Posted: 13 Dec 2011 11:07 AM PST from CapitalAccount: Today MF Global's former executives, the CFO and the COO, along with Jon Corzine, the former CEO, testified before the senate agriculture committee. They told the committee that they don't know how an estimated 1.2 billion dollars in customer funds went missing. Unfortunately, all three of them could not offer an explanation, with both Henri Steenkamp and Bradley Abelow saying that they have no idea where the money is. Jon Corzine, former CEO of Goldman Sachs, danced around the question. If you feel like you've heard this before, that's because you have. You heard it last week when former MF Global CEO Jon Corzine testified on the hill — before the house agriculture committee. Remember, this is the former CEO of Goldman Sachs, the former governor of new jersey and a former united states senator. He was at the helm of MF Global when it disclosed a more than 6 billion dollar bet on european sovereign debt that was part of an entire portfolio that counter parties started to run from in droves as the firm headed towards illiquidity and bankruptcy. How does all this sit with MF Global customers? Well, we speak with one of those customers, Gerald Celente, who was stopped out of his gold futures positions because he was unlucky enough to be a customer with MF Global. He had a segregated account, but apparently, that was no viewed as sacrosanct by Jon Corzine et al. On Nobember 14th, Gerald Celente was on Capital Account with us to break the news that his account had been frozen, and that he couldn't get his money. In other, more off-beat and off-cuff news, Jim Cramer of CNBC's Mad Money is now advising children and their parents on how and where to invest their money. He think its a good thing for children to learn how to invest at an early age and become accustomed to those stocks and companies. Maybe he should have taught them how to pump and dump stocks and "foment interest" by calling Pisani at CNBC and get people excited about a stock before he dumped it? We also cover secrete santa layaways and pawn shop regulations in Greece meant to safeguard the country's citizens from prying shop owners trying to take their gold and silver. |

| Kerry Lutz Interview with “Ranting” Andy Hoffman – The Latest Gold Takedown Posted: 13 Dec 2011 09:56 AM PST from The Financial Survival Network: Ranting Andy Hoffman is back on the show to discuss the most recent attack by "Da Boyz" in an attempt to convince the populace that everything is fine and that nothing can go wrong. However, even while the price of precious metals appears to go down, there is no evidence of any physical gold and silver holders are paying any heed. They are holding on to their metals caches and even using the brief dip as an opportunity to load up on more. Perhaps they know something that the rest of the population doesn't. As Andy stated, there is a twelve year trend of increasing precious metals prices. Nothing that has taken place in the last two days has done anything to make any metals investors believe the sky is falling. Silver is being consumed at a rapid rate. Not enough is being produced to make up for the deficit. That sterling silver flatware that you once got as a wedding gift from your dicey in-laws, could one day be your financial salvation. Time will tell. Click Here to Listen to the Interview This posting includes an audio/video/photo media file: Download Now |

| Year-end Buying Opportunities Abound in Mining Stocks Posted: 13 Dec 2011 09:34 AM PST Christmas sales are not just for retail shoppers. Tax selling season is here, and one man's stock loss may be another man's super bargain opportunity. In this exclusive interview with The Gold Report, Casey Research Master of Metals Louis James talks about year-end investment strategies in the current market environment and factors to consider next year as the global economic situation may affect precious metals and mining stocks. |

| Zulauf: Depression Will Lead To A Collapse Of The Euro Posted: 13 Dec 2011 09:26 AM PST Feliz Zulauf was interview over the weekend and offered some excellent macro insights on the situation in Europe. The Swiss macro money manager, unfortunately, has been right about the Euro's developments over the last few years and has a very dire outlook. He says the periphery is entering a periphery that will eventually lead to several nations leaving the currency union:

|

| Wow! China Gold Imports Spike 4,000% y-o-y Posted: 13 Dec 2011 09:21 AM PST UK-based International Business Times reports China's gold imports spiking 50 percent in October from September, and soaring 4,000 percent from October of a year ago, to an all-time single-month record high of 85.7 tons. Though India's anticipated record gold imports of a 1,000 tons this year could slow due to signs of slowing jewelry demand from a recent 20.3 percent crash in the rupee, since August, investors can no doubt count on China to, not only take over the gold market slack, but soon-to-dominate the New York-London gold cartel As a reminder to evolving drama in the gold market, WikiLeaks exposed China's plan to break from its sadistic recycling of trade surpluses into U.S. Treasuries, a shift in strategy by Beijing that's prompted other Asian nations to follow suit. See BER article, WikiLeaks Drops Bombshell on gold Market, GATA right again! |

| All That Glitters…Will Not Solve Europe's Debt Woes Posted: 13 Dec 2011 09:15 AM PST Fact No. 1: European governments are among the biggest holders of gold on the planet. Those two facts lead to an obvious question from a lot of investors: Why don't those governments sell gold to pay off their debts? If only it were that simple. For starters, not even the Europeans own that much gold. The borrowing needs, and subsequent debts, of countries like Italy, France and Spain are so huge, analysts say, that liquidating their gold reserves wouldn't go far toward balancing their books for the long term. "If they sold their gold, I'm not sure it would do anything to their credit rating," says Kenneth Rogoff, an economics professor at Harvard University who has studied official gold reserves. "This is not exactly a game changer." Market and political realities, too, would make it challenging for Europeans to rely on a golden parachute, experts say. For one thing, there's a risk that trying to sell the gold or use it as collateral for a loan could be seen in the market as a sign of desperation—which could drive up borrowing costs by making lenders even more wary, defeating the purpose. Awash in GoldNevertheless, some investors still need convincing that gold isn't the cure-all that Europe is seeking. After all, governments, central banks and multilateral financial institutions like the International Monetary Fund hold roughly 18% of the world's gold, according to the World Gold Council, a trade group. Italy has more gold than any nation besides the U.S. and Germany, the council says. France ranks fourth and Portugal 12th. Even Greece, the land of King Midas, is in the top 30, well ahead of wealthy nations such as Australia and emerging powers like Brazil. And with gold prices near a record in nominal terms—up 17% this year alone—the value of those holdings has soared in recent years. Italy's current gold holdings, now valued at $134 billion, would have fetched only $21 billion at the end of 2000. The other side of the coin, however, is that Italy's gold represents only about 6.7% of its gross domestic product. Portugal's supply is proportionally bigger, at more than 9% of its GDP. But cashing in its gold would barely make a dent in Portugal's government debt, which represents 93% of GDP, according to IMF data. In addition, European Union members accepted restrictions on using their gold reserves when they launched a common currency. The euro treaty prohibits the countries from financing government operations by selling gold held by central banks—which is where most European nations have their reserves—according to Natalie Dempster, the gold council's director of government affairs. |

| Posted: 13 Dec 2011 09:02 AM PST |

| Gold Daily and Silver Weekly Charts - Gold Breaks But No Silver Confirm - Did Jonny Lie? Posted: 13 Dec 2011 08:41 AM PST |

| Europe’s Problem, America’s Solution Posted: 13 Dec 2011 08:40 AM PST Greece has been out of the spotlight for a couple of weeks, which means it's past due for another market-rattling announcement. And sure enough, today we find out that its economy is shrinking even faster than expected:

Meanwhile, the big European banks have been up to their usual oddly self-destrucitive hijinks…

…for which the US has an ingenious solution:

Some thoughts Speaking of credit default swaps, what do you think this means?: "Deutsche Bank executives say their positions are well-hedged and that they buy CDS protection only from institutions based outside the countries in which the bank is trying to buy protection. In other words, Deutsche Bank wouldn't buy Italian swaps from an Italian bank." Hmm…it's not clear that Deutsch Bank buying insurance from Spanish banks to cover Italian debt, and then from Greek banks to cover Spanish debt, is all that reassuring. The people running these banks would be Darwin Awards candidates if that organization had a finance category. Meanwhile, "Obama administration and Federal Reserve officials see the euro-zone debt crisis as one of the largest threats to the sluggish U.S. economic recovery." It's only a threat because we're broke. If the US had a healthy balance sheet, a European crisis would be a once-in-a-lifetime buying opportunity. We could be like Warren Buffett, who builds up a mountain of cash in good times and uses it to buy cheap assets when lesser mortals go bankrupt. Instead we're so fragile that a few troubled banks 3,000 miles away can send us into another Depression. And about the US pressing Europe for bigger bail-out: Sometimes (okay, often) it's embarrassing to be an American. Easy money is the heroin of the financial world and we're the main pusher. Generally, the pusher wins arguments with his addict clients, so expect a coordinated US/Europe quantitative easing that dwarfs even the Fed's secret loan program of the past few years, and expect it soon. Get ready, American and European taxpayers. You're about to become proud owners of several trillion dollars of slightly used Greek and Italian credit default swaps. Merry Christmas! |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Gordon Brown famously stated that gone are the days of the boom and bust economy - yes, he really did say that - only to later find out that his irresponsible fiscal behaviour bought the former world super power of the UK to its knees begging for more. Unlike Dickens, the good old folks at the Bank of England obliged. They're the good guys you see, their favourite activities include debasing sterling, boosting debt and not buying Gold.