Gold World News Flash |

- Silver in Giant Flag or Pennant Formation

- Why Gold Stocks Have Underperformed and What Lies Ahead

- Gold loses battle for $1750- needs to push through $1765

- Rick Rule - Flight to Quality & 2012 Gold Takeovers

- Gold Seeker Closing Report: Gold and Silver Fall Over 1%

- The Chart That Proves The Fed's Policies Have Been A Failure

- The Chart That Proves The Fed's Policies Have Been A Failure

- Silver bullish on chart and in diminished bullion bank short position, Arensberg writes

- Is the US$ in Danger of Losing its Reserve Currency Status?

- The Worst In The World – The U.S. Balance Of Trade Is Mind-Blowingly Bad

- Euro Crisis Destabilizing the Dollar

- Signature Trends - In Summary

- Endgame

- The Gold Price Closed 0.9% Lower, Will The Supports Continue to Hold?

- Deflation Is Coming

- Michael Pento: S&P Europe Credit Watch & Why Gold Will Skyrocket

- Another Min Raid on Gold and Silver / Conditions Deteriorate in Europe

- Dow Theory Richard Russell: Gold, “Island of Safety”

- Pento - S&P Europe Credit Watch & Why Gold Will Skyrocket

- It’s Time to Think in Terms of Gold

- Having trouble getting gold, buyers approach AngloGold Ashanti directly

- Guest Post: It's Time To Give Up On Mainstream Economics

- Guest Post: It's Time To Give Up On Mainstream Economics

- European Bank Runs And Underestimated Physical Gold Demand

- Biggest Week of the Year?

- It's Long past Time For Europe To Give American Banks The Finger

- Gold Daily and Silver Weekly Charts - Light Volumes and Frivilous Day Trader Markets

- Commodities And Rates Lead Derisking Afternoon

- MF Global And The Truth About Our Entire System

- Deflation Is Coming: Jay Taylor

| Silver in Giant Flag or Pennant Formation Posted: 05 Dec 2011 05:51 PM PST Got Gold Report Consolidation staging for resolution likely just ahead. Largest futures traders positioned for one direction – up – are they right? HOUSTON -- In our linked charts for subscribers we noted this past weekend that the Commodity Futures Trading Commission (CFTC) commitments of traders report for silver (COT) remains more bullish than bearish. We put notations directly into the charts we share with Vultures (Got Gold Report Subscribers) so they can read at a glance our impressions of the COT action. The main reason for that more bullish than bearish “read” is because the traders the CFTC classes as “commercial,” which includes bullion banks and swap dealers combined, are presently at a very low level of “net shortness.” Not everyone does, but we subscribe to the theory that the collective positioning of the largest futures traders on the planet is a kind of window into their expectations for the price.... |

| Why Gold Stocks Have Underperformed and What Lies Ahead Posted: 05 Dec 2011 05:43 PM PST Gold is higher by 20% this year but the large cap gold stocks (GDX) are down 6% while the junior gold stocks (ETF) are down 25%. With Gold higher by 20%, we’d normally expect the gold stocks to be up 50% and more. Needless to say 2011 has been a difficult year for gold bugs. Its been a near disaster for most junior gold stocks. That being said, there are important but often ignored reasons why the gold shares have underperformed this year and reasons to consider why a big move may be only months away. First, we have to understand that gold mining is a very difficult business. The law of numbers makes it even more difficult for the largest producers. They have to operate multiple mines and then continuously acquire or find new resources to maintain reserves and maintain production levels into the future. It’s a difficult business regardless of where the Gold price is. Hence, mining stocks do not outperform Gold over time whether in a bull market or not. The fo... |

| Gold loses battle for $1750- needs to push through $1765 Posted: 05 Dec 2011 05:23 PM PST [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] The failure by Ol' Yeller to extend past $1750 has tripped some of the shorter term technical indicators into a sell mode. As you can from looking at the blue downtrend line, Gold cannot seem to extend past this line. The positive is that it is also holding the uptrending red support line with the result being a tightening pattern or almost a type of coil that is forming. Gold bulls need to watch this carefully as a failure to hold above $1650 will send the metal very quickly towards the $1600 level where it must find active buying to prevent a deeper setback in price which could potentially take it first towards $1550 and even towards the $1500 level should it fail to hold there. A push back through $1765 turns the chart pattern friendly with only a closing push through $1800 allowing for the resumption of a strong uptrending pattern and a test of the all time high. All eyes in gold are on E... |

| Rick Rule - Flight to Quality & 2012 Gold Takeovers Posted: 05 Dec 2011 04:01 PM PST  With gold remaining firm near the $1,700 level, oil over $100 a barrel and S&P putting 15 European nations on negative credit watch, today King World News interviewed one of the most street smart pros in the resource sector, Rick Rule, Founder of Global Resource Investments. When asked about the latest move by S&P putting many European nations on negative credit watch, including France and Germany, Rule replied, "It's astonishing. Obviously the rating agency's perceptions have changed fairly drastically in the last couple of years. I think what probably precipitated this, Eric, had to do with the failed bond auction in Germany. The market may have been telling the rating agency something that the rating agencies didn't already understand." With gold remaining firm near the $1,700 level, oil over $100 a barrel and S&P putting 15 European nations on negative credit watch, today King World News interviewed one of the most street smart pros in the resource sector, Rick Rule, Founder of Global Resource Investments. When asked about the latest move by S&P putting many European nations on negative credit watch, including France and Germany, Rule replied, "It's astonishing. Obviously the rating agency's perceptions have changed fairly drastically in the last couple of years. I think what probably precipitated this, Eric, had to do with the failed bond auction in Germany. The market may have been telling the rating agency something that the rating agencies didn't already understand." This posting includes an audio/video/photo media file: Download Now |

| Gold Seeker Closing Report: Gold and Silver Fall Over 1% Posted: 05 Dec 2011 04:00 PM PST Gold fell $17.60 to $1728.40 by about 8AM EST before it bumped back up to almost unchanged at $1745.30 in the next two hours of trade, but it then fell back off for most of the rest of the day and ended near its late session low of $1717.73 with a loss of 1.41%. Silver rose to as high as $32.981 by midmorning in New York before it also fell back off in late trade and ended near its late session low of $31.84 with a loss of 1.84%. |

| The Chart That Proves The Fed's Policies Have Been A Failure Posted: 05 Dec 2011 03:39 PM PST A few days ago we presented an analysis by ConvergEx showing that due to the very close historical correlation between home prices and employment, it is the Fed's view that the only way to stimulate employment (aside from such BLS shennanigans as pretending that despite the natural growth of the labor force by 90k a month to keep up with population, those willing to work are in fact declining) is to raise home prices. Raising home prices be definition means either reducing supply - an event which is proving impossible with shadow inventory in the millions and rising, even as thousands of new delinquent mortgages appear each day while homebuilders keep on chugging out new homes that remain vacant for years, or increasing demand. It is the latter that the Fed targets, by attempting to make mortgage rates ever cheaper via LSAP, Operation Twist or other Treasury curve interventions that attempt to push down long-dated yields ever lower. This works in theory. In practice, however, as the chart below demonstrates, the Fed's entire ZIRP-targeting policy over the past several years has been one abysmal failure (for everyone expect those with immediate access to the Fed's zero interest rate capital - i.e., the Primary Dealers). As proof of this we present the following chart, which maps the SAAR in New Home Sales against the 30 Year Fannie Cash Mortgage. What appears very clearly on this chart is that despite ever declining mortgage rates, there is simply no interest in home turnover, and sales are at record low levels due to lack of demand, and lack of desire to sell into a bidless market, in essence causing the entire housing market to halt. And this makes intuitive sense: the bulk of home owners who can take advantage of cheap credit are those who already have a mortgage and at best will refi into a cheaper one. For everyone else, either the bank's admissions criteria are too stringent, or the potential borrower is simply convinced that a year from today, the 30 Year mortgage rate will be another 1% lower (most likely with 100% justification). As such there is absolutely no drive to naturally restart the housing market (one can commence here a discussion of how central planning destroys every market it infect like a lethal virus, but we will spare that for another, more preachy night). For now we will leave you with this chart which proves beyond a reasonable doubt that the Fed's primary mandate: to lower the unemployment rate (by boosting home prices) has been a failure. This also means that the ovecompensating academic idiots of Marriner Eccles will do next what is a perfectly logical next step for a cabal of deviant misfits hell bent on bending the world to their will: devalue the US currency to a point that "compensates" for their failure in the housing market. And that they can and will do. Even if it means dumping crisp hundred dollar bills out of helicopters. |

| The Chart That Proves The Fed's Policies Have Been A Failure Posted: 05 Dec 2011 03:39 PM PST A few days ago we presented an analysis by ConvergEx showing that due to the very close historical correlation between home prices and employment, it is the Fed's view that the only way to stimulate employment (aside from such BLS shennanigans as pretending that despite the natural growth of the labor force by 90k a month to keep up with population, those willing to work are in fact declining) is to raise home prices. Raising home prices be definition means either reducing supply - an event which is proving impossible with shadow inventory in the millions and rising, even as thousands of new delinquent mortgages appear each day while homebuilders keep on chugging out new homes that remain vacant for years, or increasing demand. It is the latter that the Fed targets, by attempting to make mortgage rates ever cheaper via LSAP, Operation Twist or other Treasury curve interventions that attempt to push down long-dated yields ever lower. This works in theory. In practice, however, as the chart below demonstrates, the Fed's entire ZIRP-targeting policy over the past several years has been one abysmal failure (for everyone expect those with immediate access to the Fed's zero interest rate capital - i.e., the Primary Dealers). As proof of this we present the following chart, which maps the SAAR in New Home Sales against the 30 Year Fannie Cash Mortgage. What appears very clearly on this chart is that despite ever declining mortgage rates, there is simply no interest in home turnover, and sales are at record low levels due to lack of demand, and lack of desire to sell into a bidless market, in essence causing the entire housing market to halt. And this makes intuitive sense: the bulk of home owners who can take advantage of cheap credit are those who already have a mortgage and at best will refi into a cheaper one. For everyone else, either the bank's admissions criteria are too stringent, or the potential borrower is simply convinced that a year from today, the 30 Year mortgage rate will be another 1% lower (most likely with 100% justification). As such there is absolutely no drive to naturally restart the housing market (one can commence here a discussion of how central planning destroys every market it infect like a lethal virus, but we will spare that for another, more preachy night). For now we will leave you with this chart which proves beyond a reasonable doubt that the Fed's primary mandate: to lower the unemployment rate (by boosting home prices) has been a failure. This also means that the ovecompensating academic idiots of Marriner Eccles will do next what is a perfectly logical next step for a cabal of deviant misfits hell bent on bending the world to their will: devalue the US currency to a point that "compensates" for their failure in the housing market. And that they can and will do. Even if it means dumping crisp hundred dollar bills out of helicopters. |

| Silver bullish on chart and in diminished bullion bank short position, Arensberg writes Posted: 05 Dec 2011 03:17 PM PST 11:15p ET Monday, December 5, 2011 Dear Friend of GATA and Gold (and Silver): The Got Gold Report's Gene Arensberg likes what he sees in silver's price chart -- a bullish pennant -- and in a very low short position by the big market-rigging bullion banks. Arensberg's new report is headlined "Silver in Giant Flag or Pennant Formation" and you can find it at the Got Gold Report here: http://www.gotgoldreport.com/2011/12/silver-in-giant-flag-or-pennant-for... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Be Part of a Chance to Discover Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral showings as well as former mines at the property's northern and southern boundaries. -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/conference-details/vancouver-resource-investme... California Investment Conference http://cambridgehouse.com/conference-details/california-investment-confe... Support GATA by purchasing a silver commemorative coin: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT The United States Once Again Can Establish Lewis E. Lehrman, chairman of the Lehrman Institute, sponsor of The Gold Standard Now project, has released a plan to restore economic growth through a stable dollar. The plan, titled "The True Gold Standard: A Monetary Reform Plan Without Official Reserve Currencies," responds to the recurrent economic crises of the last century and outlines a detailed proposal for America's leadership on "how we get from here to there." That is, how we get from the present unstable paper dollar to a stable dollar as good as gold. James Grant, author and editor of Grant's Interest Rate Observer, says of the Lehrman plan: "If you have ever wondered how the world can get from here to there -- from the chaos of depreciating paper to a convertible currency worthy of our children and our grandchildren -- wonder no more. The answer, brilliantly expounded, is between these covers. America has long needed a modern Alexander Hamilton. In Lewis E. Lehrman the country has finally found him." To learn more and to sign up for The Gold Standard Now's free, noncommercial, weekly report, "Prosperity through Gold," please visit: http://www.thegoldstandardnow.org/gata |

| Is the US$ in Danger of Losing its Reserve Currency Status? Posted: 05 Dec 2011 02:40 PM PST |

| The Worst In The World – The U.S. Balance Of Trade Is Mind-Blowingly Bad Posted: 05 Dec 2011 01:52 PM PST from The Economic Collapse Blog:

Did you know that we buy about a half a trillion dollars more stuff from the rest of the world than they buy from us? The U.S. balance of trade is not only mind-blowingly bad – it is the worst in the world. It is being projected that the U.S. trade deficit for 2011 will be 558.2 billion dollars. That would be an increase of more than 11 percent from last year. As I have written about previously, the United States is the worst in the world at a lot of things, but as far as the economic well-being of our nation is concerned, our balance of trade is particularly important. Every single month, far more money goes out of this country than comes into it. Tax revenues are significantly reduced as all of this money gets sucked out of our communities. The federal government, state governments and local governments borrow gigantic piles of money to try to make up the difference, but all of this borrowing just makes our debt problems a whole lot worse. In the end, no amount of government debt is going to be able to cover over the fact that our national economic pie is shrinking. We are continually consuming far more wealth than we produce, and that is a recipe for economic disaster. |

| Euro Crisis Destabilizing the Dollar Posted: 05 Dec 2011 12:40 PM PST In response to pressure from Wall Street, the White House and central banks in Europe, the Federal Reserve last week drastically cut interest rates for currency swaps to benefit troubled European banks. This will flood world markets with more dollars and will soon mean rising prices for every American at the grocery store. This extra liquidity will temporarily ease the cash crunch for irresponsible bankers, but in the long run it will make the situation much worse for consumers all over the world. Equities markets registered big gains at the news, but only for a day. Make no mistake - this is not capitalism, and this is not how a free market operates. In a free market, bankruptcies happen, even to large banks. We must remember, free markets are the true and best regulators of financial mismanagement. By contrast, under our current form of special interest corporatism certain businesses are granted too-big-to-fail status and are never allowed t... |

| Posted: 05 Dec 2011 12:40 PM PST [CENTER]Monthly Cycle Trends in the XAU[/CENTER] In case you missed it here, the Market Pendulum SRA monthly cycle indicator just barely came off the bottom on the very last day of November after being undecided all month. This important monthly chart demonstrates a 5 year record. Since the bull market began in 2000, it has not missed a trick from these low levels (zero). As mentioned before, the SRA is extraordinarily accurate in the longer time frames. Unfortunately, one must wait a month for concrete confirmation in this time frame. If valid, it suggests a multi-month advance. [CENTER] Gold/Silver Reserves and Dividend Trends [/CENTER] Sprott put out an appeal for silver companies to hold a portion of their production as a reserve. Of course, if Sprott gets his way, some of these companies are going to have valuable and stronger assets on their balance sheets over time. This clearly is much better diversification than straight cash reserves or other external investments.Coeur... |

| Posted: 05 Dec 2011 12:38 PM PST by Chris Horlacher, MapleLeafMetals.ca: "There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved." The above quote, by Ludwig von Mises, should be burned in to the heads of every economist on the face of the earth because it accurately describes exactly what happens to economies after prolonged attempts by government to meddle with society through the monetary system. The theory that this quote is derived from, the Austrian Business Cycle Theory (ABCT), has enjoyed a track record of success in predicting every major economic crises since it was developed. In applying this quote to our present situation, I suppose the first questions we should ask is "Did we experience a boom brought about by credit expansion?" The following charts answer that question quite definitively: |

| The Gold Price Closed 0.9% Lower, Will The Supports Continue to Hold? Posted: 05 Dec 2011 11:22 AM PST Gold Price Close Today : 1730.70 Change : (16.30) or -0.9% Silver Price Close Today : 3230.6 Change : (31.5) cents or -1.0% Gold Silver Ratio Today : 53.572 Change : 0.018 or 0.0% Silver Gold Ratio Today : 0.01867 Change : -0.000006 or 0.0% Platinum Price Close Today : 1520.70 Change : -27.00 or -1.7% Palladium Price Close Today : 631.85 Change : -10.65 or -1.7% S&P 500 : 1,257.08 Change : 12.80 or 1.0% Dow In GOLD$ : $144.50 Change : $ 2.29 or 1.6% Dow in GOLD oz : 6.990 Change : 0.111 or 1.6% Dow in SILVER oz : 374.48 Change : 6.02 or 1.6% Dow Industrial : 12,097.83 Change : 78.41 or 0.7% US Dollar Index : 78.61 Change : 0.038 or 0.0% The GOLD PRICE and SILVER PRICE took the biggest hit on the European news. Gold dropped $16.30 (0.9%) to $1,730.70 on Comex, while silver dropped 31.5c (1%) to close 3230.6c. All right, I'm going to crawl out on that limb. I think today's drop in GOLD and SILVER was a mere reaction to the last few days' highs, and that the bottom boundary of the triangle for silver (3150c) and of the trading channel for gold ($1,690 - $1,700) will hold. Plainly, if they break those supports, they will tank, but I think they will hold. At least, they did today, with silver posting a low at 3185c and gold at 1,717.67 (protecting that $1,720 support). But up or down, I have run my nose slam up against that wall again: what else can I trust but silver and gold? Government promises? The stock market, locked in a bear trend? Banks??! Banks, who'd as soon throw you out of the lifeboat into a swarm of chummed sharks as I would step on a bug? Mercy! I reckon I'll take my chances with the GOLD and SILVER, and even if they drop 20 or 40%, I'll still have 'em where I can rub on 'em to console myself. Y'all do what seemeth good to you, but I smell a trap, and I'm not going to wait around to make sure I've identified the right stench. To my chagrin I have neglected a subject, I just discovered last night. Oh, I knew it was going on, and always suspected that your wonderful government would pull it on y'all's pension funds and IRAs, etc., but today it has drawn one step fearfully closer. I'm talking about government confiscating pension funds -- y'all's pension funds -- to dig out of their debt swamp. Argentina did it a few years ago, Hungary last year, and Ireland is eyeing 24 bn euros in their National Pension Reserve fund right now. US government debt = $15 trillion. US pension fund assets = $16 trillion. Y'all see any similarity there? Anything click in your mind? Add to other precedents Portugal today, which transferred 5.6 bn euros of private pension funds to itself to meet its budget deficit. And somebody explain to me, in the face of all this precedents, how the US government (ever trustworthy) would not do the same? All that time folks have wasted worrying about gold being seized as it was in 1934 have been watching the front door of the house while the burglars were unloading the furniture through the back door. Y'all know I am no alarmist, and I reserve my most lip-curling contempt for all those Internet Chicken Littles who every day see the sky falling. This warning is nothing new with me. The government seized gold in 1934 for the same reason that Willie Sutton robbed banks: that's where the money was. In 2011 the money isn't there, it's in pension assets, IRAs, 401(k)s, pensions, all the rest. For years when people have asked me what they should do with their IRAs, my threshold remark has been, "First, you have to decide if you want to continue in a partnership with the US government. Ownership has two parts, title and control. With your IRA or 401(k), you have title, but they have control. Yes, you will pay a penalty and tax to withdraw it, but how much is control, in your own hands, worth to you?" From long experience I know that not 1 out of 80 will choose to cash out his IRA, so powerful is the APPEARANCE that all the money is yours. ME, I don't want any part of any partnership with the yankee government. I'll take my licks AND my money, thank you very much. But I am nothing but a paranoid natural born fool from Tennessee. I will not, however, stand in the middle of the railroad tracks when an express train is barrelling down on me, driven by a maniac. Now y'all can put that IRA into silver and gold, but it is still in an IRA, and a trustee holds it, not you. If you simply MUST keep your IRA, then put it into physical silver or gold. But you ought to consider most earnestly, together with your spouse, which is more important, mere title to the IRA, or control. Sarcophagus of France and Ferkel of Germany met today and after lunch announced a list of recommendations for changes to the euro treaty, namely, automatic sanctions against deficit violating countries, debt limits written into member constitutions, and no more haircuts for creditors (save those holding Greek paper). Look deeply into it: this will established centralized budget oversight in Brussels. This is the nightmare turn, and most of all IT CONTAINS NO SOLUTION TO THE ALREADY UNPAYABLE DEBT. No solution, that is, except inflating it away, but thru the ECB rather than individual nations. Don't let all those German protestations about not making the ECB lender of last resort. If they are going to pay all that unpayable Himalaya of debt, they can only inflate it away. All other explanations are mere carpeting for the barnyard. The European announcement shaved 79 basis points off the spread between Italian and German debt almost immediately. That indicates that a lot of investors took the bait. I remind you that even if all power is centralized in Brussels, the debt remains still too large to be paid. Investors have been suckered. Dow today gained 78.14 points (0.65%) to close at 12,097.83. Maybe that's a case of buy the rumor, sell the news. S&P 500 closed up 12.8 (1.03%) at 1,257.08. My upper limit on the Dow is about 12,200. It's at that wall now. I doubt it will climb it, but if y'all can't accept that, then keep on trying to draw to that inside strait and keep holding those stocks. US Dollar index today went sideways, up 3.8 basis points, but important thing is that it remained above 78.50. Currency traders weren't buying good news out of Europe. Euro gained 0.4% to 1.399, while the Yen closed up 0.19% at 128.54c/Y100 (Y77.8/$1). Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2011, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Posted: 05 Dec 2011 11:10 AM PST Jay Taylor believes the biggest challenge facing the U.S.—deflation—could mean a better year, or even decade, for junior gold stocks. Taylor, editor of Jay Taylor's Gold, Energy & Tech Stocks, has ridden some equities to the bottom of this punishing market and is ready to pile more cash into small gold companies. In this exclusive interview with The Gold Report, he explains why market sentiment hasn't shaken his faith. |

| Michael Pento: S&P Europe Credit Watch & Why Gold Will Skyrocket Posted: 05 Dec 2011 10:57 AM PST from King World News:

With news of Standard & Poor's putting 15 European nations on negative credit watch, today Michael Pento, of Pento Portfolio Strategies, to ask him what to expect next in Europe and how this will impact gold. When asked about the European news, Pento stated, "My first thought is there goes the leveraging up of the EFSF now that Germany and France may be added to that list of nations that need to have their ratings downgraded. Because if Germany and France are going to lose their credit rating, then how are they going to be able to fund and leverage up this European financial stability fund." Michael Pento continues: Read More @ KingWorldNews.com |

| Another Min Raid on Gold and Silver / Conditions Deteriorate in Europe Posted: 05 Dec 2011 10:55 AM PST by Harvey Organ: Good evening Ladies and Gentlemen: Everybody is now waiting for the big EU summit where the boys will decide how they are going to save the Euro. I doubt if anything will be accomplished. On Friday we witnessed gold and silver rise. However the equity shares lost considerably on Friday, which is a sure sign of an attack which usually follows the day after. Their modus operandi does not change. The price of gold finished the comex session at $1730.70 down $16.30 on the day. The price of silver after being up for most of day followed in gold's footsteps down by 24 cents to $32.31. Let us head over to the comex and assess trading, inventory levels and deliveries. |

| Dow Theory Richard Russell: Gold, “Island of Safety” Posted: 05 Dec 2011 10:09 AM PST By Dominique de Kevelioc de Bailleul Following the surprise announcement on Wednesday that six central banks have lowered dollar swaps rate by 50 basis points in an effort to allow European banks to bypass a rising LIBOR rate, Dow Theory Letter author Richard Russell told King World News investors should expect a jolt in commodities price in the future. "The world's major central banks launched a joint action to provide chief emergency U.S. dollar loans to banks in Europe and elsewhere," Russell stated. "In a desperate effort to raise stocks, the central banks of the world coordinated by forcing more money into the world system." The announcement incited a stampede into equities and commodities, as traders fell over each other to buy more of their favorite inflation play, resulting in pre-holiday gifts of a 400+ points rally in the Dow, $30 rise in the gold price and a nice spike of a dollar to the price of silver. "This is exciting for now," added Russell, "but it will result in inflation within 6 months to a year." |

| Pento - S&P Europe Credit Watch & Why Gold Will Skyrocket Posted: 05 Dec 2011 10:08 AM PST  With news of Standard & Poor's putting 15 European nations on negative credit watch, today Michael Pento, of Pento Portfolio Strategies, to ask him what to expect next in Europe and how this will impact gold. When asked about the European news, Pento stated, "My first thought is there goes the leveraging up of the EFSF now that Germany and France may be added to that list of nations that need to have their ratings downgraded. Because if Germany and France are going to lose their credit rating, then how are they going to be able to fund and leverage up this European financial stability fund." With news of Standard & Poor's putting 15 European nations on negative credit watch, today Michael Pento, of Pento Portfolio Strategies, to ask him what to expect next in Europe and how this will impact gold. When asked about the European news, Pento stated, "My first thought is there goes the leveraging up of the EFSF now that Germany and France may be added to that list of nations that need to have their ratings downgraded. Because if Germany and France are going to lose their credit rating, then how are they going to be able to fund and leverage up this European financial stability fund." This posting includes an audio/video/photo media file: Download Now |

| It’s Time to Think in Terms of Gold Posted: 05 Dec 2011 10:01 AM PST Author: Louis James Synopsis: Jeff Clark shows why gold is the only sane place to keep your savings, while Louis James highlights the perils of precious metals mining in politically risky countries like Peru. Dear Reader, ROCK & STOCK STATS Last One Month Ago One Year Ago Gold[RIGHT]1,747.00 1,743.00 1,389.00[/RIGHT] Silver[RIGHT]33.15 33.83 28.50[/RIGHT] Copper[RIGHT]3.52 3.58 3.98[/RIGHT] Oil[RIGHT]101.13 92.51 87.98[/RIGHT] Gold Producers (GDX)[RIGHT]58.07 59.96 61.18[/RIGHT] Gold Junior Stocks (GDXJ)[RIGHT]29.65 31.40 41.87[/RIGHT] Silver Stocks (SIL)[RIGHT]22.90 24.01 25.31[/RIGHT] TSX (Toronto Stock Exchange)[RIGHT]12,075.09 12,241.76 13,163.53[/RIGHT] TSX Venture[RIGHT]1,556.88 1,622.04 2,095.74[/RIGHT] Earlier this year, we advised readers of our metals publications to reduce their exposure to political risk in Peru, a country where mining is one of the mai... |

| Having trouble getting gold, buyers approach AngloGold Ashanti directly Posted: 05 Dec 2011 09:58 AM PST 5:53p ET Monday, December 5, 2011 Dear Friend of GATA and Gold: AngloGold Ashanti CEO Mark Cutifani tells Takoa Da Silva of the Bull Market Thinking Internet site that big buyers of gold are having trouble getting the volumes they want and so are approaching the mining company to try to get metal directly. Apparently bullion bank deposit receipts don't have the respect they once did. You can find the interview with Cutifani here: http://bullmarketthinking.com/mark-cutifani-ceo-of-anglogold-ashanti-maj... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/conference-details/vancouver-resource-investme... California Investment Conference http://cambridgehouse.com/conference-details/california-investment-confe... Support GATA by purchasing gold and silver commemorative coins: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Granted Landmark Chandgana Power Plant License Company Press Release VANCOUVER, British Columbia -- Prophecy Coal Corp. (TSX: PCY)(OTCQX: PRPCF)(Frankfurt: 1P2) announces that its wholly-owned Mongolian subsidiary, East Energy Development LLC, has received the license certificate from the Mongolian Energy Regulatory Authority to construct the 600-megawatt Chandgana power plant. This 600-mw thermal power plant license is the first of its size issued by the Mongolian government. To ensure strict compliance with Mongolian laws and regulations in obtaining this license, Prophecy retained Mongolian and international consultants over the past 18 months and spent much effort on community relations. Coal for the Chandgana mine-mouth power plant will be supplied from Prophecy's Chandgana Tal deposit, for which the company has already obtained a full mining license. Tal contains 141 million tonnes of measured coal and is located just 9 kilometers north of Prophecy's Chandgana Khavtgai project, a deposit with more than 1 billion tonnes of measured and indicated coal. Chandgana is 60 km from Underkhann city (East Energy System) and 150 km from Baganuur city (Central Energy System). Construction of transmission lines linking the two cities through Chandgana is seen as a top priority for a much-improved and more efficient national Mongolian energy system. John Lee, chairman and CEO of Prophecy Coal, says: "Prophecy has distinguished itself as the premier candidate to build the next Mongolian thermal power plant. There is an understanding among all stakeholders that Mongolia, being one of the world's fastest-growing economies, needs additional power. With the International Monetary Fund projecting a deficit for Mongolia of more than 600 mw by 2016, this need has become urgent and can no longer be delayed." For Prophecy Coal's full press release, complete with maps, please visit: http://www.prophecycoal.com/news_2011_nov21_prophecy_granted_landmark_ch... |

| Guest Post: It's Time To Give Up On Mainstream Economics Posted: 05 Dec 2011 09:54 AM PST Submitted by ChrisMartenson.com guest contributor Gregor Macdonald It's Time To Give Up On Mainstream Economics

A Failure To See the ObviousPrior to 2008 it was generally understood that the profession hardly merited its claims of its own predictive utility. So the failure to assign enough risk to such a crisis as befell the developed world in 2008 was, frankly, no surprise. But in the aftermath of the crisis, economics, in its professional form, has revealed itself to be damagingly disconnected from observable reality. A glaring example of this is how it cannot come to any agreement as to how the debt crisis occurred, and accordingly remains quite confused in its proffered solutions. Mostly the profession remains curiously naive about the nature of debt, an understanding of which is more critical than ever as the developed world enters a 'slow' to 'no-growth' phase of its history. Indeed, many of the papers, interviews, and op-eds from central bankers and economists in the face of our present-day sovereign debt crisis are little more than an eerie restatement of the discussions which took place about private-sector debt from 2006-2008. For a profession tasked with the analysis of dynamic systems, modern economics can be ploddingly linear. And for a profession supposedly guided by math, the descent into "sociology lite" is all too routine. One of the more consistent errors (or nervous tics, if you will) comes in the area of scale and proportion. A favorite and most astonishing example for me remains former Dallas Fed President Bob McTeer's explanation of the cause of the 2008 crisis. Writing in his blog at the end of 2009, McTeer set out to defend the US Federal Reserve for its role in the catastrophe:

Let's stipulate that the issue of causality can almost always broaden out into legitimate disagreement. But Mr. McTeer's claim here is so grossly disproportionate to the total size of the credit bubble, which was not limited to housing, that one is compelled to ask if Mr. McTeer actually understands the system over which the Federal Reserve presides. This blind spot towards debt growth, and in particular the rate of debt growth, counts as one of the more curious revelations to emerge from the crisis. Indeed, while the crisis finally produced a broader appreciation by the public of debt dynamics, it also produced a clearer portrait of the economic profession's intractable position towards debt. In short, they "don't see it." And, here's what they don't see. The following chart is composed of total debt growth in the US economy from 1929 and helpfully covers the period through 2008, compared as percentage of GDP. As you can see, the rate of debt growth starting after 1999 should have been on the radar of economists and central banks. Especially the Fed. The 1985-1998 period was relatively slow by comparison. But starting in 1999, total US Credit Market Debt to GDP exploded higher, from 250% to 350%.

Let's rework the claim of McTeer, as follows: Subprime loans represented too small a portion of total credit to have either triggered or caused the crisis and recession. When growth slowed, the unsustainable amount of debt and leverage in the entire system was revealed, and thus made everything worse. The cruel irony of McTeer's faulty understanding is that the US economy would be powering out of recession right now, with typical 4-6% GDP growth, had the credit bubble been confined (contained!) to subprime. The relegation of the crisis' beginnings or causes to subprime is now considered a kind of joke that flags a financially illiterate (or political) view. The US should have been so lucky as to have merely faced a subprime problem. Now there are 10.7 million US homes in negative equity. Twenty-five years of strong credit growth, a deflationary labor shock from the developing world, and a phase transition in energy prices set the stage, not for a post-war recession, but a depression. A meandering economic stagnation that can never produce a full recovery. Founded On a FallacyModern central banking came into existence, of course, during a secular growth phase in the developed world funded by cheap energy. Its task for most of the past 100 years has been to regulate growth -- not to manage decline. Much of the commentary you saw prior to 2008, such as Ben Bernanke's sincere lack of concern about a US housing bubble ("I guess I don't buy your premise. It's a pretty unlikely possibility. We've never had a decline in house prices on a nationwide basis...") is, of course, duplicated today as we confront a similar endgame in sovereign debt. Economists in 2010, when the European crisis began, were sanguine. In the tête-à-tête between Hugh Hendry and Joseph Stiglitz last year, Stiglitz was adamant that debt service for Greece was no problem. More recently this summer, Jeffrey Sachs claimed at FT that there was a way out for Greece, by allowing the country to borrow at rates enjoyed by Germany. That may have seemed like the biggest catch to such a solution. I would submit, however, that the Sachs proposal contained a much larger uncertainty that is now the new blind spot common to the economics profession: the assumption of continued growth.

One of the more irritating personality traits of economics as a discipline is that it continually incorporates every trend into its growth model, and then identifies it as a good thing. The secular decline in US manufacturing jobs was deemed as such, as it "freed up" the populace to take service jobs. Interestingly, in our post-crisis economy, much of the selected regional strength in the US is now very much related to exports and a small resurgence in light manufacturing. The Fed should have been paying closer attention to the multi-decade trend in US manufacturing employment. Instead, Alan Greenspan, a fan of Ayn Rand, believed the world operated in a magically offsetting series of harmonics, in which self-interest propagated though the financial system, producing a grand balance of risk. It is easy to understand how debt growth, cost inflation in health care and education, and the unsustainable bloat in the financial sector would flourish under such a paradigm. After all, "one person's debt is just another person's asset," so what could possibly go wrong? Worsening What They Don't UnderstandWhen central bankers can't initially understand why markets are rebelling against debt levels, they often turn to simplistic behavioral concepts. But a small dash of social psychology can be a dangerous thing when injected into monetary policy. Perhaps some moderate respect should be given now, many years after his tenure, to Alan Greenspan, who in testimony finally admitted that "the entire model he used to describe how the world worked, was wrong." In similar fashion, Ben Bernanke in his 2011 public testimony has admitted that the Fed "cannot print oil," cannot solve problems without help from fiscal policy, and probably cannot force a faster economic recovery. But one wonders how evolved the Fed chairman really is, given his public statements in 2009 that the financial crisis was merely in the fashion of a 19th-century panic. Instead of exponential growth in private credit, capricious monetary policy from the Fed itself, or the guns-and-butter fiscal policies of the government, Bernanke voiced publicly in his PBS TV performance and also at Jackson Hole that we had merely suffered a Bagehot-type panic. This may have been why he thought, as did many others, that a normal recovery would ensue. Here is the key passage from the Jackson Hole conference on August 21, 2009, Reflections on a Year of Crisis (Interpreting the Crisis: Elements of a Classic Panic):

The Fed Chairman is using a technique here called hiding in plain sight, or perhaps secrecy by complexity. It is inarguable that a behavioral panic took place. But the aim was clear: to avoid the debt saturation in OECD/developed nations and the United States and the years of slow-to-no growth it was fated to impose. More broadly, the Fed had been "managing" the growth of debt in the US economy for over two decades. 2008 was the signal that the long, secular era of lowering interest rates to help the economy manage its debt levels had reached its endpoint.

One possible explanation for this blind-spot towards debt is that the economics profession is largely in service to the political class. Books, such as Reinhardt and Rogoff's This Time is Different, which addresses the limits imposed by debt, are generally not in favor in the current era. Equally, the moral flavor to much of the right-leaning thinking on debt is also unsatisfying, as it also does not address debt-saturation so much as fiscal rectitude. What matters instead are the levels in both private-sector debt and public-sector debt that impose operational restraints. Total debt service as a proportion of income will always create a limit eventually among private sector borrowers. That is precisely what began to occur in the US and was the prima causa of the recession. However, the precise, problematic levels of debt for sovereign nations are trickier to identify. The Tide Is ChangingThrough a combination of confidence, debt service, actual economic flows, and the marketplace, however, 2012 is almost certainly the year that the present sovereign debt problems will be resolved, one way or another. Also, this week's US dollar swap operation likely points towards one of the two macroeconomic endgame pathways that I outlined last month. The current economics profession in general, and our central banking leadership in particular, sheds even more credibility as it careens on, blinded by its own light. The process by which economic activity and resources are coaxed into being by stimulative monetary policy has reached its terminus, and the public will finally understand this dynamic over the next year. In Part II: How The European Endgame Will Be The Death Knell For Modern Economics, we predict the coming endgame to the European fiscal and monetary crises. Doing so is becoming increasingly easier as we better understand the mindset of today's economic leaders and the shrinking number of options they have to address the issues before them. In fact, we think the shroud of awe and mystery that our grand economists have wrapped themselves in is fast-dissipating, and that the systemic pain their failures will inflict in 2012 -- initially most visible in Europe -- will finally cause the populace to look to a new school of economic thinking. Click here to access Part II of this report (free executive summary, enrollment required for full access). |

| Guest Post: It's Time To Give Up On Mainstream Economics Posted: 05 Dec 2011 09:54 AM PST Submitted by ChrisMartenson.com guest contributor Gregor Macdonald It's Time To Give Up On Mainstream Economics

A Failure To See the ObviousPrior to 2008 it was generally understood that the profession hardly merited its claims of its own predictive utility. So the failure to assign enough risk to such a crisis as befell the developed world in 2008 was, frankly, no surprise. But in the aftermath of the crisis, economics, in its professional form, has revealed itself to be damagingly disconnected from observable reality. A glaring example of this is how it cannot come to any agreement as to how the debt crisis occurred, and accordingly remains quite confused in its proffered solutions. Mostly the profession remains curiously naive about the nature of debt, an understanding of which is more critical than ever as the developed world enters a 'slow' to 'no-growth' phase of its history. Indeed, many of the papers, interviews, and op-eds from central bankers and economists in the face of our present-day sovereign debt crisis are little more than an eerie restatement of the discussions which took place about private-sector debt from 2006-2008. For a profession tasked with the analysis of dynamic systems, modern economics can be ploddingly linear. And for a profession supposedly guided by math, the descent into "sociology lite" is all too routine. One of the more consistent errors (or nervous tics, if you will) comes in the area of scale and proportion. A favorite and most astonishing example for me remains former Dallas Fed President Bob McTeer's explanation of the cause of the 2008 crisis. Writing in his blog at the end of 2009, McTeer set out to defend the US Federal Reserve for its role in the catastrophe:

Let's stipulate that the issue of causality can almost always broaden out into legitimate disagreement. But Mr. McTeer's claim here is so grossly disproportionate to the total size of the credit bubble, which was not limited to housing, that one is compelled to ask if Mr. McTeer actually understands the system over which the Federal Reserve presides. This blind spot towards debt growth, and in particular the rate of debt growth, counts as one of the more curious revelations to emerge from the crisis. Indeed, while the crisis finally produced a broader appreciation by the public of debt dynamics, it also produced a clearer portrait of the economic profession's intractable position towards debt. In short, they "don't see it." And, here's what they don't see. The following chart is composed of total debt growth in the US economy from 1929 and helpfully covers the period through 2008, compared as percentage of GDP. As you can see, the rate of debt growth starting after 1999 should have been on the radar of economists and central banks. Especially the Fed. The 1985-1998 period was relatively slow by comparison. But starting in 1999, total US Credit Market Debt to GDP exploded higher, from 250% to 350%.

Let's rework the claim of McTeer, as follows: Subprime loans represented too small a portion of total credit to have either triggered or caused the crisis and recession. When growth slowed, the unsustainable amount of debt and leverage in the entire system was revealed, and thus made everything worse. The cruel irony of McTeer's faulty understanding is that the US economy would be powering out of recession right now, with typical 4-6% GDP growth, had the credit bubble been confined (contained!) to subprime. The relegation of the crisis' beginnings or causes to subprime is now considered a kind of joke that flags a financially illiterate (or political) view. The US should have been so lucky as to have merely faced a subprime problem. Now there are 10.7 million US homes in negative equity. Twenty-five years of strong credit growth, a deflationary labor shock from the developing world, and a phase transition in energy prices set the stage, not for a post-war recession, but a depression. A meandering economic stagnation that can never produce a full recovery. Founded On a FallacyModern central banking came into existence, of course, during a secular growth phase in the developed world funded by cheap energy. Its task for most of the past 100 years has been to regulate growth -- not to manage decline. Much of the commentary you saw prior to 2008, such as Ben Bernanke's sincere lack of concern about a US housing bubble ("I guess I don't buy your premise. It's a pretty unlikely possibility. We've never had a decline in house prices on a nationwide basis...") is, of course, duplicated today as we confront a similar endgame in sovereign debt. Economists in 2010, when the European crisis began, were sanguine. In the tête-à-tête between Hugh Hendry and Joseph Stiglitz last year, Stiglitz was adamant that debt service for Greece was no problem. More recently this summer, Jeffrey Sachs claimed at FT that there was a way out for Greece, by allowing the country to borrow at rates enjoyed by Germany. That may have seemed like the biggest catch to such a solution. I would submit, however, that the Sachs proposal contained a much larger uncertainty that is now the new blind spot common to the economics profession: the assumption of continued growth.

One of the more irritating personality traits of economics as a discipline is that it continually incorporates every trend into its growth model, and then identifies it as a good thing. The secular decline in US manufacturing jobs was deemed as such, as it "freed up" the populace to take service jobs. Interestingly, in our post-crisis economy, much of the selected regional strength in the US is now very much related to exports and a small resurgence in light manufacturing. The Fed should have been paying closer attention to the multi-decade trend in US manufacturing employment. Instead, Alan Greenspan, a fan of Ayn Rand, believed the world operated in a magically offsetting series of harmonics, in which self-interest propagated though the financial system, producing a grand balance of risk. It is easy to understand how debt growth, cost inflation in health care and education, and the unsustainable bloat in the financial sector would flourish under such a paradigm. After all, "one person's debt is just another person's asset," so what could possibly go wrong? Worsening What They Don't UnderstandWhen central bankers can't initially understand why markets are rebelling against debt levels, they often turn to simplistic behavioral concepts. But a small dash of social psychology can be a dangerous thing when injected into monetary policy. Perhaps some moderate respect should be given now, many years after his tenure, to Alan Greenspan, who in testimony finally admitted that "the entire model he used to describe how the world worked, was wrong." In similar fashion, Ben Bernanke in his 2011 public testimony has admitted that the Fed "cannot print oil," cannot solve problems without help from fiscal policy, and probably cannot force a faster economic recovery. But one wonders how evolved the Fed chairman really is, given his public statements in 2009 that the financial crisis was merely in the fashion of a 19th-century panic. Instead of exponential growth in private credit, capricious monetary policy from the Fed itself, or the guns-and-butter fiscal policies of the government, Bernanke voiced publicly in his PBS TV performance and also at Jackson Hole that we had merely suffered a Bagehot-type panic. This may have been why he thought, as did many others, that a normal recovery would ensue. Here is the key passage from the Jackson Hole conference on August 21, 2009, Reflections on a Year of Crisis (Interpreting the Crisis: Elements of a Classic Panic):

The Fed Chairman is using a technique here called hiding in plain sight, or perhaps secrecy by complexity. It is inarguable that a behavioral panic took place. But the aim was clear: to avoid the debt saturation in OECD/developed nations and the United States and the years of slow-to-no growth it was fated to impose. More broadly, the Fed had been "managing" the growth of debt in the US economy for over two decades. 2008 was the signal that the long, secular era of lowering interest rates to help the economy manage its debt levels had reached its endpoint.

One possible explanation for this blind-spot towards debt is that the economics profession is largely in service to the political class. Books, such as Reinhardt and Rogoff's This Time is Different, which addresses the limits imposed by debt, are generally not in favor in the current era. Equally, the moral flavor to much of the right-leaning thinking on debt is also unsatisfying, as it also does not address debt-saturation so much as fiscal rectitude. What matters instead are the levels in both private-sector debt and public-sector debt that impose operational restraints. Total debt service as a proportion of income will always create a limit eventually among private sector borrowers. That is precisely what began to occur in the US and was the prima causa of the recession. However, the precise, problematic levels of debt for sovereign nations are trickier to identify. The Tide Is ChangingThrough a combination of confidence, debt service, actual economic flows, and the marketplace, however, 2012 is almost certainly the year that the present sovereign debt problems will be resolved, one way or another. Also, this week's US dollar swap operation likely points towards one of the two macroeconomic endgame pathways that I outlined last month. The current economics profession in general, and our central banking leadership in particular, sheds even more credibility as it careens on, blinded by its own light. The process by which economic activity and resources are coaxed into being by stimulative monetary policy has reached its terminus, and the public will finally understand this dynamic over the next year. In Part II: How The European Endgame Will Be The Death Knell For Modern Economics, we predict the coming endgame to the European fiscal and monetary crises. Doing so is becoming increasingly easier as we better understand the mindset of today's economic leaders and the shrinking number of options they have to address the issues before them. In fact, we think the shroud of awe and mystery that our grand economists have wrapped themselves in is fast-dissipating, and that the systemic pain their failures will inflict in 2012 -- initially most visible in Europe -- will finally cause the populace to look to a new school of economic thinking. Click here to access Part II of this report (free executive summary, enrollment required for full access). |

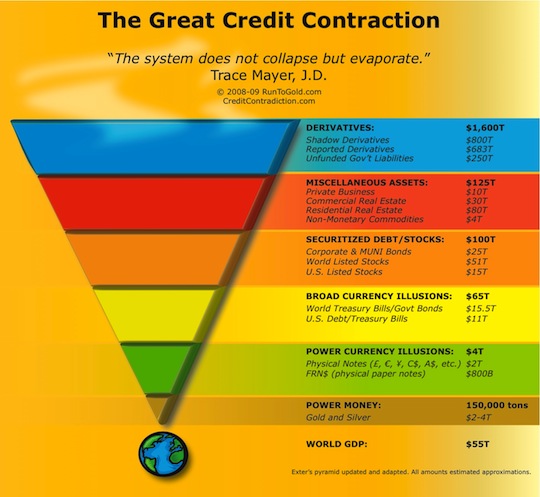

| European Bank Runs And Underestimated Physical Gold Demand Posted: 05 Dec 2011 09:51 AM PST Tweet Reading time: 6 – 10 minutes The demand for gold is vastly underestimated. About 18 months ago I wrote about Euro Gold and the Euro Zone and Euro Evaporation Leading To Credit Default Swaps and IMF Gold. One key excerpt was: The Euro is broken. This was its destiny. This is the destiny of all fiat currencies. These bureau-rats cannot stop this anymore than Cnut the Great could command the tide to halt. And here we are. THE GREAT CREDIT CONTRACTION The Great Credit Contraction has been in relentless advance for years. This is a massively deflationary period as capital, both real and fictitious, burrows down the liquidity pyramid into safer and more liquid assets. The fictitious capital that does not move fast enough evaporates. Poof goes trillions of wealth!

Fractional Reserve Banking is the banking practice in which banks keep only a fraction of their deposits in reserve (as cash and other highly liquid assets) and lend out the remainder while maintaining the simultaneous obligation to redeem all these deposits upon demand. Fractional reserve banking occurs when banks lend out any fraction of the funds received from demand deposits. Despite being a form of embezzlement and fraud this practice is universal in modern banking. This mismatch between time, borrowing short-term and lending long-term, is what creates the potential for a bank run. But an even larger looming problem lurks in 'cash and cash equivalents'. Yes, those pesky Tier I, II and III distinctions.

This is what happened when Lehman Brothers evaporated. The credit markets seized up. People acting in their own self-interest according to principles of praxeology moved into safe and liquid assets and refused to lend. Liquidity dried up overnight. Mortgage backed securities, auction rate securities and plenty of other assets which had for decades been treated as 'cash equivalents' were suddenly shunned. The bid evaporated from a loss of confidence, the prices plunged, investors were snookered and bank balance sheets were massively damaged.

The European banks have balance sheets with trillions of Euros in value recorded but assets which every rational non-ignorant person knows are severely impaired. The credit markets are freezing, trust is evaporating and as a result liquidity is drying up. Sure, the central banks of the world have joined in a massive illegal effort to lubricate the system but it will fail. Years ago when QE1 was announced I wrote The Federal Reserve Will Fail With Quantitative Easing. They are still failing just on a grander scale.

The Greek and Italian democracies were assassinated by banksters Lucas Papademos, Mario Monti and Mario Draghi who will attempt to prolong the failed banking and financial system by privatizing the gains and socializing the losses with inflationary tactics and bailouts in a vain attempt to prevent the credit liquidation. They will only succeed in prolonging and exacerbating the necessary correction. What holders of capital should understand is that European bank balance sheets are caught in an unrecoverable credit contraction spin, the appropriate emergency maneuver is to Run To Gold and only a few will make it with their purchasing power intact. The vast majority of assets will become charred wreckage as their purchasing power evaporates into worthlessness. Sure, there may be a few near miss recoveries between now and the ultimate failure but why take the risk? LATENT GOLD DEMAND There is massive latent gold demand as a 'cash or cash equivalent' asset. Why should a holder of capital store their wealth in bank deposits with counter-party risk when they can completely eliminate it by moving into unencumbered physical gold bullion? Plus, by moving into physical gold bullion they eliminate the risk associated with fiat currency becoming worthless through the deflationary event called hyperinflation. Really, hyperinflation is just the next step in The Great Credit Contraction after capital has moved almost entirely down the liquidity pyramid. The money managers allocating trillions of FRNs, Euros, Yen, etc. have not even begun moving into the monetary metals. In most cases it is only beginning to become acceptable to speak of them. Some fallaciously argue there is not enough gold to go around. Sure, there is enough gold for it to be used as the world reserve currency but it is only a matter of price. A price that Jim Rickards argues the case for in Currency Wars of being between $8,000 and $54,000+ per ounce.

The European banking and financial system is imploding before our eyes in a massive credit contraction which is just the latest wave in The Great Credit Contraction. The European banks are in an unrecoverable deflationary spin. There is only one acceptable emergency recovery procedure and that is to Run To Gold. Because so few have, therefore, the real gold demand is completely hidden and obscured from view. It will come when people lose confidence in the current banking and financial system by turning to and using alternatives that do not possess the same kinds of risks. In the Information Age bank runs happen with the click of a mouse and not lines outside the physical branches. DISCLOSURES: Long physical gold, silver and platinum with no interest in DOW, S&P 500, the problematic SLV ETF, gold ETF or the platinum ETFs. Copyright © 2008. This article was published on http://www.RunToGold.com by Trace Mayer, J.D. on December 5, 2011. This feed is for personal and non-commercial use only. Applicable legal information and disclosures are available. The use of this feed on other websites may breach copyright. If this content is not in your news reader then it may make the page you are viewing an infringement of the copyright. Please inform us at legal@runtogold.com so we can determine what action, if any, to take. If you are interested in how to buy gold or silver then you may consider GoldMoney.(Digital Fingerprint: 1122aabbLittleBrotherIsWatching3344ccdd) Copyright © 2011 RunToGold.com. This Feed is for personal non-commercial use only. If you are not reading this material in your news aggregator then the site you are looking at may be guilty of copyright infringement. Please contact legal@runtogold.com so we can take legal action immediately. Plugin by Taragana |

| Posted: 05 Dec 2011 08:20 AM PST Dave Gonigam – December 5, 2011

The eurodrama might be coming to a head… and the Federal Reserve will play a leading role, taking an ever-more active hand in keeping the Rube Goldberg contraption known as the eurozone from flying apart.

"ECB head Mario Draghi has already lowered the interbank lending rate one-quarter point in his first few days in office." "Now he is expected to take interest rates down to 1%. And in addition, if the European Summit meeting [on Friday] yields an acceptance to broad-based austerity measures, the ECB may finally assent to purchasing PIIGS' debt in unlimited quantities and duration."

The reasons we see cited most frequently in the media are these…

Afterward, Sarkozy told reporters in Paris they hope to draw up a new document by… next March.

Reuters picked up a story from the German newspaper Die Welt. Not a lot of detail to it, but when you want to drop a rumor on a Sunday afternoon before the open in Asia, you don't need many: The idea is that the Fed and the 17 eurozone central banks would join forces to pump 100 billion euros into a special fund.

In an alert to his readers on Friday, he wrote: "We may even see the Fed and the ECB lend to the IMF, which will re-lend cash to the PIIGS in the form of a 'debtor in possession' loan that will effectively allow European banks to keep pretending that they have no losses on PIIGS bonds. "Draw up your own fiat-driven, rule-changing scenario, and there's a decent chance it will be tried." "Once central banks start lending to insolvent banks, there can be no orderly exit," Dan goes on. "When sovereign defaults occur — and they will, in Greece and Portugal, and probably Italy and Spain — there will be an acceleration of money printing to keep the system propped up."

"There will be more riots and strikes, which will make the goals of budget austerity unachievable" — setting the stage for the aforementioned defaults in 2012. How do you play this? Dan says it's time to implement a strategy similar to one he put to work in November 2008 — in the teeth of the global financial crisis. It delivered a 338% gain barely three months later. Intrigued? Much more at this link.

So what accounts for last week's monster move up? "Stocks were very oversold leading into this past week, creating a situation that was likely to bounce. At the same time, there are lots of investors sitting on the sidelines right now — that means that it takes less investor participation to move the market than it usually would." Jonas' guidance for short-term traders: "I think that there is still a lot of reason to be skeptical of the market right now. That's all the more reason to approach stocks based on simple technical signals, and not on your gut."

When newspapers still held sway, the Conference Board published an index of help wanted ads that Mr. Williams says "was one of the most reliable leading indicators of economic and employment activity." A new index of online job ads has replaced it. "While the series still is nascent," he says, "it now has enough substance to be considered as a leading indicator of hiring activity." And what does it indicate? A 1.9% drop between October and November, the sixth consecutive decline. "Since May 2011, the series has declined by 13.7% and the current… pattern is suggestive of declining employment levels now, and in the near future, contrary to the gradual, but ever statistically insignificant gains reported in the monthly payroll employment surveys." By the way, Williams' real-world unemployment rate — including people who long ago gave up looking for work — stands at 22.6%.

"With the continuous firming of the Chinese yuan, the U.S. dollar is fast ceasing to be the world's reserve currency and the eurozone debt crisis has made things even worse," declared Gideon Gono, governor of the Reserve Bank of Zimbabwe. You might know him best as the man responsible for these…  …which earned him several essays like this one in The Daily Reckoning, republished in the second edition of Financial Reckoning Day. Nearly three years after Zimbabwe's hyperinflation reached most ridiculous heights, Gono still has his job… but the nation's official currency is the U.S. dollar. An ironic means of getting inflation under control, but in this case it worked. Transactions are also allowed in pounds and euros. To that list, Gono is looking to add the yuan. "As a country," he says, "we still have the opportunity to avoid being caught napping by adopting the Chinese yuan as part of consolidating the country's look East policy." For whatever it's worth, Gono's announcement comes at the same time CME Group says it will accept yuan as collateral on its commodities exchanges. Hmmm…

"Also, in your story about Germany wanting a more centralized EU government, in which the Germans will sit uber alles, I believe you misspelled 'Merkel.' I'm pretty sure the correct Teutonic spelling of her name is H-I-T-L-E-R." "What great-grandpa Adolf couldn't complete, she should be able to do with half the cost, in a quarter of the time, and with much less blood (excepting the Greeks, of course)."

"This is what happens when war breaks out and a nation takes over another: The defeated nation comes 'under new management.' This will be what Merkel will propose, except the other nations will be able to vote on it." The 5: And if the vote doesn't go the eurocrats' way, they'll keep holding votes until they get the desired outcome.

"I never received the first bill for $150 and the tax department letter states that not being notified doesn't matter. As a side note, I am current on my mortgage, taxes and other obligations…hardly a deadbeat."

"Most, if not all, of the dentists are schooled in the USA and some have offices in Mexico and the U.S. The cost of dental work in Mexico is so much cheaper." "Instead of in two visits, they will do a crown in one visit and you are on your way with a cost of $200-400 per crown, instead of $1,200-1,600 with two one-hour visits in the U.S." "The offices are very clean and the people are very professional. Side note: These offices are in the border towns of Mexico, so my friends park on the U.S. side of the border and walk to their appointments in Mexico." "Thanks, and keep up your great work with the 5 Min. Forecast."

"In a recent conversation, he said that beginning in 2013, the U.S. government will begin withholding 30% of a person's assets for anyone moving outside of the country. He plans to retire in Panama, but was not planning on such an 'incentive' to execute the plan this year. Can you verify this info, and, if true, provide any additional insights that we need to know?" The 5: Sounds as if something got lost in translation. Here's the deal: Effective January 2014, if you hold $50,000 in "foreign financial assets," you must bank at an institution that forks over your information to the IRS or face 30% withholding on the income and gross proceeds from any U.S. assets in your account. That applies no matter where you live. Meanwhile in 2008, President Bush signed a bill requiring Americans who surrender their U.S. citizenship to fork over capital gains taxes on the appreciated value of everything they own, as if they sold it. We run down a host of issues related to moving your money overseas — complete with suggested solutions — in a special report that's free for every new reader of Apogee Advisory. Access here. Cheers, Dave Gonigam P.S. "For binary traders," Abe Cofnas wrote his readers this morning, "the European debt crisis is a gift that keeps on giving. "Things could change in an instant… which is why I'm recommending three breakthrough trades that will pay off if markets move in any direction, as well as a 'greed' trade." Last week was a textbook case of applying Abe's strategy — two winners among three plays, delivering gains of 38% and 39%. The market doesn't need to go up to make money using Abe's strategy. Nor does it need to go down. It just needs to move… and everything plays out in four days or less. Abe's strategy is ideal at a time like this, when stocks are going nowhere but the Dow routinely posts big swings of hundreds of points. Here's how to make the most of the volatility. P.P.S. "We've had two successive presidential administrations who've tried to finagle the macro economy in a way that prevents any failure, and look where it's gotten us," declared Laissez Faire Books executive editor Jeffrey Tucker on Fox Business' Freedom Watch Friday.  The wide-ranging interview covers everything from the bankruptcy of American Airlines to the phenomenon of highly indebted college students living it up in McMansions. Seriously. Check it out. |