Gold World News Flash |

- Does Gold’s Correlation with Stocks Mean that it’s No Longer a Safe Haven?

- Richard Russell - Inflation Tsunami & The Island Of Safety

- Peak Oil, The New Boom-Bust Cycle and Gold

- US Dollar Technical Update

- Gold coins: the United Kingdom´s Gold Britannia

- 6 Horsemen? Central Banks Dollar Liquidity Only Prolongs The Euro Debt Crisis

- Barack Obama Is Taking A 17 Day Vacation Even As America Falls Apart All Around Him

- What Wednesday 8am Fed Headline Is Being Leaked Now?

- Gold and US Official Debt Instruments Held by Central Banks

- New Boom-bust Cycle Risks Hyperinflationary Depression and Much Higher Gold Price ? Here?s Why

- Guest Post: Psychopathic Economics 101

- When Doves Laugh: 4 Weeks Until The Quiet Coup In The Fed Gives QE3 A Green Light

- A Pocketbook Of Gold

- You Gotta Have Friends - Stock World Weekly

- EUR and Commodity Strength Supports Modestly Positive ES Open

- Saving Gold - Old reliable stands tall in crisis atmosphere

- Debt Slavery – Why It Destroyed Rome, Why It Will Destroy Us Unless It’s Stopped

- No, Dylan Grice Did Not Say Germany's Unwillingness To Print May Lead To The Rise Of Another Hitler

- Guest Post: It's Your Choice, Europe: Rebel Against the Banks or Accept Debt-Serfdom

- Guest Post: A Twenty Something Speaks

- Egan-Jones Exposes Wall Street's "Big Investment Fraud"... In 2006

- Gold, Eurodollars, and the Black Swan That Will Devour the US Futures and Derivatives Markets

- Germany Planning For Commerzbank Nationalization

- Swiss America's pro-gold commercials rejected by major TV networks

- Stock Market New Uptrend Nearly Confirmed

- In The News Today

- Silver Ready For Take-Off?

- How President Obama Is Rapidly Becoming A Gold Bug's Best Friend

- Silver Forecast: Silver To Follow Gold And Double Its 1980 High At Least

- Michael Pento - Insanity Next Week, Watch Europe & Gold!

| Does Gold’s Correlation with Stocks Mean that it’s No Longer a Safe Haven? Posted: 04 Dec 2011 08:16 PM PST In this article we examine the current and past relationship between gold and the S&P 500 index and whether or not gold still remains a “safe haven”. In the past gold has often had a low positive relationship with the S&P, with that relationship trending negative in times of economic turbulence (hence gold’s safe haven status) but that trend has not held over the past 10 weeks. We aim to answer the implications this has for gold in the future. |

| Richard Russell - Inflation Tsunami & The Island Of Safety Posted: 04 Dec 2011 08:00 PM PST |

| Peak Oil, The New Boom-Bust Cycle and Gold Posted: 04 Dec 2011 08:00 PM PST |

| Posted: 04 Dec 2011 07:37 PM PST |

| Gold coins: the United Kingdom´s Gold Britannia Posted: 04 Dec 2011 06:00 PM PST |

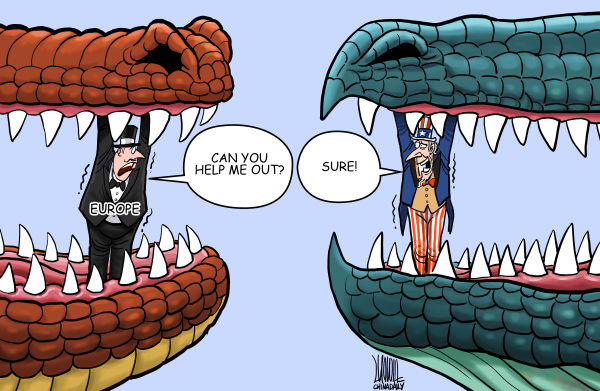

| 6 Horsemen? Central Banks Dollar Liquidity Only Prolongs The Euro Debt Crisis Posted: 04 Dec 2011 04:56 PM PST

By EconMatters

Stock markets soared after the coordinated actions on Wed. Nov. 30 from six central banks around the world -- the Federal Reserve, European Central Bank (ECB), and the central banks of Canada, U.K., Switzerland, and Japan -- to provide "temporary U.S. dollar liquidity swap arrangements." Those dollar swap lines and programs are authorized through 1 Feb. 2013.

Whenever there are six central banks acting in concert, it typically suggests something serious either already taken place or underway. Some analysts and market experts speculate that there could be a run on European banks, and an imminent collapse of the euro.

But the show of force by central banks propped up stocks, commodities rallied, and yields on most European debt also fell. The dollar swaps made it cheaper for banks to borrow dollars in emergencies, and is meant to ease the credit crunch in the financial markets, business, and individuals, instead of a "bailout" of the Euro Zone.

One latest development reported by Reuters is that Germany's Finance Minister Wolfgang Schaeuble intends to present at a crunch summit of EU leaders on 9 Dec:

At first brush, it seems more of a wishful thinking that Schaeuble's plan would "boost confidence" of investors. The separation of excess debt to be paid off with tax revenues over 20 years, while symbolic, does not really change the fiscal fundamentals leading to the current crisis in the region--sluggish growth, high debt with a significant portion maturing in the next five years, and the prospect of renewed recession, including Britain and Germany-- as illustrated by the interactive charts at our site from The Economist (updated 12 Nov 2011).

Another development as reported by NYT is that European leaders are running to the International Monetary Fund (IMF) for help. However, the IMF, in the same boat as the ECB, does not have the resource to really insulate interest rates from further deteriorating at troubled euro zone countries. Furthermore, any way you slice the numbers, the existing IMF funds just won't work:

To increase IMF funds, support from the United States and China would be necessary. But the international community has lost patience with the Euro Zone's political indecisiveness for the past 2+ years.

The U.S. so far has signaled a position of no plans to make bilateral loans to the IMF to help stem the Euro crisis. Treasury Geithner said on 15 Nov.:

Moreover, asking Congress for more money to bail out Europe would be an extremely ill-advised move for President Obama, particularly in an election year.

As for China, the country with largest reserves in the world, Bloomberg quoted China's Vice Foreign Minister Fu Ying as noting (emphasis ours),

The European union, combined, has enough resource to dig themselves out of this mess if they put their economic (vs. political) minds to it. But it all comes down to money, and the rich Germany is not going to take on more risk without serious austerity commitments from the high-debt peripherals. But countries such Greece, Spain and Italy all are having difficulties pushing through some heavy-duty austerity reform after years of living beyond their means.

Meanwhile, Geithner will travel to Europe, ahead of the EU Brussels Summit on 9 December, to push the Europeans for quicker and more decisive action. Nevertheless, most likely, the EU will act just the opposite of whatever message Geithner's trying to deliver, even if solely just to avoid the appearance of bowing to the U.S.

There are hard decisions that need to be made long ago, and when push comes to shove, they will get implemented quite swiftly by EU. However, the new dollar liquidity injection from six central banks essentially took the urgency out of a much needed decisive resolution, and the so-called crunch summit, like almost all multi-national summits, most likely would end up with very little accomplished.

According to Reuters, "Germany is dead set against any pooling of responsibility for debt within the euro zone" (i.e., the Euro Bond). On the other hand, Germany would not like to see a breakup of euro either as German export business has benefited tremendously from the Euro's "weaker sisters" artificially pushing down the Euro much lower than German's own currency would have been.

So there are very limited viable options left for now. Eventually, the Euro crisis probably could result in one or a combination of the following scenarios:

And there's this remote possibility we might hear something unexpected and surprising out of EU, as most important decisions are typically made behind closed doors, and this summit could just be a media distraction?

Some additional thoughts...

The Euro debt crisis has highlighted one common critical issue of all governments in the world--unlimited tax revenue money with very little related accountability.

In the corporate world, if a company can't properly balance its cashflow or has done something ill-conceived, shareholders would send a message by dumping the company stock en masse (The recent Netflix stock movement is a prime example), which would act as a fabulous incentive for company management to get their acts together very quickly.

However, in the case of government, regardless how much the government mis-managed a nation's finances, taxpayers have very little power to send a strong enough message. Government basically just has this unlimited (in most cases, increasing) tax revenue income year after year without the accountability and incentive of proper and efficient fiscal management.

Until there's a fundamental and structural change of how government is held accountable for running and managing a nation's resources, there could be more crises similar to the one in the Euro Zone popping up to the point of one Scary Grandioso--No more spare bailout capacity.

Further Reading: Euro Bond: Europe's Only Way Out For Now Expect A Global Recession No Matters What Happens In The Euro Zone

© EconMatters All Rights Reserved | Facebook | Twitter | Post Alert | Kindle |

| Barack Obama Is Taking A 17 Day Vacation Even As America Falls Apart All Around Him Posted: 04 Dec 2011 03:15 PM PST from The Economic Collapse Blog:

What in the world is Barack Obama thinking? The United States of America is falling apart all around him, and yet he decides to take a 17 day Hawaiian vacation. Does he even understand that he is the leader of the free world? Does he even understand that this country is mired in the worst economic downturn since the Great Depression? Last year, a similar Hawaiian vacation by the Obamas ending up costing more than 1 million dollars. Other than when I was in school, I don't remember ever taking a 17 day vacation. In fact, most Americans do not even get 17 vacation days for an entire year. Yet the Obamas seem to think that part of occupying the White House is to take as many vacations as possible. It has been reported that Michelle Obama spent over 10 million dollars of U.S. taxpayer money on vacations during just one recent 12 month period alone. It would be one thing if they were taking these vacations at a time when America was thriving, but the truth is that the U.S. is facing one crisis after another right now. Our debt is now over 15 trillion dollars. If you can believe it, the U.S. government has not been operating under an approved budget for over 900 days. More Americans fell into poverty last year than ever before. More Americans are on food stamps than ever before. An average of 23 manufacturing facilities were shut down every single day in the United States last year. According to one recent report, only 7 percent of Americans that lost their jobs during the recession have "made it back" to where they were before the recession. So perhaps Barack Obama should spend more time doing his job rather than taking extended vacations. |

| What Wednesday 8am Fed Headline Is Being Leaked Now? Posted: 04 Dec 2011 02:26 PM PST Forgive our skepticism, but since our earlier market snapshot, most of the broad risk drivers have notably receded from their evening highs - while ES remains at highs. Together with the worst Composite China PMI print in 32 months, we are seeing CONTEXT diverge notably weaker than the 'resilient' ES futures. TSYs did open modestly offered but it is the retracement in FX carry, Silver, Gold, Copper, (and even Oil) that is dragging risk 'off' as the e-mini S&P futures contract holds magically at Friday's closing VWAP. We wonder what comfortable bid is being maintained by them-that-know-better-than-us-what-comes-next? We can only assume that the old adage that the 'worse it gets the better it will be' so BTFD is back in full force but we remind those knife-catchers (alone in the equity market for now this evening) that optical backstops are showing cracks and balance sheets are deleveraging no matter what is done to prop-up sovereigns until Santa arrives.

Late Friday we saw risk come off notably and ES slowly realize and leak lower to converge (red solid oval). As all the factors opened this evening, we saw CONTEXT and ES converge once again (red dotted oval) then since the broad basket of risk assets has dropped back to unchanged from Friday's close (red arrow) while ES has held up (as seen below - at Friday's closing VWAP level (the light blue arrow) - an often important balance point for institutional traders).

Copper is 1.3% off its earlier highs, Silver 1% down from its opening level, Gold 0.5% down (back to unch) and even Oil (entirely ignoring the drama in the Middle East for now) is leaking back to only 0.4% up from Friday's close. 30Y TSYs are underperforming for now as EUR leaks back and EURJPY is only 10pips up from Friday's close. Swissy is the worst performer of the majors against the USD (and only one negative) while CAD is the strongest. Charts: Bloomberg |

| Gold and US Official Debt Instruments Held by Central Banks Posted: 04 Dec 2011 02:26 PM PST |

| New Boom-bust Cycle Risks Hyperinflationary Depression and Much Higher Gold Price ? Here?s Why Posted: 04 Dec 2011 12:52 PM PST *It is my view that the world has entered a new boom-bust cycle driven by oil prices. Oscillating oil prices – as opposed to credit cycles – will repeatedly stimulate and crash the highly levered global economy. Governments have not recognized this new cycle, and as part of a fruitless effort to retain control over deteriorating real growth and rising unemployment central banks will print more and more money, risking a hyperinflationary depression (stagflation at best). [As such,] the only respite for many investors is gold. [Let me explain.] Words: 925 So says Mark Motive ([url]www.planbeconomics.com[/url]) in edited excerpts from his original article*. [INDENT]Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and eas... |

| Guest Post: Psychopathic Economics 101 Posted: 04 Dec 2011 12:33 PM PST Submitted by D. Sherman Okst of Psychopathic Economics 101 Psychopathic Economics 101 Psychopaths flew financial weapons of mass destruction (derivatives) into the twin towers of our economy, the housing market and the stock market. Ten trillion dollars of wealth imploded in a cloud of dust. Ninety-nine percent of the economic experts – financial planners, economists, economic professors, brokers, and investors – missed the largest bubble in history as well as the systemic risk that the bubble posed. The National Board of Economic Research (NBER) (who is responsible for declaring a recession) was 9 months late calling the worst recession since the Great Depression. How Economics Were Hijacked I advocate that the larger story here isn't derivatives or the Financial Crisis of "2008," but instead how economics has been secretly hijacked. When I began researching for the book I'm writing I had a premise: "Corporatocracy" had replaced capitalism. That is true, but I realized the more important underlying fundamental was how corporatocracy came about. Corporatocracy grew out of souless corporations being given human status even though their sole purpose was creating wealth for the shareholders. Corporations themselves became uncaring individuals – many of them run by uncaring individuals. Psychopaths to be blunt. Research I conducted revealed why and how psychopaths captured economics, how this catastrophe was missed and what the ramifications will be. For more on corporatocracy please read "Why We Are Totally Finished." There is also a super documentary called "The Corporation" which can be viewed off my blog Psychopathic Economics. "Semiopaths" & Psychopaths Psychopaths aren't limited to seemingly nice people who invite you over for dinner, then cut you into pieces and serve your fresh innards on a plate. The World Health Organization has a "Personality Diagnostic Checklist" that is used in conjunction with this work. You'll recognize it by the check marks. Psychopaths used the following five weapons to take control of our global economy:

All but one of these, Regulatory Economic Capture, are new terms that I've identified. Political Economic Capture Both parties have been captured. Blaming each other's party or swapping parties isn't a solution because there is only one party and that is the ultra elite party. If you can't rob clients of 3 billion dollars or steal 10 trillion dollars (and counting) from taxpayers you aren't in the party – you are instead their food.

This didn't happen yesterday. Watching this video you can see the former Chief Executive Officer of Merrill Lynch telling President Reagan to "Speed it up, and Ronnie responds, "Oh, okay." JP Morgan Chase & Company have their former executive in Donald Regan's old position now, Bill Daley runs the White House today.

Political Economic Capture isn't "just" limited to controlling presidents. Brooksley Born headed up the Commodity Futures Trading Commission [CFTC] and warned of derivatives posing a risk to our economy back in the 1990s. Greenspan, Summers, Rubin and Congress were dispatched to muzzle her as if she were a rabid dog. You can watch the movie "The Warning" here. Our 535 flag burning, constitution shredding congressmen and women aren't public representatives – they are psychopaths (Ron Paul, his kid and a handful of other good eggs excluded). They have voted in a separate set of laws. Plutocracy allows them to do what you and I would be jailed for doing. Being a legislator today is a get out of jail and get rich card. Congress isn't a place to serve the public, it isn't where you go to honor your country – it is where you go to earn wealth 150% faster than the American that serves you while you screw them. All the while the congressman and congresswomen serve their evil psychopath master. (Please click on book cover to hear audio interview for sources below.) When Visa didn't want its fees suppressed, Psychopath Pelosi was given a 5 million IPO "opportunity" for her dirty work.

Psychopath Kerry put off legislation that would adversely impact the price of his Frannie and Feddie's stock, affording him time to dump his stock at a higher price to some mark who didn't know what he knew. Peter Schweizer wrote the book "Throw Them All Out" and in this super audio he and Jim Puplava detail how the "permanent political class enriches itself at the expense of the rest of us." In the United Banana Republic of America, if you're a really powerful ex-senator and current elitist you can rob your clients of $3,000,000,000 and not go to jail or even be investigated. All you have to do is bribe the president puppet with a $35,000 plate fundraiser and the mega banksters lawyers will take over the courtroom and argue with those trying to protect the clients who got screwed. So when believe Ann Barnhardt says, "You have to get your heads around this. You have to get your heads around the fact that there are truly evil people in the world who do not give a crap about anyone or anything except themselves, their own personal wealth and their own personal power. They would sell their grandmother to the Nazis for a nickel without hesitation if they thought they could get away with it." Watch James Koutoulas Co-Founder of Commodity Customer Coalition for MF Glaobal expalin how JP Morgan's lawyers run the show. Scholarly Economic Capture About 70% of American families owned homes. Two additional things needed to be done in order to sell junk mortgages as investments. This wasn't just junk, it was junk with a ticking time bomb rate reset sold to people with anything but stellar credit. One, the criminals had to hijack scholars to get them to say good things about these financial WMDs. Two, they needed to have their crony rating agencies falsely rate them Triple A. Not only were the mortgages pure crap, but they had names like NINJA (No Income, No No Asset, No Job), No Docs (No Documentation) and Liar Loans. With 30% of loans during a given year of the boom being subprine these psychopaths destroyed your home's value. So scholars of the once best business schools were hired for chump change. In return for $124,000 they wrote papers praising derivatives. Perfume on horse manure. Psychopath Diagnostic Checklist. ? Callous unconcern for the feelings of others. ? Incapacity for maintaining enduring relationships. ? Reckless disregard for the safety of others. ? Deceitfulness, repeated lying and conning others for profit. ? Incapacity to experience guilt. Later when things didn't work out for derivatives one of the "scholars" changed the name of the report he authored from "Financial Stability in Iceland" to "Financial Instability in Iceland." When caught on camera the psychopath just lies again to your face. "Typo" the psycho.

As Ann Barnhardt says in this amazing audio interview with Jim Puplava: "You have to start acknowledging these people for what they are, and that is: Moral degenerates, basically sociopaths and psychopaths. Meaning they don't feel any sympathy or empathy for other human beings."

This is the school where I was born. The school where kids go into massive debt to be educated by psychopaths. The school where parents unload massive amounts of their wealth to send their children to, for what they think is a super education. No wonder we have #Occupy Wall Street. ? Deceitfulness, repeated lying and conning others for profit. ? Incapacity to experience guilt. By far, Scholarly Economic Capture is the most dangerous economic capture, because future economist are being taught a lie – by liars. Current economists read the lies these "scholars" spew and perpetuate them by not thinking for themselves. Just because someone teaches at an Ivy League school doesn't make them a scholar. Psychopath Ben S. Bernanke is proof of that. Listen to him here and then read the FY2005 FOMC minutes below. They knew housing was in a bubble and were laughing at it. If our military is going to capture Americans without trials and do whatever with them for being terrorists one could only wish that this would be their starting point. But it wont be.

Statistical Economic Capture Our statistics are a joke. Sadly we're the brunt of it. Our government budget and statistics make Enron look like choir boys. The statistics have been tweaked by 'semiopath" politicians many times over decades to make him look good. The current result is that unemployment is reported at 8.x% or 9.x% when in fact it is at a depressionary level of 23.9%. GDP is baked, off by trillions. Inflation is over 10% and reported at 2-3%. These politicians didn't just lie to us about stains on blue dresses or office burglaries. No, they ingrained their lies into our current economic statistics and we have few economic professors who catch this. Our current politicians gain from 40 year old lies. Mainstream Media Economic Capture If you want any decent economic news cancel your cable and turn off your TV. My blog Psychopathic Economics lists the best sources for real economic news that anyone could ever wish for. The media outlets are owned by the mega corporations, their reporters are, at best, repeaters. Here we have my favorite reporter – just because I love the way she says "Dawler" talking about our dollar being superior to gold. Video after the jump (scroll to the 13:50 point). In any event, don't bank on CNBS to bring you economic news, they didn't in 2008, they won't in 2011 or 2012. They don't even bother to correct gross lies spewed by Psychopath Ben Bernanke – housing prices have declined on a nationwide basis during the first Great Depression. "I guess I am a Great Depression buff, the way some people are Civil War buffs. I don't know why there aren't more Depression buffs.~Ben S. Bernanke ? Callous unconcern for the feelings of others. ? Incapacity for maintaining enduring relationships. ? Reckless disregard for the safety of others. ? Deceitfulness, repeated lying and conning others for profit. ? Incapacity to experience guilt. Regulatory Economic Capture Ann's words of incompetence ring loud and clear when we consider Regulatory Economic Capture. The SEC is the poster child for ineptness. Many senior level employees earning between $99,356 and $220,000 a year had amassed collections of pornography on our dollar. So much porn that some filled up their computer hard drives and resorted to filling boxes of DVDs and CDs to store their troves of porn. The CFTC head isn't of the Brooksley Born fiber. No, he is a derivative of the gang of those whose CEO proclaims to be Doing God's work.

? Callous unconcern for the feelings of others. ? Incapacity for maintaining enduring relationships. ? Reckless disregard for the safety of others. ? Deceitfulness, repeated lying and conning others for profit. ? Incapacity to experience guilt. Is anyone really surprised 7,000 clients who were robbed blind by MF Global? Regulatory Capture isn't limited to just economics. Our inept Environmental Protection Agency [EPA] is allowing toxic carcinogens to pollute our world and create earthquakes with "fracking". Watch Gasland. If you live on the east coast you might want to consider earthquake insurance. And we have regulatory capture in our food supply chain. Amazing how a country built on farming can be taken over by Regulatory Economic Capture. |

| When Doves Laugh: 4 Weeks Until The Quiet Coup In The Fed Gives QE3 A Green Light Posted: 04 Dec 2011 11:50 AM PST from ZeroHedge:

While the world continues to be hypnotically captivated with every word out of Europe, the ongoing fiasco in the insolvent socialist continent is a welcome diversion from our own issues here in the US, which as we noted yesterday, has not "decoupled" from the rest of the world's woes but merely is "lagging." After all the European recession is now guaranteed, and no matter how it is spun it will never amount to a positive GDP event for the US, even more when considering that the PBoC's recent resumption of monetary loosening will take at least several quarters to be felt globally. But a lag to what? Why 2012 of course, and specifically the January 24-25, 2012 Fed statement when as SocGen pointed out the Fed is most likely to announce yet another $600 billion episode of quantitative easing. But why then? Why not at the December 13 meeting, the topic of Fed telegraph Jon Hilsenrath's latest piece, according to which the Fed will soon emphasize that it will never hike rates and as a result collapse all refi activity because who wants to go into a 30-year fixed at 4% when it will be available at 2% 3 months later, and at 0% 6 months after that? Simple: the Fed's balance of power is about to shift substantially. |

| Posted: 04 Dec 2011 11:10 AM PST Dear CIGAs, With the assistance of a good friend and contributor to JSMineset, Mr. Peter Carlin, Jim has co-authored a book on everything you need to know about Gold. We have an extremely limited number of these books left over. If you are interested in purchasing one NOW IS YOUR LAST CHANCE! Once they Continue reading A Pocketbook Of Gold |

| You Gotta Have Friends - Stock World Weekly Posted: 04 Dec 2011 10:20 AM PST You Gotta Have Friends - Stock World Weekly

Xcerpt from the Week Ahead Section: Stocks enjoyed a strong, bullish run this week, thanks to the efforts of the world's central bankers. Earlier in the week, Bruce Krasting discussed the ECB's need to engage in "shock and awe" tactics and make central bank friends. On Wednesday, immediately after Bruce published On FX intervention and the ECB/SMP, the Central Banks announced their coordinated plan that launched the stock market higher (although the shock and awe decision may have been made on Monday). Bruce added an introduction, "Yikes!! I posted this and a few minutes later the Fed/other CBs announces a round of coordinated measures to assist the ECB. My point in this article was that the ECB has no friends, and that was the weakest link in their defense of the EU bond market. It seems they now have friends. We shall see how good these "friends" are..." In the article, Bruce had written, "The ECB is in a bad position. The news flow and large supply have put them on the defensive. Defense is no way to run an intervention policy. At best, it's slow grind to a loss... When confronted with unstable markets where the instability is, by itself, undermining the broader economy, the first objective is to reestablish stability. There is only one way to do that in the short-term. The financial authorities must establish Two Way Risk back into the market. Ideally, the objective is to create as much risk in being long as the risk of being short. The ECB has failed to establish two-way risk. Virtually every (Italian, etc) bond that has been sold over the last few months has been a "good" sale. There has been no risk to selling, the only risk has been in buying. If the ECB wants to be successful, it must create a risk situation that is equally weighted. Call that shock and awe." (On FX intervention and the ECB/SMP) Friday was a reasonable time to take profits on at least some previous bullish trade ideas. Friday morning, Phil wrote, "I have very little to add – I just want to make sure this Alert goes out right away, so let's just get back to cash and have a nice, relaxing weekend. We can mess around with new stuff on Monday. But – as you can see from Friday's post - and that doesn't even include the White Christmas Portfolio (WCP) picks and our other bull bets – it's been a fabulous couple of weeks, so why push our luck? "Downside hedge is still EDZ. China is probably the next disaster focus now that we've beaten the bears back in Europe. The EDZ Jan $15/20 bull call spread is $2 and you can sell the $16 puts for $1.50. If I have to tell you why I love this net $0.50 hedge with EDZ currently at $17.80, you need to go back and do some remedial reading! "I still like the oil shorts but that's more like riding a bronco, whereas EDZ gives us smoother waves." John Rubino, co-author with James Turk of The Collapse of the Dollar, discussed the impact of the central banks' latest intervention in his article Fooled Again! John wrote, "The pattern is by now so familiar that it deserves a place beside other technical indicators like moving averages and Fibonacci retracements. "It begins with part or all of the global economy appearing to implode under its five-decade accumulation of debt. The public sector/central bank nexus responds with a liquidity injection, leading the markets to rally explosively and the pundits to declare the problem fixed. Then the markets gradually remember that liquidity and solvency are two different things, and that the mortgage lenders/money center banks/PIIGS countries/hedge funds/State and local governments, etc., are insolvent, not illiquid. And the cycle begins again... "Now, trading strategies work until they don't, and there's always the risk that this latest bailout will actually fix the world's problems and usher in a new era of consumer-led growth with soaring corporate profits, low inflation, and rising share prices. But…nah, why even give this possibility serious consideration? Nothing that was promised this week will make much of a near-term difference. Lower reserve requirements in China and cheaper dollar-denominated loans in Europe are just tweaks to already existing programs. More fiscal integration in Europe is inevitable if the common currency is to function as promised. But think for a moment about what this implies — Germany and France getting to micromanage Italy's pension and tax system — and it clearly isn't happening this month. Getting from here to a German-run Europe will take maybe five more near-death experiences, and in any event won't address the fact that even Germany's balance sheet (when you include its unfunded liabilities) really isn't AAA. "So, the pattern should hold: "Risk-on" trades work this week, then things get choppy for a while. Then the markets grow cautious and finally terrified...(Fooled Again!) As the chart above shows, the NYMO (NYSE McClellan Oscillator) is squarely in the middle of its range, almost exactly between overbought and oversold. As Phil said on Friday, this is a time when cash is King, so we can watch and wait for opportunities. Click on this link to sign up to read all of this week's newsletter: You Gotta Have Friends.

Note: The material presented in this commentary is provided for informational purposes only and is based upon information that is considered to be reliable. However, neither Philstockworld, LLC (PSW) nor its affiliates warrant its completeness, accuracy or adequacy and it should not be relied upon as such. Neither PSW nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this information. Past performance, including the tracking of virtual trades and portfolios for educational purposes, is not necessarily indicative of future results. Neither Phil, Optrader, or anyone related to PSW is a registered financial adviser and they may hold positions in the stocks mentioned, which may change at any time without notice. Do not buy or sell based on anything that is written here, the risk of loss in trading is great. This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. |

| EUR and Commodity Strength Supports Modestly Positive ES Open Posted: 04 Dec 2011 10:15 AM PST While EURUSD is off its highs of the evening so far, it remains 20-30pips higher and is mildly supportive (given EURJPY's move) of the 7pt better open in ES (the e-mini S&P 500 futures contract). The Italian austerity measures seem the main driver which is odd given this is not news and was fully expected. Oil is also popping (WTI above $101.50 now and Brent popping), on the Iran news we assume (both at 3 week highs now), and Gold is above $1750 as Silver outperforms +1.3% (over $33) from Friday's close - both handily outperforming USD's drop.Copper futures are almost 2% higher so far, over $360. AUDJPY is helping but the 2nd month in a row of AUS services contraction (and lowest since March) may dull that as a driver in the short-term. Back of the envelope, given the markets that are open, ES is 3-4pts rich to CONTEXT but we will update when TSYs open and the opening skirmish quiets down. ES is backto Friday's VWAP closing level - holding just about the knee-jerk post-NFP print level for now. Chart: Bloomberg |

| Saving Gold - Old reliable stands tall in crisis atmosphere Posted: 04 Dec 2011 09:39 AM PST |

| Debt Slavery – Why It Destroyed Rome, Why It Will Destroy Us Unless It’s Stopped Posted: 04 Dec 2011 07:14 AM PST Here's some interesting weekend reading about Debt Slavery and our place in its long history. ~ Ilene Debt Slavery – Why It Destroyed Rome, Why It Will Destroy Us Unless It's StoppedCourtesy of MICHAEL HUDSON Published at CounterPunch

Aristotle, The Louvre - Wikicommons Eric Gaba (Sting) Book V of Aristotle's Politics describes the eternal transition of oligarchies making themselves into hereditary aristocracies – which end up being overthrown by tyrants or develop internal rivalries as some families decide to "take the multitude into their camp" and usher in democracy, within which an oligarchy emerges once again, followed by aristocracy, democracy, and so on throughout history. Debt has been the main dynamic driving these shifts – always with new twists and turns. It polarizes wealth to create a creditor class, whose oligarchic rule is ended as new leaders ("tyrants" to Aristotle) win popular support by cancelling the debts and redistributing property or taking its usufruct for the state. Since the Renaissance, however, bankers have shifted their political support to democracies. This did not reflect egalitarian or liberal political convictions as such, but rather a desire for better security for their loans. As James Steuart explained in 1767, royal borrowings remained private affairs rather than truly public debts. For a sovereign's debts to become binding upon the entire nation, elected representatives had to enact the taxes to pay their interest charges. By giving taxpayers this voice in government, the Dutch and British democracies provided creditors with much safer claims for payment than did kings and princes whose debts died with them. But the recent debt protests from Iceland to Greece and Spain suggest that creditors are shifting their support away from democracies. They are demanding fiscal austerity and even privatization sell-offs. This is turning international finance into a new mode of warfare. Its objective is the same as military conquest in times past: to appropriate land and mineral resources, also communal infrastructure and extract tribute. In response, democracies are demanding referendums over whether to pay creditors by selling off the public domain and raising taxes to impose unemployment, falling wages and economic depression. The alternative is to write down debts or even annul them, and to re-assert regulatory control over the financial sector. Near Eastern rulers proclaimed clean slates for debtors to preserve economic balance Charging interest on advances of goods or money was not originally intended to polarize economies. First administered early in the third millennium BC as a contractual arrangement by Sumer's temples and palaces with merchants and entrepreneurs who typically worked in the royal bureaucracy, interest at 20 per cent (doubling the principal in five years) was supposed to approximate a fair share of the returns from long-distance trade or leasing land and other public assets such as workshops, boats and ale houses. As the practice was privatized by royal collectors of user fees and rents, "divine kingship" protected agrarian debtors. Hammurabi's laws (c. 1750 BC) cancelled their debts in times of flood or drought. All the rulers of his Babylonian dynasty began their first full year on the throne by cancelling agrarian debts so as to clear out payment arrears by proclaiming a clean slate. Bondservants, land or crop rights and other pledges were returned to the debtors to "restore order" in an idealized "original" condition of balance. This practice survived in the Jubilee Year of Mosaic Law in Leviticus 25. The logic was clear enough. Ancient societies needed to field armies to defend their land, and this required liberating indebted citizens from bondage. Hammurabi's laws protected charioteers and other fighters from being reduced to debt bondage, and blocked creditors from taking the crops of tenants on royal and other public lands and on communal land that owed manpower and military service to the palace. In Egypt, the pharaoh Bakenranef (c. 720-715 BC, "Bocchoris" in Greek) proclaimed a debt amnesty and abolished debt-servitude when faced with a military threat from Ethiopia. According to Diodorus of Sicily (I, 79, writing in 40-30 BC), he ruled that if a debtor contested the claim, the debt was nullified if the creditor could not back up his claim by producing a written contract. (It seems that creditors always have been prone to exaggerate the balances due.) The pharaoh reasoned that "the bodies of citizens should belong to the state, to the end that it might avail itself of the services which its citizens owed it, in times of both war and peace. For he felt that it would be absurd for a soldier … to be haled to prison by his creditor for an unpaid loan, and that the greed of private citizens should in this way endanger the safety of all." The fact that the main Near Eastern creditors were the palace, temples and their collectors made it politically easy to cancel the debts. It always is easy to annul debts owed to oneself. Even Roman emperors burned the tax records to prevent a crisis. But it was much harder to cancel debts owed to private creditors as the practice of charging interest spread westward to Mediterranean chiefdoms after about 750 BC. Instead of enabling families to bridge gaps between income and outgo, debt became the major lever of land expropriation, polarizing communities between creditor oligarchies and indebted clients. In Judah, the prophet Isaiah (5:8-9) decried foreclosing creditors who "add house to house and join field to field till no space is left and you live alone in the land." Creditor power and stable growth rarely have gone together. Most personal debts in this classical period were the product of small amounts of money lent to individuals living on the edge of subsistence and who could not make ends meet. Forfeiture of land and assets – and personal liberty – forced debtors into bondage that became irreversible. By the 7th century BC, "tyrants" (popular leaders) emerged to overthrow the aristocracies in Corinth and other wealthy Greek cities, gaining support by cancelling the debts. In a less tyrannical manner, Solon founded the Athenian democracy in 594 BC by banning debt bondage. But oligarchies re-emerged and called in Rome when Sparta's kings Agis, Cleomenes and their successor Nabis sought to cancel debts late in the third century BC. They were killed and their supporters driven out. It has been a political constant of history since antiquity that creditor interests opposed both popular democracy and royal power able to limit the financial conquest of society – a conquest aimed at attaching interest-bearing debt claims for payment on as much of the economic surplus as possible. When the Gracchi brothers and their followers tried to reform the credit laws in 133 BC, the dominant Senatorial class acted with violence, killing them and inaugurating a century of Social War, resolved by the ascension of Augustus as emperor in 29 BC. Rome's creditor oligarchy wins the Social War, enslaves the population and brings on a Dark Age Matters were more bloody abroad. Aristotle did not mention empire building as part of his political schema, but foreign conquest always has been a major factor in imposing debts, and war debts have been the major cause of public debt in modern times. Antiquity's harshest debt levy was by Rome, whose creditors spread out to plague Asia Minor, its most prosperous province. The rule of law all but disappeared when publican creditor "knights" arrived. Mithridates of Pontus led three popular revolts, and local populations in Ephesus and other cities rose up and killed a reported 80,000 Romans in 88 BC. The Roman army retaliated, and Sulla imposed war tribute of 20,000 talents in 84 BC. Charges for back interest multiplied this sum six-fold by 70 BC. Among Rome's leading historians, Livy, Plutarch and Diodorus blamed the fall of the Republic on creditor intransigence in waging the century-long Social War marked by political murder from 133 to 29 BC. Populist leaders sought to gain a following by advocating debt cancellations (e.g., the Catiline conspiracy in 63-62 BC). They were killed. By the second century AD about a quarter of the population was reduced to bondage. By the fifth century Rome's economy collapsed, stripped of money. Subsistence life reverted to the countryside. Creditors find a legalistic reason to support parliamentary democracy When banking recovered after the Crusades looted Byzantium and infused silver and gold to review Western European commerce, Christian opposition to charging interest was overcome by the combination of prestigious lenders (the Knights Templars and Hospitallers providing credit during the Crusades) and their major clients – kings, at first to pay the Church and increasingly to wage war. But royal debts went bad when kings died. The Bardi and Peruzzi went bankrupt in 1345 when Edward III repudiated his war debts. Banking families lost more on loans to the Habsburg and Bourbon despots on the thrones of Spain, Austria and France. Matters changed with the Dutch democracy, seeking to win and secure its liberty from Habsburg Spain. The fact that their parliament was to contract permanent public debts on behalf of the state enabled the Low Countries to raise loans to employ mercenaries in an epoch when money and credit were the sinews of war. Access to credit "was accordingly their most powerful weapon in the struggle for their freedom," Richard Ehrenberg wrote in his Capital and Finance in the Age of the Renaissance (1928): "Anyone who gave credit to a prince knew that the repayment of the debt depended only on his debtor's capacity and will to pay. The case was very different for the cities, which had power as overlords, but were also corporations, associations of individuals held in common bond. According to the generally accepted law each individual burgher was liable for the debts of the city both with his person and his property." The financial achievement of parliamentary government was thus to establish debts that were not merely the personal obligations of princes, but were truly public and binding regardless of who occupied the throne. This is why the first two democratic nations, the Netherlands and Britain after its 1688 revolution, developed the most active capital markets and proceeded to become leading military powers. What is ironic is that it was the need for war financing that promoted democracy, forming a symbiotic trinity between war making, credit and parliamentary democracy which has lasted to this day. At this time "the legal position of the King qua borrower was obscure, and it was still doubtful whether his creditors had any remedy against him in case of default." (Charles Wilson, England's Apprenticeship: 1603-1763: 1965.) The more despotic Spain, Austria and France became, the greater the difficulty they found in financing their military adventures. By the end of the eighteenth century Austria was left "without credit, and consequently without much debt," the least credit-worthy and worst armed country in Europe, fully dependent on British subsidies and loan guarantees by the time of the Napoleonic Wars. Finance accommodates itself to democracy, but then pushes for oligarchy While the nineteenth century's democratic reforms reduced the power of landed aristocracies to control parliaments, bankers moved flexibly to achieve a symbiotic relationship with nearly every form of government. In France, followers of Saint-Simon promoted the idea of banks acting like mutual funds, extending credit against equity shares in profit. The German state made an alliance with large banking and heavy industry. Marx wrote optimistically about how socialism would make finance productive rather than parasitic. In the United States, regulation of public utilities went hand in hand with guaranteed returns. In China, Sun-Yat-Sen wrote in 1922: "I intend to make all the national industries of China into a Great Trust owned by the Chinese people, and financed with international capital for mutual benefit."

A similar creditor-oriented austerity is now being imposed on Europe by the European Central Bank (ECB) and EU bureaucracy. Ostensibly social democratic governments have been directed to save the banks rather than reviving economic growth and employment. Losses on bad bank loans and speculations are taken onto the public balance sheet while scaling back public spending and even selling off infrastructure. The response of taxpayers stuck with the resulting debt has been to mount popular protests starting in Iceland and Latvia in January 2009, and more widespread demonstrations in Greece and Spain this autumn to protest their governments' refusal to hold referendums on these fateful bailouts of foreign bondholders. Shifting planning away from elected public representatives to bankers Every economy is planned. This traditionally has been the function of government. Relinquishing this role under the slogan of "free markets" leaves it in the hands of banks. Yet the planning privilege of credit creation and allocation turns out to be even more centralized than that of elected public officials. And to make matters worse, the financial time frame is short-term hit-and-run, ending up as asset stripping. By seeking their own gains, the banks tend to destroy the economy. The surplus ends up being consumed by interest and other financial charges, leaving no revenue for new capital investment or basic social spending. This is why relinquishing policy control to a creditor class rarely has gone together with economic growth and rising living standards. The tendency for debts to grow faster than the population's ability to pay has been a basic constant throughout all recorded history. Debts mount up exponentially, absorbing the surplus and reducing much of the population to the equivalent of debt peonage. To restore economic balance, antiquity's cry for debt cancellation sought what the Bronze Age Near East achieved by royal fiat: to cancel the overgrowth of debts. In more modern times, democracies have urged a strong state to tax rentier income and wealth, and when called for, to write down debts. This is done most readily when the state itself creates money and credit. It is done least easily when banks translate their gains into political power. When banks are permitted to be self-regulating and given veto power over government regulators, the economy is distorted to permit creditors to indulge in the speculative gambles and outright fraud that have marked the past decade. The fall of the Roman Empire demonstrates what happens when creditor demands are unchecked. Under these conditions the alternative to government planning and regulation of the financial sector becomes a road to debt peonage. Finance vs. government; oligarchy vs. democracy Democracy involves subordinating financial dynamics to serve economic balance and growth – and taxing rentier income or keeping basic monopolies in the public domain. Untaxing or privatizing property income "frees" it to be pledged to the banks, to be capitalized into larger loans. Financed by debt leveraging, asset-price inflation increases rentier wealth while indebting the economy at large. The economy shrinks, falling into negative equity. The financial sector has gained sufficient influence to use such emergencies as an opportunity to convince governments that the economy will collapse they it do not "save the banks." In practice this means consolidating their control over policy, which they use in ways that further polarize economies. The basic model is what occurred in ancient Rome, moving from democracy to oligarchy. In fact, giving priority to bankers and leaving economic planning to be dictated by the EU, ECB and IMF threatens to strip the nation-state of the power to coin or print money and levy taxes. The resulting conflict is pitting financial interests against national self-determination. The idea of an independent central bank being "the hallmark of democracy" is a euphemism for relinquishing the most important policy decision – the ability to create money and credit – to the financial sector. Rather than leaving the policy choice to popular referendums, the rescue of banks organized by the EU and ECB now represents the largest category of rising national debt. The private bank debts taken onto government balance sheets in Ireland and Greece have been turned into taxpayer obligations. The same is true for America's $13 trillion added since September 2008 (including $5.3 trillion in Fannie Mae and Freddie Mac bad mortgages taken onto the government's balance sheet, and $2 trillion of Federal Reserve "cash-for-trash" swaps). This is being dictated by financial proxies euphemized as technocrats. Designated by creditor lobbyists, their role is to calculate just how much unemployment and depression is needed to squeeze out a surplus to pay creditors for debts now on the books. What makes this calculation self-defeating is the fact that economic shrinkage – debt deflation – makes the debt burden even more unpayable. Neither banks nor public authorities (or mainstream academics, for that matter) calculated the economy's realistic ability to pay – that is, to pay without shrinking the economy. Through their media and think tanks, they have convinced populations that the way to get rich most rapidly is to borrow money to buy real estate, stocks and bonds rising in price – being inflated by bank credit – and to reverse the past century's progressive taxation of wealth. To put matters bluntly, the result has been junk economics. Its aim is to disable public checks and balances, shifting planning power into the hands of high finance on the claim that this is more efficient than public regulation. Government planning and taxation is accused of being "the road to serfdom," as if "free markets" controlled by bankers given leeway to act recklessly is not planned by special interests in ways that are oligarchic, not democratic. Governments are told to pay bailout debts taken on not to defend countries in military warfare as in times past, but to benefit the wealthiest layer of the population by shifting its losses onto taxpayers. The failure to take the wishes of voters into consideration leaves the resulting national debts on shaky ground politically and even legally. Debts imposed by fiat, by governments or foreign financial agencies in the face of strong popular opposition may be as tenuous as those of the Habsburgs and other despots in past epochs. Lacking popular validation, they may die with the regime that contracted them. New governments may act democratically to subordinate the banking and financial sector to serve the economy, not the other way around. At the very least, they may seek to pay by re-introducing progressive taxation of wealth and income, shifting the fiscal burden onto rentier wealth and property. Re-regulation of banking and providing a public option for credit and banking services would renew the social democratic program that seemed well underway a century ago. Iceland and Argentina are most recent examples, but one may look back to the moratorium on Inter-Ally arms debts and German reparations in 1931.A basic mathematical as well as political principle is at work: Debts that can't be paid, won't be. This article appears in the Frankfurter Algemeine Zeitung on December 5, 2011. MICHAEL HUDSON is a former Wall Street economist. A Distinguished Research Professor at University of Missouri, Kansas City (UMKC), he is the author of many books, including Super Imperialism: The Economic Strategy of American Empire (new ed., Pluto Press, 2002) and Trade, Development and Foreign Debt: A History of Theories of Polarization v. Convergence in the World Economy. He can be reached via his website, michael-hudson.com |

| No, Dylan Grice Did Not Say Germany's Unwillingness To Print May Lead To The Rise Of Another Hitler Posted: 04 Dec 2011 07:13 AM PST A few weeks ago, SocGen's Dylan Grice released a piece which quickly became a scathing focal point in the inflation-deflation debate, in that he speculated that it was not the Weimar-unleashed hyperinflation (which incidentally is the primary reason why most Germany now dread what the outcome of a profligate ECB would look like) that led to the surge of the Nazi party, but in fact the opposite: the stinginess of German monetary authorities in the 1930s that further exacerbated the situation and helped unleash the Hitler juggernaut. Many promptly took sides in the argument, the bulk of which were shocked that Grice - traditionally a defender of prudent monetary and fiscal policy, would go so far as suggest that it is the ECB's duty to print or else it may justify another "Hitler"-type advent. Well it seems there was more than meets the eye, and in a follow up piece the strategist says: "The purpose of the historical analysis, therefore, was not to reach conclusions about how adherence to hard money principles will linearly lead to resurgent fascism, or war on a par with that seen in the 1930s. Neither was it in any way a defence of Keynesian fiscal activism. It was to illustrate that adherence to even the best principles must come at a price, making a judgment on whether or not that price is prohibitive or not is unavoidable, and today Germany and the ECB have to make that judgment." And his conclusion: "From the beginning of this crisis I've believed the only way politicians will get ahead of it is to bring in the ECB. Since I believe politicians do want to get ahead of it, I expect the ECB to print, and print copiously. I've repeatedly emphasized that printing will solve nothing, beyond buying market confidence for a while... All ECB printing will do is buy the politicians time and space to reset government and private sector balance sheets, to reform how their economies function and be honest with their own citizens. Whether they use that time or not is a separate question (frankly, I'm not hopeful)." But instead of us putting words in Grice's mouth, here is the explanation straight from the horse's mouth. Incidentally we agree 100% with Grice on the issue that eventual printing is inevitable. Which for the TLDR crowd means the entire Grice missive can be summarized as follows: 'buy gold.' From Dylan Grice: My point was that there is always a price. Today, the price of Germany and the ECB holding on to their hard money principles is a possible break-up of the single currency. But both have signalled that they won't pay that price ("if the euro fails, Europe fails"). So my conclusion was that since Germany's stance is logically inconsistent (it wants to hold onto its principles but it doesn't want to pay the price), it will ultimately be forced to choose. My prediction was that it will sacrifice its principles. The three broad criticisms I got from readers were:

Let's go through each one in turn. Complaint #1: Grice's history is disgraceful and wrong One common response to my thesis was that "fear of inflation" had nothing to do with Germany's decision not to devalue. In fact, the key factor was the foreign debt Germany owed to the Allies. A number of you replied with this criticism, but the following was my favourite.

Fanmail, eh?! To be fair to Irate Reader 1, foreign debt was an issue. According to Adam Tooze [See "Wages of Destruction: the Making and Breaking of the Nazi Economy" by Adam Tooze], then American President Herbert Hoover was leaning very heavily on Germany not to devalue because he was concerned about the value of American loans to Germany. But to say the Allies were setting German policy is quite an exaggeration. According to Tooze, the UK was very keen on Germany following its policy of devalution, while the French were offering them cheap refinancing credit. Keeping America onside was deemed by Germany - rightly or wrongly - to be in Germany's best interests. Of course, the logic that said Germany couldn't devalue because devaluation would merely lead to an increase in the real debt burden is flawed, because the alternative policy of deflation also leads to an increase in the real debt burden (because the debt was denominated in gold). What Germany needed then, as various countries in the eurozone need today, was to default, plain and simple. So if Irate Reader 1 and those who made the same point are correct, the parallel with today is ironically even more acute. Then it was the US forcing an overindebted country into depression rather than allowing it to default; today Germany is doing the same thing. But as it happens, it's just not correct to claim that fear of inflation had nothing to do with Germany's decision to deflate rather than devalue. According to a speech given by then Reichbank president Hans Luther in September 1931:

At the same event, then-Chancellor Bruning said:

If that's not fear of inflation driving a deflationary policy, I'm not sure what is. As for the charge that my observations were Germanophobic ? I think that implies that I'm blaming Germany for their depression, or even for what followed. But I wasn't (and I don't as it happens). I'm not interested in blaming anyone for what happened. Sometimes things just happen. I am just trying to understand why and how. Complaint #2: Grice's history is simplistic Another common complaint was that I wasn't doing justice to an historical event with complex causes. One client wrote:

But I thought it was best summarized by a reader's comment on the write-up of my original piece on the FT's excellent Alphaville site:

Shamanism?! I actually looked up shamanism in the dictionary and found it had something to do with the American-Indian religion. I think he meant charlatanism. Anyway, these readers were frustrated that my treatment did not do justice to a highly complex phenomenon. Why was I so sure unemployment was the decisive factor behind the Nazi rise, as suggested in the chart below? If professional historians who have devoted their entire careers to the study of Hitler's rise to power cannot agree, how can a four-page investment strategy report? And anyway I wasn't attempting to provide the definitive answer. The fact is we don't know and we probably won't ever know, because we can't ever know what the single major cause was, or even if there was a single major cause. That's why I wrote.

But what seems obvious to me is that the misery caused by yet another German economic crisis combined with uniquely German circumstances (e.g. the humiliation at Versailles, a 15 year decline in living standards, a calling into question of the liberal economic doctrine of boundless growth) drove demand for a new belief system capable of explaining the world around them. So I find it highly implausible to say that the depression - which I proxied with the unemployment rate - had nothing to do with that demand, and that it was merely coincidental to political radicalism. If we accept that the depression was one factor, it follows that anything weakening the intensity of that depression would have lowered the probability of the Nazis gaining power. And if we accept that an inflationary policy would have mitigated the intensity of the depression, the thought experiment and any logical conclusions derived from it seem perfectly valid to me. Complaint #3: Grice is a hypocrite calling on the ECB to print This was actually a slightly puzzling one for me, as I thought I'd made my position clear. But I couldn't have been because quite a few of you raised the same objection. As (another) irate client wrote:

Or another good one from the Alphaville readers' comments

This is not what I said. I argued only that Germany's principled stance exacerbated its depression and served the Hitlerite cause. If we all agree that serving the Hitlerite cause was a bad thing, then we presumably also agree that a willingness to compromise its principles would have been a better thing. I found this not only interesting, but challenging too, because the corollary is that there is no such thing as an unbendable principle. This might be an uncomfortable observation, but that doesn't make it false. If a principle is unbendable it ceases to be a principle. It instead becomes a rule. And I agree with Doug Bader, the British WW2 fighter pilot, who said "rules are for the obedience of fools and the guidance of wise men." The purpose of the historical analysis, therefore, was not to reach conclusions about how adherence to hard money principles will linearly lead to resurgent fascism, or war on a par with that seen in the 1930s. Neither was it in any way a defence of Keynesian fiscal activism. It was to illustrate that adherence to even the best principles must come at a price, making a judgment on whether or not that price is prohibitive or not is unavoidable, and today Germany and the ECB have to make that judgment. I categorically did not recommend that the ECB or Germany go down the printing path. What I actually wrote on page 4 was this.

As a general principle, I don't make policy prescriptions. I don't believe my view on what should be done is particularly relevant to investors. The world is full of opinions about how the world should work, and how it should be run. Does it really need another one? I don't think it does, but to bend a principle (!) for the sake of clarity, here's what I think should happen. I think the ECB shouldn't get involved. I think it shouldn't sanction any ECB funding of the ESFS either. I think it should tell governments who made this mess that they can fix it. It should say, "If you want a central bank that prints money when things get tough go and launch your own currency using your own central bank and print until your hearts are content." But then, I'm not emotionally attached to the euro, or Germany's popularity in Europe. And I think the ECB and Germany's politicians are. Nor is this a new idea on these pages. It is a position we've taken since the crisis broke. On 27 May 2010, after the very attempt to ring-fence the peripheral eurozone economies, I wrote a piece called "Print baby print" in which I said the following:

From the beginning of this crisis I've believed the only way politicians will get ahead of it is to bring in the ECB. Since I believe politicians do want to get ahead of it, I expect the ECB to print, and print copiously. I've repeatedly emphasized that printing will solve nothing, beyond buying market confidence for a while. Ultimately, I believe the eurozone's structural problem is its government-heavy, over-regulated, anti-entrepreneurial welfare model which I believe is broken. In client discussions I've drawn the parallel between today's uncompetitive eurozone, with the unrealistic social promises it has made to future generations, and Detroit. All ECB printing will do is buy the politicians time and space to reset government and private sector balance sheets, to reform how their economies function and be honest with their own citizens. Whether they use that time or not is a separate question (frankly, I'm not hopeful). |

| Guest Post: It's Your Choice, Europe: Rebel Against the Banks or Accept Debt-Serfdom Posted: 04 Dec 2011 06:35 AM PST Submitted by Charles Hugh Smith from Of Two Minds It's Your Choice, Europe: Rebel Against the Banks or Accept Debt-Serfdom The European debt Bubble has burst, and the repricing of risk and debt cannot be put back in the bottle. It's really this simple, Europe: either rebel against the banks or accept decades of debt-serfdom. All the millions of words published about the European debt crisis can be distilled down a handful of simple dynamics. Once we understand those, then the choice between resistance and debt-serfdom is revealed as the only choice: the rest of the "options" are illusory. 1. The euro enabled a short-lived but extremely attractive fantasy: the more productive northern EU economies could mint profits in two ways: A) sell their goods and services to their less productive southern neighbors in quantity because these neighbors were now able to borrow vast sums of money at low (i.e. near-"German") rates of interest, and B) loan these consumer nations these vast sums of money with stupendous leverage, i.e. 1 euro in capital supports 26 euros of lending/debt. The less productive nations also had a very attractive fantasy: that their present level of productivity (that is, the output of goods and services created by their economies) could be leveraged up via low-interest debt to support a much higher level of consumption and malinvestment in things like villas and luxury autos. According to Europe's Currency Road to Nowhere (WSJ.com):

Flush with profits from exports and loans, Germany and its mercantilist (exporting nations) also ramped up their own borrowing--why not, when growth was so strong? But the whole set-up was a doomed financial fantasy. The euro seemed to be magic: it enabled importing nations to buy more and borrow more, while also enabling exporting nations to reap immense profits from rising exports and lending. Put another way: risk and debt were both massively mispriced by the illusion that the endless growth of debt-based consumption could continue forever. The euro was in a sense a scam that served the interests of everyone involved: with risk considered near-zero, interest rates were near-zero, too, and more debt could be leveraged from a small base of productivity and capital. But now reality has repriced risk and debt, and the clueless leadership of the EU is attempting to put the genie back in the bottle. Alas, the debt loads are too crushing, and the productivity too weak, to support the fantasy of zero risk and low rates of return. The Credit Bubble Bulletin's Doug Nolan summarized the reality succinctly: "The European debt Bubble has burst." Nolan explains the basic mechanisms thusly: The Mythical "Great Moderation":

In simple terms, this is the stark reality: now that debt and risk have been repriced, Europe's debts are completely, totally unpayable. There is no way to keep adding to the Matterhorn of debt at the old cheap rate of interest, and there is no way to roll over the trillions of euros in debt that are coming due at the old near-zero rates. Never mind actually paying down debt, sovereign, corporate and private--the repricing of risk and debt mean even the interest payments are unpayable. Consider this chart of one tiny slice of total EU debt:

There is no way to push the repricing genie back in the bottle, and so there is no way to roll over this debt and add to it--and to support the high-cost structure of Euroland's welfare-state governments and their astounding debt, then debt must be added, and in staggering quantities. Austerity won't put the repricing/bubble burst genie back in the bottle. A funny thing happens when more of the national income is diverted to debt service (making interest payments and rolling over existing debt into new higher-interest debt): there is less surplus available for investment and consumption, which means that both productivity based on investment and consumption based on debt will plummet. This leaves the nation with lower productivity and lower GDP, which means there is also less tax revenues being collected and more bankruptcies as companies and individuals accept the reality that their debts cannot be paid. The repricing genie responds to this decline in national income, surplus and taxes by repricing risk of default even higher, and so the interest rate is also repriced higher. This makes servicing the mountain of existing debt even more costly, and so even less national income is available for consumption, investment and taxes. This is called a positive feedback loop: each action reinforces the other, i.e. a self-reinforcing feedback loop. Debt and risk are repriced higher, the burden of debt service reduces national income available for investment, consumption and taxes, which further reprices risk higher, and so on. So you see, Europe, there is only one choice: either accept the endless debt serfdom of ever-rising interest payments and lower income and productivity, or rebel against your pathetic lackey leadership and renounce the entire mountain of unpayable debt. Grasp the nettle and renounce the euro as the fundamental cause of your fantasy and collapse, and revert to national currencies which enable the market to discover the price of your underlying productivity and ability to borrow money. Renouncing the euro does not mean renouncing the freedoms of the European Union: the two are only bound at the hip in the minds of your enfeebled leadership, who are in thrall to the leveraged-26-to-1 banks that are poised on the edge of insolvency. Let the banks implode in bankruptcy, clear the worthless "assets" of debt from the books, and let the market price currencies and everything else. The only other choice is debt-serfdom. All the other schemes and proposals are simply variations of one single fantasy: that the feckless leadership can fool the repricing genie with parlor tricks. They can't. Everybody with any understanding of the situation knows that the debt bubble has already burst, and risk and debt cannot be repriced back to fantasy levels. That repricing has already occurred, and cannot be revoked or shoved back in the bottle. The Great European Debt Bubble has already burst, and so now it boils down to a simple choice: debt serfom or open rebellion against the banks that profited so handsomely from the euro-fantasy. There is no middle ground, as the debt cannot be repaid, not now and not in the future. It cannot be reshuffled, masked, or hidden; it can only be renounced. It's your choice, Europe; choose wisely. If you want a model for sanity and growth, look to Iceland. They renounced their unpayable debts and debt-serfdom, and let the market reprice their currency, debt and risk. The nightmare is past for them; they chose wisely. Now it's your turn to choose. The debt-serfdom will fall to you, not the banks or your Elites. |

| Guest Post: A Twenty Something Speaks Posted: 04 Dec 2011 04:28 AM PST Guest Post: A Twenty Something Speaks By Steak

(As much as anyone else, I am guilty of complaining that "the younger generation" is absent from the developing collapse dialogue. More than once I have said that if permanent change is to be made, first the young must become involved, then change needs to be embraced by the average Jane and Joe. But when the young raise their voices in anger or protest, such as the On Wall Street contingent, my tendency is to complain about the methods they use or the process they follow. This is patently unfair of me and hypocritical to boot. With this thought in mind I present the following from Steak, a ZH Veteran by any measure with more time in than me, who many know from the playlists he drops into the comment section from time to time. Please take a few moments and read what he has to say.) Cognitive Dissonance 12/04/2011

To my peers: Being born in 1984 offers a special perspective on where society is at present, as well as where it might be going. We are digital natives who also remember the old ways. Our first years of elementary school were characterized by paper encyclopedias, library card filing systems, and Apple II computers. We reached our teenage years just in time for AOL Instant Messenger to become a dominant force in our social lives, and we weren't just pioneers on Facebook, we were on THE Facebook. Having a foot planted on each side of distinct historical eras defines us. While the question of generational divides along technological lines is a commonly explored theme, the great divide unique to us is economic. Those before us only knew and only expect an ever increasing level of prosperity. Those after us only know the turmoil of collapse. The older ones are attached to a world that never truly existed, and the younger ones have trouble imagining any sort of better world. All the while we children of 1983/84 grew up in the last parabolic push of the most prosperous era in human history. It was enough that we can remember in vivid detail how it was, but it did not last so long in our lives that we have some fundamental expectation for it to persist. At least where I grew up, the idyllic childhood in the bubble years was disrupted by a sign that perhaps things were worse than appeared on the surface. Around the time my cohort was starting middle school, many of us had new kids in our classes. Atlanta being a popular place for refugee resettlement, in the mid 90's there was a wave of immigrants from the former Soviet republics. We gave them shit as 'ruskies' and 'commies', but they came along early enough that by high school we were all just part of the same groups. They were hard, all of them. Where they came from there was hunger, deeply ingrained organized crime, and ethnic hatreds. Their parents were PhDs who had to work for the mafia just to make ends meet. There was a deep appreciation on their part that America was a place, still in those last few years, where if one followed the rules there was a shot at a comfortable life. It all seemed so dramatic. We were just kids, and those were stories from distant lands. We didn't know they were describing the violence of collapse. They didn't know they were only the first victims of a wave that would follow them here and one day sweep the world. Looking back, those things are clear both to us and to them. Being born 1983/84 put us in a unique position on the day of the inflection point of our time. By September 2001 we were seniors in high school and all around 18. Sure there was talk about how the government would respond, but on that day and in the following months the real question was how WE would respond. Go to college or go to war? In May of 2002 Eminem spoke directly to us when he said:

Fuckin' assassins hijackin' Amtracks crashing, All this terror America demands action, Next thing you know you've got Uncle Sam's ass askin' To join the army or what you'll do for there Navy. You just a baby, Gettin' recruited at eighteen, You're on a plane now, Eating their food and their baked beans. I'm 28, They gonna take you 'fore they take me