saveyourassetsfirst3 |

- Direxion's 2x ETFs Becoming 3x ETFs

- Family Dollar Is Fairly Valued At Present Levels

- 2 Buys For A Down Market

- Faber: No Free Markets, Just Government Manipulation

- JP Morgan Converts MF Global Silver Into JPM Vaults

- Eurozone Being Swallowed by Expanding Debt Black Holes

- The Eurozone Has 10 Days At Most

- Gold: How To Avoid Getting Ripped Off

- Fed to Intervene in Europe?

- Euro zone weighs tighter fiscal ties

- More ‘Black Friday’ B.S.

- The Fear Index continues its relentless rise

- Venezuela Repatriates ‘People’s Gold’ Due to Gold’s ‘Historic’, ‘Symbolic’ …

- Gold to Profit from Economic Uncertainty

- Should the Fed Save Europe From Disaster?

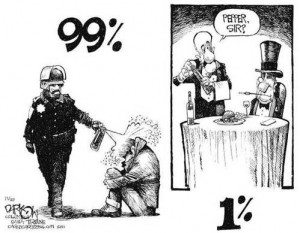

- No Laws Were Broken

- WATCH: Abrupt Economic Collapse

- Contingency Planning for Extreme Scenarios

- Gold may hit $3,000 if US devalues dollar

- RISK ON: Stocks are surging on euro bailout news this morning

- Worlds most expensive model car made of gold and platinum

- This year could have been the most violent "Black Friday" in history

- Australian gold production falls

- Links 11/28/11

- Thanks For Giving Us Cheap Gold And Silver

- World’s most expensive model car made of gold and platinum

- New gold bugs are young and restless

- John Williams: Hyperinflation Warning, Preserve Value with Gold

- Make-Or-Break Week For Europe

- Is This December Similar to 2007 and 2008 for Gold and Stocks?

| Direxion's 2x ETFs Becoming 3x ETFs Posted: 28 Nov 2011 07:06 AM PST By Michael Johnston: Direxion, one of the largest issuers of leveraged exchange-traded funds, will make significant changes to ten of its products next week. The Direxion ETFs currently offering 2x and -2x exposure to their underlying index will begin seeking to deliver daily results that correspond to 3x or -3x of the related benchmark. That change will obviously increase the volatility of these products, and will also have an impact on margin requirements for investors with positions in these funds. The changes affect five pairs of products, including leveraged ETFs focusing on BRIC stocks, Indian equities, gold miners, natural gas firms, and retail companies:

Complete Story » | |||||||||||||||

| Family Dollar Is Fairly Valued At Present Levels Posted: 28 Nov 2011 06:27 AM PST By Valuentum: As part of our process, we perform a rigorous discounted cash-flow methodology that dives into the true intrinsic worth of companies. In Family Dollar's (FDO) case, we think the firm is fairly valued at $53 per share, with the stock trading slightly higher than these levels. For some background, we think a comprehensive analysis of a firm's discounted cash-flow valuation, relative valuation versus industry peers, as well as an assessment of technical and momentum indicators is the best way to identify the most attractive stocks at the best time to buy. This process culminates in what we call our Valuentum Buying Index (click here for more info on our methodology), which ranks stocks on a scale from 1 to 10, with 10 being the best. If a company is undervalued both on a DCF and on a relative valuation basis and is showing improvement in technical and momentum indicators, it Complete Story » | |||||||||||||||

| Posted: 28 Nov 2011 06:03 AM PST By Michael Bryant: We may be near or at a temporary bottom in the market, which may present a good buying opportunity. The two-year graph of the S&P 500 (SPY) shows that technical indicators are flashing buy signals. (Click charts to expand) Plus, the euro seems to be near or at a temporary bottom. That is good for stocks, since they generally rise as the dollar falls against the euro. Historically, December is the third best month of the year for stocks, after November and April. Plus, euro rescue proposals and a bright start to the U.S. shopping season may boost stocks. Two interesting buys are Majestic Silver (AG) and Chesapeake Energy (CHK). First Majestic Silver is a low-cost silver miner that mines entirely in Mexico. I did an interview with the CEO here. Based on 2009 figures, the company produced silver at a cost of Complete Story » | |||||||||||||||

| Faber: No Free Markets, Just Government Manipulation Posted: 28 Nov 2011 05:43 AM PST from King World News:

With stock rallying globally, along with gold and silver, today King World News interviewed legendary investor Marc Faber, author of the Gloom Boom and Doom Report. Faber told KWN governments now control the global markets, "I really think that it's very difficult to forecast perfect markets. A perfect market is when you have a market where no participant has a controlling influence on the market. We no longer have free markets, we have manipulated markets by governments through monetary and fiscal policies." Read More Continue reading @ KingWorldNews.com | |||||||||||||||

| JP Morgan Converts MF Global Silver Into JPM Vaults Posted: 28 Nov 2011 05:41 AM PST

Blythe just tried to sneak a massive 613,738 ounce silver adjustment past the market this afternoon on one of the thinnest trading days of the year, but The Doc's all over it like white on rice- and WAIT TILL YOU SEE WHERE THE RABBIT TRAIL THE DOC JUST RAN DOWN LEADS! The Morgue adjusted 613,738 ounces of silver from eligible vaults into REGISTERED vaults on Wednesday! Not to be beaten, Scotia topped its 1.2 M oz deposit reported Wednesday, by receiving a massive deposit of 2,395,835 ounces! Rather coincidental seeing Brink's had a nearly identical withdrawal Tuesday of 2,346,587 ounces! Read More @ SilverDoctors | |||||||||||||||

| Eurozone Being Swallowed by Expanding Debt Black Holes Posted: 28 Nov 2011 05:36 AM PST Eurozone Being Swallowed by Expanding Debt Black Holes by Nadeem Walayat, MarketOracle.co.uk:

The stock markets plunged last week and euro-zone bond market volatility increased with PIIGS yields spiking to new Euro highs as pressure mounts on the ECB to start printing money to monetize bankrupting PIIGS debt that effectively act as expanding debt black holes that threaten to swallow first the whole of Eurozone and soon after collapse the worlds financial system. The pressure cooker reached a new extreme with the apparent shock of the FAILURE of a German Bund auction as the eurozone debt crisis contagion appeared to have spread to Germany as it experienced its worst bond auction since the launch of the Euro in failing to sell some 2/3rds of a routine auction which the mainstream press took as evidence of the flight of capital from the euro-zone accelerating on risks of announcements for a Euro-bond and the start of inevitable money printing of several trillions of euros as I have warned of several times over the year as being inevitable, where the longer the delay will result in more desperate actions. | |||||||||||||||

| The Eurozone Has 10 Days At Most Posted: 28 Nov 2011 05:31 AM PST Wolfgang Münchau: The Eurozone Has 10 Days At Most by Joe Weisenthal, BusinessInsider.com:

If you're looking for some good Euro-scare meat, look no further than this column from the FT's Wolfgang Münchau. The basic gist: No really, now we're getting into endgame. Why now? Because the increase in core yields, the failure of that German bund auction, and the increase in Spanish and Italian short-term yields, as well as the tightening of money for the banks, means it's all almost over unless Europe immediately cooks up some kind of ECB-backed/Eurobond/fiscal union concoction. I am hearing that there are exploratory talks about a compromise package comprising those three elements. If the European summit could reach a deal on December 9, its next scheduled meeting, the eurozone will survive. If not, it risks a violent collapse. Even then, there is still a risk of a long recession, possibly a depression. So even if the European Council was able to agree on such an improbably ambitious agenda, its leaders would have to continue to outdo themselves for months and years to come. Read More @ BusinessInsider.com | |||||||||||||||

| Gold: How To Avoid Getting Ripped Off Posted: 28 Nov 2011 05:26 AM PST Gold Buyers Guide: How To Avoid Getting Ripped Off by Peter Schiff, EuroPac.net via GoldSeek.com:

Below is a summary of my 15-page special report, "Classic Gold Scams and How to Avoid Getting Ripped Off." If you'd like to learn more and receive a free download of the full report, go towww.goldscams.com. I've always advocated that investors hold at least 5-10% of their portfolios in physical precious metals. With major Western nations now defaulting on their debts, more and more investors have decided it's time to take my advice and own an asset that doesn't depend on the solvency of an ETF, bank, or government. Unfortunately, with all these news buyers in the gold market, there is ample opportunity for dishonest firms with big advertising budgets and celebrity endorsements to make a quick buck. If you are thinking of buying gold or silver for investment, diversification, or asset protection reasons, this quick guide will help you avoid common scams and pitfalls. Read More @ GoldSeek.com | |||||||||||||||

| Posted: 28 Nov 2011 05:20 AM PST from GoldMoney.com:

The vast majority of politicians, bankers, academics and financial analysts are all in favour of the ECB increasing its money-printing effort – with the Germans routinely castigated as "sado-fiscalists" and "neo-Calvinists" for daring to have reservations about this – and we are moving closer to some sort of effort to "paper over" the eurozone debt crisis. This is literally the only way the "show can be kept on the road", as further sovereign debt defaults in Europe – inevitable without some increased form of debt monetisation – will cause serious damage to Europe's overleveraged and undercapitalised banks. Bank failures in Europe would then spread to America and the rest of the world. It's not overly dramatic to say that the entire world financial system could collapse as a result of chaotic sovereign debt defaults in the eurozone's periphery. Read More @ GoldMoney.com | |||||||||||||||

| Euro zone weighs tighter fiscal ties Posted: 28 Nov 2011 05:00 AM PST Indications that European officials were making progress toward tighter fiscal integration and other steps to address the region's long-running debt crisis triggered a rebound in risk appetite Monday, lifting global equities and sinking the U.S. dollar. The Wall Street Journal reported that euro-zone leaders were discussing a pact that would make fiscal rules legally binding and would allow European authorities to enforce budget discipline... Read | |||||||||||||||

| Posted: 28 Nov 2011 04:27 AM PST U.S. Thanksgiving has become a highly ritualized holiday with a large segment of the American population. Eat turkey. Watch football. Go shopping. And then listen to the media lie about the shopping the next day. In this respect, Thanksgiving 2011 was a carbon-copy of the last several years. Turkeys have again (briefly) become an "endangered species" in the U.S., and (so-called) "Black Friday" was another crushing economic disappointment. Those who have only heard the hype from the mainstream media may be somewhat confused by this prognosis, so let's dive into the data. "Black Friday sales rise 6.6% to record," gushed Bloomberg. Sounds impressive! Or does it? It seems those tricky little scamps at Bloomberg left out one thing in their calculation: the word "inflation". Literally left it out. Bloomberg wrote an entire article comparing last year's shopping with this year's shopping without even once mentioning the word "inflation". This is not some innocent oversight. As I remind readers again and again, comparing dollar-figure numbers without adjusting for inflation is utterly meaningless. It is comparing "apples" to "oranges". Whether one is reporting retail sales or GDP figures, the only way to engage in credible analysis is to adjust for inflation in order to compare data in constant dollars. Indeed, GDP data is exclusively reported using (supposedly) inflation-adjusted dollars. It is universally understood that failing to "deflate" GDP figures by the prevailing rate of inflation means that the statistic no longer reports "economic growth". It merely indicates the rate of inflation. And so it is with Black Friday 2011. When seeking reliable data for U.S. inflation, regular readers know there is only one place to go: to John Williams of Shadowstats.com. We know this is the most reliable inflation data available for one very simple reason. John Williams calculates his inflation statistics the same way they were calculated a generation ago. Conversely, the U.S. government has "massaged" its inflation calculation so extremely over the past 25 years that it is no longer even recognizable in relation to older calculations. Again we have a deliberate attempt to deceive. If the U.S. government genuinely believed it had come up with "a better inflation calculation", then all it had to do was plug the old data into the new formula, and then all the inflation data would be consistent. In deliberately refusing to provide consistent inflation data, the U.S. government has been doing with its inflation data what Bloomberg just did with its Black Friday reporting: intentionally leaving out a simple calculation in order to produce data which would provide a meaningful comparison. Since Bloomberg refused to do this, I'll take the liberty of doing it for them. Shadowstats watchers know that U.S. inflation has been hovering close to 10% all this year. Therefore, to engage in a meaningful comparison of Black Friday 2011 with Black Friday 2010, we simply need to subtract the (approximate) 10% from 6.6%. We immediately see that the large, positive number which Bloomberg was trumpeting has now turned into a negative number. What does that mean? Simple. It means Americans bought fewer goods than a year ago rather than more goods. By converting the dollar-figures into constant numbers, when we observe that Americans spent more than 3% less than last year (in "real dollars"), this directly translates into more than 3% less goods purchased. It was at this point that Bloomberg went from merely dishonest to comedic: "…shoppers paid more for goods and unleashed some pent-up demand." Well they certainly paid more for goods, but precisely how does buying 3% less goods "release pent-up demand", let alone reduce bloated inventories? | |||||||||||||||

| The Fear Index continues its relentless rise Posted: 28 Nov 2011 02:15 AM PST October was in the end a flat month for the price of gold, which oscillated between its major resistance level above $1,800 per troy ounce and strong support around $1,650. Nevertheless the Fear ... | |||||||||||||||

| Venezuela Repatriates ‘People’s Gold’ Due to Gold’s ‘Historic’, ‘Symbolic’ … Posted: 28 Nov 2011 01:17 AM PST | |||||||||||||||

| Gold to Profit from Economic Uncertainty Posted: 28 Nov 2011 12:46 AM PST by The Gold Report and Clive Maund, GoldSeek.com:

The mountains of debt engulfing Western economies is likely to lead to hyperinflation according to Clive Maund, president of clivemaund.com. In this exclusive interview with The Gold Report, Maund details the scenario he sees for collapse. The Gold Report: Clive, on clivemaund.com you said "for fundamental and technical reasons the U.S stock markets look set to plunge soon." So, it seems we're headed for either deflation or hyperinflation. The course seems set for hyperinflation, but what's your best guess as to what's going to happen? Clive Maund: The key point to grasp is that the world needs a "reset" and sooner or later it is going to get it. By that I mean that all the dross of debt and derivatives that have accumulated over many years and are now dragging the world economy into the mire are going to have to be cleared away before the world can move forward again. Many readers will be familiar with the experience of working at a computer that "locks up" when too many applications and programs are open. When you arrive at this point, you cannot move forward or back, and there is nothing else for it but to hit the reset or restart button. That is the point the world economy has now arrived at with this debt crisis, and the longer business leaders and politicians take to grasp the nettle and write all this debt and derivative mess off, the worse it is going to get. So what if banks go bust? You can always create new ones later. Read More @ GoldSeek.com | |||||||||||||||

| Should the Fed Save Europe From Disaster? Posted: 28 Nov 2011 12:44 AM PST The dam is breaking in Europe. Interbank lending has seized up. Much of the financial system is paralysed, setting off a credit crunch just as Euroland slides back into slump. by Ambrose Evans-Pritchard, Telegraph.co.uk:

The Euribor/OIS spread or`fear gauge' is flashing red warning signals. Dollar funding costs in Europe have spiked to Lehman-crisis levels, leaving lenders struggling frantically to cover their $2 trillion (£1.3 trillion) funding gap. America's money markets are no longer willing to lend to over-leveraged Euroland banks, or only on drastically short maturities below seven days. Exposure to French banks has been slashed by 69pc since May. Italy faces a "sudden stop" in funding, forced to pay 6.5pc on Friday for six-month money, despite the technocrat take-over in Rome. Read More @ Telegraph.co.uk | |||||||||||||||

| Posted: 28 Nov 2011 12:36 AM PST by Greg Hunter's USAWatchdog.com:

It looks like the EU is getting a bailout from the IMF that could be nearly $800 billion. Gold is going straight up, and I am sure global stock markets will also surge on the bailout news. This will not really fix what is wrong. It will also not put an end to the chronic crisis mode Europe and the U.S. have been in for the past 3 years. I mean, if all the global bailouts didn't fix the problem, including $16 trillion pumped out by the Fed after the 2008 meltdown, what's another $800 billion going to do? The reason why things are not going to get better is that corruption is rampant and the financial system is totally broken. Bailouts are treating the symptom, but the disease is unbridled fraud. Many people don't realize this because the corporate controlled mainstream media will not report on crimes of the financial elite. Read More @ USAWatchdog.com | |||||||||||||||

| WATCH: Abrupt Economic Collapse Posted: 28 Nov 2011 12:35 AM PST Abrupt Economic Collapse – The Time Draws Near | |||||||||||||||

| Contingency Planning for Extreme Scenarios Posted: 28 Nov 2011 12:33 AM PST Governments Request "Contingency Planning for Extreme Scenarios Including Rioting and Social Unrest" by Mac Slavo, SHTFPlan.com:

The writing is on the wall. If you can't read it, then you're going to have a problem – very soon. It was in early 2009 that we first warned our readers of the coming wave of riots and social unrest that would envelop the globe. Nearly three years on we're seeing a progressive increase in tension among those affected by deteriorating economic conditions and the trend towards social unrest seems to be accelerating. Absolutely nothing has been resolved in terms of the economic and financial woes facing the world, despite the literally trillions of dollars of wealth in the form of credit and monetary easing that has been committed to the crisis. As the economic paradigm shifts and hundreds of millions of citizens from the world's advanced economies are thrown into poverty (including 100 million from the U.S. alone), the situation is getting critical. So much so that what once existed only in the realm of conspiracy theory and alternative news web sites – that governments, especially in the U.S., are planning for large-scale economic meltdown and social unrest – is now a foregone conclusion in political circles. Read More @ SHTFPlan.com | |||||||||||||||

| Gold may hit $3,000 if US devalues dollar Posted: 27 Nov 2011 11:51 PM PST | |||||||||||||||

| RISK ON: Stocks are surging on euro bailout news this morning Posted: 27 Nov 2011 11:10 PM PST From Bloomberg: Stocks rose for the first time in 11 days and U.S. equity futures, commodities and the euro advanced as European leaders drafted a framework for the region's bail-out fund and America's Thanksgiving retail sales jumped to a record. Treasurys declined. The MSCI All-Country World Index added 1.4 percent at 12:16 p.m. in London. Standard & Poor's 500 Index futures rallied 2.7 percent, signaling the U.S. gauge may halt a seven-day losing streak. The euro strengthened 1 percent to $1.3367. The yield on the 10-year German bund advanced five basis points, with the similar-maturity Treasury yield jumping 10 points. The cost of insuring against default on European government debt fell for the first time in eight days. Oil rose 3.1 percent. About $4.6 trillion was wiped from the value of global equities this month on mounting concern that Europe's debt crisis is spreading. Bond markets in the euro area "are not functioning normally," Bank of France Governor Christian Noyer said. Moody's Investors Service said the "rapid escalation" of the crisis threatens all of the region's sovereign ratings as Belgium paid the most since 2000 to sell debt. U.S. retail sales over the Thanksgiving holiday climbed 16 percent to a record. "European leaders have been pushed into a position that they have to do something," said Mike Lenhoff, the London-based chief strategist at Brewin Dolphin Securities Ltd., which oversees $39 billion. "We are getting to a point where policy makers are now responding. The message from the market is clear: get your act together or we are going to destroy you." Stocks (MXWD) Rebound Industry groups tracking mining and financial stocks were the best performers on MSCI All-Country World Index, helping the gauge rebound from a 10-day, 9 percent slump. The index is valued at 11.1 times estimated profits, compared with a five-year average of 13.6 times, data compiled by Bloomberg show. The Stoxx Europe 600 Index rallied 2.7 percent for its largest gain in a month as the gauge rebounded from its biggest weekly slide in two months. All 19 industries in the benchmark measure climbed more than 1 percent with gauges of banks and insurance companies posting the biggest gains. Deutsche Bank AG jumped 6.3 percent, BNP Paribas SA appreciated 8.7 percent, Societe Generale SA advanced 5.1 percent and UniCredit SpA added 4.4 percent. The Organization for Economic Cooperation and Development said today that growing doubt about the survival of Europe's monetary union has caused global growth to stall and represents the main risk to the world economy. The 34 OECD nations will expand 1.9 percent this year and 1.6 percent next, down from 2.3 percent and 2.8 percent predicted in May, the Paris-based organization said in a report. German Trading S&P 500 futures gained 2.8 percent, indicating the equity benchmark will rebound from its largest weekly retreat since September. AT&T Inc. added 1.9 percent in German trading as it was said to consider offering to divest as much as 40 percent of T-Mobile USA's assets to convince the Justice Department to let the company take over the U.S. unit of Deutsche Telekom AG. Retail sales totaled $52.4 billion during the holiday weekend and the average shopper spent $398.62, up from $365.34 a year earlier, the Washington-based National Retail Federation said yesterday, citing a survey conducted by BIGresearch. The Dollar Index, which tracks the U.S. currency against those of six trading partners, declined 1 percent, with the pound rising 0.8 percent to $1.5562. The euro appreciated 0.9 percent versus the yen. New Zealand's dollar surged 2 percent against the greenback after Prime Minister John Key was re-elected with his party's biggest mandate in 60 years. Preparing a Loan The International Monetary Fund said today it isn't discussing a rescue package with Italy after La Stampa newspaper reported it may be preparing a loan of as much as 600 billion euros ($802 billion). The European Financial Stability Facility may insure bonds of troubled countries with guarantees of 20 percent to 30 percent of each issue to be determined in light of market circumstances, according to EFSF guidelines to be considered by finance ministers this week. Treaty change is necessary to give veto power over member-state budgets to the European Union Commission, Germany's Finance Minister Wolfgang Schaeuble said on ARD television in Berlin yesterday. Noyer reiterated his resistance to buying more government bonds from the euro area to shore up confidence, saying that "any lasting liquidity backstop" must come from governments and not the central bank. Monetary authorities from the U.S. and U.K., which have been buying "significant amounts" of public debt, would be risking spikes in long-term interest rates "in a different inflation environment," and markets are already hedging against inflation "tail risks," he said. 10-Year Yield Belgian 10-year bonds fell 22 basis points to 5.65 percent after the nation sold 2 billion euros ($2.68 billion) of bonds maturing between 2018 and 2041. The debt agency in Brussels sold 450 million euros of bonds due in September 2021 at a weighted average yield of 5.659 percent, up from 4.372 percent in the previous sale on Oct. 31 and the most since January 2010. Demand for the securities was 2.59 times the amount of notes sold, up from 1.65 times a month ago. It's the first debt sale since Standard & Poor's lowered Belgium's credit standing one step to AA with a negative outlook on Nov. 25. Coalition talks produced a budget agreement less than 24 hours later. Italian bonds rose for the first time in six days as the country's banking association promoted an initiative to encourage purchases of the securities today. The yield on the 10-year security dropped 14 basis points after surging 62 basis points last week. The government sold 567 million euros of September 2023 index-linked bonds at a yield of 7.3 percent. The maximum target for the auction was 750 million euros. 15 Governments The yield on the 30-year Treasury bond advanced 10 basis points to 3.02 percent, rising above 3 percent for the first time since Nov. 18. The MSCI Emerging Markets Index (MXEF) jumped 2.2 percent, heading for its biggest gain in a month after closing last week at a seven-week low. The Micex Index surged 3.1 percent in Moscow as oil rose in New York. The Hang Seng China Enterprises Index (HSCEI) of Chinese stocks listed in Hong Kong gained 2.3 percent and the BSE India Sensitive Index (SENSEX), or Sensex, rose 3 percent, the most since Aug. 29. The Markit iTraxx SovX Western Europe Index of credit-default swaps on 15 governments dropped from a record, falling seven basis points to 378. Debt-insurance costs for European financial companies also fell from the highest ever, with the Markit iTraxx Financial Index of default swaps linked to the senior bonds of 25 banks and insurers declining 18 basis points to 340. Gasoline climbed 3 percent to $2.5224 a gallon. Copper jumped 2.7 percent to $7,422.75 a metric ton. New York silver futures advanced 2.8 percent, leading gains in the S&P GSCI index of 24 commodities, which gained 2.2 percent, the most since Oct. 27. To contact the reporters on this story: Rob Verdonck in London at rverdonck@bloomberg.net. To contact the editor responsible for this story: Alexander Kwiatkowski at akwiatkowsk2@bloomberg.net. More on stocks: Stocks could be approaching a major breakout Top strategist Ritholtz: Euro crisis could cause stocks to "grind up" How the euro could trigger a 2008-style crash | |||||||||||||||

| Worlds most expensive model car made of gold and platinum Posted: 27 Nov 2011 10:30 PM PST | |||||||||||||||

| This year could have been the most violent "Black Friday" in history Posted: 27 Nov 2011 10:05 PM PST From The Economic Collapse: We all knew that this was coming, didn't we? Each year, Black Friday violence just seems to get worse and worse. What does it say about American consumers when they are willing to fight like crazed animals just to save a few bucks on cheap plastic crap made in China? Not that retailers are innocent in any of this. It certainly seems as though many of them purposely create wild situations on Black Friday where customers will rush like crazy people into their stores and nearly riot as they fight over discounted merchandise. The more Black Friday madness there is, the more of an "event" it becomes, and the higher the profits of the retailers go. This year, there was more Black Friday hype than ever... and there was also more Black Friday violence... Read full article... More Cruxallaneous: Ten secrets retailers won't tell you about "Black Friday" Five ways to save time and money on your holiday shopping How to decide if switching to a credit union is right for you | |||||||||||||||

| Australian gold production falls Posted: 27 Nov 2011 10:00 PM PST In the third quarter, Australian mines produced a total of 66 tonnes of gold - 2.4% less than in the previous quarter. Nevertheless, Australia has retained its position as second largest gold ... | |||||||||||||||

| Posted: 27 Nov 2011 08:50 PM PST Dear readers, My e-mail problems seem to be fixed. It was my fault. I had used up my allotted disk space and needed to do some housekeeping. In addition, some of you seemed concerned re my talk of a site redesign. Not to worry, what I have in mind is more like a site facelift. I want it cleaned up and streamlined further. That is one reason I've been so loath to move ahead. Most "web designers" seem to favor busy "look at me" treatments, when that it the LAST thing I want. Big emitters aim for climate delay BBC Phone Deals Raise Coverage Problems Wall Street Journal Disruptions: Fliers Must Turn Off Devices, but It's Not Clear Why New York Times. This is complete BS, they are on different frequencies. I never turn off my cell out of general cussedness, and I never have a signal in the air (if I have gotten any calls, I don't get the message until I land). 'Journalism, not truth, is the first casualty of war' Tehelka (hat tip reader May S) The Stench of Elitism in Defense Spending Winslow T. Wheeler, Center for Defense Information (hat tip reader Alexis). Two months old but still worth reading. Pakistan has had enough Guardian (hat tip reader May S) Greeks Balk at Paying Steep New Property Tax New York Times Diary: In Greece London Review of Books (hat tip reader Crocodile Chuck) Reports Of IMF Package For Italy Not Credible – International Financial Officials eFXNews (hat tip reader SteveA) European rumourthon misses the mark MacroBusiness IMF Says No Talks Under Way With Italy Bloomberg Central Banks Ease Most Since 2009 to Avert Contagion Bloomberg The eurozone really has only days to avoid collapse Wolfgang Munchau, Financial Times High school student reprimanded by principal for tweet criticising Kansas governor Daily Mail (hat tip reader May S) Senators Demand the Military Lock Up American Citizens in a "Battlefield" They Define as Being Right Outside Your Window ACLU (hat tip readers Andy B and Parvaneh Ferhadi) Bank debit card fee plans face Justice Dept. antitrust review Los Angeles Times. OMG, the DoJ is gonna wake up and actually do something? Occupy LA await eviction deadline BBC Banks scramble to plug capital deficits Financial Times. Typical stupid pro cyclical behavior. Where the hell were the grownups in 2009 and 2010? Why weren't the regulators making a stink about dividends and pay levels then? Hedge fund chief backs transaction tax plans Financial Times Wall Street Pay Hits a Wall Wall Street Journal. The securities industry is supposed to be a high-risk, high return arena. But high risk means downside. I guess everyone thought the real deal was looting, which is a much safer business. Antidote du jour (I think this is from reader Helene. I grabbed the photos from her message when forced to downsize my mailbox and failed to record her name. Apologies if I got it wrong): | |||||||||||||||

| Thanks For Giving Us Cheap Gold And Silver Posted: 27 Nov 2011 08:50 PM PST Precious Metals Stock Review | |||||||||||||||

| World’s most expensive model car made of gold and platinum Posted: 27 Nov 2011 08:30 PM PST | |||||||||||||||

| New gold bugs are young and restless Posted: 27 Nov 2011 07:30 PM PST | |||||||||||||||

| John Williams: Hyperinflation Warning, Preserve Value with Gold Posted: 27 Nov 2011 06:00 PM PST | |||||||||||||||

| Posted: 27 Nov 2011 05:10 PM PST Dollar Collapse | |||||||||||||||

| Is This December Similar to 2007 and 2008 for Gold and Stocks? Posted: 27 Nov 2011 05:02 PM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Did JP Morgan Just Convert 614,000 Ounces of MF Global Clients' Silver into JPM Licensed Vaults?

Did JP Morgan Just Convert 614,000 Ounces of MF Global Clients' Silver into JPM Licensed Vaults?

Gold and silver prices had another down day last Friday, with the Comex November gold contract down 2.3% over last week. Percentage losses were greater in silver, platinum and palladium, with investors growing more and more scared of the possibility of a disorderly breakup of the eurozone. Friday saw the yield on three-year Italian government debt reach 8.3%, as the clamour for the European Central Bank to "do more" (a euphemism for print money) grows stronger by the day.

Gold and silver prices had another down day last Friday, with the Comex November gold contract down 2.3% over last week. Percentage losses were greater in silver, platinum and palladium, with investors growing more and more scared of the possibility of a disorderly breakup of the eurozone. Friday saw the yield on three-year Italian government debt reach 8.3%, as the clamour for the European Central Bank to "do more" (a euphemism for print money) grows stronger by the day.

No comments:

Post a Comment