saveyourassetsfirst3 |

- Debt, Money Supply And Economic Growth

- HDGE: The Active Bear ETF Under The Microscope

- Strictly silver detector

- Big Markets Herald Sea Change?

- Gold, Orange Juice, and ‘Tang’

- King of safety

- The new price era of oil and gold

- Dollar Pre-Eminence Grows as Foreign Banks Double Deposits at New York Fed

- Keith Neumeyer: The Silver Market Lacks Integrity

- An Italian exit scenario

- Gold Falls Again on Options Expiry –Supported by Global Debt Crisis & Iranian Oil Jitters

- Europe's Financial Crisis Creates Sell-Off

- Two "secrets" for building wealth with dividend stocks

- 4 Reasons Gold to Rise on Euro Break-Up

- The could be the most important takeaway from the MF Global disaster

- Investment in gold ETFs hits new record high

- Our Professional Criminal Class

- Kazakhstan Buys Its Own Gold Output

- Gold & Silver Market Morning, November 22, 2011

- 17 Quotes About The Coming Global Financial Collapse..

- Free-Market Banking Creates Stability and Prosperity

- Massive Raid on Silver and Gold as Options Expiry

- Europe Weighs Heavily on Global Markets

- Major Catalysts Ahead to Trigger Next Breakout in Gold Market

- Silver Market Update

- Satyajit Das: Extortionate Privilege – America’s FMD

- The "Gold Beta" Of Mining Stocks and Why We Continue To Avoid Them

- Central banks in gold rush

- Pullback In Gold And Silver Is A Buying Opportunity

- Ned Schmidt: “Wait for Gold and Silver to Bottom”

| Debt, Money Supply And Economic Growth Posted: 22 Nov 2011 06:51 AM PST By Pater Tenebrarum: Market Forces and Intervention Both inter- and intra-market correlations have lately become extremely pronounced. In the stock market it has become very difficult for investors to produce alpha, this is to say outperformance based on judicious stock picking. Generally speaking, the so-called "risk assets" group comprised of stocks, commodities and lower rated bonds tends to perform best when the market's inflation expectations are rising, in short whenever additional money printing is expected. It tends to perform poorly when inflation expectations are declining, or putting it another way: whenever the authorities give corrective market forces some breathing room. After four decades of unbridled credit expansion post Bretton Woods, too many sectors of the economy have ended up with their balance sheets destroyed as a result of capital malinvestment. The banking system itself is continually under threat of a deflationary collapse due to the enormous amount of credit and fiduciary media created Complete Story » |

| HDGE: The Active Bear ETF Under The Microscope Posted: 22 Nov 2011 06:28 AM PST By Zacks.com: Thanks to a shaky economic situation, many investors have dialed back exposure to equities, preferring instead to wait things out in the bond market or even in cash. Yet, while some have taken this approach to investing in this difficult time, many have looked to the ETF world in order to provide new options that can potentially push portfolios far higher in the turmoil. After all, yields remain anemic across the curve and the Fed has yet to signal any revisions to this policy in the near term. In light of this, many have looked towards 'alternatives' in order to help juice returns while also diversifying portfolios in the process. While there is certainly no shortage of choices in this field, such as volatility ETPs and gold, one of the more interesting, and unknown, is undoubtedly the Active Bear ETF (HDGE) from AdvisorShares. This intriguing product looks to give investors Complete Story » |

| Posted: 22 Nov 2011 05:14 AM PST Hey fellas, Hate to expose "the secret" even though it isn't one, but I have had some recent success by buying boxes of half dollars from the bank and sorting through. I have found roughly 200 dollars or so worth of silver, for nearly 0 dollars and would like to continue doing so. The issue is time and productivity. It takes about 30 minutes at a minimum to sort through all the coins and at that point, it hardly seems worth it. The question is, are there any metal detectors or things of that nature that can allow an individual to buy, say, 10 thousand dollars worth of half dollars, pour them out and just scan and find the silver? It would increase productivity and arbitration success. Any ideas = greatly appreciated! |

| Big Markets Herald Sea Change? Posted: 22 Nov 2011 05:03 AM PST The Super Committee became the "Stupor Committee" and stunk up the D.C. Beltway. So yet another deadline and opportunity has come and gone and the American people are delivered yet another example of the lack of leadership they have become accustomed to. More proof that we need a "Drain-O election" to unclog the buildup of "political hair" in the giant drain of Washington. Technocrats in Europe, deal fumblers in the U.S. and yet the Big Markets are not acting like they want to price in another end-of-world scenario - at least not yet. If the Big Markets were pricing in "really bad" they would be doing so by cutting new and lower lows. Rhetorically: Does the chart below suggest new and lower lows? So far, at least, the lows put in for 2011 were higher than last year for the S&P 500. Despite very worrisome, seemingly extremely bearish contemporary news the Big Markets have not been a place that rewards mega-bears. Certainly not in the same way that the Big Markets rewarded mega-bears in the fall of 2008 and early 2009. Continued… We assign a great deal of respect to the action of the Big Markets and the collective wisdom of countless thousands and millions of investors/traders worldwide. In our simple view the chart of the Big Markets does not "match" the news, worry and angst we are all subject to when we read the news or tune into cable financial television. Our impression is that if the Big Markets matched the news and if equities markets reflected the very dire predictions of the numerous prophets of doom on the cable networks, they would have to be marking new and lower lows, not higher lows as we see today. Thus, our view is forming, once again, that if the chart doesn't match the news and the expectations/predictions of the "gloomy doomers;" … If the chart doesn't reflect the general impression of "dire" that dominates the airways, it therefore must be discounting something less than dire – something less than the "end-of-the-world-as-we-know-it." As we muse on that for a moment, our thoughts turn to what on earth the Big Markets could see amidst an ocean of troubling signals, with squadrons of potential black swans in every direction? Of course there is not just one thing, there are hundreds of "things" the market is discounting at the same time. If we subscribe to the notion that it is on the margin that markets are moved and market battles won and lost, then although we know that it is not just one thing that moves the markets, we have leave to discover the one or two or three things at the margin that the markets are using as an overriding fulcrum to lever the action one way or another. It is in that context that we ask the question below. (We ask, we do not posit this as the only answer.) Is the collective action of the Big Markets in recognition that there is now a national discussion about debt, deficits and the reduction of the Federal government expense? Even though those discussions, debates and arguments are very messy, painful and so far not very productive? Are the Big Markets now heralding that a political sea change is about to unfold? In short, is the market "saying" that it welcomes the messy discussion because it is a discussion we have needed to have for a very long time? We are enamored by that notion. It is a good-sounding idea to us here at Got Gold Report. We would like to think that the S&P 500 is beginning to price in a badly needed sea change in the political landscape. Perhaps in the opposite way that it reacted once it became clear who the Democratic nominee was going to be (and the hard left turn the country would take under him) in the summer of 2008. And if it can turn in higher lows in this environment, imagine what it could do with the news of good progress on that front sometime in the future. Along those lines we are also thinking that the S&P may already be looking forward to next November, handicapping the odds of a clean sweep by the kind of people that would do what is necessary to slow down the growth in government spending. People who would put checks on the malignant explosion of even more mind-numbing, job killing punitive regulation which causes so much interference and uncertainty to business; people who would make it Job One to repeal the onerous and anti-productive mistakes of Obamacare and Dodd-Frank. Closer to the Barn Looking in a little closer to the barn, we are interested in how sentiment has been so beaten up for the smaller, less liquid and more speculative junior miners and explorers we love to 'game' here at Got Gold Report. Just below is a chart of the Canadian Venture Exchange Index or CDNX as it appeared at mid-day of Tuesday, November 22, 2011. As of October, the CDNX had turned in its second largest correction ever. Nearly a 50% give-back, second only to the record plunge of 2008-2009. We have quite a few resource company "dogs" in the hunt and therefore we could be considered pretty biased, but with that caveat, here's what we are closely watching at the moment. The CDNX still has a good opportunity to "prove up" a fledgling "V-bottom" just ahead. The "proving" would be in the form of a higher turning low. The best we could hope for at this point would be for the current pullback to check up above that little consolidation at the top of the "V" and then advance back up into and through the "gap" which showed right after the Fed announced Operation Twist in September. A higher turning low at this point, and especially over the next week, would be a strong signal that the protracted negative liquidity event we have endured since at least April was morphing into a new positive liquidity event. We realize that may sound like an impossibility to many of our readers. Most especially to the those who have become overly discouraged by all the news and nervousness and those who have watched their holdings being mercilessly and relentlessly pummeled by negative liquidity. Having acknowledged that this has been an unusually harsh negative liquidity event, however, let us also note that negative liquidity events are ALWAYS temporary. Let us note that when negative liquidity events change over into positive liquidity events they end up leaving us a signal in the charts. We see more of the tracks of bulls than bears in the chart mud, so to speak. And one sign that would tell us that there are more bull tracks than bear scat on our Little Guy market trail would be a confirmed V-bottom on the chart above. That's why we are so intent upon marking it in real time should we get that new, higher turning low just ahead. We cannot make the "call" yet. Indeed, we aren't yet close to making that call, but the conditions are lined up for us close enough to share our thinking with readers and Vultures as we go into our Thanksgiving reflection period now. If, that's if, we are going to see a change in the markets for The Little Guys; if we are going to morph from the protracted negative liquidity event period back into a new version of the opposite just ahead, it could very well show up as a new, higher turning low in the chart just above, which would "confirm" the V-bottom formation. That failing and if the CDNX instead tracks lower, to below the 1500 level again, then the negative liquidity period "virus" just hasn't run its course yet and we will remain in "Bargainville" a while longer. Happy Thanksgiving to all our U.S. based readers and Vultures. That is all for now, but there is more to come.

|

| Gold, Orange Juice, and ‘Tang’ Posted: 22 Nov 2011 04:45 AM PST One of the most difficult tasks for those of us in the precious metals sector is to explain how and why our paper "fiat currencies" are worthless (or nearly so) to the majority of our populations. The primary reason for this difficulty is the relentless propaganda campaign to attempt to delude us into believing that this fiat-paper has value, or at least to confuse the issue to the point where ordinary people don't know what to believe. I have tried various approaches to pierce this veil of propaganda. I have pointed out how not only currency but any "good" which can be created in infinite quantities and at zero cost is by definition worthless. I then noted that U.S. dollars are currently being created in near-infinite amounts – and at zero cost (i.e. 0% interest rates). Separately, I observed that the U.S. dollar is nothing less than a "leaky bucket" when it comes to storing wealth. In the less-than-100 years since the Federal Reserve was created to "protect" the U.S. dollar it has lost 98% of its value, with its current rate of depreciation greater than at any other time in history. I have explained that because our fiat currencies are worthless (or nearly so), that as a matter of simple arithmetic this directly implies that all bonds are nearly worthless as well – since they are denominated in this worthless paper. Often, however, the way to convey understanding with respect to an elusive concept is to place it in the context of an analogy. This is especially helpful when attempting to combat the brainwashing-effect of serial propaganda, since the analogy will be outside of that web of propaganda. Thus I will attempt to illustrate the stark differences between gold (and silver) and banker-paper, through comparing orange juice to "Tang" – the orange-flavored beverage. It is an easy and obvious comparison. On the one hand we have orange juice: a natural substance which is aesthetically pleasing, is "good for us", and because it is something which occurs in nature, it is only available in finite quantities. Proof of its scarcity is seen by simply looking at its steadily rising price. Here in Canada; orange juice prices have risen by over 30% just in the last year (sound familiar?). The reason? The supply of orange juice is increasing much more slowly than the paper which we use to pay for it. As a matter of elementary economics (and arithmetic), with the paper supply rising much more quickly than the orange juice supply, orange juice is rapidly becoming relatively more valuable versus our paper currencies. Then there is "Tang": an artificial, chemical-laced, sugar-infused imitation of orange juice. Our natural inclination as human beings is to prefer "natural" to "artificial"; and to prefer "the real thing" to mere imitations. On that basis alone, the majority of us would clearly view Tang as vastly inferior to orange juice – despite all of the advertising which proclaimed to us that Tang was "the orange drink of astronauts". Then there is supply. Unlike orange juice, Tang can be produced in near-infinite quantities. The chemicals which go into Tang can be manufactured to exceed any possible level of demand, and should we ever run out of sugar there is always "imitation sugar" to replace that as well. Consequently, not only do we view Tang as being obviously inferior to orange juice, but as a matter of basic economics we expect orange juice to continue to become relatively more and more valuable in relation to Tang. To this point, I have already provided two irrefutable bases for preferring orange juice to Tang, and most importantly those arguments translate precisely into a comparison between gold (and silver) and paper money. However, beyond those reasons, the rapacious bankers have given us an even bigger reason for shunning their fiat-paper: dilution. |

| Posted: 22 Nov 2011 04:22 AM PST

Safe and Sound The King ~TVR |

| The new price era of oil and gold Posted: 22 Nov 2011 03:45 AM PST 'If society consumed no energy, civilization would be worthless. It is only by consuming energy that civilization is able to maintain the activities that give it economic value. This means that ... |

| Dollar Pre-Eminence Grows as Foreign Banks Double Deposits at New York Fed Posted: 22 Nov 2011 03:19 AM PST  Foreign bank deposits at the Federal Reserve have more than doubled to $715 billion from $350 billion since the end of 2010 amid Europe's debt turmoil, buttressing the dollar's status as the world's reserve currency. Forty-seven non-U.S. banks held balances of more than $1 billion at the New York Fed as of Sept. 30th, up from 22 at the end of 2010, according to a survey of 80 financial institutions by ICAP Plc, the world's largest inter-dealer broker. The dollar has appreciated 7.2 percent since Standard and Poor's cut the nation's AAA credit rating Aug. |

| Keith Neumeyer: The Silver Market Lacks Integrity Posted: 22 Nov 2011 02:45 AM PST The Hera Research Newsletter (HRN) is pleased to present an incredibly powerful interview with Keith Neumeyer, Chief Executive Officer, President and Director of First Majestic Silver Corp. (TSX:FR / NYSE:AG). Mr. Neumeyer began his career at the Vancouver Stock Exchange and worked in the investment community for 26 years beginning his career in a series of Canadian national brokerage firms including McLeod Young Weir (now Scotia McLeod), then Richardson Greenshields and then Walwyn Stogell McCuthchen (which became Midland Walwyn). |

| Posted: 22 Nov 2011 01:53 AM PST This post originally appeared on Credit Writedowns Editorial note: this article is neither a policy recommendation or a prediction. Rather, this articles looks to outline one potential outcome of the current policy choices in the European sovereign debt crisis, building upon the discussion from three recent articles "Deflationary crisis responses", "Predicting the future of policy making", and "Why France will be forced out of the eurozone". One week ago today, I was running through Italian default scenarios because the policy choices in the sovereign debt crisis have narrowed with most of the risk being on the downside. At the time, I asked "Could Italy unilaterally exit the euro zone and redenominated euro debts at par into a new Lira currency to forestall the default? Perhaps. That is something to consider at a later date. For now, here's what will happen if Italy defaults." That later date is now. So let's get cracking on what would bring about a unilateral Italian exit and how it could be accomplished. Nationalism and "Beggar Thy Neighbour" economic policyLet me quote something as a jumping off point which applies here that I wrote nearly three years ago about Ireland and what I correctly predicted would be a banking crisis.

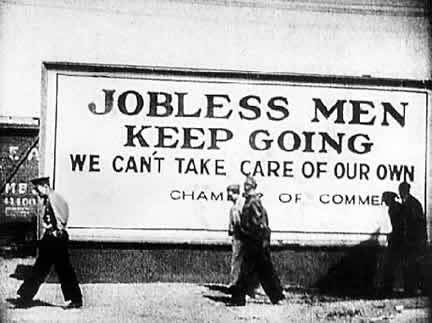

When the chips are down, an us versus them mentality starts to seep into policy choices. What happens is that significant economic downturns create economic distress that causes people to circle the wagons. One day, it's boom time; all is well and we are full of hope for the future. We are minding our business, working hard, tending to our families and enjoying life. The next thing you know, the economy is in a deep slump; we or some of our neighbours are jobless, penniless… and angry. What caused this? Who caused this? When times are tough, people start looking for someone to blame. And usually it is not the In-group which gets the blame; it's usually "them": out-groups like minorities, immigrants and foreigners. Dylan Grice calls this "in-group bias" and predicts the following:

If the downturn is protracted enough and deep enough, this us versus them mentality spreads into the mainstream at the political and national level. And we see economic nationalism, an 'every nation for itself' strategy enter mainstream politics. That's what World War I, the Great Depression and World War II were all about. So I expect no different here with the sovereign debt crisis if policy choices point mostly to downside scenarios. The saving grace highlighted in the Irish example above is that it really does take longer for these things to play out than one expects. I was talking about the European banking crisis in early 2009 and here it is late in 2011. So that tells me, with the right leaders and right policy choices, none of these downside scenarios is automatic. They may be likely, but there is reason to hope and exhort leaders to prevent calamity. The Current Situation in EurolandUnfortunately, these last three years have been largely wasted. Instead of bank recapitalisation, credit writedowns and rebalancing in the euro zone, we have seen self-serving and one-sided morality tales of sinful fiscal profligacy and creditor-centric policy solutions that are wholly inadequate to fix the institutional deficits of the euro zone. This morality tale is really a fairy tale. Spain is the perfect example of a country that never should have joined the euro zone. It had a fiscal surplus right through to 2007 and still has better numbers on debt than Germany. The last of the three articles upon which this discussion is built, the excerpt I posted last night by Philip Whyte and Simon Tilford, is magnificent in laying these unfortunate circumstances. The question then is what now? How do the Europeans escape this roach motel of an economic prison they have constructed while still respecting the laws of the existing unworkable institutional structure? No one wants a free for all. We see now that Italy will default without the central bank acting as a lender of last resort. And Italy's default would trigger a cascade of interconnected bank runs default and Depression as did the insolvency of Creditanstalt in 1931. German policy makers are aware of this. The Irish Times has written how Merkel's pragmatic allies offer hope of new outlook whereby the euro zone evolves toward a more integrated fiscal union with penalties for free riders and an exit clause for those that can't make it. Germany is moving fast to implement this solution. Alas, this is a flawed project for two reasons. First, trying to make the 'sinners' of the eurozone periphery more Germanic fails to understand the dynamics of intra-European capital and current account balances. Put crassly, the euro zone is one giant vendor financing scheme. You can't have Germany and Spain both running current account surpluses with each other at the same time. The imbalances will continue. Second, Policy makers have run out of time. They caused this problem by dithering; we wouldn't be here if they had cut the cord early on. I still think the ECB will move eventually. But it will be too late; the debt deflation will have already set in, aided and abetted by a growth-crushing fiscal policy strait jacket that in the last month has moved from the periphery to France, Italy and Austria as contagion has spread. The Italian JobEven so, the ECB may not move at all. And therefore, we must run through the various worst-case policy remedies available and think about which one could be chosen. What about a unilateral exit from the euro zone? I ran through the exit scenario a year ago and it looked bleak, one reason I saw it as unlikely at the time. But things have deteriorated and so the best alternative to a negotiated agreement for policy makers in Italy may well be exit. So I have been thinking about this and have come up with an outline plan. The plan is based on how countries exited the gold standard during the Great Depression. I have said many times that the euro is like gold.

I like to think of the Euro as gold and the Euro countries as having implicitly retained their national currencies with a fixed rate to the Euro. If you recall, that actually was the setup when the countries pegged their currencies to the ECU before Euro money was introduced. So the euro area countries can de-peg like the gold standard countries did and unwind the euro structure by running the "euroization" process in reverse. Here's how one could do it.

The hard part is about capital flight, inflation and the cost of retooling the systems for New Lira. But this is all a one time cost. Warren Mosler wrote up a plan like this for Greece that Randall Wray featured here last week. In his scenario, euro bank deposits remain as euros and existing euro denominated debt would remain in euros as well. RepercussionsStaying in the zone. The political repercussions of a redomination would be huge. Although I have talked about this as a eurozone exit, it could be just a redomination, meaning that the New Lira would depreciate and Italy could fully re-euroize the economy without leaving the euro zone. Since we're running through scenarios, we should consider this outcome, as countries in the Depression did eventually re-peg to gold via the Bretton Woods currency regime. But I think the impetus here is to escape the euro and the persistent current account deficits as well as to escape the anti-growth policies of the euro zone that have caused Italian sovereign debt levels to spike. Moreover, it is unlikely that the German plan of fiscal oversight, penalties and exclusion would solve Italy's fundamental problems of low growth and eroding uncompetitiveness in a currency with an elevated value. Inflation. This would be mitigated by the taxation policy which would give the new currency value. But we see how Iceland has battled inflation in the wake of a large currency depreciation. In some ways you could consider this a one-time standard of living adjustment. But the adjustment will be severe since markets tend to overshoot to the downside. It's not clear how low a New Lira would sink, and so inflation would be a big problem. Bank solvency. This was the biggest issue to begin with. The redomination solves Italian bank solvency since all their accounts would be in New Lira. But this solution heaps all of the burden of adjustment onto foreign lenders via the exchange rate adjustment. German, Dutch and French banks would be insolvent if the New Lira lost a lot of value as they would be repaid in depreciated currency. I think this point highlights what I have been saying about apportioning losses in a creditor-friendly way. The foreign lenders have used the fact that the euro is one zone to lend cross-border and increase their return on equity. They bear some of the responsibility for the credit growth in the periphery. The foreign currency losses they would take from a New Lira demonstrates this. National Solvency. That problem would be solved. The burden of adjustment would then fall to the exchange rate. Contagion. Clearly, an Italian exit would break apart the euro zone. All of the countries now on the hot seat would consider redominating as well. Once a euro exit takes place, it would be a mad rush to follow. In France in particular, politicians would be desperate to redenominate and depreciate the currency in order to escape the foreign currency losses. Thus would begin a currency way via competitive currency devaluation. In conclusion, a unilateral exit would be a devastating event for Italy and the euro zone. Inflation would be high but bank and national solvency issues would recede. If the exit were done under these nationalistic pre-conditions of redomination, most of the adjustment burden would fall on foreign creditors. Italy would become export competitive again and could focus on economic growth strategies instead of ones of fiscal adjustment. The benefit of this particular plan is that it can be implemented quite quickly. Just as during the Great Depression, those countries that left the gold standard first saw the earliest return to economic growth. I would expect the same to be true here again for the euro area countries today. |

| Gold Falls Again on Options Expiry –Supported by Global Debt Crisis & Iranian Oil Jitters Posted: 22 Nov 2011 01:13 AM PST |

| Europe's Financial Crisis Creates Sell-Off Posted: 22 Nov 2011 01:06 AM PST Nothing is safe, even gold is down... But gold, and especially silver, are set to explode. |

| Two "secrets" for building wealth with dividend stocks Posted: 22 Nov 2011 12:18 AM PST From Dividend Growth Stocks: Most investors aren't very good at investing. I suspect over their lifetimes, most investors will end up losing money in the stock market. So why do they keep coming back, and is there anything that can be done to turn the losses into gains? The formula for success in the market is relatively simple. Buy low, sell high. So why do so many people do so poorly? It seems they are doing the exact opposite of what they should be doing. Byran Harris, a senior editor at Dimensional Fund Advisors, put together an analysis that showed many investors in 2008 and 2009 "fled equities during the worst months of the global financial crisis, while others waited for signs of a turnaround before investing more. Their emotional reactions may have exacted a large price on their wealth." Investors during this period sold over $266 billion of U.S. equity mutual funds. Following their emotions, investors will significantly under-perform a mutual fund by jumping in and out of it. A University of Nebraska study, confirmed this by examining the the timing of mutual fund investors. The study found that between 1991 and 2004, the average active fund investor substantially underperformed the growth of a dollar invested in the fund over the entire measurement period. If we can't trust our emotions, how can we succeed in the stock market and still sleep at night? Here is how to do it... Read full article... More on dividend investing: How to know if a stock's dividend growth is sustainable Casey Research: Stay away from these popular income stocks now Fifteen safe dividend stocks that could pay you 15% income in 15 years or less |

| 4 Reasons Gold to Rise on Euro Break-Up Posted: 22 Nov 2011 12:12 AM PST Europe kicks problem down the road to give them time to print money. |

| The could be the most important takeaway from the MF Global disaster Posted: 22 Nov 2011 12:08 AM PST From Peter L Brandt: MF Global clients looked on as their money was stolen under the watchful eyes of your incompetent Uncle Sam. I have traded commodity markets since the late 1970s. I have always been told – and I believed – that my money was safe, held in segregated bank accounts under the jurisdiction and regulatory supervision of an agency of the U.S. government, the Commodity Futures Trading Commission. I have been lied to! My money was never safe. Neither was or is yours, if you are a futures trader. No matter what firm you use for futures trading – Merrill Lynch, Goldman Sachs, JP Morgan, Morgan Stanley, Citi Group – your money could disappear, even though the U.S. government has been charged with keeping it safe. The saddest part of this story is that the media has not even identified the real story – that investors can be robbed with the U.S.government as the accomplice... Read full article... More on MF Global: A shocking take on the MF Global scandal Must-read: "The entire system has been utterly destroyed by the MF Global collapse" More outrageous details emerge about Jon Corzine, Democrats, and the MF Global collapse |

| Investment in gold ETFs hits new record high Posted: 22 Nov 2011 12:00 AM PST Yesterday the US Congressional 'super-committee' tasked with identifying ways of cutting the US government's budget deficit was still failing to agree on ways of closing the deficit. ... |

| Our Professional Criminal Class Posted: 21 Nov 2011 10:30 PM PST The political corruption in this country is no longer whispered about. It is out in the open and fairly well recognized. Productive society is getting plundered by the parasite class in Washington DC and their friends. The MF Global collapse is merely the latest scandal that has harmed citizens. The lack of prosecutions in the [...] |

| Kazakhstan Buys Its Own Gold Output Posted: 21 Nov 2011 09:22 PM PST ¤ Yesterday in Gold and SilverGold got sold off a bit right at the open of trading in New York on Sunday night...and that pretty much set the tone for the rest of the Monday. The real decline didn't start until the London trading day began at 8:00 a.m. local time...which was 3:00 a.m. Eastern. Gold then got sold down until about half-past lunchtime, before a smallish rally began that lasted until the equity markets opened at 9:30 a.m. in New York. By that time, gold was only down a bit over ten bucks. But that's when the real selling started...and by the time that its low of the day was in a few minutes after 2:00 p.m. in New York, the gold price had been clocked for a hair under sixty bucks. The subsequent rally wasn't allowed to get far...and spot gold closed at $1,677.30...down $47.50 on the day. Net volume was pretty hefty at 166,000 contracts. The chart for silver was pretty much the same as gold's...but there were a couple of notable differences. The first was that silver's low of the day [$30.59 spot] came just a few minutes after 11:00 a.m. Eastern time...not minutes after 2:00 p.m. like gold...and the rally that began at that time, had considerably more legs associated with it. Silver's rally of $1.05 off its low, shaved the loss on the day to only 77 cents...and the metal closed at $31.64 spot. Net volume was 37,000 contracts. The dollar didn't do a whole heck of a lot until about 7:30 a.m. in London. Four hours later the dollar was up about 45 basis points...and pretty much held that gain until shortly before 11:00 a.m. Eastern time. Then, in the space of about an hour, the dollar shed about 35 basis points of that gain...and then slowly rallied into the close. The dollar finished up about 30 basis points on the day. Even a cursory examination of the dollar chart vs. gold shows absolutely no co-relation between the gold price and the dollar whatsoever. Yes, the gold stocks gapped down at the open...but it's open for debate as to how much that had to do with what the gold price was doing...and what was going on in the general equity markets. The reason I say that is simple. The gold stocks hit their low just minutes after 11:00 a.m...many hours and many, many dollars before the actual gold price hit its low of the day minutes after 2:00 p.m. The gold stocks cut their losses in half by the end of the trading day...and the HUI only finished down 1.95%. All things considered, I consider that to be a rather impressive performance. It was a bifurcated market in the silver equities yesterday. As a group, the smaller producers got smoked...but, as a group, the big cap silver companies only reported smallish losses...and there were actually some green arrows. But Nick Laird's Silver Sentiment Index was still down 2.84%. (Click on image to enlarge) The CME's Daily Delivery Report was posted at its usual time yesterday...but the page was completely blank for all commodities. The only thing under the header was this note..."!!! No Data !!!". Does that mean nothing happened, or that data was not reported? Who knows...but at this point in the November delivery month, it probably doesn't matter either way. GLD reported it's first decline since October 27th...showing a smallish withdrawal of 58,363 troy ounces. There were no reported changes in SLV. Over at the Zürcher Kantonalbank in Switzerland for the week that was, their gold ETF showed a tiny decline of 5,156 troy ounces...but over in their silver ETF, they showed a more substantial withdrawal of 916,842 ounces. As always, I thank Carl Loeb for providing these numbers for us. The U.S. Mint did not have a sales report on Monday. On Friday, the Comex-approved depositories reported taking in 618,463 ounces of silver...and shipped 246,135 troy ounces of the stuff out the door. The link to that action is here. Silver analyst Ted Butler had a fairly big report to subscribers on Saturday...and here are two and a half free paragraphs... "It [has occurred] to me that it is financial terrorism that best describes the behavior of the manipulators in the silver market. When a world commodity, like silver, declines 30% in a matter of days [twice this year], or when it declines 7% in a day [Thursday] for no good economic reason, it is natural to wonder why that occurred. When the only plausible explanation is that the sell-offs occurred as a deliberate attempt to scare innocent holders out of the market through fear and intimidation [of further loss], is that not financial terrorism?" "As I've indicated previously, the key to these sudden and sharp silver sell-offs is in the sequence of events. In every single instance, it is never a case of investors suddenly deciding to sell and that collective selling action which precipitates the price decline. Rather, it is always the case of the price first being suddenly rigged lower [at the quietest of trading times] and investors then reacting to those lower prices and selling after the price has come down. Also, in every single instance, those who initiated the suddenly lower prices [the COMEX commercials], then reap the whirlwind of their financial terrorism by buying all the positions they were able to intimidate into being sold. Scare folks into selling so that the financial terrorists can then buy from those that had been terrorized." "This is a crooked, rotten racket that has been going on for decades in silver. The only difference is that it is not al Qaeda or some militant terrorist group at work, but a consortium of leading banks and firms financially terrorizing that segment of the public that has chosen to invest in silver. Instead of being organized by bin Laden, the silver terrorists are organized and protected by the CME Group." I have an embarrassingly large number of stories today, so I'm going to pass the buck again...and leave the final edit up to you. The next five trading days for gold and silver are going to be very busy...and very interesting. Just another option expiry in gold, Embry tells King World News. Twice in a week, the Financial Times pays grudging respect to gold. Iran advises its citizens against buying dollars or gold. ¤ Critical ReadsSubscribeOlder, Suburban and Struggling, 'Near Poor' Startle the CensusThey drive cars, but seldom new ones. They earn paychecks, but not big ones. Many own homes. Most pay taxes. Half are married, and nearly half live in the suburbs. None are poor, but many describe themselves as barely scraping by. Down but not quite out, these Americans form a diverse group sometimes called "near poor" and sometimes simply overlooked — and a new count suggests they are far more numerous than previously understood. This very sad [but very true] story was posted in The New York Times on Friday night...and I thank Roy Stephens for sending it my way. The link is here.  On Capital Flight and Forced RepatriationDoug Casey has been talking about getting some of your assets out of your home country for years...out of the reach of your government...especially the U.S. government. Capital flight is a perfectly logical consequence in today's world. Barely a day passes where we are not reminded that nothing is safe any more. Not our currencies, not our equities, not our bonds and certainly not our banks/brokers. The word "Repatriation" sounds nice enough but really it means "Theft and expropriation". There will be nothing voluntary about this. There will be little [if any] due process. If this happens...and the folks in Brussels are pushing hard...a very dangerous precedent will have been set. Flight capital will have been made illegal. This story was posted over at zerohedge.com on Saturday...and I thank Washington state reader for sending it along. The link is here.  The Run On Europe Begins As Global Investors Head For The Hills...Until recently, the concern about Europe has been mostly theoretical--a potential train-wreck that would occur if/when the world's lenders decided that the continent's problems extended beyond the basket case known as Greece and cut lending to Europe's "core." Well, that concern is no longer theoretical...it's happening, as the world's lenders are increasingly deciding that it's better to be safe than sorry, and they're pulling their money out of Europe. This editorial by Henry Blodget is posted over at the businessinsider.com website...and I thank Australian reader Wesley Legrand for forwarding it. The link is here.  Dollar Pre-Eminence Grows as Foreign Banks Double Deposits at New York FedForeign bank deposits at the Federal Reserve have more than doubled to $715 billion from $350 billion since the end of 2010 amid Europe's debt turmoil, buttressing the dollar's status as the world's reserve currency. Forty-seven non-U.S. banks held balances of more than $1 billion at the New York Fed as of Sept. 30th, up from 22 at the end of 2010, according to a survey of 80 financial institutions by ICAP Plc, the world's largest inter-dealer broker. The dollar has appreciated 7.2 percent since Standard and Poor's cut the nation's AAA credit rating Aug. 5th, the second-best performance after the yen among developed-nation peers, according to Bloomberg Correlation-Weighted Currency Indexes. This Bloomberg story was filed yesterday...and I thank reader Scott Pluschau for sending it along. The link is here.  Former AIG CEO Sues US Government for at Least $25 BillionA company run by former American International Group Chief Executive Maurice "Hank" Greenberg Monday filed a $25 billion lawsuit against the United States, claiming that the government takeover of the insurer was unconstitutional. In its complaint, Greenberg's Starr International said that in bailing out AIG and taking a nearly 80 percent stake, the government failed to compensate existing shareholders. It said this violated the Fifth Amendment, which bars the taking of private property for public use without just compensation. A fine outstanding citizen like Hank Greenberg hiding behind the skirts of the U.S. Constitution? That's rich! Mr. Greenberg is Honorary Vice Chairman and Director of the Council on Foreign Relations and a member of David Rockefeller's Trilateral Commission. West Virginia reader sent me this Reuters piece that was posted over at cnbc.com yesterday...and the link is here.  MF Global trustee: $1.2 billion missingA trustee seeking to distribute customer securities overseen by bankrupt MF Global Inc. estimated Monday that $1.2 billion in client money may be missing, twice as much as previously expected. "At present, the Trustee believes that even if he recovers everything that is at US depositories, the apparent shortfall in what MF Global management should have segregated at US depositories may be as much as $1.2 billion or more," the trustee said in a statement. The 1-paragraph story posted over at marketwatch.com yesterday is cut and paste above...and the link to the hard copy is here. I thank Casey Research's own Bud Conrad for sharing this story with us.  |

| Gold & Silver Market Morning, November 22, 2011 Posted: 21 Nov 2011 09:00 PM PST |

| 17 Quotes About The Coming Global Financial Collapse.. Posted: 21 Nov 2011 08:53 PM PST 17 Quotes About The Coming Global Financial Collapse That Will Make Your Hair Stand Up from The Economic Collapse Blog:

Read More @ TheEconomicCollapseBlog.com |

| Free-Market Banking Creates Stability and Prosperity Posted: 21 Nov 2011 08:51 PM PST by Gabriel M. Mueller, GoldMoney.com:

It has long been held that the only way to achieve a "stable" currency is to have a national central bank which issues and regulates said currency. Such a central bank will issue trustworthy money – not too much and never too little – that every citizen can use and, as a result, the economy should grow and thrive because of its solid monetary foundation. This is the ideal. It is an ideal, however, which remains historically false. Take a look at the current situation in the European Union, for instance. Officially established in 1999, the European Central Bank held the responsibility to issue one, common currency – the euro – for all participating European nations to use in order to provide a platform for economic growth, trade, travel, and (most importantly) peace. Read More @ GoldMoney.com |

| Massive Raid on Silver and Gold as Options Expiry Posted: 21 Nov 2011 08:51 PM PST by Harvey Organ: Good evening Ladies and Gentlemen: Tomorrow is options expiry on the December contract so the bankers orchestrated an all out assault on the paper gold/silver comex market. This will probably continue until first day notice. As I told you many times, do not play with these crooks as they will fleece you every time as the regulators are in bed with the perpetrators. The price of gold finished the comex session at $1678.30 down 46.40 dollars. The price of silver followed in gold's footsteps falling by $1.30 to $31.11. Let us now head over the comex and assess the damage. Read More @ HarveyOrgan.Blogspot.com |

| Europe Weighs Heavily on Global Markets Posted: 21 Nov 2011 08:20 PM PST As of Friday, November, 18 the problems in Europe were guiding the markets down and I predicted it would continue without any good news. Dow Jones Industrial Average: Closed at 11796.16 +25.43 after completing a full five wave correction. Price is under the 20-day moving average but above the important 50 and 200-day averages. Volume was normal and momentum has peaked and turned mildly lower. Europe continues to weigh heavily on all global markets with a stream of continuing bad news and little of anything positive. Mr. Trichet was called to the German Prime Ministers office in a rush today to hammer out new agreements. I am beginning to wonder if the IMF and their colleagues would like to see a European crash so they can rush in and clean-up the pieces on the cheap. The one reason I think this is not true is the high risk game they are playing with huge, NYC global bank loan exposure to European debtors. At last report, default on those mammoth loans would wipe out capitalization of all BIG FIVE NYC lenders. New support is 11750, and resistance is 11800. Unless there is good news from Europe this weekend, Monday could see some very hard markets' selling. S&P 500 Index: Closed at 1215.65 -0.48 on105% of normal volume (high for a Friday) and peaked and turned lower on momentum. Price slipped under all moving averages, which is bearish. Today's trading range was small and tight just like the Dow Jones. There was little interest in trading today as investors could find little they liked and lots of things not to like. On a positive note, the price did support on a lower channel line at 1200 and came back up 15 points. So, support is 1200 and resistance is 1250. The chart is negative with a large, parabolic top. Expect traders to do very little until December 1st with a Thanksgiving holiday arriving next week. Markets will be very slow or, closed November 23-28 with the holiday on the 24th. Look for an early December rally in stocks if Europe can post any kind of a positive solution. If they can't, the IMF will, and USA stocks can rise to close out the trading year of 2011 for the funds and their managers. S&P 100 Index: Closed at 547.80 -0.27 after touching a support channel line on 540. New resistance is 555.89 on the 200-day moving average. Momentum was turning down on normal volume. The close and the averages are all clustered between 547 and 556. We forecast trading for the rest of November between 540 and 560 with a brand new rally beginning on December 1, 2, and 5. November will be choppy, trading in a tight range going nowhere unless something very positive happens in Europe with a larger media splash. Nasdaq 100 Index: Closed at 2253.95 -18.14 on strong price support at 2250 with 200-day average resistance nearby at 2256.69. This trading index is now settled on 2250 but the close was on a hard, short down bar, which is negative. Volume was 105% of normal. Momentum peaked and turned down. Unless there is more bad news on Monday, we think the 2250 support can hold and that this index should trade mildly higher as our leading stock market indicator. Last year at this time, the Nasdaq managed to rise about 50 points over the last two weeks of November. This can happen again, but better news is required to support that trend. Even if Europe is delayed in finishing their credit problems, NYC can offer some positive media pap to rally stocks and get this market moving. Watch the Nasdaq 100 index for leading signals telling us what happens next. 30-Year Bonds: Closed at 142.78 -0.19 as bonds did rise on negative credits in Europe. Early November momentum based and has begun to rally. Price is solidly above all moving averages, which is bullish. Traders in Europe have been shedding their paper and buying bonds from the USA and Japan. Its interesting the Euro currency is doing so well, closing today at 135.13. New bonds' support is 141.50 with resistance at 143.00. These bonds did touch 145.00 in late September and early October making a bear double top. The primary magnet price is 140.00 offering very hard support. We think the bonds can trade between 139.50 and 143.00 for the balance of November. If global stocks get moving on news in early December, the bonds begin to sell with vigor. GDXJ Junior Gold Miners and XAU: The GDXJ closed at 29.24 -0.30 and fell under all moving averages on normal volume and peaked-selling momentum. Today's trading range was short and the price is acting like it wants to support at 28.00. Gold found support on the December futures today as well. New and lower GDXJ support is 27.5. Should the price go there next, we think that would be followed by a pivot rally reversal. This index is slower than the others. Look for more mild selling on Monday followed by abnormally low volume until Thanksgiving is completed and traders are back to work on November 28th. The XAU closed at 196.04 -1.75 on peaked and falling momentum. The all important metal to shares ratio is mildly down telling us more selling in both the XAU and GDXJ next week. There is hard resistance for the XAU near 202-203 on three moving averages. That should be the XAU high price for all of next week. Gold: Closed at 1722.10 +4.30 after touching a top channel line and selling this week from a high near 1800. Momentum peaked and is turning lower. The close was right on our 50 day average for support and resistance at 1722.85. The 20-day average is 1741.18 where we see the price going next week, pre-holiday. Gold is moving in a larger trading continuation triangle. If the price can hold that 50-day average and we say it will, we can get some mild up-tick buying next week stopping at 1738.50 resistance. I am beginning to see less rally upside pressure for both gold and silver for November-December due to cycles, dates, and holidays; but mostly on negative European news. December futures closed higher at 1726.00. Silver: Closed at 32.29 +071 resisting on the 200-day moving average of 34.58 this week. Momentum has peaked and turned down. The price slipped under $34 in a nest of 7 support and resistance prices between $32 and $34. Price is under all the moving averages so now it has 10 points of resistance between our close and $35.00.There is very hard price support at $30.00. For now, we think $32.08 will hold and the price is stuck in chop until December 1st. Watch for silver to trade between $32.00-$34.48 for the rest of November. US Dollar: Closed at 78.05 -0.24 with price above all moving averages staying strong with the USA bonds. Resistance is 78.50 and support is 77.36 on the 20-day average. The dollar should trade in chop for the balance of November followed by new selling along with bonds when stocks rise in early December. The dollar was supported on a falling Euro as was the Yen. "Super Committee" failure on November 23, just before Thanksgiving, can affect markets. Obviously the date was picked so failure would have mild effects. Nothing happens with traders throughout the four day weekend. A real response could arrive on Monday, November 28; but we don't expect much as most expected committee failures. They will not impose any cuts at all. Crude Oil: Closed at $98.80 -2.92 after price touched just over $100 and then retreated. Price is far above all moving averages on rising momentum, climbing a very tall lower channel line in a major rally since the first of October. Since October 1, oil has gone up from $77 to $103.00. New resistance is $105 and support is $98.50. The trading range is $98.50 to $102.50. There is strong support for oil at $95-$96. Watch for oil prices to continue to hit $105-$106 and fall back to $95.00 until the middle of February barring any global political troubles. Iran is getting hot again but that has been on and off for months-years. CRB Index: Closed at 312.21 -2.31 on flattening momentum and selling to support at 310.00 before a mild, two point recovery into the close. This index has been in a wider trading range selling lower since last March 1. After price dropped recently, under the lower support channel line, it rebounded on several commodities. For now, we are selling off for the balance of November and the holiday. If 310 support is broken, price could then drop to 300-295 on the chart base. The next larger CRB rally cycle begins on December 1 and normally is in bull mode to May 1, 2012, with several normal corrections. Last year at this time price rose from 295 to a high in April near 370; a 75 point rally in the entire run. Resistance is 317.62 on the 20-day average. And, support is just under the close at 310.00. Expect more selling until the end of November this month. -Traderrog This posting includes an audio/video/photo media file: Download Now |

| Major Catalysts Ahead to Trigger Next Breakout in Gold Market Posted: 21 Nov 2011 06:36 PM PST In bull markets, corrections and consolidations are needed to periodically cleanse the market of extreme optimism and an overbought condition. After a market has strong run it inevitably reaches a point of resistance. This is where there are more buyers than sellers. A market can correct in two ways. Either it declines and retraces much of the preceding gains relatively quickly or a market will consolidate near its highs for a long period of time. The first correction is a function of price while the second, time. The correction or consolidation ends when a fundamental catalyst emerges which triggers greater demand that overwhelms current supply. The consolidation has endured due to a working off of the overbought condition from 2009-2010 gains as well as the lack of a real catalyst. The Fed, though accomadative has been on hold while emerging markets turned their focus to inflation. European bond markets were in fair shape into the summer. However, the good news for gold investors is that a trio of major catalysts lie on the horizon and should easily trigger the next breakout. The obvious catalyst is a massive bailout of European nations and European banks through a $3 Trillion debt monetization (the figure stated by many). Until last month the European crisis was limited and a hope of being contained. Since then interest rates on French bonds, which had been following Germany began following Spain and Italy higher. The 10-year yield on French bonds has surged in the past six weeks from about 2.50% to nearly 4%. Meanwhile, Ambrose Evans Pritchard, the intrepid reporter wrote that Asian investors are pulling out of German Bunds and Europe all together. Bund yields (10-year) look to be forming a double bottom just below 2%. Bunds stopped rising in last month as yields surged in Spain, Italy and France. Understandably, Germany has stood in the way of an ECB bailout. However, the sooner the crisis spreads to Germany, the sooner we can expect a German-led ECB bailout. Moving over to Asia, we hear that China has started to turn its focus away from inflation and towards growth. Last weekend the Chinese Vice-Premier, Wang Qishan indicated publicly that "ensuring growth is the overriding priority," and "unbalanced growth would be better than a balanced recession." He also noted the persistent weakness in the global economy. China's tightening, which began October 2010 has been effective. It was recently reported that Chinese inflation rate has fallen in recent months from a high of 6.5% to 5.5% and industrial production growth slipped to a one-year low. GDP growth has slowed in recent quarters from 9.7% down to 9.1%. According to analysts at Citigroup, the slowdown could intensify. Bloomberg reports: If tightening measures aren't relaxed, property investment will "scale back significantly" in the next two quarters, "dragging down the whole production chain and GDP growth," Minggao Shen and Ben Wei, analysts at Citigroup, wrote in a report dated yesterday. Exporting firms are also facing an environment worse than in late 2008 due to the overseas slowdown and rising costs, they said. Last but not least let us consider the USA. Our bond market remains the strongest in the world while the US Dollar is likely to rally further in the near term. This combination along with lower commodity prices and a global move to inflationary policies will allow the Fed the political cover to institute another round of debt monetization. Combined with potential action in China and imminent action in Europe, this is powerful policy that should result in a massive catalyst for select markets. The current investor psychology of fear, indifference, and surrender is leaving them vulnerable as they miss the big catalysts that lie directly ahead. Gold and gold stocks remain in excellent position for a potentially tremendous 2012 and 2013. Required action from Europe, a shift in Chinese policy and more monetization on steroids from the Fed is going to catapult the bull market in precious metals like we haven't seen since the late 1970s. In our premium service, we seek to manage the short-term risks in this volatile sector while keeping focused on the major opportunities. The technicals are lined up while fundamental catalysts are soon to emerge. The combination could lead to an explosive 2012 for gold bugs. We invite you to learn more about our service. Good Luck! Jordan Roy-Byrne, CMT |

| Posted: 21 Nov 2011 06:06 PM PST |

| Satyajit Das: Extortionate Privilege – America’s FMD Posted: 21 Nov 2011 06:01 PM PST Yves here. I'm putting myself in the rather peculiar position of taking exception to a guest post. One might argue as to why I'm featuring it. Das gives an articulate but nevertheless fairly conventional reading of views of market professionals about the US debt levels. For instance as you'll see, it conflates state government deficits (which do need to be funded in now skeptical markets) with the Federal deficit. And this sort of thinking, due to fear of the Bond Gods, is driving policy right now. In addition, he posits that depreciation of the US dollar continues apace. I'm always leery of what amount to trend projections. Complex systems often have unexpected feedback loops. There is an interesting question of whether markets have over-anticipated QE3. In addition, the dollar has fallen to the point where it is becoming attractive for manufacturers to repatriate activities. But given the loss of managerial "talent" (and here I mean people who know how to run operations, not executives) and infrastructure, there will be a marked lag before the weakened dollar produces the next leg up of domestic production. By Satyajit Das, derivatives expert and the author of Extreme Money: The Masters of the Universe and the Cult of Risk Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives – Revised Edition (2006 and 2010) Extortionate Privilege… Given the magnitude of the US debt problem and the lack of political will, the most likely policy is FMD – "fudging", "monetisation" and "devaluation". US states and municipalities demonstrate "fudging". In the boom years, local government revenues increased from rising property values and taxes allowing additional services and larger payrolls. When the housing bubble burst and property values dropped an average of 35% reducing tax revenues, these entities found it difficult to cut expenses or increase taxes. Instead, some cities and states relied on fiscal "magic tricks" to close budget gaps each year but at great future cost. Illinois, which has not made the required annual payments to its pension funds for years, borrowed $10 billion in 2003 and used the money to invest in its pension funds. When the recession sent investment returns below their target, Illinois sold an additional $3.5 billion worth of pension bonds and is planning to borrow $3.7 billion more for its pension funds. US state and local government have unfunded pension liabilities nearing $3.5 trillion. Others are selling off assets to temporarily plug budget holes, without viable plans to permanently fix finances. There is no shortage of creative ideas of financing government debts. Bankers suggested the US issue perpetual debt, that is, the government would not be obligated to pay back the amount borrowed at all. Peter Orzag, former director of the US Office of Management and Budget under President Obama and now a vice-chairman at Citigroup, suggested another creative way to correct the problem – lotteries. To encourage savings, banks should offer lottery-linked accounts offering a lower rate of interest, but also a one-in-a-million chance of winning $1million for each $100 deposited. As governments printed money to service their debts, US Post issued 44-cent first class "forever stamps" that had no face value but were guaranteed to cover the cost of mailing a first class letter, regardless of how high that cost might be in the future. Between 2007 and 2010 the public bought 28 billion forever stamps. The scheme summed up government approaches to public finance – US Post was cleverly hiding its financial problems, receiving cash up-front against the uncertain promise to pay back the money somewhere in the never, never future. Debt monetisation – printing money – is the second option. The US Federal Reserve is already the in-house pawnbroker to the US government, purchasing government bonds in return for supplying reserves to the banking system. Expedient in the short term, its risks debasing the currency and setting off inflation. The absence of demand in the economy, industrial over capacity and the unwillingness of banks to lend have meant that successive rounds of "quantitative easing" – the fashionable moniker for printing money – have not resulted in higher inflation to date. But the longer term risks remain. Monetisation is inexorably linked to devaluation of the US dollar. The now officially confirmed zero interest rates policy ("ZIRP") and debt monetisation is designed to weaken the dollar. On 19 October 2010, US Treasury Secretary Timothy Geithner told the Financial Times: "It is very important for people to understand that the United States of America and no country around the world can devalue its way to prosperity and Competitiveness. It is not a viable, feasible strategy and we will not engage in it." The facts show otherwise. Despite bouts of dollar buying on its safe haven status, the US dollar has significantly weakened over the last 2 years in a culmination of a long term trend which with minor retracements. In 2007 alone, the US dollar weakened by about 8% improving America's external position by $450 billion, as US foreign investments gained in value but its debt denominated in dollars were unaffected. On a trade weighted basis, the US dollar has lost around 18% against major currencies since 2009. The US dollar has lost around 30% against the Swiss Franc, 25% against the Canadian dollar, 37% against the Australian dollar and 16% against the Singapore dollar over the same period. US dollar devaluation makes it easier for the US to service its debt. In the balance of financial terror, it forces existing investors to keep rolling over debt to avoid realising currency losses on their investments. It also encourages existing investors to increase investment, to "double down" to lower their average cost of US dollars and US government debt. The weaker US dollar also allows the US to enhance its competitive position for exports – in effect, the devaluation is a de facto cut in costs. This is designed to drive economic growth. Valery Giscard d'Estaing, French Finance Minister under President Charles de Gaulle, famously used the term "exorbitant privilege" to describe the advantages to America of the role of the US dollar as a reserve currency and its central role in global trade. That privilege now is not only "exorbitant" but "extortionate". How long the rest of world will allow the US to exercise this "extortionate privilege" is uncertain. A World Without the US Dollar… Winston Churchill famously observed that Americans can be counted on to do the right things but only after all other possibilities have been exhausted. Unfortunately, it is doubtful that the US debt problem will be resolved by resolute American actions. The deployments of FMDs seem more likely. America remains the world's only military super power and constitutes a quarter of the global economy. This means that what happens in America is unlikely to stay in America. The world must prepare for the denouement of the US debt crisis. At best, actions by America will usher in a prolonged period of stagnation for the US economy reducing global economy growth. At worst, continuation of a strategy of FMD and maintaining the balance of financial terror will create a volatile and dystopian economic environment. As a significant amount of US government debt is held outside the country, foreign investors will suffer significant losses, through depreciation of the US dollar. These investment losses will limit the financial flexibility of these countries, limiting their future growth. The damage may lead to political instability. In China, the blog-o-sphere has seen fierce criticism of the central government and its management of its reserves. Foreign lenders may simply give up on the US, write off their existing investments (either explicitly or implicitly) and withhold further investment. This would trigger a major collapse of the US dollar and US government bond prices, triggering a different kind of financial crisis. A policy of devaluation of the US dollar may trigger trade and currency wars. Many emerging markets have already implemented capital controls. These will be strengthened and supplemented by other measures such as trade sanctions. There are already accusations of protectionism, currency manipulation and unfair competition. This is reminiscent of the trade wars of the 1930s and will retard global growth. US dollar devaluation is also destabilising for emerging markets and commodity prices. Low interest rates and the falling US dollar have encouraged investors to increase investments in emerging markets, offering better returns and higher growth prospects. These flows have pushed up asset prices and currency values distorting economic activity in these countries. As most commodities are priced and traded in US dollars, the lower value of the currency causes price rises. Low interest rates have encouraged speculation in and stockpiling of commodities. Higher commodity prices and strong capital flows are fuelling inflation in emerging markets. Central banks in these emerging countries have been forced to increase interest rates and restrict bank lending to reduce price pressures. Given that emerging markets have been a key driver of economic growth globally, this risks truncating the recovery. Any problems with the US dollar and unequivocal acceptance of America's creditworthiness are amplified by its pre-eminent role in economic activity and financial markets. There are limited alternatives to the dollar in global trade, especially given the problems of Japan and the Euro-Zone. US government bonds are traditionally seen as a safe-haven as well as the preferred form of collateral used widely to secure borrowing and other obligations. If the quality of US government bonds were to fall significantly, then this would affect the solvency of the banking system which have substantial holdings. US government bonds are used as collateral to raise funding (in the "repo" market) and secure trading in financial instruments. Falls in the value of US government bonds or a loss of confidence in their value as surety would lead initially to a global "margin call", as the value of the collateral is marked down setting off a "dash for cash". In an extreme case, where US governments bonds are not accepted as collateral, it would lead to a contraction of liquidity and financial activity generally. Many of these problems are not new. Politicians and policy makers have persistently refused to deal with the role of the US dollar as a reserve currency and large global financial imbalances for many years. Recent proposals, such the use of Special Deposit Rights ("SDRs") or introduction of Keynes' Bancor, are impractical. No Exit … The US is in serious, perhaps irretrievable, financial trouble. There is a lack of political or popular will to take the action necessary to even stabilise the position. The role of US dollars and US government bonds in the financial system mean that the problems are likely to spread rapidly to engulf other nations. As John Connally, US Treasury Secretary under President Nixon, beligerently observed: "Our dollar, but your problem." Minor symptoms, often increasing in frequency and severity, can provide warning of a life threatening problem in a key organ, such as the heart. Since 2007, the global financial markets have been providing warnings of an impending serious crisis. Private sector credit problems have spread to sovereign nations. Debt problems of smaller nations have flowed on to larger nations. The problems are gradually working their way to the issue of US debt. Without rapid and decisive action, which seems to be unlikely, a major organ failure within the global economy may now beinevitable. Th magnitude of the problem and its effects are so large, market participants would do well to heed Douglas Adams famous advice in The Hitchhikers Guide to the Galaxy. Find dark glasses that go black in the case of a crisis and a towel to suck on. |

| The "Gold Beta" Of Mining Stocks and Why We Continue To Avoid Them Posted: 21 Nov 2011 05:51 PM PST |

| Posted: 21 Nov 2011 05:47 PM PST |

| Pullback In Gold And Silver Is A Buying Opportunity Posted: 21 Nov 2011 05:44 PM PST |

| Ned Schmidt: “Wait for Gold and Silver to Bottom” Posted: 21 Nov 2011 05:01 PM PST

Ned Schmidt: Wait for gold and silver to bottom Jim is joined on Financial Sense Newshour by Ned Schmidt to discuss gold and silver cycles. Ned advises holding what you have, but wait for gold and silver to bottom before buying more. Ned believes silver will bottom before gold, by spring at the latest. Ned is a financial engineer specializing in global capital flows. He has been an advocate and practitioner of value oriented investing for thirty years. Ned began his investment career as a security analyst following the oil industry in the early 1970s. In the 1980s he was manager of an investment management group with discretionary responsibility for about $3.5 billion. During the past decade he also taught institutional investment management as The Roland George Visiting Professor of Applied Investments at Stetson University. He currently manages the Argyle Global Equity Appreciation Fund, an offshore mutual fund in the top quartile of global equity funds the past three years by Standard and Poors. Ned currently publishes THE VALUE VIEW GOLD REPORT, and writes for THE GLOBAL ADVISOR published in Toronto. Much More @ FinancialSense.com |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

From

From

Is the world on the verge of another massive global financial collapse? Yes. The western world is drowning in an ocean of debt unlike anything the world has ever seen before, and our financial markets are gigantic casinos that are dependent on huge mountains of risk and leverage remaining very stable. In the end, this house of cards that has been built on a foundation of sand is going to come crashing down in a horrifying manner. Usually in this column I go on and on about why things will soon get much worse. But today I am going to take a bit of a break. Today, I am going to let some of the top financial professionals in the world tell you why things will soon get much worse. Many of the quotes that you are about to read just might make the hair on the back of your neck stand up. Most people out there have no idea what is about to happen. Most people out there are working hard and are busy preparing for the holidays and they are hopeful that the economy will turn around soon. But that is not going to happen. We are heading for another major global financial collapse, and when it happens the U.S. economy is going to get even worse.

Is the world on the verge of another massive global financial collapse? Yes. The western world is drowning in an ocean of debt unlike anything the world has ever seen before, and our financial markets are gigantic casinos that are dependent on huge mountains of risk and leverage remaining very stable. In the end, this house of cards that has been built on a foundation of sand is going to come crashing down in a horrifying manner. Usually in this column I go on and on about why things will soon get much worse. But today I am going to take a bit of a break. Today, I am going to let some of the top financial professionals in the world tell you why things will soon get much worse. Many of the quotes that you are about to read just might make the hair on the back of your neck stand up. Most people out there have no idea what is about to happen. Most people out there are working hard and are busy preparing for the holidays and they are hopeful that the economy will turn around soon. But that is not going to happen. We are heading for another major global financial collapse, and when it happens the U.S. economy is going to get even worse. On the twenty-seventh of February, 1818, [the Suffolk Bank] was organized which was destined to exert upon the currency of New England an influence little dreamed of by its projectors, but so wholesome that it gave uniformity and stability to the circulation [currency], reduced the discount [rate for redemption of paper notes] to a minimum, and by holding [over-issuing of paper money] in check tended to keep [the American economy] in a sound and healthy condition. ~

On the twenty-seventh of February, 1818, [the Suffolk Bank] was organized which was destined to exert upon the currency of New England an influence little dreamed of by its projectors, but so wholesome that it gave uniformity and stability to the circulation [currency], reduced the discount [rate for redemption of paper notes] to a minimum, and by holding [over-issuing of paper money] in check tended to keep [the American economy] in a sound and healthy condition. ~

No comments:

Post a Comment