saveyourassetsfirst3 |

- Gold Seeker Closing Report: Gold and Silver End Slightly Higher

- 7 Dirt Cheap, Highly Profitable Buys With Major Upside You Must Consider

- Sabrin: “The Federal Reserve Destroys Money”

- John Paulson Slashes Gold Holdings And 6 Other Big Portfolio Moves

- Paulson Scales Back Position In GLD By Nearly $2 Billion

- Canadian And Aussie Dollars Face Same Troubles

- Revett Minerals: The Lowest Risk Silver Miner You've Never Heard Of

- Russia Aims To Buy 100 Tons Of Gold

- THRIVE – One of the Most Important Films Ever Made

- Gold is Not an Investment, Gold is Money

- Silver Predator Enters Into Letter of Intent to Acquire Nevgold Resource Corp.

- Gold price hits new record high in India

- Doug Casey talks to James Turk

- GEAB N°59 est disponible! Crise systémique globale : 30.000 milliards USD d'actifs fantômes vont disparaître d'ici début 2013 / La crise entre dans la phase de décote généralisée des dettes occidentales

- Paulson Sells Gold ETF – Buys Physical Bullion? Soros Not Gold Bearish

- "Agflation" update: The U.S. crop situation is still dangerously tight

- "Anti-capitalist" Michael Moore exposed as a fraud

- Gadhafi’s Gold-Money Plan Would Have Devastated Dollar

- On the Dubious Defenses of the Netting of $4 Trillion of US Bank CDS to the Eurozone

- Links 11/15/11

- Gold & Silver Market Morning, November 15, 2011

- Russian Central Bank Aims to Buy 100 Tonnes of Gold in 2011

- Russian Central Bank Aims To Buy 100 Tons Of Gold In 2011

- Goldman and Credit Suisse Bullish on Gold Due to US Interest Rates

- 'You have to love gold here,' Leeb tells King World News

- Is gold headed to $2,200? - Do charts sense Chinese buying?

- Physical gold to trump ETFs by 500% in 2011 hears Dubai conference

- Why Proposals That Italy Should Sell Its Gold Are Ridiculous

- Bloomberg: Gold Traders most Bullish Since 2004

- Dollar Teetering on the Abyss

| Gold Seeker Closing Report: Gold and Silver End Slightly Higher Posted: 15 Nov 2011 07:20 AM PST Gold fell $20.07 to $1760.23 by about 4AM EST before it rose to see a $5.60 gain at $1785.90 by about 9:45AM EST and then chopped back lower midday, but it still ended with a gain of 0.08%. Silver slipped to $33.742 before it rebounded to $34.796 and then also fell back off a bit, but it still ended with a gain of 0.76%. |

| 7 Dirt Cheap, Highly Profitable Buys With Major Upside You Must Consider Posted: 15 Nov 2011 06:11 AM PST By David Alton Clark: In this article, we will discuss the following S&P 500 stocks: Microsoft (MSFT), Qualcomm (QCOM), Visa Inc. (V), MasterCard Incorporated (MA), Freeport-McMoRan Copper & Gold Inc. (FCX), Gilead Sciences Inc. (GILD) and Corning Incorporated (GLW). Company Reviews The stocks covered are the top seven S&P 500 (SPY) large cap or better stocks with the highest profits margins coupled with PEG ratios near or below one. Additionally, these stocks have great stories and positive catalysts for future growth. Compelling Fundamental Statistics High Profitability A company's profitability is conceivably the most important statistic to understand before investing in a stock. Each time you consider starting a position in a stock, you should prudently scrutinize its earnings information. The reason earnings are so vital to investors is that they tell you about the relative profitability of a company. Earnings per share is defined as the net income of a company divided by the Complete Story » |

| Sabrin: “The Federal Reserve Destroys Money” Posted: 15 Nov 2011 05:44 AM PST Professor Murray Sabrin spills the beans on why Congressman Ron Paul is disregarded by the Media Establisment. "Either the other current candidates do not know about this (the Federal Reserve System), which means they are unqualified to be President, OR they have been told NOT to talk about it. There are only two possibilities. You either don't know about it, or you have been told NOT to talk about it. None of the other candidates in all of the debates have mentioned the words Federal Reserve out of their lips. Why? When it's the most powerful institution in the world. More powerful than the President. More powerful than that lunatic from Iran that we're so worried about. The Federal Reserve destroys money, do you know what that means? It means that our standard of living will have to go down. That's what it means." |

| John Paulson Slashes Gold Holdings And 6 Other Big Portfolio Moves Posted: 15 Nov 2011 05:40 AM PST By Osman Gulseven: John Paulson is one of the prominent hedge fund managers on the Street. John Paulson's fund management style is distinctive and extremely complex. As a former investment banker, he uses both merger arbitrage opportunities as well as credit default swap options. In late June, Paulson's hedge fund took a tough beat from Sino-Forest scandal. Muddy Water's report on Sino Forest has decimated the stock prices. As Paulson was one of the largest shareholders, his hedge fund took a beat that is claimed to be as high as $720 million. Paulson revealed a memo to to the investors, stating that, based on the initial-cost of shares; the actual loss was around $100 million. As of the 2011 third quarter, Paulson & Co. had a diversified portfolio of equities. According to Edgar Online, Paulson favors financial stocks, followed by commodity and energy investments. Financial stocks constitute 26.85% of the holdings, followed by Complete Story » |

| Paulson Scales Back Position In GLD By Nearly $2 Billion Posted: 15 Nov 2011 05:37 AM PST By John Spence: Hedge fund manager John Paulson reduced his holdings in the world's largest gold exchange traded funds by 36% in the third quarter, according to regulatory filings. Paulson & Co. cut its holdings in the $72.4 billion SPDR Gold Shares (GLD) to 20.3 million shares from 31.5 million at the end of the second quarter, Reuters reported Tuesday. Based on current prices, Paulson unloaded about 1.1 million ounces of gold valued at nearly $2 billion, according to the article. "Paulson's motivation to sell some of his stake was unclear, but analysts said he might be transferring positions from SPDR to other holdings to better shield his positions or cut management fees charged by the SPDR," Reuters reported, adding the fund could also be selling gold to meet fund redemptions. Paulson's |

| Canadian And Aussie Dollars Face Same Troubles Posted: 15 Nov 2011 05:24 AM PST By MarketPulse FX: By Dean Popplewell The Canadian dollar is now trading on the back foot for the first time in three days. The reasons are multiple, justifiable and easily identifiable. Europe, commodities and risk adjustment. The political readjusting in Europe over the weekend, albeit good and warranted, does not change anything in the short to medium term. Ballooning periphery yields and a lack of an ECB presence had the market unwinding some of the riskier trades that were entered into before the Rome meetings. Now we are back trading a defined and contained trading range, dictated by sovereign interest on top and corporate bids below. Currently, with commodity prices under pressure and the EUR for sale on rallies has the currency looking vulnerable right hand side with the dollar edging towards those sovereign CAD bids as the EURO sovereign crisis enters a questionable and threatening new period for policy makers. A breach Complete Story » |

| Revett Minerals: The Lowest Risk Silver Miner You've Never Heard Of Posted: 15 Nov 2011 05:23 AM PST By Thomas Kelly: When it comes to precious metals miners, the speculative element seems to drive investment flows on a short term basis. But exploring for minerals is an inherently risky business, and over the long term, speculative investments are more often rewarded with red ink than generous profits. For mining companies in particular, the risk of serial dilution, expropriation of properties by foreign governments, and ever-rising development costs mean that very few of the seemingly promising small miners being touted will actually bring riches to shareholders. If the investor is going to make a solid profit in small cap miners, the critical point is not to bet on the biggest opportunities, but instead, to minimize the risk involved in playing what is an inherently speculative game. For the development stage miner, the biggest risk to the shareholder is normally dilution. Developing a mine costs a lot of money, and with little or Complete Story » |

| Russia Aims To Buy 100 Tons Of Gold Posted: 15 Nov 2011 05:16 AM PST

by Grigori Gerenstein, London Stock Exchange.com: MOSCOW -(Dow Jones)- The Central Bank of Russia has purchased 90 metric tons of gold to date in 2011 and is on course to buy 100 tons before the end of the year, deputy head of the bank Sergey Shevtsov said as quoted by the bank's press service. The bank said earlier it would aim at buying 100 tons of gold every year and increase the proportion of gold in the country's reserves as a safeguard against volatility on the international financial markets. On Oct. 1 the Central Bank's gold reserve stood at 852.14 tons, up from 789.9 tons on Jan. 1. In the course of 2010 Russia's gold reserve increased by 24% to 25.2 million troy ounces, while its value in dollar terms increased by 60% to $35.788 billion. The share of gold in the country's total gold and currency reserves in the course of 2010 increased by 2.4 percentage points to 7.5%. Read more @ LondonStockExchange.com |

| THRIVE – One of the Most Important Films Ever Made Posted: 15 Nov 2011 04:53 AM PST I just finished watching what I believe to be on of the most important films ever made. THRIVE is an unconventional documentary that lifts the veil on what is really going on in our world by following the money upstream – uncovering the global consolidation of power in nearly every aspect of our lives. [...] |

| Gold is Not an Investment, Gold is Money Posted: 15 Nov 2011 04:20 AM PST by David Schectman, MilesFranklin.com:

"Is America unaware of what's going on its southern border, or does it need that excuse to close the borders and lock in Americans – and their assets? That question is as far as we take you with that, and you are on your own to decide."–James Dines If you are wondering why gold and silver prices are stuck in a rut you can lay blame on the MF Global situation as longs are being liquidated by the Trustee to facilitate cash settlements and with 150,000 customer accounts frozen the vast array of potential buyers are unable join the feeding frenzy. In addition, the CME is raising margin requirements this week and also adds to the liquidation of gold and silver. This should come to an end quickly. Read More @ MilesFranklin.com |

| Silver Predator Enters Into Letter of Intent to Acquire Nevgold Resource Corp. Posted: 15 Nov 2011 03:48 AM PST Silver Predator Corp. ("Silver Predator") (TSX: SPD.TO) and Nevgold Resource Corp. ("Nevgold") (TSX-V: NDG.V) are pleased to announce that they have entered into a letter of intent (the "LOI") whereby Silver Predator will acquire all of the outstanding securities of Nevgold (the "Proposed Transaction"). Nathan Tewalt, Chief Executive Officer of Nevgold, will be assuming the position of Chief Executive Officer of Silver Predator upon completion of the Proposed Transaction. |

| Gold price hits new record high in India Posted: 15 Nov 2011 03:30 AM PST Yesterday the Indian gold price rose 30 rupees to hit a new record high of 29,296 rupees per 10 grams. But rising prices are not scaring investors away - Indians keep transferring their funds to ... |

| Doug Casey talks to James Turk Posted: 15 Nov 2011 03:17 AM PST Interesting talk. Some kind of far out stuff towards the end. Doug Casey talks to James Turk (54 min 10 sec): http://www.youtube.com/watch?v=hSyJjC_jBWQ info from YouTube: In this video, Doug Casey, founder and chairman of Casey Research Institute, talks to the GoldMoney Foundation's James Turk about the greater depression that is facing the developed world. In Casey's view, finding intriguing investment opportunities is difficult at the moment, owing to the dislocations affecting economies as a result of central banks' money printing efforts. He does however think that tangible assets such as precious metals, land and fine art remain the best options available at the moment. In stark contrast, Casey is extremely downbeat on bonds and the US dollar. He thinks that given the incredible levels that bond prices have risen to as a result of panicked safe-haven buying by hedge funds, they represent an excellent shorting opportunity for speculators. Turk and Casey also discuss the opportunities to be had in mining shares, though Doug also points out the significant risks that mining companies face -- relating to political pressure from politicians and environmentalists. He says that investors need to be aware of these risks, but remains bullish on junior gold and silver producers. Casey and Turk also discuss whether or not technological advances will ever gold obsolete as a potential form of money and store of value. Casey points out that according to Aristotle's definition of good money, gold will always remain the best form of money. In his words: "gold is uniquely suitable for use as money". Viewers can subscribe to free "Conversation with Casey" at www.caseyresearch.com. This interview was recorded in Sydney, Australia on 10 October 2011. |

| Posted: 15 Nov 2011 02:42 AM PST - Communiqué public GEAB N°59 (15 novembre 2011) -  Nous arrivons vers la fin du second semestre 2011 et 15.000 milliards d'actifs-fantômes se sont bien envolés en fumée depuis Juillet dernier comme anticipé par LEAP/E2020 (GEAB N°56 ). Et, selon notre équipe, ce processus va se poursuivre au même rythme tout au long de l'année en venir. Nous estimons en effet que, avec la mise en place de la décote de 50% sur les dettes publiques grecques, la crise systémique globale entre dans une nouvelle phase : celle de la décote généralisée des dettes publiques occidentales et de son corollaire, la fragmentation du marché financier mondial. Notre équipe considère que 2012 va voir une décote moyenne de 30% de l'ensemble des dettes publiques occidentales (1) auquel s'ajoutera un montant équivalent de disparition d'actifs des bilans des établissements financiers mondiaux. Concrètement, LEAP/E2020 anticipe donc la disparition de 30.000 milliards d'actifs-fantômes d'ici le début 2013 (2) et l'accélération courant 2012 du processus de partition du marché financier mondial (3) en trois grandes zones monétaires de plus en plus déconnectées : Dollar, Euro, Yuan. Ces deux phénomènes se nourrissent l'un l'autre. Ils vont notamment être à l'origine de la baisse de 30% de la devise US en 2012 (4), comme nous l'avons annoncé en Avril dernier (GEAB N°54 ), sur fond de forte réduction de la demande de Dollars US et d'aggravation de la crise de dette publique US. La fin 2011 va donc voir, comme prévu, le détonateur des dettes publiques européennes déclencher l'explosion de la bombe US. Dans ce GEAB N°59 nous analysons donc en détail cette nouvelle phase de la crise ainsi que la prochaine aggravation de la crise de dette US. Par ailleurs, nous commençons à présenter, comme annoncé dans les GEAB précédents, nos anticipations sur l'avenir des Etats-Unis pour la période 2012-2016 (5) en commençant par un aspect fondamental des relations euro-américaines (et plus généralement du monde tel qu'on le connaît depuis 1945), à savoir la relation militaire stratégique USA-Europe : nous estimons qu'en 2017 le dernier soldat US aura quitté le sol de l'Europe continentale. Enfin, LEAP/E2020 présente ses recommandations ; ce mois-ci : devises, or, retraites par capitalisation, secteur financier, matières premières. Dans ce communiqué public nous avons choisi de présenter les éléments qui déterminent la prochaine aggravation de la crise de la dette US, tout en faisant le point sur les conséquences du sommet européen de la fin Octobre et du sommet du G20 de Cannes. Comme anticipé par LEAP/2020 depuis plusieurs mois, le sommet du G20 de Cannes s'est révélé être un échec flagrant puisqu'il n'a accouché d'absolument aucune mesure significative, se révélant incapable d'aborder les questions du changement de système monétaire international, de la relance de l'économie mondiale et de la réforme de la gouvernance globale. Si la question grecque a pris une telle place au cours de ce sommet, c'est notamment parce que ce dernier n'avait aucun contenu. George Papandreou a ainsi permis aux dirigeants du G20 de « faire comme si » la Grèce avait perturbé leurs travaux (6) alors que, en fait, elle leur a permis de cacher en partie leur impuissance à définir le moindre agenda commun. Parallèlement, les décisions du sommet européen de la semaine précédant le G20 illustrent désormais de manière officielle l'émergence de l'Euroland (doté notamment de deux sommets spécifiques chaque année (7)) et affirment de facto sa primauté décisionnelle au sein de l'UE (8). La pression de la crise a également permis en quelques jours de renforcer les capacités politiques de l'Euroland à progresser sur le chemin d'une intégration accrue (9), préalable à toute évolution positive vers le monde d'après la crise (10).  Ainsi un gouvernement d'unité nationale s'est enfin mis en place en Grèce (11), où il faut littéralement construire un Etat moderne doté d'un cadastre, d'une administration efficace et permettant aux Grecs d'être des citoyens « normaux » de l'Euroland et non pas des sujets d'un système féodal où grandes familles et église se partage la richesse et le pouvoir. Trente ans après son intégration sans conditions dans la Communauté européenne, la Grèce va devoir passer par une phase de transition de cinq à dix ans comme l'ont connue les pays d'Europe centrale et orientale avant leur accession à l'UE : douloureux, mais inévitable. Ainsi, l'Italie est enfin parvenu à se débarrasser d'un leader typique du monde d'avant la crise caractérisé par son « bling-bling », son affairisme, son rapport sans scrupules à l'argent, son autosatisfaction tout aussi récurrente qu'infondée, sa main-mise médiatique, son eurocriticisme récurrent et son nationalisme de pacotille (12), et bien entendu sa libido débordante. Les scènes de joie dans les rues italiennes montrent qu'il n'y a pas que du mauvais dans la crise systémique globale ! Comme nous l'indiquions dans le GEAB précédent, nous considérons même que 2012 sera pour l'Euroland l'année de transition permettant d'entamer la construction du monde d'après … et non pas seulement de subir la déconfiture du monde d'avant la crise. Ainsi le Royaume-Uni est tout simplement définitivement « mis à la porte » des réunions de l'Euroland (13). Et les autres pays membres de l'UE hors zone Euro se sont à nouveau regroupés derrière l'Euroland en refusant de soutenir la proposition britannique d'un droit de véto des 27 sur les décisions de l'Euroland. La dérive du Royaume-Uni connaît donc un coup d'accélérateur illustré par les tentatives accrues des Eurosceptiques britanniques (qui sont généralement les fantassins de la City (14)) pour tenter de couper au plus vite le maximum de liens avec l'Europe continentale (15). Loin d'être une preuve du succès de leur politique, c'est au contraire un aveu d'échec complet (16) : après vingt ans de tentatives ininterrompues, ils n'ont pas réussi à briser le processus d'intégration européenne qui reprend de plus belle sous la pression de la crise. Ils tentent donc de « larguer les amarres » par crainte (fondée d'ailleurs (17)) de voir le Royaume-Uni obligé de se fondre dans l'Euroland d'ici la fin de cette décennie (18). Sur le fond, c'est une fuite en avant désespérée qui, comme le souligne Will Hutton dans un article remarquable de lucidité paru dans le Guardian du 30/10/2011, ne peut conduire le Royaume-Uni qu'à l'éclatement avec une Ecosse qui veut revendiquer non seulement son indépendance (19) mais également son ancrage européen, et à une situation socio-économique de marché financier off-shore sans protection sociale (20) ni base industrielle (21) : en résumé, un Royaume-Désuni à la dérive (22) ! Et l'allié américain étant dans un état aussi désespéré, la dérive peut s'éterniser pour le plus grand malheur du peuple britannique qui se montre de plus en plus agressif avec la City. Même les anciens combattants commencent à rejoindre le mouvement Occupy the City (23) : visiblement, sur ce point, il y a une étonnante convergence de points de vue entre l'Euroland et le peuple britannique ! Pour se consoler, les financiers britanniques pourront se dire qu'ils détiennent la plus grande proportion d'actifs publics japonais hors Japon … mais au moment où le FMI met en garde de plus en plus fermement le Japon sur le risque systémique de sa dette publique qui dépasse les 200% du PIB (24), est-ce bien une consolation ?  Puisque nous parlons d'endettement public, il est temps de revenir aux Etats-Unis. Les toutes prochaines semaines vont en effet rappeler au monde que c'est bien ce pays, et non pas la Grèce, qui est l'épicentre de la crise systémique globale. Dans une semaine, le 23 Novembre, la « supercommission » du Congrès en charge de réduire le déficit fédéral US devra avouer son échec à trouver les 1.500 Milliards USD d'économies sur dix ans. Chaque parti affûte déjà ses arguments pour faire porter la faute de l'échec sur l'autre camp (25). Quand à Barack Obama, en-dehors de ses minauderies télévisées avec Nicolas Sarkozy, il contemple passivement la situation tout en constatant que le Congrès a mis en pièce son grand projet de plan pour l'emploi présenté en fanfare il y a à peine deux mois (26). Et ce n'est pas l'annonce complètement irréaliste d'une nouvelle union douanière du Pacifique (sans la Chine) (27) à la veille d'un sommet de l'APEC où Chinois et Américains s'affrontent de plus en plus durement, qui va renforcer sa stature de chef d'Etat et encore moins ses chances de réélection. Cet échec prévisible de la « supercommission », qui ne fait que refléter la paralysie totale du système politique fédéral américain, va avoir des conséquences immédiates et très lourdes : une nouvelle série de dégradation de la note de crédit des Etats-Unis. L'agence chinoise Dagon a ouvert le feu en confirmant qu'elle allait à nouveau baisser cette note en cas d'échec de la « supercommission » (28). S&P va probablement faire baisser encore d'un cran la note US et Moody's et Fitch n'auront plus d'autres choix que de se mettre au diapason puisqu'elles avaient donné un répit jusqu'à la fin de l'année sous condition de résultats en matière de réduction du déficit public. Au passage, pour essayer de diluer l'information négative pour les Etats-Unis, il est fort probable qu'il y aura une tentative de relancer la crise de l'endettement public dans la zone Euro (29) en abaissant la note de la France pour affaiblir le Fonds Européen de Stabilisation Financière (30). Tout cela prépare une fin d'année très mouvementée sur les marchés financiers et monétaires et va entraîner des chocs violents dans les systèmes bancaires occidentaux et, au-delà, pour tous ceux qui sont détenteurs de Bons du Trésor US. Mais au-delà de l'échec de la « supercommission » à réduire le déficit fédéral, c'est toute la pyramide de l'endettement US qui va être à nouveau auscultée, dans un contexte de récession mondiale et bien entendue américaine : chute des recettes fiscales, poursuite de l'augmentation du nombre de chômeurs et en particulier des chômeurs qui ne reçoivent plus d'indemnités (31), poursuite de la chute des prix de l'immobilier, …  Gardons à l'esprit que la situation de l'endettement privé US est nettement pire que celle de la Grèce ! Et que dans ce contexte, nous sommes à un doigt de la panique générale à propos de la capacité des Etats-Unis à rembourser leur dette autrement qu'avec des Dollars dévalués. Cette fin 2012 va donc conduire nombre de détenteurs de la dette américaine à se poser sérieusement la question de cette capacité et du moment où elle sera soudainement mise en doute par les opérateurs (32). Que peuvent proposer les Etats-Unis après un échec de la supercommission ? Pas grand-chose en fait, surtout en année électorale. D'une part car elle a été créée parce que le reste ne fonctionnait pas ; d'autre part car la question n'est pas tant le montant que l'aptitude à entreprendre une réduction significative dans la durée. Et l'échec de la « supercommission » sera justement perçu comme l'incapacité des Etats-Unis à affronter le problème du déficit. Pour ce qui est du montant, un rapide calcul envoyé par un des lecteurs américains du GEAB permet de constater à quel point les « efforts » de réduction budgétaire envisagés actuellement sont ridicules par rapport aux besoins: Si l'on considère le budget fédéral des Etats-Unis comme celui d'un ménage, les choses s'éclairent. Il suffit d'enlever 8 zéros pour avoir un budget qui signifie quelque chose pour chaque citoyen : Revenu familial annuel (impôts sur le revenu) : + 21 700 Dépenses familiales (budget fédéral) : + 38 200 Nouvelles dettes sur la carte de crédit (dette nouvelle) : + 16 500 Bilan des dettes passées sur la carte de crédit (dette fédérale) : + 142 710 Réductions budgétaires déjà réalisées : - 385 Objectif de réduction budgétaire de la super-commission (pour une année) : - 1 500 Comme on peut facilement le constater, la « supercommission » (tout comme le Congrès dans son ensemble en Août dernier) ne parvient même pas à s'entendre pour réduire de 10% …. l'augmentation annuelle de la dette fédérale. Car il s'agit bien de cela : contrairement à l'Europe qui, en quelques mois, invente de nouveaux mécanismes et réduit très fortement ses dépenses et son endettement futur (33), les Etats-Unis continuent à s'enfoncer à pleine vitesse dans un endettement croissant. D'ailleurs, pour le semestre à venir, Washington prévoit d'émettre 846 Milliards USD de Bons du Trésor, soit 35% de plus que l'année dernière à la même époque (34).  On a vu avec la faillite du fonds d'investissement MF Global comment les maîtres de Wall Street pouvaient s'effondrer d'un seul coup du fait de leurs erreurs de stratégie sur l'évolution des dettes publiques européennes. Jon Corzine n'est pas Bernard Madoff. En terme de sens moral, il doit certes en être proche mais, pour le reste, rien de comparable. Madoff était un franc-tireur de Wall Street alors que Corzine c'est la grande aristocratie : ancien PDG de Goldman Sachs, ancien gouverneur du New Jersey, principal donateur de la campagne Obama pour 2012, pressenti pour remplacer Tim Geithner au poste du Secrétaire d'Etat au Trésor en Août dernier (35), … et de facto l'un des « créateurs » d'Obama en 2004 (36). On touche ici au cœur de la relation incestueuse Wall Street/Washington que dénonce désormais une majorité d'Américains (37). Ainsi en Août encore il apparaissait comme un « intouchable » au sommet de Wall Street ; et pourtant il s'est trompé entièrement sur l'évolution des événements. Il a cru que le monde d'avant continuait et que, comme « toujours », les créanciers privés seraient remboursés « rubis sur l'ongle ». Résultat : des pertes énormes et une faillite qui fait perdre beaucoup d'argent à ses clients et met 1.600 employés à la rue (38). Nous avons annoncé dans le GEAB précédent que nous entrions dans la phase de décimation des banques occidentales. Cette phase a donc bien débuté et les clients de l'ensemble des opérateurs financiers (banques, assurances, fonds d'investissements, fonds de pension (39)) doivent dorénavant se poser des questions sur la solidité de ces institutions. Et comme le montre le cas Corzine, ils ne doivent surtout pas supposer que parce que ces institutions ou leurs dirigeants sont connus et dotés d'une solide réputation, elles sont a priori plus solides que les autres (40). Ce n'est pas la bonne connaissance des règles du jeu financier d'hier (qui a fait leur réputation) qui compte désormais, c'est l'aptitude à comprendre que les règles du jeu ont changé qui est devenue déterminante. --------- Notes: (1) Qui se montent à plus de 45.000 milliards USD en 2010 pour les seuls Etats-Unis, Japon, Royaume-Uni et Euroland. (2) Plus la crise s'aggrave, plus la quantité d'actifs-fantômes augmente. Ce processus continuera jusqu'à ce qu'on retrouve un ratio actifs financiers/actifs réels compatibles avec un fonctionnement socio-économique soutenable, probablement autour des ratios des années 1950/1970. (3) Enclenché avec la crise de la dette grecque qui se traduit notamment par un dégagement rapide du système financier de l'Euroland hors du Dollar. Le fait que ce processus ait été initié à l'origine par Wall Street et la City pour « casser » la zone Euro ne fait qu'illustrer à nouveau d'une part l'ironie de l'Histoire ; et d'autre part le fait que lorsqu'une époque se termine, toutes les actions des acteurs du monde qui disparaît se retournent in fine contre eux. (4) Même le Financial Times reconnaît désormais que le Dollar US est devenu plus fragile que l'Euro. Source : FT, 04/11/2011 (5) Nos anticipations sur l'UE et l'Euroland feront parties d'une prochaine livraison du GEAB. (6) La seule chose qui a été perturbée sérieusement par la Grèce c'est le plan de communication du président français Nicolas Sarkozy qui comptait faire des sommets européens et du G20 un double tremplin pour tenter de regagner de la crédibilité auprès des Français. Or, en la matière, ce fut un double échec : loin d'avoir réglé la crise grecque comme il l'avait annoncé à la télévision, elle lui a explosé à nouveau à la figure à la veille du G20 ; quant au G20, un résultat nul donne la note de son organisateur : zéro ! LEAP/E2020 profite de cette occasion pour confirmer son anticipation du 15 Novembre 2010 (GEAB N°49 et maintient que le candidat de l'UMP (Sarkozy ou un autre) ne sera pas au second tour de l'élection présidentielle française de 2012 qui se jouera donc entre le candidat du PS, François Hollande, et la candidate du Front National, Marine Le Pen. (7) Et on ne peut que constater que ce sont des décideurs du niveau européen (Mario Monti, ancien Commissaire européen, en Italie et Lucas Papademos, ancien vice-président de la BCE, en Grèce) qui, en Grèce comme en Italie, prennent les rênes du pouvoir consacrant là aussi l'intégration accélérée de la zone Euro y compris au niveau politique. Cette situation va d'ailleurs renforcer l'urgence de réformes institutionnelles démocratiques pour la gouvernance de l'Euroland car les peuples n'accepteront pas plus d'une année encore une telle évolution dont ils ne sont que les spectateurs. Il faut noter que la plupart des citoyens allemands, français, italiens, espagnols, … n'ont pas trouvé du tout aberrante la proposition de référendum grec sur les mesures anti-crises, contrairement à leurs dirigeants. Sans s'en rendre compte George Papandreou a probablement fortement stimulé l'exigence d'un futur référendum trans-Euroland sur la gouvernance de la zone Euro d'ici 2014/2015. Voir à ce sujet l'article de Franck Biancheri publié le 06/10/2011 sur le Forum Anticipolis. (8) Le Royaume-Uni en fait directement les frais (nous y revenons dans ce GEAB) qui voit sa marginalisation confirmée et renforcée : il a perdu toute capacité d'influence sur l'Euroland. D'ailleurs, signe des temps, Nicolas Sarkozy s'est permis de violemment rabrouer David Cameron en lui disant que les dirigeants de la zone Euro en avaient assez de l'entendre donner ses conseils pour la bonne gestion de l'Euro alors qu'il est fondamentalement contre la devise européenne. Nicolas Sarkozy n'étant fort qu'avec les faibles, l'indice de « force » de Cameron est donc tombé bien bas ! Source : AlJazeera, 24/10/2011 (9) Source : Paulson Sells Gold ETF – Buys Physical Bullion? Soros Not Gold Bearish Posted: 15 Nov 2011 01:04 AM PST |

| "Agflation" update: The U.S. crop situation is still dangerously tight Posted: 15 Nov 2011 12:03 AM PST From Bloomberg: The U.S. is reaping its smallest corn harvest in three years after a drought damaged what was a record crop as recently as July, driving annual prices to an all-time high and curbing an expansion in global food supplies. The government will forecast production of 314.7 million metric tons tomorrow, 27.4 million tons less than four months ago, the average estimate of 30 analysts surveyed by Bloomberg showed. The cut is equal to output in Argentina, the second-biggest exporter. The U.S. Department of Agriculture already expected a third annual drop in global corn stockpiles and the first in soybean inventories in three years, offset by an expansion in wheat reserves to the largest in a decade. Corn, used mostly to make livestock feed and ethanol, is the only one of eight members of the Standard & Poor's GSCI Agriculture Index to gain this year. At a time when global food prices tracked by the United Nations fell 9.1 percent from a record in February, U.S. consumers are paying the most ever for pork chops, ground beef, flour and cheese. World food costs are 68 percent higher than five years ago and combined corn, wheat and soybean stockpiles are dropping to a three-year low, data compiled by Bloomberg show. "The situation has improved, but it remains tight," said Michel Portier, the head of Agritel, a Paris-based adviser to about 2,000 farmers. "The smallest weather problems could cause a price jump. For now, all goes well, but it's clear that on a global level, we still need a good harvest in 2012." Soybeans Slump Corn futures have climbed 5 percent this year to $6.605 a bushel on the Chicago Board of Trade, outpacing the 12 percent drop in the S&P GSCI Agriculture Index. Prices have jumped 15 percent from this year's low of $5.7225 on Oct. 3, and the most-widely held option gives the owner the right to buy corn at $7 by Nov. 25. Futures indicate rising prices through at least mid next year. Soybeans have slumped 14 percent this year to $12.05 a bushel as wheat tumbled 17 percent to $6.57 a bushel. The USDA probably will cut its corn forecast tomorrow for a fourth consecutive month after yields were curbed by the hottest summer since 1955 in the Midwest, the main growing region. U.S. stockpiles before next year's harvest begins in September may drop 29 percent, reducing global inventories to a five-year low of 122.75 million tons, the analysts surveyed said. Wheat Supplies World wheat inventories before next year's harvest will rise 3.3 percent to 202 million tons, and soybean stockpiles will drop 7.7 percent to 63.91 million, according to the Bloomberg survey. Combined inventories of corn, wheat and soy may drop 1.5 percent to 388.7 million tons. R.J. O'Brien & Associates LLC, a Chicago-based futures broker, asked the USDA yesterday to delay the report until Nov. 14 to allow for account transfers after the collapse of MF Global Holdings Ltd. The USDA said it has no plans to postpone. Pilgrim's Pride Corp., the second-largest U.S. poultry producer, reported on Oct. 28 a third consecutive quarterly loss, citing higher grain costs. Tyson Foods Inc. (TSN), based in Springdale, Arkansas, and the largest U.S. meat processor, said in September it paid about $250 million more for grain and feed in its fiscal third quarter that ended July 2. Gains in corn prices may be curbed should livestock farmers use the slump in wheat to add more of that grain to their feed. Wheat-feed use will rise more than 9 percent to 124.2 million tons this marketing year, the most in about two decades, the London-based International Grains Council estimates. 'Constant Drag' "Wheat is a constant drag on the corn market," said Dale Durchholz, a senior market analyst at AgriVisor LLC, a consultant in Bloomington, Illinois. "The wheat carryout we're dealing with right now isn't burdensome, but it's more than comfortable." Global wheat production may rise by 5.1 percent to 681.2 million tons this year, the third-biggest crop since at least 1960, the USDA estimated in October. The IGC expects 684 million tons and the UN's Food & Agriculture Organization 691 million tons. Agricultural demand may also be weaker than expected should economies keep slowing. Corn demand rose 1.1 percent in 2009, the least in six years, as nations contended with the worst global recession since World War II, USDA data show. Soybean use fell 3.9 percent that year, the most since 1984, and wheat consumption retreated 0.7 percent in 2008, the most in four years, according to the USDA. Global Expansion The global economy will expand 4 percent next year, unchanged from this year, the International Monetary Fund forecast in September. The Washington-based group cut its 2012 prediction by 0.5 percentage point. The economy in China, accounting for almost 22 percent of global corn consumption, will expand 9 percent next year, the IMF estimates. Global corn usage will gain 2.4 percent to 863 million tons in the 12 months ending in June, the IGC said Oct. 27, raising its forecast by 10 million tons. Wheat consumption will advance 3.4 percent to 677 million tons, the group said. U.S. demand for corn used to make ethanol may exceed feed use for the second straight year in 2012, the USDA estimates. Refiners will buy 5 billion bushels (127 million tons) in the 12 months ending in August, and livestock farmers 4.7 billion bushels, the USDA said in a report Oct. 12. Ethanol Profit Refiners are buying more corn as profit margins last week widened to the most in a year, data compiled by Bloomberg show. Gasoline futures rallied 26 percent in the past year on the New York Mercantile Exchange, boosting the competitiveness of ethanol. Corn for immediate delivery cost 18.2 cents a bushel more than futures last month in Decatur, Illinois, the highest October premium in at least four years, data compiled by Bloomberg show. The city is home to Archer Daniels Midland Co., the second-largest U.S. ethanol producer. Pilgrim's Pride reported a third-quarter loss of $162.5 million on Oct. 28 and said prices for feed ingredients remain volatile. There was "another structural shift" in corn prices this year that will persist through at least 2012, Tyson Foods President Donnie Smith told analysts on a conference call on Sept. 7. Farmers contended with extreme growing conditions this season. Average temperatures in the Midwest were as much as 8 degrees Fahrenheit above normal in July, and some farms from Illinois to Indiana were the driest ever that month, according to Kyle Tapley, an agricultural meteorologist for Rockville, Maryland-based MDA Information Systems Inc. Price Gains Corn futures have averaged about $6.895 this year, more than twice the annual average of the past decade, and are heading for the costliest year on record. Soybeans averaged 76 percent more than the 10-year average and wheat 61 percent more. "The situation is not going to be as dire as last year," said Abdolreza Abbassian, a senior economist at the UN's FAO in Rome. "On the one hand, there's supply that has improved, but on the other hand, we have economic conditions that are not allowing for a very rapid increase in demand." To contact the reporters on this story: Jeff Wilson in Chicago at jwilson29@bloomberg.net; Whitney McFerron in Chicago at wmcferron1@bloomberg.net. To contact the editor responsible for this story: Steve Stroth at sstroth@bloomberg.net. More on agriculture: Dining out is about to get much more expensive China just made a huge purchase in the United States This popular food item could skyrocket 40% in the next few weeks |

| "Anti-capitalist" Michael Moore exposed as a fraud Posted: 15 Nov 2011 12:01 AM PST From Economic Policy Journal: Michael Moore rants and raves against the rich. All indications are that he is part of the group, though he will deny it on camera. ... The fact is that Moore is so wealthy, he does not need to worry about his income. According to public tax records, Moore owns a massive vacation home on Torch Lake, Michigan – one of the most elite communities in the United States – in addition to his posh Manhattan residence. Here's a... Read full article... More on Michael Moore: Michael Moore just hit a stupid new low Michael Moore says he's filled with joy about GM collapse... Top investor: Michael Moore's Capitalism movie is ridiculous |

| Gadhafi’s Gold-Money Plan Would Have Devastated Dollar Posted: 14 Nov 2011 11:21 PM PST by Alex Newman, TheNewAmerican.com:

It remains unclear exactly why or how the Gadhafi regime went from "a model" and an "important ally" to the next target for regime change in a period of just a few years. But after claims of "genocide" as the justification for NATO intervention were disputed by experts, several other theories have been floated. Oil, of course, has been mentioned frequently — Libya is Africa's largest oil producer. But one possible reason in particular for Gadhafi's fall from grace has gained significant traction among analysts and segments of the non-Western media: central banking and the global monetary system. According to more than a few observers, Gadhafi's plan to quit selling Libyan oil in U.S. dollars — demanding payment instead in gold-backed "dinars" (a single African currency made from gold) — was the real cause. The regime, sitting on massive amounts of gold, estimated at close to 150 tons, was also pushing other African and Middle Eastern governments to follow suit. Read More @ TheNewAmerican.com |

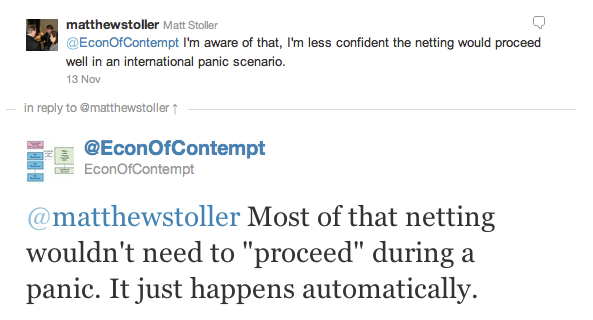

| On the Dubious Defenses of the Netting of $4 Trillion of US Bank CDS to the Eurozone Posted: 14 Nov 2011 10:48 PM PST One of the reasons I'm not a big fan of Twitter is that I don't see it as being useful save for communicating short updates (Raid on Zuccotti Park! Come help fast!) or a terse assessment with a tiny URL. Even more can be misconstrued (or can pretend to be misconstrued by a nay-sayer) than in longer forms of communication. Nevertheless, I think we can safely make some conclusions re the following tweet from Economics of Contempt on the over $4 trillion notional of US bank exposure to Eurozone risks. A Reuters story recounts how the Financial Stability Oversight Council is trying to get a grip on the positions. Even the bank lobbying group the International Institute of Finance is cautious:

Nevertheless, there is not much room for misinterpretation of this exchange: In the Economics of Contempt remark, it isn't hard to detect a patronizing, "Ah, you non-insiders just don't get how this works, do you?" tone. The problem with EoC's airy assurance is the intense regulatory focus says the authorities don't buy the industry's reassurances, and for good reason. Any time a big dealer implodes (and per Bear Stearns and MF Global, they can fail suddenly and catastrophically), it can set off a domino effect of counterparty shortfalls as one side of supposedly netted positions is suddenly not there. An excellent primer on FT Alphaville that we highlighted earlier explains how this can happen. And remember, MF Global (not unlike LTCM in 1998) failed in an manner that the authorities did not anticipate and would not have been monitoring at other dealers. And the poster child of this is Lehman. Unlike Bear and MF Global, its distress was widely recognized, if not universally believed. And contra EoC, the position marks, and therefore any related netting, were not as clean and tidy as he implies. One tax lawyer at a major dealer bank (and being a tax lawyer means you really need to understand how the trades work) told me that two years before the death of Lehman, he heard from a colleague that Lehman was so desperate to lower its funding costs that every day the "repo gremlins" would go through the firm to hock anything and everything they could. He even said if there was any way to take the firm's staplers and put them into a structured vehicle so they could repo them, they would. Towards the end, Lehman was engaged in mighty aggressive strategies to fund itself, and JP Morgan woke up and realized it might be more than a tad exposed, and seized $8.6 billion in cash and collateral, which was the proximate cause of the BK filing. This example relates directly to EoC's netting assertion: valuation of complex exposures and instruments is not at all straightforward (JP was clearly hosed by Lehman; even after grabbing the collateral, a lawsuit alleges "JP Morgan was stuck with loans to LBI of more than $25 billion secured by many of LBI's worst securities.") Satyajit Das, in his first of two posts on the Lehman bankruptcy, explains in some detail about how the valuation of positions under ISDA contracts is not at all straightforward and some methods have never been tested in court. In particularly, Lehman's 1.2 million in derivatives positions have given rise to over 6,000 lawsuits with over $60 billion at issue. You might not deem that to be too bad (6,000 versus 1.2 million) until you read in Das's post that one lawsuit between the Lehman estate and Normura involves over 4,000 derivatives positions. And in that suit, Normura posted nearly $00 million with Lehman, but now alleges Lehman owes it over $200 million. That is a $700 million valuation dispute that will be settled in court. Similarly, as Das noted:

So if two sides of a trade can have disputes this big in roiled markets, how much faith we can have in netting? Tom Adams raised other issues via e-mail:

The fact that European authorities are doing everything they can to avoid having an involuntary restructuring of Greece which would trigger its comparatively modest CDS exposures says the authorities are very concerned that an undercapitalized CDS protection writer could kick off major disruptions, potentially a systemic event. The fact that senior regulators who are in contact with each other (a big contrast to before the crisis, when communication and coordination was limited) suggest that the risk is real. And that is what makes EoC's position so troubling. He presents himself as an expert in these matters, even if his expertise on Lehman is limited to having read the Valukas report, rather than actually involved in valuations and litigation for the bankruptcy, as Das is (and has been for all the major financial firm bankruptcies of the last 20 years). So if he really does know this terrain, he should also know better than to keep peddling his "nothing to see here, move along" line as often as he does. |

| Posted: 14 Nov 2011 10:00 PM PST Japan farms radioactivity fears BBC Was Napster the day the music died? VoxEU Latin America better prepared to weather a slowdown in global economy McClatchy Greece Keeping Euro Is Only Choice: Papademos Bloomberg. And Mexico kept insisting it would defend its currency peg right up to the eve when it threw in the towel in 1994. Greek conservatives stance threatens bailout Irish Times (hat tip reader Aquifer) Europe prepares for breakup MacroBusiness Jump in Italian and Spanish yields spooks stocks Financial Times. Yields on bunds are also up. WOW: Europe Is Really Getting Slammed Today Clusterstock Sending a Harsh Message, U.S. Issues First Fine for Tarmac Delays New York Times 60 Minutes: Congressional Insider Trading Credit Writedowns Ireland and Greece: Blackjacked by the Banks CounterPunch (hat tip reader 1 SK) Occupy Wall Street: New York police clear protest camp BBC. This is pretty sympathetic coverage. Police Sweep Protest From Zuccotti Park New York Times. Lead front page story, 70 arrested. At least the first of the image series is a policeman with his teeth bared (!) roughing up a protestor. So the police efforts to sanitize the coverage were not 100% effective. Blue Cross CEO Discusses Health Care Business C-SPAN (hat tip reader Skippy). Mike check! Quan adviser Dan Siegel quits over Occupy Oakland SF Gate (hat tip reader Aquifer) In foreclosure-plagued Vegas, empty homes go to pot Los Angeles Times Corker proposes alternative to MERS Housing Wire (hat tip reader Lisa Epstein) Text of the bill is here. The MERS section is thin. Paulson cuts gold ETF holding Financial Times Bank Excuses on Foreclosure Growing Stale New York Times. This is a gratifying read. Big Banks Turn Unemployment Benefits Into a Profit Center Dave Dayen, FireDogLake Marketocracy Barry Ritholtz (hat tip April Charney) Antidote du jour. Richard Smith's boy kitten, Fisher (he has a girl too, Minsky, from the same litter); pic by Uschileins Töchterlein: |

| Gold & Silver Market Morning, November 15, 2011 Posted: 14 Nov 2011 09:00 PM PST |

| Russian Central Bank Aims to Buy 100 Tonnes of Gold in 2011 Posted: 14 Nov 2011 08:53 PM PST ¤ Yesterday in Gold and SilverThe gold price certainly tried to rally at the open of trading in New York on Sunday night...but that happy state of affairs wasn't allowed to last too long. After that, the price didn't do much until shortly before 2:00 p.m. Hong Kong time [2:00 a.m. in New York]...and then the dollar headed north and the precious metal prices headed south. Gold's low price of the Monday trading session came at half-past lunchtime in London...and from there, the price rallied about ten bucks. Then, shortly before 9:00 a.m. Eastern time, the New York high was in...and even though gold made several rally attempts after that, there was always a ready seller in the wings once a rally showed any legs at all. Gold closed at $1,780.30 spot...down $8.20 on the day. Volume was mostly air, so these price changes I spoke of in the preceding paragraphs were made on vapours...and it's easy to push the price around when volume is vanishingly small. Net Comex volume was 66,000 contracts. Silver's price path was very similar to gold's...and the only real difference was that silver's low of the day came at 1:15 p.m. Eastern time...about fifteen minutes before the Comex close...while gold's low was 12:30 p.m. in London. Like gold, it was obvious that silver wanted to rally after the 12:30 p.m. London low, but ran into the same not-for-profit seller at 8:45 a.m. in New York. Silver closed at $34.24 spot...down 42 cents from Friday's close. Net volume was around 23,000 contracts. Ever since MF Global went bankrupt, it appear that trading volumes in the precious metals has really fallen off, so I get the impression that most of MF Global's clients still haven't been able to get up to speed elsewhere, as they were one of the big commercial traders on the Comex. [Please note my comments about the quality of the CME's volume numbers in the last paragraph of 'The Wrap' - Ed] As I mentioned in the first paragraph, the dollar began to rally about 2:00 p.m. Hong Kong time...and hit its zenith at 12:30 p.m. in New York. The precious metals fell as the dollar rose for a short period of time, but this relationship came to an end at 12:30 p.m. in London trading...as the precious metals were in rally mode...and probably would have stayed that way if these sellers of last resort hadn't shown up at 8:45 Eastern. The gold stocks rallied to almost unchanged shortly after the equity markets opened in New York yesterday morning...but that didn't last long, as they drifted lower as the day went along. The HUI hit its low of the day at 2:30 p.m...not the 1:15 p.m. low for the metal...and then recovered a bit into the close, finishing down 1.74%. With silver closing down more than gold in percentage terms, Nick Laird's Silver Sentiment Index reflected that by closing down 2.12%. (Click on image to enlarge) The CME's Daily Delivery Report showed that 13 gold contracts were posted for delivery tomorrow. As I mentioned a couple of times this month, November is not a traditional delivery month for either gold or silver...and that's why nothing much of substance is going on at the moment. The December delivery month will be radically different in both metals. It wasn't an exciting day over at GLD yesterday. They reported a smallish withdrawal of 12,459 troy ounces...and there was no reported change over at SLV. The U.S Mint sales are still moving at glacial speed this month. They did have a report on Monday, but only sold 3,000 ounces of gold eagles and 253,000 silver eagles. The totals for the month so far are not worth mentioning. It was pretty much the same at the Comex-approved depositories on Friday. The reported receiving 10,000 ounces...and didn't ship anything. The Commitment of Traders Report [for positions held at the close of trading on Tuesday, November 8th] was released yesterday at 3:30 p.m. Eastern time...and both gold and silver showed deterioration in the Commercial short position. In silver, the Commercial traders went long 2,248 contracts...but added another 4,117 short positions...for a net increase of 1,869 contracts. There was a bit of a rally during the reporting week, so some of this deterioration might be attributed to the small Commercial traders [Ted Butler's raptors] selling long positions and taking profits. The act of doing that has the mechanical effect of increasing the Commercial position, as it reduced the overall long position of the entire category. In gold, the Commercials [mostly bullion banks] increased their net short position by a rather chunky 14,399 contracts. Since gold had a substantial rally during the reporting week, it would be no surprise to me if the small commercial traders were selling longs and taking profits. I didn't have a chance to talk to Ted Butler about it yesterday, so I'm not sure what the Disaggregated COT Report showed. Needless to say, I wasn't overly happy with this report, because what it tells me is that this rally in both gold and silver is going to end the same old way as the last one. There's nothing in this COT report, or the one before that, that indicates that JPMorgan et al are going to let this market do what it really wants to do. Sure, we're going to get some really good rallies in the weeks and months ahead...but eventually it will end in the same way as every other rally has...a smack-down out of the blue...and probably in the thinly-traded New York Access Market, or in the Far East. Silver analyst Ted Butler had his weekly review posted on his website on Saturday...and here are a couple of free paragraphs... "Recently, I have been suggesting the two things to watch is if JPMorgan increases its crooked concentrated short position in COMEX silver and if the short position in shares of the big silver ETF, SLV, grows. JPMorgan did increase its COMEX silver short position a couple of weeks ago...and that circumstance must be closely monitored. The new short position in SLV has been released...and it shows a sharp increase as well. As of Oct 31st, the short position in SLV grew by 4 million shares/oz to just over 24 million shares. The short position in SLV now stands at 7.5% of all shares outstanding, an outrageously large amount." "This means that 7.5% of all the shares in SLV have no silver backing, in violation of the prospectus, because the shorts don't deposit silver. Such a large percentage of shares shorted represents fraud and manipulation in a fund that promises that metal backs each share. Worse, there is no data available, to my knowledge, as to the identity of the short sellers of shares. That means it could be that JPMorgan is the big short in SLV in addition to being the big short on the COMEX. That is crooked beyond description. I still own shares in SLV, but I am fed up with the sponsor of this trust, BlackRock, for allowing this fraud and manipulation to continue. BlackRock, the world's largest money manager, pretends to be above all this, just like the CME and JPMorgan. Nothing is ever these big firms' responsibility. I am starting to think that BlackRock may be as crooked in matters related to silver, as are the CME and JPMorgan." And as I've been saying for many years, dear reader...I wouldn't touch either GLD or SLV with a 10-foot cattle prod. As usual, I have a lot of stories for your reading pleasure today...and I hope you get a change to skim them all. You can immediately see that silver has not been allowed to close above its 50-day moving average during gold's recent run-up...but eventually it will. Goldman and Credit Suisse Bullish on Gold Due to US Interest Rates. Former German chancellor silent on Fed memo linking him to gold suppression. 'You have to love gold here' - Stephen Leeb ¤ Critical ReadsSubscribeGuan Jianzhong: Downgrading the USThe chairman of China's only independent credit rating agency, Dagong Credit, warned they might have to downgrade the US again. The only question remains is the timeline. I listened to this interview and got no hint as to when it might happen. The story is posted over at the aljazeera.com website...and I found it to be a very frank discussion between the journalist and the chairman...certainly nothing like you'd hear in the American press. It's worth the time if you have about 24:53 on your hands. I thank reader Al Conle for digging this up on our behalf...and the link is here.  European Ponzi Goes Full Retard As EFSF Found To Monetize... ItselfIf you check the first file in the top drawer of the You-can't-make-this-stuff-Up filing cabinet, this is the story you'll find. Tyler Durden over at zerohedge.com can hardly contain himself as he goes supernova on this piece that showed up in The Telegraph on Saturday. The title says it all...and I thank West Virginia reader Elliot Simon for sending me this story...and it's a must read. The link is here.  Goodbye 'bunga bunga', hello prison for Berlusconi?Here's a story that belongs on the front page of the National Enquirer...and also qualifies for a spot in the you-can't-make-this-stuff-up filing cabinet. He could move back to his beloved Villa San Martino, a former monastery turned into lavish residence in the outskirts of Milan, and escape the harsh winters of the northern Italian city by relaxing in the stunning Villa Certosa, his summer residence on the island of Sardinia. There, he could spend days admiring nature, the fireworks from the fake volcano he had built in his gardens to entertain his guests, and finally indulge in the presence of the many topless women who were photographed at the villa during his premiership — without having to apologize for it. But Silvio Berlusconi is not a man who likes to rest. He admits he doesn't sleep longer than three hours a night, and in the past two decades he has proved he possesses an enviable stamina for a man his age. Should he feel restless, he could always watch a game of his beloved A.C. Milan, the top Italian soccer team he owns, or organize one of his infamous 'bunga bunga' parties, allegedly his favorite after-dinner pastime, without worrying about the public sentiment over it. But there is another, less pleasant alternative: He could spend the rest of his life in prison. This piece was posted over at the msnbc.msn.com website...and I thank Washington state reader S.A. for the story. The link is here.  The great euro Putsch rolls on as two democracies fallEurope's scorched-earth policies have begun in earnest. The inherent flaws of monetary union have created a crisis of such gravity that EU leaders now feel authorized to topple two elected governments. As I long feared, the flood of cheap credit into Southern Europe and the slow death of Club Med industry by currency asphyxiation have together created such a dangerous situation for world finance that informed opinion is willing to turn a blind eye to EU sovereign trespass. Some even applaud. The Greeks were ordered to drop their referendum on measures that reduce their country to a sort of Manchukuo, with EU commissars "on the ground", installed in each ministry, drawing up lists of state assets to be liquidated to pay foreign creditors. Europe's president Herman Van Rompuy swooped in to Rome to clinch the Putsch. "Italy needs reforms not elections," he said. We are not that far from use of EU judicial coercion, and then EU police power, and ultimately EU "border troops" - for those old enough to remember Soviet methods of fraternal assistance. The New World Order crowd is in full cry in Europe...and Ambrose Evans-Pritchard over at The Telegraph is up on his high horse once again. I wonder which country is next? I thank Roy Stephens for this story, which I consider to be a must read...and the link is here.  Walker's World: The Euro TitanicThey have rearranged the deck chairs, told the band to change their tunes and replaced some of the ship's officers. But the Titanic of the world's currency markets is still holed below the waterline and the passengers are all trapped on board. Germany, with its folk memory of the hyper-inflation of the 1920s, is terrified of inflation and will use all its considerable influence in Europe to prevent this from happening. Germany is also digging in its heels and refusing to let the European Central Bank become a lender of last resort. So if the debt cannot be inflated away, and if there isn't enough growth that allows it to be paid off, the remaining option is default which is the worst outcome of all. Just ask those who recall the domino defaults of 1931 and what followed. The Titanic of the currency markets sails on and the seawater pours in... This very well written UPI piece was filed from Paris yesterday...and is well worth your time. The link is here...and I thank Roy Stephens for sending it |

| Russian Central Bank Aims To Buy 100 Tons Of Gold In 2011 Posted: 14 Nov 2011 08:53 PM PST  "The Central Bank of Russia has purchased 90 metric tons of gold to date in 2011 and is on course to buy 100 tons before the end of the year, deputy head of the bank Sergey Shevtsov said as quoted by the bank's press service." "The bank said earlier it would aim at buying 100 tons of gold every year and increase the proportion of gold in the country's reserves as a safeguard against volatility on the international financial markets." |

| Goldman and Credit Suisse Bullish on Gold Due to US Interest Rates Posted: 14 Nov 2011 08:53 PM PST  Gold ETF data shows continuing safe haven flows and diversification into gold. Global holdings of gold rose last week, by nearly 897K oz, their largest weekly rise since the week ending Aug 5, 2011...when holdings rose by a net 1.089M oz, according to Reuters. Total gold ETF holdings stand at around 68.854M oz, up a full 1.749M oz in the last month. November is shaping up to show the largest monthly inflow since July. So far this month, holdings have risen by 947K oz. Goldman Sachs today reaffirmed that it remains overweight in commodities. On gold it says it will roll over its Dec 11 long to Dec 12. |

| 'You have to love gold here,' Leeb tells King World News Posted: 14 Nov 2011 08:53 PM PST  Fund manager Stephen Leeb was interviewed by King World News yesterday and noted the indifference of central bankers to inflation even as a huge part of the population is struggling just to feed and warm itself. Leeb loves gold as another round of monetary easing is about to begin. I thank Chris Powell for writing the introduction...and the link to the KWN blog is here. |

| Is gold headed to $2,200? - Do charts sense Chinese buying? Posted: 14 Nov 2011 08:53 PM PST  Gold's action is frightening some of the more fundamentalist analysts. On Friday Edel Tully of UBS, a very powerful gold dealer, said: "Gold hit our one-month forecast of $1,775 this week, but we're sitting tight for now, rather than making any short-term forecast changes. Right now, physical demand has moved to the background, leaving gold heavily dependent on the actions of specs and investors, a less-than-ideal position. Physical buying out of Asia is much diminished." And, indeed, over at LeMetropoleCafe.com, there have been repeated complaints about discounts to world gold in India and thin premiums in China, suggesting no Asian off-take. |

| Physical gold to trump ETFs by 500% in 2011 hears Dubai conference Posted: 14 Nov 2011 08:53 PM PST  Physical gold will outsell ETFs by 500 per cent this year, Standard Bank's Walter de Wet told the 8th Dubai City of Gold Conference on Sunday. Two years ago the position was completely reversed with physical gold sales running at only 20 per cent of ETFs. 'It's a complete flip from ETFs to physical gold,' he said. 'And it seems to reflect people's lack of trust in financial systems and the shift in investment flows towards Asia and the Middle East.' This story was posted over at the arabianmoney.net website on Sunday...and I thank reader Christopher Cathis for sharing it with us. The link is here. |

| Why Proposals That Italy Should Sell Its Gold Are Ridiculous Posted: 14 Nov 2011 06:00 PM PST |

| Bloomberg: Gold Traders most Bullish Since 2004 Posted: 14 Nov 2011 05:54 PM PST |

| Posted: 14 Nov 2011 05:07 PM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Russian Central Bank Aims To Buy 100 Tons Of Gold In 2011

Russian Central Bank Aims To Buy 100 Tons Of Gold In 2011

No comments:

Post a Comment