saveyourassetsfirst3 |

- CDNX at 2003 Levels Despite ‘High’ Metals Prices

- Silver Bull Seasonals

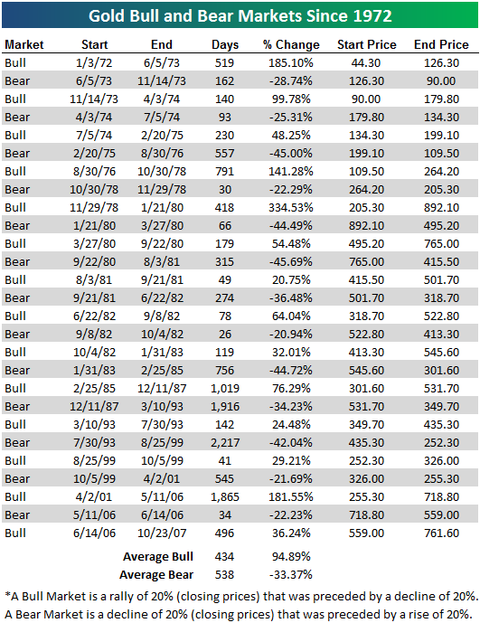

- TABLE – Gold Bull and Bear Markets Since 1972

- Why Gold and Silver Assets Will Continue to Trump Diversification

- Pan Asian Gold Exchange to Destroy Gold and Silver Shorts.

- The Week In Technology: 6 Stats You Need To Know

- Ampio Pharmaceuticals On A Roll With New Licensing Agreement

- Precious Metals

- coinflation traffic exploding, acquired by pcgs

- Satyajit Das: The Financial Compass

- Silver Technicals

- Has Hedging Killed The Goose That Was To Lay The Golden Egg? Part II

- Position Limits back in play at the CFTC

- Gold is the past and the future.

- DEFINITION: Gold Indexes – The HUI and XAU

- Why the GOLD Bull Market is Far from Over

- Gold is Confidence in Money Systems

- The IMF's Gold sale to India

- Can the Chinese really achieve their “Five-Year Plan”?

- Cot Report, FOMC

| CDNX at 2003 Levels Despite ‘High’ Metals Prices Posted: 18 Sep 2011 04:49 AM PDT HOUSTON -- From the Chart Book. The view from 30,000 feet of the Canadian Venture Exchange Index or CDNX reveals a startling fact. Today, in September of 2011, the CDNX is trading at levels first reached eight years ago despite gold being more than $1,400 higher and silver being more than $35 higher in price. The chart just below brings the notion into bright focus.

Continued…

By comparison, the larger, more liquid and better capitalized mining shares have done a better job of maintaining their relative-to-gold value in this Great Gold Bull market, but nearly all analysts agree the big miners are undervalued relative to metals prices. Just below is a similar chart of the Amex Gold Bugs Index or HUI for comparison. With so much anxiety and concern about the future; with mind bogglingly difficult challenges facing policymakers both here in North America and in Europe amid festering discontent by the voters; with the memory of the 2008 Panic still fresh enough to be a huge drag on investor confidence, we reckon there are ample 'reasons' for the small mining company shares to be so inexpensive at the moment. The 24-carat question looking ahead is if the small miners will remain so bloody cheap on a relative basis, or if they are instead staging for a reversion to the mean. Until we start to see more investor confidence, however, there are excellent bargains to be had. That goes for ordinary investors as well as for the larger predatory mining companies looking to purchase future feed stocks from the beaten-down juniors.

Clearly the small mining companies we often refer to as "The Little Guys" have been mistreated by a scared and troubled market. We think just as clearly the Little Guys offer tremendous, compelling opportunity for traders and investors looking ahead, if, that's IF, the world manages to hold itself more or less together. As it is the smaller companies seem to be discounting a bleak tomorrow, if relative price is any guide. Over time, however, we expect that the world will find ways to resolve the issues that have it so vexed at the moment. And, we figure that gold will continue to play a very important role as a store of value and as the best-respected international "currency." We see more demand for gold not less. Therefore we view now as a time for accumulation of undervalued resource company bargains in anticipation of a less-fearful investing public sometime in the future. We are particularly interested in accumulating shares in companies that are in the transition phase from explorer to sure-enough low-cost gold or silver producer, such as our Vulture Bargain #4, Timberline Resources (AMEX:TLR). TLR, together with its partner Highland Mining, is slated to begin production of between 50,000 and 70,000 ounces of low-cost high-grade gold annually at their Butte Highlands underground mine in Montana early next year. (Timberline Resources Home Page).

We look for the partners to continue advancing Yaramoko with even more aggressive drilling now that the rainy season is winding down and for Riverstone to begin further drilling at Karma while they update the known resources later this year or early next. |

| Posted: 18 Sep 2011 03:08 AM PDT From Zeal Research: CLICK IMAGE TO ELARGE

The bottom line is silver definitely has strong seasonal tendencies. While they mirror gold's strategically as expected, since gold action drives silver-trader sentiment, they also differ from gold's tactically at times. Silver's best odds for rallying are in autumn and winter, when its strongest seasonal rallies unfold. Its weakest behavior occurs in the summer doldrums, the end of which are the best time to buy silver and silver stocks. But it is always crucial to remember that seasonality is a secondary driver at best. The tailwinds and headwinds seasonal tendencies create can be easily overcome by sufficiently-overextended technicals and sentiment. Silver seasonality is always worth considering when making silver-related trading decisions, but it must be relegated to the smaller peripheral role it deserves. Read more @ 24hrGold |

| TABLE – Gold Bull and Bear Markets Since 1972 Posted: 18 Sep 2011 02:57 AM PDT For our next Bespoke Reference post, we highlight the historical bull and bear markets for Gold since 1972 (post Bretton Woods). Since '72, there have been 14 bull and 13 bear market cycles (20% rises/declines preceded by a 20% decline/rise). The average bull market in Gold has lasted 434 days with gains of 94.89%. The average bear is a bit longer at 538 days with average declines of 33.37%. The current bull market in Gold that started in June of 2006 is a bit longer than the average at 496 days with gains of 36.24%. CLICK IMAGE TO ENLARGE

|

| Why Gold and Silver Assets Will Continue to Trump Diversification Posted: 18 Sep 2011 02:45 AM PDT From JS Kim: Read More @ 24hrGold |

| Pan Asian Gold Exchange to Destroy Gold and Silver Shorts. Posted: 18 Sep 2011 02:39 AM PDT From Antal E. Fekete: Currently, PAGE is running a 10 ounce mini physical gold contract for the domestic retail market. This contract allows the average retail investor to buy physical gold or set up an account with a brokerage firm and trade futures. This enables all of the customers of the Agricultural Bank of China who are approx 320 million retail customers and 2.7 million corporate customers, to buy and sell these contracts straight from their bank account in Renminbi (RMB is the Chinese currency of mainland China). This could impose a big draw down on the physical market. In fact, Andrew Maguire said "To give a further idea of scale, if just 1% of their customers bought a single 10 ounce contract, that would equate to 1,000 tons of physical gold being drawn down…." Read more @ 24hrGold |

| The Week In Technology: 6 Stats You Need To Know Posted: 18 Sep 2011 12:02 AM PDT By Michael Comeau: Do you need the most important statistics emenating from the technology world? Then keep on reading, because these six numbers will give you the quick-and-dirty downlow of the biggest stories in tech for the week: Complete Story » |

| Ampio Pharmaceuticals On A Roll With New Licensing Agreement Posted: 17 Sep 2011 11:52 PM PDT By VFC: Ampio Pharmaceuticals (AMPE) recorded another solid week last week, breaking through the nine dollar price-per-share barrier while continuing an uptrend that started in mid August. The uptrend has been supported by a string of encouraging news releases over the past month that may be attracting new investor attention to this company, just at a time when significant catalysts are coming due. Ampio's market strategy is built on bringing already-approved products to market for the treatment of new indications, a strategy which can greatly reduce the time and costs associated with developing brand new, and unknown drugs. Multiple clinical studies are underway testing Ampio's repositioned products in new indications, and the remainder of the year should see some of the results from those trials hit the press wires. Of immediate importance, however, are the developments surrounding Zertane. Zertane is already on the market as a pain medication, but additional research revealed Complete Story » |

| Posted: 17 Sep 2011 10:28 PM PDT Trader Tracks Situational Alert Wednesday, 9-7-11 7am: One major news item today selling gold was the German Supreme Court saying the government can legally extend credit to the PIIGS. This calmed the markets and was not unexpected. This court did not want the responsibiity for wrecking the global bond market. They have left that nasty task to the German Parliament voting on the same subject on 9-29-11. Merkle does not have the votes and methinks the 9-29-11 vote goes against the credit payouts and this would be a market rocker for certain and will at first sell metals and then support a rally. Obama has a few things to announce in his USA speech tomorrow evening, which should TEMPORARILY calm markets too, putting a further damper on precious metals trading, while pumping stocks and the US Dollar. I said TEMPORARY. These proppers will not work and if that 9-29-11 vote goes against the handouts, and I think it will, stocks and bonds will smash and PM's will fly after an initial reaction selling dip. Trading action on this Wednesday morning confirms the wider trading ranges of precious metals as the prices go higher and remain on trend. After a hard review of about ten silver and gold charts I do not see any technical violations of the major trends. Not only will this volatility continue as the prices rise but the trading ranges will continue to spread wider yet. This morning Dec gold was trading in a range of $79.80. Not that long ago a $3-$5 daily move was a big deal. We said this was coming and now that its here some hands are getting sweaty. Nobody said this stuff was easy. Daily Dec gold last price at 649am PST is 1816 after opening at 1876, touching a high of 1883.20 and then selling down to 1803.40 near our 1807 support number. For now, ( lots of trading remains in today's session) support is 1807 and we should recover 1/2 of the selling from 1883 to 1803, which gives a maybe close of 1840, say 1838.50 on the technicals. The daily chart looks messy but the first fallback of recent significance posted a low near 1708 establishing the continuous floor for the next price projections. When a market flys up so fast the retraction selling is equally hard and even faster but normally as the bull remains, you do drop 1/2 of the former gain. Its like two steps forward and one step backward. Monthly gold is rising in a tightening bull triangle. There is lots of time and room in that chart for gold to find $2250-2350 where I see another pausing high. The daily gold chart has been pushing at the top and above the longer view trading channel. This is hard bullish trading and today's low drop was in the middle of the upward daily channel signaling the longer trend is intact and we have lots of room to rise. The weekly chart appears even more bullish as we have had 2.5 years of steady rising gains but the last five weeks drove the price UP AND OVER THE CHANNEL TOP. Currently, we are still consolidating but the next pop-up rallies should be just ahead. Have patience please and wait before installing new longer term bull trades. We will alert. Silver sold less than gold this morning and the last price on Dec futures was 40.85; a firm support and resistance price. Price is supported on the bottom of the bull trading channel so we are fine. The low was 40.38 not even under $40. The high was $42.275. Hard upper resistance is $43.85. The weekly chart looks perfect with the prices rising up in the middle since June, 2010. The monthly chart is building a huge continuation triangle. This graphic shows a maximum of one more month of price containment and probably less before a big bull bust out. On the 15 minute gold chart the price drop supported in the channel's middle near 1803-1807. New close resistance is now 1815.50; a common gold stop and go price. The higher resistance then becomes 1848.50, which I expect this week. Obviously, patience is a virture demanded in trading. This is why in our last newsletter and alerts we encouraged our traders and investors to wait for a better shares entry. Today we are still waiting but it won't be long. I hope I have calmed your nerves this morning. Try not to get too caught up in the daily action or it can make you crazy. Weekly trends tell the tale and the tale is bullish. –Traderrog This posting includes an audio/video/photo media file: Download Now |

| coinflation traffic exploding, acquired by pcgs Posted: 17 Sep 2011 10:22 PM PDT http://www.coinweek.com/news/coin-gr...inflation-com/ Coinflation.com (www.Coinflation.com), an increasingly popular informational website that provides the values of precious metals and the intrinsic values of gold, silver and base metal coins, has been acquired by Collectors Universe, Inc. (NASDAQ: CLCT), the parent company of Professional Coin Grading Service (www.PCGS.com). Coinflation.com was founded in 2004 by Alec Nevalainen who now has joined Collectors Universe as part of the transaction. The number of unique monthly visitors to the website has more than quadrupled in the past year to over 640,000 |

| Satyajit Das: The Financial Compass Posted: 17 Sep 2011 06:33 PM PDT By Satyajit Das, the author of Extreme Money: The Masters of the Universe and the Cult of Risk Roddy Boyd (2011) Fatal Risk: A Cautionary Tale of AIG's Corporate Suicide; John Wiley & Sons Inc, New Jersey Justin Cartwright (2010) Other People's Money; Bloomsbury, London Nicholas Dunbar (2011) The Devil's Derivatives: The Untold Story of the Slick Traders and Hapless Regulators Who Almost Blew Up Wall Street…And Are Ready To Do It Again; Harvard Business Press, Boston, Massachusetts Barry Eichengreen (2011) Exorbitant Privilege: The Rise and Fall of the Dollar; Oxford University Press, Oxford Diana B. Henriques (2011) The Wizard of Lies: Bernie Madoff and the Death of Trust; Times Books/ Henry Holt & Company & Scribe Publications, Melbourne Graeme Maxton (2011) The End of Progress: How Modern Economics Has Failed Us; John Wiley, Singapore South is the narrative focused on a supposedly pivotal or at least newsworthy event – Too Big To Fail and In Fed We Trust are examples of this approach, taking as their point of departure the collapse of Lehman Brothers. The relative calm of the last 18-24 months has meant there has been few additions to this list. As the crisis re-intensifies, there will be other Lehman weekends and books about it. East is titles trying to draw more general points from an individual aspect of the crisis, such as the history of an individual organisation or type of instrument, derivatives and securitisation feature prominently. Fatal Risk, Devil's Derivatives and The Wizard of Lies are examples of this genre. West is the professional economist's analysis of the crisis or aspects thereof. Exorbitant Privilege belongs to this class of book. North is the solution manual – the 10-point plan to solve the problems, delivered with polemic gusto. End of Progress comes closest to that type of book. Then there is the centre – fiction. Untroubled by facts, the author proceeds to use the power of literary rendition to describe the issues. The publicity of Other People's Money claims that it is a novel about the financial crisis. In Fatal Risk, Roddy Boyd, an investigative reporter (an endangered creature soon to be listed on the CITES list), provides a solid history of AIG and its problems. Based largely on his own reporting for the NY Post and interviews, Mr. Boyd provides an accurate chronology of events leading up to the implosion, requiring a government bailout in September 2008. Fatal Risk struggles to explain the insurance deals that were used to hide losses and the financial instruments within AIG's Financial Products operations that were responsible for the problems. The omitted technical details are critical. It was a failure to understand the structure and risk of these contracts, at least at senior levels of AIG, which brought about their downfall. There is also a lack of explanation of the rationale for AIG's expansion into non-insurance business – the desire to monetise its 'AAA' rating, balance the volatility of its re-insurance operations and also over confidence about it capabilities in risk assessment. Mr. Boyd largely accepts that Hank Greenburg, the driving force behind AIG growth and expansion into financial derivatives, was a superb risk manager, who personally oversaw the exposures of the company. Implicit in this argument is the suggestion that had Greenburg not been ousted as a result of Elliott Spitzer's investigations, the problems may not have occurred. Writing about the Battle of Borodino, Tolstoy observed that: "It was not Napoleon who directed the course of the battle, for none of his orders was carried out and during the battle he did not know what was going on." The same might be true of AIG. An alternative view might be that AIG was too large, ruled by fear of an autocratic CEO and lacked rudimentary controls that its non-insurance businesses required. Given that Greenburg presided over this state of affairs, the cautionary tale of the book's sub-title might just be an older and more familiar one – avoid powerful and dominant chief executives and entry into businesses which existing management is not experienced in. A career as a trained physicist who turned to financial journalism at Risk Magazine provided Nicholas Dunbar with a unique vantage point to the comings and goings in the market. Mr. Dunbar turned this insight into his first book Investing Money, which examined the demise of Long Term Capital Management. The Devil's Derivative focuses on the role played by derivatives in the current crisis with an emphasis on the Collaterallised Debt Obligations ("CDOs") and other manifestations of structured finance. Well-researched and knowledgeable, The Devil's Derivative has some problems. The experienced practitioner will find little knew here but the inexperienced will struggle to come to terms with the material as it assumes some basic knowledge. Mr. Dunbar's desire to titillate, perhaps to appeal to a wider readership, frequently distracts. Tales of men in expensive Italian suits in Knightsbridge night clubs drinking £400 bottles of Belvedere Vodka and cavorting with eastern European blondes might confirm the reader's suspicions but are not integral to the story. The subject matter of The Devil's Derivative has also been covered before and better by the Financial Times' Gillian Tett in Fool's Gold. Oddly, The Devil's Derivative's very long sub-title (24 words and 100 characters) – "The Untold Story of the Slick Traders and Hapless regulators Who Almost Blew Up Wall Street …. And Are Ready to Do it Again" – unconsciously competes with that of Fool's Gold (13 words and 82 characters) – "How Unrestrained Greed Corrupted A Dream, Shattered Global Markets and Unleashed A Catastrophe". Marshall McLuhan's famous aphorism – "the medium is the message" – has now been replaced by the lengthy sub-title which obviates the need to read the book. Diana B. Henriques, a senior writer for the NY Times (are there "junior" writers?), covered the Madoff Affair. The Wizard of Lies is her book of the newspaper articles, collating the history of the life and times of Bernard Madoff, grandee of finance, feted investment manager and finally convicted master Ponzi scammer. The thorough and (perhaps excessively) detailed biography is "long" on personal details (houses, clothing, charities, holidays, parties, friendships and personal behaviour) but "short" on real insight (the motivations and most importantly the why's). Madoff emerges as a curiously dull figure, especially relative to the scale of the fraud he was able to perpetrate. A central figure as insipid as Madoff rather robs the narrative of drama. In the absence of the charismatic villain, Ms Henriques unfortunately miss the opportunity to delve into two interesting issues to the extent warranted. The first is the efforts of the eccentric Harry Markopolos to draw the attention of regulators to the fraud. The SEC's damning post-mortem contrasts with Ms. Henriques excuses for their failure and criticism of Mr. Markopolos for alienating regulators over their ignorance of derivatives. Curiously, Ms. Henriques assertions that Markopolos' questions were irrelevant because no derivatives are required for a Ponzi scheme conflicts with Madoff's claims that his investment strategy depended critically upon derivatives. The second issue is the complicity of feeders fund, which channelled investors into the Madoff Fund, and wealthy investors in their own destruction. There is a little analysis or coverage of how much they knew and why they continued their involvement. Answers to both these questions would have shed greater light on Madoff but also perhaps the prevailing culture. Madoff was possible because everyone believed in his or her constitutional right to get rich. Investors ignored what they suspected was a Ponzi Scheme or even investigate the source of the returns, in the belief that they would always be able to get out before it collapsed. Everyone, including regulators, believed in this, ultimately to their own detriment. Exorbitant Privilege is a readable short history of the US dollar and how it came to dominate global trade and financial transaction. The title pays homage to the description of the benefits to America of the dollar's reserve status, attributed to Valéry Giscard d'Estaing, France's finance minister in the 1960s. Barry Eichengreen, an international monetary historian, who in his 1992 book, Golden Fetters argued that the inflexibility of the gold standard exacerbated the Great Depression, tells the story of the dollar's ascent. The history is solid and factually reliable demonstrating how the international monetary system based on the dollar evolved, allowing America the capacity to borrow more cheaply and more aggressively than might otherwise have been feasible. Professor Eichengreen glosses over the geo-political basis of this power. America's military and industrial strength at the time of the Bretton Woods meetings as well as the economic and military weakness of Britain and France battered by two world wars underpinned the rise of the dollar. Exorbitant Privilege sees the dollar's continued dominance as mainly the effects of incumbency and the absence of a viable alternative. Professor Eichengreen seems to not fully recognise the role that the dollar's dominance together with trade imbalances played in the current global crisis. He also underplays the backlash against the dollar, primarily from major holders of US government bonds such as China. The chapter on the financial crisis is highly derivative and unsatisfying. In the end, the author cannot find any alternative to a continuation of the existing system because there is really no alternative to the dollar. Economist, author and presenter Graeme Maxton's End of Progress is a damning attack on the underlying drivers of economic growth – financialisation, pollution and poor allocation of scarce resources, like oil and water. The book is a powerful polemic highlighting some of the key challenges facing mankind, although they only infrequently trouble policymakers or citizens, busy acquiring the latest must-haves. Mr. Maxton hits the mark in identifying the problems. His attempt to blame all this on modern economic thinking is less convincing, attributing perhaps too much power and importance to the "dismal science" and its practitioners. Economics is the outcome of a tacit societal accord where economic growth at all costs is the consensus. The sociology of crowds, greed and DNA of homo sapiens were arguably more important than economists in setting the stage for the present crisis. In the final chapter, perhaps at his publisher's urging, Mr. Maxton sets out a check list of "solutions". The prescriptions are predictable – lower population; better distribution of resources; and reformation of economics – fair profits; better pricing of the world's resources. Unfortunately, as Scottish philosopher David Hume observed: "All plans of government, which suppose great reformation in the manners of mankind, are plainly imaginary." Mr. Maxton's short book (probably no more than 50,000 words) ranges widely if thinly over its key pre-occupations. The evidence is not always complete, but there is no doubting the message. Mr. Maxton raises critical issues that should be on the top of the policy agenda. Asked about the difference between non-fiction and fiction, a writer who migrated from the second to the first responded: "There is no need to do any research; nor do facts matter." He could just as easily be talking about modern fiction, which has no end and no beginning. This does not prevent the story being told in many ways. Justin Cartwright's Other People's Money is acclaimed as a "brilliant" and "beautiful" novel about the crisis. The critics and reviewers quoted extensively on the cover were clearly reading a different book. Mr. Cartwright's well written and cleverly crafted work is at heart an old fashioned tale of the rise and fall (well almost) of the monied classes of England that readers of Dickens and Thackeray would recognise. Borrowing its title from Nomi Prin's book about corporate America and the eponymous film featuring Danni De Vito and Gregory Peck, Other People's Money has little to do with finance. Mr. Cartwright's grasp of banking is rudimentary and painfully second hand. Fortunately, it is irrelevant to an old tale of the scions of families destroying the family business. The characters are cliched and often border on caricature – the English merchant banker resembling Colonel Blimp, his second wife with acting ambition, a slavishly devoted assistant who is secretly in love with her boss, a self indulgent son who travels the world on his trust money seeking experiences, a conscientious son who becomes an unhappy banker with a Californication wife devoted to urban organic farming, a sundry affair with a hirsute South African rugby player, a despotic American banker etc. The characters that dot the book are shallow and unconvincing. The real people who populate Michael Lewis' The Big Short are far more interesting and better drawn than Mr. Cartwright's cast. The one exception is the auteur Artair MacCleod with his wild dreams of bringing the works of Flann O'Brien to the stage with Daniel Day-Lewis. Bumbling MacCleod with his dependence on the rich to realise his flaky artistic dreams points to the uneasy compact between those who have money and those who have dreams in modern society. Other People's Money's ending is also too contrived and too trite to be credible. But Mr. Cartwright does understand something of the role that ordinary people play in the world of money. One character expresses it accurately: "The rest of us are just the extras, without speaking parts, just fill in the blank spaces in the frame." It is sad that there wasn't more of such sharp observations in Other People's Money. |

| Posted: 17 Sep 2011 05:00 PM PDT |

| Has Hedging Killed The Goose That Was To Lay The Golden Egg? Part II Posted: 17 Sep 2011 04:00 PM PDT Gold University |

| Position Limits back in play at the CFTC Posted: 17 Sep 2011 02:23 PM PDT A few weeks ago I told my loyal readers that big news would be coming out of the CFTC back doors. Well, it looks like someone was turned again. This should NOT be shocking, silver longs can only one day HOPE justice is served, position limits are implemented, and we become wealthy beyond imagination. But not so fast. That would mean someone takes the hit (JP et al), and surely they will not just allow themselves to loose a few hundred billion overnight. "The CFTC has already missed a deadline in the Dodd-Frank law to finalize position limits. Three of the five commissioners at the CFTC, including one Democrat, have expressed skepticism that position limits can prevent large run-ups in prices. CFTC Chairman Gary Gensler had hoped to get the measure approved in September, but now it is expected to be pushed into early October." Click here... |

| Gold is the past and the future. Posted: 17 Sep 2011 01:23 PM PDT From Bud Conrad of Casey Research:

As to what speculators – what anyone – should do, it doesn't really matter whether the fall of the dollar precipitates the level of crisis we expect. The steps we advocate are reasonable for anyone who doesn't want to get hurt by a currency crisis: buying physical gold (and silver – both are still relatively cheap in inflation-adjusted dollars); getting a useful portion of one's assets into a stable country outside of the US (preferably one with no involvement in the "War On Terror/Islam"); and investing a fraction of one's portfolio in gold stocks. That these moves are also the same as those you need to make for realizing enormous profits is not a coincidence but a reflection on our times. Read more at GoldSeek.com |

| DEFINITION: Gold Indexes – The HUI and XAU Posted: 17 Sep 2011 01:12 PM PDT The HUI Index represents the symbol of the AMEX Gold BUGS Index. BUGS stands for Basket of Un-hedged Gold Stocks which means that companies included in the HUI Index limit any hedging of their gold positions to one and a half years. To the contrary, another major gold index, the XAU Index, does include companies that hedge for the long term. As a result, the HUI Index tends to be more volatile than the XAU Index. At its inception in March 1996, the HUI Index was set at a value of 200. The HUI Index tracks a group of companies (i.e. there were 15 in 2008) involved in the mining of gold. The HUI Index is a modified equal dollar weighted index. In computing the HUI Index, AMEX ranks these gold mining companies based on market capitalization. AMEX then gives greater index weighting to the top three ranked HUI Index companies while the remaining HUI Index stocks are given equal weighting.

View the HUI list at KITCO |

| Why the GOLD Bull Market is Far from Over Posted: 17 Sep 2011 01:02 PM PDT Ask yourself:

Read more @ GoldForecaster |

| Gold is Confidence in Money Systems Posted: 17 Sep 2011 12:58 PM PDT From Julian D. W. Phillips: Here we are in 2011, looking at the second most important currency in this unbacked money system losing its name by the day. While governments will attempt to limit the collateral damage a default of Greece (and who else?) the contagion effect of the loss of confidence will run like an epidemic. In the end the very structure of the money systems will be questioned. As government management of their debt and other finances are seen to be lacking, as well as out of their control, confidence in the very system is in decay. Read more @ GoldSeek.com |

| Posted: 17 Sep 2011 12:34 PM PDT

WTF seriously? Read the entire bit @ IMF.org ~MV |

| Can the Chinese really achieve their “Five-Year Plan”? Posted: 17 Sep 2011 10:16 AM PDT From ChinaDaily: Tangent Capital Partners Senior Managing Director James Rickards, an investment banker with more than 35 years of experience in capital markets, is skeptical about China's ability to drive future global growth. He said what is termed as China's new growth model might not be realized at all.

Carson Block, founder of Muddy Waters Research, also challenged Roach's analysis and said that he is missing the point. "You are looking at the government statistics. In China, collection of data are challenging for the government. You really have to look around you. You can learn a lot more about the macro picture in China by observing around you," said Block, who started out his short-selling business in China for a little more than a year ago. Today, Block is widely known as a major short seller of Chinese companies. Including Sino-Forest, Muddy Waters has released reports on five Chinese firms and in each case the company's stock plummeted. Three of the companies have subsequently been delisted.

On Sept 12, Block announced that his firm was shorting the stock of Silvercorp Metals Inc, a Chinese silver miner accused of fraud by an anonymous short seller last month. Shortly after Block's Twitter post saying that he's shorting Silvercorp, the company plunged 20 percent. Read More @ ChinaDaily |

| Posted: 17 Sep 2011 06:41 AM PDT Good afternoon. We are 48 hrs from launching www.silvergoldsilver.com (I think). I thank all those who have donated to the cause and thank those that are about to donate as well. As the new site moves forward, it will evolve into many spheres. Especially, the forums, in which I am going to extend the topic list to more touchy subjects if people get bored of silver and gold on some days and would like to just vent it out on another subject. There has been some confusion as of late regarding the VIP tab. The VIP tab will not be functional on launch. That will be for a month down the road, and the information there will be privileged info that will be paid for such as a newsletter, video's, picks, etc. Paying subscribers will gain an edge before its release to the public a few days or weeks later. Were talking a very minor payment if you want to be a part of the VIP such as $5-10 a month, or something along those poverty lines. The money will be used to maintain the site. If you do not choose to be a part of the VIP, the blog, forums and chat will still be available for free. So no worries. People thought the entire site was pay only, THIS IS NOT THE CASE. ____________________________________________________________________________ Cot Report: Tuesday Sept 6th-13th Only, does not include this past Wed-Fri. Gold: The Large Specs were caught long earlier and when the chart double topped so to speak they started pitching longs and taking provide to the tune of a massive 13,062 contracts. They also decided to add 2,462 short. The large commercials did the very opposite: They added 9,351 long and covered 7,895 contracts on the plunge again albeit. Remember this is as of Tuesday the 13th. So Fridays rally was not included in this, and it seems like someone got squeezed like a sour grape in the last 3 hours of trading. Silver: The large specs, again, did the opposite of the commercials: They sold off 597 longs and ADDED 323 short. I am assuming they covered the majority of these on Friday. The commercials ADDED 1288 long! and Covered 631! Ha! Seems like Fridays late day rally benefited the bankers, and the larger specs got slammed. For those thinking silver is going to roll over and head back to $12/oz...well, I'm not seeing that in this COT. In fact, being so close to the trend line, I was expecting a massive increase in the commercial shorts. It was the opposite, which tells me, that we are still in a bullish sentiment for BOTH metals. Add in the fact, that the comex deliveries are non existent, is evident of the shortage of commercial grade metal still. They painted the chart, and shorts got killed on Friday. The week approaching is particularly important as we have a 2 day FOMC meeting, and Thursday is Comex Options expiry. So lets play out some scenarios. 1. The Ben Bernank says some sort of print hint, or print itself or twist, or whatever. The PM's should explode to the upside along with the Bank stocks. Those that have shorted the PM's for options expiry beatdown will be squeezed like lemons, seeds and all. This will pave the way for $50-75 silver and $2200-$2500 Gold by New Years Day. 2. The Ben Bernank baulks, and says he can wait for some more printing. Markets literally implodes, Gold retraces to its MA, no idea what silver does, Euro region literally catches on fire and the 2009 lows will be welcomed with at least 2 major EU banks failures, and the secession of Greece by New Years Day. After Greece leaves, the domino effect will be catastrophic. I dont care to paint that picture. 3. The Ben Bernank paints a rosy picture, no markets buy it, but no markets sell it. Non Event. So position yourself accordingly to YOUR plan, keep buying the phyzz, and pray for the printing presses-its the path of least resistance for all markets right now. I have already done a phone interview with an expert on the metals market. This will be available when the site is launched as an introductory series. Have a great weekend. Keep your head up. Doesnt matter if we go up or down from here, they cant even buy time anymore with fiat. Those times are over. We will win. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

~TVR

~TVR Even if the regime change we foresee takes decades to come about, the softest "soft landing" imaginable will still be very painful, with repeated flights from paper currencies. That is why we have been saying that

Even if the regime change we foresee takes decades to come about, the softest "soft landing" imaginable will still be very painful, with repeated flights from paper currencies. That is why we have been saying that  AMEX maintains the HUI Index in accordance with the eligibility criteria set forth in Exchange Rule 901c. Composition of the HUI Index is reviewed quarterly at the close of trading on the last Friday in March, June, September and December. AMEX can also, at its discretion, decide to add or remove companies from the HUI Index to respond to changes in the gold mining industry and to ensure that the companies included in the HUI Index are still a fair representation of gold mining companies.

AMEX maintains the HUI Index in accordance with the eligibility criteria set forth in Exchange Rule 901c. Composition of the HUI Index is reviewed quarterly at the close of trading on the last Friday in March, June, September and December. AMEX can also, at its discretion, decide to add or remove companies from the HUI Index to respond to changes in the gold mining industry and to ensure that the companies included in the HUI Index are still a fair representation of gold mining companies. The report also stressed the fact that the credit crisis was impacting the full spectrum of the financial market in one way or another, with losses distributed between banks, insurance companies, pension funds, hedge funds, and other investors. We note that credit card finance alonside car finance has been included in assets acceptable to the Fed as collateral, which tells us it is not over by a long shot.

The report also stressed the fact that the credit crisis was impacting the full spectrum of the financial market in one way or another, with losses distributed between banks, insurance companies, pension funds, hedge funds, and other investors. We note that credit card finance alonside car finance has been included in assets acceptable to the Fed as collateral, which tells us it is not over by a long shot. In 2000 gold stood at just below $300, and when the euro arrived it stood at just over €250. Confidence was nearly absolute in the U.S. dollar at the time and the currency the world's energy was priced in. The euro was about to be launched to replace currencies like the Deutschemark, the French Franc and the rest of Europe's currencies. Today and eleven years later, gold is standing six times higher than the level at the turn of the century, despite all attempts to keep it contained. Why?

In 2000 gold stood at just below $300, and when the euro arrived it stood at just over €250. Confidence was nearly absolute in the U.S. dollar at the time and the currency the world's energy was priced in. The euro was about to be launched to replace currencies like the Deutschemark, the French Franc and the rest of Europe's currencies. Today and eleven years later, gold is standing six times higher than the level at the turn of the century, despite all attempts to keep it contained. Why? Remember it? The IMF gold sale to India at around $1050 and ounce. Now the IMF is trying to figure out what to do with the proceeds. Sounds like they are leaning towards a contribution to the Poverty Reduction and Growth Trust (PRGT).

Remember it? The IMF gold sale to India at around $1050 and ounce. Now the IMF is trying to figure out what to do with the proceeds. Sounds like they are leaning towards a contribution to the Poverty Reduction and Growth Trust (PRGT). Roach countered that the massive urbanization taking place in China is evidence that the consumption model is happening. Twenty-five years ago, about 25 percent of the nation was urbanized. Today that figure is close to 50 percent. At least another 310 million Chinese people will move from the countryside to the cities, according to the Organization for Economic Co-operation and Development (OECD).

Roach countered that the massive urbanization taking place in China is evidence that the consumption model is happening. Twenty-five years ago, about 25 percent of the nation was urbanized. Today that figure is close to 50 percent. At least another 310 million Chinese people will move from the countryside to the cities, according to the Organization for Economic Co-operation and Development (OECD). Spreadtrum Communications, however, has rebounded from an initial 34 percent tumble after CEO Leo Li organized a conference call with investors to address doubts raised by one of Muddy Waters' reports. As of Thursday, Spreadtrum's stock was trading at $20.67, close to its initial stock price before Block's critical report of fraud at the company.

Spreadtrum Communications, however, has rebounded from an initial 34 percent tumble after CEO Leo Li organized a conference call with investors to address doubts raised by one of Muddy Waters' reports. As of Thursday, Spreadtrum's stock was trading at $20.67, close to its initial stock price before Block's critical report of fraud at the company.

its really awesome try more ,

ReplyDeletecoinflation gold and silver app

Oh my god You Don't Know this App Extreme Car Driving Simulator Mod Apk (Unlimited Money)

ReplyDelete