saveyourassetsfirst3 |

- Gold Seeker Closing Report: Gold and Silver Fall Slightly While Stocks Gain

- Gold heading to $2,350 per ounce after 4th wave consolidation

- Return Of The Euro Shorts

- 1980 Gold Parabolic, BGMI, HUI and Some Small Miners with Big Earnings

- Oil Spread Shrinks 32% For No Apparent Reason

- Trump, Apmex, and Goldilocks

- Bankers Expect Weak Profit Performance In The Future

- Will the Dollar Hinder Precious Metals in the Short-term?

- WATCH – Gerald Celente on Jobs, Gold and more..

- The Aussie Dollar Comes Under Pressure

- Dylan Grice Deconstructs The “Perpetual Ponzi Machine” Of Global Finance, Sees Gold At $10,000 In A World Of Dishonesty

- WATCH – James Turk talks with John Brimelow

- Silver Commitments of Traders Update

- The downgrade of Europe has begun

- Richard Russell: 12 tips for surviving the "End of America"

- Overnight

- Palladium price lags on weak Chinese car sales

- Silver Update – 9.14.11 “Bottleneck” – BrotherJohnF

- WATCH – Stella on Australia's PHYSICAL Exchange

- Gold money and currency competition in the US

- Gold & Silver Market Morning, September 14, 2011

- Resort to SDRs for Next Bailouts Will Spur Rush to Gold: Jim Rickards

- Is gold being suppressed? - Christopher Barker

- Europe's banks are staring into the abyss

- Merkel and Sarkozy to hold crisis talks with George Papandreou

- Resort to SDRs for next bailouts will spur rush to gold, Rickards says

- Gold's smashing amid Swiss devaluation was dead giveaway, Embry tells King World News

- John Brimelow talks with James Turk

- Guest Post: Massive New Radiation Releases Possible from Fukushima … Especially If Melted Core Materials Hit Water

- Eric Sprott: Silver is the investment of the decade

| Gold Seeker Closing Report: Gold and Silver Fall Slightly While Stocks Gain Posted: 14 Sep 2011 07:13 AM PDT Gold climbed $17.30 to $1844.70 in early Asian trade before it fell to see a $15.12 loss at as low as $1812.28 by early afternoon in New York, but it then bounced back higher in the last hour of trade and ended with a loss of just 0.22%. Silver rose to as high as $41.32 by about 7AM EST before it fell back to as low as $40.315 and ended with a loss of 1.63%. |

| Gold heading to $2,350 per ounce after 4th wave consolidation Posted: 14 Sep 2011 05:52 AM PDT

In my most recent few forecasts for subscribers and public articles I've discussed a major correction in Gold, and it dropped $208 within 3 days of that forecast several weeks ago as Gold traders will recall. Last week I wrote about further consolidation being required in what I'm seeing as a either 4th wave likely "Triangle Pattern" that will consolidate the 34 month run from $681 to $1910 into August of this year, or a 3 wave "A B C" pattern. We are right now in some form of C wave, it's just a matter now of confirming if we are going to get a "D and E" wave to follow, or the C wave drops lower before we bottom. A Triangle pattern serves to let the "economics of the security" catch up with the prior large movement upwards in price. In essence, the crowd behavior pushed the price of Gold a bit too high too fast, and this consolidation pattern lets the fundamentals catch up to price action. We had a parabolic move I discussed many weeks ago, and those always end badly to the downside. The $208 drop in three days is a typical reaction to a spike run like that. At the end of the day though, I had been forecasting what I call a "Wave 3" top and was looking for a multi week or multi month consolidation pattern before Gold could move higher. Let's examine what that triangle projection may look like. They take the form of 5 waves, or what we can call ABCDE in a pattern. The biggest drop is always the "A" wave, and that was 1910 to 1702 in 3 days or less. The next biggest drop is the "C" Wave, and that was 1920 to 1793, noting it was a Fibonacci 61.8% drop relative to the A wave. In other words, each successive wave down in the 5 wave triangle is smaller. This is due to the sentiment finally shifting and the trading patterns moving from people chasing the hot sector or stock or metal, to the long term investors accumulating the dips. If we end up consolidating in a "Triangle", then Gold should end up looking something like the below pattern I drew, with a target of $2,350 per ounce many months out: The other pattern we are watching for at TMTF is the ABC Correction pattern. We had the A wave down to 1702, which corrected 50% of the move from 1480-1910 in 3 days. Rarely do you get a major move down like that and not get some type of "re-test" of that low, but because the fundamentals for Gold are strong and getting stronger, we are favoring the Triangle pattern still as most likely. With that said, there is a fat and juicy "Gap" sitting in the chart around 1660 on Gold and dropping down there is what a lot of traders are watching. If that were to fulfill, then we will see an ABC correction ending around $1643, and then Gold will begin another multi month rally to new highs: At TheMarketTrendForecast.com I teach people my crowd behavioral methodologies and give them reliable forecasts in advance so they can be prepared with their investments. Consider working with us and following the SP 500, Silver, and Gold by going towww.MarketTrendForecast.com You can take advantage of a 33% discount over the next 48 hours as well. Tags: gold forecasting service, Gold price forecast, spot gold forecast, trade gold futures and spot |

| Posted: 14 Sep 2011 05:37 AM PDT

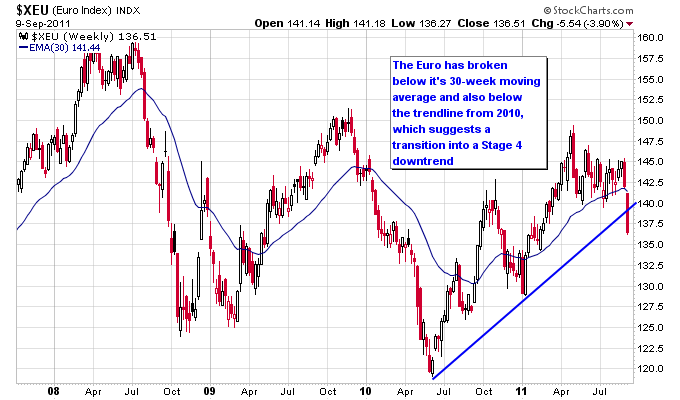

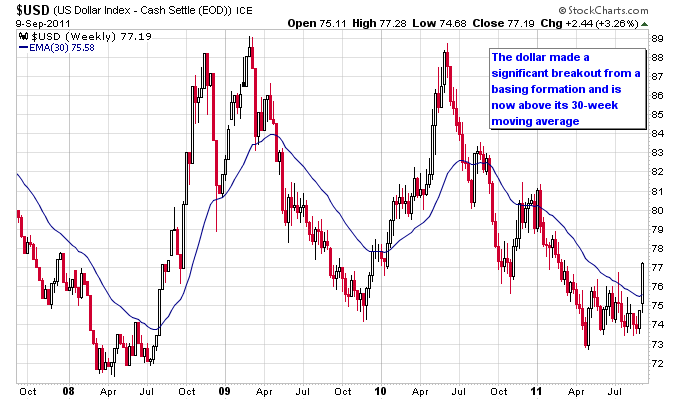

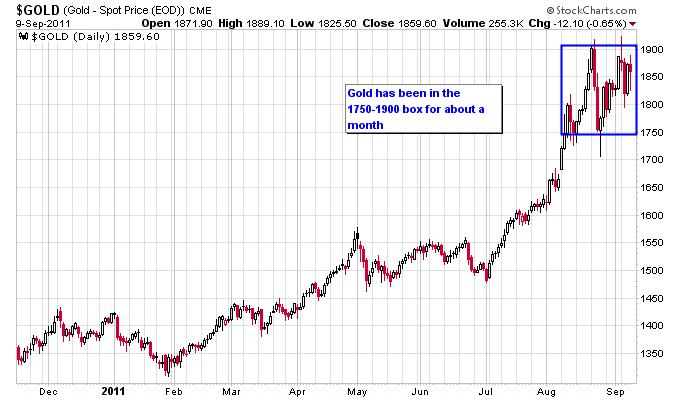

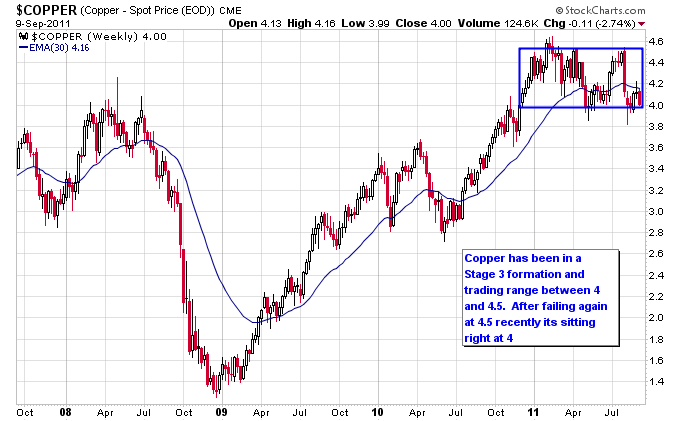

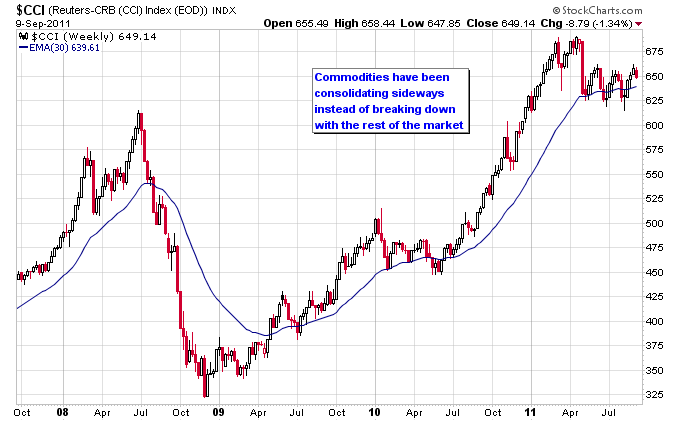

Back in July I wrote an article discussing the fact that the Euro had failed so far to come under pressure during this wave of the European debt crisis. In fact it was still in a technical uptrend since bottoming in 2010 after the first wave of the Euro crisis. Last week the picture for the Euro changed significantly as it fell -3.90% for the week and fell out of a trading range between 140 and 145. The breakdown out of this trading range could be the beginning of a new Stage 4 downtrend for the Euro, as it is now trading below its 30-week moving average which has also turned lower. The U.S. dollar conversely has broken out of its trading range and could be on the verge of a new Stage 2 uptrend. This will undoubtedly have an impact on other sectors of the market, as the dollar has shown to be negatively correlated to most asset classes since the 2008 financial crisis. Chris Puplava from Financial Sense just wrote a good article showing some of the correlations of the dollar to other asset classes. Most sectors of the stock market appear to have a negative correlation in the -0.40 to -0.50 range to the U.S. dollar, which could be characterized as a moderate negative correlation. What this basically means is that they don't always move in the opposite direction of each other, but have shown a tendency to move in opposite directions. Since most sectors of the stock market have transitioned into a Stage 4 downtrend it is not very helpful to the stock market to now have a rising dollar. Gold actually has a negative correlation of less than -0.20 to the dollar, which means that gold has shown a weaker tendency to move in the opposite direction of the dollar than the stock market. This runs contrary to a lot of common thinking that gold always runs counter to the action in the U.S. dollar. Relatively speaking, this weaker negative correlation is good news for gold since gold has been the leading sector of the market over the last few months. Gold is currently consolidating under the 1900 level which it needs to take out for its uptrend to remain intact. Two other charts worth paying attention to now that the dollar is attempting to rally is copper and the commodities index. Both have been consolidating in a Stage 3 instead of breaking down with the rest of the market. But a rallying dollar could potentially be the push needed to transition them into a Stage 4. This potential structural shift in the movement of the U.S. dollar is bearish for the stock market. The stock market didn't really need this bad news, since it has already broadly transitioned into a Stage 4 downtrend across most sectors of the market. Stan Weinstein, who outlined the Stage Analysis method in the bookSecrets For Profiting In Bull And Bear Markets, says in the book that above all else, do not buy or hold anything in a Stage 4. I definitely agree with that statement, as the only way to lose significant money in the market is to stay on the wrong side of the market and build up losses. As a trend follower the number one job is to listen to the message of the market, which includes the bearish potential outcome of a trend change in the dollar. |

| 1980 Gold Parabolic, BGMI, HUI and Some Small Miners with Big Earnings Posted: 14 Sep 2011 05:24 AM PDT

I've spent the past couple of weeks learning a new skill – making charts using Microsoft Excel. This article will use my new skills to compare gold's current C-wave development with gold's great parabola that concluded on January 21, 1980, as well as examine the historic relationship of gold with gold mining stocks using both the BGMI (Barron's Gold Mining Index) and HUI (Amex Gold Bugs Index). Then we will conclude with some charts of miners that appear to have not only explosive future earnings, but also explosive future price appreciation. The upper portion of this chart is the great 1977-1980 gold parabola that blew up on January 21, 1980. I am showing you this in the context of historical perspective and not in the context of price prediction. Honestly, I shudder to think what it what take for gold to now double it's current price of $1857 to over $3700 in the next 10 weeks. But I do recognize that it is possible – particularly because, as we observed in 1980, it has happened before. I can indeed think of several realistic mechanisms to make this happen as 'historically contemplated' on this chart (think Bernanke and QE 3, Europe and sovereign defaults, Comex futures short squeeze of exciting proportion, and other possibilities including war and so on). The mining indices we are familiar with, such as the HUI (Amex Gold Bugs Index) and XAU (Philadelphia Gold/Silver Sector Index), believe it or not, have not existed for all that long. The HUI dates back to mid-1997 and the XAU only to mid-1995. Fortunately, there is an index of precious metal mining stocks that predates both the HUI and XAU – and it is the BGMI (Barron's Gold Miners Index). Data and charting of this historical index is available online (BGMI link HERE) and dates back to 1939. This next chart shows you both the BGMI price action to the present day, as well as a log-scaled chart that suggests the relationship between this index of gold miners to the ever changing price of gold. The lower portion of the chart suggests that a BGMI/Gold ratio at or below 1:1 has been consistent with the beginning of huge gold miner stock rallies, particularly since 1978. Unfortunately, I did not design both of these charts ('glued' one atop the other) with the identical time frame – which means that 1.0 readings on the lower chart do not line up precisely with the rally origins in the upper chart. But hey, I warned you I am just learning how to do this stuff. At any rate, using this metric it appears the gold miners are seriously oversold and likely to rally hard. The current reading is well below 1:1. Let's turn now to the HUI index and see if it too is suggesting a bullish future for the miners. The HUI index consists of 16 miners that are not equally weighted within the index. I have noted these miner's ticker symbols in the upper left corner of the chart. The immediately striking observation one makes is that gold tends to be priced at 2 times that of this index. (ie. if gold is $1000, the HUI would be close to $500). Then we notice that at the beginning of gold's secular bull market in 2001, the miners were way out of whack – with gold comparatively selling at a 4-5X premium to the gold bugs index. This led to a miners rally that nearly tripled their value in less than 16 months. The HUI miners bottomed ahead of gold, reaching a closing price of just $35.99 on November 14, 2000. As of this date September 11, 2011, the HUI index has gained 17 times it's value in November, 2000 ($628.34 vs. $35.99). By the way, gold bottomed on April 5, 2001, 5 months following the miner's low, with a closing price of $255.45. As of this past week, gold has appreciated over 7 times it's value since making it's secular market low in April 2001 ($1857 vs. $255). The other thing we notice about this chart is that since 2008 the mining index has not been able to get back to it's more 'balanced' 2X relationship with gold. At present gold is selling for about 3 times the price of the index. Will the HUI index now rally more fervently than gold to close this oversold difference? I don't know. I can observe that while miners rallied strongly higher during the final 3 months of gold's 1980 parabola (gaining 50+%), they were no match for the rocket launch of the precious metal itself, as gold literally more than doubled in this time period. However, once gold and the miners peaked and then spent 3 months working off a severely overbought status with a sharp 25-35% correction, the miners proceeded to literally double in the following 6 months as gold made a failed attempt to reach the parabolic high. Finally, let's take a look at the daily/weekly charts of three miners with big earnings. I studied about 200 miner charts to select these three to show you. There are more than three that interest me, of course, but I will need to get to them another time. This is Claude Resources Inc. (CGR). The earnings data, past and estimated is noted on the weekly chart. The right side of the chart is the daily view of CGR. Next up is Great Panther Silver (GPL). The earnings data is on the weekly side of the chart as well as the daily side. And finally my personal favorite which is Minefinders Corp (MFN). The float is small at 84Million shares, gold and silver mines producing in 'safe' Mexico, and the projected earnings are simply breathtaking. Any stock that can go from .09 per share to $1.76 in just three years deserves a good hard look. (!) And which of these stocks do I own? Not one. But that may change this week. Good trading to you. John Townsend |

| Oil Spread Shrinks 32% For No Apparent Reason Posted: 14 Sep 2011 05:23 AM PDT By Carlos X. Alexandre:c The debate over the spread between Brent and West Texas Intermediate has produced many theories and, thus far, all of them are simple guesses as to what the oil market is actually doing. From Brent being the "de facto" world benchmark to the irrelevance of WTI, many explanations draw heavy emotions from some participants. Reality is that I don't really care what the benchmark actually is, as long as I can determine where the market is headed and the logic makes sense, even if I am wrong. On September 7, the November contract closed at $114.81 for Brent and $86.31 for WTI, and the spread was $28.50. Yesterday the spread was only $19.49 - Brent closed at $109.77 and WTI at $90.28 - or a significant 32% reduction in the spread in only six days. Considering that commodities have an inverse correlation with the dollar, the dollar index increased 2% Complete Story » |

| Posted: 14 Sep 2011 05:20 AM PDT From Robbie Whelan of the WSJ and BMG:

On Thursday, the newest tenant in Donald Trump's 40 Wall Street, a 70-story skyscraper in Manhattan's Financial District, will hand Mr. Trump a security deposit worth about $176,000. No money will change hands—just three 32-ounce bars of gold.

Mr. Trump said he sees the deal as a repudiation of the Obama administration's economic policies, of which he has been a vocal critic. To view the Robbie Whelan article: Trump's New Gold Standard |

| Bankers Expect Weak Profit Performance In The Future Posted: 14 Sep 2011 05:18 AM PDT By John M. Mason: The big bankers are projecting more bad news for their third quarter performance. A discussion of this can be found in the New York Times article "Banks Brace for a Season of Fall-Offs." In what is taken as a reflection of the industry, JP Morgan Chase "warned that third-quarter trading revenue was likely to fall about 8 percent from a year ago. Investment banking income is also expected to drop by one-third from a year earlier." Note two things about this information. First, the trading revenue does not come from the trading done by the banks, but from trading transactions initiated by the banks' clients. Second, the investment banking income relates to the fees earned on acquisitions and stock and debt offerings. As the economy recovered from the financial collapse, these sources of income provided an uplift for the troubled banking industry. But, as we have seen, the revenue from Complete Story » |

| Will the Dollar Hinder Precious Metals in the Short-term? Posted: 14 Sep 2011 05:17 AM PDT

Based on the September 9th, 2011 Premium Update. Visit our archives for more gold & silver analysis. Conventional wisdom has it that there are three safe haven currencies—the Swiss Franc, the Japanese Yen and the U.S. dollar. But perceptions are changing. The US dollar is no longer the default shelter for long-term investors. Instead, the Swiss franc and the Japanese yen have been the hideaways in a financial storm along with history's longest used currency—gold. But both the Swiss and Japanese governments are desperately trying to curtail their currencies appreciation and to curb the inflow of investments by selling their currencies into the market and creating an oversupply, which will lower prices. They have both cut interest rates to zero. A strong currency makes it difficult to export your country's goods. It's easy to understand why investors have perceived the Swiss franc as a safe haven. Switzerland boasts a strong economy, which is not plagued by high national debt and budget deficits. With its conservative Swiss banking monetary policy, it has not resorted to money printing schemes with names like "quantitative easing." The Swiss franc reached milestone parity with the dollar in 2011 and since then has appreciated by an additional 20%. The franc is up 5.41% against the euro this year and almost 14% against the dollar. However, last Tuesday, the Swiss franc plunged dramatically versus the euro and other major rivals after the Swiss National Bank took the extraordinary step of setting a floor for the euro/Swiss franc exchange rate at 1.20 francs and vowed to buy "unlimited quantities" of euros to defend it. Needless to say, this gave gold a boost. It reached a record of $1,923.70 an ounce in trading Tuesday of contracts for December delivery, before retreating below $1,900. The price of oil has fallen because of the global slowdown, eliminating another place where investors might be tempted to stash cash. The SNB's move was widely viewed as positive for gold because the metal will gain even more popularity as a safe-haven investment of choice. For the past 14 months the franc has experienced a parabolic rise as financial instability beset many of its neighbors as well as the US. The move by the SNB puts the central bank in direct conflict with a strong desire by market participants to buy safe-haven assets. Since there is a good chance that the eurozone crisis will only get worse, the Swiss intervention could prove to be very costly to the SNB. The move underscores the particular challenges facing Switzerland at a time of global economic uncertainty. This is not the first time the Swiss central bank has resorted to such a strategy to contain the franc. It used a similar strategy in the late 1970s to weaken the currency against the Deutschmark. The central bank's new target commits it to buying euros and selling francs any time the euro falls below 1.20 francs. That amounts to setting a floor for the euro or a ceiling for the franc. What is true in the long-term does not necessarily have to be valid in the short-term. Even though the long-term outlook for the dollar is rather cloudy, investors have been buying large amounts of dollars in the last few days. It seems that the fact that German officials reluctantly start to admit that a Greek default may be the only way to resolve the current crisis of the euro has coerced investors into buying the greenback rather than gold and the Swiss franc. Why is that? One way to explain this is to point to the recent depreciation of the franc against the dollar. The aforementioned peg of the franc to the euro has affected the USD/CHF exchange rate as well. This means that, at least in the short term, the franc is less attractive that it was a couple of weeks ago. If you couple that with the recent parabolic rally in gold and the fact that investors and traders start to doubt whether gold is poised to continue its move up in the short-term, you may come to the conclusion that in the short-term the dollar has recently become more attractive. This is why we currently see a considerable movement of capital from the eurozone to the USA. All of the factors mentioned above have added to the recent move up in the USD Index. To see how this may influence the precious metals sector, let's move on to the technical part of today's essay. We will begin with the long-term Euro Index chart (charts courtesy by http://stockcharts.com). The index moved sharply lower this week, and it is now below the declining resistance line marked with red on the above chart, which opened the door to significant declines towards the 135 level. If the downward move continues, the index may move to the level of 130 or even lower. This week's developments will likely have further positive implications for the dollar. In the short-term USD Index chart, we saw the index break above the declining resistance line last week. This short-term move in fact created a breakout from the long-term perspective as well. This has become a bullish signal since this move ignited a move above the long-term resistance line which in turn will likely ignite a rally from a long-term perspective. The hitherto rally has brought the USD Index levels up to as high as 77-78 and the move is likely to continue to the level of 80 or even higher. All this will likely have negative implications for the precious metals sector. Please, recall what we wrote on September 7th in our essay on gold and the Swiss franc: (…) the recent appreciation in the euro seems to be short-lived and we currently do not view it as a bullish signal for precious metals. The following rally in the USD Index took the dollar above the declining trend channel, which – if confirmed and no additional factors emerge – will likely correspond to a decline in the precious metals. This is precisely what followed – the euro retraced and declined further, the dollar rallied and the PMs moved lower. Combine that with the fact that the move in the USD Index was significant and that it appears to be an early part of a bigger move up. This is where medium- and long-term correlations come into play and these are negative for the dollar and the precious metals sector. Consequently, the precious metals sector is likely to move lower based on dollar's rally. Summing up, the situation in the USD Index is bullish this week and quite the opposite is true for the Euro Index. The latter declined sharply this greatly contributed to the positive moves of the dollar. The short-term implications for precious metals are bearish. The influence of these currencies is likely to be very visible throughout the precious metals sector. It appears that the key signal to watch for this week is whether the USD Index can retain its upside potential. This would greatly increase the probability of lower precious metals' prices in the weeks ahead. While this is pertinent to the short-term, the long-term outlook (following years) for precious metals has not changed and remains bullish. We advanced arguments in favor of such a point of view in our recent essay about the comparison between two gold bull markets. To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Gold & Silver Investors should definitely join us today and additionally get free, 7-day access to the Premium Sections on our website, including valuable tools and unique charts. It's free and you may unsubscribe at any time. Thank you for reading. Have a great and profitable week! P. Radomski * * * * * Interested in increasing your profits in the PM sector? Want to know which stocks to buy? Would you like to improve your risk/reward ratio? Sunshine Profits provides professional support for Gold & Silver Investors and Traders. Apart from weekly Premium Updates and quick Market Alerts, members of the Sunshine Profits' Premium Service gain access to Gold Charts, Gold Investment Tools and Analysis of Gold & Silver Prices Naturally, you may browse the sample version and easily sign-up for a free weekly trial to see if the Premium Service meets your expectations. All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. |

| WATCH – Gerald Celente on Jobs, Gold and more.. Posted: 14 Sep 2011 05:02 AM PDT Russia Today From 9.11.11: |

| The Aussie Dollar Comes Under Pressure Posted: 14 Sep 2011 04:46 AM PDT By Forexyard: By Russell Glaser The Australian dollar has been one of the worst performing currencies this week as reduced risk sentiment weighs on the currency. The fact that AUD market positioning continues to increase stands out in this "risk off" trading environment. With market speculation running wild of a potential Greek default and French banks coming under funding pressures, risk sentiment has plummeted as traders move into safe haven assets such as the USD and US Treasuries. The AUD is considered a high beta currency and has been sent sharply lower over the past few days. Versus the USD the AUD is down 2.1% this week alone and has shed 5.2% since its September 1st high. The AUD is also down sharply in the crosses with the AUD/NZD falling 1.1 % this week and the AUD/JPY down 3.1% as well. Data released on Monday showed the Australian trade surplus declined to Complete Story » |

| Posted: 14 Sep 2011 03:48 AM PDT There is a demand for honest brokers, fund managers, lawyers, dentists, doctors etc. And there is a demand for honest currency. |

| WATCH – James Turk talks with John Brimelow Posted: 14 Sep 2011 01:42 AM PDT James Turk talks with John Brimelow about the global gold market:

|

| WATCH – Stella on Australia's PHYSICAL Exchange Posted: 13 Sep 2011 10:01 PM PDT Stella announces Australia's first Physical Bullion Exchange |

| Gold money and currency competition in the US Posted: 13 Sep 2011 10:00 PM PDT As the euro slowed its slide against the dollar and European equity markets rebounded slightly, spot gold price was up slightly to $1,831 per troy ounce with a nice quick rebound from the $1,800 per ... |

| Gold & Silver Market Morning, September 14, 2011 Posted: 13 Sep 2011 09:00 PM PDT |

| Resort to SDRs for Next Bailouts Will Spur Rush to Gold: Jim Rickards Posted: 13 Sep 2011 08:53 PM PDT ¤ Yesterday in Gold and SilverWell, the smack-down about 9:15 a.m. in London proved to be gold's low for the day on Tuesday. Then, from slightly under the $1,800 price mark, gold worked its way back...and by 9:00 a.m. in New York, gold had recovered over $30 of its loss...and was actually higher than its Tuesday close. That happy state of affairs didn't last, as selling pressure showed up...and by 10:20 a.m. Eastern, the gold price had given back about twenty bucks worth of its previous gain. But then the seller disappeared...and gold rallied smartly until 2:00 p.m. in the thinly-traded New York Access Market...and then basically traded sideways for the remained of the electronic trading session. The gold price finished up a whisker under twenty dollars. Net volume was decent at around 175,000 contracts. Silver moved higher right from the open in Far East trading yesterday morning, with the interim high coming about 12:30 p.m. Hong Kong time. Then the price rolled over, with the low of the day coming pretty much at the London silver fix which occurs around 12 o'clock noon in London. From that low, silver rose sharply until minutes before 9:00 a.m. in New York...and then traded sideways to down until minutes after 11:00 a.m. Eastern. Then away it went to the upside, with the high of the day [just like gold's] coming moments before 2:00 p.m. in the New York Access Market. The silver price then gave up a bit of those gains going into the close of trading at 5:15 p.m. Eastern. Silver closed up 84 cents on the day. Net volume was in the neighbourhood of 37,000 contracts. Despite the fact that the gold price did pretty well for itself during the New York trading session, the shares were somewhat more reluctant to join the party...and it wasn't until a rally that began around 1:30 p.m...that the shares moved permanently into positive territory. The HUI finished up a rather anemic 0.60%...which is certainly better than the alternative. The silver stocks turned in a rather mixed performance on Tuesday...and Nick Laird's Silver Sentiment Index closed up only 0.47% (Click on image to enlarge) The CME's Daily Delivery Report showed that 13 gold, along with 2 whole silver contracts, were posted for delivery on Thursday...a real 'nothing' sort of day. By the way, the deliveries of physical metal reported in this CME report, never leave the Comex. All they do is change ownership from one member's account to another...and are probably moved from one rack to another as a result of this change in ownership. The actual physical added to, or removed from the Comex, is reported when I talk about the goings-on at the Comex-approved depositories a couple of paragraphs down. It's only there where actual physical metal is moved in and out of the exchange itself. The GLD ETF reported a minor withdrawal of 19,469 troy ounces...and there were no reported changes over at SLV. The U.S. Mint had another sales report yesterday. They sold another 1,000 ounces of gold eagles, along with 200,000 ounces of silver eagles. As I mentioned in this column yesterday, it's been a very soft month for bullion sales from the mint. Month-to-date only 19,000 ounces of gold eagles...4,000 one-ounce 24K gold buffaloes...along with 901,000 silver eagles, have been sold. However, we do have another thirteen reporting days left in the month, so I'm sure the numbers will improve, but I'll stick my neck out and state right now that it will probably one of the slowest sales months of the year. It was another action-packed day over at the Comex-approved depositories on Monday...as they reported receiving 614,152 troy ounces of silver...and shipped an impressive 1,563,718 ounces of the stuff out the door. Almost all the action was at Brink's, Inc...and the link is here. I don't have a lot of stories today, but the ones I do have are mostly about the crisis in Europe in general...and Greece in particular. It seems like gold and silver are 'consolidating' their recent gains...but nothing could be further from the truth, as the blatant interventions by the bullion banks over the last seven days is the cause of that. Is gold being suppressed? - Christopher Barker. Gold's smashing amid Swiss devaluation was dead giveaway, Embry tells King World News. Europe's banks are staring into the abyss. ¤ Critical ReadsSubscribeMerkel seeks to calm Greek 'insolvency' fearsGerman Chancellor Angela Merkel attempted to reassure nervous markets about the future of the eurozone as US President Barack Obama urged greater efforts to solve the EU debt crisis. Ms. Merkel said in an interview with Germany's RBB radio station that the top priority for policymakers was to avoid an "uncontrolled insolvency" for Greece, warning this would have serious consequences for the rest of the eurozone. She also stressed that the currency region had to remain intact, warning that if Greece were to leave the group, others would swiftly follow. Markets were unconvinced, with bourses in Germany, France, Spain, Italy and Greece falling between 1pc and 2.2pc...and the markets have already priced in the near certainty of a Greek debt default. This story from yesterday's edition of The Telegraph is Roy Stephens first offering of the day...and the link is here.  Merkel and Sarkozy to hold crisis talks with George PapandreouAngela Merkel and Nicolas Sarkozy will hold crisis talks with the Greek prime minister, George Papandreou, on Wednesday in an attempt to defuse the eurozone's escalating debt crisis. With President Barack Obama putting pressure on Europe's politicians to show the necessary leadership to prevent a Greek debt default triggering a market meltdown, the German chancellor and the French president will on Wednesday insist that Athens stick to its tough deficit-reduction programme. The US fears the worsening eurozone situation risks a return to the mayhem in the global markets seen three years ago this week when Lehman Brothers went bankrupt. This story was posted in The Guardian yesterday evening...and is Roy Stephens second offering of the day. The link is here.  Property Pinch: Greeks Vow to Rebel Against New 'Monster Tax'This is a follow-up story from one I ran on this issue in this column yesterday. The country's well-oiled protest machine has already been fired up. The influential Federation of Real Estate Owners said it would only accept the tax if no other extra contributions were levied. The trade union of state energy utility DEI, which is to collect the tax and switch off the power supply to owners who refuse to pay up, said it would block the process by refusing to issue electricity bills. The threat is credible because virtually all DEI employees are union members. You can't make this stuff up. This story, posted in over at the German website spiegel.de yesterday, is Roy Stephens third offering of the day. This short article is certainly worth the read...and the link is here.  Outside View: Greece must default, dump euroIt is doubtful Greeks are willing to let their economy sink to Third World status to perpetuate the myth of European unity. As important, the Germans like lecturing the world about the virtues of Teutonic thrift and efficiency too much, to let go of mercantilism...and to let debtor nations accomplish trade surpluses and obtain the euro needed to repay their debts. If Greece had its own currency, it would still have had to reduce government spending, increase taxes and cut wages but not by nearly as much as richer EU states and the ECB now demand because Greece could also devalue its currency against those of richer EU economies to make its exports more competitive, accelerate growth and increase debt servicing capacity. In the end, necessity will trump pan-Europeanism. The Greeks will default on their debt and, if they are smart, eventually dump the euro. This UPI story from yesterday is Roy Stephens fourth story in today's column...and the link is here.  Italian Borrowing Cost Rises at Auction as Investors Shun Indebted NationsItalian borrowing costs jumped at a 6.5 billion-euro ($8.8 billion) bond auction as contagion from Europe's debt crisis leaves investors shunning the region's most-indebted nations. Investors have dumped Italian debt as divisions among European governments over how best to fight the region's debt crisis sparked concern the contagion would spread to the bloc's third-biggest economy. Bonds have dropped even after the government passed a 54 billion-euro austerity plan that failed to ease concerns that weak growth would lead to a credit rating downgrade and hurt efforts to cut Europe's second-biggest debt. Amid "talks about a Greece default" and "a possible downgrade of the Italian debt in the next couple of months, today's auction results are not too bad," Annalisa Piazza, a fixed-income analyst at Newedge Group in London, said in an e-mailed note to investors. Not too bad??? More whistling past the graveyard. I thank reader Scott Pluschau for this Bloomberg story...and the link is here.  Europe's banks are staring into the abyssWhere now for European banks? Sir Howard Davies, former chairman of Britain's Financial Services Authority, said on BBC Radio's Today programme on Tuesday morning that he thought the French government was only days away from having to recapitalise the country's banking system for a second time. It's hard to disagree. The panic seems to have been temporarily stemmed by a statement from BNP Paribas to the effect that it wasn't having the problems widely reported of finding dollar funding. There was also an emphatic denial of discussions over state intervention. But no-one is kidding themselves. Italy had to pay the highest spread since joining the euro to sell its bonds on Tuesday. There are growing fears over whether Europe's largest borrower can stay the course. This longish piece in yesterday's edition of The Telegraph is a must read...and it's also Roy Stephens final offering of the day. The link is here.  Is gold being suppressed? - Christopher BarkerIn commentary posted yesterday at the Motley Fool, market watcher Christopher Barker notes the growing consensus that Western central banks have been intervening surreptitiously in the gold market to suppress the monetary metal's price and to support their own currencies. Barker's commentary is headlined "Is Gold Being Suppressed?"...and I thank Chris Powell for providing the introduction...and the link to this must read essay is here. Don't forget to voice your opinion in the "Motley Poll" at the bottom of the article. |

| Is gold being suppressed? - Christopher Barker Posted: 13 Sep 2011 08:53 PM PDT  In commentary posted yesterday at the Motley Fool, market watcher Christopher Barker notes the growing consensus that Western central banks have been intervening surreptitiously in the gold market to suppress the monetary metal's price and to support their own currencies. Barker's commentary is headlined "Is Gold Being Suppressed?"...and I thank Chris Powell for providing the introduction...and the link to this must read essay is here. Don't forget to voice your opinion in the "Motley Poll" at the bottom of the article. |

| Europe's banks are staring into the abyss Posted: 13 Sep 2011 08:53 PM PDT  Where now for European banks? Sir Howard Davies, former chairman of Britain's Financial Services Authority, said on BBC Radio's Today programme on Tuesday morning that he thought the French government was only days away from having to recapitalise the country's banking system for a second time. It's hard to disagree. The panic seems to have been temporarily stemmed by a statement from BNP Paribas to the effect that it wasn't having the problems widely reported of finding dollar funding. There was also an emphatic denial of discussions over state intervention. But no-one is kidding themselves. Italy had to pay the highest spread since joining the euro to sell its bonds on Tuesday. There are growing fears over whether Europe's largest borrower can stay the course. |

| Merkel and Sarkozy to hold crisis talks with George Papandreou Posted: 13 Sep 2011 08:53 PM PDT  Angela Merkel and Nicolas Sarkozy will hold crisis talks with the Greek prime minister, George Papandreou, on Wednesday in an attempt to defuse the eurozone's escalating debt crisis. With President Barack Obama putting pressure on Europe's politicians to show the necessary leadership to prevent a Greek debt default triggering a market meltdown, the German chancellor and the French president will on Wednesday insist that Athens stick to its tough deficit-reduction programme. The US fears the worsening eurozone situation risks a return to the mayhem in the global markets seen three years ago this week when Lehman Brothers went bankrupt. |

| Resort to SDRs for next bailouts will spur rush to gold, Rickards says Posted: 13 Sep 2011 08:53 PM PDT  Eric King sent me this blog yesterday...and I'm going to link the GATA dispatch, because Chris Powell's preamble to the story is rather extensive...and he provides other links as well. It's definitely a must read...and the link to the GATA release is here. |

| Gold's smashing amid Swiss devaluation was dead giveaway, Embry tells King World News Posted: 13 Sep 2011 08:53 PM PDT  The smashing of gold simultaneous to the devaluation of the Swiss franc was a dead giveaway of surreptitious intervention by Western central banks, Sprott Asset Management's John Embry told King World News yesterday. Conditions for a rising gold price, Embry adds, are more favorable than they've ever been. I thank Chris Powell once again for providing the preamble...and the link to the KWN blog, which Eric headlined "Embry - Institutional Gold Holdings will increase 12 fold," is here. |

| John Brimelow talks with James Turk Posted: 13 Sep 2011 08:00 PM PDT John Brimelow, of goldjottings.com, and James Turk, Director of the GoldMoney Foundation, talk about premiums over spot paid for physical gold around the world. They explain the importance of ... |

| Posted: 13 Sep 2011 05:52 PM PDT Governments Underreported Severity of Fukushima |

| Eric Sprott: Silver is the investment of the decade Posted: 13 Sep 2011 05:39 PM PDT |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The occasion will mark the first time the Trump Organization has accepted 99.9% pure gold bullion, rather than cash, as a deposit on a commercial lease. The tenant, precious-metals dealer Apmex, will sign a 10-year lease for 40 Wall's 50th floor at a leasing rate of about $50 a square foot, according to Apmex Chief Executive Michael R. Haynes. The company is promoting the use of gold as a replacement for cash in some situations.

The occasion will mark the first time the Trump Organization has accepted 99.9% pure gold bullion, rather than cash, as a deposit on a commercial lease. The tenant, precious-metals dealer Apmex, will sign a 10-year lease for 40 Wall's 50th floor at a leasing rate of about $50 a square foot, according to Apmex Chief Executive Michael R. Haynes. The company is promoting the use of gold as a replacement for cash in some situations. "Gold has been a valuable asset class for the last 10,000 years, but the world has drifted away from it," Mr. Haynes says. "I figured, Trump is a smart guy, and he'll realize that taking gold is a better idea than taking cash."

"Gold has been a valuable asset class for the last 10,000 years, but the world has drifted away from it," Mr. Haynes says. "I figured, Trump is a smart guy, and he'll realize that taking gold is a better idea than taking cash."

No comments:

Post a Comment