saveyourassetsfirst3 |

- Secret Silver Buying by Russian Billionaire, Chinese Traders…

- Silver Backwardation Doubles Overnight

- Sell in May? Commodities- Yes, Stocks and Bonds- No

- Not All Emerging Market Currencies Are Equal: Expect the Gap to Widen

- Parallels to the 1970s Suggest Further Dollar Weakening and Parabolic Move in Gold Ahead

- It Takes Two to Tango: The Fed and ECB in a Bad Faith Dance

- Weekly Market Movers: May 2-6

- Chapter 4: Silver Equities

- Chapter 5: Alternative Silver Investing

- All that glisters is not gold…

- The U.S. dollar on the edge of a great cliff! Within a hair of ALL-TIME LOW!

- The Case for a 100 Percent Gold Dollar

- Gotterdammerung

- David Freedom

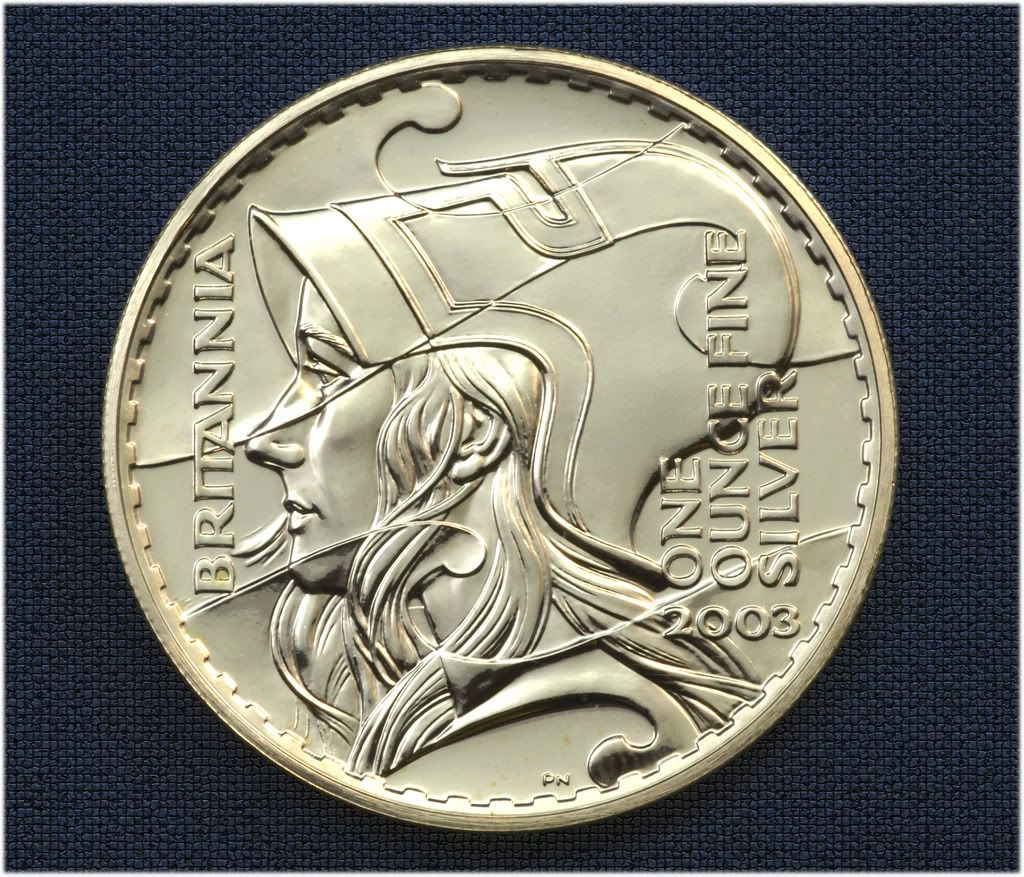

- Britannias

- David Freedom – 2011 Forecast & Update

- Blythe..Why are you covering your shorts at 5000 year highs (the "top") if silver/gold are supposed to go down now? Got Tells?

| Secret Silver Buying by Russian Billionaire, Chinese Traders… Posted: 01 May 2011 07:00 AM PDT |

| Silver Backwardation Doubles Overnight Posted: 01 May 2011 01:19 AM PDT |

| Sell in May? Commodities- Yes, Stocks and Bonds- No Posted: 01 May 2011 12:47 AM PDT The Simple Accountant submits: After the short holiday week, the final week in April was much more eventful in the U.S. markets: Lots of economic data, a press conference with Fed Chairman Bernanke following the FOMC meeting, another slide in the U.S. Dollar index, extended gains in risk assets, and more indifference in the bond market. Let's get into the numbers and then look at where we might be going in May and beyond. Complete Story » |

| Not All Emerging Market Currencies Are Equal: Expect the Gap to Widen Posted: 30 Apr 2011 11:55 PM PDT ForexBlog submits: A picture is truly worth a thousand words. [That probably means I should stop writing lengthy blog posts and instead stick to posting charts and other graphics, but that's a different story...] Take a look at the chart below (click to enlarge images), which shows a handful of emerging market ("EM") currencies, all paired against the US dollar. At this time last year, you can see that all of the pairs were basically rising and falling in tandem. One year later, the disparity between the best and worst performers is already significant. In this post, I want to offer an explanation as to why this is the case, and what we can expect going forward. In the immediate wake of the credit crisis, I think that investors were somewhat unwilling to make concentrated bets on specific market sectors and specific assets, as part of a new framework for managing risk. Complete Story » |

| Parallels to the 1970s Suggest Further Dollar Weakening and Parabolic Move in Gold Ahead Posted: 30 Apr 2011 11:50 PM PDT Financial Sense submits: Written by Chris Puplava The news last week was dominated by the Fed's historic press conference and the subsequent moves in metals and the dollar. Fed Chairman Bernanke pretty much gave a green light to USD bears and precious metal bulls in once again advancing the illusion that rising commodity prices are in no way related to our weakening currency but purely a byproduct of a strong global economy. When the world's most powerful monetary authority shows such little regard for dealing truthfully with current realities on the ground, is it any wonder the USD continues to plummet as gold and silver climb even higher? click to enlarge images Source: Bloomberg

The above famous quote goes hand in hand with another one from Mark Twain, "History doesn't repeat itself, but it does rhyme." Complete Story » |

| It Takes Two to Tango: The Fed and ECB in a Bad Faith Dance Posted: 30 Apr 2011 11:12 PM PDT Erwan Mahe submits:Ben Bernanke was not exactly straightforward with us when he claimed that the dollar's decline on forex markets ran contrary to the FOMC's policy goals, as he sought shelter behind Treasury Secretary Tim Geithner's comment that a strong dollar is in the interest of the United States. Those with a long memory may recall that in his 2000 study, Japanese Monetary Policy: A Case of Self-Induced Paralysis, Mr. Bernanke clearly advised the BOJ to depreciate its currency to pull Japan out of the deflation liquidity trap in which it had been stuck for many years. Check out this quote from Depreciation of the yen:

Complete Story » |

| Posted: 30 Apr 2011 10:36 PM PDT US employment data and Australian, British and European rate decisions are the main events this week. Here is an outlook for this week's market-movers. Will the blow that the dollar got from Ben Bernanke continue to push the dollar lower? Or will it consolidate as the market is calmer after the news? Economists believe that Federal Reserve officials will get ready to end QE2 in September's statement by selling the securities it purchased to decrease borrowing costs. However, the current, small continuation of QE2 in the form of QE2 Lite announced just now is a factor weighing heavily on the greenback.

Complete Story » |

| Posted: 30 Apr 2011 05:00 PM PDT |

| Chapter 5: Alternative Silver Investing Posted: 30 Apr 2011 05:00 PM PDT |

| All that glisters is not gold… Posted: 30 Apr 2011 04:45 PM PDT Food for thought |

| The U.S. dollar on the edge of a great cliff! Within a hair of ALL-TIME LOW! Posted: 30 Apr 2011 04:30 PM PDT Money And Markets |

| The Case for a 100 Percent Gold Dollar Posted: 30 Apr 2011 04:30 PM PDT Mises.org |

| Posted: 30 Apr 2011 04:00 PM PDT Gold University |

| Posted: 30 Apr 2011 11:50 AM PDT Contact: david@thevictoryreport.org On Zerohedge: Exclusive TVR Editorials:

|

| Posted: 30 Apr 2011 09:39 AM PDT I don't think I've posted Britannia pictures or many coin shots at all since GIM 1. Might as well, some of the new folk may not know what they look like. Got Kookaburras, Pandas, Kangaroos, Pandas, Mexican coins and a bunch of other stuff. Isn't the gold Britannia just luscious?        |

| David Freedom – 2011 Forecast & Update Posted: 30 Apr 2011 09:01 AM PDT As we near the halfway point, an update on my 2011 forecast.

Forecast: "As food and energy prices rise, nations will feel the sting of money printing(already happening). This will only increase the number of civil protests (RIOTS). Developing nations will feel the brunt of higher inflation, which will lead to various measures to control price increases (e.g., Russia's recent announcement of food controls or COMEX margin hikes)." Forecast: From a follow-up post (1/30) "QE2 appears to be an exercise in replacing the toxic assets purchased from the banks for Treasuries. Instead of returning any money back to the Treasury, they are exchanging the toxins for Treasuries. Thus, the Fed's balance sheet will remain in the $2T…" 2011: The rest of the story - During the April FOMC meeting, The Bernanke confirmed the end of QE2 after June. This was It is imperative that interest rates remain below the rate of inflation (i.e., negative real rates) to encourage currency velocity to feed the insolvency; otherwise, they are truly pushing on a string. My best guess is a 3-month experiment ending with a spike in long-dated Treasury rates and a contraction in GDP and the stock market sometime in the fall or winter of this year. To help fill the gap, global central banks will be the buyers of last resort. What they call it, or how it's communicated is still to be determined, but rest assured, there will be more currency printing. Global QE continued – some real fireworks to follow, along with some bombs. Precious Metals and Commodities – Ways to play it - If you understand why you are holding physical monetary metal, I won't need to tell you to hold through this period. Again, if you follow the 30% rule, you will not be forced to sell into weakness. If you have a trading position in paper gold and/or silver and miners play catch-up for the remainder of the 2nd quarter, you could take some profits. You may look at stocks/funds impacted by rising rates. As an example, in a period of rising rates, demand for mortgages and other loan products diminishes. If I could offer one more bit of advice, it would be to reduce debt to a manageable amount. ~David Freedom |

| Posted: 30 Apr 2011 06:53 AM PDT Crimex News: Gold: Deposits to dealer, ZERO Silver: -2166 contracts or 10.83 million oz -Deposits to dealer, ZERO -Straight from Harvey blog: "When you have tiny notices with a large open interest standing certainly is causing headaches for our bankers as they scour the planet looking for metal to satisfy our longs. No doubt Blythe will be very busy this weekend trying to encourage the option |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The common thought is to leverage up and inflate it away. Again, my philosophy is not about getting rich, it's about protection. I would consider this gambling and those that gamble must be prepared to lose.

The common thought is to leverage up and inflate it away. Again, my philosophy is not about getting rich, it's about protection. I would consider this gambling and those that gamble must be prepared to lose.

No comments:

Post a Comment