saveyourassetsfirst3 |

- A Hyperinflationary Great Depression Is Coming to America by 2014! Here's Why

- The Anti-Climactic ‘Downgrade’ of the U.S.

- Platinum may not be a best bet for the future

- Shuttling wealth through a crisis

- Where next for Gold-Silver and the SP 500 Indexes?

- Silver Shorts Feel the Burn

- New Milestone for the Gold-Silver Ratio

- Silver Spikes and Corrections

- Dollar Cycle

- Hello World! Welcome to the begining of the 4th inning in this silver trade...

- How Strong Is the U.S. Economy?

- Got Cold Feet - Swapped Silver for Gold

- The Great Gold Tsunami Lies Ahead: Richard Russell

| A Hyperinflationary Great Depression Is Coming to America by 2014! Here's Why Posted: 23 Apr 2011 05:40 AM PDT The U.S. economic and systemic-solvency crises of the last four years only have been precursors to the coming Great Collapse: a hyperinflationary great depression. Outside timing on the hyperinflation remains 2014, but there is strong risk of a currency catastrophe beginning to unfold in the months ahead...moving into a full blown hyperinflation [in a few] months to a year... depending on the developing global view of the dollar and reactions of the U.S. government and the Federal Reserve. [Let me go into more detail.] Words: 2726 |

| The Anti-Climactic ‘Downgrade’ of the U.S. Posted: 23 Apr 2011 04:32 AM PDT If we needed any confirmation of what humorless creatures bankers are, we got that today with Standard & Poor's warning of a "negative outlook" on the credit-rating of the U.S. economy. Last year around this time, I'll admit I got a good chuckle when Ben Bernanke played his April Fool's Day joke on the world, and claimed that he had "finished quantitative easing, and begun the Federal Reserve's exit strategy". It was the sort of mad-cap humor Bernanke had previously made famous with phrases like "Goldilocks economy" and "soft-landing". However, for April Fools Day this year, what do we get from Helicopter Ben but the exact, same joke. Even worse, it's been repeated ad nauseum by various other Fed-heads virtually every time one of them comes near a microphone. Only Fed-head Lockhart appears not to have gotten the memo on the "joke", as he was busy talking about business-as-usual – i.e. quantitative easing to infinity. Now here we are, a full two weeks past April Fools Day, and Standard & Poor's belatedly decides to try its hand at humor. Guys, your timing is terrible! And it can't even be redeemed by the punch-line you threw in, that "it may take until after the 2012 elections to get a proposal that addresses the concern." In medical terms, this would be like a doctor quipping that he had "concern" for the health of one of his patients – at the patient's wake. The U.S. is hopelessly insolvent. The only "issue" is how long its creditors allow it to continue with the Ponzi-scheme financing necessary to feign solvency. To some extent, we understand why the "game" has been allowed to continue, when we hear about the Federal Reserve's "secret payments" to foreign entities all around the world. In agreeing to funnel trillions in Bernanke-bills, as partial restitution to some of Wall Street's foreign fraud-victims, the Fed was able to "buy some time" for the U.S. government. However there is absolutely no doubt about the final outcome here. But don't take the word of a Canadian for this (nor the various Chinese "academics" who have been suggesting the same thing, with ever more regularity). Just ask Boston University Professor Laurence Kotlikoff. Kotlikoff has calculated the United State's total debts and liabilities at roughly $200 trillion. Note that I said this was a "calculation" – not an opinion. The only "issue" one can take with Kotlikoff's numbers concern the time-frame which he used in assessing liabilities. It is absurd to suggest that a (relatively puny) $14 trillion economy can even continue to service this "Mount Everest" of debt for more than a few years – before total collapse would occur. |

| Platinum may not be a best bet for the future Posted: 23 Apr 2011 04:15 AM PDT If this cheap replacement for platinum catalysts works for most applications, the price of platinum could drop substantially. Quote: Discovery Could Make Fuel Cells Much Cheaper One of the biggest issues with hydrogen fuel cells, aside from the lack of fueling infrastructure, is the high cost of the technology. Fuel cells use a lot of platinum, which is frightfully expensive and one reason we'll pay $50,000 or so for the hydrogen cars automakers say we'll see in 2015. That might soon change. Researchers at Los Alamos National Laboratory have developed a platinum-free catalyst in the cathode of a hydrogen fuel cell that uses carbon, iron and cobalt. That could make the catalysts "two to three orders of magnitude cheaper," the lab says, thereby significantly reducing the cost of fuel cells. Although the discovery means we could see hydrogen fuel cells in a wide variety of applications, it could have the biggest implications for automobiles. Despite the auto industry's focus on hybrids, plug-in hybrids and battery-electric vehicles — driven in part by the Obama administration's love of cars with cords — several automakers remain convinced hydrogen fuel cells are the best alternative to internal combustion. Hydrogen offers the benefits of battery-electric vehicles — namely zero tailpipe emissions — without the drawbacks of short range and long recharge times. Hydrogen fuel cell vehicles are electric vehicles; they use a fuel cell instead of a battery to provide juice. You can fill a car with hydrogen in minutes, it'll go about 250 miles or so and the technology is easily adapted to everything from forklifts to automobiles to buses. Toyota, Mercedes-Benz and Honda are among the automakers promising to deliver hydrogen fuel cell vehicles in 2015. Toyota has said it has cut the cost of fuel cell vehicles more than 90 percent by using less platinum — which currently goes for around $1,800 an ounce — and other expensive materials. It plans to sell its first hydrogen vehicle for around $50,000, a figure Daimler has cited as a viable price for the Mercedes-Benz F-Cell (pictured above in Australia). Fifty grand is a lot of money, especially something like the F-Cell — which is based on the B-Class compact — or the Honda FCX Clarity. In a paper published Friday in Science, Los Alamos researchers Gang Wu, Christina Johnston and Piotr Zelenay, joined by Karren More of Oak Ridge National Laboratory, outline their platinum-free cathode catalyst. The catalysts use carbon, iron and cobalt. The researchers say the fuel cell provided high power with reasonable efficiency and promising durability. It provided currents comparable to conventional fuel cells, and showed favorable durability when cycled on and off — a condition that quickly damages inferior catalysts. The researchers say the carbon-iron-cobalt catalyst completed the conversion of hydrogen and oxygen into water, rather than producing large amounts of hydrogen peroxide. They claim the catalyst created minimal amounts of hydrogen peroxide — a substance that cuts power output and can damage the fuel cell — even when compared to the best platinum-based fuel cells. In fact, the fuel cell works so well the researchers have filed a patent for it. The researchers did not directly quantify the cost savings their cathode catalyst offers, which would be difficult because platinum surely would become more expensive if fuel cells became more prevalent. But the lab notes that iron and cobalt are cheap and abundant, and so the cost of fuel cell catalysts is "definitely two to three orders of magnitude cheaper." "The encouraging point is that we have found a catalyst with a good durability and life cycle relative to platinum-based catalysts," Zelenay said in a statement. "For all intents and purposes, this is a zero-cost catalyst in comparison to platinum, so it directly addresses one of the main barriers to hydrogen fuel cells." |

| Shuttling wealth through a crisis Posted: 23 Apr 2011 12:55 AM PDT Quote from FOFOA's latest post: That's right, gold is not at its highest and best use being spent (circulated) as a currency during a hunger crisis. Instead, if you are one with PLENTY of net worth, gold is the very best way to shuttle your wealth THROUGH a crisis to the other side. If you are forced to deploy this wealth for food during a crisis, then you apparently planned poorly. Couldn't agree more - gold is not meant to be used during a crisis, but after. |

| Where next for Gold-Silver and the SP 500 Indexes? Posted: 22 Apr 2011 05:29 PM PDT Market Trend Forecast |

| Posted: 22 Apr 2011 05:25 PM PDT |

| New Milestone for the Gold-Silver Ratio Posted: 22 Apr 2011 03:29 PM PDT SOUTHEAST TEXAS -- As we prepare to return to our Houston-area HQ, we couldn't help but notice that the gold/silver ratio (GSR) marked a new milestone as of the close on Thursday. The graph below shows the lowest weekly-close gold/silver ratio since 1980, as the important ratio closed just slightly below the lowest weekly close level marked in 1983. Details are on the graph. ... |

| Posted: 22 Apr 2011 01:58 PM PDT

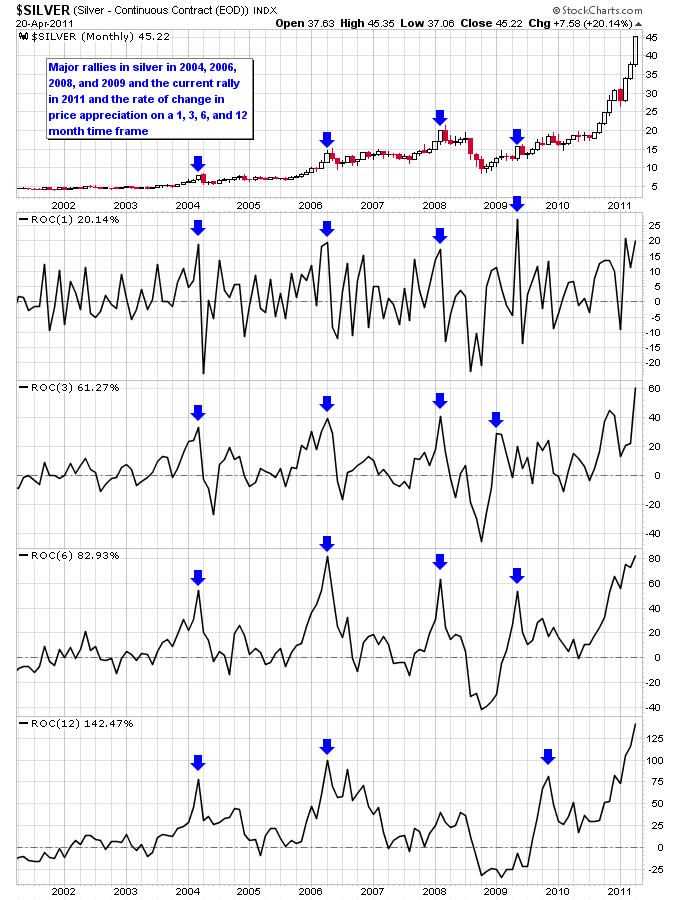

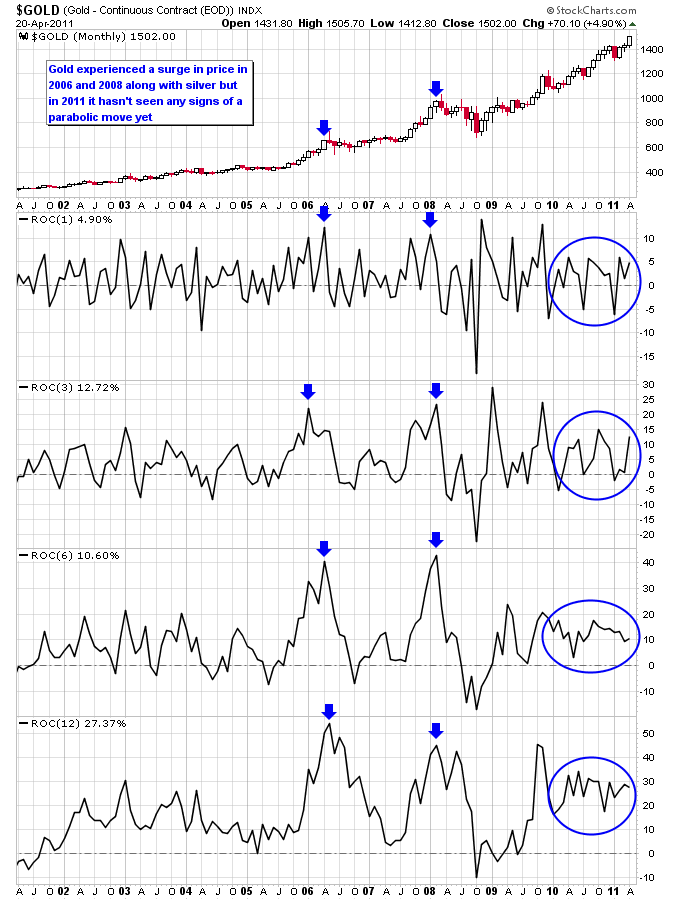

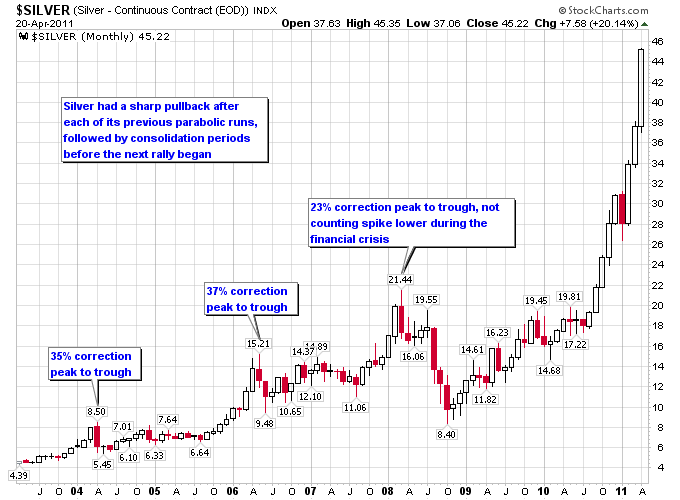

Silver continues its powerful and relentless move higher. From August 2010 until now this is the biggest rally during this silver bull market that started early last decade. Silver has also been the star performer of the financial world over the past year as you can see on the graph below. How does this current silver spike compare to the past? The next chart shows the major moves higher in silver during this bull market in 2004, 2006, 2008, 2009, and the current rally. Also shown is the rate of change in price appreciation on a 1-month, 3-month, 6-month, and 12-month time frame. Interestingly, the 1-month rate of change shows that at the end of each rally, silver had it's biggest monthly gain of the entire move. Right now silver is close to putting in its biggest monthly gain of this rally and has a week yet to go in April. Silver would have to gain more than 25% during this month though to eclipse it's biggest month to date which occurred in 2009. On a 3-month and 12-month time frame this is clearly the biggest gain of this silver bull to date, but on a 6-month time frame it is still in the same ballpark as the silver rally in 2006. I noted in a recent article that we've still yet to see a big increase in speculation in the gold market along with silver. The next chart shows gold with the same rate of change indicators and you can see that in 2006 and 2008 gold started to go parabolic at the same time as silver. This time around though gold has been extremely tame given the huge increase in activity in the silver market. The last speculative period in gold actually occurred at the end of 2009. When will this parabolic move in silver end? I've still yet seen a technique that is good at timing the end of an extreme move in a market, including oscillators and overbought indicators. In 2008 many people tried to call the bottom early only to see the market swoon to levels most people didn't believe was possible. Currently the opposite is happening in silver, where it is blowing through the overbought indicators that previously worked to call major tops in silver. In bull markets the surprises come to the upside, and that's really what is happening right now. What is more certain is what will likely happen after this silver spike ends, which is a correction in silver followed by a consolidation period. The correction will get rid of excessively bullish sentiment in silver, and the consolidation will move investors' focus to other markets, which will prepare silver for its next bull move. The next chart shows the peak to trough corrections in silver following the rallies in 2004, 2006, and 2008. Notice how the corrections were over after a couple months, and then the consolidation period began. The only deviation from the pattern was in 2008 when the financial crisis pushed silver to an extreme low, and also expanded silver's consolidation period which provided the foundation for this current explosive silver rally. |

| Posted: 22 Apr 2011 01:53 PM PDT

For many months now I've been warning we were going to have a dollar crisis and that dollar crisis would drive the final leg up in gold's ongoing two year C-wave advance. We are now on the verge of the panic selling stage of this three year cycle. On Monday the dollar briefly rallied on the S&P downgrade of US debt (who knew?). That had the potential to mark the bottom of the current dollar cycle. But by this morning the dollar has given back all of those gains and then some. I've noted in the premium report that the dollar's daily cycle often turns on the employment report at the beginning of each month. The previous cycle bottomed one day after the March report and the current daily cycle topped on the April report. If this pattern continues then we can probably expect the current dollar cycle to stretch for another 2 1/2 weeks into the May report (give or take a day or two either way). I seriously doubt gold is going to suffer any meaningful correction as long as the dollar is in free fall, so I expect we are going to see the gold cycle stretch also. If the dollar does continue lower into the May employment report before putting in the cycle low it would then be set up for a more normal duration decline into the final three year cycle low due on or around the June report. Details in last night's subscriber report.

|

| Hello World! Welcome to the begining of the 4th inning in this silver trade... Posted: 22 Apr 2011 10:36 AM PDT I had such a dandy day. Busy as fuck, but dandy. Dandy b/c I got to send out my favorite text messages to those who still think I'm: a. a fuckin idiot b. mental c. dont know what I'm talking about d. full of shit The texts read something like this: "Hey fuckos, remember when I told you to buy silver at $15, well today it hit $48. Godspeed" Responses: 1. Seriously? Should I wait to |

| How Strong Is the U.S. Economy? Posted: 22 Apr 2011 09:55 AM PDT David Goldman submits: I rarely disagree with my old friend Larry Kudlow, but on last night's show we differed about the strength of the US economy. I claimed (per yesterday's posts) that the main pillars of stock market strength were foreign growth and a weak dollar; Larry sees a possible turning point in the Main Street economy. The one element of the market picture that surprises me is how stable the 10-year yield has been of late. The Fed has been buying a lot of securities recently — maybe that's the explanation. Another possibility is that real rates are actually declining (click to enlarge): I don't take the 10-year inflation indexed yield as a good proxy for real rates, but it's still Complete Story » |

| Got Cold Feet - Swapped Silver for Gold Posted: 22 Apr 2011 09:06 AM PDT Don't have the stomach for another cliff dive like '08. Not sure if it was the right move. Still holding some, but decided to place my bet on gold and take my chances. |

| The Great Gold Tsunami Lies Ahead: Richard Russell Posted: 21 Apr 2011 08:51 PM PDT  Here's another offering from Eric King over at King World News. It's a Richard Russell blog of some importance. Richard states the following..."The panic to buy gold will override everything else. It will be one of the greatest financial phenomena that most of today's investors will ever see. It will blot out everything else like a cloud blotting out the sun. I would also add silver to that 'financial phenomena'...and the link to this must read blog is here. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment