saveyourassetsfirst3 |

- Breaking Down the Economic Issues Raised by Japan's Continuing Struggles

- Volatility in global markets jumps – What does this mean?

- Silver in SPX Selloffs

- High Yield Tobacco Stocks

- My lucky day

- 7 Nuclear Stocks That Could Suffer From Japan Fallout

- END GAME

- Japanese Meltdown Will Inhibit U.S. Recovery

- Monetary Policy and the Risk of Inflation

- Gold vs. Guns and Badges

- Silver Technicals

- Louis James: Crisis Creates Opportunity with Junior Miners

- The Janus-Face Of Marketability

- Paper Tiger Preying on Gold Bugs – The IMF and its phantom Gold Sales

- Welcoming a Gold Correction

- Time to Trade Stocks and Silver for Gold?

- Gold Price Holding up Extremely Well—the Bandwagon Has Further to Go

- Bill Bonner on the Failing US Bond Market, the Coming Hyperinflation and the End of the Dollar Reserve System

- This past week in gold

- Making Money on Miners, Part I

| Breaking Down the Economic Issues Raised by Japan's Continuing Struggles Posted: 20 Mar 2011 03:31 AM PDT Edward Hugh submits: As Japanese officials continue to toil away in what we all hope will be a successful bid to avert a worst case scenario nuclear meltdown, even while thousands of Japanese still remain missing and unaccounted for, financial market participants across the globe have been struggling with themselves to answer one and the same question: Just how serious are the economic consequences of all this devastation likely to be? Basically, the economic issues raised by Japan's continuing agony can be broken down into a number of categories, and we need to think both of global and local impacts, as well as the short term, mid term and long term implications of these. Short-term Pain, Mid-term Gain? The short-term local consequences are evidently likely to be quite severe. Given that large parts of the country have been (and continue to be) without electricity, that factories have been flooded and part of the Complete Story » |

| Volatility in global markets jumps – What does this mean? Posted: 20 Mar 2011 02:49 AM PDT Gold Forecaster |

| Posted: 20 Mar 2011 02:39 AM PDT Zealllc |

| Posted: 20 Mar 2011 02:33 AM PDT Stockerblog submits: On Friday, after tobacco companies were anxiously awaiting a report from the Food and Drug Administration, it was reported that the FDA would not ban menthol cigarettes. The news caused several of the cigarette stocks to rise. Lorillard, Inc. (LO) rose by over 10% for the day. Some investors have strong feelings against investing in cigarette stocks, but if you don't, you should consider them for their extremely high yields. Lorillard has a payout of 6.6%. The stock, which markets the Newport, Kent, True, Maverick, Old Gold, and Max brands, trades at 11.6 times forward earnings. According to WallStreetNewsNetwork.com, there are over half a dozen tobacco stocks with yields in excess of 4%. Another example is Vector Group Ltd. (VGR), a Florida based tobacco company that has many brands of cigarettes including Liggett, Grand Prix, Eve, Pyramid, USA and nicotine-free Quest. The stock has a price to earnings ratio of Complete Story » |

| Posted: 20 Mar 2011 02:13 AM PDT I do a farmer's market on Saturdays. Yesterday a customer was counting out change to give to me and I spotted a silver dime in his hand from about six feet away. I don't know how I knew it was silver but I knew somehow. I could barely contain my excitement until he paid for his purchase and walked away. Yep, it was a 1940 silver dime! Pretty worn but I don't care - I like it anyway. As a bonus, he also left a 1935 wheat penny. :banana: |

| 7 Nuclear Stocks That Could Suffer From Japan Fallout Posted: 20 Mar 2011 01:36 AM PDT Investment Underground submits: by Scott A. Mathews The meltdown in Japan is potentially a global gamechanger for the nuclear industry that was thought to be entering a renaissance. Nothing signaled the gamechanger effect more than German Chancellor Merkel's move to suspend the entire German nuclear policy. The problems are principally from the storage containers of spent nuclear rods which are stored on-site at the nuclear facilities in order to save on security and consolidate the location of the waste. This shortsighted cost concern is likely to cost the entire industry, as well as raising the very valid question of how viable nuclear energy is since storage solutions have never been developed that truly eliminate risk or mitigate the accumulation of the extremely toxic waste. The U.S., which shares the same short-sighted Japanese storage techniques, will likely see this fact highlighted by policymakers in the U.S. All things considered, nuclear companies or major conglomerates Complete Story » |

| Posted: 20 Mar 2011 01:02 AM PDT For months and months I've been warning investors that the dollar was going to come under extreme pressure sometime this year. I expected it to probably happen in the spring. Many people thought I was nuts. They were sure it was the Euro that would collapse, despite the fact that the EU is doing everything they can to protect their currency while Bernanke is doing everything he can to destroy ours. On Friday the last confirmation occurred to signal the final collapse is now underway. On Friday the November yearly cycle low was violated. Cyclically that is a major catastrophe . We are now going to see the dollar get absolutely hammered for the next couple of months. The viability of the dollar as a currency will be questioned. There is a decent chance it may start to lose it's status as the world's reserve currency. (Coincidentally about the time everyone becomes convinced the dollar is going to hyperinflate that will be the point where the three year cycle low will bottom and we will see an explosive rally, along the same lines as what happened in late `08.) This is what all the top pickers in gold and silver fail to understand. They are all trying to call a top based on charts without any understanding of what is happening to the currency. In a currency collapse the market will flee into assets that will retain their purchasing power. Four weeks ago we went past the point of the stock market being able to protect one from Ben's printing press any longer. So buying stocks as protection is no longer a viable solution. Four weeks ago spiking inflation rose to the point where profit margins are now being hit. Ben will no longer be able to prop up the stock market by further debasing of the currency. Stocks have now decoupled from their inverse correlation with the dollar and will now follow the dollar down. The more Ben prints and the faster the dollar collapses, the faster the stock market is going to fall...and the quicker the economy is going to roll over into the next recession. What will happen is that liquidity will rush into the commodity markets as the only true protection against the accelerating currency crisis. This is why one has to ignore the top pickers and chartists. Overbought oscillators and stretched conditions are meaningless in a currency collapse. This is all about fundamentals. It's about protecting your purchasing power. You can't do that by exiting the one sector fundamentally best suited to protect you during this storm. Now isn't the time to be selling your gold, silver or mining stocks, its time to be buying more. For the next couple of days I am going to run a special on the 6 month subscription. 20% off the normal price. 6 months should be long enough to get investors through the currency crisis. Allow you to ride the final parabolic spike in gold and silver (C-wave finale). Avoid the inevitable crash (D-wave correction) that always follows a parabolic move. And then get long again at the bottom in preparation for the next major wave up in gold. Click here to access the premium website, then scroll down and click on the subscribe link. Enter 6monthspecial in the promotional code box and click continue. You will be linked to a page with the special offer. This posting includes an audio/video/photo media file: Download Now |

| Japanese Meltdown Will Inhibit U.S. Recovery Posted: 20 Mar 2011 12:58 AM PDT Steven Hansen submits: Modern economic theory implies spending for any reason is good. The rebuilding following a disaster would logically be a plus economically. Destruction triggers rebuilding - an economically positive event. Immediately following an economic disaster, there is dislocation. Modern supply chains are disrupted. Transport is problematic. Like a tsunami, the inter-linkage of modern supply chains ripple through all products. Japan is an exporting nation. There are products made only in Japan, or disruption of production of a product where Japan is a significant producer, or the need for Japan to import a product normally not traded internationally. In other words, a ripple will go through availability and prices - both positive and negative. The global supply chains will adapt and improvise. What will go on inside Japan will be different. Japan will have lost forever six nuclear power plants units. A loss of six nukes leaves a huge hole in a Complete Story » |

| Monetary Policy and the Risk of Inflation Posted: 20 Mar 2011 12:48 AM PDT Calafia Beach Pundit submits: The point of this chart is to put into proper perspective the Fed's efforts to inject dollar liquidity into the global economy. It uses a semi-log scale because the change in the amount of bank reserves has been extremely large in the past two years or so. The first stage of Quantitative Easing saw bank reserves soar from about $100 billion to almost $1.3 trillion, and the Fed accomplished this by purchasing MBS and Treasury securities by the bushel, in addition to extending credit to the financial system through swaps, repos and special loans. As the latter injections began unwind, bank reserves shrunk from a high of $1.28 billion in Feb. '10, to $1.07 trillion in Oct. '10. Concerned that they might inadvertently be allowing a tightening of monetary policy at a time when deflation concerns were (allegedly) meaningful and the economy was (allegedly) still struggling, the Fed launched QE2 Complete Story » |

| Posted: 19 Mar 2011 11:54 PM PDT Gold vs. Guns and Badges Mar 18th, 2011 | By Gary North Do you trust men with guns and badges to provide long-term economic growth? Or do you trust the free market? When push comes to shove — recession — most people trust guns and badges far more than they trust the free market. Do you trust the Federal Reserve System to maintain prosperity? Or would you prefer to trust gold coins held by millions of Americans? Most Americans and virtually all professors of economics trust the Federal Reserve System. That was not true in 1913, the year Congress voted (just before the Christmas recess) to create the Federal Reserve System. There is a way to avoid recessions, argued Ludwig von Mises in 1912: (1) the gold coin standard and (2) no government licensing of fractional reserve banks. We never did have both. No nation did in modern times. Ever since World War I broke out in August 1914, we lost the gold coin standard in Europe. We lost it in the United States in 1933, when Roosevelt stole the nation's gold coins by fiat decree. In short, the entire world has rejected Mises' argument. Gold-Hating Special Interest Groups There are four main groups of critics of the gold coin standard: the greenbackers, the politicians, the academics, and the investment elite. The "greenbackers" began their propaganda early, in the 1870s. They defend fiat money that is controlled by Congress. These self-taught promoters of government fiat money are monetary statists. They include lawyer Ellen Brown and Bill Still, producer of "The Money Masters" video. They have no influence in Congress or academia, because they oppose fractional reserve banking. But their system relies on people with guns and badges to support legal tender laws. In Brown's case, she has now come out in favor of Bernanke's QE2 policies. She is Bernanke's major cheerleader on the Right. What is their motive? They want big government. They come to the far Right and the far Left with the same argument: private fractional reserve banking is bad, because it makes big banks rich. They come with the same solution: "Trust Congress." Trust it to do what? To spend fiat money to create a vast welfare state. They are all Leftists, but they recruit on the Right by an appeal to the sin of envy: "Let's bust the bankers by law!" They are statists. They parade as conservatives when they pitch the Right. Just like the greenbackers, the politicians want cheap money, so that they can spend more than they take in by direct taxation, which is always unpopular. The central bank guarantees to buy government debt at low rates. This lets politicians borrow more money on behalf of taxpayers than would otherwise have been the case, since high rates make it more costly to go into debt. This is why politicians have universally created central banks with a monopoly of control over money. Then there are the vast majority of academics all over the world. They are apologists for the prevailing system. They are paid to support it. They take the king's shilling, and they do the king's bidding. Some of these academics are paid directly by the state as faculty members in tax-funded, state-licensed, accredited universities. Others are paid indirectly as faculty members in private universities that are protected from competition by means of accreditation systems that are backed up by laws against unaccredited institutions that use the word "university." Every accredited university is part of a cartel. This is why universities are not price competitive. This is why they can afford to grant tenure — a practice unknown in the private sector. There is an army of academic critics of Mises' argument that the free market should be trusted to provide economic planning, and that people backed up by other people carrying guns and badges should not be trusted. In this army are thousands of state-trained and state-accredited economists, who assert that they believe in the free market. When push comes to shove, they don't. In the entire academic profession, all over the world, there is not a single textbook in economics that says that central banking is conceptually and operationally a cartel-enforcement institution for privately owned large banks: an anti-free market institution. There never has been such a textbook. Every economics textbook separates the chapter on cartels from the chapter on central banks. Neither chapter refers the reader to the other chapter. This is not random. This is a crucial part of the arrangement between the national government and the bankers' cartel in every nation. The academic cartel joins with the bankers' cartel to screen out any suggestion in a textbook that either of these state-licensed cartels is in fact a cartel. "You scratch my back, and I'll scratch yours. You promote the right of my agents to carry guns and badges, and I'll promote yours." Finally, there is the investment elite. They want a safety net for bad investments they have recommended. They also want leverage: debt-funded, high-return speculation. They want to be on the winning side of "moral hazard." This is what central banking gives them. Members of these four special-interest groups hate the gold coin standard. They hate it for the same reason: it transfers economic authority from the cartels to private citizens. In short, it offers no guns or badges to the government. Friedman on the Fed Consider academia. The archetype of the seemingly pro-free market professors was Milton Friedman. In a recent report, "Milton Friedman's Contraption," I went into detail about Friedman's faith in central banking. His faith was misplaced. He trusted the banking cartel as a concept. He did not reject it as the creation of the United States government. He did not reject it as a cartel. On the contrary, he promoted it avidly and famously. He recommended that the Federal Reserve System's Federal Open Market Committee (FOMC) stop planning. He recommended a 3% to 5% per annum increase in fiat money. If the FOMC would just follow his advice, he assured us, there would be stable economic growth and stable prices. Friedman was terminally naïve. To promote any system of central planning ignores the obvious: this is too much power to entrust to anyone. The bureaucrats always do the wrong thing. What is the wrong thing? This: to prohibit the free market from providing the solution to the problem at hand. The central planners hold power specifically to thwart the free market. This is why the state gives them guns and badges. Friedman was viscerally committed to Federal Reserve Notes, as Mark Skousen and I learned at a dinner meeting with him back in the late 1990s. I don't want to spoil your fun. Read about it halfway through this article. It's about a $20 gold piece vs. a $20 Federal Reserve Note. I did not know what was coming. I was an innocent bystander, not an unindicted co-conspirator. There are only two conceptual options in monetary theory: a full gold coin standard in which the citizens hold the golden hammers or a system of economic planning in which elite members of the planning bureaucracy hold the digital hammers. There is no third choice. A mixture always leads to inflation, recession, and centralization. Professional gold-haters reject gold because they do not want the public to hold the hammers. They hate decentralized economic authority. They want people like themselves to have the final say. The planners will always adopt a policy different from the correct one. What is the correct one? To revoke the legal authority of the nation's central bank and let the free market replace it. As Ludwig von Mises said, when asked what the government should do to overcome a recession: "Nothing. Earlier." Friedman spent his entire career advising economists and even the U.S. Treasury (in 1943) on how to plan more efficiently. They followed his advice only when this meant taxing more efficiently and regulating more efficiently. He never caught on to how they were using him. Is this too harsh? Not at all. In 1942, when 20-year Rockefeller agent, Beardsley Ruml, who was then president of the New York Federal Reserve Bank, proposed Federal withholding taxes, Friedman went to work devising reasons. He was in the Treasury Department. Did the government accept these arguments? Yes. Did Ruml ever ask Friedman's advice on Federal Reserve policy? No. In 1963, Friedman offered his now-famous critique of the FED's policies, 1930—33. He said the FED did not inflate enough. Did academia accept this argument? Of course. Did Bernanke accept it? Yes. Friedman and Schwartz's insight was that, if monetary contraction was in fact the source of economic depression, then countries tightly constrained by the gold standard to follow the United States into deflation should have suffered relatively more severe economic downturns. Although not conducting a formal statistical analysis, Friedman and Schwartz gave a number of salient examples to show that the more tightly constrained a country was by the gold standard (and, by default, the more closely bound to follow U.S. monetary policies), the more severe were both its monetary contraction and its declines in prices and output. He got Friedman's main message: "gold . . . bad." Did Bernanke ever follow Friedman's advice on 2% to 5% money growth? Yes: in 2006–7. Did this create a recession? Yes, just as Austrian economists publicly began saying in 2006, based on the Austrian theory of the business cycle. Did he then abandon Friedman's slow growth rule and adopt Friedman's economic crisis policy: a doubling of the monetary base? Yes. On educational vouchers — his program for the more efficient use of confiscated property tax revenue — the Establishment never bothered to get around to implementing it. The teachers' union opposes it. "Nice idea in theory, Milton," academia said, "but it's just too Utopian. We'll get back to you on that." They will, too: whenever private schools constitute a major threat to the teachers' union, and the government decides to take over the private schools by providing "free" money, along with the regulations that always accompany free money from the government. Conclusion: the ruling elite always trotted out Friedman when it was convenient, but it ignored him when it wasn't. In short, it acted in its own self-interest. He was there to help where it counted most: taxation policy and a defense of the legitimacy of central banking and 100% fiat money. Friedman and all economists other than Austrian School economists hate the idea of a gold coin standard. A lot of them carry this hatred into the financial markets. They hate gold as an investment, not just as a monetary policy. They hate it at all times. They tell people not to buy it when it is cheap. They tell them this after it has doubled, then tripled, then quadrupled. Why? Because to buy gold is to vote against the Keynesian-planned economy. It is to vote against the Keynesian-dominated central bank. It is a vote against the high-tax, debt-funded government bureaucrats who think they are wiser than the decentralized planning of private citizens in a free market. They hate it because they are part of the self-appointed, self-regulated elite. They want to feather their nests by sending out people with guns and badges to extract wealth from the general public. Those who own gold are able to evade some of the effects of laws enforced by people with guns and badges. This enrages the elite. It has enraged them in the United States ever since 1791. From Alexander Hamilton to James Madison to Daniel Webster to Henry Clay to Abraham Lincoln to Teddy Roosevelt to Woodrow Wilson to Herbert Hoover to Franklin Roosevelt to today, the gold coin standard has enraged them. They want the citizenry to submit to fiat money, guns, and badges. They want the citizenry to submit to their plans. They are monetary statists because they are statists. They want fiat money because they want guns and badges. "But Gold Will Fall!" After the central banks stop inflating, gold will indeed fall. So will everything else except currency, including Treasury bonds. Will this be before the central banks produce hyperinflation? I hope so. If not, gold will fall on the far side of a currency collapse, where the value of a dollar fell to zero value. Gold will never fall to zero value. The dollar could. "But gold will fall," the experts tell us. Fall from what? "Today's unsustainable price." Did you recommend buying gold before the price got unsustainable. "No." Why not? "Because gold's price is always unsustainable." It was unsustainable at $257 back in 2001. "No, I mean it is unsustainable this high." How high? "Whatever it is today." So, gold will fall from where it is today. "Yes," So, you have shorted gold on the futures market. "No." Why not? "Because gold might go up." Why? "Because gold may be sustainable for a while." How long until it falls? "One of these days." Here is their rule: "Buy low, sell high, except when it's gold. Never buy gold." Here is the meaning of this rule: "Believe in the power of the central bank to provide wealth, in good times and better times." What about bad times? "There will be no bad times, as long as central banks have the power to create money." But unemployed workers are having bad times. "They don't count." Why not? "Because they don't work on Wall Street or in Washington." Underwater home owners are having bad times. "Only briefly. Home prices are unsustainable." You mean they will fall further. "No, I mean they are unsustainable this low." Why? "Because the Federal Reserve System is pumping in money." So, should I buy gold? "No." Why not? "Because gold's price is unsustainable." You mean it will fall. "Yes." But housing prices will not fall. "Correct." But they have been falling this year. "This is a temporary correction." Like the price of gold whenever it falls? "No. When the price of gold falls, it is a return to normal pricing." So, when the price of gold rises, this is a temporary correction. "Correct." It has been rising for over nine years. "It's a temporary correction." How long is temporary? "However long it takes for gold to fall." Would you favor a policy of the government selling its gold? "No." Why not? "Because that would require a full audit of the Federal Reserve System." Why shouldn't there be an audit of the Federal Reserve System? "Because we must maintain the independence of the Federal Reserve System." Just as we do with respect to . . . to. . . . what other government agency? "The CIA." You think the CIA should be independent. "I think the CIA has guns and badges and bombs and poisons, so I don't mess with the CIA. The CIA gets what it wants." But so does the Federal Reserve. "This is a good thing." Why? "Because the Federal Reserve is the source of wealth." So, digits are wealth. "Yes." Gold is wealth. "You can't eat gold." You can't eat digits, either. "You can get people to accept digits in exchange for wealth." How? "With badges and guns." Like the CIA. "Now that you mention it, yes." Conclusion There is an intellectual battle between the vast majority of experts and a handful of Austrian School economists. The battle is over which system to trust: one in which individuals buy and sell with their money of choice or with money issued by state-licensed banks that are under the control of the national government. It is a debate over free market decentralized planning based on private ownership vs. central planning based on government coercion. It is a debate over gold money or government digital money. The next time you hear some expert spouting off on the evils or foolishness of gold, mentally imagine a bureaucrat with two uniformed goons with badges and pistols standing at your front door. The bureaucrat says, "I'm from the government, and I'm here to help you." Regards, Gary North |

| Posted: 19 Mar 2011 06:00 PM PDT Zealllc |

| Louis James: Crisis Creates Opportunity with Junior Miners Posted: 19 Mar 2011 05:41 PM PDT Source: George Mack of The Gold Report 03/18/2011 The Gold Report: You are a fundamental investor and as such you don't look at macroeconomic trends quite so closely. As you say in one of your reports, you "kick the rocks." But, are you still bullish on gold? Louis James: I don't think those two are necessarily antipodes, nor is there any tension at all between keeping an eye on the big picture while looking for value in a specific opportunity. The one is the context for the other. I look at the overall picture, and the basic idea is to find a trend that's going to be your friend and place your bets accordingly. But, of course, you want your bets to be the best possible ones. A rising tide may lift all ships, but you don't want to bet on a leaky one. So, yes, I go out and kick the rocks to try to pick the best ones. To answer the question—yes, I am very bullish on gold. Gold is in the midst of a $25/oz. retreat as we speak, and I love days like that. That actually helps us to buy gold or gold stocks from weaker hands that are shaken by such moments. The reasons for the bull market in gold haven't gone away; in fact, they've only gotten worse—or better, depending on your perspective. We were amongst the few contrarians that were calling for a financial crisis leading to a currency crisis, before the crash of 2008. Anybody can look back at our publications to verify that, and the reasons for those predictions are still in full force. If anything, they've been made worse by quantitative easing (QE), Bernanke's non-printing printing of money (he has claimed both that the Fed is and is not printing money) and all the other things governments are doing that are, as our founder Doug Casey likes to say, not only the wrong things but the exact opposite of the right things to do. And what's bad for fiat currencies is good for gold, so, yes, we're very, very bullish on gold. That said, one we should never forget that we'll be taking one step back for every two steps forward. TGR: You believe there are fundamentals in global economies that are acting as catalysts for inflation? LJ: That is correct. And, not just inflation but, political. . . TGR: Catastrophe? LJ: Trouble. Look at the protest in Wisconsin from the government trying to balance the budget there. Unlike the federal government, state governments can't print money. So, at some point, they have to cut somewhere or they won't have anything to pay the bills. The huge response in Wisconsin is quite interesting—part of a bigger trend that is much, much deeper than trouble in the Middle East. There's a lot of trouble on many different fronts. We don't think it's a coincidence that you see political unrest at times of economic difficulties. Look at the price of food and cotton and other commodities. These are things that have immediate and direct impact on the lives of the masses—the transmission belt between economic trouble and political trouble—and eventually social upheaval. TGR: Were you implying that the Wisconsin protests are similar to the anti-austerity protests and rallies that we saw in Europe, particularly in Greece and Spain? LJ: I'm saying just that. Belt tightening is never popular, and it's just getting started. Americans are still relatively comfortable compared to people in other places. You framed your question about Europe in the past tense. That's just the warm up. The musicians tuned their instruments, and we heard the overture. All the ingredients for significant social turmoil are there, as the concert goes into full swing. The implications are quite significant and they're global. TGR: You have written about black swans. LJ: Yes. A black swan is any unexpected event that upsets your projections. Many people were expecting Arab-Israeli tensions to increase, but weren't expecting the collapse of Arab despotisms. I can't say that we saw that specific thing coming either, but I can say that we have stated in print that such despotisms eventually have to go the way of the dodo bird. Actually, it wasn't so long ago that Doug Casey did a report on Egypt wherein he said it was basically a caldron that was waiting to bubble over. But those are just examples of certain kinds of black swan—anything can come and upset the apple cart. If, for example, some U.S. state is suddenly unable to pay its bills and the lights go off, a lot of people will call that a black swan—though it should be no great surprise. Or it could be China, India or Japan. It could be the Koreas shooting at each other. I just think the climate is right; it's a black swan-friendly environment. TGR: Given that you're a bit cautious currently, you were recommending a dollar-cost-averaging strategy to enter new long positions that your readers didn't already own. LJ: Yes. TGR: If we are in a rising market, a dollar-cost-averaging strategy is a negative. It hurts investors. LJ: I disagree completely. This is not investing. This is speculation. TGR: Ok. Go ahead. LJ: To be able to sleep at night has enormous value. Of course, that's just a rubric for a larger financial concept here. We are dealing with serious risk, and I think it is very dangerous to imagine that you're investing when what you're really doing is speculating. These two are not the same thing. The junior resource sector, our focus at Casey Research, is without question the most volatile market on earth. These stocks all correct. They all fluctuate. Even market darlings and great success stories frequently will retreat 50% or more, even without a 2008-style crash, before they go on to new heights. So, there's always reason to be careful, to deploy wisely, to wait for days when the markets pull back to buy, to take cash off the table when you accumulate gains. Going all-in is a gambler's game. I can't stress this enough to people. Gains are not gains until you realize them. At Casey Research, when we report a track record it includes realized gains—not just high-watermarks stocks reach after we recommend them. We include the profits we've taken off the table, which we do routinely. TGR: Back in the fall, you visited some mining operations in Colombia. It was a due diligence trip. What do you do on these trips? You're fluent, or at least conversant, in multiple languages and I'm sure that's a big help to you. What are you looking for? LJ: I use what we call the "8 Ps," Doug Casey's formula for resource stock evaluation. As the words "due diligence" imply, my function is to verify all of the Ps, as much as I can. But it does tend to boil down to a few things. One is to go and physically look at the rocks and see if they match what management is saying. They don't always. You can go down the ladder of the mine and look at the vein on one level, see that the vein continues on levels below and reasonably conclude that there's mineralization between. That's the kind of physical verification I do. Particularly crucial is the first "P"—people. I meet with management and the technical people who will actually do the work that adds shareholder value. Do they seem to know what they're doing? What kind of experience do they have? Is it relevant to the task at hand? Will they look me in the eye when I ask them questions? Sometimes that's the most important thing. You could call it the smell test. And yes, the languages help. TGR: So, you want to get away from the guided tour. What happens when you feel like there's a discrepancy between what you're seeing with your eyes and what management has said? LJ: It's rare to get a flat out lie. It's more common for something to be not quite as rosy as described. Typically, when there's some kind of discrepancy, I discuss it with management and give them a chance to explain. I'm not interested in conflict, and we don't generally report negatively on companies. If something doesn't make the grade, we just move on to the next opportunity. TGR: What about takeover targets? Antares Minerals is gone. Newmont Mining Corp. (NYSE:NEM) is picking up Fronteer Gold Inc. (TSX:FRG; NYSE.A:FRG). Ventana Gold Corp. (TSX:VEN) is in the process of being taken over. What are some of the good opportunities left for investors, particularly in Colombia? LJ: In Colombia, one obvious candidate would be Sunward Resources Ltd. (TSX.V:SWD). It's developing a new project that has big multimillion-ounce potential, but the company hasn't finished drilling it off yet. There's still a lot of work to do. It's a new story, gathering a lot of interest. The other obvious one in Colombia would be Galway Resources Ltd. (TSX.V:GWY), which is immediately on strike from Ventana. It's got more going for it than just the proximity—good drill results show that Ventana's mineralization does indeed continue onto Galway's property. On the other hand, Galway did not get taken out with Ventana; so you have to ask yourself: If Brazilian billionaire Eike Batista is not in a hurry to take Galway over, is there any reason for us to hurry to own the stock? Colombia is perhaps my favorite jurisdiction in Latin America. The country is now headed in the right direction with new free-trade agreements and a population that wants to work and is very focused on rebuilding the economy. There are environmental issues, particularly the high-altitude Páramo ecosystem protection legislation with which Greystar Resources Ltd. (TSX:GSL) has run into trouble recently. It's important for people to understand that this was not a new regulation slapped onto Greystar. It was an existing regulation that the government never had the power to enforce before because they were in a war for 40 years or more. The government did not start changing the rules on the company—that was always a risk there. In line with that and your question about disciplined buying, we like to recommend that people buy in tranches. Buy a first tranche, maybe just 20% of your ideal position to make sure you don't miss the boat. Then, when it corrects—and they always do—buy another 20%. That gives you 40%. Then, if you get a big reversal without any bad news from the company—things go on sale periodically in our sector—back up the truck and buy a big block at low prices. That would be the sort of approach I would recommend with something like Sunward, which already has seen a great deal of share price appreciation in advance of the anticipated results. I also like Colombian Mines Corporation (TSX.V:CMJ). TGR: Colombian Mines is down 20% over the past 12 weeks, while Sunward is up 24% over the same period. LJ: Yes. Sunward has had some good drill results. It drilled into thicker and higher-grade mineralization than previously at its Titiribi Project, which is known for being big but low grade. The new results are not high grade—but higher-grade, which is important for a big bulk-tonnage project like this. It makes sense for SWD shares to appreciate. Colombian Mines hasn't had a game-changer like that yet. The company has identified a gold porphyry at its Yarumalito project. It's big and potentially could be a company-maker; but so far, the drill results haven't really sewn that up. There are assays pending that may bear on that. We'll have to see. Colombian also has the higher-grade El Dovio project, which is earlier stage but potentially very rich for the company. CMJ also has joint ventures (JVs) on some of its projects. I like using OPM (other people's money) on high-risk exploration, so I like Colombian Mines. We already own the stock and are happy with our position. We'd like to see the company gain some traction on these projects before we buy anymore. Miranda Gold Corp. (TSX.V:MAD) is a newcomer in the region, but I know the management and I like them a lot. In spite of the good people and prospective properties, Miranda hasn't had a lot of luck with its projects yet. That does happen sometimes; even with the best geologists, Mother Nature isn't always cooperative. So, I like the company but I'm waiting for it to have the tiger by the tail, or at least some indications of a company-maker on hand. TGR: What about others? LJ: Pulling back to the global picture looking for takeover targets, one of my favorites is Premier Gold Mines Ltd. (TSX:PG). That's Ewan Downie's spin out of Wolfden Resources Inc. with projects that are all potentially big, high grade and in top mining jurisdictions. Most are within spitting distance of Goldcorp Inc.'s (TSX:G; NYSE:GG) producing assets. Premier is working to proving up significant high-grade, multimillion-ounce potential targets—it has takeover written all over it. I don't know when it will happen, but I think it will. Goldcorp might be happy to see Premier spend its money and do a lot of work for it, but if Goldcorp starts thinking that somebody else may come in and scoop them up, I would expect it to move aggressively. An earlier-stage one we've mentioned in our publications would be Bayfield Ventures Corp. (TSX.V:BYV). It has a continuation of the Rainy River deposit called the Burns block. This has graduated from being just "the property next door" to having a high-grade gold shoot immediately on the Bayfield side of the property line. And you know that high-grade pocket is not going to be left hanging in the wall of an open pit. Somebody's going to want to produce that gold—it's just crying out for a takeover. Trade Winds Ventures Inc. (TSX.V:TWD) is a similar situation but not quite as extreme. It's got a multimillion-ounce gold resource growing on trend from Detour Gold Corporation's (TSX:DGC) Detour Lake deposit. The project is a 50/50 JV with Detour already, so there's a natural synergy there and potential for takeover, but it could get big enough to justify a stand-alone operation. TGR: Any other companies you might be able to discuss? LJ: Because you're interested in Colombia, I could mention Mercer Gold Corp. (OTCBB:MRGP). I like the company, I like the people and I like this particular model, which is to try to explore on the other side of the mountain from the famous Medoro Resources Ltd. (TSX.V:MRS) project in the Marmato district. Marmato is an infamous environmental disaster zone in Colombia with hoards of illegal miners dumping cyanide down the mountainside, and Medoro is the company that's working to clean that up. There aren't any swarms of illegal miners on the other side of the mountain; in fact, there are only five miners and they're all in an association with which Mercer has formed an alliance. There's no established gold resource on Mercer's side, however, and so far, Mercer's drill results have not produced any company-making discovery holes. It has the right kinds of rocks, so it's got potential but it's early stage. Medoro's riskier at this point but certainly has a great deal of upside if the company hits what it's looking for. TGR: Louis, are there any closing comments you'd like to leave with our readers? LJ: Yes. We see a great deal of possibility for correction ahead. If the trouble in the Middle East settles down, and if the economy seems to be continuing to recover and the fear factor recedes, we could see gold retreat significantly. The retreat we had in January was only about 5%, which is really quite small as far as gold corrections have gone during this cycle. Gold has retreated as much as 25% in this cycle before going on to new highs. We really haven't seen a major retreat in gold since the big ramp-up last year; so, we are urging people to be cautious. If you do buy anything now, make it a first tranche and keep some powder dry for lower prices ahead. If that doesn't happen, and if the market doesn't correct, the market may go really manic, inflating a major gold bubble. If that starts happening, you'll be able to see it and there will be time to redeploy into that bubble. So, we do urge caution right now. TGR: Many thanks, Louis. LJ: You're very welcome. Always on the lookout for the next double-your-money winner, Louis James is the master of metals at Casey Research where he's the widely read and well-respected senior editor of the International Speculator, Casey Investment Alert and Conversations with Casey. Fluent in English, Spanish and French—and conversant in German and Russian, to boot—Louis regularly takes his skills on the road, evaluating highly prospective geological targets, visiting explorers and producers at the far corners of the globe and getting to know their management teams. In addition to subject matter expertise, he's built a following on the basis of a dynamic combination of investment savvy, practical advice, experience in physics and economics and a gift for comprehensible technical writing. Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page. DISCLOSURE: |

| The Janus-Face Of Marketability Posted: 19 Mar 2011 05:00 PM PDT Gold University |

| Paper Tiger Preying on Gold Bugs – The IMF and its phantom Gold Sales Posted: 19 Mar 2011 05:00 PM PDT Gold University |

| Posted: 19 Mar 2011 04:58 PM PDT

This is an interesting time for global markets. The Nikkei followed up yesterday's sell-off with an even bigger 11% plunge today. The Yen, however, is rising in the midst of this panic. Capital is repatriating to Japan and this is going to make their crisis even worse. The U.S. equity market is also coming under pressure, which was long overdue. I noted a couple of weeks ago that I had modest put/short positions on the market. Although I am short-term bearish, I will be looking for an opening to buy. Quantitative easing is part of our foreseeable future and this totally changes the dynamic of the stock market. Oversimplified comparisons to the Great Depression are just not applicable. Gold The recent sell-off in gold is mildly confusing given the growing uncertainty worldwide. However, it is not unusual for gold to get unjustifiably punished in the initial stages of a panic. 2008 is a great example. Investors needed to raise capital any way possible, and they did it by selling an asset that should have risen in a panic. The rally that ensued in gold after the initial panic was dramatic even as stocks made new lows. Markets will always adjust to reflect true conditions. I am drawing an initial line in the sand at $1380 and taking it from there.

I've realized over the years that the way I think about the gold market is very different from most gold bugs. Fundamentally this stems from my long-term investment outlook. The gold bug community in general seems to be very anxious to see gold trading at $2000 and above. In contrast, I am very patient in seeing this bull market through. It goes against our intuition, but corrections and consolidations are very bullish indicators. A bull market needs time to build a strong base to rise from. Multiple failures to breach resistance need to be viewed by the general community as bearish indicators. You need people to talk about head and shoulders patterns and triple tops for a big move to develop. You need the shorts to pile on. Sentiment needs to be weak. This is just the way bull markets work. Honestly, I would rather see $1200 gold than $1500 right now. I always try to point out that every economic environment is different and that rigid comparisons to the past are usually wrong. For example, why is the Yen rising in such an obvious "negative Yen" environment? Weak economy does not always equal weak currency. This is the same kind of paradox that will befuddle the masses as stocks in the U.S. rise in a weak economic environment. Capital will flow out of the U.S. because the investment opportunities are looking bleaker by the day as politicians continue to ignore this monumental debt crisis. Gold will rise right along with interest rates, confusing those who believe in an inverse relationship between the two. These will be fun times for those who understand the trends that are developing. This is a time to be very patient as events unfold. Treasuries are getting a bid here and this will provide an opportunity to get short. Stocks and gold are correcting; this will present an opportunity to get long. I sense that the general investing community is very down on gold at this point in time. I'm not sure exactly when it will happen, but gold is going to experience another moonshot move. My genuine hope is for a panic sell-off in gold to occur in the midst of unsustainable deficits and flailing confidence. If this does occur, I believe it will be the last great opportunity to load up before the really monster rally begins. Source:Welcoming a Gold Correction |

| Time to Trade Stocks and Silver for Gold? Posted: 19 Mar 2011 04:53 PM PDT Market professionals and experienced investors consider it to be common knowledge that silver has more real-world uses than its precious metal sister gold. Silver is used in coins, photography, batteries, bearings, electronics, and mirrors. Silver also aids in numerous medical applications and even contributes to helping capture and use solar energy. The Silver Institute describes "silver uses" as follows:

While gold is used in numerous consumer products, such as in computers and electronics, according to geology.com about 78% of the gold consumed each year is used in the manufacture of jewelry. Investors also respect the use of gold as an alternative to paper currencies and as a safe haven asset. The point is silver tends to be in greater demand relative to gold during economic expansions and bull markets. Gold tends to be in greater demand when concerns rise about economic downturns or geopolitical events. These basic investment tenants describe how stock investors can benefit from monitoring the gold/silver ratio, which is simply a study of the demand for gold relative to the demand for silver. Before looking at how the gold/silver ratio can help us better understand the threat of an ongoing correction in stocks, we will review recent historical cases that illustrate swings in relative demand for these precious metals. According to a February 28 story in The Daily Reckoning:

On March 10 we showed how defensive assets, such as the VIX and utilities, were gaining strength relative to the stock market. Just as the changes in relative strength can help us better understand a possible shift in market sentiment, the gold/silver ratio could be termed the "defensive/expansion ratio". When investors are playing defense, the ratio rises since gold is in favor relative to silver. When investors are less concerned with Armageddon-like events and more focused on better economic times, the ratio falls since silver is in favor relative to gold. In terms of where the economy sits right now, the Fed opened its March 15 statement with an upbeat tone:

On March 15 we looked at the performance of numerous asset classes and market sectors under two scenarios – during the April-August 2010 'flash crash' correction and during the subsequent QE2-induced rally off the August 2010 lows. Today we dig a little deeper into the data to help us better understand the risk of another prolonged correction occurring in the coming months. The table below shows how investments related to precious metals performed during a defensive/corrective period (left) and during a period where economic expansion/inflation-friendly assets were in favor (right). Investments related to precious metals are highlighted in green. Gold is represented by the gold ETF (GLD). Silver is represented by the silver ETF (SLV).

Just as we would have guessed, gold outperformed silver during the 'flash crash' correction by a margin of almost 2-to-1. Similarly, when market participants became less fearful and began to focus on economic growth and QE2, silver significantly outperformed gold in late 2010 and year-to-date.

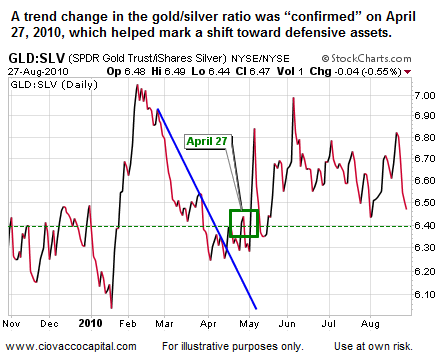

The chart below shows a bullish turn in the gold/silver ratio that was "confirmed" by a higher high on April 27, 2010. Think of April 27 as a bullish turn in the defensive/expansion ratio, meaning defensive-minded investors overtook bullish investors in terms of their conviction.

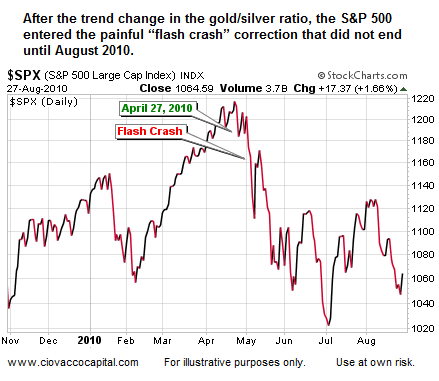

As shown below, the stock market did not perform well after the bullish turn in the gold/silver ratio. Compare April 27 in the chart above to April 27 in the chart below.

The good news is the present day gold/silver ratio is not telling us to swap our silver and stocks for gold; at least not yet. The gold/silver ratio remains in a downtrend (pink line), which means the conviction of gold buyers has not yet surpassed the conviction of silver buyers. Said another way, the conviction of defensive-minded investors has not yet surpassed the conviction of economic bulls.

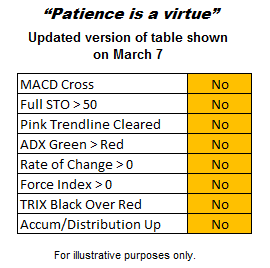

Three things need to happen from a technical perspective for gold to gain the upper hand on silver. The first one, breaking above the pink trendline, has not even occurred yet. It may indeed happen in short order, but for now the gold/silver ratio is terming the current state of the stock market as a "pullback". It may indeed upgrade the classification to a "correction", but relative to the events of 2010 we have not even met that standard yet. In terms of our investment strategy, this analysis does not alleviate our concerns about Japan and the fast-approaching completion date for QE2. As we stated yesterday, this remains a 'prove it to me' market, meaning we have been and are open to raising more cash using the incremental approach. On Wednesday, we cut back further on gold stocks (GDX), Australia (EWA), Germany (EWG), and inverse-Treasury bonds (TBT). The current state of the gold/silver ratio does leave us open to better than expected outcomes over the next few weeks. Our short-term bull/bear checklist, based on the S&P 500, remains in the "be patient" range.

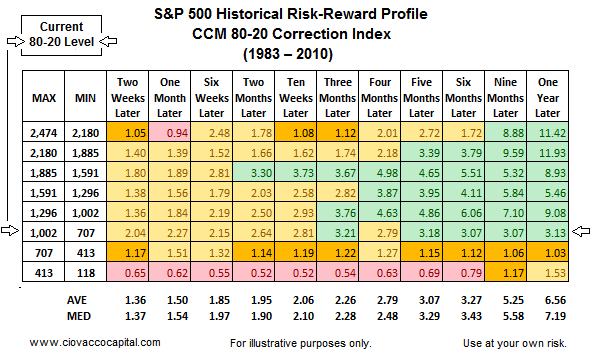

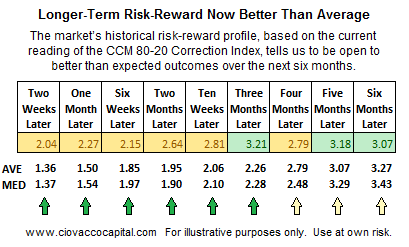

The CCM 80-20 Correction Index is telling us to remain defensive, but to also keep an open mind relative to where stocks may be in three-to-six months. In the tables below, high numbers indicate more favorable conditions in terms of historical risk vs. reward.

The figures in the tables are as of Wednesday's market close. Notice the current risk reward numbers (top of table below in yellow and green) and are attractive relative to the market's average and median profiles under various conditions.

The market's current profile, from a positive perspective, means little unless we see evidence starting to accumulate which points to a probable change in the short-term trend. Said another way, until we see evidence to the contrary, we need to maintain a defensive bias. Once the evidence begins to shift, we have to look at the market objectively to make the best allocation decisions possible. Source:Time to Trade Stocks and Silver for Gold? |

| Gold Price Holding up Extremely Well—the Bandwagon Has Further to Go Posted: 19 Mar 2011 01:34 PM PDT

Investing in gold is a subject that's been well endorsed in this publication and the spot market for gold futures has been due for a correction. But, we aren't getting much of a correction in gold (right now) because global investors feel that investment risk is high enough to justify gold future prices at almost record highs. The market for gold futures could best be described as being in a period of consolidation around the top. Short-term trading action has been about a flight to cash for obvious reasons. Virtually all commodities have been backing off this week and so has gold. But I don't see a case for falling gold prices in any sustainable manner. There is a bandwagon out there of institutional investors who have and are continuing to make long-term investments based on the expectation for higher gold prices. I certainly view gold-related investments as one of the few higher growth opportunities for investors. The rest of the economy just isn't growing that fast. Giving gold advice is a fool's game, because nobody can predict the future. It seems reasonable to expect, however, higher inflation down the road (do prices for things ever go down?) It also seems reasonable to expect both consumer and industrial demand for gold to improve. So, it therefore seems reasonable to me that the current spot price of gold is accurate; therefore, the business model for companies mining the commodity remains excellent. I think we're getting close to a decent new entry point for gold stocks. Of course, the big money has already been made. You can't have a run-up in gold prices this strong without fortunes having already been created. That's what the buy-low/sell-high investment strategy is all about. You get into the right asset when nobody's interested and you wait to see if things turn out. Going forward, the one commodity that stands out as being in the doldrums right now is natural gas. Here is an opportunity that's ripe for more economic analysis. But getting back to gold, we all know that a lot of gold stocks have had a great run. What's coming is consolidation among existing producers within the group. It's already been happening, mostly for producers of other precious metals. There's a real incentive for profitable gold miners to consolidate. It's tough to find new discoveries and purchasing existing production tends to lower costs per ounce. I think we're going to see a lot of mergers and acquisitions among the mid-tier producers this year and the potential for this should be on the equity speculator's mind.

|

| Posted: 19 Mar 2011 11:00 AM PDT The Daily Bell is pleased to present another exclusive interview with Bill Bonner. Since founding Agora Inc. in 1979, Bill Bonner has found success and garnered camaraderie in numerous communities and industries. A man of many talents, his entrepreneurial savvy, unique writings, philanthropic undertakings, and preservationist activities have all been recognized and awarded by some of America's most respected authorities. Along with Addison Wiggin, his friend and colleague |

| Posted: 19 Mar 2011 08:31 AM PDT GLD – on sell signal. SLV – on sell signal. GDX – on sell signal. Summary Disclosure End of update |

| Making Money on Miners, Part I Posted: 19 Mar 2011 07:31 AM PDT At Bullion Bulls Canada, we have made it one of our "missions" to provide a complete learning resource for precious metals miners. Our goal is to offer investors a "tool" which will allow even complete novices to this sector to learn to invest on their own with these companies. We consider our Mining Company database and "Education Vault" already superior to any other package of information available at other sites. The former provides extensive data on many of the most-promising miners, while the latter offers a complete "teaching" tool regarding all of the principle fundamentals for both precious metals miners, and precious metals themselves. There is, however, still plenty of room to build upon this. In this piece I will seek to simplify and "connect-the-dots" on various concepts which we have introduced to readers in previous articles. It is imperative that readers (and especially novice investors) familiarize themselves with all of our previous material on this subject, rather than seeking to use this piece as some simplistic "formula" which they can blindly rely upon in order to (supposedly) reap huge gains. With all mining companies, there is a specific "evolution" that takes place with any/every project which eventually becomes a mine (subject to only rare exceptions). This progression is as follows: early exploration-> extensive drilling-> resource estimate-> economic assessment-> major financing-> construction of mine-> commercial production There are two important observations which can made about this mining cycle. First, most but not all of these "phases" imply developments in a particular project which should increase the share price. This in turn implies that each phase of operations is executed competently by management, and (in the case of earlier phases) that the company experiences a certain degree of "luck" in that the mineral resource which they expect to find through their exploration and drilling is actually proven through subsequent drilling results and technical modeling. The second (and perhaps more important) observation to be made is that within each phase, we can attempt to "time the market" to a certain extent. This can be either through looking to buy when certain "clues" present themselves, or conversely choosing to sell all or part of our positions when we see other pieces of data emerge. Note that understanding and interpreting these clues properly requires not only having a thorough understanding of current market conditions, but also detailed knowledge on each phase of a miner's operations. Those lacking this level of understanding need to refer to our earlier work in order to familiarize themselves with this information. The other important caveat here is that this analysis implies (at least) stable, if not favorable market conditions. As is true with any investment, sudden swings in sentiment (either to a positive or negative extreme) will overwhelm the individual fundamentals of these companies, and render this analysis invalid. Assuming an adequate understanding of this sector and stable market conditions, astute investors should be able to utilize the following guidance in order to make more profitable "entrances" and "exits" in their investing. Early exploration: With this first phase of mining obviously representing the most-speculative period of the mining cycle, this makes the task of the investor in timing their investment decisions both easier and more difficult. It's "easier" in the sense that there are less types of activity to monitor, and success or failure is relatively straightforward to assess (again, assuming a detailed understanding of mining fundamentals). It is "more difficult" for investors precisely because of the absence of large quantities of data. There may be historical drilling results to look at, if a particular land-package has been previously explored. Note that most such "historic" work, is entirely unofficial in that it doesn't meet more stringent modern standards for mining data, designed to reduce the possibility of some sort of data-fraud being perpetrated against investors. The only other data which investors may have at their disposal is information from neighbouring mines, if this particular project is situated in an existing mining "camp" (i.e. district). All other data for investors to ponder is generated by the miner itself, (more or less) in "real time". |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Good rocks and good people are the core building blocks of successful junior miners. Casey Research Senior Editor and Mining Strategist Louis James wants to see the mineralization close up and talk to geologists to verify the powerful upside potential that may be in these stocks, which are also vulnerable to staggering corrections. In this exclusive interview with The Gold Report, Louis reveals how to benefit from the combination of geopolitical and domestic uncertainty and growth potential in the ground.

Good rocks and good people are the core building blocks of successful junior miners. Casey Research Senior Editor and Mining Strategist Louis James wants to see the mineralization close up and talk to geologists to verify the powerful upside potential that may be in these stocks, which are also vulnerable to staggering corrections. In this exclusive interview with The Gold Report, Louis reveals how to benefit from the combination of geopolitical and domestic uncertainty and growth potential in the ground.

No comments:

Post a Comment