saveyourassetsfirst3 |

- Will the U.S. Dollar or Euro Collapse and Cause Financial Armageddon?

- Gold & Silver Reading List

- Silver advances to $35.67/silver shorts in big troube/Libya in civil war/demonstrations in Egypt commence again

- Gold and Silver Mining Stocks Gain Momentum - Whats Next?

- Interview With Ben Davies - CEO of Hinde Capital

- Utah House Passes Bill Recognizing Gold, Silver as Legal Tender

- MASSIVE gold demand continues to break records in China

- Trying to solve the Silver COT Mystery

- A Deep Walkthru For Silver Manipulation - Redux

- Utah Considers Return to Gold, Silver Coins

- Has anyone noticed

- Current SEC proposal on conflict minerals will put gold market at risk - WGC

- Cheap Money, Speculation & Hoarding

- Zero Hedge: Silver Shorts Bloodbath

- The Anti-Gold Gospel According to Frieden

- The latest from Bix Wei: Silver shorts increased while price rose

- People Of Earth: Prepare For Economic Disaster

- Friday ETF Roundup: XLF Tumbles, VXX Surges on Libyan Violence

- Gold and Silver Mining Stocks Gain Momentum – What’s Next?

- Napoleon and the Commonwealth Bank – Paleo-Keynesian and Neo-Keynesian

- Stock & Gold Markets Technical Update

- The Dollar Sags as Key EU Decisions Loom

- Investing in Silver Instead of Toilet Paper Currencies

- Historical Comex closing gold and silver spot?

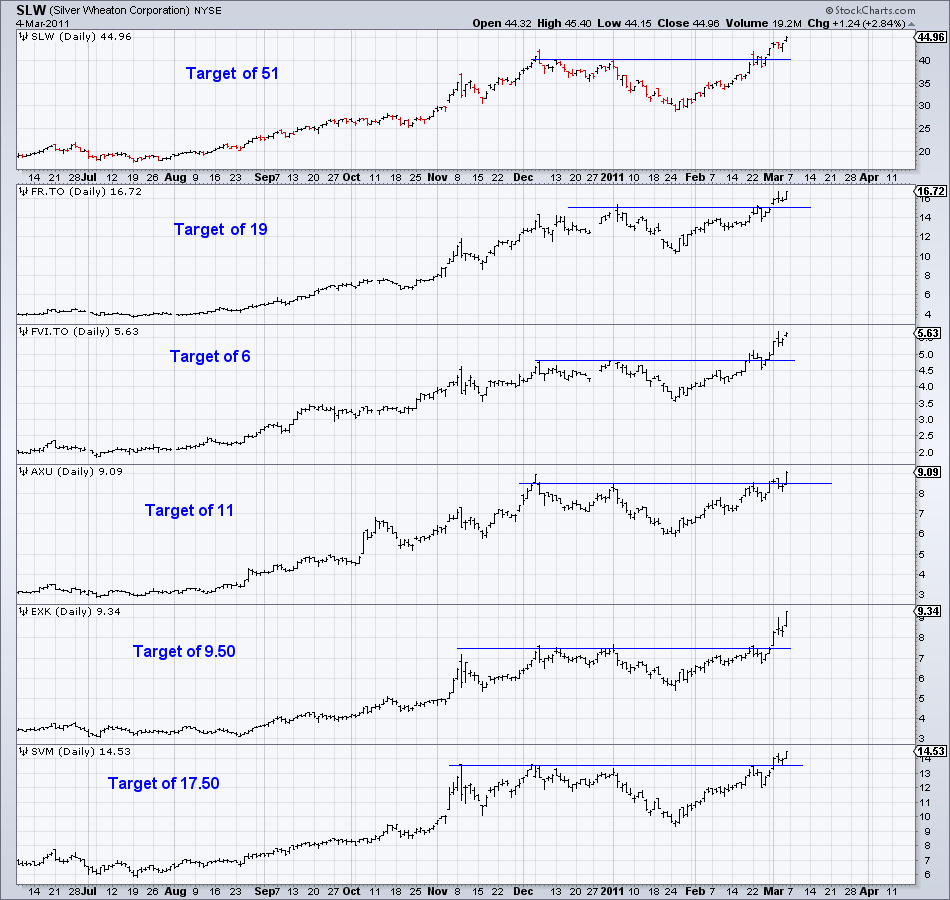

- Targets for Silver Stocks

- Dollar vs. Gold in a Dual Inflation-Deflation Economy

- An incredible chart you have to see to believe

| Will the U.S. Dollar or Euro Collapse and Cause Financial Armageddon? Posted: 05 Mar 2011 06:16 AM PST What event could trigger an unstoppable domino affect leading to a financial meltdown? You may think [that such a possibility is extremly unlikely] but daily we move closer to the real possibility that a major fiat currency such as the US Dollar or the Euro could collapse in the blink of an eye. [Let's take a look [...] |

| Posted: 05 Mar 2011 04:49 AM PST My apologies for linking to my own site in previous posts. It won't happen again. Here's another post that I would appreciate your feedback on. My take on gold & silver blogs: One of our objectives of writing is an attempt to bring the discussion of gold and silver back to the mainstream. That is, a discussion balanced with reasoned analysis, fair consideration of both sides of every issue, excluding the most outlandish hype and conspiracy theories and particularly avoiding the cheer leading seen on almost every site. In our writing you will not see the name Blythe Masters, "silver bitches", "to the moon", etc. as seen on almost every other blog and forum. But we aren't the only ones. Here's a couple of other blogs that I have found to be fairly balanced, informative and thought provoking: FOFOA. If there is one blog to read, this is it. While his posts are wordy and sometimes edgy, FOFOA is always well reasoned and thought provoking. The comments are also reasoned, subdued and respectful. Trader Dan. For those more interested in the trading aspects of gold and silver, Trader Dan is an excellent resource. He avoids the rah rah and conspiracy theories and looks at the markets with a refreshingly objective point of view. Gold Chat. This blog is written by Bron Sucheki, an analyst at the Perth Mint. As an insider, Bron has a unique perspective to share with his readers and he does so with well thought out and balanced posts. He doesn't write very often though. Unfortunately, that is it for now. If you are aware of any other blogs I should add to this list, it would be greatly appreciated. If objective, reasoned analysis is not for you and you'd prefer to read blogs filled with conspiracies, cheerleading and group think, here you go: ZeroHedge. A year ago I would've put ZeroHedge in the above group, but the site, and its readers, have changed. While always an interesting read to see what the crazies have come up with lately, ZeroHedge will post almost any conspiracy or spurious claim coming out of the wacky wing of the metals industry. The comments have devolved into two categories (1) cheer leading (silver bitches, to the moon, etc) and (2) various words for Blythe Masters. I do have deep respect for "Tyler Durden", as he does a great job of reporting things the mainstream media won't touch, I just wish he'd be more discerning about what he posts. Turd Ferguson. Turd is a smart guy that has a great understanding of the silver and gold markets, but he unfortunately panders to the conspiracy crowd by bringing up Blythe Masters in every post. His commenters likewise parrot those views with any dissent being entirely unwelcome. If he just stuck to the charts, it would be a great site. Harvey Organ. Harvey is the wackiest of the wack. Every move in open interest, every withdrawal or addition to the Comex warehouse stocks is a conspiracy. No claim is too outlandish to be included in his report. However, I do respect that he responds to challenging questions and doesn't delete dissenters comments. I must admit I still read his report every day, just don't believe any of it. Kitco Forums. For the granddaddy of cheer leading, groupthink and childish discussions, Kitco is it. I used to post there and was always attacked and shouted down. The mods even started deleting my posts. Reading the Kitco forums will make you dumber, guaranteed. Thoughts, anybody? |

| Posted: 05 Mar 2011 03:06 AM PST |

| Gold and Silver Mining Stocks Gain Momentum - Whats Next? Posted: 05 Mar 2011 01:00 AM PST |

| Interview With Ben Davies - CEO of Hinde Capital Posted: 04 Mar 2011 11:35 PM PST Image:  Next, I have three items from over at King World News. I must admit that I've had no time to listen to this Ben Davies interview, as it arrived in the wee hours of Saturday morning, but I'm sure that it will not only be interesting...but will mostly be about silver and gold. The link is here. |

| Utah House Passes Bill Recognizing Gold, Silver as Legal Tender Posted: 04 Mar 2011 11:35 PM PST Image:  Reader David in California provides our next reading material, which is a posting over at Fox News. Utah took its first step Friday toward bringing back the gold standard when the state House passed a bill that would recognize gold and silver coins issued by the federal government as legal currency. I would guess that this is the thin edge of the wedge...and it will get thicker in a real hurry. This is a must read...and the link is read more |

| MASSIVE gold demand continues to break records in China Posted: 04 Mar 2011 11:35 PM PST Image:  Pretty much everything else I have today is precious metals related in one form or another. The first item is provided by reader Ray Wiberg...and is a posting over at the mineweb.com. Author Lawrence Williams digs deeply into China's 200 tonne gold demand that they experienced in the first two months of this year. This story, which is only a handful of paragraphs, is more than worth your time...and the link is here. |

| Trying to solve the Silver COT Mystery Posted: 04 Mar 2011 07:25 PM PST Dan Norcini |

| A Deep Walkthru For Silver Manipulation - Redux Posted: 04 Mar 2011 07:23 PM PST Zerohedge |

| Utah Considers Return to Gold, Silver Coins Posted: 04 Mar 2011 07:08 PM PST Fox News |

| Posted: 04 Mar 2011 06:59 PM PST That they seem to let the metals float on Fridays lately? I was thinking they want to discourage weekend physical purchases by letting the metals rise during the days it would most likely be purchased. |

| Current SEC proposal on conflict minerals will put gold market at risk - WGC Posted: 04 Mar 2011 05:30 PM PST Mineweb |

| Cheap Money, Speculation & Hoarding Posted: 04 Mar 2011 05:29 PM PST Bullion Vault |

| Zero Hedge: Silver Shorts Bloodbath Posted: 04 Mar 2011 05:00 PM PST http://www.zerohedge.com/article/sil...orts-bloodbath Silver Shorts Bloodbath Submitted by Tyler Durden on 03/04/2011 15:56 -0500 In what can be only described as a total gutting of all silver shorts everywhere, including those with infinite Fed funded balance sheets (wink wink Blythe), all one can do is commiserate. With silver hitting $35.55 intraday, not even a last ditch attempt to spread the ridiculous Chavez rumor once more (this time the two dictators will really get peace ironed out, we promise) will prevent a battery of margin calls from forcing all the silver market timers to liquidate assets to keep their primer brokers happy. That's ok: all those market timers will sooner, or much, much later, get the top right.  |

| The Anti-Gold Gospel According to Frieden Posted: 04 Mar 2011 04:00 PM PST Gold University |

| The latest from Bix Wei: Silver shorts increased while price rose Posted: 04 Mar 2011 10:57 AM PST Email: Here's a great example of the old saying "SOMETHING IS ROTTEN IN DENMARK"! After shedding silver short contracts for the last 3 months the BPR reports that the US Banks have... INCREASED THEIR SILVER SHORT POSITION BY 5,880 CONTRACTS OR 29.4M OUNCES IN A MONTH WHILE THE PRICE OF SILVER ROSE 25%!!! http://www.cftc.gov/dea/bank/deaMar11f.htm No wonder the price of silver was on the run tonight... THE BAD GUYS ARE IN MASSIVE TROUBLE!!! Ask yourself what the price of silver would be IF the Bad Guys hadn't dumped 30M ounces of paper silver on the market? Now ask yourself... HOW WILL THEY COVER ALL THESE CONTRACTS BY MARCH 28TH?! There is a list of potential excuses the Banksters may give the CFTC for this move including the new silver miner hedges (those hedging miners are in on the scam). They may also be splitting the short between 4-5 different US banks BUT it does not negate the fact that the price of silver ROSE $7 during the time that they were selling all these shorts! Buckle up my friends...WE HAVE ARRIVED! Bix Weir www.RoadtoRoota.com |

| People Of Earth: Prepare For Economic Disaster Posted: 04 Mar 2011 10:44 AM PST

At last check, the price of U.S. crude was over 104 dollars a barrel and the price of Brent crude was over 115 dollars a barrel. Many analysts fear that if the crisis in Libya escalates or if the chaos in the Middle East spreads that we could see the all-time record of 147 dollars a barrel broken by the end of the year. That would be absolutely disastrous for the global economy. But it isn't just the chaos in the Middle East that is driving oil prices. The truth is that oil prices have been moving upwards for months. The recent revolutions in the Middle East have only accelerated the trend. Let's just hope that the "day of rage" being called for in Saudi Arabia later this month does not turn into a full-blown revolution like we have seen in other Middle Eastern countries. The Saudis keep a pretty tight grip on their people, but at this point anything is possible. A true revolution in Saudi Arabia would send oil prices into unprecedented territory very quickly. But even without all of the trouble in the Middle East the world was already heading for an oil crunch. The global demand for oil is rising at a very vigorous pace. For example, last year Chinese demand for oil increased by almost 1 million barrels per day. That is absolutely staggering. The Chinese are now buying more new cars every year than Americans are, and so Chinese demand for oil is only going to continue to increase. Much could be done to increase the global supply of oil, but so far our politicians and the major oil company executives are sitting on their hands. They seem to like the increasing oil prices. So for now it looks like oil prices will continue to rise and this is going to result in much higher prices at the gas pump. Already, ABC News is reporting that regular unleaded gasoline is going for $5.29 a gallon at one gas station in Orlando, Florida. The U.S. economy in particular is vulnerable to rising oil prices because our entire economic system is designed around cheap gasoline. If the price of gas goes up to 5 or 6 dollars a gallon and it stays there it is going to have a catastrophic effect on the U.S. economy. Just remember what happened back in 2008. The price of oil hit an all-time high of $147 a barrel and then a few months later the entire financial system had a major meltdown. Well, as the price of oil rises it is going to create a whole lot of imbalances in the global financial system once again. This is definitely a situation that we should all be watching. But it is not just the price of oil that could cause a global economic disaster. The global price of food could potentially be even more concerning. As you read this, there are about 3 billion people around the globe that live on the equivalent of 2 dollars a day or less. Those people cannot afford for food prices to go up much. But global food prices are rising. According to the United Nations, the global price of food has risen for 8 consecutive months. Last month, the global price of food set a brand new all-time record high. Many are starting to fear that we could actually be in the early stages of a major global food crisis. The price of just about every major agricultural commodity has been absolutely soaring during the past year.... *The price of corn has doubled over the last six months. *The price of wheat has more than doubled over the past year. *The price of soybeans is up about 50% since last June. *The price of cotton has more than doubled over the past year. *The commodity price of orange juice has doubled since 2009. *The price of sugar is the highest it has been in 30 years. Unfortunately, the production of food in most countries around the world is very highly dependent on oil, so as oil goes up in price this is going to make the food crisis even worse. Hold on to your hats folks. Also, as I have written about previously, the world is facing some very serious problems when it comes to water. Due to the greed of the global elite, there is not nearly enough fresh water to go around. The following are some very disturbing facts about the global water situation.... *Worldwide demand for fresh water tripled during the last century, and is now doubling every 21 years. *According to USAID, one-third of all humans will face severe or chronic water shortages by the year 2025. *Of the 60 million people added to the world's cities every year, the vast majority of them live in impoverished slums and shanty-towns with no sanitation facilities whatsoever. *It is estimated that 75 percent of India's surface water is now contaminated by human and agricultural waste. *Not only that, but according to a UN study on sanitation, far more people in India have access to a mobile phone than to a toilet. *In northern China, the water table is dropping one meter per year due to overpumping. These days, one of the trendy things to do is to call water "the oil of the 21st century", but unfortunately that is not a completely inaccurate statement. Fresh, clean water is something that we all need, but right now world supplies are getting tight. Our politicians and the global elite could be doing something about this if they really wanted to, but right now they seem perfectly fine with what is happening. On top of everything else, the sovereign debt crisis is worse than it has ever been before. All of the major global central banks have been feverishly printing money in an attempt to "paper over" this crisis, but it is not going to work. Most Americans don't realize it, but right now the continent of Europe is a financial basket case. Greece and Ireland would have imploded already if they had not been bailed out, and now Portugal is on the verge of collapse. The interest rate on Portugal's 10-year notes has now been above 7% for about 3 weeks, and most analysts believe that it is only a matter of time before they are forced to accept a bailout. Sadly, if the entire global economy experiences a slowdown because of rising oil prices, we could see half a dozen European nations default on their debts if they are not bailed out. For now the Germans seem fine with bailing out the weak sisters that are all around them, but that isn't going to last forever. A day or reckoning is coming for Europe, and when it arrives the reverberations are going to be felt all across the face of the earth. The euro is on very shaky ground already, and whether or not it can survive the coming crisis is an open question. Of course there are some very serious concerns about Asia as well. The national debt of Japan is now well over 200% of GDP and nobody seems to have a solution for their problems. Up to this point, Japan has been able to borrow massive amounts of money at extremely low interest rates from their own people, but that isn't going to last forever either. As I have written about so many times before, the biggest debt problem of all is the United States. Barack Obama is projecting that the federal budget deficit for this fiscal year will be a new all-time record 1.65 trillion dollars. It is expected that the total U.S. national debt will surpass the 15 trillion dollar mark by the end of the fiscal year. Shouldn't we have some sort of celebration when that happens? 15 trillion dollars is quite an achievement. Most Americans cannot even conceive of a debt that large. If the federal government began right at this moment to repay the U.S. national debt at a rate of one dollar per second, it would take over 440,000 years to pay off the national debt. But the United States is not alone. The truth is that wherever you look, there is a sea of red ink covering the planet. The current global financial system is entirely based on debt. If the total amount of debt does not continually expand, the system will crash. If somehow a way was found to keep this system going perpetually (which is impossible), the size of global debt would keep on increasing infinitely. Now the World Economic Forum says that we need to grow the total amount of debt by another 100 trillion dollars over the next ten years to "support" the anticipated amount of "economic growth" around the world that they expect to see. The entire global financial system is a gigantic Ponzi scheme. It is designed to keep everyone enslaved to perpetual debt. If at some point the debt spiral gets interrupted in some significant way, we are going to witness an economic disaster that is going to make what happened in 2008 look like a Sunday picnic. The more research that one does on the current global economic situation, the more clear it becomes that we are absolutely doomed. So people of earth you had better get ready. An economic disaster is coming. |

| Friday ETF Roundup: XLF Tumbles, VXX Surges on Libyan Violence Posted: 04 Mar 2011 10:25 AM PST ETF Database submits: Despite a relatively impressive jobs report, U.S. equity markets slumped in Friday trading as continued tension in the Middle East and North Africa hit the markets hard once again. The Dow was off by 88 points while the S&P 500 and the Nasdaq posted losses of 0.7% and 0.5%, respectively. Meanwhile, safe haven commodities roared higher as gold gained more than $14/oz. and oil rose by close to $3/bbl. as the prospect of further supply shocks weighed on a number of market sectors. This also carried over into the bond market where Treasury bills reversed their recent downtrend. Traders piled into these safe assets, pushing the 10-year note's yield below the 3.5% mark and the 2-year's below 0.7%. Today's losses and flight to quality came despite a decent gain in total employment, as the figure reported was still under analyst expectations. Non-farm payrolls increased by 192,000 in the month of Complete Story » |

| Gold and Silver Mining Stocks Gain Momentum – What’s Next? Posted: 04 Mar 2011 10:12 AM PST

Mounting social and political unrest in the Middle East boosted appeal for commodities as a safe investment option in recent weeks. Crude oil topped $100 a barrel and near month gold and silver futures traded above $1440 and $35 respectively, in the NYMEX. Besides geopolitical developments, currency fluctuations and stock markets influenced precious metals. The XAU Index is a proxy for gold and silver mining stocks. Last week's comment that "This week we continue to see a fight for new highs" here continues to hold for this week. In our previous essay entitled Top in Stocks and Silver? we wrote that the head-and-shoulders pattern which was under development last week has nearly been invalidated. This would of course be a bullish development. In the short-term GDX ETF chart (again, a proxy for gold & silver mining stocks), analysis of volume is our general focus point. Thursday's decline in ETF levels can be termed insignificant because it was not accompanied by an increase in volume. The chart provides barely any changes since the previous week, which by itself is somewhat bullish. In 25th February premium commentary, we wrote the following: Thank you for reading. Have a great and profitable week! P. Radomski Sunshine Profits provides professional support for Gold & Silver Investors and Traders. All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. |

| Napoleon and the Commonwealth Bank – Paleo-Keynesian and Neo-Keynesian Posted: 04 Mar 2011 10:00 AM PST 'The great Napoleon, it is said, thought he was doing a very philanthropic work by causing ditches to be made and then filled up. He said, therefore, "What signifies the result? All we want is to see wealth spread among the labouring classes"'. Yes. Napoleon was a Keynesian. Perhaps more of a Paleo- (or early stage) Keynesian. But even two hundred years ago there were Daily Reckoning editors who made it their business to expose the fallacies of government intervention. Frederic Bastiat, who wrote the quote above, was one of the best. Your editor's favourite revelation from Bastiat was the concept of what is seen and what is unseen. 'There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen.' In one of his 'Essays on Political Economy', Bastiat goes into a number of examples where the seen consequence is used to support government action, while the unseen consequences cause damage to the economy. For example, the stimulus from government spending is seen. The lost income from increased tax to pay for the stimulus is unseen. But it's not just government that Bastiat takes issue with. He also gets antsy when people remark that a broken window is good for the economy because the glazier gets some income. The glazier's income from a broken window is seen. The lost income from the items that would have been bought if the glazier wasn't needed is not seen. Importantly, the window is a replacement. But the other purchase could have been of a new good. Of course, Bastiat lays the arguments and examples out better than that. In fact, even politicians should be able to read and understand Bastiat's work. No longer could they advocate stimulus if they had read his essays. No longer would they support large military spending in favour of the economy if they had read his explanation of the fallacy. But, alas, it seems no politician will take time to read theories that undermine their own job. What a shame. So, as always, it falls upon us here to apply the common sense. And, taking Bastiat's lead, we will apply his very method: Identify what is seen ... and what is unseen. Hopefully we will prove to be good economists. 1. The carbon tax. This one is pretty straight forward. The reduction of carbon emissions is that which is seen. One obvious unseen consequence is the economic activity that does not take place because funds have been redirected by the government. Just like in Bastiat's broken window example. But there is another subtler 'unseen'. The reduced effort of individuals to offset their carbon footprint is also an unseen. Why offset your jet flight's pollution when the government is on the case? Why buy electricity from renewable energy when the government is taking up the issue? Also, assuming the price of power increases, another unseen is that economic activity is further restrained. 2. The NBN The investment and the infrastructure is that which is seen. The reduced efforts of the private sector to come up with a variety of technologies to provide high-speed internet is that which is unseen. When the government provides infrastructure on a massive scale, it stops the private sector from competing. Why use a toll road when the government's road seems free? (Of course, you have just paid for it in taxes.) In the private sector the best solution is the last one standing. When the public sector decides to go one way, it can't admit it was wrong and continues in the wrong direction. Usually it has to use its regulatory muscle to avoid being exposed as incompetent by competitors, which is only a matter of time. More on that below. 3. Quantitative Easing The increased economic activity, the rising prices and the falling interest rates are that which is seen. QE's unseen effects are very insidious. As we have explained before, new money doesn't spread throughout the economy from one moment to the next. Instead, the central bank buys bonds from banks, which then do what they want with the money. Usually the bankers and politicians have some pet project or industry in mind. And so that is where the money goes. This unnatural allocation of capital is the unseen effect of money printing. It causes one industry to benefit over another. Perhaps that is an even better classification of the seen and unseen. The seen effect is who gets the new money first. The unseen effect is who gets the money last and has to deal with higher prices as well. Here, the crude concept of trickle-down economics comes in to explain why inflation is such a problem for the poor. The rich get the bankers loans first and employ the poor last. Of course, this can be reversed, as the Commonwealth Bank set out to prove when its ATMs handed out money by mistake. Money can flow to the less wealthy first if you allow ATMs to let fly. Maybe this is the Keynesian monetary stimulus mechanism of the future? Or maybe the CBA got a little nostalgic of times past, when it was the central bank and could do such things. Money Morning editor Kris Sayce suggested that those charged with 'fraudulently' taking the CBA ATM's money should call on Keynes to defend themselves. 'We just wanted to stimulate the economy to create jobs.' Hey, if the government can do it... 4. First homeowners grant That which is seen is the homeowners who use the money to buy the house. That which is unseen is the increase in house prices (which offsets the grant), the loss in affordability to other homebuyers and the people who were taxed to pay for the grant. Anyway, the list of seens and unseens could go on, but you have caught on by now. Besides, economics seems to matter so little these days. Politics takes up all the headlines in the business section of the newspaper. And those silly politicians. If only they kept quiet, they could probably keep their jobs for longer. Remember when the government's rallying cry was to abolish the monopolies of free market capitalism? Well, the tables have been turned: 'Telstra makes broadband warning: NBN laws "create new monopoly"'. Here we have the big evil corporation fighting the government for competition, while it's also negotiating for a contract from the government. Everything is backwards. Or is it? As you may know, the true definition of monopoly is, or should be, the legal restriction of engaging in a type of business. The best examples are licences, where only those with express permission from the government are allowed to take up a certain profession or business. In other words, a monopoly is a government creation. And so it is about as un-capitalist as you can get. But back to the National Broadband Network. You just know that something that takes that much money ($36 billion) and that much time is going to go way over budget and finish well after technology renders it out of date. It's doomed from the beginning. But Telstra's claims shed light on just how groanworthy the government's policy stance is: 'In its submission to the Senate, Telstra criticises the planned 'cherry-picking' rules to stop the NBN's less regulated rivals building their own super-speed networks in metropolitan areas before the NBN is rolled out.' Yes, the government wants to make sure you don't get your broadband early and that private companies don't provide infrastructure. Even worse news is the re-emergence of the carbon price debate. Yes it's the return of the Oxygen Tax (Carbon Dioxide has two Oxygen atoms after all). Of course, not so long ago, a different Prime Minister Gillard stated that 'there will be no carbon tax under the government I lead'. The former Treasurer, also coincidentally called Wayne Swan, got quite offended at the suggestion a carbon tax was being considered: 'What we rejected is this hysterical allegation that somehow we are moving towards a carbon tax.' But now a new Julia Gillard and Wayne Swan are in government. And they are hysterical to say the least. So now the carbon tax is back. We're not sure whether the ideological drive of the Labor Party to ignore its electorate's feedback is commendable or not. On the one hand, nations do sometimes need tough leaders willing to go against popular opinion. On the other hand, that is pretty contradictory to democracy. Of course, in the present case, the ideology and policy are mistaken. So, the only commendable part in the new Julia Gillard's policy is that the tax is being called a tax, instead of a 'scheme' like last time (ETS and CPRS). And just to be clear, each of these was a tax, no matter what Julia claims. Surely the Australian voter is sick of hearing about taxes. RSPT, MMRT, ETS, the Flood Levy and now the Carbon tax. How many of these taxes have made it into law? If you ask Treasurer Wayne Swan, it doesn't really matter. The Australian was interviewing him about the Carbon tax and claims the following was said: 'Mr Swan said "every single dollar" raised under the tax would be returned to assist individuals, households and business who will be impacted.' Think about that for a moment. And read it again. It must be out of context, or why bother going through the process of taxing in the first place? Oh wait, he is Labor too, right? And what if the tax affects every Australian? And every BHP customer overseas? Whoa! Mr Swan will be racking up quite a debt. Outside of Australia, the political class seems to be less obviously stupid. In a remarkable display of DOUBLETHINK (doublethink is the act of simultaneously accepting as correct two mutually contradictory beliefs), Chinese Premier Wen Jiabao reminded his Proles (the Chinese people) how democratic China is 'The root of corruption lies in a government that has too much unrestrained power, Wen said in a two-hour online interview with citizens yesterday.' Sounds like Thomas Jefferson, right? But then, like Obama, he makes promises of how the government will interfere: '[Wen] promised to curtail food costs and tackle surging property prices. Wen also cut economic growth targets and said the government would focus on ensuring the benefits of expansion were more evenly distributed. Wen's comments came as hundreds of police deployed in Beijing and Shanghai at the site of demonstrations called to protest corruption and misrule. At least seven people were bundled into police vans near Shanghai's People's Square, while in Beijing several foreign journalists were forcibly removed from the Wangfujing shopping district.' Sounds like a government with unrestrained power to me. If you're up to date on American politics, try substituting 'Obama' where it says 'Wen' in the quote above. It works quite well for the first half. Speaking of Obama, the President kicked off the gathering of his new economic panel of advisors by lecturing them about the importance of employment. No news on whether he did any of his famous listening afterwards. Perhaps that's reserved for non Americans. Technical Glitch Keynesianism The stock markets have discovered a new way of reducing volatility. It's called the 'turn it off method' and the London Stock Exchange, Borsa Italiana and ASX have all trialed it in the last two weeks. Italy was first, with a 'technical glitch'. Fears over Italy's exposure to Libya caused the stock exchange to remain closed for a day after it had fallen 3.6% the day before. Then the LSE experienced a 'technical glitch' shortly after UK GDP was revised downwards. As your editor is writing this, the ASX has ceased trading. Why? A 'technical glitch'. But while the stock markets stopped you from taking money out, the Commonwealth Bank decided to give people extra. Tired? Stressed? You'll feel better with gold! Amongst the din of financial news, you will find that gold made a series of all-time highs. Dan on Monday: 'If you're still not sure that gold is really money, ask yourself why Egypt has banned gold exports, according to the Middle East News Agency. It's a capital control that prevents money from leaving the country in times of civil unrest. Get used to it. You'll be seeing a lot more of it as the petro-dollar standard unravels.' Even the Italian banks have caught gold fever. Traditionally enemies of mark to market accounting, Italian banks are lobbying to have their gold reserves recognised as capital. Capital that has grown dramatically in value and should thus be marked to market. Of course, now that gold pessimists have been dealt a blow, the 'gold bubble' talk has returned. Gold will be in a bubble when the Australian cricket team's captain is selling gold coins on TV. When a former Reserve Bank Governor is telling you how safe the gold ETF is. And when the Gold Coast's NRL team is sponsored by Newcrest Mining, after having been renamed the Gold Coast Doubloons. For AFL fans, the Suns will be renamed the Bullions. 'Physical Delivery' will be their motto. The really big short Last week's comments about the dollar value assigned to a human life by American regulatory institutions have proven pretty divisive. Some criticised the math and data of the reader's comment. But the best take on the matter was as follows: Haha! 8 million per life!? 6 billion people in the world.. Each of them worth $8million, what is 8,000,000 x 6,000,000,000? Er.. $48,000,000,000,000,000? That sounds expensive.. Hmm, this human race seems over valued to me.. Where can I buy a short.. As though triggered by the comment, the UK government began looking for ways to devalue British lives: 'Speed limits on the motorway could be increased to 80mph in a bid to increase productivity, Philip Hammond, the transport secretary, has suggested. Mr Hammond said that safety might no longer be the sole consideration in judging how fast cars can go and that gains to the economy from shorter journey times should also be taken into account.' Apart from being amusing, is there anything to this idea of speed limits and productivity? The Germans are supposed to be the economic powerhouse of Europe and they do have the partially speed-limitless Autobahn. Perhaps the Keynesians could adopt a stimulus package that increases speed limits. Or, we could implement an automatic stabiliser, by which the maximum speed limit in Australia is determined by last quarter's GDP growth. One thing is for sure - we know Labor has a history of sacrificing lives in its stimulus attempts. So why not try it? Nick Hubble |

| Stock & Gold Markets Technical Update Posted: 04 Mar 2011 09:19 AM PST I've consulted with the best in the business, and spent the past week tightening up my template, so 100% of the focus in my newsletter is on trading markets. I want to give you maximum coverage of all the major markets in play, as I trade them myself. To do that, at the level of professionalism I demand from myself, I have to leave economic and political commentary to others in the gold community who are much better at it that I am. To make you the most money, I need to focus 100% of my time and effort on what I do best, which is technical analysis of price and volume. The stock market is now front and center on my radar screen, and my technical work is flashing substantial signals of danger. I believe the talking heads on financial TV are drastically underestimating how fast and hard the stock market could sell-off. Look carefully at my SPY chart below. This situation could get very, very ugly.

Gold and Precious Metals

"Don't just buy my target, but instead buy all the way to my target, because sentiment figures are continuing to improve in this severely oversold market. The bottom could be put in at any time."

Gold Juniors GDXJ Chart

SIVR (Silver Proxy) 6 Mth Chart

Unique Introduction For Web Readers: Send me an email to alerts@superforcesignals.com and I'll send you 3 of my next Super Force Surge Signals, as I send them to paid subscribers, to you for free! If you want more details on the system itself, send me an email to clarity@superforcesignals.com and I'll send you the 3 set video series I'm putting together! Thank-you! The SuperForce Proprietary SURGE index SIGNALS: 25 SuperForce Buy or 25 SuperForce Sell: Solid Power. Stay alert for our SuperForce, sent by email to subscribers, for both the daily charts on Super Force Signals at www.superforcesignals.com and for the 60 minute charts at www.superforce60.com About Super Force Signals: Frank Johnson: Executive Editor, Macro Risk Manager. Email: |

| The Dollar Sags as Key EU Decisions Loom Posted: 04 Mar 2011 09:08 AM PST Brian Dolan submits: The Week Ahead, Updated March 4, 2011

The Dollar Sags as Key EU Decisions Loom The greenback slumped further as violence in Libya escalated and fears continue to mount of unrest spreading to other, more economically significant countries in the region. Despite the largest gain in jobs since census-induced hiring in mid-2010, and other signs of improvement in U.S. labor markets e.g. further declines in initial claims, the buck limped out at its lowest level for the year, according to the USD Index. But the USD's performance was mixed against most currencies other than the EUR, which rallied across the board on ECB rate hike expectations (see below). All in all, it could have Complete Story » |

| Investing in Silver Instead of Toilet Paper Currencies Posted: 04 Mar 2011 09:00 AM PST I was intrigued by an essay titled "What You Need to Know About Buying Silver Today"' which came as the result of Jeff Clark, of Big Gold, being interviewed by The Daily Crux. Of course, Mr. Clark knows all the reasons to buy silver, and deftly ticks them off, one after another, as I would do if they ever asked me, instead of everyone always rudely shouting at me, "Hey! You can't come in here!" and "Don't eat that!" and, "Stop yelling at me to buy gold, silver and oil stocks as protection against the suicidal lunacy of the Federal Reserve creating so much money!" Mr. Clark never actually gets to the point of hysterical raving that people should buy, buy, buy silver, silver, silver, and calling people idiots – idiots! – if they are not buying silver, which is convenient for me because that is exactly what I do. Idiot! You're an idiot if you are not buying silver! See? Anyway, The Daily Crux asks the Big Question On Everyone's Lips (BQOEL), which is, "Just how high do you think silver could go?" I was hoping that he would, as I would, immediately launch into "attack mode" and say, "What kind of stupid question is that to ask? The whole thing depends on the purchasing power of the dollar, which is literally headed towards zero because of the constant, massive, unbelievable over-creation of dollars by the evil Federal Reserve, which would mean that the price of an ounce of silver would be, literally, infinity dollars! That's how high silver will go, you moron, as will the prices of everything go to infinity, when the dollar has zero purchasing power left, and is, finally, like all fiat currencies, worth Exactly Freaking Zero (EFZ)!" I could mention Zimbabwe because Zimbabwe is a very recent example, of the thousands and thousands of fiat currencies through history that have gone to zero value because of over-creation, of a currency that went to zero value because of its over-creation. As a case in point, and in a particularly pointed-yet-distasteful way as befits the whole subject of currency destruction, massive inflation, bankruptcy and ruination, I remember a photo of a sign posted in a Zimbabwe toilet, advising users as to what could be properly be used as toilet paper in this particular crapper. It read, "No cardboard. No cloth. No Zim notes." How disgusting! Money that is not even usable as toilet paper! So, the question for today's Mogambo Pop Quiz (MPQ) is, "What is the price of an ounce of silver, priced in Zimbabwe dollars?" Well, since the Zimbabwe dollar is not officially worth zero, the MPQ is an easy one: The price, in Zim notes, is, literally, infinity! This means that one ounce of silver – one lousy ounce of silver! – now costs more than all the Zimbabwe dollars ever printed! Ever! And, more horrifically and closer to home, since the American dollar is on the same sorry path, the fate of the US dollar will be that of the Zimbabwe dollar, making silver a screaming bargain, and if you are not buying it, then you are an idiot! At this point, I would usually degenerate into a Patented Mogambo Brand (PMB) of raw, in-your-face aggression on how the American dollar is a Big Piece Of Crap (BPOC) because of the Federal Reserve creating so staggeringly many of them, or a rant about how we Americans are a big bunch of idiots, or how the ultimate price of one ounce of silver is, like Zimbabwe, more than all the American dollars ever printed, making silver, at less than $35 an ounce, such a screaming bargain that to not buy silver is to proclaim yourself an idiot. Mr. Clark, sensing my underlying motive, appeals to our greed! "Good choice!" I say! He says, "Many people don't realize this, but silver rose 3,646% in the 1970s, from its November '71 low to its January 1980 high. If you were to apply the same percentage rise to our current bull market, silver would climb another 500% from here, and the price would hit $160 an ounce." Wow! Of course, all of these fabulous gains in silver presume a dollar with a relatively consistent buying power, which ain't going to happen, and instead the dollar will continue to fall in purchasing power and thus everything will become more and more expensive, all the time more and more expensive, all because the despicable Federal Reserve is continuing to create So Freaking Much Money (SFMM). But you won't care! Your buying gold, silver and oil stocks all along the way, as the evil Federal Reserve kept creating so much money, will have made you rich, rich, rich! And so what is a horror of life-or-death misery for others is of no consequence to you, and you just say to yourself, "Whee! That investing stuff was easy!" The Mogambo Guru Investing in Silver Instead of Toilet Paper Currencies originally appeared in the Daily Reckoning. The Daily Reckoning has published articles on the impact of quantitative easing, bakken oil, and hyperinflation. |

| Historical Comex closing gold and silver spot? Posted: 04 Mar 2011 08:53 AM PST How can I find out what the closing Comex gold and silver spot price was on any particular day going back several years? |

| Posted: 04 Mar 2011 08:15 AM PST Recently silver shares broke higher. Earlier this week we provided our subscribers with price targets on some of the premier silver companies. Silver Wheaton (SLW) has a target of $51, First Majestic (AG) $19, Fortuna Silver (FVITF) $6, Alexco Resources (AXU) $11, Endeavour Silver (EXK) $9.50, and Silvercorp (SVM) $17.50. Jordan Roy-Byrne, CMT Jordan@TheDailyGold.com |

| Dollar vs. Gold in a Dual Inflation-Deflation Economy Posted: 04 Mar 2011 07:44 AM PST Doug Eberhardt submits: Every time you hear "the dollar's down" or "the dollar's up," what exactly does that mean? If someone says the dollar is currently trading at 76.54, as it is today, what does that tell you about the relative strength of the dollar or its purchasing power? The truth is, it doesn't tell you much at all. I began to make this case in Why Gold Is a Better Currency Indicator Than the U.S. Dollar Index. In this article I will further explain how looking at the dollar as represented by the dollar index alone doesn't paint a complete picture and how inflation and deflation are occurring at the same time - and what that means for gold investors. The Dollar Has Been Up and Down the Last Three Years We can see from the following chart that the dollar, as represented by the Dollar Index, has been above and below Complete Story » |

| An incredible chart you have to see to believe Posted: 04 Mar 2011 07:32 AM PST From Zero Hedge: The chart which we presented a few weeks ago courtesy of Sean Corrigan sees a few additional components added to it. Whereas before the chart focused on the Adjusted Austrian money supply and commodity prices, it now sees the addition of the S&P and Junk spreads. In a word: every single asset class correlates 1:1 with... Read full article (with chart)... More on inflation: The next 10 days could determine the fate of the U.S. dollar Marc Faber answers the most important question in the world The Federal Reserve is creating HUGE instability in commodities |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment