Gold World News Flash |

- Not enough metal to put dollar back on gold, Bernanke says

- Thailand also Facing the Kraken

- In The News Today

- Dwindling Comex Silver Bullion, But Where Is the Gold Coming ...

- Guest Post: Banks Face Renewed Headwinds

- Egypt Paper Plunges On Latest Stock Market Reopening Delay, 266 Day Bond Hits 12.47% Following Partial Auction Failure

- Graham Summers’ Free Weekly Market Forecast (Death of the Dollar Edition)

- Utah House Passes Bill Recognizing Gold, Silver as Legal Tender

- THE RECOGNITION STAGE

- 6 Years and Counting: Why Investing in Commodities is STILL the Way to Go!

- Smith Barney's Louise Yamada has sky-high targets for gold, silver, oil

- QE2: An Unmitigated Disaster?

- Gold Surges, Hits New All Time High Of $1,437 After Precious Metals Talked Up During PDAC Conference

- Of 5 Gold Miners, Markets Value Goldcorp's High Margins Most

- Sean Corrigan's Take On The Fed's "Apres Moi Le Deluge" Policy Which Only "A Krugman" Can Approve Of

- CHRIS IS BACK!!!! Pay your tax with Gold and Silver in Utah? WTF?

- Louise Yamada - $80 Silver, $2,000 Gold & $140 Oil

- Oil, gold both surge on MENA unrest

- Silver Wheaton CEO Not Thinking About Hedging Silver Until $50

- The Kraken Devouring China

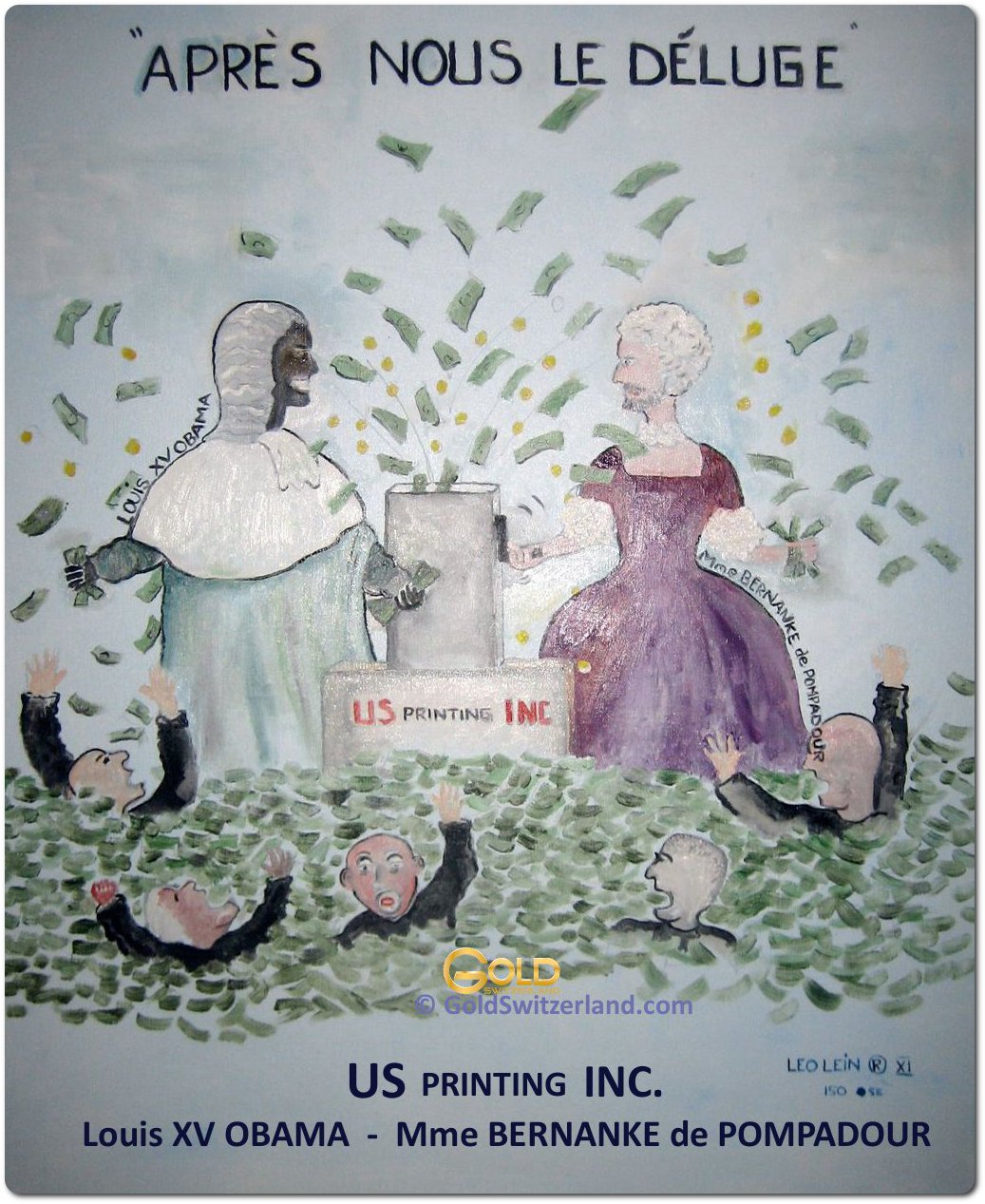

- Egon von Greyerz: "A Hyperinflationary Deluge Is Imminent", And Why, Therefore, Bernanke's Motto Is "Après Nous Le Déluge"

- Silver Liberation Army Official Communiqué No 2: Formal Declaration of War on Banker Occupation

- Physical Silver Price is Really $50 per Ounce (80% Premium on COMEX Silver Non-Delivery)

- Everything Is Now Correlated Exclusively To The Fed's Balance Sheet

- Senator James McClure – A Remembrance

- Apres nous le deluge

- We're Just Gonna Inflate Our Way Out Of It! (Or Are We...)

- U.S. considers oil market intervention

| Not enough metal to put dollar back on gold, Bernanke says Posted: 06 Mar 2011 06:30 PM PST | ||||||||||||||||||||||||||||

| Thailand also Facing the Kraken Posted: 06 Mar 2011 06:00 PM PST Many thanks to Paul, a reader who sends us this story about the problems that Thailand is also facing from the inflation beast. Any wonder why gold and silver prices are generally strong during the Asian session? Thailand may remove oil subsidy as fund runs out BANGKOK, March 4 (Reuters) - Thailand's state Oil Fund has fallen to about 7 billion baht ($230 million), the Energy Ministry said on Friday, suggesting the government may soon remove a fuel subsidy, which could add to inflation worries. [URL]http://af.reuters.com/article/energyOilNews/idAFSGE72302F20110304[/URL]Read the entire story here:... | ||||||||||||||||||||||||||||

| Posted: 06 Mar 2011 05:31 PM PST View the original post at jsmineset.com... March 06, 2011 11:10 AM Dear CIGAs, The developments in the Middle East are not a spontaneous outbreak of democracy. They are carefully planned, organized and misunderstood developments focused on crippling those that oppose Iran. The mercenaries that found their way to Libya should raise an eyebrow in the Situation Room. It is planned to initiate a spontaneous breakdown of Western civilization and financial viability based on the concept of peak oil. This concept alone guarantees a much longer gold bull market than almost anyone believes. There is no 1980 pratfall out there. Gold will stabilize in about 4 years at a very high price. This is a concept that has totally escaped the gold miners that went functionally broke on hedges by selling every ounce they mined, as fast as they mined it. That was madness, almost as crazy as their short of gold was. It is hard for a mad short taking it as a personal matter to reverse, and then go lon... | ||||||||||||||||||||||||||||

| Dwindling Comex Silver Bullion, But Where Is the Gold Coming ... Posted: 06 Mar 2011 04:33 PM PST | ||||||||||||||||||||||||||||

| Guest Post: Banks Face Renewed Headwinds Posted: 06 Mar 2011 03:25 PM PST Submitted by MacroStory.com Banks Face Renewed Headwinds "Citigroup, the third-largest U.S. bank by assets, also said U.S. regulators are examining how it structured and sold collateralized debt obligations as part of an investigation into mortgage-related businesses." - Bloomberg | ||||||||||||||||||||||||||||

| Posted: 06 Mar 2011 02:24 PM PST Remember when Egypt said that March 6 is the latest, guaranteed stock market reopen, or else? Well, the day has come and gone, and no Egypt stock market (all those who have been buying the EGPT ETF are forgiven for feeling like total idiots right about now). What however is trading are Egyptian bonds, which have plunged as a result of the ongoing total and complete chaos in the revolutionary country, which is now seeing a second wave of reactionary violence as fighting escalates between the police and protesters in Alexandria. As BusinessWeek reports: "Egypt’s borrowing costs are rising to the highest in more than two years and stocks listed overseas are tumbling as the Cairo exchange’s five-week shutdown and new rules on shareholder disclosure keep investors away. The Ministry of Finance sold 3 billion pounds ($509 million) of bonds yesterday, 1.5 billion pounds less than planned, as yields on 266-day notes climbed 31 basis points from the last auction to 12.47 percent, data compiled by Bloomberg show. Global depositary receipts of Commercial International Bank Egypt SAE sank 15 percent in London last week to the lowest level since July. Orascom Telecom Holding SAE traded 5.2 percent below its Jan. 27 close, when the Egyptian Exchange shut down." Our advice: don't expect Egypt to reopen any time soon, and certainly not before the situation in Libya is under control, which won't be for a long time. In the meantime the flight to safety trade (read gold, silver and crude) is raging overnight. And if and when it reopens, look for nothing less than freefall: "The EGX30 may drop another 10 percent when it eventually reopens, said Slim Feriani, London-based chief executive officer of Advance Emerging Capital Ltd., which manages $750 million in frontier and developing nation stocks including Egyptian shares." From BusinessWeek:

Adding insult to injury, if the EGX30 remains halted for more than 40 days, it will be moved to the symbolic equivalent of the pink sheets:

We are sure the Fadi Al Said speaks for all momentum lemmings who put their money into EGPT when he said..

Look for the escalating MENA panic to shift much more aggressively to Saudi Arabia, which despite the government's plunge protection efforts, is next in line for "delisting", and ultimately to Europe. | ||||||||||||||||||||||||||||

| Graham Summers’ Free Weekly Market Forecast (Death of the Dollar Edition) Posted: 06 Mar 2011 01:43 PM PST Graham Summers' Free Weekly Market Forecast (Death of the Dollar Edition)

The single most critical issue to note right now is the US Dollar's collapse. The US Dollar has broken below its multi-year trendline in a BIG way. Any hope of a bull market run is pretty much over and we're on our way to a MASSIVE currency devaluation.

Things are even uglier when you do a close-up of the breakdown. The greenback has already taken our support at 76.59 (its 2010 low). This leaves support at 74.98 (the 2009 low) and then 71.61 (the 2008 low). After that, it's GAME OVER for the US Dollar as we will be in uncharted territory.

Indeed, if we take out these last two lines of support, we're triggering the massive Head and Shoulders pattern which forecasts a 50% collapse in the US Dollar.

Understand, this will collapse not necessarily happen all at once. It might take years. But the chart predicts the US Dollar losing 50% of its value. The markets are already predicting this with commodities and other inflation hedges soaring across the board:

All of these assets, particularly Gold and Silver, will perform well in the coming months. However, their performance will pale compared to other, less well know inflation hedges. Why? Everyone knows that Gold and Silver are the most obvious inflation hedges out there. And to be blunt, anyone who invests in these two assets will likely do very well in the coming months as inflation erupts in the US. However, to make truly ENORMOUS gains from inflation you need to find the investments that are off the radar… investments that the rest of the investment world hasn't discovered yet. I'm talking about investments that own assets of TREMENDOUS value that are currently priced at absurdly low valuations: the sorts of assets that larger companies will pay obscene premiums to acquire. I detail the three best investments I know that fit these criteria in my new Special Report the Inflationary Storm Pt 2 which I just released to the public last Wednesday. Already two of these investments are up 5% and 13%. That's in just 10 days! I fully expect they'll ALL be in the triple figures within the next six months. And I'm only making 250 copies of this second report available to the public. Any more than that and we'll blow the lid off these investments too quickly. As I write this, there are only a few copies left. And I fully expect we'll sell out shortly. So if you want to pick up a copy of the Inflationary Storm Pt 2 (including the names, symbols, and how to buy my three NEWEST extraordinary inflation hedges) you better move quickly. To reserve a copy... Good Investing! Graham Summers

| ||||||||||||||||||||||||||||

| Utah House Passes Bill Recognizing Gold, Silver as Legal Tender Posted: 06 Mar 2011 01:19 PM PST "Massive gold demand continues to break records in China. The Extraordinary Events in the Middle East and the Coming Global Tsunami. Making the Chicken Run. " Yesterday in Gold and Silver The gold price stayed pretty much range-bound for all of Far East and London trading during their Friday trading session...but caught a bid shortly before nine a.m. in New York...with a secondary high of the day coming at 12 o'clock noon right on the button. From there, the price declined until 2:45 p.m. in electronic trading, before resuming its rally into the close...with the gold price closing virtually on its high price of the day, which was reported as $1,434.60 spot. Gold has only closed on its high of the day a handful of times in the twelve years I've been watching this market...and this is the first time I remember it closing at its high on a Friday. Whether it means anything or not, remains to be seen. The silver price gained about thirty cents up unti... | ||||||||||||||||||||||||||||

| Posted: 06 Mar 2011 01:09 PM PST At some point in any bull the market finally "catches on". That recognition phase shows up as an explosive expansion in volume on the weekly charts. In early `05 the market finally figured out that the steady rise in oil price wasn't a fluke. That it was in fact a massive bull market in the making. You can clearly see this "recognition phase" in the two charts below. The same thing happened with the major mining stocks in early `09. Silver has now reached the recognition stage. The market has also figured out what the bellweather mining stock of this secular bull is. This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||

| 6 Years and Counting: Why Investing in Commodities is STILL the Way to Go! Posted: 06 Mar 2011 12:26 PM PST | ||||||||||||||||||||||||||||

| Smith Barney's Louise Yamada has sky-high targets for gold, silver, oil Posted: 06 Mar 2011 12:16 PM PST 8:11p ET Sunday, March 6, 2011 Dear Friend of GATA and Gold (and Silver): Smith Barney's technical research chief, Louise Yamada, tells King World News that her target prices for gold are $1,500 and then $2,000, for silver $40 and eventually $80, and for oil $115 and eventually $140. Who does this respectable and establishment personage think she is -- John Embry or Jim Sinclair? You can find excerpts from the interview at the King World News Internet site here: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf | ||||||||||||||||||||||||||||

| Posted: 06 Mar 2011 10:44 AM PST By Dian L. Chu

QE2 Effects So Far:

About That Unemployment Rate... Clear Present Danger – Inflation

| ||||||||||||||||||||||||||||

| Gold Surges, Hits New All Time High Of $1,437 After Precious Metals Talked Up During PDAC Conference Posted: 06 Mar 2011 10:38 AM PST As the world continues to burn, gold hits a new all time high of $1,437 as silver is en route to pass $36. Whatever shorts did not cover on Friday night are strongly urged to postponed their "market top" speculation until another day. Elsewhere Bernanke is still confused by what the relentless march to daily all time highs in gold means... Reuters has some additional reasons why gold may be poised for much more upside:

| ||||||||||||||||||||||||||||

| Of 5 Gold Miners, Markets Value Goldcorp's High Margins Most Posted: 06 Mar 2011 08:03 AM PST Marco G. submits: Ms. Alix Steel (of Kitco Gold news fame) wrote about a fundamentally important point for gold miners (or any other type of miner), that all investors need to realize. In her article entitled "Record Gold Prices Not a Cure for Miners", she makes the point that total costs are key, and not the much-trumpeted cash costs for mining the golden metal. Following is a sampling of gold miners with cash costs and total costs extracted from her article:

The estimated margin in gold mining was arbitrarily calculated with the supplied costs and gives a truer picture of the company going forwards rather than Complete Story » | ||||||||||||||||||||||||||||

| Sean Corrigan's Take On The Fed's "Apres Moi Le Deluge" Policy Which Only "A Krugman" Can Approve Of Posted: 06 Mar 2011 07:32 AM PST The key running theme this weekend is "the flood", specifically that soon to be left in the wake of the Federal Reserve, which is now facing the last days of its ignoble existence. Previously, Egon von Greyerz shared his outlook on why the Pompadour-esque cliche will soon lead to a complete destruction of the dollar, and all other paper currencies. Now, it is the turn turn of Diapason's Sean Corrigan, who in his note from Thursday shares his view on the Fed's "reprehensible policy": "When the Chuck Prince Charleston suddenly stopped in 2008, the initial impact was just as dramatic on the market for machine tools, ceramic magnets, and silicon wafers as it was on lumber, carpets, and dishwashers and, so, the shock hit the surplus nations every bit as hard as the deficit ones as they all realised, to their horror, that they had all become nothing more than imprudent, Rueffian tailors. Since then, of course, the game has been replayed at an even more frantic pace, with governments largely taking pole position as the drivers of deficits, the media of monetization and, hence, the inflamers of inflation...By the time this last blunder works its way through the system, it will not just be the world's tinpot tyrants and biddable client kings who will pay the price for the Fed's reprehensible policy of 'apres moi le deluge', but it will be the ordinary man and woman who will have occasion to rue a programme so replete with intellectual arrogance, power-worship, and a wilful blindness to its awful, unintended consequences that only a Krugman could approve of it." From Sean Corrigan of Diapason Securities: As the ongoing rise in raw materials prices has been brought into sharper focus by the oil price spike occasioned by the Colonel's little local difficulties, several varieties of myths, half-truths, and Laputan impossibilities have once again begun to infest the punditosphere to the point where the still, small voice of rational analysis is in danger of being entirely drowned out.

What they also fail to consider is that if higher oil prices are a 'tax', then so are higher banana prices, or higher T-shirt prices, or higher soda prices. What they therefore overlook is that the development of higher prices everywhere - a state of affairs whose attainment they all mindlessly ap-plaud the Federal Reserve for striving towards — is not a blessing of modern monetary manipulation, but a bane. Implicitly a member of this same school of cart-before-the-horse Keynesians is former presidential advisor, Christina Romer, who used the pages of the NY Times last weekend to perpetuate the fallacy that when Roosevelt and his pet monetary cranks were ploughing under food and slaughtering herds while people in the land were literally starving, or when they were arbitrarily tinkering with the price of gold in semi-occult fashion over the great man's breakfast egg, their soi-disant courage in abandoning what was then the economic orthodoxy brought about a rapid end to a Depression which, in fact, turned out to be much more profound and protracted in New Deal America than in most other advanced nations — so much so, indeed, that a different strain of General Theory counter-inductionists frequently pops up to assure us that the horrors of World War II also had their silver lining in that the blessed upsurge in 'consumption' associated with tens of millions of deaths, the reduction of whole cities to cinders, and the delivery of half the globe to Communist tyranny did at least finally dispel the bogey of persistent over-capacity. [TD: that was a 185 word sentence] Warming fully to her theme, Ms. Romer went much further in her haruspications, insisting that if only the higher councils of the Federal Reserve were not now populated exclusively by 'monetary hawks' (sic), that hidebound bastion of monetary rectitude could 'engage in much more aggressive quantitative easing, both in size and in scope, to further lower long-term interest rates and value of the dollar.' As if that's what anybody needs at this point! Meanwhile, that glowering eagle among the preening hawks, Chairman Bernanke himself (no, really, this is just too much even for irony!) had the gall to tell a European audience that none of the world's present problems were his fault. He even wheeled out the hoary old fable of the 'global saving glut' - something we thought had been laid to rest alongside its complementary, pre-Crash idiocy of a 'global asset shortage.' As the man behind the screen of the most impor-tant economy in the Land of Oz, Bernanke is pre-sumably not unaware that the sins of both omis-sion and commission of which he is guilty when managing the world's reserve currency must have wider ramifications. So, when we talk of 'saving gluts', what we really mean — as no less a figure than Otmar Issing pointed out a few years ago - is not so much the voluntary, ex ante desire to forego a last nickel-and-dime, present con-sumption of American goods and services as it is the unfortunate result of the pressing, ex post dif-ficulty of disposing of the vast surplus of new dollars routinely being created with the full and enthusiastic blessing of the Fed. To put that enormous sum into perspective, we can note that the cumulative, ten-year deficits run up by all other OECD-member nations plus India and Brazil came to 'only' $3.8 trillion, or fully a third less than the US overspend. Depending on your taste, we can say that the US alone was responsible for eating up the equivalent of all the surpluses generated by the world's six biggest, non-oil, exporting nations (China, Japan, Ger¬many, Switzerland, the Netherlands, and Taiwan), or for almost twice the surpluses racked up by OPEC and Russia, combined, in a period when energy prices hit all-time, nominal dollar highs. It further tells us something of how correctly to apportion the blame for the presently inflamed nature of markets for both goods and assets when we see that, even in these last two years of supposed American 'de-leveraging' and enforced credit stringency, the US current account gap has still managed to amount to almost half the overall total registered by the entire roster of OECD deficit nations, taken all together. Now, it is true that the recipients of that Gilgamesh-like flood of Uncle Sam's suspect IOUs were not bound to pile them up in the local SWF or CB/Treasury foreign exchange account but neither is it obvious that simply to refuse all assistance to the local acquirers of dollars - leaving these to dispose of them in their own individual way - would have greatly mitigated the subsequent evils. After all, there was no official currency pegging at work in Continental Europe (not outside the pernicious system which bankrolled the importunate PIIGS, at least), yet hard-won, Teutonic and Swiss export dollars were still put to work by the local banks in financing some of the most arrant follies of the US credit bubble. Incidentally, for all the accusations of 'policy manipulation' being bandied about, we should note that, notwithstanding the risible declarations of hewing to a 'strong dollar', the Greenback has fallen further in value over the decade in question - on a real, effective, trade-weighted basis - than all bar a handful of economic basket cases and one overt mercantilist. Nor is it exactly a coincidence that an overlay of the US current account with the GDP figures for residential investment makes such a neat match. Unable to render a material settlement for the manifest of the Rest of the World's wares they desired, due to their nation's growing lack of industrial competitiveness, Americans simply took to buying and selling each other houses on a highly disproportionate scale, inadvertently providing the collateral necessary to attract funds back into the country and so to balance the books, however precariously, without overly scaring the dollar's owners with the pace of its depreciation.

Think of it as if a successful US property developer, building contractor, realtor, mortgage broker or CDO packager — in addition to a cash-out refi junkie - had spent a non-trivial portion of his earnings on a chunk of Chinese electronic and German automotive excellence — shipments for which there were insufficient local goods either to act as passable substitutes or to be accepted in payment by the foreign vendors. Note, in passing, that this lack arose in good part from the fact that too many people had become involved in non-tradable, debt-financed activities, like housing, defence, or government in general because the preferential provision of credit to those sectors made them seem far more lucrative undertakings than the tough sledding of out-competing overseas manufacturers was deemed to hold in prospect. The vicious circle which all this entailed would then be completed when the PBOC sequestered the dollars from the first sale and the local Landesbank received as a deposit those arising from the second, whereupon each institution would feed them back to those providing the mortgage finance from which our flat screen-watching, Beemer-driving hero was either making his living or eating his seed-corn. Do not misconstrue the argument here: the natural expansion of monetary means in the surexporting nation is not in itself an evil - this is, after all, exactly what the classic price-specie mechanism of self-regulating, negative feedbacks comprises. Nor do we wish to suggest that to make sales on credit is somehow not a vital part of a functioning economy, or that it is inherently reprehensible. True, such business should be conducted judiciously with a careful eye to the chances of repayment and a wise consideration of what the real value of the repaid monies is likely to buy, but without any such facility, the world would undoubtedly be a much poorer place. Where these both go wrong, however; where they become detrimental to the chances of sustained material progress is when two intertwined distortions are introduced by our modern day, state-directed, financial apparatus. The first of these occurs when what started as credit - i.e., the willing, contractual surrender of the lender's ability to buy present goods in favour of an accelerated capacity to acquire them on the part of the borrower - is turned, by the chicanery of fractional reserve banking, into money. Now, A does not cede his own ability to buy to a cash-strapped B, but rather has his bank alchemically transmute the narrow earnests of future payment - which A cautiously ac-cepted from B presumably in accord with his spe-cific knowledge of his counterparty - into the freely-employable, instantly transferrable, general medium of exchange we call money. In this way, A no longer has to wait for B to re-deem his promises by offering something of equal, produced value - either directly to A, or to the world at large in exchange for its money - before he, A, can enjoy more goods for himself. This means that a discrepancy has arisen between the quantity of goods at hand and the amount of the money with which to compete for them, all thanks to the legally unexceptionable, but logically invalid transmogrification undertaken by the CB-backstopped, fractional banking system. This may or may not manifest itself as what is today called 'inflation' - i.e., a rise in a statisti-cally-massaged index of consumer goods and services - but it ineluctably perverts the market signalling process by altering the relative prices of present goods and by introducing an artificial element of presumed capital availability into the discount afforded to future goods. Given the CB's prime agency in giving the illusion of stability to what is an inherently unsound and definitionally illiquid system - and, hence, in promoting its gross, debilitating hypertrophy - the blame for all the consequent ills of this fundamental violation of free-market principles can only lie with it and it alone. The more important the central bank, therefore, the larger its degree of incrimination in this destruction of wealth, Mr. Bernanke. The second disastrous act of interventionism takes place when that greater abundance of money in the seller's pockets - something which tends to reduce its marginal utility to him, leading him to value both goods and the labour he expends to acquire them more highly, thus raising their price and gradually lowering his competitiveness - is not offset by a reduced quantity of money in the pockets of the buyer - a lack which would otherwise bring about an equal and opposite restoration of relative valuation and pricing and so provide an ongoing impetus back towards a dynamic balance, well before the whole shape of industry becomes locked into a highly sub-optimal pattern or the burden of associated obligations grows too crushing. Rest assured, there would still be trade surpluses and trade deficits under an unhampered system of payments, but they would never loom anywhere so large if the addition to the money- backing reserves of those in credit could only come about by means of an equal-and-opposite reduction in the reserves of the debtor - a natural motion for which the over-optimistic reliance on a commensurate adjustment taking place in unanchored, often wildly fluctuating, exchange-rate parities is a very poor substitute as well as impracticably bad politics. Then again, such an 'economics of illusion' - in preferring a stealthy erosion of the capital-eaters' living standards via external devaluation to a more honest recognition of the effects of their profligacy through internal revaluation - is par for the course for the Keynes-inspired mainstream of inveterate money illusionists.

Just as the inadvisability, in normal circumstances, of pursuing 'orthodox' QE (a denomination to which we are forced since a deviancy so widely-practised can hardly now merit the adjective, 'heterodox') is widely recognised by even the most dyed-in-the-wool inflationists because of the lack of restraint it implies upon all those wishing to borrow money - not least the insatiable Jacobin meddlers who toil infernally in the bowels of the Provider State - so should we condemn out-of-hand this whole, ongoing business of QE-by-proxy. That does not, however, lead to the verdict that it is all the fault of the Others and that the Fed stands pristinely absolved of all crimes. After all, the Others are perforce operating under doctrines promulgated by, and within an institutional framework minutely devised by, the global hegemon; an ad-mixture which consists of erroneous conclusions, falsely drawn - a la Romer - from the trauma of the Great Depression, and venal, full-spectrum dominance, self-interest. Thus, though neither the diligent Mr. Wu nor the assiduous Herr Meyer could have been expected to realise it, what they were engaged in was not the investment of some of the fruits of their successful, overseas business endeavours in the American property market, as much as in the often indirect provision of finance to their own customers - affording these the means to continue to buy their goods—albeit in a form issued against the dubious security of a condo possibly owned by an entirely unrelated third party of increasingly questionable standing. Hence, when the Chuck Prince Charleston suddenly stopped in 2008, the initial impact was just as dramatic on the market for machine tools, ceramic magnets, and silicon wafers as it was on lumber, carpets, and dishwashers and, so, the shock hit the surplus nations every bit as hard as the deficit ones as they all realised, to their horror, that they had all become nothing more than imprudent, Rueffian tailors. Since then, of course, the game has been replayed at an even more frantic pace, with governments largely taking pole position as the drivers of deficits, the media of monetization and, hence, the inflamers of inflation. No-one is wholly innocent in this regard, but it is clear that, if the PBoC has vied manfully with the Fed for the laurels for much of the course of this dreadful race to the bottom, only the latter institution was guilty of redoubling its efforts at just the wrong moment last year - and only this institution was hubristic enough to accompany its outrage with the nakedly inflationist manifesto issued by its Chairman amid the high-profile mediafest of the Jackson Hole confabulation. By the time this last blunder works its way through the system, it will not just be the world's tinpot tyrants and biddable client kings who will pay the price for the Fed's reprehensible policy of 'apres moi le deluge', but it will be the ordinary man and woman who will have occasion to rue a programme so replete with intellectual arrogance, power-worship, and a wilful blindness to its awful, unintended consequences that only a Krugman could approve of it. | ||||||||||||||||||||||||||||

| CHRIS IS BACK!!!! Pay your tax with Gold and Silver in Utah? WTF? Posted: 06 Mar 2011 07:15 AM PST | ||||||||||||||||||||||||||||

| Louise Yamada - $80 Silver, $2,000 Gold & $140 Oil Posted: 06 Mar 2011 07:05 AM PST  With gold near all-time highs and silver at multi-decade highs, King World News interviewed Louise Yamada, well known for her astounding work on Wall Street. Louise had some extraordinary targets on silver and oil, and when asked gold she stated, "Gold looks fine as it is moving to a new high. Gold is probably on its way to $1,500 and then $2,000. Silver is outperforming right now, but they take turns so that is normal. Gold remains in a structural bull market that was initiated in 2002." With gold near all-time highs and silver at multi-decade highs, King World News interviewed Louise Yamada, well known for her astounding work on Wall Street. Louise had some extraordinary targets on silver and oil, and when asked gold she stated, "Gold looks fine as it is moving to a new high. Gold is probably on its way to $1,500 and then $2,000. Silver is outperforming right now, but they take turns so that is normal. Gold remains in a structural bull market that was initiated in 2002." This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||

| Oil, gold both surge on MENA unrest Posted: 06 Mar 2011 06:55 AM PST Advisor One report from Friday. . . "Gold is expected to continue to rise, not just because of the oil situation, but also in response to the euro's rise; with the ECB set now to raise interest rates in April, before the U.S., the euro is expected to continue to strengthen compared to the dollar, and the correlation between the rise of gold and the fall of the dollar is seen as continuing." Marlene Y. Yatter USAGOLD: As Libya chaos escalates, this report says oil usually exported to the U.S. from Algeria could be diverted to Europe driving up prices in the U.S. Full blown civil war possible, says Financial Times. MENA = Middle East/North Africa. Also. . . . Gasoline goes over $4 per gallon in parts of U.S. Potential problems in Saudi Arabia could weigh heavy on this afternoon's open (4pm MST). Shiites protest in Bahrain and SA. SA bans demonstrations. | ||||||||||||||||||||||||||||

| Silver Wheaton CEO Not Thinking About Hedging Silver Until $50 Posted: 06 Mar 2011 06:41 AM PST Dr. Duru submits: The number $50 per ounce appeared in another discussion about silver. I first came across this target in James Turk's theory about three stages for silver's bull market with stage 2 beginning at $50. This time $50/ounce came up in an interview with Silver Wheaton's CEO, Peter Barnes, as he discussed SLW's earnings results on CNBC (video below). Barnes noted that some "reputable banks" have made predictions for silver to hit $50/ounce by the end of the year. He thinks silver will definitely go through $50 in the next 2-3 years, but it "could be quicker." Barnes's bullishness was confirmed when he stated that hedging the company's silver is nowhere on the horizon; hedging might be considered once silver hits $50. (Silver closed at $35.33 on Friday, March 4). Silver's bull run continues apace, and I am quite surprised that SLV, the iShares Silver Trust, is already up 10% since Complete Story » | ||||||||||||||||||||||||||||

| Posted: 06 Mar 2011 06:30 AM PST I keep bringing this up even at the risk of beating a dead horse because I believe that the inflation monster is rampaging through many Asian countries, particularly China, at a pace which is putting a severe amount of stress on government policy makers not to mention consumers This is the reason that Asian demand for gold and silver is so robust and also the reason I believe that all dips in price for the metals will be eagerly bought. Factoring in the current inflation rate of China, savers there are experiencing negative REAL rates of return. Gold and silver therefore are like a lifeline to those citizens who are attempting to preserve their buying power. It could well be that part of the "strategy" behind the Fed's Quantitative Easing Policy is to put so much pressure on the Chinese that they have no choice but to let the Yuan rise to a more natural equilibrium level to defeat the Kraken. Here's the kicker however, if any upward revaluation in the Yuan were to serve to correct... | ||||||||||||||||||||||||||||

| Posted: 06 Mar 2011 06:17 AM PST From Egon von Greyerz of Matterhorn Asset Management Apres Nous, Le Deluge Happy days are here again! Stock markets are strong, company profits are up, bankers are making record profits and bonuses, unemployment is declining, and inflation is non-existent. Obama and Bernanke are the dream team making the US into the Superpower it once was. Yes, it is amazing the castles in the air that can be built with paper money and deceitful manipulation of all economic data. And Madame Bernanke de Pompadour will do anything to keep King Louis XV Obama happy, including flooding markets with unlimited amounts of printed money. They both know that, in their holy alliance, they are committing a cardinal sin. But clinging to power is more important than the good of the country. An economic and social disaster is imminent for the US and a major part of the world and Bernanke de Pompadour and Louis XV Obama are praying that it won’t happen during their reign: “Après nous le déluge”. (Warm thanks to my good friend the artist Leo Lein).  Moral and financial decadenceA deluge of an unprecedented magnitude is both inevitable and imminent. The consequences of the economic and political mismanagement will have a devastating impact on the world for a very long time. And the consequences will touch most corners of the world in so many different areas; economic, financial, social, political and geopolitical. The adjustment that the world will undergo in the next decade or longer, will be of such colossal magnitude that life will be very different for coming generations compared to the current social, financial and moral decadence. But history always gives us lessons and the one that is coming will be necessary and eventually good for the world. But the transition and adjustment will be extremely traumatic for most of us. We have reached a degree of decadence that in many aspects equals what happened in the Roman Empire before its fall. The family is no longer the kernel of society. More than 50% of children in the Western world grow up in a one parent home, either being born by a single mother or with divorced parents. Children are neither taught ethical or moral values nor discipline. Many children consider attending school as optional and education standards are declining precipitously. Most families do not have a meal around the dinner table even once a week. Sex and violence are common place on television and in real life. Both press and television create totally false values and ideals. Everyone must be young and beautiful often enhanced by surgical or digital means. Old people have little value and their wisdom is not benefitting the younger generations. The Golden Calf or materialism is the ultimate value that is worshipped and no means are eschewed to attain material goals. Since most of the prosperity that has been achieved in the last 40 years is based on printed money and debt, it is totally false and unsustainable. A major part of the Western world has improved their living standard, by exchanging services and swapping houses at ever rising prices financed by printed paper and credit. The perceived wealth that is created out of this is illusory and ephemeral. We have created a world economy which is based on debt and thin air. The Gini coefficient of income and wealth is now reaching extremes in many countries. This measures th But it is not only the US that will experience financial misery, famine and social unrest. This will also hit most European countries and in particular the UK, southern Europe, Eastern Europe and the Baltic States as well as African countries, the Middle East, Asia, yes in fact the whole world. Are boom and busts inevitable?Well if you listened to the former British Labour Prime Minster Gordon Brown, he proudly declared that he had abolished booms and busts and thus economic cycles. But he was expeditiously thrown out at the next bust which of course had nothing to do with him since he blamed the US sub-prime market for his ill-fated destiny. Cycles or ebbs and flows are a natural part of both economic life and nature. And right at the point when something could be done to limit the damage, most nations seem to have the uncanny knack of selecting the political individuals who will put fuel on the fire and make the situation catastrophically worse. Greenspan was one such individual. During his 19 years as Chairman of the Fed, he could have limited the economic and social damage that the US would suffer. Instead he took every single measure possible to ensure that there would be a catastrophe with uncontrollable consequences. But we shouldn’t just blame the incompetence of Greenspan. It was sickening to watch every sycophantic congressman and senator licking Greenspan’s boots and praising his wisdom. Because Greenspan’s money printing and incompetent interest rate management created one of the biggest financial bubbles in world economic history. But the politicians loved this. It made the stock market boom, and house prices surge. Thus the politicians were all loved by their voters who did not understand the dire consequences that were looming. And Bernanke de Pompadour is continuing the same disastrous policies of creating money out of thin air. When will they ever learn that creating money out of thin air and running astronomical deficits that never will be repaid with normal money leads to the road of total ruin? When will they ever learn? The very sad answer is that they won’t and therefore they are leading the world into a hyperinflationary depression that will have uncontrollable and cataclysmic consequences for current and future generations. Empty stomachs are riotingWe have for years warned about hyperinflation leading to famine, misery and social unrest. Well, this is exactly what is happening in many parts of the world. The protests and overthrowing of regimes in Tunisia, Egypt and Libya are primarily due to a major part of the peoples of these nations having no job, no money and little food. It is their empty stomachs that are rioting. In addition they are protesting against the leaders of these countries stealing from the people. It is virtually certain that these riots will spread to many countries in the Middle East, Africa and the developing world. This will lead to new regimes and new political orders that could either be far left or far right politically or religious extremists. But the new regimes will not be in a position to change the root of the problem which is famine and poverty. In Egypt for example there has been a quiet military coup. It is unlikely that a democratic regime will take over from the military. So the people will protest again and again. And this will be the same in most countries. Eventually the people will take the law into their own hands since no regime will be able to give them the food that they need.

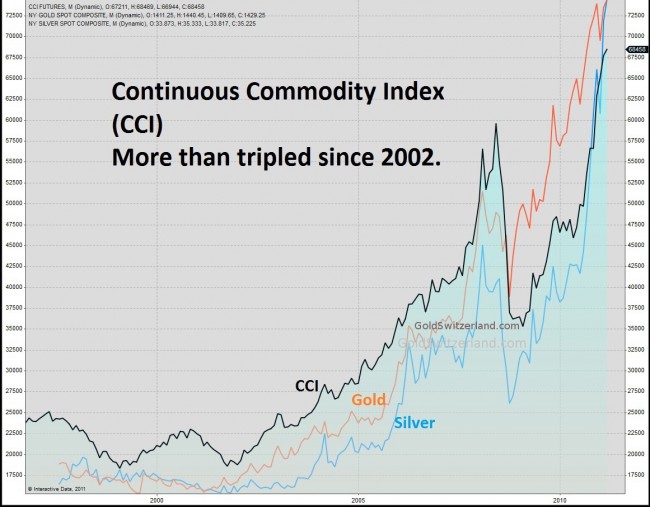

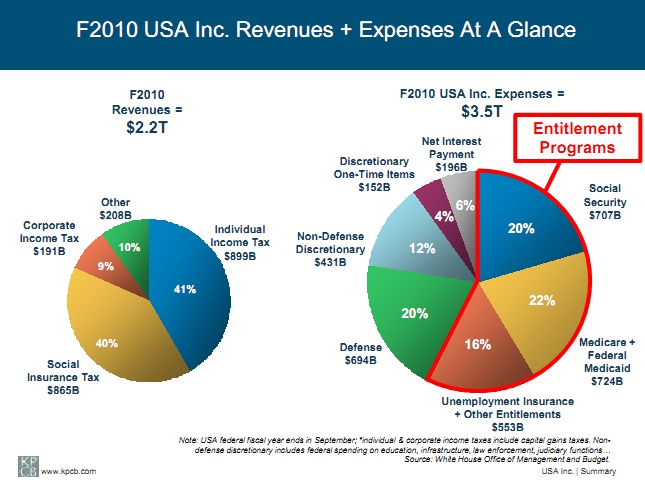

The hyperinflationary deluge is imminentAlthough food and fuel inflation is rampant worldwide already, we are only seeing the very beginning. Massive oil price rises are likely to continue as a result of the geopolitical situation as well as peak-oil. The Middle East is a time bomb waiting to go off. Israel is in an extremely precarious position and the involvement or non-involvement of the US in this conflict would both have dire consequences for Israel and peace in the world. Food prices will continue to rise dramatically. Major parts of the world are living below the poverty line today and this will increase exponentially. The lethal concoction of rising food and fuel prices is already affecting the Western world. The Continuous Commodity Index – CCI, (60% food, 17% energy and 23% metals) has almost doubled since the low in early 2009 and has gone up 42% in the last 12 months. The almost vertical rise of the CCI is one of the best indicators of hyperinflation being imminent. A catastrophe of astronomical proportions is looming. This will hit the world at a time when there is no capacity whatsoever to take any real measures that could alleviate the problems. Most countries are already running major deficits which will increase dramatically in the next few years. The banking system is bankrupt and is only holding together due to false valuations of toxic debt and derivatives. This is done with the blessing of governments since virtually no major bank could face an honest valuation of its assets. Unemployment and especially youth unemployment is currently a problem worldwide and it will get much worse. In 2010, the US government spent 60% more than its revenues. In order to balance the budget individual and corporate income taxes would have to double.

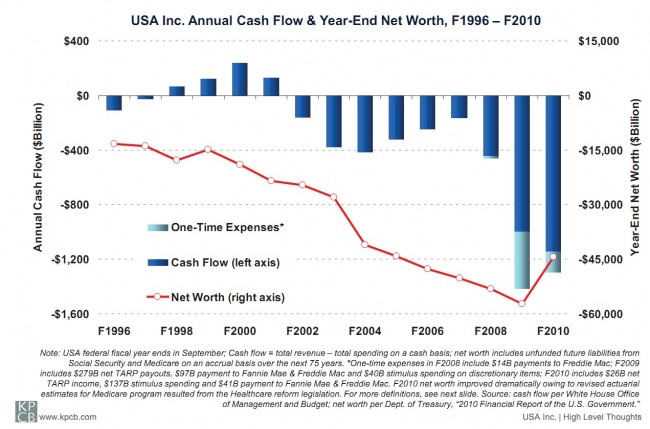

Never before in history has the world run out of real money as well as (affordable) food and fuel simultaneously. But his is exactly what is happening now and it will get substantially worse in the next few months and years. Financial misery, famine and high unemployment combined with governments that will not be in a position to give real help are a recipe for disaster that will lead to social unrest and revolutions not only in developing countries but also in the West. Hungry people are desperate people and desperate people do desperate deeds. We could see already in 2011 food shortages, and riots both in Europe and in the US. Hyperinflation WatchThe following are INDISPUTALBLE FACTS:

The above facts are clear evidence of an economy that has been totally mismanaged. But more importantly most of these trends are now starting to accelerate – a clear sign that hyperinflation is just around the corner.

With years of negative net worth and negative cash flow, the US is bankrupt today. The Federal deficit is forecast to increase by at least another $ 5 trillion in the next 5-7 years. Add to this the State deficits, the Municipal and City deficits that are rising at a galloping rate and we have a country that is going to haemorrhage to death in the next few years. One wonders when the totally ineffective and clueless rating agencies are going to fathom this. Not that it will matter if they once do. One also wonders what Mme Bernanke de Pompadour and his court are thinking. “She” and her courtiers should have above average intelligence and could not possibly avoid seeing the facts that we all see today (of course, some of us have seen it coming for over a decade). But “she” has to please her master King Louis XV Obama and her devotion to the king goes above all reasonable common sense, or rationale. So the two of them will continue to crank up the printing press and drown their people and the world in worthless paper.

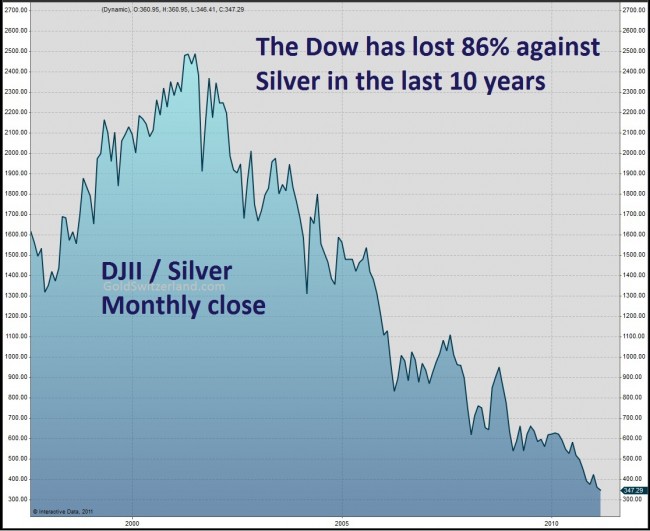

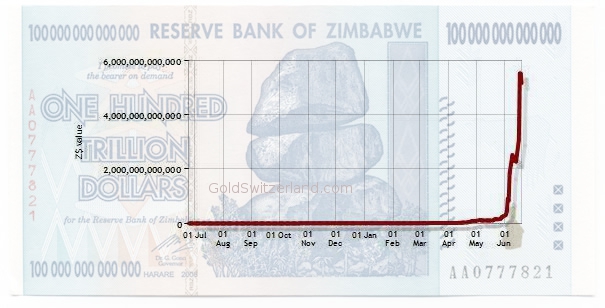

Stock MarketTo believe that the current money printing liquidity boom is real and sustainable would be a very serious and expensive mistake. The temporary and illusionary pickup that we are now seeing in the economy and stock market is the normal initial phase of a hyperinflationary economy. It must not be mistaken for a real improvement in the economy. The normal pattern at the beginning of a hyperinflationary period is that stock markets surge. This is the result of the increased liquidity and a flight to more inflation proof assets. This was the case in for example the Weimar Republic and Zimbabwe. Just look at the chart below of the Zimbabwe stock exchange that went from 1,420 in January 2005 to 5.4 trillion in June 2008, a 3 billion per cent increase. That was of course in Zimbabwe dollars. In US dollars the stock exchange went sideways with major volatility. So in hyperinflationary terms stock markets could continue to rise initially thus making them a better investment than cash. However, measured against real money, the Dow has gone down 82% against gold since 1999 and 86% against silver since 2001 (see chart above). We are currently seeing a dead cat bounce but we expect the Dow to decline a further 90%, at least, against gold in the next few years. So even if stock market investments will initially give the illusion of protecting investors, it will be a very poor hedge against the ravages of hyperinflation in real terms. ZIMBABWE STOCK INDEX 2007-2008

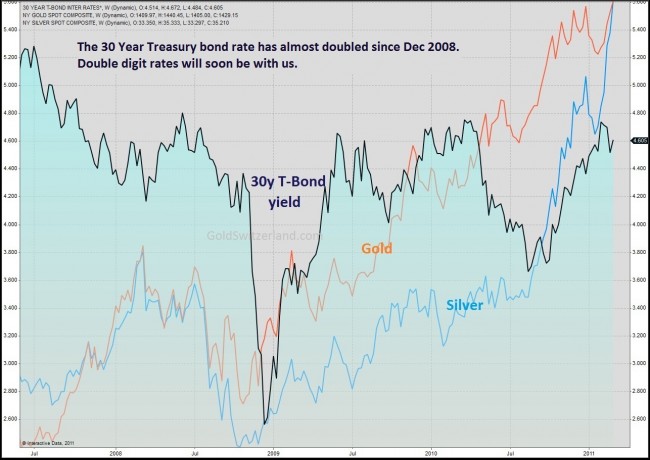

Bond marketIn January 2009, we warned investors that long term interest rates were bottoming. Since then the 30 year bond yield is up from 2.6% to 4.6% an 80% rise. But more importantly the 30 year is currently in the process of breaking a 17 year downtrend line which dates back to 1994. This confirms that rates will now start a major and rapid rise which is likely to reach the mid-teens or higher. Governments will attempt to keep short rates low due to weak economies but eventually the rising long rates will put strong upward pressure on the short rates. So the flight to government bonds that we have seen in the last few years will soon reverse into a massive rush for the exit. This will coincide with rapidly increasing financing requirements by the US, UK, EU and many other governments. The poisonous concoction of rising rates and rising financing needs will create a vicious circle of collapsing bond markets and unsustainably high financing cost. This will continue to drive interest rates even higher which will further increase deficits and necessitate even faster running printing presses. Add to that a collapsing currency and the hyperinflationary picture is complete. It is our very strong view that investors should exit bond markets entirely if they want to avoid a total destruction of their assets. Currency MarketAs we have explained for many years, hyperinflation is created by the government destroying the currency as a result of money printing to finance deficits. This leads to the cost push inflation that we are now experiencing. Add to that, shortages in commodities worldwide, thus creating the perfect hyperinflationary scenario. The Dollar, the Pound, the Euro and many other currencies will continue to decline. They can’t all decline against each other at the same time so the market will take turns in attacking one currency at a time. But all currencies will continue to decline against gold. We believe that the dollar will soon start a very rapid fall against gold and against many currencies. Investors should exit the Dollar and also the Pound and the Euro. There is no currency better than gold or silver but for any small amounts of cash we prefer the Swiss Franc, the Norwegian Krone, the Singapore dollar and the Canadian dollar. Wealth ProtectionA hyperinflationary depression will destroy the value of money as well as most assets that were financed by the credit bubble (property, stock market). Wealth protection is now critical and urgent. We see no better way of protecting assets against total destruction than physical gold and silver stored outside the banking system. Thereafter, precious metals, energy and food stocks are our preference. But it must be remembered that any asset including stocks that is held through a bank is dependent on a sound and surviving banking system. The real move in precious metals is still to come as we have outlined in many articles. Less than 1% of investors own gold. Before this economic cycle is over we are likely to see a mania in physical precious metals that will drive prices exponentially higher. And luckily for investors, this is a mania which is unlikely to end in a collapse since gold most probably will be part of a future reserve currency. Finally we are again quoting von Mises who clearly understood that “le déluge” is inevitable: “There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises | ||||||||||||||||||||||||||||

| Silver Liberation Army Official Communiqué No 2: Formal Declaration of War on Banker Occupation Posted: 06 Mar 2011 05:58 AM PST | ||||||||||||||||||||||||||||

| Physical Silver Price is Really $50 per Ounce (80% Premium on COMEX Silver Non-Delivery) Posted: 06 Mar 2011 05:46 AM PST This just in from Harvey Organ's review of the gold and silver market. Wynter_Benton update on their recent raid With permission, I can update the results of our raid. It was successful beyond imagination but that "success" has spawned even more questions about the price of paper silver going forward. It was reported by SGS that he heard that on Friday Blythe was offering 30-50 percent premium and that at least 4500 hundred contracts will stand for delivery. I am here to give you a more accurate update (and a first hand account of what happened on Friday Feb 25). Our group was detemined to stand for delivery going into Monday because we were not going to take a 30 percent premium on a price of $33.50. | ||||||||||||||||||||||||||||

| Everything Is Now Correlated Exclusively To The Fed's Balance Sheet Posted: 06 Mar 2011 05:37 AM PST (ZeroHedge) The chart which we presented a few weeks ago courtesy of Sean Corrigan sees a few additional components added to it. Whereas before the chart focused on the Adjusted Austrian money supply and commodity prices, it now sees the addition of the S&P and Junk spreads. In a word: every single asset class correlates 1:1 with the Fed's balance sheet. If the Fed is really planning on ending QE2 on June 30, the market collapse will be epic. And, yes, this should not come as a surprise to anyone. | ||||||||||||||||||||||||||||

| Senator James McClure – A Remembrance Posted: 06 Mar 2011 05:13 AM PST Long before the Tea Party movement, there was the Sagebrush Rebellion — a movement in the Rocky Mountain states to push back federal government intrusion in our daily lives. The titular head of that movement was James A. McClure, then a senator from Idaho. He did something that would be impossible to achieve today: He read every word of every bill he ever voted on. Just the presence of the 2400-page Health bill might have provoked his resignation from the Senate. When he quit the Senate after three terms, he did so because he could no longer sanction the politicos who had come to dominate Congress. "Wet-finger politicians," he called them. In many ways, he epitomized the West as it was and still is once you cut away the modern trappings. McClure didn't become someone other than who he was simply because he worked in Washington, D.C. He represented the West and, in a way, he was the West. Senator McClure is famous in gold lore for sponsoring the legislation in 1974 allowing private citizens to own gold bullion and coins. By it, Congress also repealed Franklin Delano Roosevelt's infamous gold ownership ban of 1933. It was that law coupled with the formal devaluations of the dollar in 1971 and 1973 that led me to consider gold as profession at 25 years of age. We lost Senator McClure this past week at 86 years of age and I didn't want his passing to go without a mention at the USAGOLD website. It was his bold position in the early 1970s that led to the gold industry which followed in its wake, and for that I will always be grateful. – Michael J. Kosares | ||||||||||||||||||||||||||||

| Posted: 06 Mar 2011 04:13 AM PST (After us the deluge) "The real move in precious metals is still to come as we have outlined in many articles. Less than 1% of investors own gold. Before this economic cycle is over we are likely to see a mania in physical precious metals that will drive prices exponentially higher. And luckily for investors, this is a mania which is unlikely to end in a collapse since gold most probably will be part of a future reserve currency." Egon von Greyerz USAGOLD: Nothing adds more to gold's long term value than the notion that nation states are likely to accord it a stronger role in central bank (or national) reserves. Where once central banks were net seller's of gold, they are now net buyers. I see this development, in terms of the effect on the gold price, as akin to the original Central Bank Gold Agreement which regulated the flow of gold from the central banks and ignited the now ten-year old bull market. The yellow brick road widens from here. – Michael J. Kosares | ||||||||||||||||||||||||||||

| We're Just Gonna Inflate Our Way Out Of It! (Or Are We...) Posted: 06 Mar 2011 04:00 AM PST From Contrary Investor We're Just Gonna Inflate Our Way Out If It!...Oh really? I don't think so, Scooter. In a recent discussion we mentioned the fact that lately former Fed member Larry Lindsey has been talking up the idea of a potential fiscal trap for the US. To be honest, we believe this idea has already played itself out in Japan and day by day is coming to a Euro theater near you in terms of individual country experience. The whole idea of a fiscal trap involves the combination of sovereign debt levels with manipulated domestic interest rate levels. Japan has been a poster child example of this simple concept. By artificially holding its domestic interest rates at the theoretical zero bound, it has allowed the government to lever up in a magnitude that most likely never could have happened had free market forces set domestic interest rate levels. Japan has enjoyed an artificial depressant on nominal dollar (in this case Yen) interest costs that has made incredible sovereign debt expansion feel relatively benign from an ongoing debt servicing cost perspective relative to what has been up to this point the magnitude of ongoing sovereign revenue collection.

And of course what has happened to 1 year Treasury rates since the dawn of 2007? They have fallen from literally 4.94% to under .3%. You get the picture. The government has been able to take on this magnitude of new debt as debt service costs are negligible under 30 basis points. This is the birth place of the fiscal trap. | ||||||||||||||||||||||||||||

| U.S. considers oil market intervention Posted: 06 Mar 2011 03:56 AM PST White House Considers Tapping Oil Reserves By Jackie Frank http://www.reuters.com/article/2011/03/06/us-usa-energy-reserves-idUSTRE... WASHINGTON -- White House Chief of Staff William Daley said on Sunday the Obama administration was considering tapping into the U.S. strategic oil reserve as a way to help ease soaring oil prices. Speaking on NBC television's "Meet the Press," Daley said: "We are looking at the options. The issue of the reserves is one we are considering. It is something that only is done -- and has been done -- in very rare occasions. There's a bunch of factors that have to be looked at. And it is just not the price." "All matters have to be on the table when you see the difficulty coming out of this economic crisis we're in and the fragility," Daley added. Congress has pressured the Obama administration to look to the emergency oil supply to ease consumers' fears over rising gasoline prices, which are threatening again to top $4 per gallon at U.S. gas stations. ... Dispatch continues below ... ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php Higher oil prices could undermine the fragile U.S. economic recovery and politically damage President Barack Obama as he moves toward his 2012 re-election bid. While the White House has said governments around the world had options, including oil reserves, that could be used to prevent an inflationary price spiral due to oil supply disruptions, none have taken the rare step of tapping into their oil reserves. U.S. oil prices jumped on Friday to more than $3 a barrel to $105.17, their highest level since September 2008, as fighting in Libya worsened and protests in the Middle East intensified. The International Energy Agency said the revolt in Africa's third-largest producer had blocked about 60 percent of Libya's 1.6 million bpd (barrels per day) oil output, largely due to the flight of thousands of foreign oil workers. On Thursday, U.S. Treasury Secretary Timothy Geithner played down the risks to the oil supply from political disturbances in the oil-rich Middle East and North Africa in testimony before a congressional panel. He said there was "considerable" spare oil production capacity around the world and "substantial" reserves on hand. "If necessary, those reserves could be mobilized to help mitigate the effect of a severe, sustained supply disruption," Geithner told the U.S. Senate Foreign Relations Committee. Geithner said high food and oil prices were causing hardships in many parts of the world. But he said Americans were feeling less impact. There has been support among Senate Democrats for tapping America's emergency oil supply to cool gasoline prices. Senator Jay Rockefeller urged Obama on Thursday to allow a "limited draw-down" from the oil reserves, to "protect our national security by preventing or reducing the adverse impact of an oil shortage. But Republican Senator Lamar Alexander, speaking on CNN's "State of the Union" on Sunday, said he would not support the oil reserve drawdown. On Wednesday, U.S. Energy Secretary Steven Chu ruled out releasing oil from the reserve, saying ramped-up oil production in Saudi Arabia should lower the crude price. "That's going to mitigate the price increase," he told reporters. "We're hoping market forces will take care of this." Tapping the Strategic Petroleum Reserve, created in the mid-1970s after the Arab oil embargo, is a relatively rare event. It has been U.S. policy to turn to the emergency supply only when faced with a major supply disruption. It was last done in 2005 following Hurricane Katrina, helping to drive oil prices down by about 9 percent. British finance minister George Osborne on Friday signaled he would cut the country's fuel tax to counter soaring oil prices. A one penny-per-liter rise in the fuel duty planned by the previous Labour government was due to take effect in April. Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf | ||||||||||||||||||||||||||||

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment