saveyourassetsfirst3 |

- King Dollar? The Swiss Franc (FXF) May Become the World's Currency

- Institutional Voyeurism: Gold and Gold Miners

- How to perfectly Paint silver charts 101

- Paging Blythe, we hear there are 19,500 silver contracts standing still, paging Blythe

- Forget the "fear trade"... This is the No. 1 reason gold is soaring

- Pimco's El-Erian: The Mid-East crisis is creating huge opportunity in these countries

- Exodus

- SLV ETF Adds More Silver: 2,929,386 Ounces on Thursday

- Newmont Guides Lower for 2011

- Gold, Silver “Rumored” and “Margined” Lower

- Will a Weak Dollar Do Us Any Good?

- What You Need to Know About Buying Silver Today

- Gold Up, Silver Down as Soaring Oil…

- The Worldwide Revolutionary Outlook

- He Who Begins to Count Begins to Err

- SLV - Options, weird? You tell me...

- Silver proxy SLV, 30 minute chart

- 28,000 silver soldiers still ready for big box delivery, bring it.

- Royal Canadian Mint Now Saying It’s Difficult Securing Silver

- Sound, Credible Silver Prices

- Metals Lower after Resistance Holds

- Food Price Inflation Calculator

- Did you buy silver today?

- Gold Mining Stocks Trendpower

- Okay, so I guess there are no more problems anymore...FUBM

- Paging Blythe where are u hiding today? Silver lease rates still above 1.2%, paging Blythe

- The Economy And Housing Sink Further…And The Fed Telegraphs QE3

- Civil Unrest Moving Markets

- QE2: The Road to a Gold Standard

| King Dollar? The Swiss Franc (FXF) May Become the World's Currency Posted: 25 Feb 2011 06:13 AM PST  Gary Gordon submits: Gary Gordon submits: Oil has been stealing the mainstream media headlines. And quite frankly, the Libya-inspired surge in crude should be the lead story. However, there's a far more intriguing "back-pager" that investors need to know about. The Swiss franc hit an all-time high against the U.S. dollar on Thursday. Note: You may want to look at the trend for Currency Shares Swiss Franc (FXF). We're not just talking about gains against the devalued greenback; rather, an alternative currency became the currency of choice during geo-political upheaval in the Middle East and North Africa. Consider the handful of successful investments during the worldwide financial collapse in 2008. Safe-haven seekers won with gold, the Japanese yen and the U.S. dollar. Similarly, troubled by the sovereign debt crisis in early 2010, investors looked to the U.S. dollar for comfort. During turmoil and uncertainty in 2011? Safety-seekers still went for the yen and gold, but they Complete Story » | ||

| Institutional Voyeurism: Gold and Gold Miners Posted: 25 Feb 2011 04:32 AM PST Leisa submits: Some years ago I wrote on institutional voyeurism. There is something fascinating about taking a peek under the hood of institutional holders' (IH) portfolios. I indulged this fascination this morning upon waking with the idea of wanting to look at the composition of IVs in both GLD and GDX that had these tickers as a top 5 position. My favorite place to go on IVs is J3SG My data is from their website. Here's the table that I prepared showing institutions group by the ranking of each ticker in their portfolio (click all images for enhanced viewing). What is this table saying? GDX: 52.5% of the dollars are held by 6.4% of the total IHs as a top five holding. GLD: 42.8% of the dollars are held by 16.6% of the total IHs as a top five holding. Let's take a closer look at this composition: Forty-nine percent of holdings Complete Story » | ||

| How to perfectly Paint silver charts 101 Posted: 25 Feb 2011 01:38 AM PST Do you see what I see? See how psychologically mindfucking this chart is? Welcome to Blythe's word. She is the master of the universe. She does what she wants, when she wants. Put your hands together, and pray for at least 8000 contracts to stand for delivery. Should have more insider over the weekend on this. Notice the chart pattern here on the weekly? I took this chart from Jesse's | ||

| Paging Blythe, we hear there are 19,500 silver contracts standing still, paging Blythe Posted: 25 Feb 2011 12:24 AM PST Okay here's how its going to go today: 1. Just in from a trader on the desk-Blythe is handing out 30-50% premiums OVER spot to settle in cash. 2. 19,500 remaining resolute. So you see where her problem is still??? 3. In order to get this to ZERO, she needs to HAMMER the price today to entice more to settle for cash before Monday. 4. Bring it you world corrupting whore, we have | ||

| Forget the "fear trade"... This is the No. 1 reason gold is soaring Posted: 25 Feb 2011 12:01 AM PST From Frank Holmes of U.S. Global Investors: This week, the World Gold Council (WGC) confirmed something we'd already suspected: 2010 was a remarkable year for gold. Overall demand grew by nine percent to reach a 10-year high on increased jewelry demand, strong momentum in key Asian markets, and a paradigm shift in the official sector, the WGC says. Demand for jewelry was the biggest contributor to gold demand, accounting for 54 percent of the total. That's a 17 percent rise despite gold prices jumping 26 percent in many currencies. Gold demand for technology increased 12 percent. Surprisingly, investment demand declined two percent as investment in gold ETFs dropped 45 percent. Even with the drop, 2010 was the second-highest year on record in terms of investment demand. India led the world in gold jewelry demand with more than 745 tons. China was a distant second at just under 400 tons and the U.S. third at 128 tons. While the pace of consumption has slowed in several countries, gold consumption for jewelry remains at elevated levels around the world. The story behind the rise in demand is one you've heard from us before. The WGC's data is validation that the... Read full article... More on gold: Gold guru Turk: $8,000 gold may still be too cheap Why you should be prepared for a gold price collapse This startling Chinese gold development has "stunned" precious metals traders | ||

| Pimco's El-Erian: The Mid-East crisis is creating huge opportunity in these countries Posted: 24 Feb 2011 11:52 PM PST From Newsmax: Political turmoil in Libya is pumping up oil prices globally and creating investment opportunities outside the rocky Middle East, says Mohamed El-Erian, co-head of Pimco, the world's largest bond fund. Unrest in Libya has driven crude oil prices above $100 a barrel. Yet higher crude prices are good for oil producers Russia, Canada, and Indonesia, who aren't experiencing political upheaval. So invest... Read full article... More from Pimco: Pimco CEO: These investors should prepare for major losses Bond giant Pimco is making a huge bet that deflationists are wrong Pimco's El-Erian: Middle Eastern crisis is a huge warning for the U.S.dollar | ||

| Posted: 24 Feb 2011 10:11 PM PST

Mercenary Links Roundup for Thursday, Feb 24 (below the jump).

02-24 Thursday

| ||

| SLV ETF Adds More Silver: 2,929,386 Ounces on Thursday Posted: 24 Feb 2011 08:30 PM PST Ted Butler: Speak up and be heard by the CFTC one more time. Much Higher Gold Prices Because of Move in Oil: Rick Rule. Royal Canadian Mint Now Saying It's Difficult to Secure Silver...and much more. ¤ Yesterday in Gold and SilverThe gold price wandered around either side of unchanged for most of Far East trading on Thursday, before finally catching a bit of a bid shortly after 2:00 p.m. Hong Kong time. By the time that New York opened at 8:20 a.m. Eastern yesterday morning...gold was up about six whole dollars...and that was also its high of the day at $1,416.90 spot. From the Comex open, gold struggled right up until the end of Comex trading at 1:30 p.m...and then the roof caved in as the New York bullion banks pulled their bids. In the thin volume of electronic trading, this had its usual devastating effect...and the gold price cratered over twenty bucks. Gold's low tick [$1,391.40 spot] was around 3:15 p.m...but managed to recover back over the $1,400 mark before the 5:15 p.m. New York close.

Silver hit its high of the day [around $33.80 spot] moments before the London open...and opened unchanged in New York. From there, silver slowly drifted lower before getting the living snot kicked out of it in electronic trading after the Comex close. It should come as no surprise that silver hit its nadir [$31.72 spot] at precisely the same time as gold...around 3:15 p.m. Eastern. From it's early morning high around 8:00 a.m. in London, to its absolute low in electronic trading in New York...silver got smacked for a hair over two bucks...although it did manage to recover a good chunk of those losses before the close of trading. As Ted Butler pointed out to me yesterday, the price drops in electronic trading involved very little volume...but it was as blatant a criminal act as you'll ever witness in any commodity market. It's obvious to both Ted and myself that JPMorgan et al [along with the CME] have been given a get-out-of-jail-free card by CFTC Chairman Gary Gensler...and will be allowed to wiggle out of their short positions without ending up in the slammer, no matter how much harm they do along the way.

When all was said and done yesterday, gold was down 0.68%, platinum down 0.06%, palladium down 0.51%...and silver was down 4.26%. Any questions? The dollar continued to slide lower, with some price volatility during early London trading...and closed down just under 30 basis points at the end of the New York day.

For reason's I still can't figure out, the gold shares were down right from the New York open yesterday...and continued to decline all day long despite the fact that the gold price was in positive territory until 1:30 p.m. Eastern. The HUI closed virtually on its low of the day...down 2.92%. Even though the gold price got creamed for over $20 in a two hour period...that fact doesn't stand out on the HUI chart unless you know where to look...and there's no sign of the fact that gold recovered ten bucks after its 3:30 p.m. low. The silver stocks got smoked across the board. It was wall-to-wall ugly yesterday...and it's on counterintuitive share price action days like yesterday when I wonder if someone isn't dicking with the share prices. But, as I've said before, maybe I'm looking for black bears in dark rooms that aren't there.

The CME's Daily Delivery Notice showed that 61 gold along with 10 silver contracts were posted for delivery on Monday. All the usual suspects were in attendance...and the link to that action is here. The GLD ETF had another down day yesterday...this time shedding 214,613 ounces. The SLV ETF went the other way...adding another big chunk of silver. This time it was 2,929,386 troy ounces. In the last two days the SLV ETF has added 10.4 million ounces...which is a bit over five days of world silver production. That, dear reader, is a lot! Over at Switzerland's Zürcher Kantonalbank last week, they reported adding 9,613 ounces of gold and 392,675 ounces of silver to their respective ETFs. I thank Ted Butler for those numbers. The U.S. Mint had a smallish sales report yesterday...as they reported selling another 25,000 silver eagles. Month-to-date the mint has sold 83,500 ounces of gold eagles, along with 2,663,500 silver eagles. It was another slow day over at the Comex-approved depositories on Wednesday. They received no silver at all...and shipped out a smallish 34,655 ounces. We are only three business days away from the first silver being shipped out the door for the March contract...and not a single shipment of any size has been received at the Comex to meet this delivery demand. There's still time, of course, but it's getting pretty close to the wire.

¤ Critical ReadsSubscribeAdjusted Monetary Base Goes VerticalToday's first story is courtesy of reader Mike Molleur...and is to be found posted over at zerohedge.com. The increase of $142 billion in the last two weeks is the fifth largest Adjusted Monetary Base expansion in history. The ongoing upward movement of this chart may result in some further acuteness of inflationary expectations. The story is one paragraph long...and the chart is worth the trip all by itself. Click here.  Procter & Gamble to Raise Prices as Costs IncreaseTalking about 'inflationary expectations'...reader Phil Barlett has the next read of the day. It's a Reuters piece that turned up in yesterday's edition of The New York Times. Proctor & Gamblewill raise some prices as it absorbs higher commodity costs and its sales goal may be under pressure if business does not improve in the United States and other developed markets, Chief Financial Officer Jon Moeller said. I didn't hear any signs of economic recovery in that comment, did you? Linked here.  Airfares Are Chasing Oil Prices HigherThis story is one that I shamelessly stole from yesterday's King Report...and it's from the Wednesday edition of The New York Times. Airline passengers should prepare themselves for sticker shock this year. As the carriers have tried to keep up with rapidly rising oil prices, they have already increased their fares four times since the start of the year, compared with only three increases for all of 2010. The airlines have also raised some of their fees, imposed summer peak-time surcharges and added hefty fuel surcharges on international flights. Link here.  Thousands protest against high food prices in DelhiReader 'David in California' sent me this posting from over at bbc.co.uk yesterday. Thousands of people have gathered in the Indian capital, Delhi, to take part in a rally to protest against rising food prices and unemployment. A steady stream of protesters, carrying red flags, has been marching through the streets of central Delhi since early morning...and has led to massive traffic jams in the city. As long as world's central banks keep printing money, the higher all commodity prices are going to rise. It's Economics 101. Link here.  New Home Sales Plummet 13% To 284,000 Annualized Rate, 19K Actual Homes Sold Lowest Monthly EverWashington state reader S.A. is up to the plate with our next story of the day. This is another zerohedge.com piece that shows just how bad the real estate market is in the U.S...and that's not about to change for a very long time. It's one paragraph of prose...along with two charts...and it's worth the trip. Linked here.  President of Iceland veto of Icesave repayments bill sparks outrageWhat would this column be like without at least offering from reader Roy Stephens. This AFP story was posted late last night over at the france24.com website. President Olafur Ragnar Grimsson's decision to veto a new bill on Icesave that had passed parliament with a large majority has sent shockwaves through Iceland, where many thought the painful issue was finally coming to a close. Icelandic negotiators have been struggling for more than two years to reach an acceptable deal on how to repay Britain and the Netherlands for the 3.9 billion euros ($5.3 billion) they spent compensating around 340,000 of their citizens hit by the collapse of online bank Icesave in October 2008 at the height of the financial crisis. I know exactly how the approximately 350,000 good citizens of Iceland are going to deal with this. They're going to vote it down...which exactly what they should do. This is well worth the read...and the link is here.  Hundreds of repossessed homes and idle cranes go for auction in IrelandReader U.D. has this story from Ireland that's posted over at the irishcentral.com website. Apartments that until a few years ago sold for $205,000 in the Celtic Tiger economy are now on the market at discounts as low as $34,167 during Ireland's first ever mass auction of repossessed homes. Even the upscale Dublin 4 district is offering apartments formerly on sale for $1,230,030 for a previously unheard of reserve price closer to $300,674. The auction is on April 15th. Linked here.  Rage against the Political Machine: Election Will Herald a New Era in IrelandWhile we're on the subject of Ireland...here's another Roy Stephens offering about that country...this one from the German website spiegel.de. When the Irish vote in the country's general election on Friday, they will be keen to punish those politicians they see as responsible for the country's sorry state. But the hands of the next go | ||

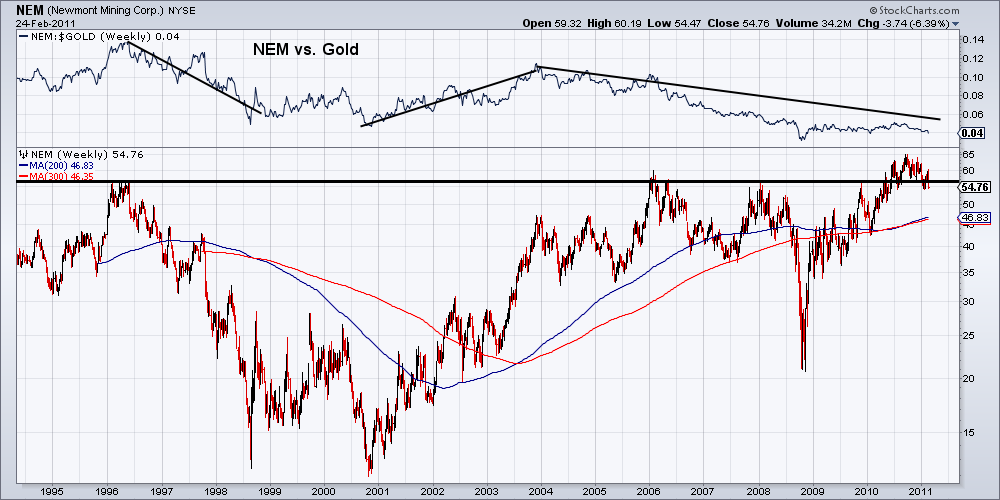

| Posted: 24 Feb 2011 06:45 PM PST Newmont Mining (NEM) reported its Q4 earnings yesterday. The company beat analyst expectations for both profits and revenue. Profits were up 46%. However, the company guided for lower production in 2011. Newmont shares took it on the chin, falling 6.3% on Thursday. Those who are looking to large cap miners as a way to play Gold might want to think again. We've written many times regarding the inability of large miners to outperform Gold. This is true not just in the past 10 years but in the past 100. Below we show the chart of Newmont and we also show the stock priced against Gold. Amazingly, Newmont today is at the same price it was in 2008, 2006 and 1996. In other words, Newmont has underperformed Gold badly. Sure, Newmont has done well the last few years, but given the law of numbers and the company's track record, there is a small chance that the company can grow enough to outperform Gold. This is why we believe that its better to own physical (e.g CEF, GTU, PHYS) than large caps. To get leverage to Gold and Silver, one needs to invest in the mid-tier and junior companies. This is what we focus on in our premium publication. If you are looking to ride this bull market and achieve growth, you need to invest in the juniors and mid-tiers. Consider a free 14-day trial to our service. Jordan Roy-Byrne, CMT Jordan@TheDailyGold.com | ||

| Gold, Silver “Rumored” and “Margined” Lower Posted: 24 Feb 2011 05:20 PM PST HOUSTON – We remain on the sidelines with our short-term gold and silver trading ammo, watching the developments unfold in patient, Vulture fashion. We Vultures are like that. We don't feel the need to chase rallies and we don't feel like we have to have our trading ammo deployed 100% of the time. This is not the first gold and silver rally we have missed and it won't be the last. In truth, we are kind of glad for the break and double glad because it has been our experience that event-driven rallies like the one underway presently are more often than not fragile. ... | ||

| Will a Weak Dollar Do Us Any Good? Posted: 24 Feb 2011 05:12 PM PST | ||

| What You Need to Know About Buying Silver Today Posted: 24 Feb 2011 05:01 PM PST | ||

| Gold Up, Silver Down as Soaring Oil… Posted: 24 Feb 2011 04:49 PM PST | ||

| The Worldwide Revolutionary Outlook Posted: 24 Feb 2011 02:34 PM PST We don't especially like numbers here at The Daily Reckoning. You can't trust them. But we follow a few of them anyway. Like these numbers... 107.01 12.70 The first number above is for the Dow. The second is for gold. They show us what happened in yesterday's trading. And yesterday, the first number was negative. The second was positive. Not that there aren't a lot more interesting, provocative numbers around. But we only follow the big picture here. And those two numbers tell us most of what we need to know. At least, they give us a good starting point. The Dow number is going down because investors are worried. That's why the gold number is going up too. What if these Cereal Revolutions get out of hand? What if they spread to Saudi Arabia? What if the price of oil keeps going up? "Gasoline at $4 a gallon?" asked a headline yesterday. What would gasoline at $4 a gallon do to the US economy? This is another of those pieces of the puzzle that we mentioned yesterday. Ben Bernanke, who would probably make a fine high school math teacher, knows nothing about economics. He thinks all he has to do is to add more money and the whole "recovery" picture will be complete. Investors will see their stocks go up. Employers will hire. Shoppers will shop. Bakers will bake more. Shoeshine boys will start slapping the leather. Wheelwrights will...well, never mind. But then, the puzzle pieces change shape. He pumps in money. The price of oil goes up. And food. And the Arabs, who depend heavily on grain imports, get themselves worked up. And then the price of oil goes up more. And stocks begin to fall. And US consumers pay more for gasoline... ..and suddenly, the picture is not at all what the Fed chairman had hoped for. But wait. It gets worse. Look at a third number: 220. It's what the big Japanese securities firm, Nomura, thinks the price of oil could reach, thanks to the Cereal Revolutions. And maybe they're right. Gaddafi is no Mubarak, say the papers. When he says he'll fight...he could mean it. And others are getting ready for a fight too. Saudi Arabia is trying to head off trouble. And reports tell us that China is worried and increasing its security measures. And what about France? And the USA? Has your editor lost his mind? Not completely. "I'll give you a prediction," said a smart French woman with whom we dined last night. "What's happening in North Africa will soon be happening in France." "And if you look at how wealth is distributed in the US," said a companion, "it is really amazing. Something like 95% of the population lives below what we would consider the poverty level here in Europe. I don't know how they live. It's only the extremely high earnings of the other 5% that makes the average seem normal. And almost all the new wealth created in the last 10 years has gone to a tiny percentage of the population. "You and I may know that Ben Bernanke and the US monetary policies are largely responsible for the wealth has been concentrated in the hands of the rich. But the man on the street has no idea. He just thinks it is wrong. And unfair. What is really amazing is that he hasn't already begun a revolution..." For more about numbers - both what they mean and what they don't mean - take a look at what Chris Mayer has to say in the column below... We were quoted in The Wall Street Journal last week. "Gold is a bet against the Fed," we said. Gold is now firmly over $1,400 an ounce. The correction seems to be over. Frankly, we were disappointed. We were hoping for a deep correction that would shake out the speculators and discourage the Johnny-come- lately investors. Didn't happen. Instead, the price barely went down at all. Less than 10% (from vague memory). Hardly a correction. We wanted lower prices so we could buy more. Because, if there were ever a sure-fire, under-priced wager here's one: betting that the Fed will err. You can understand the power of that bet just by taking the other side for a moment. Who, in his right mind, would bet that the Fed won't err? Thanks largely to the Fed and other central banks, the crisis that began 4 years ago with the bankruptcy of subprime lender Countrywide Financial was never resolved. Instead, the problems were largely increased. The private sector still has far too much debt. Now, the public sector is headed for bankruptcy too. It is only a matter of time before new crises arise and intensify. Ben Bernanke has never given the slightest indication, hint or wink to suggest that he has any idea of what is really going on or that he understands how an economy really works. At every point over the last 5 years, his analysis has been incorrect. His predictions have been wrong. And his policies have made things worse. You want to bet on Ben Bernanke? Yes, thanks...we'll take that bet. We'll take your money! *** Was there ever a problem so intractable...or a situation so awful...that government planning couldn't make worse? Here's the latest. With food prices soaring, the feds move into the market. They need to go back and read the Old Testament. An ancient Mubarak in the land of the pyramids was faced with famine. But he had the good sense to save up grain when it was cheap...and release it to the people when it was dear. These morons are doing the opposite. A pox on their houses! May their beer be always flat!

Regards, Bill Bonner, | ||

| He Who Begins to Count Begins to Err Posted: 24 Feb 2011 02:33 PM PST "If you spend more than 13 minutes analyzing economic and market forecasts," the famous investor, Peter Lynch, once remarked, "you've wasted 10 minutes." Oskar Morgenstern (1902-1977), a professional economist, probably would have agreed with Lynch. I found myself thinking about Morgenstern over breakfast recently as I was skimming financial headlines in the newspaper. He was a "numbers guy" who understood the limitations of numbers. Today's papers carry lots of angst over rising prices, commonly called inflation. "Global Price Fears Mount," reads one Wall Street Journal headline. "New Push at Fed to Set an Official Inflation Goal," reads another. Within these articles are a number of "facts." I want you to go through these and see if you can tell what the unifying fallacy is: "Annual inflation in China is almost 5%..." "Last month [in Europe], inflation unexpectedly jumped to 2.2% in the eurozone from 1.9%, the first time in more than two years it has exceeded the ECB's target of just below 2%. Some economists say it will rise about 2.5% in the next two months" "Inflation [excluding food and energy] was still weak at 1.1% in December" "UK inflation is approaching 4%..." "The Fed informally has said its goal is inflation of around 2%" "Forecasts cluster around 1.75% and 2%." There are more, but this sampling is large enough to make my point. The underlying fallacy here essentially boils down to the idea that government officials can calculate a true inflation rate to within one- tenth of one percent. And that's not all! Government officials can also dial inflation up or down to within tolerances of one-tenth of one percent. This is where Oskar Morgenstern comes in. Morgenstern was a German-born economist, educated in Vienna. When Adolf Hitler took over Austria, Morgenstern happened to be in the US. He decided to stay. Good move. Morgenstern is most famous today for his work with John von Neumann in founding game theory. I was thinking of him because of a famous essay he wrote entitled, "Qui Numerare Incipit Errare Incipit" ("He Who Begins to Count Begins to Err"). He is not the only one to take economists to task for their abuse of statistics, but his thoughtful analysis stands out in my mind. Essentially, Morgenstern's point is that we need to be more aware of the errors in such numbers. He criticized the way in which people report and use these numbers. They purport an accuracy that does not exist. Here is an extended quote from his essay, which gives us a small list of sins: "Changes in consumers' total spending power down to the last billion or less (i.e., variation of less than one-half of one percent) are reported and taken seriously. Price indexes for wholesale and retail prices are shown to second decimals, even though there have been so many computing steps that the rounding-off errors alone may preclude such a degree of precision. Unemployment figures of several millions are given down to the last 1,000s (i.e., one-hundredths of one percent 'accuracy'), when certainly 100,000s, or in some cases perhaps the millions, are in doubt." Yet, despite the huge error in such numbers, people treat them very seriously. Wage increases, in some cases, are based on changes in price indexes. People plan and make big decisions based on such poor data. "Economics is not nearly so much of a science," Morgenstern writes, "as the free use of allegedly accurate figures would seem to indicate." He suggested such figures report estimated error rates. For example, inflation might be 2%, plus or minus 2%. Doing so would make the following statement look entirely hollow and devoid of meaning, as it essentially is: "Inflation unexpectedly jumped to 2.2% in the eurozone from 1.9%." And you would laugh at a statement such as "Forecasts cluster around 1.75% and 2%." As an investor, you ought to look at the whole constellation of economic numbers with doubt and skepticism. They are not accurate. They can never be accurate. Far worse is the idea that we should target a certain inflation rate. I am simply beside myself that anyone can believe that an "inflation target" is anything other than ridiculous. We can't even measure it, but the Fed thinks it's going to control it! And not only control it, but thread it with precision to 2%! As investors, I think it is a great mistake to sit around thinking about things like unemployment, GDP, price indexes and the whole lot of garbage that gets reported and commented on by nearly everyone. The whole thing is a fraud. I think you could be a very successful investor and never parse a consumer price index in your life. In fact, they may do you harm by making you afraid to invest when the economic picture seems dim... or reluctant to sell because it is so bright. Official inflation in the US may be reported as 2%, but it may well be four times as high. Directionally, it's enough to know that prices are rising. You don't need the consumer price index to tell you that the dollars in your pocket are buying less, just like you don't need a thermometer to tell you that it's freezing cold. When inflation really gets going, the economists will be the last to know. Regards, Chris Mayer Editor's Notes: Chris Mayer studied finance at the University of Maryland, graduating magna cum laude. He went on to earn his MBA while embarking on a decade-long career in corporate banking. Chris has been quoted over a dozen times by MarketWatch, and has spoken on Forbes on Fox. Similar Posts: | ||

| SLV - Options, weird? You tell me... Posted: 24 Feb 2011 12:59 PM PST I am not an options pro...but lately there has been some interesting bets being placed, most notably in the 2013 contract. See below. If anyone trades options and sees a pattern, especially the fuck load of calls volume in the 2013, feel free to post why this is occurring. | ||

| Silver proxy SLV, 30 minute chart Posted: 24 Feb 2011 12:22 PM PST http://www.biiwii.blogspot.com Silver market expert: "But but but… SUPPLY/DEMAND I tell you!" | ||

| 28,000 silver soldiers still ready for big box delivery, bring it. Posted: 24 Feb 2011 11:18 AM PST COMEX NEWS: Gold: -volume picking up -No deposits -Massive withdrawal 64,203 oz's -1,137,300 left standing in February -GLD loses 6.67 tonnes , LOL Silver: -March OI falls 39,528 to 28,275 (FUCK SAKE!)But still high for one more day left -comatose inventories, most likely b/c they are full of shit from here on out -SLV adds 2,929,386 oz (not sure from where after yesterdays 5 million too) | ||

| Royal Canadian Mint Now Saying It’s Difficult Securing Silver Posted: 24 Feb 2011 11:10 AM PST Royal Canadian Mint Now Saying It's Difficult Securing Silver With continued reports of booming sales and tightness in the silver market, today King World News interviewed Dave Madge director of sales at the Royal Canadian Mint. When asked if the RCM is having trouble acquiring silver Madge responded, "Demand right now for silver is through the roof and it shows no signs of slowing at this point. Sourcing silver is becoming very difficult. We are competing with a great many players when it comes to purchasing silver and many of these players are bidding the price higher." Dave Madge of the Royal Canadian Mint continues: "Our advantage is that we have had long-term relationships with our suppliers and that has helped us in this situation. We have been able to leverage off of those relationships to get supply, but it still remains a big challenge sourcing material. We're looking at ways of mitigating our risk regarding supply of silver. We are anticipating it to become even more difficult to secure supplies in the future. This is based on what we are seeing firsthand and what our suppliers are telling us. We work closely with these banks to secure silver and they tell us there is a lot of competition." When asked what this means for the price of silver and how long this condition is expected to persist Madge stated, "I think you are going to see the premiums go up in order to secure silver. At some point some players will be priced out of the market. I don't think this is a short-term situation, I think there are a lot of issues going forward and this may be the new norm." The key here from Dave Madge is that he expects it to become even more difficult in the future to secure supplies of silver. In my mind this is an extremely important testimonial regarding how tight the silver market is because the information is coming directly from the Royal Canadian Mint itself. The Royal Canadian Mint is known as a world-class provider of minted products and KWN is thankful to both the RCM and Dave Madge for this interview. Eric King KingWorldNews.com http://kingworldnews.com/kingworldne...ng_Silver.html | ||

| Posted: 24 Feb 2011 10:00 AM PST Against the older monetary measures of gold and silver the Euro looks just as weak as the other three "big four" reserve currencies – the dollar, sterling and yen. | ||

| Metals Lower after Resistance Holds Posted: 24 Feb 2011 10:00 AM PST Gold fell $8.82, or 0.63%, to settle at $1,402.88. Prices are having trouble breaking through resistance in the $1,420's, a key technical barrier. Silver fell significantly, shedding $1.4, or 4.17%, to settle at $32.15. | ||

| Food Price Inflation Calculator Posted: 24 Feb 2011 09:00 AM PST Mark Thornton of the Mises Institute writes, "The price of everything seems to have skyrocketed. Only housing, the dollar and inflation-adjusted income are negative." I immediately interrupt to wittily say, "Well, housing is going down because nobody wants to buy a still-over-priced-yet-even-lower-quality house that now needs painting, a new water heater, some leaky things fixed and a new roof, especially now that inflation-adjusted incomes are negative!" The stunned silence at my rudeness was all I needed to continue, "And the ridiculous fiat dollar is going down in purchasing power because the foul Federal Reserve is creating So Freaking Much Money (SFMM) that, vis-à-vis other dirtbag fiat currencies of other dirtbag countries running budget deficits, the dollar is going down in value faster than they are because the Federal Reserve is creating more new money than all the rest of the world's dumb-ass, dirtbag central banks put together!" Seeing that everybody is completely stunned by the way I just barged into the conversation with one of my patented Stupid Mogambo Remarks (SMR), I, thus emboldened, powered forward by thoughtfully stroking my chin as if contemplating something profound, whereupon I go on, my voice rising in a crescendo of pain and outrage, "But if you calculate all prices in ounces of gold, you will find that prices will have actually gone down! I'm not sure exactly how to prove it, but this has to mean We're Freaking Doomed (WFD)!" Apparently, Mr. Thornton is not sure how to calculate it, either, but is perhaps suggesting that the horror may be found in the fact that "World food and commodity prices are up 28% over the last six months." I was surprised that I did not edit his remarks to end with at least one exclamation point, and also surprised at his use of a 6-month time-frame, instead of annualizing it, at least in some simplistic linear manner that a dolt like me can understand. In doing so, he unwittingly provides an opening for Showoff Calculator Man (SCM), as I happen to be an absolute whiz at multiplying numbers by 2! Putting my calculator where my mouth is, I quickly crank out 2 X 28% = 56% inflation! See? I CAN do it! On the other hand, 1.28% X 1.28% = 1.64%, which would seem to be a massive 64% annual inflation when compounded, even more so than the simple 58%. Yikes! Mr. Thornton ignores me, and goes on, "Higher food prices set off the revolutions in Tunisia and Egypt and the mass protests in countries like Algeria, Jordan, Yemen, Bahrain and Iran. People in these countries buy more unprocessed foods and spend a much higher percentage of their income on food, so they have been severely impoverished by Bernanke's QE2." Of course, being an American, all I really care about is how it affects me, an American, and American prices, and how in the hell I am going to afford higher prices on my American income which has, as he said earlier, gone down when inflation-adjusted. In that regard, Joel Bowman, Managing Editor here at The Daily Reckoning notes, "Wholesale prices jumped 0.8% in January. The producer price index (PPI) has now jumped 3% over the last four months. And no, that's not an annualized figure." Again, Showoff Calculator Man (SCM) comes to the rescue, and multiplies 3 times 3% to get 9% inflation, which IS an annualized figure, and more than 9% inflation when compounded, and which is scary enough to send me running, running, running, like the paranoid little weasel that I am, to the safety of the Mogambo Secret Bunker (MSB). I was hurriedly shutting the bunker's door when I heard Mr. Bowman go on, "Note that the PPI headline number is for 'finished goods' – stuff that's ready to be sold direct to consumers. In the category of 'crude goods,' the figures are far worse – up 3.3% in January, and up a staggering 15.8% over the last four months." The last four months! That's almost 48% inflation a year! Man, if ever there was a time to buy gold, silver and oil, this is it! Whee! This investing stuff is easy! The Mogambo Guru Food Price Inflation Calculator originally appeared in the Daily Reckoning. The Daily Reckoning has published articles on the impact of quantitative easing, bakken oil, and hyperinflation. | ||

| Posted: 24 Feb 2011 08:12 AM PST | ||

| Posted: 24 Feb 2011 07:00 AM PST | ||

| Okay, so I guess there are no more problems anymore...FUBM Posted: 24 Feb 2011 06:27 AM PST Middle east worse off than on Monday...check COMEX ready to default....check Physical silver supply's dwindling...check QE3 hint today...check Fuck you Blythe. CFTC=useless dont forget to thank me...I'm getting whaled on in a trade right now...wow. | ||

| Paging Blythe where are u hiding today? Silver lease rates still above 1.2%, paging Blythe Posted: 24 Feb 2011 05:04 AM PST | ||

| The Economy And Housing Sink Further…And The Fed Telegraphs QE3 Posted: 24 Feb 2011 05:01 AM PST By now many of you have seen this, but James Bullard, the head of the St. Louis Federal Reserve Bank – one of the Federal Reserve member banks that has historically been more conservative with regard to loose monetary policies, I might add – gave a speech today in which he responded to a question about printing more money by saying "never say never to QE3." Of course we know where this is going. It's funny because I was chatting casually with some people last night about the stock market and the "QE" madness and I was asked with dismay if I thought QE3 would really happen. You should have seen the look on faces when I said that QE will go a lot higher than 3…got gold? Time to remove the beautiful gift-wrapping around the today's economic reports delivered by the mainstream media and stock-promoting cable news outlets. Durable goods. The media gleefully reported a 2.7% jump in durable goods orders for January. But if you dig through the report, the gain reflected a massive order for aircraft parts from Boeing. If you exclude transportation – i.e. Boeing's order – capital goods orders actually dropped 3.6% vs. expectations of a .5% increase. Worse, excluding defense and aircraft orders, capital goods orders plunged 6.9%, the biggest decline in two years. The expectation was for a drop of 1%. How's QE1 and 2 working? How are Wall Street forecasts lookin'? How's reality look vs. what is dressed up in formal wear and presented by the media sources from which 90% of those who even bother to follow the news get their news? Housing (ad nauseum). New home sales for January reported today by the Census Bureau plunged 13% to an annual rate of 284k. 300k was the number expected by Wall Street's collective group of Einsteins. The January number collapsed 18% from January 2010. Even more horrifying, the total number of new homes sold in January was 19,000. Just let that one sink in. Annualized calculations are based on trailing 12 month sales rates. As the rate of sales declines, so does the annualization calculation. But I digress with practical matters…the 19k number was the lowest monthly new home sales number since the Census Bureau started keeping records. Here's the link to the report: LINK Please don't pay attention to the inventory estimates. To begin with, and I researched this several years ago and no one ever talks about it, when a new home goes under contract, a sale is recorded by the CB and a home is removed from their inventory count. If the contract is cancelled, the CB does not revise its numbers. For the last 5 or 6 years, at least, contract cancellations have been running around 20%, on average. Back in 2007-2008, when I used to scour homebuilder 10Q's every quarter, most homebuilders were reporting cancellation rates in excess of 30%. In other words, the inventory of homes reported is grossly underestimated. To make matters worse (sorry housing market optimists), last month new homebuilders reported an increase in housing starts – news which the market loved. BUT, and here's the golden truth, even more inventory will be building up with unsold new home sales plunging, more unsold new homes being built, a lot more existing homes on the market – the inventory of which we learned from a private, independent home data provider may be currently underreported by as much as 20% – accelerating foreclosures, bank inventory hitting the market, AND declining demand as more people – in truth and reality – lose their jobs and fall off the jobless benefits (work force welfare) payroll. The basic law of supply and demand tells us how this Romeo and Juliet will end. Much lower prices and much more pain ahead for the housing market. I'm now actually starting to see some "fringe" Wall Street firms publish economic reports which forecast big declines for housing values, so I'm not the only one who sees this coming… When you look at media reports, you can't just look at the headline number, which often shows a percentage gain from the previous month, and take it for face value. You have to pull up the actual report released by the entity which released it, dig through the details and analyze it in the context of a much longer timeframe than just month to month. Source: http://truthingold.blogspot.com/2011/02/economy-and-housing-sink-furtherand-fed.html | ||

| Posted: 24 Feb 2011 04:58 AM PST Things are really starting to get interesting as civil unrest is having real effects on various markets. Oil is testing $100, gold is near its all-time highs, and stocks are selling off. Gadhafi has opened fire on his own people, which to me indicates that his grip on power is eroding. It appears this is just the tip of the iceberg for the Middle East; if Saudi Arabia falls, then we'll really see some shocks in the oil market. I will never make the mistake of assuming the world follows a linear path. I have always said that the major risks are to the downside, whether it be civil unrest, war, or a bond default. We live in a dynamic world that people just don't understand. One second the world seems to be at ease, the next second civil unrest breaks out all over the Middle East and Africa. One second stocks can't possibly go down, the next second stocks retrace weeks of gains in 2 days. One second gold is a "barbaric relic", the next second people are buying at any price. This is just the way the world works. Understand that when U.S. government bonds suffer systematic failure, it will seemingly come out of nowhere. Gold It was only a week ago that the mainstream was saying that people were fleeing gold because of an economic recovery. Oh how quickly they change their tunes. Gold is still in a bull market. No matter what the pundits say, the price action in gold is far from bubble-like. Gold is hovering above its moving averages and is close to testing its all time highs at $1430. I will be watching this level very closely. On a breakout I will be a buyer. Some people may wonder why I just don't buy now instead of waiting. My thought process is that a breakout from long-term resistance is very bullish and implies much higher prices. However, a failure to break out above $1430 could portend considerable weakness. Buying a breakout is a higher probability trade. I may lose out on some gains, but I also protect myself from more substantial losses. Stocks Events in the Middle East may have been the catalyst, but stocks were long overdue for a correction. I've always felt that stocks needed to correct a good 10-20% before resuming their bull market. A 10% correction would bring us to about the 1st retracement level from the July lows. If stocks were to fall this low, I would be very tempted to add. While dividend yields are not as attractive relative to bonds as they were last year, a healthy correction will turn the tides in favor of stocks.

Crude Oil Crude oil was trending upward steadily until the recent events in the Middle East. $100 is the key level here. If it can hold as support, then the outlook for oil will be very bullish. Let's not forget how $100+ oil will affect Americans at the gas pump. I personally think $4 gas nationwide is coming again this summer. Discretionary spending is going to take a big hit as will GDP growth. We live in a very interconnected world. The effects of policies in the U.S. are felt abroad and vice versa. If instability persists in the Middle East, Americans will feel it at the gas pump. This will only fan the flames of growing civil unrest in the U.S. When protests really start picking up in America, you won't be hearing nonsense about America's "fight for democracy." This explanation of events in the Arab world is somewhat baffling. The U.S. has had its hand in Middle Eastern and Arab politics for a long time, and for Obama to get behind the move towards democracy (or military dictatorship if you want to get technical) in Egypt is something out of the Twilight Zone. People need to realize that the unfolding events are mostly about economics. Baby Boomers have not saved for retirement. Home prices (aka piggy banks for Boomers) are falling. Taxes are rising. Pensions are underfunded. Social Security payment increases are linked to the manipulated CPI, so Boomers are getting screwed and they know it. Younger generations of Americans are perturbed that they have to pay for the profligacy of prior generations. The government has its head in the sand and their solution to this debt crisis is to get into more debt. Pure genius! There will be civil unrest in America that will make what's happening in Wisconsin look minor in comparison. Municipalities will start going bust and you will hear the word "bankruptcy" a lot. Gold is going to make $100 moves in a day. U.S. government bonds will be as safe as AAA-rated mortgage-backed securities were. Most of the population will be shocked as they always are when things outside their narrow perspective of the world occurs. The world is going to be a much different place in the next 5-10 years. Out of the pain will come renewed awareness and economic prosperity, but we must first pay the piper. That day is approaching very quickly. Source: http://expectedreturnsblog.com/civil-unrest-moving-markets/ | ||

| QE2: The Road to a Gold Standard Posted: 23 Feb 2011 09:29 PM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment