Gold World News Flash |

- The BRIC Self Sufficiency Index

- Market Shrugs Off CSCO Guidance, Prefers to Buy the Rip

- The Economics of the Gold Standard

- In The News Today

- JH MINT Silver & Platinum at 2.5% UNDER spot!

- Silver Poised for Breakout

- Gold Seeker Closing Report: Gold and Silver End Slightly Lower

- Dutch pension fund ordered by central bank to sell gold

- Seeking Gold: An Interview With Chris Waltzek

- Gold Miners Index May Be Warning Us...

- Is The Gold Price Forming the Fatal Broadening Top Pattern That Usually Breaks Out to the Downside? Wait and See

- French bank chief wary of ‘silver bullet'

- THURSDAY Market Excerpts

- Decoding the Truth About Inflation

- Unprecedented backwardation for silver, Turk tells King World News

- Goldbugs on Parade

- “Various Chinese officials have proposed making China’s gold holdings 10,000 tons, larger than that of Fort Knox.”

- King World News has received word from James Turk that silver is in extreme backwardation. Turk stated, “There is a huge story that is brewing. Silver is in backwardation to 2015, which is 13-cents cheaper than spot. This is unbelievable. Money does

- Options for Silver Traders

- Get in the Game? Get Real!

- Hourly Action In Gold From Trader Dan

- January Deficit Grows by $50B, on Pace For $1.5T

- How Much More Demand Can Silver Handle? - February 9, 2011

- When the People Push Back

- IMF urges overhaul of global monetary system

- Gold Daily and Silver Weekly Charts

- Forced selling of Gold . . . Not Since Gordon Brown gave away 1/2 of Britain’s Gold reserves at $250 an Oz. have we seen such blatant government cooperation with market riggers

- Economic shearing: falling house prices, rising food and energy costs. The middle class is getting ripped to shreds.

- ECB's Stark: Can't insure financial system against all risks

- The Long and Frustrating Arm of Government Intervention

- Gold comes off lows after Mubarak reports

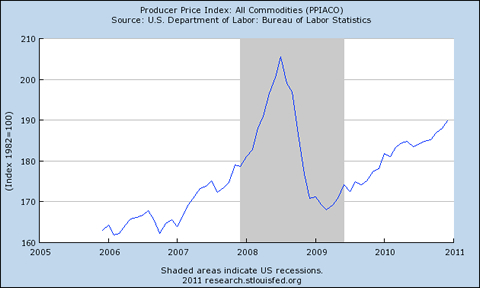

- The Inflation Tipping Point (Part Three of Four)

- Vulture Rules of the Road, Part 1

- A Trading Strategy for the Gold Correction

- China May Increase its Gold Holdings Beyond Ft Knox Level

- Technical Analysis DOES Work For Gold

- How Much More Demand Can Silver Handle?

- The Worst Possible Investing Mistake

- Grandich Client Silver Quest Resources

- Completed Pullback for Silver Wheaton

- LGMR: ECB Buys Portugal Debt, UK Rates Stay "On Hold" for Post-WWII Record

- The Two Faces of Ben Bernanke

- Increasing Government Debt to Produce Economic Growth

- 1-2-3 REVERSAL

- Gold Miners Index May Be Warning Us…

- The Violent Declines the Follow Overbought Rallies

- U.S. Housing ‘Vicious Circle’ Worsens

- Dutch govt. orders pension fund to sell gold, Zero Hedge says

- Perth Mint, Scotia out of hundred-ounce silver bars, KWN says

- Warsh, who confirmed gold swaps, to leave Fed next month

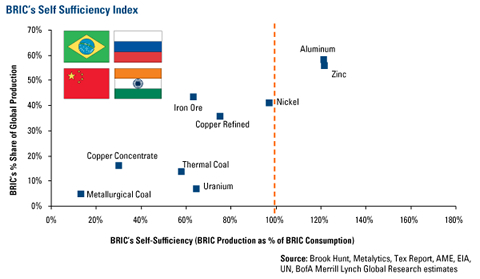

| The BRIC Self Sufficiency Index Posted: 10 Feb 2011 07:39 PM PST Demand for natural resources in the emerging world is increasing, but how much of this increased demand is met by the country's own production? This interesting chart from Bank of America-Merrill Lynch shows the supply/demand fundamentals of several key industrial metals and basic materials. The dotted line represents a key tipping point. The resources to the left of the line are those the BRIC countries must obtain outside of their own borders in order to meet domestic demand (BRIC refers to the emerging market countries Brazil, Russia, India and China). The BRICs produce an excess amount of the two metals to the right of the line and export the remaining amount to other countries.

Last year, copper, nickel and coal were all top-half performers of the 14 commodities we track in our popular periodic table. The two metals the BRIC nations produce an excess amount of (aluminum and zinc) were among the worst-performers. These materials are the necessary elements needed for emerging nations to take the next steps in their development. You can see that the BRICs must rely on imports in order to meet demand for metallurgical coal, copper concentrate, thermal coal, iron ore, refined copper and uranium. For example, BRIC production of metallurgical coal is less than 20 percent of BRIC consumption. Met coal, or coking coal, is used to make iron and steel—very important to the infrastructure build-out taking place in Asia. Thermal coal is also important because it is principally used for power generation. Coal is the primary source of electricity in the emerging world, supplying more than 50 percent of Asia's power. The BRICs consumed nearly 2 billion tons of coal for electricity in 2009, according to BP's World Energy Statistics. In order to combat these supply deficiencies, the BRICs have looked beyond their borders. In India, there were 27 cross-border deals in the metals and ores sector last year, according to research firm Grant Thornton. China has been especially proactive in this regard. From 2005 through early 2010, the country inked more than $45 billion worth of cross-border deals for coal, copper and iron ore. These are deals in countries near (Vietnam, Mongolia) and far (Peru, Canada). We think these areas are especially important for investors because these are the areas where we're seeing wider profit margins and stronger returns on capital. This is why our Global Resources Fund (PSPFX) is currently seeking the best opportunities in this area. Regards, Frank Holmes, P.S. For more updates on global investing from me and the U.S. Global Investors team, visit my investment blog, Frank Talk. The BRIC Self Sufficiency Index originally appeared in the Daily Reckoning. The Daily Reckoning has published articles on the impact of quantitative easing, bakken oil, and hyperinflation. | |

| Market Shrugs Off CSCO Guidance, Prefers to Buy the Rip Posted: 10 Feb 2011 07:02 PM PST The S&P closed up today despite earnings more disappointing than Congressman Christopher Lee's online dating skills (because 1. If you're married, don't use your real fucking email address and 2. everyone knows the easiest way to an internet girl's heart is through a cock shot and not some weird ass old man flexing pose, so really just embarrassing for all) led by technology bellwether CSCO who got their bells rung and let technology know that the weather is going to be extremely shitty with a chance of declining margins, an increasing budget deficit as the government stocks up on the rare o.b. tampons in preparation for the heavy period of economic malaise soon to be here, and the outcome of the Free Harry Baals movement coming to an inglorious end (and as a side note, Money McBags thinks the Femen Movement should 100% get behind Harry Baals).

In all, it was a news filled day in the market that in aggregate rounded up to "who fucking cares" as investors ignored rising inflation, shrinking margins, and sputtering jobs growth, by simply rolling up their foreskins and taking hits of hope and delusion. So as always, buy the dip, buy the rip, and if you can, buy the nip, because Bernanke would want it that way.

As for macro news, new claims for unemployment fell to their lowest level in 2.5 years as bad weather knocked down the phone lines and internet connections that people ordinarily use to file new claims as well as apparently knocking down common fucking sense (because, um, if the jobs report was negatively affected by the weather, shouldn't new claims have you know, also been negatively affected by the fucking weather? This is as confusing to Money McBags as M-theory or why anilingus is spelled with an "i" and not an "a"). New claims dropped 36k (or 32k if using the the number that was reported last week instead of this week's made up higher number as the "hold the shock and hope for no awe" strategy rears its ugly head) to 383k which was 27k below analyst guesses and 35k below believability. The number dropping below 400k can be taken as a good sign (that is if the number weren't more bogus than John Travolta's marriage), though this can be taken as a better sign.

In other macro news, foreclosures fell, or they didn't, depending on if you want to use a year over year number (which was down 17%), a month over month number (which was up 1%), or a non "lenders were too fucking bogged down in fixing mortgage fraud procedures to increase foreclosures" number (which would have been up a cockriffic percent). James Saccacio, the CEO if RealtyTrac commented "Unfortunately this is less a sign of a robust housing recovery and more a sign that lenders have become bogged down in reviewing procedures, resubmitting paperwork and formulating legal arguments related to accusations of improper foreclosure processing." This would usually be concerning for the market but as all investors care about is the perception of the numbers and not what is behind those numbers (unless it is Brooklyn Decker who is behind them), the release was more irrelevant than James Garfield's presidency or Lacey Banghard's IQ.

Elsewhere wholesale inventories jumped 1% while sales only rose .4% as businesses build up inventory right before people can stop affording it with the coming stagflation (and of course stagflation is coming not just because Bernanke is making sweet love to the ponzeconomy™, but also because he showed it pictures of Olivia Wilde). The budget deficit grew to $50T as spending picked up with the government busy buying the dip and finally Federal Reserve Board Governor and noted QE2 critic (even though he never had the Thomas Hoenig balls to dissent) Kevin Warsh is stepping down to do what all Americans aspire which is to live a happy life off of his wife's money. Warsh was the youngest Fed Governor by decades and simply got tired of the constant hazing of having to always erase the whiteboards, bring the doughnuts, and be the one picked to play seven minutes in heaven with Fed Governor Daniel Tarullo. Warsh is most famous for an op-ed he wrote for the WSJ where he said the Fed’s Treasury buying “poses nontrivial risks” such as unexpected movements in risk premiums across asset classes and whatever is a bit worse than stagflation, perhaps "fucking stagflation.

The big news of the day though was earnings where CSCO reported their Q and dropped ~13% after not connecting with investors who had them as the backbone to their portfolios. The company warned that their margins were under more pressure than Tom Cruise's colon in the Castro on a Saturday night or Hosni Mubarak's presidency (who by the way is supposed to be stepping down tonight so the guy exactly fucking like him can take over, so um, great fucking job guys, really. It's like Andrew Johnson restoring rich white southern confederates to power immediately after the civil war or Pam Anderson getting back with Tommy Lee after he gave her hepatitis). Along with declining margins, CSCO said they are also facing increasing competition as customers in their core network switching business are switching to products from HP and Juniper (and that line was so awful Jay Leno can use it all he wants).

In other earnings news AKAM was down 15% after reporting a good Q but giving revenue guidance for Q1 a wide margin below analyst guesses as a result of more normal seasonality after last Q's post-recession big jump in Q1 (and the margin was so wide that it immediately became the most popular member of LargeandLovely.com). And CS missed profit expectations because of debt charges and regulations that keep them from manipulating their numbers as usual.

In positive earnings news, WFMI once again crushed guesses and raised guidance because now that all food costs have skyrocketed, people don't give a shit about paying the marginal dollar to eat food that has fewer chemicals in it than Charlie Sheen's stool. Also EBAY was up ~7% after they said that they expect PayPal revenue to double by 2013 as wireless iPads making memberships to the Bangbus more prevalent during bathroom breaks in the office.

Finally, corn reserves are at 15 year low, thus potentially figuratively cornholing part of the country's food supply, NYSE is in merger talks with Deutsche Borse, Harrah's, and Las Vegas Sands where they promise to share the VIG with whomever they merge, and WFC's CFO is walking away with a $27MM retirement package which is but a small pittance for nearly ruining the global economy. Noted analyst Dick Bove (and he is noted for consistently being wrong) said "It is not normal for a CFO to leave a company for personal reasons when major disclosures about to be made," but then again, it is not normal for a man named Richard to insist on calling himself Dick, so potato-puhtato.

As always, if you need more market analysis, dick jokes, and Sara Underwood in your lives (and really who among us doesn't?), Money McBags drops some small cap analysis today on the award winning When Genius Prevailed where he breaks down RICK's Q of which he is not only a shareholder (up 30% in 2 months), but also a client. | |

| The Economics of the Gold Standard Posted: 10 Feb 2011 06:45 PM PST | |

| Posted: 10 Feb 2011 05:22 PM PST Jim Sinclair's Commentary Stratfor outlines three lousy choices for the military of Egypt. Any one of these will serve to increase tensions. There are 10 countries with similar problems. Saudi Arabia is not exempt. "This now creates a massive crisis for the Egyptian military. Its goal is not to save Mubarak but to save the regime founded by Gamal Abdel Nasser. We are now less than six hours from dawn in Cairo. The military faces three choices. The first is to stand back, allow the crowds to swell and likely march to the presidential palace and perhaps enter the grounds. The second choice is to move troops and armor into position to block more demonstrators from entering Tahrir Square and keep those in the square in place. The third is to stage a coup and overthrow Mubarak."

Jim Sinclair's Commentary Omar Sulieman is the head of the Egyptian Intelligence Service. Egypt is the place that captured insurgents in Iraq were sent to be tortured. Therefore Omar's hands are the undercurrent that accepted them. Financial TV is reporting this as a success. The Brotherhood does not want Omar. There is much more to come.

Jim Sinclair's Commentary The supply of US Treasuries increases at a time when QE has been the only swing buyer. The final Pillar of Gold at $1650 is in.

Jim Sinclair's Commentary You have to have a Gold dog regardless of what Martin says.

Jim Sinclair's Commentary When you sell your liberty for supposed protection this is what you get, Nazis. Ontario Woman Sues Over Strip-Search At Ambassador Bridge DETROIT (WWJ) – An angry and embarrassed Ontario woman who says she was strip-searched at the Ambassador Bridge without justification has sued two U.S. Customs and Border Protection agents. The Detroit Free Press says Loretta Van Beek of Stratford filed the suit in Detroit federal court against the unnamed agents. She says she was en route to her Georgia vacation home last March when one agent strip-searched and groped her while the other one watched. Van Beek says she was detained for two hours, then sent to a windowless cell and ordered to strip because she neglected to disclose she had raspberries in her vehicle. The lawsuit claims one agent aggressively groped her breasts and genital area while the other watched. Van Beek says she was then photographed and fingerprinted and sent back to Canada. Attorney S. Thomas Wienner of Rochester tells the Free Press the experience traumatized Van Beek and "She's concerned she might not be the only victim."

Jim Sinclair's Commentary There is a number whereby Martin Armstrong's reaction is nullified. Many people in finance read him but will not admit it. His second before last missive has contributed to the reaction we have experienced. There is no way I will say the price because why should we give the opposition more ammunition?

Jim Sinclair's Commentary This is the birth of a durable democracy? You have to be kidding. Omar Suleiman warns of coup as tension rises between Egyptian demonstrators, army Egypt's government and protesters edged closer to violent confrontation Wednesday as demonstrators escalated their tactics and the vice president warned of a coup if the unrest continued, saying protests must end or "the dark bats of the night" would emerge to terrorize the nation. Labor unrest continued in the nation for a second day, threatening to merge the political goals of the opposition with the more focused economic issues that have long plagued Egypt. And violence spread to a normally peaceful desert oasis 500 miles southwest of Cairo, where police killed four people. Protesters in central Cairo's Tahrir Square, reenergized by a massive crowd Tuesday after turnout began to flag on Monday, promised the biggest demonstrations yet on Friday, this time nationwide as well as in multiple locations in Cairo. On Wednesday, they defied the Egyptian army by occupying the street in front of the parliament building, creating a second front in downtown Cairo. Egyptian Vice President Omar Suleiman, in comments to Egyptian newspaper editors published Wednesday, warned sharply that the demonstrations could not continue. Suleiman, who until now has presented himself as a soft-spoken voice of reason in discussions with opposition leaders, sounded rattled as he warned of tougher measures.

Jim Sinclair's Commentary Israel supports democracy with one present exception – Egypt. What do they know that the Western world media and financial TV missed? How Egypt resolves itself is the singular most important fundamental in the political and economic world today. Egypt is more important than Afghanistan, Pakistan, Iran and Iraq at this moment in time. Israel urges U.S. to reaffirm support in light of Egypt unrest Defense Minister Ehud Barak on Wednesday stressed the importance of U.S. support for Israeli security in light of the political unrest in Egypt, while Ambassador Michael Oren urged the Obama administration to reaffirm its commitment to that regard. Barak met with Secretary of State Hillary Clinton, Secretary of Defense Robert Gates and National Security Advisor Tom Donilon at the White House on Wednesday evening, to discuss the tense situation in Egypt. The White House press office said the meeting dealt with "the need to move forward on Middle East peace, our efforts to prevent Iran from acquiring nuclear weapons, and other regional and bilateral issues." The U.S. officials stressed their country's "unshakeable commitment to Israel's security, including through our continued support for Israel's military, and the unprecedented security cooperation between our two governments," the White House said in its statement. Barak's spokesman characterized the meeting as "excellent". Israel envoy Oren later Wednesday conveyed a similar message when he urged the administration to reaffirm its commitment to Israel, in an address to the Congressional Israel Allies Сaucus reception on Capitol Hill.

Jim Sinclair's Commentary A military coup can't supply food at reasonable prices and jobs for the Egyptian unemployed. Yes, but only if they draft the entire population. This is no road to a sustainable democracy as the media would have us believe. Why anyone believes the media today is baffling to me. Egypt's Army Signals Transfer of Power CAIRO — The command of Egypt's military stepped forward Thursday in an attempt to end a three-week-old uprising, declaring on state television it would take measures "to maintain the homeland and the achievements and the aspirations of the great people of Egypt" and meet the demands of the protesters. The development appeared to herald the end of President Hosni Mubarak's 30-year rule. Several military leaders and officials in Mr. Mubarak's government indicated that the president intended to step down on Thursday. Some reports said he aimed to pass authority to his hand-picked vice president, Omar Suleiman, but what role Mr. Suleiman would play in a military government, if any, remained uncertain. In testimony before the House Intelligence Committee, C.I.A. Director Leon E. Panetta said that there was a "strong likelihood" that Mr. Mubarak would step down by the end of the day. State television said Mr. Mubarak will appear tonight with an announcement. The character of the military's intervention and the shape of a new Egyptian government remained uncertain. A flurry of reports on state media on Thursday indicated a degree of confusion — or competing claims — about what kind of shift was underway, raising the possibility that a competing forces did not necessarily see the power transfer the same way.

Jim Sinclair's Commentary Few, other than here, thought that China could do it. Few, other than here, thought India would do it. Joseph Kahama is writing a new book – "Boom, Insights and Visions into Economic Opportunities in the African Bull Market." Africa is the best of opportunities for continued growth over the next many years. Africa's share of mine deals triples Africa's share of global mining deal flows tripled from 5% in 2009 to 15% in 2010, according to a report released on Wednesday by Ernst & Young. The bulk of these deals was inbound and showed a significant growth in volume, signifying the increased interest of the rest of the world in Africa. "In one major deal, Rio Tinto offered US$3.9 billion to buy Mozambican coal miner Riversdale, while Xstrata is paying US$513 million for Sphere Minerals, with the goal of gaining three iron ore projects in Mauritania," said Adrian Macartney, mining sector leader for Africa at Ernst & Young. "When one takes into account the increasing interest in Africa's mining sector from companies in China, India, Brazil and Russia, it is easy to see why the future looks rosy," added Macartney. When it was suggested a year ago that Africa's economic recovery was on track, many thought this premature. However, a quick look at current figures shows that there can be little doubt that the continent is definitely "open for business".

Jim Sinclair's Commentary This is easy. China only needs one ounce to accomplish this. China may increase gold reserves beyond 'Fort Knox' level – Hale CAPE TOWN (miningweekly.com) – China's central bank is being advised to increase its gold holdings nearly tenfold to a level greater than the world's biggest bullion depository, the US's "Fort Knox". Global economist David Hale, who addressed the packed Mining Indaba in Cape Town attended by a record 5 700 people, says that China's gold reserves are currently at 1 050 t – only $30-billion to $40-billion compared with the country's total assets of $2,8-trillion. Various officials in China have proposed the central bank should increase its gold reserves to 10 000 t, which would give China larger gold reserves than Fort Knox. "This would be a huge development for the gold market," he says, with global mining output of gold only at 2 500 t a year. "China will probably start to buy gold in the near future, but they won't report it for two or three years," Hale says. When China announced new gold reserves from 600 t to 1 050 t in April 2009, purchsing had been done in the preceding years.. | |

| JH MINT Silver & Platinum at 2.5% UNDER spot! Posted: 10 Feb 2011 04:48 PM PST (Bullion Specials!) Silver Stock Report by Jason Hommel, February 10, 2011 We have 5 bars of silver that are each odd weight, all over 100 oz., such as 101.6 troy oz., etc. Offered at 2.5% under spot. Minimum, 1 bar. Spot Silver is about $30.20 right now. We have 7 Platinum 1 oz. bars, offered at 2.5% under spot. Minimum, 1 bar. Platinum is about $1830 per oz. now. Spot prices are locked after your wire gets to us. Please, do not send any wires until after you call us on the phone, and set aside the bullion for you. THESE ARE LIMITED QUANTITY, ONE TIME OFFERS; we cannot reorder these products. (Yet we have offers like this from time to time.) LIKELY TO SELL OUT TOMORROW. We have an ongoing regular special of gold that we are selling cheaper now, because we have a bit too much, these, we can reorder at these prices. We have 44 Gold Eagles offered at 7.1% over spot. We have 50 Gold bars offered at 4.6% over spot. We have over 13,000 one oz. silv... | |

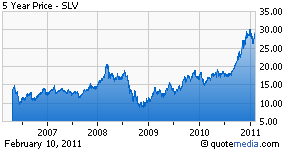

| Posted: 10 Feb 2011 04:04 PM PST Kenneth D. Worth submits: If you look at the technicals on silver they do at first glance look a little "frothy," to borrow a term from Mr. Greenspan. The value of silver has more than doubled in just the past 18 months.

In the short-term, however, any break above $30 an ounce would be a new high after a correction of 14%, and from a technical perspective this would be very bullish. This would suggest that silver is headed to $40/oz. and higher, given the strength of the previous move up.

There is talk of a bubble in precious metals. Isn't there always? There is also some discussion on this site and elsewhere of silver pushing up against its highs of the past two decades in terms of its price in relation to gold (currently around 1/45th of an ounce of gold, i.e. a gold-silver price ratio of 45 to 1). I would suggest that, rather than "froth" indicating the top of a bubble, we are currently at an inflection point in the silver market, which reflects a fundamental change in investor psychology. A return to the historic relative value of gold and silver of 15 to 1 would put silver at $91 an ounce (with gold currently around $1,365 per ounce.) That means there is tremendous upside in the silver market should investor psychology truly be changing, as it appears to be. As the Federal government continues to run multi-trillion dollar deficits, and as the Federal Reserve continues to provide the bulk of Complete Story » | |

| Gold Seeker Closing Report: Gold and Silver End Slightly Lower Posted: 10 Feb 2011 04:00 PM PST Gold fell as much as $13.20 to $1351.20 by about 8:30AM EST before it rallied to see a $1.60 gain at as high as $1366.00 three hours later, but it then fell back off a bit in the last couple of hours of trade and ended with a loss of 0.14%. Silver fell $0.618 to $29.662 before it rallied back to almost unchanged at as high as $30.278 by late morning in New York, but it also fell back off a bit in the last couple of hours of trade and ended with a loss of 0.53%. | |

| Dutch pension fund ordered by central bank to sell gold Posted: 10 Feb 2011 02:14 PM PST From The Associated Press http://www.bloomberg.com/news/2011-02-10/dutch-central-bank-pension-fund... AMSTERDAM, Netherlands -- A pension fund in the Netherlands says the country's central bank has ordered it to sell its gold holdings because it is overexposed to a fall in the value of the yellow metal. The Vereenigde Glasfabrieken pension fund said Thursday it wants to keep the gold but a Rotterdam court sided with the bank in a ruling Tuesday. The fund will now sell its gold holdings down from 13 percent of assets to 3 percent at most. The fund began buying gold in 2008 due to concerns about inflation and the stability of the euro. It argued the investment has performed well since then, rising about 70 percent to around E1,000 per ounce. The fund had E260 million in assets in December 2008, mostly in Dutch and German government bonds. ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php Join GATA here: Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf | |

| Seeking Gold: An Interview With Chris Waltzek Posted: 10 Feb 2011 01:11 PM PST A few years ago, an email from an old friend prompted me to watch a film called The Money Masters, narrated by William Still. To say I became suspicious about everything after watching it would be an understatement. I started tuning into shows like FSN, KWN, GSR and others, and was inspired. About a year ago, I began piloting interviews with folks who knew a lot more about economics and finance than I did/do. As a teacher it The show has become more erratic than I’d hoped with obligations of: a wife, a baby, a job, another baby and night school. I’m satisfied TVR is still alive. This month it was my pleasure to speak with Chris Waltzek of GoldSeek Radio. In the interview from a week or so ago Chris and I discussed the beginnings of GSR, the basics of saving, energy, his book and more.

Click To Listen To The Interview

~MV | |

| Gold Miners Index May Be Warning Us... Posted: 10 Feb 2011 12:48 PM PST | |

| Posted: 10 Feb 2011 11:14 AM PST Gold Price Close Today : 1361.90 Change : (2.90) or -0.2% Silver Price Close Today : 30.091 Change : (0.182) cents or -0.6% Gold Silver Ratio Today : 45.26 Change : 0.176 or 0.4% Silver Gold Ratio Today : 0.02209 Change : -0.000086 or -0.4% Platinum Price Close Today : 1825.10 Change : -29.00 or -1.6% Palladium Price Close Today : 821.35 Change : -8.90 or -1.1% S&P 500 : 1,321.87 Change : 0.99 or 0.1% Dow In GOLD$ : $185.62 Change : $ 0.25 or 0.1% Dow in GOLD oz : 8.980 Change : 0.012 or 0.1% Dow in SILVER oz : 406.41 Change : -0.33 or -0.1% Dow Industrial : 12,229.29 Change : -10.60 or -0.1% US Dollar Index : 78.19 Change : 0.547 or 0.7% Daily chart of the GOLD PRICE today takes the fatal shape of a Broadening Top, where highs are level or slightly rising and lows keep getting lower. Dow made a similar patter at the 2000 top, but later became a diamond top. Never mind, it only matters that it's a pattern that usually breaks out to the downside. Only other interpretation is that gold has established a ceiling of resistance at $1,367/$1,365 and must bayonet its way thru that barbed wire and machine guns before it advances further. (Whoa! My metaphor gland is SMOKING today!) On Comex today gold shut the doors down $2.90 to $1,361.90. The SILVER PRICE five day chart looks more like a rounding top, but since broadening tops sometimes show a rising upper boundary, it might be called that, too. Upper barrier for silver is 3050c, and the lower safety net is 2965c. On Comex today silver closed down 18.2c at 3009.1c. The daily chart opened about 3018c, then slammed down to 2967c, and rose smartly back to 3025c, but closed lower. Y'all don't get mad and start throwing inkwells at me through the computer, I have to tell y'all what I see. Silver can only overcome the bad juju of the last three day's chart by clearing that 3050c level. Stepping back a bit and viewing the five month chart. So far SILVER has merely made a lower high than its 3 January peak, which constitutes nothing more than a double top or maybe a peaking B-wave of an A-B-C correction. Of course, closes above $1,365 and 3050c resistance would gainsay my elaborate ratiocination. That old meth-head the US DOLLAR INDEX decided to go straight today. It burst up off yesterday's 77.50 bottom, adding 54.7 basis points and leaving that chart looking even more like a head and shoulders bottom. From here the dollar will spike its own future if it closes, even trades, below 78. Overhead it needs to break clean through 78.35. The dollar cleared its trend-change trip-wire 20 day moving average (78.13) and closed at 78.188. The Euro, on the other hand, closed at 1.3602, down 3/4 of one percent and below its 20 dma (1.3607). Early in the day stocks were knocked down and they stayed down the rest of the day. Again it was a mixed day, with some indices up and some down. Dow lost 10.6 points to close 12,229.29, looking something like the repeating decimal fraction of an ounce of silver's statutory value in "dollars of silver," that is, $1.29292929292. But I digress, for as we all know, stocks ain't like silver at all. Besides, stocks might have broken their uptrend. If so, expect the rats to come over the sides of the ship in great carpets whenever the Dow cuts through 12,000. S&P500 today closed up a meaningless 0.99 point to 1,321.87. My confidence in stocks remains as high as it has been since 2000. (Some of you won't get that, I'll bet.) Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. | |

| French bank chief wary of ‘silver bullet' Posted: 10 Feb 2011 10:41 AM PST By Scheherazade Daneshkhu … Christian Noyer, the head of the French central bank … warned against pushing banks to concentrate their assets in sovereign bonds to comply with new liquidity rules requiring banks to hold more cash and liquid assets against a market freeze. "We know by experience now, after the sovereign debt crisis, that the government debt securities market is not necessarily at all moments the most liquid and the safest, so that this concentration may be very risky," Mr Noyer told the Financial Times in an interview. … France, which currently holds the rotating presidency of the G20 group of industrialised countries, has been planning to argue at next week's meeting for reducing the volatility of commodity markets and reforming the international monetary system. … Mr Noyer, who sits on the European Central Bank's governing council, declined to blame speculators but said volatile commodity prices were an issue for central bankers because they could raise inflationary expectations among the public. Commodities were a relatively new problem due to the interest of funds and other investors, which had contributed to price rises, he said. [source] RS View: Whenever the topic of commodities comes up in the context of investment/speculation/prices, no dialog can be considered lucid or well-grounded unless the parties to the discussion have fully absorbed the deep bedrock of John Locke's thoughts on the matter. | |

| Posted: 10 Feb 2011 10:12 AM PST Gold rebounds on safe haven demand The COMEX April gold futures contract closed down $3.00 Thursday at $1362.50, trading between $1351.40 and $1366.80 February 10, p.m. excerpts: | |

| Decoding the Truth About Inflation Posted: 10 Feb 2011 09:53 AM PST Proving once again that investing in fixed-yield bonds when the foul, filthy Federal Reserve is creating so much money (so that their governments can deficit-spend it!) is a stupid, stupid, stupid idea because inflation will result, Agora Financial's 5-Minute Forecast newsletter reports that "Already since October, the rate on the 10-year has jumped from 2.4% to 3.6% – a 50% increase." Yikes! So how much value does a bond paying 2.4% lose when yield rates climb to 3.6%? I don't know, nor do I care, since I currently have less than zero interest in bonds, which is a kind of hostile antipathy towards them, not unlike that time I took the beautiful Brenda out, and when I later tried to kiss her goodnight, she said, "If your lips even come close to me one more time, I am going to claw your eyes out!" I changed my mind about Brenda, and, of course, I will eventually change my mind about bonds, too. This will be when interest rates are so high but inflation seems to be peaking, which means that I will get out of gold (which will theoretically be at its high price) and into bonds (which will be, theoretically, at their low prices). But that ain't now! Indeed, the torrent of new money continues, as The Daily Bell newsletter reports, "Central banks have pumped something like US$20 to US$50 TRILLION into the world's economy to try to reinflate economies that collapsed in 2008." The keen eyes and sharpened economic senses of Junior Mogambo Rangers (JMRs) everywhere surely detected the use of all-caps to spell "trillion," and which JMRs rightly suspect contains a secret code of some kind, perhaps relaying an important secret message to a shadowy group of insiders who have the code key, or a Secret Code Thingamabob (SCT) of some kind, such as a Mogambo Secret Decoder Ring (MSDR). Of course, there is the obvious interpretation that the $50 trillion dollars is a Hell Of A Lot Of Money (HOALOM), being just short of equaling the GDP of the Entire Freaking World (EFW)! Perhaps if we had a Mogambo Secret Decoder Ring (MSDR) to solve the mystery! Alas, the idea for the stupid rings never really worked, it cost WAAAY too much, it was made of really cheap materials (I think some of it was radioactive), with cheap labor, it was a Big Pain In The Butt (BPITB) to encode secret messages, and then I forgot how, but which wasn't the point, anyway: the Mogambo Secret Decoder Ring (MSDR) was just another attempt to make a lot of money in a hurry so that I could have a lot of money to buy gold, silver and oil because the Federal Reserve was creating so much money! Since I had no decoder ring, or code key, or any idea what I am talking about, I decided to just shut up, whereupon The Bell continued, "As this currency begins, finally, to circulate, price inflation must result, unless such money is quickly removed." And since money is obviously NOT being removed, it is no surprise that price inflation is already here, as attested to by Bloomberg reporting that "World food prices rose to a record in January on higher dairy, sugar and cereal costs and probably will remain elevated. An index of 55 food commodities climbed 3.4% from December to 231 points, the seventh straight increase." The biggest gainers were dairy prices, which were rising at 6.2%. And The Economist magazine reports that inflation in the "food" category made prices rise by a staggering 44% in the last year, and "non-food agriculturals" rising by a whopping 100.6%! More than doubling! In One Freaking Year (OFY)! Tyler Durden at zerohedge.com reports, "Corn spot up 7.76%, wheat up 5.63%, Rice up 10.08%, Hogs up 10.16%, Sugar up 5.64%, Orange Juice up 3.33%, and cotton… up 17.08%. That's in one month!" Mr. Durden's use of an exclamation point proves that he is concerned about inflation, and how fast prices are rising, too! What does this all mean to me? It means I was abso-freaking-lutely right to be buying gold, silver and oil, because monetary inflation means price inflation, and that means gold, silver and oil go up in price! Whee! This investing stuff is easy! The Mogambo Guru Decoding the Truth About Inflation originally appeared in the Daily Reckoning. The Daily Reckoning has published articles on the impact of quantitative easing, bakken oil, and hyperinflation. | |

| Unprecedented backwardation for silver, Turk tells King World News Posted: 10 Feb 2011 09:51 AM PST 5:47p ET Thursday, February 10, 2011 Dear Friend of GATA and Gold (and Silver): GoldMoney founder and GATA consultant James Turk tells King World News that silver is in unprecedented backwardation and he expects a massive short squeeze and possibly declaration of "force majeure" to rescue the shorts. Excerpts from Turk's interview are headlined "Turk -- Silver Backwardation for Years, Possible Hyperinflation" and you can find it at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/2/10_Tu... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php | |

| Posted: 10 Feb 2011 09:25 AM PST Modeled Behavior submits: By Karl Smith Will Wilkinson notes the intuition behind the golden warriors.

I would disagree. First, that money is a reliable store of value is not a virtue but a regrettable defect of our economic system. It is extremely difficult to create money that is a workable medium-of-exchange without it having some value-storing properties. This is a fundamental problem that industrious minds work to solve whenever faced with it. The less fundamental value money has the better. An item that is used as a medium-of-exchange cannot be put to productive use otherwise. More to Ryan’s point, attempts to store value as money have the potential to collapse our entire economic system. Money does not create anything. Value stored as money is value lost; lost because it represents resources not directed towards capital. Capital, unlike money, does create things. That people sometimes see it as advantageous to stop investing in capital and start holding money is the source of enormous economic instability. A sudden hoarding of cash means that businesses at once have fewer customers, fewer investors and fewer creditors. They have no choice but to retrench. They have to lay off good workers and shut down good machines. Unemployment rises. Complete Story » | |

| Posted: 10 Feb 2011 09:22 AM PST | |

| Posted: 10 Feb 2011 09:16 AM PST | |

| Posted: 10 Feb 2011 09:05 AM PST Hard Assets Investor submits: By Brad Zigler Some silver traders were left scratching their heads after reading our feature, "Playing The Silver Gosose." While the probabilities of breakout moves in the white metal were laid out in the article, no plan for actually "playing" the game was advanced. For those teased by the headline, we offer the following stratagem—a bull call spread on the iShares Silver Trust (NYSE Arca: SLV). In the article, the odds calculated for further bull moves in the near term were higher than those of a decline. Given silver's—and, consequently, SLV's—penchant for big gyrations, we can't totally discount downside volatility. What we need is a percentage shot for the near term. Hence the spread. A bull spread is constructed by buying an SLV call option and simultaneously selling short another call with a higher exercise, or strike, price. The risk of being short a call is covered—meaning there's no likelihood of margin calls—by ownership of the call with the lower strike. With SLV trading midway between $29 and $30 now, an April $32 call could be purchased for 78 cents. If you had a near-term price expectation of $36 by mid-April, you might be enticed by the prospect of risking $78 for a potential $322 payday. That's a 4-to-1 reward-to-risk ratio, after all. By selling a $34 April call—and collecting 41 cents in premium—alongside your call purchase, though, you're bestowed the same reward-to-risk potential, with just half the dollar outlay. How so? Your net premium cost would be just 37 Complete Story » | |

| Posted: 10 Feb 2011 08:56 AM PST by Addison Wiggin - February 10, 2011

“I want to encourage you to get in the game,” the president told CEOs assembled at the U.S. Chamber of Commerce across the street from the White House earlier this week. “Today, American companies have nearly $2 trillion sitting on their balance sheets… My message is now is the time to invest in America.” “I want to encourage you to get in the game,” the president told CEOs assembled at the U.S. Chamber of Commerce across the street from the White House earlier this week. “Today, American companies have nearly $2 trillion sitting on their balance sheets… My message is now is the time to invest in America.”Ah, if only it were so simple. We find ourselves in a pickle this morning. Somehow, we’ve veered off the track of providing you with incisive investment recommendations into the quagmire of presidential puffery… we apologize. In an effort to extricate ourselves, we’ve contrived an experiment… with the hopes that we can be done with this debate and get back to opportunity ASAP. What follows is, more or less, a conversation consisting of a speech given by the president asserting that the United States must be the best place on Earth to do business. And the response by an entrepreneur faced with the reality of doing business in today’s post-crisis regulatory environment.  The setting: The administration’s own Small Business Administration issued a study last year that says businesses with fewer than 20 employees are stuck with regulatory costs 42% higher than firms of 20-499 employees. The setting: The administration’s own Small Business Administration issued a study last year that says businesses with fewer than 20 employees are stuck with regulatory costs 42% higher than firms of 20-499 employees.And when it comes to environmental regulations, the cost to small business is 364% higher. Tax compliance? 206% higher. “These findings should anger us all,” wrote Gary Shapiro, president of the Consumer Electronics Association. “Over the past decade, small businesses created 70% of jobs in this country, and we are looking to them again to help lead us out of the current economic downturn.”  “America’s success didn’t happen overnight,” the president stated in one of the ‘duh’ moments of his Chamber speech, “and it didn’t happen by accident. It happened because [of] the freedom that has allowed good ideas to flourish, that has allowed capitalism to thrive; it happened because of the conviction that in this country hard work should be rewarded and that opportunity should be there for anybody who’s willing to reach for it.” “America’s success didn’t happen overnight,” the president stated in one of the ‘duh’ moments of his Chamber speech, “and it didn’t happen by accident. It happened because [of] the freedom that has allowed good ideas to flourish, that has allowed capitalism to thrive; it happened because of the conviction that in this country hard work should be rewarded and that opportunity should be there for anybody who’s willing to reach for it.”“Yes, Mr. President!” replies our friend Greg Stemm, CEO of Odyssey Marine. “We did ‘get in the game,’ hired lots of people, innovated and created a new industry out of wasted resources lost for centuries at the bottom of the ocean and abided by all applicable laws -- and, I am sorry to report, the U.S. Government is ‘encouraging’ us by trying to hand over the fruits of our labor to another government.” We’ve recounted the sordid tale many times, but for reference. The WikiLeaks cables revealed back in December that both the Bush and Obama administrations sought to lend a hand in turning over Odyssey’s Black Swan find (some $500 million in coins) to the government of Spain, in exchange for a painting in Madrid claimed by the estate of a U.S. citizen. “Your administration,” Greg continues, “is trying to change long-standing U.S. government policy and is ‘reinterpreting laws’ midstream to appease a foreign government, at the cost of hundreds of millions of dollars to U.S. investors -- hundreds of millions from our ‘balance sheets’ that we could unleash to create new jobs. “It even appears that our own government was offering to ‘assist’ a foreign government in our courts to literally steal hundreds of millions of dollars from the ‘balance sheet’ of the U.S. shareholders who earned it. The U.S. government is helping to ‘return’ property that the foreign government never owned or had any legal or ethical claim to.”  “We know what it will take for America to win the future,” continued the president as he courted the Chamber leaders. “We need to out-innovate, we need to out-educate, we need to out-build our competitors. We need an economy that’s based not on what we consume and borrow from other nations, but what we make and what we sell around the world. We need to make America the best place on Earth to do business.” “We know what it will take for America to win the future,” continued the president as he courted the Chamber leaders. “We need to out-innovate, we need to out-educate, we need to out-build our competitors. We need an economy that’s based not on what we consume and borrow from other nations, but what we make and what we sell around the world. We need to make America the best place on Earth to do business.”“It’s one thing when bureaucrats are beating you down,” Greg replies. “You learn after a while that this is just politics and business -- and sometimes you happen to be in the wrong place at the wrong time. “It’s quite another thing when the president asks you to ‘get in the game’ while the people under him go to great lengths to create problems for your company.” We’ve been following Greg’s trials and tribulations with the U.S. government in a documentary film we’ve just submitted to the Tribeca Film Festival. With any luck, we’ll get in and finish the project by the end of April. For us, Odyssey serves as a proxy for the situation many entrepreneurs across all industries face. The details of their specific challenge may be unique. But their effort to create and grow a business in an increasingly hostile environment does not appear to be so. We’ve published the complete response Greg wrote to the president below. And thank you for letting us get this off our chest.  Meanwhile, China’s biggest energy producer is buying its first stake in North American natural gas. PetroChina will buy 50% of Encana Corp.’s Cutbank Ridge assets for $5.4 billion. That gives China access to gas coming from 635,000 acres in Alberta and British Columbia. Meanwhile, China’s biggest energy producer is buying its first stake in North American natural gas. PetroChina will buy 50% of Encana Corp.’s Cutbank Ridge assets for $5.4 billion. That gives China access to gas coming from 635,000 acres in Alberta and British Columbia.If you’re keeping score (and we are), that’s $46 billion in total energy acquisitions by Chinese firms since last year. Nearly a quarter of that is in Canada alone; Sinopec paid $4.5 billion to ConocoPhillips last year to pick up a 9% stake in Canada’s biggest oil sands project. [Ed. Note: These deals will no doubt be the source of much debate at this year’s Investment Symposium in Vancouver, B.C. (July 26-29, 2011). We hope you’re making plans to join us now… the event sells out quickly, as space is limited. Our advance team, namely symposium director Bruce Robertson, is making his way back from Vancouver, as we speak. He’s finalized the contracts necessary to host this year’s event and we’re ready to start promoting it. If you know you want to join us, we recommend you register now, before the line forms and the price of entry goes up… call Barb Perriello at (800) 926-6575 and tell her you want the discount Addison is referring to.]  Major U.S. stock indexes plunged on the open today, but have recovered some of those early losses. Major U.S. stock indexes plunged on the open today, but have recovered some of those early losses.Among the factors weighing on the market: Cisco turned in better-than-expected numbers… but happened to mention its routing and switching revenue (that is, its high-margin operations) was down 7% for the quarter.  “Things are getting awfully interesting, as stocks push to recovery highs,” writes Options Hotline editor Steve Sarnoff. ”We’re seeing measures of volatility extremely low. This has me on watch for a coming increase in volatility. “Things are getting awfully interesting, as stocks push to recovery highs,” writes Options Hotline editor Steve Sarnoff. ”We’re seeing measures of volatility extremely low. This has me on watch for a coming increase in volatility.“We are seeing conditions that would warrant a serious correction coming soon to markets near you. Negative divergences are developing...China is pressing the brakes on its speeding economy...European debt worries are returning...Egyptian unrest is spreading. “But demand and liquidity are keeping the bulls in charge. The U.S. dollar is weak, and we may be nearing the point where it becomes clear, even to the staunchest bond bulls, that the long-term down trend in rates is broken.” Steve’s is on a roll again in 2011. He’s made four recommendations so far, and the average play is up 25% in just 10 days. One is up 52%. It looks as if Steve is on his way to another year of 12 or more plays that can double your money or better. Learn more about Options Hotline here.  The recent run-up in Treasury rates is taking a rest. The yield on 10-year notes peaked yesterday at 3.72% and then retreated after a decent 10-year auction and soothing words from Fed chief Ben Bernanke about inflation remaining at bay. The recent run-up in Treasury rates is taking a rest. The yield on 10-year notes peaked yesterday at 3.72% and then retreated after a decent 10-year auction and soothing words from Fed chief Ben Bernanke about inflation remaining at bay.We kid you not… The 10-year is back this morning to 3.68%.  Gold backed off overnight, too. But has now returned to roughly where it was 24 hours ago, at $1,365. Silver has picked up a nickel, to $30.25. Gold backed off overnight, too. But has now returned to roughly where it was 24 hours ago, at $1,365. Silver has picked up a nickel, to $30.25. If you’re looking for indicators that we’ll avoid a double dip in housing, you won’t find them in the latest data points… If you’re looking for indicators that we’ll avoid a double dip in housing, you won’t find them in the latest data points…

“The grain rally surged again yesterday with new 2½-year highs in corn, beans and, most importantly, wheat,” says Resource Trader Alert’s Alan Knuckman. “The grain rally surged again yesterday with new 2½-year highs in corn, beans and, most importantly, wheat,” says Resource Trader Alert’s Alan Knuckman.At $8.87 a bushel, “Wheat is closing in on the $9.00 target of the 50% recovery resistance from 2008 highs to 2009 lows.” Blame the most recent move on drought in China and wheat purchases by governments hoping to keep Egypt-scale protests from breaking out in their own backyards. Just this morning, Alan recommended taking a wheat trade off the table for potential gains of 216%. Keep an eye out next week for a special announcement on how you can join Resource Trader Alert… and also gain access to two more of our best-performing services.  We bid farewell and shed a tear this morning for a staple technology now fading into the past. We bid farewell and shed a tear this morning for a staple technology now fading into the past.2011 marks the first year since -- well, probably the 1970s -- that you can’t order a car with a built-in cassette deck. Lexus was the last make to offer it, and 2010 was the final year. Aftermarket models are still available if you can’t bear to part with that mix tape your ex-girlfriend gave back to you when you broke up. But the age of the mix tape has at last been supplanted by iPod playlists. “Now the question the automakers are asking is,” says Phil Magney of the industry research firm IHS iSuppli, “how long has the CD got to go?” How long, indeed?  “As an archaeologist who specializes in amphoras (transport jars) of the Classical Greek period,” responds a reader to Odyssey Marine’s effort to introduce a commercial model into shipwreck salvage, “and as one whose work more often than not involves shipwrecks, I would suggest that there is a clear distinction between those who seek profit from shipwrecks and those who seek to gather all traces of material culture and to then read them in such a way as to increase our understanding of history. “As an archaeologist who specializes in amphoras (transport jars) of the Classical Greek period,” responds a reader to Odyssey Marine’s effort to introduce a commercial model into shipwreck salvage, “and as one whose work more often than not involves shipwrecks, I would suggest that there is a clear distinction between those who seek profit from shipwrecks and those who seek to gather all traces of material culture and to then read them in such a way as to increase our understanding of history.“Because almost all amphora handles were stamped with tax information and because there are differences in design predicated on where any amphora was made, archaeologists have been able to understand the role of trade in ending the Greek Dark Ages as well as to trace the economy of the Greek city-states, and, in doing so, help explain why Greece failed to form a unified nation. Amphoras have no value on the open market. However, I have witnessed far too many shipwrecks that have been looted by for-profit archaeologists who have destroyed such junk items as amphoras. “Frankly, just as the Victorians collected mummies for afterdinner entertainment without regard to what they were destroying, commercial treasure hunters destroy what they consider valueless material culture. The goals of the commercial archaeologists and the scholarly archaeologists are just too disparate to co-exist. “The difference is clear: For-profit archaeologists want to make money and are looking for booty. Once you introduce a profit motive, the entire paradigm collapses. What makes leaving archaeology to those who are neither interested in making money nor selling the material culture they find seems blatantly obvious. Or do you really think that history has no value?” The 5: This is exactly our point. You’re asserting that a person seeking profit cannot also value history. We’re not experts in the field by any means. Nor do we mean to beat a moribund horse. But we know that in their lab in Tampa, Odyssey has rows of amphoras that they’ve preserved to the highest standards of the archeological community. And have published their own findings on these artifacts because the scholarly journals refuse to print research from for-profit institutions. Likewise, Odyssey employs a world-class team of historians, archeologists and oceanographers to locate and excavate the wrecks they’re seeking, including the gentleman who helped “raise” the Titanic. You think that simply by choosing to work for a for-profit company they lose their interest in history and its preservation? Right now, there is a movement afoot to strip any archeologist of their professional credentials if they go to work for a commercial outfit. How does that make any sense? Wouldn’t that encourage exactly the kind of ignorant looting you’re worried about?  “I am a contractor in Michigan who recently has been turning down work,” a reader comments on the state of the economy. “Why, you might ask? Over the past three years, I have had to reduce my work force from eight to four. Each reduction was a painful, sleepless thing for me. These people need their jobs. “I am a contractor in Michigan who recently has been turning down work,” a reader comments on the state of the economy. “Why, you might ask? Over the past three years, I have had to reduce my work force from eight to four. Each reduction was a painful, sleepless thing for me. These people need their jobs.“What I have learned is to become much more efficient with less (profit margins up). The phone has been ringing off the hook recently, but I have chosen to become more selective, rather than add employees to meet demand. “I am not sure why we have had so much action recently. I think the masses are falling for the debt-fueled recovery. I believe that most small business owners have the same attitude as I do: Increased regulation, higher taxes and forced health care benefits are not a good recipe for small business job growth. I personally believe our days of reckoning are coming. With your help, I have been preparing.”  “Am I missing something with this oil tanker pirate thing?” a third reader asks, changing tack. “I figure if I operated an oil tanker, I’d enlist the help of one ex-special forces trooper as insurance. I think that one (well-trained) fellow with one crane-mounted minigun could easily repel pirates at sea.” “Am I missing something with this oil tanker pirate thing?” a third reader asks, changing tack. “I figure if I operated an oil tanker, I’d enlist the help of one ex-special forces trooper as insurance. I think that one (well-trained) fellow with one crane-mounted minigun could easily repel pirates at sea.”“For the life of me,” adds another, “I can’t understand why the various governments of the world don’t simply allow the crews of the tankers and other vessels sailing anywhere near Somalia to have effective small arms to repel a pirate attack. “A couple of .50-caliber sniper rifles and some proper training on their use on the tanker just taken would have prevented these attacks and saved millions of dollars in goods from being seized. Political correctness run amok.” The 5: That’s the crux of the issue. “There are two barriers preventing defensive armament of merchant shipping,” according to gun rights analyst Dave Kopel of the Independence Institute. “A ship flying the American flag is governed by American law, which of course allows American crew members to possess arms. But the vast majority of commercial shipping these days is on ships that are registered to other flags, such as Liberia, Panama, Greece, the Bahamas, Hong Kong or Turkey. A permit to own a firearm for defensive purposes is not necessarily easy to obtain from such governments. “Also, territorial waters extend 12 miles from a nation’s coast. A ship that enters a nation’s territorial waters must obey that nation’s laws, including the gun laws… “Plenty of foreign ports ban arms on any nonmilitary vessel.”  “It seems the Somali pirates never take over ships headed to China,” adds another reader. “I wonder why. Payoffs? Fear?” “It seems the Somali pirates never take over ships headed to China,” adds another reader. “I wonder why. Payoffs? Fear?” “Those girls are not flat,” a reader writes after seeing our note yesterday that “stocks were flat as a Victoria’s Secret model. “Those girls are not flat,” a reader writes after seeing our note yesterday that “stocks were flat as a Victoria’s Secret model.“Victoria’s Secret normally uses much curvier models than you’d typically see on a runway,” he says. ”I’ve done my DD on this.” The 5: Is that ‘due diligence’ or… a measurement? Cheers, Addison Wiggin The 5 Min. Forecast P.S.: George Soros and T. Boone Pickens don’t agree on much politically. But they agree on one of the best opportunities in the energy patch in a long time. They’ve both taken stakes in the “special situation” that recently came on Chris Mayer’s radar. For now, shares can be had at under $3.50… but probably not for very long. Chris shares all the details here. “I guess he’s speaking to me as a CEO of an American company,” says Odyssey Marine CEO Greg Stemm, “so I’d like to respond in an open letter to President Obama: Yes, Mr. President! I’m with you on this. We’ve been trying -- but it feels like our efforts are being sabotaged by our own government. We need your help -- and all we are asking for is an honest and level playing field. We did “get in the game,” hired lots of people, innovated and created a new industry out of wasted resources lost for centuries at the bottom of the ocean and abided by all applicable laws -- and I am sorry to report that the U.S. Government is “encouraging” us by trying to hand over the fruits of our labor to another government. Your administration is trying to change long-standing U.S. Government policy and is “reinterpreting laws” midstream to appease a foreign government at the cost of hundreds of millions of dollars to U.S. investors -- hundreds of millions from our “balance sheets” that we could unleash to create new jobs. It even appears that our own government was offering to “assist” a foreign government in our courts to literally steal hundreds of millions of dollars from the “balance sheet” of the U.S. shareholders who earned it. The U.S. government is helping to “return” property that the foreign government never owned or had any legal or ethical claim to. How do I really feel about this? It’s one thing when bureaucrats are beating you down -- you learn after awhile that this is just politics and business -- and sometimes you happen to be in the wrong place at the wrong time. When you run a business, you learn to take the knocks that come from anti-business bureaucrats -- people who have never had to make payroll, never had to hire someone, never had to let someone go -- never created a job, and many who wouldn’t know how to begin to do these things. We build our companies in spite of these obstacles and pray that we aren’t destroyed by a government employee who can inadvertently wipe out our business with the swipe of his or her pen. That’s something we’ve learned to live with... reluctantly. It’s quite another thing when the president asks you to “get in the game” while the people under him go to great lengths to create problems for your company. I hope you can understand how frustrating that can be. Mr. President, if you really want to encourage us to “get in the game,” please send a message to the U.S. State Department and the Justice Department to encourage them to be absolutely honest with the courts about the actual intent and meaning of the laws that have recently twisted to serve foreign interests. Please encourage them to allow former U.S. government employees, who drafted and understand the intent of these laws, to explain that intent to the courts. Respond to the members of Congress who are calling for the State Department to allow the courts to do their work | |

| Hourly Action In Gold From Trader Dan Posted: 10 Feb 2011 08:41 AM PST | |

| January Deficit Grows by $50B, on Pace For $1.5T Posted: 10 Feb 2011 08:38 AM PST Mubarak Refuses To Step Down.. Note: Guy on Al-Jazeera just now said, he believes this will be the most violent, bloody revolution ever in the history of the world.. Protesters Complain of Torture and Detentions by Mubarak's ArmyWASHINGTON (AP) -- The federal government's budget deficit grew by $50 billion in January and is expected to finish the year as the highest in history. The Treasury Department said Thursday the deficit was one of the highest ever for the month of January, second only to the $63 billion deficit recorded two years ago. For the first four months of this budget year, the deficit totaled $418.8 billion, 2.7 percent lower than the same period a year ago. However, this improving trend is expected to reverse in coming months. The Congressional Budget Office is projecting a record deficit of $1.5 trillion this budget year, which ends in September. The estimate was revised upward last month based on a tax-cut package brokered between the White House and Republicans that will add $400 billion to this year's red ink. More Here.. Federal Reserve To Buy More Air From The Treasury Dept Dollar Is Finished: IMF Calls For Dollar Alternative Ron Paul Says Next US Crash Will Be Comparable To That Of Soviet UnionThis posting includes an audio/video/photo media file: Download Now | |

| How Much More Demand Can Silver Handle? - February 9, 2011 Posted: 10 Feb 2011 08:21 AM PST How Much More Demand Can Silver Handle? - Casey's Daily Dispatch [LIST] [*]Sign Up Now! [*]| [*]RSS Feed [*]| [*]Print this [*]| [*]Visit the Archives [*]| [*]Email to a Friend [*]| [*]Back to All Publications [/LIST] February 9, 2011 | [url]www.CaseyResearch.com[/url] Dear Reader, Everyone is familiar with the myth that booms can last forever. But another, less noticeable myth takes hold right when the boom begins to weaken. It's the idea that the central bank can slowly unwind apparent problems on the horizon. The U.S. experienced this during... | |

| Posted: 10 Feb 2011 08:15 AM PST Not much time for careful cogitations today, Fellow Reckoner. In fact, we barely have time for careless ones. We're on a bus right now, traveling from Uruguay's capital of Montevideo to the seaside town known to locals simply as "Punta". But wouldn't you know it…they've gone and enabled the bus with a Wi-Fi connection. We're in the middle of nowhere and somehow, some way, the news still finds us. Day by day, it's getting harder and harder to avoid. So we recline our chair, flick the reading light on overhead and take a look around the empire from right here on our Uruguayan coach. The reports are flooding across the wires that Egypt's dictator of 30 years is to step down. You remember Hosni Mubarak – "good friend" of one Dick Cheney and outpost sentinel for the US over in the MENA region. He's been the focal point for the rage of a generation of young Egyptians who have been busily protesting up and down the Nile. They want the old coot out, they say. This is a new generation, after all, and they're wising up to what's been left to them: poverty, massive unemployment and a generally pitiful existence. Not much, in other words. When the protests began, the Egyptian government suspended the Internet and disabled texting capabilities for cellular phones. They saw what happened in Iran a year earlier, where angry citizens took to the social media waves to bring news of the electoral fraud there to the world. They published videos of police brutality and tweeted their hearts out for all to see. "There's no way we're having any of that," Hosni must have thought. "Cut the cables!" It didn't matter, of course. The truth has a reliable habit of making its way into the light eventually. In Egypt's case, Google set to work developing "speak-to-tweet" technology, whereby citizens there could call a specific number and have their recorded voice messages converted into micro-blogs. And lo! "The government is spreading rumors of fear and of burglary and of violence," said/wrote/tweeted one concerned Egyptian. "The only incidence of theft and burglary are done by the police themselves." This will come as a shock to almost nobody. It's just what you'd expect from the crumbling edges of a failing empire. Kings, warlords, gangsters and presidents have for millennia fought to protect their privilege and power. It's what they do. And, for just as long, "the people" have been pushing back. Like all others, this trend has its ebbs and flows. For generations at a time the state gains ground, encroaching on the rights and lives of those it affects to serve. Then, when the masses have finally had enough, they storm the palace grounds and give their oppressors the boot…only to replace them with a new ruler, one who promises "change." Today, while the outposts burn in far off lands, the Antoinettes continue the party closer to home, right there in the US of A. But there's something very different about the "post-recession" vibe at this shindig. For one thing, the cost of eating cake (and of eating in general) is skyrocketing. Corn, which is used to feed the cattle, hogs and chickens, has doubled in the past six months. That has a knock-on effect. Fellow Reckoners flooded our inbox last week with stories of price hikes at their grocery stores and gas pumps. Ben Bernanke says this has little to do with his ark-worthy flood of US dollars into the world economy. Right. A trillion here…a trillion there… "What, me worry?" In other news, foreclosures in the US jumped 12% in January from the previous month. According to a report from real estate data firm RealtyTrac, lenders foreclosed on 78,133 properties for the month. "The numbers will inevitably go up," Rick Sharga, senior vice president at RealtyTrac, told the papers. "It's just a question of will it be sooner or will it be later." Meanwhile, The US Postal Service is hinting that it may default on some of its financial obligations later this year after reporting yet another quarterly loss. The cumbersome government agency said it suffered a loss of $329 million in the first quarter of federal fiscal year 2011. That was up from a loss of $297 million a year earlier. Faced with a problem caused by too much spending, the Obama Administration has promised to do just what it ought to avoid; that is, to spend more…more than any other administration in the history of the republic. More waste…more incompetence…and, incredibly, more intervention. Joel Bowman When the People Push Back originally appeared in the Daily Reckoning. The Daily Reckoning has published articles on the impact of quantitative easing, bakken oil, and hyperinflation. | |