saveyourassetsfirst3 |

- Gold & Silver: No opportunity cost of owning precious metals over bonds or cash

- Tuesday Options Recap

- Gold: The Improbable Answer to Life, The Universe, And Everything

- More Evidence Commercial Silver Supply Tight

- Gold Dances to a Different Contango

- Not Owning Gold is a Form of Insanity - Casenoves Robin Griffiths tells CNBC

- Silver Market Update

- This is one of the greatest quotes we've ever heard about gold

- This simple strategy returns up to 15% in bull and bear markets alike

- A significant stock market top could be forming now

- India, Iran mull over gold-for-oil for now

- Judge Orders Fed to Deliver Gold Records for Her Review

- Gold Is Under-owned

- Gold Outlook 2011: Irreversible Upward Pressures and the China Effect

- The “Money Supply” with a Gold Standard 2 : 1880 - 1970

- Gold Whips Near Euro-High as Germany Denies Portuguese Bail-Out…

- On the Edge with Max Kaiser-Fluctuations in the Silver Market

- Mainstream Hacks Deny Gold its Fundamentals

- New Year’s Resolutions for Your Gold Portfolio

- What is this?

- Two Americas: 12 Facts That Show That Those Who Are Too Big To Fail Are Thriving On The Bailout Money That Our Politicians Gave Them Even As The Economic Suffering Of Ordinary Americans Continues To Deepen

- A World Of Ones And Twos

- A Long Winter for the Unemployed

- Buy a House… Then Buy Another

- Judge orders documents on the Fed filed with her...big victory...open interest in silver remains strong:

- Metals Inch Higher on Dollar Decline

- The B-Word Is in the Eye of the Beholder

- John Williams: Gold Against Financial Armageddon

- PSLV: Eric Sprott Updates the Delivery Status of Silver

- US Dollar Rallies on Unemployment Data

- Outlook 2011: Fear and Love in Gold Trading

- The Job Numbers Report, Making Money Off It

- Synonymous Terms for Quantitative Easing

- Gold Seeker Closing Report: Gold and Silver Start the Week with Decent Gains

- (VIDEO) Part 3 - Silver Manipulation Explained

- A big win for GATA vs. The Fed

- Gold Is For The Little Guys Now

| Gold & Silver: No opportunity cost of owning precious metals over bonds or cash Posted: 11 Jan 2011 11:35 AM PST Are you one of the millions of people who lost money over the past decade in stocks and housing who is now buying bonds, annuities, and other fixed deposit credit based investments? If so, you are probably doing so because you think it is the conservative thing to do but, in fact, you are really being a speculator buy | ||

| Posted: 11 Jan 2011 06:42 AM PST Frederic Ruffy submits: SentimentMajor averages are little changed in a day of lackluster trading Tuesday. The table was set for morning gains on Wall Street after stocks moved broadly higher across Europe on diminishing fears about the unfolding debt crisis. Some of the optimism stems from talk Japan might begin buying sovereign debt of some troubled Euro-zone nations. In the US, the focus is shifting to earnings. Alcoa (AA) is trading down 1.3 percent despite posting better-than-expected results. Sears (SHLD) is rallying, but Supervalu is seeing serious post-earnings weakness. Meanwhile, the only economic stat of the day showed November wholesale inventories down .2 percent. Economists were looking for an increase of .1 percent. Bonds slipped on the news, but stocks showed little reaction. Meanwhile, crude oil bubbled $1.87 higher to $91.12 and gold gained $9 to $1383 an ounce. The Dow Jones Industrial Average is up 29 points and the NASDAQ has added 6. With an hour left to trade, the CBOE Volatility Index (.VIX) is off .39 to 17.15. Trading in the options market is running about the typical levels, with 8 million calls and 5.2 million puts traded so far. Bullish FlowPatriot Coal (PCX) shares are smoking Tuesday, up $2.02 to $25.59 and touching new 52-week highs. Options action is heating up as well, with 30,000 calls and 10,000 puts traded in the name through midday. Feb 30 calls are the most actives. 6,420 traded. Jan and Feb 25 calls are busy as well. Implied volatility is up 4.5 percent to 70 and overall flow is bullish after Deutsche Bank initiated coverage on PCX with a Buy rating. Complete Story » | ||

| Gold: The Improbable Answer to Life, The Universe, And Everything Posted: 11 Jan 2011 06:37 AM PST

(With apologies to Mr. Adams, may he rest in peace, I never get tired of quoting that book.) Complete Story » | ||

| More Evidence Commercial Silver Supply Tight Posted: 11 Jan 2011 05:42 AM PST More anecdotal evidence of the tightness in the commercial silver market surfaced yesterday in a piece picked up by our friends at the Gold Anti-Trust Action Committee (GATA), a press release issued by Sprott Asset Management on the delivery status of the roughly 22.3 million ounce (694-tonne) first buy for the new Sprott Physical Silver Trust (NYSE ARCA:PSLV). | ||

| Gold Dances to a Different Contango Posted: 11 Jan 2011 05:22 AM PST Hard Assets Investor submits: By Brad Zigler Some investors in the oil market lost big as they danced the contango in 2010. Owners holding shares of the United States Oil Fund (USO) actually lost 0.7 percent even though front-month WTI prices rose 15.2 percent on the year. USO's contango-resistant sibling, the United States 12-Month Oil Fund (USL), fared better by wringing out 6.5 percent in capital appreciation against the stiff carrying-charge headwind. Complete Story » | ||

| Not Owning Gold is a Form of Insanity - Casenoves Robin Griffiths tells CNBC Posted: 11 Jan 2011 01:23 AM PST | ||

| Posted: 11 Jan 2011 12:51 AM PST Silver is now looking vulnerable as last week it clearly broke down from its steep uptrend in force from last August, after making new highs at the turn of the year. As we know from experience, when silver breaks down things can turn ugly fast, and technically the only thing that has preventing it from plunging thus far following the trendline failure has been the support level in the $28 area near to its rising 50-day moving average. Silver is now short-term oversold and one scenario we should take note of here is that it could enter a trading range bounded by this support and the resistance at the highs. However, there are 3 factors in play visible on longer-term charts which suggest that a breakdown and corrective drop is now more likely than a high trading range. | ||

| This is one of the greatest quotes we've ever heard about gold Posted: 10 Jan 2011 11:54 PM PST From Investment Postcards from Cape Town: Gold is far from an over-owned trade and will eventually rally exponentially, Robin Griffiths, technical strategist at Cazenove Capital, told CNBC. He said, "I think not owning gold is a form of insanity. It may even show unhealthy masochistic tendencies which might need medical attention..." Watch the short video here... More on gold: This could be the best buying opportunity in gold all year Why it could be months before we see new highs in gold How to ensure you don't lose money in the coming gold mania | ||

| This simple strategy returns up to 15% in bull and bear markets alike Posted: 10 Jan 2011 11:50 PM PST From Bloomberg: The surest way to profit from takeover speculation in the stock market is to bet it's wrong. Electronic news services, brokerages, and newspapers reported at least 1,875 rumors about potential buyouts of 717 companies between 2005 and 2010, according to data compiled by Bloomberg. A total of 104, or 14.5 percent, were acquired, the data show. While stocks that were the subject of takeover speculation initially jumped 2.9 percent, betting on declines yielded average profits of 1.2 percent in the next month, an annualized gain of 14 percent. Opportunities to employ the strategy are increasing as mergers recover from the worst recession in more than 70 years, data compiled by Bloomberg show. After bottoming in 2008, the number of unconfirmed stories about possible mergers surged 71 percent to 611 last year from 2009, data compiled by Bloomberg from more than 50 news providers and brokerages show. "Sell into the strength," said John Orrico, who focuses on mergers and acquisitions at New York-based Water Island Capital LLC, which oversees about $2.2 billion. "We see it as an opportunity to sell if we think the rumor is false or ridiculous, which in most cases they are." Short selling to speculate on declines on supposed takeover targets produced more than twice the average return generated by U.S. stocks, data compiled by Bloomberg show. At the same time, companies in the Russell 3000 Index had the same chance of being acquired in any 12-month period since 2005 as those that were the subject of merger stories, the data show. Versus S&P 500 Stocks tracked by Bloomberg fell 0.2 percent, 0.6 percent, and 1.2 percent on average in the day, week, and month following a rumor report, Bloomberg data show. The S&P 500 rose 0.03 percent, 0.2 percent, and 0.5 percent on average during the same periods. The 14 percent annualized profit from short selling compares with a 6.2 percent yearly return since 1900 before dividends for U.S. stocks, inflation-adjusted data from the London Business School and Credit Suisse Group AG in Zurich show. Short selling is the sale of borrowed stock in the hope of profiting by buying the securities later at a lower price and returning them to the shareholder. Akamai Technologies Inc. has been the subject of more buyout rumors than any other U.S. company since the start of 2005, data compiled by Bloomberg show. The provider of computing services that speed delivery of Internet content remains independent after being named 21 times. 'Playing With Fire' The most recent instance was Dec. 16. After rallying 1.7 percent when the speculation was reported, shares of the Cambridge, Massachusetts-based company lost 3.8 percent in the next week as the S&P 500 gained 1.1 percent. A telephone call and e-mail to Jeff Young and Jennifer Donovan, spokesmen for Akamai, weren't returned. "Don't chase rumor stocks," said Michael Vogelzang, Boston-based chief investment officer at Boston Advisors LLC. "You never know where you are in the chain, whether you're the first to hear it or the last. You're just playing with fire because you know if it doesn't work out, it's going to come down." Netlist Inc., a maker of computer-memory systems, rose 1.9 percent when rumors were reported on Dec. 28, 2009, that Microsoft Corp. might buy the Irvine, California-based company. The shares declined 2.2 percent a day later, 9.4 percent a week later, and 31 percent in 30 days. 'Outside the Bounds' "Netlist makes memory modules that go into servers, so Microsoft is not the type of company that would want to go and buy them," said Richard Kugele, an equity analyst at Needham & Co. in Boston. "There's a difference between hardware companies and software companies, and it's just completely outside the bounds of what they do." Jill Bertotti, a spokeswoman for Netlist at Allen & Caron Inc., declined to comment. By the time market chatter is publicly reported, it's been passed around trading desks via instant messages and e-mail and is usually old news, according to Todd Salamone, an equity analyst at Schaeffer's Investment Research in Cincinnati. Profiting from the reports is impossible because shares have already rallied, he said. "I don't know where that stuff comes from," he said. "The rumors tend to create a pop, and eventually the fundamentals and technicals take over, especially in those situations that prove to be only rumors. It's a very short-term event." Other Signals Even when they coincide with other bullish signals such as increased options trading, rumors usually don't prove accurate. Call volume in New York-based Jefferies Group Inc. jumped amid unconfirmed takeover reports on Feb. 27, 2008. Calls on the company changed hands 12,692 times that day, 24 times the four-week average and the most in almost a year, and the shares gained 3.7 percent. A deal never occurred and Jefferies dropped 3.4 percent the next day, 10 percent the next week, and 20 percent in 30 days. The S&P 500 lost 4.7 percent in a month. Thomas Tarrant, a spokesman for Jefferies, declined to comment. Some stocks eventually are acquired after years of buyout stories. Melville, New York-based OSI Pharmaceuticals Inc. was the subject of takeover chatter nine times from 2005 to 2009, and the shares posted one-month declines averaging 9.1 percent. Tokyo-based Astellas Pharma Inc. bought the company in June. OSI surged 52 percent on March 1, after Astellas said it would begin a hostile takeover offer. There were no rumors on record in the days before that announcement. Jenny Keeney, a spokeswoman for Astellas in the U.S., referred a request for comment to the company's Tokyo office. A call there outside normal business hours wasn't returned. Rumor Origination "The question that remains unanswered is where does the takeover story originate," said Michael McCarty, managing partner at Differential Research LLC in Austin, Texas. "It's most likely from someone who's interested in selling." Deliberately spreading false rumors may violate securities laws, especially if the intent is to sway prices, said James Cox, a professor at Duke University School of Law in Durham, North Carolina. Proving a market-manipulation case is difficult, according to Peter Henning, a law professor at Wayne State University in Detroit and a former federal prosecutor. "You might be able to see a unicorn before you see a market manipulation case established based on rumors," Henning said. "It's so difficult to pin down, and even if you can, to try to link them. You get lots of investigations announced and very few cases brought." Losing Money Many rumors are losers from the start. MetroPCS Communications Inc., the Richardson, Texas-based wireless network, lost 1 percent on Sept. 21, 2009, after a news service reported unconfirmed chatter of a potential bid. Shorting the stock paid 34 percent over the next month. MetroPCS fell 49 percent in 2009, the fourth-biggest retreat in the S&P 500, data compiled by Bloomberg show. A call and e-mail to Diana Gold, a MetroPCS spokeswoman, weren't returned. BioCryst Pharmaceuticals Inc. of Birmingham, Alabama, surged 8.5 percent on Nov. 4, 2009, amid takeover bets. While it jumped 13 percent the following day and 21 percent in a week, it posted a 25 percent slump through the beginning of December. Catherine Collier Kyroulis, who represents the company at WeissComm Group, said BioCryst declined to comment. Short selling rumors "is not a bad strategy," said Mark Yusko, the Chapel Hill, North Carolina-based president of Morgan Creek Capital Management LLC, which allocates about $10 billion to hedge funds. "The data confirms a lot of things that we've seen as we've gone through the last 20 years of information access and availability. As information has become ubiquitous, it is very difficult to separate the real information from the fake." To contact the reporter on this story: Tara Lachapelle in New York at tlachapelle@bloomberg.net. To contact the editor responsible for this story: Nick Baker at nbaker7@bloomberg.net. More trading ideas: Three ideas for safely buying stocks today This could be the best buying opportunity in gold all year World's top trading firm reveals its top five ways to profit in 2011 | ||

| A significant stock market top could be forming now Posted: 10 Jan 2011 11:37 PM PST From Gold Scents: Sometime between early February and early April the market should drop down into a major yearly cycle low. Last year, that cycle low came during the first week of February. Since the current daily cycle is now in the timing band for a bottom, we should see an intermediate top fairly soon. Yearly cycle corrections are major corrections, only exceeded by the four-year cycle low in severity. So once the correction begins, it should be a doozie. The severity of the impending correction will tell us whether the cyclical bull is on it's last legs or not. If the correction retraces back to or maybe a little below the 200 DMA, then... Read full article (with charts)... More on stocks: If you're thinking of buying stocks today, read this first Trader alert: These stocks are set to make huge moves soon Top analyst Rosenberg reveals an amazing fact about the stock market | ||

| India, Iran mull over gold-for-oil for now Posted: 10 Jan 2011 08:46 PM PST Image:  Today's final story is one that sort of slipped under the radar on the weekend. It was a posting at indiatimes.com and filed from New Delhi that bears the rather sensational headline of "India, Iran mull over gold-for-oil for now". India is determined to ensure steady crude oil supplies from Iran and is even considering settling payments with gold in the short term before the two countries agree on a mutually accepted currency and a bank to clear the transactions. It's not an overly long story...and, once again, I thank reader 'David in California | ||

| Judge Orders Fed to Deliver Gold Records for Her Review Posted: 10 Jan 2011 08:46 PM PST Plenty of paper silver...but metal is scarce, Sprott warns. Not owning gold is insane, Casenove's Griffiths tells CNBC. India, Iran mull over gold-for-oil trade. 'American the Beautiful' 5- oz Bullions Go to "Profiteers"...and much, much more. ¤ Yesterday in Gold and SilverThe gold price didn't do a lot yesterday, pricewise. It gained five bucks by 11:00 a.m. Monday morning Hong Kong time...and stayed there until 3:00 p.m...before sliding into the New York open. A sharp rally commenced...that ran into equally sharp selling...with gold's low [$1,364.60 spot] coming at the London p.m. gold fix...which was 10:00 a.m. in New York...right on the button! From there, gold climbed to its high of the day, which was $1,377.30 spot, which came at the close of trading at 5:15 p.m. Eastern time. Not much to see here, but it was gold's first positive day of the new year.

What I said about gold, pretty much applies to the silver price yesterday as well...with the high of the day posted at $29.14 spot. The low was around $28.60 spot sometime during the lunch hour in London. Looking at the New York chart on its own, it's impossible to tell when the high was...as every time that silver poked its nose over $29.10 spot, it got sold off. Silver finished up 40 cents on the day.

Here's the New York Spot Silver chart on its own...

The world's reserve currency didn't do much during the Monday trading day, anywhere in the world...although there was a 45 basis point sell-off between 8:00 a.m. and 12:30 p.m. Eastern time yesterday. From that low, the dollar traded sideways into the New York close.

Not surprisingly, because gold hit its low of the day at precisely 10:00 a.m. Eastern time, which was the London p.m. gold fix...that was also the precise bottom for the gold stocks...as the HUI chart shows below. And, like the gold price, the stocks finished in slightly positive territory [up 0.26%] as well.

The CME's Daily Delivery report is hardly worth mentioning, as only 9 gold and 3 silver contracts were posted for delivery tomorrow. Nothing to see here, folks. For a change, the GLD ETF showed an increase yesterday. It was only 48,800 troy ounces...but an increase nonetheless. However, over at the SLV ETF it was an entirely different story, as 1,709,855 ounces of silver were reported withdrawn. That's the second withdrawal of 1.7 million ounces in as many business days. I'm not sure if it's a legitimate withdrawal because of the price action...or did someone have urgent need for the silver that they had temporarily stored there? The U.S. Mint had a sales report as well. They sold another 5,000 ounces of gold eagles yesterday...along with a whopping 1,136,000 silver eagles! Month/year-to-date, the mint has sold 33,500 ounces of gold eagles, along with 3,357,000 silver eagles. Over at the Comex-approved depositories on Friday, they reported that 300,296 troy ounces of silver were withdrawn...and the link to that action is here. While I'm on the subject of silver, my bullion dealer here in Edmonton is off to his best start to a year, ever. As a matter of fact, he has all the business he can handle...and then some. Most people showing up now are all new customers that are buying silver because they've heard or read that this is the 'sure thing' for 2011. Isn't the Internet just grand? Ordinarily, I'd say that that might be an indication that a top was close...but that is definitely not the case this time. If was I was a bullion bank, or any other entity short the silver market right now, I'd be shaking in my boots at news like this. And it gets worse, or better, depending on who you are. Scottish reader Ian McGlone sent me the following tidbit yesterday morning... "Ed, this just appeared on the bullionvault.com website. Price & liquidity warning - Silver - Our inbound silver deliveries have been delayed. We only sell bullion which is physically under our control, so we find ourselves currently unable to offer silver on our own market. Naturally, the market remains open for all our customers to quote their own prices; but as we ourselves currently have no silver to offer, there is a tendency to higher prices for both buyers and sellers. Buyers are advised to be appropriately cautious when confirming their order's limit price. We are advised silver be delivered on Tuesday 11th Jan 2001." Not that anyone would want to throw gasoline on this fire...but here's a press release from yesterday that Ted Butler sent my way. It's from Sprott Asset Management. Eric has just made public what everyone and his dog knows about now...that it took them over ten weeks to get all the silver they ordered. "Frankly, we are concerned about the illiquidity in the physical silver market," said Eric Sprott. "We believe the delays involved in the delivery of physical silver to the Trust highlight the disconnect that exists between the paper and physical markets for silver." Gee, I wonder where Eric got that idea from? Anyway, the GATA headline to the press release reads "Plenty of paper silver...but metal is scarce, Sprott warns". Needless to say, it's worth the read...and the link is here. Ted Butler and I were discussing both CEF and Sprott's physical silver funds yesterday...talking about how soon they would have offerings. I note that CEF's silver fund has a premium of only 6.8% in both U.S. and CAN$ terms...but over at Sprott, they reported 13.5% as of the close yesterday. I would suspect [at this premium] that Sprott will have an offering pretty soon. In his commentary to clients on last week's trading activity, silver analyst Ted Butler had this to say on Saturday... "There were no obvious physical market factors to account for this [past] week's price decline, particularly in silver. All signs pointed to an old-fashioned Comex-orchestrated affair, complete with late-night spoofing [phony offers] and actual selling at thin times to get prices rolling down hill to scare and induce others to sell. I guess the regulators at the CFTC...and the criminal enterprise also known as the CME Group...need a good night's sleep and can't be bothered with late night Comex shenanigans."

¤ Critical ReadsSubscribeAlgeria in turmoil as riots stretch over third dayIt's Tuesday...and I have three days worth of stories to post. I've edited them as much as I'm going to...and the final edit is up to you. The first is follow-up to the story I posted about food price riots in Algeria. This story is posted over at the france24.com website...and was sent to me by reader Roy Stephens. Algerian protesters angered by rising food prices and widespread unemployment have clashed with police in a third day of rioting that has highlighted growing anxiety among the country's youth. The headline reads "Algeria in turmoil as riots stretch over third day". It's a longish story with an 85 second video imbedded...and the link is here.  Rioting spreads across Tunisia; unrest also reported in AlgeriaFrom Algeria to Tunisa...comes this offering from Scott Pluschau. The headline in the L.A. Times reads "Rioting spreads across Tunisia; unrest also reported in Algeria". Tunisia's problems sound the same as Algeria's problems. Protests and strikes driven by unemployment and high food prices continued to sweep across the tightly controlled North African nation of Tunisia on Friday amid police attempts to clamp down on the unrest. The link to the story is here.  Food Agriculture Organization - Food IndexTalking about food prices...I posted a similar graph to the one below, last week. It's the "Food Agriculture Organization - Food Index" graph. It shows that world food prices are at record highs...even higher than they were in 2008. I thank Casey Research's own Bud Conrad for sharing it with us.

Sarkozy takes G20 case to Obama as food prices soarHere's a Reuters piece from reader Carl Loeb that's headlined "Sarkozy takes G20 case to Obama as food prices soar". Soaring food prices and riots in places like Algeria offer Sarkozy ammunition to press for more coordination between G20 governments to combat wild swings in vital commodity prices as well as exchange rates versus the long-dominant U.S. dollar. Paris is also pressing for international efforts to impose greater transparency in commodity markets trading and pricing, and for tougher regulation of trading in commodity derivatives. The link to this worthwhile story is here.  Stock market plunge sparks protest in BangladeshHere's an American Press story posted over at apnews.myway.com...that was sent to me by reader Scott Pluschau. The headline reads "Stock market plunge sparks protest in Bangladesh". Bangladesh suspended trading at its main stock exchange Monday and security officials used batons to disperse thousands of angry investors upset over a market plunge. It's a very short read...and the link is here.  Cash-Strapped Argentines Begin Year on a Tense NoteThe next item is from yesterday's edition of The Wall Street Journal. Because it's subscriber protected...there are only about three paragraphs of text for you to read. The first paragraph tells you a lot... "Argentines are starting the new year facing a cash crunch—literally, a shortage of bills at banks and automated-teller machines due to what critics say is faulty planning at the central bank, as well as persistent inflation.". The rest of the text is well worth your time...and I thank Washington state reader S.A. for sending it along. The headline reads "Cash-Strapped Argentines Begin Year on a Tense Note"...and the link is here.  Walker's World: Euro train wreckHere's Roy Stephens next offering of the day. It's a UPI piece filed from Washington that's headlined "Walker's World: Euro train wreck". This week will be the first test of the year for the survival of the euro, as Portugal, Spain and Italy all have bond auctions. The countries are likely to raise the money they need. The first question is how much they will have to pay in interest to compensate investors for the risk. The second question is: who will take the risk? The link to the story is Posted: 10 Jan 2011 07:55 PM PST | ||

| Gold Outlook 2011: Irreversible Upward Pressures and the China Effect Posted: 10 Jan 2011 05:01 PM PST | ||

| The “Money Supply” with a Gold Standard 2 : 1880 - 1970 Posted: 10 Jan 2011 05:00 PM PST | ||

| Gold Whips Near Euro-High as Germany Denies Portuguese Bail-Out… Posted: 10 Jan 2011 04:43 PM PST | ||

| On the Edge with Max Kaiser-Fluctuations in the Silver Market Posted: 10 Jan 2011 04:30 PM PST Goldsilver | ||

| Mainstream Hacks Deny Gold its Fundamentals Posted: 10 Jan 2011 03:30 PM PST | ||

| New Year’s Resolutions for Your Gold Portfolio Posted: 10 Jan 2011 03:27 PM PST | ||

| Posted: 10 Jan 2011 12:59 PM PST | ||

| Posted: 10 Jan 2011 12:03 PM PST

What ended up happening is that Wall Street hoarded all of this cash. Lending to individuals and small businesses actually decreased. The Federal Reserve started handing out gigantic piles of nearly interest-free money which many of these big Wall Street banks immediately loaned back to the U.S. government at a significantly higher rate of interest. Talk about easy money. Now the big Wall Street banks and the ultra-wealthy are swimming in cash and sales of luxury goods in the United States are absolutely skyrocketing. Meanwhile, millions of "ordinary" Americans continue to slip into poverty. So is the answer to all of this just to "tax the rich" and redistribute the wealth again by giving more handouts to the poor? Of course not. The American people don't need more handouts. What the American people desperately need are some good jobs. But Wall Street is hoarding the cash they got during the bailouts. It would be one thing if these big Wall Street banks had made a ton of money based on their own efforts. It is a very American thing to be able to enjoy the fruits of hard work. However, the truth is that many big Wall Street banks and financial institutions may have completely imploded if not for the bailouts. They were "too big to fail" and our politicians jumped to their service. Our politicians redistributed wealth by taking trillions of dollars that belonged to us and to future generations and handed it to the folks on Wall Street. So now the boys and girls over on Wall Street are thriving while tens of millions of "average" Americans are desperately suffering. Does that seem right to you? Isn't it about time that the U.S. government gets out of the "redistribution of wealth" business altogether? Just consider the following statistics. Even as the economic suffering of ordinary Americans continues to deepen, those who got big piles of bailout money are living the high life.... #1 According to Stephen Lewis of Monument Securities, luxury retailers in the United States have seen an 8.1 percent increase in sales compared to a year ago, while "discount stores" that cater to the poor and the middle class have only seen a 1.2 percent increase in sales compared to a year ago. #2 The sad truth is that just about every company that deals in luxury goods is booming, while those that primarily serve ordinary Americans are not doing nearly as well. Just consider the following quote from a recent article by Ambrose Evans-Pritchard of the Telegraph....

#3 Elderly Americans in particular are really having a hard time of it right now. A recent study by a law professor from the University of Michigan found that Americans that are 55 years of age or older now account for 20 percent of all bankruptcies in the United States. Back in 2001, they only accounted for 12 percent of all bankruptcies. #4 The number of Americans on food stamps has hit another all-time record. There are now 43.2 million Americans enrolled in the food stamp program. #5 According to the U.S. Conference of Mayors, visits to soup kitchens are up 24 percent over the past year. #6 Meanwhile, the price of food continues to go up. This hits poor and middle class Americans much harder than it hits the wealthy. According to a report on 55 top food commodities by the Food and Agriculture Organization, global food prices reached a new record high during December. #7 Lester Brown, the president of the Washington-based Earth Policy Institute, is publicly declaring that the world is just "one poor harvest" away from total chaos....

#8 The price of clothes is also increasing dramatically. It turns out that cotton is 80% more expensive now than it was back at the beginning of 2010. #9 Americans will also be paying more at the gas pump this upcoming year. In fact, former Shell Oil President John Hofmeister recently stated that Americans could be paying 5 dollars for a gallon of gasoline by the end of this upcoming year. #10 Health insurance rates are also skyrocketing. Blue Shield of California recently announced plans to raise health insurance rates by an average of 30% to 35% this year, and some individual policy holders could actually see their health insurance premiums rise by a whopping 59 percent. #11 On top of everything else, the U.S. Census is now telling us that there are millions more poor people in America than they had previously calculated. The U.S. Census Bureau recently revealed that the figure of 43.6 million Americans living in poverty that they announced last September was way too low and that actually 47.8 million Americans are now living in poverty. #12 If all of these economic problems were not bad enough, now many state and local governments are seriously considering raising taxes. In Illinois, there is now a proposal to raise state income tax rates by 75 percent. A recent article that appeared on the CNBC website explained why Illinois is so desperate for cash....

So won't the big Wall Street banks and the ultra-wealthy get hit by these tax increases too? Some of them will, but many of them have learned to "play the game" so well that they barely pay any taxes at all. As I have written about previously, a third of all the wealth in the world is now held in offshore banks. When taxes go up, the ultra-wealthy are not the ones that have their wealth "redistributed". Instead, it is poor saps like you and I that have our wealth "redistributed". In fact, the next time another "financial crisis" comes along, the financial "powers that be" will once again come running to Congress and come running to the Federal Reserve begging for more bailouts. Now that the precedent has been set, it will only seem natural to redistribute even more of our wealth to the folks over on Wall Street so that we can "save" the financial system. But the truth is that our financial system is completely doomed to fail in the long run and throwing our money into the financial system is like throwing our money into a black hole. In the end, all of us are going to greatly suffer when the financial system finally crashes. But for the moment the wealthy are partying with all of the money that they have looted from the rest of America, and the rest of us which were "small enough to fail" have been left to scratch and claw and fight with each other as we desperately try to survive in this horrible economy. | ||

| Posted: 10 Jan 2011 11:32 AM PST --Maybe the modern world is just too big, urban, and indebted for governments to effectively manage it—especially given the obligations they've taken on. That's what we're pondering in rainy Melbourne this morning. And our thoughts continue to be with all the folks up in Queensland dealing with the floodwaters. --Many miles away, in Lisbon, financial markets continue to wreak their own kind of havoc on the best laid plans of European bureaucrats and central planners. Both the Wall Street Journal and the Financial Times are reporting that the European Central Bank (ECB) stepped up its purchases of Portuguese government debt yesterday. --The yield on 10-year Portuguese government debt is 7.18%. That's not epic. But it's 3% higher than where they were year ago. And more importantly, yields continue to rise compared to German 10-year government bonds. --Portugal's public debt isn't as bad as some other economies in Europe. And its banks aren't as bad off as Irish banks. But when your economy doesn't grow much, and you have budget deficits and debt servicing costs, the money has to come from somewhere. It doesn't help that rising rates—driven by investors who've had enough—make debt service and future borrowing that much expensive. --Who's going to pay for all of this? Will taxes be raised? Will bondholders be forced to take a haircut? Or will China save the day? --Back in November, on a State visit to Portugal, Chinese President Hu Jintao said," We are ready to take concrete measures to help Portugal overcome the global financial crisis." That meant, presumably, buying Portuguese government bonds. The Chinese have given similar assurances to Spain and Greece since then. --Portugal has to borrow about €1.25 billion tomorrow and another €20 billion this year. That's chump change to China, with over $2.6 trillion in foreign exchange reserves. But is it a lousy investment idea? Why would any sane investor loan money to bankrupt and demographically challenged Western governments for more ten or thirty years? Hmm. --Is it boring to read about what's going on in Europe when you're sitting here in Australia trying to figure out what shares to buy on the stock market this year? Probably. So why do we bother writing about things that are happening thousands of kilometres away? Good question! --As a major importer of capital from Europe and America, what happens in those places matters a lot to Australian banks. And what happens to Australian banks determines what the price of money is for small businesses and households in the Australian economy. Portugal may be a long way away. But another debt crisis originating in Europe will hit you in your wallet just the same. --Markets aren't doing much in the presence of this uncertainty and the absence of any other compelling drivers. Everything is drifting...while everyone tries to work out what the world will look like when it goes off the dollar standard...and what changes to make before that world gets here. --One investment category to think about for a dollar crisis world: energy. As a popular investment idea, oil has never fully recovered from its 2008 fall from grace. But as a scarce commodity vital for everyone in the global economy, it's never gone away either. And like all commodities, it's traded in dollars, meaning it's directly impacted by systemic dollar devaluation in America. --Australia is energy rich (coal and uranium) but crude oil poor. That makes your investment choices pretty slim, when it comes to crude. But we've picked over the patch before and have a few ideas. Stay tuned. --In the meantime, did you see that Alaska oil pipeline has been shut down? It's kind of a big deal, when it comes to the oil price. The Alaska pipeline—operated by the good people at British Petroleum—accounts for 15% of America's daily oil output. That's a significant disruption to the oil supply of the world's biggest user. No wonder crude prices were up 1.5%. --And finally, today is a binary day where all the numbers signifying the day, month, and year are either zero or one. It doesn't matter if you sort them by day/month/year, or month/day/year either. That probably has no significance at all. But it's kind of unusual. You can learn more here. Similar Posts: | ||

| A Long Winter for the Unemployed Posted: 10 Jan 2011 11:32 AM PST It was snowing when we left Baltimore. Bad weather... The weather has been odd this year. Florida had its coldest spell ever this year. Freeways in Southern California were closed because of the snow. Forecasters are predicting the coldest January in many years. And Cancun, Mexico hit record lows just when the experts were there debating how to cure global warming. Here in Paris it is raining...temperature about 45 degrees. Very typical for this time of year. The first business week of the year was calm. Traders and investors were getting back to their desks, reading the papers, and trying to get a grip on what was going on. No one wanted to panic until he had chance to figure out what to panic about. Except for a big drop in gold early in the week, nothing much happened... Investors seemed mostly optimistic. Most believed that a slow recovery really was on the way. But the actual reports were mixed and perplexing. For example, last Thursday, the employment figures were reported as both a triumph and a setback. This from AP:

That sure sounds like good news. But Bloomberg gave the story a different spin:

Hmmm... Not so good after all. It turned out that private employers added 103,000 jobs last month, while the government cut 10,000. But that wasn't why the unemployment rate fell. The fine print in the AP story gives the real reason.

What's the real story? What's really going on? The employment numbers are fishy. Last year, for example, a total of about 1.1 million new jobs were created. That sounds nice, until you realize that the economy needs to add about 120,000 jobs per month - or 1.4 million - just to stay even with population growth. Right now, there are 130 million people with jobs. According to the feds, there are 15 million more who would like to have jobs but can't find work. That puts the total workforce at 145 million. But wait; ten years ago the portion of the population that wanted to be employed was just over 50%. That would be about 160 million today. What happened? Do fewer people want to work today? Or are there actually fewer jobs, and more people unemployed, than the official figures tell us? Based on these numbers, the real tally of the jobless is probably about 30 million, or about 18.7%. The Great Correction continues... And more thoughts... Now, here's some bad news. As far as we could tell, the Obama team only had one good man on it...former Fed chief and DR hero Paul Volcker. But word came last week that Volcker is out as head of the president's economic advisory committee. Dear Readers are reminded that Volcker saved the day back in 1979. He pledged to cut inflation. He kept his word. It wasn't easy. He put interest rates up over 15%...at a time when the CPI was running at 13%. And Ronald Reagan backed him up. If you're going to get control of inflation you can't trail the CPI. You have to get ahead of it. Which is why Bernanke's pledge is such nonsense. He says that as inflation rates go up, he'll put up the key Fed lending rate to 2%. He's already increased the monetary base to 3 times what it was under Volcker. He's committed to raising it another 33% by the end of June, bringing it to 4 times its 1980s level. When all that latent inflation becomes real inflation we'll see prices rise more than just 2% per year. We'll see them fly. What we won't see is Ben Bernanke getting ahead of them by putting rates up even more than inflation. It won't happen. Because it goes completely against the grain of Ben Bernanke's theories. The US is in a Great Correction. He thinks it needs stimulus, not austerity. When inflation rates finally begin to go up, he'll dither. He won't want to put up interest rates at all. At first, he'll hope that it is just a fluke. He'll delay. He'll hesitate. He'll stall. At first, the rise of inflation will be confused with a growing economy. Prices will move up. Consumers will spend money just to get rid of it. Businessmen will think they have more demand on their hands. They may even hire more workers. Stocks may go up. Bernanke won't want to nip this "recovery" in the bud. "Growth" - even with inflation - is better than no growth, he will reason. Then, when CPI is really getting up some real speed...and the inflation rate is headed towards 10%...he'll realize that it is too late. The only way to get ahead of it would be to "pull a Volcker"...and bring the whole economy down around him - like Volcker did. But Volcker was still dealing with an essentially healthy economy. It could survive the fall. Today, the economy is much heavier...and more fragile. Debt levels are three times what they were back then. Stocks are high, with a long way to fall too. And unemployment - as we saw above - is already about 12%, with mortgage rates still near 50-year lows. Imagine what would happen with the prime rate above 10%. Who would hire anyone? How could the US finance its deficits? What would it do to the US economy? We don't know...but we'll guess that Sherman did less damage to Atlanta. Inflation will run wild... *** State of Zombies How bad is unemployment? Maybe these figures from Insider Monkey will help. Dear Readers will note that they give away the most bread in the same city where they have the most circuses:

Regards, Bill Bonner.

| ||

| Buy a House… Then Buy Another Posted: 10 Jan 2011 11:31 AM PST Investment ideas are cyclical. They go dormant for a while, then revive, like fashions or cicadas - obeying their own curious rhythms. During the past few years, rare was the investment thinker who said you should buy a house. Housing was in a bubble that was deflating. But the investment seasons turn. Today some smart investors are once again saying you should a buy house. John Paulson is one of them. You may know him as the man who turned the greatest trade of all time. Betting against the housing market, he netted a cool billion dollars for himself in 2007. One fund he managed rose 590% that year. Today, he is one of the richest men in America. His advice today is very different. "If you don't own a home, buy one," Paulson said. "If you own one home, buy another one, and if you own two homes, buy a third and lend your relatives the money to buy a home." That's a strong endorsement. It sounds similar to the advice another investor gave his audience in 1971, at the dawn of one of America's biggest housing bull markets. The investor was Adam Smith (George Goodman) on The Dick Cavett Show. Here is a snippet from that conversation: Smith: The best investment you can make is a house. That one is easy. Cavett: A house? We were talking about the stock market. Investments... Smith: You asked me the best investment. There are always individual stocks that will go up more, but you don't want to give tips on a television show. For most people, the best investment is a house. Cavett: I already own a house. Now what? Smith: Buy another one. It was good advice. In the 1970s, US stocks returned about 5% annually, which failed to keep pace with inflation. Still, it was an up-and-down ride. In 1974, the stock market fell 49%. But here are the average selling prices for existing homes in the 1970s as inflation heated up: 1972 - $30,000 1973 - $32,900 1974 - $35,800 1975 - $39,000 1976 - $42,200 1977 - $47,900 1978 - $55,500 1979 - $64,200 You can see that housing held up pretty well. And think about the effect of a mortgage on 80% of that house in 1972. That would mean $6,000 in equity, a sum that went up fivefold in eight years. It's hard to find a better inflation fighter than that. Granted, today's market is different, but still. Apart from this, you might also reflect on the fact that it is quite absurd today to think that anyone can buy an average house for any of these prices - and that, too, is the point. The average price today is $257,500 - even after the great collapse in the last few years. "If you have a 7% mortgage and your house is worth half a million dollars," Adam Smith writes, "you may gripe about shoes and lamb chops and tuitions like everybody else, but your heart isn't in it." Your heart won't be in it because you'll be in fine fettle with your house. Of course, you can do a lot better than 7% today. For the first time, the rate on 30-year mortgages slipped below that on the 30-year Treasury bond. You can get a 30-year mortgage at little more than 4% today. Factoring in mortgage rates, housing affordability is back to where it was in September 1996. Then mortgage rates were 8% and the average price of a home was $171,600. As Murray Stahl writes: "One can actually buy a home for a monthly payment that is not very many dollars different from the monthly payment one would have needed in September 1996, when rates were significantly higher." Adjusted for inflation, Stahl points out that the payment for an average-priced home today is about 30% lower than it was 14 years ago. The advice of Paulson and Smith starts to make sense now, doesn't it? Essentially, real estate is a way to buy now and pay later. And the case for housing extends to other property types, too. Owners of quality real estate are getting deals on mortgages that we are unlikely to see for a generation. In my investment letter, Capital & Crisis, I haven't recommended a real estate stock since 2006. That may soon change. I've spent quite a bit of time looking over blue chip real estate stocks. Real estate, after a long absence from the menu, is back on. Regards, Chris Mayer, | ||

| Posted: 10 Jan 2011 10:03 AM PST | ||

| Metals Inch Higher on Dollar Decline Posted: 10 Jan 2011 10:00 AM PST Gold put in a modest gain on Monday, rising $6.10, or 0.45%, to settle at $1,375.68. Silver rebounded $0.43, or 1.49%, reversing Friday's losses. | ||

| The B-Word Is in the Eye of the Beholder Posted: 10 Jan 2011 10:00 AM PST Precious metals opened Tuesday's session with some indications that today could possibly turn out to be a day of 'repairs' as conditions (a slightly lower dollar and rising European-oriented fears) were somewhat more conducive to the process. | ||

| John Williams: Gold Against Financial Armageddon Posted: 10 Jan 2011 10:00 AM PST The ShadowStats editor says that the bottom-bouncing economy is weaker than ever, with specters of hyperinflation and systemic financial collapse on the not-so-distant horizon. | ||

| PSLV: Eric Sprott Updates the Delivery Status of Silver Posted: 10 Jan 2011 09:59 AM PST Sprott Physical Silver Trust Updates Investors on the Delivery Status of its Silver Bullion Purchases Press Release Source: Sprott Asset Management LP On Monday January 10, 2011, 7:00 am EST TORONTO, Jan. 10 /PRNewswire/ - Sprott Asset Management LP is pleased to provide investors with an update on the delivery status of silver bullion purchased by the Sprott Physical Silver Trust (NYSE ARCA:PSLV - News) ("Trust"). As of November 10, 2010, the Trust had contracted to purchase a total of 22,298,525 ounces of silver bullion. As of December 31, 2010 a total of 20,919,022 ounces of silver bullion had been delivered to the Trust. The Trust expects to take delivery of the final 1,379,503 ounces of silver bullion by January 12, 2011 and will subsequently publish the serial numbers of all bars held by the Trust on its website: www.sprottphysicalsilver.com. "Frankly, we are concerned about the illiquidity in the physical silver market," said Eric Sprott, Chief Investment Officer of Sprott Asset Management. "We believe the delays involved in the delivery of physical silver to the Trust highlight the disconnect that exists between the paper and physical markets for silver." Additional detail on the Trust can be found in the final prospectus available on EDGAR (www.sec.gov/edgar.com) and SEDAR (www.sedar.com) or on the Trust's website at www.sprottphysicalsilver.com. http://finance.yahoo.com/news/Sprott...872357399.html | ||

| US Dollar Rallies on Unemployment Data Posted: 10 Jan 2011 09:58 AM PST 01/10/11 St. Louis, Missouri – The Jobs Jamboree on Friday didn't turn out to be as robust as the "experts" forecast, as jobs created totaled 103,000 far less than the 170,000 that was forecast… But the media and the White House chose not to focus on that less than stellar result… Instead, they chose to focus on the unemployment rate slipping to 9.4% from 9.7%. In fact The Washington Post's story on the jobs report was titled: "Unemployment rate falls sharply in December"… Since the media and the White House chose not to "tell the rest of the story" I'm here to do just that! While it was nice to see the unemployment rate slip to 9.4%… Let me remind you that as unemployed people see their unemployment benefits run out, they are dropped from the "official list of unemployed"… I've always marveled at the stupidity in that… But it is what it is…and so…having these people drop off the unemployed roster, is just like creating a job for them according to the BLS… and there you go! Voila! A falling unemployment rate! This accounted for over half of the 0.4% fall… So, we could very well see this continue for the foreseeable future… However, according to John Williams over at Shadow Stats, the "real" unemployment rate remains at 23%… I choose to pin my colors to the mast of someone that doesn't manipulate, substitute, and make other hedonic adjustments… So, whenever I'm interviewed or I give a presentation, I use the John Williams version of unemployment! And let's not lose sight of the fact that at least 250,000 new jobs need to be created each month for our economy to grow… With only 103,000 jobs created, we're a far cry from a growing economy, and when the markets finally figure this out, maybe we can get back to fundamentals! OK… So… What did this do to the dollar… Well, all the hoopla about the unemployment rate falling gave the dollar even more strength throughout the day on Friday. And… The overnight markets haven't stopped selling euros (EUR), Aussie dollars (AUD), gold, and the rest of the non-stock, risk assets. The Japanese yen (JPY) is getting sold and the only two currencies hanging on are Swiss francs (CHF) and Canadian dollars/loonies (CAD). Pound sterling (GBP) is holding on too, but that one puzzles me and I don't see how that can continue, if the bias to buy dollars continues. And… I do believe it will continue for now… Now, don't get me wrong here, I'm not a willy nilly, jump from one side of the fence to the other depending on who's winning-type of person… No, that's not me! I do, however, believe that there will continue to be periods of time when the dollar, for some unknown reason, is attractive to investors. It's been that way for the past, almost 9 years now, and it will continue to be that way. I call it "circuit breakers", or "speed bumps"…for if the dollar had done nothing but go down during its underlying weak trend that began in February 2002, we would be singing the blues right now, and things would be far worse, and no amount of stimulus or quantitative easing would help, (not that they do now either)… So, like I said above, the Canadian dollar/loonie is holding on versus the US dollar's rally. Canada has been the beneficiary of an oil price that's the highest it's been in 2 years, and some stronger economic data, like the report that printed on Friday. Canadian unemployment inched downward as 22,000 jobs were created in December, after adding 15,200 jobs in November. The unemployment rate remained at 7.6%. Later this week, Canada will print its trade balance. I would have to think that the stronger economic data stops with that report, though… I believe we'll see the Canadian trade deficit widen… But before you go jump off a cliff because they have a trade deficit… Let me remind you that their trade deficit is less than $2 billion. Well… Fed chairman, Big Ben Bernanke, spoke to lawmakers on Friday, following the Jobs Jamboree, and I truly expected some fireworks… But none surfaced. I do have to take issue with one thing he said on Friday… And that is… Bernanke feels that the deficit is caused by the unemployment problem. The Big Boss, Frank Trotter, point that out to me as he walked through the office on Friday. I said… "He said what?" Why didn't one, just one, lawmaker question him on that? Look… I've had my differences with Big Al Greenspan, and now with Big Ben Bernanke, but I have good reason… Shoot, Rudy, if I had been a lawmaker in that room I would have shot back at Big Ben with question after question, as to how that works, and how did we have a growing deficit, before the financial meltdown, and a low unemployment rate? Oh, there are so many questions that could have been asked, but not one lawmaker could think of them… Or they had stage fright… So… in the end, is it Big Ben's fault that no one questions him? Now… I'll give him that the current deficit contains the unemployment problem…but that's just a small piece of the structural deficit… I saw a great short interview with David Walker, a guy that I used to quote all the time when he was the head of the General Accountability Office, for he was the only person in the former administration that would say, "Hey, we need to stop spending"! Well, David Walker, quit his job because no one would listen to him, and he worked with Addison Wiggin in the film I.O.U.S.A. David Walker is now the CEO of Comeback America… and when asked about the deficit, he had this to say… "The Congress and the Fed are doubling down to try to help improve the economic recovery and jobs. But what they are not doing is dealing with the real threat, which is the structural deficit. It is imperative that Congress begin to take steps to deal with the structural deficit, because that represents the threat to our country and our families in the future." He went on to say, "Well, first, we need to take a tough line on spending for fiscal 2011 and 2012 with regard to discretionary, including defense. After all, discretionary spending went up over 20% between fiscal 2008 and fiscal 2010. Buy what we really need to do is not focus as much on the short term deficits, but put mechanisms in place to deal the true threat that's structural. We need real pay as you go rules on the spending and tax side that eliminate the trillions of dollars of loopholes, tough but realistic discretionary spending caps that do not exempt the base defense and homeland security budget, but the war costs would be exempted, and debt to GDP targets that would be set for the future in a way that wouldn't undercut the economic recovery or efforts to deal with unemployment, but would have automatic spending cuts and, or tax surcharges if they are not hit." He finished by saying, "We need something real, we need something substantive. It's time for results, not rhetoric." Thank you, David Walker… You should run for President! OK… Well… The Aussie dollar was weakened last week by the floods that will interrupt the economy and exports… This week, the Aussie dollar will be weakened by the news last night that China's trade surplus narrowed… Aussie retail sales were stronger than expected in December, but that was of little help for the Aussie dollar. Speaking of China… Yes, their trade surplus narrowed in December by a large amount… In US dollar terms, the monthly balance went from $22.89 billion to $13.10 billion… And overall, the Chinese trade surplus was down over 6% versus 2009, to $183.1 billion… Exports fell and imports gained, which is bad medicine for a trade surplus! I hope the lawmakers in the US back off their rhetoric about putting tariffs on Chinese goods… The rising Chinese renminbi (CNY), along with the lingering recessions in the Eurozone and the US are reducing the trade surplus… One more thing about China… I found this and thought, "WOW!"… The dollar should get sold on this news… But NOOOOOOOO! It didn't happen. Apparently, we've all become comfortably numb… Oh! Here's what I saw… You be the judge… A senior PBOC (People's Bank of China) official said that China's proportion of USD in its FX reserves was too high… The problems of the imbalances continue, folks… The imbalances existed before the financial meltdown, and they still exist today, with no signs of unwinding… So… the euro is looking like it is replaying January 2009, here in 2010. If you recall, last January, the euro was falling steadily each day, because of Greece… This year it's Ireland, and the fear that contagion problems will surface for the other periphery countries of the Eurozone. Last year, the euro fell to 1.18, before turning around… But remember the calls for it to collapse back then? Well… It didn't! And it won't now… But weaken it will, as long as there are questions about the periphery countries and their fiscal needs. Then there was this… from the UK Telegraph this past weekend… "Imbalances between East and West will grow and grow"… Just ahead of the Seoul summit back in November, Mervyn King, Governor of the Bank of England, sounded the following warning… Unless the G20 collectively recognize imbalances as a problem and agree policies to unwind them over time, "then I fear that the next 12 months will be an even more difficult and dangerous period than the one we've been through". The first condition achieved some recognition at the summit, but not the second. Agreement on solutions remains as far away as ever…and that is real bad news, as it cannot go on forever. Someday it will stop…and when it does, the world as we know it will disappear." That's what I was talking about earlier… To recap… The dollar rally continues with the euro being the main currency to take on water versus the dollar. The jobs data was not as robust as expected, and over half of the 0.4% fall in the unemployment rate can be attributed to those that have given up looking for a job, or had their unemployment benefits run out. China's trade surplus fell in December by 6% from 2009. And David Walker, gives us his thoughts on the deficits… Chuck Butler | ||

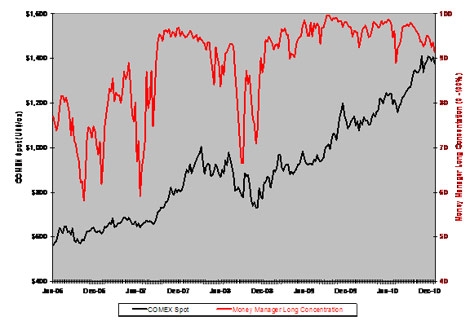

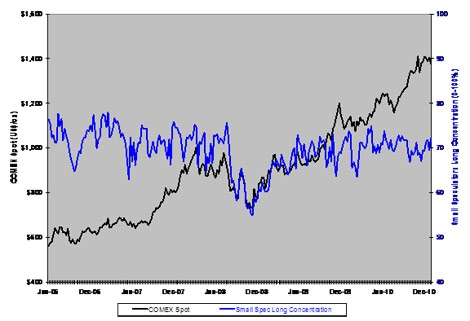

| Outlook 2011: Fear and Love in Gold Trading Posted: 10 Jan 2011 09:52 AM PST 01/10/11 San Antonio, Texas – Wall Street has been calling gold a bubble since 2005 when it hit $500. Some media naysayers remained negative even as they wrote the headlines proclaiming record highs and saw gold rise almost 30 percent in the past 12 months. Interestingly, despite gold's latest run, it was still a laggard compared to many other commodities. In the commodity world, gold didn't even place in the top half in 2010. Against a basket of 14 commodities that includes everything from aluminum to wheat, gold's 29.52 percent return places it eighth. Palladium took the top spot with a 96.6 percent return, followed by silver with an 83.21 percent return. Natural gas continued its cellar-dwelling ways, dropping 21.28 percent to become the worst-performing commodity of the basket. There are two main drivers of gold demand: The Fear Trade and the Love Trade.

Fear Trade: The fear trade is what you often hear about from the media and the gloom-and-doomers. The fear trade is driven by negative real interest rates—where inflation is greater than the nominal interest rate—and deficit spending. Whenever you have negative real interest rates coupled with increased deficit spending, gold tends to rise in that country's currency.

In the U.S., we're in the middle of an extended period of negative real interest rates that will likely last through the year. The Federal Reserve is acutely aware that if interest rates should spike, it would be catastrophic for the economic recovery. Looking back over the past 400 years, there has been a major currency or credit crisis every decade and, historically, it takes approximately four years to heal from the contraction. The U.S. economy is on the road to recovery, however the elevated number of home foreclosures and high unemployment make it unlikely the Fed will risk a relapse by raising interest rates any time soon. The government is also unlikely to cut spending or welfare support during the healing process. As for deficit spending, we still have an oversized government, creating regulatory traffic jams for business development and hurdles for economic trade.

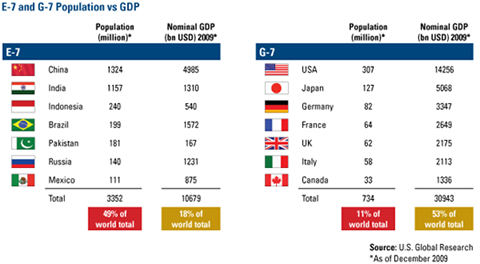

Love Trade: The love trade is significant and unique to gold. People buy gold out of love and those in emerging markets are especially amorous of the metal. We refer to the most populous seven of the emerging economies as the E-7. Currently, the E-7 countries hold nearly half of the world's population but make up less than 20 percent of global GDP. The G-7 industrialized nations are a mirror of this; they host 11 percent of the world's population but control more than 50 percent of the global economy. But things are changing.

I've discussed this many times but it's important to grasp how today's world looks a lot different than yesterday's. Many of these emerging economies are averaging over 6 percent GDP growth and personal incomes are rising around 8 percent. In addition, emerging economies are home to 27 percent of the world's purchasing power, according to economic research firm ISI. It is customary in most emerging countries to give gold as a gift to friends and relatives for birthdays, weddings, and to celebrate religious holidays. In December, the Shanghai Gold Exchange reported that China imported five times more gold in 2010 than 2009 and that was just during the first 10 months of the year. In India, spending on gold rose 100 percent on a year-over-year basis through September, according to Morgan Stanley. Russia's central bank holdings of gold rose 7 percent in 2010. What is important to remember when looking at the history of gold is that in the 1970s, China, India and Russia were isolationists with no significant global economic footprint. The world's population was 3 billion and today we have witnessed an awakening of epic proportions. These countries are growing with free market policies and massive infrastructure spending. In the 1970s, gold rose on the fear trade and the cold war. Today the world is significantly different and the love trade drives gold. If QE2 was the fuel that sent gold prices to the moon, the gold holiday season was the vehicle they rode in. Gold prices rose steadily as Ramadan came early, which then carried into the Diwali season of lights in India. Then came Christmas, with shoppers around the world spending more than they had in years.

Next is the Chinese New Year—the Year of the Rabbit—on February 3. It's believed that people born in the Year of the Rabbit are wise, financially lucky and have a gift for making the right decision—similar to how gold investors are feeling these days. Looking Ahead It's impossible to predict where gold prices will be 12 months from now, but we think gold prices could double over the next five years. This would mean roughly a 15 percent return, if you compounded it annually. However, it will by no means be a straight line. Volatility is always inherent in commodity investing. It's a non-event for gold to go up or down 15 percent in a year—this happens 68 percent of the time. For gold stocks, the volatility is even more dramatic—plus or minus 40 percent, historically. We have always suggested that investors consider a 10 percent weight in gold funds and rebalance their portfolio each year to capture the volatility and not chase return. Since gold was up almost 30 percent last year, it could easily correct from its peak by 10 to 15 percent. This is why we believe gold stock investors need to be active, not passive, when it comes to managing portfolios. Investors looking to either add to or initiate new positions in gold must be aware of this volatility and use it their advantage. Use sharp selloffs as cheap entry points and make sure to rebalance those portfolios in order to lock in profits from 2010's big gains. Regards, Frank Holmes, P.S. For more updates on global investing from me and the U.S. Global Investors team, visit my investment blog, Frank Talk. Frank HolmesFrank Holmes is chief executive officer and chief investment officer of U.S. Global Investors Inc. The company is a registered investment adviser that manages approximately $4.8 billion in 13 no-load mutual funds and for other advisory clients. A Toronto native, he bought a controlling interest in U.S. Global Investors in 1989, after an accomplished career in Canada's capital markets. His specialized knowledge gives him expertise in resource-based industries and money management. The Global Resources Fund was also Morningstar's top performer among all domestic stock funds in the five-year period ending Dec. 31, 2006. Special Report: Legally Collect Thousands of Dollars Each Year…From the OTHER government-backed retirement program! Finally – you can get on the inside! Here's why you must do so now… | ||

| The Job Numbers Report, Making Money Off It Posted: 10 Jan 2011 09:27 AM PST While all eyes this morning will be on the U.S. employment numbers, investors are looking at the wrong job numbers. It's common sense that, as the U.S. economy improves and as U.S. corporations improve earnings, there will be more hires. It's also a fact that the job numbers are skewed, because so many Americans have given up looking for work. In my years of analyzing the economy, I've never found a way for investors to make money from the ups or down of the unemployment numbers. Sure, these numbers can help us see if the economy is improving or deteriorating, but how do you make money from them? I don't think we can make money from the U.S. job numbers report, but we can make money form the job numbers report of another country. As we all know, several euro countries experienced credit and debt problems last year. This led to a drop in the value of the euro, a corresponding rise in the value of the U.S. dollar and the recent opportunity provided to investors in the gold market. I have long been a fan of the Canadian dollar and I have often written how Americans can make money off the rise in the value of the Canadian dollar vs. the American dollar. This morning, while the world was fixated, waiting for the U.S. unemployment numbers to be released, Statistics Canada reported that the jobless rate in Canada at the end of 2010 came in at 7.6%. In 2010, the Canadian economy added 368,500 jobs. In 2010, Canada recouped all the jobs lost during the recession of 2009! What other Western country has pulled off this feat? Only Canada. The Canadian S&P/TSX Composite ended 2010 with its biggest two-year advance since 1980. In fact, the S&P/TSX Composite is up 50% in the period from January 1, 2009, to December 31, 2010. And the Canadian dollar has rallied against the greenback. In January of 2009, it took $1.27 Canadian to buy $1.00 American. Today, the Canadian dollar is worth more than the U.S. dollar. It takes $1.01 American this morning to buy $1.00 Canadian. Only the Bank of Canada had the courage to raise interest rates twice in 2010. As the U.S. dollar continues to weaken, saddled with the ever-increasing debt backing the greenback, the Canadian dollar will continue to shine. For the past three to four years, I've been urging American investors to buy U.S. stocks on Canadian stock exchanges so that they may also enjoy the currency appreciation of the Canadian dollar. This will continue to be a great strategy for investors in 2011. Michael's Personal Notes: The perfect storm could be brewing for the economy and the stock market and I want my readers to tread carefully in the first few months of 2011. According to an analyst earnings consensus report compiled by Bloomberg, the S&P 500 stocks saw their earnings grow 20% in the last quarter of 2010. If this estimate proves correct, S&P 500 companies are about to report their best fourth-quarter earnings results in about 10 years. I believe that the sharp rise in corporate earnings has long been discounted by the stock market. In fact, that's what the bear market rally since March of 2009 has all been about: the stock market reacting to higher future corporate earnings. In 2011, the scenario is much different. Those that were bearish on stocks in 2009 and 2010 are now turning bullish (remember, the stock market always delivers the opposite of what is expected of it), interest rates will rise this year, and companies will face higher costs. The bottom line is that we will not see a jump in corporate earnings in 2011 like we did on 2010. The easy money in the stock market has already been made. Where the Market Stands; Where it's Headed: The Dow Jones Industrial Average opens this final trading day of the first week of 2011 up 1.03% for the year. I'm of the opinion that the bear market rally that started on March 9, 2009, is still alive and well and some more immediate-term gains are possible from the market. However, on Wednesday, I flashed a "caution" short-term signal for the market, as our sentiment indicators show too many investors and advisors turning bullish on the stock market—which is negative for stocks. Interest rates have also been rising with the bellwether 10-year U.S. Treasury yielding 3.4% this morning. In October of 2010, the 10-year Treasury was yielding 2.4%, a 41% jump in long-term yields in less than four months despite what the Fed is doing with QE2! Immediate-term stocks could move higher, but I'm turning bearish on the short to medium term for stocks. What He Said: "Many of today's consumers have purchased properties with very little down payment. They've been enticed by nothing-down, interest-only, second and third mortgages. Bottom line: the lower-interest-rate environment sucked consumers into the housing market big-time. And that will eventually cause us all problems." Michael Lombardi in PROFIT CONFIDENTIAL, June 22, 2005. Michael started warning about the crisis coming in the U.S. real estate market right at the peak of the boom, now widely believed to be 2005. Sign Up for PROFIT CONFIDENTIAL and | ||

| Synonymous Terms for Quantitative Easing Posted: 10 Jan 2011 07:57 AM PST I was having a leisurely breakfast with the family when I read where Philipp Bagus, writing at Mises Daily newsletter, quotes James Bullard, president of the St. Louis Federal Reserve Bank, as saying, "it's important to defend inflation from the low side as we would on the high side." I thought to myself, "Defend inflation? Inflation needs to be defended from being too low? Arrgghhh!" As indicated by the surprising use of the pirate-sounding phrase, "Arrgghh!" you can tell that this sublime idiocy drives me Up The Freaking Wall (UTFW), as soon indicated by a few almost-obligatory and loud Mogambo Screams Of Outrage (MSOO) emanating from my lips, which, unfortunately, upset my stupid family, and they all started complaining about the noise and the way that food was flying out of my mouth and getting all over everything. Amid rude comments like, "Calm down, you idiot!" and, "Ewww!" I just explained, "Screw you!" got in my car and went to work. As I was driving along, thinking about this idiot Bullard, and thinking about how the Federal Reserve has become a malignant organization that is going to destroy us with catastrophic inflation as a result of their terrifying creation of So Freaking Much Money (SFMM) so that the Obama administration can borrow the money and spend it, and thinking about how I can possibly save my job, which is hanging by a thread, when – suddenly! – I had a Brilliant Mogambo Idea (BMI)! With mounting excitement, I stepped on the accelerator, horn blaring, swerved into the parking lot and, to save time, took the Handicapped Parking space. Some moron walking by shouted out to me, "Hey! You can't park there!" to which I replied, "I'm not normal! Ask anybody who knows me, you moron!" and stomped off in a rush. Bursting breathlessly into my boss's office, I excitedly said, "Thanks to the genius of James Bullard of the Federal Reserve, I now know that we have got to defend incompetence on the upside as well as the downside! Too much incompetence is as bad, or maybe worse, as too much competence! So get off my butt about what a lousy employee I am!" Well, as soon as I said that last sentence, I knew that I had made a mistake, mostly by observing the way my boss kind of stared at me for about ten seconds, slowly clenching and unclenching her fists. I explained to her how Mr. Bagus explained that, "Money printing cannot make society richer; it does not produce more real goods," although creating more and more money "has a redistributive effect in favor of those who receive the new money first and to the detriment of those who receive it last." "Eureka!" I exclaimed. "This is exactly what we want! You and I would gain now, at the expense of some other jerks down the line, which defends my incompetence perfectly and makes us look good!" That's when she said, in cool, measured tones through gritted teeth, "I read that article, too. And he goes on to say, 'The money injection in a specific part of the economy distorts production. Thus, QE does not bring ease to the economy. To the contrary, QE makes the recession longer and harsher.' So do you want things to get worse for us, longer and harsher, by rewarding your staggering incompetence instead of throwing you bodily out of the building and taunting you all the way to your stupid car?" It was fascinating to see her struggling to control her emotions and her obvious desire to punch my brains out, but she doesn't because, the way I figure it, she can see that I am four inches taller than her, thirty pounds heavier than her, and have a much longer reach than her, so that before she could even reach me, I could – pop, pop, pop! – put a few good left jabs where they would do the most good, in a self-defense kind of way, spinning her around so that I could put in a few roundhouse hooks to pound on her kidneys awhile before I go for the knockout, all while yelling, "Usurper! This job should have been mine! And should be mine because at least I am smart enough to buy gold and silver when the foul Federal Reserve is creating so much excess money that catastrophic inflation in prices must, because it always does, happen, making me rich enough to quit this lousy job, while you and your stupid 401(k) is in common stocks that have not done a thing in a freaking decade, even in nominal terms, and in inflation-adjusted terms you are losing your Big Fat Butt (BFB), and whose future is equally dim!" This is when I decided to lighten the mood, which was obviously becoming strained, by asking, "Did you see where he went on to say that the Fed's ruinous program of Quantitative Easing 2 would be more descriptive if it was called 'Quantitative Straining'? Hahaha! That's funny!" Her expression didn't change. So I said, using some bathroom humor, "Straining? Like on the toilet? Like when you are constipated?" Not even a smile. Heedlessly, I went on, "Or how about his 'Quantitative Destruction II'? Or 'Crisis Prolongation III'? Hahaha! Good stuff, huh?" There was still no change in her expression, so I went recklessly and desperately on, "Currency Debasement I? Bank Bailout I? Government Bailout II?" By this time I was racking my brain, frantic for something else to say. Then I remembered his "Consumer Impoverishment" which is the most perfect descriptor of them all! Hahaha! But I hesitated, suddenly seeing that she could use this "impoverishment" thing against me when discussing my poor work performance, and, suddenly out of ideas, I decided to leave the area. I pretended to get an important phone call on my cell phone, asking me for important, important data to close a big, big sale, the figures for which were back at my office, where I had to go right now to retrieve them, which was difficult in that I did not have my cell phone with me and had to pretend that my wallet was a damned phone. "Brrring brrring!" I said. Alas, I don't think she bought it. But since she is too stupid to buy gold and silver when the filthy Federal Reserve is creating so much excess money, when 4,500 years of history proves that it will cause terrible inflation in prices, I don't care! Soon, because of the rise in the prices of gold and silver, I will be able to buy this whole company, then we'll see who throws who bodily out of the building! Hahaha! Revenge will be sweet! Hahahaha! And the best part is that not only are gigantic profits from buying gold and silver guaranteed by 4,500 years of history, but that it is so easy! Whee! The Mogambo Guru Synonymous Terms for Quantitative Easing originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||