Gold World News Flash |

- S&P Touches 1300, 1300 Says it Liked it

- Predictable Gold and Silver Correction A Half-Done Buying Opportunity

- Correction In Gold Nears a Key Target

- Hourly Action In Gold From Trader Dan

- Crude Oil Falls on Profit Taking, Gold Plunges as Investors Flee

- Alan Greenspan Entertains Metal Standard, Again

- A Simple Shake Could Set Silver Free

- Nothing Has Changed

- Gold Seeker Closing Report: Gold and Silver End Lower

- January Largest Monthly Negative Money Flow for SLV

- The World Is Waiting For The Sunrise: A Practical Guide to the Re-Monetization of Silver

- Gold Price and Silver Price Continue to Fall, Both Metals Still In Primary Uptrend

- Zerohedge: “Sarkozy Goes Postal On Jamie Dimon, Says Bankers Made World Into Madhouse”

- Just One Stock: Heavy Upside From a Leveraged Play on Rising Silver Prices

- Inflation: Inevitable…But Not Predictable

- All 100 Ounce Silver Bars Will be Gone in a Matter of Days

- THURSDAY Market Excerpts

- 45% of Investors Expect China Financial Crisis Within Five Years

- Sarkozy insists Paris and Berlin will never abandon the euro

- Inflation to Help the Less Fortunate?

- M2 Surges By Biggest Weekly Amount Since 2008 As It Hits Fresh All Time Record

- Money & Markets Charts ~ 2.17.11

- Gold Reverses from Former Congestion

- Inflationary Thursday – Dow 15,000 + $5 Will Get You a Happy

- Sarkozy Goes Postal On Jamie Dimon, Says Bankers Made World Into Madhouse

- Fed to Monetize MOST of the US Debt

- Masters of Monetary Policy

- Chris Martenson Interview With Jim Rogers: Why Inflation Is Raging Worldwide And He's Shorting US Treasury Bonds

- A Report on Price Inflation from the Front Lines

- How We Blew It

- More Reason To Buy Gold/Silver: CBO Baseline Shows Staggering Debt

- Gold Gouged

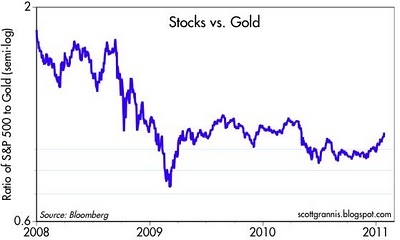

- Stocks Gain Against Gold, And That's Good News

- Gold Daily and Silver Weekly Charts

- Goodnight Amazon: World's Most Overhyped Retailer Misses Top Line

- Mythbusting Gold's Volatility

- In The News Today

- DoGS FiGHT aT DaVoS

- Is the Selling Over for Gold?

- Gold and Silver Resource Shares, Before You Shoot Your Next Arrow

- The Republican Deficit

- Egyptian unrest may set off vicious economic cycle

- Will Gold, Silver and Oil Prices Soar on Social Unrest In The Middle East?

- Is the Selling Over In Gold?

- Four Reasons Why The Government Is Destroying The Dollar

- Trading Analysis The General Public Does Not Look At

- The Troubling Doubling of Money Supply

- Time to Buy Gold Stocks…Again

- Fraud Suit Against JP Morgan Displays Bankster ‘Culture’

- Nine Reasons Why You Cant Resist The Charm of Gold

| S&P Touches 1300, 1300 Says it Liked it Posted: 27 Jan 2011 06:08 PM PST Despite new claims for unemployment putting up the largest weekly increase since September 2005 (and you all remember September 2005, right? Alan Greenspan was still a genius, iPads were still just the truncated spelling of a sanitary napkin, and Kim Kardashian's vagina was still underwraps (and some guy named Damon Thomas too)), despite Japan being downgraded by S&P due to greater risk of default than Charlie Sheen's liver, and despite a little bit of happiness being squelched by studies showing breast implants are linked to a rare form of cancer (And no shit, really? You mean to tell Money McBags cutting open your tit and shoving something artificial in there might be a health risk? Shit, what's next, finding out that eating Twinkies causes obesity or watching CNBC causes dementia?), the market continued to rally as investors buy the fucking rip.

The S&P flirted with 1,300 today in ways that would make the delightful Lisa Ann seem like a cocktease (and Ms. Ann, Money McBags can be reached at moneymcbags@gmail.com should you ever want to tease anything of his) as it nudged above that psychological support level before closing a Robert Reich nut hair below it at 1299.54. Money McBags doesn't know what to say anymore as the market races to the next bubble top (as opposed to the next muffin top), he just hopes you all are properly hedged and can get out before cookie crumbles.

That said, before Money McBags gets to the macro news, he has to go on a bit of a rant today because the Financial Crisis Inquiry Commission released their final report on the global clusterfuck (also known as the ponzeconomy™) and the report was strangely just one sentence: "Everyone acted like a bunch of asshats." Ok, it was a bit longer than that (probably two sentences claiming that they were asshats and douchelickers) but Money McBags only read the highlights because he is waiting for the book on tape to come out.

The point is, and what really puts a turd in Money McBags' punchbowl (or a copy of Pride and Prejudice in his bookcase if you will), is that in a letter to the FCIC, Fed Chariman Ben Bernanke admitted that the Fed just fucking missed the complete collapse of the financial system, no really, he did. But Money McBags guesses that all is forgiven because it's not like that was their main job. Oh wait, what's that? That is pretty much their only fucking job? Well fuck Money McBags but at least we fired all of the assholes who fucked up and said things in 2005 like: the economy “might bend but would likely not break” from a large home-price drop, and that the market may rest on “solid fundamentals," and now say: " it was hard for many FOMC participants, in the summer of 2005, to ascribe substantial conviction to the proposition that overvaluation in the housing market posed the major systemic risks that we now know it did." Oh wait, what's that? The fucking assclowns who said that are the same people who are still running the show? Are you kidding Money McBags? Holy shit. This is more fucking cockposterous than if Exxon rehired Captain Hazelwood and put him in charge of ship safety, neighbors insisted that Roman Polanksi take their RV and drive their babysitter home, or President Obama appointed Michael Jackson's doctor as Surgeon General. Seriously.

Look congress/executive branch/Tina Wallman, Money McBags knows that you like to keep all of your chummy buddies at GS happy and he knows you just recycle the same shitty people through the same shitty jobs, but here is DOCUMENTED PROOF that these fuckers MISSED THE ONLY THING THEY HAD TO NOT MISS. Fucking A, you think Faye Reagan would keep getting hired if she always ducked and missed the money shot? Fuck no, because taking it on the chin IS HER JOB. So how the fuck can these guys still be in charge of this shit when they SUCK AT THEIR JOBS? They have already shown that they aren't capable, so what makes you think they won't fail again? Sucking at one's job isn't a random walk and sometimes past performance is an indicator of future success and the fact that we have LEARNED NOTHING FROM THIS DOWNTURN and are still sucking off the assholes who missed it, is so fucking ridonkulous that it makes Money McBags' balls hurt just to think about it (which is why he spends his day thinking about this). Rant over.

Anyway, as for macro news, new claims for unemployment were up to 454k, a jump of 51k and the highest the number has been since October, right before QE2 created all of those jobs, oh wait, what's that? QE2 wasn't geared towards creating jobs? It was just supposed to pump up the markets so rich people could have their paper net worth artificially grow and cause them to buy maybe one more tennis bracelet from Tiffany's for their "babysitter"? Well Money McBags guesses he was misled. Anyway, witch doctors blame the huge jump in new claims on snowstorms because when in doubt just blame an inanimate variable (and the jump was so large that it made Evel Kneivel roll over in his grave and it wasn't even within a standard deviation of analyst guesses of 405k).

In other macro news pending home sales rose 2%, which beat analyst guesses of a 1% rise and is now only 5% below last year's ass awful number. Meanwhile, bookings for durable goods increased bv .5% according to the Commerce Department, or fell by 2.5% if we take out transportation and anything else that might have made the number look shitty. Analysts guessed durable goods would rise 1.5% but in fairness to them, no one cares about this number anyway.

Internationally, S&P downgraded Japan from "super happy fun times" to "country and western karaoke night." The ratings agency expressed concerns over Japan's escalating debt (which is now twice GDP) and their inability to stop Godzilla after all of these years. In their report, S&P said Japan's government lacks a "coherent strategy” to address the debt, before adding "for fucksake, they don't even speak in English, so how are we supposed to understand any strategy of theirs?" That said, unlike the PIIGS, most of Japan’s debt is held domestically, so when the Pokemon hits the fan, they will implode rather than explode.

In the market, a shit ton of companies reported earnings led by NFLX who grew subscribers by 3.1MM and saw their stock price rise 15% which meant shorts like Whitney Tilson once again took it in the pooper (which of course makes NFLX a win-win stock for Mr. Tilson). Profits were up 52%, revenue was up 34%, and gullibility was up 900% as the plethora of free subscribers inflated numbers and caused gross margins to go down from 38% to 34.4%, but luckily for NFLX, that part of the press release was pixelated over. After the quarter, a number of analysts raised their target prices with Cannacord Genuity (formerly Cannacord Adams which, as always, is Canadian for "Roth Capital") leading the way with a target price of $250, which is only about $1 Billionty too low.

In other news, 1985's NFLX, MSFT, proved that you can be too big and fail as despite 5% revenue growth, their profit fell slightly as tablet sales started to eat in to sales of computers as if sales of computers were a cheesecake and tablets were Kirstie Alley. Elsewhere, QCOM shares jumped ~6% after the company put up a good Q and raised its outlook for the year citing the need for mobile phones to have more and better chips to be able to properly display HD porn while users are dropping logs at the office. Also, Motorola's recently spun off mobility business announced their first Q today and dropped 12% on weak guidance, proving once and for all that you can't polish a turd.

Finally, SBUX was flat despite a blow out Q as they announced that higher input prices will start to hurt margins and as a result gave guidance way below Street guesses. When reminded that Bernanke says there is no inflation, SBUX CEO Howard Schultz replied: "Are you talking about the guy who also missed the biggest economic downturn in our lifetime? Or are you talking about Scarlett Bernanke, who is causing my assets to inflate? Either way, they can both go fuck themselves because inflation is here, though if it is Scarlett, then I'd like a window seat for that."

As always, Money McBags has a shitload more at the award winning When Genius Prevailed where he self-fellates himself today about his small cap analysis that has pointed out winners such as CRUS and TMRK. Yeah, Money McBags writes a ton of dick jokes, and yeah, the market is completely full of shit, but his small cap analysis is as good as anyone on the Street and as always, all he charges is your dignity. And Money McBags is well aware that today's headline sucked, but shit it's 2am and Money McBags needs all of the beauty sleep he can get (especially if this is the beauty). | |||

| Predictable Gold and Silver Correction A Half-Done Buying Opportunity Posted: 27 Jan 2011 06:05 PM PST | |||

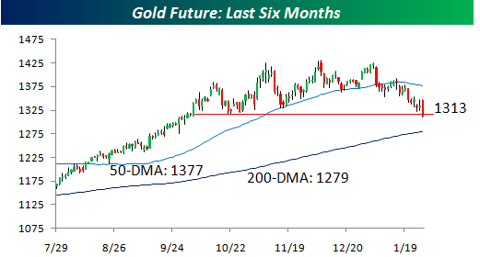

| Correction In Gold Nears a Key Target Posted: 27 Jan 2011 06:01 PM PST Gold and Silver got whomped again yesterday, adding yet more carnage to a correction that will soon enter its fifth week. For long-term investors who have chosen to ride out the storm, the selloff must have seemed brutal. And yet, from early December's high at $1432 to yesterday's $1310 low, the loss so far has amounted to just 8.5 percent. Granted, it's been worse for some owners of mining shares, which have declined by a little more than 17 percent, basis the ARCA Gold Bugs Index. But even that falls shy of the 20 percent standard that is often applied to separate relatively mild corrections from truly ugly ones. | |||

| Hourly Action In Gold From Trader Dan Posted: 27 Jan 2011 05:23 PM PST | |||

| Crude Oil Falls on Profit Taking, Gold Plunges as Investors Flee Posted: 27 Jan 2011 05:12 PM PST courtesy of DailyFX.com January 27, 2011 07:51 PM Crude oil fell slightly as the commodity remains well-bid amid improvements in the global economic economy. Meanwhile, gold plunged as investors continue to liquidate the metal aggressively. Commodities – Energy Crude Oil Falls on Profit Taking Crude Oil (WTI) - $85.19 // $0.45 // 0.53% Commentary: Crude fell on Thursday, with WTI shedding $1.69, or 1.94%, to settle at $85.64, while Brent lost $0.52, or 0.53%, to settle at $97.39. The spread between the two benchmarks widened to a record -$11.75. At this point, it’s not even worth looking at WTI as a reflection of global oil supply and demand. Crude continues to consolidate just under the key $100 level as the market digests a significant inventory drawdown over the past few months and a surge in global demand during the second half of 2010 (3mmbbl/d+). Evidence that growth is slowing or OPEC production is picking up will be necessary to change the bias in pric... | |||

| Alan Greenspan Entertains Metal Standard, Again Posted: 27 Jan 2011 05:08 PM PST Few casual observers of the world of international finance would see Alan Greenspan as an advocate for sound money. After all, he led the charge behind one of the largest financial bubbles in world history as chairman of the Federal Reserve. That doesn’t mean, though, that a bad apple is wholly bad. In fact, it was 45 years ago in 1966 when Alan Greenspan wrote in his paper, “Gold and Economic Freedom,” that support for fiat currencies came only from “welfare statists” who were interested in deficit spending, not economic stability. Those words, which have been quoted many times over the years, haven’t been matched in their ferity, especially not from a central banker! However, Greenspan’s famous words were hidden until recently. In an interview with Fox Business channel, he admitted support for a gold standard, or some other form of limit on the amount of currency that could be produced. Greenspan even went so far as ... | |||

| A Simple Shake Could Set Silver Free Posted: 27 Jan 2011 05:06 PM PST There is no more silver! Really, there isn't any left. There is a danger lurking in the shadows of the COMEX silver market. Prices are (generally) rising, but the supply of silver is falling, and it's falling quickly. Why, you ask? Unfortunately, there has been confusion in the paper and physical metals market…as if silver investors hadn't already noticed. Silent Market in Control With the rise in silver prices came new speculative interest from bankers, average investors, and even the next-door neighbor. The problem is very simple: the supply of silver for the investing class is imaginary—a product of the banking system and fractional reserve silver. In order to supply investment demand, investment banks (JP Morgan and others) have been selling off paper silver in droves, hedging their bets on the futures market, and hoping that no one ever bothers to take delivery. It has become evident, especially in this most recent move toward $30, that the price o... | |||

| Posted: 27 Jan 2011 04:43 PM PST This article originally appeared in The Daily Capitalist. It is apparent to me that the factors that underlie the causes of our boom-bust cycle still exist. Nothing has changed. While the President's message to the nation was optimistic, much of his speech was dedicated to telling us how much we need the federal government to become "winners" in a globally competitive world. Alas, I believe that it is the free market that is needed to spur economic growth, not more government spending. I found the speech rather depressing in the sense that the Administration is still planning more spending on "infrastructure" including green energy, education, and physical repairs. Unfortunately, none of those things will contribute in any way to growth. My argument is not that we don't need roads, bridges, and schools, but that more spending on these things will not result in our ability to be more competitive or help to revive our economy. I have written extensively on this blog about the failures of the economic policies of the last two administrations. It is clear that nothing has been accomplished by any of the spending projects and bailouts that were supposed to have bailed us out. Recently a Fed paper tried to justify the bailouts as having saved the world from collapse, but it was nothing more than "curve fitting" to achieve a desired result. There is no believable evidence that bailouts or fiscal stimulus has done anything positive for the economy. In fact, it is far easier to weigh and demonstrate the damage to the economy of such policies. I and others would argue that all the negative consequences the advocates of bailouts predicted would happen without a bailout happened anyway. The numbers speak for themselves. I propose to you that nothing has changed on the policy front that would do anything to revive the economy. While I believe that reducing taxes is a benefit to taxpayers, the Laffer Curve doesn't always work because it depends on the underlying economic problems. Presently those problems are not a lack of spending as almost all Keynesians, Neoclassicists, Monetarists, and econometricians believe. It bears repeating that if we could spend our way to prosperity, then countries like Zimbabwe would be rich. Presently what the economy needs is capital to fund expansion and it appears that such capital is lacking in the economy, or the economy would be growing. By spending more the federal government only reduces the pool of available capital to entrepreneurs, drives up the cost of capital, and results in more debt piled onto the backs of future generations. Further, QE only serves to diminish the supply of "real" capital. By real capital I do not refer to the money that the Fed creates from thin air, but actual savings resulting from production and other economic activity. I continue to monitor the numbers every day and while there are some glimmers of improvement, they don't amount to a trend. I see things such as an improving manufacturing sector but it is almost like a mirage, shimmering in the distance: there is an unreal quality to it. If the dollar should go up, if Europe continue to have fiscal crises, and if inflation becomes rampant everywhere (a not unreasonable scenario), then exports would suffer. So what do we see on the policy front?

This shows ignorance of basic economics. We are still trying to get through the housing crises that vastly over-produced and overvalued housing. There have been some basic reforms to the villains, Freddie and Fannie and now Mrs. Boxer wishes to undo all that for purposes of political expediency. In other words, the taxpayers are to be put back into the business of guaranteeing reckless lending behavior. Also, it won't spur the economy. All that money the borrowers save on their mortgages will come from the employees of the banks who have less income to spend themselves. It's the old Robbing Peter fallacy.

Folks, it just more of the same. Don't read their lips, watch what they do. My forecast of stagnation and inflation still stands. | |||

| Gold Seeker Closing Report: Gold and Silver End Lower Posted: 27 Jan 2011 04:00 PM PST Gold continued yesterday's after hours access trade advance and rose $14.35 to as high as $1347.95 in Asia before it fell back off in London and saw a $2.42 loss at $1331.18 by a little before 9AM EST and then bounced around near unchanged for most of the morning in New York, but it then fell of even further in late morning trade and ended near its 11:30AM EST low of $1316.55 with a loss of 1.1%. Silver climbed 69 cents to $27.81 before it fell back to $27.27 a little after 4AM EST and then climbed back to as high as $27.728 by midmorning in New York, but it also fell back off in late trade and ended near its new late morning low of $26.785 with a loss of 0.41%. | |||

| January Largest Monthly Negative Money Flow for SLV Posted: 27 Jan 2011 02:30 PM PST LV has shed a net 495.14 tonnes of silver so far in January to 10,426.43 tonnes. Monthly out-flow 130 tonnes larger than next highest silver "get-out" of April 2010. Negative money flow expected by GGR. Look for dip buying to surface soon. HOUSTON – We expected a spate of vigorous January profit taking here at Got Gold Report and repeatedly suggested Vultures (Got Gold Report subscribers) raise a Bargain War Chest in late November and all through December as gold and silver seemed to be straining to mark new highs. Both of our very highly profitable short-term gold and silver trades were recently stopped out as the profit taking correction took out key technical support levels. Both trades proved to be the largest nominal gains for a single trade in our gold and silver trading history. | |||

| The World Is Waiting For The Sunrise: A Practical Guide to the Re-Monetization of Silver Posted: 27 Jan 2011 02:17 PM PST | |||

| Gold Price and Silver Price Continue to Fall, Both Metals Still In Primary Uptrend Posted: 27 Jan 2011 11:49 AM PST Gold Price Close Today : 1318.40 Change : (14.60) or -1.1% Silver Price Close Today : 27.045 Change : (0.087) cents or -0.3% Gold Silver Ratio Today : 48.75 Change : -0.382 or -0.8% Silver Gold Ratio Today : 0.02051 Change : 0.000159 or 0.8% Platinum Price Close Today : 1780.60 Change : -31.00 or -1.7% Palladium Price Close Today : 803.45 Change : -9.55 or -1.2% S&P 500 : 1,299.54 Change : 2.91 or 0.2% Dow In GOLD$ : $187.99 Change : $ 2.15 or 1.2% Dow in GOLD oz : 9.094 Change : 0.104 or 1.2% Dow in SILVER oz : 443.33 Change : 0.18 or 0.0% Dow Industrial : 11,989.83 Change : 4.39 or 0.0% US Dollar Index : 77.75 Change : -0.147 or -0.2% GOLD PRICE and SILVER PRICE completed in European trading last night (for us) the upward reaction begun yesterday. Mercy there was none once they began falling. Wow. 'Twas a short-lived silver and gold rally, no? The GOLD PRICE dropped from a high of $1,347 to $1,310.30. Comex gold gave up $14.60 and ended at $1,318.40. Aftermarket saw it trading near the low at $1,311.40. The SILVER PRICE held up a little better than gold, but still took a rough beating with a knobbly club. Peaked last night at 2780c, then dropped to 2725c around 4:00 a.m., while Wall Street executives and traders were still wrapped in their beds, with visions of felonies danced in their heads. Silver then danced along that level, even rallied a bit. From the New York open it rallied to 2770c again at 10:30, then staged a Niagara Falls clean down to 2674c by 11:30. Comex silver closed down only 8.7c to 2704.5c. On both charts today's action looks like a kind of cattywampus key reversal. That is, they tried to break into new high ground, then closed lower -- much lower -- than the day before. That stage-whispers that tomorrow will see more grief, wailing, and lower prices. Although -- I hasten to emphasize -- both SILVER and GOLD remain in a primary uptrend (bull market) that will last another 3 to 10 years, this present correction has not yet played out. Gold has virtually locked in a further correction to $1,300 - $1,290, maybe the 200 day moving average at $1,279.50 (right now). Silver, too, will fall further, likely heading to 2500c or even to the 200 DMA, now standing at 2209c. An alternative reality will follow if I am misreading these charts and both metals roar back, but I most strongly doubt that. You would have first warning shot of that if gold climbed over $1,345 and silver over 2800c. About now y'all will have to prove your mettle, and whether you are a bunch of geese that panic at every breeze, or whether you understand the primary trend and why you must hold on. More than that, you must grasp that the market is about to offer you -- at the bottom of this move -- a colossal buying opportunity. While the US dollar index continues to wallow and sink like a torpedoed garbage scow, other parts of the world make no more economic sense. Stocks rise, on the hope that a US and world economy will re-materialize out of the speculative mists. Right, they will appear right on the heels of Santa Claus, the Easter Bunny, and the Tooth Fairy. Everything's possible, some things just ain't too likely. Specifically, the dollar index fell 14.7 basis points today to 77.751. Chart looks like the EKG of somebody on cocaine, up, down, all over the place. Maybe it found some sort of bottom today at 77.60, but I sure wouldn't swing over hell using that for a rope. Falling wedge buildeth still, arguing that an upside move will come. Ahh, but when? STOCKS measlied along again today, Dow gained 4.39 (Be still, my beating heart!) to 11,989.83. S&P packed in a monstrous 2.91 points to 1,299.54. I don't know who is buying, but I have some fine development land in a Florida swamp I'd like to sell them. Rising wedge will eventually wreak its vengeance and gut the optimists, sadly. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. | |||

| Zerohedge: “Sarkozy Goes Postal On Jamie Dimon, Says Bankers Made World Into Madhouse” Posted: 27 Jan 2011 10:58 AM PST | |||

| Just One Stock: Heavy Upside From a Leveraged Play on Rising Silver Prices Posted: 27 Jan 2011 10:42 AM PST Ananthan Thangavel submits:  Several times a week, Seeking Alpha's Jason Aycock asks money managers about their single highest-conviction position - what they would own (or short) if they could choose just one stock or ETF. Ananthan Thangavel is founder and managing director of Lakshmi Capital, a New York-based wealth management firm focused on absolute return and specializing in alternative asset management. If you could only hold one stock position in your portfolio (long or short), what would it be? Complete Story » | |||

| Inflation: Inevitable…But Not Predictable Posted: 27 Jan 2011 10:41 AM PST Government is not like science or technology – where we build, intentionally, on past experience to create something that becomes better and better over time. Instead, it is rather like an evolutionary development…that often ends with extinction. Since America's modern social welfare democracy is not the product of enlightened rational, accumulated decision-making, America's leaders will be unable to re-design it for the new conditions it faces. Instead, this social welfare democracy will face extinction – like dinosaurs and Neanderthal man…and all previous forms of government…all previous forms of paper money…and all previous monetary systems. In other words, don't expect the US government to reduce its deficits and bring its finances under control voluntarily. It will take a crisis…and maybe even a revolution. Let's look at the financial situation more closely. As near as I can tell, the Great Correction continues, much as we thought it would. This is "Year 5" of the Great Correction. There is much more to go. A Great Correction is very different from a recession. It is not a pause in an otherwise healthy economy. Instead, it is a change of direction…an adjustment to new circumstances (similar and related to the adjustment needed in government itself). After 60 years of near continuous credit expansion, the economy is finally deleveraging…reducing credit in the private sector. To give you one small indication of the kind of adjustment that is taking place, let's look at some good news. US manufacturing is finally picking up. For the first time in 10 years, more people are now joining the manufacturing labor force than leaving it. Of course, this is just what you'd expect. Labor costs are going down. At the margin, America's competitive position is improving. But this is not, as the media has advertised, "proof" the economy is recovering. Far from it. It is proof that the economy is not recovering at all. It is going in a different direction…and responding to a different set of circumstances. Much of the last 10 years was spent in bubble territory. During that time the economy was losing manufacturing jobs, not gaining them. The economy is not now "recovering" to the bubble conditions of 2005-2006. It is moving on. And it's a good thing. Who would want to go back to an economy that destroyed real jobs in manufacturing while creating phony, unsustainable jobs in finance and housing? Now the economy is simply doing what it should do: it's adjusting to new conditions. Unfortunately, it will take time. You don't shift the world's largest economy overnight. So, the rate of joblessness is likely to remain high for many years as the transition takes place. The other major feature of the Great Correction is the weakness of the housing industry. This too is perfectly predictable. The nation has too many houses – and they're still too expensive. The figures show that about one in four homeowners is underwater. And there is no reason to think he'll come to the surface any time soon. The latest S&P/Case-Shiller numbers show the housing market seems to be entering a second dip. Once homeowners realize this, they are likely to also come face to face with their grim choices. They can default. Or they can wait it out – paying more for housing than the going rate. Many will choose to default, bringing housing prices down further. Some won't have a choice: they won't be able to meet mortgage payments. Housing and jobs are the twin pillars of household wealth in America. The papers are full of stories about what happens to people when these pillars give way. High unemployment rates have lowered household income and forced people to take jobs at salaries far below their peaks. A record number, 43 million, of Americans now depend on food stamps. Children are moving back in with their parents – even adult children. And tax receipts are falling. At the local and state level this is causing havoc. The feds can print money. But California, Illinois and New Jersey can't. And between the 50 states there is something like $2 trillion worth of unfunded pension obligations. So far, all of those things were expected. It is a Great Correction, after all. Also expected – but still not fully appreciated – was the reaction of the US government and the Fed. When the crisis began, we calculated that it would take about seven years to bring debt levels in the private sector down to where a new period of genuine growth could begin. We just looked at the debt levels and guessed about how long it would take to default, restructure and pay them down. There were plenty of other calculations based on different assumptions. But they all came up with about the same answer: between 5 and 10 years. But we all underestimated the ability of the feds to muck things up. Thanks to federal intervention, it now looks as though this period of transition may take much longer. Obviously, the feds are adding debt while the private sector is getting rid of it. But it goes beyond that. The feds are also propping up the industries that need to be cut down to size – finance and housing – at a cost of over a trillion dollars. The feds are also trying to engineer a recovery…and promising one. As I mentioned above, a recovery is just what we don't need. But promising that the economy will return to its previous condition leads people to think that they don't really have to make major changes. All they have to do is wait. This further delays the transition to a new economy. Pretending the economy will return to its old pre-2007 self also makes people think that they will be safe in pre-2007 investments. So they stick with stocks and bonds…and eschew the one asset they most need. With all the talk of a "slow recovery" investors don't suspect that there is anything really wrong…or at least nothing that a few trillion in stimulus spending can't fix! So, they don't make the sort of changes that they need to make – in their personal finances and in their investments. The feds are not only stalling the transition, they are also destroying the currency and the credit of the world's largest economy. This further confuses the situation and creates huge uncertainties. Investors are nervous. They don't know what to expect. They become reluctant to commit to large long-term projects – just the kind the country needs, in other words. If you can't trust the value of the money, how can you make a capital investment that will only pay off five years from now? How can you even make a budget or a business plan? Serious investors hold off…or put their money into the growth economies overseas, where the risk/reward ratio is more favorable and the financial authorities are not actively trying to undermine the local currency. What is in some ways most remarkable is that even five years into the correction, the US authorities still seem to have no idea of what is going on. Ben Bernanke recently told us that we could expect 3% to 4% growth this year. Since he completely missed the biggest financial crisis in 80 years, you have to question his forecasting abilities. But even if he is right about the GDP growth rate, he doesn't seem to understand what it means. He admits that 3% to 4% growth is not enough. He's thinking about employment. At that growth level, you can barely keep up with new people coming into the workforce, let alone reabsorb the 15-30 million who are currently out of work. It is also too slow to keep up with the debt load. The deficit is expected to be about 10% – two to three times more than the anticipated additional GDP. This will mean, grosso modo, an increase in the national debt equal to 6% or 7% of GDP. You can't expect to do that for very long. But here is the remarkable thing: so far, there is little official recognition of the dark, dangerous road that the feds are driving down. In the fedsʼ minds, the problem is that the economy is growing too slowly. Three percent isn't enough. They believe they need more growth…and they believe they can get it by "stimulating" the economy. It is as though they were driving down a wet country road at breakneck speed. The radio is not working very well, so they step on the accelerator, trying to catch the radio waves before they get away. When this doesn't work, they go even faster. This is not the way to make the radio work. It is the way to get in a serious wreck. To be continued tomorrow… Regards, Bill Bonner Inflation: Inevitable…But Not Predictable originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||

| All 100 Ounce Silver Bars Will be Gone in a Matter of Days Posted: 27 Jan 2011 10:35 AM PST  Today King World News interviewed one of the top gold and silver dealers in the United States about tightness in the silver market. Bill Haynes is President and owner of CMI Gold & Silver for and when asked about a shortage in silver he stated, "All of the major suppliers of 100 ounce silver bars are either weeks or months out, some will not even take orders. I had some conversations with a number of people who buy from them, had to dig through the information and some of them revealed that they thought the refineries were having trouble and the manufacturers were having trouble getting the physical product which falls right into the silver shortage." Today King World News interviewed one of the top gold and silver dealers in the United States about tightness in the silver market. Bill Haynes is President and owner of CMI Gold & Silver for and when asked about a shortage in silver he stated, "All of the major suppliers of 100 ounce silver bars are either weeks or months out, some will not even take orders. I had some conversations with a number of people who buy from them, had to dig through the information and some of them revealed that they thought the refineries were having trouble and the manufacturers were having trouble getting the physical product which falls right into the silver shortage." This posting includes an audio/video/photo media file: Download Now | |||

| Posted: 27 Jan 2011 10:21 AM PST Gold futures settle under $1320 The COMEX February gold futures contract closed down $14.60 Thursday at $1318.40, trading between $1315.70 and $1347.50 January 27, p.m. excerpts: | |||

| 45% of Investors Expect China Financial Crisis Within Five Years Posted: 27 Jan 2011 10:17 AM PST In a global Bloomberg poll, 45 percent of investors are expecting a financial crisis in China within the next five years, and yet another 40 percent are expecting that one could take place sometime after 2016. Those polled included investors, traders, and analysts, and about 53 percent indicated that they also consider the Chinese economy to be in a bubble fueled by speculation. According to Bloomberg: "On Jan. 20, China's National Bureau of Statistics reported that the economy grew 10.3 percent in 2010, the fastest pace in three years and up from 9.2 percent a year earlier. Gross domestic product rose to 39.8 trillion yuan ($6 trillion). "Any Chinese financial emergency would reverberate around the world. The total value of the country's exports and imports last year was $3 trillion, with about 13 percent of that trade between China and the U.S. As of November, China also held $896 billion in U.S. Treasuries. The trade and investment links between the two nations were underlined with Chinese President Hu Jintao's visit last week to the White House for meetings with President Barack Obama… "…Worries center on the danger that investment, which surged almost 24 percent in 2010, may be producing empty apartment blocks and unneeded factories. [...] Jonathan Sadowsky, chief investment officer at Vaca Creek Asset Management in San Francisco, says he is 'exceptionally worried' that the Chinese would eventually face 'major dislocations within their banking system.'" By region, 60 percent of the Asia-based respondents think exaggerated expectations are to blame for China's overheating asset prices. The potential problems China may face include diminishing exports to consumer-driven economies, how to manage its vast dollar reserves, and soaring inflation… not to mention how it will handle pressure to allow its renminbi currency to appreciate further and faster. You can read more details in Bloomberg's coverage of a global poll showing that investors expect a China crisis within five years. Best, Rocky Vega, 45% of Investors Expect China Financial Crisis Within Five Years originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||

| Sarkozy insists Paris and Berlin will never abandon the euro Posted: 27 Jan 2011 10:06 AM PST by Sam Edmonds "To those who would bet against the euro, watch out for your money because we are fully determined to defend the euro," Sarkozy told delegates at the World Economic Forum in Davos. "Mrs. Merkel and I will never – do you hear me, never – let the euro fail." In his impassioned speech, Sarkozy urged the audience to consider the importance of European economic integration in a social and historical context. "You have to understand, the euro is Europe. And Europe is 60 years of peace. We will never allow the euro to be destroyed." The CEO of investment banking giant JP Morgan Chase, Jamie Dimon, described the EU as "one of the greatest human endeavors of all time." [source] MORE… Sarkozy: No turning our backs on the euro "The disappearance of the euro would be so cataclysmic that we can't even possibly entertain the idea," Sarkozy said. He acknowledged months of worries about the 17-nation euro's survival since the European Union and International Monetary Fund had to bail out debt-laden Greece and then Ireland last year. But despite those concerns, he said, "the euro is still there."

… JP Morgan Chase & Co. chief executive James Dimon said governments were right to act by rescuing Ireland and Greece from default rather than risk a run on the continent's banks. Europe "did the only good choice, which is to get through this crisis, because if you don't fix it here, you're going to fix it there, which is in the banking system," he said. … Sarkozy said that global currency imbalances — notably China's low-valued currency and the dominance of the U.S. dollar in world trade — "one of these days will bring down the whole pack of cards unless we attend to this very swiftly and very strongly." [source] RS View: One of the primary reasons "the euro is still there" despite what might seem as a loose and untenable hodge-podge of uncoordinated individual national economies, tax structures and sovereign debt burdens is that the euro's central bank has a solid gold foundation of reserves that are prudentially structured with (dare I call it "state-of-the-art") mark-to-market accounting. ANOTHER primary reason that "the euro is still there" despite all else is that the euro is not trying to be anything other than a currency unit for all Europeans who need such a thing. It is not trying to be all things to all people, nor is it overextending itself as the whole world's go-to reserve asset. (To be sure, it is in that overextended capacity that the U.S. dollar uniquely has feet of clay.) This well-defined mission statement is more or less the context behind the comment of European Central Bank president Jean-Claude Trichet when he said at a session in Davos, "The euro delivered what had been asked from it, namely price stability." Any fear amongst gold investors that gold reserves might be supplanted by the IMF's SDR program is simply unfounded (it's merely a tactful political diversion) because the special power and potency of reserves is in their ability to command respect in the minds of all counterparties during any "last resort" defense of a regional currency, and only gold universally commands that level of restorative power in the minds of the population. The SDR, by contrast, would be totally impotent and dead on arrival at such a time in the minds of anyone except, perhaps, the bureaucratic economic advisors who continue to advance the silly SDR notion at the present time. | |||

| Inflation to Help the Less Fortunate? Posted: 27 Jan 2011 10:00 AM PST I almost didn't read the essay by Gary Gibson, the managing editor of the Whiskey & Gunpowder newsletter, because he was talking about Paul Krugman, whom Mr. Gibson refers to as "cheerleader of the state," and for whom I have a much, much lower opinion, probably because of my envy of his career success despite being, as far as I can tell, a complete failure in predicting the bursting messes we are in, or ever warning against them as they were building, when it was obvious to the Austrian economists all along. I mean, as an economist, how bad can you be and not suffer for it, for crying out loud? My problem with it is that "gladly suffering fools" was never popular anywhere I ever worked, as all my employers were very specific in demanding "results" and "competence," which I obviously could not deliver, as my career path of perennially bouncing along the bottom, never really getting past the "trainee" rung of the corporate ladder, so richly attests. Anyway, Mr. Krugman writes that he and his hotshot Democrat buddies view their position as, "It's only right for the affluent to help the less fortunate." So that, in a nutshell, is it! He, apparently speaking for all Democrats, wants to help the "less fortunate," and he is as full as any Democrat with his own self-righteousness and smug self-satisfaction in proudly declaring himself so. Well, I got some Hot Mogambo News (HMN) for Mr. Krugman; everybody wants to eliminate suffering, and the affluent have always helped the less fortunate, to one degree or another, although it has never been enough to satisfy everybody, a tradition of whining carried forward even to today when total government spending is almost exactly half of total spending in the Whole Freaking Country (WFC)! Half! I mean, if spending half of GDP by local, state and federal governments to let them "help" is not enough, how could it EVER be enough? I thought it was actually funny when he ridiculously villainized all others as greedy and irresponsible, with the laughable mischaracterization, "The other side believes that people have a right to keep what they earn, and that taxing them to support others, no matter how needy, amounts to theft. That's what lies behind the modern right's fondness for violent rhetoric: many activists on the right really do see taxes and regulation as tyrannical impositions on their liberty." Hahahaha! "No matter how needy"? Hahahaha! "Violent rhetoric?" "Tyrannical"? Again, hahahaha! But as absurdly silly as this, and he, is, his real comic punch line came with the sublime, "There's no middle ground between these views." Hahahaha! Hahahahaha! Truer words were never spoken! Hahahahahahahacoughcoughcoughhahacough! That was so funny that I was laughing so hard, and so long, that I started coughing, which I notice, now that I see it written out, does not convey the experience as well as I had hoped, but which still, I hope, conveys the Utter, Utter Contempt (UUC) I have for Mr. Krugman and his egregiously bad economic idiocies, the sum of which is always "more spending, more budget deficits, and more taxation of the rich." I say this not because Mr. Gibson says, "Mr. Krugman is unquestionably on the side of evil," which is true, but because the most evil thing that you can do to poor people (and the others in that "less fortunate" category) is to make suffer more! Which they do when they must pay higher prices for the things they need to survive. How cruel! How monstrous! And that – that! – is exactly what Mr. Krugman guarantees – guarantees! – when he urges more monstrous amounts of government deficit-spending, more insane increases in national debt, and an insanely increasing money supply, all thanks to an irresponsible Federal Reserve creating the money necessary to the task. And then, as Mr. Krugman does, to advocate more taxes when he knows these business expenses are always passed on to the ultimate consumer in the form of higher prices, which fall disproportionately high on the poor, and when he knows that raising taxes inhibits economic growth, he seems to be the epitome of insanity! This is madness! This man is, obviously then, truly evil. And he is evil because he advocates deliberately inflicting pain on the poor! He is thus a villain. He is thus a monster. As a guy who has seen a lot of "how things work," I am thus a guy who knows that there is nothing that I can do about horrid people like Paul Krugman, or about Princeton, or about The New York Times, except seethe and bemoan the low quality of public education, so rampant in the American school system, that allows this kind of thing to flourish. And I'm a guy who also knows that having a lot of silver will be both a terrific financial asset to own in terms of capital gains as silver rises in the massive inflation in prices caused by the massive over-creation of money by the Federal Reserve, and I'm a guy who has seen enough movies to know that silver is also a weapon against werewolves, especially when made into a hollow-point magnum bullet, at which point it becomes a defense against everything else, too! Hahaha! Being serious for a moment, except vampires, of course, which I figure probably, explains why The Lone Ranger was famous for his silver bullets, although we'll never know because all the documentary evidence is mysteriously "lost." So while I am not quite sure of the precise utility of silver bullets, either now or in the Old West, I am sure of silver reacting to the sorry economics of Mr. Krugman, as it rises along with, and surely ahead of, the massive rises in other prices caused by the Federal Reserve creating enough money to let the government help the "less fortunate" by making them more miserable. And that is why the decision to buy gold, silver oil is so easy that you happily say, "Whee! This investing stuff is easy!" The Mogambo Guru Inflation to Help the Less Fortunate? originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||

| M2 Surges By Biggest Weekly Amount Since 2008 As It Hits Fresh All Time Record Posted: 27 Jan 2011 09:42 AM PST Desperation kitchen sink anyone? The M2, which up until now was merely diagonal, is about to go parabolic. In the week ending 1/17/2011, Seasonally Adjusted M2 surged by $46.6 billion, the biggest weekly increase in the broadest tracked monetary aggregate (ever since the cost-cutting associated with discontinuing the M3) since 2008. One look at the chart below indicates precisely what is fueling the endless market ramp. Furthermore, for those who realize there is a 93% correlation between M2 and gold, we would certainly recommend putting on the M2/Gold convergence trade on. | |||

| Money & Markets Charts ~ 2.17.11 Posted: 27 Jan 2011 09:28 AM PST View this week's chart comparisons of gold against fiat currencies, oil and the Dow. Stay tuned for our next Money & Markets segment of The Solari Report next Thursday, February 3, 2011. Click here to view all charts as a pdf file. See previous Money & Markets Charts blog posts here. Currency charts are from StockCharts.com. Gold vs Oil Gold [...] | |||

| Gold Reverses from Former Congestion Posted: 27 Jan 2011 09:11 AM PST courtesy of DailyFX.com January 27, 2011 07:35 AM Weekly Bars Prepared by Jamie Saettele Gold is testing a multiyear support line. A break below 1317.10 (10/22 low) would put 1270.30 (June high) in play. Resistance does extend to 1352.70 but price has reversed from the center of a former congestion zone. What’s more, the rally from the low is in 3 waves. Bottom line – gold remains vulnerable.... | |||

| Inflationary Thursday – Dow 15,000 + $5 Will Get You a Happy Posted: 27 Jan 2011 09:10 AM PST Inflationary Thursday – Dow 15,000 + $5 Will Get You a Happy MealCourtesy of Phil of Phil's Stock World Are they rioting in Africa? Check – they are rioting in Africa! Toppling governments in Tunesia? Check, government toppled. Riots and demonstrations also in Albania, Belarus, Jordan, Libya, Lebanon, Ireland,Egypt, Yemen, Zambia… Even the British Royal Family attacked in their limo after being booed and jeered by a mob chanting "off with their heads." If nothing else disturbs you while you buy your NFLX today – that last one should. Rich folks in an industrialized nation trying to go to the theater in their limo and being attacked by an angry mob. How long before we (in the top 1%) need to armor our cars and hire bodyguards? Is this part of the Fed’s plans to create jobs – make the top 1% so much richer than the bottom 99% that we’ll need to hire guards just to go shopping at Whole Foods as we drive past the bread lines? “We’re in an era where the world and nations ignore the food issue at their peril,” World Food Bank’s Josette Sheeran said in an interview yesterday at the agency’s Rome headquarters. Risks of global instability are rising as governments cut subsidies that help the poor cope with surging food and fuel costs to ease budget crunches. The global recession has eroded government aid that helped people in poorer countries afford bread, cooking oils and other staples. The U.N.’s Food Price Index surged to 214.8 in December, exceeding the previous record in 2008 when rising costs and fears of shortages sparked riots from Haiti to Egypt. More than 100 people have died this month in protests in Tunisia against food inflation, unemployment and alleged corruption, according to the U.N.

The numbers are already staggering. According to the IMF’s very conservative measurement, which peg US inflation at just 1.5%, the end of year inflation is 4.6% in China, 3.7% in the UK, 5.9% in Brazil, 8.8% in Russia, 8.3% in India, 4.4% in Mexico, 6.4% in Turkey, 5.7% in Indonesia, 10.9% in Argentina, 11.9% in Iran, 26.9% in Venezuela, 10.4% in Egypt, 11.8% in Nigeria, 15.5% in Pakistan… Judging from who’s rioting and who’s overthrowing their government I’d say about 10% is the point at which you may want to consider doubling up your security detail before you head downtown. Don’t worry though, we can easily afford the minimum wage thugs we hire to bash in the skulls of the unemployed thugs who want to get their hands on our stuff, right? POT, for example, announced a 103% increase in earnings last quarter as the price of fertilizer skyrocketed as speculators snapped up supplies. The stock is so high now ($175) that the company is announcing a 3 for 1 split so we can give a few shares to the help next Christmas – isn’t that charming? India’s market plunged 5% this month, the Shanghai Composite is off 17.5% since November and Egypt (EGPT) dropped 10.6% TODAY but don’t let that bother you – everything is just fine – until it isn’t, of course but then, who could have ever seen that coming, right? Most of this Global inflation is being sparked by our own Federal Reserve, since the Dollar is 62% of global reserves and almost all commodities are priced in Dollars and the Dollar is down 4% for the first month of 2011 – putting that much more pressure ON TOP OF those shocking 2010 inflation rates. Well The Bernank gave the rest of the World a huge FU yesterday as the Fed announced (unanimously now that Hoenig is no longer a voting member): "The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period." That comment has been interpreted to mean until US jobs come back and that means, pretty much, forever. This was enough to send the Dollar down to month-lows at 77.70 and that popped gold back to $1,346 (up 1.5%) overnight and sent oil back to $87.50 (up 1.5%) and copper back to $4.30 (up 1.5%) and silver up to $27.50 (also 1.5%) – so a pretty uniform boost to commodities on a 0.5% dip in the dollar is clearly disproportionate and will, of course, choke the life out of global consumers. Yay – let’s buy some commodities!!! Actually, to be honest, we already did. We went bullish on gold on Tuesday and bullish on silver yesterday in Member Chat, even as we took short-term short bets on the indexes because we feared exactly what happened yesterday – the Fed is keeping those free money spigots going full-throttle, no matter what the consequences are for the bottom 99% (hence the title of yesterday’s post). This is good for the markets but bad for the World. I feel bad about making money this way but, as I said yesterday: "You’d better be out there making an assload of money because you’ll need it to keep up with rising prices for things you buy and declining values of your US assets." Now we have to factor in the price of security people to guard our gold when we’re going out to the AAPL store for our IPhone 5s (which will also be able to be used as a credit card!). Keep in mind that gold and silver are our defensive plays. In Member Chat yesterday, Jromeha mentioned he’s 80% in cash and 85% short the market on the 20% in play and I said I thought that was an excellent way to play what I felt was a blow-off top after the Fed. We added 2 disaster hedges yesterday, a TZA spread that pays 500% if we get to $17 by April and a QID play looking for a quick 66% if they hit $11 by March. That’s in addition to our very short play on the Dow so we are SHORT in the short-run – DESPITE all the foolishness out of the Fed. Something has got to give and the dollar remains stubborn above the 78 line and the Russell hasn’t taken back 800 and our "Secret Santa Inflation Hedges" from Christmas and our "Breakout Defense Plays" from early December are up HUGE and need to be protected, as do the dozens of other long-term bullish trades we’ve selected since the beginning of the year. It’s those short, sharp shocks that will get you in this market – the long-term will take care of itself.

Hey, at least we’re not Japan, which lost its AA rating this morning as S&P downgrades their long-term debt to AA-. S&P also notes Japan’s demographic situation will strain government finances even more in the future. Will this cause the Yen to drop and the Dollar to pop? Hell no – Japan’s economy may be a 20-year disaster in progress but it’s not a Bernanke! Sarkozy is over in Davos talking up the Euro, saying: "Whether it be [German] Chancellor Merkel or myself, never will we turn our backs on the Euro. Never will we abandon the Euro," he said. He added that those who bet against the euro should watch out for their money. "The Euro spells Europe. The euro is Europe and Europe has spelled 60 years of peace on our continent, therefore we will never let the Euro go or be destroyed," he insisted. BUT - "The dollar will continue to be the world’s number one currency," he said. Spain, Ireland, Greece and Portugal will probably remain “stuck in recession” for the next 18 months and be the laggards in a three-speed European recovery, Standard & Poor’s said. S&P sees Germany, Europe’s largest economy, and Finland leading the euro region’s recovery this year, with growth of at least 2 percent, Chief European Economist Jean-Michel Six in Paris said today. The U.K., France, Italy, Belgium, Luxembourg and Netherlands will follow, with expansion of in a range of 1.5 percent to 2 percent. The “three-speed” recovery will “complicate” the job of the European Central Bank this year, said Six, who sees the first interest-rate increase at the end of 2011. If the Pending Home Sales don’t send us off a cliff, we’ll be looking at an upside play on FAS and XLF again (we had one on Tuesday that went very well already). Our last entry points (with option plays, of course) were $29.25 on FAS and $16.25 on XLF and today is another POMO day, courtesy of the Fed, as is tomorrow and free money always does wonders to cheer up the Financial sector. NUE missed earnings and RCL, RTN, PG, MUR, CY, MO, MJN, JBLU, BMY, DHI, CNX, CL, AUO, OI, DRE, ETFC and AMLN all missed either earnings or revenue targets since yesterday’s close but don’t let it bother you as long as the dollar keeps going down – that makes everything we buy more "valuable" – even poorly performing stocks! Isn’t investing simple? We can’t wait to clear the last of our technical hurdles (Russell 800) so we can put that sideline cash into play and, like our mindless inflation hedges from December that have doubled and tripled up already – we look forward to betting on the next round of the decline and fall of the United States of America – you burn Rome, we’ll bring the fiddles!

Sign up to try out PSW subscription services here. | |||

| Sarkozy Goes Postal On Jamie Dimon, Says Bankers Made World Into Madhouse Posted: 27 Jan 2011 09:08 AM PST It has just not been Jamie Dimon's day... or week. After a lawsuit earlier in the week implicated his firm in a mortgage scandal for selling "sack of shit" loans, which is very reminiscent of what Goldman did to AIG, the JPM boss had hoped that he could spin his lies and get everyone to forget that he and his klepocratic colleagues virtually destroyed the financial system, and net a reduction in supervision and regulation. After all the banks have been in purgatory where they have had to subsist on bonuses that average just over $300k for JPM (and $400k for Goldman): how on earth are they supposed to do that. During a Davos session Dimon lashed out at persistent bank bashing nearly three years after the global credit crisis began, saying it was "unproductive and unfair.. Not all banks are the same and I just think that this constant refrain 'bankers, bankers, bankers' is just unproductive and unfair. People should just stop doing that." Enter Nicolas Sarkozy, who more so than anyone is concerned by the events in Tunisia and Egypt, considering an increasing percentage of the French population is of North African descent, and quite soon they may decide to do just what their Tunisian (and after tomorrow, Egyptian) brethren have done, and just get rid of their useless president. Quote Sarkozy talking to Dimon, per Reuters:

Wow. This could rival the best rant any angry blogger could come up with. And Jamie's second attempt to make it seem like his feces don't stink suffered massive failure:

Too bad that earlier today, as part of the FCIC disclosure we got the following revelation from none other then Chairprinter Shalom-Packard himself:

Sorry Jamie. Mission to get you to run the world all over again has experienced massive failure... for now. | |||

| Fed to Monetize MOST of the US Debt Posted: 27 Jan 2011 09:06 AM PST We begin today with a confession. We have grievously erred. Ironically, it was a government agency (gasp, nooo!) that highlighted our error. We were trying to get a grip on the Fed's vaunted second round of quantitative easing, the unsinkable QE2. We made our calculations with the best of intentions: According to the Fed's plan, they were going to purchase $600 billion in Treasury purchases across eight months. And roll another $275 billion in maturing mortgage securities (MBSs) over into Treasuries. Total price tag: $875 billion. Here's where we went wrong. On Nov. 4, 2010, we said we thought the Fed planned "to monetize all of the debt that Treasury plans to spit out from now through the middle of next year, and then some." (Emphasis added.) We assumed a federal deficit of $1.2 trillion. Or $800 billion for the first eight months of the fiscal year. $875 billion meant the Fed was monetizing 109% of the deficit from November 2010-June 2011. Now, the Congressional Budget Office has upped its estimate of the fiscal 2011 deficit to $1.5 trillion, spitting egg all over our faces. The Fed is not monetizing "all" of the deficit across an eight-month span "and then some"…it's monetizing only 88%. We were off by 21%. Nostra culpa. Although following their line of thinking, it probably leaves the door open for QE2 part deux. Or even QE3. Indeed, gold has given back much of the late-day gains that materialized yesterday after the Fed announced no changes to its QE2 policy. The spot price is back to $1,334. Silver, on the other hand, is holding its ground at $27.66. Ah, well, let's call it even… The CBO report included another nugget that confirms another forecast we've been criticized for: Yesterday's report indicates Social Security will pay out $45 billion more in benefits this year than it will collect in taxes. With no changes to the program, CBO says Social Security will now run permanent deficits…and will drain all the Social Security trust funds by 2037. You may recall during much of 2010, we projected Social Security would go into the red on Sept. 30, 2010…the end of the federal fiscal year. Of course, the reality is worse than even the CBO admits because Congress already spent all the "trust fund" money, leaving IOUs in its place. Addison Wiggin Fed to Monetize MOST of the US Debt originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||

| Posted: 27 Jan 2011 09:00 AM PST Pity the poor English. Here's the latest: LONDON – Prime Minister David Cameron 's coalition government received a body blow on Tuesday after official figures showed that Britain's economy shrank by half a percent in the last three months of 2010. The figures on the economy's performance from October to December are subject to revision as the data are refined in coming weeks. But the message to the Cameron government seemed clear: Its policies of steep spending cuts and tax increases, Europe's most ambitious austerity program, faced, at a stroke, a sharply heightened political vulnerability. The decline came after four consecutive quarters of economic growth. Spokesmen for the opposition Labour Party and trade union officials seized on the new figures, saying they showed the government had lost its gamble that it could impose the tough austerity measures and still keep the economy growing. The government responded by blaming the snow blizzards that hit Britain last month, the country's coldest December in 100 years, and saying it would "not be blown off course by bad weather." The government blames the weather. Analysts blame the conservative government's austerity measures. They're both wrong. The weather had some effect. But not enough to take a full percentage point off GDP. (The difference between expectations and the actual result.) Cuts in government spending, meanwhile, should reduce GDP – at first. But the cuts haven't even begun yet. It's not the weather. It's not the government. It's the Great Correction, doing its job. In the minds of most economists, any slowdown, whatever the cause, is bad news. They think economies have to run hot all the time in order to provide "growth," jobs and profits. Here at The Daily Reckoning we take a different view. Sometimes economies need to take a rest. They need to check the map. Just racing along is not necessarily a good thing. They need to be sure they're headed in the right direction. But there's the problem, right there. London has the same knuckleheads in the drivers' seat as Washington. Mervyn King, England's answer to Ben Bernanke, said that since he and his colleagues took over, "there has not been a single quarter of negative growth." But that speech was made in 2007. To what did he attribute this grand performance? In a more recent speech, he explained that since "monetary policy is a flexible instrument that can be changed in either direction each month, it is the best tool for managing the economy in the short run." Well, the bank of Mervyn King and the bank of Ben Bernanke are on the same page. Neither government can use fiscal policy – both are out of money. But they still have monetary policy…or to be more exact, they still have the printing press. So, they push down on the accelerator…and head for a ditch. And here's an item that helps us understand better how the zombie state works. The New York Times reports: Mortgage Giants Leave Legal Bills to the Taxpayers Since the government took over Fannie Mae and Freddie Mac, taxpayers have spent more than $160 million defending the mortgage finance companies and their former top executives in civil lawsuits accusing them of fraud. The cost was a closely guarded secret until last week, when the companies and their regulator produced an accounting at the request of Congress. The bulk of those expenditures – $132 million – went to defend Fannie Mae and its officials in various securities suits and government investigations into accounting irregularities that occurred years before the subprime lending crisis erupted. The legal payments show no sign of abating. Documents reviewed by The New York Times indicate that taxpayers have paid $24.2 million to law firms defending three of Fannie's former top executives: Franklin D. Raines, its former chief executive; Timothy Howard, its former chief financial officer; and Leanne Spencer, the former controller. See how the zombies do it? The mortgage companies collude with the Fed (artificially low rates) and Congress (deductibility of interest payments, implied federal backing of Fannie and Freddie) to stick Americans with trillions in mortgage debt. Then, when the bubble blows, the feds take over Fannie and Freddie, adding $5 trillion to America's national debt. And the taxpayers get to pay the legal bills too. What's not to like? The lawyers are happy. The feds are happy. Fannie and Freddie's bondholders are happy. All the insiders are happy. It's just the outsiders – the poor schmucks who haven't figured out how to get on the gravy train – who aren't happy. And who cares about them? Regard, Bill Bonner Masters of Monetary Policy originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||

| Posted: 27 Jan 2011 08:44 AM PST

So said investing legend Jim Rogers when he spoke recently with ChrisMartenson.com about the inflationary pressures rising dramatically around the globe, despite some governments' best efforts to downplay them. Jim shares his "outside in" perspective on US monetary and fiscal policy, and how international players find themselves forced to react. He sees a lot of fundamental imbalances that need to be corrected for, as well as shortages of almost everything developing. In his words, "It's going to be a real mess before it's over." Download/Play the Podcast In this podcast, Jim explains why:

As with our recent interviews with Marc Faber and Bill Fleckenstein, Jim ends the interview with his specific outlook for 2011. On Thu, Jan 27, 2011 at 12:28 PM, Adam Taggart wrote: Tyler - Here's an interview between Chris and Jim Rogers we just released. Jim makes the case for higher inflation, higher interest rates, and less of just about any hard asset: http://www.chrismartenson.com/blog/interview-jim-rogers-why-inflation-raging-worldwide-and-hes-shorting-us-treasury-bonds/51747 HTML below. --tx, A

So said investing legend Jim Rogers when he spoke recently with ChrisMartenson.com about the inflationary pressures rising dramatically around the globe, despite some governments' best efforts to downplay them. Jim shares his "outside in" perspective on US monetary and fiscal policy, and how international players find themselves forced to react. He sees a lot of fundamental imbalances that need to be corrected for, as well as shortages of almost everything developing. In his words, "It's going to be a real mess before it's over." Click the play button below to listen to Chris' interview with Jim Rogers: [swf file="http://media.chrismartenson.com/audio/jim-rogers-2011-01-22-final.mp3"] Download/Play the Podcast In this podcast, Jim explains why:

As with our recent interviews with Marc Faber and Bill Fleckenstein, Jim ends the interview with his specific outlook for 2011.

| |||

| A Report on Price Inflation from the Front Lines Posted: 27 Jan 2011 08:41 AM PST We asked, you responded. In Monday's edition of your Daily Reckoning, we addressed the steady, inexorable creep of inflation. And this despite our guardian angel central bankers doing their best to maintain price stability…through, we are told, the flagrant manipulation of our currency. Here's Jean-Claude Trichet, head of the European Central Bank, reporting from the frontlines: "All central banks, in periods like this where you have inflationary threats that are coming from commodities, have to…be very careful that there are no second-round effects" on domestic prices, Mr. Trichet told The Wall Street Journal from his office overlooking Frankfurt's financial district. "Can you believe it, Dear Comrade?" we wrote on Monday. "If we are reading Mr. Trichet's comments correctly, it would seem that the world's food and energy communities are consciously rallying against us. Long thought to be soulless, mindless vegetables and minerals, commodities have apparently taken it upon themselves to 'become' more expensive, to raise their own prices. We can almost hear the battle cries coming from the fields: Ears of corn unite!" Given the fact that we are now at war with self-inflating vegetables and energy sources, we decided to conduct a little front-line reconnaissance operation…with the help of the Daily Reckoning brain trust. Specifically, we asked readers to send us some boots-on-ground anecdotes from their own gas pumps and grocery stores. "Are you noticing a price creep in your monthly bills?" we wondered. "Could it be that inflation is already here, that it has infiltrated our defenses and lurks in our very midst?" Reckoners filed the following field reports: Don, writing from Goffstown, NH, notes that, "Locally, gasoline is up 8-10 cents/gallon. Food is up about 10% over last year. And McDonald's announced this morning it will be raising its prices." Fellow Reckoner, Anna, observed: "Those rebels, the vegetables, fruits, corn, and other food items, have attacked our neighborhood stores in ways unimaginable. When growing a lowly bell pepper in my garden this past summer, I had no way of knowing that the scoundrel would turn traitor and cost $4.39 each at my local supermarket. Had I known that, I would have established a green house to grow these crooks in and, thereby, would have used their rebellion for my benefit. "Ah, the value of hindsight," Anna continued, "it counts for naught. And the asparagus! It was raging at a full price of $3.98 per pound! I couldn't believe my eyes. I could go on but I am sure by now you get the picture. This is not JUST 10%. The bell pepper was at least four times higher than the same item last winter. The asparagus, by comparison, was ONLY around 40% higher. And it was not just these two vegetables but to continue would take more pages than you would want to read." Chimes another reader, "VTY": "The recent Scottsdale antique car auction had bidders paying anything just to secure something that wasn't greenbacks. Cars that seemed pricey a year ago at $50K were going for twice that. To me, that means the big money is scared; they have lost faith in government, the Fed and our ability to manage our future. "Besides," VTY concludes, "it's much harder to steal a 5500 pound Packard than a clutch of Krugerrands (And the Packard seems so innocent by comparison.)" And from Florida, Larry reckons: "The Tampa Bay Area has creeping inflation. Food prices, clothing, gasoline have all gone up. Makes stretching the dollar harder. Candy bars and basics like butter, milk and bread are up 20 cents or are the same price, but the sizes are smaller. McDonald's prices are going up and Arby's are closing because beef is too expensive. Go figure! "1963 Franklin Half Dollar Silver coins have gone up from $7.50 to $12.50. Other silver coins are being bought at 12 times face verses 5 times face value from the prices last year. Silver dimes are being sold for $2.10. Peace Dollars have gone up from $12.00 to $16.00 for junk silver. "But according to the Feds and the government I must be mistaken, because we only have a 2 to 3 percent inflation rate. So my figures must be wrong! But my better half wants more money to shop for food with! I'm not going to tell her she is wrong!" And "A. Grocer" has this: "I have been keeping an eye on things since I stocked shelves at the grocery store here in Elyria, Oh. We used to sell pasta 3 lbs. for $1 as an advertised special about 2 years ago. Now it goes for $1 per lb. Apple juice was advertised for 99 cents for a 64 oz. bottle. You'll be lucky to get it for $1.59 now. I could go on… Things used to go up here and there by 5 to 9 cents at a time. Now they jump 59 cents at a time…and this is just the beginning! It is truly shocking…I reckon' ya better say yer prayers my friends." There were so many emails inflating our inbox, it was hard to keep up. From Rick: "Car Insurance is up 11.3 % yoy…despite all vehicles being one year older. Health insurance up 13.5 % yoy. Homeowners Insurance up 32 % yoy…" From Rex: "Domestic beer is up $1.33 on a 12 pk in less then 8 months. That dummy Bernanke. What's next, smaller cans?" And this, from a Fellow Reckoner in the Lone Star State: "I work with those 'foot-soldiers' in the corn army. When I went into that field back in '02, you could 'enlist' 6 to 8 of these 'soldiers' for one paper dollar. Now they won't recruit for less than 68 cents. Now, the current generation of corn ears is asking 85 cents to sign on to your dinner table. This is in TEXAS; we grow corn here for crying out loud." Indeed! We also received reports from Reckoners in Europe, Asia, South America and far beyond. Who knew we had readers, for example, in Australia? (Which reminds us: Hi mum!) Thanks to everyone who wrote in. We'll feature more frontline reports, including some international insights, in future issues. For now, let's dive into today's column…also about inflation… Joel Bowman…and The Daily Reckoning Readership A Report on Price Inflation from the Front Lines originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||

| Posted: 27 Jan 2011 08:37 AM PST by Addison Wiggin - January 27, 2011