Gold World News Flash |

- Imagining the Unimaginable

- Asian Metals Market Update

- Crude Oil Rebounds after Inventories Plunge Yet Again, Gold Falls for a Third Day as

- Jim Rickards - Gold Standard Coming, Fed’s Hoenig Correct

- The Master Speaks

- Gold Seeker Closing Report: Gold and Silver Fall A Bit More

- In The News Today

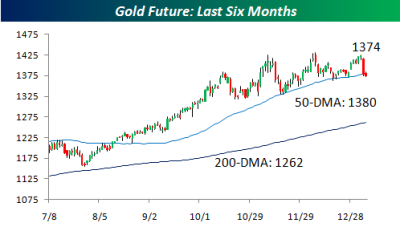

- The Gold Price Dropped to $1,373.40, Where Does That Leave Gold Against It's Moving Averages?

- EU plans for bondholder haircuts unsettles debt markets

- Kansas City Fed president calls gold standard 'very legitimate'

- Kansas City Fed president calls gold standard 'very legitimate'

- Brazil says it won't let U.S. 'melt the dollar'

- Brazil says it won't let U.S. 'melt the dollar'

- To Bee Or Not To Be?

- Harley Bassman's Model Portfolio For 2011, And Why "It Is Just A Matter Of Time" Before The Fed Creates Inflation

- Guest Post: Money And The State

- Payroll Data Dims Outlook for Gold

- A Golden Issue - January 5, 2011

- Verbosity is the Soul of Financial Fury

- Playing Chicken with Debt Limits: Obama as a Senator vs. Obama the Hypocrite President Today

- John Embry - Gold Over $2,000, Silver Above $50 in 2011

- Guest Post: How High Will Gold Go in 2011?

- Will Food Prices Continue to Rise in 2011?

- “America’s Top Crisis”

- Gold Decline is Impulsive

- Signs Of The Times

- Hourly Action In Gold From Trader Dan

- Improvement In Preliminary Jobs Report Misleading

- WEDNESDAY Market Excerpts

- Gold Daily and Silver Weekly Charts

- Gold remains precious to the Eurosystem

- How High Will Gold Go in 2011?

- Race to Debase – 2010

- Ben Bernanke Loses More Money In One Day Than All Of LTCM Ever Did... Doubled

- Mike Niehuser: Precious Metals Investment Strategy for 2011

- Why So Much Risk for that Pittance of a Reward?

- Three December Details You Hopefully Haven't Forgotten

- The Best Currency You’ve Never Heard Of

- Big Media Finally On The Case Of The Amazing "Value Deflation" Inflation

- Precious Metals Investment Strategy for 2011

- The Five Stages of Gold

- World food price index hits record high

- Gold Breaks 50-Day Moving Average

- Sprott fund found it hard to get silver, Embry tells King World News

- Midterm Trade in Emerging Gold Miner Gammon

- Alasdair Macleod: This is the year money starts to die

- Why Gold Still Has a Long Way to Run

- Fake Breakout On Gold Signals Caution

- Finance Explained In 69 Easy Sketches

- Will Angela Merkel Make or Break the Euro?

| Posted: 05 Jan 2011 06:01 PM PST Cam Fitzgerald posted the following essay in the Rick's Picks forum, but I am presenting it as a guest commentary because it discusses the all-too-real implications of America's economic crisis so bluntly. Many of you, even the pessimists, will be troubled by this grim jeremiad, and some will disparage its conclusions. But four years into what has come to be known, probably euphemistically, as the Great Recession, it is time we asked ourselves whether a collapse indeed looms that could prove equal to what we have imagined in our most troubled moments. | |

| Posted: 05 Jan 2011 06:00 PM PST Copper has been supporting all commodities. Copper rose despite gains in the US dollar. The rise in copper is supporting silver. Had copper fallen then silver would have fallen like a pack of cards. Higher base metal prices will prevent commodities from falling and they will be de linked from movements in the currency markets. | |

| Crude Oil Rebounds after Inventories Plunge Yet Again, Gold Falls for a Third Day as Posted: 05 Jan 2011 05:25 PM PST courtesy of DailyFX.com January 05, 2011 10:51 PM Crude inventories continued to plummet, sending benchmark crudes closer to $100. Meanwhile, gold continued lower as rate expectations ticked higher. Commodities – Energy Crude Oil Rebounds after Inventories Plunge Yet Again Crude Oil (WTI) - $90.29 // $0.01 // 0.01% Commentary: Crude oil added $0.92, or 1.03%, to settle at $90.30, reversing earlier losses that took the commodity as low as $88.10. The news flow for the day was across the board positive. U.S. ISM Non-Manufacturing Composite for December came in at 57.1, above the 55.7 expected and at the highest level since 2006. We also received the ADP estimate for growth in the labor force for December and it came out at a record level of 297K. Most market participants aren’t buying that figure since the ADP has been way off the mark from the government nonfarm payrolls report in the past. Most economists expect about a 170K increase to be reported on ... | |

| Jim Rickards - Gold Standard Coming, Fed’s Hoenig Correct Posted: 05 Jan 2011 04:30 PM PST  Fed Governor Hoenig shocked many observers yesterday when he stated, "The gold standard is a very legitimate monetary system...We're not going to have fewer crises necessarily. You will have a longer period of price stability or price level stability, but I don't know that you'll have lower unemployment, I don't know that you'll have fewer bank failures." King World News immediately interviewed Jim Rickards who has worked with both the Fed & US Treasury, and who also has a background in national defense as well as consulting with government directorates around the world. Fed Governor Hoenig shocked many observers yesterday when he stated, "The gold standard is a very legitimate monetary system...We're not going to have fewer crises necessarily. You will have a longer period of price stability or price level stability, but I don't know that you'll have lower unemployment, I don't know that you'll have fewer bank failures." King World News immediately interviewed Jim Rickards who has worked with both the Fed & US Treasury, and who also has a background in national defense as well as consulting with government directorates around the world. This posting includes an audio/video/photo media file: Download Now | |

| Posted: 05 Jan 2011 04:17 PM PST | |

| Gold Seeker Closing Report: Gold and Silver Fall A Bit More Posted: 05 Jan 2011 04:00 PM PST Gold climbed as much as $6.45 to $1384.55 in Asia before it fell all the way back to $1364.09 in midmorning New York trade, but it then rallied back higher in the next few hours of trade and ended with a loss of just 0.28%. Silver fell almost a dollar to as low as $28.584 before it also rallied back higher, but it still ended with a loss of 1.29%. | |

| Posted: 05 Jan 2011 01:45 PM PST Jim Sinclair's Commentary This should make a good read for those CIGAs that have been rattled by the recent reaction. John Embry – Gold Over $2,000, Silver Above $50 in 2011 With a sharp two day correction in gold and silver taking place, King World News today interviewed John Embry, Chief Investment Strategist at Sprott Asset Management. When asked about the quick decline Embry stated, "This may be the best opportunity you're going to get at least from a price sense to buy gold and silver in the next few days. I think when this correction however long it will last is over, it will probably mark the lows for the year which will then be the liftoff to the eleventh consecutive year of higher gold prices." John Embry continues: "The returns over the last 10 years, gold returned over 18% and silver close to 24% annually. These are spectacular returns and we haven't seen anything yet, we're not even close to the third leg which is the blowoff. As you know we started the Sprott Phyiscal Silver Trust about about 3 months ago. We still haven't got all of our silver in yet, we're close, we've almost got every last bar. But it's taken the better part of 2 1/2 months to get it in, so the suggestion that this physical market is tight probably isn't a strong enough suggestion, it's really tight! You and I were buying this morning John personally, you probably bought for the fund as well, but I know we were personally buying. You have to have conviction in order to buy during these dips, and you have to know the companies…You had one company that was dipping 10%, you stepped in and were a buyer, it's already recovered I think.

Jim Sinclair's Commentary This is the most telling of events. It stirs my concerns over statistics. If Roosevelt had controlled the media would there have been a Great Depression? What we are in front of is the Great Inflation based on currency induced cost push inflation. Even this event will be MOPEd. Exclusive: Volcker to step down from White House panel (Reuters) – Former Federal Reserve Chairman Paul Volcker plans to leave his role as head of a panel of experts advising President Barack Obama on the economy, sources familiar with the decision said on Wednesday. The departure of Volcker, 83, as head of the President's Economic Recovery Advisory Board is among a series of changes under review at the White House. The decision to leave the board was Volcker's. A source close to him said he was ready to continue to advise Obama on an informal basis as often as the president would like. Volcker, who became a legendary figure on Wall Street when as Fed chief he broke the back of double-digit U.S. inflation in the early 1980s by sharply raising interest rates, began advising Obama during his 2008 presidential campaign and has wielded clout on issues ranging from financial regulation to fiscal policy. The White House declined to comment on Volcker's exit. The formal announcement of Volcker's departure is likely to come on Friday when Obama is expected to make a number of announcements regarding his economic team.

Jim Sinclair's Commentary John Williams of www.shawdowstats.com says the following: "- Employment and Unemployment Increasingly Should Disappoint Recovery Expectations." The meat of this report is contained in the essay "No. 343: Updated December Jobs Report Outlook"

Jim Sinclair's Commentary The Banksters rule. This however does tell you what these crappy mortgages carried on many financial entity balance sheets are worth. That amount is NOTHING. When is enough, enough? The public is thrown out of their houses and jobs while the Banksters go from super richer to super richer. BofA Freddie Mac Putbacks Resolved for 1¢ on $ Bank of America settled numerous claims with Fannie Mae for an astonishingly cheap rate, according to a Bloomberg report. A premium of $1.28 billion was paid to Freddie Mac to resolve $1 billion in claims currently outstanding. But the kicker is that the deal also covers potential future claims on $127 billion in loans sold by Countrywide through 2008. That amounts to 1 cent on the dollar to Freddie Mac. Imagine if you had a $500,000 mortgage, and you got to settle it for $5,000 — that is the deal B of A appears to have gottem from Freddie Mac. B of A also paid $1.52 billion to Fannie Mae to resolve disputes on $3.1 billion in loans (~49 cents on the dollar). They remain liable for $2.1 billion in repurchase requests, as well as any future demands from Fannie Mae. My biggest complaint about the GSEs post government takeover is that they have been used as a back door bailout of the banks. This latest deal reconfirms that view. Its a wonder B o A didn't rally further than the 6.7% it surged yesterday . . .

Jim Sinclair's Commentary CIGA Joe sends in the following: Sorry ADP, Not Everyone Believes the Economy Created 297,000 Jobs That big positive surprise this morning from the ADP jobs report was nice while it lasted — which was all of about 30 seconds by market standards. Unfortunately, a number of traders and economists aren't willing to take seriously the report that ADP and Macroeconomic Advisors put out suggesting the economy created 297,000 jobs over the past month. A quick straw poll this morning showed a lot of disbelief in the ADP numbers, and the report did virtually nothing to move the stock market, though futures pared some losses immediately after the release. Equities meandered through morning trading, though other markets did react. In particular, bonds showed a strong reversal of earlier gains, while the dollar gained more than 1 percent and in turn pressured commodities priecs. But don't expect many major revisions for Friday's Labor Department report, expected to show nonfarm job increases of 140,000 jobs and an unchanged unemployment rate of 9.7 percent. | |

| The Gold Price Dropped to $1,373.40, Where Does That Leave Gold Against It's Moving Averages? Posted: 05 Jan 2011 01:36 PM PST Gold Price Close Today : 1378.50 Change : (44.10) or -3.1% Silver Price Close Today : 29.492 Change : (1.604) cents or -5.2% Gold Silver Ratio Today : 46.74 Change : 0.993 or 2.2% Silver Gold Ratio Today : 0.02139 Change : -0.000464 or -2.1% Platinum Price Close Today : 1730.50 Change : -25.70 or -1.5% Palladium Price Close Today : 774.40 Change : -1.60 or -0.2% S&P 500 : 1,270.20 Change : 6.36 or 0.5% Dow In GOLD$ : $175.80 Change : $ 5.93 or 3.5% Dow in GOLD oz : 8.504 Change : 0.287 or 3.5% Dow in SILVER oz : 397.49 Change : 1.29 or 0.3% Dow Industrial : 11,722.89 Change : 31.71 or 0.3% US Dollar Index : 80.26 Change : 0.814 or 1.0% The GOLD PRICE moved sideways, testing support with its foot at $1,364 a little before midday, leaving a V-bottom behind, and trading range bound between 1372 and 1380 afterwards. No doubt y'all will recall -- since y'all are not IRS agents testifying on the stand to something that might help the defendant, which questions mightily debilitate their memories -- that in December Gold posted its low at $1,362.30 (intraday). Gold dropped $5.10 and came to rest on Comex at $1,373.40. Where does that leave gold against its moving averages? Below the 20 ($1,390.06) and below the 50 ($1,379.73). Decidedly negative. But give it a day or two and it ought to work up at least a dead-cat bounce. I'm simply not sure that gold has finished this move, despite all the evidence. The SILVER PRICE had lost 31.9c when Comex closed at 2917.3c Yesterday it lost 5.2%, so today looked right calm. Patter mirrored gold's, mostly sideways with a V-spike before noon. If silver doesn't fall below 2930 tomorrow, that will begin to look like a temporary bottom. Today's low was 2859c. Before y'all start running for the hills, remember H.L. Hunt's wisdom: "Never get really elated in victory; when times are tough, never get down." Silver and gold have had a magnificent 26 month run, from 880c to 3109.6c (up 3.53 times) and from $705 to $1,422.60 (up 2.02 times). A reasonable person expects markets to zig and zag. You got the zig, now you have to live with the zag a while. Bull market remains alive, well, robust, and vigorous, and will run three to ten more years. Relax, be thankful for the gains so far, and look forward to more in good time. Let's stroll down Mem'ry Lane a while and see what we can find under the leaves. What ho! When the GOLD/SILVER RATIO bottomed on 19 April 2006, it wasn't the silver price high. That came on 11 May 2006, but only 2.3% higher. In the first two days after the high, silver lost 10.8%. In the first five trading days, 16.2%. At the ultimate correction low silver had lost 35.4% of its peak value. And today stirred yet another mem'ry beneath my balding but still slightly attractive (to my wife) pate. The Dow Jones Industrial Average today closed at 11,722.89. Coincidentally, at the bull market high on 14 January 2000, it closed at 11,722.98. It didn't reach that level again until nearly 7 years later, on 30 October 2006. And my curiosity nagged, wondering what the inflation-adjusted value of 2000's 11,722.98 was. Tom's Inflation Calculator says the Dow would have to be at 15,446.90 today to equal 2000's value. John Williams Shadow Stats, which throws out all the government's inflation-hiding "adjustments," says that to equal the 2000 value the Dow would have to be at 30,425.10. But what do I know? I'm just a natural-born fool, too stupid to believe what his government tells him. Y'all already know that the Dow closed 11,722.89 today, up 31.71. S&P500 rose 6.36 to 1,276.56. My opinion hath not wavered: in the delicatessen of investing, stocks are the superannuated liverwurst with four-day old sliced onions. THE US DOLLAR INDEX leapt 81.4 points or 1.05%, clearing 79.50 resistance AND 80 resistance. That takes the dollar back to 80.40 resistance, and aims for 80.80 and higher. Today's leap carried the buck up through its 20 DMA (80.02). Now it has bounced off its 50 DMA (79.21) and cleared its 20 DMA. Dollar will go higher. Soon. Today is "Twelfth Night," the 12th night of Christmas and eve of the Epiphany, celebrating the appearance of Christ to the Gentiles represented by the three kings. During the Twelve Days of Christmas (Christmas thru Epiphany, 6 Jan) our office will be working only four hours a day. Please be patient, leave a voice mail or send us an email at helpdesk@the-moneychanger.com. Thanks for your understanding. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. | |

| EU plans for bondholder haircuts unsettles debt markets Posted: 05 Jan 2011 01:01 PM PST By Ambrose Evans-Pritchard Michel Barnier, the single market commissioner, will publish a "consultation paper" outlining ways to shield taxpayers from banking crises. It is the first stage of what will almost certainly become a binding law. … Fears that this could evolve into a crusade against bondholders set off fresh jitters on EMU debt markets yesterday, pushing yields on 10-year Greek bonds to a record 12.59pc. … Credit Default Swaps on Irish bonds jumped 16 points to 620 after Switzerland's central bank said it would no longer accept Irish debt as collateral. … The Commission paper refers only to bank debt, unlike Germany's proposals for sovereign "haircuts". Mr Barnier hopes to restrict burden-sharing to future debt only, fearing that a catch-all approach risks setting off a fresh EMU crisis. However, Brussels may lose control once the process is unleashed. A populist backlash is gathering strength in most EU states, and regional elections in Germany may sharpen demands for retribution against cossetted monied elites. [source] RS View: Wealth-preservation-minded bondholders will increasingly look to gold to provide their portfolios with that aspect of reliability which bonds fail to deliver. | |

| Kansas City Fed president calls gold standard 'very legitimate' Posted: 05 Jan 2011 12:43 PM PST From Reuters http://www.reuters.com/article/idUSTRE7044L620110105 KANSAS CITY, Missouri -- A gold standard that forces countries to back their currency reserves with bullion is a "legitimate" monetary system, though it would not prevent financial crises, Kansas City Federal Reserve President Thomas Hoenig said on Wednesday. "The gold standard is a very legitimate monetary system," Hoenig said, adding: "We're not going to have fewer crises necessarily. You will have a longer of period of price stability or price level stability, but I don't know that you'll have lower unemployment. I don't know that you'll have fewer bank failures." ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan power plants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: | |

| Kansas City Fed president calls gold standard 'very legitimate' Posted: 05 Jan 2011 12:43 PM PST From Reuters http://www.reuters.com/article/idUSTRE7044L620110105 KANSAS CITY, Missouri -- A gold standard that forces countries to back their currency reserves with bullion is a "legitimate" monetary system, though it would not prevent financial crises, Kansas City Federal Reserve President Thomas Hoenig said on Wednesday. "The gold standard is a very legitimate monetary system," Hoenig said, adding: "We're not going to have fewer crises necessarily. You will have a longer of period of price stability or price level stability, but I don't know that you'll have lower unemployment. I don't know that you'll have fewer bank failures." ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan power plants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: | |

| Brazil says it won't let U.S. 'melt the dollar' Posted: 05 Jan 2011 12:30 PM PST By Robin Yapp http://www.telegraph.co.uk/finance/currency/8241635/Brazil-pledges-to-st... SAO PAULO, Brazil -- Brazil has sounded a new note of warning in the international "currency war" by pledging not to allow the United States to "melt the dollar." Guido Mantega, the Brazilian finance minister, raised the prospect of introducing greater controls on short-term flows of speculative capital into his country. The Brazilian real has risen more than 35 percent against the dollar since early 2009, leading some economists to label it the most overvalued currency in the world. There is widespread concern about the effects of a weaker dollar on the competitiveness of emerging markets, many of which have seen foreign investment send their currencies soaring. ... Dispatch continues below ... ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. "We're not going to allow our American friends to melt the dollar," said Mr Mantega, who views the US government's move to pump $600 billion into its economy as an unfair attempt to help exports "There are infinite measures that we can take. One of them is to manage the entry of speculative capital in the short-term." His comments came after Chile's central bank announced a plan to buy $12 billion on international markets on Monday in an attempt to stem its own currency appreciation. The Chilean peso has gained by more than 17 percent against the US dollar since June, fuelled by increases in the price of copper, which is Chile's biggest export. It was Mr Mantega who coined the term "currency war" last year as he voiced concerns that Brazilian exports were being damaged. In October he tripled the tax on foreign investments in some bonds to 6 percent, a measure he said had since been "effective." Brazil plans to make "considerable" cuts in government spending, which would help weaken the real and allow interest rates to be cut at some point from the current level of 10.75 percent. The "currency war" has been of particular concern to Brazilian manufacturing companies, which have suffered due to booming demand for cheap imports from China, which has been accused of keeping its currency artificially weak. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | |

| Brazil says it won't let U.S. 'melt the dollar' Posted: 05 Jan 2011 12:30 PM PST By Robin Yapp http://www.telegraph.co.uk/finance/currency/8241635/Brazil-pledges-to-st... SAO PAULO, Brazil -- Brazil has sounded a new note of warning in the international "currency war" by pledging not to allow the United States to "melt the dollar." Guido Mantega, the Brazilian finance minister, raised the prospect of introducing greater controls on short-term flows of speculative capital into his country. The Brazilian real has risen more than 35 percent against the dollar since early 2009, leading some economists to label it the most overvalued currency in the world. There is widespread concern about the effects of a weaker dollar on the competitiveness of emerging markets, many of which have seen foreign investment send their currencies soaring. ... Dispatch continues below ... ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. "We're not going to allow our American friends to melt the dollar," said Mr Mantega, who views the US government's move to pump $600 billion into its economy as an unfair attempt to help exports "There are infinite measures that we can take. One of them is to manage the entry of speculative capital in the short-term." His comments came after Chile's central bank announced a plan to buy $12 billion on international markets on Monday in an attempt to stem its own currency appreciation. The Chilean peso has gained by more than 17 percent against the US dollar since June, fuelled by increases in the price of copper, which is Chile's biggest export. It was Mr Mantega who coined the term "currency war" last year as he voiced concerns that Brazilian exports were being damaged. In October he tripled the tax on foreign investments in some bonds to 6 percent, a measure he said had since been "effective." Brazil plans to make "considerable" cuts in government spending, which would help weaken the real and allow interest rates to be cut at some point from the current level of 10.75 percent. The "currency war" has been of particular concern to Brazilian manufacturing companies, which have suffered due to booming demand for cheap imports from China, which has been accused of keeping its currency artificially weak. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | |

| Posted: 05 Jan 2011 12:28 PM PST

Bees – upon which the entire human food chain rests – are suffering a sharp decline. As the Guardian pointed out Monday:

As the Guardian notes, bees are essential for human food production:

The Guardian notes that bees are not the only pollinators which are declining:

The Guardian points to some of the potential causes of bee decline:

As Fast Company pointed out last month:

The EPA is still allowing the use of Clothianidin to this day. And see this. And as I’ve previously pointed out:

There is also evidence that genetically modified crops might be killing bees … or at least weakening them so that they are more susceptible to disease. See this, this, this, this, this and this. And as Agence France-Presse notes, inbreeding may be weakening the bees. (On a side note, no one has yet asked whether silver iodide or other compounds used in weather modification affect bees. They may not, but someone should test the bees for such compounds and their metabolites so that we can rule out them out as a cause of colony collapse.) Albert Einstein reportedly said:

That might have been a slight exaggeration, but Einstein was right: If we kill off the bees, we will be in big trouble. There are also reports of birds and fish mysteriously dying world-wide. While these may or may not be connected with the collapse of bee populations, it is a sign that all is not right with the world. As I wrote two years ago:

| |

| Posted: 05 Jan 2011 12:08 PM PST Harley Bassman, who used to head Merrill's RateLab, and who was one of the most erudite sellside voices on rate matters, and doubly so on mortgage issues, and subsequently moved to Merrill's prop side, has kept a low profile recently. Which is why we are happy to present his model portfolio for 2011. Bassman is a firm believer in inflation (synthetic or real), and we for one would pay good money to see the redux of the Rosenberg vs Grant debate in 2011 be Rosenberg vs Bassman. Bassman's conclusion, even though obtained in a circuitous way to our own, is comparable to the Zero Hedge thesis that the Fed will have no choice but to eventually create inflation. "In a nutshell, the FED (with the help of the Govt), is going to engineer some type of Inflation to reduce the value of both our Private and Public Debt. Since Inflation is the only solution, it will happen; it is just a matter of time. Since the entire G-7 is in the same boat, trading in Euro or Yen is purely a short-term speculation since all these currencies will be heading south." Where Zero Hedge and Bassman, however, differ, is that we are certain that the Fed will be unable to contain said inflation once it has finally been unleashed, resulting in a complete wipeout of all assets that are directly or indirectly a rate derivative (ref: a very notable reparation paying, post-WW1 central European state), which means all fiat derivatives, leaving only hard assets in the wake. Bassman's Model Portfolio for 2011 1a) Long "Big Oil" + "Big Pharm" + "Big Tobacco" + etc equities. I am precluded from making naming names, but you know what I like. Mega Cap international stocks with patent and pricing power. P/Es of 13ish (an earnings yield of 7 1/2%) and Dividend of 2 1/2% to 4 1/2%. FED will encourage Retail to reverse out of Bonds and into Stocks. 8) And of course, CMM vs CMS for 6 months, now offered at 59 3/4bps h/t First Last | |

| Guest Post: Money And The State Posted: 05 Jan 2011 11:51 AM PST The next in a continuing series (most recently: Positively Wrong: Positivism, That Is) Money and the State by Free Radical It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning. – Henry Ford Once the domain of society – of the cooperative interaction that is its natural mode of economic organization and integration – the control of money has been usurped by the state and accordingly monopolized. Moreover, the monopolization is now a fait accompli due the state’s abandonment of gold, or any other commodity, as the monetary standard. Money has been positivized, in other words, in that it is now created not by “voluntary agreement between the parties immediately affected” but by the authoritarian degree of a third party. And it is because of this positivization that society’s money has effectively been stolen from it, toppling the first of civilization’s twin pillars. How could this happen? How could the state get away with stealing society’s money? Moreover, as the government’s money metastasizes, so do its laws. And were the people to understand that the latter are no less fraudulent than the former, they would run from legal positivism as fast as they will soon be running from monetary positivism. So to legal positivism we turn in my next submission: “Law and the State” Bruce L. Benson, The Enterprise of Law, Pacific Research Institute for Public Policy, 1990, p. 12. Ludwig von Mises, The Theory of Money and Credit, LibertyClassics, p. 277. Online at The Mises Institute here. Ibid., p. 53. Ibid., p. 19 Ibid., p. 62 Ibid., p. 54. Ibid., p. 72. Karl Marx and Friedrich Engels, The Communist Manifesto, 1848, Washington Square Press, 1964, p. 94. Eustace Mullins, Secrets of the Federal Reserve, Kasper and Horton, 1952, p. 202. Congressman Charles Augustus Lindbergh, Sr., arguing against the Federal Reserve Act after its passage in 1913, as quoted by Eustace Mullins in Secrets of the Federal Reserve, p. 15. Ibid., p. 118. | |

| Payroll Data Dims Outlook for Gold Posted: 05 Jan 2011 10:09 AM PST Emerging Money submits: With U.S. companies adding 297,000 jobs last month, it looks like the American economy is ready to join the global party. This is great for the dollar and not good for gold. The monthly ADP employer services survey has become a closely watched indicator because it gives traders an advance sense of what Friday’s more comprehensive numbers from the Department of Labor are going to reveal about the job market. Complete Story » | |

| A Golden Issue - January 5, 2011 Posted: 05 Jan 2011 10:01 AM PST A Golden Issue - Casey's Daily Dispatch [LIST] [*]Sign Up Now! [*]| [*]RSS Feed [*]| [*]Print this [*]| [*]Visit the Archives [*]| [*]Email to a Friend [*]| [*]Back to All Publications [/LIST] January 5, 2011 | [url]www.CaseyResearch.com[/url] Dear Reader, Yesterday's sell-off in the commodity markets was particularly interesting - and not because of the actual price movement. Gold's rise has been riddled with similar retreats only to return higher again. What surprises me most is the reaction of the financial press. The consensus seems to say, "Don't worry. Commodities were doing almost t... | |

| Verbosity is the Soul of Financial Fury Posted: 05 Jan 2011 10:00 AM PST I have to admit that I get awfully tired of people writing to me and asking, "Are you as stupid as you look and sound?" mostly because I have truthfully answered "Yes" to this question so, so many times that I thought it was, you know, common knowledge by this time. I mean, people usually refer to me as "stupid" all the time, as in, "Shut up, stupid!" and, "Get out of my way, stupid!" which is not to mention all the times I overheard my wife telling one of the kids, "Tell your stupid father that dinner is ready." I liked it better when my parents used to look at me and shake their heads in disapproval over something I did, and they would exasperatedly ask, "For the thousandth time, what in the hell is wrong with you, boy?" and I would reply, "The same thing that was wrong with me the other 999 times you asked me that question, I assume! What in the hell is wrong with you that you ask me the same question a thousand times, when it's obvious I don't know the answer?" Well, I never did find out what is "wrong" with me, although there are a lot of theories besides stupidity, and mostly in the vein of genetic mutation, hormone imbalance, iron-poor blood, or "spawn of Satan" types of diagnoses. So, perhaps subconsciously looking for clues, I was recently going through some old Mogambo Guru pieces that I wrote, but never used, and I ran across a nice synopsis done by Atimes.com on one of my columns. I saved it because it was so good, in that pithy, "brevity is the soul of wit" sort of way that I hope to one day master, although it won't be anytime soon because I can never seem to be brief, in that the outrageous over-creation of money by a destructive, idiotic Federal Reserve and the outrageous deficit-spending of that over-creation of money by an idiotic, corrupt Congress makes me wax Loud And Long (LAL) about how we are doomed – doomed, I tells ya! – by the inflation in prices that all of this new money will cause – and is causing! – and how there will be rioting in the streets by the starving poor and the erstwhile middle-class people who had all their wealth tied up in ridiculous dollar-denominated assets which lost their market value when the dollar went to crap thanks to the despicable Federal Reserve creating so much excess money that the buying power of each of their dollars was lost and now they are Freaking Wiped Out (FWO), and angry that they did not listen to The Wisdom Of The Mogambo (TWOTM) and bought gold and silver. See? I told you I couldn't be brief! You thought I was fooling? In contrast, Atimes.com distilled my whole essay down to, "The great secret to being poor is to believe that a money-creating government, like the present one in Washington, is going to preserve the value of your income, pension and savings. The secret to being rich in such circumstances is steadily but surely to accumulate gold!!" Exactly! Perfect! And, I notice with satisfaction, correctly punctuated with double exclamation points, too! Wow! I did not realize that it could be done! Thanks, Asia Times, for showing me how! And right next to that piece, The Financial Times, apparently anxious not to be outdone, printed the letter of a reader who pointed out, in a "letter to the editor" on July 6, 2010, that George Bernard Shaw said "You have to choose between trusting the natural stability of gold and the natural stability of the honesty and intelligence of the members of the government. And with due respect for these gentlemen, I advise you…to vote for gold." And with that kind of great advice, and with the ease with which you can buy gold and silver ("Here's my money, give me gold and silver!"), sometimes it takes rummaging around in old Stupid Mogambo Guru Crap (SMGC) to remind oneself that, "Whee! This investing stuff is easy!" The Mogambo Guru Verbosity is the Soul of Financial Fury originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |

| Playing Chicken with Debt Limits: Obama as a Senator vs. Obama the Hypocrite President Today Posted: 05 Jan 2011 09:49 AM PST | |

| John Embry - Gold Over $2,000, Silver Above $50 in 2011 Posted: 05 Jan 2011 09:42 AM PST With a sharp two day correction in gold and silver taking place, King World News today interviewed John Embry, Chief Investment Strategist at Sprott Asset Management. When asked about the quick decline Embry stated, "This may be the best opportunity you're going to get at least from a price sense to buy gold and silver in the next few days. I think when this correction however long it will last is over, it will probably mark the lows for the year which will then be the liftoff to the eleventh consecutive year of higher gold prices." John Embry continues: "The returns over the last 10 years, gold returned over 18% and silver close to 24% annually. These are spectacular returns and we haven't seen anything yet, we're not even close to the third leg which is the blowoff. As you know we started the Sprott Phyiscal Silver Trust about about 3 months ago. We still haven't got all of our silver in yet, we're close, we've almost got every last bar. But it's taken the better part of 2 1/2 months to get it in, so the suggestion that this physical market is tight probably isn't a strong enough suggestion, it's really tight! You and I were buying this morning John personally, you probably bought for the fund as well, but I know we were personally buying. You have to have conviction in order to buy during these dips, and you have to know the companies...You had one company that was dipping 10%, you stepped in and were a buyer, it's already recovered I think. | |

| Guest Post: How High Will Gold Go in 2011? Posted: 05 Jan 2011 09:37 AM PST Since CNBC has been issuing a non-stop barrage of its own version of reality vis-a-vis gold and other precious metals, it may be time for some counterpoint. For all those who believe that the drop in gold from levels which were virtually all time highs on Monday, is the equivalent of the apocalypse, we urge that you sell: volatility will be a key part of the game, and it may be prudent for timid elements to run into the levered safety of 5x beta stocks, trading at 100x forward P/E multiples, which are guaranteed to never go down. It will also likely shake out the weak hands, and certainly provide some cheaper entry points (something which we are confident Cramer's endless prattling on gold will do on its own sooner or later). That said, here are some amusing observations by Jeff Clark of Casey Research on how high gold could go in 2011. Keep in mind that just as all the program content on CNBC, this is nothing but pure abject speculation. In a world of central planning, none can predict the future with any does of certainty. By Jeff Clark, Casey Research How High Will Gold Go in 2011? After stellar years for both gold and silver, what prices will precious metals hit in 2011? Here's an analysis based strictly on their price behavior in the current bull market. First, take a look at the annual percentage gains that gold has registered since 2001 (based on London PM Fix closings):  Excluding 2001, the average gain is 20.4%. Tossing out the additional weak years of '04 and '08, the average advance is 24.8%. So we can make some projections based on what it's done over the past 10 years. From the 12-31-10 closing price of $1,421.60, if gold matched…

As you can see, silver had its biggest advance in 2010. The average of the decade, again excluding 2001, was 27.5%. And also tossing out the '08 decline, the average gain is 34.3%. So, from the 12-31-10 closing price of $30.91, if silver matched...

| |

| Will Food Prices Continue to Rise in 2011? Posted: 05 Jan 2011 09:25 AM PST "Food inflation will become America's top crisis," in 2011 reads one of the top 10 forecasts issued by the National Inflation Association (NIA) this morning. "Americans can cut back on energy use," the NIA surmises, "by moving into a smaller home and carpooling to work. They can cut back on entertainment, travel and other discretionary spending. "However, Americans can never stop spending money on food. "The days of cheap food in America are coming to an end," the forecast continues. "The recent unprecedented rise that we have seen in agricultural commodity prices is showing no signs of letting up." Indeed. You've already seen sugar futures at a new 30-year high. Coffee futures reached a new 13-year high last week. Orange juice, corn, soybeans and palm oil have all stretched to near three-year highs in the past week or so. Last month, global food prices surpassed their mid-2008 records, according to a report out this morning from the United Nations Food and Agriculture Organization (FAO). The FAO's food price index clocked in at 214.7 in December – up 4.2% in just a month, and breaking the previous record of 213.5 in June 2008. "It will be foolish to assume this is the peak," says FAO senior economist Abdolreza Abbassian. He calls the situation "alarming," but dutiful bureaucrat that he is, he won't call it a "crisis." Heck, even the Super Big Gulp ain't what it used to be:

7-Eleven has surreptitiously shrunk its famous beverage container from 44 ounces to 40. Seems people started noticing it last summer…but only this week did the lid get blown off (so to speak) with a column in the Austin American-Statesman. An alert reader compared the Super Big Gulp with a true 44-ounce container from a competitor…and it came up four ounces short. 7-Eleven confirmed it did make the change. But pressed for an explanation, a hapless PR flack could merely say, "We don't have announcements; we just have information, so I'm not sure if we ran an announcement or not." "This is called short sizing," says Resource Trader Alert editor Alan Knuckman, who has almost single-handedly propped up 7-Eleven's Big Gulp business in recent years. "And it could have come from two different commodity-related angles… "First, maybe because corn prices have rallied so much in the past 12 months, this is indicative of a rise in the price of corn syrup. "Or second, maybe – since the cost of the cup is worth more than the soda inside – this was an energy saving technique in the face of higher energy prices. Either way, they're clearly shrinking the size of a beverage to increase margins. "But!" Alan continues. "This may not be the only place we'll see a change. If 7-Eleven is REALLY watching their commodity prices closely, they'll soon realize that the price of coffee has nearly doubled since last year. "The best way to make this whole short sizing debacle a nonissue" according to Alan, "is to simply profit from the same forces that are shrinking our servings. In 2011, as always, it will all come back to commodities!" Addison Wiggin Will Food Prices Continue to Rise in 2011? originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |

| Posted: 05 Jan 2011 09:24 AM PST by Addison Wiggin - January 5, 2011

"Food inflation will become America's top crisis," in 2011 reads one of the top 10 forecasts issued by the National Inflation Association (NIA) this morning. "Food inflation will become America's top crisis," in 2011 reads one of the top 10 forecasts issued by the National Inflation Association (NIA) this morning.We begin today's 5 with an ongoing look at what you might expect as an individual investor in 2011. We pick on the NIA because they happen to be echoing sentiments we expressed in Apogee last year. And have followed up with a few more forecasts that are curiously in line with our own. "Americans can cut back on energy use," the NIA surmises, "by moving into a smaller home and carpooling to work. They can cut back on entertainment, travel and other discretionary spending. "However, Americans can never stop spending money on food. "The days of cheap food in America are coming to an end," the forecast continues, "The recent unprecedented rise that we have seen in agricultural commodity prices is showing no signs of letting up." Indeed. You've already seen sugar futures at a new 30-year high. Coffee futures reached a new 13-year high last week. Orange juice, corn, soybeans and palm oil have all stretched to near three-year highs in the past week or so.  Last month, global food prices surpassed their mid-2008 records, according to a report out this morning from the United Nations Food and Agriculture Organization (FAO). Last month, global food prices surpassed their mid-2008 records, according to a report out this morning from the United Nations Food and Agriculture Organization (FAO).The FAO's food price index clocked in at 214.7 in December -- up 4.2% in just a month, and breaking the previous record of 213.5 in June 2008. "It will be foolish to assume this is the peak," says FAO senior economist Abdolreza Abbassian. He calls the situation "alarming," but dutiful bureaucrat that he is, he won't call it a "crisis."  Heck, even the Super Big Gulp ain't what it used to be: Heck, even the Super Big Gulp ain't what it used to be: |  |

7-Eleven has surreptitiously shrunk its famous beverage container from 44 ounces to 40. Seems people started noticing it last summer... but only this week did the lid get blown off (so to speak) with a column in the Austin American-Statesman.

An alert reader compared the Super Big Gulp with a true 44-ounce container from a competitor... and it came up four ounces short. 7-Eleven confirmed it did make the change. But pressed for an explanation, a hapless PR flack could merely say, "We don't have announcements; we just have information, so I'm not sure if we ran an announcement or not."

"This is called short sizing," says Resource Trader Alert editor Alan Knuckman, who has almost single-handedly propped up 7-Eleven's Big Gulp business in recent years. "And it could have come from two different commodity-related angles...

"This is called short sizing," says Resource Trader Alert editor Alan Knuckman, who has almost single-handedly propped up 7-Eleven's Big Gulp business in recent years. "And it could have come from two different commodity-related angles..."First, maybe because corn prices have rallied so much in the past 12 months, this is indicative of a rise in the price of corn syrup.

"Or second, maybe -- since the cost of the cup is worth more than the soda inside -- this was an energy saving technique in the face of higher energy prices. Either way, they're clearly shrinking the size of a beverage to increase margins.

"But!" Alan continues. "This may not be the only place we'll see a change. If 7-Eleven is REALLY watching their commodity prices closely, they'll soon realize that the price of coffee has nearly doubled since last year.

"The best way to make this whole short sizing debacle a nonissue" according to Alan, "is to simply profit from the same forces that are shrinking our servings. In 2011, as always, it will all come back to commodities!"

And Alan's readers know the refrain well. Right now, they're sitting on gains of 109% on heating oil... and 112% on soybean meal. If you want to play the "Millionaire's Market," here's where to start.

"Investors have yet to anticipate how bad conditions will get for grocers," Strategic Short Report's Dan Amoss wrote in this space on Dec. 22, highlighting what he expected would be a "margin squeeze" at the retail level caused by rising food costs.

"Investors have yet to anticipate how bad conditions will get for grocers," Strategic Short Report's Dan Amoss wrote in this space on Dec. 22, highlighting what he expected would be a "margin squeeze" at the retail level caused by rising food costs. Yesterday, Bank of Montreal downgraded a couple of grocers, and cut its forecast for a couple more. The stocks tumbled anywhere from 2.1% to 7.4%.

Even that august body the Federal Reserve recognizes commodities prices are causing a "margin squeeze" for retailers. Tucked into otherwise-meaningless minutes from the Fed's Dec. 14 meeting released yesterday, we caught this intriguing bit:

Even that august body the Federal Reserve recognizes commodities prices are causing a "margin squeeze" for retailers. Tucked into otherwise-meaningless minutes from the Fed's Dec. 14 meeting released yesterday, we caught this intriguing bit:"Although the prices of some commodities and imported goods had risen appreciably, several participants noted that businesses seemed to have little ability to pass these increases on to their customers, given the significant slack in the economy."

As our resident stock market vigilante, Dan targeted two grocers last year for a big fall. His thesis is starting to play out... and it's not too late to start applying his strategy to play the trend. His trades could potentially double your money... and help you cover your own food bills on the rise.

How do you make it work? That's where the Strategic Short Report comes in handy. Check it out here.

Still, grocers make up just one segment among retailers. Across the board, "U.S. retailers will report declines in profit margins and their stocks will decline" another of the NIA's top 10 forecasts for 2011 suggests.

Still, grocers make up just one segment among retailers. Across the board, "U.S. retailers will report declines in profit margins and their stocks will decline" another of the NIA's top 10 forecasts for 2011 suggests."Although most analysts on Wall Street believe retailers will report a major increase in holiday season sales over a year ago, NIA believes any top-line growth retailers report will come at the expense of dismal bottom-line profits.

"Retailers have been selling goods at bargain-basement prices in order to generate demand. Americans, being flush with newly printed dollars from the Federal Reserve, have been eager to buy up supplies of goods at artificially low prices. However, shareholders will likely sell off their retail stocks on this news.

"As share prices of retail stocks decline, retailers will begin to rapidly increase their prices by mid-2011."

Stocks today are down a bit after a flat day yesterday and a barnburner on Monday. Traders were unimpressed by a phenomenal hiring report from ADP, the payroll firm. It indicated 297,000 new private-sector jobs in December -- the highest number in the report's 10-year history.

Stocks today are down a bit after a flat day yesterday and a barnburner on Monday. Traders were unimpressed by a phenomenal hiring report from ADP, the payroll firm. It indicated 297,000 new private-sector jobs in December -- the highest number in the report's 10-year history.The question is how much of that was temp hiring for the holidays? Hard telling from this data... but we see 270,000 of those hires were service sector, just 27,000 goods-producing.

A stronger indicator may come on Friday with the Labor Department's monthly nonfarm payrolls, the agency's notorious statistical fudging notwithstanding. We'll be here as always sifting through the layers of dried excrement.

Gold is languishing again today after yesterday's beat-down. Right now, it's at $1,370, close to a 30-day low.

Gold is languishing again today after yesterday's beat-down. Right now, it's at $1,370, close to a 30-day low.Unlike yesterday, most of the move today appears related to dollar strength. The dollar index is up more than 1% and sits firmly above the 80 level.

Silver's taking it on the chin, too -- the current spot price is $28.99.

During 2011, "the Dow/gold and gold/silver ratios will continue to decline" suggests the last of the NIA forecasts we like today.

During 2011, "the Dow/gold and gold/silver ratios will continue to decline" suggests the last of the NIA forecasts we like today.Last year, the group forecast major declines in both indicators, and got both right. "The Dow/gold ratio was 9.3 at the time and finished 2010 down 15%, to 8.1. The gold/silver ratio was 64 at the time and finished 2010 down 28%, to 46.

"We expect to see the Dow/gold ratio decline to 6.5 and the gold/silver ratio decline to 38 in 2011. Later this decade, we expect to see the Dow/gold ratio bottom at 1 and the gold/silver ratio decline to below 16 and possibly as low as 10."

We agree. Especially with respect to Dow/gold, we expect the trend will lead us back to the lows of 1932 and 1980... both of which coincided, more or less, with major stock market bottoms.

"I find myself worrying that Big Pharma is going to pull the trigger too soon," writes our tech/biotech specialist Patrick Cox as he looks into his own crystal ball for 2011. Specifically, Patrick is thinking about a phenomenon he calls "premature acquisition" -- when a tiny company sitting on world-changing discoveries gets bought out.

"I find myself worrying that Big Pharma is going to pull the trigger too soon," writes our tech/biotech specialist Patrick Cox as he looks into his own crystal ball for 2011. Specifically, Patrick is thinking about a phenomenon he calls "premature acquisition" -- when a tiny company sitting on world-changing discoveries gets bought out."Unfortunately," says Patrick, "often the people who make decisions for big pharmaceuticals are not even scientists. They're lawyers and accountants. Therefore, you can't ‘know' how they're going to deal with a truly revolutionary new therapy."

And yes, Patrick has two of his Breakthrough Technology Alert recommendations in mind. "These two companies both own brand-new and completely disruptive sciences with truly remarkable potential to save lives and make investors rich."

It's a good problem to have, and it comes with the territory.

Patrick's December 2008 recommendation Medarex was bought out by Bristol-Myers Squibb just seven months later for a 235% gain. Patrick would rather these companies stay independent and multiply your money dozens of times over. (One of his recommendations is up 1,089%... which he considers merely a good start.)

If you'd like to learn about five companies with the best chance of delivering life-changing gains -- "wealth quakes," Patrick calls them -- his full 2011 outlook is here. Just know that with two of them, you run the risk of a buyout and merely tripling your money.

"Regarding Laissez Faire Books," a reader writes, "is there any possibility that you may offer these great books electronically?

"Regarding Laissez Faire Books," a reader writes, "is there any possibility that you may offer these great books electronically?"The 5 is great, BTW. Keep up the good work."

The 5: Indeed, there is.

And we believe our timing is about right, too. Borders, the once mighty brick-and-mortar rival of Barnes & Noble began "holding talks with publishers" today, according to DealB%k at NYTimes.com, "seeking to convert delayed payments into interest-bearing debt as part of a plan to refinance its debt." Borders has been lagging in the race to get online, and book sales through strip mall outlets don't appear to support a viable business model any longer.

As a niche publisher, our goal with Laissez Faire Books is to reignite enthusiasm for books on classical liberal economics through a vibrant (and economical) community online. Delivering fresh ideas through eBooks seems like a given, despite our own love of hard copy.

Our team is on the case right now. In fact, we can use some assistance. The only formats that are currently supported by all eReaders are .txt and .pdf files. (For the unhelpful plethora of eBooks formats available, take a look at this Wikipedia citation. Which means, for now the eBook world is equivalent to buying a TV directly from the erstwhile "must-see" TV network NBC, but only being able to watch reruns of Seinfeld and Friends, with the occasional Law & Order: SVU or Dateline: To Catch a Predator thrown in for good measure.

If you're in the market for eBooks, tell us how you'd like to see them delivered. If you're in the business of delivering them and would like to lend us some insight, please, by all means, give us a shout: 5minforecast@agorafinancial.com

[Ed note. Our first eBook will be a recast of The Case For Gold written by Ron Paul and Lewis Lehrman co-published in a joint venture with the Ludwig von Mises Institute. We just looked at cover art. Looks splendid... even electronically. We'll keep you posted as we move forward. As always, any other suggestions you have will be greatly appreciated.]

"As a new subscriber," writes another, somewhat confused, "I am somewhat confused as to what the $39.00 subscription fee is paying for. I was under the impression I was paying for your professional advice/opinion on quality 'penny stock' picks.

"As a new subscriber," writes another, somewhat confused, "I am somewhat confused as to what the $39.00 subscription fee is paying for. I was under the impression I was paying for your professional advice/opinion on quality 'penny stock' picks.

"It appears from what I read in yesterday's 5 I have to pay another fee/subscription in order to get that information. Looks like/sounds like a bait-and-switch program. Correct me if I'm wrong."

The 5: If you're already a paid subscriber to Penny Stock Fortunes, here's the website where you get all your recommendations and subscriber alerts. Just log in with your account number and enjoy.

The "service" we were describing is an all-access pass to everything we publish at Agora Financial for a "one-time-only, lifetime-access" fee. A service we affectionately call the Reserve. Unfortunately, our invitation to join the Agora Financial Reserve closed yesterday.

Still, you should be getting your Penny Stock Fortunes (PSF) recommendations by email as soon as they're released, too. If you're not, please call Andrea Michinski at 1-800-708-1020 or e-mail her at customerservice@agorafinancial.com. She can help you with any difficulties you may be having.

"With all due respect to Chris Mayer," writes a third respectful reader, "I subscribed to his newsletter, bought into the uranium argument with Cameco and promptly got stopped out, losing somewhere south (say, around Paraguay) of 20%.

"With all due respect to Chris Mayer," writes a third respectful reader, "I subscribed to his newsletter, bought into the uranium argument with Cameco and promptly got stopped out, losing somewhere south (say, around Paraguay) of 20%.

"I like Chris, I like his writing, even his logic, but don't like the losses."

The 5: Alas, no one likes the losses, least of all your publisher. Still, Chris Mayer replies: "I am grateful for the reader's kind comments about my work. But with all due respect to the reader, that loss is his own. I NEVER said sell Cameco. Never.

"I don't recommend using stop losses -- selling a stock after if falls a certain amount -- for exactly this reason. Stop losses seem like a good way to limit risk, but it is a crazy way to be.

"When something I know is cheap gets cheaper, why sell it? If anything, I think about buying more. All the great investors think this way -- Buffett, Lynch, Klarman, Greenblatt, Berkowitz, et al. The market is there to take advantage of, not to tell you what to do.

"Stop losses would've taken you out of many winning Capital & Crisis recommendations in 2010," Chris concludes.

Looking over a spreadsheet of Chris' Capital & Crisis portfolio... Cameco is up 51% from his initial recommendation just 10 months ago. Among the nine recommendations he made during 2010, the average gain is 39%. And we're actually low-balling that because we're not including a brand-new spinoff from an earlier recommendation that's up 161% in just two weeks.

If you're not already a reader and you'd like to review the portfolio yourself, we suggest a subscription to Capital & Crisis for 2011. Here's a direct link to the order form -- no "long-winded" or "plodding" presentation, if that's not your bag. Check it out.

"The Deepwater Horizon disaster," writes a fourth reader, "sinking of the rig and the failure of the blowout preventer resulted in roughly 5 million barrels of oil being released into the Gulf of Mexico over a three-month period and was proclaimed as the greatest environmental disaster ever."

"The Deepwater Horizon disaster," writes a fourth reader, "sinking of the rig and the failure of the blowout preventer resulted in roughly 5 million barrels of oil being released into the Gulf of Mexico over a three-month period and was proclaimed as the greatest environmental disaster ever."

The 5: Uh, thanks for pointing out the obvious. We'd call you a jackass right now, but we've been scolded by readers in past for being so uncouth.

Byron's attending a presentation in Washington by the American Petroleum Institute today where he is no doubt conspiring with industry insiders to further foul our waterways.

But if he were here, he'd be the first to tell you the Macondo incident was a true disaster. He was one of The Washington Post's go-to sources in weeks after the blowout, and he said straight up it happened because of a "failure of imagination."

"The industry says it never had a blowout," he told the paper, and as a result, the oil "industry is not going to spend good money on problems that it says aren't there."

"The BP oil spill left quite a mess -- ecological and human -- with long-term implications that will play out over many years," he wrote Outstanding Investments readers just last week.

But all the same, "U.S. offshore energy policy is a total mess. The nation will endure offshore energy-production problems for many years into the future, courtesy of the BP blowout and the ham-fisted government reaction to it."

Byron continues today to investigate the moratorium and its aftermath today. If you're truly interested in understanding what's happening, rather than offering knee-jerk political reactions, please stay tuned.

Regards,

Addison Wiggin

The 5 Min. Forecast

P.S. The Nasdaq composite lost ground yesterday, but one of the exchange's best-known issues -- semiconductor giant Qualcomm -- hit a two-year high, just ahead of news it was buying out a smaller competitor. The move sent one of Steve Sarnoff's Options Hotline plays to a new high -- up 223% in just four months.

Steve racked up 14 "multipliers" -- recommendations that gained at least 100% -- during 2010. And that's nothing unusual. Options Hotline readers have gotten used to a dozen or so multipliers every year, going back more than a decade. You can join them in 2011 here.

P.P.S. If you haven't viewed "Meltup" - the National Inflation Association's video documentary of the financial crisis—we recommend you do so here.

Posted: 05 Jan 2011 09:21 AM PST

Posted: 05 Jan 2011 09:18 AM PST

Hourly Action In Gold From Trader Dan

Posted: 05 Jan 2011 09:12 AM PST

Improvement In Preliminary Jobs Report Misleading

Posted: 05 Jan 2011 09:12 AM PST

Posted: 05 Jan 2011 09:01 AM PST

Gold pares losses on bargain hunting

The COMEX February gold futures contract closed down $5.10 Wednesday at $1373.70, trading between $1364.00 and $1385.20

January 5, p.m. excerpts:

(from Marketwatch)

Gold futures settled at their lowest in nearly three weeks but trimmed much steeper losses as investors bought on the recent selloff. Gold spent most of the session in the red after a private-sector jobs report showed the U.S. economy adding jobs at a faster clip. Meanwhile, the dollar rose and other commodities prices remained under pressure, but the lower prices piqued some interest. "You have some investors looking to buy this pullback," noted Matt Zeman, trader at LaSalle Futures Group…more

(from Dow Jones)

Investors continued shedding some of their fear from a fretful 2010 after Automatic Data Processing Inc. and consultancy Macroeconomic Advisers said U.S. employers added 297,000 private sector jobs last month, much stronger than the 100,000 jobs analysts forecast. The data also boosted the dollar, further pressuring dollar-denominated gold by making it more expensive for buyers using other currencies, crimping demand. Shortly after gold closed, the ICE Futures U.S. Dollar Index was up 0.9%…more

(from Reuters)

U.S. February gold futures settled down $5.10 at $1,373.70. But gold still looks likely to be firmly underpinned by factors such as concerns over sovereign risk, threats to U.S. economic stability and the prospect of rising inflation in the fast-growing developing world, analysts said. "I don't think this marks a turnaround from what has been and continues to be bullish sentiment toward gold and hard assets in general," said Credit Agricole analyst Robin Bhar…more

(from TheStreet)

On the fundamental front, recent inflationary indicators might prove helpful for gold. On top of the eurozone's larger-than-expected 2.2% inflation reading for December, the Financial Times reported that food costs in the U.K. rose 5.5% in the past year, well above their high but tolerable 3.3% inflation rate. The mounting inflation news is putting governments in a bind. With economic growth still anemic, raising interest rates to fight inflation might not be a practical solution…more

On the fundamental front, recent inflationary indicators might prove helpful for gold. On top of the eurozone's larger-than-expected 2.2% inflation reading for December, the Financial Times reported that food costs in the U.K. rose 5.5% in the past year, well above their high but tolerable 3.3% inflation rate. The mounting inflation news is putting governments in a bind. With economic growth still anemic, raising interest rates to fight inflation might not be a practical solution…more

Gold Daily and Silver Weekly Charts

Posted: 05 Jan 2011 08:44 AM PST

Gold remains precious to the Eurosystem

Posted: 05 Jan 2011 08:38 AM PST

The European Central Bank today published the year-end consolidated financial statement for the Eurosystem. This weekly procedure carries extra significance four times throughout the year when they correlate with the quarterly mark-to-market revaluation of assets, and none more so than the year's final MTM snapshot. (That being due to technical accounting considerations regarding the final treatment of excess unrealised losses (if any, on a per item basis) upon the profit/loss account.)

As dictated by the Eurosystem's harmonised accounting rules, all gold, foreign exchange, security holdings and financial instruments of the ECB and euro-member national central banks comprising the Eurosystem will be revalued at market rates and prices at the end of each quarter; specifically that the revaluation is done on an item-by-item basis for securities, interest rate swaps, futures, forward rate agreements and other interest rate instruments, and such that foreign exchange holdings are revalued on a currency-by-currency basis. In the accounting and reporting, gold and all other valuations are carried, naturally, in terms of the domestic monetary unit — the euro.