Gold World News Flash |

- Is the Fed dollar "safe and stable"?

- Price Inflation to Pay the Debt

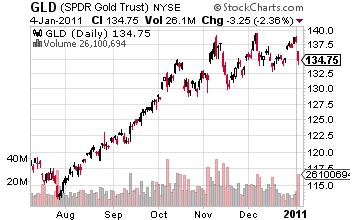

- Gold’s Fall Extra Painful With Dow on the Rise

- Gold to Go Below $1,300?

- NIA's Top 10 Predictions for 2011

- Crude Oil Falls Most Since November, Gold Plunges after FOMC Minutes

- “This is worthless, Buy Silver”

- Gold Seeker Closing Report: Gold and Silver Fall About 3% and 5%

- Rep. Ron Paul: A successful 2011 starts with oversight of Fed

- The race to debase encompasses the whole planet

- Silver and Gold Price Highs Must be Near

- CFTC's position limit plan gains needed support

- CFTC's position limit plan gains needed support

- Why Germany’s Rescue Package Policies Will Benefit Gold

- The Paper Empire

- License to Steal?

- A Total Eclipse Of The Economy

- Hourly Action In Gold From Trader Dan

- It's Déjà vu All Over Again

- Gold's run is hardly done

- The Federal Reserve was not long in using its new license. In the 37 years that followed the abandonment of the last tie to gold, successive waves of printing reduced the dollar’s purchasing power by 81%.

- The Gold Price Fell to the 50 Day Moving Average Closing at $1,378.50, Not as Bad as it Sounds

- 2011 - The year when money starts to die

- Contrary To The IMF's Lies, The IEA Finds That Surging Oil Price Actually Will Be A "Threat To The Recovery"

- Tesco 'cash for gold' move knocks pawnbrokers

- The New Gold Rush: Can the Precious Metal Go Higher in 2011 and Beyond?

- 5 Reasons Precious Metals ETFs May Stay Solid

- TUESDAY Market Excerpts

- Guest Post: The Long Swim – How the Fed Could Become Insolvent

- In The News Today

- Jim?s Mailbox

- Gold Plummets after Divergence with Silver

- Mining News Review: Week of December 27th

- Mining News Review: Week of December 20th

- Mining News Review: Week of December 13th

- Reexamining the Income-Expense Ratio

- How To Gold Bear Vadim "Chart Of The Day" Zlotnikov, The Undilutable Precious Metal Is Merely Another "Fiat Currency"

- The National Inflation Association is pleased to announce its top 10 predictions for 2011 – My Comments included.

- “Ted figures that JPMorgan et al were forced to sell on last Tuesday’s big run-up in the price of silver… or the silver price would have gone ballistic on them.”

- The Best Potential Commodity Plays for 2011

- Bloomberg's "Chart Of The Day" Is The Latest Amusing Attempt To Create A Gold Selling Frenzy

- Gold Daily and Silver Weekly Charts

- The New Gold Rush

- On The Fun (But Pointless) Debate Between Rick Santelli And Rich Bernstein On What The Yield Curve Indicates (In A Time Of Central Planning)

- Numismatics Are Fool's Gold

- A Recurring Dream About Gold

- Tuesday's Economic Temperature - Too Hot or Just Right?

- Gold Prices: Correction or Time to Buy?

- If Gold Production Rises, Can Prices Follow?

- How Likely Is $1500 Gold?

| Is the Fed dollar "safe and stable"? Posted: 04 Jan 2011 06:03 PM PST Safe and stable? The Fed doesn't explain what they mean by these terms. Can we say that a currency is safe and stable if people use it in everyday transactions? If so, then there's no question the Federal Reserve Note is at least somewhat safe and stable, because people, in spite of their complaints, have not abandoned it for anything better. True, legal tender laws force Americans to accept the Fed's money regardless of what they might prefer, but history shows that people will abandon the legal tender currency if it becomes too worthless or inconvenient to perform its function as a medium of exchange. Though we're not to that point yet, we've been heading in that direction since the Federal Reserve first rolled up its sleeves. |

| Price Inflation to Pay the Debt Posted: 04 Jan 2011 06:02 PM PST The lights of the Mogambo Security System (MSS) glowed dimly in the gloom of the bunker as I cowered in the darkness, and there were no sounds except the thumping, thumping, thumping of my terrified heart at The World Outside (TWO), a place I consider to be a vicious, hostile environment containing not only enemies of every sort, both real and imagined, but family members who want to know if I am coming out for dinner, or to tell me that someone is on the phone for me, or that somebody is going to greedily eat the last of my treasured Double-Stuf Oreos, somehow trying to get me outside and into their clutches so that they can take all my money and ask me to sign various forms and documents. |

| Gold’s Fall Extra Painful With Dow on the Rise Posted: 04 Jan 2011 06:01 PM PST So accustomed have we become to seeing bullion's worst days matched lurch-for-lurch by the stock market's that yesterday's chastening of gold and silver bulls, if no one else, came as a rude surprise. Up until now, the exhilarating pleasure of watching the stock market get the crap kicked out of it whenever gold and silver were falling was our consolation prize. Yesterday, however, with gold down nearly $50 at one point and trading $42 lower at settlement, the Dow thumbed its nose at bullion bulls by rising a token 20 points. Ouch! |

| Posted: 04 Jan 2011 05:30 PM PST Aigail Doolittle submits: Gold appears poised to tumble by at least 7% in the coming weeks due to a Diamond Top pattern it is caught in. Complete Story » |

| NIA's Top 10 Predictions for 2011 Posted: 04 Jan 2011 05:16 PM PST 1) The Dow/Gold and Gold/Silver ratios will continue to decline. In NIA's top 10 predictions for 2010, we predicted major declines in the Dow/Gold and Gold/Silver ratios. The Dow/Gold ratio was 9.3 at the time and finished 2010 down 15% to 8.1. The Gold/Silver ratio was 64 at the time and finished 2010 down 28% to 46. We expect to see the Dow/Gold ratio decline to 6.5 and the Gold/Silver ratio decline to 38 in 2011. Later this decade, we expect to see the Dow/Gold ratio bottom at 1 and the Gold/Silver ratio decline to below 16 and possibly as low as 10. 2) Colleges will begin to go bankrupt and close their doors. We have a college education bubble in America that was made possible by the U.S. government's willingness to give out cheap and easy student loans. With all of the technological advances that have been taking place worldwide, the cost for a college education in America should be getting cheaper. Instead, private four-year colleges have averaged 5.6% tuition inflation over the past six years. College tuitions are the one thing in America that never declined in price during the panic of 2008. Despite collapsing stock market and Real Estate prices, college tuition costs surged to new highs as Americans instinctively sought to become better educated in order to better ride out and survive the economic crisis. Unfortunately, American students who overpaid for college educations are graduating and finding out that their degrees are worthless and no jobs are available for them. They would have been better off going straight into the work force and investing their money into gold and silver. That way, they would have real wealth today instead of debt and would already have valuable work place experience, which is much more important than any piece of paper.Colleges and universities took on ambitious construction projects and built new libraries, gyms, and sporting venues, that added no value to the education of students. These projects were intended for the sole purpose of impressing students and their families. The administrators of these colleges knew that no matter how high tuitions rose, students would be able to simply borrow more from the government in order to pay them. Americans today can purchase just about any type of good on Amazon.com, cheaper than they can find it in retail stores. This is because Amazon.com is a lot more efficient and doesn't have the overhead costs of brick and mortar retailers. NIA expects to see a new trend of Americans seeking to become educated cheaply over the Internet. There will be a huge drop off in demand for traditional college degrees. NIA expects to see many colleges default on their debts in 2011. These colleges will be forced to either downsize and educate students more cost effectively or close their doors for good. 3) U.S. retailers will report declines in profit margins and their stocks will decline. 4) The mainstream public will begin to buy gold. 5) We will see a huge surge in municipal debt defaults. 6) We will see a large decline in the crude oil/natural gas ratio. 7) The median U.S. home will decline sharply priced in silver. 8) Food inflation will become America's top crisis. 9) QE2 will disappoint and the Federal Reserve will prepare QE3. This posting includes an audio/video/photo media file: Download Now |

| Crude Oil Falls Most Since November, Gold Plunges after FOMC Minutes Posted: 04 Jan 2011 05:02 PM PST courtesy of DailyFX.com January 04, 2011 07:51 PM Commodities fell across the board as traders locked in profits and concerns about valuations emerged. Up on deck is the government report on U.S. petroleum inventories. Commodities – Energy Crude Oil Falls Most Since November Crude Oil (WTI) - $89.29 // $0.09 // 0.10% Commentary: Crude oil fell $2.17, or 2.37%, to settle at $89.38. While the move was not huge, considering the extremely low volatility we’ve been seeing in financial markets recently, it was definitely notable. That being said, it looks like WTI was once again a laggard, as Brent and LLS fell only 1.38% and 1.51% respectively, to $93.53 and $95.88. U.S. equity markets also sold off initially, but as there was no real negative news flow to sustain the decline, indices recovered much of their losses by the end of the day. Indeed, U.S. Factory Orders actually came out better-than-expected. While we have been constructive on crude oil for many wee... |

| “This is worthless, Buy Silver” Posted: 04 Jan 2011 04:36 PM PST |

| Gold Seeker Closing Report: Gold and Silver Fall About 3% and 5% Posted: 04 Jan 2011 04:00 PM PST |

| Rep. Ron Paul: A successful 2011 starts with oversight of Fed Posted: 04 Jan 2011 02:46 PM PST By U.S. Rep. Ron Paul http://paul.house.gov/index.php?option=com_content&view=article&id=1813:... The year 2011 brings in a host of opportunities and challenges to America. Will we accelerate toward economic insolvency by continuing the policies that have created this crisis, or will a new Congress elected on the energy of the Tea Party movement find the courage to change course? With the new Republican majority in the House I will have the opportunity as a subcommittee chairman to take a careful look at our domestic monetary policy. I am excited by the prospect of real oversight of the Federal Reserve, but I also hope to focus on the important ways our foreign policy and monetary policy are related. Just last week the Financial Times reported that the limited oversight of the Federal Reserve allowed by the passage of a watered-down version of my Audit the Fed bill revealed that approximately 55 percent of the loans made available under the largest Federal Reserve bailout program, the Term Auction Facility, went to foreign banks. This is but one example of the real cost to Americans of maintaining its empire overseas, and it cries out for more transparency and oversight. ... Dispatch continues below ... ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf This is why it is key for us to understand that our foreign policy and current economic crisis go hand in hand. Some have promised to lead us back to fiscal responsibility while asserting that any reduction in our foreign and military spending is off the table. They would like us to believe that we should not only continue spending as much on the military as the rest of the world spends on their military combined, but they actually call for an even more aggressive U.S. policy abroad. They believe we should continue to bomb Pakistan, Yemen, Afghanistan, and elsewhere; that we must impose even more crippling sanctions on countries like Iran while moving steadily on to yet another Middle East war that is not in our interest. They represent the failed policies of the past and they would like to lead us down a dead-end street. We must resist the temptation of their neo-con inspired scare-mongering. There will be much work for us to do in the next year and in the next Congress. We need look no further than the grossly unconstitutional and immoral policies of the Transportation Security Administration -- demanding that we either be irradiated or fondled to travel in our own country -- to see that those who would deprive us of our civil liberties on the empty promise of full security will not be giving up easily. We must continue standing up to them and we must not compromise. We must not allow the out-of-control Department of Homeland Security to impose an East German-like police state in the United States, where neighbors are encouraged by Big Brother or Big Sister to inform on their neighbors. We must not accept that government authorities should hector us via television screens as we go about our private lives like we are living in Orwell's 1984. I am optimistic that the incoming members of Congress understand the importance of what they have been entrusted with by the American people. But I do hope that those who elected them will watch their actions -- and their votes in Congress -- carefully. An early indication will be the upcoming vote on re-authorization of the anti-American PATRIOT Act. Defeat once and for all of this police-state legislation will be a great way to start 2011 and the 112th Congress. We must move ahead with confidence. Our numbers are growing. Happy New Year! Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php |

| The race to debase encompasses the whole planet Posted: 04 Jan 2011 02:36 PM PST 10:30p ET Tuesday, January 4, 2010 Dear Friend of GATA and Gold (and Silver): Mike Maloney's GoldSilver.com has plotted the 2010 performance of gold and silver against dozens of world currencies and there can be only one conclusion: For the last 12 months the strongest currencies on the planet weren't issued by any government but rather were the old standards dug out of the ground. The data is headlined "Race to Debase 2010 Q4" and you can find it at GoldSilver.com here: http://goldsilver.com/article/race-to-debase-2010-q4/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan power plants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: |

| Silver and Gold Price Highs Must be Near Posted: 04 Jan 2011 01:13 PM PST Gold Price Close Today : 1378.50 Change : (44.10) or -3.1% Silver Price Close Today : 29.492 Change : (1.604) cents or -5.2% Gold Silver Ratio Today : 46.74 Change : 0.993 or 2.2% Silver Gold Ratio Today : 0.02139 Change : -0.000464 or -2.1% Platinum Price Close Today : 1756.20 Change : -10.90 or -0.6% Palladium Price Close Today : 776.00 Change : -19.00 or -2.4% S&P 500 : 1,270.20 Change : -1.69 or -0.1% Dow In GOLD$ : $175.30 Change : $ 5.75 or 3.4% Dow in GOLD oz : 8.480 Change : 0.278 or 3.4% Dow in SILVER oz : 396.38 Change : 0.91 or 0.2% Dow Industrial : 11,690.18 Change : 20.43 or 0.2% US Dollar Index : 79.43 Change : 0.301 or 0.4% One thing you learn trading markets or go broke quick, and that is Nothing is a given. Never take anything for granted. Always be ready for markets to do exactly the reverse of what you expect. I recur to this not because silver and gold crumpled today, but to remind y'all that today's crumpling might not mean the top came yesterday. Notoriously at tops markets make double tops, separated sometimes by what appears at first a crash. Clearly I got it wrong yesterday thinking a three wave correction was completed. That raises other possibilities. Now silver's 5 day chart has tacked on to that three wave decline yesterday a sideways movement, and today's drop. That also, top to bottom, might be an A-B-C decline, setting silver up to rise tomorrow. That's not crazy -- when a market becomes as overbought as silver now is, any whiff of trouble sends newcomers scurrying out of the market looking for cover. Another reason that yesterday might not have marked the top. Here are the details of silver and gold today. The SILVER PRICE opened around 3080c, then dropped 40c on open. Then it dropped another 30c, tried to rally, then fell to 3000c, broke through 3000c, rallied sideways off 2980c, fell yet again 60c to 29.306 at 12:45. By Comex closing silver had lost 160.4c to close 2949.2c. In the aftermarket silver traded briskly up to 2980c, leaving behind what conceivably might be denominated a V-bottom. Conceivably. The GOLD PRICE painted out nearly the self-same pattern as the SILVER PRICE, same time. Low came at $1,374.50, and Comex charge gold $44.10 to close at $1,378.50. Clearly, $1,425 offers resistance more formidable than we anticipated. In a single day it cost gold all the advance of the past six days. More, it fell to the 50 day moving average. Now that's not as bad as it sounds, since Gold has been skating up its 50 DMA since November, employing it as sure support. Might rebound off the 50 DMA and turn around. Last night I sat staring into the Great One-Eye until all the candles burned out, poring over the Gold/Silver Ratio's behaviour, toting up the odds of the Ratio extending its fall, a.k.a., silver and gold extending their rise. I came away with the conclusion that a Ratio low must be very near, which is to say, silver and gold price highs must be near. Mid-January is about as far as I think this rally can survive, but that leaves room for one more surge upward from here, or even from a lower base. Most damaging to the ratio was its poking its head through the 20 day moving average, although it didn't close there. The 20 DMA acts as a very sensitive indicator for the Ratio, and it has already reached levels that mark its maximum historical drop below the 20 DMA. On the other hand, the RSI has not fallen down to 15, but remains today at 35.36. However, the RSI did reach that extreme in November. Anyway you look at it, all this says that the Ratio's drop is living on borrowed time. Behold! I only tell you what I see. And let not these consolations pass from your mind: about three months after the peak will come a low in silver and gold that will offer a SPECTACULAR buying point. Moreover, silver and gold remain in a primary up trend (bull market) that has at least three and perhaps nine more years to run. It is just beginning. US DOLLAR INDEX today rose 30 basis points to 79.428, but the careful observer sniffs and asks, "What meaneth this trumpery?" 79.50 is the real resistance, and any close below that does that same thing to the markets that four candy bars do for a six-year old, pump him up with screams and running then drop him to the floor. STOCK indices looked a mite peakéd today. Most indices closed lower, but the Dow rose. S&P500 fell 1.69 to 1,270.20 while the Dow, almost alone among stock indices, rose 20.43 to 11,691.18. Stocks are the botulism on the investment buffet. Leave them alone. During the Twelve Days of Christmas (Christmas thru Epiphany, 6 Jan) our office will be working only four hours a day. Please be patient, leave a voice mail or send us an email at helpdesk@the-moneychanger.com. Thanks for your understanding. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. |

| CFTC's position limit plan gains needed support Posted: 04 Jan 2011 01:11 PM PST By Christopher Doering and Roberta Rampton http://www.reuters.com/article/idUSTRE70356O20110104 WASHINGTON -- A top official at the U.S. futures regulator said on Tuesday he was now in favor of a stalled position limit plan, a key turnaround that would allow the controversial rules to advance to the public comment stage. On December 16 the Commodity Futures Trading Commission introduced its plan to curb speculation in metals, agriculture, and energy markets. But at the meeting, Chairman Gary Gensler abruptly postponed a vote on the proposal. Commissioner Bart Chilton, the most vocal proponent of cracking down on speculators, was key to the postponement as he told Reuters he would have voted against the plan. It would have included a two-step approach to allow more time for the agency to gather information on the opaque swaps market. "While I will now support publishing a position limit proposal for public comment, I will continue to make the case that we need to address excessive speculation in these markets immediately," Chilton said in a statement on Tuesday. ... Dispatch continues below ... ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. The proposal unveiled in December set out general formulas for calculating limits and applied them to the spot month contract. It suggested waiting until the agency has more swaps data before expanding the limits to all months. At least three of the five CFTC commissioners must vote in favor of issuing the plan for a 60-day comment period. A separate vote will be needed to finalize the measure. Gensler has expressed his support for the plan. Fellow Democrat Michael Dunn has consistently voted to release CFTC rules for comment to help him assess the merits of proposals. Commissioner Jill Sommers and Scott O'Malia, both Republicans, have voiced concerns about the speed of reforms and a lack of information about the proposals. Industry analysts have expected commissioners to sign off on the position limit plan in private once Chilton agreed to the terms. It was not immediately clear whether commissioners would act immediately or wait until the CFTC's next scheduled rule-making meeting, slated for January 13. A spokesman for the agency declined specific comment. The CFTC has conceded it will miss a mid-January deadline to implement position limits that was stipulated in the Dodd-Frank bank reform law, which gives the agency oversight of the over-the-counter derivatives market, valued at $600 trillion globally. The CFTC is working on rules to implement the law, but it could take months to acquire the swaps data it needs to enforce position limits. In the meantime, Chilton, a proponent of hard limits, has argued the CFTC should do what it can. At the December 16 meeting Gensler agreed to instruct CFTC staff to implement Chilton's suggested "position points" system until the CFTC puts its position limit plan in place. Under the "points" system, if traders' holdings in a commodity reaches a certain threshold, it triggers heightened regulatory scrutiny by the CFTC where commissioners could vote to require the traders to reduce their holdings. "It certainly seems to be an incentive to trade where the CFTC can't see you," said an industry source closely monitoring the proposal, noting the scrutiny could be triggered only by trades in the visible futures market. A coalition of businesses dependent on buying commodities said it supports Chilton's plan as an interim measure. "In light of the existence of large speculative positions in today's energy and agricultural markets, it is imperative that the commission to do something now," said Jim Collura, spokesman for the Commodity Market Oversight Coalition. Commodity traders and investors have been fighting back against the limits, arguing they will not rein in surging energy, metals, and agricultural prices and could instead trim volumes, making prices more volatile. The CFTC said its proposal could affect nearly 80 agricultural traders and dozens of metals and energy players. It removed some provisions that had drawn the ire of Wall Street, and also included an exemption for hedgers. But the plan is expected to continue to draw fire during the upcoming public comment period. The "position points" system for added review of positions is far preferable to the actual position limits plan, said Michael Cosgrove, a managing director with GFI Group, a major brokerage. "Position limits are a dangerous cure for an imagined disease which even its proponents admit has never been diagnosed or detected," Cosgrove said. "Like trepanning, leaching, and frontal lobotomies, I fear that this cure too will do lasting damage that we cannot begin to comprehend." Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php |

| CFTC's position limit plan gains needed support Posted: 04 Jan 2011 01:11 PM PST By Christopher Doering and Roberta Rampton http://www.reuters.com/article/idUSTRE70356O20110104 WASHINGTON -- A top official at the U.S. futures regulator said on Tuesday he was now in favor of a stalled position limit plan, a key turnaround that would allow the controversial rules to advance to the public comment stage. On December 16 the Commodity Futures Trading Commission introduced its plan to curb speculation in metals, agriculture, and energy markets. But at the meeting, Chairman Gary Gensler abruptly postponed a vote on the proposal. Commissioner Bart Chilton, the most vocal proponent of cracking down on speculators, was key to the postponement as he told Reuters he would have voted against the plan. It would have included a two-step approach to allow more time for the agency to gather information on the opaque swaps market. "While I will now support publishing a position limit proposal for public comment, I will continue to make the case that we need to address excessive speculation in these markets immediately," Chilton said in a statement on Tuesday. ... Dispatch continues below ... ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. The proposal unveiled in December set out general formulas for calculating limits and applied them to the spot month contract. It suggested waiting until the agency has more swaps data before expanding the limits to all months. At least three of the five CFTC commissioners must vote in favor of issuing the plan for a 60-day comment period. A separate vote will be needed to finalize the measure. Gensler has expressed his support for the plan. Fellow Democrat Michael Dunn has consistently voted to release CFTC rules for comment to help him assess the merits of proposals. Commissioner Jill Sommers and Scott O'Malia, both Republicans, have voiced concerns about the speed of reforms and a lack of information about the proposals. Industry analysts have expected commissioners to sign off on the position limit plan in private once Chilton agreed to the terms. It was not immediately clear whether commissioners would act immediately or wait until the CFTC's next scheduled rule-making meeting, slated for January 13. A spokesman for the agency declined specific comment. The CFTC has conceded it will miss a mid-January deadline to implement position limits that was stipulated in the Dodd-Frank bank reform law, which gives the agency oversight of the over-the-counter derivatives market, valued at $600 trillion globally. The CFTC is working on rules to implement the law, but it could take months to acquire the swaps data it needs to enforce position limits. In the meantime, Chilton, a proponent of hard limits, has argued the CFTC should do what it can. At the December 16 meeting Gensler agreed to instruct CFTC staff to implement Chilton's suggested "position points" system until the CFTC puts its position limit plan in place. Under the "points" system, if traders' holdings in a commodity reaches a certain threshold, it triggers heightened regulatory scrutiny by the CFTC where commissioners could vote to require the traders to reduce their holdings. "It certainly seems to be an incentive to trade where the CFTC can't see you," said an industry source closely monitoring the proposal, noting the scrutiny could be triggered only by trades in the visible futures market. A coalition of businesses dependent on buying commodities said it supports Chilton's plan as an interim measure. "In light of the existence of large speculative positions in today's energy and agricultural markets, it is imperative that the commission to do something now," said Jim Collura, spokesman for the Commodity Market Oversight Coalition. Commodity traders and investors have been fighting back against the limits, arguing they will not rein in surging energy, metals, and agricultural prices and could instead trim volumes, making prices more volatile. The CFTC said its proposal could affect nearly 80 agricultural traders and dozens of metals and energy players. It removed some provisions that had drawn the ire of Wall Street, and also included an exemption for hedgers. But the plan is expected to continue to draw fire during the upcoming public comment period. The "position points" system for added review of positions is far preferable to the actual position limits plan, said Michael Cosgrove, a managing director with GFI Group, a major brokerage. "Position limits are a dangerous cure for an imagined disease which even its proponents admit has never been diagnosed or detected," Cosgrove said. "Like trepanning, leaching, and frontal lobotomies, I fear that this cure too will do lasting damage that we cannot begin to comprehend." Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php |

| Why Germany’s Rescue Package Policies Will Benefit Gold Posted: 04 Jan 2011 01:00 PM PST |

| Posted: 04 Jan 2011 12:49 PM PST |

| Posted: 04 Jan 2011 12:31 PM PST A senior pension fund manager sent me a link to a Washington Examiner blog entry, Europe starts confiscating private pension funds:

While some governments are "Hungary for pensions", I wouldn't worry too much about a big US pension grab -- at least not yet. I am more worried about legalized theft taking place in the markets every single day. Yahoo Finance posted a CNBC article, Investing Dying as Computer Trading, ETFs & Dark Pools Proliferate:

I also feel that all these dark pools, ETF flows, and high frequency trading platforms are wreaking havoc on the market, but they do present opportunities for stock pickers. This is because if things get really out of whack, long-term investors (like pension funds) will move in, and in extreme cases, they may even take a company private. Nonetheless, the reality is that investors are struggling to make sense of wild market gyrations caused by high frequency trading and dark pools. Over at Zero Hedge, they have been writing on this subject for a long time, but only now is mainstream media waking up to the fact that markets are routinely being manipulated by a few large and powerful players in this space. Some will dismiss this as "part of the liquidity game", but I think large pension funds should also be asking some tough questions on how these new "sophisticated" trading methods impact their holdings. For me, this is all a license to steal. Sure, it's legal, but it's still theft using multimillion dollar computers that are able to trade faster than the speed of light. And I'm not so sure that the CNBC article got it right. I think Michael Hudson got it right, the average stock is held for 22 seconds and foreign currency investment for 30 seconds. As sad as this sounds, this is the reality of our "new and improved" markets. Computers have taken over, and while there are limits to these trading platforms, they are increasingly dominating the way markets react to fundamental news. |

| A Total Eclipse Of The Economy Posted: 04 Jan 2011 12:04 PM PST |

| Hourly Action In Gold From Trader Dan Posted: 04 Jan 2011 11:56 AM PST Dear CIGAs, Gold and silver are starting off the New Year doing what many professional traders, myself included, expected them to do during the last few trading days of last year! They went soaring to the upside in front of the New Year and are just now experiencing a pullback as funds lift some longs and some new shorts are seemingly being emboldened by the notion of an "improving economy". I was extremely surprised last week to see them shooting so sharply higher with new money coming into the market as the calendar year wore down to a close. Now it seems as if we are finally seeing some of that selling showing up during the first full week of trading, which again, is out of the normal pattern. Then again, not much of anything in these markets is "normal" anymore since the funds have taken over everything. Some of this is rebalancing associated to the changes in the commodity indices that I mentioned yesterday but there is definitely a bit more to it than that. For whatever the reason, commodities are experiencing a general wave of selling today after the CCI went on to make yet another all time high yesterday. It's not just gold and silver; crude oil, the grains, the meats, etc, all are seeing a wave of selling as the algorithms trip into the sell mode for the time being. We'll just have to wait and see where the buyers surface in the sector. The "buy commodity" strategy will be in effect as long as the FOMC does not change monetary policy or scale back its QE2 program which based on today's release of their minutes, suggests is not going to happen anytime soon. Silver needs to find enough buying support to climb back above the $30 level to cement that as a base and prepare it for a leg higher. Failure to do so will drop it further and see it move down towards the $29 level. We'll have to watch if it can entice some fresh buying should it move that low. From a bullish perspective, I would prefer that it not move below $28.50 for any length of time. Gold needs to climb back above $1400 to give the bulls some encouragement for another try at $1420. I would not like to see gold get a close below $1380 as that would portend a deeper setback down towards $1365 or so. It is sitting right on the 50 day moving average which a lot of technicians watch so it will be important for the bullish cause for it to move up and away from that level quickly to keep the sentiment firmly bullish. Momentum has been declining in gold making a series of lower highs as the price has moved up which has to be monitored as the hedgies are all about chasing prices either higher or lower depending on momentum. The huge buyers of the physical market could care less about momentum but they do watch such things in an attempt to determine if they will get further fund long side liquidation allowing them to get a better price on their planned purchases. I read today that the US debt topped $14 Trillion which makes me shake my head in dismay when I hear talk about an improving economy. FOURTEEN TRILLION DOLLARS – we use to toss around the "billions" when referring to government debt; now we bandy the "trillions" around with the same carefree and lackadaisical sentiment. I keep hearing comments that as long as there is demand for US Treasuries, it shows that the US can continue to run these huge deficits and plunge itself further into debt because it is obviously not hurting demand for our IOU's. That makes me even more incredulous seeing that most of the demand is coming from the Fed itself. Then again, I am probably an outdated dinosaur who naively viewed debt as something intrinsically to be avoided. The current crop of financial talking heads seem to think that being a creditor is a curse while being a debtor is a blessing. I must have missed something back in school somewhere. I brought that up really to simply reiterate the fact that the only way this obscene burden is going to be eliminated from the shoulders of our children and grandchildren is by effectively defaulting through currency devaluation. We all know that; so does every other major holder of US Treasury debt on the planet. That is why I do not particularly care what happens to gold during these fairly regular bouts of selling. It runs higher; falls back, runs higher, falls back and just keeps repeating the process over and over again as it moves inexorably higher. Those with a scintilla of a functioning mind can understand what the US monetary authorities are doing. But you also have to keep in mind that the Fed has powerful allies on its side – mainly all those who want to do business with it. As long as those seeking profits from being primary dealers exist, those who have a vested interest in seeing the current policies continue will be around to contend with in the markets. To be successful as a long term investor, you have to recognize the fact and then use that to your advantage. History is not on their side but short term, the size of their trading accounts is. Use their actions in the market during which they push and strive against reality to look for opportunities. Technicals win in the short run but fundamental realities always win in the long run – always. Crude oil after putting in several closes above the $91 level, got whacked pretty hard during today's commodity rout and thus far has not been able to pick itself off of the carpet. Let's watch that, and copper, to see if market sentiment moves around to viewing some of today's selling as overdone. If so, we will see buying coming in sometime tomorrow, perhaps right after the margin related selling is conducted. Bonds are unchanged as I pen this but have been trading higher most of the day. If the Fed ever stops buying in there, the support levels will not hold but for now they have succeeded in having the shorts second guessing themselves. The HUI needs to close through the 580 level to generate some new upside excitement. It looks like it has enough momentum to move down towards 540 and possibly 530 before we get some stronger buying. A push back through today's session high near 561 within the next two days should shove it into a trading range pattern. Click chart to enlarge today's hourly action in Gold in PDF format with commentary from Trader Dan Norcini |

| Posted: 04 Jan 2011 11:46 AM PST Did you experience a slight case of déjà vu today seeing the price soften as the London bullion banking community newly returns from its long-weekend holiday? More to the point, a MTM-minded person can ignore today's trading shenanigans because, more importantly, gold's price remained neatly elevated right through the key year-end revaluation period...Friday, July 2, 2010... Timing Is Everything: |

| Posted: 04 Jan 2011 11:32 AM PST Take advantage of the lull, because the metal has yet to peak. Why? Because the one thing we know about 2011 is that currencies are suspect. Paper is suspect. There's too much being printed here. There's too much that's going to be printed in Europe. The stuff's worth less and less.

We got some really interesting news about gold Monday morning. The U.S. Mint says gold coin sales fell 14% this year and 74% in December. Funny thing, as someone who tried to buy U.S. coins in December, I can confirm that there was a real scarcity. My dealer reported that he just couldn't get any coins and tried to sell me Australian bullion. Very telling. We've seen big demand for gold out of China all year, and we saw lots of demand out of India, demand that tapered off at the end of the wedding season in December, according to my best source on metal… But can you imagine what would happen if our own country caught gold fever and the U.S. Mint obliged by making gold available? Does it even have enough gold available to make all the coins that are in demand? … Nothing like a nice refreshing pause to get those folks underweighted in gold up to the 20% I find reasonable, given the need of almost all countries, save China, to print more money. Don't expect gold to get away from you here. Expect some selling as people take profits. Slowly leg in. No hurry. But please don't miss it this time. [source] |

| Posted: 04 Jan 2011 11:10 AM PST |

| The Gold Price Fell to the 50 Day Moving Average Closing at $1,378.50, Not as Bad as it Sounds Posted: 04 Jan 2011 11:08 AM PST Gold Price Close Today : 1378.50 Change : (44.10) or -3.1% Silver Price Close Today : 29.492 Change : (1.604) cents or -5.2% Gold Silver Ratio Today : 46.74 Change : 0.993 or 2.2% Silver Gold Ratio Today : 0.02139 Change : -0.000464 or -2.1% Platinum Price Close Today : 1756.20 Change : -10.90 or -0.6% Palladium Price Close Today : 776.00 Change : -19.00 or -2.4% S&P 500 : 1,270.20 Change : -1.69 or -0.1% Dow In GOLD$ : $175.30 Change : $ 5.75 or 3.4% Dow in GOLD oz : 8.480 Change : 0.278 or 3.4% Dow in SILVER oz : 396.38 Change : 0.91 or 0.2% Dow Industrial : 11,690.18 Change : 20.43 or 0.2% US Dollar Index : 79.43 Change : 0.301 or 0.4% The GOLD PRICE painted out nearly the self-same pattern as silver, same time. Low came at $1,374.50, and Comex charge gold $44.10 to close at $1,378.50. Clearly, $1,425 offers resistance more formidable than we anticipated. In a single day it cost gold all the advance of the past six days. More, it fell to the 50 day moving average. Now that's not as bad as it sounds, since Gold has been skating up its 50 DMA since November, employing it as sure support. Might rebound off the 50 DMA and turn around. The SILVER PRICE opened around 3080c, then dropped 40c on open. Then it dropped another 30c, tried to rally, then fell to 3000c, broke thorugh 3000c, rallied sideways off 2980c, fell yet again 60c to 29.306 at 12:45. By Comex closing silver had lost 160.4c to close 2949.2c. In the aftermarket silver traded briskly up to 2980c, leaving behind what conceivably might be denominated a V-bottom. Conceivably. Last night I sat staring into the Great One-Eye until all the candles burned out, poring over the GOLD/SILVER RATIO behaviour, toting up the odds of the Ratio extending its fall, a.k.a., silver and gold extending their rise. I came away with the conclusion that a Ratio low must be very near, which is to say, silver and gold price highs must be near. Mid-January is about as far as I think this rally can survive, but that leaves room for one more surge upward from here, or even from a lower base. Most damaging to the ratio was its poking its head through the 20 day moving average, although it didn't close there. The 20 DMA acts as a very sensitive indicator for the Ratio, and it has already reached levels that mark its maximum historical drop below the 20 DMA. On the other hand, the RSI has not fallen down to 15, but remains today at 35.36. However, the RSI did reach that extreme in November. Anyway you look at it, all this says that the Ratio's drop is living on borrowed time. Behold! I only tell you what I see. And let not these consolations pass from your mind: about three months after the peak will come a low in silver and gold that will offer a SPECTACULAR buying point. Moreover, silver and gold remain in a primary up trend (bull market) that has at least three and perhaps nine more years to run. It is just beginning. One thing you learn trading markets or go broke quick, and that is Nothing is a given. Never take anything for granted. Always be ready for markets to do exactly the reverse of what you expect. I recur to this not because silver and gold crumpled today, but to remind y'all that today's crumpling might not mean the top came yesterday. Notoriously at tops markets make double tops, separated sometimes by what appears at first a crash. Clearly I got it wrong yesterday thinking a three wave correction was completed. That raises other possibilities. Now silver's 5 day chart (see ino.com, symbol "XAGUSDO") has tacked on to that three wave decline yesterday a sideways movement, and today's drop. That also, top to bottom, might be an A-B-C decline, setting silver up to rise tomorrow. That's not crazy -- when a market becomes as overbought as silver now is, any whiff of trouble sends newcomers scurrying out of the market looking for cover. Another reason that yesterday might not have marked the top. US DOLLAR INDEX today rose 30 basis points to 79.428, but the careful observer sniffs and asks, "What meaneth this trumpery?" 79.50 is the real resistance, and any close below that does that same thing to the markets that four candy bars do for a six-year old, pump him up with screams and running then drop him to the floor. STOCK indices looked a mite peakéd today. Most indices closed lower, but the Dow rose. S&P500 fell 1.69 to 1,270.20 while the Dow, almost alone among stock indices, rose 20.43 to 11,691.18. Stocks are the botulism on the investment buffet. Leave them alone. During the Twelve Days of Christmas (Christmas thru Epiphany, 6 Jan) our office will be working only four hours a day. Please be patient, leave a voice mail or send us an email at helpdesk@the-moneychanger.com. Thanks for your understanding. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. |

| 2011 - The year when money starts to die Posted: 04 Jan 2011 11:01 AM PST The online version is here 2011 – The year when money starts to die

Between 1716 and 1720, John Law tried to rescue the French government from bankruptcy with a scheme that came to be called “The Mississippi Bubble”. His strategy was to set up two entities: a bank whose purpose was to issue paper money, and a company whose primary but undeclared function was to refinance government debt. Law realised that he had to confiscate all gold and silver other than smaller quantities, and force French citizens to pay their taxes and buy shares in the Mississippi Company, only with the bank’s newly issued notes. These were the three essential elements of his scheme.[i] This is precisely what central banks in the US, Europe, Japan and the UK are doing today. They are rigging the markets by buying government debt at artificially high prices with freshly created paper money, having previously excluded gold and silver from any role as legal tender. The following quote from John Law, could equally be attributed to a central banker of today: “An abundance of money which would lower the interest rate to two per cent would, in reducing the financing costs of the debts and public offices etc. relieve the King.” This is quantitative easing, pure and simple, and John Law had fully anticipated modern central banking. Law’s scheme ended in disaster and as a precedent for today’s central banking this should worry us greatly. Many of us recognise the government debt bubble, which ensures that today’s rulers are relieved by the artificially low cost of their debt. But most of us are unaware of the other bubble, that of the value of money, which is also held up at artificially high levels. The money bubble is inflating primarily in quantity rather than price, making it easier to deceive the public. There is also a fundamental difference from the usual bubbles, which end with a collapse while money’s value is unaffected: in this dual bubble both debt and money will eventually collapse together; the former as nominal yields rise and the latter being reflected in rising precious metal prices. In Law’s time, it was made illegal to hold more than a minimal quantity of gold and silver coinage. Today the central banks have had a different approach, removing gold and silver from circulation altogether. Naturally, central banks have also convinced themselves that precious metals are now redundant, fully replaced by paper money, so they have carelessly reduced their own holdings to suppress prices. At the same time commercial banks offering gold and silver accounts have developed large uncovered liabilities with their customers through their fractional banking practices. Through these uncovered, undeclared positions, the strategy of depressing bullion prices has become dangerously dependant on confidence remaining in both the central banks and the banking system. We can expect the collapse in money values to be reflected in gold and silver prices rather than other paper currencies, and the warning signs are now upon us. Bullion has been climbing in value for a decade, and in 2010 buyers found it regularly difficult to get physical metal delivered to them by the banks. It is becoming clear that the ability of the central banks to keep a lid on bullion prices is at last coming to an end. And it is not just bullion prices getting out of control. In the last three months the yield on government debt has risen in spite of fresh rounds of monetary inflation. Markets are now becoming wary of future currency issuance to support the government bond markets, and they are beginning to question risk, rather than value stability. We are learning how it must have felt in Paris in the early months of 1720, when the Mississippi Company share price, as proxy for government debt, began to fall. And if the last few months of 2010 marked the beginning of the end for today’s government bonds, this new year of 2011 will mark the beginning of the end for paper money. The two bubbles are now fully interdependent. This is why we might call 2011 the year money starts to die. The central banks are beginning to lose control over bubbles one and two, and also bullion. The destruction of private sector savings has coincided with expanding budget deficits so the expansion of the money bubble will have to continue to contain the situation, because there is no alternative. As monetary inflation translates into price inflation, government bond yields will rise again, developing into a self-feeding loop of government bond prices and currency purchasing-powers falling, as the prices of commodities and raw materials rise further. This process is already underway. Rising price inflation should lead to rising interest rates, which will be unwelcome to the bubble inflators. Higher interest rates will wreck what is left of government finances, and lead to substantial losses for the banking system as well, due to the impact on the economy and asset prices. Suddenly, there will be negative feedback loops everywhere. That is what John Law discovered through the summer of 1720, and it is safer to expect history to repeat itself than not. This time, the implosion of government debt and paper currency values will not be confined to the destructive popping of the Mississippi bubble. The bubbles today are global and taken together are far bigger. The values of specie are greatly suppressed today[ii], which was not the case in John Law’s time. The adjustment, when it comes, should be far sharper, even catastrophic as a result, and the loss of confidence sudden. It will confound those who trust in a mechanistic link between the quantity of money and the general price level. It will wreck the Keynesians’ cherished experiment with expanding deficits as a means of economic regeneration. It will destroy the central banks. It will be a poor consolation that these last two consequences will at least be a pyrrhic good. Now, the New Year, reviving old desires, the thoughtful soul to solitude retires. It is the time for investment strategists to dream their forecasts, which are invariably optimistic. But there is only one question to ask of these soothsayers, and that is the fate of the two bubbles, and the suppression of gold and silver prices. Will it all unravel in 2011? Maybe, but if money does not actually die this year, this is the year money starts to die.

5 January 2011 Alasdair Macleod FinanceAndEconomics.Org Somerled Newton Poppleford Sidmouth Devon EX10 0BX Tel: +447790 419403 +441935 568393 |

| Posted: 04 Jan 2011 10:47 AM PST Can they please at least keep their lies straight? While two months ago the IMF said that "Oil price rise not threat to global recovery", we now get an FT article with the following title: "Oil price ‘threat to recovery’" based on a quote from the IEA." H.M.M.M.M. we wonder whose opinion is more accurate: an organization run by idiots (who subsequently matriculate into modestly coherent people whose only job is to bash their former employer), whose only purpose is to destroy economies under mountains of debt (or is that the World Bank?) and to bail out insolvent PIIGS... or the International Energy Agency? We'll have to get back to you on that. And while we contemplate this seemingly impossible task, here is what the FT says, which incidentally is alongside our views that every dollar increase in the price of oil means a couple basis points have to be removed from the 2011 GDP forecast.

We wonder why it was barely mentioned that alongside gold it was actually crude that recorded the biggest slide today. Although in the grand scheme of things, the Fed now needs to do everything in its power to hold both of these commodities as low as possible, or else Jan Hatzius may be forced to just revise his economic forecast yet again (and start calling loudly for that elusive QE3 once more).

And here's the kicker: somehow a cartel is suddenly expected to behave altruistically. So inspite of record liquidity which means speulators can push oil easily to $100+, producers are supposed to forego profits and to hike production to levels that actually result in a plunge in price, and drown the world in yet another glut of oil.

Good luck with that. In the meantime, things are getting ugly:

And the funny thing here is that according to Goldman there is a record amount of excess slack in the economy. So it must be all those Fed "asset swaps" that have no impact on inflation, and are just confusing speculators that $100 oil makes perfect sense. |

| Tesco 'cash for gold' move knocks pawnbrokers Posted: 04 Jan 2011 10:39 AM PST H&T Pawnbrokers shares fell by 4.5pc on Tuesday on news of a move by Tesco into the 'cash for gold' market. This posting includes an audio/video/photo media file: Download Now |

| The New Gold Rush: Can the Precious Metal Go Higher in 2011 and Beyond? Posted: 04 Jan 2011 10:05 AM PST As we embark on 2011, gold continues to climb and investors are questioning its future price direction. Is gold in a bubble? Have the price gains of the last decade - which beat out stocks, bonds and several other favored asset classes - peaked? Did today's investors miss the opportunity to buy? Since 2002, we have responded to these questions daily, as gold climbed from $275 an ounce to over $1,400. Unfortunately, most people see gold as just another dollar-based asset class to be evaluated using the same metrics as stocks and bonds, and commodities like corn and coffee. But in order to understand the benefits of buying and holding physical gold, investors must go beyond conventional economic wisdom and understand causes rather than symptoms. They need to be able to interpret the message gold is sending. Complete Story » |

| 5 Reasons Precious Metals ETFs May Stay Solid Posted: 04 Jan 2011 10:02 AM PST Tom Lydon submits: Growing on safe-haven demand, precious metals ETFs have been attracting more investors as Europe’s debt problems keep piling on. But Europe is far from the only impetus.

Since “conventional” commodity options are doing well, the Minyanville piece argues that precious metals could be consolidating or correcting. Gold, though, has not reached the technically overbought condition, so it is not as vulnerable now. Silver, on the other hand, is overbought and may need to consolidate in the next several months, according to Minyanville. Complete Story » |

| Posted: 04 Jan 2011 09:59 AM PST Gold dips; profit taking and sell stops cited The COMEX February gold futures contract closed down $44.10 Tuesday at $1378.80, trading between $1375.00 and $1417.80 January 4, p.m. excerpts: |

| Guest Post: The Long Swim – How the Fed Could Become Insolvent Posted: 04 Jan 2011 09:20 AM PST From Terry Coxon of Casey Research The Long Swim – How the Fed Could Become Insolvent You’ve seen the proof in real time. Once-dominant industrial companies, e.g., General Motors, can run out of money. The biggest banks, e.g., Bank of America, can run out of money. Even sovereign governments, e.g., Greece, can run out of money. Yes, all those organizations are still limping along, but only after being rescued by other giant institutions, such as the U.S. government, the less unhealthy European governments, the European Central Bank, and the International Monetary Fund. Below is a summary of the asset side of the Federal Reserve's balance sheet. Those are the assets that generate income for the Fed, income that currently runs about $65 billion per year. Most of the income-earning assets – chiefly the Treasury securities, agency securities, and mortgage-backed securities – have long maturities (short-term T-bills make up only a small portion of the total). Given the composition of the Fed's assets, when interest rates start rising, the immediate effect on the Fed's income will be negligible. But the Fed's interest expense will respond immediately, because the interest it is paying is interest on deposits that commercial banks are free to withdraw without notice. That's not a healthy combination. Short-term rates would only need to rise above 6.5% for the cost of keeping the $1 trillion sequestered to exceed all of the Fed's income. The Federal Reserve would be operating at a loss.

If short-term rates bob up to the 5% to 7% neighborhood and stay there, all this will happen in slow motion. Mr. Bernanke and company can still hope to find a way out. But the higher rates go, the less real hope there will be. Even without QE2, if the fed funds rate returns to its historic peak of 19% (price inflation running at a similar rate would get it there), the Federal Reserve will be losing $125 billion per year. In that case, things would move rapidly. Then we would find out what happens when the last lifeguard has swum out so far that he hasn't the strength to get back to shore. |

| Posted: 04 Jan 2011 09:00 AM PST View the original post at jsmineset.com... January 04, 2011 11:46 AM Dear CIGAs, You might recall Armstrong’s article, "Show Me Money." He has made predictions based on the last trade on the US Dollar and the Euro on the last business day of 2010. Taking his advice predicated on the close, the following will occur in 2011. 1. The US dollar declines in 2011. 2. The euro remains neutral on balance in 2011. That fits the situation well in my opinion. Jim Sinclair’s Commentary Maybe China would like a state with a good deal of waterfront property? Illinois Has Days to Plug $13 Billion Deficit That Took Years to Produce By Tim Jones – Jan 3, 2011 Illinois lawmakers will try this week to accomplish in a few days what they have been unable to do in the past two years — resolve the state’s worst financial crisis. The legislative session that began today as the House convened will take aim at a budget deficit of at least $13 billio... |

| Posted: 04 Jan 2011 09:00 AM PST View the original post at jsmineset.com... January 04, 2011 11:37 AM Jim Sinclair's Commentary Yra Speaks, CIGA Craig reports. As we are scalping on the short side, let's keep Yra’s words of wisdom in mind. Hi, Jim. I hope this note finds you safe and healthy in Africa. Your friend Yra was on CNBC this morning discussing the current selloff in the bond market. As usual, he makes terrific points. Of particular importance are his comments at the very end of the interview. He expects direct Fed intervention on the long end of the curve if price deteriorates much farther. Yippee, more QE!!! To infinity and beyond! Have a great trip. Keep up the good work. CIGA Craig Dear Jim, I hope you are well. Do you seen any special reason for one more takedown in gold? Respectfully CIGA V Dear CIGA V, The Goldman Facebook deal yesterday shows what the general public, so called experts and the media feels about what holds value today. That is a signi... |

| Gold Plummets after Divergence with Silver Posted: 04 Jan 2011 09:00 AM PST courtesy of DailyFX.com January 04, 2011 07:35 AM Daily Bars Prepared by Jamie Saettele Gold is threatening its high and one more high could complete a diagonal from 1317. I mentioned yesterday in my video and well as on the DailyFX Forex Stream that the new high in silver (bottom on the chart above) was not confirmed by a new high in gold and that this dynamic warns of a reversal. If the metals can break below their lower diagonal lines, then reversals would be confirmed. Watch the 20 day SMA in silver as well, it has pinpointed support in the metal for months and a break below would be considered bearish.... |

| Mining News Review: Week of December 27th Posted: 04 Jan 2011 09:00 AM PST We update all Mining News Review posts on a daily basis at www.metalaugmentor.com. Click here to join our mailing list or subscribe to our service. Silver Wheaton (NYSE/TSX: SLW) Silver Mining is for Suckers – December 31, 2010 Overall this short little article is fine, but Matt Badiali’s simplistic valuation technique as applied to Silver Wheaton is probably best ignored. Indeed, we find it quite ironic that Matt is trying to convince investors to be smart and own Silver Wheaton rather than a sucker and own the typical exploration and development miner, all the while relying on his audience to be suckers or else they would take such amateurish analysis with a large grain of salt. In our opinion, a much more appropriate and robust method of valuing Silver Wheaton would be through through a discounted cash flow analysis of its silver streams as we have done in our recent Royalty Company report. Mr. Badiali closes with the following: [INDENT]Today, silve... |

| Mining News Review: Week of December 20th Posted: 04 Jan 2011 09:00 AM PST We update all Mining News Review posts on a daily basis at www.metalaugmentor.com. Click here to join our mailing list or subscribe to our service. Cream Minerals (TSX-V: CMA; Pink Sheets: CRMXF) Endeavour Silver (AMEX: EXK; TSX: EDR) Cream Minerals Ltd. Closes $6,000,000 Bought Deal Offering – December 22, 2010 With all this cash it now seems unlikely that Cream is going to accept Endeavour’s latest attempt to get a piece of Nuevo Milenio through a joint venture agreement. Indeed, we find Endeavour’s latest proposal to be much less attractive for Cream Shareholders compared with the all-share offer which itself has already been rejected. Looking back Endeavour probably shouldn’t have been so greedy early on, but then again it wasn’t as if Endeavour could have known that silver was about to rise 50% between October 2010 and the end of the year when making their initial offer. [Zurbo] Amazon Mining (TSX-V: AMZ; Pink Sheets: AMHPF) Secreta... |

| Mining News Review: Week of December 13th Posted: 04 Jan 2011 09:00 AM PST We update all Mining News Review posts on a daily basis at www.metalaugmentor.com. Click here to join our mailing list or to subscribe to our service. Belo Sun Mining (TSX-V: BSX; Pink Sheets: VNNHF) Belo Sun Continues to Extend Gold Mineralization at Volta Grande – December 14, 2010 Construction challenges aside, we like this Brazilian project and consider the prospects for a future gold mine at Volta Grande to be good. The mineralization contains higher grade sections that should help with economics and the project could support an operation of above-normal size (200,000+ ounces of gold per year). We’d like to see the capital costs come down with one possibility being to develop the project in stages or perhaps to increase cutoff grades. Although we have not fully validated the project in our model, it does look leveraged to higher gold prices and becomes particularly-attractive above $1,250 per ounce (a level we suspect mining companies may consider ba... |