saveyourassetsfirst3 |

- The Inside Story on Why Silver is Such an Exceptional Investment Opportunity

- Sprott Thinks Silver Explosion Coming

- Corporate Bonds Not Worth the Risk

- Gold and Silvers Daily Review for December 10th, 2010

- When the Government Demands More Debt

- “Alternative Currency” Claims for Gold Called “Overblown” as Chinese & Indian Demand

- Something’s Wrong in the Silver Pit: But It’s Much Bigger than J.P. Morgan

- Investing in Transitional Energy: Yes, It's Coal

- A Look at All the VIX ETF Choices

- Important COT Report Today

- Euro Gold Consolidates and Targets EUR1,100/oz on Euro Survival Risk

- 4 DAY RULE

- German Hyperinflation

- The Double-Barreled Silver Issue

- Sprott says SLV has physical?

- Gold “Capped” by Surging Bond Yields…

- Crash JP Morgan buy silver - We Wish You A Merry Christmas

- Fighting Words

- Worlds Apart: A Firsthand Look at Emerging Market Growth

- Any recommendations on what safe to buy?

- Will Ron Paul Be Able To End The Fed?

- Welcome Hathor Exploration to the GGR Stable

- Discussing Key Points

- Replacing Dollar Reserves with Gold

- Gold Consolidates, Targets €1,100/oz on Euro Risk

- Eric Sprott on Silver, Sprott Asset Management

- All that Glitters is Silver...? Sprott and Franklin share on $100 silver adn the comign COMEX defualt

- Gold and Silver Rise/bonds rise fractionally.

- High Long Bond Yield Good News for Gold Holders

- Gold Seeker Closing Report: Gold and Silver Gain Almost 1% and 2%

- New Video: WHY SILVER WHY NOW

- When Irish Mouths Are Cursing

- Oil and U.S. Hyperinflation

- Swiss bank client cant get his silver back two months after asking

- Is The Herd Trading Gold and SP500?

- Why the Eurozone and the Euro Will Not Collapse - But Will Change

- Gold Down 2.8%, Silver Off 7% from Record Highs…

| The Inside Story on Why Silver is Such an Exceptional Investment Opportunity Posted: 10 Dec 2010 05:40 AM PST Silver's dramatic rise over the last two months is no fluke - it's the result of a compelling supply/demand dynamic within a unique market structure. We hope the following comments convey our enthusiasm for "the other shiny metal" as an exceptional investment opportunity. Words: 2226 |

| Sprott Thinks Silver Explosion Coming Posted: 10 Dec 2010 05:34 AM PST Perhaps silver investors might want to rethink plans to take profit with $30 silver. We believe the two articles at the link below are worthy of consideration by Vultures. They are from Sprott Asset Management and they relate to silver. Eric Sprott and David Franklin lay out their very bullish view of the silver market now that they are free to do so following the successful launch of the new Sprott Physical Silver Trust PSLV. We are indebted to the Gold Anti-Trust Action Committee (GATA) and Chris Powell for bringing them to our attention. ... |

| Corporate Bonds Not Worth the Risk Posted: 10 Dec 2010 05:18 AM PST Doug Carey submits: Just two years removed from a near complete meltdown of our financial system there are five year corporate bonds barely yielding above 2%. US Bancorp and Bank of New York five year bonds are trading at a yield of 2.3% and 2.31%, respectively. So let me get this straight. I am being paid only 0.3% above treasuries with the risk that inflation will eat away all of my return or worse and I am assuming the issuers won’t default in that time frame. Looked at another way, my cumulative yield over treasuries for five years is about 1.5%. This means that the market is assigning a cumulative probability of default over those five years of about 1.48% relative to treasuries. It’s an even worse deal when you take into account income taxes. The risk/reward ratio of corporate bonds is incredibly low and complacency is shockingly high given what has happened over the past three years. With the VIX hovering around 17 it becomes obvious just how complacent the market has gotten. In the face of this complacency I would much rather be in short-term treasuries or bank CDs and wait for yields to be high enough to make investing in corporate bonds worth my while. Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Complete Story » |

| Gold and Silvers Daily Review for December 10th, 2010 Posted: 10 Dec 2010 05:11 AM PST |

| When the Government Demands More Debt Posted: 10 Dec 2010 05:00 AM PST I always like the name Minyanville because it sounds so soothing, and it makes me think of some peaceful, beautiful little town of my childhood dreams, where everything is always nice and everybody is happy, where wishes come true for good little boys, and there are no angry fathers literally throwing you out of his stupid house and yelling after you, "And stay away from my daughter, you worthless piece of teenaged hoodlum trash!" Of course, life wasn't like that back then, and it is apparently not like that in Minyanville.com, either, as it is there that I ran across Dan Cofall of NorAm Capital Holdings, Inc, and also the host of the radio show "The Wall Street Shuffle", who is, perhaps without realizing it, summing up my horror of the gigantic increases in the money supply by the horrid Federal Reserve announcing a six month-long $600 billion creation of new money, and thus I fearlessly forecast them to create at least $1.2 trillion in the whole year! The GDP, the total of all the goods and services produced in the Whole Freaking Country (WFC), is only $14 trillion, and yet here are these Federal Reserve weenies printing up a massive, monstrous $1.2 trillion in new money! This is an unbelievable 9% of GDP, for crying out loud! And that's just the amount This Freaking Year (TFY)! This doesn't include even more money next year! And more the year after that! And more the year after that, on and on, more and more until, as Ludwig von Mises of the Austrian school of economics so famously said, the economy cracks up. And now, thanks to Mr. Cofall, we know that it is worse than the astounding $1.2 trillion, as, "The Fed granted $9 trillion (that's right, trillion) dollars of loans to countries, central banks, companies, and banks in the fall of 2008," which leads to the terrifying fact that the money supply has taken a big boost, as he notes when he says, "This $9 trillion did not exist the day before the loans were made." If you remember that changes in price always equilibrate supply and demand, this is $9 trillion of new demand, which becomes significant when followed up by the obvious fact that supply did not increase, as, as he says, "The world did not create $9 trillion of goods and services in one day." Ergo, demand swamping supply means that prices must go up to clear the market! Of course, Junior Mogambo Rangers (JMRs) look at the gigantic increase in the amount of money used to buy things, compared to the static sameness of the amount of things that can be bought, and come to the only possible conclusion, namely, "Forget that formation of Klingon battle-cruisers passing Saturn on their way here! We're freaking doomed to die of inflation in prices! Buy gold, silver and oil, and lots of arms and armaments against the coming horde of desperate, angry people who do not want to die of exposure and starvation because of high prices that keep going higher and higher, and they want to kill you and steal all your stuff! And if not them, then the government wants to kill you and steal your stuff! Or the Klingons!" The problem boils down to, as he succinctly puts it, that we "have long since passed the point of the world's debts exceeding our assets," and that, even worse, "Our debts far exceed our ability to repay those debts or, often, even service the debts." I figure that this "drowning in debt" scenario explains why people are not borrowing more money to buy more things to go farther in debt, and it is this lack of sales that explains why businesses are not going farther into debt to invest and expand to create more things for people to buy by going farther into debt, and why businesses are not hiring new workers, which explains why unemployment is so high, which explains why workers are being fired, and which explains why I will probably be "let go" in the next round of "restructuring" as people much less incompetent than I am have been fired already. Unfortunately, the Excellent Mogambo Investment Plan (EMIP) dictates that I buy gold, silver and oil when the government is acting so bizarrely, and whether I have a job or not, which may make a mockery of the EMIP slogan, "Whee! This investing stuff is easy!" The Mogambo Guru When the Government Demands More Debt originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| “Alternative Currency” Claims for Gold Called “Overblown” as Chinese & Indian Demand Posted: 10 Dec 2010 04:52 AM PST Bullion Vault |

| Something’s Wrong in the Silver Pit: But It’s Much Bigger than J.P. Morgan Posted: 10 Dec 2010 04:13 AM PST Any way you slice it – precious metals data reporting on the part of American regulators is atrocious. Simple MATHEMATICS tells us a gold / silver ratio at 48:1 is EXTREMELY contrived and REEKS of manipulation on the part of the Federal Reserve and the Banks they are charged with regulating. |

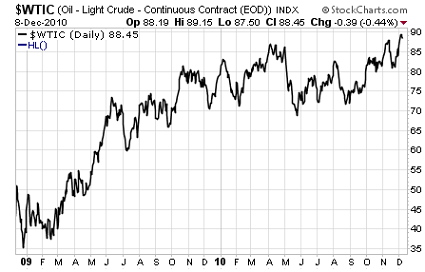

| Investing in Transitional Energy: Yes, It's Coal Posted: 10 Dec 2010 04:10 AM PST Ian Wyatt submits: The energy sector of the market is on fire. Oil recently broke through resistance at $88 a barrel and, despite a retracement to that level on Wednesday, looks poised to go higher in 2010. A weak dollar combined with upward revisions to global growth and a seemingly successful quantitative easing program (for the time being, at least) all lend credence to those calling for higher energy prices.

Complete Story » |

| A Look at All the VIX ETF Choices Posted: 10 Dec 2010 04:03 AM PST Michael Johnston submits: The impressive ETF boom that has unfolded over the last several years has been the result of a number of attractive features of the exchange-traded structure relative to traditional mutual funds. In addition to considerably lower expenses, intraday liquidity and enticing tax breaks have fueled interest in ETPs, which now number nearly 1,100 in the U.S. and hold close to $1 trillion in assets. As ETFs have become more targeted and specialized, they have allowed all types of investors to gain exposure to securities and strategies that were previously hard-to-reach. ETFs such as the Market Vectors China ETF (PEK) offer exposure to unique assets like China’s A-shares market, a new opportunity for U.S. investors (see Closer Look At The China A-Shares ETF). ETFs have also been instrumental in making commodities a widely available asset class, making it possible for all types of investors to access both futures-based and physically backed funds focusing on everything from gold and silver to natural gas and crude oil (see Top 25 ETFs By Trading Volume). Complete Story » |

| Posted: 10 Dec 2010 01:39 AM PST The CFTC commitments of traders report comes out later today at 15:30 ET. It will be for the futures trader positioning as of Tuesday, December 7, and lest we forget, Tuesday is the day when gold and silver first tested new highs and then sold off strongly, taking out the previous day's lows. Gold and silver had gotten ahead of themselves and the hottest of the hot money rushed the exits that day. Gold finished off $21.62, but still closed above $1,400 at $1,401.79 on the Cash Market, having tested as high as a new all time high of $1,430.63 earlier in the day. So even though gold closed the COT week up $15.96 or 1.2%, it closed about $22 below the previous day's (Monday's) close and about $29 under that morning's pinnacle. We traders witnessed a bearish "outside reversal" for gold. |

| Euro Gold Consolidates and Targets EUR1,100/oz on Euro Survival Risk Posted: 10 Dec 2010 01:24 AM PST |

| Posted: 10 Dec 2010 01:24 AM PST If the market can end the day with a gain we will get a 4 day rule possible trend change signal. The four day rule says; After a long intermediate rally look for the first down day to signal an intermediate trend change after the market rallies 4 or more days in a row. The four day rule is a sign of extreme sentiment. I would caution that it only works after a long intermediate rally lasting multiple months. We have those conditions right now. We have also reached extreme bullish sentiment levels. The kind of levels where we are in jeopardy of running out of buyers. Add to that the fact that the intermediate cycle is now going on it's 23rd week and we got a large selling on strength day a couple of weeks ago (a sign institutional smart money is exiting in front of a large correction.) and we can probably expect any further gains to be given back and then some when the market moves down into the intermediate degree correction. Now is not the time to press the long side in either stocks or gold. That doesn't mean one should short. Shorting bull markets is a tough trade. You have to time the exit perfectly and survive the violent fakeout rallies to make money. Not to mention you will invariably miss time the entry several times. All in all you will probably be better off just going on vacation for the next 5-6 weeks. This posting includes an audio/video/photo media file: Download Now |

| Posted: 09 Dec 2010 08:55 PM PST Wallpaper Currency-German Marks. Fiat Paper Marks Versus Gold Marks. "German 1923 banknotes lost so much value they were used as wallpaper." The true value of gold marks decoupled from fiat paper Marks in 1921-1922. Then look what happened. Price is off the charts. "It is sometimes argued that Germany had to inflate its currency to pay the war reparations required under the Treaty of Versailles, but this is misleading, because the Reparations Commission required payment to be "The German currency was relatively stable at about 60 Marks per US Dollar during the first half of 1921. "The first payment was paid when due in June, 1921. That was the beginning of an increasingly rapid devaluation of the Mark which fell to less than one third of a cent by November, 1921 (approximately 330 Marks per US Dollar). The total reparations demanded was $132,000,000,000 (132 billion) goldmarks which was far more than the (entire) total (of) German gold and foreign exchange." -Wikopedia "A medal commemorating Germany's 1923 hyperinflation. -Wikopedia "A medal commemorating Germany's 1923 hyperinflation. The engraving reads: "On 1st November 1923, 1 pound of bread cost 3 billion, (Marks) 1 pound of meat: 36 billion, 1 glass of beer: 4 billion." "The hyperinflation episode in the Weimar Republic in the 1920s was not the first hyperinflation, nor was it the only one in early 1920s Europe or, even the most extreme inflation in history (the Hungarian Pengő and Zimbabwean Dollar have both been more inflated). However, as the most prominent case following the emergence of economics as a science, it drew interest in a way that previous instances had not. Many of the dramatic and unusual economic behaviors now associated with hyperinflation were first documented systematically in Germany: order-of-magnitude increases in prices and interest rates, redenomination of the currency, consumer flight from cash to hard assets, and the rapid expansion of industries that produced those assets. (Editor: There have been numerous banana republic examples from South America. The last was in 2002). Remarks by John Maynard Keynes show unbridled naivete and/or home grown stupidity. "John Maynard Keynes described the situation in The Economic Consequences of the Peace: 'The inflationism of the currency systems of Europe has proceeded to extraordinary lengths. The various belligerent Governments, unable, or too timid or too short-sighted to secure from loans or taxes the resources they required, have printed notes for the balance." Keynes was too ignorant to understand that loans for bad credits do not exist. Secondarily, taxes cannot be wrung from the bowels of draconian unemployment. Further, the currency was worthless as it was driven into dust by the exact remedies Mr. Keynes and our modern day socialist-communists like Paul Krugman of the New York Times espouse. Our US has not had pure capitalism in decades. Soon this changes. The result will astound our Sheeple and a money-changing Federal Reserve cabal. This posting includes an audio/video/photo media file: Download Now |

| The Double-Barreled Silver Issue Posted: 09 Dec 2010 08:47 PM PST Image:  Lastly, is your big read of the day... but, considering the subject material, you should be up to it. It's Sprott Asset Management's latest Markets at a Glance Commentary... written by Eric Sprott and David Franklin. It's really two silver commentaries posted back to back. I knew back in June that Sprott was forced to sit on the first story because of their pending silver ETF application to the SEC. So, six months later... here it is. The headline reads "The Double-Barreled Silver Issue"... |

| Posted: 09 Dec 2010 06:45 PM PST I found it interesting in this Sprott piece The Silver Lining that Sprott includes SLV in his table of "real investment demand for silver". In the context of his point that GFMS and The Silver Institute neglect investment demand, I assume by the use of the word "real" Sprott must mean physical. In which case by including SLV's 305,205,951oz he is therefore saying it does have the physical. If SLV doesn't, then he shouldn't include it in the table as their holdings would represent fake paper silver. However if he doesn't include SLV then he has no point about GFMS/Silver Institute missing investment demand of 225,783,924oz because without SLV the "aggregate implied investment demand" figure from GFMS/Silver Institute covers the other funds' inflows. |

| Gold “Capped” by Surging Bond Yields… Posted: 09 Dec 2010 04:29 PM PST |

| Crash JP Morgan buy silver - We Wish You A Merry Christmas Posted: 09 Dec 2010 01:20 PM PST Crash JP Morgan buy silver - We Wish You A Merry Christmas http://www.youtube.com/watch?v=DGPi3QQbgIs |

| Posted: 09 Dec 2010 12:35 PM PST -- "The focus of the market is still in Europe, but we must be aware that the US fiscal situation is much worse than in Europe," said Chinese central banker Li Daokui. --Thems fightin' words! --Or bond selling words. The Chinese central banker was merely reminding everyone that tax cuts in the U.S. might support consumer spending (and keep money out of the hands of profligate government). But they won't do much to pay down the deficit. --You won't win many popularity contests by talking about bond yields. But they do tell an important part of the story for today's markets. If global bond vigilantes think the American government is just as insolvent as the one Dublin and the one in Madrid and the one in Athens, then U.S. bond yields will rise. Investors will demand higher interest rates to loan to the U.S., which is just what the chart below shows. U.S. Ten-year yields rise, bond vigilantes fire warning shot at Washington

--The chart is really a testament to the law of unintended consequences and/or a monument to Ben Bernanke's incompetence. Ten-year yields began rising in early October. That was right around the time Bernanke was announcing QEII and hoping it would have the opposite effect. --The lower-ten year yields go, the easier it is for the government to refinance its massive debts at low rates. But more importantly, the interest rate on a 30-year mortgage in the US tracks the ten-year yield. If rates spike on the 10-year notes, mortgage rates go up. --And when mortgage rates rise, it threatens refinancing activity, which threatens the whole U.S. housing market, which has been threatening everyone for years with its corruption of the capital of the global banking system. --Sadly, it doesn't look like it's going to get any better soon. U.S. house values could fall by another $1.7 trillion this year, according to Zillow.com. That would bring total losses in U.S. household net worth to almost $9 trillion since the housing market peaked in 2006. --That could never happen here. --But moving on, the U.S. Treasury market is massive. If rising ten-year yields are a leading indicator that investors are looking for better options, where will they go? It's a lot of money to move out of one market and into another. Will its movement cause bubbles in other asset classes like, say copper? --On the subject of copper, Diggers and Drillers Editor Alex Cowie has chimed in on what he thinks is going on. Alex sent this note earlier today: The copper market has been hurtling headlong into a prolonged shortage. Loads of copper projects shut down during the financial crisis. Now that demand is rising fast again there's just not enough new mines producing copper to keep everyone happy. In this mad scramble for copper, the highest bidder wins. Now the opportunists are turning up the heat. Those nice chaps at JP Morgan have apparently got their grubby little mitts on over HALF of the copper on the London Metal Exchange (LME). This represents 175,000 tonnes, or a THIRD of the worlds reported copper stash. Imagine you went to the pub with a hard earned thirst. It's been a hot day and you're up for a good few beers with some mates. You then find some punter got in early, and bought up a third of the pub's beer. Then he says 'when you really want this beer, I'll sell it to you at a profit'. The people that actually need the copper; sparkies, plumbers, and manufacturers are all in the same predicament. In my pub analogy you'd most likely be having words with the publican. But the genuine users of copper don't have this choice. This is a game-changer for the copper market. The price is going to jump on this sudden market tightness. JP Morgan are using the copper to build a copper backed 'exchange traded fund' (ETF). This makes it possible for anyone to buy 'shares' in actual copper metal, with the aim of sell it for a profit to the guys that actually need the stuff. Copper proucers are laughing all the way to the bank. Their comfortable margins are looking even sweeter. I've been on the copper story for a year. The first tip is up 80%. The second is more recent, and hasn't had a chance yet. It's due to jump in the next few months, and when it does, this recent copper news will take its progress up a gear or three. --If you've got an inquisitive mind, you might wonder if JP Morgan's copper position is related to its massive naked short silver position. Our colleague Eric Fry wrote about this recently as well. Good luck the JP Morgue. --How about some reader mail?

--Our position, articulated before but not recently, is that fractional reserve banking is not only unsound but immoral. Credit in a financial system should not exceed available savings. --Friedman's critique of the Fed in the 1930s was correct to a point. The collapse of banks fed a genuine liquidity crisis in which the money supply contracted and the economy with it. Sounds banks probably went down with unsound ones. --But the real problem was the credit boom that preceded the Depression. Artificially low interest rates created an asset price boom and credit boom. Capital was created and misallocated and led to all sorts of mal-investments in the real economy that were not reflective of underlying (sustainable) consumer demand (from savings). You got a stock market bubble. --Today, the Fed thinks liquidity is the problem. But solvency is the real issue. Banks are still capitalised with bad debts. A write-down in those credits will wipe out bank equity. Secured creditors of the banks (mostly other banks) and unsecured creditors (investors in bank equity) would be wiped out if banks took losses on those bad debts. Depositors would be protected to the extent they have deposit insurance. --So why not let the creditors and the equity investors get what they have coming? A big pile of losses on the risks they took? Oh...that's right. The banks who would take the biggest losses are also the banks that control and own the Fed. No wonder the Fed keeps shovelling bad money after worse. And no wonder investors are starting to head for the exits. Similar Posts: |

| Worlds Apart: A Firsthand Look at Emerging Market Growth Posted: 09 Dec 2010 12:33 PM PST Yes, we're back at home, after flying around the world. It was a good trip. No problems. No hassles. Everything went well. What was the point? "You know, my friends and relatives in the states still believe that the US is the greatest place in the world," explained an American in Melbourne, Australia. "They think the rest of the world is full of poor people who can't wait to emigrate to the US. They need to get out more." So we get out. We open our eyes. We look around. And what do we see? We see a whole world full of people who are hustling and bustling...schlepping and bussing...each trying to gain an advantage...each looking for a way to get richer, faster. The motivations all over the world are about the same. People generally want wealth, power and status. And they want to get it in the easiest possible way. But it can mean different things to different people...and they go about it differently too. In the mature economies, they look for subsidies and angles. Tax breaks. Bailouts. Boondoggles. Sinecures. "We have plenty of corruption here in India, too," a colleague noted. "But most people know they can't get much from the government. They have no choice. They have to start a business or get a job." Nothing stands still. A few years ago, the Russkies, the Indians and the Chinese were all very helpfully sitting on the sidelines. With their goofy theories and their counterproductive policies, they posed no competition. Americans found it easy to feel superior. Half the world had tied its hands behind its back. But in the '70s and '80s, things began to change. "To get rich is glorious," said Deng Xiaoping. "Perestroika," said Gorbachev. And now they're all at it. Indians, Brazilians, Turks, Indonesians - they all have faster growth rates and much less debt than the developed countries. China and Turkey are both growing about 5 times faster than the US. India, Brazil and a dozen other countries aren't far behind. The latest test scores show Chinese math students in Shanghai far ahead of Americans. And the latest reports tell us Chinese trains are setting records - at 300 mph. Nothing is off limits. No industry is safe. Nobody can expect a free lunch forever. In India, we rode in a Nano, the car Tata Motors is selling for $2,500. It was a little loud...but surprisingly spacious and comfortable. For getting around town, it seems perfectly adequate. And soon it will be available in the US. How will Detroit compete with these guys on the low end? And on the high end, there's plenty of competition too - from Japan and Germany. "But wait...Germany is a mature economy too." Well, yes...and no. Germany's factories and infrastructure were flattened in WWII. It had to rebuild from the bottom up. Its post-war government was completely new. Its currency just came out less than 10 years ago. Besides that, a large piece of present-day Germany lived under the heel of the Soviets for 45 years. They had a close-hand look at what central planning can do to an economy. America's government, meanwhile, has been in business since 1776. Its economy has been the biggest in the world for the last 110 years. It was the only major combatant in WWII to come out the other end with its wartime plant and equipment intact. It has had the world's richest people and the most gold for many years. "Nothing fails like success," is one of our Daily Reckoning dicta. Will it fail now, or later? We don't know. But readers are urged to get out more...and draw their own conclusions. And more thoughts... The news yesterday was all about the tax deal. Did President Obama drop the ball completely? He was against extending the tax cuts. How come he caved in? Will he alienate his voter base? Or did he just pull a fast one on the Republicans? The tax cuts/unemployment benefit extension deal is a kind of "stealth stimulus," say some commentators. It will stimulate the economy, with no need for another vote on Capitol Hill. The Tea Party people were dead set against any further stimulus. But there it is. "Obama tax move lifts hopes for growth," says The Financial Times. It will even eliminate the need for more QE, said one hopeful commentator. The dollar will be stronger as a result. Stocks went up 13 points on the Dow yesterday - nothing at all, in other words. But gold fell $25. But so far, bonds are telling us a different story. Yields on the 10- year T-note are over 3% - at 6-month highs. The feds have pledged to buy more than $800 billion worth of government bonds. And still prices go down. Go figure. What we figure is that investors are wary. At least a fair number of them must be thinking what we're thinking - that the authorities don't know what they're doing...that they are going to lose control of inflation...and/or that the economy is going to collapse despite all their stimuli and money printing. The effect of the tax deal (assuming it is passed) will be to increase government spending and lower government revenues. That will produce a federal budget deficit, according to official sources, of more than 8%. Meanwhile, the states are looking at huge deficits of their own. With muni bonds falling, they will have a hard time raising more money and may be pushed into bankruptcy - roughly the same drama that is on the European stage. While bonds fall, commodities soar. "Investors pile into commodities," says The Wall Street Journal. Hmmm... They must be worried about inflation...or maybe they're just speculating. It looks to us as though the feds are creating yet another bubble. It's a set-up, dear reader. Watch out for commodities and stocks. And oh yes, watch out for bonds too. *** Except for the very old, Americans have generally lived pretty easy, comfortable, safe, and prosperous lives. "That's why this downturn will be worse than the Great Depression," says a particularly gloomy friend. "Americans are not prepared for adversity. During the Great Depression, most people still lived on farms. They heated their houses with wood they cut themselves. They grew their own vegetables. They canned their own fruit. They raised their own hogs. They knew how to survive. "That's not true today. We don't know what would happen in a major crisis. But people are not ready for it. They depend on the system...the cash machines and grocery stores...and the unemployment compensation and food stamps. I don't think they could stand it if theses things break down." Regards. Bill Bonner. Similar Posts: |

| Any recommendations on what safe to buy? Posted: 09 Dec 2010 12:10 PM PST Greetings GIM! I've been an avid follower to the forum but more so as a silent reader. :p But I was hoping to get some advice on what safe is the best to buy? Size: L-XL Firesafe: Yes (preferred but not necessary) Price Range: $500-$600 Entry: Key/Combination (not digital) I have a small/medium sized Cobalt safe from "ValueSafes" an ebay seller but I'd like a larger one. I do not want a gun safe or any other safe where the handle sticks out. Probably best to have something larger that can bolt to the floor. Thanks in advance for your help! :biggrin: |

| Will Ron Paul Be Able To End The Fed? Posted: 09 Dec 2010 11:06 AM PST

And why shouldn't the Federal Reserve be fully audited? The Federal Reserve has more power over the U.S. economy than any other institution and yet it has not been subjected to a comprehensive audit since it was created back in 1913. So what would an audit accomplish? Well, it would hopefully expose what is going on inside the Federal Reserve. A very, very limited examination of Fed transactions that occurred during the recent financial crisis forced the Federal Reserve to reveal the details of 21,000 transactions stretching from December 2007 to July 2010 that totaled more than 3 trillion dollars. It turns out that the Federal Reserve was just handing out gigantic piles of nearly interest-free cash to their friends at the largest banks, financial institutions and corporations all over the globe. These revelations have many members of Congress wondering what else has been going on inside the Federal Reserve. For example, U.S. Senator Bernie Sanders was absolutely outraged by these "backdoor bailouts" by the Federal Reserve....

More members of Congress than at any other time in recent memory are openly wondering if it is now time "to pull back the curtain" at the Federal Reserve. For those who would like to see the power of the Federal Reserve greatly diminished, there should be one primary goal right now. Expose the Federal Reserve. The truth is that the more the American people learn about the Federal Reserve and about what it has been doing the more they disapprove. During his farewell speech on the floor of the U.S. Senate this week, Senator Jim Bunning noted that as the American people become increasingly aware of what the Federal Reserve is doing the less they like it....

Unfortunately, the views of Ron Paul and other anti-Federal Reserve members of the Tea Party movement are strongly opposed by many other members of the Republican Party. In a recent Bloomberg Television interview, Barney Frank noted this division within the ranks of the Republicans....

However, there is evidence that the tide is turning with the American public. According to a recent Bloomberg National Poll, the number of Americans that would like to see the Federal Reserve held more accountable or even completely abolished is increasing....

Those are very exciting numbers. A majority of Americans now want the power of the Federal Reserve to be reduced or they want it shut down entirely. If Ron Paul is able to get a comprehensive audit of the Federal Reserve passed, the revelations that would come out of that would certainly turn public opinion against the Fed even more. So what is so bad about the Federal Reserve? Well, think of it as a perpetual debt machine. Did you know that the U.S. national debt is 5,000 times larger than it was a hundred years ago? That's right - back in 1910, prior to the passage of the Federal Reserve Act, the national debt was only about $2.6 billion. Since that time, our debt has been endlessly skyrocketing. Under the Federal Reserve system, the U.S. government cannot just go out and print money. It is actually the Federal Reserve that issues our currency. The way our system works, whenever the U.S. government arranges for the Federal Reserve to issue more currency, more government debt is created at the same time. In fact, as I have written about previously, all of our money is now based on debt. No debt, no money. What we desperately need is for the current monetary system to be scrapped. The federal government should take back the power to issue currency and should implement a new system based on money that is debt-free. The truth is that it is insane that any sovereign government should have to go into debt just to produce more of its own currency. Instead, what we have under the Federal Reserve system is a money supply that will forever be expanding, a currency that will forever be deteriorating in value and a national debt that will continue to skyrocket until the entire system collapses. Since the Federal Reserve was created in 1913, the U.S. dollar has lost over 95 percent of its purchasing power. This continual debasement of our currency is called "inflation" and it is a hidden tax on every man, woman and child in the United States. It is absolutely guaranteed that every single dollar that you own will go down in value over the long-term. But the American people have come to accept that a constantly expanding national debt and a currency that is constantly losing value is the most "rational" economic system that humanity has ever come up with. So who benefits from all this? Well, for fiscal year 2010 the U.S. government paid out over 413 billion dollars in interest on the national debt. In future years that number is projected to rapidly skyrocket even more. Wouldn't you like to be getting a nice chunk of that 413 billion dollars? It turns out that loaning money to the U.S. government is very, very profitable. That 413 billion dollars is money that was transferred from the American people to the U.S. government, and then transferred from the U.S. government to big financial institutions, foreign countries, and very wealthy bankers. So what did we get in return for our 413 billion dollars? Nothing. Sadly, this is not just going on in the United States. This is going on literally in almost every nation on earth. All over the world sovereign governments are drowning in debt and so they have to drain their citizens dry so that they can meet their obligations. In the book of Proverbs, it tells us that "the rich ruleth over the poor, and the borrower is servant to the lender." Americans like to think that they live in "the land of the free", but the truth is that we have become enslaved to debt. But even worse, we have consigned our children and our grandchildren to a lifetime of debt. They will have to work all of their lives to pay trillions of dollars in interest on all of the debt that we have accumulated in this generation. How would you like to be born into a world where the previous generation had racked up a $13 trillion debt that now you were expected to pay off? There is a reason why people like Ron Paul are so obsessed with the Federal Reserve. It is not because they don't have anything better to do. It is because the future of our country literally hangs in the balance. Throughout American history, presidents, top members of Congress and leading business people have warned us about the dangers of having a central bank. In fact, even though our young people are no longer taught this, the debate over central banking was one of the most important themes in early American history. But we didn't listen to the warnings. We were convinced that we knew better. Well, now we have an economic system that is dying and a $13 trillion debt that we are passing along to our children and to our grandchildren. Perhaps we were not as smart as we thought we were. |

| Welcome Hathor Exploration to the GGR Stable Posted: 09 Dec 2010 10:24 AM PST Both gold and silver seem to have stabilized this afternoon. We note the gold/silver ratio doggedly clinging to a nicely low 48 handle, with gold in the $1,380s and silver in the $28.70s as we write. If we are reading the signals correctly, such as the flat HUI and only slightly weaker to flat readings on the small miner indexes, the precious metals markets are content to take a small breather ahead of the weekend. |

| Posted: 09 Dec 2010 10:00 AM PST Thoughts on gold, emerging markets and global infrastructure. A few excerpts from an interview. |

| Replacing Dollar Reserves with Gold Posted: 09 Dec 2010 10:00 AM PST The present world reserve currency, the US dollar, is showing growing signs of weakness and the instability of the value of dollar reserves is creating tensions around the globe. The truth is that gold possesses a great advantage over the dollar. |

| Gold Consolidates, Targets €1,100/oz on Euro Risk Posted: 09 Dec 2010 10:00 AM PST Most currencies fell against gold yesterday and again today as the euro and dollar are under slight pressure. Both gold and silver look set to finish the week slightly lower in dollars and most currencies other than the euro. |

| Eric Sprott on Silver, Sprott Asset Management Posted: 09 Dec 2010 09:42 AM PST Regular Markets at a Glance readers may have wondered why we remained so silent on the subject of silver over the last several months. Considering the significant exposure we have to silver as a firm, we can assure you that it wasn't for lack of desire to share our views, but rather due to strict solicitation restrictions imposed on us by the cross-border listing of Sprott Physical Silver Trust (PSLV) this past October. It therefore gives us great pleasure to finally share our views on silver with you. We have included two separate articles in this issue of Markets at a Glance: the first was written back in June 2010, and contains the information we used in the prospectus for the PSLV. The second is an update article written this past month that discusses new developments in the silver market and confirms our views on the metal. We urge you to read them both in order to understand our investment thesis for silver, and we hope they compel you to take a much closer look at silver as a long-term investment. Silver's dramatic rise over the last two months is no fluke - it's the result of a compelling supply/demand dynamic within a unique market structure. We hope the following articles convey our enthusiasm for "the other shiny metal" as an exceptional investment opportunity. The Silver Lining, (June 2010) By: Eric Sprott & David Franklin No matter how complex our financial system becomes, the economic axiom of supply and demand will still apply. If the demand for an asset outstrips supply, the price of that asset will appreciate. The challenge in finding supply and demand imbalances in today's market often lies in judging the quality of market data available – it frequently isn't even close to being accurate. If the numbers don't show the imbalances, it's tough for investors to determine if the market price accurately reflects the market dynamics. Nowhere is this more prevalent than in the market for silver. While gold dominates the headlines, the silver market actually enjoys a superior fundamental supply/demand story than that for gold, although you'd never know it based on the silver demand statistics from the major reporting services. As students of the precious metals markets we monitor the numerous metals reporting services very closely. According to those services, the silver market has enjoyed a stable supply/demand balance for almost ten years now. If that's the case, why has the price of silver appreciated from $5 to $19/oz over that same time period? Is the reporting services' data on the silver market truly reflective of silver's underlying fundamentals? Although there are several reporting services for silver market information, GFMS Ltd. and The Silver Institute are the most often quoted sources for silver market data. While they provide statistics for both silver supply and demand, it is their neglect of the "investment" demand category that we find problematic. GFMS and The Silver Institute use a category called "implied net investment" to capture the demand for physical silver from institutional and retail investors. The definition for "net investment" as defined by GFMS is "the residual from combining all other GFMS data on silver supply/demand…As such, it captures the net physical impact of all transactions not covered by the other supply/demand variables."1 In other words, it is not an observed figure. GFMS's "implied net investment" number doesn't include any observable demand for silver by ETF's and other reporting entities such as hedge funds - it is merely a plug used to balance the supply data for GFMS's and the Silver Institute's reporting purposes.2 As we delved deeper into the silver market, this realization prompted us to calculate our own investment demand statistic. We present our findings in Table A. While GFMS and The Silver Institute use an implied number, we calculated a real investment demand number using a handful of ETF's and two other large private investors, one of which is our own firm. Our demand metric is by no means complete or exhaustive - we only used seven sources of reported investment demand, and yet from our informal and incomplete survey we found that GFMS and The Silver Institute had underreported silver investment demand by at least 225 million ounces! This shortfall doesn't consider any other investors that may have bought silver over the past year, so real demand for silver could be multiple times higher. Given its seemingly evident market imbalances, you might wonder why silver hasn't performed better over the last year. The answer, we believe, lies in the way silver is priced. The silver spot price is dictated by paper contracts that trade on the COMEX exchange in New York. Paper contracts can be purchased "long" or sold "short". If more participants sell "short" than purchase "long", the paper market price for silver will decline. Often these contracts have little to no relationship with actual physical silver, and yet they are the most influential contract in determining silver's physical spot price. Go figure. In studying the silver market we owe a great debt to the work of silver analyst, Ted Butler. Mr. Butler has been writing about the silver market for fifteen years and has done much to inform investors about the reality of silver's physical fundamentals. Butler provides some insight into the "short" positions that exist in silver today, highlighting the fact that the eight largest silver traders currently hold a net short position of over 66,000 contracts, representing more than 330 million ounces of silver.11 This means that the eight largest COMEX traders are net short the equivalent of 48.5% of the world's total annual silver mine production of 680.9 million ounces. None of these traders are in the silver business by the way – they're all financial institutions. In addition, the COMEX silver short position held by the eight largest traders on May 3, 2010, represented 33% of total world silver bullion inventory, estimated by Butler to be approximately one billion ounces. There is no real comparison with gold, as the 24.5 million ounce concentrated net short position held by the eight largest traders represents a mere 1.2% of the 2 billion+ ounces of world gold bullion inventory as reported by the World Gold Council.12 So in comparison to total world bullion inventories, the concentrated short position in silver is 27 times larger than that for gold. In every comparison possible, the short position in COMEX silver contracts is off the charts, and if you think the short positions sound potentially disruptive, you're not alone. In September 2008 the CFTC confirmed that its Division of Enforcement has been investigating complaints of misconduct in the silver market. This investigation is ongoing and we look forward to its resolution.13 Because we believe the demand for precious metals will continue to increase in this environment, we're always interested to know the total supply available in today's physical bullion market. According to the best estimates from the USGS and current mining statistics, approximately 46 billion ounces of silver have been mined since the dawn of civilization.14 In comparison, approximately 5 billion ounces of gold have been mined throughout history.15 Reading this, a casual observer might conclude that gold is currently justified in being worth more than silver based on its relative scarcity. But the current price discrepancy ($1,250/oz gold vs $19/oz silver) is misleading. As mentioned above, there are only 1 billion ounces of silver left above ground in bullion form today. That is a surprisingly small number in relation to the 46 billion ounces mined throughout history. The reason is due to silver's consumption in manufacturing. Just like other industrial minerals, silver has been consumed in various processes over the course of history. Silver's superiority in heat transfer, conductivity and light reflectivity make it unique, and it boasts anti-microbial properties that make it ideal for surgical instruments, clothing materials and certain medical applications. The key point to remember with all these applications is that once the silver is consumed it is typically never recycled. Many of its industrial applications require such small amounts in each surgical tool, electronic device or clothing item that it isn't economic to recover from garbage dumps. For comparison, there are currently approximately two billion ounces of gold above ground in bullion form compared with the 5 billion ounces of gold mined throughout history.16 So despite being more heavily mined over time, silver bullion is now the more scarce "precious" metal than gold bullion is from an investment supply perspective. This is where the silver story gets interesting for us. At today's prices you have $19 billion dollars of silver ($19 x 1 billion ounces) and $2.5 trillion dollars of gold ($1250 x 2 billion ounces) above ground in bullion form. The size of the investment market for gold is therefore 131 times larger than that for silver. And yet, on a market relative dollar basis, investors are actually buying more silver than they are gold today. At today's metals prices, in dollar terms, the US mint has sold approximately three times more value in gold than in silver thus far in 2010 coin sales. But there should be 131 times more gold sold than silver for the market to stay in balance. None of the largest gold and silver investment vehicles reflect the 131:1 ratio, suggesting that investors have a disproportionately large interest in owning physical silver. For example, the largest gold ETF today, the SPDR Gold Trust ("GLD"), is currently ten times the dollar value of the largest silver ETF, the iShares Silver Trust (SLV). Since the SLV began trading in April 2006, the GLD has increased by $8 for every $1 increase in SLV's NAV. Again, given the choice, investors are voting with their dollars and putting disproportionately more dollars into silver than gold from a relative market size perspective. It appears that no investors are anywhere close to buying 131 times more gold than silver, which market metrics would suggest if the demand for gold and silver were relatively equal – all of which brings us to silver's 'supply conundrum': If on the supply side, as Ted Butler calculates, there are only one billion ounces of silver left in bullion form available for investment; and if, on the demand side, we were able to identify the holders of 500 million ounces spread across a mere seven investors - it implies that there is only 500 million ounces of silver left for everyone else to invest in! As large holders of silver bullion ourselves, we can tell you that 500 million ounces is not that much from a global perspective, and certainly won't be enough to satiate the world's investment demand for silver going forward. Also let us not forget the large silver short position on the COMEX that will almost undoubtedly require the purchase of 330 million ounces of silver to eventually cover. Assuming that happens, most of the silver available for investment will essentially already have been spoken for. It also serves to mention that there will be no government silver stocks capable of covering this impending supply shortfall. According to the latest audit, the US treasury currently has 7,075,171 oz of silver in storage, which is about enough to handle two months of silver eagle coin production. If the COMEX silver short sellers are ever forced to cover, they won't be able to lean on the government for a physical bailout.17 Judging by the numbers above, if hedge funds or any other large investor ever decided to invest in the physical silver market with the same voracity as they did with gold, the silver price could potentially explode. The existing silver inventory at COMEX is currently worth a little more than $2 billion at today's silver price. We already know that high-profile hedge fund managers like Soros, Paulson and Einhorn have gold holdings with a total value of over $5 billion.18 If that same purchasing power was ever applied to the silver market, we could potentially witness a dramatic rise in the silver price and an effective clearing of all the physical silver in the COMEX inventory. It deserves mention that the SPDR Gold Trust ("GLD") added almost $5 billion dollars worth of gold in the last month alone, and it would take less than half of that GLD gold investment to wipe out the entire silver COMEX inventory. The bottom line for us is that silver appears to be a fantastic investment today. Limited supply, strong demand and a potential buyer of almost half of one year's global mining silver output make a great case for owning silver in physical form. Based on our calculations, it appears that the silver investment demand statistics published by GFMS and The Silver Institute are highly misleading at best. We believe the investment demand for silver is multiple times higher than that published, and given the outrageous short position in silver on the COMEX, coupled with the unsustainable buying ratios relative to gold, the case for physical silver is simply outstanding. As the expression goes, "every cloud has a silver lining". Notice it isn't a gold lining or a platinum lining. In the silver market, the cloud has been duly represented by poor estimations of investment demand coupled with large outstanding short positions. That cloud will soon lift, revealing a "silver lining" that is far more valuable than it is today. |

| Posted: 09 Dec 2010 09:41 AM PST All that Glitters is Silver (November 2010) By Eric Sprott & David Franklin: In the four months since we filed the prospectus for the Sprott Physical Silver Trust on July 9, 2010, the silver price has rocketed up 54%, bringing its year-to-date return up to a stunning 68% (!!). Silver has now outperformed all of the other eighteen commodity components that comprise the CRB Commodity Price Index on a year-to-date basis. Silver has been the indisputable star of 2010, and we have been very long the physical metal in many of our mutual funds and hedge funds. Silver's performance since June has been influenced by a number of factors. The first and arguably most significant development took place on October 26, 2010 when comments were released by Bart Chilton of the Commodity Futures and Trading Commission (CFTC). The CFTC is the US government agency that supposedly regulates the US futures and options markets. While the CFTC has technically been "investigating" the silver market since 2008, it had revealed nothing about its findings for over two years. Everything suddenly changed when Mr. Chilton, a CFTC Commissioner no less, publicly stated that, "I believe that there have been repeated attempts to influence prices in the silver markets. There have been fraudulent efforts to persuade and deviously control that price. Based on what I have been told by members of the public, and reviewed in publicly available documents, I believe violations to the Commodity Exchange Act (CEA) have taken place in silver markets and that any such violation of the law in this regard should be prosecuted (emphasis ours)."1 These comments quickly triggered a flurry of lawsuits against the purported manipulators and set the silver market on fire. There are now no less than four lawsuits seeking class action status. They all allege that JP Morgan Chase & Co. and HSBC Securities Inc. colluded to manipulate the silver futures market beginning in the first half of 2008. The suits claim that the two banks amassed massive short positions in silver futures contracts that they had no intent to fill in order to force silver prices down for their furtive benefit. The suits also describe two 'crash' events that were set in motion by JP Morgan and HSBC, one in March 2008, and the other in February 2010, after the defendants had amassed large short positions. The suits allege that COMEX silver futures prices subsequently collapsed to the benefit of both banks in the wake of these events.2 The fallout from these accusations has undoubtedly increased the investment demand for silver, and it serves to remember, as we highlighted in the previous article, that investment demand was already understated by at least half by the major silver reporting agencies. It will be hard for them to downplay the recent demand increase, as the volume of silver contracts traded on the COMEX market on November 10th set a new record, surpassing the previous record set in December 1976 by 57%!3 This increase actually forced the CME Group to increase the margin requirements for COMEX silver futures twice in one week in order to maintain some semblance of market order.4 Silver coin sales as reported by the world's major mints have also been exploding since Chilton's comments were made. The US Mint, The Royal Canadian Mint, The Austrian Mint and The Perth Mint are all reporting record or near record sales of silver coins.5 The silver Eagle produced by the US Mint set three new records at various points in November: best annual sales, best silver Eagle mintage, and best ever month.6 Money is pouring into silver in all forms, and due to silver's relatively small market size, this capital inflow is having a huge impact on the silver spot price. As we outlined in our Sprott Physical Silver Trust prospectus and our June MAAG article, the physical silver market is surprisingly small in US dollar terms. The CPM Group estimates that above ground stocks of physical silver total 1.184 billion ounces in bar and coin form, implying a total silver market size of a mere US$33.15 billion dollars.7 At the end of 2009, approximately 500 million ounces of that 1.184 billion were already accounted for by the silver ETF's and other large holders. This left approximately 684 million ounces of silver available for sale in 2010. That is hardly enough, in our opinion, to satiate demand. The money flows into silver in November 2010 have been staggering. Consider the investment demand generated from only two sources: the iShares Silver Trust ETF (SLV) and US Mint coin sales. The SLV added approximately 18 million ounces of silver in November alone; the US Mint sold 4.2 million ounces of silver coins. If you multiply these amounts against today's silver price of $28, money is flowing into the silver market at an annualized rate of $7.5 billion dollars! At that rate of demand, it won't take long before all the remaining above ground silver is spoken for. Silver's demand profile may also benefit from the outrageous short position that exists in the silver COMEX market. The current 'open interest' in silver COMEX contracts totals an approximate 871 million ounces (!!!).8 This means there are paper contracts for over 871 million ounces of silver that have someone betting 'long' and someone else betting 'short'. In the event that the 'longs' choose to take physical delivery, there will not be enough silver to supply each buyer. It's simple math - with only 684 million ounces of silver available above ground, there won't be enough silver to go around. And considering the rate with which people have been purchasing coins and silver bars this past month, there may not even be enough physical to satiate regular spot buyers, let alone futures market participants. Considering all the recent developments in the silver market, it seems unlikely that the silver price will stay under $30/oz for long. The large quantity of money flowing into silver from investors, combined with the potential demand from those who are 'short' silver that they do not own, will likely end up swamping the physical silver market entirely. As our dear friend, Marc Faber, espouses in his book "Tomorrow's Gold", an investor can do very well by only making a few good investment decisions over his or her career. The trick is to make one good investment decision every decade or so, based on trends that will last a number of years.9 In our view, owning physical silver and the associated stocks represents that type of investment opportunity today. If that seems too simplistic, consider that in October 2001 we wrote an article that identified the investment of the last decade. It too was just a simple metal. The article was entitled "All that Glitters is Gold", and it was written when gold was still considered a relic in financial circles. We believe silver will be this decade's gold, and judging by the recent price action, it's already off to a great start. |

| Gold and Silver Rise/bonds rise fractionally. Posted: 09 Dec 2010 09:23 AM PST |

| High Long Bond Yield Good News for Gold Holders Posted: 09 Dec 2010 08:40 AM PST The Financial Times brought up the interesting point that because bond prices are so insanely high (making bond yields so preposterously low), a one-percent change in yields would negatively impact the prices of bonds much more than a one-percent change if bond yields were higher, which I assume means in the normal 3-6% range. Of course, this is just the simple arithmetic of relative percentage moves, and as such is of absolutely no interest to those of us who are not looking for easy math problems to solve, but only looking for the Easy Road To Riches (ERTR), which turned out to be to buy gold, silver and oil as a defense against the disastrous inflation in prices, and a Fabulous Money-Making Opportunity (FMMO) when thus capitalizing on it, when the evil Federal Reserve was massively and consistently increasing the money supply, and especially so when the evil Federal Reserve is creating more enormous amounts of new money to buy government bonds from someplace after a lot of banks, bankers and assorted middlemen get their cut, and "doubly especially so" when the purpose of the whole stinking, corrupt exercise is to finance monstrous amounts of government deficit-spending! I was hoping that a financial publication would want to feature me by picking up on this FMMO idea of mine to buy gold, silver and oil when the Fed is acting so treacherously, how this FMMO has made spectacular returns over the last decade, and how it is such an idiot-proof investment that even a lazy idiot like me can make Plenty Mucho Money (PMM) by merely brainlessly betting on the fool-proof, sure-fire, guaranteed inflation in prices that comes from such staggering increases in the money supply. And 4,500 years of history backs my play, too! Secretly, of course, I was hoping that Rolling Stone would beat them to the punch and choose to put me on the cover! Wow! My main reason is that my résumé (which I may soon be needing), in the section labeled "Other accomplishments," currently lists "None." How embarrassing! If this Rolling Stone thing works out, I would be able to include on my résumé, "Chosen by Rolling Stone magazine as The Best Freaking Investment Advisor In The Whole Freaking World by merely recommending only gold, silver and oil, an article replete with candid photos of me lounging around the house, chasing stupid neighborhood kids off my lawn and that kind of stuff." Apparently, I am missing the point with all of this talk about how gold, silver and oil will go up because the filthy Fed is creating so much inflation. The point is, according to Morgan Stanley, that huge losses are looming, and "a one percentage point jump in 10-year Treasury yields could wipe roughly $1.6 trillion off US bond market value. If the yield rises three percentage points, bond market value drops by $4.7 trillion." What they don't mention is that this massive $4.7 trillion loss is actually better than the $4.8 trillion loss you would expect from merely trebling the $1.6 trillion loss for the first percentage point, which is the arithmetic that we so blithely ignored at the beginning of this essay, proving once again that being stupid and lazy is costly. And bonds are sure to go up, as, for example, Mark Lundeen of Lundeen's Long-Term Market Trends newsletter writes "look at the recent 28% loss of principal in the February 2036 long bond, as the yield increased from 2.6% to 4.55%." So how much money was lost with a recent 2% rise in yields? Yow! And it gets Much, Much Worse (MMW) going forward, if history is any clue, as it inspires Mr. Lundeen to remark, "Before this bear market is over, I expect the old 1981 highs of 15% for US long bond yields to be exceeded." This 15% yield on the long-bond is Good, Good News (GGN) because it is at this point that gold will be selling near its high, whereupon we gold-bugs will sell our gold and buy bonds at their lows, reaping a fabulous yield to sustain us in the years to come as our wealth increases with the rising prices of our bonds as the economy slowly recovers over the years. In the meantime, of course, the only thing I have going for me is that the Fabulous Money-Making Opportunity (FMMO) inherent in buying gold, silver and oil when the Federal Reserve is creating so much money while I wait for 15% yields on the long-bond, which is so obvious and easy that I shout, "Whee! This investing stuff is easy!" The Mogambo Guru High Long Bond Yield Good News for Gold Holders originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Gold Seeker Closing Report: Gold and Silver Gain Almost 1% and 2% Posted: 09 Dec 2010 07:12 AM PST Gold climbed over $10 to as high as $1392.30 in Asia before it fell back to see a $0.95 loss at $1380.65 in London and then rallied to a new session high of $1394.00 at around 10AM EST ahead of another dip back to almost unchanged by late morning in New York, but it then climbed back higher in late trade and ended near its earlier high with a gain of 0.72%. Silver rose to $28.783 in Asia and fell to $28.345 in London before it also rallied back higher in New York and ended not far from its midmorning high of $28.99 with a gain of 1.91%. |

| Posted: 09 Dec 2010 06:57 AM PST :thumbs_up::thumbs_up::thumbs_up::thumbs_up::thumb s_up: |

| Posted: 09 Dec 2010 05:35 AM PST

Mercenary Links Roundup for Thursday, Dec 9th (below the jump).

12-09 Thursday

~  ~

|

| Posted: 09 Dec 2010 04:23 AM PST As precious metals investors, it can often seem to us that the U.S. government (and the banking cabal which pulls its strings) is exclusively focused on suppressing gold and silver prices – given the historic role of precious metals as a "barometer" of economic conditions, especially inflation. However, there is a different commodity that this group obsesses about to a far greater degree than precious metals: oil. The United State's enormous dependency on imported oil translates directly to enormous economic vulnerability. Indeed, U.S. paranoia about "securing" oil supplies for itself has been the driving force behind most (if not all) of the wars it has instigated in the Middle East. The U.S. dependence on petroleum goes well beyond simply the massive amounts that is spent each year by the U.S. to satisfy its oil-gluttony. Cheap oil is the essential input needed to operate the "levers" of U.S. military/economic imperialism, as well as the foundation upon which the entire U.S. domestic economy is built. Let me summarize this dependence briefly. By itself, the U.S. military is one of the ten largest oil-consuming entities on the planet. In other words, operating the U.S. war machine by itself consumes more oil each year than all but a handful of nations. Thus, the death, destruction, and misery that the U.S. military has inflicted upon its victims over recent decades is accompanied by the horrendous waste of countless billions of barrels of our most precious natural resource. In this respect, high oil prices are a "blessing" to much of the world, as the hopelessly insolvent U.S. government is totally incapable of financing any more "military adventures", now that the era of cheap oil is gone forever. Indeed, we can only assume that Iranian defiance to the U.S. regarding its nuclear program is based upon their firm conviction that any military harm which the U.S. could inflict upon Iran would pale in comparison to the economic harm it would inflict upon itself from such an attack. Thus, we know the #1 reason why the U.S. is vainly attempting to keep a lid on oil prices: having a "big stick" is of little use if you're never able to use it. The U.S. military is but one facet of the U.S. empire totally dependent upon cheap oil. Of near-equal importance is the need for cheap oil in order to pursue its agricultural imperialism. Roughly two decades ago, the U.S. government made a conscious decision to abandon most manufacturing activity – with the exception of the industrial and hi-tech sectors which service the U.S. war-machine. Replacing manufacturing as the foundation for the U.S. economy is agriculture. The "World's Only Superpower" has chosen to become a "banana republic". Indeed, on the last major, U.S. trade mission to India, the big "success" of that endeavour was being able to increase U.S. soya bean exports to India. Around the world, the story is the same. Where U.S. consumer manufactured goods used to flood the markets of countries all over the Earth, agricultural products now take their place – heavily subsidized agricultural products. U.S. agricultural imperialism is based upon first injecting massive subsidies (in excess of $100 billion per year) into its crop production. These heavily subsidized food items are then dumped into markets in every continent on the planet. For the other, wealthier economies, this extreme U.S. subsidization is met with competing subsidies. Indeed, for many years the U.S. and Europe have been locked in an endless exchange of dueling subsidies. For the less-wealthy nations, however, matching U.S. subsidies for its agricultural products is economically impossible. These nations have been forced to watch helplessly as the massive quantities of subsidized U.S. agricultural products bankrupted millions of small farmers all over the world – and severely depressed agricultural production. Thus, at the same time that rising per capita incomes in developing economies is spurring an enormous increase in demand for agricultural products, we have the U.S. government engaged in a predatory campaign which has crippled numerous economies, in addition to creating crop-shortages through depressing global production. |

| Swiss bank client cant get his silver back two months after asking Posted: 09 Dec 2010 03:19 AM PST GATA |

| Is The Herd Trading Gold and SP500? Posted: 09 Dec 2010 01:27 AM PST GoldandOilGuy |

| Why the Eurozone and the Euro Will Not Collapse - But Will Change Posted: 08 Dec 2010 08:27 PM PST Gold Forecaster |

| Gold Down 2.8%, Silver Off 7% from Record Highs… Posted: 08 Dec 2010 04:29 PM PST Bullion Vault |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment