saveyourassetsfirst3 |

- The Silver Shortage Pre-panic Line

- Top Performing ETFs and Sectors in 2010

- Friday Options Briefs: UUP, FTI, ZRAN, NDAQ

- Western Economic Foundations Rotten To The Core

- Fed Critics Go Mainstream

- Arrhythmia Research Technology's Fortune Tied to Silver Fluctuations

- iShares Launches Short-Term TIPS Bond Fund (STIP)

- The Red Dragon turns Golden – Chinese Gold demand explodes

- HK gold market hit by fake gold

- Precious Metals Ready to Break out on Chinese Demand, Korean Tension and Currency Risk

- Pimco's Bill Gross: "The U.S. needs to make things, not paper"

- Nassim "Black Swan" Taleb: Ben Bernanke is "beyond unwise, he is immoral"

- An unexpected development could send silver higher than anyone imagines

- WATCH: Bernie Sanders – Top 1% earns 23.5%

- Grain Down on Dollar Rise

- Expect Extremely Bullish Action in Mining Shares: James Turk

- Expect Extremely Bullish Action in Mining Shares

- Want JP Morgan to crash? Buy Silver

- Lots of fake gold shows up in Hong Kong

- Why Eric Sprott sees silver as the next big investing windfall

- Adrian Day: Another QE Blast Can’t Kill Commodity Boom

- China Gold Imports Increase Five- or Six-fold

- Counterfeit Gold Coin?

- Gold Sits Tight as Chinese Imports Jump on Negative Real Rates…

- Depleting Faith in Currency to Drive Gold Bull Run

- Gold will head to 1480-1525 before a major correction

- Wealth You Can Wear

- Implications of China and Russia Dropping the Dollar

- Why You Need to Get Long Silver Immediately

- The Big Fix

- The Inter-Galactic Bailout Fund

- The Pain in Spain…and in Ireland

- Trillions In Secret Fed Bailouts For Global Corporations And Foreign Banks – Has The Federal Reserve Become A Completely Unaccountable Global Bailout Machine?

- China Imports Massive Gold

- China Imports Five Times More Gold

- Risks & Demand Pushing Metals Higher

- Still About the Dollar

- Gold Seeker Closing Report: Gold and Silver Gain With Stocks Again

- Can You Keep a Secret? - New Free Shares Watch

- Why Governments Will Buy Silver

- Economic Ruination in Three Words or Less

| The Silver Shortage Pre-panic Line Posted: 03 Dec 2010 05:50 AM PST For years we have heard of the coming silver shortage but somehow price was always contained and was a wild swinging commodity. But that changed last spring when allegations of silver manipulation made it to mainstream internet sites and became a focal point of testimony by Bill Murphy of GATA to the CFTC in early spring. | ||

| Top Performing ETFs and Sectors in 2010 Posted: 03 Dec 2010 05:00 AM PST Chris Mack submits: Contrary to popular opinion the inflation trade came back with a vengeance in 2010. Year to date, the ultra silver ETF (AGQ) ranks as the highest performing ETF up 88 percent. Second place? Cotton, up 65 percent. The silver mining ETF (SIL) went public in the summer, so it is at a disadvantage when comparing year-to-date returns. Using its holdings to project year to date returns it would have been the second best performing ETF up about 81 percent year to date. Complete Story » | ||

| Friday Options Briefs: UUP, FTI, ZRAN, NDAQ Posted: 03 Dec 2010 04:46 AM PST Andrew Wilkinson submits: PowerShares DB US Dollar Bullish Fund (UUP) – A sea change in attitude toward the dollar following today’s weaker-than-expected employment report inspired one options player to cut and run from a large bullish position in the US Dollar Bullish Fund this morning. Shares of the UUP, an exchange-traded fund that tracks the performance of the dollar index, are down 1.00% to arrive at 22.93 just before 11:30 am. It looks like the trader originally purchased a massive position in March 2011 24 strike calls to gain exposure to a rising dollar, or alternatively to defend against dollar appreciation, ahead of the Fed’s decision to roll out a second round of quantitative easing. The investor appears to have purchased 105,500 calls at the March 2011 24 strike back on October 27, 2010, at a premium of $0.34 apiece. Since the calls were purchased, the fund rose approximately 3.8% from 22.65 up to this week’s high of 23.52. In hindsight, the trader would have been better advised to act ahead of Friday’s employment data release as he did when he initially purchased the calls ahead of the Fed announcement. Premium on the March 2011 24 strike calls stood at an average of $0.48 each on Tuesday when the UUP touched its intraweek high of 23.52. The plunge in the value of the dollar today combined with the adverse effects of eroding time value on the contracts pushed premium on the calls down significantly. The investor received just $0.24 per call option on the sale of all 105,500 contracts today. Net losses on the closing sale amount to $0.10 each. We do not know whether the options were tied to an underlying position or if the initial long call position was intended as a hedge against a strengthening dollar. These are important factors that would likely change the interpretation of the activity observed on the UUP this morning. FMC Technologies, Inc.(FTI) – Shares of the provider of technology solutions for the energy industry slipped 0.70% to $88.12 today, spurring one wary options market participant to construct a put spread in the December contract. The put player may be initiating an outright bearish bet that FTI’s shares are headed lower by expiration day, or may be utilizing the spread to protect the value of a long position in the underlying shares. FMC Technologies was cut to ‘hold’ from ‘buy’ at Dahlman Rose today, but analysts at Stifel upped their target share price on the stock to $97 from $75. FTI popped up on our ‘hot by options volume’ market scanner after the investor picked up 1,500 puts at the December $85 strike for a premium of $1.35 each, and sold the same number of puts at the December $80 strike at a premium of $0.40 apiece. Net premium paid to establish the spread amounts to $0.95 per contract. Thus, the trader responsible for the transaction makes money, or realizes downside protection, if FTI’s shares decline 4.6% to breach the effective breakeven price of $84.05 by expiration day in a few weeks. Maximum potential profits of $4.05 per contract are available to the put spreader should shares in FMC Technologies plummet 9.2% from the current price of $88.12 to trade below $80.00 by December expiration. Shares in FTI hit a new 52-week high of $89.00 on Thursday. Complete Story » | ||

| Western Economic Foundations Rotten To The Core Posted: 03 Dec 2010 04:40 AM PST I don't want to see gold reach $5,000/ounce. As a precious metals commentator, this may come as a shock to readers, or seem to be an open contradiction. It is neither. As I have written before, both I and others working in this sector don't "want" gold (and silver) to soar sky-high in price, we fear that gold and silver will go sky-high in price. There is a huge distinction here, yet most outside of this sector are completely oblivious to such logic. Going back a decade, to when the "old timers" like Jim Sinclair were already talking about much, much higher gold prices, these people didn't "boast" that gold and silver would soon move much higher in price, they warned people that this was about to happen. As writers in this sector explain on a regular basis, most of the price-appreciation of gold and silver is not an absolute increase in value, but simply a relative increase in nominal price – caused by the bankers' fiat currencies plummeting in value, due to excess money-printing, and even more excessive debts/deficits. When I and others talk about gold moving from its absolute bottom below $300/ounce to $5,000/ounce (and higher), what we stress over and over is that gold isn't in the process of becoming 20 times more valuable, but rather the banker-paper that we erroneously call "money" is in the process of losing 95% of its value. This prognosis excludes the U.S. – which is already certainly heading to hyperinflation, and a totally worthless currency. Yet living in the "best" of the major, Western economies – in Canada – I suffer absolutely no delusions that we are escaping the economic suicide that is recklessly pursued by the leaders of most of the other, even more debt-laden Western economies. Despite a prime minister who is a self-described "economist", Canada is arguably destroying its own fiscal foundation at an even more-rapid rate than most of the other debt-sinners. For readers outside of Canada: some brief history. During the 1980's, Canada's Conservative government (the infamous Mulroney regime) came very close to bankrupting Canada's economy – with the most grossly incompetent policies (and massive deficits) of any major Western economy. When they were finally dumped from office (after roughly tripling Canada's national debt in just eight years), the Liberal government which replaced them undertook what was (at the time) the harshest real "austerity" program in any Western economy since the Second World War. In just two years, they completely eliminated the record-deficits they inherited from the Conservatives, and then produced a decade of surpluses – the most dramatic, most impressive economic turn-around by any Western economy in a half-century. After the inevitable decay of a full decade in power, the Liberals were given "the boot" by voters, who naively assumed that the 'new-and-improved' Conservative party would somehow be different from its incompetent predecessor. They were wrong. While many "emerging market" economies have completely recovered from the Crash of '08, and are now once again steaming forward with budget surpluses, Canada continues to spiral downward. The new Conservative Prime Minister, Stephen Harper, has smashed the Mulroney records for deficits – after scoffing at the mere "possibility" of a deficit little more than two years ago. Canada's huge trade surplus is also gone – replaced with deficits. Canada's large current account surplus is also gone – replaced with record deficits. Despite sitting on one of the two or three largest pools of precious, natural resources on the planet (most notably oil), this fiscally retarded regime has absolutely no clue as to how to restore the economic prosperity that Canadians took for granted less than three years ago. And this is the best of the Western economies…or at least it was. | ||

| Posted: 03 Dec 2010 04:19 AM PST It's suddenly fashionable in the mainstream media not just to criticize the Federal Reserve but to question its reason for existing. Watch Bloomberg's clearly sympathetic take on the ascendancy of Congressman Ron Paul, who's most recent book is End the Fed: And here's an excerpt from a Wall Street Journal editorial by Cato Institute senior fellow Gerald O'Driscoll:

Some thoughts:

| ||

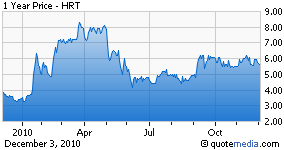

| Arrhythmia Research Technology's Fortune Tied to Silver Fluctuations Posted: 03 Dec 2010 04:13 AM PST Frank Voisin submits: Arrhythmia Research Technology, Inc. (HRT) develops medical software for analyzing the heart’s electrical impulses. Through its wholly owned subsidiary, Micron Products, Inc, the company manufactures and distributes conductive resin sensors used in the manufacture of disposable electrodes used in cardiograph equipment. It currently trades for a market capitalization of $16.6m (<$6/share), less than twice its net current asset value (NCAV) and below tangible book value, despite having a track record of zero losses over the last decade, shareholder friendly management (both dividends and share repurchases) and a product that has won numerous awards and inclusion in several prestigious studies, indicating the potential for an economic moat. Trading at nearly twice NCAV is too high to be justified on Benjamin Graham’s asset-based philosophy alone (where one would look for a discount to NCAV of approximately 1/3), so we have to look deeper and consider the Earnings Power (EPV) of the company. Using a three year average revenue rounded down to the nearest million (not a major adjustment in this case) and 10-year averages for operating expenses, we find a normalized earnings before interest and taxes (EBIT) of approximately $2.4million, ultimately leading to an EPV calculation from derived free cash flows of approximately $7.1, or nearly 20% above today’s price. This alone is not enough to justify a purchase, since there are several things working against this analysis and the company more generally. We notice immediately that $2.4million EBIT has not been achieved in four years, as the company has suffered a severe erosion in operating margins, predominately due to an increase in COGS from 61% in 2004 to 83% in 2009 (and similar figures for the three quarters of 2010). From this, we investigate whether the costs before goods sold (COGS) will decline to 10-year normalized levels, or whether we are seeing a secular change in the company’s operations. The company reports the following: Complete Story » | ||

| iShares Launches Short-Term TIPS Bond Fund (STIP) Posted: 03 Dec 2010 03:53 AM PST ETF Database submits: With another round of QE underway and strong demand for raw materials from emerging markets, inflation is once again on the mind of investors. Those looking to protect their portfolios from a surge in CPI have a number of options, ranging from gold to broad-based commodity baskets to equities of commodity-intensive companies. But among the most popular inflation hedges are TIPS, Treasuries that adjust principal amount based on changes in CPI. Demand for these securities has become so significant that in a recent TIPS auction the yield hit -0.5%. When seeking out TIPS exposure, investors have increasingly turned towards ETFs.

Complete Story » | ||

| The Red Dragon turns Golden – Chinese Gold demand explodes Posted: 03 Dec 2010 02:32 AM PST | ||

| HK gold market hit by fake gold Posted: 03 Dec 2010 02:27 AM PST FT | ||

| Precious Metals Ready to Break out on Chinese Demand, Korean Tension and Currency Risk Posted: 03 Dec 2010 01:25 AM PST gold.ie | ||

| Pimco's Bill Gross: "The U.S. needs to make things, not paper" Posted: 03 Dec 2010 12:10 AM PST From Investment Postcards from Cape Town: Bill Gross, co-founder and co-CIO of PIMCO, is to my mind one of the shrewdest money men around. His monthly Investment Outlook newsletter therefore always makes for thought-provoking reading. The following are a few excerpts from the December report: "The global economy is suffering from a lack of aggregate demand. With insufficient demand, nations compete furiously for their share of the diminishing growth pie. "In the U.S. and Euroland, many policies only temporarily bolster consumption while failing to address the fundamental problem of developed economies: Job growth is moving inexorably to developing economies because they are more competitive. Read full article... More from Bill Gross: Bond king Bill Gross loves these emerging markets Bond King Bill Gross: U.S. dollar set to get smashed Bond king Gross: Keep your eye on 10-year Treasurys | ||

| Nassim "Black Swan" Taleb: Ben Bernanke is "beyond unwise, he is immoral" Posted: 03 Dec 2010 12:06 AM PST From Newsmax: Nassim Taleb, the author and financial guru whose popular 2007 book The Black Swan predicted the current financial crisis, has strong words for Federal Reserve Chairman Ben Bernanke. Asked his opinion of the second round of quantitative easing put in place by Bernanke, Taleb flatly called the Fed chief “immoral” and called on him to stop using the savings of millions of U.S. retirees to subsidize a failed banking system. “I think that he’s taking a risk with other people’s money, and he’s trying to bail out those who made mistakes with retirees’ money,” Taleb said on CNBC. “Here we have... Read full article... More from Nassim Taleb: Nassim Taleb: Debt disease is killing the world economy Nassim "Black Swan" Taleb: Government bonds will collapse Nassim "Black Swan" Taleb: White House made the crisis much worse | ||

| An unexpected development could send silver higher than anyone imagines Posted: 03 Dec 2010 12:04 AM PST From SilverStrategies: Over the last several months we have been pondering if governments will come into the silver market. ... This same topic has been argued in the gold space for several years and now it has come to pass that central banks worldwide have thrown in the towel and became net buyers of gold. Should it be different for silver? By the way, did you notice how silver silently became mainstream again, and more and more headlines now read, "Gold and Silver..." whereas only a couple of years ago silver was nowhere in sight of anyone except the dreaded silver bugs. Much has been made about... Read full article... More on silver: What you need to know about buying silver today Coin dealers are seeing unbelievable demand for silver bullion Three new reasons to buy silver that many investors aren't aware of | ||

| WATCH: Bernie Sanders – Top 1% earns 23.5% Posted: 02 Dec 2010 09:08 PM PST Powerful words from Vermont Senator Bernie Sanders over the increasing social inequality in America, which he now defines as indicative of America's transition to a banana republic: "Many of the nation's billionaires are on the war path. They want more, more, more. Their greed has no end, and apparently there is very little concern for our country or for the people of this country if it gets in the way of the accumulation of more and more wealth, and more and more power. Today as the middle class collapses, the top 1% earns 23.5% of all income, more than the bottom 50%. Today, if you can believe it, the top 1/10th of 1% earns about 12 cents of every dollar in America… It is very clear that the people on top are doing extraordinarily well as the poverty is decreasing… Today the crooks on Wall Street, the people whose illegal, reckless actions have resulted in the millions of Americans losing their jobs, their savings, after we bailed them out, the CEOs are making more money than before the bailout. The US now has by far the most unequal distribution of income and wealth of any major country on earth." ~Dank je wel Zhedge | ||

| Posted: 02 Dec 2010 08:42 PM PST For most of 2011, we forecast there could be a chance for new price records depending upon weather, price of the US Dollar and China Demand. Technically, 2011 should be less costly. We see fundamentals going against this idea and prices going off the charts on PURE QE2 BERNANKE PRICE INFLATION. "Corn, Soybean Prices Reduce Advances in Chicago Trading as Dollar Rebounds." "Corn and soybeans pared advances in Chicago as the dollar rebounded, after sliding on optimism that an agreement to rescue Ireland's banks will prevent contagion from spreading across European debt markets." "Grains and other commodities were reacting very sensitively to the dollar's move," said Han Sung Min, a broker at Korea Exchange Bank Futures Co. in Seoul. "The dollar's decline stoked bargain-hunting (demand) after prices fell last week on concern over slowing Chinese demand." "Ireland accepted an international bailout yesterday. The accord will create a capital fund for Ireland's banks and may end up "restructuring" the financial industry, European Union finance ministers said. The U.S. Dollar Index, a six-currency gauge of the greenback's strength, slid as much as -0.7% today before erasing the decline. "The rescue plan for Ireland this weekend caused a rebound of the Euro, and due to this, of the dollar-priced commodity markets," Paris-based farm adviser Agritel said in a report on its website." "Corn lost -2.4% last week as moves by China to slow its economy threatened to curb demand for imports. Soybeans slumped -5.3%, the most since October 1. The Asian country is the biggest consumer of soybeans and the second-largest user of corn after the U.S. China ordered its banks to set aside larger reserves for the fifth time this year, draining cash from the financial system to limit inflation. Wheat for March delivery rose +0.2% to $6.855 a bushel after dropping (from) -3.6% last week." -Jae Hur, Bloomberg.net We forecast consumers will see some shocking food prices next year on inflation. Buying will continue to advance on higher demand, reserve shortages, bad weather and falling currencies like the dollar. This posting includes an audio/video/photo media file: Download Now | ||

| Expect Extremely Bullish Action in Mining Shares: James Turk Posted: 02 Dec 2010 08:33 PM PST Want JP Morgan to crash? Buy silver. Lots of fake gold shows up in Hong Kong. Why Eric Sprott sees silver as the next big investing windfall. Meet the 35 foreign banks that got bailed out by the Fed... and much more. ¤ Yesterday in Gold and SilverGold rose gently in Far East trading during their Thursday session, with an interim high set at the 8:00 a.m. London open. From there it went into an equally gentle decline, hitting an interim low minutes before 9:00 a.m. in New York. From that morning low, gold jumped up to its high of the day [$1,399.70 spot] in three separate bouts of buying, the last of which got capped around 11:25 a.m. Eastern time, just before it was about to blow through the $1,400 spot price. Then, at 12:45 p.m. during lunchtime on the east coast, some not-for-profit seller decided to erase virtually all of the day's gains in fifteen minutes. From there, gold drifted lower, hitting its low price of the day [$1,382.10 spot] minutes after 4:00 p.m... and closed the electronic trading session in New York a few dollars off that low.

Silver's price action was very similar to gold's... and a quick glance between both graphs confirms that. Silver made several attempts to break through the $29 spot level... but not with a lot of conviction that I could see. Although the high of the day was $29.05... the same seller sold off silver the same time as they sold off gold. Silver closed at another record-high price despite all the shenanigans that went on.

The other two precious metals suffered similar fates at exactly the same times. Both had monster gains posted intraday, before someone showed up to sell them off. Despite that, platinum finished up 1.54%... with palladium closing up 3.83%. Gold finished Thursday's trading down 0.12%... with silver up 0.42%. During Thursday's trading, the dollar finished down about 50 basis points, but had a really big intraday gain of 55 points that began at 5:30 a.m. Eastern time... followed immediately by an even bigger decline of 85 basis points. The sell-off began at precisely 9:00 a.m. in New York... and ended two and a half hours later at precisely 11:30 a.m. Once that bottom was in, the world's reserve currency gained back about 10 basis points going into the New York close at 5:15 p.m. Eastern.

The relationship between the dollar's activity and gold during that big drop in the dollar between 9:00 a.m. and 11:30 a.m. Eastern time is there, but rather disjointed. Here's the New York gold chart broken out on its own so you can see the details more clearly. One thing is for sure, there was no dollar reason why gold got smacked between 12:45 and 1:00 p.m. yesterday afternoon. Someone obviously dumped a position in a hurry... and it's hard to tell whether it was 'da boyz' or not, but it sure looks like something they would do.

The gold share action was interesting... and rather subdued... as the price of gold rose and fell over the New York trading session. I was particularly intrigued by the fact that there was no big panic selling of the shares when that not-for-profit seller smacked all the precious metals yesterday at 12:45 p.m. Eastern. Considering the fact that gold actually finished down on the day, I consider the share price action to be a big positive, with the HUI finishing up 1.34%.

The CME Delivery Report yesterday showed that another 520 gold contracts were posted for delivery on Monday. The big issuers was JPMorgan with 450 contracts in its client account... and the big stopper was Deutsche Bank with 371 contracts to be received. After three delivery days have passed in the December contract... 7,558 contracts have already been posted for delivery. In silver, there was another 313 contracts posted for delivery. The big issuers was, once again, JPMorgan with 256 contracts in their proprietary [house] trading account. The Bank of Nova Scotia was the big stopper with 180 contracts received. Month-to-date... 1,003 silver contracts have been posted for delivery. Thursday's delivery report is worth a quick look... and the link is here. The GLD ETF had another addition to report yesterday. This time it was 146,462 ounces of gold. There was a small withdrawal from SLV yesterday... 128,766 ounces. My guess is that this was a fee payment of some kind. The U.S. Mint had a sales report as well. Nothing changed in the gold eagle category... but they reported 42,000 silver eagles sold. December is normally the biggest month of the year for silver eagle sales... and, considering the blistering production pace of the mint, it will be interesting to see how this particular December fares compared to prior years. It was pretty busy day over at the Comex-approved depositories on December 1st... as the four warehouses reported a net drawdown of 599,879 troy ounces of silver on that date. The link to that action is here.

¤ Critical ReadsSubscribeMeet The 35 Foreign Banks That Got Bailed Out By The FedIt was a pretty quiet news day yesterday... and I'm delighted [at least from my point of view] that I don't have too many stories to post. The first one out the door today is this piece that was sent to me by reader U.D. It's a zerohedge.com offering bearing the headline "Meet The 35 Foreign Banks That Got Bailed Out By The Fed". I also note in a story from yesterday's edition of The Wall Street Journal that G.E., McDonald's, Harley-Davidson Inc... and Verizon [plus a bunch of U.S. hedge funds] also got blood from U.S. taxpayers. The zerohedge.com story is linked here... and the graph imbedded in the article is worth the trip all by itself.  Fed ID's companies that used crisis aid programsMy last story on who got all the dough from the Fed is this news.yahoo.com piece that I shamelessly stole from yesterday's King Report. The headline reads "Fed ID's companies that used crisis aid programs"... and the link is here.  ECB bows to German veto on mass bond purchasesToday's next offering is courtesy of reader Roy Stephens. It's an Ambrose Evans-Pritchard article that was posted over at telegraph.co.uk early yesterday evening. The headline reads "ECB bows to German veto on mass bond purchases". The European Central Bank has rebuffed calls for mass purchases of southern European bonds, despite growing pressure from Spain and Italy for dramatic action to buttress [the] monetary union. German economic minister Rainer Burderle said in Berlin on Thursday that... "the permanent printing of money is not a solution." True enough, I'm sure, Rainer... but we're well beyond the "print, or die" event horizon already. The story is well worth the read... and the link is here.  Nigeria: Dick Cheney To Be Charged Over Alleged Bribery CaseThis next story is quite something. I didn't know whether to laugh... or throw a party. It appears that a "Business Opportunity" arose somewhere in Nigeria when Dick Cheney was CEO of Halliburton. Apparently this business opportunity did not come cheap... and now Dick is a wanted man... and an order for his arrest is about to placed through Interpol. You just know someone is a criminal of the first order of magnitude when a country like Nigeria charges you for criminal conspiracy... amongst other things. 'David in California'... who sent me the story... said that there should be a world-wide national holiday when this guy drops dead. I couldn't agree more. The story, headlined "Nigeria: Dick Cheney To Be Charged Over Alleged Bribery Case" is posted over at huffingtonpost.com... and is a reprint of the story that originally appeared over at newsweek.com. The link is here... and it's worth the read.  Want JP Morgan to crash? Buy SilverThe rest of my reading today is precious metals related... with the first one coming from yesterday's edition of The Guardian. RT's Max Keiser got a huge soap box to stand on as the headline reads "Want JP Morgan to crash? Buy Silver". Well, I did my share yesterday and bought some. The link to the story is here.  Lots of fake gold shows up in Hong KongThe next store is from Thursday's Financial Times. It's imbedded in a GATA release that's headlined "Lots of fake gold shows up in Hong Kong". I urge you to read this, because its not only true, but very high tech as well... and the link is here.  Why Eric Sprott sees silver as the next big investing windfallHere's a story from the Monday edition of Canada's Globe and Mail. It's an interview with Eric Sprott, CEO of Sprott Asset Management. The headline reads "Why Eric Sprott sees silver as the next big investing windfall". Needless to say, this is very much worth your time... and the link is here. I thank reader Doug Beiers for sharing this story with us.  Expect Extremely Bullish Action in Mining SharesInterviewed by Eric King over at King World News, GoldMoney founder and GATA consultantJames Turk sees an imminent breakout in silver and then gold and the gold and silver miningshares. Excerpts from Turk's interview are headlined "Expect Extremely Bullish Action inMining Shares" and the link to this short blog is here | ||

| Expect Extremely Bullish Action in Mining Shares Posted: 02 Dec 2010 08:33 PM PST Image:  Interviewed by Eric King over at King World News, GoldMoney founder and GATA consultantJames Turk sees an imminent breakout in silver and then gold and the gold and silver miningshares. Excerpts from Turk's interview are headlined "Expect Extremely Bullish Action inMining Shares" and the link to this short blog is here. | ||

| Want JP Morgan to crash? Buy Silver Posted: 02 Dec 2010 08:33 PM PST Image:  The rest of my reading today is precious metals related... with the first one coming from yesterday's edition of The Guardian. RT's Max Keiser got a huge soap box to stand on as the headline reads "Want JP Morgan to crash? Buy Silver". Well, I did my share yesterday and bought some. The link to the story is here. | ||

| Lots of fake gold shows up in Hong Kong Posted: 02 Dec 2010 08:33 PM PST Image:  The next store is from Thursday's Financial Times. It's imbedded in a GATA release that's headlined "Lots of fake gold shows up in Hong Kong". I urge you to read this, because its not only true, but very high tech as well... and the link is here. | ||

| Why Eric Sprott sees silver as the next big investing windfall Posted: 02 Dec 2010 08:33 PM PST Image:  Here's a story from the Monday edition of Canada's Globe and Mail. It's an interview with Eric Sprott, CEO of Sprott Asset Management. The headline reads "Why Eric Sprott sees silver as the next big investing windfall". Needless to say, this is very much worth your time... and the link is here. I thank reader Doug Beiers for sharing this story with us. | ||

| Adrian Day: Another QE Blast Can’t Kill Commodity Boom Posted: 02 Dec 2010 07:44 PM PST Source: Karen Roche and Brian Sylvester of The Gold Report 12/01/2010 The Gold Report: Adrian, you recently published Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks, your first book in 28 years. Why another book after all this time? Adrian Day: I think the topic is remarkably crucial and important. Everybody understands the main drivers behind the increase in resources prices, but most people, including those in the business, aren't yet fully grasping the scale of the resource shortage that I see coming. They know China's demand is going up. They know it's more difficult to get permitting and more difficult to find new deposits. But I don't think they really appreciate the extent of the problem. TGR: What is the most important thing for investors to know? AD: One of the keys is to really understand what kind of investor you are because what you buy and how you trade depends on that a lot.

So, the first thing is that people have to know themselves. TGR: You talk about this enormous resource shortfall. Surely, the U.S. doesn't appear to be on the brink of any boom. Why is it so big, especially considering that there was no shortage 5 or 10 years ago, when our economy was booming? Even China isn't growing at the rate it was. AD: It doesn't matter whether the U.S. is booming or not. It doesn't matter whether Europe is booming or not. China has been driving the resource market and will continue to drive it for the next decade. That's what really matters; that's why I say it doesn't really matter if China's economic growth slows from 9.5%–5%. The demand for resources will still be very dramatic, and much higher than it is now. Just think about it. Everybody in China wants the same things we do. They want houses with electricity and running water and indoor plumbing. That takes steel and copper. If they move from a rural area into the city, at some point, they want a car. That takes aluminum and platinum, rubber for the tires and, of course, oil to run it. Obviously, cars are much more resource-intensive than bicycles and China is changing from bicycles to cars. When countries industrialize, they tend to go through a characteristic pattern. Typically, the demand for commodities—resources—starts to grow as the GDP increases. It starts from a very low base and slowly over a period of 10–15 years, or even longer, it begins to gather momentum to double that level. When the GDP reaches a certain level, though, the industrializing economies hit that takeoff point. Then the demand for resources starts to accelerate. For Japan in the 1960s and Korea in the 1980s, demand for most resources accelerated for a full decade until the economy industrialized and matured, and then the demand reached a plateau. The demand doesn't decline; it reaches a plateau. The critical thing is that demand for resources increases and accelerates at that takeoff but it increases on a per-capita basis because individual's needs and wants change. They go from bicycles to cars, from shacks to apartments, from open fires to stoves, from hanging up clothes to using dryers and so on. All these new wants require more resources than the old necessities. China represents 20% of the world's population. So unless its industrialization reverses—not slows down but reverses—the demand for resources is about to accelerate. TGR: So slow acceleration brings an evolving country to a tipping point, after which the demand grows exponentially. AD: Absolutely. And we could look at copper. . .at all of the resources. The pattern of consumption would be similar. It has much more significance than what happened in Korea or even Japan, because it's China—because of the population. TGR: How do the other BRIC countries figure into your equation? AD: India is a long way behind. India today is about where China was 10 years ago. As China's economy reaches a mature stage—mature in terms of the consumption of commodities, which probably will be 10–15 years from now—India will be just about at that takeoff point. TGR: So, we have two tidal waves coming? AD: Absolutely. India right behind China, and then Brazil and another country with a large population, right behind India. TGR: Why aren't the general investment markets seeing this? AD: I think that in very long-term, dramatic trends, people always tend to be playing catch-up. You see it with individual companies with big discoveries that continue to grow. The stock price goes up, but it's still good value because investors also generally have difficulty with a big trend getting ahead of them. Their understanding of it is always lagging. TGR: What makes your book different? AD: My book is very much a primer, if you like, not aimed at experts in the field but rather for educated investors who don't really know much about resources. I think it is particularly helpful for newer investors, or investors who are new to resources, because I try to write without jargon. I'm not trying to show people how clever I am. I'm trying to make it understandable to ordinary, intelligent people who know a little about investing but don't necessarily know anything about resources. So I think that's one thing that makes it different. It's very accessible. I don't cover every single resource out there but I try to cover the main resource areas in separate, short chapters. I try to help people with practical advice. TGR: You've talked a lot about quantitative easing in the U.S. in conversations, lectures and interviews. How does that factor into the trend toward higher commodities prices? AD: There are always two major areas to consider any time you look at commodities—the supply/demand factors and the overall economic environment. Other things being equal, a declining dollar means higher commodity prices. More money being put into the system and low interest rates mean higher prices for commodities. Well, guess what? We've got a falling dollar, more money being put into the system and low interest rates. So, we have the perfect economic environment on top of the perfect supply/demand situation. TGR: An accelerant on the flames. AD: I have no doubt that, at some point in the next few years, we're going to see an upward, albeit temporary, correction in the dollar. I have no doubt that we're going to see a slowdown in China. When China's GDP growth drops from 9.5%–5%, 4% or 3%, everybody will think the world's ending—but that's still pretty good, positive growth. But it wouldn't surprise me if we had setbacks. Let's not forget that during the U.S. industrialization from 1870 to the start of World War I, the U.S. had a depression, a recession, strikers getting shot in the streets—all sorts of problems. Think of England's industrialization after the Napoleonic War, from 1815–1840, when Britain transformed from an agrarian to an industrial economy. Again, recession, deflation, the Peterloo Massacre. . .all sorts of problems going on intermittently. I have no doubt that will happen in China, too; but if you take the big-picture view and don't let these setbacks scare you, you'll look back to see that they only last a short period of time. They're just interruptions in the big theme. TGR: Right. AD: Resources are more cyclical than most things and there are basic economic reasons for that. If you look back in history, the longest sustained periods of rising prices for commodities across the board always can be identified by a new source of demand—not a shortage. So, if you look at resources from 1870–1914, when both the U.S. and Germany were industrializing, you see a long upward move in resources. The same goes for the period from 1815–1840. Investors must understand major market drivers and why the industrialization of China, and the growing middle class that goes with it, are so important. People in cities use more resources than people in the countryside. Middle-class people buy things that use more resources than poorer people, etc. If we come into a slowdown, look at whether those major drivers have reversed and are no longer valid. Is this the end or just a temporary slowdown? If you agree that this is a long-term super cycle, don't let the corrections scare you. Corrections can be very sharp and severe. Gold declined 50% from 1973–1974. A lot of people freaked out and sold right at the beginning of the second leg up, which, of course, was the biggest leg up. Similarly, commodities corrected very, very sharply in 2008—and many investors panicked, sadly; but the key is that they bounced back very quickly, as well. I think that was a reflection of the real fundamental demand in China. Of course, at the end of 2008 huge inventories had been built up both there and in London. An exaggerated move in commodities prices resulted when speculators got in and hedge funds built up. When the prices started to correct, the decline also was exaggerated because not only was there slowdown in fundamental demand, but also a depletion of the inventories and hedge funds and speculators were dumping at the same time. Despite all of that, resources bounced back very, very quickly. Copper came back. Aluminum came back. It was not because the U.S. economy had a huge rebound; they came back purely because of Chinese demand. It wasn't speculation, it was real demand. TGR: What basic strategies do you tell people to employ? AD: The main strategic advice I give to people is to be really careful not to sell out too soon. I believe this is a multiyear bull market in resources. We'll see resources prices go much higher. I don't want to sound as if I'm waving my arms because I don't normally talk that way. Still, over 5, 10, 15 years, I think prices will go higher than we can imagine right now. Part of that will be in deflated dollars, of course; but if you buy quality companies with sound balance sheets that own resources in the ground in good jurisdictions, avoid the temptation to sell when the stock moves a little bit. You may not have the opportunity to buy back. TGR: Here at the Hard Assets Conference, when we hear the term "resources," we can probably figure we're talking about mineable materials. Is that how you define resources? Or, do you mean something broader? AD: I must admit I am switching around a bit between the words "resources" and "commodities," but in this context I'm talking about everything from the precious metals to the base metals to energy—oil, gas, uranium, geothermal; and when we say "commodities" we include agriculture. I think agricultural assets will be among the best-performing assets over the next decade. TGR: You mentioned selling and not selling too soon. How do you strike a balance between taking some money off the table—taking profits—and staying in the game long enough to maximize what you should maximize? AD: That's always a critical decision. When we buy shares for a client, we know in advance whether it is likely to be a core holding or a trading stock. As Doug Casey would put it, we know whether it's an 'eating sardine' or a 'trading sardine.' Obviously, you want to get rid of the trading sardine before it starts smelling. TGR: Any examples come to mind? AD: Sure. If you have a big position in Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX), that would be a core holding, an eating sardine, and I'd be pretty cautious about selling it. I certainly wouldn't sell all of it. If the stock moved to a point where I thought it was just overpriced and other copper companies started looking particularly attractive relative to Freeport, I would start to trim the Freeport but I certainly wouldn't sell it all. I would only sell out if something dramatic happened, such as a major change in strategy or something fundamental happened to change the company. TGR: Does that philosophy apply to micro-cap stocks? AD: No, absolutely not. Freeport's market cap is upwards of $46 billion. Micro caps are at the other end of the spectrum. The situation is the opposite when you have a small company that needs to keep raising money and is mostly dependent upon a single asset. In that case, I think you'd want to be much more of a trader. I'm not a geologist and I don't have technical training, so I tend to favor companies not for a particular property or whether the geology looks good but because they have a good business plan, a diversity of assets, good management, a sound balance sheet and so on. With them, you're not buying a specific property with a particular drill hole or drill-hole season. When we do buy companies that depend on a single property, we tend to be very quick at selling on either good or bad news. TGR: Does your new book focus more on these micro caps or the major players? AD: Both. The first part of the book talks about the whole macro issue—supply difficulties, demand and where it's coming from and how resources act during both deflations and inflations. It talks about how economic factors affect resources, and then it goes into each particular sector—oil, gas, uranium, coal, etc.—for both big and small companies. TGR: Any examples of those? AD: Not really, because I don't spend a lot of time in the book discussing individual companies simply because things change so much. In fact, I'd written about some companies in the manuscript that I sent in to my publisher in March and when they sent me the pages back for final editing in May, two of them had been taken over. So it just doesn't make sense in a market like this to talk a lot about junior companies. TGR: More broadly speaking, does your buy-and-hold strategy apply to resources? AD: I don't think you can afford to be exclusively a buy-and-hold investor in the resource area because these stocks are so volatile. It also depends on what sector of the market you're looking at. Let me step back a bit. Considering the enormous increases in commodities prices I foresee over the next 10 years, I think you want to be exposed. You don't want to try to be too clever and trade only to find that you missed out on a big move. The moves can come very quickly. I know an awful lot of people who panicked and sold at the end of 2008. By the time they finally bought back into the market, they paid double or triple their selling prices. In other words, I'd avoid the temptation to get out of the sector altogether. There are times to be more heavily invested in copper and times to be more heavily invested in oil. Focus on commodities that are particularly cheap and attractive right now. When they get expensive and perhaps less attractive, reduce your exposure. So, certainly you're trading on the various sectors as time goes on. Particularly the juniors, I think you want to be active and you want to take profits. No question. TGR: What other sectors will benefit from the growth in China and India? AD: Look at where people spend their disposable income and the effects of a growing middle class. Typically, when you have a poor rural country you have very rich and very poor but a very small middle class. When the economy industrializes, the middle class grows. For example, 15 years ago Brazil had a very small middle class—a lot of very wealthy and a lot of very poor. Brazil still has a lot of very wealthy and a lot of poor, but many of them have gone from abject poverty to barely scraping by. They're poor but a lot better off than they were. And there's a growing middle class. Now, one effect of this growing middle class in Brazil has been on the mortgage business. One stock we own is Gafisa SA (NYSE:GFA), the third largest Brazilian residential construction and real estate company, which is also a mortgage lender. Just 10, 15 years ago, there were virtually no residential mortgages in Brazil. Basically, the residential mortgage business did not exist. TGR: Why was that? AD: Well, 15 years ago the country had just torn up its second currency. It had 500% inflation and 50% interest rates. Would you want to borrow if interest rates were 50%? Or, would you want to lend for 30 years if you had two currency changes in 10 years and inflation at 500%? Now that inflation is down to about 5% or 6%, the real is a strong currency and interest rates—while still higher than most countries—are at a much more reasonable level, 10%–12%. So, people now are prepared to borrow money and people are prepared to lend it. It's not that people in Brazil didn't want to own a house. Everybody wants to own a house. It just didn't make economic sense. Even today, mortgages represent just 3% of GDP compared with more than 10% in Mexico and Chile. For the first time, 30-year mortgages have been introduced. So, there's still tremendous growth potential even if the economy didn't continue to grow. TGR: You just mentioned one company in your portfolio. Adrian Day Asset Management has both gold and resource accounts. What are some of the core holding in those? AD: In the gold accounts, we have about 25%–30% in the seniors and about 30% in pure explorers. We also have some in GLD or in gold bullion, depending on which is appropriate. The rest is in juniors, smaller producers, etc. In my investing for clients, I tend to look for the simplest and most direct way of investing. If I can find a really quality company that is an obvious choice, I stop there. Why go further down the food chain? In some of the other commodities—let's say uranium—the obvious choice is not necessarily a great company. So, I'd look at some options to Cameco Corp. (TSX:CCO; NYSE:CCJ). But in copper, for example, Freeport is great. It's the biggest public copper mining company in the world and it has great assets, diversified assets. It has a great balance sheet, good management and it pays a great dividend. Why go any further? TGR: How about in gold? AD: Virginia Mines Inc. (TSX:VGQ) is still one of my largest holdings. TGR: Did you happen to see André Gaumond (Virginia's president and CEO) at the Hard Assets Conference? AD: Yes. I was glad to see him. I had dinner with him on Sunday, actually. You can speak to every single person in the business and not one has a bad thing to say about André Gaumond or Paul Archer (VP, exploration). They are well regarded by everybody. It's not just a plug for Virginia but it explains the sort of thing we look at. Again, I'm not a geologist, so what attracts me to Virginia is not its properties. If you asked me about the company's properties, I could tell you maybe a sentence about each. It's not the geology of the properties. Virginia obviously has great management with a great track record. But it's the business plan. It's not a pure joint venture (JV) company, but it has a strong balance sheet and $44 million in cash and money coming in. The cash coming in from the JVs it manages gives it the cash flow to put money into the ground and not have to keep going back diluting shareholders. Where it sees key properties it likes, the company can afford to put money into exploration without always coming back to the market. That's the key. To me, the key in juniors is the dilution. If you're not getting income, you must have dilution, either at the company or property level. The question is: Which is better? You want to avoid diluting shareholders continually and exaggeratedly. The traditional model, of course, is to raise money, drill a hole and go back saying, "Hey, we have some good results. Give us more money," drill another hole, go back, etc. Some companies have gone back two or even three times in the same year—and that's a big drag on their stock prices. The model I like minimizes that to an extent or even avoids it. TGR: You said you could give us a sentence or two about Virginia's properties? AD: The company's biggest asset outside the $44M in cash is the royalty it owns on Goldcorp Inc.'s (NYSE:GG; TSX:G) Éléonore Property. The last resource estimate Goldcorp put out at the beginning of this year actually doubled the resource, bringing it up to 9.4 million ounces (Moz.)—but it's going to be bigger than that. You can do a net present value on a royalty quite easily using a discounted cash-flow model. Make an assumption on a gold price and a discount rate, and then you know what the thing is worth today and what someone else would be willing to pay for it. At $1,100 gold steady with a 5% discount, it's worth about $180 million. Add the $180M to the $44M and you find that those two assets alone equal or actually exceed the market cap of the entire company; it has no debt, so everything else comes free, including a zinc deposit, which is just sitting on the shelf. It's free; that and the 4 Moz. gold resource it owns at different projects—all free. Its JVs—all free. I like free; so not only would I buy Virginia now, it's an example of my ideal kind of company. Not relying on a particular project or a drill hole, I'm betting on Virginia. I'm patient. I don't mind how long I have to wait. Whether it wins this year, next year or three years from now, I think Virginia will win. In the meantime, the downside is very limited because the stock's selling for less than that asset value. I like that kind of model where the downside is low and the upside's just a matter of time. TGR: And doesn't the royalty actually increase when Éléonore goes into production? AD: Oh, yes. Right now, they're just getting $100,000 a month I think. Actually, it's unusual even to have advance payments. But when Éléonore goes into production, which is scheduled for 2014, the royalty goes up. As the production goes up and the price of gold goes up, the royalty actually goes up to 3.5%. That would be a very, very attractive royalty—cash flow that is also profit. | ||

| China Gold Imports Increase Five- or Six-fold Posted: 02 Dec 2010 07:02 PM PST Source: China Gold Imports Increase Five- or Six-fold There's been lots of news about China, India, and gold in recent days as imports, investment demand, and prices are all soaring now that the locals see consumer prices rising and look for ways to protect themselves from further depreciation of the currency. Depending on whether you read this Bloomberg report or this Reuters story, Chinese gold imports have increased five- or six-fold during the first ten months of the year. First, from Bloomberg:

And from Reuters:

It looks as though both reports might be correct since they are comparing the first ten months in 2010 to two different time periods in 2009 – the full year in the first and, presumably, just the first ten months in the second. However you calculate the increase, that's a lot of gold to be importing for the world's number one gold producer. | ||

| Posted: 02 Dec 2010 05:23 PM PST I'm still processing this thread over on AR15.com...the poster thinks he may have a fake gold coin. If interested, please read and post your feedback. http://www.ar15.com/forums/topic.html?b=1&f=5&t=1120619 | ||

| Gold Sits Tight as Chinese Imports Jump on Negative Real Rates… Posted: 02 Dec 2010 04:35 PM PST | ||

| Depleting Faith in Currency to Drive Gold Bull Run Posted: 02 Dec 2010 02:44 PM PST

This essay is based on the Premium Update posted on December 1st, 2010 There is a good reason why the U.S. government prints the phrase "In God We Trust" on the currency. You have to have faith that the pieces of papers you carry in your wallet have value and that you can exchange goods and services for those bits of paper. Fiat money is not "backed up" by anything; intrinsically it is useless paper (nowadays not even that, but mere electronic bookkeeping entries). It is valuable only as far as people believe in its anticipated purchasing power. When a few weeks ago the US Federal Reserve said it would create another $600 billion to buy US Treasury debt, that made a total of $2.3 trillion added since the Fed began its QE program almost two years ago. In terms of simple math, Ben Bernanke has added three times as many dollars to America's core money supply as all the previous treasury secretaries and Fed chairmen put together. To create fiat money all you need is ink, paper and the printing press. Gold, on the other hand, requires gold mines, workers, expensive equipment and time. There will never be limitless, unending supplies of gold. The U.S. dollar has lost around 33% of its value in the past 10 years. This decline took place because the world is waking up to the awful realization that America has borrowed and spent its way into a hole. Meanwhile, gold has climbed from $300 per ounce to over $1,400 an ounce. Fiat money requires that consumers and investors and nations have faith in it, something the U.S. dollar is rapidly losing – despite the recent upswing in the USD Index. As long as that continues to happen, people will turn to something tangible which they can trust – gold and silver. Speaking of gold, let's take a look at its long-term chart (charts courtesy of http://stockcharts.com.) One the above chart, we have a major development worth noting. The consolidation period is now visible here as it has been ongoing for nearly 2 months. It began back in October after gold reached the upper border of the very long-term trading channel. It is possible that we will now see gold's price break out above recent price levels and the $1,600 target level remains valid. This target is obtained reached by analyzing the 1.618 phi number and extrapolating the upper border of the accelerated trading channel (marked with a red ellipse on the above chart). With all of these bullish signals present, let's consider what could invalidate them. There's one thing that one of our Subscribers asked us about, and it's featured on the chart below. Gold's short-term chart at first glance appears to reveal a possible bearish head and shoulders formation. This is however not yet confirmed. When such a situation arises, it is important to study recent volume trends. What we have seen lately is strong volume with rising prices and lower volume when prices decline. For this reason, the bearish head and shoulders pattern should not be of major concern today. Gold's price has been stopped recently at the intersection of several resistance lines but daily volume levels and other signs indicate gold's next move is likely to be up. Such a move would immediately invalidate the bearish head and shoulder's pattern and would likely result in a suggestion on our part to increase speculative positions in gold, silver, and mining stocks. From a non-USD perspective, we see how gold's price movements differ between non-USD markets and its price based on the dollar. Since our last update, we have seen a near perfect bounce off the 50-day moving average for non-USD gold prices. In the previous Premium Update we commented: Gold moved to its previous high, which was followed by a correction to its 50-day moving average – just like it was the case in the past before continuation of a strong rally. Non-USD investors have seen price movement above previous highs, which has not yet been seen on the USD side. The upside from a non-USD perspective appears to have been higher, mostly due to the weakness of the euro. We wrote about this as likely outcome in our Premium Update two weeks ago: At this time for non-USD investors it seems best to hold long-term positions and enter small speculative positions right away. The reason we feel that speculative positions can be taken ahead of the correction is two-fold. First, the timing of any correction is quite difficult to pinpoint as the precious metals stopped responding to USD rallies, and secondly, the correction appears as though it will likely be quite small. Furthermore, the rally, which will likely follow could last for several months, thus making any small price decline, which was missed insignificant. The target for gold priced in currencies other than the dollar is much higher than gold is today (marked with red ellipse on the above chart), so there is still much room for further gains. Meanwhile, it seems that Investors who held their positions at that time are happy that they did. Summing up, although recent price action in the short-term shows some bearish signs, daily volume levels dispel this sentiment. The head and shoulders pattern has not been confirmed and likely will not be. The positive signs from volume levels far outweigh this coincidental pattern and we remain bullish for gold in the short-, medium-, and long-term. From a non-USD perspective, gold is seeing new highs and the outlook remains strongly bullish. To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time. Thank you for reading. Have a great and profitable week! P. Radomski * * * * * Interested in increasing your profits in the PM sector? Want to know which stocks to buy? Would you like to improve your risk/reward ratio? Sunshine Profits provides professional support for precious metals Investors and Traders. Apart from weekly Premium Updates and quick Market Alerts, members of the Sunshine Profits' Premium Service gain access to Charts, Tools and Key Principles sections. Click the following link to find out how many benefits this means to you. Naturally, you may browse the sample version and easily sing-up for a free weekly trial to see if the Premium Service meets your expectations. All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. | ||

| Gold will head to 1480-1525 before a major correction Posted: 02 Dec 2010 02:43 PM PST David Banister- www.MarketTrendForecast.com Excerpted from TMTF November 28th: In the intermediate term then, I'm looking for further consolidation likely for another week or so followed by a breakout over $1425 leading to my objectives of $1480-$1525 to complete the entire rally from the $1040 lows in February of this year. Many are starting to get bearish on Gold and Silver up here, and to me that is bullish and indicative of "4th wave mentality". In a 4th wave, there is growing bearish sentiment, but not so much as to topple the bull structure. To wit, last week in my ATP service I recommended a brand new Core Position in a Gold,Silver stock and it rallied as much as 40% intra-week at it's highs. We are in a super bull market for Gold stocks as I outlined in August of 2009, and we have another four years left to go. I'm seeing alot of amazing chart patterns in the Junior space that are in relentless climbs. Owning the the explorers that are finding the Gold is how best to take advantage of the remaining four years. At ATP, we are exposed to Rare Earths, Silver, Gold, and Oil and Gas related plays in our Core Positions. Make sure you own hard assets and precious metals resources one way or another. My silver forecast in late August was basically predicated on the small investor swarming into the Silver market to buy up coins, look for that to continue and Silver to be over $30 in the not too distant future. Below is my updated Gold forecast using a weekly chart, remember to Keep it Simple! You can follow our weekly updates or consider subscribing by going to www.MarketTrendForecast.com | ||

| Posted: 02 Dec 2010 02:30 PM PST 24K gold chain in 1/20 and 1/10 oz. link sizes: :shine: Snip: "If you own any form of gold, you are already well aware of those facts. But have you considered the implications of traveling with that gold? Sure, coming from Vietnam in 1975, you probably got barely a sideways glance for carrying gold TAELs, or even a suitcase full of cash. But today, in the age of TSA "love tap" pat-downs and full-body x-ray scanners, and when you must declare any amount of cash over $10,000 on your way in or out of America, leaving the country with a stack of gold bullion is probably going to raise a few eyebrows - if not land you in a TSA backroom somewhere. That's why it is important not just to own gold, but to consider owning it in various forms that give you both discretion and portability. There is no substitute for gold bullion, but there are far more portable alternatives, and which are far less likely to raise eyebrows (sure, numismatics are collectibles, but good luck explaining to customs the difference between a Gold Eagle and a Saint Gaudens). Take 24-karat gold jewelry, for instance. To the casual observer, or the TSA agent, it's not unlike any other necklace or bracelet. To you, it is a portable store of wealth. A "money belt" customs will ignore. And a great insurance policy should you find yourself in need of money on the road." http://www.321gold.com/editorials/ca...sey120310.html http://www.heirloom24k.com/clk/GLD It's not cheap, but the idea is sound and something like this might be useful if you have need to cross a border in an emergency, etc. :beerglass: fyi, R.:dance: | ||

| Implications of China and Russia Dropping the Dollar Posted: 02 Dec 2010 01:53 PM PST By Tony Richardson | ||

| Why You Need to Get Long Silver Immediately Posted: 02 Dec 2010 12:54 PM PST By Brian Hunt, editor in chief, Stansberry & Associates If you haven't taken our repeated advice to buy silver, the market just gave you an extraordinary reason to take action… right now. In mid-October, I wrote on our sister site, Growth Stock Wire, about a coming rally in the U.S. dollar. Bearish bets against the currency were near record levels… and Ben Bernanke was telling the world he was ready to print money to prop up the economy. When a trade gets extremely popular, it's like a boat's passengers crowding themselves on one side of the ship. It's natural for the ship to tip over and throw them all into the water, then lurch in the opposite direction. As you can see from the chart below, that rally has come… and the dollar is screaming higher…  Nowadays, stocks, precious metals, and commodities all tend to trade inversely with the U.S. dollar. When the dollar sinks, those three typically soar. When the dollar rises, those three typically decline. That's exactly what has happened with stocks and commodities lately… Since the dollar is rallying, the rallies in stocks and commodities (which we predicted in September) have sputtered. This is what makes the recent action in silver all the more impressive. You see, while silver was "supposed" to decline like stocks and commodities did, it actually soared to its highest price all year.  There's something important we need to take away from this situation… When an asset doesn't decline when it is "supposed to" – if a company jumps 5% after it releases terrible earnings… or if a commodity shoots 10% higher after a major consumer says it won't use much of it in the coming year – it's a big bullish signal for that asset. It tells you what you hear in the press or see at first glance isn't the whole picture. It tells you the fundamentals driving the asset are strengthening… This is what just happened in the silver market. More people are waking up to the fact that governments around the world have wrecked their finances… and that they plan to print money in order to pay for bailouts, entitlements, and welfare programs. Now that folks are watching whole countries go bankrupt on the nightly news and reading how U.S. government spending is exploding, they are waking up to the idea of owning gold and silver as a "real money" way to protect themselves from these disasters. Indians, Chinese, Europeans, Americans… you name it. They're buying gold and silver. They're buying these metals in such volume, you get situations in silver like we're seeing… It won't decline even when it is "supposed to." This isn't to say that silver can't suffer a correction. Silver is a volatile asset. It's in its nature to go through booms and busts. But the long-term outlook is solid. I don't see any political will to stop the big spending and bailouts you hear about every day. So if you haven't bought silver, go ahead and buy. Sure, it's climbed a lot in the past few months. But as we've seen in the past few weeks, there are incredible forces driving the metal up. As more people flock to "real money," silver is going to go higher. Good investing, Brian Hunt P.S. For more on why silver is skyrocketing, I encourage you to watch an amazing video our publisher just put together. I have to warn you – this video will likely offend you. But I think it's something every American should see… and it could have a huge impact on your life. Click here to view it now. Further Reading:

The last time silver was this bullish was during the 1970s, when the precious metal rose 3,600%. Chris Weber notes so far, we're "only" up 518% this time. "My old forecast of $187 per ounce may start to not look so wild," he says. Read more here: If You Haven't Bought Silver Yet, Read This. Porter Stansberry is known for his "crazy" predictions. He called GM, Fannie Mae, and Freddie Mac going bankrupt. His latest claim is his "craziest" yet: "The U.S. isn't just headed for a currency crisis," he says, "we're in one right now." Learn more here: Porter Stansberry's "Craziest" Prediction Yet. | ||

| Posted: 02 Dec 2010 11:50 AM PST "Hey why's the market up big?" your editor asked a stockbroker friend yesterday. "Because everything's great today?" the friend deadpanned. "But wasn't everything broken yesterday?" your editor persisted. "Yes," the friend replied. "But today it's fixed." "Even Europe?" your editor asked incredulously. "Wasn't Europe super-broken yesterday? Wasn't Ireland bankrupt? And wasn't the euro falling to its lowest level in nearly a year?" "Yep," said the friend. "But that was yesterday. Today, Trichet [the President of the European Central Bank (ECB)] came out and hinted the ECB might launch a European-style quantitative easing program. The ECB, in other words, might start buying up shaky bonds from Ireland, Spain and Portugal." "And that's good right?" your editor joked. "Yeah," the stockbroker answered, "that's good because any time any government steps in to fix a problem, you can be sure it will be fixed. So if the Irish borrowed more money than they can repay, no problem, the ECB can fix that, just by lending the Irish more money on different terms, while also printing euros to buy up a bunch of Irish bonds. It's perfect really." "So is that the only reason the Dow is up 250 points?...Because the ECB fixed the Irish debt problem?" your editor wondered. "No," the friend replied, "the US economy is also doing just great, according to all these bozos that are showing up on CNBC today. Everything is just great. You can't sell a house and you can't get a job, but, hey, don't worry about that, the ISM number was better than expected." "You're sounding a little sarcastic there, buddy," your editor cautioned. "Maybe you should try buying some call options for a change. As I keep writing in the Daily Reckoning, the stock market might be a short, but the bond market is a better short. This quantitative easing stuff is NOT bearish for stocks; it is bullish. Think about it; the housing market is flat-lining, the commercial real estate market is sketchy, all the TV people say gold is in a bubble and short-term bonds pay pitiful yields. So the money HAS to go somewhere. The stock market at least offers the hope of something better. I'm not saying things ought to be this way, just that they are this way." "Yeah, maybe your right," the bearish stockbroker groaned. "But it's hard for me to invest by default." "I don't blame you," your editor replied. "But just remember that cash isn't the riskless trade it used to be. Thanks to quantitative easing – and sundry other dollar debasement schemes – cash is sort of the 'new safe' – certain to lose value, but probably not very quickly." The stockbroker laughed, but he wasn't really laughing...and neither was your editor. Whatever the theoretical merits of Ben Bernanke's quantitative easing experiment, the actual demerits are considerable. For starters, printing dollars is a strange way to instill confidence in the dollar...or in the economy that generates 13 trillion dollars worth of GDP every year. For another thing, governments and bureaucracies fix far fewer items than they break, especially if the item happens to be complex...like a $13 trillion economy. The government does a decent job fixing potholes, but not such a good job fixing things as complex as ethnic strife in foreign lands or medical insurance, or even automobile registrations. Governments muck things up. That's what they do. That's what Ben Bernanke is doing. Maybe, by some modern miracle, QE1, QE2 and whatever additional QEs may follow, will succeed in stimulating economic activity without also stimulating inflation. But we doubt it. "We have to reinforce the authority of the public authority," Trichet declared yesterday. "It is on the authority of the public authority that we can continue the resistance to an environment which is very demanding and will continue to be demanding for a period of time." Translation: We have to have more money to throw at the identical tactics that are already failing. Our response: Falsum in uno, falsum in omnibus. Translation: "False in one thing, false in everything." The curative power of currency debasement is a false concept – just as false as the "benefit" of every other governmental intrusion into the private sector. [Think: Social Security]. Neither Jean-Claude Trichet nor Ben Bernkanke needs "more authority"...or more money to indulge their monetary fallacies. They need more time in a La-Z-Boy doing crossword puzzles. Let the debtors default and let the capitalists pick up the pieces. Eric Fry, | ||

| The Inter-Galactic Bailout Fund Posted: 02 Dec 2010 11:50 AM PST The Fed is now bailing out the whole world! But who will bail out the Fed? After the news came out yesterday, the Dow rose 249 points. Gold was up $2. Here's the latest from Bloomberg:

"Whoa...did you see that?" asked an Indian analyst we met this morning. "This is it. They're really turning on the presses now. They're trying to bail out the entire world. I never would have believed it. But it makes sense." The US official may not be discussing it openly, but Fed figures show that the US central banks is already bailing out foreigners. Reports tell us that 35 foreign banks took advantage of its EZ money policies. It appears that the Fed is supporting Europe's banking sector. And it would not be surprising if the US also backed the IMF. It's not just the banks that are in trouble in Europe. Governments are deep in debt too. They are so intertwined, that it's hard to know where private debt ends and public debt begins. Americans may see the dollar rising against the euro and feel a little patriotic pride. But this is not a good thing for Americans. If Europe comes unhinged, the crisis will waste no time in hitting American banks and the US economy. Ben Bernanke has been trying to get the dollar to go down. A rising greenback makes Germany's products less expensive and US exports less competitive. It contributes to the threat of deflation...and encourages a long, drawn-out Japanese-style slump by prompting people to save, rather than spend. Not only that, collapse of European economies would kill world trade. Exporters would be out of business. Importers would be out of money. The whole planet would be out of luck. The crisis would make its way around the world like a giant tsunami...wiping out stock markets immediately...and then swamping almost all economies. Yes, dear reader...this is the downside of globalization.. One region's problem can easily become a disaster for everyone. So, what's going to happen? We wish you wouldn't ask us questions like that, dear reader. But we'll take a guess. The European situation is more dangerous than most Americans realize. It could still melt down. US authorities must know this. And they must know too that if Europe melts down, so will the USA. So, the rumors will probably turn out to be true. The US will back the IMF. The IMF will back Europe. Europe will back Ireland. Ireland will back its banks. And the banks will back their lenders. Meanwhile, the euro will be backed by the dollar, which will also back the US economy, US banks, the US government, and about half the households in Christendom...not to mention the others! Who's got the kind of money you need to do all this backing? Ah...there's the rub... There's the weak link in this strange and magical chain. Let's see, if all the world's debts are guaranteed by paper money...isn't the paper money itself impaired by the amount of the losses? Won't the losses be passed along to dollar holders everywhere? Yes. But, no one knows how much the losses are. And no one knows how much extra "stimulus" money the feds are going to put out. And no one knows when people will get scared and flee the dollar...the euro...and all paper currencies. And no one knows what a panic out of the dollar would produce. And no one wants to find out. So, what's the solution? We won't bother to offer a solution to the world's financial authorities. They won't pay any attention anyway. But how about a solution for you? Did you buy gold when we suggested it, dear reader? We hope so. And more thoughts... The New York Times tells us that astronomers had seriously underestimated the number of stars in the universe. They can't see the little ones. Which means, their last count was probably a few trillion off. Or maybe a few gazillion off. Which suggests to us that astronomers and federal debt analysts must be using the same calculators. Both are trillions off the mark. But the reason we bring this up is to give dear readers hope. Maybe...circulating around one of these invisible stars...a few billion light years away from earth...is a habitable planet. And maybe, the people who live there are very good with figures...and money. And maybe they're also very accomplished space travelers. And very generous. And maybe they'll show up – any time now – and offer to bail out the whole Milky Way ...if not the whole damned universe. Regards, Bill Bonner, | ||