saveyourassetsfirst3 |

- Sayonara Japan: Saying My Goodbyes to Japanese Stocks

- China Gold Imports Increase Dramatically

- Dollar Rally Looking Exhausted

- Nov. Retail Sales: Impressive

- Many Ways to Ride the Gold Bull

- Why Governments Will Buy Silver

- Palladium

- I've Sold My Gold – Should You?

- Mania Territory For Gold is Coming Soon!

- Will the Trickle Out of the U.S. Dollar Now Become a Torrent?

- Cycle Charts for the Dow, Gold and Oil Most Revealing!

- China Plays Catch Up for Gold

- China could be flashing a HUGE warning for commodities

- The greatest decision any European country can make

- END GAME: The Federal Reserve is now bailing out the world

- Counterfeit Gold Infiltrates Hong Kong Retail Market

- Bundesbank Joins Fed in Demanding Secrecy For Gold Swaps

- It is Just a Matter of Time Before Gold Becomes Priceless! Here’s Why

- Gold Market Lending

- Bill Haynes interview by Phoenix Fox 10 News

- Direction of Gold, USD Index and U.S./Chinese Stock Markets

- Gold Rises vs. US Dollar, Eases from Euro Record, as "Complications" Threaten Both Currencies

- Gold-Euro… Breaking out

- When Banks Rob People

- Debt = Money, Money = Debt

- Strange Events at the Comex..Gold and silver continue to advance

- Metals Move Higher Ahead of ECB Rate Decision

- The S&P 500, Gold, Oil & the Banks – What a Conundrum

- Surviving Inflation

- A Gold Buyer’s View of the Lopsided Risk-Reward Ratio

- QE2: Bad in Theory…And in Practice

- Dr Dave Janda interviews CFTC commissioner Bart Chilton

- Gold Seeker Closing Report: Gold and Silver Gain With Stocks While Dollar Falls

- Everybody Loves Silver !

- Buying Silver to Break JP Morgan

- Gold, Juniors, Gas: Technical Thumbs Up!

- Gold and Silvers Daily Review for 1st December 2010

| Sayonara Japan: Saying My Goodbyes to Japanese Stocks Posted: 02 Dec 2010 06:40 AM PST Jake Berzon submits: The time has come for me to admit that buying EWJ, an exchange traded index fund of large Japanese stocks, three years ago was a mistake. Much of the rise in EWJ over the past six months was the function of the appreciating Yen, which hit a 15 year high against the U.S. dollar about a month ago. It was not, however, due to underlying stocks rallying in Yen terms. As I have previously written, I am looking for U.S. dollar to appreciate over the next six months. Down the road, the corresponding weakness in the Yen will be good for the large Japanese exporters, which are well represented in EWJ. However, any strength in underlying stocks will likely be lost once translated to U.S. dollars. Complete Story » | ||

| China Gold Imports Increase Dramatically Posted: 02 Dec 2010 06:25 AM PST  Tim Iacono submits: Tim Iacono submits: There’s been lots of news about China, India, and gold in recent days as imports, investment demand, and prices are all soaring now that the locals see consumer prices rising and look for ways to protect themselves from further depreciation of the currency. Depending on whether you read this Bloomberg report or this Reuters story, Chinese gold imports have increased five- or six-fold during the first ten months of the year. First, from Bloomberg:

Complete Story » | ||

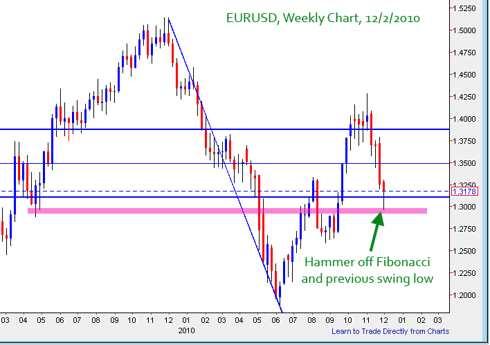

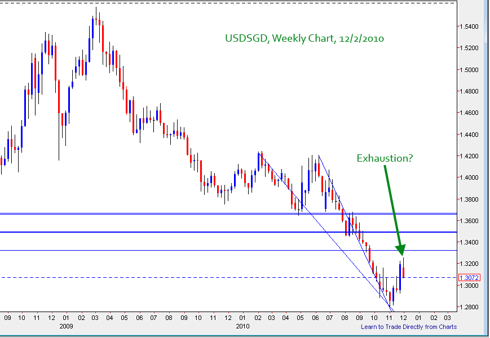

| Dollar Rally Looking Exhausted Posted: 02 Dec 2010 05:38 AM PST Simit Patel submits: I think the US dollar may be showing some signs of exhaustion from its recent rally. Consider: 1. Gold, silver, and oil are testing their previous highs again. 2. The US dollar is at major Fibonacci retracement levels against many currencies, measuring from the dollar’s high in May of this year to the lows reached in October. Below is the GBPUSD, which illustrates one such example. (Click charts to enlarge) 3. How the dollar fares tomorrow (Friday) may be especially worth watching, as the weekly charts currently look like they are showing some pin bars. Below are weekly charts of the US dollar vs the Singapore dollar and Euro vs the US dollar -- both of them are currently showing pin bars conveying dollar weakness. Fundamentally, we also have lots of Fed purchasing activity through December 9 -- see the schedule -- and the ongoing national debt and budget deficit issues. What do you think? Could we see some dollar weakness in the week ahead, or is there still more strength to come soon? Complete Story » | ||

| Posted: 02 Dec 2010 05:33 AM PST Wall Street Strategies submits: The word "strong" being used alongside "retail sales" has almost been in hiding since 2007, and rightfully so. Consumers went through massive psychological and financial shocks in 2008 and 2009, and for many the daily challenges still exist; after all, check out the traffic trends at dollar stores. Even though data was pouring in early in November (from independent research firms and from color on 3Q10 earnings calls) that suggested the holiday season was off to a strong start, there was a general reluctance in the air to utter such a six-letter word for fear that Black Friday would be all doorbuster buying instead of the vital self-gifting that enhance a retailer's margins. Complete Story » | ||

| Many Ways to Ride the Gold Bull Posted: 02 Dec 2010 04:45 AM PST Investment U submits: Over the past decade, gold has trounced stocks across the board. No big secret there, of course. Complete Story » | ||

| Why Governments Will Buy Silver Posted: 02 Dec 2010 03:41 AM PST Over the last several months we have been pondering if governments will come into the silver market. Before we get into that, it is important to note that governments are very different animals and there are over two hundred of them out there. Therefore, it is a very liberal generalization to lump them all together as if their needs, objectives and agendas were the same, thus expecting them all to act in the same fashion for the same reasons, is a big stretch. That said, it's the stigma, the psychological effect, the sentiment and the message it would send to markets that prompts us to group them together in investors' minds as a market force. | ||

| Posted: 02 Dec 2010 02:24 AM PST Will we see it surpass gold in the next 2 years? | ||

| I've Sold My Gold – Should You? Posted: 02 Dec 2010 02:05 AM PST Since the dawn of this financial crisis, my portfolio has included an allocation to gold. I viewed this as an important element of stability and protection and I believed in a longer-term story taking hold. Last week I kissed the precious metal goodbye for now and this is my explanation as to my reasoning. Words: 1382 | ||

| Mania Territory For Gold is Coming Soon! Posted: 02 Dec 2010 02:05 AM PST The chief institutional strategist at Canada's biggest bank, Royal Bank of Canada (RBC), believes gold prices are probably heading the way of the NASDAQ in the 1990s and the Nikkei in the 1980s into mania territory on the road to $3,800 an ounce. Words: 595 | ||

| Will the Trickle Out of the U.S. Dollar Now Become a Torrent? Posted: 02 Dec 2010 02:05 AM PST Yesterday, another brick was taken out of America's dollar fundamentals. China and Russia have announced that they intend to stop using the U.S. dollar and begin to pay for trade between their two countries in renminbi and rubles, respectively, from now on. It begs the following question: Will the OPEC countries of the Middle East follow suit in abandoning the U.S. dollar? Words: 614 | ||

| Cycle Charts for the Dow, Gold and Oil Most Revealing! Posted: 02 Dec 2010 02:05 AM PST Larry Edelson's proprietary cycle analyses suggests that we could experience declines in the Dow 30 and S&P 500 to 9,000 and 1,000, respectively, by April of 2011; a potential decline in the price of gold to as low as $1126 by August of 2011 and a decline in the price of crude oil to as low as $69 next year - before taking off to record highs. Words: 781 | ||

| Posted: 02 Dec 2010 12:31 AM PST If prices are determined at the margin, then who are the marginal buyers and sellers? | ||

| China could be flashing a HUGE warning for commodities Posted: 01 Dec 2010 11:58 PM PST From Zero Hedge: As usual, Soc Gen's Albert Edwards does not pull any punches: "Once again, investors see China plays as the only investment game in town. Dylan and I remain convinced we are witnessing a bubble of epic proportions which will burst – catching investors as unawares as the bursting of the Asian bubbles of the mid-1990s." Already we have seen traces of Edwards proving correct after the Chinese market has swooned dangerously in the past week. Should the world realize that, as Edwards claims, even near-unlimited liquidity is insufficient to keep the system going, the China-initiated avalanche will be severe... ... And here is the canary in the coalmine: Once again, China's leading indicator is pointing towards a very significant slowdown in economic growth ahead. The last time the Chinese OECD leading indicator was this weak, Read full article... More on China: China crisis watch: Benchmark stock index plunging... Marc Faber: "China and the U.S. are on a collision course" GOLD CRAZY: New wave of Chinese money is set to slam the gold market | ||

| The greatest decision any European country can make Posted: 01 Dec 2010 11:46 PM PST From Bloomberg: Iceland is betting its decision two years ago to force bondholders to pay for the banking system's collapse may help it rebound faster than Ireland. Iceland's taxpayers face a smaller debt burden than their Irish counterparts, where the government's guarantee of the financial system in 2008 backfired this year when the banks came close to insolvency. Iceland's budget deficit will be 6.3 percent of gross domestic product this year and will vanish by 2012, compared with the 32 percent shortfall in Ireland, the European Commission estimates. While analysts expect Iceland's recession to extend into next year, the nation's exporters are benefiting from a 28 percent drop in the krona against the dollar since September 2008. The decline may help the nation of 320,000 people rebalance its economy faster than Ireland, whose euro membership rules out a currency devaluation. With Iceland's OMX share index up 17 percent this year, the third-biggest gain in Europe after Denmark and Sweden, Nobel Prize-winning economist Paul Krugman says Iceland may be an example of "bankrupting yourself to recovery." "The difference is that in Iceland we allowed the banks to fail," Iceland President Olafur R. Grimsson said in a Nov. 26 interview with Bloomberg Television's Mark Barton. "These were private banks and we didn't pump money into them in order to keep them going; the state did not shoulder the responsibility of the failed private banks." 'Burning' Question The island's bank debt remains with the failed lenders, whose creditors have yet to recoup $85 billion. Deciding who should bear the cost of banking failures is becoming a "burning" question in Europe, Grimsson said. "Senior bondholders in some countries must accept that they may have to take haircuts or participate in restructurings," said Michael Derks, the London-based chief strategist at FXPro Financial Services Ltd., in an interview. "It just doesn't add up otherwise; senior bondholders will need to participate. There is no avoiding it." Ireland and Iceland boasted growth rates in excess of 5 percent from 2005 to 2007 as they opened their economies to international investment. Both then succumbed to an overheated financial industry that outgrew their economies. Iceland's recession will be deeper this year than Ireland's, though the Atlantic island will overtake the euro member in 2012, the Organization for Economic Cooperation and Development said in a report published Nov. 18. One Letter, Six Months In 2009, the joke was: What's the difference between Iceland and Ireland. Answer: One letter and about six months. "Almost two years on, the joke is on the jokers," Krugman said in a Nov. 24 column published in the New York Times. "At this point, Iceland actually looks a bit better than Ireland." Ireland's 85 billion-euro ($111 billion) rescue package came after weeks of negotiations during which German Chancellor Angela Merkel was forced to water down demands that bondholders bear part of the cost of future bailouts, instead of heaping the full burden on taxpayers. Irish banks' senior bonds rose Nov. 29, the day after the country's rescue was announced, as investors were spared the prospect of sharing losses with taxpayers. Bank of Ireland Plc's 1.47 billion euros of senior floating-rate notes due September 2011 gained almost 10 percent to 90 cents. Bondholders of Iceland's Kaupthing Bank hf, by contrast, will get back about 26 cents per euro, according to brokerage H.F. Verdref hf. 'Heterodoxy Is Working' While Irish bank bonds rose, the euro fell as much as 1.3 percent against the dollar, its lowest value since Sept. 21. Speculation that the European Central Bank may delay an exit from emergency funding supported the euro today. The single currency gained 0.4 percent against the dollar to trade at 1.3197 at 10:47 a.m. in London. Krugman says Ireland's "orthodox" response – pushing through austerity measures and guaranteeing bank liabilities to stay in the euro – contrasts with Iceland's "heterodox" solution – devaluing the currency, restructuring bank debt and putting capital restrictions in place. "Heterodoxy is working a whole lot better than orthodoxy," according to Krugman. Iceland's budget will be in surplus by 2012, compared with Ireland's deficit of 9.1 percent of GDP, the European Commission estimates. Unemployment in the euro member will stay at 13.6 percent this year and next, compared with a 2011 peak of 8.1 percent in Iceland, OECD data show. 'Tremendous Burden' Iceland, which started EU accession talks this year, is experiencing a "durable recovery" that is "forecast to pick up steam" next year, the IMF said in an October report. Iceland's government says it had no choice but to let the lenders fail. Before their collapse, the banks had debts equal to 10 times Iceland's $12 billion GDP. "Trying to rescue a banking system that is too big is a tremendous burden," Finance Minister Steingrimur Sigfusson said in an interview in Oslo. "There was not a question that we would rescue the banks; they were far too big." An Irish bank failure would plunge much of the rest of the euro region into crisis, said Valdimar Armann, an economist at Reykjavik-based asset management company GAMMA. "The banks are too entangled in the European web of banks," he said. European banks had $509 billion in claims against Ireland at the end of June, Bank for International Settlements data show. Euro-region governments will assess how far investors should bear potential write-offs on a case-by-case basis starting in 2013, finance ministers said on Nov. 28. Kaupthing, Landsbanki Islands hf and Glitnir Bank hf failed two years ago after they were unable to secure short-term funding. Kaupthing's so-called winding-up committee said Nov. 26 that it's dealing with 28,167 claims filed by creditors across 119 countries totaling $63 billion. To contact the reporter on this story: Omar Valdimarsson in London at valdimarsson@bloomberg.net. To contact the editor responsible for this story: Tasneem Brogger at tbrogger@bloomberg.net. More on the euro: Pimco's El-Erian: Bailouts won't save the euro Forget Greece and Ireland, this is the only country that matters Euro CRISIS: Plans for a European "bank mutiny" are picking up steam | ||

| END GAME: The Federal Reserve is now bailing out the world Posted: 01 Dec 2010 11:39 PM PST From Bloomberg: Federal Reserve data showing UBS AG and Barclays Plc ranked among the top users of $3.3 trillion from emergency programs is stoking debate on whether U.S. regulators bear responsibility for aiding other nations' banks. UBS was the biggest borrower under the Commercial Paper Funding Facility, with $74.5 billion overall, more than twice as much as Citigroup Inc., the top U.S. bank recipient, according to the data released yesterday. London-based Barclays Plc took the biggest single amount under another program that made overnight loans, when it got $47.9 billion on Sept. 18, 2008. "We're talking about huge sums of money going to bail out large foreign banks," said Senator Bernard Sanders, the Vermont independent who wrote the provision in the Dodd-Frank Act that required the Fed disclosures. "Has the Federal Reserve become the central bank of the world? I think that is a question that needs to be examined." The first detailed accounting of U.S. efforts to spare European banks may add to scrutiny of the central bank, already at its most intense in three decades. The Fed, which released data on 21,000 transactions, said in a statement that its 11 emergency programs helped stabilize markets and support economic recovery. The Fed said there have been no credit losses on rescue programs that have been closed. The growth of the U.S. mortgage-backed securities market and the dollar's status as the world's reserve currency enticed overseas banks such as Zurich-based UBS to buy assets in the country before 2008. They paid for the holdings with U.S. dollars, and when funding seized up, the Federal Reserve refused to take the risk that European firms would unload the assets and further depress markets for housing-related investments. 'Much Worse' "Things would have been worse if they hadn't lent to foreigners," said Perry Mehrling, senior fellow at the Morin Center for Banking and Financial Law at Boston University and author of "The New Lombard Street: How the Fed became the Dealer of Last Resort." "We're finally getting to understand the role of the Fed in the world." Fed spreadsheets showed the central bank became the world's lender of last resort as dollars flowed to European banks as well as Bank of America Corp. and Wells Fargo & Co, among top borrowers from the Term Auction Facility at $45 billion each. Goldman Sachs Group Inc., which posted record profit last year, borrowed more than $24 billion from another program. Milwaukee-based Harley-Davidson Inc. and Fairfield, Connecticut-based General Electric Co. sold commercial paper, a form of short-term debt, to the Fed under a program that lent as much as $348.2 billion at its peak. Sanders, the Vermont senator, said yesterday he plans to investigate whether banks profited by borrowing from the Fed and investing the funds in Treasurys, benefiting from the difference in interest rates. 'Bailout Protection Act' U.S. Representative Mike Pence, an Indiana Republican, said he planned to introduce a "European Bailout Protection Act" to restrict the flow of International Monetary Fund loans to European countries. He said he was responding to reports that U.S. officials might bolster a European fund designed to deal with this year's debt crisis, which has spread from Greece to Ireland. Edwin Truman, a former Fed official who is a senior fellow at the Peterson Institute for International Economics in Washington, said any push to confine the Fed's role to U.S. banks would create a "massive exercise in financial protectionism." "It would lead to retaliation, so U.S. banks in London or Tokyo would expect the same kind of treatment," Truman said. William Poole, senior economic adviser to Merk Investments LLC and a former Federal Reserve Bank of St. Louis president, said he was surprised by the extent of non-U.S. bank borrowing. Commercial Paper "I was under the impression that each country bore the responsibility for supervising the banks headquartered in their borders," Poole said in an interview. The $74.5 billion received by UBS through the CPFF, which bought short-term debt, represents total borrowings by UBS over the life of the program. The total outstanding at any point in time never exceeded about half that sum, said Karina Byrne, a UBS spokeswoman. Byrne said the bank's tapping the Fed fund "should be seen in the context of our overall desire to maintain flexibility and diversification in our funding sources." The loan to a Barclays unit came from the Primary Dealer Credit Facility, created to make sure U.S. securities firms and foreign firms' U.S. affiliates had cash to satisfy clients' financing demands. Barclays took the loan the week in September 2008 that it acquired the U.S. operations of Lehman Brothers Holdings Inc. Mark Lane, a spokesman for Barclays, declined to comment. 'A Big Operation' Paris-based Natixis borrowed $27 billion under the commercial paper program. "We've got a big operation in the U.S.A.," Victoria Eideliman, a spokeswoman for the bank said. "It was, for us, natural that we participate in this program like all the banks. When we participated, the liquidity situation was very tense." The $182.3 billion rescue of American International Group Inc. spared European banks that traded with the New York-based insurer from having to raise as much as $16 billion in capital, according to a June report from the Congressional Oversight Panel, which reviews bailout spending. Fed Chairman Ben S. Bernanke addressed questions in a 2009 Congressional hearing about why non-U.S. banks benefited from the AIG rescue. 'The Obligation' "I would point out that the Europeans have also saved a number of major financial institutions, and the issue of whether those institutions owed American companies money has not come up," Bernanke said. "So I think that there is a sense that we all have the obligation to address the problems of companies in our own jurisdictions." Three of the top seven borrowers under the CPFF program were private firms. New York-based Hudson Castle received $53.3 billion in aggregate, BSN Holdings took $42.8 billion, and Liberty Hampshire Co., a unit of Guggenheim Partners LLC, drew $41.4 billion, Fed data show. Hudson's website says it develops "customized debt products." A person who answered its phone said no one was available to comment. A Guggenheim spokesman didn't return phone calls. BSN Capital Partners Ltd., which was associated with BSN Holdings according to a 2006 Standard & Poor's note, was founded by John Burgess, a former Deutsche Bank AG managing director. Burgess declined to comment. To contact the reporters on this story: Bradley Keoun in New York at bkeoun@bloomberg.net; Hugh Son in New York at hson1@bloomberg.net. To contact the editor responsible for this story: David Scheer at dscheer@bloomberg.net. More on the Federal Reserve: Today's entertainment: The Fed's "Quantitative Easing" is finally explained The Fed just confirmed that "QE2" is nothing more than a secret bank bailout Chinese ratings agency compares the Fed's insane policies to "drinking poison" | ||

| Counterfeit Gold Infiltrates Hong Kong Retail Market Posted: 01 Dec 2010 10:03 PM PST http://www.bloomberg.com/news/2010-1...t-reports.html This just in These counterfeit gold are unusually high tech, unlike old tungsten fakes. Reports in hong kong say it contains an alloy of 7 elements. fake bars contains 51% gold, hard to identify Only good method against it is ultrasound http://www.youtube.com/watch?v=rh0Mcagio5Q more updates later | ||

| Bundesbank Joins Fed in Demanding Secrecy For Gold Swaps Posted: 01 Dec 2010 08:38 PM PST China gold imports soar almost five fold on inflation concerns. India's gold imports up 11.6% from Q3/2009. SLV adds another big chunk of silver... and GLD adds gold. Interview with CFTC Commissioner Bart Chilton... and much more. ¤ Yesterday in Gold and SilverIt was a very quiet day for gold on Wednesday. The high price tick was around $1,398 spot in very late morning trading in London... about 6:45 a.m. Eastern time. From that point, gold declined to its New York low [$1,381.20 spot] exactly four hours later... then didn't do much for the rest of the Wednesday trading session. Nothing to see here, folks.

Silver's price was pretty flat until late morning in Hong Kong... and then it began to rise... with its high of the day [around $28.85 spot] coming shortly after twelve noon in London. Silver's spike low [$28.09 spot] in New York came at the same moment as gold's low... 10:45 a.m. Eastern time. From that low, silver rose to $28.65 by half-past lunchtime on the east coast before getting sold off about two bits into the close of electronic trading at 5:15 p.m. Volatility such as this is to be expected in the most rigged market in the world.

The world's reserve currency hit its high of the day [around 81.35] shortly after trading began in the Far East on Wednesday morning and... except for a 35 point bounce between 9:00 a.m. and 11:20 a.m. Eastern time... it was all down hill from there into the dollar's low [80.57] at exactly half-past lunchtime in New York. Checking the dollar action against the gold price action, it's safe to say that there was barely any co-relation at all... as gold and silver's New York highs and lows bore little relationship to the dollar's price movements.

The gold stocks bottomed at 10:15 a.m... about fifteen minutes before the spike lows in both metals. Then rose to gold's New York high at 12:15 p.m. From that point the stocks more or less traded sideways for the rest of the day. The HUI finished up 1.29% on the day. I'm sure that if the Dow hadn't done as well as it did, the HUI would have probably finished in negative territory.

With silver up again, the silver stocks were [once again] the stars of the day. Nick Laird over at sharelynx.com must have read my mind, because he provided his famous "Silver Seven Stock Index" graph... and you can see that we are rapidly approaching the old highs of early 2008. This is the reason that my own stock portfolio is 60/40 silver/gold.

I can't let Wednesday's general equity market action pass without commenting on the miracle rally in the Dow on Wednesday. There was a big POMO from the Fed yesterday... some say as much as $8 billion... and some of it obviously ended up in the futures market... and the ensuing short-covering rally fed on itself... as the Dow had broken through [and closed below] the 50-day moving average on Tuesday. Technically, the equity market was set up for a drop of biblical proportions... but that was not allowed to happen. This was all courtesy of the President's Working Group... aka the Plunge Protection Team. Note all the 'saves' at the 11,000 level lately... plus all the 'saves' at the 10,000 level in late August. It's my opinion that the Dow is worth less than ten cents on the dollar.

There are no markets any more... only interventions. Yesterday's CME Delivery report showed that an additional 924 gold contracts were posted for delivery on Friday. The big issuers were Bank of Nova Scotia... and JPMorgan in both their client and proprietary accounts. The big stopper [receiver] was Deutsche Bank for its proprietary [house] account. There was finally some decent deliveries in silver. 600 contracts were posted for delivery on Friday. The big issuer was JPMorgan in its house account... with the big stoppers being Bank of Nova Scotia for its house account... and JPMorgan for its client account. The action is certainly worth checking out... and the link is here. There were some big additions in both the GLD and SLV ETFs yesterday. GLD added 234,340 ounces... and SLV added a rather chunky 1,759,557 troy ounces of silver. I'm sure that SLV is still owed quite a bit more than that. The U.S. Mint reported that 2,000 one-ounce gold eagles were sold on December 1st. There was nothing reported for silver eagles. There wasn't a lot of activity at the Comex-approved depositories on the last day of November. They showed a very small withdrawal of 11,137 ounces. The link to that 'action' is here.

¤ Critical ReadsSubscribeFed loaned hundreds of billions to foreign banks and companiesToday's first story is from yesterday's edition of The Wall Street Journal... and is posted as a GATA release because it's subscriber protected. The first paragraph reads... "The Federal Reserve, forced by Congress to release details on more than a trillion dollars' worth of loans made during the financial crisis, disclosed the breadth of its lending to U.S. businesses desperate to raise cash and the surprising degree to which it supported struggling foreign banks in the worst days of 2008 and 2009." Chris Powell's headline reads "Fed loaned hundreds of billions to foreign banks and companies"... and the link is here.  A Glimpse at the Socialist Senator Who Fought the FedHere's another story from yesterday's Wall Street Journal on the same subject. This one was sent to me by Washington state reader S.A. The headline of the article reads "A Glimpse at the Socialist Senator Who Fought the Fed". It's a story about Senator Bernie Sanders... but also deservedly mentions Congressmen Grayson and Paul. The link to the story is here.  Fed Names Recipients of $3.3 Trillion in Crisis AidWashington state reader S.A. has one more piece on this Federal Reserve story. It's posted over at Bloomberg... and is headlined "Fed Names Recipients of $3.3 Trillion in Crisis Aid"... and the link is here.  30 Weeks of Consecutive Equity Fund OutflowsThe next item is a posting from zerohedge.com that was sent to me by reader 'David in California'. The flight from domestic equity funds in the U.S.A. is unrelenting. The headline reads "30 Weeks of Consecutive Equity Fund Outflows". I suggest you find the time to run through this... as the graph alone is worth the trip. The link is here.  Q3 Foreclosure Sales Volume Plunges As Discount On Foreclosed Homes Hits 5 Year HighDavid has another zerohedge.com posting for us today. It's U.S. real estate related... and it's as ugly as my worst nightmares could imagine. The headline reads "Q3 Foreclosure Sales Volume Plunges As Discount On Foreclosed Homes Hits 5 Year High". It's depressing, but not surprising... and I suggest you spend a few minutes reading through it... and the link is here.  Nigel Farage: The money struggle is the struggle against totalitarianismLast week I ran a video clip of British politician Nigel Farage ripping the European parliament a new one. He's at it again, as he makes it abundantly clear that the money issue is what it always has been, a core question of democracy. There are two interviews posted in this GATA release... and if you have the time, they are worth listening to. The headline reads "Nigel Farage: The money struggle is the struggle against totalitarianism". Chris Powell's preamble is worth your time as well. The link to all is here.  Flash: Bundesbank joins Fed in demanding secrecy for gold swapsMy last four items today are all precious metals related. The first one is another GATA release bearing the headline "Flash: Bundesbank joins Fed in demanding secrecy for gold swaps". The Bundesbank brushed off 13 specific questions posed by the German journalist Lars Schall, whom GATA had encouraged to pose the questions. The first of the questions was: "Does the Bundesbank have gold swap arrangements with the United States/Federal Reserve?". The answer to that question... along with the other 12 questions... is linked here.  China Gold Imports Soar Almost Five fold on InflationIn a Bloomberg story filed from Beijing earlier this morning is this headline that reads "China Gold Imports Soar Almost Five fold on Inflation". Hidden in the story, is this paragraph... "Gold imports this year by India have already exceeded 2009 levels as consumers boost jewelry purchases, the World Gold Council said Nov. 17. Imports totaled 624 metric tons by the end of the third quarter, compared with 559 tons in all of 2009, according to the London-based industry group today." I thank reader U.D. for sending this along very late last night. In my opinion, it's a must read... and the link is here.  | ||

| Posted: 01 Dec 2010 04:50 PM PST Blanchard | ||

| Bill Haynes interview by Phoenix Fox 10 News Posted: 01 Dec 2010 04:48 PM PST For years the airwaves have been full of telemarketer ads that proclaim the virtues of investing in gold. And, because of gold's performance over the last ten years and because of the ongoing global financial crisis and because the ads continue to | ||

| Direction of Gold, USD Index and U.S./Chinese Stock Markets Posted: 01 Dec 2010 04:19 PM PST | ||

| Gold Rises vs. US Dollar, Eases from Euro Record, as "Complications" Threaten Both Currencies Posted: 01 Dec 2010 04:09 PM PST | ||

| Posted: 01 Dec 2010 01:26 PM PST | ||

| Posted: 01 Dec 2010 12:36 PM PST --Picture a banker with a gun in his hand pointed at the economy's head. "Bail me out, or the economy gets it!" he says. It opens up a whole new meaning for term "bank robbery." We've written about the growing social tension between bankers and people in the latest issue of AWG. --But at the moment, we seem to have a reached an impasse in world economic history. The industrial Welfare states are tired, broke, and barely summoning the energy to engage in one last orgy of mass consumerism in an off-putting celebration the birth of a 2,000 year old Jewish radical. They are doing their best, mind you (although not all that footage is from Black Friday, it captures the spirit of the absurdity pretty well). --But then you wouldn't blame ordinary people for doing crazy things when the people are supposed to be running the show are running the financial system into the ground. You wouldn't have guessed anything was permanently broken (insolvent) about European and American banks based on yesterday's trading action. It was a big up day, and probably a good day for insiders to continue selling into a rising market. --In fairness there WAS some encouraging news about global manufacturing. China's purchasing managers index—a gauge of manufacturing activity—showed its seventh consecutive month of expansion. According to the Financial Times, "Global manufacturing roared ahead in November after a summer lull in activity faded away, powered by northern European countries, China and India." --That's good news if you sell iron ore. Maybe that's why consultancy Platts said overnight that it expects iron ore exporters like Brazil's Vale and Australia's very own Rio Tinto to raise prices on iron ore by 7% in 2011. "The new norm will be average spot prices nearer $US150 a tonne than the $US100 a tonne we saw a year ago," says Steve Randall, the managing director of the Steel Index, which tracks iron ore and steel prices. --But is really going to happen? --The prevailing global model of the last 50 years has been for low-cost exporters to generate a trade surplus be selling goods into the more affluent developed world. This is the model that's under so much stress right now. Brazil, China, and India are not yet ready, in their own opinion, to rely on domestic consumption to generate economic growth. They'd like for the U.S. dollar to remain stable so they can keep their currency just a bit cheaper and maintain export competitiveness. --Poor old greenback, though, is a dead currency walking. And so we are where we are. The Western Welfare States are drowning in debt and face restructuring, deleveraging, and years of lower economic growth and high unemployment with gradually (or perhaps not so gradually) lower standards of living. --No one is quite ready or willing to deal with that world though. And yesterday, stocks didn't deal with it all. Albert Edwards of Societe Generale says the dynamic duo of emerging markets (EM) and commodities are primed for a fall, despite yesterday's manufacturing data. He writes:

--Alright then, what about the future? --David Murray has seen the future. And it has a big national piggy bank and a much lower net foreign debt for Australia. Murray is the chairman of Australia's Future Fund, whose job it is to fund the pensions or Australia's public servants. His interview in yesterday's Australian Financial Review was a real eye opener. --"Mr. Murray...has also sounded the alarm on Australia's net foreign debt, which represents 60 per cent of gross domestic product. He said the assumption that Australia could maintain a high level of foreign borrowings because the economy was underpinned by the mining boom and demand from Asia was worrying." --What did he really say? "That's a very, very risk position...The debate is all being run at a level that completely ignores this vulnerability." --What's vulnerable? How about Australian housing? The AFR writes that, "If Australia's economy were to slow, the ability to service those foreign borrowings could be affected. There is also the risk that the cost of foreign capital could rise further, which would be felt by many through higher domestic mortgage rates. Bank's foreign borrowings have funded Australia's housing boom." --The net foreign debt—mostly money borrowed by the big banks to fund the housing boom—is a far more important figure to Australia's debt conversation that public-debt-to-GDP ratios. The government debt in Australia is small (although growing). It's the fact that the banks borrow so much from abroad to fund asset price growth here that is worrying. But then, we've been down this road before. --Finally, over the last few weeks, a select group of Daily Reckoning readers have been reaping the benefits of a new project we've undertaken with our friend Greg Canavan. Greg is one of Australia's best value investors, which is another way of saying he knows how to find a quality company under any market conditions. --This is a valuable skill for any investor to have, especially when investment markets are so uncertain. Which is why Greg is regularly in demand - in person, in print and on the airwaves - by CNBC, Sky Business, Lateline Business, Boardroom Radio, The Sydney Morning Herald, Ninemsn and The Australian, to name a few. --The project is simple in theory: to identify some of the best-value stocks trading on the ASX today—from retail, to the banks, to the miners—and give you some great ideas about securities analysis and how to value a business that you can use in your own investing strategy, so you can make more intelligent investment decisions, today. --Working with Greg, we've put all those ideas and information together in a free series of special reports—the Sound Investments Series. You can access the latest report—and the complete series archive—by going to the Sound Investments Series and entering your e-mail details there. --You'll be sent instructions on how to download your reports (the latest one on how to identify quality underpriced stocks in any market was only published a few hours ago). If you've already signed up for the Series, or you're not interested don't sweat it. We'll back tomorrow with more reckoning from the brink of the next financial crisis, wherever it is. Similar Posts: | ||

| Posted: 01 Dec 2010 12:10 PM PST

Most of the time, any money that is created comes into existence as debt. Either the U.S. government goes into more debt when it gets more dollars from the Federal Reserve or individual Americans go into more debt when they take out loans from individual banks. First, let's examine what happens when the U.S. government gets more money from the Federal Reserve. Under our current system (which is fundamentally flawed), the U.S. government cannot just fire up the printing presses and print a bunch of dollars if it decides that more money needs to be produced. Rather, if the U.S. government needs more money it asks the Federal Reserve for it. So who is the Federal Reserve? Well, they are actually not part of the U.S. government. In fact, the Federal Reserve is about as "federal" as Federal Express is. The Federal Reserve is actually a privately-owned central bank that has been given authority by the U.S. Congress to issues our currency, set our interest rates and essentially run our economy. All U.S. government debt is created through the Federal Reserve system. When the government wants more money, the U.S. government swaps U.S. Treasury bonds for "Federal Reserve notes", thus creating more government debt. Usually the money isn't even printed up - most of the time it is just electronically credited to the government. The Federal Reserve creates these "Federal Reserve notes" out of thin air. These Federal Reserve notes are backed by nothing and have no intrinsic value of their own. The Federal Reserve then sells these U.S. Treasury bonds to investors, other nations (such as China) or sometimes they "sell" them back to themselves. In fact, the Federal Reserve has been gobbling up a whole lot of U.S. Treasuries lately. Some refer to this as "monetizing the debt", but that is not quite an accurate statement. When the Federal Reserve creates money this way, it does not also create the money to pay the interest on the debt that has been created. Eventually this puts pressure on the U.S. government to borrow even more money to keep the game going. So what this creates is a spiral where the U.S. government must keep borrowing increasingly larger amounts of money, where the money supply is endlessly expanding and where the value of the U.S. dollar is destined to continue going down forever. Do you think it is some big mystery why the value of the U.S. dollar has declined over 95 percent since the Federal Reserve was created in 1913? Just look at what our national debt has been doing over the last 40 years. It just continues to go up and up and up.... As long as the Federal Reserve system exists, the national debt will keep going up, the money supply will keep going up and the U.S. dollar will continue to decline in value. This is not because of some big mistake. This is what the Federal Reserve system was designed to do. It was designed to trap the U.S. federal government (and by extension all of us) in perpetual debt. If the U.S. government really wanted to get out of debt it would take back control of our currency from the bankers and would start issuing debt-free money. But don't expect that to happen any time soon. In fact, the Federal Reserve is just getting more powerful and becoming more out of control. According to data released on Wednesday, over $9 trillion in overnight loans were made by the Federal Reserve to major banks and large financial institutions during the financial crisis in 2008 and 2009. Now, the truth is that this number is inflated because each time one of these loans was "rolled over" it was counted as a new loan by the Fed. So don't get too excited about the $9 trillion figure. But still, the amount of money that the Federal Reserve just whipped up out of thin air and lent out to its friends at extremely low interest rates is absolutely mind blowing. In 2010, the Federal Reserve has initiated a massive new round of "quantitative easing", and it is yet another example of how out of control the Federal Reserve is becoming. So exactly what is quantitative easing? Well, essentially what happens is the Federal Reserve conjures up gigantic amounts of money out of thin air and uses it to buy up things like U.S. Treasury bonds and mortgage-backed securities. The Fed hopes that by injecting hundreds of billions into the system it will "stimulate" the economy. Prior to 2008, the Federal Reserve had never been so bold as to print up hundreds of billions of dollars whenever it wants. But now it seems as though the Federal Reserve is just going to zap hundreds of billions of dollars into existence whenever their friends are in trouble or whenever they feel the economy needs a little "stimulus". So can you or I "zap" money into existence? No, if we print money we go to jail. Can the U.S. government "zap" money into existence? No, only the Federal Reserve is allowed to do that. But most Americans will never understand how this system works. The second primary way that our money comes into existence is through fractional reserve banking. According to the New York Federal Reserve Bank, fractional reserve banking can be explained this way.... "If the reserve requirement is 10%, for example, a bank that receives a $100 deposit may lend out $90 of that deposit. If the borrower then writes a check to someone who deposits the $90, the bank receiving that deposit can lend out $81. As the process continues, the banking system can expand the initial deposit of $100 into a maximum of $1,000 of money ($100+$90+81+$72.90+...=$1,000)." This is actually an oversimplification, but let's roll with it. Many Americans would be shocked to learn that if we all went down to the bank today and wanted to take our money out, the bank would only be able to satisfy a small fraction of our requests. The bank does not keep all of your money in the bank. It lends most of it out. In fact, any bank can loan out as much money as it wants as long as it keeps enough in reserve to satisfy legal requirements. Each time a loan is made by a bank, more money is created and more debt is created. Isn't this kind of insane? Well, yes, but at least banks have to maintain a certain amount of discipline by keeping some money in reserve. Unfortunately, Federal Reserve Chairman Ben Bernanke is on the record as saying that he wants to completely remove all reserve requirements for banks. Keep in mind that Bernanke is in charge of "running" our economy. There are a few members of Congress such as Rep. Ron Paul that have tried to hold the Federal Reserve accountable. The following is an excerpt from remarks that Ron Paul made to Bernanke during a congressional hearing a while back....

Unfortunately, Ron Paul is vastly outnumbered by members of Congress who seem to believe that the Federal Reserve is doing a great job. In fact, a bill that would have provided for a one-time audit of the Federal Reserve got shot down. Apparently members of Congress did not think it was a good idea for the American people to be able to get a peek inside the institution that issues our money and runs our economy. It is time for the American people to wake up. The borrower always ends up the servant of the lender. In America today, virtually all of our money comes into existence as debt, nearly all of our major purchases are made with debt, the popping of debt bubbles has caused almost every major financial crisis we have had, our state and local governments are drowning in a sea of debt, and our federal government has piled up the biggest mountain of debt in the history of the world. Any economic system that is based on debt is destined to fail - including ours. Isn't it about time to start asking ourselves how we got into this gigantic mess in the first place? Unfortunately, Americans have been so dumbed-down by our pathetic education system and are so busy gorging themselves on endless amounts of entertainment that they literally have no idea how our system works. Most people will never wake up until a complete and total economic collapse happens. By then, it will be far too late. | ||

| Strange Events at the Comex..Gold and silver continue to advance Posted: 01 Dec 2010 11:31 AM PST | ||

| Metals Move Higher Ahead of ECB Rate Decision Posted: 01 Dec 2010 10:00 AM PST From the Fed's QE2 to a potentially similar move from the ECB, there is little indication that the current monetary paradigm is set to change anytime soon. That leaves gold at the mercy of the whims of traders with no telling how high the metal can go. | ||

| The S&P 500, Gold, Oil & the Banks – What a Conundrum Posted: 01 Dec 2010 10:00 AM PST We are seeing head and shoulders patterns developing in several trading vehicles. While these can mean substantial downside is ahead, there is always the potential that they could fail. Failed patterns result in fast, potentially devastating moves. | ||

| Posted: 01 Dec 2010 09:00 AM PST Normally, I am usually wailing about how We're Freaking Doomed (WFD) because the treacherous Federal Reserve has spent so many years creating so much money that we got inflation, as you would expect, and the inflation was in stocks, inflation in bonds, inflation in houses, creation of a gigantic pile of derivatives that are estimated to total in the quadrillions of dollars, inflation of the financial services industry, and cancerous growth of a huge, suffocating system of socialist governments, which is not to mention a half-century of inflation in the prices of consumer goods, averaging (according to "official government statistics") at an annual inflation of 4.4%!! I deliberately used the double exclamation point to convey the horror of 4.4% inflation, which means (in practical terms) that prices double every 16 years! If you are nonchalantly thinking to yourself, "I don't care that prices will double in 16 years because I probably won't live that long since I am an overweight drug addict, a serious alcoholic with a bad dietary regimen, and who gets no exercise at all." In that case, perhaps you would be interested to know that in eight years, prices will be 41% higher, which amounts to prices being higher by almost half again than they are now! Prices higher by a half! If you are a really bad example of a short, wasted life, perhaps thinking that even eight years is pushing the actuarial boundaries of your mortality, then I am sure that you think you will live another four years. Everybody thinks they will live another four years! And in four years, at a measly 4.4% inflation, prices will be 19% higher! And you can take it from me, if I can get my message through that drug and alcoholic haze of yours, that it will be much, much worse than that. In fact, inflation will be whole magnitudes worse because Ben Bernanke, in the worst monetary policy mistake in the history of the Federal Reserve, is actually trying to create inflation in prices! Yow! This new policy goal of deliberately creating price inflation – which is entirely new in the history of economics, which is primarily engaged in PREVENTING inflation – is very convenient for the Federal Reserve because it is now stunningly embarking in more quantitative easing (QE2), which, in practical terms, means the Federal Reserve will create another whopping $600 billion of new money – in the next six months! – into the economy by buying government bonds so that the government can outrageously deficit-spend this Huge Freaking Chunk Of Money (HFCOM)! So, obviously horrified by this, I normally do not suggest that the general stock market could go up, but it could now actually have a "buy rating" because of all of this! The reason is that the horrid little creep Ben Bernanke is sold on the new idea that there is a "wealth effect" created when people have assets that are going up in price, which means that they feel wealthier, they will spend more money, and then – presto! – everything will be peachy again and we will have prosperity from now on! Whee! My embarrassingly sophomoric sarcasm aside, a corrupt, intellectually-impoverished Federal Reserve has been given the green light to create preposterous amounts of money and use it to buy anything it wants, as both a way of financing government deficit-spending and, perhaps on a quest for "wealth effect" by pumping up asset prices. And it will obviously succeed! If the Fed prints up enough trillions in new money and uses it to buy half of the shares of the whole US stock market, what do you think will happen to prices of stocks? Hahaha! Me, too! And who's to stop them? I can't, either! And then astronomical share prices will start becoming more and more justified as the inflation in all other prices, the result of the gigantic, unbelievable inflations in the money supply, start rising quickly, too. Of course, this is all hypothetical, and the only thing that we know for sure – for sure! – is that gold and silver will rise in price as a result of the inflation in all prices caused by all this new money entering into the economy, as that is what has happened Every Other Freaking Time (EOFT) in the last 4,500 years when any dirtbag government got the bright idea to borrow the country into bankruptcy, and then create a lot of money out of paper to pay the bills to temporarily forestall bankruptcy, all the time having to pay higher and higher interest rates to go farther and farther into debt. And it is this apparent awesome economic certitude of a 100% sure-fire guarantee of the rise of gold and silver that makes me shout in self-satisfied glee and merriment, as in, "Whee! This investing stuff is easy!" Surviving Inflation originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||

| A Gold Buyer’s View of the Lopsided Risk-Reward Ratio Posted: 01 Dec 2010 08:45 AM PST What a beautiful city! We're talking about London. It was all dressed up for Christmas last night. And we got to see quite a bit of it. Student protestors blocked the streets around Trafalgar Square...and there was so much snow and ice...taxis must have stayed home. We walked from Mayfair to Southwark, using one of the pedestrian bridges to get over the river. It was snowing - large flakes floated down and settled on the sidewalks. There were Christmas trees and toys in the shop windows...along with the usual fashions, paintings and jewelry. People gathered in warm pubs and cafes to escape the cold; they looked so inviting, we wanted to stop in each one and have a drink. The Royal Festival Hall was brightly lit up...as were all the major buildings along the Thames. We've never seen it so lovely. Too bad we're leaving town this morning...on our way to Mumbai (aka Bombay.) Uh oh... What's this? Gatwick Airport is closed. Our flight is delayed. Well...more time to reckon! But what are we reckoning with...oh yes...money. Alas, the world of money looks much less attractive than the world outside our snow-bound window. In fact, it is downright ugly. The stock market seems to be rolling over. Yesterday, the Dow fell 46 points, not enough to make much of a difference. Gold rose $18. Here's what we see - Big Risks/Little Rewards. That is probably what gold market buyers see too. You'd expect gold to rise when there is consumer price inflation. And there is quite a bit of it. But not in the US...nor in most of the developed countries. Maybe some people are buying gold to protect themselves from inflation, but it looks to us as though they are buying it for another reason - because they are fearful that something is going to go wrong. Right now, world financial authorities have a number of balls in the air - China's property bubble...its excess capital investment...its rising inflation; Europe's collapsing bank debt...the euro...government funding problems; America's continued housing decline...high unemployment...overpriced stocks and bonds...Ben Bernanke and QE2. Gold market investors are betting that the authorities are going to drop one of these balls. Maybe more. Remember, these are the same klutzes who saw no trouble coming...and then misunderstood it when it arrived...and made things worse. And in Europe alone, they will need more than two hands. Here's the latest from the Telegraph:

And more thoughts... Meanwhile, in Ireland, the public mood is turning as dark as December. Irish voters are threatening to turn away the rescue boats and instead throw the bankers overboard. The Telegraph report continues:

*** If Ireland shirks its debt load, others will too. And then, the euro will collapse. (It fell below $1.30 yesterday.) And if the euro goes...so does world trade. And if world trade collapses so do the US stock market and the US economy. And remember, that's just one of the risks. There are more. So what should you do? Easy. Buy gold on dips. Sell stocks on rallies. Don't worry. Be happy. *** "Should I buy farmland," asks a Dear Reader. Answer: yes and no. There. Always trying to be helpful. Farmland has been a great investment for many years. But yields - from renting out farmland - are near record lows. This suggests that capital gains will be low over the years ahead. There's a time for every purpose under heaven; this is probably not the best time to buy farmland. On the other hand, farmland isn't going away. And over the long-term it is likely to hold its value...and perhaps increase. Here's a report sent to us yesterday from the heartland of the homeland:

Regards, Bill Bonner, | ||

| QE2: Bad in Theory…And in Practice Posted: 01 Dec 2010 08:41 AM PST Over the next eight months the Federal Reserve will conduct QE2 - quantitative easing, the sequel. It will buy $600 billion worth of US long-term bonds in the open market, close to 7% of all Treasuries in public hands. $600 billion is also roughly equivalent to the total amount of net debt the federal government will issue during the Fed's QE2 campaign. The Fed has already taken short-term rates down to zero, pushing income-seeking investors and savers to chase after higher-yielding, higher-credit-risk and/or higher-duration (riskier) bonds. Now, with the magic of QE2, the Fed wants to drive long-term rates down to unseen levels and push investors of any Treasuries (short or long) towards higher-risk assets - junk bonds, real estate, stocks, and commodities. The Fed also hopes (that is all it can do at this point) that low interest rates will nudge businesses to invest and to hire. That's unlikely. The value of any asset is the present value of its future cash flow. As my favorite philosopher, Yogi Berra, (allegedly) said, "In theory, there is no difference between theory and practice. In practice there is." In theory, lower interest rates decrease the rate that businesses use to discount future cash flows - making future cash flows more valuable today - and that is what the Fed is betting on. In practice, however, the fickle source of lowered interest rates is not lost on businesses. Rising government debt levels and overheating printing presses don't generate confidence about future cash flows. High government debt eventually leads to higher taxation, higher interest rates, and lower growth. So the Fed's action may produce an opposite result from what it intends. QE2 is like a drug prescription that comes with the list of side effects that are often worse than the disease it was supposed to cure. It is difficult to know all the side effects and unintended consequences of QE2, but it may result in a substantial decline in the dollar, stagflation (inflation will show up not where the Fed wants it - i.e., in house prices - but where the Fed does not want it: in prices for things like food, gasoline, clothing, electricity etc.), lower economic growth and much higher interest rates. Yes, paradoxically QE2 may actually result in higher interest rates - investors expecting higher inflation will demand higher interest. Despite the Fed's efforts, the dollar may or may not decline against the euro. As in a race to the bottom, the US is racing with PIIGS rampaging through Europe. The Fed's artificial manipulation of short- term and long-term interest rates creates a long-term problem for the economy. Government intervention (be it Chinese or US) in the free market creates excesses that are not allowed to self-correct and thus, leads to bubbles. QE2's possible success worries me more than its failure, because it will come with all the side effects I just mentioned, plus the eventual popping of newly created stock market and real estate bubbles. The Fed wants to create asset bubbles, praying for the wealth effect - stock and real estate appreciation to make people feel wealthier (at least on paper, for a while) so they will spend their phantom wealth. However, the Fed is like a Judas goat leading gullible (yield-deprived) savers to the slaughterhouse. The paper wealth that is created will vanish as bubbles burst (they always do), wealth will be destroyed, and consumers will find themselves further in debt. Japan was QEing from 2001 to 2006 and created a bubble in Japanese bonds that partially burst, but the economy did not lift out of stagnation. Eventually, Japan stopped hiding its true intentions of propping up the equity market - on November 4th of this year the Bank of Japan announced it will be buying Japanese stock ETFs and REITs. The Fed's actions over the last two decades remind us of Scarlett's famous line from Gone with the Wind: "I can't think about that right now. If I do, I'll go crazy. I'll think about that tomorrow." Unfortunately, the Fed's toolbox is missing a very important, must-have tool to fix the current problem: the "do nothing" tool. The "do nothing" tool would let the economy self-heal, even if unemployment stayed at 10% for a while and housing prices found (declined to) their true level. However, that is unlikely to happen, as it requires pain. Americans have little tolerance for pain - after all, the most prescribed drug in the US is Vicodin, a painkiller. This is why, regrettably for the US, QE2 is unlikely to be the last QE: as the QE2 effect wears off (assuming it succeeds at all), then QE3, 4...10 and so on will follow. What should investors do? If the Fed "succeeds" and creates a short-term bubble in stocks and other asset classes, investors' true time horizons and investment disciplines (i.e. adherence to the investment process) will be put to the test. They will have to engage in the game of looking-for-a-bigger- fool-to-buy-your-overvalued-assets. In the giddy phase of a bubble, ignorance is wonderful bliss and knowledge and adherence to the investment process are a curse - as disciplined investors will always sell too soon and will not partake in the bigger fool game. However, when the bubble bursts, the money will flow to its rightful owners. The Fed doesn't want you to be in cash, it wants you to reach for yield and to speculate - but don't. In the absence of good investment opportunities, the worst thing you can do is take guidance from the Fed. Regards, Vitaliy N. Katsenelson,

| ||

| Dr Dave Janda interviews CFTC commissioner Bart Chilton Posted: 01 Dec 2010 07:50 AM PST This was from Ted Butler's site, which I subscribe to. Quote: On Sunday, fellow subscriber, Dr. Dave Janda, conducted a very informative and constructive interview with Commissioner Chilton on his radio program. I highly recommend you take a listen http://www.davejanda.com/audio/BartChilton112810.mp3 | ||

| Gold Seeker Closing Report: Gold and Silver Gain With Stocks While Dollar Falls Posted: 01 Dec 2010 07:15 AM PST Gold rose to as high as $1396.74 in London before it fell to see a slight loss at $1382.10 by late morning New York, but it then rallied back higher in the last couple of hours of trade and ended with a gain of 0.15%. Silver climbed to $28.824 and dropped to $28.101 before it also rallied back higher and ended with a gain of 0.61%. | ||

| Posted: 01 Dec 2010 07:02 AM PST | ||

| Buying Silver to Break JP Morgan Posted: 01 Dec 2010 06:58 AM PST For just over a week, activists have been spreading an online call to silver investors: buy physical silver and help bring down JP Morgan. Though the title "activist investor" is often reserved for billionaires with more proxy votes in a company than they know what to do with, this new age surge in investing activism should be appreciated, even if it is a little misdirected. | ||

| Gold, Juniors, Gas: Technical Thumbs Up! Posted: 01 Dec 2010 06:14 AM PST | ||

| Gold and Silvers Daily Review for 1st December 2010 Posted: 01 Dec 2010 12:07 AM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment