Gold World News Flash |

- Will Gold Fall In A Real Recovery?

- Gold Market Update

- Paper, Plastic, or Silver

- Gold and Silver's Daily Review

- Why silver is the top pick for 2011

- The Derivatives Market Monstrosity

- Denmark Gives Away $7B USD, or 2% of GDP to Carbon Credit Traders

- Gold Market Technicals & Tactics - Dec 24, 2010

- Silver and Gold Price Heavily Undervalued, How Far Can They Rise?

- Why Fed Money Creation Hurts the Poor Population

- Simon Black On Why Cuba, That Bastion Of Communism, May Just Be The Ideal Home For Future Expats

- Guest Post: Legislation Proposed To Criminalize Calls For A "Run On The Bank"

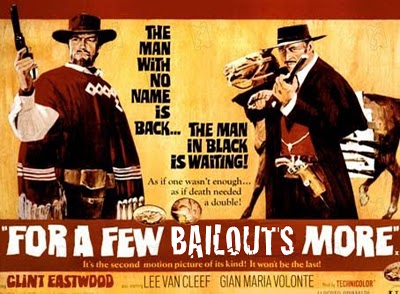

- The Tax-Payers' Tab: a Cool $9 Trillion and Then Some

- A Visit from the Ghost of Economic Future

- So the price of silver could get disorderly on the upside?

- If you buy it, they will crash – must view video – insiders want JPM to crash as much as those fighting financial terrorism

- Floyd Norris On The End Of The American Love Affair With Stocks

- Gold is Money, What About Silver? Can Gold be Debt?

- Debt or Silver? Let JP Morgan know they are the target (***)

- Rhodium Trading Thoughts

- The JP Morgue Whistleblowers Are Back

- Will Gold Price Fall in a Real Economic Recovery?

- Gold Stocks HUI Falling Wedge

- Silver Steep Uptrend About to Break Higher

- Robert Zoellick, World Bank President Reaffirms A Global Role for Gold

- Crude is hyper bullish while Gold is trying to find a bottom

- Investor Gold Profit, Protection Despite Banking Cartel Manipulation Intervention

| Will Gold Fall In A Real Recovery? Posted: 26 Dec 2010 01:00 PM PST We have heard many commentators implying that a U.S. economic recovery that leads to the sort of growth that was seen before 2008 will give investors reasons to divest from gold. As the year end approaches and another year is on us, it seems wise to us to look at this carefully. All of us would dearly love to see a real recovery, with rising housing prices moving back to levels seen in 2008, strong employment data and consumers with plenty of disposable income to make life stress free again. In such a climate, one can understand that these desires would be accompanied by a fall in the gold price, which to many is a thermometer measuring the ailments of the developed world economies. But is that the reason that gold is at current levels? |

| Posted: 26 Dec 2010 04:09 AM PST |

| Posted: 26 Dec 2010 12:05 AM PST People who own silver know the reasons why it keeps going up, but they are not usually very chatty about telling others. For the bull market in precious metals to power forward to the next level, it's in the enlightened self interest of every bullion investor to start offering to pay others in metals. |

| Gold and Silver's Daily Review Posted: 25 Dec 2010 07:05 PM PST Ahead of the Christmas break both Asia and London are quiet with the gold price holding, but barely moving. The morning Fix in London is an eye opener, Fixing at $1,380.50 but in the euro at €1,062.61 €11 higher than yesterday's Fix. This equals the peak level of gold in the euro. The tendency of the market is to strengthen not to fall as many believed it would. The fundamentals have not changed, with demand coming from the east in the main as the west focuses on other things. |

| Why silver is the top pick for 2011 Posted: 25 Dec 2010 06:09 PM PST |

| The Derivatives Market Monstrosity Posted: 25 Dec 2010 06:02 PM PST I assume that you, as an intelligent person who understands that the treacherous, greedy, vampire banks creating so much excess money means We're Freaking Doomed (WFD), are Up To Your Freaking Ears (UTYFE) in gold, silver and oil, and you have had it UTYFE with your family always complaining about how you spend all the family's income on gold, silver and oil instead of luxuries, family vacations, adequate food, clothing, medical care, dental care, blah blah blah, the list goes on and on. |

| Denmark Gives Away $7B USD, or 2% of GDP to Carbon Credit Traders Posted: 24 Dec 2010 02:00 PM PST Denmark Gives Away $7B USD, or 2% of GDP to Carbon Credit Traders The Danish tax authority has been robbed blind by a carbon trading scandal that has rocked the market for carbon off sets: while the story saw some press a year ago, significantly higher losses have since been reported and the MSM has ignored the story. The Danish Auditor General is on the case now as the scope of the crime has become obvious, and grown exponentially since it was first reported. Originally discussed as a quasi-small-time dollar scam, the reality a year later is a lot larger: Europol is estimating a value on the case of 38 Billion Kroners and the values seem to keep going up. Connie Hedegaard, then the Climate & Energy Minister for Denmark is now the EU Climate Commissioner. While she was with the Danish government, she helped set up and manage a system where there were no background checks on the listings of permitted traders. This removal of identification was done even though the EU requires at least passport. This helped a group of fake, rogue traders set up a program that looted the Danish economy of up to 2% of its gross GDP in lost VAT taxes. Here's How: The Denmark CO2 permit registry was setup with extremely lax rules and regulations, possibly intentionally. In 2007, Ms. Hedegaard removed the requirement for identification and in a very short period of time traders figured out the loopholes and started to back up the proverbial truck. How? To put it simply: you could round robin CO2 credits, booking the VAT as a bonus each time. What is painfully obvious is that over 1,100 of the 1,256 (or about 88%) of the registered traders listed in their system were bogusly set up for fraudulent activity. The traders have since been delisted as the scope of the crime becomes obvious. The fake but registered traders used made up, unique addresses for their business: in one famous case, a trader was listed as trading out of a parking lot in London. In another, the trader took the name of a dead Pakistani national. The fraud centered on the use of VAT as a mechanism to generate real non-taxed cash flow. An international trader would buy VAT free credits from one nation, and then resell them to a VAT added customer in a second nation, pocketing as much as 25% of the cost of the trade as a personal commission. The trader then kept the VAT difference in lieu sending in the VAT to the necessary tax system, effectively arbitraging the VAT system (See, e.g., Cap and Trade; Leaving Las Vegas, “The Hole You’re In”). This trade was coined a “carousel” as the traders would re-export the credits, claiming the VAT only to reimport the credits and reselling them again with a new VAT assigned. They could wash, rinse and repeat booking up to a 25% VAT in the process each time. Here is the Danish Emissions Trading Registry CR User Manual. The how to manual. Jack H Barnes was named the audited Top Stock Picker in 2005 by Forbes’s “Best of the Web”. He is a retired hedge fund manager. He now writes about Global Macro Economic issues at jackhbarnes.com. His twitter feed can be reached here. Links of Interest to Story |

| Gold Market Technicals & Tactics - Dec 24, 2010 Posted: 24 Dec 2010 09:26 AM PST Super Force Signals A Leading Market Timing Service We Take Every Trade Ourselves! Email: [EMAIL="trading@superforcesignals.com"]trading@superforcesignals.com[/EMAIL] [EMAIL="trading@superforce60.com"]trading@superforce60.com[/EMAIL] Weekly Market Update Excerpt Dec. 24, 2010 Gold and Precious Metals US Dollar Chart US Dollar Analysis: [LIST] [*]The Dollar rally has been plagued by distribution volume, and now looks like it will rally only slightly higher before declining again! [/LIST] [LIST] [*]Study the volume on my chart. The power volume of this move is happening ondollar selling!Big Volume equals Big Money Flows. [/LIST] [LIST] [*]The Federal Reserve's action is deluding the Dollar's fans. The Fed Balance Sheet, if it was ever really audited, would probably give Ron Paul a real heart attack. It is unacceptable that Ben Bernanke would not even admit QE is money printing. That tells me a lot about how far down this road we are now, to US dollar perdition. [*]The... |

| Silver and Gold Price Heavily Undervalued, How Far Can They Rise? Posted: 24 Dec 2010 08:52 AM PST Gold Price Close Today : 1,380.00 Gold Price Close 17-Dec : 1,378.60 Change : 1.40 or 0.1% Silver Price Close Today : 2931 Silver Price Close 17-Dec : 2911.3 Change : 19.70 or 0.7% Gold Silver Ratio Today : 47.08 Gold Silver Ratio 17-Dec : 47.35 Change : -0.27 or -0.6% Silver Gold Ratio : 0.02124 Silver Gold Ratio 17-Dec : 0.02112 Change : 0.00012 or 0.6% Dow in Gold Dollars : $ 173.37 Dow in Gold Dollars 17-Dec : $ 172.32 Change : $ 1.05 or 0.6% Dow in Gold Ounces : 8.387 Dow in Gold Ounces 17-Dec : 8.336 Change : 0.05 or 0.6% Dow in Silver Ounces : 394.86 Dow in Silver Ounces 17-Dec : 394.73 Change : 0.13 or 0.0% Dow Industrial : 11,573.49 Dow Industrial 17-Dec : 11,491.91 Change : 81.58 or 0.7% S&P 500 : 1,256.77 S&P 500 17-Dec : 1,243.91 Change : 12.86 or 1.0% US Dollar Index : 80.490 US Dollar Index 17-Dec : 80.360 Change : 0.13 or 0.2% Platinum Price Close Today : 1,714.60 Platinum Price Close 17-Dec : 1,704.00 Change : 10.60 or 0.6% Palladium Price Close Today : 754.10 Palladium Price Close 17-Dec : 741.85 Change : 12.25 or 1.7% Sorry that I missed sending y'all a commentary yesterday evening. I simply ran out of daylight, and had a supper engagement I dared not miss. My wife would have thrashed me with briers had I been late. My ever-vigilant friend and ready critic CR wrote -- not steamily but emphatically -- to rebuke me for writing that the government and central bank price suppression scheme was not working. I take the rebuke, and make my apologetic correction. I was looking at the short term when I said the scheme to suppress the SILVER PRICE and the GOLD PRICE was not working. While techincally that is true -- prices are rising in spite of all their manipulations -- we don't know how much faster they might have risen had markets not been manipulated, or might be rising now absent the manipulation. We only know that the suppression is not working. Again, while that might be technically true, it might be efficient enough for the manipulators' purposes. Having tortured myself by reading tedious pounds of their turgid writing -- pick up Foreign Affairs some time -- I have come to understand that from their standpoint, it is enough to win at the end of the day. They really don't concern themselves with silly worries like "the dollar's ultimate demise if inflation continues." They win if they get to 5:00 p.m. without the world exploding. Thus if they can keep silver and from running wild and scaring the populace out of their fiat private money, they have won for the day. To stop a panic, they need only stop it today. As Keynes famously said, sneering at the necessity of long term thinking, "In the long run we're all dead." For them, victory in the short run is victory. But CR was even more correct from a long term standpoint. When the banking cartel conspiracy -- and doubt not that when any group of men plots to seize control of the monetary system and the economy to loot it systematically, that IS a conspiracy, and that did happen and continues daily -- they had to drive public money -- silver and gold -- out of circulation and replace it with their private money. The arrogant gall of this, overturning the right and practice of all human history, steals one's breath. Yet have they so well succeeded that in this world not a single country can be found where silver and gold are in daily use as money. More than that, they have effected a collossal depression of silver and gold prices. Dig into history, look for prices and wages, and the numbers are so low you cannot grasp them. Here is a single example. In 1850 the master of the lighthouse at Hunting Island, South Carolina, earned $500 a year. He had charge of the island, three families, and all the installation and buildings. Let's guess that job today would bring $80,000 a year. At that time $500 equalled 24.1875 oz. of gold, but today at $1,400 an ounce, that lighthouse master's yearly salary would equal only $33,852, less than half what we would expect. Silver's undervaluation is even worse. $500 then equalled 386.7 oz. At $30 an ounce, the master's salary was worth only $11,601 today, about an eighth of what we expect. See how undervalued the SILVER PRICE and the GOLD PRICE is? How far down the conspiracy has depressed their value by diluting the world's money supply with their private fiat money? Right now the market is re-adjusting silver and gold upward, and remember: markets always overshoot, so from this extreme undervaluation, before this bull market ends, both silver and gold will reach extreme overvaluation. And that's all I've got to say about that. Yesterday silver, gold, and the US dollar all dropped. Stocks were mixed, with the Dow up slightly while all other indices fell slightly. (Prices above are for 23 December, not today.) What does it mean? Technically, not much, because it most likely arises from traders pulling out of the market ahead of the Christmas holiday, taking off positions so they won't have to worry about them over the long weekend. Remember, governments love to throw surprise parties over long weekends. You'll begin to get some idea of where markets are headed next week, but even that may be deceiving. When the big cats are away, the little mice on the trading floor like to play, running markets up and down to reap some day-trading profits. It's activity meaningless to the longer term. Notice at least on the scoreboard above that silver and gold and the dollar advanced over the last week. That's an uptrend, even with the metals' little fall yesterday. Unless silver and gold pull some remarkable trick on Monday, I won't send a commentary, but will resume on Tuesday, 28 December. For this Christmas, set aside sorrow and mourning and fear, and rejoice in a blessed and merry Christmas! Y'all enjoy your weekend. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. |

| Why Fed Money Creation Hurts the Poor Population Posted: 24 Dec 2010 07:00 AM PST If you are like me, then you don't quite understand what the hell is going on with this economic stuff, but you are pretty sure that it starts with the foul Federal Reserve creating so much excess money and that a lot of people ought to be in prison Right Freaking Now (RFN). Knowing that, you then think to yourself that your Whole Freaking Life (WFL) is one long, dreary testament to the fact that all great mistakes start with having the money to finance them. And knowing that, you then remember that the Federal Reserve is actually only a private bank (owned by sinister, shadowy people, unnamed foreign powers, various shell corporations and probably invaders from outer space, each with a secret agenda of their own) that has literally been given the power to counterfeit money. And knowing that, you then remember that 4,500 years of history proves that when banks are given permission to create more money, they always end up doing it to excess, and after the inflationary booms that all this new money causes, it always ends badly for everybody when the booms go bust. And knowing that, you are thusly Scared Out Of Your Freaking Mind (SOOYFM), you are feverishly buying gold, silver and oil, you are armed to the teeth, and you usually wake up in the middle of the night screaming your guts out in fear at the unstoppable catastrophe bearing down upon us because the foul Federal Reserve is unbelievably creating new money at the unbelievable rate of an unbelievable $1.2 trillion a year, which is an unbelievable, staggering sum that will be "needed" by the unbelievably desperate, unbelievably clueless Obama administration so that it can deficit-spend that much money this coming year. And Obama will assuredly get another $600 billion to $800 billion in more "supplemental appropriations" through the year, as Congress does every year, to total probably more than $2 trillion in new debt. "To what end?" you ask? Well, the alleged purpose of this fiscal and monetary insanity is to ludicrously and tragically attempt to, literally, buy the government out of bankruptcy with all this new money, while simultaneously continuing to pay the half – half! – of the population that regularly receives government payments, all of which increases the money supply, which decreases the buying power of all existing dollars, which is manifested as higher prices. And higher prices is the Worst That Can Happen (WTCH) as far as the many, many poor employed people, the many, many poor unemployed people, and the many, many poor unemployable people are concerned, as they are forced to "get along" by somehow paying continually higher prices, but without more money, and sometimes without any money at all! And so while quantitative easing to create mountains of new money, and massive government deficit-spending to distribute the money, may do wonders for keeping asset prices up and thus benefit the part of the population that owns inflated financial and housing assets, the Price To Be Paid (PTBP) is higher inflation in consumer prices, which is paid in terms of sheer deprivation, misery and suffering by the many, many poor employed people, the many, many poor unemployed people and the many, many poor unemployable people. The only hope for these poor people, who insist on electing morons who deficit-spend money which they allow the Federal Reserve to create, thus making their miserable plight worse, is if they manage to squeeze out enough money each month to buy some silver. But they won't buy silver, even though most of them can and know they should, and they won't stop voting for the deficit-spending morons because they don't know that they shouldn't, although they should know that they shouldn't, making their whole sad situation doubly their own fault. So while there is nothing to be done about the poor since they insist on always making themselves more miserable, those who buy silver every month will not have to worry about such things as poverty, and instead will merrily spend their time whistling a happy tune they call, "Whee! This investing stuff is easy!" The Mogambo Guru Why Fed Money Creation Hurts the Poor Population originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Simon Black On Why Cuba, That Bastion Of Communism, May Just Be The Ideal Home For Future Expats Posted: 24 Dec 2010 06:43 AM PST Sovereign Man, Simon Black, writes in from Santiago Chile, shares his latest observations on gold and provides his two most recent recommendations for those who have decided to expatriate and are now just contemplating which country to call home. In summary: "I would recommend the country for pioneer expats who don't mind putting up with squalor and the lack of amenities... but Cuba makes up for it in other ways, like warm weather, gorgeous women, great salsa culture, and zero crime against foreigners." It will be the most supremely ironic end of the US empire if those disgruntled with the regime end up defecting to the one country which currently best exemplifies Regan's "evil empire. " Questions: Cuba, Gold, and why Chile is the answer, via SovereignMan.com It's a long flight from Auckland to Santiago. Hell, it's a long flight from Auckland to anywhere. You know, Australia is about 15 hours from anywhere, and New Zealand is 3 hours from Australia... so it's out there. Simon Black Senior Editor, sovereignman.com |

| Guest Post: Legislation Proposed To Criminalize Calls For A "Run On The Bank" Posted: 24 Dec 2010 06:34 AM PST Submitted by reader Jan Legislation proposed to criminalise calls for a "run on the bank" There's something going on in the Netherlands: http://nos.nl/artikel/207170-oproep-...strafbaar.html Calling for a "bank run" in public will possibly become a criminal offense. Ministers Opstelten of Security and De Jager of Finance are preparing a proposal for a new law. They want to be able to penalize people who are openly calling for a "bank run" a maximum of 4 years or a fine of 19.000 euro. According to the ministers a bank run can seriously endanger a bank. The behaviour of the president of De Nederlandse Bank (our State bank, our "FED"), Noud Wellink, was part of the reason for the bankruptcy in 2008 of the DSB bank. Politicians called for his (voluntary) resignation, since it became widely known that he acted wrongly, by putting the DSB bank under suspicion in public, in name of the Nederlandsche Bank, and by allowing a banking license in the first place. (at least, that is the official message, it was very clear that the reputation of the DSB was tarnished by the Central Bank) The president of the DSB, Dirk Scheringa fell for the bait and took out his own money. Later he put it back, but by then, it was too late; by then, the warning was issued, and the run had begun. As of late, there's been several campaigns to mobilise the "silent majority" into a more active stance against taking on private debt and risk, of private banks. Of course the overleveraged position of banks, and their key role in the present Fiat currency system is the cause of this vulnerabillity. This should have been adressed, not the wish of the savers to take out their own money, and warning others. That is the elephant in the room; that banks here aren't necesserally in a worse shape than anywhere else, but are extending their risk to society at large, because they're engaged in both speculation, and in handling the day-to-day financial affairs of corporations and individuals. Drs. Jasper Blom of the UvA (University of Amsterdam) stated in a publication that the Basel Accord, to stipulate rules for banks to restrict risk, have been "watered down", and that essentially nothing has changed since 2008. Politicians are, according to him, uninterested, and unconcerned, while it is their responsibillity. Yes, the positition of the Netherlands in the international banking cartel is very important. Moreover the position of the Netherlands is very important to the american government, as can be seen by the latest Wikileaks cables. The controller of the dutch stockmarket, the Euronext is owned (since 2006) by the NYSE ! And: "In 2009, the Netherlands was the largest destination for United States direct foreign investment, with 13.4% of the total. This made the United States the largest direct foreign investor in the Netherlands. Vice versa, the Netherlands was the ninth-largest direct foreign investor in the United States in 2009. In 2008, however, the Netherlands was the largest direct foreign investor in the United States." |

| The Tax-Payers' Tab: a Cool $9 Trillion and Then Some Posted: 24 Dec 2010 06:33 AM PST The Tax-Payers' Tab: a Cool $9 Trillion and Then SomeBy PAM MARTENS

In December 1, the Fed was forced to release details of 21,000 funding transactions it made during the financial crisis, naming names and dollar amounts. Disclosure was due to a provision sparked by Senator Bernie Sanders of Vermont. The voluminous data dump from the notoriously secret Fed shows just how deeply the Federal Reserve stepped into the shoes of Wall Street and, as the crisis grew and the normal channels of lending froze, the Fed effectively replaced Wall Street and money centers banks in terms of financing. The Fed has thus far reported, without even disclosing specifics of its lending from its discount window, which it continues to draw a dark curtain around, that it supplied, in total, more than $9 trillion to Wall Street firms, commercial banks, foreign banks, corporations and some highly questionable off balance sheet entities. (Much smaller amounts were outstanding at any one time.) A careful review of these data makes it highly likely the GAO will be releasing some startling findings come next July 2011. That’s when the American people will have a much clearer picture of how the Federal Reserve shoveled taxpayer money to Wall Street by the trillions. As a result of Senator Sanders’ legislative efforts, the Government Accountability Office (GAO) is to complete an audit by next summer of the Fed’s lending programs during the financial crisis. The data starkly show a comatose Wall Street being resuscitated with whatever financial might the Federal Reserve could pump into its tangled web of funding vehicles. It also points to how the Fed was dispersing sums which dwarfed the U.S. Treasury’s $700 billion TARP (Troubled Asset Relief Program) bailout program while allowing the TARP to take the media heat for obscene funding of Wall Street. The Fed has made the task of seeing the big picture of what it was up to exceptionally difficult by segregating its multi-prong funding into a dizzying array of spread sheets. Nonetheless, a few things jump off the pages. On the spread sheet for the Primary Dealer Credit Facility (a program to provide overnight loans to key brokerage firms, known as primary dealers because they assist the Fed in open market operations) are astronomical sums that Citigroup, Morgan Stanley and Merrill Lynch were drawing from the Fed on a regular basis from the Spring of 2008 to the Spring of 2009 (and potentially well beyond). The three firms borrowed almost equal sums which cumulatively totaled over $6 trillion, and that does not include their borrowing from other Fed facilities. In its current release the Fed cut off these data as of May 12, 2009 while the program lasted until February 1, 2010, making the full extent of this funding unknown at present. Calls to the Fed on this point had not been answered at CounterPunch’s press time. Citigroup owns one of the largest commercial banks in the country, Citibank. One could reason that the bank’s solvency had come under serious question at that time and it needed massive liquidity to meet depositor withdrawals from its bank as well as to fund its $2 trillion balance sheet (with another $1 trillion in off-balance-sheet vehicles). Why Morgan Stanley and Merrill Lynch, which are large investment banks and retail brokerage firms, needed funds of this magnitude raises many questions. Runs on banks, which invest depositor funds in illiquid assets like real estate and corporate loans, are typically met with a government liquidity response. Brokerage firms, on the other hand, hold stocks and bonds which can typically be sold in seconds with the proceeds “settling” (available to pay out) 3 business days later. Liquidity problems were likely aggravated at Morgan Stanley and Merrill Lynch because they each cater to both institutional clients and retail mom and pop investors. While the mom and pop accounts should have had little trouble cashing out of most stocks, municipal bonds and well known corporate bonds, less liquid securities in institutional accounts may have found their markets frozen for trading and needed interim financing -- this may have included problematic commercial paper positions in some money market funds used by the big brokerage firms for both retail and institutional clients.

Was this publicly traded stock from the firms’ proprietary trading desks, otherwise known as the in-house casino? Was it illiquid private equity in which the firms had their money tied up? Was it equity tranches from the dubious Collateralized Debt Obligations (CDOs)? If it was either of the latter, how could it have been properly priced as collateral? The Fed describes the equity as follows: “Securities representing ownership interest in a private corporation….” Without knowing the details of these securities, or the other unspecified junk bonds used as collateral, we don’t know the extent of the trash the Fed was swapping for cash with Wall Street. Merrill Lynch was rescued in a buyout by Bank of America on September 15, 2008, the same day that Lehman Brothers filed bankruptcy. The Fed risking $9 trillion of taxpayer money to bail out positions of dubious worth is highlighted further in the spread sheet for the Commercial Paper Funding Facility, which loaned $38 billion more than TARP, or a total of $738 billion to fund not just U.S. corporations but foreign banks as well, potentially because they were ensnarled in Wall Street’s off-balance-sheet funding schemes. Most alarming, a significant portion of this went to conduits that hide liabilities of Wall Street firms off their balance sheets, leaving Wall Street short of capital for emergencies just like this one, and shareholders in the dark about the true risk of the company’s balance sheet. The Commercial Paper Funding Facility was announced by the Fed on October 7, 2008, 3 weeks after Lehman Brothers filed for bankruptcy. Its first funding day was October 27, 2008 and its last funding day was January 25, 2010. One of the borrowers on both its first day and last day of funding and many days in between was an entity called Hudson Castle, whose cumulative borrowings were over $50 billion from the Fed for commercial paper it sponsored for three off-balance-sheet conduits: Belmont Funding LLC, Ebbets Funding LLC, and Elysian Funding LLC. On April 12 of this year, Louise Story and Eric Dash, writing for the New York Times, reported that while Hudson Castle was set up to appear to be an independent business, its board was controlled by Lehman; Lehman owned a quarter of the firm; and it was staffed with former Lehman employees. The reporters had gotten their hands on an internal 2001 Lehman memo indicating that the arrangement would maximize Lehman’s control over Hudson Castle “without jeopardizing the off-balance-sheet accounting treatment.” The memo noted further that Lehman would serve “as the internal and external ‘gatekeeper’ for all business activities conducted by the firm.” The internal document was authored by Kyle Miller, who worked at Lehman at the time but went over to Hudson Castle to become its president. According to the article, until 2004, Lehman had an exclusivity agreement with Hudson Castle, but the deal ended in 2004, with Lehman reducing its board seats from five to one. Lehman was far from alone in having employees leave to set up conduits which conveniently benefited their former Wall Street employer by moving debt off the balance sheet. It was the norm, not the exception. A July 2010 staff report from the Federal Reserve Bank of New York, titled “Shadow Banking,” noted the following about the shadow system in which conduits played a significant role:

In other words, the leverage in the system was not coming just from mortgage securitizations and esoteric derivatives but from off-balance-sheet debt parking schemes quite similar to that used by Enron. On May 6 of this year, Viral Acharya, a Professor of Finance at NYU’s Stern School of Business, gave enlightening testimony on conduits to the House Committee on Financial Services’ Subcommittee on Oversight and Investigations. Professor Acharya reported as follows:

Because asset-backed commercial paper is short term in duration with typically long-term assets, commercial banks like Citigroup (which is one of the largest players in the conduit field) provide liquidity guarantees to make the commercial paper investor whole if the paper can’t be rolled over at maturity. With Citigroup’s solvency in serious doubt at the peak of the financial crisis, its tentacles of backstopping conduits and issuing boatloads of commercial paper itself is likely to have played a pivotal role in seizing up this market. This might explain why we see corporate names like McDonalds, Caterpillar and Harley-Davidson selling commercial paper directly to the Fed according to the spreadsheets released on December 1. With Citigroup having such a large presence in the conduit market, it strains the imagination how Citigroup’s former top executives, CEO Chuck Prince and Executive Committee Chair, Robert Rubin, could have testified to the Financial Crisis Inquiry Commission on April 8 of this year that they had no idea until months into the crisis that Structured Investment Vehicles (SIVs) created by Citigroup and roosting off its balance sheet had liquidity puts that could, and did, force billions of the toxic assets back onto the bank’s balance sheet. SIVs are first cousins to conduits but typically have more leverage. Citigroup’s SIVs were shielding subprime debt instruments from being reflected on its balance sheet but were forced back on when they became impaired, leading to staggering losses for the bank. It appears that what was essentially taking place in the Commercial Paper Funding Facility at the Fed was that the taxpayer stood in for the liquidity puts the Wall Street banks had no money to backstop. Another well kept secret is that much of the commercial paper backed by dubious “assets” and housed in conduits regularly found its way into both retail and institutional money market funds. Those funds are supposed to be the safest of the safe and available to redeem at any time without a loss (or never breaking a buck in Street parlance). The Fed’s buck shot approach to spewing money at banks, brokerages, corporations, across the pond, and into the hands of questionable entities, may have been as much to save money market funds from a panic run as to save the Wall Street banks. Let us hope the GAO conducts a thorough investigation in this area. Whether it was Credit Default Swaps or Collateralized Debt Obligations squared or conduits or SIVs, two words emerge from the hubris: leverage and greed. By leveraging the balance sheet, upper management could lay claim to massive compensation and bonuses. This picture is encapsulated by an introductory comment by Phil Angelides, Chair of the Financial Crisis Inquiry Commission, at the outset of a hearing on Citigroup on April 8, 2010:

It takes only reading comprehension skills and zero Wall Street experience to read the above paragraph and know that this firm would blow up. How did Robert Rubin, former co-chair of Goldman Sachs and former U.S. Treasury Secretary, not see this at Citigroup. Mr. Rubin received over $125 million in compensation at Citigroup. Sandy Weill, the man who built the behemoth and its far flung network of dysfunctional parts and served as its CEO, received over $1 billion. The taxpayer received the tab. ***** Pam Martens worked on Wall Street for 21 years; she has no security position, long or short, in any company mentioned in this article. She writes on public interest issues from New Hampshire. She can be reached at pamk741@aol.com Pic credit: William Banzai7 |

| A Visit from the Ghost of Economic Future Posted: 24 Dec 2010 05:41 AM PST What does the ghost of Christmas Future have to show us? What grave? What empty chair? What jokers at the funeral? The end of the year approacheth. What do we know? What have we learned? Where have we come to? Come hither specter… Come, tell us your secrets. Take us by the hand… Show us tomorrow. And then… What ho! A shimmering light…our candle blew out by a sudden gust of wind that seemed to come from nowhere. And then, a voice…disembodied, ghastly… "Heh, heh…want to see the future, eh? Go to Prichard…" What? With those cryptic words, the shade vanished. Christians go to bed tonight with visions of flat screens and eternity dancing in their heads. In the hush of the Christmas Eve, they hear everlasting life breathing softly in their ears. For this night recalls the Holy Night in which Christ was born. If you believe the story, the savior freed Christians from the grip of death. Yes, their bodies might decay. But their souls would be immortal. We only mention it because we read in the news that Christmas has become a secular holiday. Few people remember the religious significance of it. And many don't care, even if it is recalled to them. Not that we care what people think. But we are defenders of lost causes, underdogs, and diehards. Since Christian traditions seem to be in danger; we will rally to their standard. What has this got to do with money? Probably nothing. But it's Christmas Eve, for ch**** sakes. Besides, does everything we write have to be about money, money, money? Well, does it, dear reader? It does? Oh… Well, in that case, let's just imagine that these Christians are right. Let's imagine that death has been conquered. Sin has been beaten. Eternity is ours! If this were so, then the Ghost of Christmas Future might actually exist, no? If you can have everlasting life, you must have more than just the here and now. You must have the past and the future available to you. Infinity in both directions, right? So, why couldn't the shade take a peak at tomorrow? And why couldn't he give us a hint of what is in store? Come back, oh spook. Tell us more of your secrets. Prichard? What do you mean? We look around. We wait. But we see nothing. No spook. Not even a shadow. Nothing. Listen. We don't hear anything either. Hummmph. Well, we're on our own. We have to make our own guesses about what tomorrow looks like. Now, the mistake most people make most of the time is in thinking that tomorrow will be like today. It if is bright and sunny, they imagine it will be bright and sunny tomorrow. If it has been bright and sunny for a long time, they imagine it will be bright and sunny forever. Got a leak in your roof? Betcha you will think of repairing it AFTER a rainstorm, not before one. After a long dry spell you forget that it can rain at all. Why bother to fix the roof? Now that that is established, we wish to take issue with it. Because, guess what? They're usually right. Tomorrow usually is like today. And if we were in a guessing mood, we'd guess that 2011 would be a lot like 2010. But with some major differences. The trouble with betting that tomorrow will be like today is that you can't make any money – or even protect your money – that way. Nothing changes? No pain. No gain. No problem. It's the unexpected changes that hurt. That's why buying stocks here is likely to be so costly. One poll says investors are 58% bullish. Another says 71%. Both say bullishness is at extraordinary levels. "When everyone is thinking the same thing, no one is thinking." That's what the old timers say. When everyone expects stocks to rise, the smart money bets that they will go down. Because the buyers have already bid them up. The money is to be made on the other side – betting that they will go down. So, the shrewd investor should be out of stocks – even if he thinks stocks are more likely to go up than down. The odds favor the seller, not the buyer. The shrewd investor should be out of bonds too. Again, this is not because he has the Ghost of Christmas Future whispering in his ear. It's only because he can do the math. Lend money to the government for 10 years and you will earn a yield of 3.34%. This is at a time when the Fed – custodian of the world's dollar supply – has increased the core monetary assets of the banking system by $1.4 trillion…and fully intends to raise the inflation rate. The foundation of the system is the Fed's own assets. It pays for those assets with money it creates out of thin air. Ben Bernanke is creating three times as much money as all the other Fed chiefs put together. What does 3.34% say about this? It says investors have lost their minds. Maybe they think the Great Correction will keep inflation rates down for the next 10 years. Even so, the risk is far too great. Something will almost surely go wrong. The dollar will collapse. Or the bond market. Or both. Shrewd investors don't know what is coming. But with this kind of crackpot monetary policy, they know they have to protect themselves. They know the odds favor betting against US Treasuries. What else? A shrewd investor should be invested in gold. Not that there is any guarantee that gold won't go down with everything else. Christmas Future is going to be a rough time. China could blow up. Commodities should get hit hard. World trade could sink. Emerging markets could backslide. Housing could take another major dip. Europe could see more debt crises. None of the fixes so far have fixed anything. The debt is still there. It grows larger each year. Sooner or later, at least one European economy is bound to go broke…possibly the euro and the European Union too. The Europeans are trying to solve the problem of too much debt by borrowing more money. And they're not alone. The Americans are doing the same thing. Even if the national government doesn't go broke in 2011, there are bound to be some state and local governments that get into deep doo-doo. What's this? The New York Times reports – from Prichard, Alabama! This struggling small city on the outskirts of Mobile was warned for years that if it did nothing, its pension fund would run out of money by 2009. Right on schedule, its fund ran dry. Then Prichard did something that pension experts say they have never seen before: it stopped sending monthly pension checks to its 150 retired workers, breaking a state law requiring it to pay its promised retirement benefits in full. The situation in Prichard is extremely unusual – the city has sought bankruptcy protection twice – but it proves that the unthinkable can, in fact, sometimes happen. And it stands as a warning to cities like Philadelphia and states like Illinois, whose pension funds are under great strain: if nothing changes, the money eventually does run out, and when that happens, misery and turmoil follow. "PRICHARD IS THE FUTURE," [emphasis added] said Michael Aguirre, the former San Diego city attorney, who has called for San Diego to declare bankruptcy and restructure its own outsize pension obligations. "We're all on the same conveyor belt. Prichard is just a little further down the road." Oh…you sly wisps of smoke… You clever shivers… You shimmering puffs of air… Thanks. And Merry Christmas. Bill Bonner A Visit from the Ghost of Economic Future originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| So the price of silver could get disorderly on the upside? Posted: 24 Dec 2010 05:39 AM PST |

| Posted: 24 Dec 2010 04:44 AM PST zerohedge.com: Promptly after those two cuddly bears explained how the JP Morgue is manipulating the silver market, and the xtranormal video went viral, forcing the FT to release an indemnification that “according to sources” JPM had covered a major portion of its silver short (only to subsequently end up with 90% control of other metals [...] |

| Floyd Norris On The End Of The American Love Affair With Stocks Posted: 24 Dec 2010 04:12 AM PST Three weeks ago when we noted the 30th consecutive outflow from US-based equity mutual funds (now at 33 straight weeks), we said: "America's love affair with stocks is over, has bypassed the marriage stage and gone straight to the bitter divorce." Today, we are happy to see that the the NYT's Floyd Norris for repackaging our metaphor in a slightly more palatable fashion: "The love affair of American investors with the stock market appears to have ended." His piece in today's NYT "For U.S. investors, the glow is off domestic stocks" will not be news to anyone who follows our weekly report on ICI data: "The year now ending will be the fourth consecutive year in which mutual funds that invest primarily in American stocks experienced net outflows of funds, meaning that investors as a group withdrew more money than they put in." And yet stocks continue to ramp higher, in big part due to the rapid increase in NYSE margin interest which means the bulk of investors are buying stock increasingly on leverage, but still the question to just who continues to do the actual holding remains unanswered. Indeed, only a few people, Charles Biderman among them, have answered with the response that everyone knows is true, yet most are afraid to utter. As for Norris' observations, which finally bring broad popular attention to this key topic which we have been hammering on for about 33 weeks in a row, here is the gist:

But if the bolded sentence is true, it means that everything we hear on CNBC is a lie... After all, if the surge in the market is not sufficient to inspire confidence that the economy is improving, and that in turn is not sufficient to get people to start investing in stocks again, then isn't the whole premise of restarting the virtuous cycle via QE X also fatally flawed? "Give it time" the optimists will say. Any week now there will be an investment in stocks. Fair enough, but that means rates will start to trickle ever higher, and every 1% rise in rates is equivalent to a 10% drop in home prices... Not to mention that the accompanying rise in commodity prices, most notably oil, will wipe out every last fiscal stimulus implemented in the past year and result in a crunch in profit and net income margins, once prices are unable to be passed through, destroying all hopes of an S&P 2011 EPS in the mid 90s. In retrospect we feel bad for Bernanke: at this point even the blind can see just how massive of a catch 22 the Chairman has boxed himself into, whereby every incremental dollar of monetary "stimulus" just raises the sword of Damocles a few inches higher. |

| Gold is Money, What About Silver? Can Gold be Debt? Posted: 24 Dec 2010 04:11 AM PST |

| Debt or Silver? Let JP Morgan know they are the target (***) Posted: 24 Dec 2010 04:01 AM PST |

| Posted: 24 Dec 2010 03:51 AM PST |

| The JP Morgue Whistleblowers Are Back Posted: 24 Dec 2010 03:32 AM PST Promptly after those two cuddly bears explained how the JP Morgue is manipulating the silver market, and the xtranormal video went viral, forcing the FT to release an indemnification that "according to sources" JPM had covered a major portion of its silver short (only to subsequently end up with 90% control of other metals markets), here they are back, explaining in Part 2 of the series just what the next steps in the unwind of the biggest metal manipulation scheme will look like. The kicker: a JPM insider has told one of the bears that there is no commercial silver left, "it's all smoke and mirrors, and the CFTC can do nothing about it other than pray." Other topical items explained: silver backwardation, that there are two commissioners at the CFTC on the JP Morgue's payroll, the BIS' fractional gold system and the usage of side pockets for sovereign gold, and pretty much everything that ties the loose odds and ends in the PM manipulation story.

|

| Will Gold Price Fall in a Real Economic Recovery? Posted: 24 Dec 2010 01:02 AM PST We have heard many commentators implying that a U.S. economic recovery that leads to the sort of growth that was seen before 2008 will give investors reasons to divest from gold. As the year end approaches and another year is on us, it seems wise to us to look at this carefully. All of us would dearly love to see a real recovery, with rising housing prices moving back to levels seen in 2008, strong employment data and consumers with plenty of disposable income to make life stress free again. In such a climate, one can understand that these desires would be accompanied by a fall in the gold price, which to many is a thermometer measuring the ailments of the developed world economies. But is that the reason that gold is at current levels? |

| Posted: 24 Dec 2010 12:58 AM PST You can consider this Gold Market update to be gift wrapped. As I am unable to get presents to each and every reader this year for logistical reasons, these Gold and Silver Market updates are going to have to suffice, which is perfectly reasonable given how bullish they are. Little has changed since the last updates were posted on the 5th December, but what change there has been has increased immediate upside potential in both gold and silver substantially, as the minor reaction in gold and sideways action in silver of recent weeks has served to further unwind the earlier overbought condition. |

| Silver Steep Uptrend About to Break Higher Posted: 24 Dec 2010 12:54 AM PST |

| Robert Zoellick, World Bank President Reaffirms A Global Role for Gold Posted: 23 Dec 2010 11:30 PM PST I have written on Robert Zoellick's recent mention of gold HERE. From what I recall, he pulled back somewhat on his comment, yet just two days ago, he reiterated his position. Hat tip to Fauvi for the find: World Bank head reaffirms gold as "reference point" to monetary system reform Wednesday December 22, 2010 14:30:43 EST PARIS, Dec 22, 2010 (Xinhua via COMTEX News Network) -- World Bank President Robert Zoellick reaffirmed his proposal to use gold as a "reference point" to reform the current international monetary system on Wednesday in Paris. "What I suggested is that gold serves as a key reference point to allow people to assess the relations between different currencies," Zoellick told the press here at the end of his meeting with French President Nicolas Sarkozy in the Elysee Palace. "It's an approach that we can take, others also estimate that we can establish a benchmark against prices of principal commodities," the World Bank president said in response to a journalist's question. "I didn't propose a gold standard, which is an important distinction because it would directly link currency to gold," said Zoellick, denying reports that he had called for a return to the " gold standard" to modify the present monetary system, which he called "Bretton Woods II." "The system should also consider employing gold as an international reference point of market expectations about inflation, deflation and future currency values," Zoellick wrote in an article published in Monday's Financial Times. Some media said Zoellick's proposal to revive gold's role in guiding exchange rates worked as a shock wave to current discussions and disputes over the international monetary system. The "gold standard" is a system in which the standard economic unit of account is a fixed weight of gold. Under the Bretton Woods system, which was set up in 1944 in the United States, the U.S. dollar was directly pegged to gold -- 35 dollars equaled per ounce -- while other currencies were pegged to the dollar. The Bretton Woods fixed exchange rate regime broke down in 1971, when the United States unilaterally terminated convertibility of the dollar to gold. Source HERE. Misthos here. The most important global currency relationship that exists today is the Chinese RMB and the US Dollar. The US needs to desperately depreciate its currency to better manage debts and to increase exports, and historically, there has always been a strong currency (or gold) to devalue against. However, China is not allowing this to happen, or at least not as fast as the US would like, and so we have the situation we have today: A currency war of exporting inflation by the US to China. Would gold be a better "currency" to depreciate against? And if this is not "technically" a gold standard, isn't this policy espoused by Zoellick giving gold a recognized monetary status? After all, those that believe that gold has a monetary status of sorts are usually ridiculed and consigned to the tin foil hat brigade. (myself included) Nonetheless, knowing how governments love to spend, such a policy, in my opinion would be extremely inflationary to gold. There's a lot of debt out there, and a lot of global trade re-balancing to be done. The real question is: Are these goals possible, or realistic? Or will the system breakdown on its own, forcing the gold issue upon reluctant governments? Time will tell. |

| Crude is hyper bullish while Gold is trying to find a bottom Posted: 23 Dec 2010 09:54 PM PST We start with Commodities today and they are strong regardless of the fact that U.S Dollar has been a lot stronger in last week but first and foremost, Crude WTI which we went all out bullish off 2 days back as we wrote “WTI is now trading at a discount of $3.51 to Brent and as Brent is making new highs then WTI must follow too and we mince our words at that”. As we write Crude WTI is now trading at $91.40 and Brent is still maintaining a healthy distance of nearly $3 even after WTI has pushed upward rather sharply. |

| Investor Gold Profit, Protection Despite Banking Cartel Manipulation Intervention Posted: 23 Dec 2010 09:48 PM PST “Is the gold price being manipulated? There are those who say no, while others say yes - notably The Gold Anti Trust Association (GATA) - and on balance it looks to an impartial observer (relatively) that the answer is probably in the affirmative. But perhaps no more so than any other commodities and some stock prices. There is a whole mammoth industry out there - the big banks, hedge funds etc. - whose whole purpose is to make money from money and the more you have in the first place the easier it is to do. Not by producing anything useful, but through manipulation of prices through short selling in huge volumes to drive prices down, buying on the turn, allowing prices to rise back up, taking profits, then more short selling to drive prices down again and the cycle continues. This works better in a bull market, which gold has been in for the past ten years or so. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Originally published at

Originally published at .jpg) This mystery is further intensified by one Fed spread sheet showing that the largest Wall Street firms deposited a total of $2.1 trillion in stocks as collateral in order to obtain liquid funds from the Fed. Depositing stocks as collateral began on the day Lehman died and was done in large size by Lehman Brothers, Morgan Stanley, Merrill Lynch, and Citigroup. Raising additional red flags, tens of billions of dollars in stocks were posted as collateral by the London operations of Morgan, Merrill and Citi.

This mystery is further intensified by one Fed spread sheet showing that the largest Wall Street firms deposited a total of $2.1 trillion in stocks as collateral in order to obtain liquid funds from the Fed. Depositing stocks as collateral began on the day Lehman died and was done in large size by Lehman Brothers, Morgan Stanley, Merrill Lynch, and Citigroup. Raising additional red flags, tens of billions of dollars in stocks were posted as collateral by the London operations of Morgan, Merrill and Citi.

No comments:

Post a Comment