Gold World News Flash |

- Does the Gold-Silver Ratio Really Revert to Its Mean?

- Will The Housing Market Continue To Decline?

- Serious problems ahead for the British pound

- Crude Moves Toward $90 as Equities Rally, Gold Little Changed but Trend Intact

- A SuBPRiMe CHRiSTMaS CaRoL (PaRT II) (plus MR NeuTRoN UPDaTe)

- Gold Seeker Closing Report: Gold and Silver End Slightly Higher

- Wake-Up Call: Top 10 Trends of 2011

- James Turk: Pound may beat dollar to hyperinflation

- Stewart Thompson: Central banks use gold to control markets

- Has Gold Peaked?

- Lefty Rep. Dennis Kucinich starts his own campaign to end the Fed

- A Single Trader, JP Morgan, Holds 90% Of LME Copper

- 'Career Average' to Replace Final Salary?

- Minefinders: The Best of Both (Gold and Silver) Worlds

- Commodity market concentration starts to worry even Wall Street Journal

- A Global Glut of Deepwater Oil…With One Major Exception

- In The News Today

- Printing Money Not Actually in Bernanke’s Bag of Tricks

- TUESDAY Market Excerpts

- IMF completes gold sales program

- LGMR: Gold 2011 Forecast at $1500, $1600 or "Outrageous" $1800 on Euro Crisis

- Money Creation Home Invasion

- IMF concludes gold sales

- All the Gold Price Needs To Do Is Not Drop, That Shows it's Planning Another Advance

- The Wonderful World of Charles Fabrikant

- The "Sovereign Man" On What To Look For "When The Gold Market Tops"

- Bernanke Denies Printing Money. Mogambo Not Convinced

- 2011 Gold Outlook

- Gold Daily and Silver Weekly Charts

- Gold is Flat

- CFTC Delays Position Limits

- Gold's gains to stay for the long haul

- Tinsel Tuesday – Market Decorations Make Us Merry

- As ETFs Pass $1 Trillion In AUM, What Next?

- Stop Shooting Yourself in The Foot! Buy The Real Silver

- The U.S. Dollar: Backed By The FULL FAITH AND CREDIT Of The Federal Reserve Printing Press

- Silver Outperforms Gold - Profit! Silver Underperform Gold - Profit Again!

- Pretium Resources Closes Initial Public Offering and the Acquisition of the Snowfield Project and Brucejack Project

- Top Pick Candidate for the AOL Challenge

- Debt at Every Turn: New Governors Attack the Debt Crisis

- Vietnamese seek safety in gold as currency wobbles

- What to Expect From Gold Prices in 2011

- THe TWeLVe ZeRo HeDGe DaYS oF CHRiSTMaS

- What's in Your Stocking: Gold or a Pig's Tail?

- Russia's Central Bank Purchases 300,000 Ounces of Gold in November

- Alka Singh: Gold Equities' Upside Greater than Gold

- Dec 21st- A sample real time ABC pattern

- Gold and Dow: Liquidity Flows For 2011

- A Vote for Gold

| Does the Gold-Silver Ratio Really Revert to Its Mean? Posted: 21 Dec 2010 06:30 PM PST Mike Stall submits: In our earlier essay, we saw how the silver-gold pair is ideal to bet on for mean reversion. We also saw how to make use of the mean reverting properties of any ratio. Continuing on that topic, we will investigate whether mean reversion holds true for the gold-silver ratio in particular. We will examine variables one should watch over when looking at regime changes (points where the mean is set to new values). We will also explore a simplistic trading strategy on the ratio based on some core parameters that determine entry and exit points. It must be noted that this essay is a simplistic approach to pair study. Real life strategies could be more complex. Also, mean reversion is not a winning proposition all the time. With proper stop losses, however, it will be observed that it works out well on the winning side over a number of trades. Where pair trading scores over normal trading is that positions are hedged and market exposure is lesser than single positions. Also, when one realigns portfolios (i.e. using pair trading signals to work in the long term), the question of losses is obsolete – the attempt is to increase returns of the precious metals portfolio and it has been observed that acting on information from the ratio will increase returns significantly (as compared to not acting on it at all). Complete Story » | ||||

| Will The Housing Market Continue To Decline? Posted: 21 Dec 2010 06:10 PM PST This article originally appeared in The Daily Capitalist. The quick answer to the headline of this article seems to be yes. The volume of housing that is in mortgage trouble is rising as prices drop in vulnerable markets around the country. There isn't a sufficient floor of buyers in those markets to stop further declines and foreclosure sales that appear to be on the horizon. It depends on the market. For example, the recent Case-Shiller 20 cities report shows that coastal California has had a positive trend: Los Angeles +4.4%; San Diego +5.0%, and San Francisco +5.5%. Another area of strong growth is Washington DC (+4.5%) which is an island of government transfer payments in a sea of trouble. The bad news is that estimates of homes underwater and likely to default have gone up, depending on who you wish to listen to. The most recent and scariest number floating around is from Laurie Goodman at Amherst Securities:

Lender Processing Services (LPS) tracks performance on 40 million mortgage loans in the country. Their October report says that delinquencies remain about 2.7 times historical average, foreclosure inventories are 7.4 times and rising. Delinquencies have flattened a bit as more homes are moved to foreclosure. More loans are starting to move into foreclosure in the six and 12 month delinquency:

Based on Ms. Goodman's research, Nouriel Roubini sees losses to lenders reaching $1 trillion, assuming lenders recover 50 cents on the dollar on an average $200,000 per home. These are thumbnail estimates but previous estimates were that there were perhaps 3.5 million homes of shadow inventory. CoreLogic reports on negative equity in homes:

The interesting thing is that low interest rates do not seem to provide the stimulus for the housing market:

That suggests that neither rising rates nor tighter lending standards will have a major impact on housing as long as people perceive that prices are still falling. It goes without saying that housing starts are still at historical lows. Home sales are still off. RE/MAX reported that home sales in November fell nearly 5% from the prior month and are about 26% lower than a year earlier. The September S&P Case-Shiller home-price indexes reported that home prices declined:

I agree with many analysts that the Cash For Houses tax credit program just delayed the inevitable, caused a momentary spike in sales, and then after this summer when the credits expired, the market reasserted itself. Another cruel unintended consequence is that many buyers who bought because of the credits now are finding that their homes are declining in value. Here is something on the positive side: net worth is increasing because of deleveraging. The Fed's Flow of Funds report said:

The numbers show that while mortgage debt is being reduced, the value of homes is declining more. It is likely that this trend will continue. But 11 million more foreclosures? The trouble with historical analysis is that it doesn't predict the future. Goodman's analysis is thorough, but it is based on assumptions that are yesterday's news. It is difficult to refute her forecast, it all depends on her assumptions, but I'm not sure I buy in to it. There are too many things that can prevent 11 million foreclosures. One thing is an increase in money supply and resulting price inflation. Because I don't see unemployment improving dramatically in 2011, it is my belief that the Fed will continue its quantitative easing program past the June, 2011 period it has set for itself to buy $600 billion of U.S. Treasurys. It is conceivable that the Fed's balance sheet will expand beyond $1.7 trillion to much more than $2 trillion. I believe that will cause price inflation. Price inflation will appear to cause a rise in housing prices or at least flatten prices out. This in turn will (i) bail out borrowers as their homes increase in value and push toward positive equity, (ii) allow home owners to refinance their mortgages, and (iii) attract buyers to the market putting upward pressure on home prices. It is clear that housing prices will continue their slide for at least another year in the softer markets. | ||||

| Serious problems ahead for the British pound Posted: 21 Dec 2010 05:09 PM PST FGMR - Free Gold Money Report December 21, 2010 – Last week the British pound fell 3.0% against the US dollar. Some say it was because of UK bank exposure to Spain, which Moody’s warned could be downgraded. Others blamed the UK’s close economic link and heavy debt exposure to Ireland, which Moody’s did actually downgrade last week by 5-levels to Baa1. This low grade is barely above junk status. These downgrades in different corners of Europe no doubt had some impact on Sterling’s weakness, but there is I think another factor closer to home. It is the growing awareness of the runaway spending and borrowing by the British government. Despite all the rhetoric and promised cuts in spending by the newly elected coalition, the hard fact is that government spending and borrowing continue to soar – and look as if they are spiraling out of control. The following chart illustrates the magnitude of the problem as UK government debt nears... | ||||

| Crude Moves Toward $90 as Equities Rally, Gold Little Changed but Trend Intact Posted: 21 Dec 2010 04:25 PM PST courtesy of DailyFX.com December 21, 2010 08:51 PM Crude is hovering just under $90 ahead of tomorrow’s government report on U.S. petroleum inventories. Gold is consolidating as 20%+ gains for the year are digested. Commodities – Energy Crude Moves Toward $90 as Equities Rally Crude Oil (WTI) - $89.95 // $0.13 // 0.14% Commentary: Crude advanced for a third straight session, adding $1.01, or 1.14%, to settle at $89.82. Oil is now at the very top end of the $87 to $90 range that has contained prices this month. Another 2-year high in U.S. equity markets was the catalyst, with seemingly no bad news of significance on the radar at the moment. The Fed continues to be extremely supportive with its loose monetary policy, and corporate earnings are rebounding swiftly despite persistently high unemployment. More importantly, global growth is booming with the IMF expecting 4.2% growth in 2011 after 4.8% growth in 2010. It’s easy to get caught up in the v... | ||||

| A SuBPRiMe CHRiSTMaS CaRoL (PaRT II) (plus MR NeuTRoN UPDaTe) Posted: 21 Dec 2010 04:05 PM PST continuation... When E Benron Scrooge awoke, it was still very foggy and extremely cold, and there was no noise of people on Wall Street. Keynes' ghost bothered him. He didn't know whether it was a dream or not. Then he remembered that a spirit should visit him at the opening NYSE bell. So instead of having a Brazilian butt, head and back wax, E-Benron Scrooge decided to lie awake and wait what to see what happens. Suddenly, the NYSE opening bell struck. Light flashed up on his trading screen and a small hand drew back the curtains of his bed. Then E-Benron found himself face to face with the visitor. It was a strange figure – like a child: yet not so like a child as like an old decrepit Randian fool. "Who, and what are you?" E-Benron Scrooge asked the ghost. "I am Maestro the Ghost of Busted Bubbles Past. Rise and come with me." The ghost took Scrooge back in time, to a place where E Benron Scrooge studied as a young PhD candidate. There Scrooge could see his younger self playing foolish market equilibrium games with other delusional central banker wannabes. They were cheerfully running around a cheap imported Chinese Christmas tree; and although they were hopelessly naive in their theoretical assumptions, they had lots of geek fun. The spirit also took E-Benron Scrooge to a money printing factory where Scrooge was an apprentice. Scrooge saw the merry Christmas Eve they spent on the printing presses with his boss Mr Fuzzidice and his family. There was food and music and dancing and everybody was happy. Then the spirit took Scrooge to yet another place. Scrooge was older now. He was not alone, but sat by the side of a beautiful young girl. There were tears in her eyes. "It is sad to see," she said, softly. "that yet another moron has displaced me – the love of fools gold. Your heart was full of real gold once, but now …? I think it is full of QE crap. Fiat fraud begets fraud...swindle begets swindle...error begets error and the whole cycle soon becomes woebegotten. May you be happy in the lunatic path you have chosen." "Spirit," said Scrooge, "show me no more. Take me home. Why do you torture me?" "One shadow more," said the ghost. They were in another scene and place; a room, not very large or handsome, but full of comfort. There was a happy group celebrating Christmas with all their warmth and heartiness. Scrooge recognized his former girlfriend. She was married now and had children. Sweetheart said her husband with a smile, "I saw an old friend of yours this afternoon. E-Benron Scrooge it was. I passed his office window; and as it was not shut up, and he had a candle inside, I could see him there. His QE plan to revive the economy is faltering miserably and there he sat alone. Quite alone in the world, I do believe." "Spirit," said Scrooge in a broken voice, "Take me back! I cannot bear it any longer." He struggled with the ghost to take him back. And finally Scrooge found himself in his own bed again. He was very exhausted and sank into a heavy sleep.

SPECIAL UPDATE: MR NEUTRON RETURNS

| ||||

| Gold Seeker Closing Report: Gold and Silver End Slightly Higher Posted: 21 Dec 2010 04:00 PM PST Gold gained as much as $6.48 to $1391.98 at the open of trade in New York before it fell to see a $4.60 loss at $1380.90 by a little before 10AM EST, but it then rallied back higher for most of the rest of trade and ended near its earlier high with a gain of 0.16%. Silver jumped over 1% to as high as $29.563 before it fell back to as low as $29.005 in midmorning New York trade, but it also rallied back higher for most of the rest of trade and ended near its earlier high with a gain of 0.24%. | ||||

| Wake-Up Call: Top 10 Trends of 2011 Posted: 21 Dec 2010 03:36 PM PST After the tumultuous years of the Great Recession, a battered people may wish that 2011 will bring a return to kinder, gentler times. But that is not what we are predicting. Instead, the fruits of government and institutional action – and inaction – on many fronts will ripen in unplanned-for fashions. Trends we have previously identified, and that have been brewing for some time, will reach maturity in 2011, impacting just about everyone in the world. 1. Wake-Up Call In 2011, the people of all nations will fully recognize how grave economic conditions have become, how ineffectual and self-serving the so-called solutions have been, and how dire the consequences will be. Having become convinced of the inability of leaders and know-it-all "arbiters of everything" to fulfill their promises, the people will do more than just question authority, they will defy authority. The seeds of revolution will be sown…. 2. Crack-Up 2011 Among our Top Trends for last year was the "Crash of 2010." What happened? The stock market didn't crash. We know. We made it clear in our Autumn Trends Journal that we were not forecasting a stock market crash – the equity markets were no longer a legitimate indicator of recovery or the real state of the economy. Yet the reliable indicators (employment numbers, the real estate market, currency pressures, sovereign debt problems) all bordered between crisis and disaster. In 2011, with the arsenal of schemes to prop them up depleted, we predict "Crack-Up 2011": teetering economies will collapse, currency wars will ensue, trade barriers will be erected, economic unions will splinter, and the onset of the "Greatest Depression" will be recognized by everyone…. 3. Screw the People As times get even tougher and people get even poorer, the "authorities" will intensify their efforts to extract the funds needed to meet fiscal obligations. While there will be variations on the theme, the governments' song will be the same: cut what you give, raise what you take. 4. Crime Waves No job + no money + compounding debt = high stress, strained relations, short fuses. In 2011, with the fuse lit, it will be prime time for Crime Time. When people lose everything and they have nothing left to lose, they lose it. Hardship-driven crimes will be committed across the socioeconomic spectrum by legions of the on-the-edge desperate who will do whatever they must to keep a roof over their heads and put food on the table…. 5. Crackdown on Liberty As crime rates rise, so will the voices demanding a crackdown. A national crusade to "Get Tough on Crime" will be waged against the citizenry. And just as in the "War on Terror," where "suspected terrorists" are killed before proven guilty or jailed without trial, in the "War on Crime" everyone is a suspect until proven innocent…. 6. Alternative Energy In laboratories and workshops unnoticed by mainstream analysts, scientific visionaries and entrepreneurs are forging a new physics incorporating principles once thought impossible, working to create devices that liberate more energy than they consume. What are they, and how long will it be before they can be brought to market? Shrewd investors will ignore the "can't be done" skepticism, and examine the newly emerging energy trend opportunities that will come of age in 2011…. 7. Journalism 2.0 Though the trend has been in the making since the dawn of the Internet Revolution, 2011 will mark the year that new methods of news and information distribution will render the 20th century model obsolete. With its unparalleled reach across borders and language barriers, "Journalism 2.0" has the potential to influence and educate citizens in a way that governments and corporate media moguls would never permit. Of the hundreds of trends we have forecast over three decades, few have the possibility of such far-reaching effects…. 8. Cyberwars Just a decade ago, when the digital age was blooming and hackers were looked upon as annoying geeks, we forecast that the intrinsic fragility of the Internet and the vulnerability of the data it carried made it ripe for cyber-crime and cyber-warfare to flourish. In 2010, every major government acknowledged that Cyberwar was a clear and present danger and, in fact, had already begun. The demonstrable effects of Cyberwar and its companion, Cybercrime, are already significant – and will come of age in 2011. Equally disruptive will be the harsh measures taken by global governments to control free access to the web, identify its users, and literally shut down computers that it considers a threat to national security…. 9. Youth of the World Unite University degrees in hand yet out of work, in debt and with no prospects on the horizon, feeling betrayed and angry, forced to live back at home, young adults and 20-somethings are mad as hell, and they're not going to take it anymore. Filled with vigor, rife with passion, but not mature enough to control their impulses, the confrontations they engage in will often escalate disproportionately. Government efforts to exert control and return the youth to quiet complacency will be ham-fisted and ineffectual. The Revolution will be televised … blogged, YouTubed, Twittered and…. 10. End of The World! The closer we get to 2012, the louder the calls will be that the "End is Near!" There have always been sects, at any time in history, that saw signs and portents proving the end of the world was imminent. But 2012 seems to hold a special meaning across a wide segment of "End-time" believers. Among the Armageddonites, the actual end of the world and annihilation of the Earth in 2012 is a matter of certainty. Even the rational and informed that carefully follow the news of never-ending global crises, may sometimes feel the world is in a perilous state. Both streams of thought are leading many to reevaluate their chances for personal survival, be it in heaven or on earth. Regards, Gerald Celente [Editor's Note: The above essay is excerpted from The Trends Journal, which is published by Gerald Celente. The Trends Journal distills the ongoing research of The Trends Research Institute into a concise, readily accessible form. Click here to learn more about and subscribe to The Trends Journal.] Wake-Up Call: Top 10 Trends of 2011 originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||

| James Turk: Pound may beat dollar to hyperinflation Posted: 21 Dec 2010 03:05 PM PST 11p ET Tuesday, December 21, 2010 Dear Friend of GATA and gold: GoldMoney founder, Free Gold Money Report editor, and GATA consultant James Turk writes tonight that Britain may beat the United States to hyperinflation. Turk's commentary is headlined "Serious Problems Ahead for the British Pound" and you can find it at the FGMR Internet site here: http://www.fgmr.com/serious-problems-ahead-for-the-british-pound.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | ||||

| Stewart Thompson: Central banks use gold to control markets Posted: 21 Dec 2010 02:46 PM PST 10:54p ET Tuesday, December 21, 2010 Dear Friend of GATA and Gold: In commentary published today at GoldSeek, Stewart Thompson of the Graceland Updates letter emphasizes again that central banks buy and sell gold not to "make money" but rather to control the value of their currencies, moving their currencies up and down as politics seems to require -- that is, to rig currency markets. This point was made four years ago by the British economist Peter Millar in his excellent study, ""The Relevance and Importance of Gold in the World Monetary System," which you can find at GATA's Internet site here: Of course the same point has been made quite often lately by market analyst James G. Rickards of Omnis Inc., who has suggested that the Federal Reserve peg the dollar to a higher gold price through "open market" purchases and sales of gold, rather than through the traditional surrpetitious maneuvering of intermediaries: Thompson writes today: "With quantitative easing effectively dead now as a tool to handle any further worsening of the crisis, the central banks will look to accelerate their gold buy programs to revalue gold higher, and keep it higher. The point of revaluation is to devalue the debt that is owed by the government to its citizen creditors. "There is no possible way on this earth that I am going to stand before you four days before Christmas as gold revaluation gets under way and top-call myself or you out of your gold items. "The central bank buy programs are not about accumulating gold as an asset, as you accumulate it as an asset, an investment. They use gold as a control mechanism, and it takes very little gold to control the entire paper money system. "The central banks have no interest in buying gold cheaply or selling it 'high.' During gold revaluation (now) they want to pay higher and higher prices for gold, to ease their ability to pay their creditors in paper money." Compare the thoughtfulness of Thompson, Millar, and Rickards with the cavalier remarks of supposed analysts like Jon Nadler of Kitco, who insists that central banks have absolutely no interest in the price of gold, and Jeff Christian of CPM Group, who says he has consulted for most central banks and has found that they hardly ever think about gold at all even as they claim to sit on huge gold reserves. Of course the Fed somehow thinks about gold enough to refuse to give GATA access to its records about gold and particularly the records of the Fed's gold swap agreements with foreign banks: Thompson's commentary is headlined "Gold and Dow: Liquidity Flows For 2011" and you can find it at GoldSeek here: http://news.goldseek.com/GoldSeek/1292949285.php CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | ||||

| Posted: 21 Dec 2010 02:28 PM PST Greg Blonder submits: Over the last decade, it was hard to lose money on gold. Gold prices, and related precious metal stocks and funds, averaged around 20% a year returns, sailing through the economic downturn. So, naturally, many people are wondering - will this extraordinary run continue, or has gold peaked? Most observers, myself included, agree that fear and speculation are the main drivers behind the rise in gold. Its future prospects are debated ad infinitum, with partisans on every side and in between. A tiny minority of economists and politicians hope to return their country's currency to a "gold standard", despite the very serious flaws and dangers this blast from the past would engender (see comment below). But, what if we took their proposal seriously? After all, their concerns are moving the market. Would this perspective shine light on the future of gold prices? Complete Story » | ||||

| Lefty Rep. Dennis Kucinich starts his own campaign to end the Fed Posted: 21 Dec 2010 01:53 PM PST Kucinich Proposes Landmark Reform of Monetary Policy; Congressional Press Release http://www.kucinich.house.gov/News/DocumentSingle.aspx?DocumentID=217846 As the nation struggles with long-term unemployment at rates not seen in generations, contracted credit, and the hoarding of public dollars by the banks, U.S. Rep. Dennis Kucinich, D-Ohio, today introduced a dramatic new proposal to establish fiscal integrity, reassert congressional sovereignty, and regain control of monetary policy from private banks. The National Emergency Employment Defense Act of 2010 would allow the federal government to directly fund badly-needed infrastructure repairs and fund education systems nationwide by spending money into circulation without increasing the national debt. The bill would end the current practice of fractional reserve lending, whereby the economy depends upon private financial institutions to lend money into circulation. Kucinich stated: "The staggeringly bad employment and economic numbers represent a massive problem which cries out for bold action. Rather than crossing our fingers and hoping that banks will finally lend some of the billions of public dollars they haven't thus far seen fit to lend, we can take action. My bill would replace the Federal Reserve System's dependence on private banks to create credit. In its place, a Monetary Authority under the Treasury Department would directly inject liquidity into the economy by purchasing much-needed public infrastructure repair. Today we have idle capital, millions of able-bodied but unemployed workers, unused equipment, and record low interest rates. These conditions are the best possible time to make a long-term investment in our nation's infrastructure. My bill would do exactly that." See the legislation here: http://kucinich.house.gov/UploadedFiles/NEED_ACT.pdf * * * Excerpts from the legislation. Findings. ... (17) The authority to create money is a sovereign power vested in the Congress under Article I, Section 8 of the Constitution. (18) The enactment of the Federal Reserve Act in 1913 by Congress effectively delegated the sovereign power to create money to the Federal Reserve system and private financial industry. (19) This ceding of constitutional power has contributed materially to a multitude of monetary and financial afflictions, including: (A) growing and unreasonable concentration of wealth; (B) unbridled expansion of national debt, both public and private; (C) excessive reliance on taxation of citizens for raising public revenues; (D) inflation of the currency; (E) drastic increases in the cost of public infrastructure investments; (F) record levels of unemployment and underemployment; and (G) persistent erosion of the ability of Congress to exercise its constitutional responsibilities to provide resources for the general welfare of all the American people. (20) A debt-based monetary system, where money comes into existence primarily through private bank lending, can neither create nor sustain a stable economic environment, but has proven to be a source of chronic financial instability and frequent crisis, as evidenced by the near collapse of the financial system in 2008. (21) Banks pyramided their value by spending money into existence, greatly inflating the value of bank holdings, inflating the value of their asset bases, enticing unknowing investors to participate in financing schemes like the bundling of subprime mortgages, and ultimately bringing undercapitalized banks and the entire financial system to the edge of ruin, creating circumstances where the taxpayers of the United States were called upon to save the banks from their own imprudent money-issuing practices, misspending, and misinvestments. The banks' ability to create money out of nothing ultimately became the taxpayers' liability, and raises a fundamental question about a practice of money creation which threatens the wealth of the American people. (22) Abolishing private money creation can be achieved with minimal disruption to current banking operations, regulation, and supervision. (23) The creation of money by private financial institutions as interest-bearing debts should cease once and for all. (24) Reclaiming the power of the federal government to create money, and to spend or lend money into circulation as needed, eliminates the need to treat money as a federal liability or to pay interest charges on the nation's money supply to financial institutions; it also renders unnecessary the undue influence of private financial institutions over public policy. (25) Under the current Federal Reserve System, the persons responsible for the conduct of United States monetary policy have been unaccountable to the Congress and the nation, have resisted auditing by the General Accounting Office, and have claimed exemptions from some federal statutes, including the Civil Rights Act of 1964, that apply to all agencies of the federal government. (26) The conduct of United States monetary policy by the Board of Governors of the Federal Reserve System, and specifically the failure of board members to safeguard the financial system against wholesale fraud and abuse of citizens, demonstrates the risks of maintaining a system wherein the power to create and regulate money has been delegated to private individuals who are unaccountable to the people of the United States in any way, even through their representatives in Congress. (27) The Board of Governors of the Federal Reserve System has acted unilaterally to create and spend $1.25 trillion for the purpose of acquiring mortgage-backed securities, in disregard for the constitutional requirement that all Federal Government spending originate in the House of Representatives. (28) An examination of the historical record demonstrates that the exercise of control by the United States Government over the money system has provided greater moderation in the supply of money and promoting the general welfare, and has been indispensable in times of national emergency for generating resources required to support public investment, provide for national defense, and promote the general welfare, and is therefore superior to private control over the money system. (29) As our money system is a key pillar in maintaining general economic welfare and as the Federal Reserve System and its private banking partners have consistently failed to promote or preserve the general welfare, it is essential that Congress, in the name of protecting the economic lives of the American people and the long-term security of our nation, reassume the powers and responsibilities granted to it by the Constitution. PURPOSES. The purposes of this Act are as fol1ows: (1) To create a full employment economy as a matter of national economic defense; to provide for public investment in capital infrastructure; to provide for reducing the cost of public investment; to retire public debt; to stabilize the Social Security retirement system; to restore the authority of Congress to create and regulate money; to modernize and provide stability for the monetary system of the United States, and for other public purposes. (2) To abolish the creation of money, or purchasing power, by private persons through lending against deposits, by means of fractional reserve banking, or by any other means. (3) To enable the federal government to invest or lend new money into circulation as authorized by Congress and to provide means for public investment in capital infrastructure. (4) To incorporate the Federal Reserve System into the Executive Branch under the United States Treasury, and to make other provisions for reorganization of the Federal Reserve System. (5) To provide for an orderly transition. (6) To make other provisions necessary to accomplish the purposes of this Act. ... ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan power plants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: | ||||

| A Single Trader, JP Morgan, Holds 90% Of LME Copper Posted: 21 Dec 2010 01:43 PM PST When a week ago we reported that JP Morgan has denied it owned more than 90% of the copper positions on the LME, we suggested that this could very well mean that Blythe Master's firm could just as easily control 89.999% of the copper and still not misrepresent the truth per that non-commital press release. Turns out our unbridled cynicism was spot on as usual. The Wall Street Journal has just reported that in the copper market "a single trader has reported it owns 80% to 90% of the copper sitting in London Metal Exchange warehouses, equal to about half of the world's exchange-registered copper stockpile and worth about $3 billion." Oh and yes, while JP Morgan technically is not singled out, we will be delighted to issue a retraction the second JP Morgan approaches us with a refutation that it is not the trader in question. And while we are at it, we also will repeat our claim that it was indeed JP Morgan that reduced its massive silver position, as per the recent FT article: as above we will immediately issue a retraction and apologize should JPM's legal department contact us that we are wrong on this. Somehow we don't think that will be an issue. And so it is once again made clear that the biggest market manipulating cartel in the world is not only JPM's commodity trading operation, but the "regulators" at the CFTC, who are doing all they can do to delay implementing rules on position limit- a stalling tactic whose sole purpose is to make the life of Jamie Dimon as comfortable as possible while he corners the copper market (and offloads his PM shorts to some "foreign bank"), even if that means the complete collapse in faith in the commodity market. Presumably, this means that Mr. Gensler has received an outsized Christmas gift to assuage his conscience. As for the commodity market, well, just look at what has happened to the stock market now that everyone knows it is nothing but a house of cards scam where a few robots front run each other. We are confident to quite confident tomorrow's ICI report will confirm that 33rd consecutive outflow from domestic equity funds. It is a pity that the same fate will now happen to the commodities market, as everyone tells Gensler to shove his corrupt market, and moves to physical. Frankly, it couldn't happen to a nicer group of so-called regulators. From the WSJ:

Please keep the bolded text in mind, as you read the following description of the idiocy spewed on TV tonight, via the Street:

In other words: per Cramer, the story broken by the WSJ is just fabulation and JPM's 90% lock of the copper market is as indication of proper supply/demand dynamics. Because, in some parallel universe, JP Morgan controlling 90% of the market is real demand... You read that right. And this person is on TV, advising lemmings how to throw their money into a ponzi which nobody even pretends to hide. That said, we are not worried about Cramer: following the next market crash, which is coming, after his termination from what is left of CNBC, he will make millions selling his latest book written in second grade friendly-English, titled "This time, I promise, it is different." With a subtitle:" Trust me - I was on TV...in spite of my atrocious Nielsens rating."

| ||||

| 'Career Average' to Replace Final Salary? Posted: 21 Dec 2010 01:36 PM PST The BBC reports, Public pension schemes 'should be career average':

I'm not going to debate the pros & cons of final salary versus career average pension schemes, but it's obvious that policymakers in Britain are looking to make cuts to pensions and this, along with the switch to CPI, are all part of the measures they're introducing now. The US is also taking note as many states are struggling to cope with their own ballooning pension costs. CBS's 60 Minutes had a segment on the municipal bond market this past Sunday which took a close look at the financial mess plaguing many states (see videos below or click here). Will a collapse in the municipal bond market be the next major hurdle? Who knows? But I can guarantee you the Fed and the US government will do whatever it takes to avoid any collapse of the municipal bond market. In the meantime, pension reforms will continue around the world, and many policymakers will be looking at Britain to see how their reforms are working out and whether they can bolster their pension system now that the day of reckoning has arrived.

| ||||

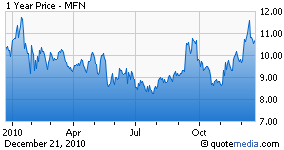

| Minefinders: The Best of Both (Gold and Silver) Worlds Posted: 21 Dec 2010 01:05 PM PST Minefinders (AMEX:MFN)[TSE:MFL] is headquartered in Vancouver but all of its mines are located in Northern Mexico. It has very unique attributes, notably the hybrid nature of its mineral reserves (approximately 50/50 gold to silver).

Complete Story » | ||||

| Commodity market concentration starts to worry even Wall Street Journal Posted: 21 Dec 2010 12:39 PM PST Trader Holds $3 Billion of Copper in London By Tatyana Shumsky and Carolyn Cui http://online.wsj.com/article/SB1000142405274870411850457603408343693141... As commodity prices soar to new records, the ability of a few traders to hold huge swaths of the world's stockpiles is coming under scrutiny. The latest example is in the copper market, where a single trader has reported it owns 80% to 90% of the copper sitting in London Metal Exchange warehouses, equal to about half of the world's exchange-registered copper stockpile and worth about $3 billion. The report coincided with copper prices soaring to new records on Tuesday. Commodities prices rallied along with stocks. The Dow Jones Industrial Average gained 55.03 points, or 0.48%, to 11533.16, its highest level since August 2008. Crude oil jumped to its highest level in more than two years and topped $90 a barrel in late electronic trading in New York. Corn and soybeans rose amid worries about hot weather in Argentina. Copper soared to a new record of $4.2705 per pound on Tuesday in New York, and is up 28.3% this year. The LME's three-month copper contract closed at $9,353.50 a metric ton, up 1.6% on the day, a new record. ... Dispatch continues below ... ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. J.P. Morgan Chase & Co. recently had a large position in copper, though it is unclear whether the U.S. bank increased its holdings, or whether a new player has taken dominant position. "Regardless of who owns it, the only thing of note here is that we are being told that one person has a substantial position," said David Threlkeld, president of Resolved Inc., a metals consultancy. Single traders also own large holdings of other metals. One trader holds as much as 90% of the exchange's aluminum stocks. In the nickel, zinc and aluminum alloy markets, single traders own between 50% to 80% of those metals and one firm has 40% to 50% of the LME's tin stockpiles. While commodities exchanges scrutinize all holdings to ensure a single player isn't trying to corner the market, and many of the positions are owned by big firms on behalf of clients, the large holdings do result in a concentration of ownership that could skew prices. At the same time, thousands of new investors are flooding into the commodities markets, either directly or through exchange-traded funds, seeking to take advantage of an expected rise in prices of raw materials as the global economy continues to recover. While commodities regulators in the U.S. are considering restricting the amount of futures contracts any one trader can hold, they have no jurisdiction over physical holdings. The LME has strict rules to prevent market squeezes but does not limit how much metal a single trader may hold. Instead, the exchange demands the dominant holder make metal available for short-term periods at very limited profit margins. The LME says it closely watches individual holdings. Copper demand is likely to outstrip supply this year by an estimated 455,000 metric tons, says Barclays Capital. Copper inventories at the LME have been declining since February. Consumption is growing rapidly in China, Brazil, and the U.S. And the creation of ETFs to hold physical metal is helping drive demand. On Tuesday, ETF Securities, a London-based provider, said that its newly-announced copper-backed ETF has added about 850.5 tons of copper, up 43%, to reach 1,445.5 tons. Last month, the LME reported that a single holder owned more than 50% of the exchange's copper. People familiar with the matter at the time said J.P. Morgan was the holder. On Tuesday, the LME reported that a single holder now has as much as 90% of the stockpiles, without naming the firm. The LME reports data two days in arrears, so the position increased on Friday. In the aluminum market, about 70% of the LME metal is locked up, MF Global base metals analyst Edward Meir said during LME Week in London in October. LME aluminum stocks currently total around 4.3 million metric tons. As one example, Swiss commodity trading firm Glencore International AG bought about 1.6 million tons of the metal from United Co. Rusal Ltd. earlier this year, market participants said at the time. Glencore then turned around and presold the metal. So even though the aluminum is sitting in LME warehouses, visible to all traders, it is effectively locked up. These sorts of deals have skewed physical trading in these metals, as other consumers have paid increasing premiums to get hold of stocks, even though the metal looked like it was available in warehouses. Holding ready-for-delivery metals on an exchange isn't a cheap undertaking for traders, who are responsible for paying insurance, storage and financing costs. And "the end game is to find somebody to buy something you have already bought for a higher price," Mr. Threkeld said. The recent boom in metal prices has enabled traders to purchase the physical metal, sell a futures contract at a much higher price and still make a profit after paying for storage and insurance. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | ||||

| A Global Glut of Deepwater Oil…With One Major Exception Posted: 21 Dec 2010 12:00 PM PST It's boom time for offshore drilling. Not in the US, of course, but that shouldn't come as any surprise. After all, there are few "enemies" Congress pursues with more gusto than that of conspicuous productivity. Almost three weeks have past since President Barack Obama passed a 7-year moratorium on drilling for oil and natural gas within 125 miles of the Florida coast. And still, unremarkably, the industry soldiers on…elsewhere. Indeed, production from deepwater drilling, having doubled over the past five years to some five million barrels per day, continues to capture a larger piece of the total global supply pie. Thanks mostly to new discoveries and ongoing investment in exploration and development in Brazil and West Africa, that figure is projected to double by 2020, when contributions from the deep will make up more than 10% of total global production. Of the deepwater discoveries made during the past decade, Brazil boasts 7 of the top ten, as measured by volume. At very best estimates, fields Tupi (2006), Jupiter (2008), Franco (2010), Lara (2008), Jubarte (2001), Mexilhao (2001) and the newly discovered Libra deposit (2010), could contain up to 40 billion barrels of oil equivalent – about half the size of Saudi's elephant Ghawar Field. That may sound like a bit of a stretch and, to be fair, many of these discoveries are relatively fresh and estimates can vary quite a bit on the size of the deposits. Moreover, governments with total or majority control over their national reserves tend, as governments do, to err on the side of optimism when evaluating the size of their own fields. But that's probably as true for Saudi and Russia, say, as it is for Brazil and the West African nations. Overestimating the size of one's endowment is nothing new, after all. Nevertheless, even if only one third of Brazil's recently discovered deepwater deposits end up in the "recoverable" basket, that still puts the total reserves more or less on par with Alaska's Prudhoe Bay giant…a field discovered more than four decades ago which is laboring under an 11% annual decline rate. And the South American field leader is showing no signs of slowing down, either. Given its recent spate of discoveries, it should come as little surprise that Brazil is doubling down on its deepwater bet, a tactic seen in sharper relief when compared to the post BP blowout response by the US. "The Department of Interior (DOI) is pretty much squashing offshore development in the name of safety," Byron King, our resident oil man noted in yesterday's 5-Minute Forecast. "'No more blowouts' is a nice slogan, but it seems that the DOI wants to achieve that worthy goal by just shutting down offshore development for all purposes. "Since June," continued Byron, "the DOI has approved less than one new offshore drilling permit per week – and only in shallow waters, less than 500 feet depth. Almost NONE of the permits are for exploration wells, with the few approvals being for developmental drilling in known areas. "It's a recipe for falling future output and eventual energy shortages in the US," concluded Byron, to which 5 editor Dave Gonigam astutely added, "And it stands in stark contrast to what other governments are doing." Indeed. Already South America's largest economy, Brazil hopes to increase its deepwater production from 1.4 million barrels per day, as measured in 2009, to 3.5 million by 2020. Deepwater production in the US, by comparison, looks set to remain stable at 1.2 million barrels per day…after having only increased from 1 million barrels per day since 2000. Elsewhere, too, nations unable to afford the luxury of environmental hysteria are taking advantage of the political fallout in the US to advance their own deepwater programs. Where the Gulf of Mexico remains paralyzed, the Gulf of Guinea, for example, flourishes with exploration activity. Reports The Wall Street Journal: "Tullow [Oil PLC] in July announced a significant discovery off Ghana after drilling in 4,685 feet of water. A nearby field, estimated to contain up to 1.5 billion barrels of oil, is scheduled for first production in December. "Chevron, meanwhile, announced the acquisition of three large deep-water exploration blocks in Liberia. It plans to begin drilling there this year. The company also bought deep-water acreage in the Turkish Black Sea and in China." With the BP disaster still fresh in the minds of many Americans, the Obama administration has obviously decided it cannot afford the political cost of more deepwater drilling. The Brazilians and West Africans, however, seem to have decided they cannot afford not to drill. Joel Bowman A Global Glut of Deepwater Oil…With One Major Exception originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||

| Posted: 21 Dec 2010 11:55 AM PST My Dear Friends, I am physically back in the US. I am sure the rest of me will catch up soon. This is what 19 hours of traveling can do to you. The flight from Joberg went through Dakar and was 19 hours from start to finish. That is the last time I do that. From now on it is Joberg to Dubai to JFK. That is much more civilized. Regards,

Jim Sinclair's Commentary The Green Hornet says "The only way public pensions are going to remain functional is by government bailouts or QE to infinity." I cannot disagree with that at all. It further influences me to say that all of this is coming to a head very soon. Gold will trade at $1650 and beyond soon. 2011: The Year Public Pension Plans Get Whacked The traditional defined-benefit pension that is the dominant retirement plan for public-sector employees officially has a huge target on its back. And 2011 is shaping up as the year politicians begin to take serious aim at cutting promised benefits. What was a mere trickle of states and municipalities starting to address massive unfunded pension liabilities in 2010, which are now estimated to total more than $1 trillion, looks to grow to a torrent in 2011. New Jersey Governor Chris Christie may be the most voluble agitator for pension cutbacks, but he's got plenty of company across the country. Here's what some other states and cities are considering: Virginia. Governor Bob McDonnell recently proposed that Virginia's public employees be required to chip in 5 percent of their pay to the state's pension fund. Virginia stopped requiring public employee pension contributions in 1983. Houston. Mayor Annise Parker has started the "conversation" by deeming the city's three major pension plans covering Houston's police, firefighters, and municipal employees unsustainable. "There's a difference between a fair pension and a gold-plated pension, and the citizens of Houston have to know that we can find a fair balance in there," Mayor Parker told the Houston Chronicle. Maryland. A proposal released yesterday by a state pension commission would increase the years of service for workers to qualify for Maryland public retirement benefits. Employees would need 15 years on the job (up from the current 5) to qualify for retiree health benefits, and the vesting period for the state's pension plan would increase from its current five years to 10 years. The commission also wants to shift half of teacher pension costs from the state to local counties.

Jim Sinclair's Commentary Here is another clear and present danger that must result in QE to infinity. There is no way out. The revenues of states have but one way to go, and that is DOWN. The expenses of states cannot be practically reduced to meet any equilibrium with the drop in revenue. States will have to be bailed out, and that means QE to infinity. That means gold will trade at $1650 and better.

Jim Sinclair's Commentary There is no practical solution to the gathering economic and social clouds other than QE to infinity. Gold will therefore trade at $1650 and higher. Wave of Muni Defaults to Spur Layoffs, Social Unrest: Whitney A wave of defaults by state and local governments in the coming months will spark a selloff in the municipal bond market, hurting US economic growth and stocks and causing social unrest as governments are forced to lay off workers and cut back on services, well known financial analyst Meredith Whitney told CNBC Tuesday. Responding to the uproar over her "60 Minutes" interview broadcast on CBS Sunday night, Whitney defended her prediction that at least 50 to 100 cities and towns could default on their debt as states and the federal government cut back on financial support. Muni experts, including an analyst from Standard & Poor's, dismissed her predictions, saying the numbers don't add up. "I appreciate that the reaction is so violent," she said in a live interview with CNBC. "I didn't put the debt on these states. We're looking at the numbers. This is how it plays out." The big problem is that cash-strapped states will no longer be able to provide the financial support to municipalities as they have in the past, said Whitney, who is CEO and founder of Meredith Whitney Advisory Group.

Gold looks poised to move higher Following a period of volatility and year-end position-squaring, gold looks set to move higher, and may have a good shot at hitting the US$1,525 an ounce level. For many years now, the gold bull has been moving in very dependable Elliott Wave and Fibonacci patterns. But every once in a while, the outlook becomes a little less clear. In recent weeks, for example, as we approach the end of 2010, we have seen a lot of price volatility as position squaring and year-end machinations hold sway. But having said that, it does look like gold should be poised to rise in the short term, and I'm looking for a completion to a 5 wave rally that began from about $1,040 per ounce in February of this year. During the past couple of months, I see a clear Fibonacci trading day relationship on Gold's swings from pivot highs to pivot lows. 8 days of correction, 13 days of rally, 8 days of correction is the recent pattern over the past 5 weeks or so. Below is a chart outlining these crowd behavioral based patterns that I rely on for both my trading service and market forecasting services. You can see the clear relationships, confirmed by the stochastics indicators at the tops and bottoms as well:

Jim Sinclair's Commentary When confidence in the dollar collapses it is exactly like the event herein depicted.

Jim Sinclair's Commentary Here is where the bad stuff hits the fan. The accounting firm opined on the OTC derivatives. That subject cannot stand the light of day a criminal investigation is sure to put on it. N.Y.'s Cuomo Sues Lehman Accounting Firm Ernst & Young New York Attorney General Andrew Cuomo sued Ernst & Young LLP, accusing the firm of facilitating a "major accounting fraud" by helping Lehman Brothers Holdings Inc. deceive the public about its financial condition. For more than seven years before Lehman declared bankruptcy in 2008, the investment bank engaged in transactions approved by Ernst & Young whose purpose was to move debt off its balance sheet and make it appear less leveraged, Cuomo said in a statement. This was done through what are known as "Repo 105" transactions. "This practice was a house-of-cards business model designed to hide billions in liabilities in the years before Lehman collapsed," Cuomo said today in one of his last cases as attorney general. "Just as troubling, a global accounting firm, tasked with auditing Lehman's financial statements, helped hide this crucial information from the investing public." The state seeks to recover fees collected by Ernst & Young for work performed for Lehman between 2001 and 2008, which exceed $150 million, and investor damages and equitable relief, Cuomo said. He will be sworn in as New York governor on Jan. 1. His successor will be New York Democratic state Senator Eric T. Schneiderman. Charles Perkins, a spokesman for Ernst & Young, didn't immediately respond to a call and e-mail seeking comment.

Jim Sinclair's Commentary You have to know this is all coming to a head very soon. Those that heaped criticism on Bernanke are now at the door of the Fed with their Begging Bowls. The Fed created the money in the first place with QE to infinity. Fed extends USD swaps with major central banks FRANKFURT (Reuters) – The world's major central banks said on Tuesday they would extend emergency supplies of U.S. dollar funding to money markets, in a sign that authorities remain concerned about financial instability as governments grapple with debt problems. The European Central Bank, the Bank of Japan, Bank of Canada, the Bank of England and the Swiss National Bank extended their U.S. dollar liquidity providing operations with the U.S. Federal Reserve until August 1, an indication they view the money markets as still fragile. The swap lines, which had been due to expire next month, were established to ease strains in short-term money markets by ensuring banks do not have trouble obtaining dollars, although banks have used the lines relatively little since the middle of this year. The Fed's policy-setting panel opened swap lines, first with the ECB and the SNB in December 2007 and later with other central banks, including those of Sweden, Mexico and Brazil. These lines were discontinued in January this year because market conditions had improved, but in May the central banks decided to reopen the operations after the sovereign debt crisis ignited. Now they have been extended again.

Jim Sinclair's Commentary How is this situation going to be rectified? The simple answer is that it won't be fixed in any manner. It will be papered over by the Fed buying new State debt, a classic form of QE. $2tn debt crisis threatens to bring down 100 US cities More than 100 American cities could go bust next year as the debt crisis that has taken down banks and countries threatens next to spark a municipal meltdown, a leading analyst has warned. Meredith Whitney, the US research analyst who correctly predicted the global credit crunch, described local and state debt as the biggest problem facing the US economy, and one that could derail its recovery. "Next to housing this is the single most important issue in the US and certainly the biggest threat to the US economy," Whitney told the CBS 60 Minutes programme on Sunday night. "There's not a doubt on my mind that you will see a spate of municipal bond defaults. You can see fifty to a hundred sizeable defaults – more. This will amount to hundreds of billions of dollars' worth of defaults." New Jersey governor Chris Christie summarised the problem succinctly: "We spent too much on everything. We spent money we didn't have. We borrowed money just crazily. The credit card's maxed out, and it's over. We now have to get to the business of climbing out of the hole. We've been digging it for a decade or more. We've got to climb now, and a climb is harder." | ||||

| Printing Money Not Actually in Bernanke’s Bag of Tricks Posted: 21 Dec 2010 11:00 AM PST Mr. Ben Bernanke. Mythbuster! "One myth that's out there," he told 60 Minutes, "is that what we're doing is printing money." Ha. Ha. Ha. Can you imagine anything so laughable? So ridiculous? So absurd? And to think that even we, at The Daily Reckoning, believed it. How could we be so credulous? Of course, the Fed is not printing up money. How could we have been so naïve? The days of printing up money are long gone. Now, the Fed doesn't do anything of the sort. Instead, it merely buys US government debt from banks. That's not printing money. Nope. Not at all. Not even close. But wait. How does it pay for the bills, notes and bonds it buys? Oh, well, it certainly doesn't print up money. Instead, it merely credits the banks with the money…electronically. No printing involved. The banks then have money that didn't exist before. The banks are supposed to lend it out. For every dollar they get from the Fed they can lend out 10. That's how it works. So, IF anyone wanted to borrow the money, and IF the Fed had bought, say, $1 trillion worth of US government debt, the banks COULD lend ten times that amount…thus increasing the supply of money in circulation by $10 trillion. Does that sound like printing money to you? Nah… Of course not. Does it sound like it might cause inflation? Well, yes… It would be rather surprising if it didn't. Consumer price inflation is now running at about 1% per year. Why so low? Because, so far, the banks aren't lending. The Fed adds money to the system. But it doesn't get passed along. Why not? Because we're in a Great Correction. The economy is saturated with debt. People are trying to dry out. And no matter how many times the Fed offers them a drink; they're still on the wagon. Of course, if the economy were to go on a binge again, the banks would lend, people would borrow, and all that money the Fed didn't print would suddenly come out of hiding. Consumer prices would go up. Hyperinflation could come quickly. Then what would Mr. Bernanke do? He says he would raise interest rates immediately, should the CPI hit 2%. Well, dear reader, do you believe him? We do. At least as much as we believe he's not printing money. Regards, Bill Bonner Printing Money Not Actually in Bernanke's Bag of Tricks originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||

| Posted: 21 Dec 2010 10:15 AM PST Gold edges higher in holiday-thinned trading The COMEX February gold futures contract closed up $2.70 Tuesday at $1388.80, trading between $1381.40 and $1393.00 December 21, p.m. excerpts: | ||||

| IMF completes gold sales program Posted: 21 Dec 2010 10:13 AM PST From Reuters http://af.reuters.com/article/metalsNews/idAFN2127057720101221 WASHINGTON -- The International Monetary Fund said on Tuesday it had concluded the sale of 403.3 tonnes of gold under a program approved in September 2009 to help boost its lending resources. All gold sales were at market prices, including direct sales to official holders, the IMF said in a statement. The gold sales amounted to one-eighth of the IMF's total gold reserves. The fund sold 200 tonnes to India's central bank last year. Other buyers have included Bangladesh, Sri Lanka and Mauritius. The IMF said on Nov. 29 it told 19.5 tonnes of gold in October but it has not yet provided details of sales in November or December. ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | ||||

| LGMR: Gold 2011 Forecast at $1500, $1600 or "Outrageous" $1800 on Euro Crisis Posted: 21 Dec 2010 10:02 AM PST London Gold Market Report from Adrian Ash BullionVault 21 Dec., 08:15 EST Gold 2011 Forecast at $1500, $1600 or "Outrageous" $1800 on Euro Crisis, US-China Currency War THE PRICE OF GOLD in professional wholesale dealing touched a 4-session high early Tuesday at $1390 per ounce, rising for Euro and UK investors as world stock markets hit new two-year highs. Platinum prices rose to $1715 the ounce at today's London Fix, gaining some 14.6% higher from New Year 2010. Slipping back from $29.50 an ounce on Tuesday, the silver price stood more than 74% higher from the start of the year. "Trading has been very thin so far," says a London dealer in a note, likening Tuesday's volumes to "the late days of summer." Noting strong inflows into newly-launched US precious-metal and platinum trust funds, recent demand is "demonstrating bullishness across the entire complex," says a London analyst, "indicating wider interest." On the political front today, North Korea said it wou... | ||||