Gold World News Flash |

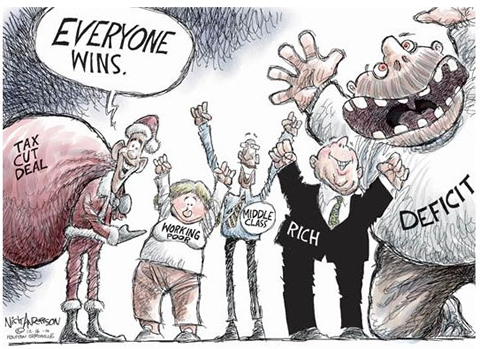

- What’s Wrong With a Win-Win-Win(-Lose)?

- Gold extends gains on euro woes, tensions in Korea

- A golden year end? Technicians split on whether gold has bottomed

- Crude Oil Consolidation Continues, Gold Advances as ETF Holdings Surge

- It’s Never Too Early to Predict the Future!

- Gene Arensberg: Bullion banks still reducing silver shorts

- Gold to go in a Boca Raton Mall

- Join GATA at the Vancouver conference in January

- Paul says he'll ask Fed about transactions with foreign banks

- Paul says he'll ask Fed about transactions with foreign banks

- 3 Things to Watch As Silver Season Ends

- Big Activity in GLD, SLV and Comex Silver Stocks

- Don't Forget Where You Came From

- This Popular Gold Investment Is a Snow Job

- Silver/Gold Ratio Reversion 4

- Gold Stocks Still Cheap 2

- [## ALL DECEMBER REPORTS POSTED TO THE WEBSITE ##]

- FIRST U.S. GOLD ATM VENDING MACHINE ARRIVES IN FLORIDA

- CFTC Delays Position Limits – Bullion Banks Reduce Silver Shorts

- Fancy Florida ATM Skips The Folding Cash, Spits Out Gold

- The Effects of Central Banking on Gold and Paper Currencies

- How Leveraged Is JP Morgan?

- John Embry: Gold, silver could go ballistic by year-end

- Weekly precious metals review at King World News

- Once one PIIG flies, they all will, Ben Davies tells King World News

- Tanzania Proving Fertile Ground for Junior Miners

- When Gold Correction Ends, Uptrend Should Remain Intact

- Inflation Scorecard: Gold’s Mixed Performance

- Tax Measure Gives Deal to Wealthy Roth IRA Converters

- Good vid on VERY REAL SILVER SHORTAGES AROUND THE WORLD

- A Look At The Upcoming Calendar As The Sleepiest Week Of The Year Arrives

- NY GIANTS EAT SHIT AND DIE

- Sean Corrigan On Six Sigma Events In The Bond Curve, "Inexorably Rising Risk", And Other Observations

- Sean Corrigan On Six Sigma Events In The Bond Curve, "Inexorably Rising Risk", And Other Observations

- Sick of the Afghanistan farce? Buy Silver – Crash JP Morgan – which in turn will crash the Fed – which in turn will force the US to pull out of various foreign occupations (that do nothing but make bankers rich).

- In The News Today

- Review Of Europe In 2010, And The 2011 Continental Outlook From The Rosy Prism Of Erik Nielsen; Is A New European Brady Plan Coming?

- Gold Short-term Bearish but Medium and Long-term Bullish

- Gold: Strong Nerves and Patience of Ten Men

- The Greater Good: Relative Value and the Endowment Effect

- Guest Post: For How Much Longer Can China Resist Raising Rates?

- How to Protect Your Family and Wealth from the End of America

- Gold and Silver Investing Facts That Can Make You Rich

- GDXJ Gold Stocks ETF Investment Is a Snow Job

- U.S. Economy Muddling Through, More Crises, More Global Risk Aversion Ahead

- The End of America

- Gold Investment "A Crowded Trade"...?

- Gold Investment "A Crowded Trade"...?

- Gold Bubble to Burst?

- Gold Investing: True Mania Still Ahead

| What’s Wrong With a Win-Win-Win(-Lose)? Posted: 19 Dec 2010 05:32 PM PST This past Friday, President Obama signed the kind of law that makes everyone happy… an extension of the Bush-era tax cuts. It's a deal Republicans like because it keeps income, dividend, and capital gains tax rates relatively low for another two years. While Democrats like it for its extension of unemployment benefits, reduction of Social Security payroll taxes, and extension of tax credits for children, college tuition, and a variety of other items. Perhaps best of all, as you can below, this unique win-win piece of legislation — that's designed to make absolutely everyone happy — also makes the deficit leap with joy…

What's Wrong With a Win-Win-Win(-Lose)? originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |

| Gold extends gains on euro woes, tensions in Korea Posted: 19 Dec 2010 05:11 PM PST By Lewa Pardomuan Tensions on the Korean peninsula following Seoul's plan to go ahead with live firing drills from a disputed island near the disputed northern border offered additional support. Bullion has risen as much as 30 percent this year. But dealers expect slow trading ahead as the year-end nears. Spot gold added $10.90 an ounce to $1,383.90 an ounce by 0038 GMT, but it was still well below an historical high around $1,430 hit earlier this month. … Some dealers in Hong Kong saw physical buying related to the tensions on the Korean peninsula, which could escalate into war. The U.S. the U.S. envoy to the United Nations Susan Rice said disagreements on the U.N. Security Council over the crisis are so severe that it is unlikely they can be resolved. "There's a little bit of buying by investors here. People are cautiously bullish. People are still talking about high inflation everywhere next year," said a dealer in Hong Kong. [source] | |

| A golden year end? Technicians split on whether gold has bottomed Posted: 19 Dec 2010 05:06 PM PST By Peter Brimelow Last week's losses were not in the end all that dramatic. Using the New York floor close settlement on the CME most active contract Gold – 100 Oz (Comex) Commodities Exchange Centre, gold only lost $5.70 on the week. Nevertheless, some professional technicians were very upset. Gold dealer ScotiaMocatta's analyst was outspoken on Friday afternoon: "This is the second consecutive down week off of record 1435 high. Last week's price candle warned of a possible reversal in the metal. The lower close this week confirms an end to the bull move. We suggest that the market will probe lower next week to former lows 1351 and 1330." Nervousness at the year's end is understandable. Investors' gains in gold are substantial. And, particularly in Europe, key gold markets will actually be closed for much of 2010 as the Christmas season takes hold. At the JSMineset website, this has been worrying Dan Norcini. He said on Wednesday that New York traders "LOVE this time of year as it gives them a chance at picking the pockets of both longs and shorts as they can use the thin trading conditions to go after both upside and downside stops. A lot of them put their kids through college based on the money they secure during holiday trading conditions." … But equally worth consideration is the point made, in contrast to the conventional wisdom, on Lemetropolecafe on Thursday: "…the Christmas season means that the traditional gold supplying markets (Australia, Europe, America) are closed or much inhibited, while the key buying markets in Asia in the main continue to function." [source] | |

| Crude Oil Consolidation Continues, Gold Advances as ETF Holdings Surge Posted: 19 Dec 2010 03:32 PM PST courtesy of DailyFX.com December 19, 2010 08:51 PM Crude remains stuck in a narrow range, but a breakout is likely imminent. Gold is trying to regain its footing as U.S. Treasury yields back down. Commodities – Energy Crude Oil Consolidation Continues Crude Oil (WTI) - $88.27 // $0.25 // 0.28% Commentary: Crude oil is up to kick off the new week, as the commodity stays firmly inside its recent $87 to $90 consolidation range. Last week crude was essentially flat, at least when looking at WTI, the U.S. benchmark. As we wrote about last week, WTI remains depressed due to a persistent glut at the NYMEX delivery point, Cushing, Oklahoma. We saw UK Brent rally about $1 to nearly $92, while LLS gained about $0.60 to $93.50. As we get the typical winter draw in crude stocks (specifically at Cushing), we should see those spreads tighten and WTI may then join the other crudes in the $90’s. But even if spreads remain wide, oil in general remains supported by bullish fundame... | |

| It’s Never Too Early to Predict the Future! Posted: 19 Dec 2010 01:34 PM PST For more reading, check out this week's Stock World Weekly! Barron's already has the 2011 Outlook on the Cover. We were discussing the generally bullish mood in Member Chat and Barfinger said "So, Phil, what is your response to the bullish preview?" That was a great question because it made me think. Does he expect a "rebuttal"? I can understand that as I've been fairly bearish but let's not confuse caution (I called for a cash out when the Dow hit 11,200 in early November, it peaked at 11,444 on the 5th and closed Friday at 11,491) with bearishness - it's just that my now 45 days of running around saying "the sky is falling" while it stays in place does make me seem like a perma-bear. The "October Overbought Eight" was my first bearish portfolio since April 28th's "Hedging for Disaster - 5 Plays that Make 500% if the Market Falls" (and it did, and they did). THAT was a bearish outlook! We are not that bearish here, otherwise it would have been the easiest thing in the World to re-up those plays for the new year. We expect a correction, but hopefully not the kind we had between May 4th and July 2nd, where the Dow dropped 1,600 points in just over 2 months. We are HOPING for a nice 20% pullback off the 15% gain from 9,800 to 11,270 back to the 11,000 line and holding that would make us very bullish going into next year. That would be 1,180 on the S&P (the declining 200 dma) and just 5% down from Friday's close - THAT's how bearish I am! Where we are now is simply where the 5% Rule told us we'd be back on May 5th, where the chart pointed out that 1,240 is 20% off the upper, non-spike consolidation at 1,550 that marked the high for the S&P. 20% is the most powerful level in the 5% Rule and that's why it's been safer to wait and see how this line resolves than place long-term bets in either direction into the slow and volatile holidays. Think if it this way: If you come across a fire that is consuming a house from the inside and the firemen show up and spray water on the outside, then I will stand there and tell you that the house will still burn to the ground. However - I will also tell you that the house is going to be soaked in water. The two things are not mutually exclusive - just as a slow-moving economic collapse and a booming stock market are not mutually exclusive - especially if that collapse is the result of a transfer of wealth from the working class to the investing class (see the 1920s). So the Fed and other Central Banks can print money to paper over a Global Economic melt-down and they can funnel Trillions of Dollars into the Global Banking system that still has a multi-Trillion Dollar hole to fill (see John Mauldin's comments this weekend) and we can have the ILLUSION of a growing economy through top-down inflation. Money is poured into the top through tax breaks to the wealthy (actually the extension of existing tax breaks that have already destabilized the economy so they now cost money but provide no new benefit), which includes Corporations who are already sitting on $2Tn in cash and not hiring - as well as the Fed injecting it directly into the banks in case the lack of taxation doesn't leave them with enough money to hide the gaping holes on their books. I am, at the moment, not sure that enough is being done to fill our global pool but we're getting there and, like our burning building example, in the short run - enough money is being spent to at least make us wet. We need to invest like we're in the late 90s but, as I said earlier this year - is it mid 1998 or December 1999? That's pretty hard to tell. With the new Republican Congress coming in next month, we need to be careful as any real attempt at austerity in the US may have global repercussions. Right now, we are doing China a huge favor by sending what used to be our middle class running for Wal-Mart and the Dollar Store to buy all their goods but what happens when they can't afford that anymore? Our last bullish portfolio was October 23rd's fairly conservative "Defending Your Portfolio With Dividends" and that's a good one to read as we talk about the benefits of a long-term, conservative investing strategy. I'm sorry it's not "sexy" but this is a dangerous environment to be placing directional bets in, as we can see from the very mixed performance in our very aggressive $10,000 to $50,000 Portfolio over the past 3 weeks. The premise there is that we stand a far better chance of making big gains to the downside than the upside but we're getting pummeled in our bearish bets as the market grinds up against upside resistance. If we do punch through, then great and we can start playing more bullish but not until. Dow 11,500 should not be too much ask for as a show of good faith from a true bull market, right? I shouldn't say that because our new newsletter is going to be mass-marketed and they are going to want me to do this sort of thing for "exposure". Anyway, the bullish premise I feel most comfortable with is the inflationary one. There is simply more money floating around and that leads to a weaker dollar with higher rates (so bonds go down) but gold goes up and it's oil that flat-lines (other than compensating for the weak dollar) because people simply can't afford it and buy as little as they can. Higher rates depress home prices in the US, keeping pressure on banks to hoard cash and China is forced to go on an global buying spree to keep the Yuan in check - something they've already been doing with commodities. By the end of the year, China will begin to run out of cash as they spend another $1Tn to keep things going (just $769 per citizen). I'd be gung-ho bullish now if I wasn't worried the Euro will collapse as that is the fly in the ointment. If the Euro falls apart then the dollar rises quickly and China may lose control of the Yuan peg (they don't want it going up vs. Euros or Yen) and, of course, commodities will drop fast and trigger a market sell-off, which will hold housing prices down despite what should be lower rates. We already know it is all about the dollar and, as you can see from this chart - we're pretty low at the moment with the S&P, Gold and Oil up about 10% on a 3.5% down dollar (UUP is a 2x ETF) - so my bearish caution flag lasts until Europe stabilizes, once again making the US Dollar clearly the worst currency to invest in: I know it is very tedious waiting for a solid investing signal but, as we learned from our very small commitment in the $1050P, it's just as tedious to put your money on the wrong side of a bet. If you read the notes from other bloggers about their best and worst calls of 2010 - they are individual stocks. My best calls for the year are calling the entire market at a top in April and at a bottom in July, if you get that right, the individual picks sort of take care of themselves! At the moment, my worst call may be calling a top too early in early November. As you know however, we pick dozens of individual plays in both directions every week so this isn't about that - We have our "5 Trades to Make 5,000%" on a breakout from last weekend and, while we made a lot of short-term bearish bets this week, we also had long ideas (mostly hedged) on HMY, XLF, CAKE (Monday), TNA, IWM (Tuesday), CCJ, CHK, EXC, TNA, XLF (Wednesday), UNG, GLD, AAPL (Thursday), GLW, TOT and AXP on Friday. Clearly from the S&P chart above, we are either in the bottom of a huge breakout channel or the top of a rollover and, as you can see from the chart on the right - fools rush in where professionals tread lightly. Overall, it's more fun to be a fool, Motley or otherwise, but this is a site that's about investing, not gambling and we are waiting for a confirming signal before making any serious commitment. We're already in the right place - we just have to wait PATIENTLY for the right time. We are able to take bullish positions as we already have downside hedges (our failed attempts at making bearish profits) and, we don't really expect a massive sell-off (but it is still a concern). If we don't fail by Tuesday, I expect us to drift into the New Year and, over the next two weeks, we'll get a little more deeply into the big picture stuff that is likely to move us in 2011 but, sadly, politics may have something to do with what happens to the stock market so cover your eyes and ears if that sort of thing worries you! For now, we have two weeks of very light trading and it's been a fairly uneventful weekend so no reason for us not to test 11,500 on the Dow yet again on Monday. Whether we actually hold it or not - that's the Million Dollar question! | |

| Gene Arensberg: Bullion banks still reducing silver shorts Posted: 19 Dec 2010 12:45 PM PST 8:40p ET Sunday, December 19, 2010 Dear Friend of GATA and Gold (and Silver): The Got Gold Report's Gene Arensberg reports tonight that that latest trading data shows that the biggest commercial traders continue to reduce their short positions in silver. And while the U.S. Commodity Futures Trading Commission last week failed to impose position limits in the precious metals futures markets, Arensberg notes that the limits recommended by the commission's staff -- no more than 25 percent of deliverable supply -- would require the biggest commercial traders to keep cutting their short positions. Arensberg's commentary is headlined "CFTC Delays Position Limits; Bullion Banks Reduce Silver Shorts" and you can find it at the Got Gold Report here: http://www.gotgoldreport.com/2010/12/cftc-delays-position-limits-bullion... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | |

| Gold to go in a Boca Raton Mall Posted: 19 Dec 2010 12:31 PM PST Boca Raton, Florida was recently added to the list of 14 locations where you can buy gold bullion from a "Gold to go" ATM style vending machine, this American shopper explaining why it might make sense to own some of the precious metal these days. I have no idea what they charge for coins and bars relative to spot, but my guess is that you'll pay a lot more at a Gold to go machine than you would at a good coin shop or at one of the many high volume dealers that can be easily found on the internet. | |

| Join GATA at the Vancouver conference in January Posted: 19 Dec 2010 12:13 PM PST 8:11p ET Sunday, December 19, 2010 Dear Friend of GATA and Gold (and Silver): GATA will be participating again at the Vancouver Resource Investment Conference, to be held Sunday and Monday, January 23 and 24, 2011, at the Vancouver Convention Centre West at Canada Place on Coal Harbour. In addition to GATA Chairman Bill Murphy and your secretary/treasurer, speakers will include GATA favorites Al Korelin of the Korelin Economics Report, silver market analyst David Bond, Frank Holmes of U.S. Global Investors, newsletter writer Jay Taylor, Mau Capital's John Lee, Peter Grandich of The Grandich Letter, GoldSeek.com proprietor Peter Spina, and Kitco.com senior analyst Jon Nadler. Dozens of resource companies will be exhibiting and making presentations, and the conference is always a great opportunity to meet and question resource company executives. To register for the conference and to learn more about it, please visit: http://cambridgehouse3.com/conference-details/vancouver-resource-investm... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | |

| Paul says he'll ask Fed about transactions with foreign banks Posted: 19 Dec 2010 11:56 AM PST Let's hope that includes gold swaps like the ones the Fed acknowledged here: http://www.gata.org/files/GATAFedResponse-09-17-2009.pdf * * * Congressman Paul Says Fed Transparency Is His Goal By Tabassum Zakaria http://www.reuters.com/article/idUSTRE6BI1BD20101219 WASHINGTON -- Republican Congressman Ron Paul, the new head of the subcommittee that oversees the Federal Reserve, said on Sunday he will seek greater transparency but will not be sending subpoenas to the central bank chairman from Day 1. Paul, a longtime critic of the Fed, will be the new chairman of the domestic monetary policy subcommittee of the House Financial Services Committee when the new Congress is seated in January. "Now that doesn't mean that the first week in January I send over a subpoena for (Fed Chairman Ben) Bernanke and demand that he come over with a pile of papers. I don't think that would be logical," Paul said in an interview on C-SPAN. He will be sending requests for information to others at the Federal Reserve such as the accountants, "and say this is what I want, and see what happens," Paul said. "And then they can still hide behind the law if I want to demand every transaction with foreign banks," he said, adding that it would benefit Americans to know who was getting bailed out. Paul has written a book called "End the Fed" and believes the dollar should be backed by gold or silver. The United States stopped linking the dollar to gold in 1971. Republicans will control the House of Representatives in January after winning a majority of seats in the November elections on a wave of anti-government and anti-incumbent sentiment. ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan power plants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: | |

| Paul says he'll ask Fed about transactions with foreign banks Posted: 19 Dec 2010 11:56 AM PST Let's hope that includes gold swaps like the ones the Fed acknowledged here: http://www.gata.org/files/GATAFedResponse-09-17-2009.pdf * * * Congressman Paul Says Fed Transparency Is His Goal By Tabassum Zakaria http://www.reuters.com/article/idUSTRE6BI1BD20101219 WASHINGTON -- Republican Congressman Ron Paul, the new head of the subcommittee that oversees the Federal Reserve, said on Sunday he will seek greater transparency but will not be sending subpoenas to the central bank chairman from Day 1. Paul, a longtime critic of the Fed, will be the new chairman of the domestic monetary policy subcommittee of the House Financial Services Committee when the new Congress is seated in January. "Now that doesn't mean that the first week in January I send over a subpoena for (Fed Chairman Ben) Bernanke and demand that he come over with a pile of papers. I don't think that would be logical," Paul said in an interview on C-SPAN. He will be sending requests for information to others at the Federal Reserve such as the accountants, "and say this is what I want, and see what happens," Paul said. "And then they can still hide behind the law if I want to demand every transaction with foreign banks," he said, adding that it would benefit Americans to know who was getting bailed out. Paul has written a book called "End the Fed" and believes the dollar should be backed by gold or silver. The United States stopped linking the dollar to gold in 1971. Republicans will control the House of Representatives in January after winning a majority of seats in the November elections on a wave of anti-government and anti-incumbent sentiment. ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan power plants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: | |

| 3 Things to Watch As Silver Season Ends Posted: 19 Dec 2010 11:40 AM PST Silver season is coming quickly to a close after one of the best five month rallies in silver history. From mid-August to early December, silver managed to rise more than 66% from top to bottom, a sign of silver's strength against what is normally a positive, but not nearly as pronounced, rise in silver prices. In moving forward, there are three main events on which silver investors need to focus. Chinese Monetary Policy China represents a growing portion of gold and silver demand, and the country is a popular investment destination for foreign investors. While Chinese citizens are stocking up on gold and silver as an inflation hedge to negative real interest rates, the Chinese central bank will soon be forced to act in order to keep inflation in check. Currently, one-year rates on the Chinese mainland are 2.5% while inflation rises toward highs at 5.1%. With these fundamentals at play, the Chinese can effectively borrow cash to store in gold and silver, poc... | |

| Big Activity in GLD, SLV and Comex Silver Stocks Posted: 19 Dec 2010 11:33 AM PST "Gold only falls $13 on a one cent rise in the dollar. The U.S. gets its first gold vending machine. Ron Paul says the Fed spends more money than Congress. Richard Russell speaks... and much more. " Yesterday in Gold and Silver The gold price gained a whole five bucks by 11:00 a.m. Hong Kong time on Friday morning, but the moment that trading in Hong Kong ended around 5:30 p.m. local time, the gold price headed south. It rallied a bit going into the New York open, but then rolled over and hit its low of the day [$1,364.00 spot] at 11:00 a.m. Eastern time. From that 11:00 a.m. low, gold traded higher until precisely 1:30 p.m. when floor trading ended and electronic trading began. That point was gold's high at $1,380.10 spot. The gold price traded sideways from there. Volume was very light. The fact that the gold price did as well as it did is really quite something in the face of a dollar that was up over a full percent from its lows yesterday. More on... | |

| Don't Forget Where You Came From Posted: 19 Dec 2010 11:25 AM PST December 17, 2010 Unfortunately, due to millions of years of evolution, human beings make absolutely terrible investors. It appears that most investors seem to have a good memory for very long term trends and very short term trends but for some reason they seem to forget about the intermediate term trends. As a result of this they lose money! For example: Long Term From 1980 to 2000 a long term trend in the stock market catapulted the general stock markets like the Dow Jones and NASDAQ to dizzying heights. The massive long term trend was powerful, profitable and hard to forget about. Ever since the NASDAQ bubble popped in 2000 many investors have been adding to their beloved tech stock positions trying to ‘dollar cost average’ for the next wave up. Eleven years later these investors continue to rationalize why their buy and hold strategy will be paying off any year now. Real-estate and its bull market is yet another example of investors rememberin... | |

| This Popular Gold Investment Is a Snow Job Posted: 19 Dec 2010 11:21 AM PST By Matt Badiali, editor, S&A Junior Resource Trader Saturday, December 18, 2010 Folks looking to make a fortune in small gold stocks need to be careful: There's a right way to do it… and there are a lot of wrong ways to do it. One of the wrong ways to do it is by owning one of the world's most popular ETFs right now. The symbol is GDXJ. It goes by the name "Market Vectors Junior Mining Fund." And that name is a snow job. "Junior" miners are the bloodhounds of the mining world. They are tiny companies that scour the world looking for the next big gold or silver discovery. And when I say "tiny companies," I mean it. Junior miners are microscopic compared to the popular mining companies you might now. Many junior miners are around $30 million in market value. Compare this to mega-gold miner Barrick, with a market value of around $52 billion. That's more than 1,700 times the size of a $30 million company. Junior mining stocks are popular with investors and ... | |

| Posted: 19 Dec 2010 11:18 AM PST Adam Hamilton December 17, 2010 2826 Words Silver has been a rock-star in recent months, rocketing higher to dazzling gains. After such a blistering near-vertical ascent, technicians understandably fear this metal has become wildly overbought. Nevertheless, an alternative perspective on silver’s recent levels counters its extreme technicals. Compared to gold, its primary driver, silver actually looks reasonably-priced today. After a stupendous 72% rally in just over 4 months, considering silver fairly-valued seems like quite a stretch. I predicted silver’s autumn rally back in mid-August when it traded under $18, but the magnitude of this year’s typical seasonal advance was greater than... | |

| Posted: 19 Dec 2010 11:16 AM PST Adam Hamilton December 10, 2010 2537 Words Earlier this week, the flagship HUI gold-stock index powered up to new all-time record highs. While fantastic for gold-stock investors and speculators, such lofty achievements inevitably cement more big bricks on top of the wall of worries. At their highest levels in history, are gold stocks wildly overbought and doomed to correct hard? Provocatively, a strong case can be made that they actually remain cheap! Given the HUI’s epic progress in its secular bull, this assertion can sound absurd at first. This index hit its secular-bear low of 35.99 in mid-November 2000. This past Monday, it closed at 590.99. The larger gold and silver stocks included in the HUI have collectively ... | |

| [## ALL DECEMBER REPORTS POSTED TO THE WEBSITE ##] Posted: 19 Dec 2010 10:48 AM PST

This post has been generated by Page2RSS | |

| FIRST U.S. GOLD ATM VENDING MACHINE ARRIVES IN FLORIDA Posted: 19 Dec 2010 10:22 AM PST | |

| CFTC Delays Position Limits – Bullion Banks Reduce Silver Shorts Posted: 19 Dec 2010 09:59 AM PST LAS VEGAS - We are still on the road as we write this brief weekend note for readers and subscribers, but ready to head back to the ranch in Texas. Today we take a look at the CFTC hearing on metals position limits and a close look at the positioning of the bullion banks in silver futures, but first, just below is this week's closing table. ... | |

| Fancy Florida ATM Skips The Folding Cash, Spits Out Gold Posted: 19 Dec 2010 09:50 AM PST By KELLI KENNEDY, Associated Press BOCA RATON, Fla. (AP) – Shoppers who are looking for something sparkly to put under the Christmas tree can skip the jewelry and go straight to the source: an ATM that dispenses shiny 24-carat gold bars and coins. A German company planned to install the machine Friday at an upscale mall in Boca Raton, a South Florida paradise of palm trees, pink buildings and wealthy retirees. Thomas Geissler, CEO of Ex Oriente Lux and inventor of the Gold To Go machines, says the majority of buyers will be walk-ups enamored by the novelty. But he says they're also convenient for more serious investors looking to bypass the hassle of buying gold at pawn shops and over the Internet. "Instead of buying flowers or chocolates, which is gone after two or three minutes, this will stay for the next few hundreds years," Geissler told The Associated Press in a telephone interview. The company installed its first machine at Abu Dhabi's Emirates Palace hotel in May and followed up with gold ATMs in Germany, Spain and Italy. Geissler said they plan to unroll a few hundred machines worldwide in 2011. He said the Abu Dhabi machine has been so popular it has to be restocked every two days. The gold-leaf-covered machine at Boca Raton's Town Center Mall sits outside a gourmet chocolate store and works just like the two cash ATMs beside it. Shoppers insert cash or credit cards and use a computer touch-screen to choose the weight and style they want. The machine spits out the gold in a classy black box with a tamper-proof seal. Each machine, manufactured in Germany, carries about 320 pieces of different-sized bars and coins. Prices are refigured automatically every 10 minutes to reflect market fluctuations. At prices from one point earlier this week, a two-gram piece cost about $120, including packaging, certification and a 5 percent markup. An ounce cost about $1,470. Buyer beware: A gram of the heavy metal is much smaller than you think, about the size of a fingernail. An ounce is a little larger than a quarter. Owners said the machine, which will hold around $150,000 in cash and gold, will be flanked by an armed bodyguard for now. Several live security cameras are fixed inside and outside the machine. The popularity of gold is cyclical, but it's riding high these days in part because of fears stoked by financial collapse. Geissler, who plans to open a machine in Las Vegas by the year's end, said the collapse of the Lehman Brothers investment firm was the impetus for the flashy ATMs. His customers refused to buy bonds, stocks and other funds from the financial industry, so they focused on precious metals. As investors continued to lose faith in the global finance market system, the company worked on the gold-leaf finished ATM, banking that the protection of purchasing power found in gold would lure market leery customers. "Gold always comes back to its real value," Geissler said. "It's not diamonds, it's not silver, it's not real estate. It's just gold." Dave Jones, who brokered the deal to bring the machines to the U.S., predicts gold will become a parallel currency in the next five years. He said they plan to install about 40 more machines at upscale malls and hotels around the U.S. "Gold has a place in everyone's portfolio," said Jones, of Boca Raton-based PMX Gold. "It's a good hedge against inflation and it's a good comfort level." Associated Press writer Suzette Laboy contributed to this report. Source: http://pmxgold.com/media/cms/12172010.html | |

| The Effects of Central Banking on Gold and Paper Currencies Posted: 19 Dec 2010 09:39 AM PST "When will the gold bubble burst?" CNBC's Larry Kudlow wondered aloud this morning. A question to which your California editor would reply, "We know what gold is and we know what a financial bubble is, but we don't see any gold bubbles." Perhaps Kudlow is referring to the fact that the gold price is rising…in response to the Central Banking Bubble. On its face, the idea is ludicrous that one man can steer an entire economy, simply by adjusting one little interest rate. The idea is a doubly ludicrous that one institution can nurture economic growth, simply by printing money. And yet, a nation of investors places its faith in the Cult of Central Banking, as folks like Larry Kudlow pay homage to Ben Bernanke every business day. So far, the true believers have profited from their faith. It has paid well to embrace this cult and to trust the Delphic utterances of its high priests like Alan Greenspan and Ben Bernanke. But this whole central bank thing is getting a little out of hand. The early central bankers admitted their fallibility. They would adjust interest rates up or down, depending on the prevailing economic circumstances, then hope for the best. But the more that the central bankers' tinkering and meddling appeared to succeed, the more they tinkered and meddled, and the more they believed in the power of their tinkering and meddling. Eventually, the central bankers not only believed in the power of their intrusions and manipulations, but also in the wisdom of them. Before long, the central bankers considered their activities to be not merely a responsibility, but an imperative, a social duty; perhaps even a "calling" – a kind of Divine Right of Central Banking. Armed with these potent delusions, central bankers around the world continue to meddle, day by day, month by month. And the investor-flock continues to trust in their mystical powers. This nearly universal faith in a priesthood of monetary medicine men is an extreme idea…taken to an extreme. It is a bubble – the effects of which are as varied as they are non-quantifiable. But one effect is very clear: currency values are perpetually in decline. The more the medicine men prescribe their remedies and elixirs, the faster the purchasing power of their paper currencies erodes. Observing this trend, rational, forward-looking investors scout around for assets the central bankers are not trying to protect – assets that require no protection whatsoever. Gold is an obvious choice. It is the timeless choice of all investors who reject the Cult of Central Banking and who, therefore, distrust paper currencies as a store of value. Gold is rising because Central Banking is in a bubble. But the gold bubble, itself, will not arrive until the Central Banking Bubble bursts – the moment when investors universally spurn the cult of Central banking as heresy, and rebuke central bankers, themselves, as agents of wealth destruction. At that moment, when gold is trading north of $10,000 an ounce…or $20,000…or $100,000, the gold bubble will have arrived. And when it does, we will be there to issue a "sell" recommendation. Speaking of "sell" recommendations, Jay Shartsis, a seasoned options pro at R.F. Lafferty in Lower Manhattan, warned his clients on Wednesday, "A big stock market decline is coming." To support his bearish call, Shartsis has highlighted a variety of market signals and sentiment indicators. Late last week, for example, Shartsis noted that the "CBOE equity put/call ratio hit .27 – the lowest in my memory. And now 8 days in a row, this ratio has been sitting below .60 – that's a sell signal." Then earlier this week, Shartsis observed, "With the stock market near the highs for this move, there are only 127 new highs on the NYSE and 88 new lows. The new lows number is way above where it would be if this market was in good underlying shape. Yesterday saw 3% of all NYSE stocks at new lows – a condition that has happened only 36 times in the past. Two months afterwards, the S&P 500 was lower on 32 of those 36 instances."

Lastly, Shartsis called attention to the nearby chart, as he remarked, "The chart displays the Options Speculation Index. It is a measure of total call buys plus put sales (those are bullish transactions), divided by total put buys plus call sales (bearish transactions). So this is a very comprehensive gauge and it now reflects the most bullish option trader sentiment probably ever recorded. No fear at all. Note that the index is considerably higher than it was before the flash crash last May. A big market decline is coming!" Shartsis has been wrong before, of course. But he has also been right. We predict he will be one of the two this time around. Eric Fry The Effects of Central Banking on Gold and Paper Currencies originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. | |

| Posted: 19 Dec 2010 09:38 AM PST By Jeff Nielson, Bullion Bulls Canada As investor enthusiasm soars in the silver sector, and more and more writers offer their views on this sector, we are now seeing a down-side to the increased "buzz": we are seeing the over-zealous and/or under-informed begin to make wild assertions about this market – which seriously impairs the ability of more sober voices to make themselves heard. As is often the case in such scenarios, we start with a piece of concrete information, and then pile atop that fact some sloppy arithmetic, and highly dubious "logic". The result is nothing but outrageous rhetoric, rhetoric which the anti-precious metals cabal of bankers can use (and has used) to discredit the serious commentators in the sector. What I refer to in particular are the "reports" from several commentators that JP Morgan is "short 3.3 billion ounces of silver". Were this true, it would indeed be major "news" – given that best estimates are that the total, global stockpile of silver is roughly one billion ounces. Sadly, this "3.3 billion" number has no more relevance than the numbers released by the U.S. government which it calls "economic statistics". To illustrate the absurdity of this claim, we must see how that number was produced. As I said earlier, we started with a fact: that JP Morgan is short more than 300 million ounces in the Comex futures market. While this has never officially been announced, it is a conclusion which is the process of simple, straightforward deductions (and known CFTC data). Taking that number, the zealots then added another fact: the claim by Jeffrey Christian that the world's bullion markets were leveraged by approximately 100:1. Here is where their analysis totally falls apart. To begin with, the "100:1" number itself is not a "fact". It is treated as such because (to use some legal terminology) it is "an admission made against one's own interests", and as I have explained before, our legal system (justifiably) attaches a high degree of credibility to such admissions. However, two points must be made immediately. First, this was just a rough estimate, not a precise statistic. Any reputable commentator utilizing such a number must account for the fact that it is only an approximation. In this respect, a number of commentators failed miserably. The "3.3 billion ounce short position" which some commentators were practically shouting from the rooftops was arrived at by taking JP Morgan's (known) short position, multiplying that by 100 (i.e. the 100:1 leverage) – and (after some creative arithmetic) arriving at a total of 3.3 billion ounces. It's hard to know where to start in criticizing this figure. To begin with, given Christian's crude estimate, there is no way that the calculation could (justifiably) be expressed as "3.3 billion". This implies a degree of precision here which simply doesn't exist. I should also point out if we opt for a similar (but simpler) calculation, and merely multiply the (known) 300+ million ounces which JP Morgan is short by 100 (100:1 leverage), then that calculation produces the number "30 billion ounces". The same "logic" is being used, merely a slightly different calculation. Obviously if anyone would have claimed that JP Morgan was short 30 billion ounces of silver, the author of such an estimate would have been greeted with laughter. Simply playing-around with these numbers to produce a slightly more plausible number doesn't change the entirely faulty premise on which this calculation is built. The "leverage" in the derivatives market is "paper leverage". Indeed, the very definition of a "derivative" is that it is a paper proxy for something which exists in "the real world". Thus, the entire premise of multiplying a known, real short position by the paper leverage of the derivatives market – and then expressing that result as a measurement of silver is simply ludicrous. In other words, when we multiply JP Morgan's (real) short-position by its leverage in the derivatives market, the "answer" is not a measurement of silver, but a measurement of leverage. It is in this respect that some commentators have turned into a flock of Don Quixotes – tilting at windmills. More articles from Bullion Bulls Canada…. | |

| John Embry: Gold, silver could go ballistic by year-end Posted: 19 Dec 2010 09:37 AM PST 9:24a ET Sunday, December 19, 2010 Dear Friend of GATA and Gold (and Silver): In new commentary for Investor's Digest of Canada, Sprott Asset Management Chief Investment Strategist John Embry talks back to U.S. Treasury Secretary Tim Geithner and Warren Buffett's business partner, Charles Munger, and predicts that precious metals will surge shortly. Embry's commentary is headlined "Gold, Silver Could Go Ballistic By Year-End" and you can find it at the Sprott Internet site here: http://www.sprott.com/Docs/InvestorsDigest/2010/MPLID_112610_pg401Emb.pd… CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | |

| Weekly precious metals review at King World News Posted: 19 Dec 2010 09:37 AM PST 12:31p ET Saturday, December 19, 2010 Dear Friend of GATA and Gold (and Silver): Bill Haynes of CMI Gold & Silver and Dan Norcini of JSMineSet.com are interviewed by Eric King for the weekly precious metals market review at King World News. The interview is about 24 minutes long and you can listen to it here: http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2010/12/18_… CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia — Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: – Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. – Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. – Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | |

| Once one PIIG flies, they all will, Ben Davies tells King World News Posted: 19 Dec 2010 09:36 AM PST 12:01p ET Saturday, December 19, 2010 Dear Friend of GATA and Gold: In an 18-minute inteview with Eric King at King World News, Hinde Capital CEO Ben Davies explains why he doesn't think the euro zone will stay together. Rather, Davies says, the withdrawal of one of the weaker members to avoid crushing austerity is likely to prompt the withdrawal of all the weaker members and in turn smash the banks and insurance companies in the stronger euro-member countries that are creditors to the departing members. You can listen to the interview at King World News here: http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2010/12/18_… CHRIS POWELL, Secretary/Treasurer Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 | |

| Tanzania Proving Fertile Ground for Junior Miners Posted: 19 Dec 2010 09:36 AM PST Mobile Guru submits: With all that shines still being golden, and the fact we are finishing up 2010 in the $1400 area for gold- the projection of $2000/oz does not seem that crazy. Whether gold corrects some this year or continues on its bullish run, finding junior gold companies can be very good investments. Keep in mind, historically there are certain times to invest in a specific junior gold company and other times when the return may not justify the risk. Click to enlarge: | |

| When Gold Correction Ends, Uptrend Should Remain Intact Posted: 19 Dec 2010 09:32 AM PST

The past week witnessed rather volatile trading in gold bullion as the price declined to the 50-day moving average ($1,369), thereby retracing 62% of its three-week advance from the middle of November to early December. (Read more about Fibonacci retracement numbers here.) It will be very bullish for gold to hold these levels, but failing that it will take a decline below the November reaction low of $1,337 to indicate a larger correction. Click to enlarge: | |

| Inflation Scorecard: Gold’s Mixed Performance Posted: 19 Dec 2010 09:29 AM PST Hard Assets Investor submits: B y Brad Zigler Real-time Monetary Inflation (Last 12 Months): -1.5% The world’s reserve currencies turned in a mixed performance against gold for the week ending Thursday. The Swiss franc was most resilient, rallying 2.7 percent against bullion, while the euro inched up 0.7 percent. Gold and the yen squared off to a standstill. Sterling lost 0.4 percent to the metal. | |

| Tax Measure Gives Deal to Wealthy Roth IRA Converters Posted: 19 Dec 2010 09:29 AM PST BLOOMBERG NEWS The extension of current income-tax rates gives wealthy taxpayers the equivalent of an interest-free loan if they convert a regular Individual Retirement Account to a Roth by Dec. 31. Investors in traditional IRAs pay taxes up front on conversions to Roth IRAs to get tax-free withdrawals later. Earners in the highest tax brackets who expected rates to rise next year were faced with reporting all the additional income from conversions on their 2010 returns. With the tax legislation, wealthy savers can now defer and use those tax dollars to earn something, according to Christine Fahlund, a senior financial planner at Baltimore-based T. Rowe Price Group Inc. "It's the deal of the century," said Ed Slott, a certified public accountant in Rockville Centre, New York, and founder of website irahelp.com. "It's like Congress is giving you an interest-free loan to build a tax-free savings account." This year taxpayers can choose to report the taxable income from the conversion in 2010, or split it equally between 2011 and 2012. Federal income-tax rates were set to rise in 2011 to as high as 39.6 percent, up from 35 percent, when tax cuts instituted by President George W. Bush were to expire. The Senate passed an $858 billion tax-cut plan Dec. 15 that would keep existing income tax rates for all earners through 2012. The House voted 277-148 for final passage even though many House Democrats wanted to limit the tax cut extension to the first $250,000 of family income. President Barack Obama is scheduled to sign the measure into law this afternoon. Tax Brackets That means a taxpayer in the top income bracket with an IRA worth $1.2 million would likely pay 35 percent or $420,000 in federal taxes when converting the entire account to a Roth IRA this year, according to Fahlund. They would have paid $475,200 if income tax rates had increased in 2011 to 39.6 percent, or $55,200 more in taxes. Conversions work best for savers who know they're going to be in as high or higher tax brackets in the future, and can pay the taxes with money from outside the IRA, said James Lange, a Pittsburgh-based certified public accountant and author of "The Roth Revolution: Pay Taxes Once and Never Again." Deferring the income from conversions made this year makes sense for most taxpayers who will be in the same or lower tax brackets in 2011 and 2012, said Slott, the accountant. New York Payers For New York taxpayers, there's a potential additional benefit of deferring, said Mitch Drossman, national director of wealth planning strategies for New York-based U.S. Trust, which manages almost $300 billion in client assets. New York state income-tax rates rose to as high as 8.97 percent from 6.85 percent in 2009 and are scheduled to fall back to 6.85 percent in 2012. That means savers can defer the income to a time when they may have lower tax rates, Drossman said. The Internal Revenue Service lifted income restrictions this year on converting to Roth IRAs from traditional IRAs, meaning taxpayers making more than $100,000 a year in adjusted income can make the change. There's no cap on the amount that can be converted to a Roth IRA from a traditional IRA. It's too early to know whether taxpayers are electing to report the income on 2010 conversions on their 2010 returns or wait until 2011 and 2012. They have until April 15, 2011 plus any extensions to decide, said Fahlund of T. Rowe. The firm saw more than a fourfold increase in the number of investors converting in 2010 through November compared with a year earlier, she said. Conversions Increase Vanguard Group Inc. based in Valley Forge, Pennsylvania, has seen a fivefold increase in the number of Roth IRA conversions this year to about 150,000 as of the end of November compared with 2009, said Maria Bruno, who specializes in retirement and retirement income for the largest U.S. mutual- fund manager. USAA in San Antonio has seen a fourfold increase in members converting some or all of their traditional IRA assets to a Roth IRA through October, said Kevin O'Fee, assistant vice president of USAA Retirement Strategies. The taxes owed on switching to a Roth IRA from a regular IRA depend on whether the assets being transferred are pre- or post-tax dollars. If tax-free dollars are included, converters will pay income-tax rates on a percentage of the conversion amount, said Slott, the accountant. Savers who expect to be in a lower tax bracket in 2010 than in 2011 or 2012 shouldn't defer the income from the conversion, said David M. First, a tax partner at accounting and advisory firm Marcum LLP in New York. And those who are going to be affected by the alternative minimum tax in 2010 and not in 2011 and 2012 may also want to report the income in 2010, First said. Partial Transfers Since the default option set by the IRS for those who switch is splitting the income between 2011 and 2012, wealthy taxpayers opting to defer don't have to do anything, according to John Bledsoe, founder of John Bledsoe Associates, an estate and tax planning firm in Dallas, Texas, whose clients have an average net worth of at least $10 million. "For most people, advising them not to convert now is like telling them to not wear a seat belt while driving," Bledsoe said. "There's no logic for not doing it." When converting to a Roth IRA, savers should try to avoid converting so much in one year that it bumps them into a higher tax bracket, said Fahlund of T. Rowe. One option is to do partial conversions so the income is smaller, she said. Investors who later change their minds about a Roth IRA have until October 2011 to undo the switch. Savers may also want to set up more than one Roth IRA to invest separately in stocks and bonds so they can undo a particular portion of the conversion if an asset class performs poorly, said Drossman of U.S. Trust. Charitable Giving For savers age 70 and a half and over, the tax bill includes a provision that allows them to give up to $100,000 from a traditional IRA directly to charity without incurring taxes. In 2010, donors had to include the distribution as income and received a charitable income-tax deduction for their gifts. The bill would restore the exclusion from income retroactive to the beginning of 2010 and extend it to 2011 as well, said Kim Wright-Violich, president of San Francisco-based Schwab Charitable. | |

| Good vid on VERY REAL SILVER SHORTAGES AROUND THE WORLD Posted: 19 Dec 2010 09:21 AM PST | |

| A Look At The Upcoming Calendar As The Sleepiest Week Of The Year Arrives Posted: 19 Dec 2010 08:53 AM PST The upcoming week will be largely one where absolutely nothing happens. Anemic volumes will continue to be anemic, outflows will continue, and nobody will care about news flow or technicals. That said, here is Goldman's analysis of the few items that actually may matter globally in the upcoming 7 days. What Matters in FX Next Week: Getting Ready for the Holidays On the policy front, the US Senate voted for the bipartisan fiscal package late in the week and the European summit established a stabilization mechanism (ESM) for crises past 2013 to replace the temporary EFSF. An unexpected and positive development was the agreement for the ECB to raise its capital in order to reign in potential challenges from volatility in its asset (or collateral) portfolio. Finally, on the data front we had a positive surprises from the Philly Fed survey and the IFO posted new record highs with future expectations trending strongly to the upside and confidence in the German retail sector hovering at levels not seen since the early nineties. | |

| Posted: 19 Dec 2010 08:26 AM PST | |

| Posted: 19 Dec 2010 07:31 AM PST Diapason Securities' Sean Corrigan is rapidly emerging as one of our favorite macro commentators. With his dose of weekly skepticism, he has quickly assumed the position vacated by Goldman Sachs' Jan Hatzius when it comes to the 3Ms: market, monetary and macroeconomic commentary (courtesy of the now well-known and very infamous flipping by the German strategist on his outlook on the economy). In his latest outlook piece, Corrigan dissects recent moves in the bond market, noticing a 6 sigma, three-decade statistical aberration when it comes to the 2s5s30s butterfly, and continuing through the implications of increasing bond vol on other risk assets (a topic which we believe will receive much more focus in the coming weeks and months), on fund flows (his views on the implications of the December Z.1 statement are worth the price of admission alone), on the cooling off of the European "economic miracle", and lastly, on what China's refusal to attempt a soft landing means for global risk. His conclusion is as always absolutely spot on: "in short, that risk assets can continue to rise, pro tem, it also means that RISK itself will be climbing inexorably up the scale and on into the danger zone." From Sean Corrigan's December 17 edition of Money, Macro and Markets As the increase in the total of US Federal debt outstanding since the LEH-AIG collapse reached the $4 trillion mark, another week began and another sell-off took place in the bond market, with 2004 Euro$ now a cool 140bps off their early November highs in one of those classic, up by the stairs, down by the escalator moves to unwind the previous four months', Fed—inspired rally. Only a little less dramatic has been the thumping taken by the belly of the curve where — for example — the 2x5-30 butterfly has jumped 120+bps in just five weeks, a sizzling six-sigma move in a three-decade statistical record. When we note that this was preceded by a 3½ sigma, 28-year outperformance of the middle versus the wings, taking it then to a series record low — and that half the rejection move occurred just during the past week - we can perhaps grasp some measure of the dislocation being suffered (as well as give vent to our usual despair at the idea that modern financial markets somehow exist to assist in the rational allocation of scarce capital!) Interest rate markets had, of course, been under pressure in any case - partly as a result of the slow diffusion of core European creditworthiness out to its prodigal fringe, via the ECB and its market support operations; partly because basis swaps showed 'Zone banks were again scrambling for USD roll-overs; and partly due to the year end reallocation of funds into an equity market which had only struggled back to par as late as early September, but which finally made a new high on the very day the bond rout began.

Remember, that for as long as people accept the money it spends into existence, a maintenance - or even a debilitating over-expansion - of the quantity of the medium of exchange needs no other agency than a determined treasury acting in concert with its willing accomplices at either the central bank alone, or among the commercial counterparts over which that engine of inflation broods and clucks, in addition.

Part of the problem for the market is that — unlike in the US — the business of reinvigorating the flow of money peaked no less than 22 months ago and has been decelerating ever since (though this has been offset somewhat by the more aggressive use to which this money is being put, at least in Germany). If past is in anyway prologue, the story for the next few quarters should be one of relative disappointment in economic performance, with the disappointment in economic performance, with the IfO and the business revenues (to which the survey tends to respond) peaking out and headline inflation potentially catching up. In these same German revenue data can be seen the global dichotomy, writ in rather large letters and bearing the rubric: 'Go EAST, young man!" If this last is the case, they might just be keeping their fingers crossed that the deceleration in real money supply already in evidence for some time past will temper the pace of industrial activity and even allow for an amelioration of the rate of price rises, as has typically happened in the past. The problem with relying on the working of such a macroeconomic comovement to spare them this toughest of decisions, however, is that it both makes the fatal mistake of assuming ceteris is indeed paribus AND that the inevitable magnitudes and delays - inherent in what is not, after all, a law of hard, physical science, but merely a dim mirror of the combined effects of millions of subjective human choices - will not come to bite them most grievously in the behind. That the debate may not yet be fully settled may be seen in the official Xinhau mouthpiece which ran a post-Conference piece saying, correctly, that:- | |