Gold World News Flash |

- The December 16, 2010 edition of Casey's Daily Dispatch, now available

- An hour with Jim Rickards and the once and future money

- US Public Debt Set To Pass US Annual GDP.

- The First Stage of Inflation Has Already Hit, Next Up Is the Currency Collapse

- Gold Seeker Closing Report: Gold and Silver Fall Over 1% More

- Gold and Silver Firm Ahead of EU Summit on Debt Crisis

- RICHARD RUSSELL WISDOM

- Laughing at Fiscal Absurdity

- Currency Wars and China

- If Today Marked the Bottom of the Gold Price Decline, Then Tomorrow it Ought Not Drop Through $1,365

- Gold: Currency Wars and China

- The Unwavering and Inimitable Ron Paul

- CFTC Open Meeting On Speculative Position Limits is Today

- In Abu Dhabi, Christmas comes decked with gold

- Gold 411 - December 16, 2010

- THURSDAY Market Excerpts

- Hourly Action In Gold From Trader Dan

- The Dollar Threads a Needle

- Guest Post: Rebalancing Act For Your Portfolio

- “The Fed Will End Itself Before I'm Able To”

- How $90 Oil Affects the Global Economy

- How/Why I'm putting all my cash into gold

- Jim Willie: “Silver is breaking out in all majors currencies.”

- Schmidt's Gold Thoughts

- Gold Daily and Silver Weekly Charts - Gold With 50 Day Moving Average

- Simon Black's Advice To Young People: Grab Your Ankles

- How to Give the Gift of Gold

- False Choice: Yield vs. Safety

- The Rise, Fall, and Rise Again of Privateers

- Richard Koo's Latest: "Europe And US Have Learned Nothing From Japan's Lessons And Will Repeat Its Mistakes"

- Jim?s Mailbox

- Should Hank Paulson Be In Jail?

- Some Irish seen turning to gold, shunning banks

- Tolerating Deception for the Sake of Economic Growth

- Cameron says, ‘UK shouldn't have to pay'

- Jim's Mailbox

- On The Importance of Trade and New Economic Growth

- Money & Markets Charts ~ 12.16.10

- How America Became a Communist Nation

- Top Tick Bernanke: How The Chairman Lost $46 On The Fed's Holdings Since The Launch Of QE2

- Modern Monetary Theory , or How the US Monetary System Really Works

- ECB strengthens balance sheet as risks rise

- Gary North: Ron Paul's potential questions for Ben Bernanke

- Gary North: Ron Paul's potential questions for Ben Bernanke

- Buried Deep Within The Files That The Federal Reserve Released On Thier MBS Purchase Program, We Found TARP 2.0!!! More Taxpayer Money To The Banks!

- The Morning Gold Report

- Fake-Out Thursday – Oil Scam Continues Unabated

- Gold declines to two-week low on investor sales after 26% rally in 2010

- Bullish Indicators Not Bullish Enough to Indicate Recovery

- Gold Breaks Short Term Support Line

| The December 16, 2010 edition of Casey's Daily Dispatch, now available Posted: 16 Dec 2010 06:30 PM PST | ||||||||||||||||||||||||||||||||||||

| An hour with Jim Rickards and the once and future money Posted: 16 Dec 2010 04:55 PM PST 1a ET Friday, December 17, 2010 Dear Friend of GATA and Gold: Market intelligence analyst James G. Rickards of research firm Omnis Inc. made a long presentation to the "Rethinking the Future International Security Environment" conference held Dec. 7 in Washington by the Applied Physics Laboratory of Johns Hopkins University. The second half of Rickards' presentation elaborated on his recent incisive observations about gold, as expressed at King World News and elsewhere. Rickards told the Johns Hopkins conference that he considers gold to be the secret economic weapon of the U.S. government, and he noted that devaluing currencies against gold in times of economic distress has been done frequently throughout history. He said he expects the United States to avert the dollar's collapse by returning it to a gold standard or even to avert the collapse of currencies worldwide by sponsoring a new gold-backed international currency, with gold revalued to perhaps $4,000 per ounce under either scenario. During the question period at the end of his presentation Rickards asserted that the paper gold markets in New York and London have sold claims to far more gold than the sellers possess or likely can obtain and that those markets will crash and resort to cash settlement if enough buyers ever try to take delivery. Of course that has been one of GATA's main arguments lately. In regard to devaluation against gold, it may be time again to note the study published in 2006 by the British economist Peter Millar, "The Relevance and Importance of Gold in the World Monetary System." Millar argued as Rickards does while predicting gold's revaluation at a somewhat higher price. Millar's study can be found at GATA's Internet site here: Rickards is a scholar and lawyer and described himself to the Johns Hopkins conference as a refugee from the bond market who converted to gold when he perceived how haywire things were going in the world financial system. (He got an especially close look as counsel to Long-Term Capital Management when it collapsed in 1998.) While his presentation is nearly two hours long, after the aggravatingly short segments given to him on business television it is a delight to have a chance to hear him lecture a bit. His reflections on gold begin at about 62 minutes into the video of his presentation, which is posted at the Internet site of the Applied Physics Laboratory of Johns Hopkins University here: http://outerdnn.outer.jhuapl.edu/rethinking/VideoArchives/MrJamesGRickar... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | ||||||||||||||||||||||||||||||||||||

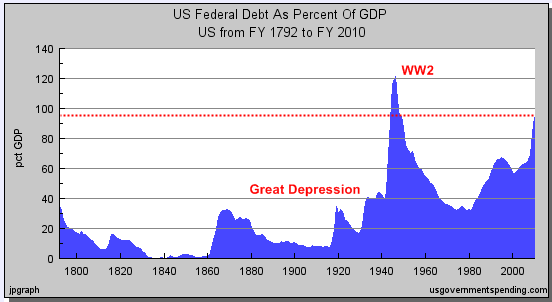

| US Public Debt Set To Pass US Annual GDP. Posted: 16 Dec 2010 04:37 PM PST People may not even realize that during the Great Depression, US Federal debt as a percent of GDP did not even reach 40 percent. Part of this was because the size of government was much smaller in military, public services, and entitlements. The only time in history that the US as a whole spent more than it produced was during World War II. That is the only time but we are now quickly approaching the 100 percent range of federal debt to GDP as a percentage. The US Treasury and Federal Reserve are aiming to pull the economy out of the Great Recession by going into further debt. Think about this for a few minutes. What led the US into a major financial crisis were banks allowing people to go into too much debt buying homes, cars, and other things they clearly were not able to afford. While the banks were bailed out courtesy of taxpayers, the central banks are aiming to go deeper into debt just to create additional bubbles. Bankers are loving this and their profits reflect this change. Yet as many chastise economies around the world for going too deep into debt it is likely we will hit the 100 percent threshold next year. Take a look at the amount of debt relative to our nation's production: Does the above even look healthy to you? Starting in the 1970s the US government thought it would be smart to simply "deficit spend" and put all expenses on the US credit card. So for a few decades this worked but now what? If debt was the solution to everything then why not give every American an open ended credit card with $1 million dollars pre-loaded? It would be simple given most Americans already have a credit card. Yet wealth is reflected by what can actually be produced and the Federal Reserve simply printing money dilutes the currency of the US. Common sense would tell you this. | ||||||||||||||||||||||||||||||||||||

| The First Stage of Inflation Has Already Hit, Next Up Is the Currency Collapse Posted: 16 Dec 2010 04:11 PM PST The First Stage of Inflation Has Already Hit, Next Up Is the Currency Collapse One of the biggest misconceptions about inflation is that the US Dollar needs to collapse in order for inflation to occur. While a currency collapse often accompanies periods of heightened inflation, this is not necessarily true. Case in point, the US Dollar actually rallied this year despite commodity prices exploding higher:

* per metric ton ** cents per pound As you can see, we've had an inflationary spike in commodity prices in 2010 despite the US Dollar rallying 2% during that time. Indeed, the inflation the US is experiencing today is rather unusual as it has been accompanied by deflation at the same time. As I write this, the US is experiencing deflation in housing prices and incomes combined with inflation in the cost of living (energy, food, commodity prices). Thus, we see deflation and inflation occurring simultaneously. It's not surprising as the Fed's primary moves since the Financial Crisis hit are: 1) Buying debt 2) Pumping money into the banks The first move was designed to attempt to stop debt deflation. As I've noted in other articles, the Fed is failing miserably at this (bonds are tanking). The purpose of the Fed's secondary move was to shore up the banks' balance sheets (with hundreds of trillions in derivative exposure and off-balance sheet toxic debt, most US banks are insolvent). Indeed, the monetary base has more the doubled since the Financial Crisis began.

What you're looking at is the Fed producing $1.2 trillion of money out of thin air. The reason we haven't yet seen inflation in the form of a US Dollar collapse is because: 1) Europe is imploding pushing the US Dollar up 2) Banks are sitting on this money (not lending) so it's not getting into the economy Regarding #2, the below chart explains everything:

The above chart depicts the amount of money US banks are sitting on in excess of what the Fed requires them to hold (all banks must hold a certain amount of cash in reserves). As you can see, up until early 2010, US commercial banks were sitting on nearly $1.2 trillion in excess reserves. So in plain terms, the Fed's money pumping (at least the money we know of) has simply been sitting on banks' balance sheets. In other words, banks aren't lending it out, so it's not getting into the economy (yet). This is why the US Dollar has yet to truly collapse: the Fed's money pumps have yet to get into the economy. Instead, the banks are just sitting on them. However, this doesn't account for the Fed money pumps that are non-public. It's no secret that the Fed has been pumping hundreds of billions of Dollars to financial firms without the public's consent. According to the Neil Barofsky, Special Inspector General of the TARP program, the Wall Street bailout could end up costing the US up to $23 trillion before it's over. Obviously a heck of a lot of money has been flowing into Wall Street that we don't know about. And Wall Street has done what it does best, pour this money into the financial markets… which has driven stocks, commodities, and risk assets in general THROUGH the roof. This is also why stocks and commodities have displayed such an unusually high correlation since the Fed started its QE 1 program in March 2009: it's all about Wall Street putting some of the Fed's money pumps into the markets. Thus today in the US we have debt and housing deflation… combined with cost of living and asset price inflation. However, I want to stress that the inflation we are seeing today is just a taste of what's to come in the next year. Indeed, our current inflation is all about loose money flowing into commodities, pushing up the cost of living. This is the financial speculation form of inflation and is just a precursor to the next, FAR MORE serious stage of inflation: the currency collapse. On that note, I'm currently preparing subscribers for the coming Inflationary Storm in the US, not with ordinary inflation hedges (though we're currently up 23% and 66% on our first two inflation trades, respectively) but with three incredible inflation trades that 99.9% of the investment world and fund managers don't know about. All three of these investments currently trade at HUGE discounts to their underlying assets. In fact, they're so cheap that all of them are prime take-over targets REGARDLESS of when inflation erupts in the US. Indeed, I fully expect all three of these investments to be up in the triple digits within six months. And I just revealed all three of them, including their names, symbols, and how to go about investing in them in a special report called The Inflationary Storm to subscribers of Private Wealth Advisory on Wednesday. Already two of them are up. One by as much as 6%... in less than 48 hours. To find out what these investments are, you can pick up a copy of The Inflationary Storm now by taking out a "trial" subscription to Private Wealth Advisory. To do so…

An annual subscription to Private Wealth Advisory costs just $180. However, I realize my analysis and investment style are not for everyone.

| ||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Fall Over 1% More Posted: 16 Dec 2010 04:00 PM PST Gold remained near unchanged in Asia and London before it fell almost 2% in early New York trade to as low as $1361.07 by about 10AM EST, but it then rallied back higher in the last few hours of trade and ended with a loss of just 1.08%. Silver fell to as low as $28.322 before it also rallied back higher, but it still ended with a loss of 1.47%. | ||||||||||||||||||||||||||||||||||||

| Gold and Silver Firm Ahead of EU Summit on Debt Crisis Posted: 16 Dec 2010 03:40 PM PST Mark O'Byrne submits: Gold Gold and silver were higher this morning ahead of a crucial EU summit on the deepening eurozone debt crisis today. The euro firmed slightly in overnight trade but has since given up those gains and is trading at USD 1.322, and €1,047/oz. Given that the crisis shows no signs of abating any time soon, with concerns shifting from Ireland and Greece to Belgium, Portugal and Spain, gold will likely continue to receive safe haven demand for the foreseeable future. Complete Story » | ||||||||||||||||||||||||||||||||||||

| Posted: 16 Dec 2010 01:11 PM PST | ||||||||||||||||||||||||||||||||||||

| Posted: 16 Dec 2010 12:11 PM PST I was cowering inside the Mogambo Bunker Of Fear (MBOF) in preparation for the release of the news from the Federal Reserve about how much credit those treacherous bastards created last week, expecting it to be a Big Whopping Bunch (BWB) since they have already announced that they were going to create an astounding $600 billion in the next six months as part of their shameful new Quantitative Easing 2 crap, which comes to $100 billion per month as part of their shameful Quantitative Easing 2 crap, which comes to $25 billion per week as part of their shameful Quantitative Easing 2 crap. This $25 billion a week is, again, $100 billion per month, which is, again, $600 billion in six months, which is a huge $1.2 trillion per year, which is a massive $6 trillion in only 5 years, all in an economy with a GDP measuring a measly $14 trillion! I cleverly extrapolate all of this not to show off my skills with mathematics, which are impressive only in the way I misunderstand and misuse them to ... | ||||||||||||||||||||||||||||||||||||

| Posted: 16 Dec 2010 12:00 PM PST | ||||||||||||||||||||||||||||||||||||

| If Today Marked the Bottom of the Gold Price Decline, Then Tomorrow it Ought Not Drop Through $1,365 Posted: 16 Dec 2010 11:31 AM PST Gold Price Close Today : 1370.40 | ||||||||||||||||||||||||||||||||||||

| Posted: 16 Dec 2010 11:04 AM PST | ||||||||||||||||||||||||||||||||||||

| The Unwavering and Inimitable Ron Paul Posted: 16 Dec 2010 11:00 AM PST Hey, our old friend Ron Paul is in the news. The New York Times carried an article about him. Astonishingly, it wasn't negative. Yes, it mentioned that Ron was regarded as a "crank." But in context, that didn't seem so bad. "I was with Ron just last week," said colleague Addison Wiggin. "He was just coming up for the chairmanship of the House subcommittee that oversees the Fed. He said he thought he had a 'snowball's chance in Hell' of getting the post. "The last time he was in line for it, the Republican hierarchy blocked him. But that was then. This is now." A few years ago, everyone hated Ron. The left hated him because he wanted to withdraw funding for its pet projects. The right hated him because he wanted to rein in the US military. Now, things have turned around. The left likes Ron because he wants to bring the troops home from Iraq and Afghanistan. The right likes Ron because he is a consistent opponent of deficit spending. The young are fascinated by him. What sort of Congressman votes no on his colleagues' boondoggles? What sort of conservative opposes the Pentagon and calls for an audit of the Fed? What sort of politician sticks to his principles, even when they are out of favor? Most recently, the right-wingers have been howling for Julian Assange's blood. They say he's a "traitor" – despite the fact that as an Australian, he has no loyalty to the US. Sarah Palin says he should be pursued like an Al Qaeda operative (though he has committed no crime, as far as we know). Rep. Peter King asked the Attorney General to name WikiLeaks as a terrorist organization. But good ol' Ron keeps his head and his cool. He praises Assange for revealing the "delusional" nature of US foreign policy. And poor Julian. Half the world wants to see him hang. And for what? He published some documents that US and foreign governments would rather keep secret. It may be a crime; politicians can make anything a crime. But since when was that a sin? Even as to the crime, we have our doubts. If publishing is a crime, your editor is in trouble. If publishing "sensitive" documents that make US officials look like fools is a crime, we're all in trouble. Regards, Bill Bonner The Unwavering and Inimitable Ron Paul originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||||||||||||||||||||||||||||||||

| CFTC Open Meeting On Speculative Position Limits is Today Posted: 16 Dec 2010 10:44 AM PST "CFTC now admits it will miss the deadline on position limits. 32 consecutive weeks of outflows from mutual funds. Massive selling of U.S. currency lies ahead. Swiss banks are resisting metal deliveries. A must read GATA release... and much more. " Yesterday in Gold and Silver The gold price was pretty steady in Wednesday trading in the Far East... but starting at 1:00 p.m. Hong Kong time, gold got sold off about ten bucks going into the morning gold fix in London around 10:30 a.m.GMT...5:30 a.m. in New York. Gold then rose back to almost unchanged by 8:00 a.m. in New York, before rolling over and heading lower for the rest of the Wednesday trading day. The gold price closed virtually on its low of the day... which was $1,377.80 spot] Silver's price path was very similar to gold's on Wednesday... except far more volatile price wise... with the highs and lows pretty much corresponding with what happened to the gold price. Silver's low price tick of the d... | ||||||||||||||||||||||||||||||||||||

| In Abu Dhabi, Christmas comes decked with gold Posted: 16 Dec 2010 10:44 AM PST Dec. 16, 2010 (The Associated Press) ABU DHABI, United Arab Emirates – The $11 million symbol of the season has become the latest extravagance at the Emirates Palace hotel, which boasts its own marina, heliport and a vending machine that pops out small gold bars. The hotel's general manager, Hans Olbertz, was quoted in local newspapers Thursday as saying the 43-foot (13-meter) faux fir has 131 ornaments that include gold and precious stones such as diamonds and sapphires. Olbertz told Dubai's Gulf News that he worked with one of the jewelers in the hotel to create a "unique tree and experience for our guests this year." … Christmas spirit is not rare in the United Arab Emirates, which is officially Muslim but hosts a huge foreign population. [source] RS View: Whereas our dominant Christmas colors seem to be typified by red and green (in homage to debt and dollars, surely), I've got to say, in my eyes, this tree of sparkles and gold strikes a more satisfyingly firm and resplendent chord. [Too bad the slideshow accompanying the article doesn't include a "night" shot to show off the lights and sparkles to better effect. But with a pricetag at $11M, I can understand why the hotel would be keen to keep a watchful eye and the house lights on!] | ||||||||||||||||||||||||||||||||||||

| Posted: 16 Dec 2010 10:13 AM PST Gold 411 - Casey's Daily Dispatch [LIST] [*]Sign Up Now! [*]| [*]RSS Feed [*]| [*]Print this [*]| [*]Visit the Archives [*]| [*]Email to a Friend [*]| [*]Back to All Publications [/LIST] December 16, 2010 | [url]www.CaseyResearch.com[/url] Dear Reader, Driving back from dropping the kids off at school this morning, I tuned into the radio news and found myself irritated by almost every story. Granted, I may be more crotchety than usual just now, due to the typical holiday stress compounded by an injured Achilles tendon that has been giving me problems on and off for months - and is now "on."... | ||||||||||||||||||||||||||||||||||||

| Posted: 16 Dec 2010 10:06 AM PST Gold futures step lower as year-end approaches The COMEX February gold futures contract closed down $15.20 Thursday at $1371.00, trading between $1361.60 and $1387.30 December 16, p.m. excerpts: | ||||||||||||||||||||||||||||||||||||

| Hourly Action In Gold From Trader Dan Posted: 16 Dec 2010 09:16 AM PST | ||||||||||||||||||||||||||||||||||||

| Posted: 16 Dec 2010 09:15 AM PST | ||||||||||||||||||||||||||||||||||||

| Guest Post: Rebalancing Act For Your Portfolio Posted: 16 Dec 2010 09:09 AM PST Submitted by David Galland of Casey Research Rebalancing Act for Your Portfolio Has the latest pullback in precious metals and related stocks given you a sickening feeling in the pit of your stomach?

The importance of this information is two-fold: | ||||||||||||||||||||||||||||||||||||

| “The Fed Will End Itself Before I'm Able To” Posted: 16 Dec 2010 09:00 AM PST Representative Ron Paul (R-TX) talked to Maria Bartiromo the other day about the central bank, the value of gold, and his upcoming chairmanship of the Monetary Policy subcommittee of the House Financial Services Committee in which he's hoping to host a debate between Paul Krugman and an Austrian economist. Favorite line: "I'm always fascinated that the Treasury is in charge of the strong dollar policy and, yet, it's the Fed that creates the money. The Fed determines the value of the dollar. If you print a lot of dollars, the value of the dollar has to go down." | ||||||||||||||||||||||||||||||||||||

| How $90 Oil Affects the Global Economy Posted: 16 Dec 2010 09:00 AM PST With 10 shopping days before Christmas, it's looking more and more likely: The holiday-season price of gasoline will top $3 a gallon for the first time. According to AAA, the national average today for regular unleaded is $2.984 – up nearly a dime over the last month. The price of crude oil is up $7 a barrel over the same period. "Of course," you might say, "it's the weaker dollar. No surprise there." Except the dollar actually strengthened a bit over the last month. And over the last three months, it's gone basically nowhere, while crude has jumped over 12%.

And that's West Texas Intermediate crude, the light sweet stuff that's (relatively) easy to pull out of the ground. Brent crude – the benchmark for much of the rest of the world – is already above $90 a barrel. $90 oil is "a mild threat to the global economy," says The Financial Times. Could it be even worse for Americans? It's been said that every $1 added to the price of a barrel of oil is $100 billion subtracted from GDP. Even in a $14 trillion economy, that adds up. Case in point: FedEx just announced its profits fell 18% in the third quarter. Its fuel costs were 26% higher than Q3 2009. No doubt that's one reason you'll be paying 3.9% more to ship something via FedEx starting next month. (No luck switching to UPS; it's jacking up rates 4.9%.) So why are oil prices outpacing the dollar? As is often the case these days, we look to China for an answer. "Last summer," says Byron King, editor of Outstanding Investments, "the Chinese government announced that it wants domestic industries to become more efficient in their use of electricity (most of which comes from polluting coal-fired plants in China). The Chinese government enforced this edict by – literally – pulling the switches on the power grid and blacking out entire factory complexes and industrial areas. Nothing subtle about it, eh? "So what did the Chinese factory owners do? They threw other switches and fired up their backdoor diesel generators. The result? There was an instant, sustained surge in demand for diesel fuel across China. Indeed, starting in August, oil imports surged into China, as did imports of refined diesel fuel. "This action helped strengthen oil and refined product prices all fall across the world. Add into this the generally inflationary conduct of US monetary policy. And add on a generally declining US oil inventory as refiners crank out heating oil in anticipation of the cold winter. There's your $90 oil." Dave Gonigam How $90 Oil Affects the Global Economy originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||||||||||||||||||||||||||||||||

| How/Why I'm putting all my cash into gold Posted: 16 Dec 2010 08:59 AM PST By Andrew Sullivan, CFA There are many ways to get exposure to gold, including buying physical metal itself in bullion form, mining shares, mutual funds, and exchange-traded funds (ETFs). The safest option is physical gold because there is no mining or counterparty risk (where the gold is stored), but it can be inconvenient to buy and store. … even at nominal highs, there is still a very attractive risk/reward ratio on offer with gold and how the real risk is holding cash. Therefore I'm choosing gold over paper while I wait for excellent investing opportunities. And I'm doing it today…

[source] Excerpts from the aforementioned article: (December 15, 2010) — Commercials advertise "Cash for Gold," but as I see it, the far smarter move is "Gold for Cash." Cash loses purchasing power dramatically over time, and with a global currency war and sovereign debt crisis just beginning, this threat is heightened. There aren't many liquid money alternatives except gold, and because gold is still very attractive in relation to cash, I think buying gold is the right thing to do. … Today, you've got two choices for money: currencies issued by central banks, or hard assets like gold. Remember that in a debt crisis, debtholders worry about getting their money back. Well, it's a similar situation in a sovereign debt crisis, except that governments that borrow in their own currencies can always pay debtholders back by creating more of it, diluting the existing currency's value. Therefore, by holding cash, you expose yourself to the very real risk of losing significant purchasing power as a sovereign debt crisis unfolds. … Given current dynamics, I consider a $5,000 price very likely in the future, so let's look at our upside and downside potential in the next few years. At $5,000, we have $3,600 of upside from the current $1,400 price. My estimate of downside is $1,100, just above where India bought gold from the IMF last year, meaning we're risking $300 ($1,400 minus $1,100). This means we have $3,600 of upside and $300 of downside, a 12:1 ratio. In other words, our initial capital of $1,400 could increase 260% or decrease 20% in nominal terms. But because our only other choice for money is paper currency, if we don't buy gold, we are risking $3,600 in purchasing power for a potential $300 gain, a 1:12 ratio. This is why your real risk isn't in buying gold, it's in staying in cash, which has an excellent chance of decreasing in relation to gold. The standard argument against gold is that because it doesn't produce income, it can't be valued. I disagree with this statement because valuation at its heart is about predicting the future. For stocks and bonds, this means estimating future cash flows. But if an asset does not have cash flows, you need to fall back to economic fundamentals and predict both supply and demand for that asset in the future. Consider artwork. Art dealers know how many paintings exist by a particular artist, so supply is easy. They also know how deep demand is — whether it's a new artist with possibly flaky support or an established name with many buyers who will enter the market should prices fall. This, and a wealth of information gathered in the business, allow them to determine whether a painting is good value or not. Similarly, with gold, the supply side is easy to determine: it increases by roughly 1% to 2% per year. The tricky part is gauging future demand and how it will change. But it's really not that hard-demand is off the charts. India and China and other emerging powers know they don't have enough gold relative to their reserves and the size of their economies, and they're desperate to diversify away from dollars. The same goes for investors and ordinary folk worried about the ongoing destruction of the dollar. So instead of income flows, valuation centers on an analysis of supply and demand. … Just like an art dealer can value a piece of art because she is intimately familiar with the supply and demand dynamics that drive prices, you can do the same with gold. If that's too daunting, here's an easy alternative: listen to the professionals, the gold and silver analysts that have followed metals for years. I do. Not for positive reinforcement, but because they spend all day studying and thinking about precious metals, and consequently understand the dynamics multiple times better than those who haven't done any research. And right now, most of the people who know the most about the sector are overwhelmingly bullish, while many with bearish sentiment know relatively little about gold. There is the risk that tunnel vision can creep into some analyses, but the difference in knowledge and time spent on the subject is in many cases 1,000 to 1, so as I see it, it's a no-brainer to whom you should listen. [source] RS View: Precisely! | ||||||||||||||||||||||||||||||||||||

| Jim Willie: “Silver is breaking out in all majors currencies.” Posted: 16 Dec 2010 08:58 AM PST | ||||||||||||||||||||||||||||||||||||

| Posted: 16 Dec 2010 08:45 AM PST | ||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Gold With 50 Day Moving Average Posted: 16 Dec 2010 08:23 AM PST | ||||||||||||||||||||||||||||||||||||

| Simon Black's Advice To Young People: Grab Your Ankles Posted: 16 Dec 2010 08:07 AM PST To all who watched the recent student demonstrations in London (in which members of the royal family ended up being victims of righteous mob anger), and mused that things like this can never happen in the US, Simon "Sovereign Man" Black has some words of caution: prepare to grab your ankles. His advice is what some may consider borderline anarchistic: "Stop playing by everyone else’s rules. Refuse to be enslaved by the idea that it’s your civic and moral responsibility to pay off the debts of your government’s failures. Cast off the yoke of their control… and summon the courage to live a life by your own design." Yet judging by recent violent events in ever more European countries, who have decided on precisely this outcome, is this such a far fetched perspective of what reality may soon become? From the Sovereign Man: Young people: get ready to grab your ankles If you’re reading this and under 30, let me be absolutely clear about one indubitable point: your government is going to sacrifice your future in order to pay for its own mistakes from the past. | ||||||||||||||||||||||||||||||||||||

| Posted: 16 Dec 2010 08:05 AM PST Hard Assets Investor submits: By Brad Zigler Now’s the time when we scurry about, looking for those perfect holiday gifts for friends and family -- provided, of course, that we still have the wherewithal to buy presents after being in the market for 11 1/2 months. Complete Story » | ||||||||||||||||||||||||||||||||||||

| False Choice: Yield vs. Safety Posted: 16 Dec 2010 08:01 AM PST The 5 min. Forecast December 16, 2010 12:04 PM by Addison Wiggin - December 16, 2010 [LIST] [*] Oil persists near $90 a barrel… Why it’s more than just a “falling dollar” story [*] Bernanke Backfire reaches new heights… triggering a sell signal for bonds [*] Playing catch-up: Dept. of Energy issues a warning readers of The 5 have heard since early 2008 [*] New rosy numbers for the housing market… The 5 checks the footnotes for the real story [*] More trouble for commercial real estate: Cube rats given less space to fill out their TPS reports [/LIST] With 10 shopping days before Christmas, it’s looking more and more likely: The holiday-season price of gasoline will top $3 a gallon for the first time. According to AAA, the national average today for regular unleaded is $2.984 -- up nearly a dime over the last month. The price of crude oil is up $7 a barrel over the same period. “O... | ||||||||||||||||||||||||||||||||||||

| The Rise, Fall, and Rise Again of Privateers Posted: 16 Dec 2010 08:00 AM PST In August 1812, the Hopewell, a 346-ton ship laden with sugar, molasses, cotton, coffee, and cocoa, set sail from the Dutch colony of Surinam. Her captain was pleased because he reckoned that in London the cargo would sell for £40,000 – the equivalent of at least several million dollars in today's economy. The Hopewell carried fourteen guns and a crew of twenty-five, and for protection she sailed in a squadron of five other vessels. It was difficult, however, to keep a squadron together in the vast expanse of the Atlantic Ocean, and on August 13 the Hopewell became separated from her sisters. Two days later her crew spotted another ship, armed and approaching rapidly. At three hundred yards, the approaching schooner fired a round off the Hopewell's bow and called for her to present her papers and prepare to be boarded, but the captain was not about to give up his cargo so easily, and he opened fire. A hail of musket and cannon balls tore into the Hopewell in return. Broadside after broadside was exchanged as the more nimble adversary bore down repeatedly. At last, the Hopewell could fight no longer, and her captain ordered the flag to be struck. The attacker, an American schooner out of Baltimore, was neither a pirate ship nor a ship of the US Navy, then next to nonexistent. In fact, it is best to think of the Comet not as a ship at all, but as a business enterprise. The Comet's owners and its crew, from Captain Thomas Boyle down to the lowliest cabin boy, were hunting the Atlantic for prizes: British commercial ships to be captured, condemned, and sold for profit. Piracy? Not at all. The Comet was a privateer, a ship licensed by the United States, then at war with Great Britain, to harass British vessels and confiscate their cargoes. The privateer's license was no mere formality. Without the license and a legal proceeding, the privateer could not sell its prizes legally. More important, courts throughout the world recognized a privateer's license as valid. Pirates, in contrast, were barbarians and operated outside the rule of law; if caught, they would be hanged. Even the British, then the enemy, recognized that a privateer acted within the law of nations, and its captain and crew, if captured, would be accorded the same rights as captured officers and crew of the US Navy… Thus, private means were used to wage public wars. Public navies were expensive, especially because they had to be maintained in peacetime as well as in wartime, and, until the late nineteenth century, tax systems tended to be ineffectual and inefficient. Governments, therefore, sometimes relied heavily on private initiative and enterprise to fight their wars. With a few extra cannon and men, a merchant vessel could be converted into a commissioned vessel capable of capturing small prizes should any cross its trading route. The more adventurous might build ships solely for the purpose of capturing prizes. The merchant vessels went on "voyages"; the commissioned vessels "cruised" and became known as privateers. The great era of Elizabethan exploration and expansion, for example, was financed and run by privateers. Sir Francis Drake, Sir Martin Frobisher, and Sir Walter Raleigh all operated as privateers with the Crown as partner. Privateering played a critical role in the American Revolution, with approximately seven hundred commissioned ships, compared to approximately one hundred ships in the US Navy. Thomas Paine owned stock in privateers, as did General George Washington. Benjamin Franklin did not own such stock, but he went to great lengths to commission privateers in France. He wanted to secure the release of American soldiers held in British prisons, but because the American military captured few prisoners, he had little with which to barter. Privateers provided a ready supply of prisoners for exchange. The apogee of the privateering system undoubtedly occurred during the War of 1812… The Comet, for example, was owned by a group of wealthy Baltimore investors who had anticipated the war. Commissioned on June 29, just eleven days after the declaration of war, this ship cleared Baltimore's harbor along with several other privateers on July 12, and it captured its first prize on July 26. Thus, in less than thirty days a fleet of cruisers was launched from the US coast ready to harass and imperil the British commercial fleet throughout the Western world. The privateers' entrepreneurial foresight stands in sharp contrast to that of the US Navy. As the war began, the navy had just eight seaworthy ships… [I]ncentives were the key to the privateering system. Most obvious, privateers chased down and captured enemy merchant ships to lay claim to the vessel and its cargo. In pursuit of this final objective, however, incentives were used throughout the privateering system. A privateering firm earned revenues from ransoms and the sale of prizes. The captain and crew were paid almost entirely in shares in the firm. The owners typically kept half the shares, and the captain and crew the other half (with some shares allocated to the vessel's repairs and maintenance and some reserved for the captain to reward especially meritorious conduct). The Comet's articles of agreement were typical. When the Comet captured the Hopewell, Captain Boyle and his crew owned 256.75 shares in total (plus 13.25 shares at the captain's disposal for rewards). Boyle himself owned 16 shares, the first lieutenant 9, the captain of marines 6, each able-bodied seaman 2, and so forth down to the greenhands, who owned 1 share each. Taxes, duties, and payments to auctioneers ate up about half of the value of a typical prize, but the crew of a privateer lucky enough to bring in prizes would still profit handsomely. The Hopewell's capture paid an able-bodied crewman $210.78, or about seven month's worth of salary in alternative employment, and Captain Boyle's 16 shares were worth $1,686.24, or at least $90,000 today. Of course, not all voyages were successful. Privateering was a high-risk, high-reward profession. Sophisticated markets allowed crewmen to sell some of their shares forward. A crewman who wanted funds right away, for example, could sell his shares to speculators… Naturally, the owners were well aware that a crewman who sold too many shares would no longer have an incentive to work as hard once onboard the ship, so contracts usually limited forward sales to roughly half a crewman's total. A crewman who wanted to sell shares also had to obtain the services of a surety, a bonding agent, who would promise to make good on the shares should the crewman abscond entirely. Shipbuilders commonly were paid partially in shares, thus improving their incentives for high-quality workmanship. In addition, the captain used the shares he held in reserve as bonuses; the first sailor to spot a prize and the first to board a fighting prize, for example, received bonus shares. Injured crewmen also received insurance payments, and in the event of a crewman's death his shares were bequeathed to his heirs. Assaults on any male prisoner of rudeness to a female prisoner resulted in fines. Thus, incentives ranging from wage contracts to performance bonds were used throughout the privateering system. Although the War of 1812 is not much remembered today, it was the war that confirmed America's independence. In this second war of independence, the privateers were the first to launch. They swept out from America's coasts, capturing and sinking as many as 2,500 British ships and doing approximately $40 million worth of damage to the British economy (approximately $525 million in today's dollars). Despite some early successes, such as the defeat of the Guerrière by the Constitution, the US Navy was for the most part captured or bottled up in port by 1813. Only the privateers continued to venture out. Jerome R. Garitee, author of The Republic's Private Navy: The American Privateering Business as Practiced by Baltimore During the War of 1812, sums up the situation well: "Private armed vessels were the only successful American offensive weapon after 1813 [that were still] engaged in the War of 1812. According to a Baltimore editor, they 'sustained the honor of the country' almost single-handedly. In doing so, they were one important factor encouraging Britain to terminate the war. British shipowners, colonial merchants, and insurance companies suffered heavy losses, and British vessels paid high insurance rates just to cross the Irish Channel after American privateers began operating in larger numbers in British waters." Aside from the direct military gains, the privateers brought revenue and goods into the country. Amazingly, the privateers had to pay import duties on their prize goods! To understand why privateering ended, it is important to understand that it was always a government program…[Privateering] never accomplished exactly what the government wanted, but when governments could not easily raise the funds to maintain large navies and when monitoring of the navies was difficult, privateering was a good option. Navies, however, gave governments greater flexibility: governments could order navy personnel to do what they wanted them to do without having to change piece rates on the fly. So when navies became more economic and easier to monitor, privateering became relatively less useful… Government's growing power made the end of privateering inevitable. The rise and decline of an organizational form, in and of itself, has no great significance, but privateering's decline signaled an important change in Americans' understanding of their country. The Founders feared and despised standing armies as a threat to liberty. For them, the country's defense was best left to citizens who would take up arms in times of national peril, form militias, overcome the peril, and then return to their normal lives. The Second Amendment protects and reflects this understanding, and privateering fit neatly within this line of thinking. Explaining why the United States would not sign the Treaty of Paris, Secretary of State William Marcy said: "The United States consider powerful navies and large standing armies as permanent establishments to be detrimental to national prosperity and dangerous to civil liberty. The expense of keeping them up is burdensome to the people; they are in some degree a menace to peace among nations. A large force ever ready to be devoted to the purposes of war is a temptation to rush into it. The policy of the United States has ever been, and never more than now, adverse to such establishments, and they can never be brought to acquiesce in any change in International Law which may render it necessary for them to maintain a powerful navy or large standing army in time of peace." Regards, By Alexander Tabarrok The Rise, Fall, and Rise Again of Privateers originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||||||||||||||||||||||||||||||||

| Posted: 16 Dec 2010 07:45 AM PST Nomura's chief macroeconomist, Richard Koo, whose views we have often repeated on Zero Hedge, is out with his latest prediction which unfortunately has nothing good to say about the future of the US: "We have shown—using the example of the ¥2,000trn in output that was saved in Japan and the fact that the fiscal stimulus provided by World War II quickly pulled the world’s economies out of depression—that fiscal stimulus can be a potent tool during a balance sheet recession. Unfortunately, participants in the US fiscal debate remain oblivious to this point and continue to discuss the pros and cons of fiscal policy using fiscal elasticities measured when the economy was not in a balance sheet recession. This implies that economists are heavily underestimating the elasticity of fiscal stimulus during such recessions—just as their counterparts in Japan did a decade ago—making policymakers reluctant to implement further stimulus. This reluctance leads to further economic weakness. The situation in Europe is no different from that in the US. I therefore have to conclude that the western nations have learned nothing from Japan’s lessons and are likely to repeat its mistakes." To be sure, Koo is more in the Krugman camp when it comes to rescuing a fallen Keynesian regime, and believes that stimulus at any cost is the only resolution. That said, the US now exists in a universe in which all the incremental debt issuance is being monetized directly by the Fed: an event is unparalleled in the history of the country. As such we fail to see how one can extrapolate arguments from even a bearish case that may be applicable to the current global state of affairs, which courtesy of Reinhart and Rogoff, we know is at or beyond a tipping point in terms of sovereign leverage. That said, the full note is a must read: Roller coaster ride for bond market participants The world’s bond markets have been on a two-week roller coaster ride. The week before last, the US jobs report appeared to show clear signs that any recovery in the labor market would be delayed. But that was followed last week by the announcement of an agreement between President Obama and the Republican Party that was seen as having positive implications for the economy. The November payrolls report, released on Friday, 3 December, came in below market expectations. However, some attributed the weak results to excessively strong October data, and the general view seemed to be that the results for October and November should be viewed together. Surprise agreement between President Obama and Republican Party The suddenly announced agreement between President Obama and the Republicans came as a surprise to many. The president secretly negotiated this deal with key Republican officials without consulting senior officials in his own party. News of the agreement initially sparked a heavy sell-off in the bond market. The resulting rise in yields was large enough to suggest that the downtrend in interest rates was finally over. The sell-off also led to higher mortgage rates. The agreement contains broad-ranging economic stimulus in the form of a two-year extension of the Bush tax cuts for all taxpayers, including high earners, full expensing of investments, an extension of unemployment insurance, and a reduction in payroll taxes. I do not think the extension of Bush tax cuts themselves will spark an economic recovery—after all, those tax cuts were unable to prevent the current recession. Most of the increase in unemployment insurance benefits will probably be earmarked for consumption, but it is difficult to tell how much the payroll tax cuts will boost spending. With the US household sector still deleveraging, I project that most of the tax cuts for that sector will either be saved or used to pay down debt. On the other hand, full expensing and other provisions may help. The IMF estimates the plan would lift US GDP by about 1%. Altogether, the package can be expected to provide a certain amount of support for the economy (compared with a situation in which nothing was done), although it remains to be seen whether the Democrats will approve all of the measures. Use of credit cards in US drops precipitously Thanksgiving Day, the third Thursday in November, marks the start of the Christmas shopping season. This year saw the lowest use of credit cards in the 27-year history of the survey. Only 17% of US consumers used credit cards during this period, down nearly half from the corresponding ratio for 2009. On a quarterly basis, credit card use in Q3 was off a full 11% from the same quarter a year ago. This is especially noteworthy given that the economy was already extremely weak in 2009 Q3. Part of the reduced activity, of course, is attributable to stricter card issuance standards adopted since the financial crisis, which are said to have caused 15 million Americans to lose their credit cards. More recently, however, credit card companies’ attitude towards lending has undergone a change. With profits depending on people using credit cards, issuers are now engaged in a fierce competition and have unveiled a variety of incentives to encourage consumers to make greater use of their cards. However, there has been little response from consumers, reflecting the continued efforts of US households to minimize debt. Collapse of housing myth and rising US household savings Last week I was talking with someone I met at a certain store in New York who insisted he would never use that store’s credit card again. I asked why, because I happen to carry the same card and have been very happy with it. He answered that he had spent too much with the card and now regretted it terribly. Many US consumers now find themselves in similar circumstances, and that is reflected in the credit card usage data noted above. I attribute this change in sentiment to concerns driven by the high unemployment rate coupled with the fact that US housing prices, after going 70 years without ever dropping, have declined substantially, leaving many people owing more than their homes are worth. This marks a 180° turnaround from the world in which steadily rising home prices represented a form of savings. Now, instead of increasing, these “savings” are in many cases shrinking. Japan’s real estate myth began with the end of World War II and lasted 45 years, and its collapse had a major impact on consumers’ behavior. The US housing myth was alive for a full seven decades. Accordingly, we should not underestimate the psychological shock resulting from its collapse. US tax deductions for various types of interest continued from Great Depression to 1970s Some market participants believe that with the US household savings rate as high as it is, savings are more likely to decrease than increase going forward, and that a reduced savings rate would quickly spark a recovery in the US economy. But if the current increase in US household savings is driven by the collapse of a 70-year housing myth, I think US consumers’ propensity to save may well remain at elevated levels. Americans who lived through the Great Depression, which began with the stock market crash of 1929, experienced a long-term trauma that left many of them insisting they would never again borrow money. This aversion to debt caused the after-effects of the balance sheet recession to linger on for decades because businesses and households were not borrowing and spending private savings even after their balance sheets were repaired. The US government responded by creating a variety of tax deductions for interest in an attempt to make it easier for people to borrow money. Until the 1970s virtually all types of interest—ranging from interest on credit card loans to interest on automobile loans—were deductible in the US. Upward pressure on savings rate will take time to correct Starting in the 1970s, however, US households’ savings behavior began to move in the opposite direction, leading eventually to excessive borrowing and insufficient savings. The government responded by gradually phasing out most deductions for interest, home mortgages being the key exception. But it took more than 40 years since the Great Depression to reach that point. That Japanese businesses and households remain averse to debt even today, some 20 years after the real estate bubble collapsed, also suggests that this type of trauma takes a great deal of time to get over. I think it can be argued that the US will require less time to recover. The US bubble was relatively mild in comparison with that of Japan, where 20 years ago it was said that the land underneath the Imperial Palace was worth as much as the entire state of California. However, I see a real possibility that the collapse of the 70-year housing myth and the consequent increase in the savings rate will continue until housing prices start to rise again. After all, the movement of US housing prices (but not commercial real estate) is surprisingly similar to that of Japanese prices 15 years ago in terms of the percentage increase, the duration of the increase, the percentage decline, and the duration of the decline. Re-examining US deleveraging process Last week the Fed released flow-of-funds data for 2009 Q3. The numbers indicated that the private sector deleveraging process continues, although the pace of increase in savings has moderated somewhat. As I noted in the 13 July 2010 edition of this report, the flow-of-funds data for the US for the past two years have some serious problems and cannot be taken at face value. The data divide the economy into five sectors—households, nonfinancial businesses, financial institutions, government, and the rest of the world—such that the financial surpluses or deficits for all five sectors sum to zero. The data are used to determine which sectors in the nation’s economy are saving (= financial surplus) and which are borrowing and investing (= financial deficit). For the last two years the sum of these five figures has been nowhere near zero, as Exhibit 1 shows (note that, in Exhibit 1, nonfinancial corporates and financial institutions are grouped together as the “corporate sector”). The fact that these five figures do not sum to zero is an indication that some or all of the figures are not accurate. But without these data it is impossible to determine the scale of the deleveraging process currently underway in the US private sector. That is why I presented two measures of the “private sector” in the 13 July report: one defined as households plus the corporate sector, and the other defined as zero minus the sum of government and the rest of the world, drawing on the property that the financial surpluses and deficits of the five sectors must sum to zero (Exhibit 2). The first measure is shown in the graph as a narrow line; the latter, as a thicker line. In theory these two lines should trace exactly the same paths. Historically there has always been some divergence between the two, but recently the disparity has grown much larger. A look at the gap between the two measures for the past few years shows that if the narrow line is correct, private sector deleveraging represents at most about 8.28% of GDP. But if the thicker line is accurate, the private sector deleveraging process could amount to as much as 13.29% of GDP, which is far greater than the 8.5% (of GDP) increase in the government’s fiscal deficit during this period. That would suggest that there are still substantial deflationary gaps in the US economy. Statistics prevent accurate measure of deleveraging On my recent visit to Washington, I was able to speak with some of the people responsible for compiling this data series. I took the opportunity to ask them about the causes of these problems with the flow-of-funds data over the past two years. They replied that the financial crisis had thrown their estimates completely off course and that they themselves were not sure what to do about it. I was even told that it would be another two years before more accurate data were available. Over the next two years, they said, new data will be used to enhance the precision of figures that can currently only be estimated. Pessimistic estimates may be closer to reality But for the policymakers and market participants who must evaluate the economy now, two years is far too long a time. When I asked the economists which of the two lines illustrating private savings behavior was closer to the reality, they said the thicker line was probably a better approximation of actual economic conditions. Their reasoning was that the thicker line can be estimated using just two types of primary data: the trade balance and fiscal balance. The estimation process is therefore far simpler than that required for the thinner line. That would imply that, as the flow-of-funds data are corrected going forward, it is far more likely that the thinner line will move closer to the thicker line than the other way around. That, in turn, suggests that the increase in savings and minimization of debt in the US private sector will continue. US private savings increased by 13.29% of GDP between 2006, when savings hit bottom, and the present. That is not far from the corresponding figures for Ireland (21.93%) and Spain (18.30%), which also have fallen into balance sheet recessions as their housing bubbles collapsed. It is also worth noting that, at 8.67% of GDP, US private savings are large enough in absolute terms to finance most of the nation’s fiscal deficit, which recent estimates put at 9.91% of GDP (Exhibit 1). Americans no longer averse to saving With US borrowings from the rest of the world having dropped from a peak of 6.03% of GDP in 2006 to just 1.24% today, the US can no longer be characterized as having an extremely low savings rate. We tend to automatically assume that the US does not save enough because that was the case for many decades. However, the data cited above demonstrate that current conditions in the US are very different from those that obtained in the past. The US now has a massive surplus of private savings—money that is saved but not borrowed and spent by the private sector—and that has triggered a balance sheet recession. On a brighter note, the existence of this surplus means the US private sector is now capable of financing the bulk of that country’s fiscal deficits. That, in a word, is why US long-term interest rates have fallen as much as they have in spite of the government’s large fiscal deficits. Agreement reached by President Obama and Republicans a step in the right direction In that sense, I think President Obama’s agreement with the opposition Republican Party to carry out further economic stimulus is a step in the right direction. It would have been even better if the package had centered on government spending instead of tax cuts, which are unlikely to provide a significant boost to the economy. In Washington, the general explanation for the focus on tax cuts was that all 60 of the new members of Congress who were elected in November are proponents of small government and would therefore be amenable to tax cuts but not increased government spending. But tax cuts provide little stimulus when the private sector is deleveraging because they do not necessarily lead to new spending. They do, however, produce a definite increase in the fiscal deficit. Tax cuts therefore increase the national debt while having relatively little impact on the economy and can further increase the size of government as a percentage of GDP. Mistaken view that fiscal stimulus is inefficient alive and well in US At a conference I participated in during my recent trip overseas, there was a debate over the multiplier effect of fiscal stimulus in the US. I was rather surprised to find that US financial specialists are repeating the mistakes of their counterparts in Japan a decade ago. Specifically, they continue to use the past results of quantitative models to estimate the multiplier effect of fiscal stimulus. As such models generally indicate the elasticity is no higher than 1.3, they argue that the economic expansion resulting from fiscal stimulus will be unable to offset the corresponding increase in the fiscal deficit. I would argue that this number is useless today because it was measured before the US fell into a balance sheet recession. The figure depends on the quantitative models’ key assumption that the US economy would limp along at zero growth even without any fiscal stimulus. These models do not assume today’s balance sheet recession world in which, absent fiscal stimulus, each surplus dollar saved by the private sector reduces final demand by the same amount, triggering a downward spiral in GDP. It was only because the government borrowed some 8% of GDP every year that Japan’s GDP stabilized at 0% growth during that nation’s balance sheet recession. Had the government stood by and done nothing, Japan’s economy would have shrunk by 8% a year. In other words, these quantitative models and the elasticities derived from them can be useful when the economy is at or near equilibrium, but are utterly useless when the economy is so far from equilibrium that the government must run fiscal deficits worth 8% of GDP just to keep output from contracting. Fiscal elasticity far higher during balance sheet recessions When Japan’s bubble collapsed, for example, national wealth worth three years of GDP was swept away in the world’s worst-ever financial tsunami. With households and businesses facing heavy balance sheet damage, excess private savings amounted to some 8% of GDP. Had nothing been done, Japan’s GDP would have contracted by about 8% a year. At the very least, output would have fallen back to the pre-bubble level of 1985. The cumulative gap between 1985 GDP and actual GDP from 1990 until businesses finished paying down debt in 2005 amounts to some ¥2,000trn. As Japan’s national debt increased by ¥460trn during this period, that means the government succeeded in supporting ¥2,000trn of economic activity with ¥460trn in additional debt. In other words, fiscal stimulus had an elasticity of four or five. Although this number is much larger than 1.1 or 1.2 figure typically mentioned for Japan’s fiscal stimulus, it is not hard to understand why. The economic impact of the government stepping in to borrow and spend money that would ordinarily be borrowed and spent by the private sector is reduced by the amount the private sector would have borrowed and spent. But during a balance sheet recession, the private sector is not borrowing and spending—in fact, it is paying down debt. Consequently, any money borrowed and spent by the government is fully reflected in higher final demand. It is therefore only natural that the elasticity of fiscal stimulus would be dramatically larger during such a recession. When properly measured, the elasticity of fiscal stimulus during such periods is very high—several times the estimates arrived at using data from ordinary periods. If balance sheet recessions were a frequent occurrence, it would be possible to derive reasonably accurate estimates of fiscal elasticities for such periods. But there was not a single occurrence between the Great Depression of the 1930s and Japan’s experience in the 1990s. Accordingly, we simply do not have the data needed to accurately measure elasticities during such periods. Europe and US may repeat Japan’s mistakes We have shown—using the example of the ¥2,000trn in output that was saved in Japan and the fact that the fiscal stimulus provided by World War II quickly pulled the world’s economies out of depression—that fiscal stimulus can be a potent tool during a balance sheet recession. Unfortunately, participants in the US fiscal debate remain oblivious to this point and continue to discuss the pros and cons of fiscal policy using fiscal elasticities measured when the economy was not in a balance sheet recession. This implies that economists are heavily underestimating the elasticity of fiscal stimulus during such recessions—just as their counterparts in Japan did a decade ago—making policymakers reluctant to implement further stimulus. This reluctance leads to further economic weakness. The situation in Europe is no different from that in the US. I therefore have to conclude that the western nations have learned nothing from Japan’s lessons and are likely to repeat its mistakes. Fiscal positions of European nations grow increasingly precarious It would appear that Germany and the IMF have finally realized the severity of the fiscal problems facing countries like Ireland and Spain and are beginning to work in earnest on aid packages for these countries. When I visited the IMF on my recent trip to Washington, it was clear that the Fund viewed assistance for Ireland as being critical. Officials I spoke with were driven by a sense of urgency, knowing that if the IMF and the EU were unable to stop the crisis from spreading, problems could propagate from Portugal to Spain, with devastating consequences. The IMF knows it needs to take a stand in Ireland. The Fund’s strategy is to buy time by providing assistance, during which time the problem countries are to engage in fiscal consolidation to the extent that it is truly necessary. Here, “truly necessary” means that without IMF aid, Ireland would have to cut fiscal expenditures starti | ||||||||||||||||||||||||||||||||||||

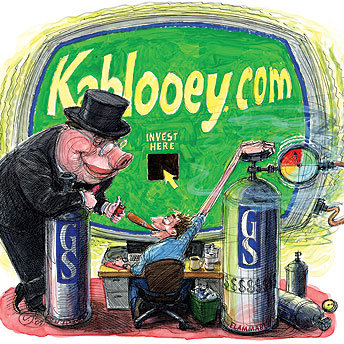

| Posted: 16 Dec 2010 07:30 AM PST View the original post at jsmineset.com... December 16, 2010 11:07 AM Dear Jim, Here is another classic cartoon telling it like it is. CIGA Doug Jim, Support point 1 has failed; previous support point 1 has now become resistance. With the current level of the USDX, resistance is now $1383. Support point 2 is $1356. CIGA Stefaan More… Act Like a Jack Ass and You’ll Always Get Treated Like One CIGA Eric Three taps and out on the gold stocks has created a significant breakout in the gold stocks. Rather than galvanizing investors resolve to hold their positions, it’s obvious that weak hands can still be easily spooked out of their positions by ‘timely’ garbage analysis and news flow. Over the years the markets have taught me this personal message, "Act like a jack ass and you’ll always get treated like one." The stock operators, fully aware of the technical significance and potential of three taps and out, con... | ||||||||||||||||||||||||||||||||||||

| Should Hank Paulson Be In Jail? Posted: 16 Dec 2010 07:27 AM PST Leading bank analyst (and Zero Hedge columnist) Chris Whalen has raised the question of whether criminal charges should be brought against former Treasury Secretary Hank Paulson. Any discussion of whether Paulson committed unlawful actions as Treasury Secretary needs to start with Tarp. As the New York Times wrote last year:

Indeed, Congressmen Brad Sherman and Paul Kanjorski and Senator James Inhofe all say that the government warned of martial law if Tarp wasn't passed:

Bait And Switch The Tarp Inspector General has said that Paulson misrepresented the big banks' health in the run-up to passage of TARP. This is no small matter, as the American public would have not been very excited about giving money to insolvent institutions. And Paulson himself has said:

So Paulson knew "by the time the bill was signed" that it wouldn't be used for its advertised purpose - disposing of toxic assets - and would instead be used to give money directly to the big banks? Senator McCain also says that Paulson pulled a bait-and-switch:

Even the New York Times called Paulson a liar in 2008:

What tax breaks is the Times talking about? The article explains:

Tarp is just one of Paulson's shenanigans as Treasury Secretary. And Paulson's acts as head of Goldman Sachs are beyond the scope of this essay. | ||||||||||||||||||||||||||||||||||||

| Some Irish seen turning to gold, shunning banks Posted: 16 Dec 2010 07:24 AM PST By Yara Bayoumy Ireland's government has guaranteed deposits but anxiety about what the future holds, particularly after Dublin was forced to seek a bailout from the EU and the IMF last month, has some savers seeking alternatives to the banks. "There has been an increase in demand, sustained over a period of months. There's been a slight increase in the last month. We get that every single day. From mom and pop investors to high net worth individuals," Mark O'Byrne, executive director of bullion dealer GoldCore, told Reuters. O'Byrne said the firm always advised its customers not to turn their savings exclusively into gold. "Gold is a classic hedge against the rest of your portfolio and you should put 5-10 percent," he said, adding that more companies were diversifying their cash holdings into gold than before. "We had a few (corporate deposits) per year before, now we have a few per week," he said. … Tom Crowley, a 46-year-old accountant, said he decided a few months ago to invest in gold. With banks reliant on state support, construction firms going bust and the euro under pressure over the debt crisis, gold was a "very attractive option". He now has about five percent of his portfolio in gold, "but it's something that I'm building up," he told Reuters. "I see it as a hedge and safe haven from turbulent markets. The currency risk … and what will happen with the euro prompted me to look at gold." … Ireland's banks have suffered large outflows of deposits, largely among corporate customers, since the middle of the year due to uncertainty over a growing financial crisis with its roots in years of reckless lending. … Neil Donnelly, CEO of AllSafes.ie, told Reuters the sale of home safes had increased by 80 percent in the three months to the end of November compared to a year ago. "We've seen a steady increase (in sales) since January, a larger increase in the last four, five months or so," he said. [source] RS View: Also notable is that Donnelly of AllSafes was further quoted, "More people are storing cash at home than before. A handful of customers … have said 'I don't trust the banks. I want to keep my cash at home'." Once a person has reached the point where she feels that keeping cash in a safe at home serves her needs for financial peace of mind, she will soon find her thoughts remain troubled. Ignoring the simple fact that cash can physically burn away in a hot fire (choose a fireproof safe!), she will realize that, even if its physical safety is assured, it can nonetheless "burn away" through devaluation via inflation and exchange rate movements due to ongoing fiscal laxness and poor management by her country's politicians and monetary officials. A transition from cash to gold looms large as the next logical step toward ultimate peace of mind. Once again we are reminded of Jonathan Spall's timely refrain: "All it needs are a few percentage points of allocation from portfolios to gold for the impact to be profound." | ||||||||||||||||||||||||||||||||||||

| Tolerating Deception for the Sake of Economic Growth Posted: 16 Dec 2010 07:00 AM PST During the height of the credit crisis of 2008-9, the Federal Reserve and Treasury launched so many different lending programs and bailout facilities that it was hard to keep track of them all. Each program or facility used a distinct acronym to represent its particular portion of Bernanke's Bailout Buffet. Thus, for example, the Commercial Paper Funding Facility became simply the "CPFF." But the Fed also served up bailout facilities known as the TARP, TOP, TAF, TSLF, TALF, PDCF, AMBSPP, etc. At the end of the day, this "alphabet soup" of lending programs contained distinctions without a difference. On the receiving side of every acronym you would find a Wall Street banker with a hat in his hand. For ease of accounting, the Fed could have simply merged all the programs together into one giant WSBBF (Wall Street Banker Bailout Facility). But politics prevented that option. So instead, the Fed created lots of different programs and facilities with essentially identical mandates. And if you're curious about the volume of lending they conducted, or about any other component of the Fed's balance sheet, you can find the information right here…or at least most of the information. A friend of The Daily Reckoning recently discovered a curious error on the Federal Reserve's own Web site. By way of background, our anonymous source is neither a professional economist nor a professional investor. In fact, he's not even an amateur economist or investor. He's just a guy with an eye for detail.

One month ago, our source noticed an apparent error on the website of the Cleveland Fed. Specifically, he observed that the "Detailed View" of the Fed's balance sheet did not match the "Summary View."