Gold World News Flash |

- Gold Prices Should Stay High for Years to Come

- Oil Demand’s Triumphant Return

- J.P. Morgan vs. Silver: so Far – go Gold

- Nevada Sunrise Completes Non-Brokered Private Placement

- Empire of Fraud no. 7 (Eleven billion reasons to buy gold now)

- The Silver Shortage Pre-Panic Line

- No, The Big Banks Have Not "Paid Back" Government Bailouts and Subsidies

- Gold Market Update - Dec 05, 2010

- JP Morgan Silver Manipulation Explained

- Silver Market Update - Dec 05, 2010

- Time to Buy or Sell Gold and Silver

- Graham Summers’ Weekly Market Forecast (Euro hype over? Edition)

- SP 500 Deflated By Gold

- Cash4Gold - The Other (And Far More Hilarious) Side Of The Story

- 100% Sure Thing?

- 20 Years Of Turmoil, Chaos And War

- Got Gold?

- You Won't Make A Dime Chasing the Headlines

- Oil Demand's Triumphant Return

- The scramble for physical metal intensifies

- Massive Short Squeeze at Hand in Gold and Silver Markets

- Got Gold Report – Gold, Silver Sizzling

- Guest Post: The Twin Pillars Of Civilization

- “Keiser Report” featured contributor Beinki tries to buy a pineapple with Silver (***)

- The Perils of the Bond Market

- The Federal Reserve and Its Secret Set of Books

- Bill Downey: The silver shortage pre-panic line

- No inflation? In north of England, they say: Baaah, humbug

- CFTC's delay on position limits aggravates Chilton

- What Is Gold a Hedge Against?

- About Those High Gold Prices

- Gold Seeker Weekly Wrap-Up: Gold and Silver Gain Almost 3% and 9% on the Week

- COT Silver Report – December 3, 2010

- Secrecy of Central Bank Gold Lending Condemned in New Study

- USD's Local Top, Gold and Silver's Bullish Outlook

- Pre-war nickels have 35% silver (I give this one ** since it provides some really interesting info. about nickels)

- Guest Post: Will 2012 Be As Critical As 1860?

- Fearing Global Macro Gods?

- Will governments start buying Silver?

- Silver video from the Lisbon Lassie

- Gold Market Update

- Silver Market Update

- IMF Tells Eurozone To Buy More, More, More Bonds And That It Needs A Bigger Boat, Er, Rescue Fund; Belgium Wants A Bigger Pie Too

- Major, Major System Collapse Coming?

- HOW YOU CAN HELP DESTROY THE WALL STREET CRIMINAL BANKS

- Weekly Market Round-up: Investors still cautious despite stronger FTSE 100 performanc

- CFTC's delay on position limits aggravates Chilton

| Gold Prices Should Stay High for Years to Come Posted: 05 Dec 2010 07:10 PM PST Equedia Network Corporation submits: It's about time the contrarians realize that the world has changed. Complete Story » |

| Oil Demand’s Triumphant Return Posted: 05 Dec 2010 06:09 PM PST Lost in the shuffle of the European debt woes, a second round of quantitative easing and gold's record run has been the resurgence in global demand for oil. Global oil demand is strong; in fact, it has never been stronger. Oil demand during the third quarter of this year was up 3.7 percent, the fourth-straight quarter of growth. |

| J.P. Morgan vs. Silver: so Far – go Gold Posted: 05 Dec 2010 06:07 PM PST |

| Nevada Sunrise Completes Non-Brokered Private Placement Posted: 05 Dec 2010 06:04 PM PST NEVADA SUNRISE GOLD CORPORATION (TSX-V:NEV - NVSGF.PK) (the "Company") is pleased to announce that further to its news release dated November 05, 2010, it has closed its non-brokered private placement offering (the "Offering") consisting of 2,000,000 Units (the "Units") at a price of $0.20 per Unit, yielding the Company gross proceeds of $400,000 (the "Offering"). |

| Empire of Fraud no. 7 (Eleven billion reasons to buy gold now) Posted: 05 Dec 2010 06:03 PM PST |

| The Silver Shortage Pre-Panic Line Posted: 05 Dec 2010 04:00 PM PST |

| No, The Big Banks Have Not "Paid Back" Government Bailouts and Subsidies Posted: 05 Dec 2010 03:56 PM PST The big banks claim that they have paid back all of the bailout money they received, and that the taxpayers have actually made money on the bailouts. However, as Barry Ritholtz notes:

Moreover, as I pointed out in May, the big banks have received enormous windfall profits from guaranteed spreads on interest rates:

The newly-released Fed data shows that the Fed also threw money at many of the big banks at ridiculously low interest rates. And as I also pointed out, the government gave tax subsidies to the too big to fails:

Indeed, the Wall Street Journal noted this week:

And as I've previously reported:

When all of the different bailouts and subsidies given to the big banks are added up, it is obvious that they have not come anywhere close to "paying back" what we gave to them. |

| Gold Market Update - Dec 05, 2010 Posted: 05 Dec 2010 02:38 PM PST Clive Maund Things really couldn't look better for gold and silver both fundamentally and technically - and this is said in the knowledge that there are still a lot of naysayers around - if there weren't we really would have cause to be worried. Fundamentally, the major development of recent days that caused markets to soar is the realization that the addled leaders of Europe are set to put aside any principles or laws that stand in the way and backstop the European bond markets, before following the glorious example set by the US and wholeheartedly embracing the instant solution to all problems large and small (apart from insignificant matters like high unemployment) - QE heavy. They are going to step in and support the markets and print as much money as it takes. This is of course great news for the markets - the interests of the elites and of speculators are to be protected at all costs - and the costs will be pushed onto the ordinary guy in the street in the form of... |

| JP Morgan Silver Manipulation Explained Posted: 05 Dec 2010 02:35 PM PST |

| Silver Market Update - Dec 05, 2010 Posted: 05 Dec 2010 02:34 PM PST Clive Maund Although silver's uptrend which began in August has been steep, and it is still substantially overbought after its "running correction" of recent weeks, there doesn't appear to be any sign of it ending in the near future. On the contrary, silver looks set to continue to rise steeply and the rate of advance may even accelerate. On its long-term chart we can see how, having broken above the strong resistance near to its 2008 highs, silver has embarked on a steep uptrend that looks likely to at least rival the powerful uptrend of late 2005 and early 2006 - and if it rivals it in percentage terms, we are looking at a target in the $36 area for this move, which is certainly suggested by the upper trendline drawn on the chart. Given that silver is a much more volatile market than gold, and that gold itself is expected to accelerate away to the upside, it is clear that a spectacular advance may be in store for silver which takes it considerably higher than our provi... |

| Time to Buy or Sell Gold and Silver Posted: 05 Dec 2010 02:16 PM PST |

| Graham Summers’ Weekly Market Forecast (Euro hype over? Edition) Posted: 05 Dec 2010 01:56 PM PST

Last week’s explosive rally was due to three factors:

1) Stocks came perilously close to breaking down so the PPT stepped in 2) A bullish falling wedge pattern in stocks 3) Euro options expiration/ ECB intervention

Regarding #1, stocks came right on the verge of breaking below their 50-DMA. Given the technical nature of the stock market rally (the market hasn’t traded based on fundamentals in months) this would have heralded a major decline.

With the Fed and the US Government’s claims of a recovery hinging largely on the fact stocks are up, the powers that be couldn’t possibly allow this, so what do we get? A ramp job that takes stocks up nearly 4% in three days.

From a technical picture, this move was predicted by the bullish falling wedge pattern that formed over the preceding three weeks (see the chart below). Of course the only reason this pattern formed in the first place was because “someone” stepped in and propped stocks up every time they came close to breaking below 1175.

Regardless, the ramp job that occurred Wednesday through Friday satisfied this pattern. As I write, the S&P 500 has failed to best its early November intraday high (1227). A move above that level could portend a greater breakout, however, this will all hinge on the Euro.

Last week was options expiration week for the Euro. Already oversold, the currency was due for a bounce. Options traders took advantage of this to gun the Euro higher when rumors swirled that the European Central Bank would potentially issue a larger bailout.

Nevermind that the rumors proved false or that the European Union continues to collapse, in today’s market it’s trade first and think later. With that in mind, I want to note that the Euro is now coming up on major resistance.

If the Euro rises to break into the gap then we’re likely to see a move to 136, which would correlate to the S&P 500 breaking out to new highs. However, given how fragile things are in the Euro zone, this move could also be finished and we’re heading back down to new lows in due course.

Indeed, the big picture here hasn’t changed. The Euro is destined to make new lows having already been rejected at its multi-year trend-line. Given the high correlation between the Euro and stocks in the last few months, this predicts a full-scale collapse in the stock market at some point in the coming months.

On that note, Gold hasn’t bought into this latest Euro rally in the slightest, breaking out to new all-time highs in both Dollars and Euros, indicating that the flight from paper money continues in a big way. This is confirmed by Silver, which has also recently broken out in both Dollars and Euros.

To conclude, the markets are set to consolidate, if not correct this week. Euro options expiration is over. And the ramp job from last week needs to cool. Whether we’ll get a sideways trading range or a move to the downside all hinges on the Euro’s action, so keep your eyes there for signs of which way we’re headed.

Good Trading!

Graham Summers

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

|

| Posted: 05 Dec 2010 01:32 PM PST |

| Cash4Gold - The Other (And Far More Hilarious) Side Of The Story Posted: 05 Dec 2010 01:00 PM PST By now, everyone has heard accusations that Cash4Gold is nothing but a predatory site, seeking to "steal" the gold of people in distress for a painfully low price. Often times these stories involve Glenn Beck in some capacity. Of course, there is always "the other side" to every story. Below we provide just one such "other" side. It just so happens that the side is about as funny as it gets. Courtesy of Bruce Krasting |

| Posted: 05 Dec 2010 12:47 PM PST Bernanke did himself and the American people a great disservice tonight. He said that he was 100% certain that “He” could contain the consequences of his policy of quantitative easing. No person in a position of responsibility should make such bold statements. There is always risk. |

| 20 Years Of Turmoil, Chaos And War Posted: 05 Dec 2010 12:41 PM PST FWe are approximately five years into The Fourth Turning Crisis. Every previous Fourth Turning had an economic dimension that eventually led to a do or die all out war. The mainstream linear thinkers see a recovery and a return to their concept of normality. They will be shocked and flabbergasted when they realize that this is only the beginning of a 20 year period of turmoil, chaos and war. It seems that some study of history would benefit the mainstream talking media heads pretending to know what is happening and political hacks in Washington D.C. who pretend to administer the affairs of state. The cycles of history are not identical, but the alignment of generations is always the same. The cycles are consistent because a long human life is always between 80 and 100 years. The previous Fourth Turnings in U.S. history were the American Revolution, the Civil War and the Great Depression/World War II. The descriptions are as follows: (snippet) he turnings of history are like the seasons. It is impossible to go directly from Fall to Spring. You must withstand the bitter harshness of Winter in order to get to the revitalizing warmth of Spring. The intensity and depth of Winters will vary. Those who prepare for a potentially harsh Winter in advance will be more likely to survive. The morphology of Fourth Turnings as described by Strauss & Howe is:

An honest assessment of where we sit in this cycle shows that we are still in stage one. The housing collapse brought about the near destruction of the worldwide financial system. The sudden shift in mood has been borne out by the angry rise of the Tea Party and the startling result from the recent election. Society is on the verge of stage two. There has yet to be the reunification and reenergizing of society. It still feels like things are falling apart. The sun is slowly setting on this stage and a dark brutal Winter night beckons. More Here.. |

| Posted: 05 Dec 2010 11:54 AM PST

Today, the property is growing a nice cedar forest in the Pacific Northwest. The property produced gold on and off for 40 years at the turn of the last century. The old historic tailings still have a trace of gold in it, per ton. Our property is for sale, and has started to generate a real interest in it. Historically, the resources associated with the mine, while not large enough to capture any commercial interest, is large enough to generate interest from small operators who are looking for a source of rock to process. Our mine has about 13,000 oz of estimated gold resources associated with it. It has never been drilled, so these resources are based on a quartz blow out at surface which could be loaded up and hauled out by dump trucks to an off-site milling facility. We purchased the mine, as a long term investment so that we would have an asset to be sold during an economic blow off crisis that drives up gold above the long term average price. You have to have inventory in order to make a profit when others want what you have. This is our inventory. It has been publically for sale now since Gold was around 1,000 per oz. We have marked up our total investment by over 300% and would gladly take a cash offer for the property. In the first 12 months the property was for sale, we didn’t hear from anyone who was serious. That changed a few weeks ago, when we started to get real interest from real miners. In one case, a geologist with a history of gold mining in the area made an offer for the property. In another case, a professional hard rock miner is pondering an offer to operate the property. We have an exploration permit that is already in effect. Now, this weekend, we have a new 3rd group of investors touring the property. These people already bought and built a “free gold” milling facility, but have not lined up a source of rock ready to be processed. Our location “may” fill that bill perfectly. I share all of this, as an example of how not all physical gold, has to be in a mobile condition. We own hard physical gold still embedded in the quartz that has held it for millions of years. This gold is sitting at the surface of our property. The Gold trapped in the rock will have doubled its physical quoted value ($700 per oz or so at purchase, $1,400 current gold quote) while we are looking at booking a multi hundred % change in value for that raw gold. One of the real benefits of our cedar forest & historic mine, is that it has year around water and provides a great place to take the family camping. It’s paid off and sits in a national forest. Because the property is a forest right now, it has an extremely cheap holding cost. Finally, the mine property provides us with a leveraged bet on Gold, Timber and we have a supply of 5 acre building lots in a national forest. So while the property is for sale, we are in no rush to sell. We may even pull the property from the market, and relist it at a higher price, if we get a chance to have the quartz blow out drilled and a new resource estimate is generated. That is the ironic thing about this type of investment. The resell value can increase, even if our hard costs have already been fixed. Not all oz. are the same, some of them are still frozen in time, but that doesn’t mean their resell value is frozen. Far from it. Disclosure: Jack H Barnes owns a slice of a historic gold mine, and is looking for a buyer. I am long physical metals, private equity in historic reserves, but does not have exposure to paper metals at this time. This disclosure and others are available at JackhBarnes.com

|

| You Won't Make A Dime Chasing the Headlines Posted: 05 Dec 2010 11:33 AM PST Following the lead of QE to infinity, so it will be. While often quite entertaining, headline explanations are basically useless. You won't make a dime chasing the headlines. Follow the money for the real news. EU rescue fund should be increased: Belgian finance minister Reuters, Sat, Dec 4 2010 By Justyna Pawlak BRUSSELS (Reuters) – The European Union's permanent rescue fund should be larger than the money available currently and the increase could be made before 2013, Belgian Finance Minister Didier Reynders said on Saturday. However, any decision to top up funds for countries with crippling debt problems should be made after the 27-member bloc decides on the shape of a permanent solution to address financial crises, he said. Euro zone finance ministers outlined plans on Sunday for such a permanent system, which the bloc would put into place in 2013 and base it on the current European Financial Stability Facility (EFSF) that was set up in May. Together with money from the International Monetary Fund and other cash, 750 billion euros ($989 billion) was made available in May for rescue efforts. The short Euro "play" is progressing nicely.

|

| Oil Demand's Triumphant Return Posted: 05 Dec 2010 11:21 AM PST |

| The scramble for physical metal intensifies Posted: 05 Dec 2010 10:12 AM PST December 4, 2010 – The scramble for physical gold and silver is intensifying. People increasingly want to own the real thing, and not some paper substitute, all of which come with counterparty risk. This conclusion is apparent from the following two charts of gold and silver forwards, which are based on data made available by the London Bullion Market Association through November 24th (the most recent data available). Because gold is money, gold almost always trades in contango, meaning the future price is higher than the spot price. The percentage difference between gold’s spot and future price is gold’s interest rate, so in this regard, gold is not different from other moneys, except gold’s interest rate is lower than those of national currencies. Interest rates are a reflection of risk, and because gold’s purchasing power cannot be debased by central bank or government actions, the risk o... |

| Massive Short Squeeze at Hand in Gold and Silver Markets Posted: 05 Dec 2010 10:03 AM PST "Silver and gold prices take flight... as do the shares. The '4 or less' bullion banks have stopped shorting the silver and gold market... for the moment. Interviews with Ben Davies, Chris Whalen, Jim Rickards and John Hathaway... and much more. " ¤ YESTERDAY IN GOLD AND SILVER Gold was up about $7 by the time that Hong Kong trading was through for the day on Friday, but by the time that floor trading began in New York at 8:20 a.m. Eastern time, those gains had vanished... despite the fact that the dollar had declined about 25 basis points up to that point. Once the job numbers were released, the dollar headed south as gold and silver prices headed north. But the moment that London closed for the weekend, the gold price basically flat-lined until shortly before 4:00 p.m. Eastern time. Then, in the space of 15 or 20 minutes, it tacked on another eight bucks or so... hitting its high of the day [$1,417.00 spot], before closing almost at that high. This was highly unusual gold... |

| Got Gold Report – Gold, Silver Sizzling Posted: 05 Dec 2010 09:47 AM PST Both gold and silver turned in stellar performances this week as the herky-jerky Forex market continued to make mincemeat out of all but the most nimble of short-term Forex traders. Gold actually closed out a week above $1,400 nominal in USD for the first time ever and silver followed suit with a $29 handle showing on the last Friday trade on the Cash Market – another new 30-year intra-day high of $29.35. |

| Guest Post: The Twin Pillars Of Civilization Posted: 05 Dec 2010 09:04 AM PST The next post in a continuing series (most recently "RIP, Homo Economicus") by Free Radical The Twin Pillars Of Cilivization Gold is the child of Zeus. Without money, there can be little in the way of economic specialization, or what is commonly known as the division of labor. And without the division of labor, there can be little in the way of civilization. In pre-agricultural hunter-gatherer society, labor is primarily limited to these two endeavors, the hunting generally done by men and the gathering by women. So, too, is labor limited in early agricultural society, the men generally doing the farming and women the domestic work. And while proto-money might be involved, economic exchange is generally limited to barter, which requires a coincidence of wants that is far too inelastic to allow for the manifold exchange of goods and services that is the lifeblood of civil society. Money, in other words, is essential to any society that we would call civil, prompting us to ask what, in fact, money is and how it comes to be. The answer, simply enough, is that money becomes what it is through the very same process of exchange upon which civil society depends:

Money, then, is simply a commodity that, as an inherent store of value, is used as a medium of exchange. And given its considerable attributes – e.g., beauty, density, indestructibility, malleability, homogeneity, divisibility, transportability – it is little wonder that, over time, gold became the commodity of choice, the preeminent medium of exchange the world over. Nor is it any wonder that with the subsequent emergence of banknotes and other fiduciary media, which greatly facilitated indirect exchange and therefore the division of labor, it was gold that usually backed them up. Gold, then, is a good that is especially good as the money upon which civil society depends. So good, in fact, that if something is said to be “as good as gold,” it is receiving what is understood to be the highest possible praise, just as that which is described as “golden” – a golden moment, for example – is understood to be “of the greatest value or importance.” And thus does it come as no surprise that the ethic of reciprocity, all but unknown in this terminology, has been accepted the world over as the golden rule:

The preeminent moral precept of virtually every major religion and culture in human history, the golden rule is indeed a fundamental ethical truth that is as precious to civil society as the metal itself is. Thus, it is not too much to say that as gold has historically been the foremost currency of commerce, the golden rule has been the foremost currency of morals, the ethic that civil society has always “banked on” in one form or another. Nor is it too much to say, then, that together, gold and the golden rule stand as the twin pillars of civilization – the means by which individuals have traditionally cooperated to improve their lot in life, there being no other reason for civil society to exist:

Indeed it has. And if left to its own devices – i.e., if its members are allowed to interact freely and of their own accord – the human species will use its commodity money and its common morality to continually improve its overall wellbeing. But let us ask, what is so important about acting freely, and why is this so vital to the advance of civil society?

1. Marcus G. Singer, The Encyclopedia of Philosophy, MacMillan Publishing, 1967, p. 366 |

| “Keiser Report” featured contributor Beinki tries to buy a pineapple with Silver (***) Posted: 05 Dec 2010 08:47 AM PST |

| Posted: 05 Dec 2010 08:36 AM PST By Jeff Nielson, Bullion Bulls Canada There can be no greater travesty of "reporting" by the mainstream media than their failure to warn investors of the horrifying risks which accompany any investments in the bond market today. It is a greater failure than when they failed to warn investors adequately about the NASDAQ tech-bubble, and a greater failure than when they failed to warn investors about the massive U.S. housing bubble (and Wall Street Ponzi-schemes associated with that bubble). There are two reasons why this failure outweighs even those previous episodes of catastrophic myopia. First of all, the global bond market is much larger than either the NASDAQ, or the U.S. housing market (even at their bubble-peaks) – thanks to the mountains of sovereign debt which the bankers have seduced our "leaders" into creating. Secondly, unlike those suckers in the tech-bubble or the U.S. housing market at those bubble-peaks, the chumps in today's bond market have no possible up-side to their investment. It's one thing to be foolish enough to "invest" in a market at the peak of one of history's greatest asset-bubbles. However, it requires a quantum-leap in stupidity to buy into one of history's greatest bubbles when the only, possible direction in which that investment can go is down. To understand the situation in the bond market properly, it's first necessary to note a trait which is totally unique to bonds (among conventional investments). The bond market is always going "up". When interest rates fall, and the "yield" on the bond declines, the price of that bond rises by an equal, inverse amount. Conversely, when the price of a bond falls, this automatically means that its yield rises (again by an equal, inverse amount). I will not criticize the media for reporting on the bond market as the proverbial glass that is always "half-full", other than to observe that it is a trait which is common to all shills. The point to be made here is that unique to all investments, bonds have a built-in "hedge". For conservative investors, that has always been an attractive selling point. However, what readers (and investors) must be aware of is that because bonds are perfectly hedged in this manner, this automatically greatly limits the net gain which can possibly be earned by an investor. If the bond increases greatly in price, the yield plummets. If the yield soars, the bond-holder suffers a capital loss to eat into that gain. Indeed, under the best of circumstances bonds can only be recommended as a rational investment when there is a significant, positive (real) differential between the yield on the bond and the rate of inflation. Any time that this yield differential is zero, or worse, negative, then bonds become a guaranteed money-loser as a long-term investment. Yes, the capital appreciation of bonds might bail out an investor under those circumstances, but that brings us to the second unique trait of bonds: a maximum price. Buy an equity, and the theoretical gains are potentially infinite, since an infinitely profitable company could generate a theoretically infinite share price. Conversely, bonds have an absolute ceiling on their price: when interest rates approach zero. Thanks to the Federal Reserve buying-up every U.S. Treasury in sight (because "QE I" never ended), U.S. interest rates are at their absolute lows. Short-term yields are virtually zero. And while longer-term yields are significantly higher, we now know that those interest rates are as low as they can possibly go (over any kind of longer time horizon). We know this because "QE II" was supposed to bring down both short-term interest rates and (more importantly) longer-term rates. In fact, longer term rates have edged higher since "QE II" was announced – a clear message from the market that the Treasuries-bubble has reached its saturation point, and no matter how many Bernanke-bills "Helicopter Ben" cranks-out on his printing press, the only possible direction for U.S. interest rates is higher. In other words, absolutely the only possible direction in which the U.S. bond market can go is lower. That brings us to the questions: how low, and how fast? More articles from Bullion Bulls Canada…. |

| The Federal Reserve and Its Secret Set of Books Posted: 05 Dec 2010 08:33 AM PST I have been grudgingly getting to work every day and on-time since, unfortunately, it looks like my incompetence, stupidity and sheer lazy worthlessness is going to produce another losing quarter, and the rumor is that the Board of Directors is looking for heads to roll. This prompted me to suggest to my boss that instead of firing me, the company should bail out the business segment that is losing money (mine) by loaning money to it, which everyone knows will never be paid back, so that the consolidated company books could show a huge tax-deductible loss by virtue of loss reserves on the eventual default, and my little division could also help the bottom line by booking a tax-deductible interest expense on the loan that we never pay back! I carefully explained how the important benefit would be, of course, that I could continue to be my happy – although incompetent, stupid and lazy – self, there would be bonuses for the executive staff, and the company would benefit when everyone would look at me and say to themselves, "Wow! The company must be doing very well if they can afford to hire a half-witted clown!" which will create a kind of "wealth effect"! Money will start flowing! I explained to her, breathless with my hopeful optimism, "It's like magic!" Or, I said, triumphantly playing my ace of trumps, the accountants could find a way to "lose" all the money and save enough in evading taxes to offset the whole deal! Well, I could tell by the look on her face that she was not very keen on the idea to, as she put it, "dare to come into my office and suggest that we commit fraud and evade taxes so that we all land in prison and die in disgrace" but I calmly explained that the Federal Reserve apparently can't account for $9 trillion in their own off-balance sheet transactions, and nobody is under arrest, or going to jail, or being investigated, or anything! $9 trillion! In an economy that has a GDP of $14 trillion! "And so," I went on, "our piddly fraud would be but a triviality compared to $9 trillion, which is a Huge Freaking Amount (HFA) of money, in that it is a whopping 65% of GDP and (coincidentally) 65% of the national debt, and is 4.8 times larger than the entire monetary base of the Whole Freaking Country (WFC)!" She was visibly choking on her outrage, which I suspected was because she thought I was making this up as part of another Mogambo Scheme Of Desperation (MSOD) to save my worthless butt from the firing squad. So, to allay her suspicions, I told her that I got this information from Money News, which reported that when "Rep. Alan Grayson (D-Orlando) asked Inspector General Elizabeth Coleman of the Federal Reserve some very basic questions about where the trillions of dollars that have come from the Fed's expanded balance sheet, the IG didn't know." Shockingly, "nobody at the Fed seems to have any idea what the losses on its $2 trillion portfolio really are," which probably explains why Rep. Grayson said, "I am shocked to find out that nobody at the Federal Reserve is keeping track of anything." TheDailyBell.com, commenting on this interesting news item, said, "During the questioning of Coleman, Grayson asks her over and over if there is a formal accounting available for the trillions in off-book balance sheet activity for the Fed" until she finally "all-but-admits that she actually has no authority even to examine the Fed's off-balance sheet activities." This is where I got all excited at the possibilities, and said, "So all we have to do is to deny anybody the authority to look at a secret set of books!" Well, tragically, my stupid boss nixed my Terrific Mogambo Plan (TMP), and now I am desperate enough, and scared enough, about losing my stupid job that I show up, on-time, every stupid day to do my stupid job, whereupon I have rediscovered that I hate working and all that effort and striving to be at least minimally competent, which means I have to spend a lot of my Valuable Mogambo Time (VMT) actually handling stupid problems instead of, like previously, ignoring them until they somehow solve themselves or just mysteriously go away. The worst part, of course, is that I have to be around my stupid co-workers, who stupidly do not buy gold, silver and oil when the horrid Federal Reserve is creating so much money, and even when I tell them that they are stupid for not buying them, they still don't buy them! Stupid! These are, I suppose, the same "common people" who went another $2 billion deeper in installment debt last month, taking that source of indebtedness back up to $2,411 billion, which is a cool $24,110 for every private-sector worker in the Whole Freaking Country (WFC), which is an important statistic since only private-sector workers can make a profit with which to pay the taxes which supports half the economy already! Apparently, the money was used for "personal consumption expenditures," which increased $17.3 billion, or 0.2%, according to the Bureau of Economic Analysis, which also reports that "Personal income decreased $16.8 billion, or 0.1 percent, and disposable personal income (DPI) decreased $20.3 billion, or 0.2 percent, in September." People made less money, even as things cost more! Yikes! And as for the terror of inflation and especially the ruinous, runaway inflation that will result from the Federal Reserve creating so much money, the new Gross Domestic Product Deflator is understandably up, hitting 2.3%, which is up from last month's 1.9%. Hurriedly concocting some inflammatory and meaningless statistics in a pathetic attempt at attention-getting, I breathlessly declare that this is a gigantic 21% increase in the growth of inflation! Which it is! Check it yourself, moron, if you don't believe me! And with the evil Ben Bernanke purposely misusing the Federal Reserve to "target" 2% inflation in prices by creating – out of thin air – whole multiples of that in new money as a percentage of the money supply, the Fabulous Mogambo Advice (FMA) to buy gold, silver and oil as protection against such inflationary horrors rings clearer and louder, although it can be argued that the ringing of inflationary horror can ring louder, but not necessarily clearer. And as for easy, it hasn't gotten any easier, either, because it is already so easy to buy gold and silver ("Here's my money, gimme my metal!") that those who buy them justifiably say, "Whee! This investing stuff is easy!" The Mogambo Guru The Federal Reserve and Its Secret Set of Books originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day."

|

| Bill Downey: The silver shortage pre-panic line Posted: 05 Dec 2010 08:32 AM PST 12:45p ET Sunday, December 5, 2010 Dear Friend of GATA and Gold and Silver: Bill Downey of GoldTrends.net credits GATA Chairman Bill Murphy's testimony at the March 25 hearing of the U.S. Commodity Futures Trading Commission with sparking the explosion in the price of silver. Downey's commentary is headlined "The Silver Shortage Pre-Panic Line" and you can find it at Gold-Eagle here: http://www.gold-eagle.com/editorials_08/downeyb120310.html CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:http://www.gata.org/node/16 |

| No inflation? In north of England, they say: Baaah, humbug Posted: 05 Dec 2010 08:32 AM PST UK Ram Raiders Flock to Rustle Sheep By Andrew Bounds http://www.ft.com/cms/s/0/355bba18-ff1b-11df-956b-00144feab49a.html#axzz… Criminal gangs targeted manhole covers and copper wiring when rocketing Chinese demand rendered them valuable commodities. Now they have a new target: sheep. North Yorkshire has been hit by at least three large thefts in the Dales in recent weeks. In the past year there have been eight cases of sheep rustling in the county and three of cattle theft, with goats, dogs, poultry, and horses also being stolen, police say. In the worst case 271 sheep were taken from fields in Lancashire this year. The rise in rustling has been driven by the same kind of global trends that made mundane objects such as manhole covers lucrative criminal cargo when steel prices soared.

he weak pound means many sheep are being exported, while traditional sellers such as New Zealand are struggling with drought and sending what lambs they do have to newly wealthy Asia. This is helping push up prices at home. In September police stepped up patrols in Cumbria after thefts in the fells around Ulverston and Windermere. Feeding troughs have also been stolen, possibly for use in fattening up the animals before selling them to backstreet butchers. Police say the gangs may use sheepdogs and have trucks capable of carrying dozens of animals, making them resemble legitimate farmers. PC Alison Taylor of Cumbria police said: "The area where these sheep have been stolen is isolated, fenced fell land which covers hundreds of acres, making them an easier target." Andrew Jones, MP for Harrogate and Knaresborough, said 133 animals had been taken in four incidents in his constituency in the past few months. "People in our agricultural sector have very low incomes and it is hard that just as prices rise they become a target for thieves." The animals might be hard to sell because they are tagged to make them traceable from their field of origin, and police have asked the public not to buy meat of uncertain origin. NFU Mutual, which insures two-thirds of farmers, said cases were at a 10-year high. NFU Mutual's Tim Price said: "We have seen a resurgence. We have had dozens of claims this year after about half a dozen last year." He noted that some sheep had been butchered in fields, making the meat dangerous to eat. "The thieves know the price of commodities very well," he said. "When meat prices go up they take livestock. When scrap metal prices go up farm gates go missing." Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 |

| CFTC's delay on position limits aggravates Chilton Posted: 05 Dec 2010 08:32 AM PST Statement on Position Limits, "Keeping Promises" Thursday, December 2, 2010 http://www.cftc.gov/PressRoom/SpeechesTestimony/CommissionerBartChilton/… Yesterday the commission held the sixth in a series of open meetings to address rules implementing the Wall Street Reform and Consumer Protection Act of 2010. I commend the CFTC's staff for working diligently on the myriad rules mandated by the act, even now in the face of a pay freeze. The staff of the CFTC truly exemplifies the meaning of "service" in the performance of their roles as dedicated public servants. I am concerned, however, with regard to the potential derailment of what I consider to be one of the most important rules required by the Reform Act: implementation of speculative position limits. Congress put special emphasis on this provision, to protect markets and consumers from excessive speculation in commodities markets. Indeed, we were given a specific implementation date for position limits on energy and metals contracts — January 17, 2011 — well in advance of the majority of other reform act rules. We have a commitment to enact this rule on time, a "promise to keep," with the American consumer, who is affected daily by the prices discovered on commodities markets. The commission had originally intended to discuss position limits at yesterday's meeting; unfortunately, that did not occur. Now it appears that the commission does not intend to address position limits at its next scheduled open meeting, on December 9, 2010. This makes meeting the mandatory statutory deadline difficult, but certainly not impossible. The reform act was passed over four months ago — this provision isn't a "surprise" to anyone. It didn't fall out of the sky. Of course there are issues surrounding its implementation, but none of those excuse us from meeting the statutory requirements Congress has given us. This proposal should be discussed on December 9 at the commission's next meeting; a proposal should be put out for public comment as soon as possible; and we should commit to meeting the statutory deadline. We can always find excuses, justifications, or pretexts for inaction — this rule is too important to let any of those get in the way of fulfilling our statutory responsibilities, and keeping our promise. Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:

|

| Posted: 05 Dec 2010 08:32 AM PST Doug Carey submits: It has finally become well known that gold is great to own in times of serious uncertainty. Investors ranging from multi-billion dollar hedge funds to blue collar retirees have been pouring money into the this metal, mostly through gold ETFs such as GLD and SGOL. If you ask these investors why they want to own gold, you will get a variety of answers. Some might say that they’re hedging against inflation. Others will say that they don’t trust the government and think the Federal Reserve will keep printing money to pay off our debt. There is the fear that the powers that be will debase the dollar vs. other currencies in a desperate attempt to juice exports and, theoretically, economic growth. And still others believe we will have to go back to a gold standard in order to hit the reset button on our impossibly overwhelmed national finances. |

| Posted: 05 Dec 2010 08:32 AM PST Scott Sumner submits: As far as I know there is really only one respectable argument that inflation expectations are approaching dangerous levels in the US. We know that 5 year TIPS spreads are low, and we know that the near to medium term consensus inflation forecast is low. We know actual inflation is low and falling. But then there are those gold prices. I’ve never been convinced that the high gold prices were signaling US inflation fears. One problem is that gold prices are set in a global market, so it’s not clear why we should assume they are forecasting high inflation in the US, rather than the eurozone, Japan, India or China. India has generally been the world’s largest buyer of gold. Furthermore, most other metals prices have also been soaring, presumably due to rising demand in the developing world. |

| Gold Seeker Weekly Wrap-Up: Gold and Silver Gain Almost 3% and 9% on the Week Posted: 05 Dec 2010 08:31 AM PST Gold traded mostly slightly higher in Asia and London before it fell to see a $3.15 loss at $1385.35 a little after 8AM EST, but it then rallied back higher for most of trade in New York and ended near its late morning high of $1408.59 with a gain of 1.19%. Gold also ended just $5.40 from its all-time closing high set this past November 9th. Silver surged to as high as $29.292 before it fell back off a bit in the last couple of hours of trade, but it still ended with a gain of 1.89% at a new 30-year closing high. |

| COT Silver Report – December 3, 2010 Posted: 05 Dec 2010 08:31 AM PST |

| Secrecy of Central Bank Gold Lending Condemned in New Study Posted: 05 Dec 2010 08:20 AM PST Dear Friend of GATA and Gold: Lending of gold by central banks depresses the price and the only possible reasons for the secrecy around it are manipulation of the gold market and the enrichment, through inside information, of the financial houses to which central banks lend their gold, a study by New Orleans coin and bullion dealer Blanchard & Co. has found. The study, written by Blanchard's vice president and director of economic research, Neal R. Ryan, published today, calls on the International Monetary Fund to require central banks to make complete and frequent disclosure of their gold lending and thereby equalize information in the gold market. In its own studies this year, the IMF already had acknowledged the inadequacy of central bank gold accounting, and Ryan says he has forwarded his study's recommendations to the IMF and has been told he will receive a response soon. Among the Blanchard study's findings: -- No accurate statistics about loaned central bank gold are published by individual countries or the IMF. Instead gold loans are estimated by outside sources and these estimates vary. -- Gold loaned into the market can significantly affect the price. -- Central banks actively manage their gold loans even as they deprive the market of information about them. -- Bullion banks, the borrowers of central bank gold, have a huge advantage over the investing public in the gold market, inside information acquired in their dealings with the central banks. -- The IMF could start a transparent gold market by requiring accounting changes for central bank gold. "Why," the Blanchard study asks, "aren't gold loans made public? Good question. There is no reason (save the argument made by some that central banks are using gold loans to manipulate the gold price) Blanchard's research has been able to unearth that explains why gold lending information is not made public, except for the unconscionable advantage it gives to bullion banks." |

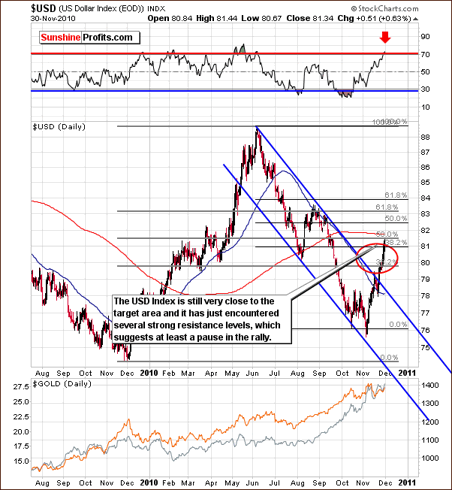

| USD's Local Top, Gold and Silver's Bullish Outlook Posted: 05 Dec 2010 08:12 AM PST Przemyslaw Radomski submits: Even though we posted our previous essay just a few days ago, much happened since that time, so without further introduction we will dive right into the USD Index chart (charts courtesy of StockCharts). Complete Story » |

| Posted: 05 Dec 2010 07:52 AM PST |

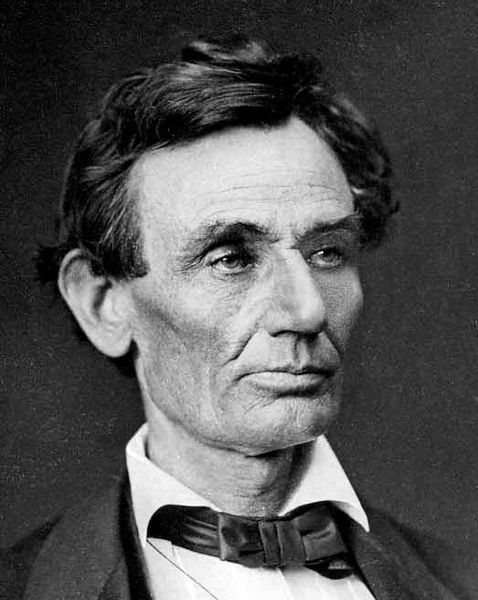

| Guest Post: Will 2012 Be As Critical As 1860? Posted: 05 Dec 2010 07:38 AM PST Submitted by Jim Quinn of The Burning Platform Will 2012 Be As Critical As 1860? “We are not enemies, but friends. We must not be enemies. Though passion may have strained, it must not break our bonds of affection. The mystic chords of memory will swell when again touched, as surely they will be, by the better angels of our nature.” – Abraham Lincoln

We are approximately five years into The Fourth Turning Crisis. Every previous Fourth Turning had an economic dimension that eventually led to a do or die all out war. The mainstream linear thinkers see a recovery and a return to their concept of normality. They will be shocked and flabbergasted when they realize that this is only the beginning of a 20 year period of turmoil, chaos and war. It seems that some study of history would benefit the mainstream talking media heads pretending to know what is happening and political hacks in Washington D.C. who pretend to administer the affairs of state. The cycles of history are not identical, but the alignment of generations is always the same. The cycles are consistent because a long human life is always between 80 and 100 years. The previous Fourth Turnings in U.S. history were the American Revolution, the Civil War and the Great Depression/World War II. The descriptions are as follows: American Revolution (Fourth Turning, 1773-1794) began when Parliament’s response to the Boston Tea Party ignited a colonial tinderbox—leading directly to the first Continental Congress, the battle of Concord, and the Declaration of Independence. The war climaxed with the colonial triumph at Yorktown (in 1781). Seven years later, the new “states” ratified a nation-forging Constitution. The crisis mood eased once President Washington weathered the Jacobins, put down the Whiskey Rebels, and settled on a final treaty with England. The Civil War (Fourth Turning, 1860-1865) began with a presidential election that many southerners interpreted as an invitation to secede. The attack on Fort Sumter triggered the most violent conflict ever fought on New World soil. The war reached its climax in the Emancipation Proclamation and Battle of Gettysburg (in 1863). Two years later, the Confederacy was beaten into bloody submission and Lincoln was assassinated–a grim end to a crusade many had hoped would “trample out the vintage where the grapes of wrath are stored.” The Great Depression & World War II (Fourth Turning, 1929-1946) began suddenly with the Black Tuesday stock-market crash. After a three-year economic free fall, the Great Depression triggered the New Deal revolution, a vast expansion of government, and hopes for a renewal of national community. After Pearl Harbor, America planned, mobilized, and produced for war on a scale that made possible the massive D-Day invasion (in 1944). Two years later, the crisis mood eased with America’s surprisingly trouble-free demobilization. There is a consistent tempo to all Fourth Turnings. An event or series of events leads to the initial Crisis. As the Fourth Turning progresses it becomes more intense, chaotic, dire and bloody. It eventually exhausts itself as a victor is left in control of the battlefield. Picture George Washington at Yorktown, Ulysses S. Grant at Appomattox, and Douglass McArthur on the Battleship Missouri. The events during a Fourth Turning will always be different. The consistent aspect of all Fourth Turnings is the mood of the country, the same generational dynamics, and the reactions of the generations to events. Strauss & Howe describe this Crisis period as follows: “The spirit of America comes once a saeculum, only through what the ancients called ekpyrosis, nature’s fiery moment of death and discontinuity. History’s periodic eras of Crisis combust the old social order and give birth to a new. A Fourth Turning is a solstice era of maximum darkness, in which the supply of social order is still falling but the demand for order is now rising.”

The turnings of history are like the seasons. It is impossible to go directly from Fall to Spring. You must withstand the bitter harshness of Winter in order to get to the revitalizing warmth of Spring. The intensity and depth of Winters will vary. Those who prepare for a potentially harsh Winter in advance will be more likely to survive. The morphology of Fourth Turnings as described by Strauss & Howe is:

An honest assessment of where we sit in this cycle shows that we are still in stage one. The housing collapse brought about the near destruction of the worldwide financial system. The sudden shift in mood has been borne out by the angry rise of the Tea Party and the startling result from the recent election. Society is on the verge of stage two. There has yet to be the reunification and reenergizing of society. It still feels like things are falling apart. The sun is slowly setting on this stage and a dark brutal Winter night beckons.

1860 Election – Spark that Ignited an Epic Conflagration

Turnings throughout history have consistently lasted between 15 and 25 years, except one. The Civil War Crisis Turning lasted only 5 years and seems to not fit the standard definition of a Turning. Strauss & Howe reflected that: “By the usual pattern of history, the Civil War Crisis catalyst occurred four or five years ahead of schedule and its resolution nearly a generation too soon.” The truth is that instead of a drawn out Crisis over 15 to 20 years that would have had undulations of pain and suffering, the U.S. experienced the most savage 5 years in our history, with 620,000 Americans killed and 400,000 wounded. Ten percent of all Northern males 20–45 years of age died, as did 30 percent of all Southern white males aged 18–40. Strauss and Howe conclude that there are two lessons from the Civil War Crisis:

The catalyst for the Crisis was the election of Abraham Lincoln as President of the United States. After the Compromise of 1850, who would have envisioned the election of an unknown Congressman from an abolitionist party that didn’t even exist in 1850. Beyond that, could anyone have predicted the carnage from the bloodiest war in the history of mankind being the result of that election? Many people do not know that there were four candidates for President in 1860 and that Lincoln won the election with only 39.8% of the popular vote. Lincoln won the Presidency and he wasn’t even on the ballot in Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, North Carolina, Tennessee, or Texas. The Republican Party realized they had a tremendous opportunity to win the Presidency as the Democrats were in disarray. Since it was essential to carry the West, and because Lincoln had a national reputation from his debates and speeches as the most articulate moderate, he won the party’s nomination on the third ballot on May 18, 1860. The Republican platform stated that slavery would not be allowed to spread any further, and it also promised that tariffs protecting industry would be imposed, a Homestead Act granting free farmland in the West to settlers, and the funding of a transcontinental railroad. All of these provisions were highly unpopular in the South. The Democratic Party split into two factions due to the issue of slavery. Stephen A. Douglass became the Northern Democrat candidate. He was a moderate on the slavery issue. John C. Breckinridge was selected by the Fireaters from the Deep South. Breckinridge supported extending slavery into territories whose voters did not want it. A fourth party called the Constitutional Union Party made up of die-hard former Southern Whigs and Know Nothings who felt they could support neither the Democratic Party nor the Republican Party was formed. They nominated John Bell of Tennessee for President. The party platform advocated compromise to save the Union, with the slogan “the Union as it is, and the Constitution as it is.” The voter turnout rate in 1860 was the second-highest on record (81.2%, second only to 1876, with 81.8%). The voter turnout in 2008 of 56.8% was the highest for a Presidential election since 1968. Nominee: Abraham Lincoln Nominee: John C. Breckinridge Nominee: John Bell Nominee: Stephen A. Douglass Party: Constitutional Union Party: Northern Democrat % of Vote: 12.6% % of Vote: 29.5% Electoral Votes: 39 Electoral Votes: 12 As the 1850s progressed the firebrands in the North and South became more entrenched in their dogmatic positions. The Transcendental Generation Prophets came to power and compromise was no longer an option. Both Lincoln and Jefferson Davis were from this Prophet generation. Aging Prophets are always the moralistic drivers of Fourth Turnings. Strauss & Howe stress the importance of the Prophet Generation during a Fourth Turning: A Crisis catalyst occurs shortly after the old Prophet archetype reaches its apex of societal leadership, when its inclinations are least checked by others. A regeneracy comes as the Prophet abandons any idea of deferral or retreat and binds the society to a Crisis course. A climax occurs when the Prophet expends its last burst of passion, just before descending rapidly from power. The election of Abraham Lincoln proved to be the catalyst for the Crisis. Seven southern states seceded from the Union before Lincoln took office. The attack on Fort Sumter started a spiral of carnage and butchery that could not be reversed. The Crisis reached regeneracy after the Union debacle during the First Battle of Bull Run. Lincoln realized winning this war would require full mobilization and all out war. He ordered the enlistment of 500,000 soldiers, suspension of habeas corpus, taxation, and expansion of government power. The next four years were a swirl of savagery and unprecedented tragedy. It convulsed to a chaotic conclusion with the surrender at Appomattox and assassination of Lincoln in the same week. The Crisis exhausted itself with the climax seeming more like a defeat than a victory. Are the actions of politicians 150 years ago worth understanding in order to determine how our current Crisis will develop? Since every Crisis period has the exact same generational configuration and generations react to events in similar manner, I believe it is worthwhile to examine the Civil War dynamics. Historian Gordon Leidner’s conclusions about the Civil War period are revealing:

The insights gained from the Civil War Crisis are that compromise and moderation are discarded. The firebrands control the field. The Prophets push for an all out war to settle the pressing issues of the day. They are willing to sacrifice the young in their moralistic fervor to satisfy their vision of the future. The final verdict will depend on the strength, judgment, and wisdom of the Prophet leaders during a Crisis. 2012 Election – Crisis Leader Sets Stage for Dark Days Ahead

Nomad (Gen X) Prophet (Boomer) Prophet (Boomer)

Prophet (Boomer) Nomad (Gen X) Prophet (Boomer) Artist (Silent) By 2012 we will have reached the 7th year of this Crisis. The linear thinking media and supposed “thought leaders” are convinced that the worst days of this Crisis have passed. They believe that the Federal Reserve and Government leaders have taken the proper actions to avert a Great Depression. They will be shocked when the Crisis deepens and gets far worse than today. Every action taken by our leaders since 2005 has worsened the Crisis. Rather than letting the culprits of the financial crisis fail, they have propped up these criminal institutions with taxpayer funds. By not accepting the pain early in this Crisis, these leaders have ensured that this Crisis will be more tragic, brutal and wrenching. The mood of the country continues to darken, even as the mainstream media and government cheerleaders falsely insist that things are getting better. By year 7 of the American Revolution Crisis, George Washington was on the verge of defeating the British at Yorktown and bringing that Crisis to a positive conclusion. The Civil War Crisis had concluded with Union victory by year 5. The Great Depression/WWII Crisis was in a lull period, with GDP growing by 13% in 1936 as government spending and personal consumption surged. The economy gave the appearance of recovery because FDR’s New Deal programs created make work schemes using government funds. Americans know the 1930s as the Great Depression. As proof of how meaningless GDP calculations are versus how real Americans are affected, the GDP increased by 63% in the four year period between 1934 and 1937. Despite this phenomenal growth, the unemployment rate remained at 17%. In comparison, GDP has advanced by only 5.1% from the bottom in the 2nd quarter of 2009 until today and the unemployment rate on a comparable basis is 23%. Franklin Delano Roosevelt won the 1936 election over Alfred Landon in one of the greatest landslides in history, with 523 electoral votes to Landon’s 8. The current Crisis appears to be in a lull similar to the 1930s. Government actions can mask deeper problems for awhile, but pressure continue to build. The problems did not go away. The bad debts did not disappear. The Wall Street criminals are still free to loot the American middle class. No one has been prosecuted for the greatest financial fraud in history. The National Debt continues to balloon by $4 billion per day. The USD is slowly being replaced as the worldwide reserve currency. Political ideologues have taken control of both parties. Worldwide trade tensions and social contract broken promises are leading to riots and chaos across the Europe. The onset of peak cheap oil is raising prices for fuel and food and setting the stage for coming resource wars. Fundamentalist religious leaders are pushing for a religious war between Christianity and Islam. The extremists are gaining control of the agenda. The sudden shift in mood has occurred. The hard working middle class of this country are frustrated, angry and feel betrayed by their leaders. The American people are fed up with all politicians. The liberal ideologues and conservative ideologues have staked out immovable positions on social, financial, and foreign trade issues. Compromise is as likely as it was in 1860. The Tea Party will not compromise. Their agenda is to change politics in Washington DC. They will be a thorn in both party’s side. The possibility of the Tea Party becoming a 3rd party is quite possible. This brings us to the 2012 Presidential election. The current |

| Posted: 05 Dec 2010 07:26 AM PST A few years ago, when I was allocating money to directional hedge funds (L/S Equity, Global Macro and Commodity Trading Advisors), I just loved conference calls and reading interesting monthly letters.

I leave you to carefully read the entire comment and will only tell you that I'm not as concerned as Mr. Jensen is on some of these factors. The biggest risk I see is geopolitical risk, which can escalate quickly (not just Iran; look at Korea too).

You should read Ms. Flanders entire post to get the details, but there is another, simpler reason why Germany won't leave the eurozone: it is profiting off all these bailouts:

Finally, Tyler Durden of Zero Hedge posted the humorous skit below discussing the possible manipulation of the silver market by JP Morgan. The skit is funny, but if there is any truth to this, the fallout will wreak havoc on financial markets and the real economy.

|

| Will governments start buying Silver? Posted: 05 Dec 2010 06:41 AM PST |

| Silver video from the Lisbon Lassie Posted: 05 Dec 2010 06:34 AM PST |

| Posted: 05 Dec 2010 06:25 AM PST |

| Posted: 05 Dec 2010 06:25 AM PST |

| Posted: 05 Dec 2010 04:50 AM PST It appears that one way or another, the IMF will provide a lot more American money to the European rescue. Reuters reports that according to the IMF the euro zone should have a bigger rescue fund and the European Central Bank should boost its bond buying to prevent the sovereign debt crisis from derailing economic recovery. "International Monetary Fund chief Dominique Strauss-Kahn will present the report on the economy of the 16 countries using the euro at a meeting of euro zone finance ministers and European Central Bank President Jean-Claude Trichet on Monday." And presumably, and we are speculating here, if the Euro zone can not afford it, the IMF will be more than happy to step in. After all recall that on August 30, the IMF extended the duration of the Flexible Credit Line (FCL), "concurrently removing the borrowing cap on this facility, which previously stood at 1000 percent of a member’s IMF quota, in essence making the FCL a limitless credit facility, to be used to rescue whomever, at the sole discretion of the IMF's overlords." We would think that an infinite amount of money should be enough to rescue even Spain when the time comes. Which begs the question: with everyone expecting muni bonds to be the purchasing target of QE3, will Bernanke again fool everyone and instead opt for direct European bond monetization? After all, the destruction of dollar value is and always has been the Fed's primary imperative, and what better way to achieve this than to collateralize the greenback with Greek bonds? And not surprisingly, Belgium which is next after Portugal, Spain and Italy, to go bankrupt, has joined the chorus demanding for far more money. From Bloomberg:

But, but, neither Portugal nor Ireland had problems "like that" a month ago... How can this be? Could fat, corrupt, pathologically lying Euorpean career bureaucrats be, gasp, lying to us? And with Germany opposed to more funding, the only remaining source of capital is America, courtesy of the IMF. This is what we said last time around the IMF pledged an infinite amount of US dollars to rescue Europe, precisely in anticipation of just such an event:

Too bad the threat of the FCL did nothing to protect against market volatility. Which is why it is now time to put in action.

|

| Major, Major System Collapse Coming? Posted: 05 Dec 2010 04:47 AM PST |

| HOW YOU CAN HELP DESTROY THE WALL STREET CRIMINAL BANKS Posted: 05 Dec 2010 02:48 AM PST We've discussed this before. Deposits are the lifeblood of all banks. There are 8,000 banks in the US. The Wall Street criminal banks control the vast majority of deposits. If enough "small people" withdraw their funds from these criminals, they will collapse. If your financial situation allows, bring down these scumbags. Maverick Fed Governor Hoenig: [...] |

| Weekly Market Round-up: Investors still cautious despite stronger FTSE 100 performanc Posted: 05 Dec 2010 02:40 AM PST View the original article at Stockopedia December 03, 2010 04:47 AM Analysts were divided this week on whether a rally in London markets that started on Tuesday afternoon was anything more than a shallow gesture. Certainly by Friday, investors were holding fire ahead of key data coming out of the US. The FTSE 100 opened the week at 5691 points before bottoming out Tuesday at 5522 and then marching ahead to 5779 on Friday morning before investors backed off.* Overall, it was an encouraging performance inspired by a rebound in the strength of the Euro against the dollar and healthier job figures in the States. Reflecting that mood, a mighty 161 London-listed stocks reached new 12-month highs this week, double the number last week, while just 44 slumped to new lows. Excitement in the Falklands* This week, despite all manner of uncertainties surrounding the oil discovery by*Desire Petroleum*(LON:DES) in the Falkland Islands, shares in the group soared – as did those of others near... |

| CFTC's delay on position limits aggravates Chilton Posted: 05 Dec 2010 01:55 AM PST Statement on Position Limits, "Keeping Promises" Thursday, December 2, 2010 http://www.cftc.gov/PressRoom/SpeechesTestimony/CommissionerBartChilton/... Yesterday the commission held the sixth in a series of open meetings to address rules implementing the Wall Street Reform and Consumer Protection Act of 2010. I commend the CFTC's staff for working diligently on the myriad rules mandated by the act, even now in the face of a pay freeze. The staff of the CFTC truly exemplifies the meaning of "service" in the performance of their roles as dedicated public servants. I am concerned, however, with regard to the potential derailment of what I consider to be one of the most important rules required by the Reform Act: implementation of speculative position limits. Congress put special emphasis on this provision, to protect markets and consumers from excessive speculation in commodities markets. Indeed, we were given a specific implementation date for position limits on energy and metals contracts -- January 17, 2011 -- well in advance of the majority of other reform act rules. We have a commitment to enact this rule on time, a "promise to keep," with the American consumer, who is affected daily by the prices discovered on commodities markets. The commission had originally intended to discuss position limits at yesterday's meeting; unfortunately, that did not occur. Now it appears that the commission does not intend to address position limits at its next scheduled open meeting, on December 9, 2010. This makes meeting the mandatory statutory deadline difficult, but certainly not impossible. The reform act was passed over four months ago -- this provision isn't a "surprise" to anyone. It didn't fall out of the sky. Of course there are issues surrounding its implementation, but none of those excuse us from meeting the statutory requirements Congress has given us. This proposal should be discussed on December 9 at the commission's next meeting; a proposal should be put out for public comment as soon as possible; and we should commit to meeting the statutory deadline. We can always find excuses, justifications, or pretexts for inaction -- this rule is too important to let any of those get in the way of fulfilling our statutory responsibilities, and keeping our promise. ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

It is also not as expensive as you might think it is.

It is also not as expensive as you might think it is.

No comments:

Post a Comment